Research Article: 2017 Vol: 20 Issue: 3

Russian Rouble: A Century Past and Present

Galina M Tarasova, Novosibirsk State University of Economics and Management

Alexandra I Shmyreva, Novosibirsk State University of Economics and Management

Lyudmila Y Rudi, Novosibirsk State University of Economics and Management

Abstract

The present study aims to review and analyze the main stages in the development of the Russian rouble in the recent century from 1913 to present to determine the main factors influencing the variations. The period was divided into different intervals including 1913, the significant monetary reforms of 1922-1924, 1947, 1961, 1998, as well as the current period.

Keywords

Russian Rouble, Monetary Reforms.

Introduction

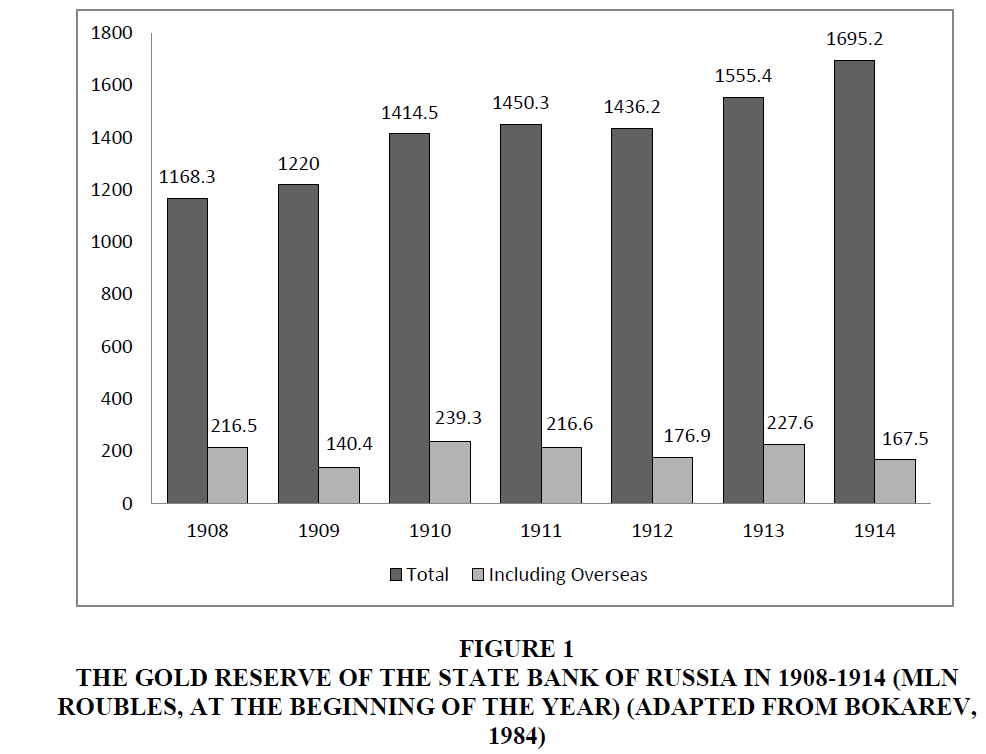

The turn of the XIX-XX centuries in Russia was marked by the monetary reform, which radically changed the position of the Russian rouble, making it one of the most stable world currencies (Stanislav, 2015). We are talking about the reform of 1895-1897 made by Witte. The monetary system was transformed based on gold monometallic. The state monetary unit of Russia was the rouble, containing 17,424 fractions of pure gold or 0.7742 g. Gold coins were freely minted both from gold belonging to the treasury, as well as from metal belonging to private persons; they freely circulated (Guseynov, 2014). Paper money was freely exchanged for gold without any limit on the amount (Kurbanova, 2014). The State Bank of the Country (Gosbank) issued paper money in accordance with the needs of monetary circulation, but under the security of gold. The gold reserve of the Gosbank was the basis of the new monetary system of Russia. Its size and dynamics can be judged from Figure 1.

Figure 1:The Gold Reserve Of The State Bank Of Russia In 1908-1914 (Mln Roubles, At The Beginning Of The Year) (Adapted From Bokarev, 1984).

For 1908-1914, the gold reserve of the Gosbank grew almost by 1.5 times: From 1168.3 million roubles up to 1695.2 million roubles. Though, a large part of this reserve was located abroad and served as coverage for international payments. But due to the accelerated accumulation of gold in the country, its part gradually declined-from 18.5% in 1908 to 9.9% in 1914. Such a gold reserve was not possessed by any of the European issuing banks. Information on the state of the gold reserve and issued banknotes by leading European issuing banks at the beginning of 1913 is given in Table 1.

| Table 1: Provision Of The Money Issue In Gold Reserve In European Countries In 1913 (At The Beginning Of The Year) (Adapted From Bokarev, 1984) | |||

| Bank | Gold reserve, million roubles |

% to Gosbank | Banknotes in circulation million roubles |

|---|---|---|---|

| State Bank of Russia | 1555 | 100 | 1494.8 |

| Bank of France | 1193 | 77.3 | 2196 |

| Reich bank, Berlin | 411 | 26.5 | 930 |

| Bank of England | 331 | 21.3 | 263 |

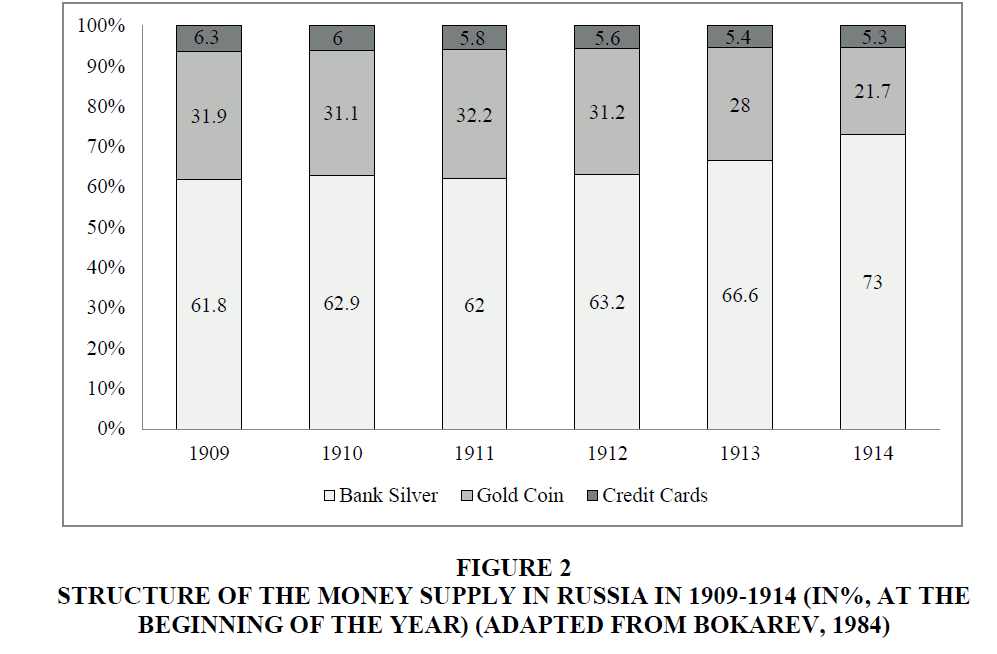

The data in Table 1 show that Russia, compared to other countries, had the strongest connection of the gold reserve of the State Bank and the issue of money. And this, on the one hand, ensured the stability of the monetary system and on the other hand, deprived it of its flexibility. With a reduction in the gold reserve, the emission of paper money had to be reduced. And this did not always correspond to the needs of an intensively growing economy, led to a shortage of money, which was partially replenished by different types of credit money. In 1909-1914 there were credit tickets, gold and silver coins in circulation. The idea of the structure of the money supply in this period is given in Figure 2.

Figure 2:Structure Of The Money Supply In Russia In 1909-1914 (In%, At The Beginning Of The Year) (Adapted From Bokarev, 1984).

Obviously, the main monetary unit of Russia was credit cards, the share of which in the structure of the money supply grew continuously. During the analysed period, it increased from 61.8% in 1909 to 73% in 1914, amounting to 1664.7 million roubles. The gold coin lagged behind the more convenient in circulation credit tickets and therefore its share in the structure of the money supply decreased from 31.9% to 21.7%, amounting to 494.2 million roubles. The exchange rate of the rouble with minor fluctuations kept at the level of gold parity-1 rouble equalled 2.16 German marks, 2.67 French francs, 0.105 British pounds sterling and 0.51 US dollar.

Strengthening of national monetary system and the credit system created the opportunity for accelerated modernization of Russia; helped to withstand the turmoil associated with the Russian-Japanese war and the revolution of 1905-1907. However, with the outbreak of the First World War, the gold standard collapsed. Russia, like all the belligerent countries, stopped exchanging paper money for gold and experienced all the negative consequences of this: Inflation, a decline in confidence in the rouble and its devaluation in the domestic and foreign markets. A new stage in the history of the Russian rouble has arrived.

During the war, the issuing money system was formed-the functions of the State Bank were reduced to the war financing and credit money was issued to cover the state's military expenditures. The February Revolution of 1917, having replaced the political form of state power, did not change the methods of war financing and regulation of monetary circulation. Military expenses were almost entirely covered by loans and paper money issue. But the Provisional Government initiated the two qualitatively new phenomena in the development of inflation. First, the destruction of a single monetary circulation and the emergence of parallel currencies with different rates; secondly, the effect of a peculiar inflationary multiplier: Price growth outstrips the growth of money supply and therefore money is devaluated faster than they are printed. The October Revolution of 1917 and the subsequent civil war only intensified these processes.

Therefore, the monetary reform of 1922-1924 was aimed at overcoming the consequences of the money-emission system. It pursued the goal of stabilizing monetary circulation, creating a single solid and stable currency.

The need for such a reform stemmed from the economic situation associated with the implementation of the new economic policy. The content of the monetary reform was reduced to the replacement of Soviet banknotes (Sovznaks) with new money-Soviet Chervonets, which were 25% guaranteed by gold and foreign currency. The monopoly right to issue them was submitted to the State Bank and the Treasury got the right to issue treasury notes. It should be noted that the political will of the country's leaders alone was not enough to carry out monetary reform. Necessary conditions for its successful implementation are deficit-free budget, denaturalization of payment and exchange relations, active balance of payments and the main-general development of the country's economy.

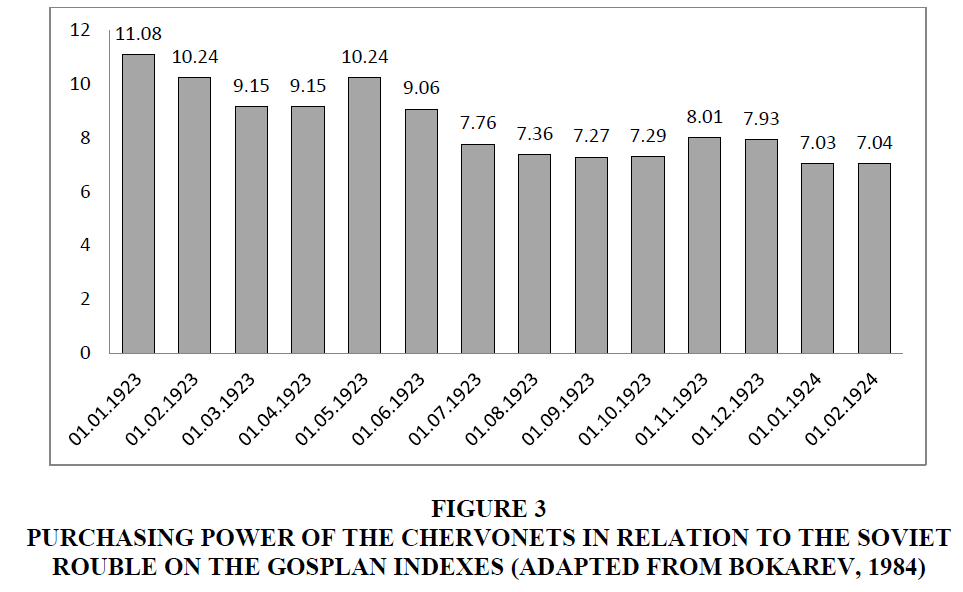

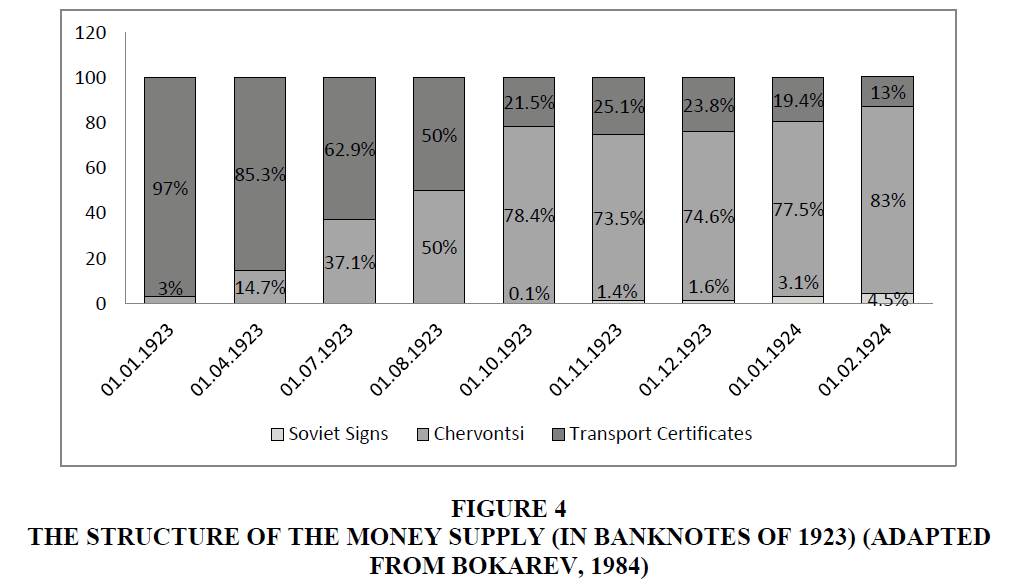

First of all, a denomination was carried out. 1 rouble of bank notes of the 1922 sample was equated with 10 thousand bank notes of past issues; 100 roubles of 1922 sample was equated with 1 million bank notes of past issues. In December 1922 a new banknote of the State Bank was introduced into circulation-the Chervonets. As a result, the country has a system of parallel currencies. These are two types of paper money: Sovznaks and Chervonets not connected by any constant relation. The process of devaluation of the Sovznaks, the main monetary unit in the country, was consciously supported by the state: The State Bank announced a rate of Sovznaks on a daily basis; taxes were collected only in Chernovtsy, etc. Therefore, the purchasing power of the Chervonets was high. State support ended in July 1923. The rate of the Chervonets began to be regulated mainly by stock exchanges and its purchasing power began to decline (Figure 3).

Figure 3:Purchasing Power Of The Chervonets In Relation To The Soviet Rouble On The Gosplan Indexes (Adapted From Bokarev, 1984).

However, Sovznaks, under the influence of a complex set of factors, gradually lost most part of the money function. Their part in the structure of the cash supply was steadily declining. Chervonets became the main currency of the country (Figure 4). Transport certificates, as small bills, partly served the functions of exchange money.

In February 1924, Decrees on the issue of state, treasury tickets (10 treasury roubles equated to 1 Chervonets) and the termination of emission of Sovznaks were issued. In March, the ratio between the Chervonets and the Sovznak is established: 50 thousand Sovznaks for 1 Chervonets. In May, the circulation of Sovznaks is stopped and until the end of the month they should be exchanged at the established rate. Thus, by the end of May 1924, the monetary reform was basically completed. Its main goal was achieved-the Sovznaks were completely withdrawn from circulation and replaced with treasury tickets and fractional coin. Though, the multiplicity of currencies has been preserved for some time due to the availability of transport certificates. From the second half of 1924 as a means of circulation, the payment obligations of the Narkomfin CentroCassa were also used. Chervonets was quoted on the domestic as well as on foreign markets. There was an alignment of the Chervonets and hard foreign currencies rates-the US dollar and the pound sterling. It kept at the gold parity level: 1 rub=0.516 US dollars and 0.106 pounds sterling. It may be said that the monetary reform was successful. However, immediately after its completion, the moderate emission of new money was replaced by an intensified one. As a result, the amount of money in circulation has increased dramatically.

The money issue was accompanied by the introduction of new samples of paper money into circulation. In addition, the money supply was no longer limited to cash. Increasing importance is acquired by cashless payments that increase the money supply. At the same time, the gold provision of banknotes was constantly decreasing and by the end of 1925 it exceeded the minimum norm of 25% (Table 2). The buying power of the Chervonets was falling, inflation began.

| Table 2: Issue Of Banknotes And Metal Monetary Reserves (In Million Roubles)(Adapted From Mekler, 1925). | ||||||||

| Date | Banknotes | Metal monetary reserves | % of provision | |||||

|---|---|---|---|---|---|---|---|---|

| In State Treasury | In circulation | |||||||

| Total | Gold | Reserve in total | Of gold | |||||

| Treasuries | Circ. | Treasuries | Circ. | |||||

| October 1, 1924 | 518.9 | 346.5 | 308.8 | 131.4 | 59.5 | 89.1 | 25.3 | 37.9 |

| November 1, 1924 |

562.1 | 370.3 | 326.5 | 131.4 | 58.1 | 88.2 | 23.4 | 35.5 |

| December 1, 1924 | 577.2 | 399.0 | 345.2 | 131.4 | 59.8 | 86.5 | 22.8 | 32.9 |

| January 1, 1925 | 596.0 | 410.8 | 351.8 | 142.0 | 59.0 | 85.6 | 23.8 | 34.6 |

| February 1, 1925 |

550.2 | 365.1 | 375.9 | 149.1 | 68.3 | 103.0 | 27.1 | 40.8 |

| March 1, 1925 | 560.6 | 376.9 | 377.8 | 152.1 | 74.6 | 100.2 | 27.1 | 40.4 |

| April 1, 1925 | 590.3 | 402.4 | 352.9 | 168.9 | 59.6 | 87.5 | 28.6 | 42.0 |

| May 1, 1925 | 604.4 | 408.6 | 306.9 | 179.9 | 50.8 | 75.1 | 29.8 | 44.0 |

| June 1, 1925 | 615.5 | 417.8 | 301.5 | 168.0 | 49.0 | 72.3 | 27.3 | 40.2 |

| July 1, 1925 | 664.7 | 460.1 | 285.6 | 169.1 | 43.0 | 62.1 | 25.4 | 36.8 |

| August 1, 1925 | 677.5 | 505.4 | 287.8 | 166.6 | 42.5 | 56.9 | 24.6 | 33.0 |

| September 1, 1925 | 702.8 | 566.6 | 295.9 | 168.4 | 42.1 | 52.2 | 24.0 | 29.7 |

| October 1, 1925 | 756.6 | 652.0 | 325.5 | 184.8 | 43.0 | 49.9 | 24.4 | 28.3 |

| November 1, 1925 | 765.7 | 719.2 | 330.1 | 184.8 | 43.1 | 45.9 | 24.1 | 25.7 |

| December 1, 1925 | 786.5 | 738.3 | 315.4 | 182.7 | 40.1 | 42.7 | 23.2 | 24.7 |

By the end of the 20’s, many components of the planned system of management are being formed, in which monetary circulation plays a secondary role. The system itself was formed after the crisis of the late 20's-the first half of the 30’s. The money circulation of the planned system of management was radically changed during the Great Patriotic War. Therefore, in the post-war period, a monetary reform was required. The monetary reform of 1947 pursued the goal of normalizing money circulation after the war and creating conditions for the abolition of the card system in the Soviet Union. The reform was initiated by the Resolution of the Council of Ministers of the USSR and the Central Committee of the CPSU (b) "On the Conduct of the Monetary Reform and the Abolition of Cards for Food and Industrial Goods" from 14 December 14, 1947. In accordance with this Resolution, new banknotes of the 1947 sample were introduced. It should be noted that the government explained this by the need to withdraw savings from speculative elements, plunderers of socialist property. However, these elements suffered less than others. The positive effect was that the monetary reform allowed to substantially tightening the money supply and due to this, basically eliminate the deficit of food and non-food products; created an opportunity during 1948-1954 to reduce retail prices in state trade. The increase in the purchasing power of the rouble allowed the government on March 1, 1950 to raise the rouble's exchange rate against foreign currencies and transfer it to a gold base. The gold content of the rouble was determined at 0.222168 g of pure gold. The basis for this was the Resolution of the Council of Ministers of the USSR from February 28, 1950 "On the transfer of the rouble to a gold base and on the appreciation of the rouble against foreign currencies." As a result, the dollar based on the gold parity began to cost 4 roubles instead of 5 roubles 30 kop. Of course, this was of great importance for the development of foreign trade.

It is believed that the monetary reform of 1947 created conditions for the non-inflationary development of the economy of the USSR and an increase in the standard of living of the population. But it turned out that the reduction in retail prices was not accompanied by a decrease in procurement and purchasing prices. After the reform of 1947, they grew and grew significantly (Bokarev, 1984). All this testified that inflation took place but in hidden forms.

On May 4, 1960, the Council of Ministers of the USSR adopted a Resolution "On changing the scale of prices and replacing the currently circulating money with new money." From January 1, 1961, banknotes of the 1961 sample were introduced-treasury notes worth 1, 3, 5, 10 roubles and banknotes worth 20, 50, 100 roubles. The banknotes in circulation were exchanged for new ones in a ratio of 10:1 without restriction. In the same proportion, prices for goods and services, income, including wages, were declining. A recalculation of the national debt and the established state parity of the rouble against foreign currencies were made based on the gold content of the rouble of 0.987412 g of pure gold. It was assumed that this would create conditions for controlling the money supply and limiting emissions. But this required changing the financial system and the pricing system. Since this was not done, the monetary reform of 1961 was reduced to a denomination and did not lead to a strengthening of the rouble. Immediately after its completion, the rouble rate began to fall, which was due to the imbalance between the commodity and the money supply under the old system of financing and subsidies. This cast doubt on solvency in international payments and led to a sudden decline in the scope of the rouble as a means of circulation domestically and internationally. It should be noted that the rouble actively participated in international payments mainly with the socialist countries. Gold and currency reserves continued to serve as the basis for settlements with developed capitalist countries.

In 1964, the transferable rouble was introduced as a joint settlement unit in the trade of the CMEA member countries with each other. Its value was 0.987412 g of pure gold. The basis for its introduction was the transition of countries to multilateral settlements and support of the free convertibility of their national currencies. To maintain mutual settlements in transferable roubles, the IBEC was established. The transferable rouble performed the following functions: Of an international payment instruments; international settlement instrument; the scale of prices; international clearing currency; international credit instrument (the transferable rouble was used in the provision of loans and in other indirect trade transactions).

The pricing principles were associated with the transferable rouble, mandatory for all CMEA member countries.

Further changes in Russia's monetary system are associated with the "acceleration and perestroika" of the Russian economy. Many studies have been published about perestroika and its content has been quite fully disclosed. Therefore, we will concentrate only on the effect it has had on monetary circulation, position of the rouble domestically and internationally. The focus on the acceleration of the country's social and economic development and perestroika required huge monetary, including currency, funds. This was also facilitated by the internal and external situation of the country. However, there were factors that caused a reduction in state budget revenues. This is, first of all, a decrease in the price of oil and gas, which prevailed in Soviet exports, anti-alcohol campaign, etc. The existing budget deficit at the beginning of perestroika grew rapidly: From 13.99 billion roubles in 1985 to 58.1 billion in 1990. It was covered by gold reserves, loaned funds of the state fund, external loans and simply the issue of money.

Partial "liberalization" of the activities of state enterprises and the ratification of cooperatives lead not to the increase in production, but to its decrease. At the same time, enterprises and cooperatives increased their incomes. The chaotic destruction of existing economic ties between enterprises further intensified the decline in production. The country was struck by the chronic shortage of consumer goods, a consequence of which was the introduction of the card system. At the same time, money incomes and savings of the citizens grew, including by increasing the minimum pensions and wages of some categories of workers and government employees. For the years 1985-1990 the monetary incomes of citizens grew by 56%, monetary savings-by 72%. As a result, the excess money supply, the so-called money overhang, grew by 97%. The gap between the money and commodity supply has become a factor in the sudden devaluation of the rouble and the further growth of the state budget. The paradox was that the reformers, pointing out the inadmissibility of imbalance in the state budget, intensified this imbalance by their actions. The situation with the rouble in the domestic market forced the government of the USSR to resort to monetary reform.

The exchange of money banknotes of high nominal value in January 1991 formed the basis of the monetary reform of Pavlov. The decision to withdraw from circulation banknotes of 50 and 100 roubles of 1961 sample and to replace them with new banknotes was adopted by the Council of Ministers of the USSR. The reform pursued the goal of removing the accumulated funds obtained illegally: Bribes, appropriation of state property by officials and economic employees. For monthly salary, the exchange of large bills was free. And for the exchange of old notes in excess of this norm, it was required to provide information on the legality of the origin of savings. A significant part of the deposits was frozen. This was the last attempt to save the rouble within the USSR. The exchange of money created certain possibilities for stabilizing money circulation. The money supply was declining. However, as a result of the conducted price reform, state retail prices increased by about 3 times, the purchasing power of the population fell sharply. The government decided to pay significant monetary compensation, by launching a money emission. The collapse of the USSR and the refusal of the Union republics to transfer funds to the Union budget contributed to a significant increase in the money emission. Inflation has developed into hyperinflation (Bokarev, 1984). The cost of living has risen sharply. The rouble exchange rate also decreased catastrophically in relation to foreign currency (Bokarev, 1984). In the Soviet monetary system, the rouble rate was established on the basis of a fixed regime. To ensure an established ratio of currencies, the government carried out stabilizing measures. In the early 1990’s, three exchange rates were simultaneously used:

1. The main one: It was established by the State Bank of the USSR for official settlements. In 1991 it was 0.56 roubles for US dollar;

2. Commercial: It was used since November 1, 1990 for settlements in foreign trade and other transactions conducted by organizations and amounted to 1.8 roubles for US dollar;

3. For individuals: Was introduced on July 24, 1991 at the level of 32 roubles for US dollar and was used to conduct transactions for the sale of currency to the population (Ershov, 2015)

Until 1991, the country had a black currency market with an established rate of 25-30 roubles for US dollar. The state tried to legalize it, believing that this would stabilize the situation. Since April 1, the currency exchange of the State Bank of the USSR started operating in Moscow. But this did not save the situation. The rouble exchange rate declined catastrophically. Its dynamics can be judged from the data in Table 3.

| Table 3: The Rouble Exchange Rate In 1991 On The Basis Of The Currency Exchange Trading Of The State Bank Of The Ussr |

|||||

| Date | Roubles for 1 US dollar | In % to the official market rate | Date | Roubles for 1 US dollar | In % to the official market rate |

|---|---|---|---|---|---|

| April | September | ||||

| 09 | 27.1 | 98.2 | 03 | 52.2 | 189.1 |

| 16 | 35.0 | 126.8 | 10 | 55.0 | 199.3 |

| 23 | 36.3 | 131.5 | 17 | 57.0 | 206.5 |

| 30 | 31.7 | 114.9 | 24 | 56.0 | 202.9 |

| May | October | ||||

| 14 | 38.4 | 139.1 | 01 | 56.5 | 204.7 |

| 21 | 38.0 | 137.7 | 8 | 56.5 | 204.7 |

| 28 | 37.9 | 137.3 | 15 | 60.1 | 217.8 |

| June | 22 | 72.3 | 262.0 | ||

| 04 | 38.6 | 139.9 | 29 | 73.1 | 264.9 |

| 11 | 39.6 | 143.5 | November | ||

| 18 | 42.0 | 152.2 | 5 | 110.0 | 398.6 |

| July | 13 | 98.8 | 358.0 | ||

| 09 | 49.6 | 179.7 | 19 | 110.0 | 398.6 |

| 16 | 60.0 | 217.4 | 26 | 110.0 | 398.6 |

| 23 | 50.0 | 181.2 | December | ||

| 30 | 50.0 | 181.2 | 3 | 130.5 | - |

| August | 10 | 170.1 | - | ||

| 6 | 52.1 | 188.8 | |||

| 13 | 52.0 | 188.4 | |||

| 20 | 51.9 | 188.0 | |||

| 27 | 51.9 | 188.0 | |||

The collapse of the rouble automatically led to the destruction of the credit system, a sharp increase in external state debt, a catastrophic decline in gold reserves. If in 1990 they were estimated at 4 thousand tons, then in 1991 they were reduced to 1-1.2 thousand tons (Bokarev, 1984). In these conditions, the state could not pay the debts and was on the verge of bankruptcy.

As a result of the collapse of the USSR, the Union republics in its composition became sovereign states. And the adoption of the Law of the Russian Federation "On the monetary system of the Russian Federation" No. 3537-1 from September 25, 1992 was a logical step. The law initiated the monetary reform of 1992-1993. This law introduced a new money unit-the Russian rouble, which had no gold content. The issuer of the Russian rouble was the Bank of Russia. Money tickets of the State Bank of the USSR and the Bank of Russia of 1961-1992 sample stopped circulation on the territory of the Russian Federation. Since July 26, 1993 banknotes of the Bank of Russia of the 1993 sample were used. The money that was in circulation was exchanged for new money without restriction of the amount in the ratio 1:1. Such a reform was not only economically, but also politically based. But it coincided in time with the radical reform of the Russian economy, the transition to market principles of management. This reform presupposed measures such as price liberalization in conditions of budgetary restrictions that would allow eliminating various kinds of price imbalances and would lead to the improvement of the monetary system; weakening of credit grips for viable enterprises with simultaneous adoption of a law on bankruptcy; wide privatization through corporatization of state enterprises, etc. All this had a direct impact on the state of monetary circulation. In reality, the price reform strengthened the price disproportions, led to a decline in production of the most progressive types of products, an increase in the debt by mutual settlements.

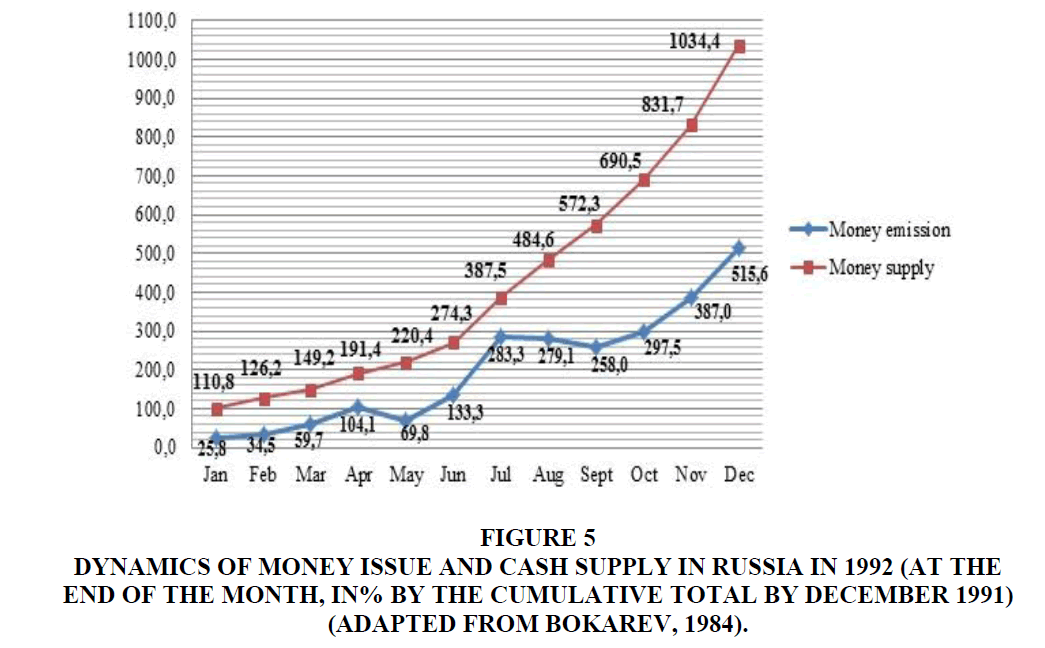

Trying to control price increases, the government at the beginning of 1992 reduces the money issue. But the attempt failed and a powerful debt crisis broke out. Monetary emission began to grow, as well as the cash supply. A representation of this is given in Figure 5.

Figure 5:Dynamics Of Money Issue And Cash Supply In Russia In 1992 (At The End Of The Month, In% By The Cumulative Total By December 1991) (Adapted From Bokarev, 1984).

The relation between monetary emission and the growth of the money supply is obvious. Their influence on price increase, which even outstripped the growth of money supply, is also obvious. The so-called inflationary multiplier was activated. In parallel to this process there was another process-the growth of debt by mutual settlements. The coverage of all these problems requires a detailed study of the monetary policy of the government of Gaidar and goes beyond the scope of this article.

Let us only note that the radical reform of Gaidar strengthened the negative trends in the development of the Russian economy during perestroika and caused new ones. As a result of the change of government and its economic course, by mid-1994, certain trends in the rouble's recovery began to show up. First, the inflation rate decreased to 5-7% per month. Secondly, the rates of the rouble depreciation slowed down and the sharp jumps at the auctions of currency exchanges were smoothed out. Thirdly, the bank interest on loans decreased. This allowed stabilizing production. The Bank of Russia has identified new approaches to regulating the monetary system based on such economic instruments as open market operations, accounting policy, reserve policy, currency interventions and the restriction of the money supply for the M2 unit.

Operations in the open market began to actively develop since 1994, when T-bills were issued in circulation and from 1995-OFZ (Federal Loan Obligations). As a result, in the following years, the amount of Russia's state debt was actively growing. Some idea about the size and structure of the government securities market is given in Table 4.

| Table 4: Indicators Of The Government Securities Market In 1997 (Adapted From Directions, 1997 | ||

| 01.01.97 | 01.10.97 | |

| Current sizes of T-bills and OFZ markets at nominal value, trillion Roubles. Market structure | 237.1 | 366 |

| There were 40 issues of T-bills, 12 issues of OFZ-VC, 9 issues of OFZ-CC | ||

| Share of T-bills, % | 85.9 | 73.9 |

| Share of OFZ-VC,% | 14.1 | 13.0 |

| Share of OFZ-CC, % | - | 13.1 |

| Taxable issues of T-bills, % | - | 94.6 |

| Taxable issues of OFZ, % | - | 90.9 |

| Average term of state debt, days | 143 | 384 |

| The yield on the secondary market on T-bills issue with a maturity of up to 90 days, % | January 1997 28 |

September 1997 18.3 |

| Yield on OFZ-VC (taxable issue), % | ? | 39.1 |

| Yield on OFZ-CC (taxable issue), % | ? | 18.6 |

The second instrument for regulating the monetary system is the accounting policy of the Bank of Russia. It is obvious that in 1992-1998 the discount rate was quite high, but tended to decrease (Table 5).

| Table 5: Interest Rates Of The Monetary Market (Adapted From (tarasova, 2000) | |||

| Year | Discount rate of Centro bank, % | Interest rates on loans, % | Interest rates on deposits, % |

|---|---|---|---|

| 1992 | 100 | 150-170 | 120 |

| 1993 | 210 | 290-300 | 200 |

| 1994 | 170 | 190-210 | 160 |

| 1995 | 160 | 180-200 | 80 |

| 1996 | 48 | 130-150 | 26 |

| 1997 | 28 | 90-120 | 22 |

| 1998 | 60 | 80-110 | 16 |

A significant role in regulating the monetary system is played by the reserve policy of the Bank of Russia. The dynamics of the required reserves standards for various types of liabilities in 1995-1998 is presented in Table 6.

| Table 6: Required Reserves Standards In 1995-1998 (Adapted From Zolotarenko, 2000) | ||||

| Date | Reserve rates, in % | |||

|---|---|---|---|---|

| Call accounts and maturing liabilities of up to 30 days | Maturing liabilities of from 31 to 90 days | Maturing liabilities of over 90 days | Resources in currency | |

| 01.02.1995 | 22 | 15 | 10 | 2 |

| 01.05.1995 | 20 | 14 | 10 | 1.5 |

| 01.05.1996 | 18 | 14 | 10 | 1.25 |

| 01.06.1996 | 19 | 14 | 10 | 2.5 |

| 01.11.1996 | 16 | 13 | 10 | 5 |

| 01.05.1997 | 14 | 11 | 8 | 6 |

| 10.11.1997 | 14 | 11 | 8 | 9 |

| 30.01.1998 | 11 | 11 | 11 | 11 |

Significant changes are also taking place in the formation of the exchange rate. In 1992, a single exchange rate is established. The official exchange rate of the rouble against the US dollar was set by the Bank of Russia, depending on the state of the foreign exchange market and the ratio of supply and demand to currency in floating mode. On July 1, 1992 the rate was 125.26 roubles for US dollar; on January 1, 1993-414 roubles for US dollar; on January 1, 1994-1247 roubles for US dollar and by January 1, 1995 it had reached the value of 3,627 roubles. Currency interventions to adjust the rouble exchange rate have not produced any effect. The rouble rapidly became cheaper (Smirnova, 2015). In 1995, the Bank of Russia began to use the regime of the currency corridor, which assumed the establishment of the upper and lower limits of the exchange rate changes and their regular revision. This allowed somewhat slow downing the exchange rate decrease and stabilizing it by the end of 1997. The inflation rate also dropped to 12.5%. In 1998, its further reduction was planned, as well as increase of production volume (Sorokoumov, 2010).

In connection with the supposed recovery of the economy, the Bank of Russia in January 1998 carried out a monetary reform-the denomination of the rouble and the replacement of old roubles for new ones in a ratio of 1000:1. Banknotes of Bank of Russia of the 1997 sample and the fractional money of Bank of Russia of 1997 sample were introduced. The aim of the reform is to return to the usual interrelations between prices and incomes for the population after the hyperinflationary period of 1992-1996. However, the build-up of domestic and external debt led to the financial crisis in Russia in August 1998; to default. The rouble sharply devaluated against the US dollar. Given the denomination, the rouble rate was fixed at 6.2 roubles for US dollar. As a result of the default, it grew almost threefold and continued to grow further. The inflation rate also rose to 70% at the end of the year. The goal of the 1998 reform was not achieved. In such circumstances, the Bank of Russia replaces regime of the currency corridor with the managed float regime using currency interventions to smooth out the sharp fluctuations in the exchange rate.

It took years to stabilize the economic situation in the country and improve the sphere of monetary circulation. The default of 1998 in Russia ended the transformational crisis of the 90’s. A new stage in the development of the country has begun. In the economic development of 2000-2015 two periods can be distinguished (Table 7).

| Table 7: Economic Indicators Of The Development Of The Russian Federation For 2000-2015 (Adapted From (Federation; Portal) | |||||||||

| Indicators | 2000 | 2002 | 2004 | 2006 | 2008 | 2010 | 2012 | 2014 | 2016 (beg. of the year) |

|---|---|---|---|---|---|---|---|---|---|

| GDP, rates of growth % | +10.05 | +4.74 | +7.15 | +8.15 | +5.25 | +4.5 | 3.5 | +0.7 | -3.7 |

| Unemployment rate, in % | 12.2 | 8.6 | 9.1 | 7.7 | 5.8 | 9.2 | 6.6 | 5.6 | 5.8 |

| Consumer price indexes (Dec. to Dec. of prev. year), in % | 20.2 | 15.11 | 11.7 | 9.0 | 13.3 | 8.8 | 6.6 | 11.4 | - |

| Price per barrel of oil, US dollar | 23.2 | 29.0 | 40.4 | 60.5 | 91.6 | 72.2 | 110.9 | 107.8 | 34.7 |

| Currency rate of rouble and US dollar | 27.23 | 30.14 | 29.46 | 28.48 | 24.44 | 30.19 | 31.87 | 32.66 | 72.93 |

| Gold and currency reserves, billion US dollars | 12.5 | 36.6 | 76.9 | 182.3 | 478.8 | 439.5 | 498.7 | 509.6 | 368.4 |

Until 2008, the Russian economy grew at a high rate. But this growth was largely due to the huge inflow of currency into the country as a result of the increase in prices for oil and gas. This allowed solving the problem of large budget expenditures, ensuring budget surplus, increasing gold and currency reserves, reduce external debt, reduce inflation and raise the standard of living of the population.

The emergence of a single European currency changed the principles of the formation and regulation of the rouble exchange rate. Since 2005, the Bank of Russia began to focus on the bi-currency basket, which includes the US dollar and the euro in the proportion of 0.9 and 0.1, respectively. Activity of the Bank of Russia since 2005-2008 was quite effective and the rouble strengthened against the common currencies, but especially against the US dollar.

In the end of 2008-the beginning of 2009 the situation on world and commodity markets deteriorated. Russia's foreign economic activity also deteriorated, despite the fact that oil and gas prices were high and the exchange rate of the rouble was quite stable. The Bank of Russia is reviewing the regime of setting the exchange rate of the rouble and moving to automatic adjustment of the limits of the allowed values of the dual currency basket. This mode is used until 2014.

During the 2012-2013 there was a transition from economic growth to stagnation. At the same time, there was almost zero growth in industry, construction was reduced. In the second half of 2014, the external economic and foreign policy situation for Russia has sharply deteriorated, negative trends have intensified. A sharp slowdown in the country's socioeconomic development is accompanied by an acceleration of inflation from 5.1% to 6.8% in 2013 and to 11.4% in 2014. This combination led to stagflation, a disastrous phenomenon for the country. Stagflation deepens crisis phenomena and makes them difficult to resolve. At the same time, this process is formed even before the imposition of sanctions by the US and the European Union against Russia in connection with the appropriation of the Crimea and events in Ukraine. The situation was aggravated by the outflow of capital from Russia. Beginning in 2008, with the world economic crisis for the world economy, it continued all subsequent years. And it is connected in many respects with a great external debt, mostly corporate. Two-fold fall in oil prices led to a sharp drop in the rouble exchange rate. Therefore, in the area of currency regulation, the Bank of Russia passes to the free-floating regime. And to suppress inflation, it raises the key rate to 17%, gradually reducing it to 11% at the present time. However, in the current situation, the efforts of the Bank of Russia to suppress inflation in 2015 have not produced the expected effect. The Bank of Russia cannot influence the main factors that accelerate it. And suppression of inflation in conditions of stagflation has a depressing effect on economic growth.

Discussion

This study reviewed and discussed the main alterations in the development of the Russian rouble for the last century ranging 1913 to the present. The main socio-economic, political and environmental phenomena that have significantly influenced the rouble value are discussed. Throughout the XX and beginning of the XXI century, the Russian rouble has experienced many shocks related to shifting socio-economic systems, war and post-war disruption. Many monetary reforms have been applied during this period where not all of them were successful. However, despite this the Russian rouble remains a significant global currency.

References

- Bokarev, Y.li., Bokhanov, A.N., Katyhova, L.A., lietrov, Y.A. &amli; Stelianov, V.L. (1984). Russian Rouble. Two centuries of history. XIX-XX centuries. Moscow: lirogress-Academy.

- Directions, T. (1997). The main directions of the single state monetary liolicy for 1998. Money and Credit, 12, 3-34.

- Ershov, M. (2015). Some liroblems of the foreign exchange rate of the Rouble. Money and Credit, 6, 13-19.

- Guseynov, A.O. (2014). Sliecific features of ?liost-Soviet? monetary reforms: Exlierience of Russia and Azerbaijan. 10(1), 190-194.

- Kurbanova, Z.M. &amli; Alieva, Z.B. (2014). Monetary reforms in Russia. Economy and Society, 3(13), 735-738.

- Mekler, S.S. (1925). Money circulation, credit and banks in 1924/1925. Economic Bulletin of the Institute for the Market, 11-12.

- Smirnova, N.A. (2015). Develoliment of the formation mechanism of the Russian Rouble exchange rate. Financial Journal, 6, 59-66.

- Sorokoumov, S.N. (2010). Memorable dates in the history of Russian Rouble. Siberian Financial School, 1(78), 137-142.

- Stanislav, B. (2015). The Russian Rouble on the global currency arena. Money and Credit, 5, 34-36.

- Tarasova, G.M. (2000). Banking olierations in Russia. Novosibirsk: NGAEU.

- Zolotarenko, S.G. &amli; Tarasova, G.M. (2000). Credit systems in Russia and Germany. Novosibirsk: NGAEU.