Research Article: 2025 Vol: 29 Issue: 1

Service Delivery in Select Public Sector Banks using Queuing Model - A Comparative Study

Suresh Chandra Ch, Vignan's Foundation for Science, Technology & Research

Ajith Kumar P, ICFAI Business School, Department of Finance and Accounting

Sarika Samisetty, Kakatiya Institute of Technology & Science (KITS)

Prem Kumar, Vaagdevi Degree & PG College, Telangana State

Citation Information: Chandra Ch, S., Kumar, A.P., Samisetty, S., & Kumar, P. (2025). Service delivery in select public sector banks using queuing model - a comparative study. Academy of Marketing Studies Journal, 29(1), 1-17.

Abstract

Purpose: The purpose of the study is to examine the service delivery procedures followed in the three select public sector banks and evaluation of the service delivery using Queuing Model. The study further examines the key factors determining the Service delivery. Design/methodology/approach: Using purposive sampling, three banks were selected, and data were gathered through a multi-stage purposive sampling technique. A Queuing model assessed service delivery over 30 days, while Factor Analysis identified key determinants of service quality. Secondary data from academic and industry sources supplemented the analysis. Findings: The study found that United Bank of India (UBI) excels in service delivery, with shorter wait times and efficient customer flow, enhancing customer satisfaction. Conversely, State Bank of India (SBI) and Canara Bank showed inefficiencies, such as longer wait times, indicating a need for improved service management to boost customer satisfaction.

Keywords

Queuing Model, Service Quality, Service Rate, Waiting Time.

Introduction

The Indian banking sector, along with other regional markets, benefits significantly from increased GDP and population growth. Furthermore, the sector is bolstered by innovative disruptions and the implementation of efficient service delivery models. These factors collectively enhance the sector's ability to adapt and thrive in a rapidly evolving economic landscape. The service delivery is one of the most important determinants in the overall services offered to the customers. Among the extended services marketing mix is the Service Delivery process. A service delivery is a process of enabling the delivery of a service. The service delivery requires an inter link between service provider and the customer who requires the service. The service link keeps existing as long as the stakeholder completely feels the service is delivered. During the process of service delivery, the customer needs to have clear assumption on requirement of service. In order to ensure that the services are delivered with an intention to make the customer loyal to the services of banks; the banks have been following unique sets of service delivery models (Alhijawi & Kilani, 2020).

According to Gronroos (1984), the service delivery is conserved as “collection of perceived discernments which results into a prediction process where the customers put together service anticipated with service they actually receive”. In the words of Gamliel (2006), the service delivery refers to the extent to which the service level delivered to customers will become equal to what the customers have actually anticipated. The concept of Service Delivery is more concerned with answering the questions such as where, when and how the service products are reached to the customers. The service delivery includes involvement of critical operating system which include physical infrastructure and personnel and involvement of customers in the service delivery process. Most of the times, the service delivery approaches “Theatre Analogy” to differentiate both low contact services and high contact services. Deviation in services delivery will lead to unsuccessful delivery and it will have significant impact which leader to misperception to the banking services. Further, lack of accuracy in the services delivery in banking will also leader to customer dissatisfaction.

The service delivery system focuses on the following 4 key dimensions Brown, (2019).

a. Service Culture

b. Service Quality

c. Bank’s Staff engagement

d. Customer Loyalty and Customer Experience

The Service culture is a framework that focuses on the principles of banks to provide the assured services, the bank’s norms, mission and visions and the set of value propositions prescribed by the banks (Smith 2021). The service culture also prescribes on the controlling mechanism of the services delivered to the bank’s customers. The service quality includes the set of procedures and the strategies practiced by the banks with a vision to provide prompt bank’s services to its customers. In order to ensure that the services are delivered as expected by the customers, the banks must frequently monitor the service quality efficiency and identify the gaps in customer expectations and bank’s performance in delivering of service quality Choudhury, (2007).

Bank’s Staff engagement would focus on the implementation of procedures and principles set by the banks. The bank staff efficiency in the delivery of services in terms of service time, service delivery, customer waiting time for the services is the key determinants in the evaluation of staff engagement to the service delivery. The customer loyalty and experience include the satisfaction, intelligence and perceptions on the services delivery which create them a sense of satisfaction and build loyalty to the bank’s services. The service delivery process of banks focuses on both physical and virtual channels. The physical channel provides the services through Employees, ATMs, Branch operations, whereas the virtual channel provide the online services including self-service and employee service channels. Most of the virtual channels focus on providing the customer queries and extended add-on services.

Significance of Service Delivery

The competition in banking industry in India and favourable reforms has strengthened the accessibility of banking services to the people. Growing competition among the banks and rising availability of bank branches have facilities the customers to prefer the banking services which have significant quality in effective service delivery Gupta, & Sharma (2022).

In the banking industry, service delivery models are tailored to the nature of customer interaction, distinguishing between high contact and low contact services. For high contact services, which emphasize direct interaction with customers, the system encompasses three main components: the Service Operating System, Service Delivery System, and Other Contact Points. The Service Operating System involves visible service facilities, including branch interiors, exterior design, and customer-facing equipment, along with staff who interact directly with customers to meet their needs. Conversely, for low contact services, where customer interaction is minimal, the focus shifts to components such as Other Contact Points, Service Delivery System, and Service Operations System. In this model, customers often engage with banking services remotely, relying on digital platforms and remote communication without frequent physical visits, emphasizing the need for effective online interfaces and trust in the service provided (Davis, 2018).

Review of Literature

The studies on Service Delivery with special reference to banking services are segregated and key observations from the literature is presented here.

Studies on Rural and Technological Innovations in Service Delivery

The RBI introduced the service area approach in April 1989, aiming to bring all rural branches under NABARD's ownership. This initiative sought to enhance financial inclusion through innovations like improved credit delivery systems and non-banking working days. Despite its potential to transform rural banking, these innovations did not gain widespread acceptance from banks, hindering the potential positive impact on service delivery in rural areas (Patel, 1993). Mishra (2009) examined customer satisfaction in the Indian retail banking sector amidst technological advancements, economic uncertainty, and rising competition. The study identified seven key factors influencing satisfaction, including service quality, bank personality, customer convenience, and pricing policies. Addressing these factors is crucial for banks to enhance their service delivery and meet customer expectations effectively.

Rao & Singh (2021) explored the relationship between digital service delivery and customer preferences in Indian banks. Their research indicated that customers prefer banks that offer robust online and mobile banking options. The convenience of managing finances digitally without needing to visit a physical branch has become a major driver of customer loyalty and preference. The study emphasized the need for continuous innovation in digital services to stay competitive.

Lolemo and Pandya (2024) investigated the impact of digital banking services on customer satisfaction in India. The study highlighted that the adoption of digital platforms has significantly enhanced customer convenience, leading to higher satisfaction levels. Key factors included the ease of use, accessibility of services, and the speed of transactions. The study recommended that banks continue investing in digital infrastructure and user-friendly interfaces to maintain and improve customer satisfaction.

Efficiency and Cost in Service Delivery

Hunter's (1995) study focused on 118 US banks, analyzing the relationship between service delivery systems and costs. The research found that while improved bank office operations significantly reduced costs, overall service delivery systems tended to increase costs. An empirical model developed during the study highlighted the existence of scale economies in bank office operations, suggesting that improved operations can lead to more efficient service delivery. Similarly, Zomerdijk and Vries (2007) emphasized the need for distinct designs for contact and non-contact activities in banking operations. They highlighted the critical roles of both front and back offices in service delivery, arguing that effective service delivery design is essential for producing and delivering quality services. This approach can help banks optimize their service delivery systems, balancing cost and efficiency.

Studies on Customer Experience and Perception on Service Delivery

Studies on customer experience and perception in banking highlight key factors influencing service delivery. Ruoh (2005); Yan (2005) examined how consumer waiting experiences are affected by wait disconfirmation, finding that customers tolerate longer waits when they perceive bank services as valuable and scarce, emphasizing the need for effective expectation management. Choudhary (2008) identified four critical dimensions of service quality in Indian retail banking—bank officials' attitudes, service convenience, competence, and tangibility—concluding that enhancing employee skills and attitudes is vital for improving customer satisfaction. Shayestehfar and Yazdani (2018) compared service quality perceptions between banks in Isfahan and Dubai, noting that higher service quality was perceived in Dubai and recommending that banks focus on professional training and efficient problem-solving. Sharma and Verma (2022) highlighted the role of personalized banking services in boosting customer satisfaction, suggesting that tailored advice and support significantly enhance loyalty. Patel and Desai (2023) found that personalized communication, facilitated by CRM systems, positively impacts customer preferences and trust, recommending regular, personalized interactions to improve satisfaction. Together, these studies underscore the importance of personalized service, effective communication, and staff competence in enhancing customer experience and service delivery Sharma and Verma (2022); Patel and Desai (2023).

Studies on Adoption and Utilization of Online Banking

Szopinski (2016) studied the adoption of online banking in Poland, comparing usage across different age groups, job designations, and educational qualifications. The study found that younger, educated customers were more adept at using online services. To enhance service delivery, the author recommended that banks educate customers about online banking procedures, highlighting the need for customer education in the digital age.

Studies on Enhancing Service Quality through Training and Knowledge

Anthonia and Olalekan (2018) emphasized the critical role of frontline personnel's knowledge in achieving high service quality in Nigerian commercial banks, advocating for regular training and improved customer relationship management to enhance service excellence. Kumar and Agarwal (2016) further investigated the relevance of SERVQUAL models in modern banking, focusing on performance, synthesis, GAP analysis, and quality attributes essential for improving customer satisfaction and service delivery. Kumar et al. (2018) extended this by examining SERVQUAL’s impact on brand loyalty and customer satisfaction within Indian banks, noting that public sector banks performed relatively well in meeting customer expectations. Kumar et al. (2021) expanded on this by comparing service quality dimensions—reliability, responsiveness, assurance, empathy, and tangibles—between public and private sector banks, revealing that private banks generally performed better, leading to higher customer satisfaction. Nair and Bhat (2022) complemented these findings by linking high service quality with increased customer loyalty in the Indian banking sector, emphasizing the need for prompt service, courteous staff, and efficient problem resolution, and advocating for ongoing employee training to maintain high service standards.

Studies on Modern Business Architecture and Technological Advancements

The Deloitte report 2019 underscored the critical role of adopting new business architectures and advanced technologies to optimize service delivery in banking, emphasizing that technological advancements are key to enhancing overall service quality. In line with this, Srivastava and Jain (2023) explored how emerging technologies like AI and blockchain are transforming service delivery and customer engagement in Indian banks, noting that AI-driven chatbots, personalized financial planning tools, and blockchain security measures have significantly improved customer satisfaction through enhanced security, faster transactions, and personalized experiences. Additionally, Mehta and Kapoor (2023) investigated the influence of mobile banking apps on customer engagement, revealing that feature-rich, user-friendly apps with functionalities such as instant fund transfers, bill payments, and mobile check deposits greatly boost customer satisfaction. They advised banks to continuously update their mobile apps to incorporate new features and refine user experience.

To examine the service delivery of banks to the customers, an attempt is made to evaluate the service delivery in terms of waiting in queue, average waiting time, number of customers on an average waiting for the bank’s services, probability that the bank’s service facility is busy are calculated using Poisson Exponential Multiple Server Infinite Population Model. Here, the customer arrival rate to the banks is computed on the basis of visits to the bank branches.

Objectives

The study aimed to present the detailed analysis on the following objectives.

1. To examine the service delivery implemented in select banks.

2. To compare the service delivery in select banks using Queuing model.

3. To analyze the key determinants of Service Delivery using Factor Analysis.

Methodology

The study is primarily based on observational study and also relies on primary sources of data collected from the customers of select bank branches operating in select districts of Telangana state situated in India. The banks are selected on the basis of its presence in the Warangal district. Based on the highest frequency of branches, State Bank of India(SBI), Union Bank of India(UBI) and Canara Bank are selected. The sample respondents are the bank customers and the responses are collected using multi-stage purposive sampling method. Further, to extract the data for Queuing model, Observation method is applied and the data is collected for 30 working days’ period averages. Journals, articles, annual reports of select banks and internet sources are utilized for the compiling of this research paper.

Analysis and Discussion

State Bank of India's Digital Transformation and Enhanced Service Delivery: A Comprehensive Overview

State Bank of India (2024) continues to lead in digital transformation, as highlighted in its 2023-24 annual report. Through continuous technological innovation, SBI remains relevant in the digital era, particularly appealing to millennial preferences. The bank’s multichannel delivery model, encompassing digital, mobile, ATM, internet, social media, and branch services, ensures customers have diverse transaction options available anytime, anywhere. The flagship mobile banking and lifestyle app, YONO, extends beyond traditional financial services, offering investment, insurance, and shopping solutions to enhance the customer experience. Customer centricity is the cornerstone of SBI’s service delivery, with every branch dedicated to providing exceptional customer satisfaction. The bank's commitment to evolving customer preferences, especially those of the younger generation, drives its focus on digital initiatives, transforming the retail banking landscape. The 2023-24 annual report underscores how SBI is leveraging technology across its business operations, from designing innovative products and streamlining processes to improving service delivery and monitoring. These efforts ensure that SBI remains at the forefront of digital banking, providing a comprehensive and enhanced customer experience. Through continuous digital innovation and a customer-centric approach, SBI sets the benchmark for service delivery in the banking industry Tables 1-4.

| Table 1 Service Delivery in State Bank of India | ||

| Sl.No. | Service | Description |

| 1. | Customer-Centric Service Excellence | Prioritizes exceptional customer satisfaction through digital initiatives. |

| 2. | Doorstep Banking Services | Offers cash withdrawal, cheque collection, and other services at customer's doorstep (for specific age groups and situations). |

| 3. | Innovative Loan Processing Solutions | Uses RLMS and VVM for uniform underwriting, seamless delivery, and product digitization in loan processing. |

| 4. | Streamlined Credit Delivery | Improves credit delivery with auto-renewal for leads and revamped Agri Tech Stack for agriculture loans. |

| 5. | E-Pharmacy Scheme for Retirees | Provides doorstep medicine delivery at attractive prices for eligible retirees. |

| 6. | Empowering SMEs with Enhanced Services | Strengthens SME centers with dedicated teams for personalized service based on loan amount. |

| 7. | Driving Digital Business Solutions | Leverages technology for product design, process streamlining, service delivery, and monitoring. |

| Table 2 Service Delivery in Union Bank of India | ||

| Sl.No. | Service | Description |

| 1. | Digital Banking Services | Provides internet banking, mobile banking, and other digital services for convenient access. |

| 2. | Advanced Digital Contact Center | Ensures seamless service delivery across multiple channels with advanced capabilities. |

| 3. | AI and Machine Learning Integration | Employed for fraud detection, customer analytics, and personalized services for improved efficiency and satisfaction. |

| 4. | Vyom App | Offers over 400 features to enhance customer engagement and service delivery. |

| 5. | AI-based Conversational Banking | Provides AI-powered voice bots for interaction and service delivery on platforms like Alexa and Google Assistant. |

| 6. | Generative AI and Robotic Process Automation | Utilizes Generative AI for automation and RPA CoE for monitoring and optimization of automated processes. |

| 7. | Enhanced Access and Service Excellence (EASE) Framework | Contributes to improved operational efficiencies, customer offerings, and faster service delivery through best practices. |

| Table 3 Service Delivery in Canara Bank | ||

| Sl.No. | Service | Description |

| 1. | Digital Banking Services | Offering mobile & internet banking services for fund transfers, bill payments, etc. |

| 2. | Branch Banking | Extensive network with upgraded infrastructure, trained staff, for face-to-face interactions. |

| 3. | Customer Service | Providing superior service through call centers, email, social media, and CRM systems. |

| 4. | Financial Inclusion | Promoting financial inclusion through basic banking, microfinance, and digital literacy programs. |

| 5. | Doorstep Banking Services | Offering cash & cheque services, no-frill accounts, at select centers. |

| Table 4 Service Delivery Evaluation Using Queuing Model | ||||

| Sl.No. | Measurement Unit | UBI | SBI | Canara Bank |

| 1 | Average customer arrival to Union Bank of India branches | 30 | 32 | 24 |

| 2 | Service rate of Branch Employee of Union Bank of India | 25 | 24 | 17 |

| 3 | Average number of branch employees providing the services to the customers came for services | 3 | 3 | 3 |

| 3 | Model applied for analysis | M/M/s | M/M/s | M/M/s |

| 4 | Average number of customers in the Queuing System (Ls) | 1.29≡ 1 | 1.478≡ 1 customer | 1.5941 customers |

| 5 | Average number of customers in the branch waiting in the Queue (Lq | 0.0941 | 0.1446 | 0.1834 |

| 6 | Average waiting time spent for service delivery (Ws) by the customers | 0.0431≡ 3 | 0.0462 ≡ 3 | 0.0665 ≡ 3 |

| minutes and 47 seconds | minutes | minutes and 10 seconds | ||

| 7 | Average waiting time of customers in the queue waiting in bank branch (Wq) | 0.0031 Hours ≡ 11 seconds | 0.0045 Hours = 16 seconds | 0.0076 Hours ≡ 27 seconds |

| 8 | Traffic Intensity(probability that customer need to wait | 40.00% | 44.44% | 47.06% |

| 9 | Probability that the bank employee is idle | 29.41% | 25.42% | 23.29% |

| 10 | Probability that the service provider is busy | 0.31% | 0.45% | 0.76% |

The 2023-24 annual report details significant enhancements in customer convenience through SBI’s Doorstep Banking Services, now available across 1,080 Banking Centres. These services include:

1. Cash Withdrawal

2. Delivery of Prepaid Instruments/Gift Cards

3. Pickup of Cheque Book Requisition Slips

4. Life Certificate through Jeevan Pramaan

5. Pickup of Nomination Forms, Standing Instructions, and Fund Transfer Requests

6. Pickup of Cheques for Collection/Clearing, IT/Govt/GST Challan with Cheque

7. Delivery of Statements of Account, Term Deposit Advice, and TDS and Form 16 Certificates.

8. Delivery of Demand Drafts and Pay Orders

Union Bank of India's Digital Transformation and Enhanced Service Delivery

The Union Bank of India (2024) has embraced digital transformation to enhance its service delivery and operational efficiency. By investing in technology, UBI provides internet banking, mobile banking, and other digital services, making banking more accessible to its customers. The integration of advanced technologies is expected to drive significant cost savings and foster innovation in service delivery. In an era marked by rapid technological advancements and shifting market dynamics, UBI has continually adapted its strategies to maintain competitiveness and enhance service delivery. The bank operates seven Digital Banking Units (DBUs) and has implemented advanced digital contact center capabilities to ensure seamless service delivery across multiple channels. UBI’s digital initiatives include online account management, mobile banking, and internet banking, significantly improving service delivery and customer satisfaction Szopinski, (2016).

UBI leverages artificial intelligence (AI) and machine learning (ML) to drive innovation and improve service delivery. These technologies are employed for fraud detection, customer analytics, and personalized banking services, enhancing operational efficiency and customer satisfaction. Digital transformation has been a pivotal component of UBI’s strategy. The launch of the Vyom app, offering over 400 features, has significantly enhanced customer engagement and service delivery. The bank has implemented AI-based conversational banking through voice bots on platforms like Amazon Alexa and Google Assistant, further enhancing customer interaction and service delivery. In FY2024, UBI is advancing with the implementation of Generative AI to automate routine tasks and improve service delivery. Additionally, the establishment of the Robotic Process Automation Center of Excellence (RPA CoE) ensures continuous monitoring and optimization of automated processes.

UBI has progressively adopted reform measures built into the Enhanced Access and Service Excellence (EASE) framework, contributing immensely towards achieving enhanced operational efficiencies, improved customer offerings, and faster service delivery. This framework includes best practices and models for enhancing product development, service delivery, and overall organizational performance. Through these strategic digital initiatives and technological advancements, UBI continues to set a benchmark in the banking industry, ensuring high levels of customer satisfaction and operational excellence.

Service Delivery at Canara Bank: Key Insights from the 2023-24 Annual Report

Canara Bank (2024) has made significant strides in enhancing its digital banking capabilities, introducing a diverse array of mobile and internet banking services. These platforms offer essential functions such as fund transfers, bill payments, balance inquiries, and comprehensive account management, reflecting the bank’s commitment to modernizing and expanding its service delivery through digital channels. The bank continues to prioritize its extensive network of branches, catering to customers who prefer face-to-face interactions. Canara Bank has focused on upgrading branch infrastructure, investing in staff training, and enhancing overall service quality. These efforts aim to improve customer satisfaction and ensure a seamless banking experience at physical locations.

Canara Bank places a strong emphasis on delivering superior customer service through multiple channels, including call centers, email, and social media. The implementation of advanced Customer Relationship Management (CRM) systems enables the bank to effectively track and manage customer interactions and preferences, thereby enhancing service quality and responsiveness. A core initiative for Canara Bank is promoting financial inclusion, particularly in rural and underserved areas. The bank’s efforts include providing basic banking services, microfinance solutions, and digital literacy programs, all aimed at expanding financial access and supporting community development. In addition to digital and branch banking advancements, Canara Bank has introduced Doorstep Banking Services at 100 selected centers. These services include:

1. Basic Banking Facilities: Receipt and payment of cash and cheques at designated counters.

2. No-Frill Accounts: Basic banking services tailored to low-cost accounts.

3. Commitments and Standards: Adhering to the Charter for products and services, ensuring compliance with relevant laws and regulations.

4. Ethical Dealings: Upholding principles of integrity and transparency in customer interactions.

5. Secure Banking Systems: Operating a reliable and secure banking and payment system.

6. Customer Grievances: Addressing and resolving customer complaints swiftly and sympathetically, especially those arising from errors, delays, or technological issues.

Canara Bank’s main focus on service delivery emphasized on the following strategies:

1. Personalized Banking: Leveraging data analytics to offer customized products and services tailored to individual customer needs.

2. Digital Innovation: Exploring emerging technologies like artificial intelligence and blockchain to boost operational efficiency and improve customer experiences.

3. Strengthening Cybersecurity: Implementing robust security measures to protect customer data and prevent fraud.

4. Employee Training: Investing in ongoing employee development to enhance skills and ensure high-quality customer service.

Analysis on Service Delivery in Select Banks

Among the five select branches from urban areas and five select branches from rural areas, bank wise average customer arrival rate is determined and Service rate of branch is also computed. Based on the results obtained using the Queuing model, the results are computed and bank wise results are presented in Table 4.

The service delivery performance across Union Bank of India (UBI), State Bank of India (SBI), and Canara Bank has been evaluated through a queuing model, specifically the Poisson Exponential Single Server Infinite Population (M/M/S) model. This model is instrumental in analysing and understanding the service dynamics at bank branches, particularly concerning customer arrival rates, service rates, and system efficiency.

The queuing model analysis of Union Bank of India (UBI), State Bank of India (SBI), and Canara Bank, as presented, offers a technical assessment of each bank's service delivery efficiency. The M/M/s model in queuing theory describes a system with multiple servers (s) where arrivals follow a Poisson process, and service times are exponentially distributed. The M/M/s queueing model was employed to derive various performance metrics, including the average number of customers in the system, waiting times, and service provider utilization (Johnson & Lee, 2020).

Average Number of Customers in the Queuing System (Ls)

UBI demonstrates superior service efficiency with an average of 1.29 customers in the queuing system, equivalent to roughly one customer at any time. This indicates a relatively lower level of congestion compared to SBI and Canara Bank, which have averages of 1.478 and 1.5941 customers, respectively. The higher values for SBI and Canara Bank suggest a more crowded service environment, which could impact the overall service experience due to increased wait times and potential delays.

Average Number of Customers Waiting in the Queue (Lq)

The analysis reveals that UBI also excels in managing queue length, with an average of 0.0941 customers waiting in line. This is significantly lower than SBI and Canara Bank, which have averages of 0.1446 and 0.1834 customers waiting, respectively. This discrepancy underscores UBI’s more effective queue management, leading to a more streamlined and less burdensome experience for customers.

Average Waiting Time for Service Delivery (Ws)

UBI achieves the shortest average waiting time for service delivery, recorded at 0.0431 hours, or approximately 3 minutes and 47 seconds. In contrast, SBI and Canara Bank exhibit longer waiting times, with averages of 0.0462 hours (2 minutes and 46 seconds) and 0.0665 hours (3 minutes and 59 seconds), respectively. The extended waiting times at SBI and Canara Bank suggest a potential need for operational improvements to reduce delays and enhance customer satisfaction.

Average Waiting Time in the Queue (Wq)

The average waiting time in the queue is minimal for UBI at 0.0031 hours (approximately 11.16 seconds), indicating efficient queue processing and minimal customer delay before service initiation. Conversely, SBI and Canara Bank show longer average waiting times in the queue, with 0.0045 hours (16.20 seconds) and 0.0076 hours (27.36 seconds), respectively. These longer wait times reflect increased customer delay and suggest a need for optimizing queue management processes.

Traffic Intensity (Probability that a Customer Needs to Wait)(P)

UBI’s traffic intensity stands at 40%, which is the lowest among the banks analyzed, indicating a lower likelihood of customers needing to wait for service. In comparison, SBI and Canara Bank have higher traffic intensities at 44.44% and 47.06%, respectively. The increased traffic intensity at SBI and Canara Bank suggests higher customer demand relative to service capacity, potentially leading to longer wait times and a greater strain on service resources.

Probability that the Bank Employee is Idle(P0)

UBI has the highest probability of employee idleness at 29.41%, which could indicate underutilization of staff or inefficient resource allocation. In contrast, SBI and Canara Bank exhibit lower probabilities of idleness, at 25.42% and 23.29%, respectively, suggesting a more consistent engagement of staff during service hours. The lower idle rates at SBI and Canara Bank imply more efficient staff utilization and potentially better alignment with customer demand.

Probability that the Service Provider is Busy (Pq)

UBI’s service providers are least likely to be busy, with a probability of 0.31%, suggesting that they are less frequently engaged with customers compared to SBI and Canara Bank, which have probabilities of 0.45% and 0.76%, respectively. The higher probabilities for SBI and Canara Bank indicate greater staff engagement during peak periods, which could contribute to longer wait times and increased service pressure.

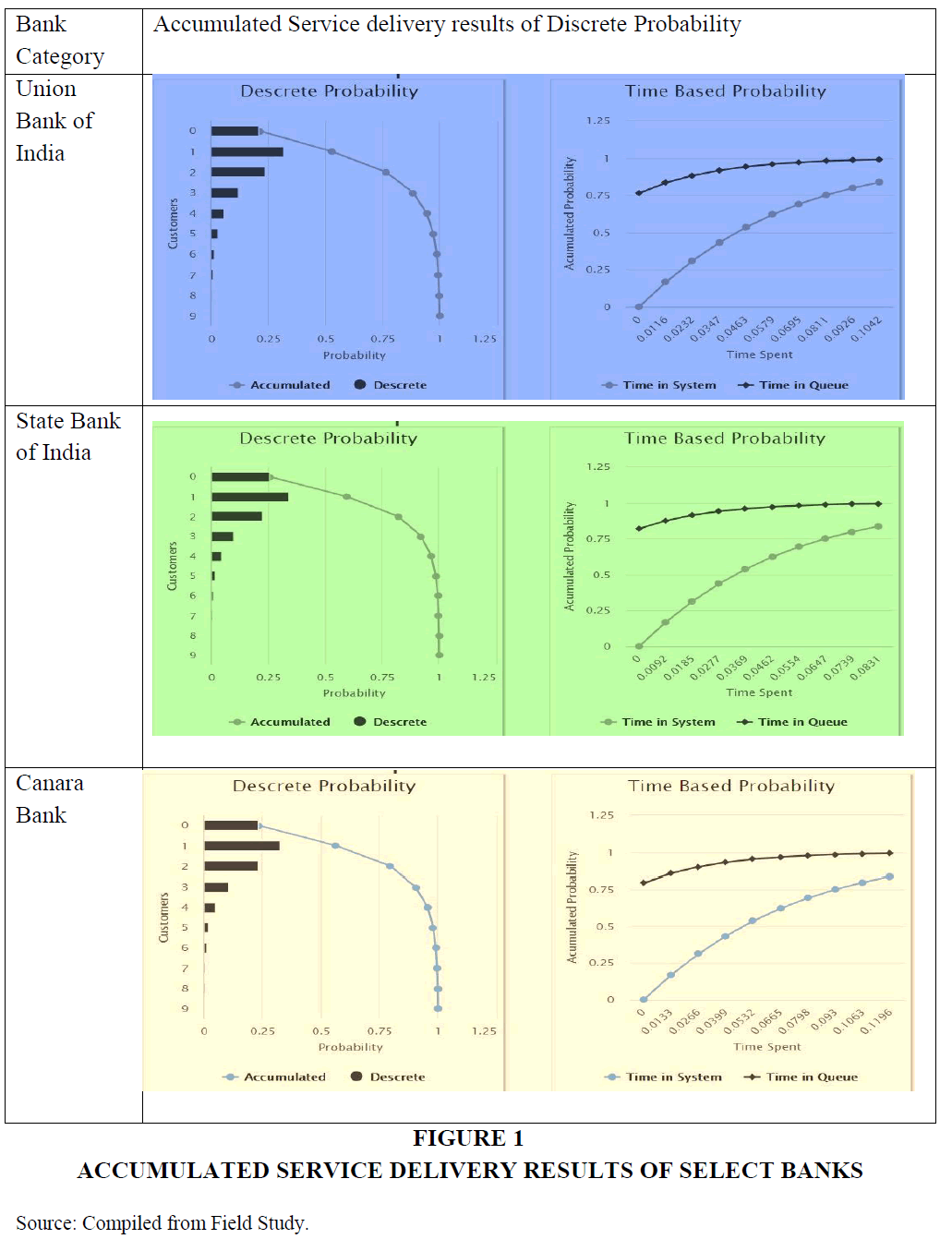

The tendency of discrete probability of the accumulated and discrete results are shown in Figure 1.

Results of Factor Analysis

Factor analysis is utilized as a dimension reduction technique to condense the number of dimensions affecting customer perception of service delivery into distinct factors. This analysis is conducted in phases to determine sampling adequacy and to further examine the identified components or factors. Phase I details the outcomes of the sampling adequacy assessment. To evaluate sampling adequacy, the "Kaiser-Meyer-Olkin (KMO) Measure of Sampling Adequacy" and Bartlett’s Test of Sphericity are employed. As shown in annexure-1, the KMO test results indicate a value of 0.916, suggesting that the sample data is 91.6 percent adequate. Additionally, the p-value for Bartlett’s Test is 0.000, which is below the α = 0.01 threshold at a 1 percent significance level. These findings confirm the appropriateness of performing factor analysis, demonstrating that the sample data is statistically adequate and suitable for this technique.

Phase-II explains the Communalties extracted using Factor Analysis. For each of the nineteen variables, the initial Eigen value is placed as 1 and amount of extraction made for each variable is presented in the annexure-1. Results reveal that the variables are able to extract the variance up to 88 percent. The extraction of variance is in the range of 0.773 to 0.881. Highest extraction is made for the variable „provide quality of currency notes to customers" and least variance is extracted for the variable „Online bank account helps in knowing reward point statuses. Overall the extraction of variance exceeds 0.500 which prove that all variables are getting influenced, hence no variable requires elimination for the further process of factors extraction Annexure Tables 1-3.

| Annexure Table 1 Results of Sample Adequacy | |||

| KMO measure of Sampling Adequacy. | .916 | ||

| Bartlett's Test results | χ2 | 25905.543 | |

| υ | 190 | ||

| p-val | .000 | ||

| Variable/Statement | Basic weight | Extracted variance | |

| Branch allows no limit of withdrawal transactions per day | 1.000 | .827 | |

| Customers can avail Quality notes from Bank Teller | 1.000 | .808 | |

| Branches are located at convenient locations | 1.000 | .800 | |

| ATM machines show the identify name of the customers on screen. | 1.000 | .826 | |

| Customers can easily know account and balance information from branch | 1.000 | .808 | |

| Bank enables E- payments easily | 1.000 | .858 | |

| RTGS and NEFT payments systems are provided to the customers | 1.000 | .874 | |

| Bank provide SMS to customers about dues/instalments | 1.000 | .802 | |

| Customers can avail statement request by email, fax, mail to customers | 1.000 | .840 | |

| Customer care access is easy | 1.000 | .790 | |

| Customer Care connects calls without consuming much delay | 1.000 | .883 | |

| Customers will get reasonable number of voice prompts | 1.000 | .860 | |

| Customer care gives clear instructions to customers | 1.000 | .809 | |

| Customer care provides voice directions / on line directions for new users | 1.000 | .818 | |

| Online bank account helps in knowing reward point status | 1.000 | .773 | |

| Online banking provide easy bill payments | 1.000 | .881 | |

| Online banking enables easy Mobile Recharge/other recharges | 1.000 | .875 | |

| New product information is promoted through SMS | 1.000 | .883 | |

| Transaction costs for various services are minimum | 1.000 | .825 | |

| Add on services are less expensive to access | 1.000 | .841 | |

| Annexure Table 2 Results of Total Variance Using PCA Method | |||||||||

| Component | IEV | ESSL | RSSL | ||||||

| Sum | Var% | Cumulative (%) | Sum | Var% | Cumulative (%) | Sum | Var% | Cumulative (%) | |

| 1 | 12.979 | 64.896 | 64.896 | 12.979 | 64.896 | 64.896 | 8.920 | 44.600 | 44.600 |

| 2 | 3.699 | 18.497 | 83.393 | 3.699 | 18.497 | 83.393 | 7.759 | 38.793 | 83.393 |

| 3 | .871 | 4.353 | 87.746 | ||||||

| 4 | .510 | 2.549 | 90.294 | ||||||

| 5 | .416 | 2.079 | 92.374 | ||||||

| 6 | .342 | 1.709 | 94.082 | ||||||

| 7 | .231 | 1.153 | 95.236 | ||||||

| 8 | .165 | .825 | 96.060 | ||||||

| 9 | .149 | .745 | 96.806 | ||||||

| 10 | .136 | .681 | 97.487 | ||||||

| 11 | .092 | .461 | 97.948 | ||||||

| 12 | .080 | .400 | 98.348 | ||||||

| 13 | .063 | .317 | 98.664 | ||||||

| 14 | .058 | .290 | 98.955 | ||||||

| 15 | .048 | .242 | 99.197 | ||||||

| 16 | .040 | .199 | 99.396 | ||||||

| 17 | .037 | .183 | 99.579 | ||||||

| 18 | .036 | .182 | 99.762 | ||||||

| 19 | .027 | .133 | 99.895 | ||||||

| 20 | .021 | .105 | 100.000 | ||||||

| Annexure Table 3 Results of Rotated Component Matrix | ||

| Variable/statement | Component | |

| 1 | 2 | |

| RTGS and NEFT payments systems are provided to the customers | .896 | |

| Online banking enables easy Mobile Recharge/other recharges | .886 | |

| Customer care provides voice directions / on line directions for new users | .879 | |

| Customers will get reasonable number of voice prompts | .878 | |

| Branch allows no limit in transactions per day | .875 | |

| Transaction costs for various services are minimal | .865 | |

| Customers can easily know account and balance information from branch | .859 | |

| Bank provide SMS to customers about dues/instalments | -.857 | |

| Online bank account helps in knowing reward point status | .854 | |

| Branches are located at convenient locations | .854 | |

| Customer care access is easy | -.843 | |

| New product information is promoted through SMS | .897 | |

| Customer Care connects calls without consuming much delay | -.897 | |

| Online banking provide easy bill payments | .891 | |

| Bank enables E- payments easily | .888 | |

| Add on services are less expensive to access | .879 | |

| Customers can avail statement request by email, fax, mail to customers | .877 | |

| ATM machines show the identify name of the customers on screen. | -.872 | |

| Customer care gives clear instructions to customers | .869 | |

| Customers can avail Quality notes from Bank Teller | -.863 | |

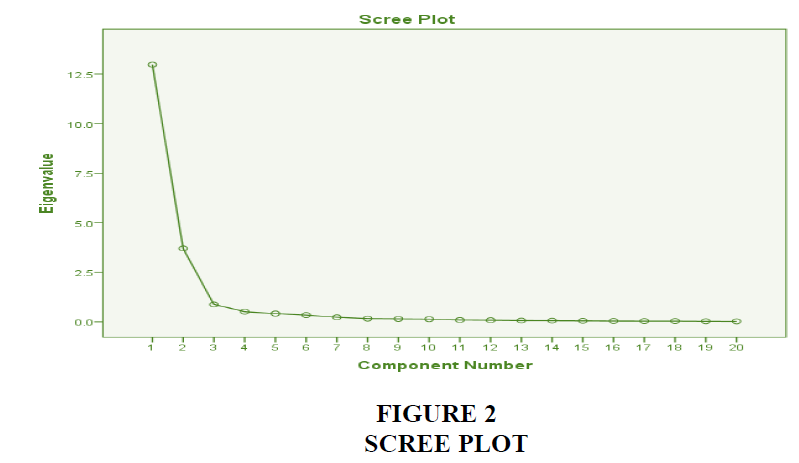

Phase-III explains the statistical results of total variance explained using “PCA method”. All the twenty variables/components are assigned Eigen values and further, RSSL is computed. The results reveal that two factors exist as per the results of total variance explained. Factor-1 explains 44.60 percent of total variance and factor-2 explains 38.79 percent of total variance. Overall, factor analysis is able to explain 83.39 percent of total variance. The Scree plot results shown in Figure 2 explains the amount of variation observed on a line graph for first two factors, the line graphs show maximum vertical shape and for the rest of the variables, it is showing the horizontal line trend.

Hence, the results support the extraction of two factors.

Phase-IV explains the results of Rotated Component Matrix presented. On the basis of Varimax method, the total 20 variables/components are extracted into two factors.

Factor-1 is an integration of eleven variables. Factor-1 is titled as “Efficacy of Operational Services”. The following eleven variables are combined into factor-1.

a. Efficacy of Operational services

1. RTGS and NEFT payments systems are provided to the customers

2. Online banking enables easy Mobile Recharge/other recharges

3. Customer care provides voice directions / on line directions for new users

4. Customers will get reasonable number of voice prompts

5. Branch allows no limit of withdrawal transactions per day

6. Transaction costs for various services are minimal

7. Customers can easily know account and balance information from branch

8. Bank provide SMS to customers about dues/instalments

9. Online bank account helps in knowing reward point status

10. Branches are located at convenient locations

11. Customer care access is easy

Factor-2 is an integration of nine variables. The factor-2 is titled as “Efficacy of Customer Services”. The following variables are grouped into factor-2.

b. Efficacy of Customer Services

1. New product information is promoted through SMS

2. Customer Care connects calls without consuming much delay

3. Online banking provide easy bill payments

4. Bank enables E- payments easily

5. Add on services are less expensive to access

6. Customers can avail statement request by email, fax, mail to customers

7. ATM machines show the identify name of the customers on screen.

8. Customer care gives clear instructions to customers

9. Customers can avail Quality notes from Bank Teller

Conclusion

The analysis of service delivery with regard to three select banks, i.e., State Bank of India (SBI), Union Bank of India (UBI), and Canara Bank highlights the banks' strategic emphasis on digital transformation to enhance customer satisfaction and operational efficiency. SBI's comprehensive multichannel approach, including its innovative YONO app, positions it as a leader in digital banking, catering effectively to the younger demographic. UBI's adoption of advanced technologies like AI and its Vyom app further demonstrates its commitment to improving service delivery. Canara Bank's focus on both digital and branch banking, coupled with its initiatives in financial inclusion and personalized services, underscores its balanced approach to service delivery. UBI's service delivery performance is marked by shorter waiting times, lower queue lengths, and more efficient management of customer flow, leading to a superior overall service experience. SBI and Canara Bank face challenges such as longer waiting times and higher traffic intensities, which may affect customer satisfaction negatively. The findings suggest that SBI and Canara Bank could benefit from targeted improvements in queue management, service delivery speed, and staff utilization to enhance their service efficiency and customer experience. The factor analysis results show that, efficacy of operational services and customer services are the determined factors using principle component analysis.

Limitations

The study is based on the observational study made on select branches of three public sector banks situated in Warangal district only. For the study on recording customer arrival rate and service rate, the data is recorded for the 30 days period only. Head and Chest Branches are not considered for the evaluation. Further, the study focuses on the select dimensions and the sample study is restricted to 710 respondents drawn from the three select branches.

References

Alhijawi, B., & Kilani, Y. (2020). A collaborative filtering recommender system using genetic algorithm. Information Processing & Management, 57(6), 102310.

Indexed at, Google Scholar, Cross Ref

Brown, L. M. (2019). Banking service quality: Procedures and strategies for excellence. Banking Review, 22(2), 112-130.

Canara Bank. (2024). Annual report 2023-24.

Choudhary, R. (2008). Dimensions of service quality in Indian retail banking. International Journal of Bank Marketing, 26(7), 492-510.

Choudhury, K. (2007). Service quality dimensionality: A study of the Indian banking sector. Journal of Asia-Pacific Business, 8(4), 21-38.

Davis, M. N. (2018). Bridging gaps in service quality: Techniques for banks. International Journal of Banking Studies, 10(1), 78-94.

Gamliel, E. (2006). Service quality and customer satisfaction: The role of customer expectations. Journal of Services Marketing, 20(4), 273-281.

Indexed at, Google Scholar, Cross Ref

Gronroos, C. (1984). A service quality model and its marketing implications. European Journal of Marketing, 18(4), 36-44.

Indexed at, Google Scholar, Cross Ref

Gupta, R., & Sharma, P. (2022). Impact of competition and reforms on the Indian banking industry. Journal of Banking and Finance, 34(1), 56-78.

Indexed at, Google Scholar, Cross Ref

Hunter, C. (1995). The relationship between service delivery systems and costs in US banks. Journal of Banking and Finance, 19(4), 567-584.

Johnson, K. R., & Lee, A. H. (2020). Monitoring and improving service quality in the sector. Journal of Financial Management, 18(4), 234-249.

Indexed at, Google Scholar, Cross Ref

Kumar, A., & Agarwal, R. (2016). The relevance of SERVQUAL models in modern Performance, synthesis, GAP analysis, and quality attributes. International Journal of Bank Marketing, 34(5), 673-692.

Kumar, A., Agarwal, R., & Singh, S. (2018). SERVQUAL’s impact on brand loyalty and customer satisfaction within Indian banks. Journal of Financial Services Marketing, 23(4), 385-397.

Kumar, A., Agarwal, R., Singh, S., & Bhattacharya, P. (2021). Comparing service quality dimensions between public and private sector banks. International Journal of Bank Marketing, 39(2), 256-274.

Lolemo, S., & Pandya, H. (2024). The impact of digital banking on customer satisfaction and loyalty in commercial banks: A systematic literature review. International Journal of Management, Economics and Commerce, 1(1), 69-75.

Indexed at, Google Scholar, Cross Ref

Mishra, B. (2009). Customer satisfaction in the Indian retail banking sector: An analysis of influencing factors. International Journal of Bank Marketing, 27(5), 342-359.

Nair, S., & Bhat, R. (2022). Linking high service quality with increased customer loyalty in the Indian banking sector. Journal of Financial Services Marketing, 27(2), 194-210.

Patel, A. (1993). The service area approach and its impact on rural banking. Journal of Rural Banking, 12(4), 45-60.

Patel, R., & Desai, S. (2023). The impact of personalized communication on customer preferences and trust in banking. International Journal of Bank Marketing, 41(1), 45-62.

Patel, S., & Desai, M. (2023). Enhancing customer satisfaction through personalized communication in CRM systems. Journal of Relationship Marketing, 22(2), 115-132.

Indexed at, Google Scholar, Cross Ref

Rao, P., & Singh, R. (2021). Exploring the relationship between digital service delivery and customer preferences in Indian banks. Journal of Financial Services Marketing, 26(3), 210-225.

Indexed at, Google Scholar, Cross Ref

Ruoh, N. Y. (2005). The impact of wait disconfirmation on consumer waiting experiences in banking. Journal of Banking & Finance, 29(6), 1349-1368.

Sharma, A., & Verma, H. (2022). The impact of personalized banking services on customer satisfaction and loyalty. Journal of Financial Services Research, 61(1), 67-85.

Indexed at, Google Scholar, Cross Ref

Sharma, P., & Verma, R. (2022). The role of personalized banking services in customer satisfaction. Journal of Financial Services Marketing, 27(3), 307-319.

Shayestehfar, H., & Yazdani, M. (2018). Comparative analysis of service quality perceptions in banks: Isfahan vs. Dubai. International Journal of Quality & Reliability Management, 35(3), 548-563.

Smith, J. A. (2021). Understanding service culture in banking: Principles, norms, and quality. Financial Services Journal, 15(3), 45-67.

Srivastava, R., & Jain, P. (2023). How emerging technologies like AI and blockchain are transforming service delivery and customer engagement in Indian banks. Journal of Financial Technology & Innovation, 5(2), 198-214.

Indexed at, Google Scholar, Cross Ref

State Bank of India. (2024). Annual report 2023-24.

Szopi?ski, T. S. (2016). Factors affecting the adoption of online banking in Poland. Journal Business Research.

Indexed at, Google Scholar, Cross Ref

Union Bank of India. (2024). Annual report 2023-24.

Yan, R. N. (2005). The impact of wait disconfirmation on consumer waiting experiences in banking. Journal of Consumer Research, 31(2), 216-229.

Indexed at, Google Scholar, Cross Ref

Zomerdijk, L. G., & Vries, J. (2007). Service design for contact and non-contact activities in banking operations. International Journal of Service Industry Management, 18(4), 321-341.

Indexed at, Google Scholar, Cross Ref

Received: 14-Aug-2024, Manuscript No. AMSJ-24-15138; Editor assigned: 16-Aug-2024, PreQC No. AMSJ-24-15138(PQ); Reviewed: 26-Sep-2024, QC No. AMSJ-24-15138; Revised: 28-Oct-2024, Manuscript No. AMSJ-24-15138(R); Published: 16-Nov-2024