Research Article: 2020 Vol: 19 Issue: 3

Strategic Management of Development and Institutional Formation of Organizations

Viera Bartosova, University of Zilina

Vladimir Minaev, Tula of Branch RANEPA

Anastasiia Charkina, Interregional Academy of Personnel

ManagementViktoriia Cherniakhivska, Interregional Academy of Personnel Management

Nadiia Andriichenko, Sumy State University

Abstract

The article is devoted to solving the scientific problem of strategic management and methodological substantiation of the development of organizations in the context of international business. The feasibility of using new institutional strategies for the development of organizations has been identified and methodologically substantiated. The logical-process model of the strategic institutional development of the organization has been developed and the transactional approach to the analysis of the effectiveness of the formation and integration development of organizations has been highlighted.

Keywords

Strategic Management, Economic Organization, Strategic Institutional Development, Transactional Approach, Institutional Strategies.

JEL Classifications

M5, Q2

Introduction

The problem of institutional development of market structures in the global economy, despite its demand for practice and a considerable number of scientific publications, remains still unsolved. The conceptual and scientific/methodological base of interaction of economic organizations with the institutional environment is undeveloped. Conceptual framework does not consider many important aspects of these relations, and the mechanisms of institutional processes are studied fragmentarily, mainly at the macro level. Economic organizations are at the same time the main objects and subjects of social transformation. The leading role of organizations in changing institutional system is an essential factor that requires the development of this and other related scientific concepts. Due to extension of object and clarifying the scientific framework of institutional research, we offer to introduce some new notions that express the essence of economic relations associated with mutual development of organizations, business entities and the institutional environment.

Literature Review

The activity of all economic organizations, including corporate structures, is carried out under the influence of interaction with the environment, segments of which form many physical, technological, economic, political, structural and other restrictions. According to Castoriadis (1987), institutional constraints imposed by formal (laws, regulations and regulations) and informal (rules, customs, stereotypes) regulations cover all segments of the external environment of economic organizations while setting the limits of their possible actions and ensuring freedom of action at the same time (Drobyazko et al., 2019 a & b; Durmanov et al., 2019 a &b). The set of these constraints creates institutional environment where the organization operates (Mintzberg, 1984). Any economic organization does not interact with all existing institutions, but only part of them, which has a direct impact on its activities and forms the individual limits of its institutional field (IF).

Methodology

An essential feature of institutional interaction between the organization and environment is its institutional climate. Institutional climate is a condition of institutional field of an organization that remains constant for some time and is characterized by certain parameters of the institutions included into it. These parameters include accepted concepts, parameters, effectiveness, certainty and quality of formal and informal regulations that form institutions, as well as mechanisms for their implementation. The institutional climate may be represented by concrete and targeted characteristic of the institutional environment of a particular organization, group of organizations, or all economic organizations of studied system, which may be the national economy.

Findings and Discussion

The nature of the institutional field is determined by the ability of its parameters to promote the achievement of goals and objectives of the organization and can be preferential, restrictive and liquidating. The preferential institutional climate provides for the development of economic organizations, the restrictive climate is characterized by a state that promotes stagnation of production, and the need to develop measures for “survival” of the organization, and, finally, the liquidating climate may be represented by closure or bankruptcy of economic organizations (Dixit, 2009).

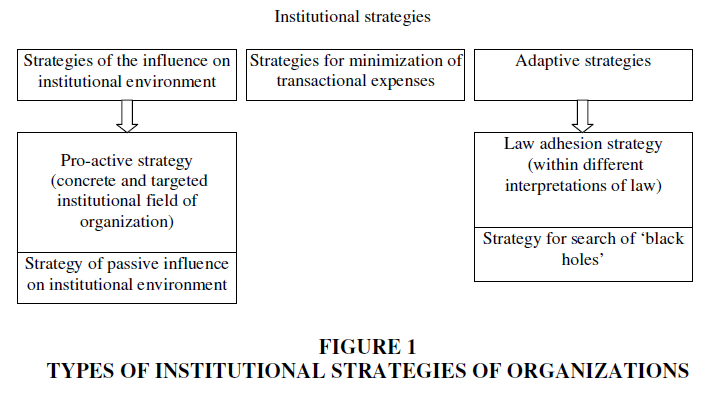

The institutional climate is a concept that dependents on the condition and dynamics of the institutions that influence the activities of economic organizations. Institutional climate of the organization changes with inclusion or exclusion of a number of rules from the institutional field. The task of any organization in terms of regulation of its own institutional field is to change its parameters (composition of regulations, quality, efficiency) in order to improve the institutional climate. Institutional policy of economic organizations is a manifestation of their curiosity, reflected in the achievement of goals, and is characterized by adherence to some rules and regulations, the development and the exclusion of other regulations (Figure 1).

Institutional policy is inseparable from the technical, economic, environmental, personnel, organizational and other components of the general policy of the organization. Its elements are already visible in the activities of organizations in various industries. For objective economic reasons, accounting for institutional factors and the desire (mostly undeclared) to develop institutional policies are peculiar for large companies and organizations (Makedon et al., 2019a). At the same time, the greater economic and management potential of the company, the more it is able to form and realize the institutional component of general development policy.

Institutional strategy should create directions of institutional policy.

According to authors, institutional strategy is an integral part of the general strategy, which has a significant impact on the formation of the goals of the organization and choice of ways to achieve them. According to Young et al. (2008) institutional components are becoming more and more critical in general strategies of large organizations. Figure 1 shows current typology of corporate institutional strategies.

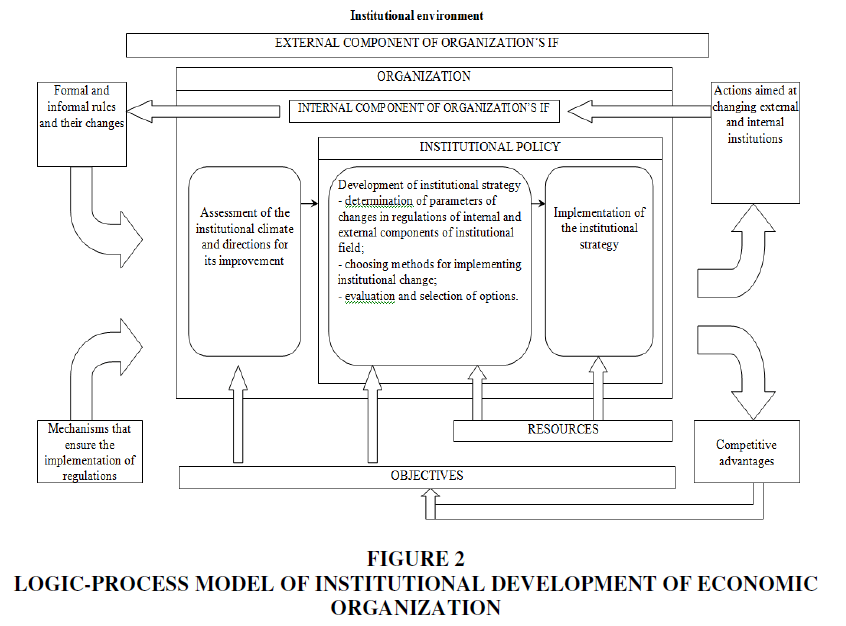

Based on the logical-process method, the process of institutional development of an economic organization can be represented schematically in the form of blocks united by causal logical connections (Figure 2). An organization is considered as a system that has a specific purpose and constraints set by institutes and regulations being under development.

The model contains three feedback loops that directly influence the institutional development process of an organization:

- Loop for development of the external component of organization's institutional field;

- Loop for the development of the internal component of organization's institutional field;

- Loop for development of organization's objectives.

The main tasks of the mechanism of implementation of the logic-process model is evaluation of institutional field in terms of its influence on the possibility of achieving organization's objectives, development of institutional strategy that determines parameters of changes in the regulations of internal and external institutions, and actions aimed at adjusting objectives and changing the content of the institutional field (Gomes & Wojahn, 2017).

In the last decade, approaches to evaluation of the efficiency have undergone some changes. Under conditions of centralized of managed economy, it was considered as a category of social production efficiency. While domestic literature of that period was mostly devoted to issues of efficiency of social production and national economic efficiency, now the problems of calculation of commercial efficiency, risks of investments, management efficiency are more widely discussed. Such researcher as Tricker (2009) outlines the following conceptual approaches to evaluation of corporate development effectiveness.

An approach based on transaction cost theory

This approach focuses the attention of the organization's managers on the possibilities of different forms of savings by improvement market behavior of individual firms through the conclusion of long-term contracts that regulate joint activities. According to transaction costs theory, the most important integration factor is the so-called specific assets of cooperating enterprises, i.e. specific characteristics of resource potential (fixed assets, personnel, know-how), cooperatives that ensure efficiency. They include the following: focused specialization of production and equipment; close location of adjacent industries; the presence of complementary specializations of the workforce and cooperation in research and development (Roe, 2005). The increase in the level of “specificity” of the assets of the cooperating business entities results in the increase of motivation to enter into long-term bilateral (multilateral) contractual relations as an alternative to focusing on independent market behavior or concluding one-off agreements.

Transactional approach to analyzing the effectiveness of economic integration has some drawbacks. The most serious of them are specified below. First, there is a lack of focus on the prospective interaction of partners, possible change in technological and economic conditions of production as a result of the emergence of new target plants. Secondly, such important factor as the ability to jointly manage financial resources, the interaction of financial institutions and businesses, is not considered. Third, the efficiency of the joint activity is evaluated only by “profit – expenses” criterion.

Approach for ensuring competitive advantage

According to this approach, integrative decisions of corporate management should be aimed at long-term competitive advantages (Zingales, 1997). In this case, the potential of competitive ability is not associated current profit indexes but it is considered as a set of pre-emptive factors that guarantee the long-term benefits of an organization in commodity markets.

Most important factors are listed below:

1) Quality (consumer characteristics) and price of products;

2) Innovation potential, the sufficiency of production and marketing capacities;

3) The existence of a long-term strategy of activities that ensures the maintenance or increase of sales volumes;

4) Availability of corporate culture. In the context of this approach, the sources of creating competitive advantage also include optimization of external and internal corporate relations: these advantages are mostly determined by how company has managed to organize technological chains of interaction with suppliers, sales, service organizations, research institutes and customers.

Approach based on the theory of financial management

According to this theory, the main motives for merging into a corporate structure and joint activities are as follows:

1. Synergistic effect determined by the fact that total result exceeds the sum of added effects (case of synergistic merger, the cost of the merged entity exceeds the sum of costs of merging entities).

2. Operating savings due to elimination of duplication of management functions, their centralization and reduction of marketing costs.

3. Economy associated with the growth of production scale: its concentration leads to lower costs as well as more efficient use of resources.

4. Savings on tax payments, associated with: integration with a company that has tax benefits; acquisition of unprofitable firm to conceal its high profits; increase in depreciation at the time of the merger (which reduces the taxable base).

5. Purchase of assets at market price that is much less than their recoverable price. The effectiveness of such acquisition is achieved if the cost of a third party is less than costs for deployment of similar production, and if the management of parent firm finds effective ways to use new assets.

6. Diversification does not lead to an increase in the value of the organization but ensures the reduction in corporate risks and aims at gaining long-lasting competitive advantages.

7. Benefits from borrowing, which can significantly increase the value of organization (it is easier for larger organization to attract credit resources at lower interest rates due to the reduction of financial risks) and other effects.

The approach related to the specific interaction of shareholders and managers

The central problem of this conceptual approach is to align the actions of the managing organizations with the interests of the shareholders: managers, taking advantage of access to financial and economic information and business relationships, can use this potential in their own interests; shareholders are forced to bear certain expenses (“agency” costs) in order to minimize the potential loss (Makedon et al., 2019b). This aspect of analysis of the efficiency of organization's institutional establishment becomes more critical due to possible underdevelopment of the national stock market and high motivation of management to obtain ownership of company shares and redistribute shareholder ownership in its favor.

The approach aimed at forming mutually beneficial long-term business relationships

This approach is used in the design and analysis of domestic integrated structures, since the switch from conventional practice of constant change in suppliers to establishment of stable long-term cooperative relations with suppliers and users is observed in country's economy.

Considering the experience of Japanese organizations, it is necessary to distinguish “effect-forming” factors that can be applied to integrated corporate structures (Nee, 2003; World Bank, 2018):

- Development of real intra-company relations, including exchange of resources (which should be empirically fixed through volumes of mutual cooperative deliveries);

- Availability of a common system of internal corporate planning and quantitatively defined tasks for the members of the organization;

- Development of a system of cross-ownership of shares within the group;

- The focus on increasing investment potential (including from borrowed sources) and on maintaining the competitive state of the production facilities rather than volume and dynamics of current profit of the group members;

- Optimization of the bank's role in the group (it should be generally subordinated to the main commodity producers; the share of long-term industrial investments in the bank's loan portfolio should show increase).

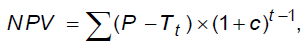

The possibility for use of capital value index for analysis and development of special effective regulations of business operations is conditioned by the fact that it is one of main indexes of successful operation of organization in market environment since a set of indexes that characterize long-term business activity of organization is used in calculation of capital value. Considering this fact, the evaluation of the efficiency of institutional strategies of organizations can be based on calculation of net discounted flow:

(1)

(1)

Where: C is discount rate;

t is the period of time;

NPV is net discounted income;

P is total income;

T is transaction costs.

An important methodological component of evaluation of effectiveness of corporate strategies is a multi-parameter approach.

Together with determination of overall performance of organization, it is reasonable to evaluate of main business entities that often have conflicting interests within the scope of multi-parameter approach (Garriga & Melé, 2004; Lojpur, 2005). It is easy to differentiate between different groups of people interested in evaluating the efficiency of integrated structure: owners, managers of the integrated structure, shareholders, labor collective, business partners (including consumers, suppliers, and financial institutions), authorities and administrations of various levels. The efficiency criteria for different groups of stakeholders differ considerable. Therefore separate efficiency criteria (Table 1) should be considered for each group. In terms of multi-parameter approach, the higher satisfaction of different group and individual interests, the higher efficiency of organization.

| Table 1 Indexes, characterizing the interests of individual groups in the development of the organization | ||

| Groups concerned | Basic interests | Type of interests in results |

| Shareholders/owners | Getting maximum return on invested capital considering risk, increasing organization value | Dividends |

| Management | Stability of organization development and strength of own position | Labor payment Promotion |

| Investor, creditors | Refund of equity capital with interests | Return on capital |

| Servicing organizations | Guarantee of employment and payment of wages | Wage Labor safety |

| Consumers | Stability of supplies of necessary raw materials and equipment | Price per goods Effective period of contracts |

| Purchasers | Procurement of products and services | Prices for goods and services |

| State bodies | Stability of organization's activity for payment of taxes and preservation of jobs | Tax base and payments |

Recommendations

The number of external variables by all stakeholder groups is usually quite large, and organizations are forced to identify alternative problems and their solutions. Efficiency is determined by the ability of an organization to choose priorities and consistently solve tasks while focusing on the main direction. The other difficult task is the management of the interests of internal groups, which can be considered as different entities with their specific target settings, according to which the work is organized. Achieving a balance between these goals (and therefore interests) requires reconciling positions and making compromise decisions that are acceptable for members of different groups and the system as a whole. Efficiency criteria should reflect the interrelationships that arise between the many goals and interests of different groups. Efficiency criteria include profit and growth, earnings per share, long-term investment, public relations and many other parameters that determine not only the economic status of an organization, but also its place in the social system.

Conclusion

The methodology of institutional establishment and development of organizations presented in the scientific article is based on the following principles: 1) systematic approach that represents an organization as a complex system of interconnected, interdependent elements together with assessment of the development of an integrated organization over entire life cycle; 2) comprehensiveness, which is expressed in the assessment of the influence of internal and external factors, considering specific activities of all groups of members of the corporate structure and ensuring compliance of corporate goals with national interests and socio-economic interests of the territory; 3) multidimensionality, which involves determining the overall economic effect of the organization's activity as a set of private effects in implementation of corporate programs that affect the final result.

Methodological approach was proposed to evaluate the efficiency of institutional strategies of an organization as an element of institutional environment development that affect the performance and cost effectiveness of business entities of different levels.

References

- Castoriadis, C. (1987). The Imaginary Institution of Society. Cambridge: Polity Press.

- Dixit, A. (2009). Governance institutions and economic activity. American Economic Review, 99(1), 5-24.

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019a). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education , 22(4).

- Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., & Marova, S. (2019b). Factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal.

- Durmanov, A.S., Tillaev, A.X., Ismayilova, S.S., Djamalova, X.S., & Murodov, S.M. (2019a). Economic-mathematical modeling of optimal level costs in the greenhouse vegetables in Uzbekistan. Revista Espacios, 40(10).

- Durmanov, A., Bartosova, V., Drobyazko, S., Melnyk, O., & Fillipov, V. (2019b). Mechanism to ensure sustainable development of enterprises in the information space. Entrepreneurship and Sustainability Issues , 7(2), 1377-1386.

- Garriga, E., & Melé, D. (2004). Corporate social responsibility theories: Mapping the territory. Journal of B usiness E thics, 53(1-2), 51-71.

- Gomes, G., & Wojahn, R.M. (2017). Organizational learning capability, innovation and performance: study in small and medium-sized enterprises (SMES). Revista de Administração (São Paulo), 52(2), 163-175.

- Lojpur, A. (2005). Management in the Process of the Corporate Governance. Montenegrin Journal of Economics, 1(1), 119-126.

- Makedon, V., Drobyazko, S., Shevtsova, H., Maslosh, O., & Kasatkina, M. (2019a). Providing security for the development of high-technology organizations. Journal of Security & Sustainability Issues, 8(4).

- Makedon, V., Kostyshyna, T., Tuzhylkina, O., Stepanova, L., & Filippov, V. (2019b). Ensuring the efficiency of integration processes in the international corporate sector on the basis of strategic management. Academy of Strategic Management Journal.

- Mintzberg, H. (1984). Who should control the corporation?. California Management Review, 27(1), 90-115.

- Nee, V. (2003). New institutionalism, economic and sociological. Handbook for Economic Sociology, 1-7.

- Roe, M.J. (2005). The institutions of corporate governance. In Handbook of new institutional economics (pp. 371-399). Springer, Boston, MA.

- Tricker, R. (2009). Corporate governance: Principles, policies, and practices, University press, Oxford.

- World Bank (2018). Corporate Governance: A Framework for Implementation, Washington.

- Young, M.N., Peng, M.W., Ahlstrom, D., Bruton, G.D., & Jiang, Y. (2008). Corporate governance in emerging economies: A review of the principal–principal perspective. Journal of Management Studies, 45(1), 196-220.

- Zingales, L. (1997). Corporate Governance. NBER Working Paper 6309, Cambridge, Mass