Research Article: 2021 Vol: 24 Issue: 3

Sales, operating cost and moderating effect of working capital on net profit of Indonesian consumer goods manufacturers

Nanu Hasanuh, Universitas Singaperbangsa Karawang

Hari Sulistiyo, Universitas Singaperbangsa Karawang

Sri Suartini, Universitas Singaperbangsa Karawang

Gusganda Suria Manda, Universitas Singaperbangsa Karawang

Harpa Sugiharti, Universitas Singaperbangsa Karawang

Citation Information: Hasanuh, N., Sulistiyo, H., Suartini, S., Manda, G. S., & Sugiharti, H. (2021). Sales, operating cost and moderating effect of working capital on net profit of Indonesian consumer goods manufacturers. Journal of management Information and Decision Sciences, 24(3), 1-8.

Abstract

The purpose of this study is to examine the influence of moderating effect of working capital in the influences of sales and operating cost on net profit. The population is the consumer goods manufacturers listed in Indonesia Stock Exchange (IDX) period 2015-2017. Sample selection method used purposive sampling and obtained 23 consumer goods manufacturers. This research used secondary data that obtained from the annual financial statement of manufacturing sector in IDX. Data analysis is conducted through regression analysis by utilizing the Moderation of Absolute Difference Method using software SPSS version 22. The result showed that partially, the variables of sales and operating cost have a positive and significant effect on net profit. This study empirically proves that working capital is a moderating variable capable of moderating the influence of the sales and operating cost variables on net profit in manufacturing companies.

Keyword

Sales, Operating cost; Working capital; Net profit; Manufacture.

Introduction

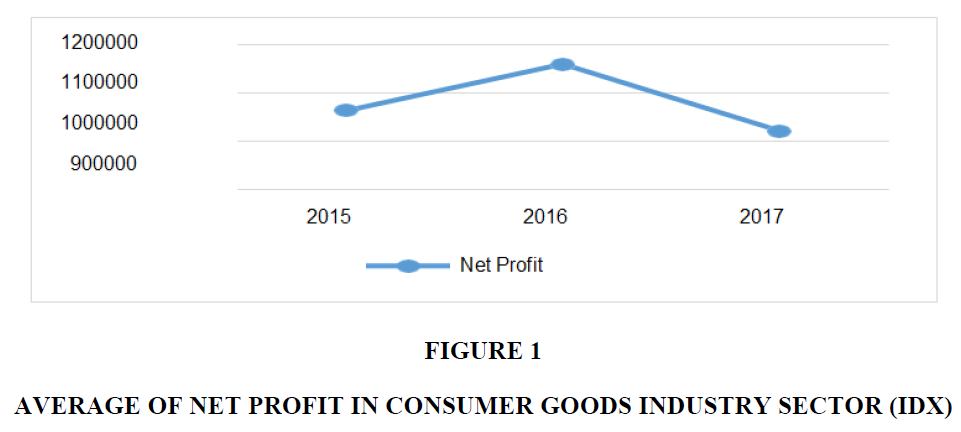

In general, the company established has a target or goal to be achieved. Although the goals between one company and another company are different, but the main goal of a company is to get maximum profit (Smith et al., 1987). According to Cashmere (2015), the ultimate goal to be achieved by a company that is most important is to get a profit or maximum profit, besides other things. Profit is the difference between income over expense related to its business activities, used as the indicator of company’s continuity so that the company's operational activities can run smoothly. Profit obtained is an indicator that can be used to measure the company's financial performance and can be used as a basic for determining the company performance for a period (Warren et al., 2011). Figure 1 showed the average of net profit in consumer goods manufacturers listed in IDX during 2015-2017.

Figure 1 showed that the average level of net profit from year to year has changed. Net profit of consumer goods manufacturing fluctuated every year. From the graph above, it is known that in 2016 net profit increase from the previous year, while in 2017 the net profit drastic decline from previous year. Thus, indicating that the condition of the company is not in a favorable condition. To find out the success of a company in obtaining net profit can use the total of working capital owned by company. Working capital is the one component that available in the company that used to operate the company activities. Working capital is also reduce risk and increase profit. Aside from increasing in working capital, the profit of company also affected by other factors, namely sales. Sales is the company activities and the main source of the company income. Teratai (2017) outlined there is a close relationship regarding sales to the increase in the company's net profit in this case can be seen in the company's income statement, because in this case the profit will arises if the sale of products is greater than the costs incurred. To carrying out the company activities, a company will not be separated from the cost or operating cost incurred, because the cost is a sacrifice of the company in order to obtain profit. Jusuf (2014) state that a company can reduce operating costs, to increase net profit. Likewise, vice versa, if there is a waste of costs (such as excessive use of office equipment) will result in reduced net profit.

The objective of this research is to examine the influence of working capital, sales and operating cost, both partially and simultaneously, on net profit in consumer goods manufacturers listed in Indonesia stock exchange during 2015-2017. This study aims to analyze the influence of working capital, sales and operating cost on net profit by empirically studying the consumer goods manufacturers listed in IDX during 2015-2017.

Literature Review and Hypothesis

The Influence of Sales (X1) on Net Profit (Y)

One of the information that is usually presented in the income statement is income. It reflects the result of a company's main activity of sales. In general, companies conduct sales activities to obtain maximum profits so that the company can continue to operate (Tjiptono, 2012; Swastha, 2010; Cashmere, 2015). Research on the effect of sales on net profit has been carried out by Teratai (2017), Tumanggor et al. (2017), and Hidayanti et al. (2018) showed that sales have a significant effect on net profit. Risyana and Suzan (2018) showed that sales have a positive effect on net profit. Ferliyanti (2019) showed that sales have a positive effect on net profit. The higher the total sales that are successfully obtained by a company, the higher net profit the company will get. Thus, the hypothesis proposed is:

H1: There is a significant effect of sales on net profit in Indonesian manufacturing companies.

The Influence of Operating Cost (X2) on Net Profit (Y)

In the day to day operational activities of companies, companies need supporting costs so that the company's operational activities become smooth, namely operating costs (Kieso et al., 2011; Muneeb Mehta, 2014). The smaller the operating costs of a company, the greater the profit the company. Research on the influence of operating costs on net profit has been carried out by Tumanggor et al. (2017) showing that operating cost has a negative effect on net profit. Risyana and Suzan (2018) showed that operating cost has an effect negative on net profit. Hidayanti et al. (2018) showed that of research if operating costs have a significant effect on net profit. This means that the greater the operating cost incurred by the company, the smaller net profit that will be obtained, the smaller operating cost incurred by the company, the greater net profit that will be obtained.

H2: Operating cost significantly influences the net profit of Indonesian manufacturing companies.

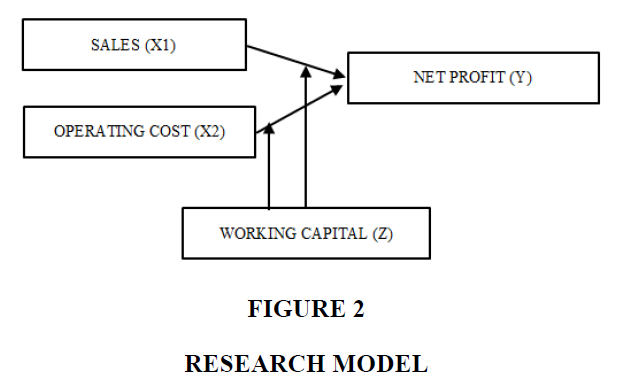

The Influence of Working Capital on Net Profit

In carrying out its business activities, companies need to be supported by adequate facilities and infrastructure. This support can be obtained in terms of working capital which should be in the company (Subramanyam & Wild, 1996; Harahap, 2011). With working capital, allowing the company to operate smoothly, the company also will not experience financial difficulties, so the company will get a profit (Ismail, 2017). Research on the effect of working capital on net profit has been done by Teratai (2017) showed that working capital has a significant effect on net profit. Zahara and Zannati (2018) showed that working capital has a positive and significant effect on net profit. This means that the increased working capital owned by a company, net profit obtained by the company will also increase (Figure 2).

H3: Working Capital is able to strengthen the positive effect of sales on net profit.

H4: Working Capital is able to weaken the negative effect of operating cost on net profit

H5: Sales and operating cost simultaneously influence the net profit.

Research Methodology

The method used is quantitative research methods. According to Sugiyono (2016), quantitative research methods can be interpreted as research methods based on the philosophy of positivism, used to examine certain populations or samples, data collection using research instruments, data analysis is quantitative/statistical, with the aim of testing hypotheses that have been set. The empirical investigation was conducted to examine the influence of working capital, sales, and operating costs on net profit on consumer goods manufacturing.

The population in this study is the consumer goods manufacturers listed in the Indonesia Stock Exchange period 2015-2017. This research sample was taken by purposive sampling technique. Based on the sampling criteria, the total samples used in this study were 23 companies.

The method of data analysis in this study is regression analysis with The Absolute Difference Method. There are conditions that should be fulfilled before the regression analysis, namely classical assumption test that consist of normality test, multicollinearity test, autocorrelation test and heteroscedasticity test. Hypothesises were tested in the form of partial and simultaneous effects. Partial hypothesis testing is done by t-test, while simultaneous testing is done by the F-test.

Equation function in this study is formulated as follows:

Where, Y = Net Profit; α = Constants; β1 β2 β3 = Independent Variable regression coefficient X1 = Sales; X2 = Operating Cost; X3 = Working Capital; e = The level of error.

Results

The results of the descriptive statistical test are shown in Table 1.

| Table 1 Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std Dev. | |

| Net Profit | 69 | 3087 | 12762229 | 1482108.52 | 2845602.434 |

| Working Capital | 69 | 30626 | 27697384 | 4107295.81 | 6914501.595 |

| Sales | 69 | 216952 | 99091484 | 15299579.01 | 26578341.612 |

| Operating Cost | 69 | 65096 | 11307271 | 2196330.74 | 3005696.504 |

Furthermore, normality test was conducted by using statistical analysis with the Kolmogorov Smirnov (Table 2).

| Table 2 One-Sample Kolmogorov-Smirnov Test | ||

| Unstandardized Residual | ||

| N | 69 | |

| Normal Parametersa,b | Mean | 0.0000000 |

| Std. Deviation | 0.46611515 | |

| Most Extreme Differences | Absolute | 0.079 |

| Positive | 0.040 | |

| Negative | 0-.079 | |

| Test Statistic | 0.079 | |

| Asymp. Sig. (2-tailed) | 0.200c,d | |

Table 2 showed a significant Kolmogorov-Smirnov value at 0.200>0.05. Thus, the residuals for data are normally distributed or have met the assumptions of normality. In addition, multicollinearity test aims to test whether the regression model found a correlation between independent variables. The results of the multicollinearity test were shown in Table 3.

| Table 3 Multicollinearity Test | ||

| (Constant) | Tolerance | VIF |

| Ln Working Capital | 0.142 | 7.044 |

| Ln Sales | 0.112 | 8.947 |

| Ln Operating Cost | 0.141 | 7.094 |

Table 3 showed that it has tolerance value of variables are more than 0.1 and the VIF are also have value between 1-10 so there is no multicollinearity in these variables. Autocorrelation test is a test aims to test whether in the linear regression model there is a correlation between the error in a period with the period before. The Durbin Watson value is 2.134 and this value is compared with the table value using a significant value of 5%, the number of samples of 69 (n) and number of independent variables (k = 3). The Durbin Watson value showed du value is 1.7015< 2.134 < 2.2985 (Table 3). Moreover, the moderating regression analysis was conducted. First analysis was to perform moderation test effect of sales (X1) to net profit (Y) moderated by working capital (Z) (Table 4).

| Table 4 Moderation Test of Sales and Operating Cost, Net Profit, and Working Capital | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1* | 0.977a | 0.954 | 0.952 | 0.43506 |

| 2** | 0.969a | 0.940 | 0.937 | 0.49639 |

The value of adjusted R2 is 0.952 or 95.2%, which showed that the influence of the dependent variable on net profit (Model 1). The results also showed the value of the determination coefficient (Adjusted R-Square) is 0.937 (Model 2). This showed that the influence given by operating cost (X2) and working capital (Z) on net profit (Y) is 93.7%.

Table 5 showed the results of partial testing of Model 1. It showed that the variable of sales (X1) obtained the Sig. value = 0.000 <0.05. Thus, there is a positive effect of sales on net profit. This confirms the acceptance of the hypothesis H1. Likewise, there is an effect of working capital on net profit with a Sig. value of 0.000 <0.05.The absolute difference value of the sales (X1) and working capital (Z) showed that statistically these two variables significantly affect the net profit (Y). Thus, working capital is able to moderate the effect of sales and net profit. Thus, it can be said that working capital is a quasi-moderating variable. The next analysis was to examine a positive value of Zscore (WC) on Y. This showed the moderating effect of Z in the effect of X1 (sales) on Y (net profit) with significant value of 0.001 <0.05). Thus, H3 is accepted.

| Table 5 Sales, Net Profit and Working Capital | ||||||

| Model (dependent: NP) | Unst. Coefficients | Std. Error | Beta | t | Sig. | |

| 1 | (Constant) | 12.318 | 0.086 | |||

| Zscore(SALES) | 0.636 | 0.132 | 0.321 | 4.810 | 0.000 | |

| Zscore(WC) | 1.422 | 0.136 | 0.718 | 10.446 | 0.000 | |

| SNM1 | 0.808 | 0.223 | 0.109 | 3.621 | 0.001 | |

| 2 | (Constant) | 12.286 | 0.118 | 103.729 | 0.000 | |

| Zscore(OC) | 0.446 | 0.139 | 0.225 | 3.201 | 0.002 | |

| Zscore(WC) | 1.587 | 0.134 | 0.802 | 11.821 | 0.000 | |

| SNM2 | 0.734 | 0.269 | 0.095 | 2.728 | 0.008 | |

Table 5 also showed that the operating cost (X2) has the Sig. value = 0.002 <0.05. Thus, there is a negative influence of pperating cost on net profit. This confirms the acceptance of the hypothesis H2. Likewise, there is a moderating effect of working capital on net profit with a sig. value of 0.000 <0.05. The absolute difference value of operating cost (X2) and working capital (Z) showed the statistically accepted effects on the net profit (Y). It is empirically stated that working capital affects the relationship between operating cost and net profit (Model 2). Hence, working capital is a Quasi-moderating variable (Sig. Value=0.008 <0.05). Thus, H4 is accepted.

In Table 6, the Sig. value for Model 1 is 0.000<0.05. It means that all independent variables are able to explain the dependent variable of net profit. The results also showed that the hypothesis 5 was accepted, indicated by the Sig value of 0.000 <0.05. Thus, all independent variables are capable of explaining the dependent variable of Net Profit (Model 2).

| Table 6 ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1* | Regression | 254.028 | 3 | 84.676 | 447.359 | 0.000a |

| Residual | 12.303 | 65 | 0.189 | |||

| Total | 266.331 | 68 | ||||

| 2** | Regression | 250.315 | 3 | 83.438 | 338.627 | 0.000a |

| Residual | 16.016 | 65 | 0.246 | |||

| Total | 266.331 | 68 | ||||

Discussion

The results showed that working capital has a significant effect on net profit in consumer goods manufacturers listed in the Indonesia Stock Exchange during 2015- 2017. The results of this study are supported by Teratai (2017), Tumanggor et al. (2017) and Zahara (2018) stating that that working capital has a partial influence on net profit. The results of this study are supported by Teratai (2017), Tumanggor, 2017; and Hidayanti (2018) stating that that sales have a partial influence on net profit. The results of this study are also in line with Hidayanti (2018) stating that that there is a close relationship of sales to an increase in the company's net profit, that with the higher sales of products a company turns out to result in increased company profits. In the influence of sales on net profit, the results confirmed that sales are a source of income of manufacturing company. This is also assisted by an increase in the performance of company distributor in ensuring the quality the goods. In running a business, this sales process is the key to its activities (Al Hayek, 2018).

In term of influence of operating cost (X2) on net profit (Y), the results showed that in carrying out their activities, large companies certainly need money and will always incur operational costs. The results of this study are in line with Pasaribu (2017) stating that operating costs partially have no effect on net profit. However, the results of this study contradict with the Hidayanti et al. (2018) stating that that operating costs has an influence on net profit. Likewise, Tumanggor et al. (2017) stated that that operating costs have a negative effect on net profit. Risyana and Suzan (2018) stated that operating cost have a negative effect on net profit. Negative influence means that operating costs are inversely proportional with net profit.

Lastly, in the influence of working capital on net profit, the results affirm that working capital, sales and operating cost simultaneously contribute as much as 94.2% on net profit in manufacturing companies. It is argued that working capital rotates continuously within the company because to finance daily operations (Gulia, 2014; Bhunia, & Das, 2015; Bagh et al., 2016). Working capital consisting of cash, accounts receivable, and inventories must be utilized as efficiently as possible (Soewignyo, 2014). The working capital accommodates the possible adverse consequences arising from a decrease in the value of current assets, such as a decrease in the value of uncollectible receivables or a decrease in the value of inventories.

Conclusion

The results of data analysis showed that partially the variable of sales has a positive and significant influence on net profit in consumer goods manufacturers listed in Indonesian stock exchange period 2015-2017. Operating cost partially has a positive and significant influence on net profit in consumer goods manufacturers. The results also showed that sales and working capital simultaneously have a significant effect on net profit in manufacturing companies. Likewise, operating cost and working capital also have simultaneous effect on net profit in manufacturing companies. Lastly, the empirical investigation showed the moderating role of working capital in the relationship between sales, operating cost and net profit of Indonesian consumer goods manufacturers.

References

- Al Hayek, M. A. (2018). The Relationship Between Sales Revenue and Net Profit with Net Cash Flows from Operating Activities in Jordanian Industrial Joint Stock Companies. International Journal of Academic Research in Accounting, Finance and Management Sciences, 8(3), 149-162.

- Bagh, T., Nazir, M. I., Khan, M. A., Khan, M. A., & Razzaq, S. (2016). The impact of working capital management on firms’ financial performance: evidence from Pakistan. International Journal of Economics and Financial Issues, 6(3), 1097-1105.

- Bhunia, A., & Das, A. (2015). Underlying relationship between working capital management and profitability of pharmaceutical companies in India. American Journal of theoretical and applied business, 1(1), 27-36.

- Cashmere. (2015). Financial Statement Analysis. Revised Edition, Eighth Edition. Jakarta: PT Raja Grafindo Persada

- Ferliyanti, H. (2019). The Effect of Production Costs, Operational Costs, and Sales on Net Profits in Manufacturing Companies Listed on the Indonesia Stock Exchange 2012-2016. Champion Familiar Journal, 4(1), 52-62.

- Gulia, R. (2014). Effects of working capital management on firms profits-evidence from the pharmaceutical sector. International Journal of Management and Social Sciences Research, (IJMSSR), 3(1), 103-107.

- Harahap, S.S. (2011). The 11th Printing Accounting Theory. Jakarta: Raja Grafindo.

- Hidayanti, F., Yahdi, M., & Wiayanti R.D.P. (2018). The Effect of Sales Volume and Operational Costs on Company Net Profit (Empirical Study of Food and Beverage Sub-Sector Manufacturing Companies Listed on the Indonesia Stock Exchange 2012-2016). Counting: Journal of Accounting, 1(3), 88-99.

- Ismail, R. (2017). Working capital-an effective business management tool. International Journal of Humanities and Social science invention, 6(3), 12-23.

- Jusuf, J. (2014). Credit Analysis for Account Officers. Jakarta: PT Gramedia

- Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2011). Intermediate Accounting, Problem Solving Survival Guide (Vol. 1). John Wiley & Sons.

- Muneeb Mehta, A. (2014). Impact of Operating Expenses on Net Profit Margin in Cement Sector of Pakistan. Interdisciplinary Journal of Contemporary Research in Business, 5(11), 284-293.

- Pasaribu, A.M. (2017). Operating Income and Operating Expenses on Net Profits at Food and Beverage Companies. Journal of Micro-Political Economy Entrepreneurs. 7(2), 173-180.

- Risyana, R., & Suzan, L. (2018). The Influence of Sales Volume and Operating Costs on Net Profit (a study on Food and Beverage Manufacturing Companies Listed on the Indonesia Stock Exchange for the 2014-2016 Period). eProceedings of Management, 5(2), 2449-2459.

- Smith, J. M., Skousen, K. F., Stice, E. K., & Stice, J. D. (1987). Intermediate Accounting: Comprehensive Volume. Thus,uth-Western Publishing Company.

- Soewignyo, T. (2014). Analysis of the effect of working capital, discounted prices, and sales on the net income of food and beverage manufacturing companies listed on the Indonesian stock exchange. JBE (Journal of Business and Economics), 72-85.

- Subramanyam, K. R., & Wild, J. J. (1996). Going ? concern status, earnings persistence, and informativeness of earnings. Contemporary Accounting Research, 13(1), 251-273.

- Sugiyono. (2016). Quantitative Research Methods, Qualitative, and R & D. Bandung: Alfabeta.

- Swastha, B. (2010). Sales Management. Yogyakarta: BPFE.

- Teratai, B. (2017). The Effect of Working Capital and Sales on Net Profit in Food and Beverage Sub-Sector Companies Listed on the Indonesia Stock Exchange for the 2011-2015 Period. Journal of Business Administration, 2(2), 297-308.

- Tjiptono, F., & Chandra, G. (2012). Strategic Marketing. Yogyakarta: Andi.

- Tumanggor, M., Dahen., L.D., & Saputra, S.E. (2017). The Influence of Operational Costs, Sales Volume, Working Capital and Total Asset Turnover on Net Profits in Metal and Similar Sub-Sector Companies Listed on the Indonesia Stock Exchange. Undergraduate thesis, STKIP PGRI West Sumatera.

- Warren, C., Reeve, J., & Duchac, J. (2011). Financial & managerial accounting. Nelson Education.

- Zahara, A., & Zannati, R. (2018). The Effect of Total Debt, Working Capital, and Sales on Net Profit in Coal Sub-Sector Companies Listed in Bei. Journal of Management and Business Research (JRMB) Faculty of Economics UNIAT, 3(2), 155-164.