Research Article: 2022 Vol: 21 Issue: 3

Strategic Sustainability in Real Estate Investing Focused on the New Norm

Montajula Suvattanadilok, King Mongkut’s Institute of Technology, Ladkrabang Business School

Citation Information: Suvattanadilok, M. (2022). Strategic sustainability in real estate investing focused on the new norm. Academy of Strategic Management Journal, 21(S3), 1-11.

Abstract

This study aims to examine the role and extent of the influence of variables such as technological innovation, external factors, and economic stability on strategic sustainable real estate profitability in Thailand and their mean differences to determine which variable has the greatest influence of all. The issue is that real estate cannot be developed in the event of a pandemic due to a shortage of funds. A total of 400 questionnaires have been provided to participants in Bangkok's real estate market. Another effective variable of technological advancement is employee preparation, which includes information management. Some financial terms, such as "sustainable cash flow" and "while in" real estate investing, have various connotations. Other factors, ranging from cultural norms about community design and appearance to institutional financials, design, and business frameworks, are said to have a significant impact on long-term strategic success. The findings indicate that the capital employed by both real estate enterprises is a critical factor in determining the stakeholders' profitability. Profitability and value of the real estate company are influenced by collaborative efforts between stakeholders such as renters, developers, and construction builders. This indicates that both real estate businesses rely heavily on investor trust to generate revenue. As the public's preference for online transactions increases, future research could look into electronic real estate investment trust (eREITs), or electronic real estate investment trusts. The author recommends that crowdfunding platforms, in particular, will help to keep real estate dynamic even during a crisis.

Keywords

Technological Innovation, Economic Stability, Strategic Sustainable Real Estate Profitability, Investment, Employee Training.

Introduction

The outbreak was the cause of the decline, but a slowdown in new condominium supply units has already resulted in a decrease in units in 2019 (Alderman, & Beuhlmann, 2020). Prior to the emergency, the number of foreign buyers, particularly in China, had decreased as a result of the currency rate (Thaiger, 2020). The slowdown remains optimistic because excess supply causes far more problems. The condominium market would grow a balance even without the outbreak, while the supply would slow down progressively. Nearly no new supply joins the good news to compete with the current ones. The developers concentrated on the sale and completion of their unsold assets. It will be about 40,000 units a year to supply new detached homes and this has occurred over the past ten years (Delmendo, 2020). This reflects the constant growth in the capital's land prices as good sites become increasingly rare. In areas next to existing and proposed mass-transit lines, particularly the latter, who will extend into the suburbs, an increasing share of Thai buyers favor townhouses over condominiums.

Customer retention is critical in real estate, as it is in other industries, to ensure that their product remains in consumers' minds and they do not switch to competing brands (Suvattanadilok, 2020). The pandemic coronavirus has slowed housing demand. Numerous homes and condominiums with a combined value of more than $15 billion remain unsold (Gascon & Haas, 2021). Despite the lack of demand, developers made an attempt to sell what remained (Tan, 2020). In reality, home prices have increased, but new construction and sales have decreased (Tan, 2020). According to the Real Estate Information Center (REIC), the pandemic is likely to result in a 15% decline in the national housing market this year, owing to a 5.5 percent decline in GDP growth and a sharp decline in housing maintenance rates (Cakmakli et al., 2020).

The majority of real estate providers' first-quarter listings indicate that they maintained a healthy average net profit margin (Severino, 2021). At the moment, public spending is the primary driver of the real estate industry, and the government has canceled all major real estate-related transportation projects. Interest rates are also a significant consideration for developers and buyers (Tandon, 2020). Since the pandemic's outbreak, China's foreign buyers have had additional time to investigate numerous opportunities (Sharma, 2020).

The residential market will experience a two-stage recovery. After international travel resumes, the second phase of recovery will focus on business and leisure travel, as some 2021 late estimates indicate (Parpart, 2020). In various markets, e-commerce-related logistics were involved, primarily in Southern China and India. Volumes of investment decreased by 50 percent in the first half of 2020 (Gan, 2020). Investors look at occupying markets with great caution, with challenges in terms of the price of the future tenancy risk. Repricing takes place in a variety of countries, but at present, yields are not expected to substantially decrease in the short term in most countries, given the low interest rates (Limited, 2020). The problem is that real estate cannot be developed during a pandemic because of a lack of sufficient funding. If alternative technologies, such as digital transformation, become the main technology utilized to access online trade platforms, the subsequent transition of real estate inhabitants and owners may be challenging.

Literature Review

Technological Innovation

Technology will significantly improve productivity by investing in revenue, benefit, or business expansion technologies and participating in the recovery to maintain a competitive edge. Dhrifi (2015) states that businesses must exchange certain current costs to ensure that they have long-term benefits. Two main market strategies can be chosen to improve the company's worth, as the second indicates: income increase or profitability. Specifically, property could attempt to help with the selected strategies like increasing asset value, stimulating productivity, but may also have other implications for other strategies such as improving core business functions, in addition to that area of focus. Other objectives of property investment could include, among others, increasing the overall company creativity, improving core business productivity, and employee satisfaction (Aho et al., 2013; Cakmakli et al., 2020).

The importance of immobilization techniques is used to calculate a collection of immobilization strategies which align with the core enterprise profitability plan for growth or growth in sales (Zhou & Luo, 2018). Thus, the immobilization techniques that were only associated with the central profitability strategy in the original model cost reduction, for one group of companies, flexibility and productivity is essential. Taking into account the viability of corporate real estate strategies, growth is positively connected to a corporate strategy of productivity, the architecture factor for workplaces, the sustainability factor and the technical factor of access to employees (Suvattanadilok, 2020). So, companies adopt real estate strategies to encourage growth in profitability taking account of location quality, size and cost of occupancy. The model allows us to examine the link between investment and technological innovation at the same time as economic development and economic growth in a different vein of empirical literature on this subject (Kauko, 2018). It encourages technical progress and thus stimulates economic development in a successful manner. On this basis, several endogenous growth models have shown that human capital's contribution has an impact on technological development and has a long-term effect on economic growth. The future of real estate also depends on how technology works (Kiefer et al., 2019). When considering the dynamics and processing, it is important to remember that this is not a technological upheaval linear evolution with abrupt transformations, but rather the corresponding recursive creation of trial and error, with unequal time and space evolutionary processes.

There must be appropriate selections of varying standards of consistency and accessibility in business, because sustainable drivers: production technology, society, governance, and user modes all change rapidly, and it is critical that no particular property or building kit has been ignored, even if it appears to be minimal at some point (Schäfer & Mayer, 2019). These standards primarily contribute to the construction industry's country-specific sustainable development strategy and the determination of a building firm to engage in processes to continuously improve building working conditions, increase productivity in the use of available resources, retain natural resources' capacity to refresh technologies, and improve resource production in a building. Therefore, the author hypothesized:

H1a: Technological Innovation Influence Significantly on Economic Stability.

H1b: Technological Innovation Influence Significantly on Strategic Sustainable Real Estate Profitability.

Economic Stability

According to Kinderman (2012), disclosure helps to avoid and helps to create harmful economic and social imbalances in corporate openness and confidence. Furthermore, not everyone understands the crisis management of buildings and real estate in the same way that various strategies are applied. The economic, cultural, ethical, educational and psychological aspects of crisis management appear to be less concentrated (Waldron, 2018). Social, environmental and economic enterprise costs of implementation, growth and restructuring are driven by the strengths of the government. A precise strategic focus on a sustainable agenda's primary area of expenditure and planned costs promotes efficient implementation of positive financial results (Klettner et al., 2014). In addition, government policy, which also covers sustainable aspects of investor relations practitioners' assessment phase, urges firms to report more than past strategic sustainability efforts. Moreover, this view not only confirms the external demand for real business, the sustainability policy of the estate, but also the progress and business statements of the participants (Savitz, 2013). Well-developed infrastructure allows manufacturing and distribution of the products produced (Ghazali, 2010).

It will raise investment efficiency and operational costs will be lowered. From the standpoint of the internal market, the business situation is strengthened by the strengths of sustainability, which necessitates investments in staff preparation, environmental indicator optimization, and modern business adoption overall approach (Charfeddine & Kahia, 2019). On the one hand, this proposal underlines that these non-traditional investments increase moral capital, and otherwise optimize consumption prices both inside and outside, so, in conjunction with the modern organization, both effects improve the orientation of the role of the real estate companies and their organizational and strategic role efficiency in the use of current money (Liu et al., 2018). There are a variety of indexes and income (or business) indicators, economic analyses and summaries on topics such as the user price index (the measure), and unemployment. Moreover, economic theory and practice have not been made with a clear response to what should be finished. Experts believe that it was the war that helped out of the depression country (Yamarone, 2017). The author concentrates on integration in particular material and semiotic areas of human action, in particular sustainable economic systems in relation to the subject (Lejano & Stokols, 2013).

H2: Economic Stability Influence Significantly on Strategic Sustainable Real Estate Profitability.

Strategic Sustainable Real Estate Profitability

The author concentrates on integration in particular material and semiotic areas of human action, in particular sustainable economic systems in relation to the subject. The author stress all of those different structures the integration problem mentioned previously emerged as a solution the complementary structures should rather not be viewed as competing. These mortgages were just unsustainable in relation to the true economic development material basis (Lejano & Stokols, 2013).

Conceptual Framework

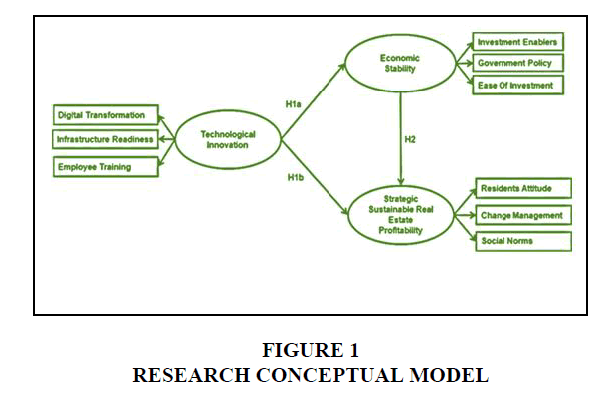

Zhou & Luo (2018) discovered Strategic sustainable real estate profitability is a major factor in technical advancement. Also, Zhou & Luo (2018) developed a set of immobilization methods associated with the core company's profitability strategy for revenue development or growth, the value of immobilization techniques is being used. Economic stability and investment convenience have formed a two-way correlation, which is considered to be an investment attractor (Kauko, 2018). Kauko also discovered the impact of technological innovation on economic stability. Moreover, investment could influence higher investment and consumption in the short term and reflect negatively long-term growth (Ghazali, 2010). Ghazali considered the impact of external factors on economic stability significantly. Lejano & Stokols (2013) emphasize all the different structures of the previously mentioned integration problem as a solution and, in relation to the material reality of economic growth, these mortgages have been unsustainable. As a result, based on previous research, the researcher has derived the following modified conceptual frame (Figure 1).

Methodology

This study is looking at individuals who own and/are operating actual properties in the real estate industry in order to collect evidence for longer-term viability methods as well as new residential and commercial property and leaseholders want to know that their investment will give them a constant development.

Throughout the research period, surveys will be conducted with institutional approval, and 400 volunteers will be supplied with the questionnaire. The researcher and crew will next contact the volunteers. Between February and March 2021, the investigators will conduct a six-week survey. Data gathering and security are the investigator's and team's responsibility. The database does not contain the participants' names or any other personally identifiable information. A total of 400 questionnaires will be distributed randomly to residents of real estate developments in Bangkok and surrounding provinces and the investigator and teammates will contact residents and property owners in the lobbies of the residences to solicit assistance with the survey.

The following are the findings of the investigation.

Table 1 summarizes the statistical measure of model consistency in Confirmatory Factor Analysis in relation to the research hypotheses and data on Organization Environment. As illustrated below, the model fit displays statistical findings that are within the stated level: X2=47.108 with 14 degrees of freedom (df), and X2/df=3.365. This matches the specified level and has a p-value of .000, which also matches the declared level. The RMSEA, RMR, GFI, and CFI readings are all within the specified ranges.

| Table 1 Goodness Of Fit Test For Confirmatory Factor Analysis Of The Model Of This Study |

||

|---|---|---|

| Goodness of fit statistics | Levels | Statistics |

| Chi-square | 47.108 | |

| Probability level (p) | >0.05 | 0.000 |

| X2/df | <5.00 | 3.365 |

| RMSEA | <0.08 | 0.077 |

| RMR | <0.05 | 0.011 |

| GFI | ≥0.9 | 0.976 |

| Comparative Fit Index (CFI) | ≥0.9 | 0.984 |

As shown in Table 2, the total effect of technological innovation (1.088) on strategic sustainable real estate profitability is statistically higher in comparison with economic stability. Afterwards, technological innovation has a clear overall impact (0.761) on economic stability.

After evaluating the structural model's fit, the suggested model's hypotheses are tested. Table 3 illustrates the Association Strength concept. This section summarizes the findings of three hypotheses from the Real Estate Profitability Model. All hypotheses are supported, as indicated in Table 4. Notably, the study concludes that technological innovation has a significant positive association (R=0.711**) with economic stability in Thailand. Following that, economic stability has a significant positive link with strategic sustainable real estate profitability (R=0.684**).

| Table 2 Standardized Modified Structural Equation Modeling Total Effects |

|||||||

|---|---|---|---|---|---|---|---|

| Economic Stability | Strategic Sustainable Real Estate Profitability | ||||||

| Variables | Direct | Indirect | Total | Direct | Indirect | Total | |

| Technological Innovation | 0.761 | - | 0.761 | 1.715 | -0.627 | 1.088 | |

| Economic Stability | -0.639 | 1.051 | 0.413 | -0.824 | - | -0.824 | |

| **significant at the 0.01 level (2-tailed). | |||||||

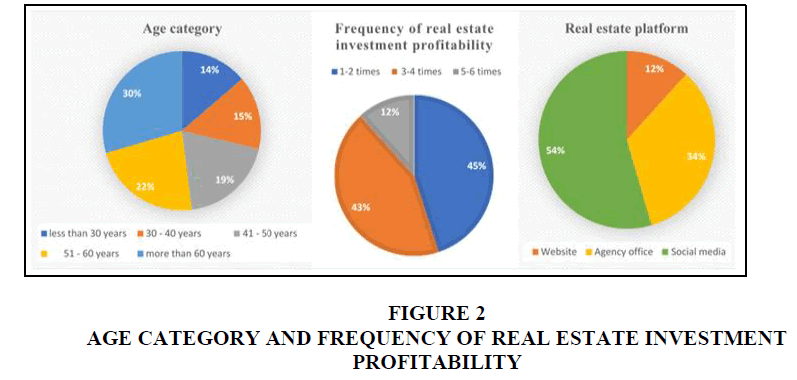

Figure 2 shows that 118 real estate investors over the age of 60 were the most assigned part of the survey, accounting for 29.5 percent of respondents. Following that, 90 real estate investors between the ages of 50 and 60 comprised 22.5 percent of the respondents to this study. Also, Figure 2 shows that 180 real estate investors stated that their investment in real estate was profitable 1-2 times per year, accounting for 45.0 percent of the total number of respondents. Following that, 173 real estate investors, or 43.3 percent of those who responded to the survey, stated that their real estate investment was profitable three to four times per year. According to Figure 2, 218 real estate investors reported that they use social media to receive information about properties, which was the most allocated component of the study, accounting for 54.5 percent of respondents. Following those 135 real estate investors reported that they use agency offices to exchange property information, accounting for 33.8 percent of the respondents to this report.

• Technological Innovation (TI)

• Technological Innovation (TI)

• Economic Stability (ES)

• Strategic Sustainable Real Estate Profitability (SSREP)

Discussion

According to Kumar et al. (2017) strengthening the firm's competitive advantages, continuous improvement in technology innovation capabilities, and human resource innovation capabilities are needed for all firms to be effective in the real estate market. Furthermore, Zhou & Luo (2018) discovered a direct relationship, demonstrating that rises in higher education input are a driving force for technological innovation, and technological innovation is a driver for economic development. Furthermore, Liu & Xia (2018) asserted that the government should provide adequate export subsidies and tax rebates for real estate. They also noted that such policies could optimize economic benefits and foster technological innovation for overall economic growth. While the author discovered that technological innovation has a significant impact on economic stability through employee preparation and digitalizing real estate platforms (r=0.711**, H1a, Table 4.).

| Table 3 Correlations Between The Variables | ||||

|---|---|---|---|---|

| Correlations | ||||

| TII | ESS | SSSREP | ||

| TII | Pearson Correlation | 1 | .711** | .552** |

| Sig. (2-tailed) | 0 | 0 | ||

| ESS | Pearson Correlation | .711** | 1 | .684** |

| Sig. (2-tailed) | 0 | 0 | ||

| SSSREP | Pearson Correlation | .552** | .684** | 1 |

| Sig. (2-tailed) | 0 | 0 | ||

Note: **. Correlation is significant at the 0.01 level (2-tailed).

Vanags & Butane (2013) discovered that an integrated approach to the economic and ecological aspects of a sustainable investment climate is expected to lay the groundwork for increased sustainability and harmonization of the investment environment in the real estate industry. Furthermore, Goering (2009) asserted that if we pursue the encouragement of those who want to push the envelope of sustainable planning to include more than individual properties, we will encounter a useful dynamic for potentially triggering a reevaluation of long-standing methods of constructing American communities; sprawled and expensive. In line with this, the author discovered the effect of technological innovation on strategic sustainable real estate profitability through online information exchange with investors (r=.552**, H1b, Table 4.).

| Table 4 Hypotheses Testing | |||

|---|---|---|---|

| Hypotheses | R | Association Strength | Results |

| Technological Innovation Influence Significantly on Economic Stability (H1a). | 0.711** | Strong Positive correlation | Supported |

| Technological Innovation Influence Significantly on Strategic Sustainable Real Estate Profitability (H1b). | 0.552** | Strong Positive correlation | Supported |

| Economic Stability Influence Significantly on Strategic Sustainable Real Estate Profitability. (H2). | 0.684** | Strong Positive correlation | Supported |

Carrasco-Gallego (2021) believes that a macroprudential instrument focused on the loan-to-value ratio for real estate will help stabilize the economy and ensure the system's sustainability. Furthermore, Kauškale & Geipele (2016) discovered that land and real estate are the main components of the material socioeconomic base, so all land redistribution issues were always relevant and significant for the society's growth. Moreover, real estate has always been linked to economic, social, ecological, technical, political, and legal issues. Walker & Goubran (2020) also noted that recent urban and demographic changes in cities, as well as changing political, social, cultural, economic, and technological realities, are pushing the real estate sector to respond to the call for sustainable urban living and to go beyond cost savings. Similarly, the author discovered that economic stability has a significant influence on strategic sustainable real estate profitability through strategic government policy toward real estate and investment enablers (r=0.684**, H2, Table 4.).

Conclusion

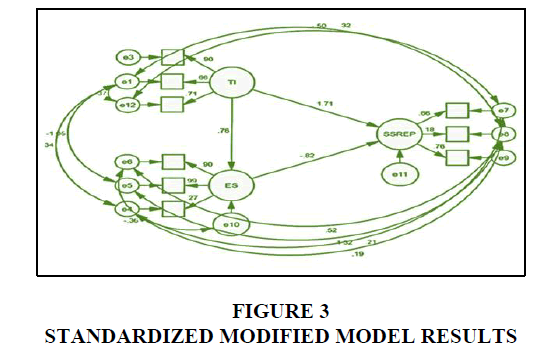

A very straightforward digital transformation has a huge effect on overall market innovation in real estate (estimated to be r=0.90) Also, employees will benefit from ongoing training and professional development (this has been shown in Figure 3. to be a factor of 71 in the rate of technical progress). An affordable housing requirement such as the regulations are making housing less risky for developers and has a coefficient of between -0.99 and -0.14 in the research shown in Figure 3. The Figures above highlight a key enabler for investors: The probability of sustainability when an investment in real estate is a property.

Some financial terms, like "Sustainable cash flow" and "while in" investing in real estate, are being interpreted in various ways. Other factors, shown in Figure 3, are said to have a significant effect on long-term strategic profitability, ranging from social norms such as public opinion about community design, and appearance, to institutional financials, design, and business frameworks. In addition, resident expectations of profitability in the area include the levels of expectations and their tolerance for financial loss, as seen in the Figure 3 (r=0.66). The findings show that the capital used by both real estate companies is the primary driver of the stakeholders' profitability. Integrated cooperation among stakeholders such as tenants, developers, and construction builders influence the real estate industry's profitability and valuation. This indicates that both real estate firms depend heavily on investor trust to make money.

Managerial implications

This article advises that firms that take the initiative in building a sound online platform in order to leverage the new advances in technology in property management to achieve the greatest production potential. In a given case, this could be a product of educational activities, social literacy, and helping residents expand their digital capabilities. In order to determine the impact of technological innovation and long-and overall market stability on long-term profitability, the study looks at technological innovation and overall market stability as variables.

Recommendations

Investors look for a variety of sources of liquidity in the best practices when examining the real estate sector opportunities. Future research should investigate the proportion of the public's online interest in investment vehicles, as well as the introduction of the eREIT, or electronic real estate investment trust, to determine how large this sector would grow. The real estate situation has been brought to a halt for the new normal because of an unexplained blockage, it seems. Business analysts should look to include more quantifiable measures of future profitability and other aspects of sustainable real estate projections in their recommendations to aid in making better financial forecasts.

Limitations

There are many barriers and restrictions to real estate trade-off progress. One challenge is the difficulty that growing restrictions have in maintaining a high quality of life in an area, while also helping growing businesses. Furthermore, real estate investors face a conundrum in which they tend to wait until a critical time of high-growth trade-off is formed. The problem is that real estate can hardly develop without adequate capital access during a pandemic. If other technology such as digital transformation becomes the dominant technology for using online exchange platforms, real estate residents’ and owners' transformation may be problematical.

References

Aho, E., Alkio, M., & Lakaniemi, I. (2013). The Finnish approach to innovation strategy and indicators. InHandbook of Innovation Indicators and Measurement. Edward Elgar Publishing.

Alderman, D., & Beuhlmann, U. (2020). The Virginia tech–US forest service February 2020 housing commentary: Section I.

Cakmakli, C., Demiralp, S., Kalemli Ozcan, S., Yesiltas, S., & Yildirim, M.A. (2020). COVID-19 and emerging markets: An epidemiological model with international production networks and capital flows.

Indexed at,Google Scholar, Cross Ref

Carrasco-Gallego, J.A. (2021). Real Estate, Economic Stability and the New Macro-Financial Policies. Sustainability, 13(1), 236.

Indexed at,Google Scholar, Cross Ref

Charfeddine, L., & Kahia, M. (2019). Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis.Renewable energy,139, 198-213.

Indexed at,Google Scholar, Cross Ref

Delmendo, L. (2020). Property in Thailand brings good returns. So why isn’t the market more vibrant?.

Dhrifi, A. (2015). Foreign direct investment, technological innovation and economic growth: empirical evidence using simultaneous equations model.International Review of Economics,62(4), 381-400.

Indexed at,Google Scholar, Cross Ref

Gan, C. (2020). China's E-commerce market: The logistics challenges.

Gascon, C.S., & Haas, J. (2020). The impact of COVID-19 on the residential real estate market.The Regional Economist,28(4).

Ghazali, A. (2010). Analyzing the relationship between foreign direct investment domestic investment and economic growth for Pakistan.International Research Journal of Finance and Economics,47(1), 123-131.

Goering, J. (2009). Sustainable real estate development: the dynamics of market penetration.Journal of Sustainable Real Estate,1(1), 167-201.

Indexed at,Google Scholar, Cross Ref

Kauko, T. (2018). Innovation in urban real estate: the role of sustainability.Property Management, 37(2), 197-214.

Indexed at,Google Scholar, Cross Ref

Kauškale, L., & Geipele, I. (2016). Economic and social sustainability of real estate market and problems of economic development–a historical overview.Baltic Journal of Real Estate Economics and Construction Management,4(1), 6-31.

Indexed at,Google Scholar, Cross Ref

Kiefer, C.P., Del Rio Gonzalez, P., & Carrillo?Hermosilla, J. (2019). Drivers and barriers of eco?innovation types for sustainable transitions: A quantitative perspective.Business Strategy and the Environment,28(1), 155-172.

Indexed at,Google Scholar, Cross Ref

Kinderman, D. (2012). ‘Free us up so we can be responsible!’The co-evolution of Corporate Social Responsibility and neo-liberalism in the UK, 1977–2010.Socio-Economic Review,10(1), 29-57.

Indexed at,Google Scholar, Cross Ref

Klettner, A., Clarke, T., & Boersma, M. (2014). The governance of corporate sustainability: Empirical insights into the development, leadership and implementation of responsible business strategy. Journal of Business Ethics, 122(1), 145-165.

Indexed at,Google Scholar, Cross Ref

Kumar, A., Kaviani, M.A., Hafezalkotob, A., & Zavadskas, E.K. (2017). Evaluating innovation capabilities of real estate firms: A combined fuzzy Delphi and DEMATEL approach.International Journal of Strategic Property Management,21(4), 401-416.

Indexed at,Google Scholar, Cross Ref

Lejano, R.P., & Stokols, D. (2013). Social ecology, sustainability, and economics.Ecological Economics,89, 1-6.

Limited, B. (2020). Bangkok’s condominium market in 2019 and operators’ strategy for survival in 2020.

Liu, C., & Xia, G. (2018). Research on the dynamic interrelationship among R&D investment, technological innovation, and economic growth in China.Sustainability,10(11), 4260.

Indexed at,Google Scholar, Cross Ref

Liu, Y., Li, J., & Yang, Y. (2018). Strategic adjustment of land use policy under the economic transformation.Land Use Policy,74, 5-14.

Indexed at,Google Scholar, Cross Ref

Parpart, E. (2020). Real estate market to pick up in second half of 2020.

Savitz, A. (2013).The triple bottom line: how today's best-run companies are achieving economic, social and environmental success-and how you can too. John Wiley & Sons.

Schäfer, S., & Mayer, H. (2019). Entrepreneurial ecosystems: Founding figures and research frontiers in economic geography.Zeitschrift für Wirtschaftsgeographie,63(2-4), 55-63.

Indexed at,Google Scholar, Cross Ref

Severino, R. (2021). Economic Insights: The economy’s uncertain path forward.

Sharma, A. (2020). Covid-19 impact: Co-working companies catering to startups may fade.

Suvattanadilok, M. (2020). Strategies of entrepreneurs to maintain clothing customers in Thailand.Revista Argentina de Clínica Psicológica,29(3), 709.

Tan, J. (2020). Thailand's condo market sinks as Chinese investment ebbs.

Tandon, S. (2020). Tata Realty not buying into Work from Home culture; planning for a massive office space portfolio.

Thaiger, T. (2020). Thailand's property market waits for an end to Covid-19.

Vanags, J., & Butane, I. (2013). Major aspects of development of sustainable investment environment in real estate industry.Procedia Engineering,57, 1223-1229.

Indexed at,Google Scholar, Cross Ref

Waldron, R. (2018). Capitalizing on the state: The political economy of real estate investment trusts and the ‘resolution’of the crisis.Geoforum,90, 206-218.

Walker, T., & Goubran, S. (2020). Sustainable real estate: Transitioning beyond cost savings. InSustainability. Emerald Publishing Limited.

Indexed at,Google Scholar, Cross Ref

Yamarone, R. (2017).The economic indicator handbook: How to evaluate economic trends to maximize profits and minimize losses. John Wiley & Sons.

Zhou, G., & Luo, S. (2018). Higher education input, technological innovation, and economic growth in China.Sustainability,10(8), 2615.

Indexed at,Google Scholar, Cross Ref

Received: 08-Dec-2021, Manuscript No. ASMJ-21-10325; Editor assigned: 10-Dec-2021, PreQC No. ASMJ-21-10325(PQ); Reviewed: 20-Dec-2021, QC No. ASMJ-21-10325; Revised: 29-Dec-2021, Manuscript No. ASMJ-21-10325(R); Published: 05-Jan-2022