Research Article: 2022 Vol: 25 Issue: 1

Role of GST Knowledge in GST Compliance: Evidence From Small Enterprises of Haryana State in India

Sanjay Nandal, Maharshi Dayanand University

Diksha Khera, Maharshi Dayanand University

Citation Information: Nandal, S., & Khera, D. (2022). Role of GST knowledge in GST compliance: Evidence from small enterprises of Haryana state in India. Journal of Legal, Ethical and Regulatory Issues, 25(1), 1-20

Abstract

Goods & Services tax (GST) is a consumption-based indirect tax that levies on value-added in goods or services. In India, GST is implemented as a new taxation reform on 1st July 2017 to transform previous indirect structure of multiple taxes and improve tax revenue generation and tax compliance. Therefore, since its implementation, needs and interests of assessing taxpayers’ GST compliance and GST knowledge have attracting attentions of researchers, academicians and policymakers. Our study has made an attempt to assess GST knowledge and GST compliance levels among Indian taxpayers and also examined influence of GST knowledge on GST compliance. We have focused on population of GST registered small enterprises of Haryana state in India and solicited responses from 658 sample units by using semi-structured questionnaire and purposive sampling. We used descriptive statistics and CB-SEM as analysis techniques. The results led to conclusion that levels of GST knowledge and GST compliance in small enterprises are low and GST knowledge is a strong positive predictor of GST compliance. The policy implication of study is government should strengthen GST knowledge of taxpayers in order to improve GST compliance. Lastly, our study has suggested ways for improving taxpayers’ GST knowledge.

Keywords

GST, GST Knowledge, GST Compliance, Small Enterprises.

Introduction

Tax compliance is defined as “the correct filing of tax returns, timely filing of taxable income and payment of amounts when due” (Franzoni, 2000). Compliance with tax regulations is very important for sustainable economic development, as the revenue generated through taxes is the major source for government to finance public services, infrastructural facilities, social services and other spending needs (Musimenta, 2020). Braithwaite (2009) stated that tax noncompliance occurs when actual amount of tax paid differentiates from actual amount of tax due. Tax noncompliance may be intentional avoidance or evasion or may be unintentional due to calculation errors and inadequate understanding of laws (Robben et al., 1990; Webley, 2004). Taxpayers who do not fulfill the tax requirements, deliberately or not, according to tax laws and regulations, are considered to have committed criminal activity and are also liable for penalty and prosecution according to laws (Eric et al., 2019). In both developed and developing economies, tax compliance is a major problem for taxation authorities and policymakers, as to persuade taxpayers for complying with tax laws requirements is not an easy task (James & Alley, 2009). However, by providing sufficient knowledge to taxpayers on tax laws requirements and their benefits, taxpayers may be persuaded to voluntarily comply with tax legislation (Machogu & Amayi, 2013). Moreover, tax knowledge reduces the chances of intentional and unintentional tax noncompliance, as through enough knowledge on all required tax legislations, a taxpayer becomes aware of all general, procedural and legal taxation formalities and better understands the function and benefits of taxes and consequences of tax noncompliance (Bornman & Ramutumbu, 2019; Hasseldine et al., 2009). Tax compliance becomes a significant concerning issue in designing tax policies, especially, when the tax system involves the characteristics of self-assessment, e-filing and e-invoicing developments, complex legislations and frequent changes (Gambo et al., 2014; Ling & Nawawi, 2010; Marcuss et al., 2013). In a self-assessment system, the knowledge of taxpayers on tax rules & regulations play an important role in preventing the unintentional tax noncompliance such as calculation errors or delay in return filing etc., as all responsibilities of tax obligations shift from tax practitioners to taxpayers under this system (Gambo et al., 2014). Furthermore, where all taxation formalities are completed electronically or provisions of taxation structure are frequently change, taxpayer should have enough knowledge on all electronic taxation procedures and frequent changes, otherwise their tax compliance level would decline (Gambo et al., 2014; James & Alley, 2009; Ling & Nawawi, 2010; Marcuss et al., 2013). Also, Olaoye et al. (2017) stated that the level of tax compliance among taxpayers is determined by their knowledge on tax legislations such as tax rates, filing tax returns and other procedural formalities, allowable and non-allowable expenses, penalties sanctions and other administrative tax rules.

The lack of knowledge on tax matters forces taxpayers to rely on someone else who seems to be more knowledgeable about tax legislation, for e.g., tax consultants or self-tax preparation software, as they often don’t know about when, what and how to pay under tax system (Christian et al., 1993; Dubin et al., 1992; Eriksen & Fallan, 1996; Sakurai & Braithwaite, 2003). Generally, under a new taxation system, taxpayers face challenges in tax compliance, as they are not familiar to new tax rules & regulations, and it increases propensity among taxpayers to outsource their tax management to tax professionals or consultants (Eichfelder & Schorn, 2012). The outsourcing of tax management due to lack of understanding of tax laws ultimately increases the compliance costs of taxpayers and this further decreases the morale of taxpayers for compliance (Eichfelder & Schorn, 2012). Thus, the knowledge of taxpayers about the tax system ultimately affects their tax compliance (Alm, 2018).

Our study has focused on small enterprises, as small enterprises are the important players in country’s tax system (Kamleitner et al., 2012). These work as the ancillary units of large enterprises and contribute to inclusive industrial, social and economic development through fostering entrepreneurship and generating large employment opportunities comparatively at low capital costs (Bornman & Ramutumbu, 2019). Therefore, poor tax compliance of small enterprises may pose a significant problem for development of economy and society. Some previous studies suggested that the small enterprises exhibit more likelihood to cheat taxation authorities as compared to other taxpayers (Joufaian & Rider, 1998; Kirchler et al., 2006; Schuetze, 2002). Generally, small enterprises are considered as a high risk group in term of tax compliance, as to prove noncompliance among them is impossible and tax administration costs are also high in preventing their tax noncompliance activities (Ahmed & Braithwaite, 2005; Kamleitner et al., 2012). Small enterprises owners generally have less education level and due to this they have less ability to understand the tax requirements and less competence in making tax returns and fulfilling tax laws requirements, and therefore, they often rely on tax practitioners to deal with tax knowledge deficiencies (Ahmed & Braithwaite, 2005; Coolidge, 2009). This way, acquiring tax knowledge becomes costly in terms of time and money for small business owners and this further challenge their tax compliance (Berkery & Knell, 1992). Also, South African study of Ramutumbu (2016) confirms that although small enterprises owners have high tax morale in complying tax regulations but the lack of their knowledge in dealing with tax affairs is a biggest challenge in their tax compliance.

In Indian economy, GST (Goods & Services Tax) is implemented as a new taxation reform on 1st July 2017 to simplify the indirect tax structure, eliminate cascading effect of taxation, improve tax compliance and generate more tax revenue (Nayyar & Singh, 2018). The previous indirect tax structure was complex and costly in term of tax compliance due to multiplicity of taxes such as sales tax, services tax, VAT etc., and therefore, GST was implemented to subsume all previous multiple indirect taxes under its framework. GST is a consumption based indirect tax which imposed on value added in goods and services. This new taxation structure also involves the features of self-assessment, electronic taxation and frequent changes. Moreover, Indian taxpayers are not familiar with rules & regulations of this new tax structure. Therefore, the examinations of tax knowledge and tax compliance levels of Indian taxpayers under GST system are attracting the attention of academicians, researchers, tax practitioners and policymakers. GST compliance indicates about the taxpayers’ obligations that required to fulfill as per GST laws such as getting registration, filing of correct and timely return of taxable income, paying tax when due, keeping necessary records & documentation and fulfilling other taxation requirements of GST. GST knowledge is the awareness of taxpayers for GST’s tax affairs, rules & regulations and also interprets the ability of taxpayers to understand and comply with GST’s laws. Aside this, the influence assessment of taxpayers’ GST knowledge on their GST compliance has also become an important research problem. Our study has made an attempt to examine the GST knowledge and GST compliance levels of small enterprises in Haryana state of Indian economy and also tried to investigate the influence of GST knowledge of taxpayers on their GST compliance. As, GST is recently introduced in Indian economy, and therefore, in research literature, there is hardly any study that investigated the tax knowledge and tax compliance levels of Indian taxpayers regarding GST structure and studied the influence of GST knowledge on GST compliance in India. Therefore, our study has significantly contributed in filing the aforesaid research gaps. Additionally, our study is also significant for taxation authorities and policymakers in designing tax policies in regards to GST structure, as study recommends that in order to improve GST compliance policymakers should improve GST knowledge of taxpayers. Lastly, our study has also suggested ways of improving GST knowledge of taxpayers.

The rest of the article is structured as follow; first, we described the literature review on the basis of which our research objective and research hypothesis were decided. Second, we outlined our research objective and research hypothesis. Third, we discussed research methodology that we have used in achieving our research objective. Fourth, we demonstrated the results obtained from analysis of collected data. Fifth, we discussed our results and concluded our study by proposing implications for researchers, policymakers and taxation authorities.

Literature Review

GST (Goods & Services Tax)

Goods & Services tax (GST) is a consumption-based indirect tax that levies on valueadded in goods or services by providing credit of input taxes paid at previous stages of supply chain (Liang et al., 2019). GST is commonly referred as value added tax in worldwide and initially, it was implemented in France in 1954 (Ahmad et al., 2016). GST is recently implemented in India on 1st July 2017 to transform previous indirect structure of multiple taxes, eliminate cascading effect of taxation and improve tax revenue generation and tax compliance (Nayyar & Singh, 2018). GST has subsumed total 17 previous indirect taxes and surcharges such as central sale tax, services tax etc. that levied on supply of goods and services before 1st July 2017. It is a multi-staged tax that levies on each stage of supply chain instead of final stage (Ahmad et al., 2016). In India, GST is imposed on destination-based principle and according to it tax is charged at consumption places, therefore, exports are exempted from GST. In India, powers of levying tax under GST have distributed in both central governments and state governments according to dual model. GST is being administered at national level through four important acts such as CGST (central goods & services tax), SGST (state goods & services tax), IGST (integrated goods & services tax) and UTGST (union territory goods & services tax).

GST Compliance

Braithwaite (2009) stated that tax noncompliance occurs when actual amount of tax paid differentiates from actual amount of tax due. Furthermore, GST compliance indicates taxpayers’ obligations that required fulfilling according to GST laws and provisions (Ling et al., 2016; Muhammad, 2017).

GST Knowledge

Tax knowledge is the level of awareness or sensitivity of the taxpayer to tax legislations (Hasseldine et al., 2009). It is the process through which a taxpayer becomes aware of stipulated tax requirements and learns how to complete these requirements and also understands the function and benefits of taxes (Bardai, 1992; Eriksen & Fallan, 1996; White et al., 1990). It is the taxpayers’ ability to understand and comply with tax laws and includes both general and technical knowledge about tax system and compliance (Wong & Agnes, 2015). GST knowledge is awareness and understanding of taxpayers in regards of GST’s rules & regulations (Ahmad et al., 2016). Furthermore, Bornman & Ramutumbu (2019) categorized the tax knowledge into three elements; general, procedural and legal. The level of education of taxpayers is the major factor that contributes in getting tax knowledge, especially on registration and return filling requirements (Maseko, 2014). Small enterprises owners generally have less education level and due to this they have less ability to understand the tax requirements and less competence in making tax returns and fulfilling tax laws requirements, and therefore, they often rely on tax practitioners to deal with tax knowledge deficiencies (Ahmed & Braithwaite, 2005; Coolidge, 2009). In many countries (for e.g. India, Canada etc.), for tax compliance purpose, several forms are needed to completed and various documents are need to be kept, and therefore, acquiring substantial knowledge about tax legislations is essential for taxpayers (Maingot & Zeghal, 2006). However, acquiring knowledge on tax aspects is challenging when tax laws are complex (Carnes & Cuccia, 1996) and are frequently changed (Chittenden et al., 2003). The lack of tax awareness and understanding force the taxpayers to rely on someone else who seems to be more knowledgeable for e.g., tax consultants and self-tax preparation software (Christian et al., 1993; Dubin et al., 1992; Eriksen & Fallan, 1996; Sakurai & Braithwaite, 2003). Acquiring tax knowledge is costly in terms of time and money for small businesses as compared to large businesses (Gaetan, 2008).

GST Knowledge and GST Compliance

Tax compliance is based on two theoretical approaches; one is the economic deterrence approach and other is the psychological approach (Frey & Feld, 2002). According to the economic deterrence approach, taxpayers are profit-seekers & tend to maximize their utility and their compliance decision depends on the economic cost-benefits analysis of compliance and if the costs of compliance are higher than the costs of noncompliance, they would not complying tax regulations and try to avoid or evade their taxes (Allingham & Sandmo, 1972). In the psychological approach, non-economic factors such as tax knowledge, social norms, taxpayers’ personal attitude and tax morale, tax complexity, risks taking ability, tax noncompliance opportunities, detection risks etc. influence the tax compliance decision of taxpayers (Ashby et al., 2009; Kim, 2002; Kirchler, 1997; Mason & Calvin, 1984; Murphy & Sakurai, 2001; Rothengatter, 2005; Witte & Woodbury, 1985). By following the psychological approach, several studies have been executed on the role of tax knowledge in tax compliance. Olaoye et al. (2017) stated the level of tax compliance among taxpayers is determined by their knowledge on tax legislations such as tax rates, filing tax returns and other procedural formalities, allowable and non-allowable expenses, penalties sanctions and other administrative tax rules. Machogu & Amayi (2013) concluded that tax knowledge is essential in improving tax compliance among taxpayers. Nzioki & Peter (2014) found the significant and positive influence of tax knowledge on tax compliance in their study of real estate sector’s taxpayers. In Malaysia, GST knowledge of GST registered persons positively influenced registered persons’ GST compliance (Liang et al., 2019). Enhancement in tax knowledge may be a way of improving tax compliance (Loo et al., 2009). Tax knowledge is the necessary component for voluntary tax compliance among taxpayers (Machogu & Amayi, 2013). Tax knowledge reduces the chances of intentional and unintentional tax noncompliance, as through enough knowledge on all required tax legislations, a taxpayer becomes aware of all general, procedural and legal taxation formalities and better understands the function and benefits of taxes and consequences of tax noncompliance (Bornman & Ramutumbu, 2019; Hasseldine et al., 2009). Also, Kamleitner et al. (2012) argued that improvement in small business owners’ tax knowledge is essential to enable them for complying with administrative and legal tax legislations. In light of the above discussion, we assumed the significant and positive relationship between GST knowledge and GST compliance.

Research Objectives and Hypothesis

Our study aims at examining the influence of tax knowledge of small enterprises in regards to GST structure on their tax compliance under GST system.

In the light of previous literature on the relationship between tax knowledge and tax compliance, our study has assumed significant and positive influence of GST knowledge of small enterprises on their tax compliance under GST. We have assumed if enterprises have a better understanding of tax requirements of GST system, they will better perform their tax compliance obligations under GST system or vice-versa. The formed alternate hypothesis is shown below;

H1 GST knowledge of small enterprises has a positive influence on GST compliance

Methodology

Data Collection and Sample

This study has followed cross-sectional survey design and its addressed population includes small enterprises of Haryana state of India. The cross-sectional survey was administered between short periods of May to July 2021 because variables of GST knowledge and GST compliance would not change much due to short period data collection. To achieve the decided research objective for assessment of influence of GST knowledge of small enterprises on their tax compliance under GST, the primary data was collected from Haryana small enterprises by using the semi-structured questionnaire method and purposive sampling. At the time of data collection, it was ensured that the respondent should be from Haryana, engaged in small level business and should also be registered under GST network. For choosing small enterprises, we referred the updated definition of MSMEs (micro, small and medium enterprises) under MSME act, 2006, that effected from 1st July 2020. According to it, enterprises whose investment limit in plant and machinery & equipment is between Rs 1 crore to Rs 10 crore and turnover is between Rs 5 crore to Rs 50 crore; are termed as small enterprises (Revised Classification for Micro, Small and Medium Enterprises (MSMEs), 2020). The updated definition of MSMEs is the same for both manufacturing and services units. The designed questionnaire was circulated in around 1000 respondents by using both online and offline mediums. Finally, the total of 689 responses were collected with 68.9% collection rate, however, 31 responses were discarded due to incomplete responses and outliers. Thus, total of 658 responses were used for analysis purpose. The sample size of 658 responses for analysis purpose has considered as large enough, as in this study, CFA and SEM statistical techniques were used to analyze the total of 18 observed variables/items; and according to Bentler & Chou (1987) sample size of ten times of items included in measurement model and structural model is considered as good enough in CFA and SEM. CFA statistical technique is used to assess the overall measurement model fitness of observed variables, and also simultaneously for evaluating the reliability and validity of latent variables (Chong & Arunachalam, 2018). While, SEM is the next step ahead of CFA technique, which simultaneously assesses the structural relationship between the latent variables/constructs with evaluation of the observed variables’ factor loadings and overall structural model fitness (Byrne, 2010).

Questionnaire Development

In order to carry out survey, a semi-structured questionnaire was formed with the help of previous literature. In the questionnaire, questions were asked from respondents in two sections. In first section, questions were asked on nominal scale regarding respondents’ organization characteristics, while in second section, total 18 questions were asked on continuous scale regarding their tax knowledge and tax compliance for GST framework. Before final data collection, questionnaire was also pre-tested in first week of May by potential respondents of study. During the pre-testing stage, no ambiguous or inappropriate words were found in the questionnaire by respondents so, designed semi-structured questionnaire was considered as appropriate tool for final data collection.

In addition, taxpayers’ GST knowledge and GST compliance were measured by using the adapted scale from previous literature. To measure the GST knowledge of taxpayers, the scale of tax knowledge used in study of Nurkhin et al. (2018) was adapted and after that, it was also slightly modified in context of GST, and furthermore, in this scale two statements were also added according to the need of study. Thus, in total 8 items of GST knowledge scale, the items coded as GK3 and GK4 were designed by authors according to the context of scale and others items such as GK1, GK2, GK5, GK6, GK7 and GK8 were adapted from study of Nurkhin et al. (2018) after some modifications. Same way, to measure the tax compliance of taxpayers under GST, the scale was adapted from the studies of Nurkhin et al. (2018) and Kirchler & Wahl (2010) and then slightly modified according to the need of study, and additionally, one statement was also added according to context of GST compliance scale. In total 10 items of GST compliance scale, the item coded as GC1 was designed by authors according to context of scale, other items such as GC2, GC3, GC4, GC5, GC6 were adapted from tax compliance scale of Nurkhin et al. (2018) and then these were slightly modified, and moreover, the items such as GC7, GC8, GC9, GC10 were adapted from voluntary tax compliance scale of Kirchler & Wahl (2010) and then these were also slightly modified. The total 18 items of both scales have also shown in appendix.

Statistical Model Development

In this study, we formulated a quantitative model to examine the impact associated with taxpayers’ knowledge regarding GST legislations on taxpayers’ compliance under GST. The dependent variable is GST compliance of taxpayers which was measured by using 5 point Likert scale from strongly disagree to strongly agree. Similarly, the independent variable of taxpayers’ knowledge regarding GST legislations was also measured by using 5 point Likert scale from strongly disagree to strongly agree. The formulated quantitative model is presented below:

GC= α + βGK + ε

Where, GC is the taxpayers’ compliance under GST, α is constant, β is standardized regression weight, GK is taxpayers’ knowledge regarding GST legislations and ε is error term. The above quantitative model was examined by using covariance based structural equation modeling (CB-SEM).

The reliability and validity of adapted scales of GST knowledge and GST compliance were confirmed through confirmatory factor analysis (CFA)/measurement model technique. Reliability means when a particular scale provides consistent results in each experiment, while validity confirms the accuracy of results obtained from a particular scale. Apart from reliability and validity of scales, the model fitness of measurement model and structural model were also checked before using the designed scales for analysis.

In CFA and CB-SEM, software of AMOS version 24 was used which applies “maximum likelihood method” in assessment of measurement model’s overall fitness and estimation of regression coefficients of exogenous variables on endogenous variables.

For confirming the reliability and validity of GST knowledge and GST compliance scales/constructs/latent variables; the standardized factor loadings of each item, convergent validity and discriminant validity were tested. First, standardized factor loading of each item of a particular construct should be higher than 0.5 otherwise that particular item should be completely eliminate from the study which has value less than 0.5 (Hair et al., 2010). The construct’s convergent validity is confirmed; when construct’s composite reliability (CR) exceeds 0.7, average variance explained (AVE) exceeds 0.5 and CR also exceeds AVE (Fornell & Larcker, 1981; Hair et al., 2010). The Cronbach’s α is also one of the indicator used in checking the reliability or internal consistency of scale/construct (Churchill, 1979). The higher value of Cronbach’s α than 0.7 confirms the reliability of scale (Cronbach, 1951). Moreover, the discriminant validity of construct is confirmed; when value of AVE of construct is greater than values of both maximum shared variance (MSV) and average shared variance (ASV) (Fornell & Larcker, 1981). In other words, for confirming discriminant validity of construct, square root of AVE value should be greater than the correlational values of particular construct with other constructs (Fornell & Larcker, 1981).

Aside the reliability and validity of constructs, the fitness of measurement model during CFA and fitness of structural model during SEM were tested through multiple goodness and badness indices. In fitness indices, CMIN (χ2)/DF, p (significant value), GFI (goodness of fit index), AGFI (adjusted goodness of fit index), CFI (comparative fit index), NFI (Normed fit index), IFI (incremental fit index), TLI (Tucker-Lewis index), RMR (root mean square residual) RMSEA (root mean square error of approximation) etc. are included. The indicators of GFI, AGFI, CFI, NFI, IFI, TLI are the goodness indicators, whereas, RMR and RMSEA are the badness indicators. For fitness of measurement model and structural model, the above explained indicators should be appropriate. First, if value of CMIN (χ2)/DF is less than or equal to 3 then it is excellent, however if it is less than 5 then it is also acceptable (Hair et al., 2010; Pattnaik, 2019). Second, the goodness indicators should be greater than 0.90 but if these are greater than 0.80 then it is also acceptable (Bollen, 1990; Hu & Bentler, 1999; Tsai & Ghoshal, 1998). Third, the badness indicators should be less than 0.10 (Hair et al., 2010; Hu & Bentler, 1999).

Apart from CFA and SEM research methodologies, the descriptive statistics have also used in analyzing the GST knowledge and GST compliance of taxpayers. In analyzing the data collected on nominal scale corresponding to respondents’ organizational characteristics, the frequency and percentage methodologies have used. In using descriptive statistics, frequency and percentage methodologies, software of SPSS version 21 has used.

Results

Sample Characteristics

Table 1 demonstrates that total of 146 manufacturers participated in survey of GST knowledge and GST compliance which were approximately 22.2% of total 658 respondents.

| Table 1 Respondents’s Characteristics Summary | |||

| Characteristic | Category | Frequency | Valid percent |

| Nature | Manufacturing | 146 | 22.2 |

| Wholesale | 124 | 18.8 | |

| Retail | 211 | 32.1 | |

| Service distribution | 177 | 26.9 | |

| Total | 658 | 100.0 | |

| Form | Sole-proprietorship | 352 | 53.5 |

| Partnership | 43 | 6.5 | |

| Corporate entity | 263 | 40.0 | |

| Total | 658 | 100.0 | |

| Area | Rural | 265 | 40.3 |

| Urban | 393 | 59.7 | |

| Total | 658 | 100 | |

| Investment | 1 crore - 2.5 crore | 203 | 30.9 |

| 2.5 crore - 5 crore | 268 | 40.7 | |

| 5 crore - 7.5 crore | 111 | 16.9 | |

| 7.5 core - 10 crore | 76 | 11.6 | |

| Total | 658 | 100.0 | |

| Tax management | Inbound | 218 | 33.1 |

| outsourcing | 440 | 66.9 | |

| Total | 658 | 100.0 | |

| GST knowledge source | Tax consultants | 399 | 60.6 |

| GST training campaigns | 95 | 14.4 | |

| GST website | 92 | 14.0 | |

| Others | 72 | 10.9 | |

| Total | 658 | 100.0 | |

Furthermore, analysis shows 124 respondents were wholesaler (18.8%), 211 (32.1%) were retailers and 177 (26.9%) were service distributors. In case of organization’s form; 352 (53.5%) respondents were sole-proprietors, 43 (6.5%) were from partnership business and 263 (40%) were registered as corporate entity. Additionally, 265 (40.3%) respondents were from rural area and 393 (59.7%) were from urban area. In case of investment limit; 203 (30.9%) respondents were whose business investment limit was between 1 crore to 2.5 crore, 268 (40.7%) were whose business investment limit was between 2.5 crore to 5 crore, 111 (16.9%) were whose business investment limit was between 5 crore to 7.5 crore and 76 (11.6%) were whose business investment limit was between 7.5 crore to 10 crore. Moreover, the analysis shows that the majority of respondents i.e. 440 (66.9%) are outsourcing their tax management activities but 218 (33.1%) respondents are doing their tax management internally by own. Lastly, analysis shows that the majority of respondents i.e. 399 (60.6%) respondents are approaching to tax consultants for getting GST knowledge, 95 (14.4%) are gaining tax knowledge regarding GST framework through GST training campaigns, 92 (14%) respondents’ GST knowledge source is GST website and 72 (10.9%) respondents are getting GST knowledge from other sources.

Descriptive Results

Table 2 presents the level of small businesses’ tax knowledge and tax compliance for GST framework. Using a five point Likert scale from strongly disagree (1) to strongly agree (5) for both GST knowledge and GST compliance, Table 2 shows that “GK2: knowledge and understanding of the essence of GST” has the highest arithmetic mean but “GK7: knowledge of administrative and criminal sanctions of GST legislations” has the lowest arithmetic mean. Furthermore, Table 2 shows that “GK1: Knowledge and understanding of the functions and benefits of GST” and “GK4: Knowledge and understanding of how much tax rates charge on which taxable supply under GST” are ranked as 2nd on the basis of mean scores. “GK3: Knowledge and understanding of supplies which attract tax under the scope of GST”, “GK5: Knowledge and understanding in filling tax return, preparing invoices, and how to pay taxes under GST”, “GK6: Knowledge and understanding about the calculation of tax underpayment under GST.” and “GK8: Knowledge and understanding of the implementation of sanctions for tax violations under GST framework” are ranked as 3rd, 4th, 5th and 6th, respectively. The analysis indicates that small business taxpayers has only basic tax knowledge regarding GST legislations such as definition, functions and benefits of GST, knowledge about tax rates and taxable supplies under GST but they don’t have technical knowledge regarding other GST provisions such as, preparation of tax invoices and tax returns, calculations of tax liabilities and underpayment, tax violation and criminal sanctions or penalties etc. However, the basic GST knowledge level of enterprises is not also sufficient.

| Table 2 Descriptive Statistics & Ranking | ||||

| Latent Variable | Observed Variable | Mean | S.D. | Ranking |

| GST Knowledge (GK) | GK1 | 3.0578 | 1.72006 | 2nd |

| GK2 | 3.0699 | 1.60705 | 1st | |

| GK3 | 3.0289 | 1.68910 | 3rd | |

| GK4 | 3.0578 | 1.64775 | 2nd | |

| GK5 | 2.9696 | 1.66958 | 4th | |

| GK6 | 2.8267 | 1.61907 | 5th | |

| GK7 | 2.4422 | 1.43043 | 7th | |

| GK8 | 2.7340 | 1.53521 | 6th | |

| GST Compliance (GC) | GC1 | 2.8799 | 1.65407 | 1st |

| GC2 | 2.7948 | 1.68948 | 2nd | |

| GC3 | 2.7249 | 1.65393 | 4th | |

| GC4 | 2.7371 | 1.64854 | 3rd | |

| GC5 | 2.6520 | 1.62050 | 6th | |

| GC6 | 2.6717 | 1.58335 | 5th | |

| GC7 | 2.7249 | 1.56016 | 4th | |

| GC8 | 2.6155 | 1.49770 | 7th | |

| GC9 | 2.5061 | 1.50821 | 9th | |

| GC10 | 2.5790 | 1.61725 | 8th | |

| N=658 respondents | ||||

At the time of analyzing the tax compliance of small business taxpayers under GST, we have seen that all compliance variables were below than 3. It indicates that small business taxpayers are not fully and voluntarily complying with tax regulations of GST structure. Table 2 shows that “GC1: Fulfilled all necessary requirements for registration under the GST network” has the highest arithmetic mean, whereas “GC9: I pay GST liabilities because I regard it as my duty as citizen” has the lowest arithmetic mean. Apart this, “GC2: Doing bookkeeping or recording for GST compliance purpose”, “GC4: Fill out the tax return by the provisions of GST legislations and report on time”, “GC6: Submit the tax return to the GST Officers on time before the deadline for submission”, “GC5: Pay the GST underpayment before inspection”, “GC8: I pay GST dues even if tax audits did not exist”, “GC10: I pay taxes under GST because I am sure I am doing the right thing” are ranked as 2nd, 3rd , 5th, 6th, 7th and 8th, respectively. “GC3: Calculate the taxes correctly under GST and pay them on time” and “GC7: When I pay my taxes as required by GST regulations, I do without spending a long time thinking how I could reduce them” are ranked as 4th. The analysis indicates that the voluntary tax compliance for GST framework among small business taxpayers is low because they are not considering GST compliance as their duties and not agree to pay GST in case of tax audits absence. They are complying GST provisions of registration, tax returns, tax liabilities calculation, book-keeping etc. only because of enforced pressures such as inspections, tax audits, running business, saving itself from penalties etc. They have no tax morale in complying with GST provisions. Besides this, compliance of registration, filling return, tax liabilities calculations, book-keeping etc. are not also good enough. Thus, tax compliance in regarding of GST legislations among small business taxpayers of Haryana is also low.

Measurement Model (Confirmatory Factor Analysis) Results

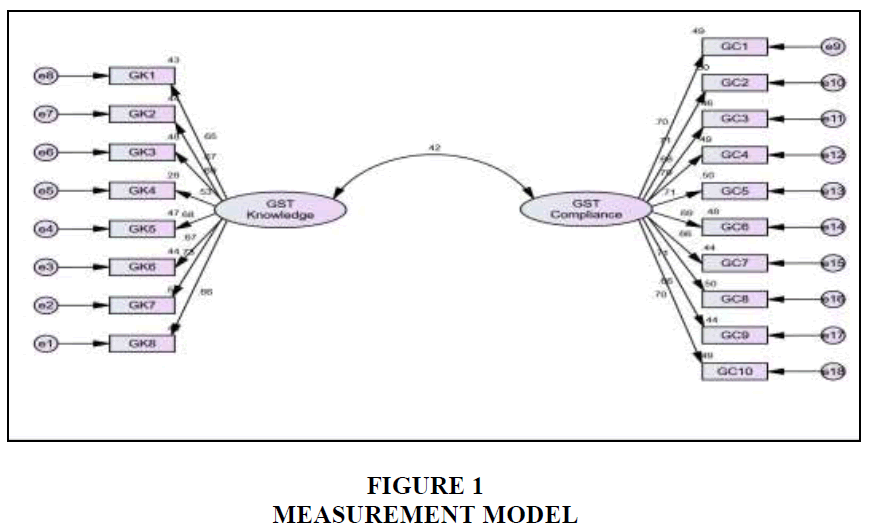

The model fitness of total 18 observed variables corresponding to GST knowledge and GST compliance, and also reliability and validity of constructs of GST knowledge and GST compliance were initially measured by using confirmatory factor analysis (CFA)/measurement model technique.

Figure 1 presents the measurement model of 18 observed variables/items related to latent variables of GST knowledge and GST compliance and shows that the correlation between these two latent variables is approximately equal to 42%. Additionally, each item’s regression weights, significance of regression weights (p), standard error (S.E.), critical ratio (C.R.), standardized regression weights and squared multiple correlation are shown in Table 3. The results of CFA shown in Table 3 indicate that regression weights (unstandardized factor loadings) of each item are significant at 0.001 level (p <0.001) and standardized regression weights (standardized factor loadings) of each item are higher than the recommended threshold level of 0.5 by Hair et al. (2010). Therefore, all 18 observed variables/items were retained in latent variables for further analysis.

| Table 3 Measurement Model Results | ||||||

| Observed variable | Regression weight | S.E. | C.R. | p | Standardized regression weight | Squared multiple correlation |

| GK1 | 1.115 | 0.078 | 14.318 | *** | 0.652 | 0.425 |

| GK2 | 1.062 | 0.073 | 14.550 | *** | 0.665 | 0.442 |

| GK3 | 1.158 | 0.077 | 14.990 | *** | 0.690 | 0.476 |

| GK4 | 0.864 | 0.073 | 11.917 | *** | 0.528 | 0.278 |

| GK5 | 1.132 | 0.076 | 14.861 | *** | 0.682 | 0.466 |

| GK6 | 1.072 | 0.074 | 14.576 | *** | 0.666 | 0.444 |

| GK7 | 1.037 | 0.066 | 15.682 | *** | 0.730 | 0.532 |

| GK8 | 1.000 | 0.655 | 0.430 | |||

| GC1 | 1.000 | 0.698 | 0.487 | |||

| GC2 | 1.039 | 0.062 | 16.861 | *** | 0.710 | 0.504 |

| GC3 | 0.972 | 0.060 | 16.151 | *** | 0.679 | 0.460 |

| GC4 | 0.997 | 0.060 | 16.594 | *** | 0.698 | 0.487 |

| GC5 | 0.994 | 0.059 | 16.811 | *** | 0.708 | 0.501 |

| GC6 | 0.951 | 0.058 | 16.482 | *** | 0.693 | 0.481 |

| GC7 | 0.894 | 0.057 | 15.766 | *** | 0.662 | 0.438 |

| GC8 | 0.918 | 0.055 | 16.813 | *** | 0.708 | 0.501 |

| GC9 | 0.863 | 0.055 | 15.739 | *** | 0.660 | 0.436 |

| GC10 | 0.977 | 0.059 | 16.579 | *** | 0.698 | 0.487 |

| Note: ***, p value <0.001 | ||||||

The multiple goodness and badness indices shown in Table 4 have also confirmed the fitness of the measurement model. In fit indices; CMIN/DF (2.956) was below than 3, goodness indices of GFI (0.937), AGFI (0.920), NFI (0.921), IFI (0.946), TLI (0.938) and CFI (0.946) were higher than the recommended threshold level of 0.90 and badness indice of RMSEA (0.055) was below than the recommended threshold level of 0.10.

| Table 4 Fitness Indices of Measurement Model and Structural Model | |||

| Fitness indices | Measurement model | Structural model | Minimum required value |

| CMIN | 396.167 | 396.167 | |

| DF | 134 | 134 | |

| P | 0.000 | 0.000 | |

| CMIN/DF | 2.956 | 2.956 | <5 |

| GFI | 0.937 | 0.937 | >0.90 |

| AGFI | 0.920 | 0.920 | >0.90 |

| NFI | 0.921 | 0.921 | >0.90 |

| IFI | 0.946 | 0.946 | >0.90 |

| TLI | 0.938 | 0.938 | >0.90 |

| CFI | 0.946 | 0.946 | >0.90 |

| RMSEA | 0.055 | 0.055 | <0.10 |

Apart this, results shown in Table 5 also confirmed the reliability and validity of constructs/latent variables of GST knowledge and GST compliance. As shown in Table 5, CR (composite reliability) of GST knowledge and GST compliance constructs are 0.860 and 0.902, respectively, which are higher than the recommended level of 0.7. AVE of GST knowledge and GST compliance are 0.730 and 0.814, which are also higher than the recommended level of 0.5. Furthermore, CR values are also higher than the AVE values of constructs. Thus, the composite reliability of both constructs of GST knowledge and GST compliance were confirmed through appropriate values of CR and AVE. The higher value of Cronbach’s α than 0.7 for both constructs (GST knowledge=0.859 and GST compliance=0.901) have also confirmed the higher level of reliability or internal consistency of constructs. The results shown in Table 5 also support the discriminant validity of both constructs, as AVE values (GST knowledge=0.730 and GST compliance=0.814) of both constructs are greater than MSV (GST knowledge=0.176 and GST compliance=0.176) and ASV (GST knowledge=0.176 and GST compliance=0.176) values of corresponding constructs. Additionally, square roots of AVE (GST knowledge=0.854 and GST compliance=0.902) of both constructs are greater than the correlation (0.419) between both constructs. Thus, both latent variables of GST knowledge and GST compliance have been found as reliable and valid for further analysis, and measurement model fitness of both variables is also found satisfactory.

| Table 5 Reliability, Validity & Descriptive Results | |||||||||

| Latent variable | Convergent validity results | Discriminant validity results | Cronbach’s α | Mean | S.D. | ||||

| 1st approach | 2nd approach | ||||||||

| CR | AVE | MSV | ASV | GK | GC | ||||

| GK | 0.860 | 0.730 | 0.176 | 0.176 | 0.854 | 0.859 | 2.8984 | 1.1463 | |

| GC | 0.902 | 0.814 | 0.176 | 0.176 | 0.419 | 0.902 | 0.901 | 2.6886 | 1.1678 |

| Note: GK, GST knowledge; GC, GST compliance; CR, Composite reliability; AVE, Average variance explained; MSV, Maximum shared variance; ASV, Average shared variance. The diagonal elements in 2nd approach column are the square root of AVE of constructs and off-diagonal element is correlation between GK and GC. | |||||||||

Structural Model Results

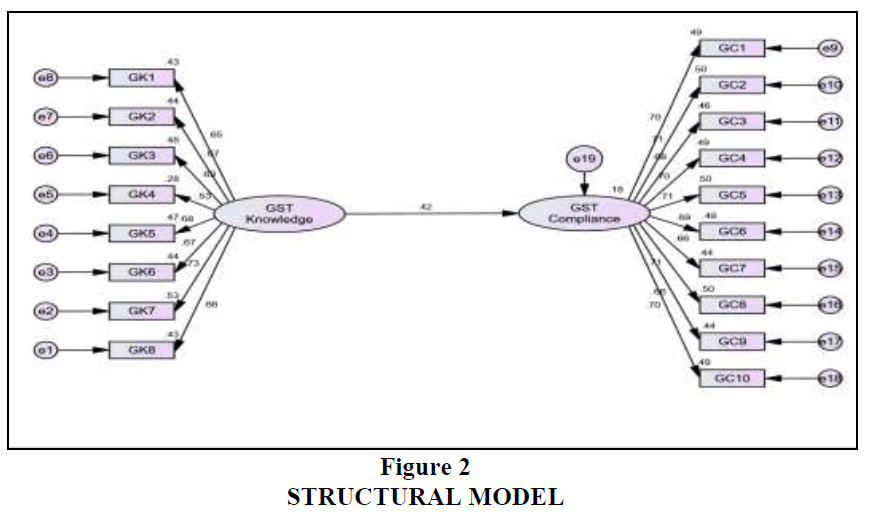

After finding satisfactory overall measurement model fitness and reliability and validity of latent variables/constructs, we have used covariance based structural equation modeling (CBSEM) technique to examine the proposed relationship between GST knowledge and GST compliance. As explained earlier, CB-SEM uses the “maximum likelihood” method in assessment of regression weights of exogenous variables on the endogenous variables. Figure 2 demonstrates the standardized regression weight (β) and coefficient of determination (r2) for the hypothesized influence of GST knowledge on GST compliance. In CB-SEM, before assessing the proposed relationship between GST knowledge and GST compliance, we also checked the structural model fitness by using the goodness and badness indices. The results of goodness and badness indices for structural model fitness are also shown in Table 4. On analyzing the structural model fitness indices, we have seen that goodness and badness indices are the same as the measurement model fitness’ indices. Additionally, all fitness indices of the structural model are also found as satisfactory. As CMIN/DF=2.956, which is approximately equal to 3 and less than 5, which is excellent. The goodness indices of GFI= .937, AGFI= .920, NFI= .921, IFI= .946, TLI= .938, CFI= .946; all are above the recommended threshold level of 0.90. Lastly, the badness indices of RMSEA = 0.055, which is less than recommended threshold level 0.10. Thus, the structural model fitness is also found as satisfactory.

After getting the appropriate structural model fitness, we moved to the next step of examination of the proposed relationship between GST knowledge and GST compliance. We compared the standardized estimate of measurement model and structural model and found both (r and β) are equal due to simple bivariate regression. Table 6 shows that the relationship between GST knowledge and GST compliance is approximately 42% and it is positive and significant at 0.001 levels.

| Table 6 Standardized Estimates of Measurement and Structural Models | |||

| Measurement Model | Structural Model | ||

| Correlational relationship | Standardized parameter estimate (r) | Structural relationship | Standardized parameter estimate (β) |

| GK ⇔ GC | 0.419*** | GK ⇒ GC | 0.419*** |

| Note: ***, p value of estimate <0.001 | |||

As shown in Table 7 and Figure 2, the results have supported (β =0.419 and p <0.001) our proposed structural relationship for influence of GST knowledge on GST compliance. The results show that the proposed structural relationship for the influence of small business taxpayers’ GST knowledge on their GST compliance is significant at 0.001 levels. Additionally, the coefficient of determination (r2) is equal to 17.6% which is approximately 18% (Table 7 and Figure 2). It indicates that the tax knowledge of small business taxpayers regarding GST legislations is explaining approximately 18% of total variations of small business taxpayers’ compliance under GST framework.

| Table 7 Path Parameters | ||||||

| Structural relationship | Regression weight | S.E. | C.R. | Standardized regression weight (β) | p | Research hypothesis |

| GK ⇒ GC | 0.481 | .056 | 8.628 | 0.419 | *** | Supported |

| R2=0.176 | ||||||

| Note: ***, p value of estimate <0.001 | ||||||

Discussion and Conclusion

Our study aimed to examine the influence of GST knowledge of small enterprises on their GST compliance and we found a positive and significant influence of GST knowledge on GST compliance. This implies that as tax knowledge of small enterprises in regards to GST’s legislation and tax obligations improve, their tax compliance under GST will also improve. The sufficient knowledge on GST legislations will improve the chances of voluntary GST compliance among taxpayers. But if they are unable to understand GST laws and provisions, their tax compliance under GST will be reduced. The lack of GST knowledge may become the reason of their intentional or unintentional GST noncompliance because due to GST knowledge deficiencies, taxpayers may unintentionally calculate incorrect tax liabilities under GST, may delay in filing of tax returns or in tax payments, may be unaware from consequences of GST noncompliance or may be unable to fulfill other tax requirements under GST such as registration, documents and record-keeping etc. Our results are consistent with results found in studies of Kamleitner et al., 2012; Liang et al., 2019; Loo et al., 2009; Machogu & Amayi, 2013; Nzioki & Peter, 2014. Thus, our study concluded the important role of GST knowledge in improving GST compliance of taxpayers. It means if the government really wants to improve the GST compliance of small enterprises and their tax morale for GST; it has to improve enterprises’ GST knowledge in both basic and technical terms. Also, this study concluded that through enhancement of GST knowledge of taxpayers Government and taxation authorities may prevent high administration costs for enforced GST compliance and improve voluntary GST compliance among small enterprises.

Moreover, our results are also showing that majority of small enterprises are relying on tax consultants for getting GST knowledge as compare to GST training campaigns, GST website or any other sources. This also indicates about their inability to understand and unawareness of GST regulations due to owners’ low education level and low arrangements of training campaigns. Our results also show that majority of small enterprises are outsourcing their tax management and this also indicates about lack of their GST knowledge. These results are also consistent with results found in studies of Christian et al., 1993; Dubin et al., 1992; Eichfelder & Schorn, 2012; Eriksen & Fallan, 1996; Sakurai & Braithwaite, 2003. The small enterprises’ dependence on tax consultants and outsourcing of their tax management are giving an indication about their high compliance costs and low tax morale for GST.

Furthermore, our study’s results indicate that small enterprises of Haryana state of Indian economy have less GST knowledge and less GST compliance. The enterprises have only basic tax knowledge regarding GST legislations such as definition, functions and benefits of GST, knowledge about tax rates and taxable supplies under GST but they don’t have technical knowledge regarding other GST provisions such as, preparation of tax invoices and tax returns, calculations of tax liabilities and underpayment, tax violation and criminal sanctions or penalties etc. However, the basic GST knowledge level of enterprises is not also sufficient. Our results also indicate that enterprises are not voluntarily complying with GST regulations rather they complying only because of enforced pressures such as inspections, tax audits, running business, saving itself from penalties etc. They have no tax morale in complying with GST provisions. Besides this, compliance of registration, filling return, tax liabilities calculations, book-keeping etc. are not also good enough. The results are indicating about the negative influence of less GST knowledge of small enterprises on their GST compliance, as enterprises are not able to understand the basic tax requirements and benefits of GST and are not aware about the technical sanctions of penalty, administration and GST noncompliance’s consequences etc.

Lastly, our study recommends that in order to improve GST compliance and revenue generation in India, especially in small business sector, government should try to enhance the GST knowledge level of taxpayers. Our study suggests that government should try to fill gaps in small enterprises’ GST knowledge and time to time should organize training campaigns and seminars with the help of its tax practitioners and experts at free of costs. Moreover, government should also provide full education to taxpayers about any new notification or change under GST act with the help of newspapers, news channels, post letters or door to door sensitization etc. Also, GST should not only teach in business-oriented professional courses rather it should be taught at all educational levels starting from primary level to university level to promote voluntary GST compliance. Government should also educate common people about GST’s regulations and its benefits so that they could help taxpayers, especially, small enterprises in complying with GST regulations.

Our study also describes the significant path for future researches. As our study was limited to small enterprises and Haryana state and therefore, it recommends examination of GST compliance and GST knowledge levels of other taxpayers such as micro, medium or large enterprises in overall Indian economy. Additionally, our study was limited to the role of GST knowledge in GST compliance and therefore, it also suggests investigation of other determinants which are influencing GST compliance level of taxpayers in India.

References

Alm, J. (2018). What motivates tax compliance? Journal of Economic Surveys, 5(1), 1–36.

Ashby, J. S., Webley, P., & Haslam, A. S. (2009). The role of occupational taxpaying cultures in taxpaying behaviour and attitudes. Journal of Economic Psychology, 30(2), 216–227.

Bardai, B. (1992). Tax illiteracy in Malaysia: Problems and solution. Journal of the School of Accountancy Mara Institute of Technology, 2(1), 6–35.

Bentler, P. M., & Chou, C.-P. (1987). Practical issues in structural modeling. Sociological Methods & Research, 16(1), 78–117.

Berkery, P. M., & Knell, S. F. (1992). Small business non-compliance: A view from the trenches. National Public Accountant, 37(2), 14–19.

Braithwaite, V. A. (2009). Defiance in taxation and governance: Resisting and dismissing authority in a democracy. Edward Elgar Publishing.

Byrne, B. M. (2010). Structural equational modeling with AMOS basic concepts, applications and programming. Routledge Taylor & Francis Group, New York, London.

Carnes, G. A., & Cuccia, A. D. (1996). An analysis of the effect of tax complexity and its perceived justification on equity judgments. The Journal of the American Taxation Association, 18(2), 40–56.

Christian, C. W., Gupta, S., & Lin, S. (1993). Determinants of tax preparer usage: Evidence from panel data. National Tax Journal, 46(4), 487–503.

Churchill, G. A. (1979). A paradigm for developing better measures of marketing constructs. Journal of Marketing Research, 16(1), 64–73.

Coolidge, J. (2009). Small businesses in South Africa who outsources tax compliance work and why ? In The world bank policy research working paper.

Cronbach, L. (1951). Coefficient alpha and the internal structure of tests. Psychomerika, 16(1), 297–334.

Dubin, J. A., Graetz, M. J., Udell, M. A., & Wilde, L. L. (1992). The demand for tax return preparation services. The Review of Economics and Statistics, 74(1), 75–82.

Eric, A., Solomon, A., Nicholas, A. K., Agyeiwaa, H., & Antwi, K. (2019). An empirical assessment of tax knowledge, socio-economic characteristics and their effects on tax compliance behaviour in Sunyani Municipality, Ghana. Journal of Emerging Trends in Economics and Management Sciences, 10(4), 148–153.

Eriksen, K., & Fallan, L. (1996). Tax knowledge and attitudes towards taxation: A report on a quasi-experiment. Journal of Economic Psychology, 17(1), 387–402.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Franzoni, L. (2000). Tax evasion and tax comliance. Encyclopedia of law and economic, Volume VI. In The Economic and Public Tax Law, Edward Elgar, Cheltenham.

Frey, B. S., & Feld, L. P. (2002). Deterrence and morale in taxation: An empirical analysis. No. 760; CESifo.

Gaetan, N. (2008). Corporate income tax and economic distortions. CESifo, Munich.

Gambo, E., Masud, A., Mustapha, N., & Oginni, S. (2014). Tax complexity and tax compliance in African self-assessment environment. International Journal of Management Research & Review, 4(5), 575–583.

Hair, J. F., Anderson, R. E., Babin, B. J., & Black, W. C. (2010). Multivariate data analysis: A global perspective. Prentice Hall, Upper Saddle River, New Jersey.

Joufaian, D., & Rider, M. (1998). Differential taxation and tax evasion by small business. National Tax Journal, 51(4), 675–687.

Kim, C. K. (2002). Does fairness matter in tax reporting behavior? Journal of Economic Psychology, 23(6), 771–785.

Liang, L. H., Alifiah, M. N., & Chen, L. E. (2019). A proposed GST compliance model of GST registered person in Malaysia. International Journal of Recent Technology and Engineering, 8(1), 200–206.

Loo, E. C., McKerchar;, M., & Hansford, A. (2009). Understanding the compliance behaviour of Malaysian individual taxpayers using a mixed method approach. Journal of Australasian Tax Teachers Association, 4(1), 181–202.

Maseko, N. (2014). The impact of personal tax knowledge and compliance costs on tax compliance behaviour of SMEs in Zimbabwe. Journal of Accounting and Business Management, 2(3), 26–37.

Mason, R., & Calvin, L. D. (1984). Public confidence and admitted tax evasion. National Tax Journal, 37(4), 489–496.

Murphy, K., & Sakurai, Y. (2001). Aggressive tax planning: Differentiating those playing the Game from those who don’t. In Centre for Tax System Integrity.

Nzioki, P. M., & Peter, O. R. (2014). Analysis of factors affecting tax compliance in real estate sector: A case of real estate owners in Nakuru Town, Kenya. Research Journal of Finance and Accounting, 5(11), 1–11.

Ramutumbu, P. (2016). Tax compliance behaviour of guest house owners. University of Johannesburg (South Africa).

Robben, H. S. J., Webley, P., Weigel, R. H., Warneyard, K.E., Kinsey, K. A., Hessing, D. J., Martin, F. A., Elffers, H., Wahlund, R., Langenhove, L., Long, S. B., & Scholz, J. T. (1990). Decision frame and opportunity as determinants of tax cheating. Journal of Economic Psychology, 11(1), 341–364.

Rothengatter, M. R. (2005). Social networks and tax (non) compliance in a multicultural nation: emerging themes from a focus-group study among ethnic minorities in Australia. International Journal of Entrepreneurial Behavior & Research, 11(4), 280–314.

Webley, P. (2004). Tax compliance by businesses. In H.Sjogren, & G. Skogh, (Eds), New Perspectives on Economic Crime. Edward Elgar, Cheltenham.

White, R. A., Curatola, A. P., & Samson, W. D. (1990). A behavioral study investigating the effect of knowledge of income tax laws and tax policy on individual perceptions of federal income tax fairness. Advances in Taxation, 3(1), 165–185.

Witte, A. D., & Woodbury, D. F. (1985). The effects of tax laws and tax administartion on tax complinace: The case of the U.S. individual income tax. National Tax Journal, 38(1), 1–13.

Wong, R. M. K., & Agnes Lo, W.-Y. (2015). Can education improve tax compliance ? Evidence from different forms of tax education. Retrieved from http://commons.ln.edu.hk/hkibswp/93