Case Reports: 2020 Vol: 26 Issue: 4

Socio-Economic Impacts Of Covid-19 on the Tunisian Economy

Nadia Mansour, University of Sousse – Tunisia & University of Salamanca – Spain

Salha Ben Salem, University of Monastir - Tunisia

Abstract

The health crisis caused by Covid-19 is in the process of transforming itself into a serious planetary economic crisis, to the point of being compared to a world war affecting both developed and developing countries. Covid-19 has spread extremely rapidly in recent weeks with a very high number of infections affecting Tunisia and most countries in the world. This paper analyses the impact of COVID-19 on the Tunisian economy and the possible solutions for the post-crisis period. In Tunisia, the economy and its social situation are impacted by government measures aimed at the fight against the Covid-19: total containment, curfew, crossborder blockade, cut roads... How to find the necessary means to take off the Tunisian economy? What are the economic indicators related to the COVID virus -19?

Keywords

Development, Economic, Social, Coronavirus, Tunisia. JEL: O11.

Introduction

Coronaviruses are a large family of viruses that can be pathogenic in animals and humans. According to the World Health Organization, Several coronaviruses are known to cause respiratory infections in humans, ranging from the common cold to more serious illnesses such as Middle East Respiratory Syndrome (MERS) and Severe Acute Respiratory Syndrome (SARS). Few natural hazards threaten additional deaths, economic distraction, and social than large-scale disease outbreaks. For example, the 2009 H1N1 influenza outbreak resulted in more than 18,000 deaths. Between December 2013 and April 2016, the Ebola epidemic generated more than 28,616 cases and 11,310 deaths in Guinea, Liberia, and Sierra Leone…

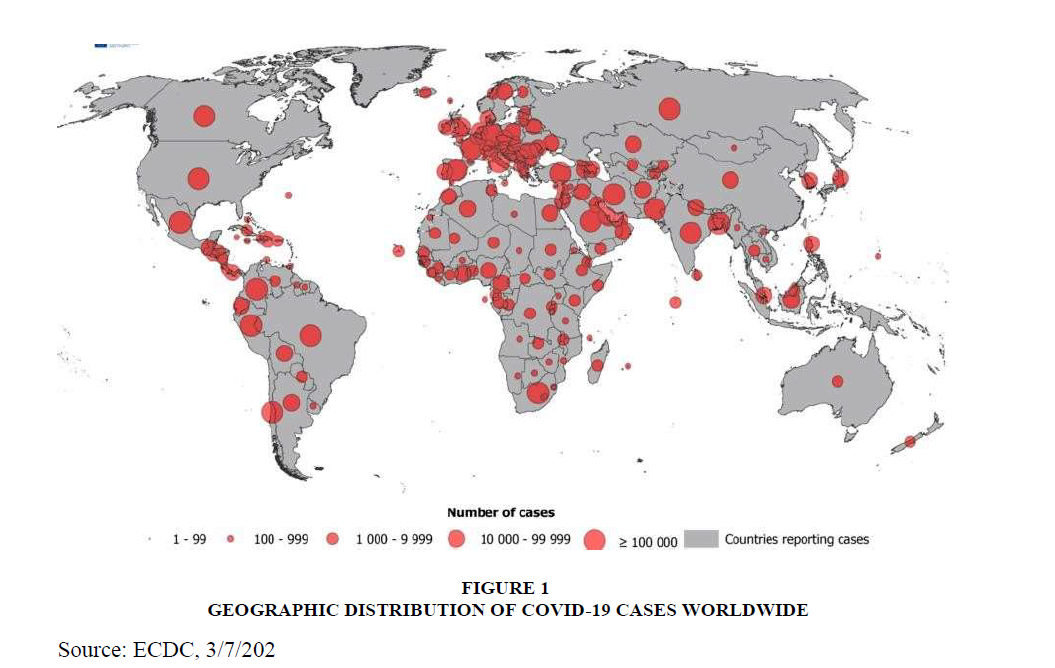

The latest coronavirus that has been discovered is responsible for coronavirus 2019 disease (COVID-19). This new virus and disease were unknown before the outbreak in Wuhan, China, in December 2019. COVID-19 is now a pandemic and is affecting 213 countries and territories around the world with 11,084,490 cases and 526,397 deaths on 3/7/2020.

Unfortunately, these epidemics have an effect not only on human health but also on the economies of countries. Also, “the Coronavirus 2019 (Covid-19) global pandemic has not only caused infections and deaths, but it has also wreaked havoc with the global economy on a scale not seen since at least the Great Depression. Covid-19 has the potential to destroy individual livelihoods, businesses, industries, and entire economies.” (Timothy, 2020) in Figure 1.

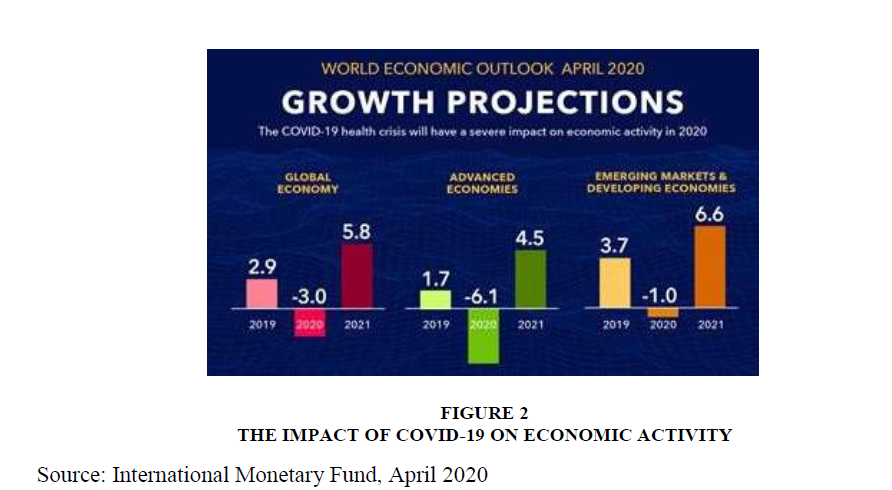

Also, economists' projections are increasingly shifting towards scenarios of severe economic impacts of this crisis, given the international spread of the pandemic and the severity of the containment measures that are being imposed. As an illustration, the current situation corresponds to the sixth scenario (out of 7) analyzed by McKibbin & Fernando (2020) who tried to quantify the impacts on economic growth in 24 developed and developing countries. Their results show that the loss of GDP in the European zone would be -8.4%, -6.2% in China, -3.8% in Mexico, -8.0% in Brazil, -5.5% in Turkey, -4.7% in Indonesia…

Experts, therefore, expect a serious effect in Africa. For months a surge of the coronavirus epidemic in Africa, where poverty and the lack of health infrastructure make fear the worst, with 432,421confirmed cases and 10,646 deaths on 03/07/2020.

In developed countries with a well-structured economy, the effect of the crisis will be more or less reduced while in countries like Tunisia, whose growth rate has not exceeded 1% for the year 2019 and for which the year 2020 is proving a little delicate and difficult, the impact will be more or less high. Agriculture will not be able to have the same yield as last year so the harvest must be much lower than that of 2019, the same for the tourism sector where the crisis has hit hard and hotels are deserted.

This epidemic, which has not yet disappeared, will automatically have a disastrous effect on all economic activities: tourism, trade, services, transport, crafts, catering, all the more so as in the industrial sector, even if some companies have been authorized to continue their activities, the number of employees mobilized remains very limited in Figure 2.

The decisions of the state in Tunisia to deal with the pandemic of COVID-19:

The Covid-19 crisis has shaken the global equilibrium and it put the sovereign functions of the Tunisian State back at the heart of its management to limit its repercussions.

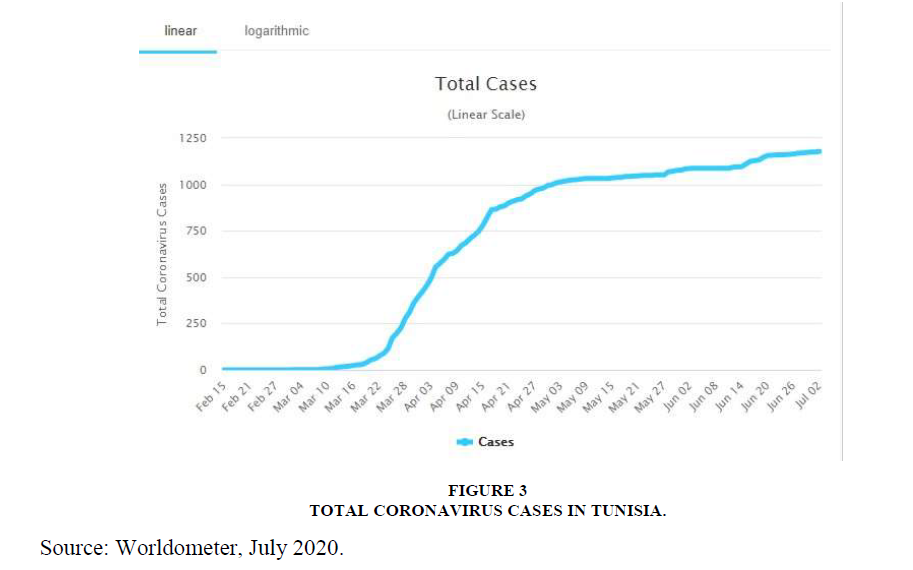

Also, the Head of Government announced the general confinement, which means that all citizens and residents of Tunisia remained at home during this period except for necessary and urgent needs. The general confinement was applied from Sunday 22 March 2020 to 4 May 2020 in Figure 3.

The presidency of the government declared that given the urgent need to apply general containment to prevent the spread of the coronavirus, the state will devote all human and material resources to guarantee the supply and delivery of all essential and vital needs.

Also, the labor force declined from 3.6 million employees in the formal productive sectors to only 1.5 million. These are mobilized mainly in emergency activities: police, military, health, grocery, and related services, banking sector.

Because of the current situation, national containment measures and the closure of international borders have been taken. At the same time, the trade on which Tunisia is heavily dependent has been restricted. Also, the month of Ramadan will have a strong impact on household incomes and aggregate demand can be expected. A sharp fall in output and purchasing power is felt for at least 3 months.

At this stage, it is difficult to give an opinion on future economic developments but it is necessary to detect the different effects of this health crisis on the Tunisian economy.

Socio-economic impacts of COVID-19 on Tunisian economy

The Tunisian government is facing a very vulnerable economic situation, a deterioration of the world economy due to the coronavirus pandemic and the volatility of oil prices.

The World Bank points out that "Tunisia has twin deficits and high indebtedness and limited reserve stocks, while growth is low, employment is stagnating and inflation is relatively high".

With the general shutdown, this period was characterized by less consumption, less production, less investment, so that Tunisia experienced a national economic recession and will also be affected by what is happening in its partners (Europe, China ...). Even with the partial and progressive deconfinement on 4 May, the resumption of work was partial with more precautions. The Tunisian economy cannot escape a decline in its GDP, an increase in unemployment and poverty, a widening of the public and current account deficits, etc., given the multitude of mechanisms for transmitting this health shock to the real economy, resulting in simultaneous shocks to the supply and demand of almost all the markets for goods and services. For the GDP, 4.3% is the expected expectation of the fall for the year 2020, (IMF, 2020). Tunisia is facing a major depression: it is much worse than the 2007-2008 recession. It is a difficult situation for the Tunisian economy, especially since the GDP has fallen by 20% since 2011. (GDP measured in current US $).

On the demand side, the shock affects domestic consumption, but also the exports (especially to Europe), as well as public and private investment. Tunisia should also expect a drop in foreign direct investment and a deterioration in sovereign ratings, which would make it even more difficult for it to access financing on international markets.

The most affected sectors in terms of their head-on exposure to the crisis during the first phase starting in January are those sectors whose companies source raw materials from international markets and intermediate goods as part of their integration into global value chains. Examples include the electronic industries, the pharmaceutical sector, and the textile sector. But it also concerns the trade sector impacted by the interruption of supply chains. From early March, when the pandemic spread beyond China several exporting sectors, the tourism sector and international transport were impacted. Then, once the pandemic took hold in Tunisia, the shock was transmitted to different degrees to all sectors, apart from a few such as the telecommunications and agriculture sectors.

-Banking Sector

The banking sector has a major impact on the economy and it is at the heart of the country's economic and monetary stability and will be so when the crisis ends.

Indeed, it contributes to the acceleration of economic growth while intervening in the financing of different sectors of activity such as construction and public works, agriculture, communication, transport, tourism... It is, in fact, all banks and financial institutions as well as the central bank that carry out claims and transactions between themselves and vis- à-vis non-financial agents.

As far as the banking and financial sector is concerned, the effects of Covid-19 on the first quarterly 2020 indicators published by the financial institutions will be very insignificant. Although the extension of maturities also concerns the month of March, banks will be forced to return maturities already drawn down.

This measure will not have a significant impact on the published information and ratios for the first quarter. It should be noted that at the date of this study, out of the top 10 banks representing nearly 70 billion dinars of the sector's outstanding as of 31 December 2019, only 4 of them had published 1st quarter indicators (Deloitte’s Office, 2020).

It must be noted that the crisis has not been mentioned in the published information. In the leasing sector. The quarterly indicators have been published and the same observation should be made. That of very little information available in connection with the fallout from the crisis.

It is in this context that the CBT (Central Bank of Tunisia) has been reactive and has taken, since March 17, 2020, exceptional measures to support the Tunisian economic fabric. These measures aim at helping all the actors of the place to get through this unprecedented crisis.

Nevertheless, these emergency measures will have an impact on Tunisian banks. Moreover, the banks themselves are suffering the full impact of this crisis. In particular at the level of resources, deposits, and cash flow, which are decreasing as the last weeks.

-Small and Medium Enterprises (SME)

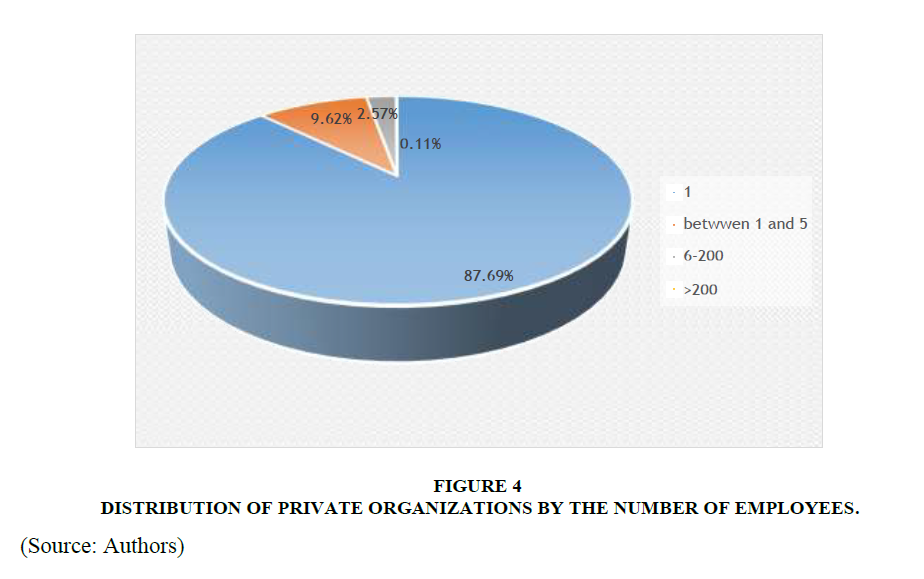

The Tunisian economy is particularly made up of SME. According to the National Institute of Statistics (2017), there are in Tunisia, 771,000 enterprises in the private sector, distributed as follows in Figure 4.

These figures show that this economic fabric is fragile and often needs rather significant banking access.

However, the central bank's policy rate was, before the pandemic crisis, 7.75%, which clearly shows that bank loans are very expensive and inaccessible to most companies.

Indeed, it’s difficult to measure the impact of the coronavirus on the international economy but for the Tunisian economy, SMEs and investors are facing major financial problems as they already have structural problems of productivity and organizational capacity to adapt to developments in the international market. The shocks they are experiencing are very significant in terms of declining productive capacity during the period of containment and falling demand. These shocks will reduce their economic profitability and increase their financial vulnerability. According to the IACE (March 2020), 81% of Tunisian companies will be affected by this crisis depending on the sector of activity Table 1.

| Table 1: The Tunisian Companies Impacted By the Crisis of COVID-19 | ||

| Business Sector | Organizations impacted | Organizations no impacted |

|---|---|---|

| Industry | 85.11% | 14.89% |

| Building | 69.23% | 30.77% |

| Trade | 76% | 24% |

| Service | 85% | 15% |

| Other | 80.77 | 19.23% |

The main consequences of the current crisis, cited by the business leaders interviewed are pressure on cash flow, short-time working, risk of closure, postponement of investments. The companies that will resist best are those that have already started their digital transformation and modernized their business model, which have not very high fixed costs and moderate financial charges.

Indeed, it turned out that the rate of entrepreneurs who stopped their production is higher in the southern regions than in the other regions. Thus, in the Southern region, which includes the governorates of Gabes, Gafsa, Kébili, Tozeur, Médenine, and Tataouine, the companies that stopped their activity is 81%, those that reduced their activities are 18%, while those that kept working are only 1%.

The impact of Covid-19 on the monthly expenses of contractors (supplies, reimbursement, for example) has been disastrous. Once again, it is the regions of the South that are the most affected by the crisis, since the percentage of entrepreneurs having difficulty repaying their loans is high. This is also the case for entrepreneurs having difficulties supplying their stock.

So, in the immediate future, the priority is to save our businesses, especially SMEs. The 3,000 million dinar emergency plan put in place by the government to save the economy is already insufficient.

Despite this difficult situation, several Tunisian companies have been involved in consolidating the state's efforts in the face of this crisis, such as the textile company “Consomed” where 150 people, 110 women, have isolated themselves in a factory for a month to make protective gear like masks to help their country’s fight against coronavirus. (The North Africa Journal, 2020). The employees made huge sacrifices to support Tunisia. Hence the state must encourage the social involvement of enterprises.

-Petroleum & Oil

In the assembly of the Organization of the Petroleum Exporting Countries (OPEC) in Vienna on March 6th, a refusal by Russia to reduce oil production triggered Saudi Arabia to retaliate with extraordinary discounts to buyers and a threat to pump cruder. This caused the steepest one-day price crash seen in nearly 30 years, On March 23rd, Brent Crude dropped by 24% to $34/barrel to stand at $25.70 (Maria et al, 2020).

For Tunisia, taking advantage of the situation depends, however, on the country's flexibility. National storage capacities are limited and purchases in the coming months could already be contracted. It would, therefore, be impossible to take advantage of the downward price trend in the very short term.

About to oil prices, the World Bank states that a sharp reversal of the recent oil price dynamics would "exacerbate pressures on current operations and public finances".

Indeed, this fall will be at the origin of a drop in tax revenues in 2021 knowing that oil companies contribute actively to corporate tax in Tunisia. In 2019, and according to provisional results figures, oil companies have collected 1.121 billion dinars in taxes. This represents 29.2% of the total tax collected.

Also, the fall in the price per barrel will push several producing countries to devalue their currencies or push them to low levels. This will reduce Tunisia's competitiveness in terms of Foreign Direct Investment, compared to regions such as Latin America or Africa which are already favored by Tunisia. At the same time, the Euro is likely to appreciate, which is not entirely in Tunisia's favor.

-Airline business & Tourism

Some sectors will be profoundly affected, by the health crisis, and sectors that are quite strategic such as the transport sector, especially the air industry, since we are at a standstill at the international level: airports closed, air traffic heavily handicapped… However, airlines have very important fixed charges so they cannot stay 4 or 5 weeks without normal traffic and the problem is that even after the crisis, they are not going to work at the same pace compared to the period before the health crisis.

This situation on an international scale closely affects several companies such as the Tunisian national airline "Tunisair" which already has several and recurrent problems even before this crisis. Since, it has a lot of fixed costs with 8400 employees and a gap between income and expenditure, technical problems and, aircraft maintenance problems... So "Tunisair" has suffered and will suffer further with this crisis because it is concerning other sectors very impacted: the tourism sector.

According to the Betton Woods Institution (2020), the coronavirus pandemic, if it worsens, will harm tourism, exports, and domestic demand and, consequently, on growth, employment, and household vulnerability in Tunisia.

Tourism which represents 10% of the Tunisian GDP and which employs almost 450,000 employees, is among the sector most affected by this crisis. The rate of closure of hotels, tourist activities and catering, crafts and related leisure activities, represents 95%. The World Tourism Organization estimates that the drop in COVID-19 related tourism activities will reach rates of -3% and -40% during 2020 with forecasts of full recovery by 2022.

-Social & Education

The particularity of this kind of macroeconomic shock in developing countries compared to developed countries is the additional channel it takes through the informal economy and particularly the informal labor market. In Tunisia, several hundreds of thousands are currently in precarious situations with a loss of income probably beyond the period of confinement. The International Labor Organization (ILO) estimates the loss of jobs worldwide (March 2020) at 5.3 million, 13 million, and 24.7 million respectively for three crisis scenarios considered (low, medium, and severe).

In Tunisia, 6 million Tunisians will be directly impacted in their portfolio by the anticoronavirus measures. The problems are related to the loss of jobs and income, banking pressures, and also by the consequences of containment: lack of production, the decline in supplies, speculation...

For example, on the island of Djerba, 180,000 people are blocked: Djerbians and international residents are confined, living in an almost total blockade. The island, described as a "center of contamination", is cut off from the world. A blockade that creates shortages in certain foodstuffs and causes prices to soar by 30 to 40% for necessities. Djerba is not an exception, several areas are blocked due to the lack of means to generalize the COVID-19 tests to reassure and restore minimum living conditions.

This situation is becoming a source of stress for Tunisian families with very serious social consequences, which is reflected in an increase in violence in some families. The number of abused women is multiplied *4. For this reason, the government calls on civil society and non-profit organizations to take responsibility.

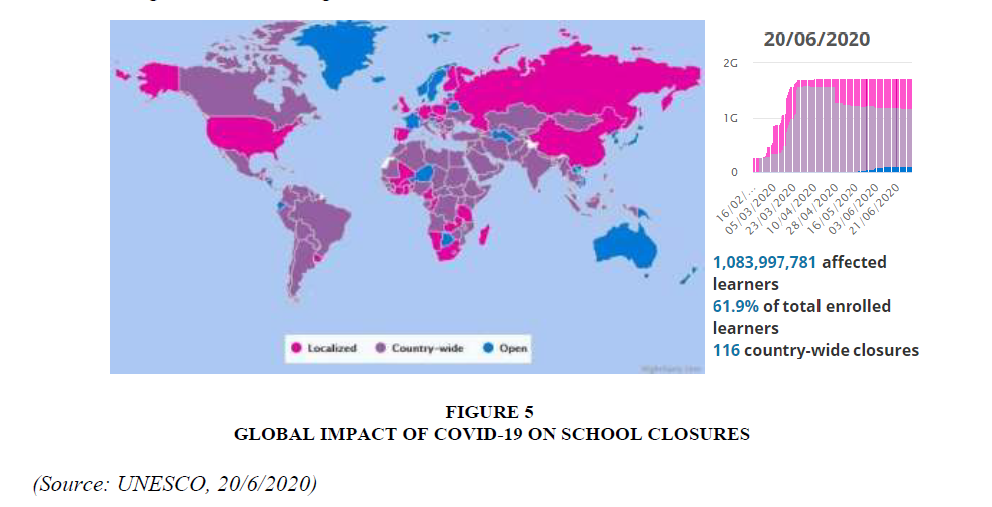

For education, most of the world's governments have provisionally closed educational institutions to contain the spread of the COVID-19 pandemic.

These national closures affect more than 90% of the world's student population. Several other countries have implemented localized closures affecting millions of more learners.

UNESCO is supporting countries in their efforts to moderate the direct impact of school closures, especially for more vulnerable communities, and to facilitate the continuity of Education for All through distance learning in Figure 5.

For Tunisia, there are 2,771,845 are affected learned by this school closure, including 1,408,954 total females and 1,362,891 total males. The classification according to levels is presented in the following Table 2:

| Table 2: Impact of COVID-19 on school closures in Tunisia | |||

| School type | Females | Males | Total |

|---|---|---|---|

| Pre-Primary | 122,346 | 128,467 | 250,813 |

| Primary | 577,174 | 624,562 | 753,029 |

| Secondary | 509,188 | 537,847 | 1,047,035 |

| Tertiary | 171,587 | 100,674 | 272,261 |

(Source: UNESCO, 3/5/2020).

“Whilst the intention of these closures is on a public health basis to prevent both spreads of the virus within institutions as well as to prevent carriage to other vulnerable individuals, these closures have had a widespread socio-economic impact. Some of these impacts include social isolation, dropout rates with students less likely to return once closures are ended… Additionally, there exists a wide disparity amongst populations with higher- income families able to access technology that can ensure education continues digitally as of social isolation” (Maria et al, 2020, P5).

In this context, the Tunisian state tries to encourage distance learning and for this reason, the Chamber of Computer Equipment INTECH tries to offer PCs and tablets to students who do not have laptops because, with 200 thousand students, there are 20 thousand students who cannot connect to the Internet.

Thus, the aim is to ensure equal opportunities for all students. This is so that they can connect to virtual classes.

On the other hand, this crisis was a source of motivation for young Tunisian researchers and some called Tunisia, "Land of miracles". Several universities have taken the initiative to consolidate the efforts of the state to address this health crisis by creating respirators for the hospital of Sousse, a sterilization tunnel in the university hospital in Sousse, creation of Glove-boxes to public hospitals…

Also, the Pasteur Institute of Tunisia is one of the few institutions in Africa to conduct preliminary research for a vaccine for this virus.

Scenarios after COVID-19

Economic crisis theory identifies three development scenarios after a shock (Dennis, 2013). The first scenario is non-convalescence. Thus, the country hit by a crisis does not manage to recover its pre-shock economic dynamics. This is the case for Greece, following the 2008 crisis, and for Tunisia following the 2011 crisis.

The second scenario is the convalescence which shows that economies, impacted by exogenous factors, suffer losses, and an economic slowdown. But manage to return to their precrisis growth levels.

The third scenario is called "Better reconstruction". It shows that countries affected by a crisis suffer losses. But manage, thanks to the disaster, to develop in a better state than before the shock. Classic examples are Japan and Germany after the Second World War and the United States after the 2008 financial crisis.

The "Better Reconstruction" in Tunisia is possible if Tunisians understand that even if by chance the Covid-19 did not wreak havoc. Other crises will hit the country, starting with the climate crisis which is beginning to take its toll. After this crisis, investment in knowledge, culture, and research and development must be an absolute priority.

Also, Schumpeter (1942) spoke of creative destruction, in fact at the level of each crisis, there are phases of destruction and phases of creation that will come after the crisis. Unfortunately, Tunisia is now in the phase of destruction at the level of the economy. There will be jobs that will disappear and others that will appear and others that will develop ... certainly, there will be a profound change in cartography at the international level with the technological and digital development ... So there will be new needs that will be developed, new expectations, new priorities...

For the post-crisis period, the Tunisian state has to anticipate the creation that is going to happen and the digitalization of the economy. Before the Covid-19 crisis, Tunisia was in the midst of a digitalization project. All over the world, this notion has moved and is still moving very well with the development of digital, artificial intelligence, robotics... Today, start-ups that have developed a digital approach are gaining new customers and new market shares. So the transformation is going to take place at the level of this digital sector in Tunisia and these very promising and innovative fields will change people's lives.

Tunisian Response

The problems and consequences of this health crisis are quite profound and the solutions are not only at the level of Tunisia but also depend on its partners. It is difficult to find a revival, at the level of the next months, because the crisis is very deep and even if companies are recovering a little bit the level of production, Tunisia depends on other markets and other countries, such as France, the European space (the economic transactions between Tunisia and Europe account for around 85%), China... especially at the level of imports. Tunisia has a deficit that exceeds 3 billion dinars and "today, Tunisia is ranked 60th out of 65 emerging countries in terms of financial soundness, far behind Morocco (26th) and Egypt (37th)..." (Taoufik Baccar, ex-governor of the Central Bank of Tunisia).

So there will be problems throughout the year 2020 with changes in people's behavior, logistics, relations between countries, the geopolitical situation...Hence it is necessary, now, to mobilize to face this crisis that the country is going through like all the countries of the world, to go from the management of the crisis to a restructuring of the economy.

Therefore, Tunisia needs crisis management in a scientific method. In this context, the government must start by creating a "war room" composed of competent people, to take decisions in a structured way and by anticipation with a clear vision.

But the most urgent need, of course, remains the supply of food to the population (especially the most deprived and those living in disadvantaged areas). One could also think of promoting the logistical capacities of the Post Office and launch a national e- commerce program in partnership with companies already operating in the field, supermarkets and, farmers to make distribution channels more fluid.

Currently, the state has mobilized 2.5 billion to accompany anti-coronavirus containment measures and to deal with social problems. More than 700,000 people will each receive 200 DT (80 euros) to compensate for their loss of income and technical unemployment. This is a small gesture of compensation for a hard containment.

Indeed, 4 billion dinars is the amount of international aid mobilized by Tunisia to counter Covid-19. It is almost 1.4 billion dollars, granted urgently in the form of grants and loans by international organizations: IMF, World Bank, European Union... The funding will be used to finance health processes, support social security and, help businesses weather the crisis.

Tunisia faces two crises: health and economic crisis. Among the solutions proposed in the field of health to finance the misdeeds and accelerate the exit from this sanitary crisis, is to privatize 900,000 hectares of state land, nationalized in 1964. This privatization will provide additional funds to renovate health infrastructures that need to be upgraded quickly. Also, it is necessary to consolidate the field of scientific research especially as young Tunisian researchers have shown great competence during this difficult period.

For the oil field, the state must take advantage of the “Nawara” gas project, located in the extreme south of Tunisia, and came on stream in the middle of a shut-in period. This gas project will produce almost one billion cubic meters of gas annually and will provide a revenue of 1.4 billion dinars, or almost 1.3% of the Tunisian GDP. It is a pure advantage for economic recovery after Covid-19.

For the banking and financial sector, the total contribution in the national effort to combat Covid-19 has reached 112 million dinars (MD) at present, whereas it was initially estimated at 15 million dinars (MD). An amount that will be supplemented by additional contributions. The sector also contributes to the implementation of the accompanying measures decided by the government to support Tunisian companies and low-income individuals, through its banks, leasing and, factoring companies, in particular, the rescheduling of the borrowings.

And, to preserve the health and soundness of the banking and financial system, appropriate measures should be identified to alleviate the consequences of this crisis (Deloitte office, 2020). For example:

1. Easing of drawing conditions on national and international money markets;

2. Controlling refinancing costs by creating new resources;

3. Strengthening the capital base of banks through cash injections.

On the other hand, 6.75% is the key interest rate of the Central Bank of Tunisia. This rate puts the interest rates of commercial banks at the level of 9-10%. This rate paralyzes credits and represents an obstacle to access liquidity. In the context of a pandemic, this rate is heavy, indicating an inconsistent policy. It must, therefore, fall rapidly to help public and fiscal policies.

For Tunisian SMEs, they need a rescue plan within the framework of a partnership with the Tunisian State, taking into account their degree of exposure to this major crisis. Therefore, the State and in the short term, it will have to continue its efforts to meet the expectations of enterprises by bringing flexibility to the collection of tax and financial revenues, by requiring banks (through the Central Bank of Tunisia) to reschedule debts without additional costs and to reduce employer contributions.

To conclude, in the international market, countries concluded two points. On the one hand, this crisis has shown huge independence of the different countries from imports (the hides, gloves, gels, tests...), this is not only the case of Tunisia but also of France, Italy...China has become the factory of the world and therefore many decision-makers today realize that some industries must be developed.

On the other hand, China is going to be held responsible at the international level for the spread of this pandemic, since the virus was conceived in China and it was not reliable enough in terms of information management and decision making... hence the international confidence is going to decrease with this country.

Tunisia, therefore, has two alternatives. First, Tunisia must present itself as an alternative to the Asian and Chinese market concerning pharmaceutical products by offering more services and added value. Morocco and Senegal have already started on this path. Of course, it is difficult, but Tunisia can take advantage of its historical relations with European countries, especially as the European culture is well developed in Tunisia.

Then, Tunisia must develop all activities related to digital and artificial intelligence. Experts estimate that 60 to 80% of current jobs will disappear (secretariats, assistance, intermediate functions ...) and jobs will appear concerning big data, digital...

On the international market, digital companies have not been affected by this health crisis, unlike other sectors. People in confinement are increasingly turning to companies and start-ups that develop online services: distribution, services, online banking, online financial organizations...For example, the turnover of the company "Netflix", has exceeded the turnover of ExxonMobil, a global company operating in the oil sector. Similarly, Tunisians are increasingly involved in digital, social networks, applications ... The Tunisian state must, therefore, take advantage of the situation by adopting a digital culture, and must liberalize this sector, it must provide tax incentives and encourage young people to create their start-ups and develop in the digital sector.

Moreover, the first action to be taken is the digitalization of the markets. Another priority is the introduction of mobile payment solutions. Also, a legislative project must be launched to facilitate digitalization. This will, among other things, make it possible to regulate everything concerning legalized signatures and certified copies to save Tunisians precious time. Also, the establishment of digital platforms for coordination with the various stakeholders at the central and regional level, between the administration, the post office and telecommunications operators, and good communication with citizens.

Finally, a legal framework dedicated to telework must be created and companies must be encouraged to offer their employees the possibility to work remotely.

Conclusion

Never before has the world experienced such a sudden halt in all its activities. In Tunisia, as everywhere else in the world, the economy will suffer a loss whose magnitude is difficult to predict but whose negative repercussions will surely be enormous. While economic activity could restart later this year, less favorable scenarios should be considered...The COVID-19 pandemic has already brought human suffering and major economic disruption around the world.

Therefore, “the economic risks of epidemics are not trivial. Victoria et al, (2017) estimated the expected yearly cost of pandemic influenza at roughly $500 billion (0.6 percent of global income), including both lost income and the intrinsic cost of elevated mortality. Even when the health impact of an outbreak is relatively limited, its economic consequences can quickly become magnified. Liberia, for example, saw GDP growth decline 8 percentage points from 2013 to 2014 during the recent Ebola outbreak in West Africa, even as the country’s overall death rate fell over the same period” (David & al, 2018).

The COVID-19 crisis is a reminder that the financial sphere will not be able to function asynchronously with the real economy and that it is vulnerable to systemic macroeconomic shocks. For the Tunisian government, it must live up to this event, consolidate the Tunisian consumer, and try to respect the application of financing measures, taxes, support for SMEs ... For example, in the U.S.A, they have injected 20% of liquidity to avoid a cyclical economic crisis.

However, this crisis can be transformed into an opportunity if the state manages to catalyze the vectors of social solidarity, eliminate all the bureaucratic constraints that limit the release of energies within organizations, and free the energies of human resources, particularly young people, who have shown in recent weeks how knowledge and research can be useful for society as a whole.

It is also necessary to consolidate the fundamentals of economic development, and accelerate the development of the social and solidarity economy, solve the structural problems of public enterprises, agriculture, education, transport, and health...because, today, with all the goodwill shown by all the actors in the health sector, Tunisia occupies 122nd position out of 195 countries according to the Global Health Security Index, with a score of only 26.3/100, in terms of detecting and reporting epidemics.

Tunisia is lagging far behind in terms of the digital transformation of institutions, the modernization of regulations...This crisis should make it possible to catalyze all energies to modernize the country. Digital transformation is a priority including digital financial services and G2P payments (from the government to citizen) and vice versa (P2G), boosting the development of participatory financing platforms (Crowd-funding) and the sharing economy (P2B and P2P).

References

- David, E.B., Daniel, C. & Sevilla, J.P., 2018, “Pandemic and the global economy: New and resurgent infectious diseases can have far-reaching economic repercussions”, Financial & Development, Vol: 55, N°2.

- Deliana, K., Cynthia, H. C., John, R., Desmond, E. W., Tushar, S., Lise, D.M. & Rebecca, E.B., 2019, “Long? distance effects of epidemics: Assessing the link between the 2014 West Africa Ebola outbreak and U.S. exports and employment”, Health Econ, Vol: 28, pp: 1248–1261.

- Deloitte office, 2020, “ Covid-19 : Impact des mesures de la Banque Centrale de Tunisie sur les Banques”.

- Dennis, E., 2013, “Developing country vulnerability in light of the global financial crisis: Shock therapy?”, Review of Development Finance, Vol: 3, Issue 2, pp: 61-83.

- European Centre for Disease Prevention and Control, 2020. https://www.ecdc.europa.eu/en/geographical-distribution- 2019-ncov-cases IACE, 2020, “L’impact du COVID-19 sur les entreprises tunisiennes”. https://www.iace.tn/limpact-du-covid-19-surles- entreprises-tunisiennes/ International Monetary Fund, 2020, “Emergency Financing and Debt Relief”.

- Maria, N., Zaid, A., Catrin, S., Ahmed, K., Ahmed, A., Christos, I., Maliha, A., & Riaz, A., 2020, “The Socio- Economic Implications of the Coronavirus and COVID-19 Pandemic: A Review”, International Journal of Surgery.

- National Institute of Statistics, 2017. http://www.ins.tn/en/statistics-tunisia-national-institute-statistics North Africa Journal, 2020. https://north-africa.com/category/covid-19/

- Schumpeter, J., 1942, “Capitalism, Socialism and Democracy”, USA.

- Timothy, L., 2020,” The economic impact of the Coronavirus 2019 (Covid2019): Implications for the mining industry”, The Extractive Industries and Society.

- Victoria, Y.F., Dean T.J., & Lawrence, H.S., 2018,” Pandemic risk: how large are the expected losses?”, Bulletin World Health Organ. Vol: 96, pp: 29–134.

- Warwick, M. & Roshen, F., 2020, “The Global Macroeconomic Impacts of COVID-19: Seven Scenarios”, Centre for Applied Macroeconomic Analysis, CAMA Working Paper.

- World Bank Group, 2019, “Pandemic Preparedness Financing”, World Health Organization: health, nutrition&population.

- World Bank, 2020, "How Transparency Can Help the Middle East and North Africa", April.

- Worldmeter, 2020. https://www.worldometers.info/coronavirus/

- Wouter Botzen, W.J., Olivier, D., & Mark, S., 2019, "The Economic Impacts of Natural Disasters: A Review of Models and Empirical Studies," Review of Environmental Economics and Policy, Association of Environmental and Resource Economists, Vol: 13, pp: 167-188.