Research Article: 2021 Vol: 25 Issue: 5

Strategies Complimenting to Protect Usdinr Currency Futures with Goal of Maximum Return and Minimum Loss

Dr. P. Govindasamy, Vels Institute of Science, Technology and Advanced Studies, Tamilnadu

Dr. V Gajapathy, School of Management, Presidency University, Bangalore

Dr. Ashok Kumar Katta, Vels Institute of Science, Technology and Advanced Studies, Tamilnadu

Mr. R. Ravimohan, Vels Institute of Science, Technology and Advanced Studies, Tamilnadu

Abstract

The aim of the investors is going to protect returns of their investment and try to maximize proceeds and that to compromise market optimum. The worldwide foreign exchange market is the biggest market on the planet with over US$ 5trillion exchanged every day, as indicated by Bank for International Settlements (BIS) information. The foreign exchange market, be that as it may, isn't the lone path for investors and dealers to partake in foreign trade. While not close to as extensive as the foreign exchange market, the currency futures market has a good day by day average nearer to $100 billion. In view of this, the working models with the currency futures in respect of USD-INR and the approach such as covered call, covered put, protective call and protective put. These procedures are utilized to shield the profits from existing situation in currency futures, which creates hope for decrease misfortunes or improve the profits on it.

Keywords

Currency Derivatives, Investors Economy, Currency Future Strategies, Covered Put and Call, Protective Call and Put.

Introduction

The timing of an investment when to buy or sell is facilitated by a study of those tabulated information. Purchasing and selling of scrip is certainly not a simple assignment in the event that you need to bring in cash doing it. A huge number of financial backers have lost the cash in past taking a stab at speculating future value developments (Gunaseakar, 2018). Derivatives market in India has enlisted a ? touchy expansion and is required to proceed with something similar in the year to come. N.D. Vora (2002), in a way, the performance of derivatives depends on how the underlying asset performs. STP. Raghavan (2018), Putting resources into foreign resources has demonstrated the benefits of broadening, and most individual investors enjoy the advantages of global resources. Not-withstanding, except if the foreign securities have been given in U.S. dollars, the portfolio will encounter currency risk. Currency risk is the risk that one currency moves against another currency, contrarily influencing a investor’s general return. All in all, the swapping scale between the two currency forms can move antagonistically and dissolve the profits of a foreign investment. Financial backers can acknowledge currency risk and pray for divine intervention, or they can utilize supporting methodologies to moderate or dispense with the danger currency risk. (Implied Link-1), Currency futures, likewise called forex futures or foreign exchange futures, are exchange-traded futures contracts to buy or sell a specified amount of a particular currency at a set price and date in the future. Currency futures were introduced at the Chicago Mercantile Exchange (now the CME Group) in 1972 soon after the fixed exchange rate system and the gold standard were discarded (CME Group, 2020). Considering all this information this research creates models for the currency futures derivatives contract strategies such as covered call and put, and protective call and put with suitable payoff table and payoff chart.

Review Literature

Implied Link-2 (web) Forward contracts can be used for hedging purposes and enable an investor to lock in a specific currency's exchange rate. Forwards can be customized by amount and date as long as the settlement date is a working business day in both countries. Inferred Link-2 (web) Forward agreements can be utilized for supporting to minimize risk purposes and empower a financial backer to secure a particular currency swapping scale. Forwards can be customized by sum and date as long as the settlement date is a functioning work day in the two nations. Implied Link- 3 (web), It is seen that wide assortment of currency futures contracts are accessible. Beside the well-known agreements like the EUR/USD, there are additionally E-Micro Forex Futures gets that exchange at 1/tenth the size of ordinary currency futures contracts, just as emerging market currency matches like the PLN/USD (Polish zloty/U.S. dollar futures contract) and the RUB/USD (Russian Ruble/U.S. dollar futures contract). Various contracts trade with changing levels of liquidity; for example, the day-by-day volume for the EUR/USD contract may be 400,000 versus 33 for an emerging market like the BRL/USD (Brazilian genuine/U.S. dollar) (Fischer Black, 1975). A financial backer who needs the activity on a stock has two different ways of getting it. He can bargain straightforwardly in the stock, or he can bargain in the option. For comparable dollar activity, he as a rule needs to take a bigger offer situation in the option than he would take in the stock. Fernandies & Santos (2002), the outcomes show that the new risk measure was more factual significant than the customary beta of CAPM, for that the data provided by the proportion of the exhibition (modified alpha) appeared to be more solid. Bartram (2004), in his article gave a complete record of the current observational proof on the utilization of derivatives by and large and options specifically by non-monetary organizations across various underlying and nations. James Chong (2004), this investigation is particularly clear for GBP/DEM rides and less significantly for JPY/DEM rides. Nonetheless, the options trading technique benefits of the value taker are inadequate to exceed transaction costs, an outcome considered reliable with market effectiveness. Ederington (2005), propose that spreads for mixes are more modest than for straight buys and deals of individual options. Charles & CAO (2005), he found that option trading procedures dependent on these discoveries produce economically critical strange returns in the scope of 1–3% each day. Garner (2006), he found that merchants are enticed into long option methodologies since buying a option furnishes them with limitless benefit potential with risk restricted to the premium paid. The utilization of options and futures in risk managing scenarios particularly the liquidity risk was all around scrutinized by Don M. Chance (2008). Their primary commitment was to give reasoning to the utilization of futures and options in flawed capital market sectors for risk the board purposes by a risk disinclined firm that faces joint cost commitment and liquidity risk. The scientific outcomes showed that there was a supporting job for options on futures and the extra openness to value risk made by the options position is somewhat counterbalanced by a change of the futures position. Mathematical outcomes showed that the presence of liquidity risk lessens the ideal futures fence proportion and that options are not typically utilized before a liquidity need really emerges. Laporte & Edward (2011) has investigated the options trading systems to dispose of all market risk and transform a customary iron condor trading into an iron cockroach approach in the U.S. Keene & Andrew (2013) expressed in this article about a equity trading methodology wherein options are utilized to trade transient price focuses because of the rise of impetus occasions in 2013. The principle topics shrouded remember the test for picking price targets during impetus occasions, the utilization of options market to move toward impetus trading, and the estimation of estimated move objectives. Ramasamy & Prabhakaran (2018), He tracked down that in various market discernment and price developments and various methods are helpful. Options techniques are mind boggling positions made including a blend of options and underlying shares which assist the financial backer with profiting by his view. John & Hull (2018) According to him, the options, futures, and other derivatives gives researchers a new look and cutting edge in derivatives markets. By fusing the business' most blazing points, for example, the securitization and credit emergency, he helps overcome any barrier among hypothesis and practice in his book called choices, options, and other derivatives. Shalini, (2018), she tracked down that short-put synthetic straddle method is compelling in upgrading gets back to the option merchant by lessening the premium outlay to the option dealer. Kalainesan et al., (2020), he expressed in his presentation that relying upon where the basic resource is according to the option strike price, the option can be in, out, or at the money. Ramakrishnan, P.R. (2020), financial backers who traded are encouraged to painstakingly peruse the model risk disclosure document, given by the intermediary to his customers at the hour of consenting to arrangement.

Objectives of the Study

The objectives of the study are place as follow: -

Options design model for covered call - currency long futures and short call

Options design model for covered put – currency short futures and short put

Options design model for protective call – currency short futures and long call

Options design model for protective put – currency long futures and long call

Research Methodology

Our investigation on the point “Strategies complimenting to protect USDINR currency futures with the goal of maximum return and minimum loss” depends on solely on secondary information taken from different journal articles and reports gave by NSE, BSE.

Results

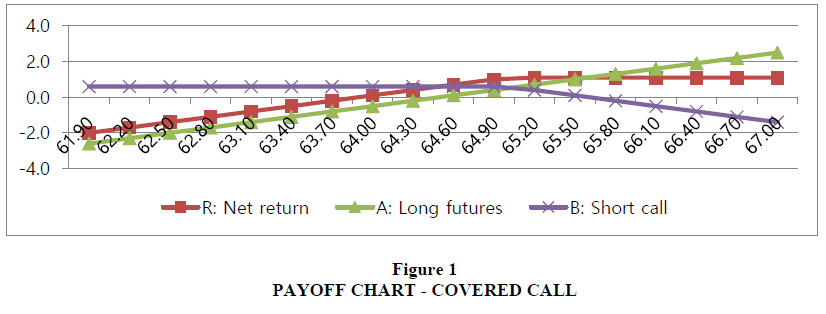

Covered Call

Objective: Assume that you have a long position on USD-INR futures and you are keen on diminishing the expected misfortune on it if market deliberates. While you diminish misfortunes, you are not sharp for any money payout to accomplish the goal.

Option design: You short OTM USD-INR call option with same prime of life as that of futures options. This methodology of having an existing long position in currency and a supplementing short call position is called covered call. In this strategy the long position provides “cover” to the short call i.e., on the off chance that the call options gets worked out, you could use the long position to carry the currency to resolve the claim on short call. Thus the name covered call.

Payoff: On the off chance that USD-INR debilitates, the futures position will bring about misfortunes and the short call position won’t get worked out. The premium generated from short call can counterbalance part of the misfortunes from long futures position. Then again if USD-INR reinforces, long currency futures position will turn profitable and short call position may get exercised and therefore offsetting part of the profits in Table 1.

| Table 1 Payoff Table-Covered Call | |||

| Spot | R-Net Return | A-Long futures at 64.50 | B-Short call (65 strike at 0.6) |

| 61.90 | -2.0 | -2.6 | 0.6 |

| 62.20 | -1.7 | -2.3 | 0.6 |

| 62.50 | -1.4 | -2.0 | 0.6 |

| 62.80 | -1.1 | -1.7 | 0.6 |

| 63.10 | -0.8 | -1.4 | 0.6 |

| 63.40 | -0.5 | -1.1 | 0.6 |

| 63.70 | -0.2 | -0.8 | 0.6 |

| 64.00 | 0.1 | -0.5 | 0.6 |

| 64.30 | 0.4 | -0.2 | 0.6 |

| 64.60 | 0.7 | 0.1 | 0.6 |

| 64.90 | 1.0 | 0.4 | 0.6 |

| 65.20 | 1.1 | 0.7 | 0.4 |

| 65.50 | 1.1 | 1.0 | 0.1 |

| 65.80 | 1.1 | 1.3 | -0.2 |

| 66.10 | 1.1 | 1.6 | -0.5 |

| 66.40 | 1.1 | 1.9 | -0.8 |

| 66.70 | 1.1 | 2.2 | -1.1 |

| 67.00 | 1.1 | 2.5 | -1.4 |

Model

You as of now have a long futures position in USD-INR at 64.50 and you are quick to diminish misfortunes on this position if USD-INR debilitates past 64.50 that is, goes underneath 64.50. As expressed above, you are not quick to pay any advance money to purchase security and in this way you got short call at strike of 65.00 and furthermore get premium of 0.6. On the off chance that USD-INR debilitates beneath 64.50, the futures position bring about misfortunes and the misfortunes are somewhat counterbalanced by the premium established on short call. Simultaneously, when USD-INR reinforces above 64.50 and keeps on fewer than 65.00, there is benefit in long futures position and you likewise procure premium on short call which isn’t worked out. In this way the joined returns are higher than independent long futures. Furthermore, if USD-INR fortifies over 65.00, the call gets practiced and incompletely counterbalances the benefit on long futures position. Additionally, an exporter with USD receivables can diminish hazard by composing a call option in Figure 1.

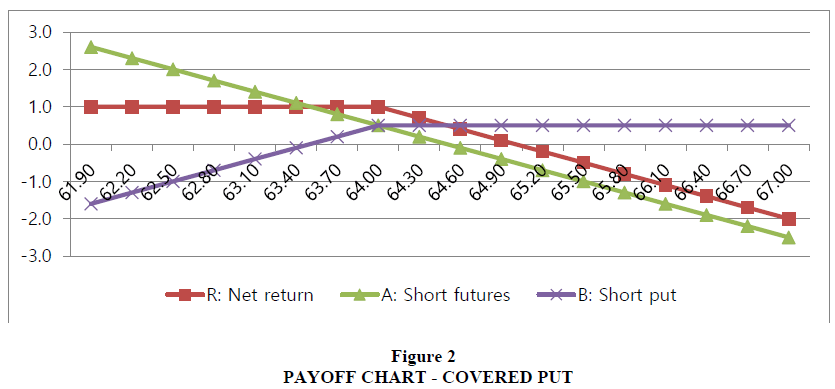

Covered Put

Like covered call, you could likewise short a put on the rear of a current short currency futures position. This blend is called covered put.

Model

You as of now have a short futures position in USD-INR at 64.50 and you are quick to diminish misfortunes on this position if USD-INR reinforces past 64.50 that is, goes above 64.50. As expressed in Table 2, you are not quick to pay any forthright money to purchase security and accordingly you go short put at strike of 64.00 and furthermore get premium of 0.5. In the event that USD-INR debilitates beneath 64.50, the futures position brings about misfortune and the misfortunes are halfway balanced by the premium got on short put. Simultaneously, when USD-INR debilitates beneath 64.50 and stays under 64.00, there is benefit in short futures position and you likewise procure premium on short put which isn’t worked out. Hence the joined returns are higher than independent short futures. What’s more, if USD-INR debilitates fewer than 64.00, the put gets practiced and part of the way counterbalances the benefit on short futures position. Essentially, an importer with USD receivables can lessen hazard by composing a put option in Figure 2.

| Table 2 Payoff Table-Covered Put | |||

| Spot | R-Net Return | A-Short futures at 64.50 | B-Short put (64 strike at 0.5) |

| 61.90 | 1.0 | 2.6 | -1.6 |

| 62.20 | 1.0 | 2.3 | -1.3 |

| 62.50 | 1.0 | 2.0 | -1.0 |

| 62.80 | 1.0 | 1.7 | -0.7 |

| 63.10 | 1.0 | 1.4 | -0.4 |

| 63.40 | 1.0 | 1.1 | -0.1 |

| 63.70 | 1.0 | 0.8 | 0.2 |

| 64.00 | 1.0 | 0.5 | 0.5 |

| 64.30 | 0.7 | 0.2 | 0.5 |

| 64.60 | 0.4 | -0.1 | 0.5 |

| 64.90 | 0.1 | -0.4 | 0.5 |

| 65.20 | -0.2 | -0.7 | 0.5 |

| 65.50 | -0.5 | -1.0 | 0.5 |

| 65.80 | -0.8 | -1.3 | 0.5 |

| 66.10 | -1.1 | -1.6 | 0.5 |

| 66.40 | -1.4 | -1.9 | 0.5 |

| 66.70 | -1.7 | -2.2 | 0.5 |

| 67.00 | -2.0 | -2.5 | 0.5 |

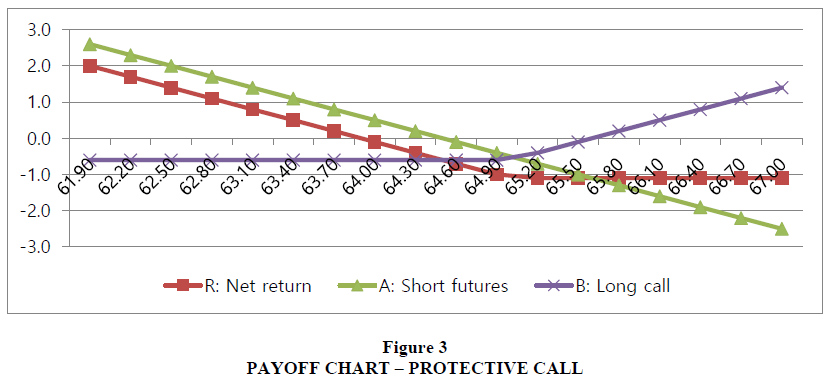

Objective Assume you as of now have a short position on USD-INR futures and you are keen on diminishing the likely misfortunes on it, if market fortifies. While you try to lessen misfortunes, you are alright to pay additionally to accomplish the goal.

Option design: You purchase OTM USD-INR call option with same prime of life as that of futures contract. This methodology of having a current short position in currency and a long call position is called protective call.

Payoff: On the off chance that USD-INR reinforces, the futures position will bring about misfortunes and the long call position will get worked out. The result from long call will part off the way counterbalanced the misfortunes from short futures position. Then again if USD-INR debilitates, short currency futures position will turn beneficial and long call position may not get practiced and hence the premium misfortune on long call will counterbalance part of the benefits.

Model: You as of now have a short futures position in USD-INR at 64.50 and you are quick to lessen misfortunes on this position if USD-INR fortifies past 64.50 that is, goes above 64.50. As expresses in Table 3, you are alright to pay forthright money to obtain assurance. You go long call at strike of 65.00 and pay premium of 0.6. On the off chance that USD-INR fortifies over 65.00, the futures position bring about misfortunes and the misfortunes are halfway counterbalanced by acquire in long call. Simultaneously, when USD-INR debilitates beneath 64.50 there is benefit in short futures position however it is somewhat balanced by the premium paid on long call. Accordingly, the misfortunes in joined procedures are lower than independent short futures. If it’s not too much trouble, note that in price scope of 64.50 to 65.00, the misfortunes in the consolidated system are higher than the independent short futures in Figure 3.

| Table 3 Payoff Table-Protective Call | |||

| Spot | R-Net Return | A-Short futures at 64.5 | B-Long call (65 strike at 0.6) |

| 61.90 | 2.0 | 2.6 | -0.6 |

| 62.20 | 1.7 | 2.3 | -0.6 |

| 62.50 | 1.4 | 2.0 | -0.6 |

| 62.80 | 1.1 | 1.7 | -0.6 |

| 63.10 | 0.8 | 1.4 | -0.6 |

| 63.40 | 0.5 | 1.1 | -0.6 |

| 63.70 | 0.2 | 0.8 | -0.6 |

| 64.00 | -0.1 | 0.5 | -0.6 |

| 64.30 | -0.4 | 0.2 | -0.6 |

| 64.60 | -0.7 | -0.1 | -0.6 |

| 64.90 | -1.0 | -0.4 | -0.6 |

| 65.20 | -1.1 | -0.7 | -0.4 |

| 65.50 | -1.1 | -1.0 | -0.1 |

| 65.80 | -1.1 | -1.3 | 0.2 |

| 66.10 | -1.1 | -1.6 | 0.5 |

| 66.40 | -1.1 | -1.9 | 0.8 |

| 66.70 | -1.1 | -2.2 | 1.1 |

| 67.00 | -1.1 | -2.5 | 1.4 |

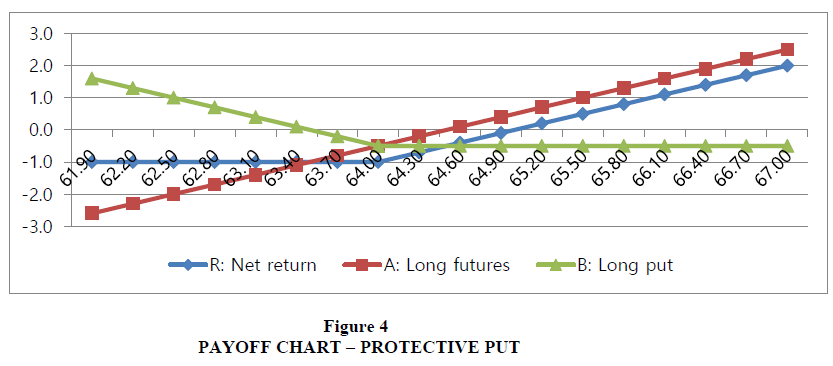

Protective Put

Like protective call, you could likewise have since a long time ago long put on the rear of an existing currency futures position. This mix is called protective put.

Model: You as of now have a long futures position in USD-INR at 64.50 and you are quick to lessen misfortunes on this position if USD-INR debilitates underneath 64.50. As expressed in Table 4, you are alright to pay forthright money to purchase security. You go since a quite while long put at strike of 64.00 and pay premium of 0.5. In the event that USD-INR debilitates fewer than 64.00, the futures position brings about misfortune and the misfortunes are mostly counterbalanced by gain in long put. Simultaneously, when USD-INR fortifies above 64.50 there is benefit in long futures position however it is incompletely balanced by the premium paid on long put. Consequently, the misfortunes in joined strategy are lower than independent short futures. Kindly note that the price scope of 64.00 – 64.50, the misfortunes in joined strategy are higher than the independent long futures in Figure 4.

| Table 4 Payoff Table-Protective Put | |||

| Spot | R-Net Return | A-Long futures at 64.5 | B-Long put (64 strike at 0.5) |

| 61.90 | -1.0 | -2.6 | 1.6 |

| 62.20 | -1.0 | -2.3 | 1.3 |

| 62.50 | -1.0 | -2.0 | 1.0 |

| 62.80 | -1.0 | -1.7 | 0.7 |

| 63.10 | -1.0 | -1.4 | 0.4 |

| 63.40 | -1.0 | -1.1 | 0.1 |

| 63.70 | -1.0 | -0.8 | -0.2 |

| 64.00 | -1.0 | -0.5 | -0.5 |

| 64.30 | -0.7 | -0.2 | -0.5 |

| 64.60 | -0.4 | 0.1 | -0.5 |

| 64.90 | -0.1 | 0.4 | -0.5 |

| 65.20 | 0.2 | 0.7 | -0.5 |

| 65.50 | 0.5 | 1.0 | -0.5 |

| 65.80 | 0.8 | 1.3 | -0.5 |

| 66.10 | 1.1 | 1.6 | -0.5 |

| 66.40 | 1.4 | 1.9 | -0.5 |

| 66.70 | 1.7 | 2.2 | -0.5 |

| 67.00 | 2.0 | 2.5 | -0.5 |

Conclusion

All investors’ are looking decent dividend and capital gain as ROI for their investments. In order to satisfy investors’ companies adopt various strategies in announcing and committing dividend payout to their equity capital providers. It is to characterize as wealth creation is a measure of income (Shankar, 2021). The above is itemized result for instance of these systems and the connected compensation of diagram. Kindly note the distinction in every one of the procedure regarding greatest benefit, benefit zone and most extreme misfortune. The following observations have brought better position in currency futures.

1. USD-INR reinforces above 64.50 and keeps on fewer than 65.00, there is benefit in long futures position.

2. USD-INR debilitates beneath 64.50 and stays under 64.00, there is benefit in short futures position and you likewise procure premium on short put which isn’t worked out. Hence the joined returns are higher than independent short futures.

3. USD-INR debilitates beneath 64.50 there is benefit in short futures position however it is somewhat balanced by the premium paid on long call.

4. USD-INR fortifies above 64.50 there is benefit in long futures position however it is incompletely balanced by the premium paid on long put

References

- Billingsley, R.S., & Chance, D.M. (1985). Options market efficiency and the box spread strategy. Financial Review, 20(4), 287-301.

- Britain, P., & Garner, C. (2006). Eight simple but proven option strategies. FUTURES-CEDAR FALLS IOWA THEN CHICAGO-, 35(12), 6.

- Cao, C., Li, H., & Yu, F. (2005). Is investor misreaction economically significant? Evidence from short?and long?term S&P 500 index options. Journal of Futures Markets: Futures, Options, and Other Derivative Products, 25(8), 717-752.

- Chaput, J.S., & Ederington, L.H. (2005). Vertical spread design. The Journal of Derivatives, 12(3), 28-46.

- Chong, J. (2004). Options trading profits from correlation forecasts. Applied Financial Economics, 14(15), 1075-1085.

- Ferguson, R. (1993). Some formulas for evaluating two popular option strategies. Financial Analysts Journal, 49(5), 71-76.

- Fischer Black., (1975). Financial Analysts Journal, 1(4) (Jul. - Aug., 1975), 36-41+61-72,

- Govindasamy, D. P., Shankar, D., Uma, K., & Ravimohan, M.R. (2021). Modeling of dividend payout, retention, yield, capital gains and irrelevance and its impact on value of the firm. Journal of Contemporary Issues in Business and Government, 27(2), 5166-5178.

- Govindasamy, P., & Ravimohan, M.R. Analytical study on max pain theory and pcr is the novel strategy in options trading.

- Govindasamy, P. et al. (2020). Exhilarating Challenges of Rural Credit and Microfinance Modeling. Mukt Shabd Journal, 9(4), pp.211-218. http://shabdbooks.com/gallery/22.pdf

- Hull, J.C. (2018). The Black-Scholes-Merton Model. Options, Futures, and Other Derivatives, 10th ed. New York: Pearson.

- Keene, A. (2013). Using options to trade with measured-move targets. FUTURES, 32-44.

- Laporte, E. (2011). How can we eliminate all risk in one direction on our iron condor. FUTURES, 15.

- Kalainesan, Mr.N. et al. (2020). Options pricing under multiple sources of uncertainty - case analysis. PURAKALA Journal, 31(18), 341-351.

- Premraj, H. et al. (2020) Case analysis on constructing and admonishing financial portfolios and investment strategies. Adalya JournaL, 9(4),699-706.

- Ramakrishnan, P.R. et al. (2020). Market movements of equity and currency derivatives – an empirical analysis. UGC Care Group-I: Alochana Chakra Journal, 9(4), 3166-3171.

- Ramasamy, V.G., & Prabakaran (2018). Optimal trading strategies and performance of options at NSE. International Journal of Advanced Research,1337-1344.