Research Article: 2021 Vol: 25 Issue: 1S

Strategic Management of Working Capital and Financial Performance of Listed SMEs In Nigeria

Abimbola Abosede JOSHUA, Mountain Top University

Godswill Osagie OSUMA, Covenant University Nigeria

Ochei Ailemen IKPEFAN, Covenant University Nigeria

AGBEYANGI B.A., Federal polytechnic, Nigeria

Areghan ISIBOR, Covenant University Nigeria

Abstract

This study revealed the effects of effective management of WC on the financial performance of listed SMEs in Nigeria. The data for the study was spawned from the annual reports published by the listed SMEs in Nigeria. The proxy for the dependent variable is profit after tax (PAT) while that of the independent variables includes; inventories, trade and other receivables, gross profit and monetary policy rates. There are Nine (9) listed SMEs on the Alternative Security Markets (ASeM) while 5 were sampled by adopting the scientific random sampling technique. The study made use of panel regression analysis to empirically unravel the effects of the independent variables on the dependent variable of SMEs under study for seven years spanning from 2012 to 2018. It was revealed that positive but insignificant relationship exist between the dependent variable and three (3) independent variables, only trade and other receivables (TOR) were significantly and negatively related to the dependent variable. Thus, the recommendation that the Nigerian government should revisit the interest rate on SMEs loans to enhance accessibility and affordability which in the long run promotes the development of the sector and the nation at large.

Keywords

Working Capital Management (WCM); Small and Medium Enterprises (SMEs); Financial Performance; Panel Regression.

Introduction

Several researchers have identified SMEs as the catalyst for the growth and development of an economy. (Fasesin, Ayo-Oyebiyi & Folajin, 2017; Raji, 2017; Atsu & Ojong, 2014). They are the major sub-sector providing greater number of job opportunities as it account for 70% of the employment on the average, provision of foods and value creation for up to 50% - 60% on average, adding to per capita income of nations and enhancing entrepreneurial skills which is the life-wire of any economy, providing greater solutions to poverty and unemployment that is necessary for economic development of any nation as well as contributing to about 50% aggregate to the GDP of countries irrespective of the level of income (Aliyu, 2013; Atsu & Ojong, 2014; Oladimeji & Aladejebi, 2020).

Many developed countries grew as a result of greater focus and stimulations of the Micro, Small and Medium-sized entrepreneur as it plays significant roles in transforming a traditional economy to a modern one by imbibing innovations necessary to enhance revenue generation and socio-economic development (Aliyu, 2013; Atsu & Ojong, 2014). Also, greater involvement of SMEs in the international market enhances growth and development of countries as opportunities are provided for innovation, growth, skills, human capital development and enhancement of productivity since SMEs response rate to changes in markets is faster when compared with larger firms (Oladimeji & Aladejebi, 2020). However, despite these roles played by the SME, they are also faced with various challenges that impede their growth and development which include obsolete technology, difficulty in accessing bank loans and inadequate or lack of capital and financial resources (Etuk & Mba, 2010 cited in Atsu & Ojong 2014; Fasesin et al 2017; Adegbie & Alawode, 2020).

According to the Small and Medium Enterprise Development Agency of Nigeria (SMEDAN), over 80% of SMEs do not survive beyond the first five years (Atsu & Ojong, 2014). To alleviate these challenges, the government of Nigeria made efforts in establishing several regulators such as the Small and Medium Entrepreneur Development Agency of Nigeria (SMEDAN), Nigerian Directorate of Employment (NDE), Bank of Industry (BOI) among others. However, much progress has not been achieved despite these efforts. The Alternative Securities Market (ASeM) launched by the Nigerian Stock Exchange (NSE) was introduced particularly for emerging companies with high potentials for growth in Nigeria which will facilitate easy access to the capital market with rules and regulations that are less stringent. The Executive Director, Business Development of the Exchange, Haruna Jalo-Waziri opined that the Nigerian Stock market has placed good belief in the exacting role of growing enterprises in a developing country and this has spurred a driven platform for sustainable development and growth of small and medium companies. In this light, more WC will be available for listed SMES on the ASeM which could bring about better working capital management in order to ensure the business survival and sustainability. (Yahaya, 2016; Salawu & Alao, 2014; Javid, 2014).

However, the profitability of any organization does not guarantee survival and to enhance business sustainability, SME must strive hard to always meet its short term or immediate obligation (Raji, 2017). Adequate WCM is the life-giving force of organizations for contributing to growth, survival, solvency, value creation and profitability of organizations as it benefits both the profitable and non-profitable organizations (Javid, 2014; Fasesin et al, 2017; Uguru et al., 2018). Therefore, failure of any organisation to manage its working capital effectively can ensure cessation or bankruptcy of such firm (Raji, 2017; Adamu, 2015; Javid, 2014; Agyei-Mensah, 2012).

Theoretically, working capital can be deduced when deduct the current assets from the current liabilities and its adequacy is pivotal for existence, continuity, sustainability and going concern of SMEs as it ensures that the short-term obligations are duly met when due (Osuma et al., 2018). It is a measure of organisations’ financial health and company’s efficiency on a short-term basis. Therefore, efficiency of working capital management is imperative to enhance the competitive business environment and to ensure efficient utilization of resources (Adamu, 2015).

Many Small and Medium-sized companies liquidated shortly after the commencement of business largely because of improper WCM (Kiprotich et al., 2015). The roles played by the SMEs across the globe are widely recognized but the high rate of sudden failure of SMEs had impeded these roles. To minimize this rate of failure, a need for an effective, efficient and adequate management of working capital is imperative to enhance survival and going concern of SMEs. (Yahaya, 2016; Salawu & Alao, 2014; Javid, 2014).Thus, an effective management of WC is vital because a healthy working capital position is crucial for a successful business operation and as a crucial aspect of financial management, WCM requires adequate attention (Osuma at al., 2019; Oladimeji & Aladejebi, 2020). According to Joshi (2013), cited in Yahaya and Bala (2015), no business can survive smoothly without an effective WCM because it has been seen as the controlling nerve centre and the lifeblood of any type of business.

Several researches have been carried out on the subject matter most especially in Nigeria yet none focused on the listed SMEs in Nigeria (Gorondutse et al, 2017; Fasesin et al, 2017 & Raji, 2017; Oladimeji & Aladejebi, 2020). The study of Fasesin et al, (2017) and Raji (2017) on the subject matter focused on SME in Osun State Nigeria and not the listed SME, while the study of Adamu (2015) and that of Osuma et al (2018) dealt with deposit money banks in Nigeria. Also, Uguru, et al (2018) as well as Criscent (2016) on the subject matter dealt with the food and brewery industries. Therefore, since researchers have not explored the listed SMEs on the Nigerian Stock Exchange to determine the relationship between WCM and the listed SMEs’ performance focusing on their lending ability, this form a gap which the research aimed at investigating into. The shortcomings observed in the previous researches aid the decision of this study with the focus on the listed SMEs in Nigeria.

Research Hypothesis

H0: There is no significant impact of an efficient WCM on the financial performance of listed SMEs in Nigeria.

Literature Review

Small and Medium Enterprises

The introduction of Small and Medium Enterprises came into existence as far back as 1940 with the objectives of enhancing industrialization and trade (Adegbie & Alawode, 2020). SME as a concept varies in definition based on the individual nation, agencies, policies and roles performed. However, defining SMEs could be based on the level of turnover, employees’ capacity, profit, finance available, the size when compare with that of the industry, total investment and value of assets (Bernard et al, 2019). According to the Bank of Industry (2018), SMEs are enterprises that have the employee capacity of a minimum of ten (10) and a maximum of two hundred (200) with the total assets of not less than ?500 million and the turnover of not less than ?500 million. In Nigeria, SMEs have been a consistent source of Nigerian economic growth and development. Recently in Nigeria's macro-economic environment, SMEs has propelled a higher level of development of GDP as experienced by other developing countries such as Ghana and Kenya.

Concept of Working Capital

Working capital is one of crucial aspect of financial management of any entity that requires adequate consideration (Uguru et al., 2018; Oladimeji & Aladejebi, 2020). Working capital include funds necessary for the running of business for a period of one year (Oladimeji & Aladejebi, 2020). Yahaya (2016) stated that working capital could mean a short-term obligation of an organisation which is part of its financial resources that changes in form on a daily basis. It is also regarded as the management decision regarding the current assets and current liabilities of the business (Oyebamiji, 2015). Working capital can be a comparative advantage to organisations as it relates to liquidity, profitability and solvency (Peng & Zhou, 2019; Troilo et al, 2019; Magni & Marchioni 2020 cited in Zimon & Zimon, 2020). Management of working capital entails effective administration of all current liabilities and assets which is significant to SMEs than large companies since a larger portion of the former assets constitutes current assets (Javid, 2014). However, determining the optimal working capital is a challenge to many organisation (Zimon & Zimon, 2020). Okoye et al, (2016) stated that management of working capital is a decision that involves managing current assets and current liabilities as well the relationship existing between them (Cited in Adegbie & Alawode, 2020; Bernard et al, 2019).

Effective WCM and the Performance of SMEs in Nigeria and Abroad

Raji (2017) examined the subject matter on the performance of SMEs in Nigeria and focused on twenty-eight (28) SMEs in Osun state using time-series data from 2010-2014 financial statements. The study employed a correlation coefficient to test the model and discovered that the net trade cycle, account payables period and cash conversion cycle has a positive effect on the firms’ performance while the inventory turnover in days and the accounts receivables period has a negative effect with firms’ performance. The study of Oladimeji and Aladejebi (2020) aimed at investigating the relationship existing between WCM and profitability of some selected SMEs in Nigeria. The study revealed that for the period under consideration (2014-2018), there is no relationship between the WCM and SMEs. Therefore, the study recommended that the policies of government should focus on enhancing the growth of SMEs and SMEs should imbibe prudent and strategic policies aiming at improving their WC. The study of Adegbie & Alawode (2020) also indicated significant and positive statistical effect WCM on performances of SMEs in poultry industry in Ogun State, Nigeria. Bernard et al, (2019) also revealed a positive and significant statistical relationship between the WCM and the export performance of SMEs in Sri Lanka as WC components such as the inventory management, payable management and receivable management had a positive effect on the export performance in the Sri lanka’s context.

The study of Ndagijimana & Okech (2014) in Nairobi considered all SMEs registered with the Federation of Small and Micro Enterprises revealed that majority of small, medium enterprises in Nairobi buy and sell on credit with a long time of repayment which hurts their cash flow and thereafter could not be able to meet their financial obligations. The study also revealed that many of these SMEs engaged in huge debt with high-interest rates and as a result were not able to pay back the debt. In Tunisia, Bellouma (2014) carried out a research on the subject matter considering 386 Tunisian companies in export trading covering years 2001-2008, the study revealed that there is a negative relationship between profitability and the components of WC under consideration. This is due to the fact that the companies have been experiencing an inadequate level of liquidity which makes it difficult for them to be able to meet up with the level of operating cost. Tufil (2013) investigated the subject matter in Pakistan textile industries considering One hundred and seventeen (117) listed textile companies covering years 2005-2010 (Six years). The findings revealed that liquidity and firm size positively related with profitability of the listed companies under consideration while working capital management has no positive relationship with profitability.

Farooqi & Shajar (2016) averred that working capital management is an arm of management that is essential in all aspects of life. The study revealed the effects an adequate management of working capital has on Indian automobile industries using Mahindra Ltd, Maruti Suzuki India, and Tata motors as case study. The study discovered that the ratio of debtors’ turnover and that of current ratio were positively and significantly related with profitability of both Suzuki and Tata Motors while the rate of inventory turnover of all the three companies was on the reduced side. The study of Gorondutse et al (2017) in Malaysia considered sixty-six (66) listed SMEs from 2006- 2012 (7 years) using the regression method of analysis, the findings indicated that the working capital elements had positive and negative relationship with profitability. The study revealed that the profitability of Malaysian companies depends on effective working capital management. Wambugu (2011) unravelled the effects of an adequate working capital management on the SMEs’ profitability in Kenya. The study adopted a cross-sectional survey research design conducting an in-depth interview. Considering the significant effects of an adequate management of working capital on the SMEs’ profitability in Kenya, it was stated in the study that managers of SME companies can improve the performance of their companies through an effective WCM.

Dato-on et al. (2014) examined the subject matter on SMEs in Cebu. It was discovered that inadequate liquidity as a result of surplus current assets in Cebu SMEs has impeded on the solvency. Ikpefan et al. (2019) averred that deposit mobilization plays a germane role in maintaining an optimum working capital for running the affairs of a business. However, in 2013, the Central Bank of Nigeria (CBN) launched an amount of Two Hundred and Twenty Billion Naira (N220,000,000,000) share capital to assist the SMEs in agriculture and manufacturing sectors when considered the contribution of these SMEs on the development and growth of Nigerian economy (Okunlola et al., 2019). Nyabwanga et al. (2012) examined the subject on SMEs in Kisii South District of Kenya. The study revealed that the prevailing WCM practices among the SMEs in this district have positive effects on the financial performance system. The study of Sajid (2013) on the same subject matter considered the fifty-four (54) listed SMEs on the Karachi Stock Exchange between years 2006-2010 revealed that an effective working capital management is positively and significantly related with the performance of these SMEs as it enhances their performances.

The study of Thomas et al. (2015) in the Machakos Sub-country of Kenya considering 22 listed SMEs out of 159 revealed poor WCM among the SMEs and as a result there is a record of mass failure in the performances. The study revealed a low level of efficiency in receivables, inventory and cash management among the SMEs. The study of Javid (2014) examined the effects of an effective WCM on the SMEs in Pakistan revealed that the performances of companies in Pakistan is significantly related to WCM.

Theoretical Review

The theory authenticating this study is discussed under this section. Theory of WCM aimed at providing extensive strategies reducing financial risk and sustaining financial operations in any organisations. This theory assists in giving directions on how to manage the affairs of organisations and include:

Agency Theory – Cost of Free Cash Flow

According to Jensen and Meckling (1976), agency theory holds a relationship that is contractual between two or more persons that is the principal and the agent in which the agent has an obligation to perform services on behalf of the principal. However, Jensen and Meckling (1976) cited in Hassan et al, (2017) opined that the agency theory central on transaction costs and contracting analysis. The theory held on two-sided transaction which means that financial transactions involve two or more parties who acts in their own best interest though with different expectations (Hassan et al, 2017). However, according to Jensen (1986), agency cost of free cash flows opined that manager (the agents) accumulate cash in their custody and thereby make an investment decision which might not be in the interest of the shareholders (the principals) due to divergence of decisions between the principals and the agents. Free cash flows are excess cash available to finance all viable projects with positive net present value after discounting with the company’s cost of capital (Owele, 2014). Therefore, with an efficient and adequate WCM, managers are tending to invest the principal money in the viable projects which are in the best interest of the shareholders (the principals).

Methodology

This research anchored on the theory of commercial loan which was established by Adam Smith in the 18th century (Sanghani, 2014). This theory states that banks should make short-term commercial loans available for the industrial manufacturers of goods such as SMEs to have sufficient working capital to carry on their business activities smoothly. For example; a rice farmer may need short term loan to finance the production of rice and in which repayment can only be made after the rice germinated and finally sold in the market. Therefore, this theory proposes that by making this form of financing available short-term, the maturity would be in time to keep the banks are always on the alert to meet the unannounced the needs of customers, depositors, and investors who are in need of funds. The theory also stated that the short-term loans for commercial businesses are self-liquidating loans for working capital, instead of financing long-term capital projects like; plants, machinery, purchase of land and buildings etc. The liquidity of the listed SMEs here would be maintained when assets are held in short-term loans that would be liquidated in a regular sequence of the business cycle. Therefore, the commercial loan theory can also be termed as working capital loans because banks finance the producer's business cycle through the various successive stages associated with the production of the goods.

Sample Population

There are nine (9) listed SMEs) on the Nigerian stock exchange under the alternative securities market (ASeM) bourse. Table 1 shows the list of SMEs listed on the Alternative securities market segment.

| Table 1 Table Showing the Listed SMES | ||

| COMPANY | TICKER | SECTOR |

| ANINO INTERNATIONAL PLC | ANINO | OIL AND GAS |

| CAPITAL OIL PLC | CAPOIL | OIL AND GAS |

| CHELLARAMS PLC | CHELLARAM | CONGLOMERATES |

| JULI PLC | JULI | SERVICES |

| MCNICHOLS PLC | MCNICHOLS | CONSUMER GOODS |

| OMOLUABI MORTGAGE BANK PLC | OMOMORBNK | FINANCIAL SERVICES |

| RAK UNITY PET. PLC | RAKUNITY | OIL AND GAS |

| SMART PRODUCTS NIG. PLC | SMURFIT | CONSTRUCTION/ REAL ESTATE |

| THE INITIATES PLC | INITSPLC | SERVICES |

Sample Size

This study adopted five (5) listed Small and Medium Enterprises out of the Nine (9) listed on the alternative security market using the simple random sampling technique for selection which made up a total of 55.56% of the sample population as indicated in Table 2 above. The sample used for this study includes; Capital Oil PLC, Smart Products Nigeria PLC, RAK unity petroleum PLC, Chellarams and McNichols PLC.

| Table 2 Justification of Variables | ||||

| S/no | Variables | Identifier | Data Source | Definition |

| 1 | Profit after tax | PAT | Financial Statement | This is the profit that is earned after all forms of overhead expenses have been deducted. It is used to capture the dependent variable which is financial performance. |

| 2 | Inventories | I | Financial Statement | This is an element of current assets that denotes the stocks, raw materials e.tc available for sale. It is used to capture the independent variable which is working capital. |

| 3 | Gross profit | GP | Financial Statement | This profit differs from the profit after tax in that it covers deductions associated with the sale of its product. Thus, it cannot be taken as a strong measurement of profitability because tax and other expenses are yet to be taken into consideration.. |

| 4 | Trade and other receivables | TOR | Financial Statement | This is also a component of current assets that arise as a result of credit sales made to customers. They are treated as the company's assets. It is also used to capture the independent variable in this study. |

| 5 | Rates of monetary policy | MPR | WDI Report. | The rate of monetary policy is usually fixed by the Apex bank i.e. the Central Bank of Nigeria (CBN). This is the rate at which banks borrow from the (CBN). |

NB: WDI means world development indicators.

Source of Data Collection

The study sourced for secondary data obtained from the published annual financial reports of the companies to ensure the reliability and validity of our findings.

Model Specification

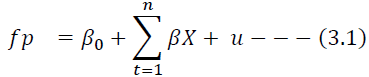

The implicit and econometric expression of the model used in this study is stated below. The implicit expression of the model is stated thus; PAT = f (I, GP, TOR.MPR………….Ut)

where:

PAT: represents profit after tax.

I: represents inventories.

GP: gross profit.

TOR: trade and other receivables.

MPR: monetary policy rate.

U: error term.

FP stands for the dependent variable (Y) which is financial performance proxied by PAT, β0represents the constant, and βX represents the independent variables (X) which are working capital captured by I, GP and TOR.

Re-statement of Hypothesis

H0: There is no significant impact of an efficient WCM on the financial performance of listed SMEs in Nigeria.

Results and Discussion

Table 3 below reveals the descriptive statistics of the variables adopted to conduct the panel least square for this study. The summary or descriptive statistics presents variables employed in the model. PAT is between a minimum of -4.76 and a maximum of 6493 with a mean of -9847250. However, I range from a minimum of 29213.00 and a maximum of 6.00. The mean of GP is 1.22 and it ranges from -177 to 1.09, also the mean of TOR is 1.10 and it ranges from 177 to 8.69 and MPR has a mean of 12.80 which ranges from 12.0 to 14.0 respectively.

| Table 3 Descriptive Statistics | |||||

| PAT | I | GP | TOR | MPR | |

| Mean | -9847250. | 28586367 | 1.22E+08 | 1.10E+08 | 12.80714 |

| Median | 5387300. | 2818236. | 43945726 | 37750263 | 12.66000 |

| Maximum | 64938507 | 6.00E+08 | 1.09E+09 | 8.69E+08 | 14.00000 |

| Minimum | -4.76E+08 | 29213.00 | -177539.0 | 177481.0 | 12.00000 |

| Std. Dev. | 89804635 | 1.01E+08 | 2.49E+08 | 1.96E+08 | 0.821561 |

| Skewness | -4.193209 | 5.335116 | 3.116323 | 2.302468 | 0.556649 |

| Kurtosis | 22.06271 | 30.57176 | 12.01063 | 7.960264 | 1.686070 |

| Jarque-Bera | 632.5067 | 1274.665 | 175.0545 | 66.80576 | 4.325194 |

| fProbability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.115026 |

| Sum | -3.45E+08 | 1.00E+09 | 4.28E+09 | 3.86E+09 | 448.2500 |

| Sum Sq. Dev. | 2.74E+17 | 3.49E+17 | 2.10E+18 | 1.31E+18 | 22.94871 |

| Observations | 35 | 35 | 35 | 35 | 35 |

From the correlation matrix in Table 4; it reveals that a negative relationship exists between profit after tax (PAT) with trade and other receivables (TOR) and monetary policy rate (MPR) is also negatively related with all the independent variables except the dependent variable which is the profit after tax (PAT). Also, the correlation matrix table shows that there is no incidence of multicollinearity as the variables show no sign of correlational association of up to 0.8 and above.

| Table 4 Correlation Matrix | |||||

| PAT | I | GP | TOR | MPR | |

| PAT | 1.000000 | ||||

| I | 0.142558 | 1.000000 | |||

| GP | 0.056487 | 0.150182 | 1.000000 | ||

| TOR | -0.280305 | 0.304904 | 0.024847 | 1.000000 | |

| MPR | 0.086299 | -0.166024 | -0.081273 | -0.256389 | 1.000000 |

Regression Analysis

In order to empirically ascertain the relationship that exist between an efficient WCM and financial performance of five (5) listed SMEs on the alternative securities market (ASeM) in Nigeria, the panel data regression analysis was adopted. Table 5 and Table 6 give a detailed discussion of the result of the panel regression analysis. In Table 5, the Hausman test results are to ascertain the appropriate model for the panel regression. The rule of thumb for the test states that if the probability value (p-value) is less than or equal to 0.05 (5%) which is significant statistically, the null hypothesis should be rejected. Thus, making the Fixed Effect Model (FEM) appropriate. On the other hand, it also states that if the probability value (p-value) is statistically insignificant at 0.05 (5%), the null hypothesis should be accepted. Thus, making the Random Effect Model (REM) appropriate.

| Table 5 Hausman Test | |||

| Correlated Random Effects - Hausman Test | |||

| Equation: Untitled | |||

| Test period random effects | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Period random | 4.004370 | 3 | 0.2610 |

| Table 6 Panel Regression | ||||

| Period random effects test equation: | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 5080437. | 19497796 | 0.260565 | 0.7966 |

| I | 0.241770 | 0.183089 | 1.320504 | 0.1986 |

| GP | -0.006513 | 0.066499 | -0.097948 | 0.9228 |

| TOR | -0.190898 | 0.091748 | -2.080681 | 0.0479 |

| MPR | 4534332. | 19294604 | 0.235005 | 0.8158 |

| Effects Specification | ||||

| The period fixed (dummy variables) | ||||

| R-squared | 0.260284 | Mean dependent var | -9847250. | |

| Adjusted R-squared | 0.068953 | S.D. dependent var | 89804635 | |

| S.E. of regression | 90074274 | Akaike info criterion | 39.70512 | |

| Sum squared resid | 2.03E+17 | Schwarz criterion | 40.14951 | |

| Log-likelihood | -684.8397 | Hannan-Quinn criter. | 39.85853 | |

| F-statistic | 0.977416 | Durbin-Watson stat | 1.556085 | |

| Prob(F-statistic) | 0.481559 | |||

From the analysis in Table 5, it is seen that the probability value of 0.2610 is greater than 5% (i.e. 0.2610>0.05) the null hypothesis would be accepted meaning that the Random Effect Model would be adopted.

Table 6 represents the panel regression of the dependent variable (PAT) and the independent variables (I, GP, TOR, and MPR). The coefficient of determination (r2) is 0.26 (26%) which reveals that 26% of the total variation in the dependent variable (PAT) is explained by the independent variables (I, GP, TOR, and MPR) while the remaining 74% are explained by external factors that are usually termed outlier because they are not well fitted in the regression line. The Durbin Watson test stat of 1.556085 lies within the acceptance region and this also depicts that there exists no serial correlation which is usually associated with time-series data. The regression coefficient of the variable shows the significance and direction, and from the estimated model only TOR is significant but negatively related to profit after tax (PAT) while all other variables are insignificant.

Conclusion and Recommendations

Although, Nigeria government has been making a tremendous effort to enhance the growth and development of this sector, yet the effort seems inadequate. From the analysis above, we can conclude that external factors such as government monetary policy rate (MPR) had been impeding the level of performance of the listed SMEs in Nigeria. Current assets and liabilities are the components of working capital, which are negatively impacted as a result of the high-interest rate placed on loans obtained by these SMEs to finance their business. Therefore, this study is of the opinion that the government of Nigeria should revisit the interest rate on SMEs loans to enhance accessibility and affordability which in the long run will promote the development of the sector and the nation at large.

Acknowledgement

The Authors earnestly appreciate Covenant University for sponsoring this research.

References

- Adamu Y. (2015). Working capital management and financial performance of deposit money banks in Nigeria. Research Journal of Finance and Accounting 6(16), 57-61.

- Adegbie, F.F., & Alawode, O.P. (2020). Financial management practices and performance of small and medium scale poultry industry in Ogun State, Nigeria. Journal of Finance and Accounting, 8(2), 90-106.

- Agyei-Mensah, B. (2012). Working capital management practices of small firms in Ashanti region of Ghana. International Journal of Academic Research in Business and Social Sciences 2(1), 567-583.

- Aliyu, A.J. (2013). Impact of government interventions on small scale enterprises in Mubi north local government area, Adamawa state, Nigeria. Journal of Economics and Sustainable development, 4(17), 121-128.

- Atsu, A.I. & Ojong C.M. (2014). The role of government in the development of SME in Nigeria between 1991-2012.International Journal of Business and Social Research 04(12), 16-26.

- Bank of Industry, (2018). Micro, Small and Medium Enterprises definitions. Retrieved from http://www.boi.ng.

- Bellouma, M. (2011). The impact of working capital management on profitability: The case of small and medium-sized export companies in Tunisia. Management International 15(3), 71-88.

- Bernard, D.T.K., Almeida, A., Perera, S., Senevirathna, M., Jayarathna, H., & Munasighe, A.A.S.N. (2019). The effect of working capital management on the export performance of small and medium export enterprises. Evidence from export manufacturing sector in Sri Lanka. Journal of Economics and Business, 2(3), 660-675.

- Criscent, I.E (2016). Effects of working capital management on the performance of food and beverage industries in Nigeria. Arabian Journal of Business and Management Review, 6(5), 1-7.

- Dato-on, V.E., Monto, R.P., Catalay, N.M., Villanueva, G.B., Velez, J.K. & Temanel, E.O. (2014). Working capital management of small and medium enterprises in Cebu. UV Journal of Research, 173 – 189.

- Deloof, M. (2003). Does working capital management affect profitability of Belgian firms? Journal of Business, Finance and Accounting, 30, 573-58.Eljelly A.M.A. (2004).

- Liquidity-profitability trade-off: An empirical investigation in an emerging market. International Journal of Commerce and Management (IJCOMA), 14, 48-61.

- Falope, O.I, & Ajilore, O.T. (2005). Working capital management and corporate profitability: Evidence from panel data analysis of selected quoted companies in Nigeria. Research Journal of Business Management, 3, 73-84.

- Farooqi, S.A., & Shajar, S.N. (2016). Impact of working capital management on the profitability of automobile industry in India: an empirical study of selected automobiles company. Pacific Business Review International, 1(1), 1–9.

- Fasesin, O.O., Ayo-Oyebiyi, G.T., & Folajin, O.O. (2017). Working capital management and its influence on the performance of Small and medium enterprises in Osun State Nigeria. International Journal of Business and Law Research 5(3), 16-24.

- Gakure R., Cheluget K. J., Onyango J. A. &Keraro V. (2012). Working capital management and profitability of manufacturing firms listed at the Nairobi stock exchange. BAM 2: 680-686.

- Gorondutse, A.H., Alli, R.A., Abubakar A., Naalah, M.N.I. (2017). Effects of working capital management on SMEs profitability in Malaysia. Polish Journal of Management Studies, 16(2),99-109.

- Hassan, U.O., Mberia, H.K. & Muturi, W, (2014). Effect of working capital management of firms’ financial performance: A survey of water processing firms in Puntland. International Journal of Economics, Commerce and Management 5(1), 479-497.

- Ikpefan, O., A., Ibinabo, H., Osuma, G., O., and Omojola, O., (2019). Relationship Marketing and Deposit Mobilization in Five Deposit Money Banks in Nigeria. Academy of Strategic Management Journal 18(6), 1-15.

- Javid S. (2014). Effects of working capital management on SMEs performance in Pakistan. European Journal of Business and Management 6(12), 206-220.

- Jensen, M. (1986). Agency cost of free cash flow, corporate finance and takeovers. American Economic Review 76, 323-329.

- Jensen, M.C. and Meckling, W.H. (1976). Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics 3(4), 305-306.

- Joshi R. (2013). Working capital management of commercial banks in Nepal. Being an MSc. A thesis submitted to the Faculty of Management Tribhuvan University, Shankar Dev Campus, Kathmandu. In Yahaya, A., & Bala, H. (2015). Working Capital Management and Financial Performance of Deposit Money Banks. Research Journal of Finance and Accounting, 6(16), 57-71.

- Khan (2012). Working capital management and firm’s profitability in Pakistan: A disaggregated analysis. AJBM 6, 3253-3261.

- Kiprotich, S., Kimosop, J., Sarmwei, J., & Abalo, M. (2015). An assessment of working capital management practices on small, medium enterprises in Eldoret Municipality. International Journal of Economics, Commerce, and Management, 3(8), 323-337.

- Magni, C., & Marchioni, A. (2020). Average rates of return, working capital and NPV-consistency in project appraisal: A sensitivity analysis approach. International Journal of Business and Social Science, 5(12), 160-164.

- Ngagijimana, J.P., & Okech, T.C. (2014). Determinants of working capital management practices in small and medium enterprises in Nairobi. International Journal of Business and Social Science 5(12), 160-164.

- Nyabwanga, R. N., Odera, P. Luminba M. Odondo, A.J., & Otieno, S. (2012). Effects of working capital management practices on financial performance: A study of small-scale enterprises in Kisii South District, Kenya. African Journal of Business Management, 6(18) 580 – 587.

- Okoye, L.U., Erin, O., Modebe, N.J., & Achugamonu, U. (2016). Working capital management and the performance of consumer and industrial goods sectors in Nigeria. 28th IBIMA conference: Theme-Vision 2020: Innovation Management, Development Sustainability and Competitive Economic Growth. 4408-4418.

- Okunlola, F.A., Osuma, G.O., & Omankhanlen, E.A. (2019). Agricultural finance and economic growth: Evidence from Nigeria. Business: Theory and Practice, 2019(20), 467-475.

- Oladimeji, J.A., & Aladejebi, O. (2020). The impact of working capital management on profitability. Evidence from selected small businesses in Nigeria. Journal of Small Business and Entrepreneurship Development 8(1), 27-40.

- Oladipupo, R.N., & Okafor, C.A. (2013). Relative contribution of working capital management to corporate profitability and dividend payout ratio: Evidence from Nigeria. International Journal of Business and Finance Research, 3 (2), 11 – 20.

- Osuma, G.O., Babajide, A.A., Ikpefan, O.A., Nwuba, E.B. & Jegede, P.W. (2019). Effects of Global Decline in Oil Price on the Financial Performance of Selected Deposit Money Banks in Nigeria. International Journal of Energy Economics and Policy. 9(3), 187–195.

- Osuma, G., Ikpefan, A., Romanus, O., Ndigwe, C., & Nwadimmah P. (2018). Working capital management and bank performance: Empirical research on ten deposit money banks in Nigeria. Banks and Banks System 13(2), 49-61

- Owelle, M.L. (2014). Working capital management approaches and the financial performance of agricultural companies listed on Nairobi securities exchange. M.Sc. Dissertation, University of Nairobi Business School.

- Oyebamiji, N.A. (2015). Working capital management and firms' performance: A study of manufacturing companies in Nigeria. M.Sc Thesis. University of Nigeria, Enugu Campus.

- Peng, J., & Zhou, Z. (2019). Working capital optimization in a supply chain perspective. European Journal of Operational Research 277, 3846-3856.

- Raji S. (2017). Impact of working capital management on small and medium enterprises’ performance in Nigeria. Arabian Journal of Business and Management Review, 7(1), 1 – 5.

- Sajid G. (2013). Working capital management and performance of SME Sector. EJBM, 5, 60-68.

- Salawu, R.O., & Alao, J.A. (2014). Working capital management and the performance of quoted manufacturing companies in Nigeria. Research Journal of Finance and Accounting, 5(14), 80-92

- Sanghani, D.A., (2014). The Effect of Liquidity on the financial performance of Non-Financial companies listed at the Nairobi securities exchange. A research project submitted for the degree of Master of Science in Finance, School of Business, University of Nairobi.

- Sushma, V., &. Bhupesh, S. (2007). Effect of working capital management policies on corporate performance: An empirical study. Global Business Review, 8(2), 267-281

- Thomas N., Ombaki C., Zablon E., & Jared A. (2015). Influence of working capital management practices on financial performance of small and medium enterprises in Machakos Sub-County, Kenya. International Journal of Sciences: Basic and Applied Research (IJSBAR), 30(4), 286 – 309.

- Troilo, M., Walkup, B.R., Abe, M., & Lee, S. (2019). Legal systems and the ?nancing of working capital. International Review of Economics & Finance, 64, 641–56

- Tufil, S. (2013). Impact of working capital management on profitability of the textile sector of Pakistan. Proceedings of 3rd international conference on Business management.2-25. University of Management and Technology, Lahore, Pakistan.

- Uguru, L.C., Chukwu, O.C., & Elom J.O. (2018). Effects of working capital management on the profitability of brewery firms in Nigeria. IOSR Journal of Economics and Finance, 9(2), 9-20.

- Wambugu P. M. (2011). Effects of working capital management practices on profitability of small and medium enterprises in Nairobi County, Kenya. A research project for MSc. in Business Administration, Kenyatta University.

- Yahaya, A., & Bala, H. (2015). Working Capital Management and Financial Performance of Deposit Money Banks. Research Journal of Finance and Accounting, 6(16), 57-71.

- Yahaya, A. (2016). The effects of working capital management on the financial performance of pharmaceutical firms in Nigeria. International Journal of Economics, Commerce, and Management 4(4), 349-367.

- Zimon, G., & Zimon, D. (2020). Quality management systems and working capital SMEs in GPO – A case of Poland. Administrative Science, 10(76), 1-13.