Research Article: 2025 Vol: 29 Issue: 1

Strategy in the Digital Age

Srinivas Ainavolu, Vijay Patil School of Management, Navi Mumbai

Citation Information: Ainavolu, S. (2025). Strategy in the digital age. Academy of Marketing Studies Journal, 29(1), 1-7.

Abstract

Strategic management has to do with the competitive advantage enjoyed by firms and is said to be more than operational effectiveness (Porter, 1996). In a typical competitive scenario, a firm is present in an industry based on the perceived ‘fit’. There must be a contextual fit for the firm and then the probability of that firm doing well shall be better. The substitutability to the dot and comma may not be tracked or ever be present. Hence, often used phrase is ‘closely substitutable’, as the idea is customer base shall be common in such context. Thus, industry as we understood is cluster or group of firms in similar offering space to customers. This is an important source of firm performance.

Keywords

Strategic Management, Need Identification, Digitalization, Marketing.

Introduction

The need identification by an early mover may be replicated and frameworks and models reused or used in an improvised manner by next movers. This initial advantage may be enjoyed for some time by the early mover because the space for competition did not exist earlier, which got termed as blue ocean (Kim & Mauborgne, 2005). Compared to the competitor blood spilled space that looks like red colour spread on floor or water, the uncontested markets look like blue seas that have not seen any activity. The company that spots the opportunity enters the ‘blue ocean’ and offers the goods to the customers willing to offer even more price than the expectation from the early mover, as the perceived value is more due to scarcity.

Companies have bundle of competencies that also give competitive advantage by being valuable (Barney, 1991). These competencies are the abilities of the firms in ‘utilizing’ the resources they possess or they have access to in the market. The competencies when are usable across industry domains the firm is present in, in other words with lot of transferability, these are called ‘core competencies’ (Hamel & Prahalad, 1990). Firms’ competencies do keep changing due to the contextual demands, and technological developments. When the capabilities respond to the requirements and get into ‘changeable’ mode, these get addressed as ‘dynamic capabilities’ (Teece et al, 1997; Teece, 2007). The shift and changes are warranted given the changes.

The beginning of the digital business was the Internet and it was felt that strategy still be relevant in the changed context (Porter, 2001). This paper proposes how the traditional value-creating dimensions of industry and firm are shifting in terms of their potential in this digital age. Paper summarizes and provides a framework for further exploration.

Context for Strategy Making

Strategic management is said to be more than operational effectiveness (Porter, 1996). In a typical industrial scenario, a firm chooses to participate in an industry based on the perceived ‘fit’. Here, industry is the cluster or group of firms producing almost substitutable products/services (henceforth, mentioned as products for simplicity) (Porter, 1996). The substitutability to the dot and comma may not be possible or present in reality. Hence, often used phrase is ‘closely substitutable’.

The business experiences context on a much broader level. The sensitization is given or happens to scholars and analysts on various dimensions. Firm performance is seen as an additive reflection of various ‘effects’ (Ainavolu, 2009). Each of these effects accrue from one of the participating contextual elements. For instance, particular industry participation facilitates or retards the performance as industries have their own performance cycles. For instance, steel and cement witness a correlated up or downward movement because construction goes up and low cyclically. The research question of ‘how much industry matters’ for the performance of the participating firm was also explored (Rumelt, 1991).

When the industry movement is up or downward, not all the companies in the industry shall gain or lose market share accordingly. When there is a recession in the broader economy, not all companies suffer equally (Osiyevskyy et al., 2020). Similarly, intra-industry ups and downs shall be different for various companies. A few companies gain market share even when the industry is witnessing a downward trend. The reason for this could be the inorganic growth these companies are focusing on. When the industry is beyond the maturity stage in the industry life cycle parlance, there shall be a few companies that focus on consolidations. At the same time, there shall be a few companies’ owners who give away, and divest themselves (Wenzel et al., 2021). This intra-industry diverse response shall be covered in the next sections.

Industry and Economy Related Dynamics

Industry is understood as a cluster or group of firms in similar offering space to customers. The need identification by an early mover may be replicated and reused by the next movers. This initial advantage may be enjoyed for some time by the early mover because the space for competition did not exist earlier and got termed as ‘blue ocean’ (Kim, 2005). Compared to the battle-witnessed, blood spilled space that looks like red colour spread on floor or water, the uncontested markets look like blue seas that have not seen any activity. The company that spots the opportunity enters these blue ocean waters and offers the goods to the customers who may be willing to offer even more price than the expectation from the early mover, as the perceived value is more due to scarcity (Chae et al., 2020).

Companies or firms as these are interchangeable called in literature, come with bundle of competencies. These competencies are the abilities of the firms in ‘utilizing’ the resources they possess or they have access to in the market. The competencies when are usable across industry domains the firm is present in, in other words with lot of transferability, these are called ‘core competencies’ (Hamel & Prahalad, 1990). Firms’ competencies do keep changing due to the contextual demands, and also technological developments. When the capabilities respond to the requirements and get into ‘changeable’ mode, these get addressed as ‘dynamic capabilities’ (Teece et al, 1997).

The economy broadly moves in different directions, and sometimes even year on year the growth rates witnessed shall be different. Relative movement in terms of absolute and real growths being higher or lower than witnessed previous year. What explains this is a broader question, and some of the answers are contemplated here. Global trade cycles can vary year on year. Similarly, the production of agricultural and industrial goods can be different from year on year. The reasons can be on different counts, seasonal fluctuations, weather changes, sudden wars affecting both production and logistics etc. When the economy broadly on upswing, all the industries there move up is general expectations of managers, which in many cases, reflect the realities. Building on Peng and Luo’s (2017) findings regarding the crucial role of micro interpersonal ties & managerial effectiveness in driving organizational success, we can further conclude that the performance of a firm embedded in an economy is contingent upon the economic trajectory- it can be high or low based on economy moving up or low.

Similarly, the emerging contexts present the notion of business groups. If the business group is doing well in general terms, all the companies within the portfolio of that group may have access to investments, knowledge flows through technology transfers can happen, hiring top talent may happen (Ma et al., 2006). Thus, the business group or parent affiliation may also have a bearing on the ‘performance’ of the companies (Xufei et al, 2007).

Technological Developments and Environmental/ Climate Concerns

Industries get flooded with technology options. Sometimes the industry matures with one generation of technology, and nothing encouraging breakthroughs or even inching forward happens. This is the time when pioneering technologies don’t get introduced (Mitchell & Skrzypacz, 2015). The reasons could be on account of low returns or margins such industries witness or no advancements related to the field are happening. For instance, in power generation technologies for over sixty years, hardly any developments happened (Bose, 2010) in terms of heating up water to turn it into steam and using this steam to rotate the turbine to generate electric current. After this long gap, metallurgical boosts helped the industry to achieve super-critical and ultra-super-critical points. However, the infusion of newer renewable technologies that became ‘possible’ like longer wind turbines and affordable Solar Photo Voltaic made it appear like a game changer (Hussain et al., 2017).

The environmental pressures have increased recently is an understatement. There are industries for which achieving the license to carry on is becoming impossible. The climate concerns are making the companies pronounce ‘net zero’ dates proactively (Stern & Valero, 2021). However, the emission standards and related regulations are slow to evolve. Global conventions of countries and institutions are putting pressure on the economies, nation-states, and industries (Flagg, 2015). Hence, is pressure on the participating companies too. Regulations are slow to change in a fast-moving industry as the implications are yet to be understood and people are still grappling with the possibilities.

Digital and Related Developments

Industry 4.0 and digital platforms are often talked about (Veile et al., 2022). The production process has moved over two hundred years ago into more mechanized. The steam and the steam-using machinery take the credit for this. Not that steam was new to mankind, but leveraging steam for achieving production was a new discovery of the eighteenth-century (Wang et al., 2017). This was the first generation of technologies. Electricity invention was a big boost, wherein many tasks could be achieved by using electricity. The orbit change is easier to appreciate. The earlier rotational motion achieved using steam is now achieved using motors that utilize the electrical energy that got generated at a far-off place too. Cross-country transportation was facilitated earlier by steam, and now cross-country energy flows are achieved using electrical transmission. This became the second wave.

Information technology facilitated huge data storage, processing, and retrievals (Philip Chen & Zhang, 2014). The generation of computers helped people leverage their power and achieve efficiency and effectiveness. Fourth-generation technologies came with ‘Connectedness’ wherein sensors deployed at various points in the process transmit the data and help people monitor and control processes and parts thereof. This helps one in predictive maintenance and also improves the production cycles to inch towards ‘ideal’ which is most efficient. The implications of the ‘industry 4.0’ as it is pronounced seem like science fiction, but the field reality is dawning on in many areas.

Digital Technology as the Enabler

Technology is referred to as the intermediary between the inputs and the output. All that causes the transformation is addressed as technology, as per organizational theory perspective. Technology can be simple or complex. The complexity and the outcome quality often are seen as going together, but not necessarily. The next level is, superimposing the technologies that deal with the data and transactions on the operational elements and achieving superior performance. Facilitation happens as many of the informational inputs can be relayed quickly using digital and the decisions can be communicated either automatically, or manually but at a higher speed.

Digital’s Impact on the Product Offerings

The product life cycles were expected in different industries. The introduction of technologies and the varying abilities of the participants in the industry around their extent of leveraging technologies has become another important variable. In other words, the tool exists for all but the ability to utilize the tool is the differentiating factor. Choosing the product to offer must be based on the market information, and to the extent of ‘right segment’ to target. Increased access to dependable information is now possible with big data around the interested area. Running the surveys and with control is possible. Earlier dependency on small sample surveys in limited geographies, extrapolated onto large populations was giving misleading results. Now dependability and authenticity are better.

Digital’s Impact on the Channel for Reaching Out

Erstwhile dependence on the physical location and reach through channels or company-owned showrooms are giving way to direct access to consumers. The cost of micro-logistics must be borne by the company. In return the entire channel-related costs get saved is the takeaway. Many companies have transited at least partly to the digital space with multi-channel reach-outs implemented.

Digital’s Impact on Connecting with Customers

Earlier dependence on limited media reach to impress potential customers is now widened with many choices. The digital has enabled focused advertisement, targeted reach-out, value for money in terms of ad spend, real pay-outs in terms of only pay-on-click etc. These optimize the advertising spends and conserve resources to the real extent possible. Huge spending on full-page advertisements or high-cost displays on busy road junctions won’t promise eyeballs, and much less possibly take on eyeballs to pulling purses out pockets for actual spending. On the other hand, in digital reach out one can establish the actual connection between the characteristics, the explored audience, and the conversion rate. Thus, eyeball to the actual purchase of the target segment is verifiably measured. This shall further bring focus to the ad spending companies wish to pursue in the next time cycle.

Digital’s Impact on the Entry Barriers

For capex intensive business the demand for capital is on account of machinery and secondly on account of infrastructure required in terms of last mile facilities like showrooms. Now with the digital in place, the reach out to the customers can happen through online. For instance, in the celebrated initial example of Barnes & Noble had a huge competitive advantage of having located the stores in prime places of the city, the competitive advantage to have more footfalls and hence probably more conversions gets eliminated when the competitor is reaching out ‘virtually’ through online means. Additional advantage with online reaching out is, it can be 24x7 and neutralized this ‘value’ through having the physical stores open so shall be expensive as one has to run the operations in three shifts of eight hours each. Still, the convenience of shopping from one’s own home can never be neutralized. So, traditional entry barriers shall not be in a position to ‘gate keep’. New means of erecting entry barriers or putting up systems that are difficult to replicate have to happen.

Digital’s Impact on the Value Chain

The participants in the industry shall have their own inbound/outbound logistics. Tracking, optimizing, routing efficiently all these can be improved through digital means. These serve to improve the margins. Implementing Industry 4.0 for ‘Operations’ shall improve the efficiencies and help provide cues for ‘predictive maintenance’. These shall again improve equipment availability and drive down the cost of operations. Thus, margins improve significantly which can place the company better with respect to its industry rivals.

Digital’s Impact on the Competitor Information

For formulating the strategy, the firm has to consider both external and internal factors. Digital facilitates the availability of the competitor information and their position, even their potential product portfolio for the future. This shall help the companies strategize better by knowing the industry participants' information and hence the industry trends, in addition to the technology trends for better ‘positioning for future’.

Framework for ‘Strategy in the Digital Age’

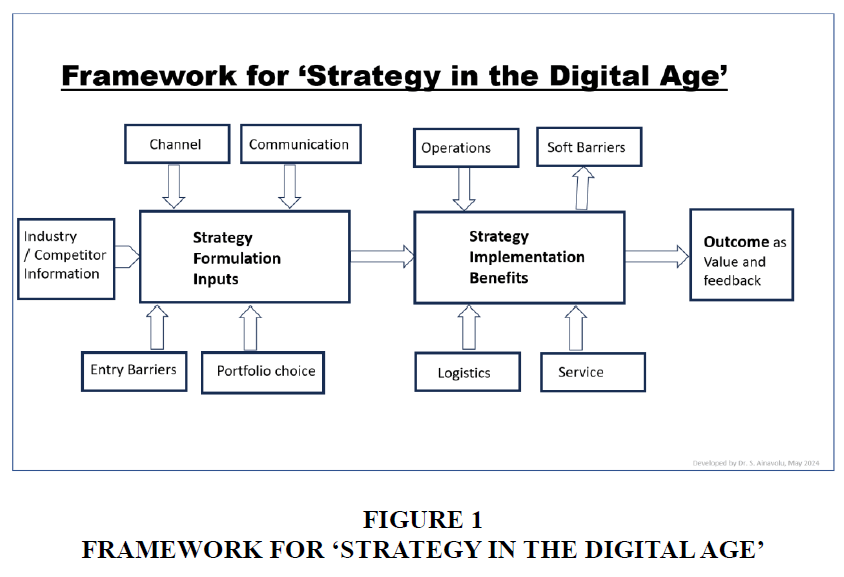

Based on the various inputs considered and process elements that shall be involved during various stages of strategy, a framework for Strategy in Digital Age is developed by the author and is presented here as Figure 1. The same shall be explained in detail in this section.

Industry/Competitor information: Given the facility and open sources of information like social media even the information about the senior personnel is available on line. Industry bodies, different organization’s related information are easily available.

Entry barriers: Earlier restrictions of the space in terms of location (from advantage perspective) and time restrictions like 10am -9pm shop opening hours etc. are not there. The reason being the virtual stores on the digital plane keep the offerings round the clock for the potential customers. Secondly, there is no need to physically make the customer visit the stores, and hence the location constraints and associated costs are also obviated.

Channel: Directly reaching out to the customers is the big advantage in the digital world. Economic incentives offered to the intermediaries go away as it is not required always to reach out to customers using the intermediaries.

Portfolio /Offerings /Bundling choice: Given the digital flexibility, the slicing/dicing can happen easily. Liking patterns, previous purchase information, similar profiled buyers’ exercised choices, all these are grouped and put together.

Communication: Multiple communications, customized communication can be easily done using digital means.

Operations: Efficiency along the value chain improves using the digital means. Systems implemented for taking care of the processes including ERP shall help the organizations easy in implementing the strategy.

Logistics: The information about the inbound/outbound logistics is put-together and mapped to suit the needs.

Service and Feedback: Service and feedback are the areas that benefit out of the digital leveraging. Customer database to service call tracking, feedback organization, all these can be comfortable and be done using digital means.

Conclusion

Based on this paper, here we appreciate and prima facie establish that Strategy is highly relevant in the digital age, the differentiation in using the technology benefits a few in the lot of all industry players. Many of the traditional concepts like ‘Entry barriers’, and ‘Strategic Marketing’ can get affected beyond recognition.

The traditional strategy framework depended mostly on static information, and aligning. With digital the flexibility is introduced, reconfiguration and recalibration are much easier. The inputs for the strategy formulation are listed, and also the benefits flowing out of strategy implementation. The task of establishing the changing contours of input elements and strategy formulation can now be attempted by studying deeply the organizational decision making process. Similarly, the outcome benefiting of the digital facilitating various processes can also be established quantitatively. Any moderating industry level factors, if exist, can also be highlighted. The interaction between various elements can be also be brought out effectively. Digital is beyond mere computerization. Digital is a culture and mind-set. If the organization is so used bureaucratic means of establishing the factuality or veracity of documents, then still the physical verifications need to happen. ERP implementations were done by many competitors in the same industry. Who benefited more and why has always been an interesting question. The negotiation process inside the organization, the political quagmire some organizations have inside affect the pace and level of play of ‘digitalizing’. These are a separate set of potential studies

References

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of management, 17(1), 99-120.

Bose, B. K. (2010). Global warming: Energy, environmental pollution, and the impact of power electronics. IEEE Industrial Electronics Magazine, 4(1), 6-17.

Indexed at, Google Scholar, Cross Ref

Chae, H., Kim, S., Lee, J., & Park, K. (2020). Impact of product characteristics of limited edition shoes on perceived value, brand trust, and purchase intention; focused on the scarcity message frequency. Journal of Business Research, 120, 398-406.

Chen, C. P., & Zhang, C. Y. (2014). Data-intensive applications, challenges, techniques and technologies: A survey on Big Data. Information sciences, 275, 314-347.

Flagg, J. A. (2015). Aiming for zero: what makes nations adopt carbon neutral pledges?. Environmental Sociology, 1(3), 202-212.

Indexed at, Google Scholar, Cross Ref

Hussain, A., Arif, S. M., & Aslam, M. (2017). Emerging renewable and sustainable energy technologies: State of the art. Renewable and sustainable energy reviews, 71, 12-28.

Kim, W. C. (2005). Blue ocean strategy: from theory to practice. California management review, 47(3), 105-121.

Mitchell, M., & Skrzypacz, A. (2015). A theory of market pioneers, dynamic capabilities, and industry evolution. Management Science, 61(7), 1598-1614.

Indexed at, Google Scholar, Cross Ref

Osiyevskyy, O., Shirokova, G., & Ritala, P. (2020). Exploration and exploitation in crisis environment: Implications for level and variability of firm performance. Journal of business research, 114, 227-239.

Indexed at, Google Scholar, Cross Ref

Porter, M. E. (1996). What is strategy?.

Prahalad, C. K., & Hamel, G. (2009). The core competence of the corporation. In Knowledge and strategy (pp. 41-59). Routledge.

Indexed at, Google Scholar, Cross Ref

Rumelt, R. P. (1991). How much does industry matter?. Strategic management journal, 12(3), 167-185.

Srinivas, A., & Khanna, S. (2008). Effect of Business Group and Industry Affiliation on Firm Performance: An Exploratory Study of Indian Business Group Affiliated Com.

Stern, N., & Valero, A. (2021). Innovation, growth and the transition to net-zero emissions. Research Policy, 50(9), 104293.

Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic management journal, 28(13), 1319-1350.

Indexed at, Google Scholar, Cross Ref

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 18(7), 509-533.

Veile, J. W., Schmidt, M. C., & Voigt, K. I. (2022). Toward a new era of cooperation: How industrial digital platforms transform business models in Industry 4.0. Journal of Business Research, 143, 387-405.

Wang, Y., Ma, H. S., Yang, J. H., & Wang, K. S. (2017). Industry 4.0: a way from mass customization to mass personalization production. Advances in manufacturing, 5, 311-320.

Wenzel, M., Stanske, S., & Lieberman, M. B. (2020). Strategic responses to crisis. Strategic Management Journal, 41(7/18), 3161.

Indexed at, Google Scholar, Cross Ref

Received: 10-Sep-2024, Manuscript No. AMSJ-24-15229; Editor assigned: 11-Sep-2024, PreQC No. AMSJ-24-15229(PQ); Reviewed: 26-Sep-2024, QC No. AMSJ-24-15229; Revised: 26-Oct-2024, Manuscript No. AMSJ-24-15229(R); Published: 19-Nov-2024