Research Article: 2025 Vol: 24 Issue: 1

STRATEGIC MANAGEMENT PRACTICES AND PERFORMANCE OF FAMILY-OWNED FIRMS IN KAJIADO COUNTY, KENYA

Edwin Elisha-Omondi, Strathmore University

Citation Information: Omondi, E., E. (2025). Strategic management practices and performance of family-owned firms in Kajiado county, Kenya. Academy of Strategic Management Journal, 24(1), 1-32.

Abstract

Businesses experience multiple opportunities and challenges in an increasingly idynamic environment, thus it is becoming very important for businesses including Family businesses to understand their environment and how to adapt as they remain steadfast on their goals, and objectives. Strategies denote the decisions and actions that firms use to respond to changes in their environment. Family enterprises are more likely to face unique difficulties, including resource constraints and family members' meddling. Family-owned businesses may be able to adjust to the changes while maintaining their momentum toward goals and objectives by implementing strategic management techniques. The resource-Based View and open systems theory are the study's guiding theories. The study’s primary goal is to determine how different strategic management approaches affect the performance of family-owned businesses in Kajiado County, Kenya. The objectives are to determine how organizational systems and structure design impact family-owned company performance and how skills impact family-owned business success in Kajiado County, Kenya. Return on Assets is one metric used to assess how well family-owned businesses perform. The efficacy and protocols of strategic management are the phenomena under inquiry in this example, and the descriptive study methodology aids in collecting data and information to characterize the phenomenon. The study's target audience was family-run businesses in Kajiado County, Kenya. Fifty-two of the sample companies provided semi-structured questionnaires to collect primary data. Both inferential and descriptive statistics (such as percentages frequencies, means, averages, and modes) were used to examine the data. The study employed inferential statistics and incredible linear regression to determine the significance and correlation between specific strategic management strategies and the success of family-owned businesses. When appropriate, charts, tables, graphs, and narratives were used into convey the analysis's findings. The findings showed that enhancing organizational systems, structures, and skills is crucial for raising performance. The medium- and long-term performance prospects have been bolstered by Family-owned firms by implementing several strategic management strategies. One suggestion is to gradually apply strategic management concepts to allow previous accomplishments to act as a springboard for new endeavors.

Introduction

Background of the Study

In today's competitive and dynamic business environment, family-owned firms play a vital part in the Kenyan economy, particularly in Kajiado County. However, their long-term success hinges on their ability to adapt and evolve effectively. One of the key factors in this adaptation is the implementation of sound strategic management practices. These practices encompass various aspects, including organisational skills, organisational structure and organisational systems, all aimed at achieving organizational goals and ensuring sustained performance. The link between strategic management practices and performance in family-owned firms is complex and multifaceted. On one hand, effective strategic management can lead to improved performance through enhanced resource allocation, competitive advantage creation, and increased operational efficiency (Pearce & Robinson, 2005). Conversely, poor strategic management practices can result in missed opportunities, ineffective resource utilization, and ultimately, reduced performance. Recognizing this crucial link, it becomes imperative to examine the specific strategic management practices employed by family-owned firms in Kajiado County and their subsequent impact on performance.

This research adopts a theoretical framework informed by two key theories: The Resource-Based View (RBV) and the Open Systems Theory (OST). The Resource-Based View (RBV) provides a lens for examining how a company's internal resources and capabilities contribute to its competitive edge and overall performance. For family-owned businesses, the RBV helps elucidate how distinctive assets like family capital, social networks, and cultural values can be utilized to gain strategic benefits. The OST, on the other hand, emphasizes the dynamic interaction between a firm and its external environment. This theory highlights the importance of environmental scanning, adaptation to changing market conditions, and resource exchange with external entities (John & Sons, 2005). In the case of family-owned firms in Kajiado County, the OST helps to understand how they navigate the complexities of the local market, adapt to economic fluctuations, and build relationships with external stakeholders.

Strategic management practices

Strategic management practices are the approaches and inactions that Ian organization employs into react to future developments in the environment (Henry, 2021). Strategic management practices refer to the systematic and deliberate actions and methods that organizations use to develop, implement, and execute their strategic plans. These practices are essential for setting the direction, making decisions, allocating resources, and achieving long term goals and objectives. Strategic management ensures that strategies are formulated in alignment with the vision, mission, environment, and long-term objectives.

The firm's goal in implementing strategic management practices is to achieve, sustain, and improve competitive advantage. Successful strategic management practice necessitates the allocation of resources that support the firm's strategy such as financial resources, supportive and informed human resources, a supportive culture, and technology (Robinson, 2007). The strategic management practices are important for any firm since they help to determine where an entity is going in the future and how it will get there. The selected Strategic management practices, that is Structure, Systems and Skills will be measured using various methods including examination of the organization's reporting relationships, division of responsibilities, assessment of the processes used for strategic planning, the deployment of technology and tools, assessments of employee competencies, leadership development programs, and performance appraisals that evaluate the ability of individuals to contribute to strategic initiatives. A number of studies have been carried out on the topic. Generally, a vast majority of them show positive effect of strategic management practices on performance. Kohn (2005) conducted research on the effect of organizational structure on performance, finding that the degree of centralization in an organization affects its ability to respond to changes and opportunities. Ansoff, et al (1970) examined the impact of effective strategic systems on performance and concluded that organizations with well-structured strategic systems tend to outperform their competitors due to their ability to adapt and execute strategies efficiently. Smith (2008) conducted a quantitative study on the effect of strategic management skills on the performance of non-governmental organizations (NGOs). The results found that NGOs with a highly skilled workforce demonstrated significantly better performance, as they were better equipped to navigate complex strategic challenges. Equally, it has been highlighted that good or bad performance relies on largely the implementation of strategy iby an entity (Kennedy, Goolsby & Amould, i2003). Kaplan and Norton (2005) proposed that a failure in strategy implementation can create a gap or weakness between strategy and performance. Most of the existing studies and findings discuss the topic where the focus is on general organizations however the current focus is on family owned firms. Equally, the studies have not focused the topic on a local context.

Organizational Performance

Performance denotes the ability of a firm to realize its goals and objectives and elevate outcomes. Kaplan and Norton (2018) defined performance as the efficiency and efficacy of operations by a management team. Performance measurement has steadily developed from dominantly financial performance perspective measures such as return on assets and return on investment to include non-financial measures such as quality, timely delivery, flexibility, and cost reduction. Kaplan and Norton suggested the balanced scorecard tool for planning strategy and performance management where the main focus is how objectives are being met. An organization is considered successful if it uses minimum resources (efficiency) to achieve its goals (effectiveness).

Isik, Arditi, Dilmen & Birgonul (2015) describes performance as the accomplishments of a firm based on some criterion. Performance is an output based on some aspects such as profitability or quantified objectives where failure and success are the two ends of a performance range (Njanja, 2017). Mukulu and Gachunga (2014) described performance as a component of an organization's results or output relative to its inputs. Performance is the net output of value generating activities that an organization is conducting that support the creation for improved profitability and a strong balance sheet. Although the definitions among authors may have variations, there is concurrence that performance concerns the attainment of superior objectives and outcomes. Several studies have already focussed on key strategic management elements and effect on performance. In the present study, particular weight will be assigned on the firms’ ability to apply key strategic elements to adjust business management with the view to enhance ability to achieve its goals and objectives.

Family Owned Firms in Kajiado County, Kenya

Chua and Sharma promote a nuanced and holistic approach to defining family-owned firms that acknowledges their evolution and complexity over time. Family-owned businesses are categorized by the connection of business, family and systems where family members have roles in decision-making and shaping the businesses’ culture and identity (Chua & Sharma, 2012). These family members have the power to shape the company's direction and are prepared to use their influence to pursue unusual objectives. Family-owned businesses dominate most countries' economies. The Family Firm Institute (2017) reports that family-owned firms comprise two-thirds of all companies worldwide, provide 70–90% of the world's GDP annually, and employ 50–80% of the workforce in most nations. These companies greatly enhance the country's economic and social progress by generating income, jobs, and social economic growth.

Asoko Insights (2021) reports that there are 3490 family-owned firms in the East Africa earning revenues in excess of $10 billion. Further analysis indicated that these firms operate across various sectors, from banks to air freight and logistics companies. Kenya comprises around 75% of these businesses; Tanzania, Uganda, and Rwanda comprise the remaining 2%. In contrast, over 40,000 acknowledged big and medium-sized businesses account for 60% of Kenya's GDP (Demirgüç-Kunt & Klapper, 2016. Approximately 490 family-owned firms in the region, working in various industries, generate over $10 million in revenue annually. Of the 490, 70 companies, or 14.3% of the total, make over $50 million annually, while 22 make over $100 million.

Kenyan family-owned enterprises face several obstacles, such as a deficiency in professionalism, an incapacity to stay abreast of technological breakthroughs, inadequate strategic planning, and difficulties incorporating the upcoming family business generation, known as "the NexGen." (Gachucha & Memba, 2020). If these issues are promptly remedied, the potential for these businesses to expand and thrive may be unrestricted. Thanks to technological advancements, family-owned companies can also more effectively handle the difficulties posed by intergenerational diversity (Gachucha & Memba, 2020).

Research Problem

Firms increasingly operate in an intensely dynamic, competitive, and complex environment; hence, they must find ways to manoeuvre in the evolving context while maintaining focus on their goals and objectives (Teece, 2007). Firms use limited and scarce resources to provide solution and create value for various stakeholders. The effectiveness of a firm in utilizing its resources to deliver solutions and create value for stakeholders determines its success or failure. Firms set goals and objectives in line with their mission and vision. Equally, the firms devise strategies that help them to actualise their objectives in terms of the specific actions and activities that help to achieve their performance objectives. Firms must focus on long term goals while remaining alive to the short term goals as influenced by their environments. Due to the intensely dynamic, competitive, and complex environment, strategies present important tools towards performance accomplishment (Grant, 2016). Strategic management practices help firms to entrench the use of strategies in actualising firm’s objectives.

Family-owned firms have specific characteristics that distinguish themselves from non-family owned firms and this includes influence of decisions by family members, and multigenerational management and employee base (Chrisman, Chua, & Sharma, 2005). The diversity of ideas, interests, and approaches among family members presents challenges in decision making particularly decisions of strategic nature. Firms need to pursue strategic decisions and actions in an objective and proactive manner. Therefore, strategic management practices are practices aimed at entrenching strategic inclinations for firms to enable them formulate and implement strategies in an objective and proactive manner. Strategic management practices ensure that resources are used objectively, proactively, efficiently, and effectively towards realisation of organisational performance objectives (Hitt et al., 2012). Strategic management practices are used by firms to maintain a competitive edge and performance throughout time (Kellermann et al., 2012). However, family owned firms are recognized to impact ownership, management, and governance, affecting how they behave strategically (Carnes and Ireland, 2013; Chrisman et al., 2015a). The family Owned firm specific iantecedents ithat influence innovation inputs, processes, and outcomes still need to be better understood now (Carnes and Ireland, 2013; Konig et al., i2013). These antecedents influence strategic management practice's methods, materials, and results.

Numerous studies have examined the strategic management practices and performance of family owned firms. Ratten, Fakhar Manesh, Pellegrini, and Dabic (2021) determined that the most prolific countries for researching family business dynamics are the United States and the United Kingdom, followed by European countries. Regarding management, family ownership of shares and control over the CEO and chairperson positions significantly increase R&D spending in family firms listed on public markets in developing nations (Ashwin et al., 2015). This study shows that a family with more influence over the company is more likely to spend on R&D to accelerate the achievement of the company's objectives since they support and defend the original vision of the business. Acosta-Prado et al. (2017) found that a sample of family-owned and non-family-owned biotechnology enterprises differed in their R&D spending, with the former having a higher risk aversion. This demonstrates how various ownership levels affect performance. One study identified a link between strategic management practices and robust family support. At the same time, another finding implies that families use these tactics more riskily since they fear not succeeding. The contradictory results of these discoveries indicate a vacuum in the literature, which motivates more study on the topic. Sciascia et al. (2015) observed that second and subsequent-generation family enterprises innovate less than non-family and founder-owned family firms. However, Ferreira and Ferreira (2017) do not uncover any evidence to suggest that the existence of many generations inside the organization moderates the association between innovation performance and absorptive ability. In Kenya, family-owned enterprises, tiny and medium-sized ones, are controlled by family interests (Ngugi, 2013). It might be interesting to see how family-owned businesses handle the strategic plan in light of the various interests of family members, given the high risk associated with strategies. It's possible that family and non-family members—especially professionals in this field—will view innovation and available strategic management methods differently.

The studies above yielded inconsistent, mixed, and scant results on the relationship between profitability and strategic management approaches of family-owned firms. Therefore, more studies need to be done to conceptualize the performance and strategic management techniques of family businesses in Kenya, particularly in Kajiado County. At the same time, most of the studies done on the topic covered the entire country and other Counties in Kenya and none for Kajiado County. Further, the existing studies were done during the centralized regime and none in the current decentralized and evolved governance regime. The recent pandemic has also heralded some changes in business approach particularly concerning supply chain, contingency plans, and regulatory environment. The current business environment present immense challenges and opportunities that firms can leverage, hence, there is need for knowledge that will help firms achieve their performance goals (Barney & Hesterly, 2015). Thus, this study aims to determine how family-owned companies manage constant change (both opportunities and challenges) without losing sight of their performance goals. Since family-owned companies are the backbone of the economy (Kinyua, 2014). Studying this issue may help one be aware of how firms utilize strategic management strategies and how they influence their performance. Therefore, it is important to expand the knowledge base in terms of finding how strategic management practices impact the performance of firms and specifically family owned firms in Kajiado County. It is against this background therefore, that this study sought to answer the following research question: What is the effect of strategic management practices on performance of family owned firms in Kajiado County, Kenya?

Research Objective

The aim of the study is to determine how strategic management practices impact

the performance of family-owned businesses in Kajiado County, Kenya.

Value of the Study

By examining the implications of strategic management practices in the Kenyan setting, the study responds to the request for additional investigations into performance of family owned enterprises (De Massis et al. 2015a; Duran et al. 2016). Because of the distinctive characteristics of family business, mainstream literature could benefit from learning from family firm study findings. This will encourage the development and applicability of the suggestions to research on various family business issues.

The study will also offer management implication for business professionals in terms of strategic management practices and their impact on performance. The managers within specific firms will be able to consider findings and recommendations in their own strategic plans based on their vision, goals, and objectives. The findings will serve as a guide for both the founder and the successor, encouraging them to be open to development of a strong culture in strategic management practices. This will also be valuable to emerging and potential entrepreneurs who can use the findings to inform their decisions in the entrepreneurial journey.

Practitioners at both macro and micro levels will use study findings to enhance their knowledge and skills in strategic management practices which they can help in proposing solutions to family owned businesses. Policy makers at the macro level particularly the trade and industry departments can use these findings to device policies that guide proper development of the businesses and their transitions into other forms. It will also help in formulating regulations to support performance in this segment. Researchers and academicians in the relevant field can use the study findings as reference for further studies and this will aid in advancement and development of the strategic management theory. Importantly, the study findings will offer a pool of knowledge to fill void in terms of innovation. Positive effect of strategic management practices on performance would be contribution to the agency theory because of challenges associated with competing interests between managers and owners of resources. Essentially, insights will provide reference and guide to Researchers and academicians in strategic management concept who can leverage it for future studies.

Literature Review

This chapter details the findings of similar studies performed in the past that help to guide this study. The theories addressed are; Resource-Based View and Open systems theory. This section also summarises the Knowledge Gaps based on the past studies and purpose for current study. The knowledge gap helps to guide this section and the entire study.

Theoretical Foundation of Study

The theoretical foundation of this study includes strategic management theories such as the open systems theory and resource-based view theories. These frameworks help analyse how family-owned firms in Kajiado County, Kenya, implement strategic management practices to enhance their performance and address unique organizational challenges. This study is based on two theories, the open systems theory and resource-based view theories that inform how organisations respond to changes in their environment.

Resource-Based View (RBV)

The proposed study is supported by the Resource-Based View (RBV), which looks at a firm's ability to compete effectively using its resources. The RBV was proposed by Penrose in 1959 and later advanced in the 1980s and 1990s through, the RBV of the Firm Wernerfelt (1984), firm resources and sustained competitiveness (Barney, 1991), and corporation core competencies (Prahalad and Hamel, 1996). The theory proposes that a firm can achieve competitiveness by innovatively conveying superior value propositions to its customers. The existing literature concurs that the Resource-Based View entails a firm’s strategic identification and deployment of resources to develop a sustainable competitive advantage (Colbert, 2004). The RBV framework proposes that a firm's competence, in some occasions, can enable them to generate value in terms of new products, better systems, or make developments in new marketplaces.

The RBV framework can be used by firms to identify, determine, and ascertain their strategic and competitive advantage. Firms can leverage the unique combination of their skills, knowledge, assets, Intellectual capital, capabilities, and talents to achieve competitive edge. The RBV is premised on the notion that organisations are primarily different because of the distinctive assets and resources of each organisation. The RBV theory asserts that, a firm comprises a pool of unique capabilities and resources that are valuable, rare, inimitable, and non-substitutable (VRIN), which enable them to attain a sustainable competitive advantage for superior performance (Barney, 1991; Collis and Montgomery, 1997). Organisations use their capabilities to combine resources in a manner that generates competitive advantage (Amabile et al, 2016). Each firm or organisations harnesses its resources to develop and cultivate unique competencies to help generate competitive advantage and ultimately attain better performance (Walsh & Kalika, 2018).

Firms operate with a limited and scarce amount of resource; therefore, they have to find ways to deploy limited resources effectively to realise their goals and objectives (Barney, 1991). The RBV theory is relevant to the study because it proposes how organisations can use their internal resources to support the implementation of strategies and strategic management practices (Barney, 1991). Strategic management practices require resources (particularly internal resources) to be able to achieve success. An organisation’s unique resources can be leveraged to support the designing, operationalization, and actualisation of organisational structure, systems, skills, and shared values (Barney, 1991).

The performance of family-owned businesses is the dependent variable in the proposed study, whereas strategic management tactics are the independent factors. Automation, diversification, leadership style, talent level, system and structure design, inventions, and acquisitions are a few strategic tactics. When considered as a whole, the RBV theory is critical because it illustrates how businesses may use their internal resources, capabilities and capacity to further competitive strategies.

Open Systems Theory

The open systems theory (OST) proposes that the operations of firms or organizations are impacted or influenced and affected by their environment (Bastedo, 2004). OST is a theory that is largely categorized within the modern system-based theories for change management. Organizations are operating in an increasingly dynamic and fast-paced business environment; hence, there is a need for frameworks that can guide them in this kind of environment. Open Systems Theory originated as a response to the necessity for a more interdisciplinary and holistic approach to understanding complex systems in the mid-20th century. Ludwig von Bertalanffy (1950) is credited as one of the founders of the theory, whereby in the 1940s and 1950s he proposed the notion of a "general systems theory". His work emphasized the interconnectedness of systems across various disciplines and levels of organization. The business environment comprises other organizations and factors that exert social, political, and economic forces. All systems are featured by a combination of an assemblage of parts or components whose relations compel them to be interdependent (Scott & Davis, 2015). Open systems operate by allowing exchanges of materials, information, and energies among others with the environment, and enabling adaptations to inflow, and outflows (Scott & Davis, 2015). The exchanges, inflow and outflows, allow growth and renewal of the system.

The changing technologies and markets have influenced the organizational perspective to shift from closed to open systems (Scott & Davis, 2015). The open system viewpoint of the firm has enabled businesses to flourish in diverse situations because they can have a better understanding of the effect of the environment on their business (Alexy et al., 2018). The environments where the firms operate hugely influence conflict resolution, decision-making, and resource distribution. The ability of an organization to manage its external environment is essential to its success, and therefore, the open system model is imperative to the open system operation of any organization. The open system model is one of the leading strategies applied in the analysis of operations, success, and management of the organization (Alexy et al., 2018).

The relevance of this in the current study is that the theory provides an approach for considering processes such as change, adaptations, and initiatives under strategic management practices. A family-owned firm or any other firm may be experiencing numerous challenges and it can use strategic management practices to revitalize itself by hiring a new CEO who improves how the firm transforms inputs. The open systems theory equally suggests that all successful firms must attain a balance between their subsystems. Therefore, in the case of a family-owned firm, the subgroups must maintain a rough state of balance while adapting to external factors. This means that, the firms need effective strategic management practices to achieve balance among subgroups and consequently drive toward goals and objectives. Strategic management practices are influenced by the environment hence; this theory is important because it can show how family owned firms need to consider the developments in the environment as they embark on innovation strategies. The open system is characterized as equifinality, which means family-owned firms can reach their ultimate goals by use of different paths where one of the plans could be the innovation plans for its systems, structure, and skills.

Strategic management practices and performance

Onyiro and Onuoha (2023) performed a study to decipher the relationship between SMPs and performance of FOBs in river state, Nigeria. A cross sectional research design was applied. A total of 72 respondents were involved among top level management of small FOBs. The dimensions of SMPs in the study were strategy implementation and control. The hypothesis was tested using spearman rank order correlation coefficient. The findings revealed that SMPs such as strategy implementation and control exert significant effect on firm performance especially for FOBs. The recommendations are for managers and owners of FOB to enhance communication flow for sufficient and timely information, and more control mechanisms into processes via methods such as participatory target setting, performance assessment, standard practices, correction measures, and feedback.

A study by Azmi et al., (2022) sought to effect of family ownership and political intervention in earnings management using a panel study in Malaysia. Family ownership and political intervention create type 1 and 2 agency problems among shareholders and stakeholders. The study adopted a quantitative method via use of 624 firms for period covering 2013 to 2017. A total of 3,120 firms were involved in the study and a panel regression analysis applied to answer the research questions. Findings revealed that the politically linked firms tend to have high prevalence participating in earning management relative to those not connected. Family businesses have prevalent to participate in earning management of performance. The implication of findings is the effect of composition of the board and level of family ownership which can have influence on earning quality. The findings also reveal the need to ensure initiatives in governance regulation for political involvement with aim to manage agency problems.

Scheef, and Zellweger (2023) examined succession processes in FOFs in the United States. Succession has a likely impact on the future performance of family owned businesses. It is important to understand the pace, sequence, and rhythm with which board chair, CEOs, owner role, and director are transitioned across generations. The study used inductive and theory creation approach anchored on sequence analysis among 142 public FOFs in the US. The findings revealed five distinct processes of how board chair, CEOs, owner role, and director are transitioned across time and roles. The transitions vary in rhythm, pace, and performance consequences. Firms with fast-paced paths and the ones with slow-paced rhythmic paths outperform the others with irregular rhythms. Early ownership transition plans generate benefits through performance.

The family's impact on HR management systems produces fundamental traits that might impact the business's operation. Research by Sánchez-Marín et al. (2019) looked at the formalization of HR procedures and the impact that family and non-family enterprises had on the performance of their respective companies. This study examined the formalization and effectiveness of the three main HR processes across family- and non-family-owned business environments: hiring, training, and remuneration. The results indicate that a greater degree of formalization in HR positively affects business success. This suggests that the relationship between established training techniques and organizational performance is negatively moderated by family engagement.

Additionally, the study's results suggest that, unlike non-family businesses, recruitment practices had a smaller moderating impact on the link between training methods and success in family-owned firms. The conclusion is that family-run firms and non-family businesses should formalize their HR policies to minimize family disputes and improve HR abilities. In the decision, family-owned companies should support the formalization of HR as it will provide the resources needed to support the organizations long-term and strategic management objectives. This study and most previous studies support the idea that human resources uniquely deliver the talent, skills, and knowledge that create a competitive advantage. It is critical to ascertain if the human resource component of family-owned businesses pertains just to top roles or to all tiers of management, including heads of functions and their assistants. The current research aims to address this gap in human resource capabilities.

Summary of Knowledge Gaps

The gaps in the proposed topic can be viewed from the elements of time, context, and location. Most of the studies reviewed pertain to foreign locations; hence, there is need to determine how the topic applies in the local context particularly with reference to Kajiado County. Second, most studies reviewed apply to general firms, but the proposed study seeks to narrow down to the family-owned firms which will help add to the existing pool of knowledge on this segment of firms. Existing theories often focus on large, urban family-owned enterprises, leaving a gap in insights on how strategic management varies in smaller, geographically isolated contexts. There is often scarce research on how resource constraints particular to rural areas affect strategic management. FOFs in Kajiado which may face distinct challenges linked to resource allocation, which are not adequately covered by existing frameworks that focus on more developed or urban settings. Additionally, there are mixed findings on the effect of strategic management practices on performance of FOFs with some revealing moderate to strong performance with others showing minimal effect (Mwaura & Muturi, 2018), hence, the proposed study seeks to get clarity on the study findings. Due to the incorporation of family dynamics, the organizational structure of family-owned businesses frequently varies from that of ordinary businesses. Family ties, succession planning, and long-term objectives may be given top priority in family-owned businesses. As a result, these companies may have special governance structures, decision-making procedures, and management philosophies that balance the needs of the business with those of the family.

Family dynamics cause organizational structures in family-owned businesses to differ from those in other types of businesses. These systems influence culture, succession planning, governance, and other aspects of family-business connections. Family-owned businesses, as opposed to generic ones, integrate family dynamics into operational frameworks, influencing long-term strategy and decision-making procedures. Since family dynamics are integrated into the business, family-owned enterprises have different organizational abilities than general corporations. They have developed distinct leadership philosophies, communication techniques, and succession planning methodologies throughout time by striking a balance between corporate goals and family values. The intricate interaction between family ties and organizational efficacy in family-owned businesses is seen in this progression.

Research Methodology

This chapter details the study's methodology, covering aspects such as the research design, target population, and sampling process, including sample size. It also addresses the pre-testing of research tools, data collection instruments and procedures, methods of data analysis and presentation, as well as ethical considerations.

Research Design

This study utilized the descriptive design technique. The proposed descriptive study strategy was appropriate since it delivers adequate findings between variables. The descriptive design technique allowed the study to determine and explain the features of the variables of interest. Descriptive design helps to characterize the relevant features of the aspects of interest from diverse angles (Best & Kahn, 2007). A descriptive research approach gives adequate flexibility to explore numerous facets of the topic under the proposed investigation (Kothari, 2004). Descriptive study design is extensively utilized in relevant studies like Chepngetich, 2022; Kosgey & and Njuguna, 2019 Mutinda & and Mwasiaji, 2018; and Mwai et al., 2018).

The current study uses a Cross-sectional Descriptive research design that entails the collection of data from a sample or population at a single point in time. This approach provides a picture of the population's behaviors, attitudes, or characteristics, or thus allowing the researcher to examine variable’s relationships at a specific moment. A descriptive design technique will help describe the characteristics of the phenomena or study topic, who, what, how, and why. The design is appropriate in describing the influential relationship among the suggested variables. While Descriptive study design can provide valuable insights into observable events, they are not very appropriate at identifying underlying processes or establishing causation. They could have limited generalizability, biases, and poor experimental control. Descriptive research may also miss contextual elements and fail to convey the dynamic character of interactions across time. Consequently, whereas descriptive research offers a basis for comprehension, it could not completely clarify the intricacies of real-world occurrences. Therefore, it will allow the study to identify the influence of strategic management practices on the performance of family-owned enterprises in Kajiado County, Kenya.

Population of Study

The population of study represents the whole collection of items that share observable properties and patterns that the researcher desires to deduce certain inferences (Cooper & Schindler, 2014). In the present proposal, the population of the study comprises family-owned companies in Kajiado County, Kenya. Specifically, the population comprises all firms registered under the County government of Kajiado by 2023 and this comprise about 1090 family owned enterprises (Businesslist.co.ke, 2024) which form the unit of analysis for this study.

It is essential to consider some factors when selecting population representation to ensure the sample is appropriate and representative for the study. The choice of the different forms is addressed through understanding the research objectives, permissions and access, sampling technique, data collection methods, data analysis methods, and considering the unique features of each group. This research adopts a comparative approach where the unit of analysis entails the comparison of multiple FOF’s. This approach entails comparing firms across and within the same industries to identify differences and commonalities in SMP and performance.

Sample Design

A decent sample size should represent the population of interest (Singh & Masuku, 2014). This study will employ a random sampling approach to select the representative sample companies. A suitable sampling procedure was utilized to choose responders from the various departments in the organization. Random sampling guarantees an equal chance for individual members of the population to be included in the sample, as well as the efficiency and efficacy of the process (Saunders et al., 2003). Given that the population size is 1090, the sample size was 5 percent of 1090, resulting in 55 enterprises.

This study employs a stratified random sampling to choose a representative sample of FOFs across various industries in Kajiado County. In stratified random sampling, the population is first divided into distinct subgroups (strata) based on specific criteria, and then samples are randomly selected from each subgroup. This affirms that all strata are represented, improving the sample's validity and enabling insightful comparisons across various population groups.

Population: 1090 family-owned firms in Kajiado County.

Strata

Size: Small (545 firms), Medium (380 firms), Large (164 firms).

Industry: Agriculture (365 firms), Retail (465 firms), Manufacturing (260 firms).

Sample Size: 55 firms.

Proportional Allocation

Size: Small (28 firms), Medium (20 firms), Large (7 firms).

Industry: Agriculture (18 firms), Retail (24 firms), Manufacturing (13 firms).

Random Selection

Randomly select 28 small, 20 medium, and 7 large firms; randomly select 18 agricultures, 24 retail, and 13 manufacturing firms (Table 1).

| Table 1 Strata Allocation | |

| Strata | Selected |

| Industry: Agriculture | 18 |

| Retail | 24 |

| Manufacturing | 13 |

| Total | 55 |

Data Collection

The study employed primary and secondary data, which was applied to characterize the strategic strategies used by family-owned enterprises and how they affect performance. Secondary data will be collected using instruments such as documentary analysis, check list, and software. The data-gathering tool applied was semi-structured questionnaires (open-ended) and close-ended questions). Open ended questions were analyzed via qualitative data analysis methods. The categories and themes helps to identify patterns or trends while techniques such as content analysis and thematic analysis were used to interpret the data. Semi-structured surveys offer respondents some flexibility in answering questions, which will help if respondents demand some flexibility and depend on the various natures of the intended questions. Questionnaires are typical instruments researchers use to gather crucial information concerning the study population (Mugenda & Mugenda, 2003). The surveys efficiently and successfully gathered vast data from the intended population (Saunders & Townsend, 2018). The questionnaire will have numerous items covering various research topics, such as the demographic profile of respondents, strategic strategies utilized, and performance components. The questionnaire was pre-tested using ten executive managers and 5 academic authorities to confirm its validity. The input obtained was utilized to make suitable revisions to questions and the design of the questionnaire.

Appointments were established with selected respondents to obtain their agreement, explain the study's goal, present the data collecting tool, and agree on a suitable time. Semi-structured questions were delivered to the chosen respondents. Some surveys were dropped to the selected respondents and collected after a week, while others were delivered over email based on distance and convenience. Due to the possibility of having a better knowledge of this study's established strategic management techniques, the respondents were top executives in the family firms. Applying senior executives from family-owned businesses as responders ensures that the information is obtained from people with substantial decision-making power and a thorough awareness of the company's strategic procedures, which helps mitigate methodological bias. By using this method, bias from lower-level staff members is reduced and strategic effects and outcomes are more accurately represented.

Secondary data collection was mainly through databases and particular sources, including reports, papers, and journals within the scope and relevance of this study. The secondary data was mainly on the strategic practices adopted by the various firms. The results were mainly reflected in views of the various respondents. The instrument for data collection is a structured data collection form. The form helps to systematically draw relevant information from sources company reports. The material of the permission form was explained again to the potential responder, highlighting aspects such as rights/terms of participation and the study's goal. Each 43 families' enterprises supplied at least one respondent whose data was obtained. The various executives were addressed through web-based surveys.

Data Analysis

Data analysis implies examining and researching data to develop findings and deductions (Van de Vijver & Leung, 2021). Data analysis involved both inferential and descriptive statistics, where descriptive statistics include percentages, frequency, mean, average, and mode inferential statistics was used and I include linear regression to establish the significance of the connection between selected strategic management strategies and the performance of family-owned firms. Statistical Package for Social Sciences (SPSS) Version 21.0 was used to analyze the data. The outcome findings were supplied via figures, tables, and graphs where appropriate.

The regression model:

YA=α + β1X1 + β2X2 + β3X3 + ε

YA = Performance

α = the Y intercept when x is zero or the constant

βij = Regression Coefficients

X1 = Organizational Structure (Resource Allocation)

X2 = Organizational Systems (Technology)

X3 = Organizational Skills (Leadership)

ε = the error term

Data Analysis, Results and Discussion

This chapter provides an analysis of the response rate, sample measures, and statistical data derived from the empirical research conducted with family-owned businesses. Furthermore, the chapter includes a review of the empirical findings. It starts with an overview of the study's response rate and respondent demographics. Next, it presents and elaborates on the key results according to the study's objectives. Finally, it discusses these findings in the context of existing research.

Profile of Respondents

The researcher analyzed the organizational structure design, organizational systems design, and skills and the performance of family-owned firms. The analysis was done through averages/means, tables, frequencies, graphs, and standard deviation. The total number of responses received was 55 and only 45 were substantially completed and used in this study.

Education Level of Respondents

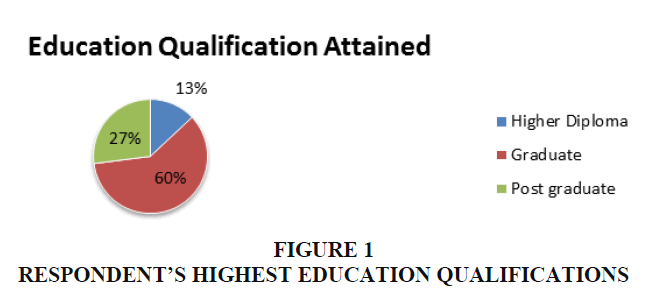

The respondents were requested to state their highest level of education qualification. The analysis that was done at the individual level entails examining the educational achievement of each participant in a study. The variables such as degree obtained, highest level of education completed, or years of schooling. The outcomes are as presentedin Figure 1 below:

The highest education level attained by respondents was categorised into three classifications as presented in Figure 1. The analysis shows that nearly 60% of study respondents had attained graduate education level; another 27% had attained post graduate level, while 13% had attained higher diploma qualifications. This result indicates that a significant number of respondents had achieved the upper tier of education that aligns appropriately with the capacity to undertake management and business administration responsibilities. The various levels of education status are an indication that the respondents’ orientations, attitudes, and experiences are likely to be varied and this was echoed in the diversity of views on the topic. The strong presence of upper tier of education qualification indicates the commitment to have leaders and executives who have the appropriate intellectual capability for the firms.

The instruments applied to measure education level are reliable and accurate. The methods and questions applied to assess education level are valid and generate consistent outcomes. The education level measured aligns with the idea being studied where the respondents’ education level is pertinent to their understanding of SMP and its effect on the performance of FOFS. The content measured under the education level sufficiently covers the skills and breadth of knowledge relevant to SMP and firm performance. The education level variable draws the appropriate aspects of education that can influence strategic decision-making in FOFS.

Respondent Job Position

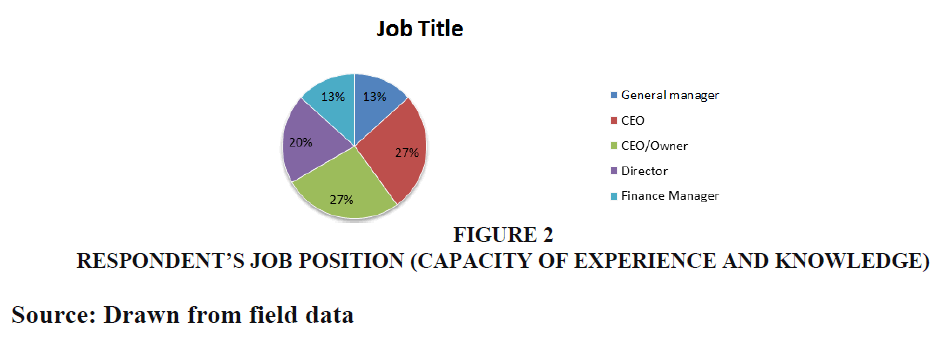

The respondents were asked to state their position in the firms and their answers are presented in Figure 2 below:

Figure 2 Respondent’s Job Position (Capacity of Experience and Knowledge)

Source: Drawn from field data

As per Figure 2, CEOs and Owner CEOs constituted the largest proportion of respondents and this implies that a large proportion of respondents have the requisite knowledgeable, experience, expectations, and authority to disclose information requested and envisions the firm’s future endeavor. The analysis reveals that nearly 54% of respondents were CEOs and Owner CEOs, 20% were directors, while finance managers and general managers comprised 13% for each position. The large proportion of CEOs and Owner CEOs implies that most of the family-owned businesses in the county are run by owners who were available for the interviews.

The presence of a large number of none owner respondents in this study on SMP and performance of FOFs may present some potential complexities; however, it does not essentially undermine the outcomes or make them unreliable. FOFs are typically owned and managed by family members, but they often engage non-family members to perform various roles, such as managerial positions. Such persons may have valuable insights into the SMPs and performance, especially if they hold vital positions or enjoy substantial involvement in decision-making processes. Thus, including these respondents in the study may help afford a more comprehensive understanding of the dynamics within FOFs.

Firm Characteristics

Period of Firm Operation

The respondents were requested to indicate the period the firm has been in existence and their responses are echoed in Table 2 below

| Table 2 Period of Firm has been in Operation | ||

| Years in Operation (Years) | Frequency | Percent (%) |

| 1 to 5 | 1 | 1 |

| 6 to 10 | 9 | 20 |

| 11 to 15 | 11 | 24 |

| 16 to 20 | 9 | 20 |

| 21-25 | 6 | 14 |

| 26 to 30 | 3 | 7 |

| 31 to 35 | 3 | 7 |

| 36 and above | 3 | 7 |

| Total | 45 | 100 |

As per table 2, all the firms included had been in operations for over five years and one is above 36 years, thus, an indication of experience or wealth on various issues pertaining to their businesses. About 20% had been in operation for 6 to 10 years, while the majority had of 27% had been in operation for between11and15 years. A smaller percentage of firms, only 34%, have been operating for over 21 years, reflecting a higher mortality rate among family-owned businesses. The analysis shows that about 20% of firms had been in operation for between 16 and 20 years which depicts a mix of two generations in the business. Firms learn with age as they interact with their environment and various stakeholders.

Number of Employees

The respondents were requested to indicate the size of workforce and the responses are revealed in table 3 below

| Table 3 Size of Workforce | ||

| Range | Frequency | Percentage |

| Oct-15 | 6 | 13 |

| 16-20 | 6 | 13 |

| 21-25 | 8 | 18 |

| 26-30 | 9 | 20 |

| 31-35 | 6 | 13 |

| 36-40 | 6 | 13 |

| 41-45 | 4 | 8 |

| Total | 45 | 100 |

As depicted in Table 3 above, the dominant workforce comprised employees totaling 21-25 and 26-30. All firms had a workforce ranging from10 to 45 which shows that most family owned firms can be classified under Small and Medium Enterprises (SMEs). The dominant presence of different sizes of SMEs has likely helped to minimize the skewness of respondent’s views.

Generation That Runs the Business

The respondents were invited to state the generation that runs the business and their responses are revealed in table 4 below

| Table 4 Runs the Business | ||

| Generation | Frequency | Percentage |

| 1st | 17 | 38 |

| 2nd | 16 | 35 |

| 3rd | 12 | 27 |

| Total | 45 | 100 |

Table 4 shows that most of the businesses in the study are run or operated by the 1st generation of family members at 40%. This is followed by 2nd generation at 33% while the 3rd generation runs 27% of the businesses. At 40% is still a substantial proportion for the founders to be running the business and this also shows a mixed generation of workforce which may have its own pros and cons. The 1st and 2nd generations run 73% of the businesses which show a relatively older generation that run most of the businesses. The older generation comes with potential benefits such as more experience in the business environment, more knowledge, and wealth of goodwill. According to Lussier and Sonfield, (2010) FOFs are run by a mix of generations and as the transition occurs, managerial practices and characteristics remain the same while others adopt. Entrepreneurs face an inescapable succession impasse: they must make either explicit or implicit strategic decisions about transitioning ownership of the family business (Bjuggren & Sund, 2011; Westhead et al, 2012).

Generation That Owns the Business

Respondents were asked to specify the generation that owns the business, with their answers shown in Table 5 below.

| Table 5 Owns the Business | ||

| Generation | Frequency | Percentage |

| 1st | 22 | 49 |

| 2nd | 15 | 33 |

| 3rd | 8 | 18 |

| Total | 45 | 100 |

The data on who owns the businesses provide interesting insights. About 53% of the firms are owned by the 1st generation or founders. This shows the hesitancy of this generation to relinquish ownership to later generations. The 3rd generation owns just 13% of the businesses and this is expected because this represents the new businesses whose survival rate is relatively low. According to a study by Cahyadi (2022), the findings revealed that the founders of FOFs have major concern on how to perpetuate their business along the family line and uphold family leadership into the 2nd and 3rd generations. They seek parenting, collaborating and harmonizing which delays transition across generations.

Organizational Skills

The respondents were required to indicate their views on several questions concerning Organizational Skills and the responses are organized and analyzed as below table 6.

| Table 6 Organizational Skills of Staff Members | ||||||||

| Organizational Skills | SA | A | N | D | SD | Total | Mean | SD |

| All stakeholders are involved in the decision-making processes | 4 | 19 | 12 | 8 | 2 | 45 | 3.33 | 2.97 |

| The firm provides adequate financial resources for skills development | 5 | 18 | 12 | 7 | 3 | 45 | 3.33 | 2.99 |

| There is adequate training of staff to meet skills needs | 6 | 19 | 13 | 5 | 2 | 45 | 3.49 | 3.11 |

| There are regular updates of its technology particularly on skill’s development | 3 | 21 | 9 | 9 | 3 | 45 | 3.27 | 2.92 |

| The firm conducts competitive recruitment for its staff capacity | 3 | 16 | 15 | 7 | 3 | 45 | 3.27 | 2.9 |

| There are clear & adequate communication channels | 6 | 21 | 9 | 6 | 3 | 45 | 3.47 | 3.12 |

| The firm develops strategic planning to prepare for its goals | 3 | 16 | 13 | 7 | 6 | 45 | 3.13 | 2.83 |

| Overall average | 3.33 | 2.98 | ||||||

This study sought opinions of respondents on various aspects of organizational skills using a five point Likert scale measurement. Descriptive statistics analysis was applied to determine the mean, standard deviation, percentages, and frequency as shown in table 6 above. The results show that a majority agreed (42 percent) that all stakeholders are involved in the decision making processes while 9 percent strongly agree on this aspect. Another 27 percent were neutral which is substantial and therefore it implies a strong indecision position on this aspect. About 48 percent of respondents indicated neutral, disagree, and strongly disagree which may imply that the views on this matter are not skewed strongly to one end. A mean of 3.33 support the finding that the respondents were largely undecided or neutral in this matter.

A majority of 40 percent held an agree position that the firm provides adequate financial resources for skills development. Another 27 percent held a neutral position on the issue of adequate financial resources for skills development. A majority of 42 percent agreed that there is adequate training of staff to meet skills needs for performance while 29 percent held a neutral position on this theme. About 55 percent of respondents indicated agree or strongly agree view which shows an overall inclination towards agree on this aspect. However, a mean of 3.49 support the finding that the respondents were largely neutral in this matter.

A majority of 47 percent indicated agreement with the statement that there are regular updates of its technology particularly on skill’s development. However, an equal proportion (47 percent) either was neutral, disagreed, or strongly disagreed with this aspect. This is an indication that the respondents may not be so sure with the status of this aspect or may also have a view that their firm is not doing enough to ensure timely regular updates of its technology. This is supported by a mean of 3.27 which support the finding on neutral position on this issue. While a majority of 36 percent agree that their firms conduct competitive recruitment for its staff capacity, a substantial proportion of 33 percent, 16 percent, and 7 percent (56 percent) either were neutral, disagreed, or strongly disagreed. The views may indicate that the firms are weak in ensuring competitive recruitment for its staff capacity. A mean score of 3.27 shows an inclination toward a neutral or indifference on the issue of competitive recruitment.

On whether there are clear and adequate communication channels in their firms, a majority of 47 percent of respondents indicated their concurrence with this statement and this is further supported by a 6 percent indicating strong agreement. Overall, most respondents are supportive of the statement that there are clear & adequate communication channels. This is supported by a mean of 3.47 which confirms an agree position on this issue. However, a 20 percent neutral position is an indication of the need by firms to underscore awareness and effective use of the communication channels. Finally, the question was posed as to whether their firms develop strategic planning to prepare for their goals. On this, a majority of 36 percent agreed that their firms develop strategic planning to prepare for their goals and this is supported further by a 7 percent who strongly agree. However, about 57 percent had views that either was neutral, disagreed, or strongly disagreed. This shows a strong contestation on whether firms develop strategic planning to prepare for their goals with possibility of weak practice on this aspect. A mean of 3.13 support the view of neutral inclination on the issue. The overall mean score for Organizational Skills is 3.33 which show a weak agree position that Organizational Skills have an impact on the performance of family-owned firms. Under the objective on Organizational Skills, the results reveal that FOFs involve stakeholders in decisions, provides adequate financial resources, facilitate adequate training of staff, perform regular updates of its technology, conducts competitive staff recruitment, and facilitate clear & adequate communication. The SD values are all above one, which asserts that the respondent’s views varied widely with the proposed statements. Essentially, a high SD shows considerable variance in experimental data relative to the mean.

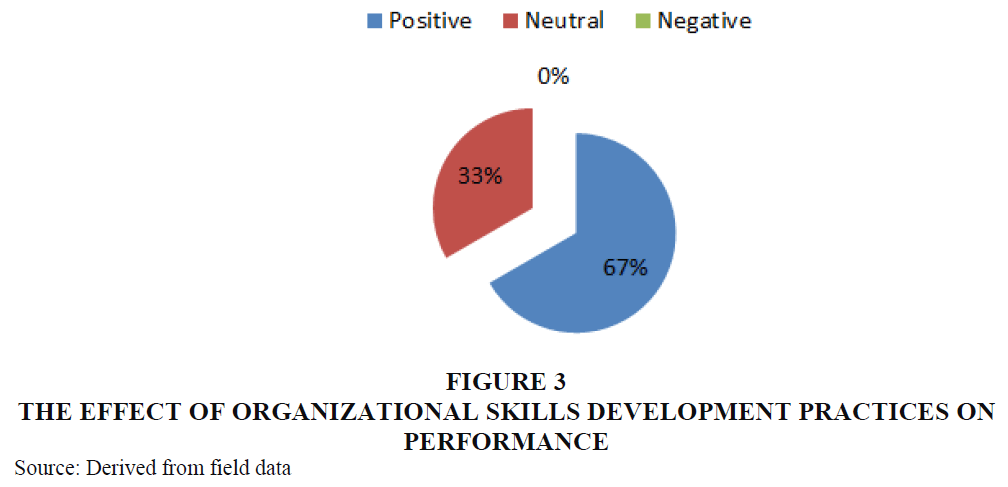

The respondents were probed on their view about the effect of organizational skills development practices on performance of family-owned firms in Kajiado County, Kenya and their responses are analyzed and presented in Figure 3 below

Figure 3 The Effect of Organizational Skills Development Practices on Performance

Source: Derived from field data

The results in Figure 3 indicate that a majority of 67 percent think that organizational skills development practices have a positive effect on performance. Equally, about 33 percent of respondents are not sure or are neutral which means they are indifferent or undecided on the effect of organizational skills development on performance. The result may infer the need to enhance awareness of organizational skills development practices. Importantly, no respondent indicated negative effect and this means that there is considerable consensus that organizational skills development practices is more inclined to impacting performance positively.

Organizational Structure Design

The respondents were required to indicate their views on several questions concerning Organizational Structure Design and the responses are organized and analyzed as below table 7.

| Table 7 Organizational Structure Design | ||||||||

| Organizational systems Design | SA | A | N | D | SD | Total | Mean | SD |

| My firm has a well-defined and clear levels of management workflows | 6 | 21 | 9 | 6 | 3 | 45 | 3.47 | 3.09 |

| The number of divisions in the firm are appropriate for successful performance of the firm | 5 | 22 | 8 | 5 | 4 | 45 | 3.13 | 2.78 |

| The firm has adequate control measure for effective implementation of plans and programs | 4 | 24 | 8 | 6 | 3 | 45 | 3.27 | 2.96 |

| The firm has a clear position of authority to support decision making and management of resources | 3 | 24 | 12 | 6 | 0 | 45 | 3.53 | 3.06 |

| The firm has clear functions to support specialization of work | 6 | 21 | 9 | 6 | 3 | 45 | 3.47 | 3.09 |

| Overall average | 3.37 | 2.99 | ||||||

The results on organizational structure design reveal several important issues. A majority of 47 percent agree on the statement that their firm has well-defined and clear levels of management workflows. This is supported further by a strong agree position at 13 percent. A 20 percent disagree and strongly disagree position combined with a 20 percent neutral may provide a small edge for agree and strongly agree position. A mean of 3.47 indicates a slight edge in terms of agree position on this issue. The 20 percent neutral views may indicate need to consider initiatives to enhance understanding and integration of organizational structure design elements in all workflow’s activities. Respondents were asked to indicate their views on whether the number of divisions in their firms was appropriate for successful performance of the firm. A solid majority of 49 percent agreed to the statement and another 11 percent supported with a strong agree position. The overall view leans towards concurrence that most firms have well-defined and clear levels of management workflows. However, a 40 percent of respondents who do not indicate agree or strongly agree may indicate an inclination towards a neutral position which is supported by a mean of 3.13. Overall, this necessitates deliberate initiatives to address challenges in management of workflows.

Approximately 62 percent of respondents either strongly agreed or agreed that the control measures in place were adequate for the effective implementation of plans and programs within their firms. This is an indication of agree leaning that indeed there is adequate control measure for effective implementation of plans and programs. However, 20 percent of respondents need to be convinced that there is adequate control while 18 percent may require more persuasion on the existence of adequate control measures for effective implementation of plans and programs. This near neutral position is supported by a mean of 3.27. The firms need to enlighten the staff further on the existing control measure and how they contribute to effective implementation of plans and programs. About 60 percent of respondents indicated that their firms have a clear position of authority to support decision making and management of resources. This is an important matter and the fact that about 40 percent of respondents disclosed views of either neutral, disagree, or strongly disagree, then the firms need to consider this aspect as a priority issue in organizational structure design. Overall, a mean of 3.53 supports an agree position on this issue. Finally, the question of clarity of functions to support specialization of work was posed to respondents and their responses indicate that a majority of 60 percent either agree or strongly agreed. The firm’s effort may need to be directed to the 20 percent of response that indicated indifference or indecision on whether the firm has clear functions to support specialization of work. This is supported by a mean 3.47 which indicates a neutral position but with a strong inclination toward agree position. The overall mean score for organizational structure design is 3.37 which show a weak agree position that organizational structure design has an impact on the performance of family-owned firms. Under the objective on Organizational Structure practices, the results reveal that FOFs have well-defined and clear levels of management, the number of divisions in the firm are appropriate for successful performance, there is adequate control measure for effective implementation of plans and programs, the firm has a clear position of authority to support decision making and management of resources, and the firm has clear functions to support specialization. However, there is need for more alertness, integration, and comprehension on the functions and their contribution to specialization of work. The SD values are all above one, which asserts that the respondent’s views varied widely with the proposed statements. Essentially, a high SD shows considerable variance in experimental data relative to the mean.

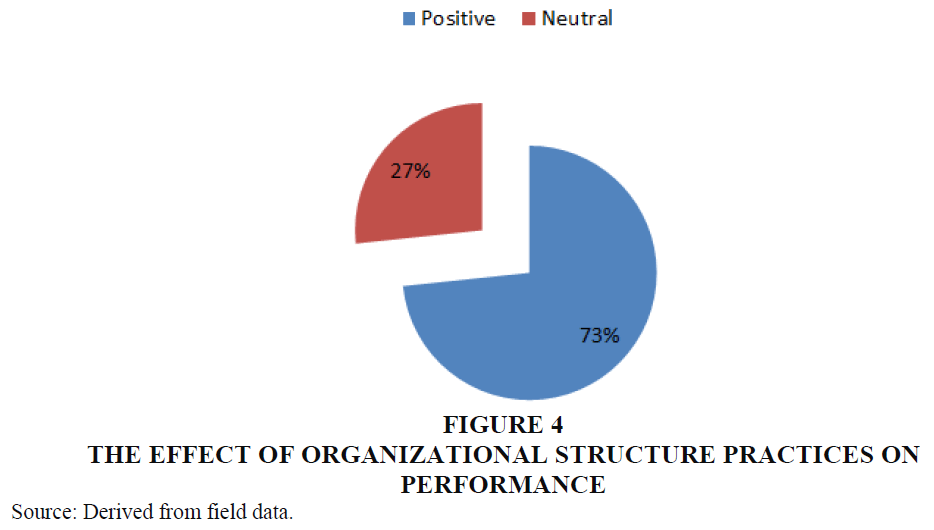

The respondents were probed on their view about the effect of organ Organizational Structure practices on performance of family-owned firms in Kajiado County, Kenya and their responses are analyzed and presented in Figure 4 below

Figure 4 The Effect of Organizational Structure Practices on Performance

Source: Derived from field data.

The study results in Figure 4 reveal that a majority of respondents at 73 percent consider that Organizational Structure practices have a positive effect on performance of their firms. At the same time, nearly 27 percent of study respondents are neutral or not sure of the statement which means that they cannot clearly discern the effect of Organizational Structure practices have a positive effect on performance of their firms. This result may underscore the need for firms to heighten awareness of Organizational Structure practices and how they can affect performance. Another important result is that no respondent opined negative effect of Organizational Structure practices on performance; thus, there is a strong concurrence of favorable effects of Organizational Structure practices on performance.

Organizational Systems

The respondents were required to indicate their views on several questions concerning Organizational Systems and the responses are organized and analyzed as below table 8.

| Table 8 Organizational Systems | ||||||||

| Organizational Systems | SA | A | N | D | SD | |||

| Total | Mean | SD | ||||||

| My firm has a well-defined and clear Workflow arrangements | 4 | 23 | 10 | 5 | 3 | 45 | 3.33 | 2.97 |

| The firm develops and uses clear work procedures for successful accomplishment of tasks and performance success | 6 | 24 | 9 | 3 | 3 | 45 | 3.6 | 3.22 |

| The firm has adequate processes to support the effective implementation of plans, programmes, and value creation. | 3 | 22 | 9 | 8 | 3 | 45 | 3.27 | 2.92 |

| The firm has a clear channel for communication among various stakeholders | 6 | 24 | 6 | 6 | 3 | 45 | 3.53 | 3.18 |

| The firm has clear feedback mechanisms for engagement and support for work improvement | 5 | 27 | 10 | 3 | 0 | 45 | 3.67 | 3.2 |

| Overall average | 3.48 | 3.10 | ||||||

From table 8, a bulk of 51.0 percent of respondents agrees that their firm has well-defined and clear workflow arrangements. The proportion indicating strongly agrees is 9 percent which goes further to support the concurrence with the statement. A significant proportion of 20 percent is uncertain or neutral which should be a point of concern to the firms. A mean of 3.33 support an inclination of neutral position on this issue. A majority of respondents at 53 percent agree to the statement that their firm develops and uses clear work procedures for successful accomplishment of tasks and performance success. Another 13 percent indicate strongly agree which echoes the overall inclination of the respondent sentiments. A sizeable proportion of 19 percent is uncertain or neutral which should be a point of concern to the firms since this may affect efficiency and overall performance. However, a mean of 3.60 support an agree position on this matter. About 49 percent of respondents indicate that their firms have adequate processes to support the effective implementation of plans, programs, and value creation. The respondents who disagreed and strongly disagreed with the statement constituted 25 percent and this is a pointer that the firms have to address effective implementation of plans through strategies such as better skill training. Overall, a mean of 3.27 support a neutrality view on this issue. Nearly 53 percent and 13 percent of respondents agreed and strongly agreed that their firms have clear channels for communication among various stakeholders’ groups. This reflects a slightly skewed concurrence that their firms have clear channels for communication among various stakeholder’s groups since about 33 percent are either neutral, disagreed and strongly disagreed. Overall, a mean of 3.53 supports a weak agree position on this issue. Finally, a majority of 60 percent agreed that their firms have clear feedback mechanisms for engagement and support for work improvement. This is further supported by an 11 percent of respondents who stated that they strongly agreed. A mean score of 3.67 shows support for an agree position on this statement. The overall mean score for organizational systems design is 3.48 which show a weak agree position that organizational systems design has an impact on the performance of family-owned firms. Under the objective on Organizational Systems practices, the results reveal that FOFs have well-defined and clear Workflow, develops and uses clear work procedures for successful accomplishment of tasks and performance success, have adequate processes to support the effective implementation of plans, programs, and value creation, have clear channels for communication, and have clear feedback mechanisms for engagement and support for work improvement.

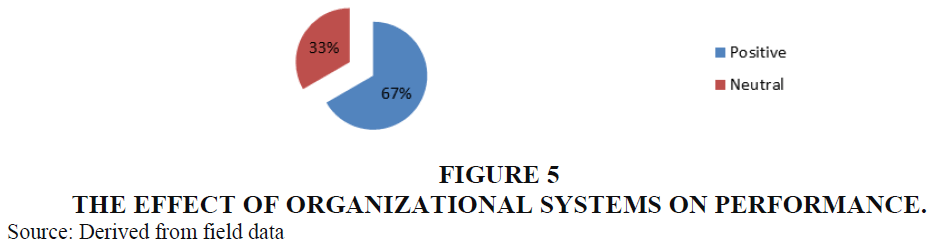

The respondents were probed on their view about the effect of organ organizational Systems on performance of family-owned firms in Kajiado County, Kenya and their responses are analyzed and presented in Figure 5 below

The study results in Figure 5 shows that a substantial majority of respondents at about 67 percent regard their organizational systems as important elements in positively impacting performance. About 33 percent indicated neutrality which shows they are not sure on whether organizational systems affect performance. The considerable proportion of respondents showing neutral position may imply their ignorance in how they can harness or leverage organizational systems for purposes of enhancing their own performance and that of their firms. The absence of a no negative response is an indication of consensus that organizational systems have some form of positive effect on performance.

The inferential analysis applied in this section incorporates correlation and multiple regression models. These analytical methods provide an opportunity to investigate and identify any existing relationships between the variable (dependent and independent). A combination of correlation and multiple regressions provide an opportunity to reveal the associations and effect of the dependent and independent variables. The total number of responses received was 55 responses.

Correlation Analysis

Pearson correlation analysis was conducted to reveal the direction and strength of association between the variables. The results are summarized in table 9 below.

| Table 9 Multiple Correlation Analysis Results | |||||

| Y | x1 | x2 | x3 | ||

| Y | Pearson Correlation | 1 | .830** | .899** | .883** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| N | 45 | 45 | 45 | 45 | |

| x1 | Pearson Correlation | .830** | 1 | .849** | .742** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| N | 45 | 45 | 45 | 45 | |

| x2 | Pearson Correlation | .899** | .849** | 1 | .882** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| N | 45 | 45 | 45 | 45 | |

| x3 | Pearson Correlation | .883** | .742** | .882** | 1 |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| N | 45 | 45 | 45 | 45 | |

The findings in Table 9 show that organizational skills exhibited a significant correlation with Performance (r = 0. 830, p< 0.01). There was also a positive and significant correlation between organizational skills and the other variables. The findings reveal a positive correlation which is statistically significant, between organizational structure with Performance (r =-0.899; p< 0.01). Equally, there is a positive and significant correlation between organizational structure and the other variables. Organizational Systems exhibited a positive and significant correlation with Performance (r = 0.883, p< 0.01) and also with the other variables. This means that organizational systems support organizational skills and organizational structure.

Results for Multiple Regression Analysis on strategic management practices and the performance of family-owned firms

A multiple regression analysis was carried out to assess the effect of the independent variables (strategic management practices) on the dependent variable (performance). The correlation coefficient (R) and coefficient of determination (R2) provide a pointer of the direction and the strength of the relationship between the strategic management practices (independent) and performance (dependent) variables. The outcomes of the analysis are summarized in Table 10 below.

| Table 10 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .929a | 0.862 | 0.852 | 0.47148 |

The summary of the multiple regressions in Table 10 above indicate a near perfect fit of the data in the model. The coefficient of determination (R-square) value was 0.862 showing that the proposed model explained nearly 86 percent of the variance in the performance (dependent) variable. This finding implies that the strategic management practices variables included in the study model substantially explained or predicted the outcome variable. The value of 1.000 for adjusted R-squared further confirms the model's strong fit. The value of standard error of the estimate was .47148, thus indicating a considerable average difference concerning the predicted and observed values.

Regression Model Fitness Test

Model fit analysis was performed to determine whether the model was appropriate for the collected data. The results are shown in Table 11.

| Table 11 Regression Model Fitness Results | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 57.114 | 3 | 19.038 | 85.641 | .000b |

| Residual | 9.114 | 41 | 0.222 | |||

| Total | 66.228 | 44 | ||||

b. Predictors: (Constant), x3, x1, x2

Findings captured in Table 11 show that the model was a good fit to the data. Essentially, the regression analysis shows that the regression model explained a major part of the variation in the dependent (organizational) variable. Specially, the regression sums of squares of 66.228 indicate that the regression model described a considerable part of the variation in the performance. The mean square for the regression model was 19.038. Additionally, the F-value is 85.641, which indicates a highly significant relationship for the variables. The related significance level is .000, which underscore the likelihood of attaining such a large F-value by accident alone was very low. The findings confirm that the regression model is statistically significant. The analysis shows a significant relationship between the variables, with the model explaining a substantial part of the total variation.

Regression Model Coefficients

The Regression model’s coefficient result is indicated in table 12.

| Table 12 Regression Model Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 0.427 | 0.245 | 1.747 | 0.088 | |

| x1 | 0.222 | 0.099 | 0.246 | 2.24 | 0.031 | |

| x2 | 0.326 | 0.155 | 0.327 | 2.095 | 0.042 | |

| x3 | 0.397 | 0.118 | 0.413 | 3.36 | 0.002 | |

The findings in Table 12 show that coefficient for organizational skills practices was (β1=0.222, p=0. 031), which suggests that a unit increase in organizational skills practices was linked with a .222 increase in performance. Similarly, organizational structure has a coefficient of (β2=0.326, p=0. 042), which indicates a positive effect on the performance. A unit increase in organizational systems is associated with a. 326 increases in the performance. The coefficient for organizational systems was (β3=0. 397, p=0. 002), signifying those organizational systems had a positive effect on the performance. A unit increase in organizational systems is associated with a .397 increase in the performance. These regression coefficients provide valuable insights into the directions and magnitudes of the relationships between the variables. The p-values for all regression coefficients reveal that every independent variable had a statistically significant effect on the performance, emphasizing their prominence in describing the variation in the results.

Discussion of the Findings