Research Article: 2019 Vol: 23 Issue: 6

Segment Report on Management Pharmaceutical Enterprises

Bui Thi Ngoc, University of Labor - Social Affair

Le Thi Tu Oanh, University of Labor - Social Affair

Phuong Thi Thanh Nguyen, Thuongmai University

Abstract

The segment report provides managers with information to evaluate business results by unit, region, and group of commodity rather than report the overall results of the whole enterprises. This article focuses on research of segment reports by divisions in service of the administration of pharmaceutical companies through the contents as follow: identifying segments to report, understanding actual content, targets, types of reports, allocation of revenues, general costs to each division, and administrator’s assessment of the effect of segment report. Case study method passed through in-depth interviews with more than 30 cases in 23 pharmaceutical enterprises. The results show that enterprises make segment reports by business sector (81.16%), with high frequency (mean 3.95); by geographical area (56.52%), with relatively high frequency (mean 3.38); other criteria (29.57%), with low frequency (mean 2.62). Segment reporting is used in controlling activities (75.36%, mean 3.36); performance evaluation (76.81%, mean 3.10); decision making (60.87%, mean 3.78). The use of segment report tends to decrease by business type from Joint Stock Co., Co., Ltd., Single-member, Co., Ltd., Private Co. In this research sample, the enterprise size decreases along with the type of business which is also a characteristic of Vietnamese enterprises. The drawback of the segmental reporting in these businesses is influenced by financial accounting, lacks uniformity and inflexibility. Through the research findings, the authors have proposed ideas to help businesses establish more effective segment report system.

Keywords

Segment Reports, Management Reports, Sections, Reviews, Controls, Decision Making.

Introduction

Businesses currently tend to conduct multi-sector, multi-field and multi-ownership investment. The trend makes the information on their financial statements bulky and the data are not specified for each industry, each field and area. In order to help administrators have sufficient information to properly assess individual segment and each area, it is necessary to have a report to divide the results by segments, regions and commodity groups. The segment report (SR) would meet the requirement to provide detailed information of each segment. In the management perspective, segment report is an important tool that helps administrators control and evaluates the performance of each segment, and on its basis, the administration decision will be made for each subject as whether to continue or cancel markets, business regions and customers. Therefore, the study focuses on segment reports serving administrators which have been previously studied by many authors. Ronen & Livnat (1981) says segment reports reflect the revenue, costs, and results of each segment, providing information for executives to make

decisions. In this view, the segment report is considered a business report but with details for each segment. Ijiri (1995) stated that “segmental reporting is the individual financial data of units, subsidiaries, or various segments of a company”. Prencipe (2004) Sharing the perspective, “A segment report is a report of operating zones (regions) of a company in detail of its revenue, expenses, profits and losses.” Birt & Shailer (2011), segment report is a report of business results based on the comparison between revenue and expenses in the conduct model and combination with the management decentralization of each segment in the organizational structure of production and business of an enterprise. Alfonso et al. (2012) “Segment report is a report on financial information by segment, business sector and other geographical areas of an enterprise to assist users of financial report to understand the operation of the previous years; to properly assess the risks and economic benefits of the enterprise and make reasonable assessments about the business”. Thus, the authors view segment reports as segment income statement.

Besides the world's viewpoints on segment reports, Vietnam’s studies include an (2013) indicates “The segment report is a report that presents details of crucial economic and financial information, giving administrators more tools to collect information”. Hong (2011); Huong (2011); Loi (2003) concur that: “A segment report is a report made in accordance with business sector or geographical area and must reflect business results of the unit basing on the above criteria.” Hang (2014) emphasizes: “A segment report is a detailed report made by business sector, geographical area, by subject or period”.

The segment report, from the perspective of accounting management, is a form of governance report. Therefore, it is made at the request of the business, not necessarily in compliance with the legal system of accounting. The basic content in a segment report comprises revenue, cost and results of each separate region. In addition, to serve corporate governance needs, a segment report can reflect other information such as assets, liabilities, prices, loans, salaries by each segment. A segment report is similar to a governance report in that it reflects the details of each subject but it differs in that a segment report is always associated with each separate segment.

How to identify a segment? A segment is defined as a separate unit (area) where financial information is reported and evaluated by a decision maker within the organization. This decision maker is usually competent to allocate resources and evaluate the performance of the entity. From a management perspective, the segment is divided into: functional departments are the segments that generate revenue such as shops, sales, markets; service departments to supply functional parts such as production, service, transportation, management, operation. From an accounting perspective, the term “segment” is understood as a division according to the business sector (such as goods, commodity groups; products, services, activities) of geographical areas (such as departments, regions, territories, stores, workshops, centers, staff groups). Indicators in a segment report usually consist of revenue, costs, results of the direct division or the costs and performance of those indirectly generating revenue. The general rule of determining a direct division is that the unit must be separated from the rest of the business for reporting purposes:

a. A segment must generate revenues and costs.

b. Segment’s results must be reviewed by the operating director.

c. A segment must have identifiable financial information.

d. A segment should be separated if it accounts for at least 10% of total assets or revenue or profit of the company.

For indirect-generating revenue segments, there must be technical methods to evaluate the results, including (i) determination of segment costs; (ii) determination of criteria to evaluate performance such as quantity of product quality, reporting deadline, amount and time of debt collection, number of customers cared, and number of products guarantee. Balancing the result with the cost, comparing with the plan, with the previous period, and with other segments of businesses should be carried out to evaluate the final results of the indirect segments.

How use of segment report in management? The segment report serves administrators in management functions including control, evaluation and decision making. To perform the control function, the segment is used to compare the plan with the performance, administrators will gasp the performance of the segment. In order to perform the evaluation function, administrators often uses the criteria of the performance of each segment to see if the segment has achieved the set goals or progress compared to the previous period. Thereby, the administrators can evaluate the performance or potential risks. As a result, the manager will be able to find timely remedies and made the right decisions. Alfonso at al. (2012) demonstrates that segment reports help to bring about 12.3% of the unit’s effectiveness. Prencipe (2004) emphasizes analysis of segment report helps to assess the risk and growth of each segment and allows better integration of internal data with each other and internal data with external data. Based on the role of segment reports for managers, we aim to explore the status of preparing and using segment report for managers in pharmaceutical enterprises. Thereby, the authors suggest ways to design, use reports, allocate general costs in the business to assist administrators utilize their control and evaluation functions.

Research Review

Research on segment reports for corporate governance has been interested by many domestic and foreign authors. Specifically:

Foreign Research Works

Michael et al. (2013) in the publication of a report on management accounting practices in small and medium-sized enterprises (SMEs) based on interviews with executives at 11 UK SMEs proposes four identification

a. For SMEs that do not usually have management accounting reports, accountants mainly comply with tax regulations.

b. Segment reports are used as a decision support tool including analysis of relevant cost, appraisal techniques ò investment cost and tools to cope with risks and uncertainty such as expected price, decision tree and penalty matrix.

c. Based on shared experiences from professional organizations, the price analysis tool is used for analysis of breakeven points, working capital management, helping businesses survive while many small businesses do not use this tool.

d. When enterprises have large scale and decentralization in management, the important economic instruments are cost estimation, responsibility centers and cost allocation techniques.

Alfonso at al. (2012), in his research paper, he points out that companies with higher management and operating costs often have more flexible and diverse segment reports. Companies using multiple forms and targets in segment reports are often large companies with wide geographic, market and operational networks. However, administrators choose segment reports because of the derived operating costs, not the above factors. The study has also found that the more a segment report costs, the more companies are honest.

Birt (2011), research into segment reports by Australia’s listed companies, analysts confirms that the more detailed the segment report, the better it is to improve the risk and growth analysis profile of various divisions and the better it is at integration of external data. Therefore, the accuracy and reliability of the analysis results are improved. The author also gives the opinion that segment reports for administrators should be more flexible and detailed. The segment report reflects the data of the main segments that need to disclose 9 sources of information and 3 sources for the secondary ones. The segment identification also has to be flexible and create favorable conditions for enterprise management.

Prencipe (2004), researched at 60 Italian companies to clarify factors affecting segment reports because the Italian legal regulations on this issue are very limited. The study is conducted using the following 3 hypotheses:

a. The similarity between segments and areas.

b. The growth rate of each segment.

c. Segment operating time.

A number of such control variables as gender, qualifications, experience, managerial education, and industry. Hypotheses are experimentally tested, and analyzed using correlation analysis and multiple regressions. The results shows that, except for the growth rate, the similarity between segments and the time of operation has a great impact on the establishment and habits of using segment reports by the management board. In addition, a number of control variables show no difference between sex and business sectors in terms of segment report use. The managerial and educational factors significantly influence the level of the use of segment reports.

Ijiri (1995), the study focuses on assessing and comparing the effectiveness of segment report by geographic area and segmental reporting by business sector in financial management and resource management. For financial management, both of kinds of segment reports by revenue generating segments are useful for financial decisions such as selling prices, distribution markets, and financial investment decisions. For financial management of indirect resources, the segment reports of the indirect segments which do not generate much-needed revenue give the administrator a basis for analyzing and evaluating the performance of human activities, regulations and processes of the segments. The study also points to differences in segment identification and difficulties in measuring the effectiveness of indirect segments.

Roberts (1989), the study conducted at UK companies aims to answer the question: “Can segment earnings reports help managers analyze and forecast in advance market changes like growth, interest rates and inflation?” The results show that segment reports help to assess the growth potentials through detailed data reported on the revenue of each product, each market and each customer subject.

Ronen & Livnat (1981) studies on segment reports in businesses in which a segment is determined on a ladder. The task of the administrator is to determine the needs for the various types of segment reports to be used. The number of reports depends on the size and nature of the business. The segment report on revenues, expenses, and results is constructed as a tree-shaped directory or in other words the matrix. A figure may reside in multiple segments. For example, the revenue of item A may be in the item A, but may also be in the exports section in the report if it is exported.

Twombly (1979) studies 231 businesses in Chicago from 1968 to 1970 on information to be provided in segment reports to facilitate the administrators’ decision-making process. The publication of accounting data on the basis of “segment” or “product range” is the main theme of selected administrators in both the public and internal segment reports. The commonly used types of segment reports are revenue reports, revenue and profit reports for each capital market type that are used more than product range reports.

These studies often refer to segment report as partial income statements. Therefore, the segment to report is often tied to revenue generating segments. There are many factors that affect segment reports such as the scale of the complexity of business operations, operating time and management habits. The general trend that administrators aim at is to widely use and publicize segment reports to the masses.

Vietnam’s Research Works

Mai (2013) conducts case studies through in-depth interviews with 10 relevant agencies in Vietnam Tourism Company in Da Nang. In each department, the head, deputy head and 1 staff member were selected, and 30 in-depth interviews conducted. The result shows, at the management level, the governance reports are very flexible; they are interested in the targets to meet management requirements rather than being formal. Senior executives are often concerned with reports of revenue, cost of capital, interest, stock prices, and operating markets. Low-level executives are often concerned about the issues they are operating in. 20% of executives will make decisions based on figures in segment report provided by accounting governance.

An (2013) studies the method of organizing the administration reporting system in manufacturing enterprises for each management level, including: factory level, sales department, marketing and sales department up to higher management levels, namely the director, the board of directors. At each level, the author gives suggestions on reporting formats as factory price report, sales report by items, geographical area, profit and loss report by items. These reports give administrators more tools to make sound investment decisions.

Hong (2011) proposes solutions to improve the segment report system from the perspective of administrating accounting regime such as types of management reports, contents and layout of segment reports for Vietnamese enterprises.

Huong (2011) has succeeded in analyzing the purpose, effects, requirements and principles of construction and factors affecting the presentation of information on segment reports, and in presenting elements of segment reports by animal feed production and trading enterprises in Vietnam. However, the limitation is that the author has not approached the segment report system in accordance with the information needed by administrators in the enterprise.

Quang (2002) has built a system of segmental accounting reports such as expense reports, inventory reports, establishing income procedures, processing data to prepare income reports and budget reports and demonstrate the role of the State in the direction of development of administrating accounting in enterprises.

In short, in both domestic and foreign studies, segment reports are considered in different aspects and fields. Foreign works mainly refer to the function of providing information on revenue, expenses, and profits. They consider the factors affecting segment reports and the commonly used types of company reports. Vietnam’ research works mainly refer to segment reports as a management report, emphasizing the criteria that need to be presented in the report including revenue, expenses, profits, liabilities, cash flow, cost and inventory. However, these studies only focus on three main issues: the role of, the content and the status of a segment report used in the enterprise. In this study, we would mention how a segment report works for the process of inspecting and evaluating the performance of administrators and the pharmaceutical industry of Vietnamese enterprises.

Research Methodology

The study is carried out with a situational method. The reason for this research method is because the information to be collected is the administrative information of the unit, which it is quite sensitive, highly confidential and difficult to exploit on a large scale.

Research participants

In order to facilitate the implementation of case studies and the reliability of the research results, we chose to directly interview four Hanoi-based pharmaceutical enterprises. These are enterprises with 10 and over 10 years of operation including 1 large-scale enterprise, 3 small and medium-sized enterprises. For each business, we conducted 3 in-depth interviews with the director, chief accountant, administrative accountant, factory manager, sales manager. Due to the busy time and workload of the chief accountant and director, it is difficult to meet face to face with the interview. We conducted an alternative method: phone-interview of 6 enterprises, indirect interview of 3 enterprises, sending interview questions to 10 enterprises. The time for this study is from January 2019 to August 2019.

The contents of the interviews focus on the following three main contents: (i) segment reports related to revenues, expenses, and results of the units; (ii) preparation of segment reports in terms of report types, content of report, reporting period; (iii) How do businesses use BCBP for decision making.

Data Collection

The process of interviewing and collecting information is always closely linked to the objectives and research questions to learn about the process of each business in the provision and use of administrative accounting information and segment reports. We outline some basic questions to be proactive in the interview. We make notes and interview recordings. After the interview, we make a description of the situation and send it back to the interviewees to verify the information and correct if there is a mistake.

In addition to the case study method, we use secondary data collection method, which is from the segment reports of 23 enterprises. On that basis, we perform the analysis and evaluation according to the predefined research objectives. Finally, we use statistical and analytical methods to assess real situation and analyze the situation; using statistics and applying personal arguments in research.

Data Analysis

The data analysis steps are as follows:

a. summarizing the data into the same excel file according to the basic questions made, giving flexible answers to encode

b. Read the entire data to find key words or key phrases, common problems in interviews, putting them together and assigning classification criteria (group names) into the same excel cell; reading again to clarify the idea of each paragraph and unify each classification criteria.

c. Data analysis: Filtering data by code, comparing its appearance with research questions to find the link between that code and segment report information. We implement this operation repeatedly to find and build a connection between the issues that need clarification according to the research objectives.

Among 23 surveyed enterprises, 9 are joint stock companies accounting for 39%, 8 limited companies, 35%; 4 one member limited companies, 17% and 2 private enterprises, 9%. In terms of scale, enterprises in the pharmaceutical industry are mainly small and medium-sized ones, with a ratio of 21/23, occupying 91%, only 2 large enterprises are State limited liability companies. In terms of business lines, companies mainly specialize in western medicine (10/23, accounting for 43%), the remaining such as businesses in traditional medicine and cosmetics account for an average of 9% and 17%. Some companies have additional businesses as raw pharmaceutical materials, medical equipment for pharmaceutical industry, including 4 enterprises, taking 17%. By type of business, Table 1 shows that the businesses are mainly in the manufacturing sector, 14/23 enterprises, 61%, followed by commercial enterprises gaining 22%, the rest is import-export businesses, 17%. Among the manufacturing companies, there are 4 out of 14 companies with Good Manufacturing Practices (GMP) standards, the remaining 10 enterprises meet basic standards licensed by the Ministry of Health.

| Table 1 Characteristics of Enterprises Participating in the Survey | |||||

| Classification of Enterprises | Code | Frequency | Percent | Cumulative Percent | |

| Types | Joint stock company | Type 1 | 9 | 39% | 39% |

| Co. Ltd. | Type 2 | 8 | 35% | 74% | |

| Limited liability company | Type 3 | 4 | 17% | 91% | |

| Private enterprise | Type 4 | 2 | 9% | 100% | |

| Total | 23 | 100% | |||

| Size | Large enterprise | 2 | 9% | 9% | |

| Small and medium-sized enterprise | 21 | 91% | 100% | ||

| Total | 23 | 100% | |||

| Business lines | Western medicine | 10 | 43% | 43% | |

| Eastern medicine | 2 | 9% | 52% | ||

| Cosmetics | 3 | 13% | 65% | ||

| Food supplementary | 4 | 17% | 83% | ||

| Pharmaceutical equipment | 4 | 17% | 100% | ||

| Total | 23 | 100% | |||

| Business type | Producing pharmaceutical products | 14 | 61% | 61% | |

| Trade in pharmaceutical products | 5 | 22% | 83% | ||

| Import and distribution | 4 | 17% | 100% | ||

| Total | 23 | 100% | |||

Research Results

Classification of Expenses for Preparing Segment Reports

Cost classification is the first step in the accounting workflow to serve as the basis for opening a detailed accounting book and preparing segment reports through the selected criteria. Currently, in pharmaceutical enterprises, the classification is mainly done by accountants replying on their working habits. For businesses with a long history such as Nam Ha Pharmaceutical Joint Stock Company, Hoa Linh Pharmaceutical Co., Ltd., the cost classification on the pharmaceutical account system has been long carried out on the accounting software system. For some newly established private enterprises, the cost classification is not considered as business is small in size and with few derived business. Table 2 on cost classification of enterprises shows that 65.2% of enterprises choose to classify by cost items to facilitate the calculation of product costs. With this classification, businesses use direct cost accounts that are direct material costs, direct labor costs, and general production costs to reflect data. In addition, the cost classification by economic content is also used in 39.1% of businesses. The entire cost of the enterprise is managed by separate cost factors such as: The cost of raw materials, wages, cost of depreciation, transportation, advertising, rent of stores, electricity, and water fee. To cater for this classification, the software allows opening cost elements without tracking on accounting accounts. Therefore, the efficiency of work is still ensured to provide the administrators and the accounting system with concise information. Some cost categories according to the behavior of costs (fixed, variable and mixed costs) are little used (26.1%) and authority-based classification is not at all employed.

| Table 2 Criteria for Classifying Expenses of Enterprises | ||||||||||

| Contents | Type | |||||||||

| Joint Stock Co. | Co., Ltd., | One-member Co., Ltd., | Private Company | Total | ||||||

| N | (%) | N | (%) | N | (%) | N | (%) | N | (%) | |

| 1. Classification by cost items | 5 | 21.7 | 6 | 26.1 | 2 | 8.7 | 2. 0 | 8.7 | 15.0 | 65.2 |

| 2. Classification by cost content | 3 | 13.0 | 4 | 17.4 | 2 | 8.7 | 0 | 0 | 9.0 | 39.1 |

| 3. Classification by cost behavior | 2 | 8.7 | 2 | 8.7 | 2 | 8.7 | 0 | 0 | 6.0 | 26.1 |

| 4. Classification according to decision-making competence | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.0 |

| 5. Other | 1 | 4.3 | 0 | 0 | 0 | 0 | 0 | 0 | 1.0 | 4.3 |

Classification of Revenue for Preparing Segment Reports

Regarding the revenue classification, the results in the Table 3 below show 100% of enterprises are interested in the revenue of individual product. This is very simple for businesses using accounting software because they do not need to open a detailed sales account for every product, but merely declare the finished product code only once when there are more new products. After that, the software with its outstanding features will synchronize all accounts related to the finished product code. For example, at HoaLinh Pharmaceutical Company, with product code TPDH0, code for a product called DaHuong 01; it just declares this code once. After that, the detailed product books, revenue books, cost price books, debt books just need be selected by the finished product codes to be able to access all data according to the finished product codes.

| Table 3 Criteria for Classifying Enterprises’ Turnover | ||||||||||

| Contents | Type | |||||||||

| Joint Stock Co. | Co., Ltd., | One-member Co., Ltd., | Private Company | Total | ||||||

| N | (%) | N | (%) | N | (%) | N | (%) | N | (%) | |

| 1. Classification by product | 9 | 39.1 | 8 | 34.8 | 4 | 17.4 | 2.0 | 8.7 | 23 | 100 |

| 2. Classified by salesperson | 6 | 26.1 | 6 | 26.1 | 4 | 17.4 | 2.0 | 8.7 | 18 | 78.3 |

| 3. Classification by geographic area | 7 | 30.4 | 6 | 26.1 | 3 | 13.0 | 2.0 | 8.7 | 18 | 78.3 |

| 4. Classification by department | 5 | 21.7 | 5 | 21.7 | 3 | 13.0 | 0 | 0 | 13 | 56.5 |

| 5. Classification by product groups | 6 | 26.1 | 2 | 8.7 | 2 | 8.7 | 0 | 0 | 10 | 43.5 |

| 6. Other | 2 | 8.7 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 8.7 |

The classification of revenue by geographic area, sales person saw 78.3%. Classification by geographic area is necessary because the products of the companies are distributed nationwide, even overseas. The classification by province creates a basis to assess the sales situation of each locality, and then the administrators will take measures to promote sales and market development in new localities. Classifying by sales staff is done because in some businesses each employee will be in charge of sales of some products such as Tropical Pharmaceutical One-member Company Limited; ThanhNam Pharmaceutical One-member Limited Company. The majority of pharmaceutical enterprises assign each sales staff to be in charge of a certain province as HoaLinh Pharmaceutical Company and NamHa Pharmaceutical Joint Stock Company. The above of classifying sales revenue is to manage the sales of each employee, assign the responsibility to collect debts attached to that employee, calculate the effective salary of each individual employee and facilitate the management to handle customer complaints. In large enterprises, with the size of between 400 and 1,200 employees, as NamHa Pharmaceutical Joint Stock Company, HaTay Pharmaceutical Company, in addition to the above classifications, also classify revenue by each sales department. to create competition among departments. Some companies also suggest some more ways to classify revenue in their companies. For example, classifying sales by customer groups such as wholesale and retail; drug stores and drug markets; traditional markets and new markets; individual and company.

Content of Segment Report

The survey results indicate that the researched units all organize the accounting work according to a combination of administrative accounting and financial accounting. On that basis, the accounting department provides administrative accounting information at management levels and according to management requirements. In the 23 businesses interviewed, 19/23 enterprises (82%) affirm the establishment of segment reports in providing information to the administrators. However, the detail level, form of reporting and content of report varies from enterprise to enterprise. For small enterprises, limited liability companies, private enterprises, segment reports are often categorized by geographical areas associated with market activities such as the North, the Central and the South. For joint stock companies and large enterprises, segment reports are very diverse in form and requirements. For example, International Pharmaceutical Company’s reports are divided into domestic and international markets. Particularly, the domestic market is monitored by each province (Hanoi, BacNinh, HaiPhong), the international market is classified by country (Laos, Cambodia). Most micro businesses do not have segment reports; they mostly use governance reports or announcements, notes or information-providing habits.

Regarding the preparation of segment reports, most organizations assumed that report should be made monthly (22/23 enterprises accounting for 95.7%); 21/23 enterprises (91.3%) thought that the segment report was prepared at the request of managers, and 17.4% thought that the report should be prepared quarterly. Requirements of each administrator are varied, and often change. For example, at HoaLinh Pharmaceutical Company, for new products under trial production, accountants must provide price reports for each batch of finished products; each batch has a time of 4 days from raw materials to completion of bottling or blistering. When the product is put into the market, the accountant must provide a sales report daily so that management can grab the situation. Traditional products are reported on a monthly basis; the format of the report is revenue accompanied capital cost. When the company implements sale promotions, sales reports are made periodically, each runs from 3-15 days. At NamHa Pharmaceutical Joint Stock Company, sales staff must prepare a sales report every week and send it to the head of the department, who prepares a monthly general sales report for the section manager.

Concerning the agent of segment reports, similar to units involved in cost estimation, the preparation task is done by the entire organization. Therefore, any department involved in the production and business process of an enterprise is responsible for preparing a segment report. However, the accounting department is the main person responsible for making these reports, followed by sales department of 69.6%, workshops (60.9%), and other segments (accounting for 17.4%). The preparation of sales related reports can be done by the accounting department or sales department depending on the management decentralization in each unit. However, with the help of accounting software, the integration of sales software, human resources, after the sales order, delivery notes are entered into software, the entire database of sales operation, cost of goods, inventory, liabilities, taxes payable can be managed on the same database. Depending on the decentralization of each unit, department or individual can retrieve related data. Making a segment report simply means selecting the time to print, selecting the object (segment) to print from the accounting software. Types of segment reports are prepared according to Table 4.

| Table 4 Types of Segment Reports | ||||||||||

| Contents | Type of businesses | |||||||||

| Joint Stock Co. | Co., Ltd., | Single-member Co., Ltd., | Private Company | Total | ||||||

| N | (%) | N | (%) | N | (%) | N | (%) | N | (%) | |

| Segment report (SR) by business sector: average rate of 81.16% | ||||||||||

| Sector1 | 9 | 39.13 | 8 | 34.78 | 4 | 17.39 | 2 | 8.70 | 23 | 100 |

| Sector2 | 9 | 39.13 | 7 | 30.43 | 4 | 17.39 | 1 | 4.35 | 21 | 91.30 |

| Sector3 | 7 | 30.43 | 7 | 30.43 | 4 | 17.39 | 2 | 8.70 | 20 | 86.96 |

| Sector4 | 6 | 26.09 | 8 | 34.78 | 4 | 17.39 | 2 | 8.70 | 20 | 86.96 |

| Sector5 | 8 | 34.78 | 5 | 21.74 | 2 | 8.70 | 0 | 0.00 | 15 | 65.22 |

| Sector6 | 6 | 26.09 | 4 | 17.39 | 3 | 13.04 | 0 | 0.00 | 13 | 56.52 |

| Segment report by geographic area: average rate of 56.52% | ||||||||||

| Area1 | 9 | 39.13 | 7 | 30.43 | 4 | 17.39 | 1 | 4.35 | 21 | 91.30 |

| Area2 | 8 | 34.78 | 7 | 30.43 | 3 | 13.04 | 0 | 0.00 | 18 | 78.26 |

| Area3 | 7 | 30.43 | 7 | 30.43 | 3 | 13.04 | 0 | 0.00 | 17 | 73.91 |

| Area4 | 4 | 17.39 | 2 | 8.70 | 0 | 0.00 | 0 | 0.00 | 6 | 26.09 |

| Area5 | 1 | 4.35 | 2 | 8.70 | 0 | 0.00 | 0 | 0.00 | 3 | 13.04 |

| Segment report by other criteria: average rate 29.57% | ||||||||||

| Other1 | 7 | 30.43 | 5 | 21.74 | 0 | 0.00 | 0 | 0.00 | 12 | 52.17 |

| Other2 | 4 | 17.39 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 4 | 17.39 |

| Other3 | 3 | 13.04 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 3 | 13.04 |

| Other4 | 7 | 30.43 | 4 | 17.39 | 2 | 8.70 | 0 | 0.00 | 13 | 56.52 |

| Other5 | 2 | 8.70 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 2 | 8.70 |

Note:

Sector1: SR by every single product: Antibiotics, cough medicines ...

Sector2: SR by product groups (Oriental, western medicine, cosmetics, food supplement...)

Sector3: SR by type of customer: wholesale, retail or export, domestic market

Sector4: SR according to customers: drug markets, drugstores

Sector5: SR by activities: producing medicine, importing medicine, trading medicine

Sector6: SR by business lines: manufacturing, trading in pharmaceutical products, real estate business, transportation services.

Area1: SR by department (sales department 1,2,3 ...

Area2: SR by region: North, Central and South

Area3: SR by province/city: Hanoi, Hai Phong

Area4: SR by industrial zones: Dong Anh Industrial Park, Phung Industrial Zone, Ha Nam Industrial Park, Bac Ninh Industrial Park

Area5: SR by export processing zone:

Other1: SR by workshop: dispensing, bottling, labeling, date stamping, testing

Other2: SR by project

Other3: SR by group of bad debt customers

Other4: SR by sale promotions, advertising programs, and drug fairs

Other5: Other SR: by sales staff, monitoring debts, purchasing materials and prices

Segment Reports by Business Sector (Average Rate of 81.16%)

Enterprises often present the revenue, cost, results of each department. The help of accounting software favors the preparation of detailed reports for each department through the opening of account codes, codes of goods and supplies, and case codes. The segment report by business sector includes the following common reports: reports for every single product, prepared through codes of supplies and goods, 100% of surveyed enterprises make segment report to this type. This is a common criterion for setting up segment reports by field. Enterprise with the fewest products, Quang Trung Pharmaceutical Private Enterprise has just 5 items, the unit with the largest number of products; the Branch of Ha Nam Pharmaceutical Joint Stock Company has 350 products. Corresponding to each specific product, businesses prepare corresponding segment report. In addition, enterprises can choose to set up segment reports by product groups, according to this criterion, the survey results reach 91.3%. The number of reports depends on product groups of the company. For example, Nam Ha Pharmaceutical Joint Stock Company has 23 product groups including cough medicines, antibiotics, ophthalmic drugs, detoxification drugs, anti-tuberculosis drugs, Hoa Linh Pharmaceutical Company has 3 product groups, including pharmaceutical products, cosmetics, supplementary foods; Hung Linh Company has 10 product groups including analgesic, neurological, cardiovascular, dermatological, digestive medicines. Classification of segment reports according to customers including wholesale and retail; export and domestic; drug markets and drugstores are valued at 86.96%. This classification is mainly used by big companies such as HoaLinh, KienVuong, MinhDuong, and NamHa, which are both manufacturing and consuming enterprises. Their customer base is quite diverse, comprising wholesale methods for small companies, retail and selling at NgocKhanh and LangHa drug markets, and also to drugstores and pharmacies nationwide. Under the classification by business activities (production, imports and trade), there are 8 joint stock companies accounting for 34.78%; 5 limited companies 21.74% and 2 one member limited companies 8.7%. Segment reports by business lines is only applied at 56.52% in large companies such as Hanoi International Pharmaceutical Joint Stock Company, DaiViet Pharmaceutical and Medical Equipment Company, the multi-sector manufacturing and trading companies.

Segment Report by Geographic Area (Average Rate of 56.52%)

Similar to segment reports by business sector, on the segment report by geographic area, businesses often present targets of revenue and expenditure and results of each sales office, region, province, city, industrial park, export processing zone. With the support of software, accountants open case codes to track and reflect the figures according to the regional criteria. Reporting by departments is the highest option with 91.3%. This type of report is used by all businesses including joint stock companies, limited liability companies, limited liability companies and private companies. Segment reports by regions such as the North, Central and South which occupies 78.26%, by provinces such as Hanoi, Hai Phong, and HaNam accounts for 73.91%. Two private enterprises did not choose because their operating market is only in Hanoi. With the classification of segment report by industrial zone, only 4 joint stock companies and 2 limited companies are selected, namely International Pharmaceutical Joint Stock Company with production workshops in Phung and BacNinh industrial zones, HoaLinh Pharmaceutical Company Linh with workshops in Phung, HaNam and DongAnh Industrial Parks. Segment report established according to export processing zone are selected by 3 manufacturing companies because they have production and processing activities for export to foreign countries (Laos, Cambodia…); they are HoaLinh Pharmaceutical Co., Ltd., ThaiBinh Pharmaceutical Co., Ltd. and NamHa Pharmaceutical Joint Stock Company. The report by geographic area helps managers assess the efficiency of each area or each market to focus on development, and know which areas are running inefficiently to divert business. This report is easy to make and easy to follow because the costs and revenue associated with the location can be tracked in detail. When a segment, a region or a province, or an industrial park has a high turnover, cost, and result value (accounting for 30% of the company's overall business results), managers will consider to separate these entities into subsidiaries.

Division Reports by Other Criteria (Average Rate 29.57%)

These reports are usually reviewed on different criteria such as: segment reports by workshop, by project, by customer group. by product, by program, or by series of activities. Businesses can reflect revenues, costs and results by each of the above groups. However, enterprises can also reflect and evaluate the performance by other criteria depending on the operational characteristics of that department. Segment reports in this group only accounts for 8.7% to 52.17%, because this is an uncommon report group, depending on the requirements of administrators. We call the management reports associated with each department and reflecting the performance of that department segment reports. The survey results also show that segment reports mentioned in this section are only available in large companies, joint stock companies while they are almost unfound in the remaining enterprises and private companies.

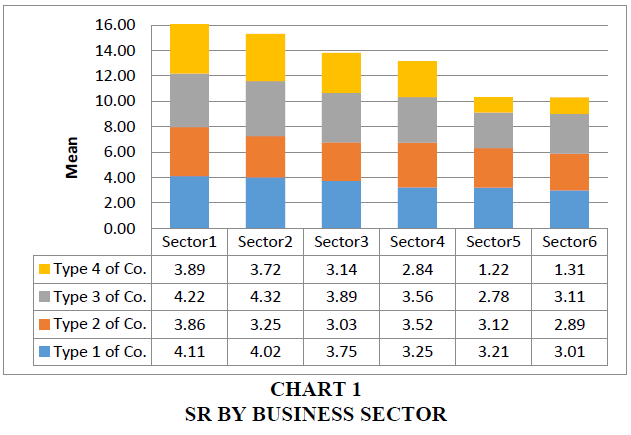

Chart 1 shows the mean values of the use of segment reports of each enterprises by sectors:

Sector1: SR by every single product such as antibiotics, cough medicines. This is one of the most common segment reporting used by all types of enterprises with a high frequency. Specifically, type 3 of Co. (Single-member Co., Ltd.,) uses segment reporting with the highest frequency (mean = 4.22), followed by type 1 of Co. (Joint Stock Co.) mean 4.11, while Co., Ltd., and Private Co. have mean values of 3.89 and 3.86 respectively. Sector2: SR by product groups such as oriental, western medicine, cosmetics, food supplement is used with lower frequency and is divided into three groups. The group of highest frequency include Single-member Co., Ltd., (mean 4.32) and Joint Stock Co (mean 4.02). It is followed by private Co. with lower frequency (mean 3.72) and Co., Ltd., with the lowest frequency (mean 3.25). Sector3: SR by type of customer such as wholesale, retail or export, domestic market and sector4: the use of SR according to customers: drug markets, drugstores decreases from Single-member Co., Ltd., (mean 3.89) to 2.84. Sector5: SR by activities such as producing medicine, importing medicine, trading medicine and sector6: SR by business lines such as manufacturing, trading in pharmaceutical products, real estate business, transportation services, Type 1 of Co. (Joint Stock Co.) has the highest frequency, (mean values of 3.21 and 3.01). Especially, segment reporting is rarely used by private Co. with mean value from 1.22-1.31.

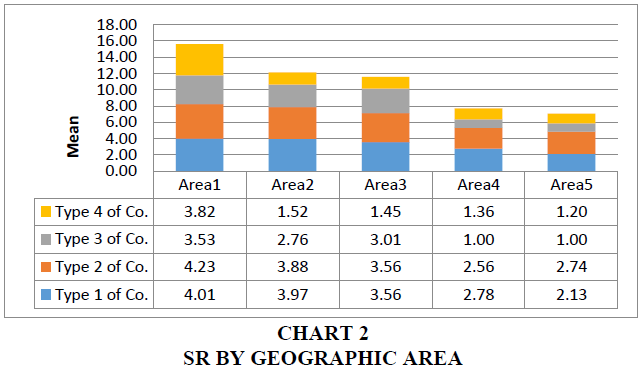

Chart 2 shows the mean values of the use of segment reporting of each enterprises by geography. Particularly, segment reporting is applied the most in area1: SR by department (sales department 1,2,3), in which Type 2 of Co. (Co., Ltd.,) has a highest requency with mean =4.23. Joint Stock Co., Single-member Co., Ltd., Private Co have relatively high frequency with mean t? 3.53-4.01. In the Area2 SR by region, area3 SR by province/city frequently used include type 1 of Co. và type 2 of Co. with mean ranging from 3.56 to 3.97. Area4 SR by industrial zones and area5 SR by export processing zone is not applied frequently with mean =2.78. Especially, segment reporting by area 2, area3, area4, area5 is rarely applied by private Co. with mean ranging from 1.0-1.52. Besides, it is rarely used by single-member Co., Ltd., area4, area5 with mean value of 1.00.

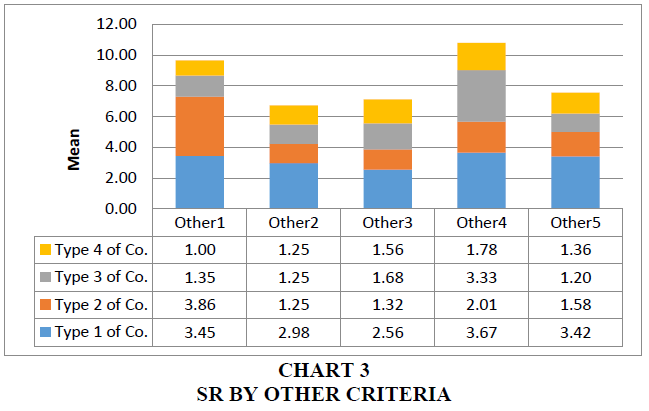

Chart 3, shows by other criteria, segment reporting is divided into 5 groups:

Other1: SR by workshop: dispensing, bottling, labeling, date stamping, testing

Other2: SR by project

Other3: SR by group of bad debt customers

Other4: SR by sale promotions, advertising programs, and drug fairs

Other5: Other SR: by sales staff, monitoring debts, purchasing materials and prices

These are uncommon criteria, usually applied in large-scale companies, with diverse activities such as different projects, regular promotions, advertising or customer support programs. In particular, these criteria arise mainly due to the requirements of directors and the ability to respond to accounting information. In order to set up segment reporting based on these criteria, accountants need to track details of transactions and events. The advantage of the criteria is that it can be reported to the managers at any time, but the disadvantages include the accountants’ passiveness and difficulty in designing software. In this research, other1 is used by Joint Stock Co. and Co., Ltd., with a relatively high frequency with means ranging from 3.45 to 3.86. In addition, other4 is also frequently used by Joint Stock Co. and single-member Co., Ltd., with means ranging from 3.67 to 3.33. Other criteria are hardly used by companies with means ranging from 1.00 to 1.58.

Effects of Segment Reports

When assessing effects of segment reports on pharmaceutical enterprises, opinions are summarized into 3 groups: (i) segment reports serving administrators’ function of controlling; (ii) segment reports serving the function of performance evaluation; (iii) segment reports serving the function of decision making. Specific results are shown in Table 5.

| Table 5 Effects of Segment Reports | |||||||||||||

| Effects of segment reports | Type of businesses | ||||||||||||

| Joint stock companies | Limited liability companies | Single-member limited liability companies | Private companies | Total | |||||||||

| N | (%) | N | (%) | N | (%) | N | (%) | N | (%) | ||||

| Segment reports serving administrators’ function of controlling: 75.36% on average | |||||||||||||

| Controlling1 | 8 | 34.78 | 6 | 26.09 | 3 | 13.04 | 1 | 4.348 | 18 | 78.26 | |||

| Controlling2 | 9 | 39.13 | 5 | 21.74 | 2 | 8.696 | 1 | 4.348 | 17 | 73.91 | |||

| Controlling3 | 7 | 30.43 | 7 | 30.43 | 3 | 13.04 | 0 | 0 | 17 | 73.91 | |||

| Segment reports serving administrators’ function of performance evaluation: 76.81% on average | |||||||||||||

| Evaluation1 | 9 | 39.13 | 8 | 34.78 | 3 | 13.04 | 1 | 4.348 | 21 | 91.30 | |||

| Evaluation2 | 7 | 30.43 | 6 | 26.09 | 3 | 13.04 | 1 | 4.348 | 17 | 73.91 | |||

| Evaluation3 | 7 | 30.43 | 5 | 21.74 | 3 | 13.04 | 0 | 0 | 15 | 65.22 | |||

| Segment reports serving administrators’ function of decision making: 60.87% on average | |||||||||||||

| Decision1 | 7 | 30.43 | 8 | 34.78 | 4 | 17.39 | 1 | 4.348 | 20 | 86.96 | |||

| Decision2 | 8 | 34.78 | 7 | 30.43 | 3 | 13.04 | 1 | 4.348 | 19 | 82.61 | |||

| Decision3 | 7 | 30.43 | 5 | 21.74 | 3 | 13.04 | 0 | 0 | 15 | 65.22 | |||

| Decision4 | 6 | 26.09 | 4 | 17.39 | 1 | 4.348 | 0 | 0 | 11 | 47.83 | |||

| Decision5 | 3 | 13.04 | 1 | 4.348 | 1 | 4.348 | 0 | 0 | 5 | 21.74 | |||

Note:

Controlling1: Controlling the implementation of plans, tasks and progress of each division

Controlling2: Controlling revenues and expenses of the sales department in detail

Controlling3: Controlling the production and product quality of the production department in detail

Evaluation1: Evaluating performance of each division

Evaluation2: Evaluating staff capacity through performance of each division

Evaluation3: Evaluating overall business performance

Decision1: Making decisions relating to products, goods and services

Decision2: Making decisions on human resources including recruitment, training, dismissal, pay raises and bonuses

Decision3: Making decisions relating to norms, cost estimates, plans and tasks of each division

Decision4: Doing research on and analysis of competitors of revenue-generating divisions

Decision5: Other effects: Comparing, contrasting and checking information and data

Segment reports serving administrators’ function of controlling (57.36% on average) is considered in 3 aspects: they are used to help control the implementation of plans, tasks, and progress of each segment by 78.26% of enterprises, control revenues and expenses of the sales department in detail by 73.91% and control the production and product quality of the production department in detail by 73.91%. In the implementation of the function of controlling, segment reports are used to compare plans with performance based on each set target. For sales areas such as drugstores, distribution companies, drug agents, wholesale and retail distribution channels, each province, each region, each nation, segment reports help monitor closely revenues and expenses, fluctuations of these two indicators of each region, detect deviations and abnormalities in the operation process and find causes. In controlling the production and product quality in detail, segment reports help consider each individual product and each separate product group of the production department and workshop. Because pharmaceutical industry is a special manufacturing one, and pharmaceutical products have direct impacts on human health, manufacturing workshops need to comply with strict pharmaceutical manufacturing regulations such as GMP standards, manufacturers’ standards,...

Segment reports serving administrators’ function of performance evaluation (76.81% on average): to perform this function, administrators often use the indicator of performance of each division, which is used by 91.3% of enterprises, the highest percentage. The indicator of performance is usually suitable for revenue-generating divisions such as sales department and marketing department. Segment reports also help to evaluate staff capacity through the performance of each division, which is used by 73.91% of enterprises; The indicator of evaluating the overall business performance is used by 65.22% of enterprises; to perform this function, segment reports are combined with administrative management reports so that administrators can make the most comprehensive evaluations of their business activities in all aspects including finance, human resources and processes. Administrators make their decisions based on these reports.

Segment reports serving administrators’ function of decision making (60.87% on average): Decision making is an important function performed by administrators, 86.96% of enterprises use segment reports to help make decisions relating to products, goods and services, such as decisions on pricing, sales and markets; 82.61% of enterprises use them to help make decisions on human resources such as recruitment, training, dismissal, pay rises and bonuses; 65.22% for decisions relating to norms, cost estimates, plans and tasks of each division and adjustments of norms, cost estimates, plans and tasks for each division; 47.83% for decisions related to competitors of revenue-generating divisions. Business decisions vary greatly depending on the management viewpoint of each enterprise, at each period of time. For example, information on production costs, prices and business results of each type of product, each business area is used to make decisions on what type of product to manufacture more or less and what business areas to expand or narrow; whether to continue to manufacture products and then sell them or use existing equipment to do outsourcing work for other enterprises; or offering reasonable pricing frameworks for market types, offering appropriate marketing and promotion policies to maximize profits and minimize business risks. Information on the use of machinery and equipment is used to make decisions to maximize machinery and equipment capacity, invest in new machinery and equipment, or replace and repair old machinery and equipment to improve their use efficiency in workshops. Information on the situation of receivable debts is used to make reasonable credit policies to urge debt recovery, as well as encourage debtors to pay their debts on time to minimize inability to collect debts. Information on liabilities, loans and borrowing costs is used to make repayment plans, select appropriate sponsors to make the most of capital in payment and reduce borrowing costs to the lowest level.

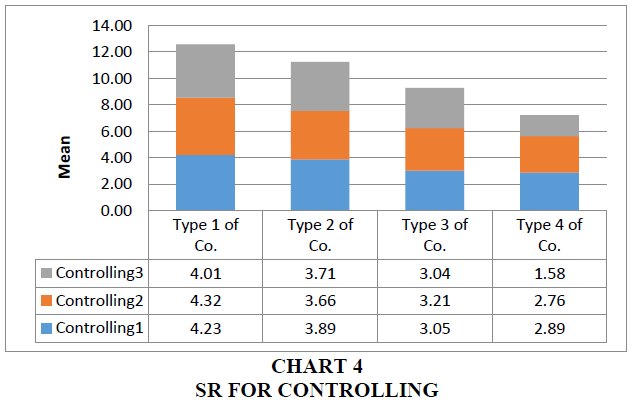

Chart 4 shows the evaluation of the advantages of segment reporting in management of companies including Joint Stock Co., Co., Ltd., Single-member Co., Co., Ltd., Private Co. C? th? nh? sau:

Controlling1: Controlling the implementation of plans, tasks and progress of each division

Controlling2: Controlling revenues and expenses of the sales department in detail

Controlling3: Controlling the production and product quality of the production department in detail

Chart 4 shows that Joint Stock Co., has the highest frequency with means ranging from 4.01 to 4.32, it is followed by Co., Ltd., with means ranging from 3.66 to 3.89, Single-member Co., Ltd., with measn ranging from 3.04 to 3.21 and private Co. with means ranging from 1.58 to 2.89. Considering each category, the frequency of usage decrease from controlling1, controlling2, to controlling3. Especially, controlling3 is not used by Private Co. with mean =1.58. the reason is that they are small enterprises with simple controlling processes so they can control the production processes directly and there is no need to use segment reporting.

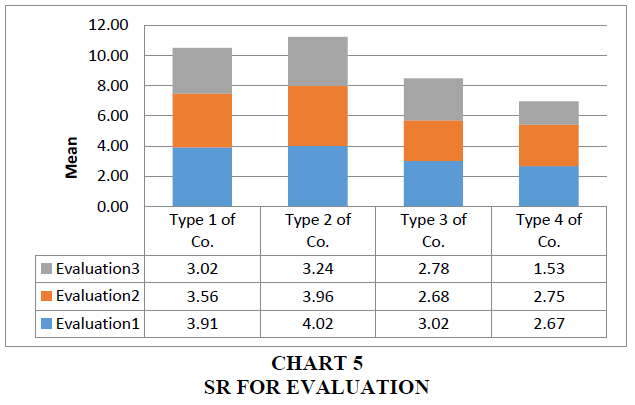

Chart 5 represents segment reporting for evaluation of managers in 3 aspects:

Evaluation1: Evaluating performance of each division

Evaluation2: Evaluating staff capacity through performance of each division

Evaluation3: Evaluating overall business performance

Unlike the controlling fuction above where there is a decreasing rule in the use of segment reporting by type of enterprises including Joint Stock Co., Co., Ltd., Single-member, Co., Ltd., Private Co and by controlling content from controlling1, controlling2, controlling3. In this evalutation function, the use of segment reporting does not follow any rule. Specifically, evaluation1 is applied frequently by Co., Ltd., mean = 4.02, evaluation1 is not used by Joint Stock Co., while evaluation1 and evaluation2 are frequently used by Joint Stock Co., Co., Ltd., with means ranging from 3.56 to 3.96. Furthermore, evaluation1, evaluation2, evaluation3 are used occasionally by Single-member Co., Private Co. means ranging from 2.68 to 2.78. Compared to controlling fuction, evaluation has smaller means.

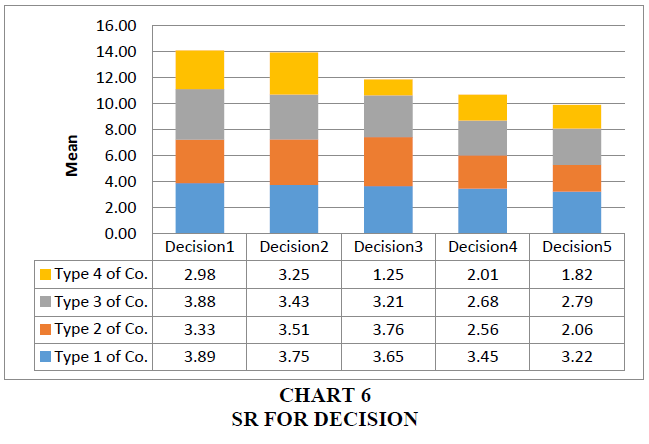

Chart 6 represents segment reporting for decision making of managers. In this study, decision making is examined in 5 following aspects:

Decision1: Making decisions relating to products, goods and services

Decision2: Making decisions on human resources including recruitment, training, dismissal, pay rises and bonuses

Decision3: Making decisions relating to norms, cost estimates, plans and tasks of each division

Decision4: Doing research on and analysis of competitors of revenue-generating divisions

Decision5: Other effects: Comparing, contrasting and checking information and data

This is the fuction with the lowest mean value compared to controlling and evaluation. Basically, decision making fuction also decrease by type of enterprises and type of decision. It can be divided into three following groups: (i) Group 1: frequently using segment reporting to make Decision1, Decision2, Decision3, Decision4 including Joint Stock Co., Co., Ltd., Single-member Co., Ltd., means ranging from 3.43 to 3.98; (ii) Group 2: occasionally using segment reporting to make Decision1, Decision2, Decision3, Decision4 inclduing Joint Stock Co., Co., Ltd., Single-member, Co., Ltd., Private Co means ranging from 2.68 to 3.33; (iii) Group 3: not using segment reporting to make Decision5 including Private Co. mean = 1.82.

Comments

In-depth interviews of 23 pharmaceutical enterprises in Hanoi showed that segment reporting has been implemented in most enterprises. However, some enterprises have not been fully aware of the importance of segment reporting, so they have not paid much attention to preparing and using segment reports. The content, format and effects of segment reports still haven’t meet administrators’ requirements, specifically:

Regarding the content and format, reports provided to administrators are still mainly financial statements with some additional information required by administrators. Therefore, these reports have not provided orientations of production and business activities, performance results and analysis of fluctuations between plans and results. There have been just information on detailed accounting and past information but no predictions for the future. Segment reports have not been regularly updated with all changes inside and outside enterprises and business leaders have not been based their decisions much on management accounting reports. Segment reporting in many enterprises has not been really clearly developed. It is single, spontaneous and not synchronized. 65.2% of enterprises claimed that their segment reporting is not suitable with their actual situations, only 34.8% of enterprises said their segment reporting is suitable.

Segment reports of pharmaceutical enterprises are drawn up simply, not yet designed in a complete and synchronous manner to serve administrative requirements. The content is mainly interpretation, data interpretation or explanation without necessary anticipation for the future. Segment reports mainly contain information on realized revenues and expenses, not such issues as provision expenses for risks including natural disasters, exchange rate fluctuations, and environmental treatment costs which affect operations and business results of enterprises. Therefore, the use of information from the segment reporting system for management and administration activities of corporate governance levels is still limited.

The identification of the reporting department of enterprises is still very confusing, so it has not tapped and assessed the effectiveness of each department in many different aspects. Most businesses only identify divisions by item, by market and by department, ignoring many other criteria. For example, APS Co., Ltd. has 4 product groups, with nearly 20 types of products and markets in Vietnam’s Northern provinces and Laos but its segment reports are only determined by commodity and product group. ThaiBinh Pharmaceutical Co., Ltd has many distribution channels such as wholesale system, retail system, agent system but its segment reports focus only on items and product groups. Enterprises only pay attention to segment reports of revenue-generating divisions such as sales departments but do not mention reports of indirect areas such as production workshops and management departments. A number of large enterprises such as HoaLinh, HaNam, KienVuong and MinhDuong, with the support of accounting software, have created commodity codes of goods and materials according to each medicine, each type of group, each customer, each geographical zone, but the exploitation of reports is inflexible, and ineffective.

Regarding the use of segment reporting to control activities, evaluate performance and make decisions, business administrators have not fully tapped the uses of segment reports in the management and operation process. Due to many reasons including management habits, level of accounting, and work habits, segment reports are only formal. Segment reports have not focused on geographic areas, sales departments, and goods, so the inspection and evaluation to determine which departments and divisions are operating effectively are very difficult. Enterprises have yet to analyze factors affecting cost fluctuations, revenue changes and consumption. Businesses do not prepare reports which analyze differences between reality and estimates or norms to help administrators have bases for decision making. Information in reports is simple and fragmented, not interconnected so it is difficult to use and assess on a large scale. Indirect divisions that generate revenues are almost unreported.

Information provided by segment reporting helps administrators consider and have bases for choosing the most effective plans and decisions. In addition to businesses that are interested in using information provided by segment reporting in management and operation to improve the efficiency of their resources, enhance their competitiveness to dominate the market share, and maximize corporate values, there are still many enterprises which have not paid due attention to management accounting in general and segment reporting in particular. Enterprises are interested in management accounting and making segment reports, but information is incomplete, the quality of information is not high and does not help much for the management and administration of enterprises. It is very necessary to raise awareness of leaders and accountants about the role of segment reporting, and improve knowledge of segment reporting so that segment reports will well serve provision of management information for businesses.

Recommendations

To meet requirements of providing information for business administrators, pharmaceutical enterprises in Hanoi need to prepare reports in groups which provide information on performance results, and on controlling, evaluation, and decision making, specifically:

a. Develop a department reporting system to provide information on performance results: To provide information on performance results, pharmaceutical enterprises should make reports on production and business activities according to the center of responsibility, showing expenses, revenues, profits and expense-to-sale ratios, profit margin, the return on equity, capital divided by management level, and other information such as the cost of inventory at the end of the period, outstanding receivable debts, uncompleted production and business expenses at the end of the period, outstanding prepaid expenses at the end of the period, cost of losses in the period for each expense center, revenue center, profit center and investment center.

b. Developing a department reporting system to control and evaluate performance: To control and evaluate activities of divisions, it is required to make reports on control of expenses, revenue and results. This is essentially a difference report which clearly identifies the cause of the discrepancy and the differential influence of each factor.

By comparing the actual figures and targets and plans and comparing with the same period of the previous year horizontally and vertically, both in absolute numbers, in relative numbers and with specific causes specified, reports point out reasons which can affect the realization of targets, while management accounting uses the continuous replacement method to assess the influence of each factor on results of the realization of targets. Therefore, there will be reasonable solutions or adjustments in the coming period.

Depending on the requirements and management level as well as the professional level of accounting and the level of modern equipment, it is necessary for enterprises to carry out analysis and report important issues such as actual production and consumption volumes, production cost, market production price, selling expense, corporate management cost and fixed asset-using situations. Pharmaceutical enterprises can prepare reports on evaluation of the investment center's performance, analysis of changes in cost of goods sold, analysis table of employee usage, and analysis table of business results of each department.

Develop a Segment Reporting System for Decision Making

Through the actual report on variable costs, fixed costs, consumption and sales of pharmaceutical products, management accounting determines the criteria for departments’ average conversion cost, average fixed cost, average selling price to provide information related to the cost, volume, and profit relationship to help executives apply the relationship analysis. Should they make decisions about whether to continue producing and consuming certain types of products? Is there any further expansion in certain market areas? With excess capacity, should enterprises promote production of certain kinds of products? Or which level can raw material prices be reduced to? Should enterprises increase or decrease the type of variable fee and charge to increase consumption and sales? To make these decisions, pharmaceutical enterprises need to develop a reporting system based on information processing methods for decision making, such as analysis report on cost-benefit-cost relationship, detailed report on profits by item, detailed report on profits by geographical area, and detailed profit report in units. In addition to the above-mentioned control, evaluation and decision-making reports, depending on business activities of enterprises, management accounting collects and analyzes relevant information for business administrators to make rational management decisions.

Recommendations for Further Research

The study can be conducted on a large scale using questionnaires to assess the use of segment report as well as how the segment report is developed and designed. Whereby, factors affecting the development and design of segment report can be identified and group analysis, comparison among types of enterprises, enterprise size, and business sectors can be conducted.

References

- Alfonso, E., Hollie, D., &Yu, S.C. (2012). Managers' segment financial reporting choice: An analysis of firms' segment reconciliations. The Journal of Applied Business Research, 6(28), 1413-1444.

- An, T.T.T. (2013). Researching the status quo and complete solutions to present and publish segment reports of companies listed on Ho Chi Minh Stock Exchange, Master thesis.

- Birt, J., & Shailer, G. (2011). Forecasting confidence under segment reporting, Accounting Research Journal, 24(3), 245- 267.

- Hang, T.B. (2014). Completing the financial reporting system in construction enterprises operating under the parent company - subsidiary model. Doctoral thesis in Economics, Academy of Finance, Hanoi.

- Hong, T.T.N. (2011). Organizing the accounting reporting system in small and medium-sized enterprises in Vietnam. The Academy level research project.

- Huong, T.T.B. (2011). Completing the accounting reporting system in animal feed producing and trading enterprises in Vietnam. Doctoral thesis in Economics, Academy of Finance, Hanoi.

- Ijiri, Y. (1995). Segment statements and informativeness measures: Managing capital vs. managing resources. Accounting Horizons, 9(3), 55.

- Ronen, J., & Livnat. J. (1981). Incentives for segment reporting. Journal of Accounting Research, 19(2), 459-481.

- Loi, V.N. (2003). Completing the financial reporting system to provide information for corporate financial analysis in Vietnam. Doctoral thesis in Economics, Academy of Finance, Hanoi.

- Mai, T.T.P. (2013). Building a segment reporting system for internal management at Vietnam Tourism Company in Da Nang. Retrieved from https://www.pwc.com/vn/en/publications/2019/pwc-vietnam-dbg-2019.pdf

- Michael, L., Malcolm. P., & Glynn. L. (2013). Management Accounting Practices of (UK) Small-Medium-Sized Enterprises (SMEs). Improving SMEs performance through management accounting education. CIMA, 9(4).

- Prencipe, A. (2004). Proprietary costs and determinants of voluntary segment disclosure: evidence from Italian listed companies. European Accounting Review, 13(2), 319-340.

- Qian, W. (2009). Three assays on segments reporting. Doctor of philosophy, School of the University of Kansas.

- Quang, P. (2002). Orientation of building a management accounting reporting system and applying it to Vietnamese enterprises. Doctoral thesis in Economics, National Economics University, Hanoi.

- Roberts, C.B. (1989). Forecasting earnings using geographical segment data: some Ukevidence. Journal of International Financial Management and Accounting, 1(2), 130-51.

- Twombly, J.R. (1980). An emperical analysis of the information content of segment data in Annual reports from an FTC prospective.in disclouse criteria and segment reporting, ed. R. Barefield and G. Holsrom (Gainesville: University of Florida Press), 56-96.