Research Article: 2023 Vol: 27 Issue: 3

Sold! Threshold Pricing Effects in Online Negotiations

Brian R. Kinard, University of North Carolina Wilmington

Citation Information: Kinard, R.B. (2023). Effectiveness and sustainability in modern e-tailing business through application of artificial intelligence. Academy of Marketing Studies Journal, 27(3), 1-8.

Abstract

Numerical boundaries are closely associated with round values (e.g., 10, 50, 100) and serve as psychological thresholds that influence price perceptions. For instance, prices set just-below a numerical boundary lower price perceptions and increase sales for a product due to the disparity consumers perceive with prices that cross below a psychological threshold. Although such effects are demonstrated in comparative retail pricing across a range of consumer product and services categories, no attention has been given to this effect in the context of online negotiations. While in-person verbal negotiations require consumers to rely heavily on memory- based processing of price information, side-by-side (stimulus-based) visual processing of information allows for an easier comparison of aligned attributes. This is of significant consequence, as online negotiations generally require the buyer to manually enter a price offer adjacent to the list price. Five studies, across four product categories, provide evidence for a threshold crossing effect in online price negotiations. Specifically, at or just-above threshold prices elicit significantly higher offers from buyers. These higher offers, if accepted by the seller, are shown to significantly elevate buyer satisfaction with the purchase. Further, the results indicate that higher initial offers lead to marginally higher counteroffers which can significantly increase the likelihood of a successful negotiation.

Keywords

Online Auctions, Negotiation; Comparative Pricing; Bidding.

Introduction

Online auction sites, such as eBid, Webstore, and Bonanza, are virtual marketplaces that bring together a global base of sellers looking to earn revenue for their unwanted items and buyers searching for bargain prices. While these websites provide the option to allow bidding on items through an auction-style format, most of the items displayed for sale are listed at a fixed price. The largest online auction site, eBay, gained popularity after introducing a buy-it-now (BIN) feature that allows buyers the chance to purchase an item before the start of bidding (eBay, 2007). These fixed price auctions now account for over 80% of the $100 billion gross merchandise volume on eBay (eBay, 2017; eBay, 2020). Today, sellers also have the option to add a “make offer” feature to their fixed price listing. This feature allows sellers to privately negotiate the price of an item with a buyer, with the list price serving as the reference point for the start of the negotiation process. The list price generally serves as a signal that anchors the buyer’s perception of what the seller is willing to accept (Chandrashekaran & Grewal, 2003). For instance, a low list price for an item could serve as a signal that the seller is more willing to accept a lower negotiated price.

Existing price negotiation research also shows that the precision of an initial offer (or reference price) serves as a more potent anchor due to its perceived reliability (Epley & Gilovich, 2001). A price that is precise (e.g., $9, $24.76, $172) signals to the buyer that careful consideration was taken in setting the price and that it is a fair and accurate representation of the item’s true value (Thomas et al., 2010). Further, verbal negotiations often occur sequentially and, in turn, require those involved in the process to make memory-based decisions. The cognitive strain required to memorize and formulate mental comparisons of precise values on a fine resolution numerical scale will likely result in less counteroffer adjustments in price (Mason et al., 2013). Indeed, research has shown that buyers make smaller counteroffer adjustments to initial price offers that are considered precise compared to their rounded counterparts (Janiszewski & Uy, 2008).

However, it is round numbers that are more frequently expressed in language (Dehaene & Mehler, 1992) and practice (Schindler & Kibarian, 1996; Stiving & Winer, 1997). For instance, the focus on round numbers is ubiquitous with categorical rankings (e.g., Billboard Top 100, S&P 500), milestones (e.g., 30th birthday, 40th anniversary), achievement benchmarks (e.g., 1400 SAT score, .300 batting average), and measures of product volume (e.g., 20 oz. soft drink, 200 mg pill). As a result, consumers tend to place greater emphasis on changes in price that cross round boundaries, particularly those that are multiples of 10 (e.g., 10, 50, 100). In fact, Kim et al. (2022) found that numerical boundaries closely associated with round values serve as psychological thresholds that influence price perceptions. Specifically, consumers perceive prices set just-above a round number to have less disparity than prices set just-below a round number. Consequently, consumers are more willing to upgrade an item when both the base and upgrade price fall on the same side of a price threshold ($40/$47) compared to when the prices fall on different sides of a price threshold ($39/$47). Similar effects have been consistently demonstrated in comparative retail pricing across a range of consumer product and services categories (see, for instance Anderson & Simester, 2003; Freling et al., 2010; Jiang, 2021; Strulov-Shlain, 2021) and underscores consumer receptivity to price reductions that cross a numerical threshold.

Given these findings, threshold crossing effects could be of significant consequence in online negotiations that require the buyer to manually enter price offers adjacent to the list price. Consider a situation where the listed price for an item is $100 but the seller is willing to negotiate on price. When manually entering an offer of $90, the buyer may make a visual comparison of the offer to the list price and perceive the magnitude discount of the offer to be greater than if the list price had been set at $99 (i.e., $100/$90 vs. $99/$90). In essence, buyers may perceive placing an offer that crosses just-below a threshold price to be of greater disparity (discount) than an offer made at the threshold level. This could certainly be of benefit to the seller, as it might lead to higher initial offers from the buyer. This would also imply that price threshold effects reported by Kim et al. (2022) work in reverse, resulting in perceptions of discount disparity in offers that cross below price thresholds.

Thus, the aim of this study is to contribute new insights on threshold crossing effects in the context of online price negotiations. In the first two studies, we find evidence that buyers are more satisfied with price offers that cross below psychological price thresholds. In Study 3, we extend the examination to the placement of offers on listed items and find a similar pattern of results, in that buyers place higher bids on items listed at threshold prices compared to just-below prices. Study 4 further replicates the results in a simulated negotiation. Finally, Study 5 finds evidence for a boundary condition that mitigates the threshold crossing effect described in this paper.

Experimental Studies

Study 1

The goal of this study is to determine if buyer satisfaction with the price paid for an item is influenced by a salient price threshold. A total of 164 participants (Mage = 39.9, 55.5% male) were recruited through Amazon Mechanical Turk (MTurk) and provided monetary compensation in exchange for their participation.

Procedure and Design

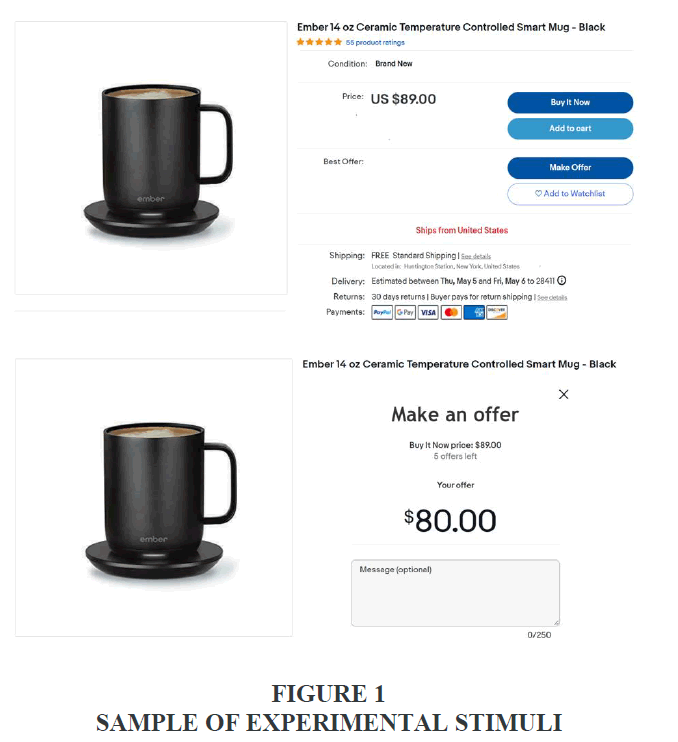

The study instituted a two- cell (list price: at threshold vs. just-below threshold) between- subjects design. Participants were instructed to read a short scenario related to the purchase of a birthday gift for their best friend. After reading the scenario, participants were shown an eBay listing for the item under consideration. Stimuli used across experimental conditions consisted of screenshots from live eBay listings that were subsequently edited using digital software (see Figure 1 for sample). To avoid potential confounds, item description, shipping costs, seller reputation, and product ratings were held constant in each listing. In the at threshold condition, participants were shown a listing for a self-heating coffee mug with a list price of $90, while participants in the just-below threshold condition were shown the same listing with a list price of $89. Participants were then informed that the seller was willing to consider offers for the item. In this study, a screenshot of an offer (i.e., $80) was presented to the participant. The offer screen was designed to replicate the “make offer” tab used by eBay. After viewing the offer screen, participants were asked to rate how satisfied they would be with the offer price if it were accepted by the seller on a 7-point scale [1 (extremely dissatisfied) to 7 (extremely satisfied)]. Unless otherwise noted, all aspects of this procedure were replicated in other studies.

Results and Discussion

ANOVA revealed a significant main effect for list price. Buyer satisfaction for an accepted offer was significantly higher in the at threshold condition (5.23) compared to the just- below threshold condition (4.61), F(1,162) = 6.03, p = .015). The results indicate that offers crossing below a price threshold are viewed more positively than similar offers that fail to cross a threshold. This suggests buyers perceive greater disparity (i.e., discount/deal) for offers that cross below a threshold, particularly when the threshold is made salient by the list price.

Study 2

While the initial results lend support for threshold crossing effects, the purpose of this study is to assess whether the findings replicate when online negotiations involve the use of precise digits just-below or just-above a price threshold. This would provide a more robust test of the effect, as the price threshold would appear less salient. In addition, this study tests if the effect found in the first study was driven merely by the perception that the just-below list price ($89) was viewed to be less expensive and signaled lower product quality compared to the at threshold list price ($90). Thus, threshold crossing effects were tested by manipulating the offer price rather than the list price. A total of 197 participants (Mage = 41.7, 57.9% male) were recruited through MTurk and provided monetary compensation in exchange for their participation.

Procedure and Design

The study was a two-cell (offer price: just-above threshold vs. just-below threshold) between-subjects design. In this study, participants were presented with listings and price offers for a video game. The choice of a video game was to test crossing effects at a new, lower price threshold (i.e., 50). In the just-above threshold condition, the list price was $54.75 with an offer of $50.25; whereas in the just-below threshold condition, the list price was $54.25 with an offer of $49.75.

ANOVA revealed a significant main effect for offer price. Replicating the findings of the first study, buyer satisfaction of an accepted offer was significantly higher in the just-below threshold condition (5.61) compared to the just-above threshold condition (5.02, F(1,195) = 8.65, p = .004). Given the consistent findings in a less salient condition, prices that cross below psychological price thresholds appear to exert significant influence on consumer price perceptions. Rather than an alternative explanation that the effect is due to just-below list (base) prices signaling a discount, lower product quality, and/or a seller’s receptivity to accept lower offers, the combined results of the first two studies affirm that changes to perceived buyer satisfaction is a direct result of an offer crossing a price threshold.

Study 3

Although the first two studies support threshold crossing effects on price perceptions, a more meaningful implication for the effect would be to demonstrate that buyers place higher offers on items listed using at threshold prices compared to just-below threshold prices. Such an effect would strengthen the proposition that a buyer’s perception of an offer that crosses below a price threshold is of greater disparity than an offer that fails to cross a threshold. A total of 191 participants (Mage = 44.8, 52.4% male) were recruited through MTurk and provided monetary compensation in exchange for their participation.

Procedure and Design

For this study, participants were prompted to manually enter in an offer price rather than view an offer placed on their behalf. The between-subjects design used a list price of $50 to represent the at threshold condition and a list price of $49 to represent the just-below threshold condition. A new product category, headphones, was used in this study to add to the generalizability of the findings. The dependent variable tested was the offer price made to the seller.

Results and Discussion

ANOVA revealed a significant main effect for list price. In line with expectations, offer prices were significantly higher ($38.62) for the at threshold list price compared to the just- below threshold list price ($36.50, F(1,191) = 5.53, p = .020). The results suggest the heightened satisfaction of having threshold crossing offers accepted spillover to offers made to sellers. A higher initial offer price is quite beneficial to a seller in a negotiation setting. Foremost is that a higher initial offer deemed acceptable to the seller provides more financial benefit. Further, it sets a higher floor to start the negotiation process. This will likely lead to fewer rounds of negotiation to reach a resolution and/or result in a higher settlement price.

Study 4

The purpose of this study is to extend the findings on threshold crossing effects to online negotiations. This study will assess if at threshold list prices result in higher initial bids, fewer rounds of negotiation, and a higher likelihood of negotiation success. A total of 172 participants (Mage = 41.0, 50.6% male) were recruited through MTurk and provided monetary compensation in exchange for their participation.

Procedure and Design

Participants were instructed to read a new, but similar, scenario that related to the purchase of an air fryer as a housewarming gift for a friend that recently moved into a new home. Participants were then prompted to provide an offer price for the item. To extend findings, a higher price threshold was introduced in the between-subjects design. A list price of $100 was set for the at threshold condition and $99 for the just-below threshold condition. A survey filter was imposed to reject any offer that was equal to or greater than $90. If the initial offer was declined, participants were notified that the seller would be willing to consider a second offer. If the second offer was also declined, the seller would make a final counteroffer to the buyer to purchase the item for $90. Participants could elect to end the negotiation process after the first offer. While it is noted that eBay limits the number of offers a buyer can send to a seller to five, the number of counteroffers was reduced in this study (3) to limit respondent fatigue.

Results and Discussion

ANOVA revealed a significant main effect for list price. Participants negotiating on a listing with a $100 at threshold list price placed significantly higher initial offers ($79.74) than those negotiating on the $99 just-below threshold counterpart ($75.91, F(1,170) = 6.20, p =.014). Of the 140 participants that decided to continue the negotiation, a similar directional effect did persist in counteroffers made to the seller. However, the difference was only marginally significant (Mat threshold = $83.29 vs. Mjust-below = $80.94; F(1,138) = 3.04, p = .084). Although the marginal significance can be largely explained by the higher initial bid offers in the at threshold condition, supplemental analysis of the absolute difference in first and second offers revealed that buyers in the just-below condition adjusted their second offer more ($7.69) than those in the at threshold condition ($5.90; F(1(138) = 9.04, p = .003). While 80.3% of negotiations resulted in a successful purchase of the item at or above the $90 minimum price, chi-square analysis revealed that significantly more offers were accepted on a listing that started with an at threshold price (86.2%) compared to a just-below price (72.9%; X2(1) = 4.67, p =.031). There was no significant difference in the number of offers required to reach an acceptable purchase price.

Based upon these findings, online sellers are advised to set prices on listed items at- or just- above threshold price points. By implementing this strategy, sellers are likely to elicit higher initial offers, receive marginally higher counteroffers, and increase the likelihood of a successful negotiation.

Study 5

Prior to suggesting a best practice, it is important to test potential boundary conditions that could moderate the threshold crossing effects detailed in this paper. One potential boundary condition that may surface relates to the number of thresholds an offer price crosses. The evidence reported in this paper suggests that the effect is a direct result of crossing a threshold, thus the effect should occur irrespective of the number of thresholds that are crossed. In essence, threshold crossing effects are not expected to be magnified when prices cross multiple thresholds. A total of 338 participants (Mage = 40.9, 51.5% male) were recruited through Mturk and provided monetary compensation in exchange for their participation.

Procedure and Design

This study incorporated a 2 (list price: at threshold vs. just-below threshold) by 2 (offer price: at the lower threshold vs. just-below the lower threshold) between-subjects design. Air fryers were listed for a price of either $90 or $89. To compare the difference in effects that result when offers cross one versus multiple thresholds, the at the lower threshold condition set an offer price of $80 while the just-below the lower threshold condition set an offer price of $79.

Results and Discussion

A two-way ANOVA revealed a significant main effect for offer price, such that buyers were more satisfied with the offer when the price crossed below the lower threshold ($79; M = 5.96) than when it did not ($80; M = 5.67; F(1(334) = 6.15, p = .014). There was no main effect for list price (F(1,334) = .021, p = .886). As anticipated, there was a significant interaction between item price and offer price (F(1,334) = 5.24, p = .023). In the just-below threshold list price condition (i.e., $89), buyers were more satisfied with the offer when the price was just- below the lower threshold ($79, M = 6.11) than when the price was at the lower threshold ($80; M = 5.54, F(1(163) = 11.48, p = .001). However, in the at threshold list price condition ($90), there was no significant difference in buyer satisfaction based on offer price ($79, M = 5.82 vs. $80, M = 5.80; F(1,171) = .018, p = .894). This suggests that while buyers are more satisfied with an accepted offer that crosses below a price threshold, an offer price that crosses multiple thresholds provides no additional perception of value.

Discussion

In five studies, across four product categories, evidence is provided for the threshold crossing effect in online price negotiations (see Table 1). There are several key practical and theoretical implications from these findings.

| Table 1 Summary: Product Categories, Prices, and Effects | ||||||||

| At or just-above threshold | Just-below threshold | |||||||

| Product category | Dependent measure | List price | Offer price | Mean | List price | Offer price | Mean | |

| Study 1 | Self-heating coffee mug | Buyer satisfaction | $90.00 | $80.00 | 5.23 | $89.00 | $80.00 | 4.61^ |

| Study 2 | Video game | Buyer satisfaction | $54.75 | $50.25 | 5.02 | $54.25 | $49.75 | 5.61^^ |

| Study 3 | Bluetooth headphones | Buyer offer price | $50.00 | ----- | $38.62 | $49.00 | ----- | $36.50^ |

| Study 4 | Two-basket air fryer | 1st offer price 2nd offer price | $100.00 | ----- | $79.74 $83.29 |

$99.00 | ----- | $75.91^ $80.94m |

| Study 5 | Two-basket air fryer | Buyer satisfaction | $89.00 $90.00 |

$80.00 $80.00 |

5.54 5.80 |

$89.00 $90.00 |

$79.00 $79.00 |

6.11^^ 5.82ns |

First, from a practical standpoint, sellers involved in online negotiations that require visual comparison of price information should set list prices for items at or just-above a price threshold. The results suggest that at or just-above threshold prices will elicit significantly higher offers from buyers. These higher offers, if accepted by the seller, are also shown to significantly elevate buyer satisfaction with the purchase. Further, the results indicate that higher initial offers lead to marginally higher counteroffers which can significantly increase the likelihood of a successful negotiation. This would be of particular importance to securing the highest possible offer if the negotiation was stunted by the buyer’s unwillingness to negotiate on price or if limits on the number of buyer/seller counteroffers were imposed. Second, if just-below threshold pricing is synonymous with precise pricing, the effects described in this paper are contrary to those reported in the negotiation literature (e.g., Mason et al., 2013; Janiszewski & Uy, 2008). However, the disparate findings reported in this paper may simply be a result of how price information is encoded and processed. Verbal negotiations require consumers to rely more heavily on memory-based processing of price information, as options are typically presented in a sequential order. Conversely, side-by-side (stimulus-based) visual processing of information allows for an easier comparison of aligned attributes (Markman & Lowenstein, 2010). The result is that a psychological price threshold is likely made more salient in visual (vs. verbal) price negotiations. This would explain the results reported in this paper and help reconcile findings in the price negotiation literature. Finally, the results demonstrate that perceptual effects demonstrated in this paper are a direct result of offers crossing below a single psychological price threshold. This supports the belief that threshold effects are categorical, rather than continuous, in nature (Kim et al., 2022). While this finding may not support left-digit processing effects, such that greater emphasis is placed on the leftmost digit in price comparisons (Poltrock & Schwartz 1984), it may provide an alternative explanation to divergent findings in just-below pricing research.

Limitations and Future Research

Although these preliminary findings prove promising and insightful, there are several limitations to the present study. For instance, it is important to note that the studies in this paper were framed in the context of a simulated gift buying situation for relatively infrequently purchased items. The gift buying context was introduced in the scenario to reduce any personal brand/product bias related to the purchase decision. It provided reasonable rationale to the participant to ignore all other factors of the decision and focus exclusively on the price element. However, any change to the level of involvement with the purchase decision may demand more elaborate processing of price information during the negotiation process. Thus, future research is needed to determine if similar threshold effects translate to other purchasing contexts.

In addition to context limitations, this paper tested a narrow range of price thresholds. According to the Weber-Fechner law, the perceived difference in numbers is compressed as the size of those numbers increase (Dehaene & Akhavein 1995). Thus, threshold effects may be mitigated in circumstances when negotiations center on high-priced items such as homes, cars, computers, televisions, or luxury jewelry. In other words, numerical magnitude may serve as a boundary condition for threshold crossing effects. Finally, the rationale and design for this paper relied heavily on the reasoned belief that threshold crossing effects are more salient in side-by-side comparisons of price. While the robust findings in this paper support this view, a comparison of threshold effects between sequential and stimulus-based presentations of price information was not performed. Thus, future research that compares threshold crossing effects in verbal vs. visual negotiations is warranted and would likely bring more clarity to the effects reported in the negotiation literature.

References

Anderson, E., & Simester, D. (2003). Effects of $9 price endings on retail sales: Evidence from field experiments. QuantitativeMarketingandEconomics, 1(1), 93-110.

Indexed at, Google Scholar, Cross Ref

Chandrashekaran, R., & Grewal, D. (2003). Assimilation of advertised reference prices: The moderating role of involvement. Journal of Retailing, 79(1), 53-62.

Indexed at, Google Scholar, Cross Ref

Dehaene, S., & Akhavein, R. (1995). Attention, automaticity, and levels of representation in number processing. Journal of Experimental Psychology, 21(2), 314-326.

Indexed at, Google Scholar, Cross Ref

Dehaene, S., & Mehler J. (1992). Cross-linguistic regularities in the frequency of number words. Cognition, 43(1), 1-29.

eBay (2007). 2007 annual report and form 10K. https://www.annualreports.com/HostedData/AnnualReportArchive/e/NASDAQ_EBAY_2007.pdf (Accessed Jan 11, 2023).

Indexed at, Google Scholar, Cross Ref

eBay (2020). 2020 annual report and form 10K. https://ebay.q4cdn.com/610426115/files/doc_financials/2020/ar/2020-Annual-Report.pdf (Accessed Jan 11, 2023).

eBay (2017). 2017 annual report and form 10K. https://ebay.q4cdn.com/610426115/files/doc_financials/2017_eBay_AnnualReport.pdf (Accessed Jan 11, 2023).

Epley, N., & Gilovich T. (2001). Putting adjustment back in the anchoring and adjustment heuristic: Differential processing of self-generated and experimenter-provided anchors. Psychological Science,12(5), 391-396.

Indexed at, Google Scholar, Cross Ref

Freling, T., Vincent L., Schindler, R., Hardesty D., & Rowe J. (2010). A meta-analytic review of just-below pricing effects. In Margaret C. Campbell, Jeff Inman, & Rik Pieters (Eds.), Advances in Consumer Research: Vol. 37, Duluth, MN: Association for Consumer Research, 618-620.

Janiszewski, C., & Uy, D. (2008). Precision of the anchor influences the amount of adjustment. Psychological Science, 19(2), 121-127.

Indexed at, Google Scholar, Cross Ref

Jiang, Z. (2021). An empirical bargaining model with left-digit bias: A study on auto loan monthly payments. Management Science, 68(1), 442-465.

Indexed at, Google Scholar, Cross Ref

Kim, J., Malkoc, S.A., & Goodman, J.K. (2022). The threshold-crossing effect: Just-below pricing discourages consumers to upgrade. Journal of Consumer Research, 48(6), 1096- 1112.

Indexed at, Google Scholar, Cross Ref

Markman, A. B., & Loewenstein, J. (2010). Structural comparison and consumer choice. Journal of Consumer Psychology, 20(2), 126-137.

Indexed at, Google Scholar, Cross Ref

Mason, M., Lee, A.J., Wiley, E.A., & Ames, D. (2013). Precise offers are potent anchors: Conciliatory counteroffers and attributions of knowledge in negotiations. Journal of Experimental Social Psychology 49(4), 759-763.

Indexed at, Google Scholar, Cross Ref

Poltrock, S. E., & Schwartz, D. R. (1984). Comparative judgments of multidigit numbers. Journal of Experimental Psychology: Learning, Memory, and Cognition, 10(1), 32-45.

Indexed at, Google Scholar, Cross Ref

Schindler, R. M., & Kibarian, T. M. (1996). Increased consumer sales response through use of 99-ending prices. Journal of Retailing, 72(2), 187-199.

Indexed at, Google Scholar, Cross Ref

Stiving, M., & Winer, R.S. (1997). An empirical analysis of price endings with scanner data. Journal of Consumer Research, 24(1), 57-67.

Indexed at, Google Scholar, Cross Ref

Strulov-Shlain, A., (2021). More than a penny's worth: Left-digit bias and firm pricing. Chicago Booth Research Paper, 19-22.

Indexed at, Google Scholar, Cross Ref

Thomas, M., Simon, D., & Kadiyali, V. (2010). The price precision effect: Evidence from laboratory and market data. Marketing Science, 29(1), 175-190.

Indexed at, Google Scholar, Cross Ref

Received: 21-Jan-2023, Manuscript No. AMSJ-22-13155; Editor assigned: 23-Jan-2023, PreQC No. AMSJ-22-13155(PQ); Reviewed: 22- Feb-2023, QC No. AMSJ-22-13155; Revised: 27-Feb-2023, Manuscript No. AMSJ-22-13155(R); Published: 14-Mar-2023