Research Article: 2020 Vol: 24 Issue: 1

Social Entrepreneurial Ecosystems: A Regional Perspective of Mexico

Allan Villegas-Mateos, Universidad de Monterrey

Mario Vázquez-Maguirre, Universidad de Monterrey

Abstract

The objective of this work is to analyze how Social Entrepreneurial Ecosystems (SEE) in low-vulnerability and high-vulnerability regions of a country may influence the creation and operation of social ventures. To do so the study follows one of the Global Entrepreneurship Monitor’s (GEM) surveys, the National Experts Survey (NES). Particularly, the instrument from 2015 when the GEM teams around the globe made a unique effort to collect data for a special topic report on social entrepreneurship including eight questions to measure social entrepreneurship as an additional section of the survey. The authors used the case of Mexico because the GEM national team collected NES responses in 5 of the 32 entities within the country (Guanajuato, Jalisco, Puebla, Querétaro, and San Luis Potosí) that year. Therefore, considering demographic and economic indicators the entities were grouped into two regions according to their levels of vulnerability. The resulting pool of data of regional NES responses in Mexico during 2015 was a total of N=188 experts, 74 located in High Vulnerability (HV) regions, and 114 in Low Vulnerability (LV) regions. The authors used non-parametric statistics to compare the differences between both regions. The results suggest that experts in low vulnerability regions perceived more favorable conditions for social entrepreneurs than in high vulnerability regions. The SEE in Mexico seems to be more consolidated in central regions where the main actors carry out most of their activities. Therefore, social entrepreneurs may face higher challenges to create and operate social ventures in peripheral regions. This study contributes to the empirical literature in regional Entrepreneurial Ecosystems (EE) by analyzing local ecosystems grouped by regions that share similar levels of vulnerability. This research also sheds light on how the EE may have conditions that can also promote the creation and development of social ventures even though the objective of these ecosystems are not primarily social but economic. In this sense, promoting an EE may favor the creation of SEE, although the latter is most needed in peripheral regions which traditionally experience higher levels of vulnerability.

Keywords

Social Entrepreneurship, Entrepreneurial Ecosystems, Impact Investment, Regional Development, GEM Mexico.

Introduction

The increasing number of private entities such as social enterprises, cooperatives, community-based enterprises, and B-corps, have reconfigured entrepreneurial ecosystems in order to create new social equilibriums that guarantee increased levels of wellbeing (Vázquez- Maguirre, 2018). Academics recognized the value of external ecosystems for social entrepreneurial organizations in creating alliances to obtain resources and support (Grant & Crutchfield, 2007). Social entrepreneurs include new actors in the ecosystem to create new equilibrium (Patrono & Sutanti, 2016). In this sense, social entrepreneurs deal with similar conditions than traditional entrepreneurs in the existing ecosystems; there is no special distinction such as a social entrepreneurial ecosystem resulting in an unclear role of social entrepreneurs (Roundy, 2017).

The Entrepreneurial Ecosystems (EE) approach offers a systemic view of the entrepreneurial activity (Cavallo et al., 2018) and is particularly important for social entrepreneurs, who must leverage complex systems of interacting players in rapidly evolving political, economic, physical, and cultural environments (Bloom & Dees, 2008). However, Roundy (2017); McMullen (2018) drove our attention to the lack of studies that define Social Entrepreneurial Ecosystems (SEE) in the regional development literature.

Moreover, the recent literature about EE has acquired special attention from the participants of the ecosystems, mainly entrepreneurial leaders and policymakers (Stam, 2015), but also from scholars that have developed many empirical studies about the concept of EE in the last years. Empirical studies focus on how rich EE enables entrepreneurship and the subsequent creation of value at a regional level (Fritsch, 2013; Tsvetkova, 2015; Cavallo et al., 2018; Purbasari et al., 2019; Aljarwan et al., 2019). Contributing to this perspective, this study aims to understand SEE in broader settings considering the important dimension of geography and how low-vulnerability versus high-vulnerability regions inside a country differ in terms of economic activities such as social entrepreneurship. We found evidence from a study of Vietnam (Hoang Tien et al., 2019) of the possibility of finding predominant social entrepreneurship out of the megacities. Conceptually, regions with higher levels of poverty (more vulnerability) will have the worst perceptions of their conditions to enhance their SEE explained by the agglomeration effect in the regional development literature related with the advantages of central locations (Todling & Wazenbock, 2003; Van Stel & Suddle, 2008) associated with lower levels of poverty and less vulnerability. Consequently, it contributes to answering how the entrepreneurial ecosystems in which social entrepreneurs are located can influence the founding and operation of their venture (Roundy, 2017).

Another area of interest evaluates the drivers of successful scaling of social impact that allow social programs to increase their beneficiaries more rapidly (Bloom & Skloot, 2010). This may explain why companies have become more involved in addressing urgent social and environmental problems in the communities where they operate. Also, there is an increasing need for dialogue with different stakeholders to move beyond paternalistic approaches to social problems and implement policies that better protect human dignity and the environment (Pirson et al., 2019). Usually, the main vehicle of investment has been through corporate social responsibility actions, new enterprises founded by social entrepreneurs have also originated with the primary objective of solving social problems in a sustainable form. Examples of these entities are social enterprises, cooperatives, community-based enterprises, and B-corps, which have reconfigured entrepreneurial ecosystems in order to create new social equilibriums that guarantee increased levels of wellbeing. These support the need to foster better social entrepreneurship initiatives, and this contribution sets the SEE perspective as an emerging path to start by accepting that they need different support mechanisms, but are also complemented by the traditional EE.

The challenge is to create market incentives to change behaviors of beneficiaries and influencers, and capitalizing on economic and social trends to attract attention and build momentum for their causes (Bloom & Dees, 2008; Bloom & Chatterji, 2009). This suggests that the best conditions to create or grow a social enterprise must be located in regions where the social problems are latent. Some have found evidence that if we change the ecosystem towards enhancing social enterprises, multiple stakeholders will be attracted to support entrepreneurial activities in this social context (Lumpkin et al., 2011). To transform the equilibrium, social entrepreneurs involve new actors in the existing ecosystem (Patrono & Sutanti, 2016). Therefore, creating an ecosystem that fosters the creation and development of social enterprises is a complex task that requires the coordination and involvement of multiple stakeholders.

The objective of this work is to analyze how social entrepreneurial ecosystems in lowvulnerability and high-vulnerability regions of a country may influence the founding and operation of social ventures. To better understand this phenomenon in the emerging literature of SEE, the authors used the case of Mexico. In terms of impact investments associated with social entrepreneurship, it is more intense in the three regions that surround Mexico’s major cities: Mexico City, Guadalajara, and Monterrey (Alianza por la Inversión de Impacto en México, 2018). However, these cities represent the highest levels of prosperity in the country (UNHabitat, 2019). This phenomenon suggests that social entrepreneurs in these cities may have more favorable conditions to thrive than their counterparts in high-vulnerability regions (where, hypothetically, social entrepreneurship might be more needed).

The rest of the paper is as follows. Section 2 discusses the conceptualization of social entrepreneurship, regional aspects of social entrepreneurial ecosystems, and the Mexican context. Section 3 describes the methodology and empirical exercise. Sections 4 and 5 present the results and discussion, and gives some conclusions and implications for future research venues respectively.

Theoretical Development

Social Entrepreneurship

Social entrepreneurship is studied as a different phenomenon from commercial entrepreneurship, even though they share some characteristics (Austin et al., 2006). The definition of social entrepreneurship has evolved from broad definitions based on social attributes to more specific management-related elements. Initially, Cornwall (1998) characterized social entrepreneurs as individuals who are socially responsible and seek to improve their communities; they recognize opportunities and gather together the necessary resources to make a difference (Thompson et al., 2000). Later definitions included abilities such as organizing and operating a venture which features social goals (Peredo & McLean, 2006); and creating a new stable equilibrium that translates into a higher level of satisfaction for the stakeholders in the system (Martin & Osberg, 2007). Ashoka (2015; 2019) highlights the sustainability dimension, scalability, and permanently solving a social need.

Social entrepreneurs differ from entrepreneurs in the wish to establish a logic of empowerment to create sustainable value (Santos, 2012). Empowerment is defined as the process of increasing the capacity of individuals or groups to make choices and to transform those choices into desired actions and outcomes (The World Bank, 2011). This seems to be a key element in social organizations; even some authors conceptualize social enterprises as a method of empowering marginalized individuals or disadvantaged groups (Levander, 2010). Value creation is also a guiding principle of social entrepreneurs when evaluating a project based on social impact measurement (Ormiston & Seymour, 2011). Dees (2001) focus his definition of social entrepreneurs on their ability to create and sustain social value. Value creation and logic of empowerment are two elements that contradict the prevailing business logic of value appropriation and stakeholder control (Santos, 2012; Vazquez-Maguirre et al., 2016). In this sense, a profit-maximizing enterprise seeks projects based on Net Present Value (NPV) or Return on Investment (ROI), which are financial indicators of the value a company can appropriate, which does not include the value appropriated by other stakeholders (communities, employees, clients, etc.). These definitions imply that social entrepreneurs can choose different forms of organizing within the public, private, or non-profit sectors, which encompass organizations that may have different institutional and economic logics. Consequently, these forms of organizing may have different needs and may require specialized support mechanisms. In this sense, to foster social entrepreneurship in a region, academics and practitioners need to understand the factors that incentivize people and organizations to become social entrepreneurs in the first place (Sullivan, 2007).

Regional Aspects of Social Entrepreneurial Ecosystems

EE can contribute to understanding not only the broad environments in which social entrepreneurs work but also to shape those environments to support their goals, when feasible (Bloom & Dees, 2008). EE literature fails to determine the required level of analysis (Stam, 2015), although, there is empirical research at the city level (Saxenian, 2006; Mack & Mayer, 2015; Spigel, 2017; Vedula & Kim, 2019) that demonstrates the importance of location within a country. Then, analyzing the EE definitions more deeply the authors distinguished the ones that support geographic differences as a condition (Spilling, 1996; Neck et al., 2004; Cohen, 2006; Mason & Brown, 2014; Stam, 2015; Mack & Mayer, 2015; Spigel, 2017). Therefore, it is particularly relevant to study EE from the regional level, especially for actors who are embedded in regions that constrain their operations and must find ways to compensate for the lack of positive regional ecosystems influence (Vedula & Kim, 2019), something that social entrepreneurs face too (Roundy, 2017).

For instance, there is not a clear definition for SEE, but analyzing how EE is defined (Van de Ven, 1993; Spilling, 1996; Neck et al., 2004; Cohen, 2006; Isenberg, 2011; Roberts & Eesley, 2011; Qian et al., 2012; Acs et al., 2014; Mason & Brown, 2014; Stam, 2015; Mack & Mayer, 2015; Spigel, 2017; Audretsch & Belitski, 2017; Auerswald & Dani, 2017; Bruns et al., 2017; Kuratko et al., 2017), it can be inferred that the approach applies to any type of entrepreneur. The entrepreneur is the central heart of any entrepreneurial ecosystem (Villegas Mateos & Amorós, 2019), his main objective is to create economic impact (generate profit), while social entrepreneurs seek primarily social impact and social value creation (Ormiston & Seymour, 2011). Although usually social entrepreneurship and entrepreneurial ecosystems are studied independently, even they are interrelated (Roundy, 2017). Consequently, this study contributes to the empirical literature in regional EE clarifying the required level of analysis by studying social entrepreneurship by regions, because social entrepreneurs need special support mechanisms, and deserve special research attention (Duncan, 2009).

Following the geographic differences related with entrepreneurial activities, the literature highlights several advantages of a central location that include highly educated people, a larger potential market, and knowledge spillovers from universities and research institutions explained by the agglomeration effect (Todling & Wazenbock, 2003; Van Stel & Suddle, 2008). These advantages could be considered attractive for an entrepreneur, but tend to decrease the attention from peripheral regions and some core activities like an investment (Roberts & Barley, 2004; Saxenian, 2006), affecting social entrepreneurs in these regions. Therefore, it is fundamental to understand where does the entrepreneurial processes are happening and their impact on local economic development (Korsgaard et al., 2015). Scholars in public administration point to the lack of social entrepreneurship as one of the reasons why communities stagnate (Sullivan, 2007).

For example, Vedula & Kim (2019) found that entrepreneurial actors (founders, investors, and other stakeholders) are strategic regarding where to locate, while they also evaluate venture performance by the relative impact of their current location (Dahl & Sorenson, 2012). This is interesting because actors that invest in social entrepreneurship ventures differ from traditional investors that focus exclusively on economic metrics (Alianza por la Inversión de Impacto en México, 2018). The former seeks an impact investment, which is made by the private sector to obtain a social and financial gain (Ashoka, 2015). In this sense, as social entrepreneurs naturally try to solve social problems to achieve the desired impact, they may locate their ventures in high-vulnerability places, distant from the advantages of central locations. This issue explains why governments try to foster entrepreneurial activities in peripheral regions by offering special incentives to attract investments and entrepreneurs to those regions (Frenkel et al., 2003). In practice, governments can only interfere in SEE by creating and improving policies and programs, but still, other factors would change the desired effects explaining why many pro-entrepreneurship programs are not effective (Lerner, 2009). However, there is evidence that entrepreneurship policy should stimulate economic growth as a necessary condition for employment generation and poverty alleviation (Edoho, 2016).

This phenomenon may result in more people and firms moving to urban regions (Amorós et al., 2013) where the largest city is generally the capital of the country and its surroundings. However, governments must prioritize the homologation of the opportunities for social entrepreneurs whether they are in big cities or small cities because one of the main motivations for them is it’s closeness to the social problem (Germak & Robinson, 2014). The small cities must be able to engage in several strategies to overcome their limitations and create vibrant entrepreneurial communities (Roundy, 2017). Therefore, considering the mentioned regional aspects of entrepreneurship and the fact that urbanized regions are mostly economically stronger (Cannarella & Piccioni, 2006), this paper aims to contribute to the SEE literature at a regional level, particularly in Latin America, by analyzing the significant differences of experts’ perceptions located between the High Vulnerability (HV) regions and Low Vulnerability (LV) regions in Mexico. In This context, the authors explore the experts’ perceptions and provide recommendations with policy implications that may help to foster social entrepreneurial activities in Mexico.

The Mexican Context

The main elements of the social entrepreneurial ecosystem in Mexico are described in Table 1. In the demand side, social entrepreneurs choose from a variety of legal figures and schemes to generate projects and enterprises that address the social issues of the country. For example, in July 2018, Mexico had 31 B-corps, a type of enterprise that arrive at this country in 2016 and that seeks to generate positive social and environmental impact while solving a social problem profitably (Inversión de Impacto en México, 2018). Also, social enterprises are expanding in urban contexts and cooperatives and community-based enterprises are common entities in rural communities (Vazquez-Maguirre et al., 2018). In addition, companies have also increased the amount of impact investment, mainly through Corporate Social Responsibility (CSR) programs and financing of social initiatives (Ashoka, 2015). However, social responsibility activities in most enterprises are only understood as charitable contributions, community sharing or voluntary corporate social work (Van Son & Van Trai, 2020).

| Table 1: Main Elements Of The Social Entrepreneurial Ecosystem In Mexico | |

| Demand | Social Entrepreneurs through organizations such as social enterprises, cooperatives, community-based enterprises and B-corps, foundations, and CSR programs. |

| Supply (Funding institutions) | Financial markets, ethical and social banking, commercial banks, social investment funds, International development agencies, crowdfunding sites, government (funding institutions). |

| Social intermediaries (social partners) | High impact incubators and accelerators, NGOs, universities, government (social institutions), consultants (social innovation methodologies, social indicators, impact evaluation). |

| Social context | Inequality, insecurity, high poverty rates, broad regions lacking access to financial services, social security, social mobility, education, formal jobs, overexploitation of natural resources, unsustainable cities. |

| Structural context | Legal: lack of legal figures for social enterprises and social investment. |

| Cultural: a paternalistic approach to social problems, stigmatization of failure. | |

| Source: Elaborated by the authors. | |

In the supply side, Mexico is gaining a reputation as a center of impact investments in Latin America. Capital committed to impact investment in Latin America has grown 12-fold in five years (2008-2013) to USD 2,018 million (Leme et al., 2014). Impact investment funds have increased in Mexico, perhaps in response to the 2008 financial crisis that has modified investment portfolios (Ashoka, 2015). Mexico had the second-largest share of invested capital with USD 100 million after Brazil (Leme et al., 2014). Micro-enterprises that seek job generation, women empowerment, and sustainable energy and agriculture are among the activities usually funded (Schau et al., 2013); eco-technologies have also had a high level of success since Mexico have an ideal climate for technologies such as solar panels, biogas and rainwater capture (Ashoka, 2015).

Meanwhile, social intermediaries are relatively young actors in the emergent ecosystem: the main incubators, accelerators, and university labs were created in the first decade of the new millennium.

In the social context, Mexico is one of the two more unequal countries of the Organization for Economic Cooperation and Development (OECD): 1% of the population receives 21% of the national income (OXFAM México, 2015). Poverty reaches 52 million people (41.9%), of which 9.3 million live in extreme poverty (CONEVAL, 2018b). This inequality partially explains the context of insecurity that prevails in the country. Mexico had more than 35,000 homicides in 2018 (INEGI, 2019a). Also, 71% of the population living in urban contexts believe the city where they live is insecure (INEGI, 2019b). Finally, Mexico is still struggling to bring financial services to each community, only 47% of adults have a bank account, and this indicator presents important variations among the north (up to 60%) and southern region (as low as 40%) (INEGI, 2018).

The structural context that social entrepreneurs face has two major challenges. First, Mexican law does not allow organizations to accept tax-deductible donations and receive income under the same legal figure. As a consequence, social entrepreneurs are forced combined different legal figures, or establishing a traditional company and sacrificing a possible 16% tax deduction (Ashoka, 2015). Second, in the cultural dimension, stigmatization of failure prevails in Mexico, making it more challenging for social entrepreneurs to continue pursuing their social venture (The Failure Institute, 2017). Also, Mexico has a historical paternalistic approach to social problems. These programs usually have sought cultural assimilation and have not taken into account local organizations (Davis, 1993); once a developmental project exhausts its budget, beneficiaries often lose interest in continuing with the project autonomously (Peredo & Chrisman, 2006). This translates into a vicious circle of dependency, poor financial habits, and institutions that do not fulfill their objectives (Johnson, 2000).

Table 2 describes the main actors of the social entrepreneurial ecosystem in Mexico. The subsequent addition of more actors to the SEE in Mexico contribute to a more complex ecosystem, with actors playing various roles and actors that have been traditionally not interested in social issues now seeking to get more involved through business strategies such as CSR, inclusive businesses, the bottom of the pyramid, or circular economy. These efforts usually concentrate in the three regions that surround Mexico’s major cities: Mexico City, Guadalajara and Monterrey (Alianza por la Inversión de Impacto en México, 2018).

| Table 2: Main Actors Of The Social Entrepreneurial Ecosystem In Mexico | |

| Main activity | Actor (year of foundation) |

| Social labs and accelerators | Ashoka (1987), Impact Endeavor (2001), Agora Partnerships (2005), Unreasonable Mexico (2012), Impact Hub (2014), Impact Lab (2014). |

| Funds focused on social impact | Angel Ventures (2008), Promotora Social M�xico (2009), Adobe Capital (2012), LATAM fund (2017). |

| Government agencies | Nacional Financiera (NAFIN) |

| Networking | Fuck Up Nights (2012), ASEM (2015), AIIMx (2015), Ashoka Support Network. |

| Corporations funding social entrepreneurs | Nacional Monte de Piedad (1990s), BBVA Momentum (2011), Santander Bank Business Innovation (2000s) |

| University labs | Ashoka Changemaker Campus in M�xico: Tec de Monterrey (Guadalajara campus), Universidad de Monterrey, UPAEP |

| Source: Elaborated by the authors with data from Alianza por la Inversi�n de Impacto en M�xico (2018) and Ashoka (2019). | |

The SSE in Mexico is relatively young as its main institutions were mostly created in the early 2000s. Incubators, social labs, funds, and government agencies are still struggling to generate strong SSE. A study of 115 social entrepreneurs in Mexico by The Failure Institute (2017) found that the life expectancy of a social enterprise is less than one year in 38.3% of the cases, 45.2% survived between one and three years, and only 5.2% lasted more than 10 years. Lack of funding was the main reason for the failure of the ventures followed by the absence of a consolidated ecosystem for social entrepreneurs. Regarding the ecosystem, the respondents highlighted an economic and social context that is not consistent and sensitive to the needs of social entrepreneurs, insufficient public policies that support social ventures, and the resistance of companies and public entities to participate and invest in enterprises with a social purpose. A similar study by GALI (2017) also provides evidence of the lack of a consolidated ecosystem: only 22% of social enterprises in Mexico received training or support from an accelerator or incubator, 23% received government support and 56% did not receive any formal support. Likewise, 85% of the companies that were incubated managed to survive more than 3 years, but 80% of the enterprises without formal training died before 2 years. This data shows the importance of supervision and institutional support in the early stages of social entrepreneurship (Alianza por la Inversión de Impacto en México, 2018) and also the urgency to conduct this research and to propose social entrepreneurship oriented policies.

Research Methodology

Data Description

Following one of the worldwide standard questionnaires of the Global Entrepreneurship Monitor (GEM) methodology, the National Experts’ Survey (NES) provides consistent data to develop an empirical (Levie & Autio, 2008). The NES provides information about the Entrepreneurial Framework Conditions (EFCs) defined by Reynolds et al. (2005) and are consistent with several components of the EE, e.g., financial support, government policies (general and regulation), government programs, entrepreneurial education (primary and secondary, and post-school), R&D transfer, commercial and professional infrastructure, internal market (dynamics and openness), access to physical infrastructure, and cultural and social norms. Particularly, in 2015 the GEM teams around the globe made a unique effort to collect data for a special topic report on social entrepreneurship, in the NES specifically, they included eight questions to measure social entrepreneurship as an additional EFC (Bosma et al., 2016). For the case of Mexico since the same year, there has been a specific regional approach that follows other countries like Chile, Germany, Spain, and the UK. That means that the NES data from Mexico in 2015 was collected in 5 of the 32 entities within the country (Guanajuato, Jalisco, Puebla, Querétaro, and San Luis Potosí) and they included the social entrepreneurship-related questions. The regional sub-teams were instructed to select at least four experts considered particularly knowledgeable in each of the generic EFCs (Table 3). This data is accurate for this study because the NES uses information based on informed judgments of experts regarding the status of each EFC in their own countries and/or regions. The regional experts were selected based on reputation and experience on their local EE.

| Table 3: Experts Per Location | |

| Location | Social Entrepreneurship |

| Guanajuato | 38 |

| Jalisco | 37 |

| Puebla | 38 |

| Quer�taro | 39 |

| San Luis Potos� | 36 |

| Total | 188 |

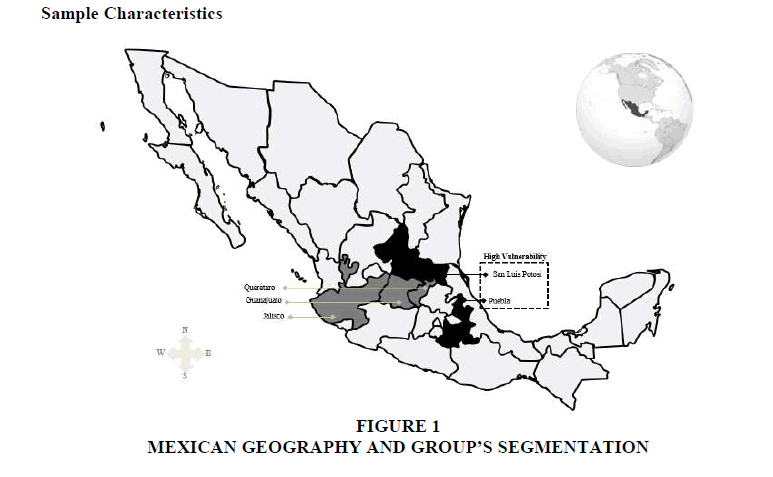

The pool of data of regional NES in Mexico during 2015 was a total of N=188 experts, 74 located in High Vulnerability (HV) regions, and 114 in Low Vulnerability (LV) regions. The HV comprises individuals that live and develop their entrepreneurship activities in Puebla, and San Luis Potosí. The LV are those who live and develop their entrepreneurship activities in Guanajuato, Jalisco, and Querétaro. The economic, geographic and demographic profiles provided guidance, and additionally considering the poverty index of 2016 when the national average was 43.6 (CONEVAL, 2018) provided a clearer distinction between high and low vulnerability regions (Table 4 and Figure 1). A description of the entire sample and the two subsamples, HV and LV, is provided in Table 5. Tests were conducted to evaluate similarities of the samples. Pearson’s chi-squared test revealed that the samples were not significantly different except for the gender composition between HV and LV.

| Table 4: Mexican Geographic And Demographic Indicators | ||||||

| Region | Male | Female | Total a/ | Regional GDP b/ | % National GDP | Poverty Index c/ |

|---|---|---|---|---|---|---|

| Low Vulnerability regions | ||||||

| Guanajuato | 28,32,687 | 30,32,090 | 58,64,777 | �$������ 914,368 | 3.90% | 42.4 |

| Jalisco | 38,53,584 | 40,26,955 | 78,80,539 | �$��� 1,466,416 | 6.26% | 31.8 |

| Quer�taro | 9,95,355 | 10,48,496 | 20,43,851 | �$������ 484,806 | 2.07% | 31.1 |

| Total | 76,81,626 | 81,07,541 | 1,57,89,167 | �$��� 2,865,590 | 12.23% | |

| High Vulnerability regions | ||||||

| Puebla | 29,49,444 | 32,33,876 | 61,83,320 | �$������ 715,143 | 3.05% | 59.4 |

| San Luis Potos� | 13,21,029 | 14,02,743 | 27,23,772 | �$������ 450,391 | 1.92% | 45.5 |

| Total | 42,70,473 | 46,36,619 | 89,07,092 | �$��� 1,165,534 | 4.98% | |

| a/ 2015 population and economic indicators in Mexico by selected locations | ||||||

| b/ Millions of Mexican pesos (2017 current prices) | ||||||

| c/ Poverty index calculated by the CONEVAL (year 2016) | ||||||

| Table 5: Sample Composition (N=188) | |||||||

| Sample Characteristics | Total | % of Total | HV | % of Total | LV | % of Total | |

|---|---|---|---|---|---|---|---|

| Demographics | Average age | 43.9 | 43 | 44 | |||

| Male | 139 | 73.90% | 46 | 62.20% | 93 | 81.60% | |

| Female | 49 | 26.10% | 28 | 37.80% | 21 | 18.40% | |

| Educational attainment | Vocational professional | 7 | 3.70% | 4 | 5.40% | 3 | 2.60% |

| University/College | 76 | 40.40% | 40 | 54.10% | 36 | 31.60% | |

| MA, Ph.D. | 105 | 55.90% | 30 | 40.50% | 75 | 65.80% | |

| Primary entrepreneurial framework condition expert specialization | Financial support | 21 | 11.20% | 8 | 10.80% | 13 | 11.40% |

| Government policies | 20 | 10.60% | 8 | 10.80% | 12 | 10.50% | |

| Government programs | 20 | 10.60% | 8 | 10.80% | 12 | 10.50% | |

| Education and training | 21 | 11.20% | 8 | 10.80% | 13 | 11.40% | |

| R&D transfer | 22 | 11.70% | 8 | 10.80% | 14 | 12.30% | |

| Commercial and professional infrastructure | 22 | 11.70% | 9 | 12.20% | 13 | 11.40% | |

| Market openness | 22 | 11.70% | 9 | 12.20% | 13 | 11.40% | |

| Access to physical infrastructure | 20 | 10.60% | 8 | 10.80% | 12 | 10.50% | |

| Cultural and social norms | 20 | 10.60% | 8 | 10.80% | 12 | 10.50% | |

| Expert specialization | Entrepreneur | 144a | 76.6%b | 57a | 77.0%b | 87a | 76.3%b |

| Investor, financer, banker | 39 | 20.70% | 7 | 9.50% | 32 | 28.10% | |

| Policymaker | 89 | 47.30% | 44 | 59.50% | 45 | 39.50% | |

| Business and support services provider | 123 | 65.40% | 42 | 56.80% | 81 | 71.10% | |

| Educator, teacher, entrepreneurship researcher | 88 | 46.80% | 25 | 33.80% | 63 | 55.30% | |

| HV=High Vulnerability experts, LV= Low Vulnerability experts | |||||||

| a Valid cases for each variable | |||||||

| b Percentage based on total valid cases for each variable | |||||||

Measures

The NES is divided into sections that evaluate EFCs, the same happened for the GEM’s special research on social entrepreneurship which had the additional eight questions for the new section at the end. The questions were answered on a nine-point Likert scale (where ‘‘completely false’’=1 and ‘‘completely true’’=9). The authors measured the internal consistency of the social entrepreneurship condition using the Cronbach’s alpha test because it helps to indicate how much a set of questions or items from a survey measure a single unidimensional latent construct (Cronbach, 1951). Cronbach’s alpha test was applied selecting the eight questions of the social entrepreneurship section. The result of this analysis is presented in Table 6. As it is possible to observe, the alpha coefficient is on the recommended level of 0.7 (Nunnally, 1978), providing evidence of acceptable reliability and consistent with the cross-national use of the NES. As a result, it is possible to use variable reduction procedures (like factor analysis or principal component analysis) to analyze the social entrepreneurship condition as described in the next section.

| Table 6: Scale Reliability | ||

| Scale | Number of Items | Cronbach’s Alpha |

|---|---|---|

| Social entrepreneurship | 8 | 0.694 |

Method

The method to analyze the differences between HV and LV follow the same procedures described in Amorós et al. (2013); Villegas Mateos & Amorós (2019) with their regional analyzes of ecosystems. It was important to calculate one single summarized variable with the eight social entrepreneurship-related questions to compare both regional groups. To do so, the authors also used principal component analysis (PCA) since its a powerfull multivariate method that is useful to analyze complex data and reduce dimensionality by using a linear combination of optimally weighted observed variables (Stevens, 1992; Hotelling, 1993; Dunteman, 1994; Lagona & Padovano, 2007; Shlens, 2009). In this way, the authors obtained as result of the PCA a summarized new construct that contains most of the variation within the data (Jolliffe, 2002). In a previous internal consistency validation process of the total questionnaire, the Bartlett and Kaiser–Meyer–Olkin (KMO) test was applied to check that the coefficient of the potential new variable was different from zero. The KMO statistic was 0.698, above the 0.5 acceptable, indicating that the PCA was viable with our sample (Dziuban & Shirkey, 1974); in addition, it was obtained a high level of significance (p˂ 0.01) from the Bartlett (below 0.5) (Tobias & Carlson, 1969).

Once the PCA was calculated (Table 7A & B), the differences between the perceptions of the HV and LV were tested. Thus, normality tests were conducted to determine if the values obtained from the experts’ responses were normally distributed. The results of these tests (Kolmogorov–Smirnov & Shapiro–Wilk) revealed that the social entrepreneurship condition was not normally distributed for both groups. Therefore, the Mann–Whitney U non-parametric test for means comparisons was selected as the most appropriate method to compare between both groups (Amorós et al., 2013). The Mann–Whitney U test has been reported as considerably more efficient and robust than the t-test when sample distributions are not normal (Conover, 1998).

| Table 7a: Description Of The Principal Component Analysis | ||

| Statement | Communalities | Component |

|---|---|---|

| extraction | matrix | |

| In my region, people who live in poverty cannot rely on the government or civil society organizations | 0.011 | 0.107 |

| In my region, you will find many business that provide people with basic needs that are covered by governments and civil society organizations in other countries | 0.256 | 0.506 |

| In my region, social, environmental and community problems are generally solved more effectively by businesses than by the government and civil society organizations | 0.116 | 0.34 |

| In my region, entrepreneurs' associations/groups challenge existing regulations that negatively impact particular groups in society or the environment | 0.247 | 0.497 |

| In my region, the government is able to bring together potential entrepreneurs, businesses and civil society organizations around specific social, environmental or community projects | 0.437 | 0.661 |

| In my region, consumers are putting pressure on businesses to address social and environmental needs | 0.511 | 0.715 |

| In my region, there are sufficient private and public funds available for new and growing firms that aim at solving social and environmental problems | 0.556 | 0.745 |

| In my region, there is a lot of media attention for new and growing firms that combine profits with positive social and environmental impact | 0.538 | 0.733 |

| Table 7b: Total Variance Explained | ||||||

| Component | Initial eigenvalues | Extraction sums of squared loadings | ||||

|---|---|---|---|---|---|---|

| Total | % of variance | Cumulative % | Total | % of variance | Cumulative % | |

| 1 | 2.672 | 33.40% | 33.40% | 2.672 | 33.40% | 33.40% |

| 2 | 1.5 | 18.74% | 52.15% | |||

| 3 | 1.053 | 13.16% | 65.31% | |||

| 4 | 0.717 | 8.97% | 74.27% | |||

| 5 | 0.682 | 8.52% | 82.79% | |||

| 6 | 0.528 | 6.61% | 89.40% | |||

| 7 | 0.453 | 5.66% | 95.06% | |||

| 8 | 0.395 | 4.94% | 100.00% | |||

Results and Discussion

The results of the Mann–Whitney U test are reported in Table 8. The social entrepreneurship condition was perceived more favorably by the experts located in the low vulnerability region (Guanajuato, Jalisco, and Querétaro), although, a strict statistic interpretation indicates it is not significant (z = −0.388, p = 0.698). This result can be explained because this group includes one of the major cities where impact investment is more developed, that is Guadalajara and is part of the entity of Jalisco (Alianza por la Inversión de Impacto en México, 2018).

| Table 8: Mann-Whitney U Test Results | |||||||

| Scales | Group | Valid cases | Mean | Standard deviation | Mean ranges | Mann-Whitney U | Z |

|---|---|---|---|---|---|---|---|

| Social entrepreneurship | HV | 98 | 21.69 | 6.53 | 78.2 | 2879.5 | -0.388 |

| LV | 61 | 21.66 | 6.24 | 81.12 | |||

From the results of the principal components analysis (Table 7 A & B), the results show that two components together explain more than half of the total variance (52.147%) this highlights the need to review how we measure social entrepreneurship because also, only three eigenvalues are above 1 which means that the other five components account for less variance than did the original variable. Asking experts if people who live in poverty cannot rely on the government or civil society organizations is the question that explains the less about social entrepreneurship. On the other side, asking if there are sufficient private and public funds available for new and growing firms that aim at solving social and environmental problems is the one that most explains social entrepreneurship.

Evidence suggests that experts in low vulnerability regions perceived more favorable conditions for social entrepreneurs than in high vulnerability region. This outcome is aligned with articles that highlight the advantages of central location explained by the agglomeration effect (Todling & Wazenbock, 2003; Van Stel & Suddle, 2008), and how these advantages tend to decrease the attention from peripheral regions (Roberts & Barley, 2004; Saxenian, 2006). As the main actors of the SEE in Mexico are usually based in one of the three largest cities of the country (Mexico, Guadalajara, or Monterrey), experts naturally have a better perception of the ecosystem around these cities. For example, the University of Monterrey (UDEM), certified as Ashoka’s changemaker campus, has only campuses in the city of Monterrey (capital and largest city of the northern state of Nuevo León) and concentrates its social entrepreneurship efforts in the municipalities of its 5-million inhabitants’ metropolitan area. UDEM constantly organizes diverse events with other actors of the ecosystem to consolidate an environment conducive to social entrepreneurship in Monterrey, but its efforts rarely transcend to other regions. Paradoxically, Nuevo León is the Mexican state with the lowest extreme-poverty rates, and one of the regions with the highest per capita income (CONEVAL, 2018). This example, which is similar to the case of Mexico City and Guadalajara (one of the three Ashoka Changemaker Campuses in Mexico is the Tec de Monterrey Campus in this city), may explain why low vulnerability regions may have better perceptions of the entrepreneurial ecosystem than a region with higher vulnerability rates.

Leme et al. (2014) found that there are many social business ideas emerging across Latin America, but many of them remain as yet undiscovered. Supply of capital for impact investing seems to be higher than the demand; therefore, many funds end up chasing the same social entrepreneurs or investing smaller amounts of money and in fewer ventures. Leme et al. (2014) suggest that, in the demand side, there are mostly small and informal ventures that lack the knowledge and institutional partners to build sound business plans and attractive pitches that convince potential investors. Additionally, the result of this works could suggest that some of these informal ventures may be located in high-vulnerability regions and could be facing difficulties to become visible for the main actors of the SEE.

The impact investing market in Latin America is still in the early stages of development (Ashoka, 2015), and the actors are still promoting structural changes that benefit the consolidation of a SEE. For example, many countries such as Mexico lack legal figures for social enterprises and social investment. Also, the region has a long tradition of paternalistic approaches to social problems that have generated dynamics where some actors expect that the government creates favorable conditions, provides funding, and promotes a social entrepreneurial ecosystem. Similarly, many communities passively expect the government to find and implement solutions to their local issues. Different actors of the SEE believe that to address these problems, they need to create a communication strategy that situates social entrepreneurship as a strategic axis for national development and also that allows the integration of impact investment in the financial and business culture of Mexico. One of the more urgent issues is promoting the creation of financial instruments and the legal figure of social enterprise (Alianza por la Inversión de Impacto en México, 2018). As these top-down solutions are slowly changing the entrepreneurial environment in Mexico, some local communities located in peripheral, highly vulnerable regions have adopted a bottom-up approach and developed incipient community-based entrepreneurial ecosystems.

A Bottom-Up Approach to Social Entrepreneurial Ecosystems

The lack of a consolidated social entrepreneurial ecosystem and the gap between the three major cities of Mexico (Mexico City, Monterrey & Guadalajara) and the rest of the country (Martínez Velázquez & Dutrénit Bielous, 2019) has generated incipient local entrepreneurial ecosystems around community-based and social enterprises, mainly in rural communities with high-vulnerability rates (Vazquez-Maguirre, 2018). These rural communities, before the lack of an ecosystem that provides knowledge, financial resources or a marketplace, have created social enterprises that act as anchor institutions that promote local SEE. These social enterprises have developed mechanisms based on local values (accountability and transparency, legitimacy, equality policies, a participatory organizational structure, social innovation, and entrepreneurial orientation) that contribute to empower every stakeholder and have built an emerging ecosystem that constitute a bottom-up approach to how SEE are generated (Vazquez-Maguirre, 2019). In these cases, local community leadership has created and funded the creation of different actors of the ecosystem, such as local suppliers and microfinance institutions, and built alliances with government, NGOs (Rainforest alliance, WWF), and local universities to boost social and commercial entrepreneurship (Vazquez-Maguirre, 2018).

The main motivation to build local SEE is to permanently solve the social issues that generated the social enterprise or community-based enterprise. As regional development literature suggests that the agglomeration effect generates advantages in central locations (Todling & Wazenbock, 2003; Van Stel & Suddle, 2008), rural communities are often located in distant regions and have difficulties to become part of a more complex entrepreneurial ecosystem. Therefore, these communities have to develop the capacities to build a local ecosystem that ideally would resemble the outcomes of those SEE located in central locations, as in the case of the three major cities in Mexico. As most rural communities fail to build even social enterprises that generate higher levels of well-being, a small number of them succeed in generating a local SEE (Vazquez-Maguirre, 2019). These examples constitute valuable cases that show how a bottom-up approach to SEE creation may work in distant, highly vulnerable regions.

Concluding Remarks And Future Research Venues

The objective of this work is to analyze how Social Entrepreneurial Ecosystems in lowvulnerability and high-vulnerability regions of a country may influence the founding and operation of social ventures. The results of this work suggest that experts in low vulnerability regions perceived more favorable conditions for social entrepreneurs than in high vulnerability regions. The SEE in Mexico seems to be more consolidated in central regions where the main actors carry out most of their activities. As the social context in Mexico presents high levels of inequality by region, there are peripheral places with high vulnerability rates where the main actors of the SEE are not present, presumably where social entrepreneurship is most needed. Therefore, social entrepreneurs may face higher challenges to create and operate social ventures in these regions. However, some of these regions have developed a bottom-up approach and created local entrepreneurial ecosystems around community-based enterprises and social enterprises. These ecosystems are not necessarily connected to major EE; instead, they are usually isolated, community-based managed, they mostly promote community development and do not necessarily include regional integration in their priorities.

This paper also sheds light on how the EE may have conditions that can also promote the creation and development of social ventures even though the objective of these ecosystems is not primarily social but economic. In this sense, promoting an EE may favor the creation of SEE, although the latter is most needed in peripheral regions which traditionally experience higher levels of vulnerability. This study also contributes to the empirical literature in regional EE by analyzing the local ecosystem grouped by regions that share similar levels of vulnerability. These regions may need equivalent special support mechanisms, institutions, and policies that foster a sound ecosystem that better suits the needs of social entrepreneurs.

This study is not free of limitations. First, the scale reliability was on the limit of acceptance rate which can be increased with a bigger sample with more entities but collecting regional data to conduct a study like this implies more resources and people involved which is a constraint. Second, the social entrepreneurship section in the National Experts’ Survey was removed after 2015 since it was only included for a special report. It can be interesting to see if there was an evolution after that time. Third, the group’s division could have been different and the results might also have changed. For example, the authors reviewed the geographic and demographic indicators (Table 4) before making the groups and for the case of Guanajuato it was categorized in the low-vulnerability region for this research but if we check updated indicators like the poverty index, it changed from bellow the national average in 2016 to above the average in 2018 (Coneval, 2018).

Beyond these limitations, future research may address what structural and social changes could have more influence in consolidating a SEE, and how this may vary among low and high vulnerability regions. Also, what are the strategies of the SEE’s main actors to reach peripherical areas where social entrepreneurship might be more needed? In this sense, future works could also study how local entrepreneurial ecosystems that are community-based may integrate into major entrepreneurial ecosystems. Another important research venue that complements the previous ideas is to explore how we measure social entrepreneurship. At least for this study the findings (Table 7 A & B) show that not all the questions in the GEM’s measure of social entrepreneurship are contributing equally to the purpose of the construct. Finally, we strongly encourage future research to focus on increasing the samples at a regional level to overcome the limitations that this study faced, and to test the study in different settings to help to validate the theoretical approach (Gulati, 2007) about social entrepreneurial ecosystems that remains underdeveloped.

Endnotes

1. B-Corps are certified businesses that meet the highest standards of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose (Visit https://bcorporation.net/about-b-corps for more information).

References

- Acs, Z.J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476-494.

- Alianza por la Inversión de Impacto en México (2018). Impact investment in Mexico: Agenda of a growing market. Alliance for Impact Investment in Mexico.

- Aljarwan, A.A., Yahya, B.A., Almarzooqi, B.M., & Mezher, T. (2019). Examining the framework of entrepreneurial ecosystems: A case study on the United Arab Emirates. International Journal of Entrepreneurship, 23(3).

- Amorós, J.E., Felzensztein, C., & Gimmon, E. (2013). Entrepreneurial opportunities in peripheral versus core regions in Chile. Small Business Economics, 40, 119-139.

- Ashoka, (2015). Social entrepreneurship in Mexico and Central America: Trends and Recommendations. Ashoka.

- Ashoka, (2019). Sobre Ashoka México, Centroamérica y el Caribe. https://www.ashoka.org/es-MX/country/mexico

- Audretsch, D.B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: Establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030-1051.

- Auerswald, P.E., & Dani, L. (2017). The adaptive life cycle of entrepreneurial ecosystems: the biotechnology cluster. Small Business Economics, 49, 97-117.

- Austin, J., Stevenson, H., & Wei-Skillern, J. (2006). Social and commercial entrepreneurship: Same, different, or both? Entrepreneurship Theory & Practice, 30(1), 1-22.

- Bloom, P.N., & Chatterji, A.K. (2009). Scaling social entrepreneurial impact. Scaling Social Entrepreneurial Impact, 51(3), 114-133.

- Bloom, P.N., & Dees, G. (2008). Cultivate your Ecosystem. Stanford Social Innovation Review, 47-53.

- Bloom, P., & Skloot, E. (2010). Scaling social impact: New thinking. Springer.

- Bosma, N., Schott, T., Terjesen, S., & Kew, P. (2016). Global entrepreneurship monitor 2015 to 2016: Special report on social entrepreneurship. Global Entrepreneurship Research Association.

- Bruns, K., Bosma, N., Sanders, M., & Schramm, M. (2017). Searching for the existence of entrepreneurial ecosystems: a regional cross-section growth regression approach. Small Business Economics, 49(1), 31-54.

- Cannarella, C., & Piccioni, V. (2006). Dysfunctions and suboptimal behaviors of rural development networks. International Journal of Rural Management, 2(1), 29-57.

- Cavallo, A., Ghezzi, A., Colombelli, A., & Casali, G. L. (2018). Agglomeration dynamics of innovative start -ups in Italy beyond the industrial district era. International Entrepreneurship and Management Journal, 1-24.

- Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1-14.

- Conover, W.J. (1998). Practical nonparametric statistics. New York: John Wiley & Sons, 16.

- Cornwall, J. (1998). The entrepreneur as building block for community. Journal of Developmental Entrepreneurship, 3(2), 141-148.

- Cronbach, L.J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297-334.

- Dahl, M.S., & Sorenson, O. (2012). Home sweet home: Entrepreneurs’ location choices and the performance of their ventures. Management Science, 58(6), 1059-1071.

- Davis, S.H. (1993). Indigenous views of land and the environment. Washington: World Bank.

- Dees, J.G. (2001). The meaning of social entrepreneurship. Retrieved from https://entrepreneurship.duke.edu/news-item/the-meaning-of-social-entrepreneurship/

- Duncan, E. (2009). A grounded theory study on social entrepreneurship: Comparison of traditional and social entrepreneurial nonprofit model. Koln: Lambert Academic.

- Dunteman, G.H. (1994). Principal component analysis. In M.S. Lewis-Beck (Ed.), Factor analysis and related techniques (157-245). London: Sage.

- Dziuban, C.D., & Shirkey, E.C. (1974). When a correlation matrix is appropriate for factor analysis? Some decision rules. Pychological bulletin, 81(6), 358-361.

- Edoho, F.M. (2016). Entrepreneurship paradigm in the new millennium: A critique of public policy on entrepreneurship. Journal of Entrepreneurship in Emerging Economies, 8(2), 279-294.

- Frenkel, A., Shefer, D., & Roper, S. (2003). Public policy, locational choice and the innovation capability of high-tech firms: A comparison between Israel and Ireland. Papers in Regional Science, 82, 203-221.

- Fritsch, M. (2013). New business formation and regional development: A survey and assessment of the evidence. Foundations and Trends® in Entrepreneurship, 9(3), 249-364.

- Germak, A.J., & Robinson, J.A. (2014). Exploring the motivation of nascent social entrepreneurs. Journal of Social Entrepreneurship, 5(1), 5-21.

- Grant, H.M., & Crutchfield, L.R. (2007). Creating high-impact nonprofits. Stanford Social Innovation Review, 5, 32-41.

- Gali. (2017). Acceleration in Mexico: Initial data of Mexican Startups. Global Accelerator Learning Initiative (GALI). Mexico City.

- Gulati, R. (2007). Tent poles, tribalism, and boundary spanning: The rigor-relevance debate in management research. Academy of Management Journal, 50(4), 775-782.

- Hoang Tien, N., Hung Anh, D.B., Minh Ngoc, N., & Y Nhi, D.T. (2019). Sustainable Social Entrepreneurship in Vietnam. International Journal of Entrepreneurship, 23(3).

- Hotelling, H. (1933). Analysis of a complex of statistical variables into principal components. Journal of Educational Psychology, 24(6), 417-441.

- INEGI (2018). Tercera encuesta nacional de inclusión financiera. INEGI. https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2018/OtrTemEcon/ENIF2018.pdf

- INEGI (2019a). Datos preliminares revelan que en 2018 se presentaron 35,964 homicidios. https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2019/EstSegPub/homicidios2018.pdf

- INEGI (2019b). Encuesta nacional de seguridad pública urbana ENSU tercer trimestre 2019. https://www.inegi.org.mx/contenidos/programas/ensu/doc/ensu2019_septiembre_presentacion_ejecutiva.pdf

- Jolliffe, I.T. (2002). Principal component analysis (2nd ed.). New York: Springer.

- Santos, F.M. (2012). A positive theory of social entrepreneurship. Journal of Business Ethics, 111(3), 335-351.

- Schau, J., Dominicé, R., Kowszyk, Y., & Parashkevova, M. (2013). La inversión de impacto en América Latina: Una mirada sobre el rol de las empresas. Santiago de Chile: InnovaciónAL.

- Isenberg, D. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. Presentation at the Institute of International and European Affairs.

- Johnson, S. (2000). Literature review on social entrepreneurship. Canadian Centre for Social Entrepreneurship, 16 (23).

- Korsgaard, S., Müller, S., & Tanvig, H. (2015). Rural entrepreneurship or entrepreneurship in the rural-between place and space. International Journal of Entrepreneurial Behavior & Research, 21(1), 5-26.

- Kuratko, D.F., Fisher, G., Bloodgood, J.M., & Hornsby, J.S. (2017). The paradox of new venture legitimation within an entrepreneurial ecosystem. Small Business Economics, 49(1), 1-22.

- Lagona, F., & Padovano, F. (2007). A nonlinear principal component analysis of the relationship between budget rules and fiscal performance in the European Union. Public Choice, 130, 401-436.

- Leme, A., Martins, F., & Hornberger, K. (2014). The state of impact investing in Latin America: Regional trends and challenges facing a fast-growing investment strategy. Bain & Company.

- Lerner, J. (2009). Boulevard of broken dreams: Why public efforts to boost entrepreneurship and venture capital have failed-and what to do about it. Princeton: Princeton University Press.

- Levander, U. (2010). Social enterprise: Implications of emerging institutionalized constructions. Journal of Social Entrepreneurship, 1(2), 213-230.

- Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31(3), 305–322.

- Lumpkin, G.T., Moss, T.W., Gras, D.M., Kato, S., & Amezcua, A.S. (2013). Entrepreneurial processes in social contexts: how are they different, if at all? Small Business Economics, 40(3), 761-783.

- Mack, E.A., & Mayer, H. (2015). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118-2133.

- Martin, R.L., & Osberg, S. (2007). Social entrepreneurship: The case for definition. Stanford Social Innovation Review, (Spring).

- Martínez Velázquez, N., & Dutrénit Bielous, G. (2019). Determinants of innovative social entrepreneurship: A case study of a Mexican social organization. Revista Brasileira De Inovação, 18(2), 223-248.

- Mason, C., & Brown, R. (2014). Entrepreneurial ecosystems and growth oriented entrepreneurship. Final Report to OECD, Paris, 30(1), 77-102.

- McMullen, J.S. (2018). Organizational hybrids as biological hybrids: Insights for research on the relationship between social enterprise and the entrepreneurial ecosystem. Journal of Business Venturing, 33(5), 575-590.

- Neck, H.M., Meyer, G.D., Cohen, B., & Corbett, A.C. (2004). An entrepreneurial system view of new venture creation. Journal of Small Business Management, 42(2), 190-208.

- Nunnally, J. (1978). Psychometric theory (2nd ed.). New York: McGraw–Hill.

- Ormiston, J., & Seymour, R. (2011). Understanding value creation in social entrepreneurship: The importance of aligning mission, strategy and impact measurement. Journal of Social Entrepreneurship, 2(2), 125-150.

- Patrono, A.H., & Sutanti, A. (2016). The ecosystem of social enterprise: Social culture, legal framework, and policy review in Indonesia. Pacific Science Review B: Humanities and Social Sciences, 106-112.

- Peredo, A.M., & Chrisman, J.J. (2006). Toward a theory of community-based enterprise. Academy of Management Review, 31(2), 309-328.

- Peredo, A.M., & McLean, M. (2006). Social entrepreneurship: A critical review of the concept. Journal of World Business, 41(1), 56-65.

- Pirson, M., Vázquez-Maguirre, M., Corus, C., Steckler, E., & Wicks, A. (2019). Dignity and the Process of Social Innovation: Lessons from Social Entrepreneurship and Transformative Services for Humanistic Management. Humanist Management Journal, 4(2), 125-153.

- Purbasari, R., Wijaya, C., & Rahayu, N. (2019). Interaction of Actors and Factors in Entrepreneurial Ecosystem: Indonesian Creatives Industries. International Journal of Entrepreneurship, 3(1S).

- Qian, H., Acs, Z.J., & Stough, R.R. (2012). Regional systems of entrepreneurship: The nexus of human capital, knowledge and new firm formation. Journal of Economic Geography, 13(4), 559-587.

- Reynolds, P.D., Bosma, N., Autio, E., Hunt, S., Bono, N.D., & Servais, I. (2005). Global entrepreneurship monitor: Data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205-231.

- Roberts, E.B., & Eesley, C.E. (2011). Entrepreneurial impact: The role of MIT. Foundations and Trends® in Entrepreneurship, 7(2), 1-149.

- Roberts, M.J., & Barley, L. (2004). How venture capitalists evaluate potential venture opportunities. Harvard Business School Case no. 9-805-019.

- Roundy, P.T. (2017). Social entrepreneurship and entrepreneurial ecosystems: complementary or disjointed phenomena? International Journal of Social Economics, 44(9), 1-18.

- Saxenian, A. (2006). The new argonauts: Regional advantage in a global economy. Cambridge, MA: Harvard University Press.

- Shlens, J. (2009). A tutorial on principal component analysis. Version 3.01 Systems Neurobiology Laboratory, Salk Institute for Biological Studies online: http://www.snl.salk.edu/*shlens/

- Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49-72.

- Spilling, O.R. (1996). The entrepreneurial system: On entrepreneurship in the context of a mega-event. Journal of Business Research, 36(1), 91-103.

- Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759-1769.

- Stevens, J. (1992). Applied multivariate statistics for the social sciences. Hillsdale, NJ: Lawrence Erlbaum Associates.

- Sullivan, D.M. (2007). Stimulating Social Entrepreneurship: Can Support from Cities Make a Difference? Academy of Management Perspectives, 21(1), 77-78.

- The Failure Institute. (2017). Causas de fracaso en empresas sociales mexicanas. Ciudad de México.

- The World Bank. (2011). Empowerment. Available at: http://www.worldbank.org/empowerment

- Thompson, J., Geoff, A., & Lees, A. (2000). Social entrepreneurship: A new look at the people and the potential. Management Decision, 38(5), 328-338.

- Tobias, S., & Carlson, J.E. (1969). Brief report: Barlett’s test of sphericity and chance findings in factor analysis. Multivariate Behavioral Research, 4(3), 375-377.

- Todling, F., & Wanzenbock, H. (2003). Regional differences in structural characteristics of start-ups. Entrepreneurship and Regional Development, 15(4), 351-370.

- Tsvetkova, A. (2015). Innovation, entrepreneurship, and metropolitan economic performance: empirical test of recent theoretical propositions. Economic Development Quarterly, 29(4), 299-316.

- UN-Habitat. (2019). Generation of evidence based on the City Prosperity Index (CPI) in the framework of the project “Infonavit leading the implementation of the 2030 Agenda: housing at the center of SDGs”,

- Van de Ven, H. (1993). The development of an infrastructure for entrepreneurship. Journal of Business Venturing, 8(3), 211-230.

- Van Son, H., & Van Trai, N. (2020). Social responsibility affecting operational efficiency: a case of enterprises in Ho Chi Minh city. International Journal of Entrepreneurship, 24(1).

- Van Stel, A., & Suddle, K. (2008). The impact of new firm formation on regional development in the Netherlands. Small Business Economics, 30(1), 31-47.

- Vázquez-Maguirre., M. (2018). Sustainable ecosystems through indigenous social enterprises. In: Leitão J., Alves H., Krueger N., Park J. (eds) Entrepreneurial, Innovative and Sustainable Ecosystems. Applying Quality of Life Research (Best Practices) (173-189). Springer.

- Vazquez-Maguirre, M., Portales, L., & Velásquez, I. (2018). Indigenous social enterprises as drivers of sustainable development: Insights from Mexico and Peru. Critical Sociology, 44(2), 323 - 340.

- Vázquez-Maguirre, M. (2019). El desarrollo sostenible a través de empresas sociales en comunidades indígenas de América Latina. Estudios Sociales, 29(53), 2-22.

- Vedula, S., & Kim, P.H. (2019). Gimme shelter or fade away: the impact of regional entrepreneurial ecosystem quality on venture survival. Industrial and Corporate Change, 28(4), 827-854.

- Villegas Mateos, A.O., & Amorós, J.E. (2019). Regional entrepreneurial ecosystems in Mexico: A comparative analysis. Journal of Entrepreneurship in Emerging Economies, 11(4), 576-597.