Research Article: 2022 Vol: 21 Issue: 5

Strategic Management Accounting Techniques and Their Effect on the Capital Structure

Mohammad Al Junidi, Applied Science Private University

Lina Warrad, Applied Science Private University

Citation Information: Al Junidi, M., & Warrad, L. (2021). Strategic management accounting techniques and their effect on the capital structure. Academy of Strategic Management Journal, 21(5), 1-18.

Abstract

This Study aimed at investigating the effect of implementing the Strategic Management Accounting Techniques (SMATs) on the financial structure of the manufacturing companies listed on the Amman Stock Exchange. To achieve the objectives of the study, a questionnaire was designed as a study tool to know the extent to which (SMATs) are applied. The findings of the Study show a statistically significant effect of the use of Strategic Management Accounting Techniques, combined and individual on the financial structure in the Jordanian public shareholding manufacturing companies listed on Amman Stock Exchange.

Keywords

Strategic Management Accounting Techniques, Activity-Based Costing System, Total Quality Management, Product Lifecycle, Target Costing, Financial Structure.

Introduction

Recently, the world has witnessed significant growth in various organizations. Conventional costing systems no longer conform to that revolution, leading to the emergence of modern and sophisticated systems that are compatible with this technological development. Furthermore many methods and techniques of management accounting have emerged as a significant development and a way of accurately costing products whether such products are goods or services. Since the manufacturing sector in Jordan is the second largest sector next to the service sector in terms of contribution to GDP with a proportion of (23.8%), the challenges facing it have been so high that the sector had to adopt all the methods and means to keep it in the field of competition.

It also forced businesses not to be content only with their capitals as a source of financing, but also to forced them to borrow from other sides by issuing bonds or borrowing from banks and other financial institutions that own large cash reserves, such as insurance companies, which made necessary for financial managements to study the best financing alternative from among available and supplied funds in the capital market with the aim of reaching the best capital structure in terms of cost and risk, as access to the lowest financing cost depends mainly on choosing the appropriate relative balance for each form of financing on the one hand, and on the other reducing the cost of such form in order to reach the ideal capital structure.

Although financing by borrowing is one of the lowest cost of financing methods as it provides tax benefits, there are changes and risks that reduce the proportion of debt financing and exceed the weight of equity financing or self-financing (retained earnings) available in these companies, thus making a mix and alternatives in financing methods that have a significant effect and importance that requires financial managements to take care and employ the latest management accounting techniques to control these changes and do the same to controllable business risks represented by fluctuation of profits and uncertainties of their future indicators in addition to fluctuations in production costs that affect reaching the ideal capital structure.

The need has therefore become urgent and a strategic goal that business companies should plan in the near term to adopt strategic management accounting techniques. In this respect, (Cadez & Guilding, 2012) confirmed that the emergence of these techniques has been in line with developments in the modern business environment. Moreover, according to the view of (Ma & Tayles, 2009), the employment of these techniques leads to the discovery of the areas of improvement and adds value to the development of accounting systems, and also works to achieve the highest levels of accuracy in collection and analysis of cost and price data, sales volume and also to reach the maximum allowable to reduce costs while maintaining required levels of quality, which would result in trying to control business risks characterized by being controllable, which in turn would impact financing decisions and achieve the optimum financial structure.

Based on the foregoing, this study aims to identify the extent to which Strategic Management Accounting techniques are used in the Jordanian public shareholding manufacturing companies listed on Amman Stock Exchange. Also, Knowing the relationship between the use of strategic management accounting techniques in the in the Jordanian public shareholding manufacturing companies listed on Amman Stock Exchange and both debt financing and equity financing in those companies, and calculating the financial ratios indicating the formation of their financing structure.

Study Hypotheses

First main hypothesis

H01: There is no statistically significant effect in relation to employment of Strategic Management Accounting Techniques on the financial structure as measured by Debt financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

The first main hypothesis is subdivided to the following sub-hypotheses:

H01.1: There is no statistically significant effect in relation to employment of the Activity – Based Costing technique on the financial structure as measured by Debt financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

H01.2: There is no statistically significant effect in relation to employment of Total Quality Management Technique on the financial structure as measured by Debt Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

H01.3: There is no statistically significant effect in relation to employment of Product Life Cycle Technique on the financial structure as measured by Debt Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

H01.4: There is no statistically significant effect of employment of the Target Costing Technique on the financial structure as measured by Debt Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

The Second Main Hypothesis

H02: There is no statistically significant effect in relation to employment of Strategic Management Accounting Techniques on the financial structure as measured by Equity Financing in the Jordanian public shareholding companies listed on the Amman Stock Exchange.

The second main hypothesis is subdivided to the following sub-hypotheses:

H02.1: There is no statistically significant effect in relation to employment of the Activity -Based Costing system technique on the financial structure as measured by Equity Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

H02.2: There is no statistically significant effect in relation to employment of Total Quality Management Technique on the financial structure as measured by Equity Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

H02.3: There is no statistically significant effect in relation to employment of the Product Life Cycle Technique on the financial structure as measured by Equity Financing in the Jordanian public shareholding companies listed on the Amman Stock Exchange.

H02.4: There is no statistically significant effect in relation to employment of Target Costing Technique on the financial structure as measured by Equity Financing in the Jordanian public shareholding manufacturing companies listed on the Amman Stock Exchange.

Theoretical Framework

Strategic Management Accounting

Although many authors of the strategic management accounting have based their writings on general strategies that provide competitive advantage to companies on the writing of (Porter, 1980 & 2012), which had explained that companies can follow one or more of the following competitive strategies:

1. Cost Leadership Strategy: This strategy focuses on achieving the greatest reduction in cost of production inputs commensurate with the cost that maintains competitive advantage (Wilson, 1995).

2. Product Differentiation Strategy: This strategy is based on that companies continue competition by providing goods or services with attractive characteristics that make customers prefer them to the goods and services of other competitors.

3. Focus Strategy: This strategy is based on the selection of a segment of customers, and practically focuses on fulfilling their distinctive needs that are different from the needs of the rest of customers. (David, 1993).

Activity - Based Costing (ABC) Accounting

The credit for creating the activity- based costing system is attributed to the two Americans, Kaplan &Cooper, who had revealed it at Harvard Business School conference in 1986. In this conference, a paper entitled “Relevance Lost” was presented by Johnson & Kaplan. Since then, there have been various definitions of Activity – Based Costing based on several views. Some define it as “a way of allocating costs to activities using cost drivers, and thus allocating costs of activities to products, meaning that they are based on activities as a criterion for cost allocation”.

These factors have shown the inability of traditional costing systems to provide the organization with various information that fit this environment especially that indirect costs have become the largest portion of the total cost pool, due to the replacement of direct labor with mechanical equipment.

Product Life Cycle

Svoboda (1995) defines life cycle analysis as “one of those modern tools that helps companies understand the environmental effects associated with the required products, processes and activities.” There is no doubt that effective product life cycle management is critical to the company's continued survival.

According to Komninos (2002), the life cycle of the product is: “the period associated with the product or service, from launching it in the market to its disappearance from it, and the significant changes in the behavior of the product in the market (such as sales volume and profit volume) associated with each certain product in the company. So, product life cycle management is very important for those companies which adopt long-term strategic planning.”

Total Quality Management (TQM)

Total quality management is one of the most important techniques of strategic management accounting, as it is based on a set of ideas and principles that aim at improving the quality of production and services, achieving the best performance, reducing the percentage of losses and working to win customer satisfaction.

The Federal Quality Institute defines the Total Quality Management as a “Comprehensive applied approach that aims at meeting customer needs and expectations as quantitative methods are used to continuously improve processes and services”.

Concept of Financial Structure

Barclay & Smith (2005) define the financial structure as the external financing mix that forms the company's financial structure and is confined in stocks (common and preferred) and debt. This means that it includes a variety of sources from which the company acquired funds to finance its investments, which are all those items that compose the liabilities whether long-term or short-term items. However, it is defined as: “that mix of stocks (common and preferred) and debts, and this mix is an external source of financing for the company, which aims to grow the working capital in order to expand business and therefore increase sales”.

The financial structure is also defined as the pool of funds through which the company's assets have been financed, which includes the debt financing and equity financing, and both constitute the left side of the balance sheet.

Literature Review

A Study by Jbarah (2017) applied to all the Jordanian manufacturing companies was led to findings indicated that Strategic Management Accounting Techniques along with their variables (Target Costing, Balanced Scorecard, Just-In Time Production System) had an effect on making investment decisions in the Jordanian manufacturing companies. While a study was conducted to determine whether the employment of Strategic Management Accounting Techniques could provide managers with information for corporate sustainability. The findings reached by the researchers showed the need for managers to employ the (SMATs) to enable them to identify, accumulate and manage their social and environmental costs associated with the activities of the corporate governance in Nigeria. Also, examined the effect of modern Strategic Management Accounting Techniques on improving the quality of financial reports. The study was able to reach some findings most notably was that there had been a statically significant effect of the benchmarking technique in terms of appropriateness and comprehensibility in improving the quality of financial reports in the Jordanian human pharmaceutical manufacturing companies.

Moreover, the financial structure and its effect on the financial performance of the public shareholding companies listed on the Khartoum Stock Exchange. The study concluded that the financial performance of the companies is affected by the mix of which the financing structure is composed, and that the increase in the debt proportion in the financial structure of the company may lead the company to face financial risks, which may in turn cause the company to declare bankruptcy and be liquidated, and that the company's reliance on equity with a larger proportion than borrowing funds in financing its dues and covering its financial needs may lead to stability in the financial performance of the company and reduce financial risks and finally that when they choose the financial structure, public shareholding companies fail to observe the factors that help achieving financial balance and avoiding bankruptcy risk.

In addition, a study aimed to test the extent of correlation and impact of the strategy of the company on the strategic management accounting system and its effect on the performance of the company. The study concluded a group of results among which was that strategic management accounting system practices in the Egyptian companies were not affected by the followed business strategy, and that this was not reflected in the performance of the companies, and that the Egyptian business environment employed a great number of Strategic Management Accounting Techniques in addition to the diversity of followed strategic choices. Another study by Abdul Hussien & Hamza (2012) aimed at demonstration of the techniques of strategic management accounting and their role in serving the objectives of contemporary management - Strategic Management - of the Romanian organizations, by studying these techniques. The study came out with a group of findings including: Companies’ orientation to use and apply strategic concepts in management and financial work is a necessity that all types of companies in all sectors must have. Another finding was that the techniques of strategic management accounting represent modern tools to meet the requirements of contemporary strategic management and contribute to the success of Romanian companies. The rationale for both traditional and modern management accounting techniques and methods in companies listed on the Thailand Stock Exchange. The initial findings of this study showed that the companies trust in the traditional management accounting methods have not changed since the financial crisis of 1997. This was due to the lack of experience of the managers of companies on the one hand, and their following centralization of management, and their attempt to avoid modern methods and techniques because they were uncertain of their results.

Methodology

Study Population and Sample

The research population and sample includes all 56 manufacturing companies listed on the Amman Stock Exchange (ASE) as provided in Amman Exchange Annual Report of 2017. In terms of the study items, the researchers distributed 56 questionnaires to managers and employees of the departments of finance at the rate of one questionnaire for each company. The researchers retrieved 54 questionnaires, and later on (2) questionnaires were excluded because the respondents were not serious about completing them. The final sample of the Study was 52, i.e. (92.8%) of the Study sample (Table 1).

| Table 1 Components of the Study Tool | ||

| Part 1: Demographic Information as represented by: Job title, educational qualification, and years of work experience | ||

| Part 2: Paragraphs of the questionnaire as represented by: | ||

| Strategic Management Accounting Techniques | Activity-Based Costing System (ABC) | Questions from 1 - 14 |

| Total Quality Management (TQM) | Questions from 1 - 16 | |

| Product life cycle (LC) | Questions from 1 - 10 | |

| Target Costing (TC) | Questions 1 - 16 | |

Testing the Reliability and Validity of the Study Tool

It is noticed from Table 2 that the Cronbach’s alpha coefficient ratios indicate a high degree of reliability for all questions of the questionnaire, as the alpha coefficient was statistically acceptable for all components of the questionnaire, because all variables were higher than 70%, and the questionnaire as a whole achieved a reliability degree of (0.947). By checking Table 2, it will be clear that the study variables have close validity in the answers.

| Table 2 Results of Cronbach’s Alpha Test and Factor Loadings | |||

| Cronbach’s Alpha | Factor Loadings | Question | Factor |

| 0.945 | 0.51 | Q1 | Activity-Based Costing (ABC)System |

| 0.87 | Q2 | ||

| 0.57 | Q3 | ||

| 0.68 | Q4 | ||

| 0.65 | Q5 | ||

| 0.61 | Q6 | ||

| 0.59 | Q7 | ||

| 0.74 | Q8 | ||

| 0.84 | Q9 | ||

| 0.61 | Q10 | ||

| 0.84 | Q11 | ||

| 0.90 | Q12 | ||

| 0.52 | Q13 | ||

| 0.54 | Q14 | ||

| 0.949 | 0.64 | Q1 | Total Quality Management (TQM) |

| 0.72 | Q2 | ||

| 0.67 | Q3 | ||

| 0.69 | Q4 | ||

| 0.66 | Q5 | ||

| 0.73 | Q6 | ||

| 0.80 | Q7 | ||

| 0.78 | Q8 | ||

| 0.75 | Q9 | ||

| 0.74 | Q10 | ||

| 0.89 | Q11 | ||

| 0.65 | Q12 | ||

| 0.72 | Q13 | ||

| 0.73 | Q14 | ||

| 0.65 | Q15 | ||

| 0.71 | Q16 | ||

| 0.939 | 0.69 | Q1 | Product Life Cycle (LC) |

| 0.74 | Q2 | ||

| 0.69 | Q3 | ||

| 0.74 | Q4 | ||

| 0.57 | Q5 | ||

| 0.91 | Q6 | ||

| 0.73 | Q7 | ||

| 0.81 | Q8 | ||

| 0.87 | Q9 | ||

| 0.78 | Q10 | ||

| 0.957 | 0.81 | Q1 | Target Costing (TC) |

| 0.71 | Q2 | ||

| 0.80 | Q3 | ||

| 0.87 | Q4 | ||

| 0.69 | Q5 | ||

| 0.67 | Q6 | ||

| 0.87 | Q7 | ||

| 0.82 | Q8 | ||

| 0.78 | Q9 | ||

| 0.88 | Q10 | ||

| 0.79 | Q11 | ||

| 0.80 | Q12 | ||

| 0.86 | Q13 | ||

| 0.87 | Q14 | ||

| 0.79 | Q15 | ||

| 0.83 | Q16 | ||

| 0.947 | All Paragraphs of the Questionnaire | ||

Descriptive Statistics of the Study Sample and Variables

Demographic distribution

It is clear from Table 3 that most of the sample members have a bachelor's degree (73.1%). As for work experience, it is noticed that the individual members of the study sample have a good experience as the percentage of those who have 10 or more years of work experience is 48.1% of the individual members of the sample, which led to increased reliability in the questionnaire as explained earlier.

| Table 3 Demographic Distribution of the Study Sample | |||

| Variable | Category | Frequency | Percentage |

| Job title | Financial Manager | 8 | 15.4 |

| Head of Accounting Division | 14 | 26.9 | |

| Management Accountant | 19 | 36.5 | |

| Cost Accountant | 11 | 21.2 | |

| Total | 52 | 100 | |

| Educational Qualification | Community College | 0 | 0 |

| Bachelor | 38 | 73.1 | |

| MA | 11 | 11.2 | |

| Ph.D. | 3 | 5.8 | |

| Total | 52 | 100 | |

| Years of Work Experience | Less than 5 Years | 11 | 21.2 |

| 5 to less than 10 Years | 16 | 30.8 | |

| 10 to less than 15 Years | 16 | 30.8 | |

| More than 15 years | 9 | 17.3 | |

| Total | 50 | 100 | |

Descriptive Analysis of Study Variables

Table 4 shows that the paragraphs related to this variable obtained an arithmetic mean of (3.560) with high application level and low standard deviation with low level of (0.499). This figure indicates that the answers of the individual members of the study are consistent. The lowest rank a paragraph has had in relation to the average answers was (3.135) with a medium level of application, namely, the paragraph related to subdivision of the product into sub-activities to facilitate costing the product. On the other hand, the highest ranking paragraph was the one related to the company’s setting a flow chart for various activities, with an arithmetic mean of (3.654).

| Table 4 Results of the Descriptive Analysis of the First Independent Variable | ||||||

| No. | Paragraphs | Rank | Mean | Standard Deviation |

Level of Application | |

| Application of Activity-Based Costing System (ABC) |

1 | The Company is aware of the cost distribution system based on the activities (ABC) | 12 | 3.500 | 0.728 | High |

| 2 | The Company has the ability to separate direct from indirect costs | 6 | 3.615 | 0.661 | High | |

| 3 | The Company has the ability to enumerate the activities that each product consumes | 3 | 3.673 | 0.678 | High | |

| 4 | The company sets a flow chart for various activities | 1 | 3.731 | 0.598 | High | |

| 5 | The company determines the cost required for each activity | 10 | 3.500 | 0.577 | High | |

| 6 | The Company uses multiple factor loadings for activity costs that take into account the causal relationship between cost and activities causing it. | 2 | 3.692 | 0.643 | High | |

| 7 | The company divides activities into those that add value to the product and those that do not add value to the product. | 5 | 3.635 | 0.596 | High | |

| 8 | The Company acts to reduce and limit activities that do not add value to the product such as (storage and handling costs). | 8 | 3.596 | 0.664 | High | |

| 9 | The Company allocates indirect costs to activities | 7 | 3.596 | 0.693 | High | |

| 10 | The Company reallocates costs of activities to products and services. | 4 | 3.635 | 0.595 | High | |

| 11 | Inspection and control of products are carried out continuously to ensure quality | 13 | 3.462 | 0.641 | High | |

| 12 | The Company has the ability to identify unutilized cost of activities | 11 | 3.500 | 0.672 | High | |

| 13 | The product is divided into sub-activities to facilitate costing the product | 14 | 3.135 | 0.627 | Medium | |

| 14 | The management of the company has the ability to form an integrated team to distribute costs based on activities | 9 | 3.577 | 0.750 | High | |

| General mean | 3.560 | 0.499 | High | |||

| Kurtosis = 0.886 | Skewness = -0.768 | |||||

It is also noticed that the skewness and kurtosis indices are within the appropriate range. According to Kamiya et al. (2014), the decision rule lies in the occurrence of the value of (Skewness) between (-1) and (+1) , and the value of Kurtosis lies between (-3.00) and (3.00) in order for the data to meet the conditions for normal distribution, and by reference to the table, it is obvious that the values of each of them are located in the appropriate range, which indicates that the data of these variables meet the condition for normal distribution.

Table 5 shows that the paragraph that had the highest ranking in relation to average answers of (4.135) with a high application level was the one about the company’s creation of an appropriate cultural environment for quality management philosophy. On the other hand, the lowest ranking paragraph with regard to average answers 3.827) with a high level of application was the one about the company’s making continuous modifications to the production processes to meet the quality requirements. The standard deviation of this axis which is (0.406) indicates that the results of this variable paragraphs are close, and the general mean of the axis is (3,936), which explains the reason why this variable has obtained a (high) application level.

| Table 5 Results of the Descriptive Analysis of the Second Independent Variable | ||||||

| No. | Paragraphs | Rank | Mean | Standard Deviation |

Level of Application | |

| Application of Total Quality Management (TQM) |

1 | The management of the company has sufficient knowledge of the total quality method (TQM) in production. | 15 | 3.846 | 0.573 | High |

| 2 | The company is acting to create a cultural environment suitable for the philosophy of quality management. | 1 | 4.135 | 0.561 | High | |

| 3 | The company is committed to training employees and developing their skills. | 6 | 3.962 | 0.559 | High | |

| 4 | The company uses scientific approach in problem solving and improving process | 5 | 3.962 | 0.522 | High | |

| 5 | The company has an effective communication and feedback system. | 10 | 3.923 | 0.518 | High | |

| 6 | The company acts to increase efficiency at work to reduce operational errors. | 3 | 3.981 | 0.506 | High | |

| 7 | Partners set standards for consumer satisfaction of the quality of their services and products | 14 | 3.865 | 0.486 | High | |

| 8 | The company continuously modifies production processes to suit quality requirements. | 16 | 3.827 | 0.617 | High | |

| 9 | The company promotes its competitive position by focusing on providing high quality goods and services | 4 | 3.962 | 0.484 | High | |

| 10 | The company reduces cost by reducing the number of defective and damaged units. | 13 | 3.885 | 0.583 | High | |

| 11 | The company applies a clear plan with identified targets, complies with quality. | 9 | 3.923 | 0.436 | High | |

| 12 | The company seeks to gain customer satisfaction by Studying their needs. | 11 | 3.923 | 0.621 | High | |

| 13 | The company diversifies its products to meet the needs and requirements of customers. | 8 | 3.942 | 0.461 | High | |

| 14 | Employees are involved in developing plans to improve quality and performance. | 7 | 3.962 | 0.522 | High | |

| 15 | Inspections of and control on products are carried out continuously to ensure quality. | 2 | 3.981 | 0.505 | High | |

| 16 | The company adopts a continuous product design and improvement strategy. | 12 | 3.904 | 0.634 | High | |

| General mean | 3.936 | 0.406 | High | |||

| Kurtosis = 1.111 | Skewness = 0.812 | |||||

Table 6 shows that the lowest ranking paragraph in terms of the level of application with respect to the average answers in it is the paragraph on management exerting efforts to reduce costs at each stage of the life cycle of the product. The highest level of application was obtained by the paragraph that relates to the company’s fixing target cost for each stage of the product life cycle, and the whole paragraphs got an arithmetic mean of (3.686), which indicates a high level of application. The standard deviation of the total paragraphs of the study axis was (0.495), and this value indicates that there is relatively little dispersion in the answers of the study sample to the paragraphs of this axis.

| Table 6 Results of Descriptive Analysis of the Third Independent Variable | ||||||

| No. | Paragraphs | Rank | Mean | Standard Deviation |

Level of Application | |

| Application of Product Life Cycle |

1 | The company is aware of product lifecycle. | 9 | 3.577 | 0.537 | High |

| 2 | The company has the ability to control the product life span. | 8 | 3.615 | 0.661 | High | |

| 3 | The company analyzes product life cycle costs. | 3 | 3.750 | 0.590 | High | |

| 4 | The company uses the ABC technique to reduce costs for each stage of the product life cycle. | 4 | 3.712 | 0.605 | High | |

| 5 | The company sets a target cost for each stage of the product life cycle. | 1 | 3.846 | 0.638 | High | |

| 6 | The Company takes into consideration the product life cycle when developing a pricing strategy for its products. | 6 | 3.635 | 0.627 | High | |

| 7 | The management takes into consideration customer desires at every stage of the product life cycle. | 2 | 3.769 | 0.645 | High | |

| 8 | The management works to reduce costs at each stage of the product life cycle. | 10 | 3.558 | 0.698 | High | |

| 9 | The management works to maximize profitability at every stage of the product life cycle. | 7 | 3.615 | 0.631 | High | |

| 10 | The management makes assessments for expected time of each stage of the product life cycle. | 5 | 3.654 | 0.520 | High | |

| General mean | 3.686 | 0.495 | High | |||

| Kurtosis = -0.874 | Skewness = 0.199 | |||||

It is clear from Table 7 that the lowest paragraph in terms of the rank of application level with respect to the arithmetic mean of the answers is the paragraph on the company’s determining the profit margin of the product based on the expected sales volume of the product. The highest level of application was obtained by the paragraph on the company’s determining the profit margin for the product before production. The whole paragraphs got an arithmetic mean of (3.962), which indicates a high level of application. The standard deviation of the total paragraphs of the study axis was (0.547), and this value indicates that there is relatively little dispersion in the answers of the study sample to the paragraphs of this axis.

| Table 7 Results of the Descriptive Analysis of the Fourth Independent Variable | ||||||

| No. | Paragraphs | Rank | Mean | Standard Deviation |

Level of Application |

|

| Application of Target Costing (TC) |

1 | The Company studies and analyzes competing products and compares them with its products. | 7 | 3.981 | 0.610 | High |

| 2 | The company determines the selling price of the product based on market studies before starting the production process. | 9 | 3.981 | 0.727 | High | |

| 3 | The total cost of the product is determined before the start of the production process. | 11 | 3.942 | 0.688 | High | |

| 4 | The company focuses on customers and earning their satisfaction. | 4 | 4.000 | 0.626 | High | |

| 5 | The company determines the profit margin of the product before production. | 1 | 4.058 | 0.639 | High | |

| 6 | The company depends on a group of reliable suppliers. | 10 | 3.962 | 0.685 | High | |

| 7 | There is an interest in product costs in the phase of design and planning. | 15 | 3.904 | 0.693 | High | |

| 8 | The company forms a specialized team to Study production costs in advance. | 2 | 4.019 | 0.610 | High | |

| 9 | The company seeks to reduce the cost of a product at an early stage of production. | 5 | 4.000 | 0.657 | High | |

| 10 | The company continuously adopts a strategy of product designing and improving. | 12 | 3.942 | 0.698 | High | |

| 11 | Inspections of and control on products are carried out continuously to ensure quality. | 3 | 4.019 | 0.754 | High | |

| 12 | Your company determines the profit margin of the product on the basis of the historical profits of the product. | 14 | 3.904 | 0.603 | High | |

| 13 | Your company determines the profit margin of the product based on the position of the product among its competitors. | 13 | 3.923 | 0.710 | High | |

| 14 | Your company determines the profit margin of the product based on the expected sales volume of the product. | 16 | 3.846 | 0.697 | High | |

| 15 | Your company determines the profit margin of the product based on the level of customer access | 6 | 4.000 | 0.657 | High | |

| 16 | The management works to reduce costs by reducing the costs of design. | 8 | 3.981 | 0.671 | High | |

| General means | 3.962 | 0.547 | High | |||

| Kurtosis = 0.804 | Skewness = -0.512 | |||||

Examining Table 8 the results indicate that the application of the Total Quality Management has obtained the highest level, with an arithmetic mean of 3.936, followed by the application of the Target Costing with an arithmetic mean of 3.962, followed in turn by the application of Product Life Cycle with an arithmetic mean of (3.686). The application of the Activity-Based Costing system ranked last with an arithmetic mean of (3.560).

| Table 8 Results of Descriptive Analysis of the Level of Application of Strategic Management Accounting Techniques | |||||

| No. | Variable | Arithmetic Mean | Standard Deviation | Rank | Level of Application |

| 1 | Activity- Based Costing System | 3.560 | 0.499 | 4 | high |

| 2 | Total Quality Management | 3.936 | 0.406 | 1 | high |

| 3 | Product Life Cycle | 3.686 | 0.495 | 3 | high |

| 4 | Target Costing | 3.962 | 0.547 | 2 | high |

It is noticed from Table 9 that the average Debt Financing amounted to 0.363. This percentage shows that the companies rely on debts by 36.3% in financing their assets. It is also noticed that the highest value of Debt Financing amounted to (0.986), which is related to Al-Qarya Food Industries and Vegetable Oil Company, but the lowest value was (0.005), which is related to Arab International Food and Investment Factories. In the opinion of the researchers, this value is logical taking in view the nature of the business of the manufacturing companies which requires large capitals for their operations and attainment of their objects. It is also noticed that the average of Equity Financing was 0.631. This ratio indicates the companies’ relying on equity by 63.1% in financing their assets. Moreover, it has become clear that the highest value of the Equity Financing was (0.995) which is related to Arab International Food and Investment Factories, and the lowest value was (0.014), which is related to Al-Qarya Food Industries and Vegetable Oil Company.

| Table 9 Results of Descriptive Analysis of the Dependent Variables of the Study | ||

| Measurements / Variables | Debt Financing | Equity Financing |

| Number of observations | 52 | 52 |

| Minimum | 0.005 | 0.014 |

| Maximum | 0.986 | 0.995 |

| Mean | 0.363 | 0.631 |

| Std. Deviation | 0.233 | 0.234 |

| Skewness | 0.780 | -0.758 |

| Kurtosis | 0.220 | 0.098 |

It is also noticed that the skewness and kurtosis indices are in relation to these variables within the appropriate range. According to Kamiya et al. (2014), the decision rule lies in the occurrence of the value of Skewness between (-1) and (+1), and the value of Kurtosis lies between (3.00-) and (3.00), we find that the values of each are within the appropriate range, which indicates that the data of these variables meet the condition for normal distribution.

Table 5 shows that the paragraph that had the highest ranking in relation to average answers of (4.135) with a high application level was the one about the company’s creation of an appropriate cultural environment for quality management philosophy. On the other hand, the lowest ranking paragraph with regard to average answers 3.827) with a high level of application was the one about the company’s making continuous modifications to the production processes to meet the quality requirements. The standard deviation of this axis which is (0.406) indicates that the results of this variable paragraphs are close, and the general mean of the axis is (3,936), which explains the reason why this variable has obtained a (high) application level.

Table 6 shows that the lowest ranking paragraph in terms of the level of application with respect to the average answers in it is the paragraph on management exerting efforts to reduce costs at each stage of the life cycle of the product. The highest level of application was obtained by the paragraph that relates to the company’s fixing target cost for each stage of the product life cycle, and the whole paragraphs got an arithmetic mean of (3.686), which indicates a high level of application. The standard deviation of the total paragraphs of the study axis was (0.495), and this value indicates that there is relatively little dispersion in the answers of the study sample to the paragraphs of this axis.

It is clear from Table 7 that the lowest paragraph in terms of the rank of application level with respect to the arithmetic mean of the answers is the paragraph on the company’s determining the profit margin of the product based on the expected sales volume of the product. The highest level of application was obtained by the paragraph on the company’s determining the profit margin for the product before production. The whole paragraphs got an arithmetic mean of (3.962), which indicates a high level of application. The standard deviation of the total paragraphs of the study axis was (0.547), and this value indicates that there is relatively little dispersion in the answers of the study sample to the paragraphs of this axis.

Examining Table 8 the results indicate that the application of the Total Quality Management has obtained the highest level, with an arithmetic mean of 3.936, followed by the application of the Target Costing with an arithmetic mean of 3.962, followed in turn by the application of Product Life Cycle with an arithmetic mean of (3.686). The application of the Activity-Based Costing system ranked last with an arithmetic mean of (3.560).

It is noticed from Table 9 that the average Debt Financing amounted to 0.363. This percentage shows that the companies rely on debts by 36.3% in financing their assets. It is also noticed that the highest value of Debt Financing amounted to (0.986), which is related to Al-Qarya Food Industries and Vegetable Oil Company, but the lowest value was (0.005), which is related to Arab International Food and Investment Factories. In the opinion of the researchers, this value is logical taking in view the nature of the business of the manufacturing companies which requires large capitals for their operations and attainment of their objects. It is also noticed that the average of Equity Financing was 0.631. This ratio indicates the companies’ relying on equity by 63.1% in financing their assets. Moreover, it has become clear that the highest value of the Equity Financing was (0.995) which is related to Arab International Food and Investment Factories, and the lowest value was (0.014), which is related to Al-Qarya Food Industries and Vegetable Oil Company.

It is also noticed that the skewness and kurtosis indices are in relation to these variables within the appropriate range. According to Kamiya et al. (2014), the decision rule lies in the occurrence of the value of Skewness between (-1) and (+1), and the value of Kurtosis lies between (3.00-) and (3.00), we find that the values of each are within the appropriate range, which indicates that the data of these variables meet the condition for normal distribution.

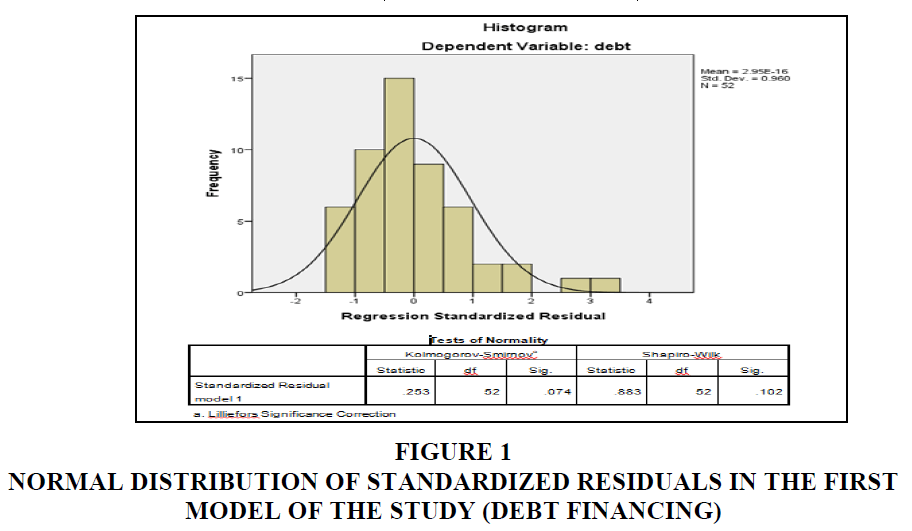

Testing Normal Distribution

Figure 1 shows the results of verifying the normal distribution of the standardized residuals in the first model of the Study using the Kolmogorov-Smirnov Test. we notice that the residuals follow the normal distribution, as (P- Value) of this test is 0.074. Consequently, parametric tests of the data related to demonstration of the effect of employment of the (SMATs) on the financial structure as measured by Debt financing can be used.

Figure 1 Normal Distribution of Standardized Residuals in the First Model of the Study (Debt Financing)

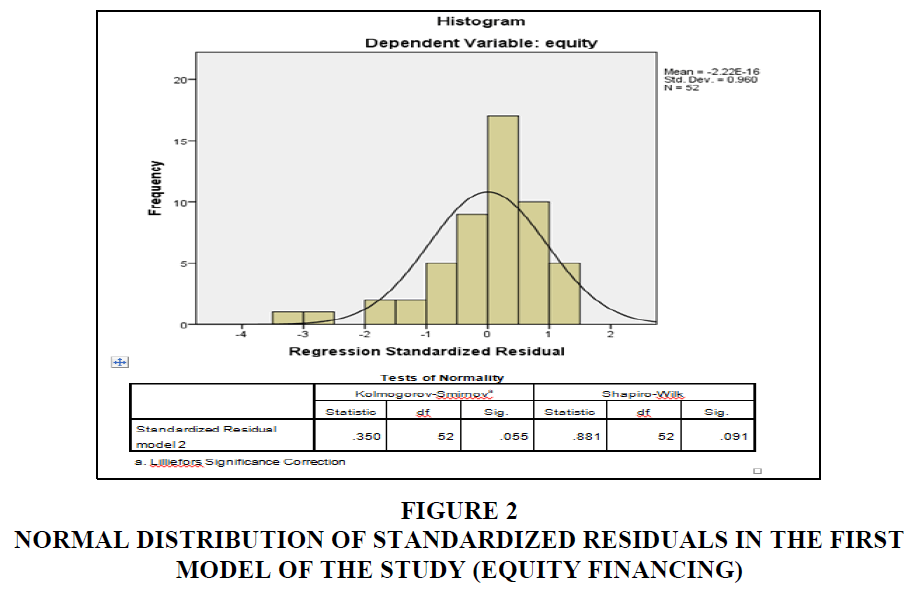

Looking at Figure 2, we notice that the standardized residuals follow the normal distribution, as the (P- Value) of this test is 0.055. Consequently, parametric tests of the data related to demonstration of the effect of employment of the (SMATs) on the financial structure as measured by Equity Financing can be used.

Figure 2 Normal Distribution of Standardized Residuals in the First Model of the Study (Equity Financing)

Multicollinearity Test

Variance Inflationary Factors (VIF) is used to detect the Multipolar and the general rule of VIF. According to this indicator, inflation exists when its values are greater than 10; consequently regression coefficients are poorly identified due to increased inflation between independent variables (Schreiber & Jackson, 2017). When reviewing Table (10), it becomes clear that with respect to the inflation coefficient all values have obtained values less than 10.

| Table 10 Validity of the Study Data for Statistical Analysis | |||

| Model | Variables | Multicollinearity | |

| Tolerance | VIF | ||

| Debt Financing | ABC | 0.680 | 1.471 |

| TQM | 0.483 | 2.071 | |

| LC | 0.535 | 1.868 | |

| TC | 0.597 | 1.675 | |

| Equity Financing | ABC | 0.774 | 1.561 |

| TQM | 0.555 | 1.207 | |

| LC | 0.652 | 1.349 | |

| TC | 0.678 | 1.475 | |

Also, when reviewing Table (10), it becomes clear with respect to tolerance that all values have obtained values greater than (0.20). Based on the previous two indicators, it is clear that all variables of the study have passed these two indicators, which means that there is no problem of multicollinearity and self-correlation in the two models of the study.

Testing the Hypotheses of the Study

It is noticed from Table 11 that the calculated F value is (5.412), which is a function at the level of (0.05), which indicates that the proposed first model of the Study has relevance and explanation power. The results of regression analysis also show the value of Sig F is (0.001), which is less than the level of significance of the test being 0.05. Therefore, the first null hypothesis must be rejected and the alternative hypothesis must be accepted. This means that there is a statistically significant effect of the use of the (SMATs) on the financial structure as measured by Debt Financing.

| Table 11 Results of Multiple Regression Test of the First Model of the Study | |||||

| Variable | β | Coefficient | Std. Error | T-Statistic | Prob. |

| Constant | 3.208 | -------------- | 0.628 | 5.105 | 0.000 |

| ABC | -0.138 | -0.297 | 0.068 | -2.026 | 0.048 |

| TQM | -0.264 | -0.461 | 0.100 | -2.656 | 0.011 |

| LC | -0.168 | -0.359 | 0.077 | -2.174 | 0.035 |

| TC | -0.175 | -0.411 | 0.066 | -2.630 | 0.012 |

| R | 0.562 | ||||

| R-squared | 0.315 | ||||

| Adjusted R-square | 0.257 | ||||

| S.E. of regression | 0.200 | ||||

| F-statistic | 5.412 | ||||

| Prob(F-statistic) | 0.001 | ||||

Moreover, the results show that the value of adjusted R2 is 0.257, which means that around only 25.7% of the fluctuations in the financial structure measured by Debt Financing can be explained by changes when using the combined (SMATs) represented by (Cost-Based System, Total Quality Management, Product Life Cycle, And Target Costing). In order to determine the effect of each of the (SMATs) on the financial structure as measured by Debt Financing, the Multiple Regression Test outputs were used as follows:

HO1-1

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.048), this means that there is a statistically significant effect of the use of Activity – Based Costing Technique on the financial structure as measured by Debt Financing. Also, when checking the value of the coefficient which is (-0.297) indicates that there is a negative effect of the Activity-Based Costing System Technique on determining the financial structure as measured by corporate debt financing, which also indicates that the Activity-Based Costing System Technique is the least influential factor on determining the financial structure as measured by corporate Debt Financing among the (SMATs) dealt with in the study.

| Table 12 Results of the Multiple Regression test of the Second Model of the Study | |||||

| Variable | β | Coefficient | Std. Error | T-Statistic | Prob. |

| Constant | -2.247 | -------------- | 0.629 | -3.573 | 0.000 |

| ABC | 0.131 | 0.279 | 0.068 | 2.019 | 0.049 |

| TQM | 0.280 | 0.064 | 0.100 | 2.813 | 0.007 |

| LC | 0.161 | 0.341 | 0.077 | 2.073 | 0.044 |

| TC | 0.181 | 0.424 | 0.066 | 2.725 | 0.009 |

| R | 0.566 | ||||

| R-squared | 0.320 | ||||

| Adjusted R-square | 0.262 | ||||

| S.E. of regression | 0.201 | ||||

| F-statistic | 5.537 | ||||

| Prob(F-statistic) | 0.001 | ||||

HO1-2

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.011), this means that there is a statistically significant effect of the use of Total Quality Management Technique on the financial structure as measured by Debt Financing. Also, checking the value of the coefficient which is (-0.461) indicates that there is an effect of the Total Quality Management Technique on determining the financial structure as measured by corporate debt financing, which further indicates that the Total Quality Management System Technique is the most influential factor on determining the financial structure as measured by corporate Debt Financing among the (SMATs) dealt with in the study.

HO1-3

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.035, this means that there is a statistically significant effect of the use of the Product Life Cycle Technique on the financial structure as measured by Debt Financing. Also, checking the value of the coefficient which is (-0.359) indicates that there is a negative effect of the Product Life Cycle Technique on determining the financial structure as measured by corporate debt financing, which further indicates that the Product Life Cycle Technique ranks third regarding the impact on determining the financial structure as measured by corporate Debt Financing among the (SMATs) dealt with in the study.

HO1-4

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.012), this means that there is a statistically significant effect of the use of the Target Costing Technique on the financial structure as measured by Debt Financing. Also, checking the value of the Coefficient which is (-0.411), indicates that there is a negative effect of the Target Costing Technique on determining the financial structure as measured by corporate debt financing, which further indicates that the Target Costing Technique ranks second in terms of impact on determining the financial structure as measured by corporate Debt Financing among the (SMATs) dealt with in the Study.

It is noticed from Table 12 that the calculated F value is (5.537), which is a function at the level of (0.05), which indicates that the proposed second model of the study has relevance and explanation power. The results of regression analysis also show that the value of Sig F is (0.001), which is less than the level of significance of the test being 0.05. Therefore, the second null hypothesis should be rejected and the alternative hypothesis should be accepted. This means that there is a statistically significant effect of the use of the (SMATs) on the financial structure as measured by Equity Financing.

Moreover, the results show that the value of Adjusted R2 is 0.262, and it means that around only 26.2% of the fluctuations in the financial structure measured by Equity Financing can be explained by changes that take place when applying the combined (SMATs). In order to determine the effect of each of the (SMATs) on the financial structure as measured by Equity Financing, the Multiple Regression Test results were based on as follows:

HO2-1

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.049), this means that there is a statistically significant effect of the use of Activity – Based Costing Technique on the financial structure as measured by Equity Financing. Also, checking the value of the Coefficient which is (-0.279) indicates that there is a positive effect of the Activity-Based Costing System Technique on determining the financial structure as measured by corporate Equity Financing, which also indicates that the Activity-Based Costing System Technique is the least influential factor on determining the financial structure as measured by corporate Equity Financing among the (SMATs) dealt with in the study.

HO2-2

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.007), this means that there is a statistically significant effect of the use of Total Quality Management Technique on the financial structure as measured by Equity Financing. Also, checking the value of Coefficient which is (-0.487) shows that there is a positive effect of the Total Quality Management Technique on determining the financial structure as measured by corporate Equity Financing, which further indicates that the Total Quality Management system technique is the most influential factor on determining the financial structure as measured by corporate Equity Financing among the (SMATs) dealt with in the study.

HO2-3

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.044), this means that there is a statistically significant effect of the use of the Product Life Cycle Technique on the financial structure as measured by Equity Financing. Also, checking the value of coefficient which is (-0.341) indicates that there is a positive effect of the Product Life Cycle Technique on determining the financial structure as measured by corporate equity financing, which also indicates that the Product Life Cycle Technique ranks third in terms of the impact on determining the financial structure as measured by corporate Equity Financing among the (SMATs) dealt with in the study.

HO2-4

Table 12 shows that the value of Sig T is less than (0.05) as it reached (0.009), this means that there is a statistically significant effect of the use of the Target Costing Technique on the financial structure as measured by Equity Financing. Also, checking the value of Coefficient which is (-0.424) indicates that there is a positive effect of the Target Costing Technique on determining the financial structure as measured by corporate Equity Financing, which further indicates that the Target Costing Technique ranks second in the impact on determining the financial structure as measured by corporate Equity Financing among the (SMATs) dealt with in the Study.

Results of the Study

Companies’ application of the (SMATs) shows that they made all sorts of actions that help in supporting their competitive position and achieving the competitive advantage, which leads to maximization of their profits by reducing costs of production. It is understood that an increase in the profits of the company means an increase in the cash resource they own, and thus this makes them able to reduce resort to borrowing as a result of their ability to rely on a larger part of their assets to finance their business, which explains the negative relationship between the (SMATs) and debt financing. This result agrees with what was reached in the study conducted by Abdul (Hussien & Hamza, 2012). The ABC technique is the least applied technique among the (SMATs) applied in the manufacturing companies. In the opinion of the researchers, this is attributed to the costs, time and effort the companies need to give to meet the requirements for applying the ABC technique. This system yields great benefits regarding cost management, however, its cost is well-suited to large-scale companies because of the huge benefits it yields to them, as the cost of application of any system should not exceed the benefits yielded thereby. On the other hand, despite the big scale of the Jordanian manufacturing companies’ business, however, it is still not considered large enough if compared to manufacturing companies in developed countries. Therefore, for many of such companies, application of this system is not deemed feasible and may rather lead to losses than benefits or profits. This has led to non- application of this system fully by many of the Jordanian manufacturing companies, which leads in turn to a negative effect of the use of this technique on the financial structure as measured by Debt Financing. This result agrees with Abdul Hussien & Hamza (2012).

The Total Quality Management Technique is the most applied among (SMATs) by the manufacturing companies. This is due to the effectiveness of this technique in increasing the ability of companies to survive, carry on and cope with the sharp competition in the markets, which in turn leads to a negative effect of the use of this technique on the resort of Jordanian manufacturing companies to debt financing. This result agrees with what was reached in two studies conducted and (Abdul Hussien & Hamza, 2012). The Product Lifecycle Technique ranks third among (SMATs) applied by the manufacturing companies. This is due to the fact that Product Life Cycle Technique is based on the costs of the necessary activities in terms of design, development, production and distribution of the product, which in turn reduce the cost of production, which drives the managements of companies to apply this technique, which leads to a negative effect of the use of these technique on the financial structure measured by Debt Financing. This result agrees with (Abdul Hussien & Hamza, 2012).

The Target Costing Technique ranks second among the (SMATs) applied by the manufacturing companies. This is because the so-called Triangle of Quality, Time and Cost is targeted by the departments in all the manufacturing companies seeking to achieve the highest profits by means of reducing costs, maintaining quality and reducing time spent, and since the Target Costing Technique agrees with this as it is concerned with the costs to be achieved to attain operating economies and the good use of available resources taking into account an appropriate level of quality in order to achieve the target profit margin for investors, this makes its application important to the Jordanian manufacturing companies, which leads to a negative effect of the use of this technique on the financial structure as measured by Debt Financing. This result agrees with what was reached in three studies conducted by Abdul Hussien & Hamza (2012). The efficiency of the management of a company in applying the (SMATs) depends on its efficiency in doing all sorts of actions that support the company’s competitive position and achieve its competitive advantage, which leads to maximization of profits, and an increase in the profits of the company leads to an increase in the cash resources owned by the company, which enables it to rely more on its own equity to finance its business and reduce borrowing, which explains the positive relationship between the (SMATs) and equity financing. This result agrees with (Abdul Hussien & Hamza, 2012).

Conclusion

The findings showed that there is a statistically significant impact of using the techniques of strategic management accounting which are (activity- based costing, quality management, product life cycle, and target cost) combined and separately on the capital structure measured by debt financing in the Jordanian manufacturing companies listed on the Amman Stock Exchange. Also, there is a statistically significant impact of using the techniques of strategic management accounting which are (activity- based costing, quality management, product life cycle, and target cost) combined and separately on the capital structure measured by equity financing in the Jordanian manufacturing companies listed on the Amman Stock Exchange.

References

Abdul Hussien, H.M., & Hamza, S.A.D.I.K. (2012). Strategic management accounting techniques in Romanian companies: An empirical study. Studies in Business & Economics, 7(2).

Barclay, M.J., & Smith, C.W. (2005). The capital structure puzzle: The evidence revisited. Journal of Applied Corporate Finance, 17(1), 8-17.

Cadez, S., & Guilding, C. (2012). Strategy, strategic management accounting and performance: a configurational analysis. Industrial Management & Data Systems, 112(3), 484-50.

David, A., Hopper, T., & Robert, W.S. (1993). Issues in management accounting. NY: Prentice: As in Wilson, Richard.

Jbarah, S.S. (2018). The impact of strategic management accounting techniques in taking investment decisions in the Jordanian industrial companies. International Business Research, 11(1), 145-156.

Indexed at, Google Scholar, Cross Ref

Komninos, I. (2002). Product life cycle management. Thessaloniki: Aristotle University of Thessaloniki, 1-26.

Ma, Y., & Tayles, M. (2009). On the emergence of strategic management accounting: an institutional perspective. Accounting and Business Research, 39(5), 473-495.

Indexed at, Google Scholar, Cross Ref

Porter, M. (1985). Industry scenarios under competitive strategy under uncertainty. Competitive Advantage–Creating and Sustaining Superior Performance; The Free Press: New York, NY, USA, 445-481.

Porter, M. E. (2012). Competitive strategy: Techniques for analyzing industries and competitors. Revista Inteligência Competitiva, 2(2).

Svoboda, S. (1995). Note on life cycle analysis. Pollution prevention in corporate strategy. National Pollution Prevention Center for Higher Education, University of Michigan.

Received: 13-Jul2021, Manuscript No. ASMJ-21-5823; Editor assigned: 15-Jul-2021, PreQC No. ASMJ-21-5823 (PQ); Reviewed: 29-Jul-2021, QC No. ASMJ-21-5823; Revised: 03-Aug-2022, Manuscript No. ASMJ-21-5823(R); Published: 8-Aug-2022