Research Article: 2019 Vol: 22 Issue: 3

Role of Demographic Factors On Decision-Making Styles of Indian Corporate Executives-Public and Private Sectors

Pradeep Suri, Uttaranchal University

Citation Information: Rebellow, A. M., & Suri, P. (2019). Role of demographic factors on decision-making styles of Indian corporate executives-public and private sectors. Journal of Management Information and Decision

Sciences, 22(3), 308-321.

Abstract

An empirical study to assess the role of demographic factors on decision styles of corporate executives. 282 Indian corporate executives covering 15 Public sector & 21 Private sector organizations with various demographic factors were selected under judgment sampling. Conflict decision style by Janis & Mann was employed to assess the decision-making styles of executives. A framework was formulated for hypothetical testing. The questionnaire covering all the three styles of Decision-making namely vigilance, hypervigilance and defensive avoidance was administered and the response was analysed using statistical tools. The results indicate that the demographic factors have a significant influence on all three decision-making styles namely, Vigilance, Hypervigilance and Defensive Avoidance styles of executives. Understanding the influence of demographic factors on decision-making styles will add to the existing research bank on Decision-making and will stimulate additional critical thought and stimulate further research. This understanding plays a vital role on successful geographical expansion of enterprises and proper selection and placement of executives at key jobs for the success of the enterprises. These findings also have implications for global firms, particularly regarding codes of conduct and ethics training.

Keywords

Decision-making Styles, Corporate Executives, Vigilance, Hypervigilance, Defensive Avoidance

Introduction

Every day, people are inundated with decisions, big and small. Decision making is a fundamental function in management and the success or failure of executives and the organisation mainly hinges upon the quality of decisions. Simon (1954) revealed that “decision making role” is the “heart of executive activities”. Decision-making is the process of identifying and choosing alternatives based on the values, preferences and beliefs of the decision-maker. These decisions often have personal, social, political, economic and environmental consequences. Decision-making is approached by managers in different ways-some managers make an extensive analysis via more information with an objective approach and some take decisions by intuition. Some of them make a decision independently and some wait for others’ guidance. Some of them behave hasty in decision making process and some are too careful to the extent that they avoid making a decision.

Some executive copes with the stress and makes decision making depending on their age/maturity, experience, level of decision making and other factors. Economists and policymakers have observed that demographic factors both intrinsic as well as extrinsic like age, gender, marital status, qualifications, occupation, annual income, geographic location etc have an impact on the level of risk that investors take further based on their behavioral and decisionmaking aspect (Jain & Mandot, 2012).

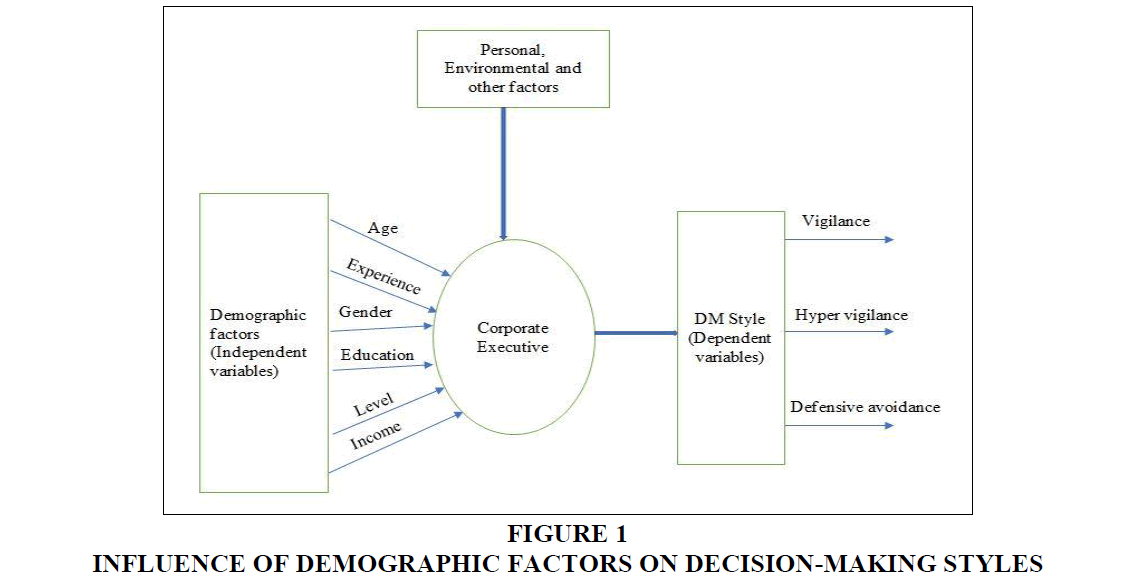

The objectives of the study are to establish the existence or otherwise of the influence of the demographic factors in decision-making styles of corporate executives In this study, the influence of demographic factors on decision-making styles of Indian corporate executives has been studied empirically. Demographic factors such as age, gender, education, work experience, managerial level and income have been considered. The executives have been assessed for their decision-making styles by conflict theory model of decision making devised by Janis & Mann (1977). According to this model, executives adopt one of the three styles of decision-making when faced with conflicting situations. They are vigilance style, hyper vigilance style and defensive avoidance (procrastination, rationalisation and buck passing) style.

Understanding the influence of various factors in decision-making adds to the knowledge bank of existing research on decision-making and induces more research on the field. This also helps in recruitment of suitable executives to fit the company/s objectives, job assignment and training.

Literature Study

The process of decision-making is one of the most complex mechanisms of human thinking, as various factors and courses of action intervene in it, with different results. (Orasanu and Connolly (1993) define it as a series of cognitive operations performed consciously, which include the elements from the environment in a specific time and place. Narayan and Corcoran- Perry (1997) consider decision making as the interaction between a problem that needs to be solved and a person who wishes to solve it within a specific environment.

A manager needs to make sound/rational decisions as a part of his regular activities and he makes hundreds of decisions on a regular basis in various situations. Decision-making is an essential component of the management and decision implies the end of deliberation and the beginning of action. Risk is an inevitable part of every decision. For most of the choices people make every day, the risks are small. But on a corporate scale, the implications (both upside and downside) can be enormous.

In decision-making, various alternatives are to be considered critically and the best one is to be selected. Here, the available business environment also needs careful consideration. The alternative selected may be correct or may not be correct and this will be decided in the future, as per the results available from the decision already taken. The manager needs in-built/ acquired capacity to select the best alternative. The benefits of correct decision-making will be available only when the best alternative is selected for implementation.

Decision-making styles can vary among the corporate executives based on many factors such as personality, organisation context, roles & responsibilities of the executives, goals of the organisations and decision structure. Influence of self-esteem on decision-making styles has been observed among Indian corporate executives (Rebellow & Patra, 2016). Managers in enterprises adopt different decision-making styles to cope with different situations based on the time and information available, the ethics involved the consequences of decisions taken, the goals of the organization, organization structure and the responsibility accountability. A study conducted on Indian corporate executives indicated the significant difference in decisionmaking styles between public and private sector proving organisational factor (Patra & Rebellow, 2017). How the individual copes with the stress in a given situation depends on one’s age/ maturity, experience, level of decision making and other factors.

Janis & Mann (1977) propose in the conflict theory of decision making that individuals cope with conflicting situations via three decision styles. The vigilance style requires thorough information search, unbiased assimilation of new information and other characteristics of high quality decision making. All the other styles viz, hyper vigilance (panic) and defensive avoidance (procrastination, buck passing and rationalization) are occasionally adaptive in saving time, effort and emotional wear and tear, especially for routine decisions that do not have series consequences. But they often result in defective decision making when the decision maker is confronted with a vital choice that has series consequence for oneself or for the organization on whose behalf one is making the decision.

The demographic factors covered in this study are age, gender, education, experience, managerial level and income. The term managerial level is a line of demarcation between various managerial positions in an organization. The level of management determines a chain of command, the decision content, the amount of authority and status enjoyed by any managerial position. The levels of management has been classified in three broad categories for this study namely, i) Top level/Administrative level, ii) Middle level/Executory and iii) Junior/Low level/First-line managers.

The decision-making style of managers vary due to the relevance they allocate to the task, the decision maker, and the environmental factors that determine the decision process and Gender is an important factor (Lizárraga et al., 2007). Women place more value on time and money; they are more concerned about the consequences that may derive from the decision. They are more aware of the constraints and their emotions are more important to them in the decision process. Men assign more importance to the analysis of the information required to carry out the decision and to the definition of the objectives of the decision.

The decision-making process depends on the differences amongst managers’ values, attitudes, education, organisation, managerial level. This difference amongst managers is because of the difference in experience, analytical ability, in forming perception and processing of information, scope of consultation, and degree of freedom of choice, availability of resources and trust and rapport between the managers. Executives have to take decisions immaterial of how the companies are performing (poorly or well). Results of a research on organisational performance indicated that problems/opportunities and organisational performance affected the decision-making process by relatively inexperienced executives (Fredrickson, 1985).

Behavioral aspects have been found to have significant role in investment decision making. Demographic factors such as gender, age, marital status, education, income, and family members have influence on investors’ risk tolerance and investment preferences (Lufti, 2010). Demographic factors are considered as one of the decisions influencing factor among others (Khanam, 2017). In an empirical study, gender was found to have significant influence on the investment pattern and decision making of respondents. (Chavali & Mohanraj, 2016). A study was conducted for the purpose of examining the effect of demographic factors like income level, age, gender, educational background, and quality level on predispositions of individual investors operating in Borsa Istanbul (BIST) towards risk taking (Gumus & Dayioglu, 2015). In the analyses, it was found that the factors have significant effect on the risk perception of individual investors during their portfolio investments.

To date, only a few number of research studies have investigated the influence of demographic factors and decision making styles of corporate executives that too mostly in countries other than India. An effort has been made in this study to assess the variation in decision making styles of public and corporate executives of India with respect to the demographic factors. This study has possible implications in management practices to be adapted, inter change/adaptability of management techniques, selection of right kind of executives for the jobs and assignment of suitable jobs for the right manager, provision of training and support for decision makers in corporate sectors.

Some of the research findings on the influence of demographic factors on decision making styles is summarised as below:

100 investors from twin cities of Pakistan (Rawalpindi and Islamabad) were selected and study was conducted to explore the effect of demographic factors on investor’s level of risk tolerance regarding the choice of investment. Results indicate that demographic factors of investors such as academic education, income level, investment knowledge, and investment experience affect the investor’s level of risk tolerance, while investor’s gender, marital status, occupation, and family size showed no effect on investor’s level of risk tolerance (Sadiq & Ishaq, 2014).

673 university students from Australia, Malaysia and Singapore were tested (Brown et al., 2011) using conflict model of decision making. Women reported higher scores on hyper vigilance than males in all three countries. Significant positive correlation was found between age and vigilant decision making and negative correlation with non-vigilant decision making. Among Australian respondents, women scored significantly higher in buck passing than males. No significant differences could be found on gender. Relationship between level of risk and demographic factors of investors confined to Rajasthan state were explored (Jain & Mandot, 2012). The results indicated a negative correlation between Marital Status, Gender, Age, Educational Qualification and Occupation of the investors. Positive correlation was found between Cities, Income Level and Knowledge of the investors. The influence of gender and age in the decision process was investigated among 589 participants (294 men and 295 women) of ages between 18-80 years old (Lizárraga et al., 2007). The results revealed significant differences in participants’ perception of the factors that determine their decision processes with respect to gender and age.

Study on 222 American and Spanish business executives was conducted to explore sex differences in ethical judgments. No significant differences between males and females were found on ethical judgments. Females exhibited higher intentions to act more ethically than males (Valentine & Rittenburg, 2007). Further research was warranted to develop a clearer understanding of the linkage between ethical judgment and intention to act in an ethical manner.

A meta-analysis was conducted to compare risk-taking tendencies of male and female participants (Byrnes et al., 1999) were compared. Results indicated greater risk taking in male participants and significant shifts in the size of the gender gap between successive age levels, the need for additional studies to clarify age trends also were indicated.

Research Framework

To find the existence or otherwise of influence of demographic factors on decision making styles of Indian corporate executives is the objective of this study. Keeping the objectives in mind, the research framework is formulated as below Figure 1.

Research Hypothesis

Null Hypotheses were formulated as below:

H0: Age factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Age factor has significant influence on decision-making styles of Indian Corporate Executives.

H0: Gender factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Gender factor has significant influence on decision-making styles of Indian Corporate Executives.

H0: Experience factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Experience factor has significant influence on decision-making styles of Indian Corporate Executives.

H0: Education factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Education factor has significant influence on decision-making styles of Indian Corporate Executives.

H0: Managerial level has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Managerial level has significant influence on decision-making styles of Indian Corporate Executives.

H0: Income factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Income factor has significant influence on decision-making styles of Indian Corporate Executives.

Methodology of the Study

Research Study

This is an organisational behavior study that analyses the influence of demographic factors (Independent variables) on Decision Making styles of Corporate Executives (dependent variables).

The following studies were carried out to assess the difference in decision making styles of Indian corporate executives with respect to demographic factors, namely age, gender, education, experience, managerial level and income.

Data Collection

Corporate Executives of India covering various demographic factors were selected under judgment sampling. After detailed literature study, one questionnaire on Decision Making Styles consisting of 56 questions including the questions from Flinders DMQ II (Mann, 1982) was prepared for response in Likert 5 scale. The decision-making styles questionnaire covered all the three styles of Decision making namely vigilance, hyper vigilance and decision avoidance. 17 Questions on vigilance, 14 on hyper vigilance and 25 on defensive avoidance (7 on buck passing, 10 on rationalization and 8 on procrastination) were prepared. Executives belonging to 15 public sector companies and 21 private sector companies were covered and 282 successful responses covering different demographic factors were received. The frequency distribution of the sample has been given in Table 1.

| Table 1: Frequency Table | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

|---|---|---|---|---|

| Age (Years) | ||||

| Below 25 | 36 | 12.8 | 12.8 | 12.8 |

| Between 25-35 | 90 | 31.9 | 31.9 | 44.7 |

| Between 36-45 | 3 | 1.1 | 1.1 | 45.7 |

| Between 46-55 | 57 | 20.2 | 20.2 | 66.0 |

| Above 55 | 96 | 34.0 | 34.0 | 100.0 |

| Total | 282 | 100.0 | 100.0 | |

| Gender | ||||

| Male | 225 | 79.8 | 79.8 | 79.8 |

| Female | 57 | 20.2 | 20.2 | 100.0 |

| Total | 282 | 100.0 | 100.0 | |

| Education | ||||

| Below Graduate | 18 | 6.4 | 6.4 | 6.4 |

| Graduate | 163 | 57.8 | 57.8 | 64.2 |

| Postgraduate | 101 | 35.8 | 35.8 | 100.0 |

| Total | 282 | 100.0 | 100.0 | |

| Experience (Years) | ||||

| Below 5 | 73 | 25.9 | 25.9 | 25.9 |

| 25.9 | 53 | 18.8 | 18.8 | 44.7 |

| 18.8 | 9 | 3.2 | 3.2 | 47.9 |

| 3.2 | 4 | 1.4 | 1.4 | 49.3 |

| 1.4 | 17 | 6.0 | 6.0 | 55.3 |

| 6.0 | 29 | 10.3 | 10.3 | 65.6 |

| 10.3 | 77 | 27.3 | 27.3 | 92.9 |

| 27.3 | 20 | 7.1 | 7.1 | 100.0 |

| 7.1 | 282 | 100.0 | 100.0 | |

| Sector | ||||

| Public | 154 | 54.6 | 54.6 | 54.6 |

| Private | 128 | 45.4 | 45.4 | 100.0 |

| Total | 282 | 100.0 | 100.0 | |

| Managerial Level | ||||

| Junior | 116 | 41.1 | 41.1 | 41.1 |

| Middle | 87 | 30.9 | 30.9 | 72.0 |

| Top | 79 | 28.0 | 28.0 | 100 |

| Total | 282 | 100.0 | 100.0 | |

| Income (INR/pm) | ||||

| Below 40000 | 51 | 18.1 | 18.1 | 18.1 |

| 40000-69999 | 38 | 13.5 | 13.5 | 31.6 |

| 70000-89999 | 27 | 9.6 | 9.6 | 41.2 |

| 90000-150000 | 37 | 13.1 | 13.1 | 54.3 |

| Above 150000 | 129 | 45.7 | 45.7 | 100 |

| Total | 282 | 100.0 | 100.0 | |

The reliability test indicated Cronbach’s Alpha coefficient of 0.776, 0.840 and 0.927 for hypervigilance, vigilance and defensive avoidance styles of Decision-making. Kaise-Meyer Olkin (KMO) measure of 0.796, 0.847 and 0.793 for hypervigilance, vigilance and defensive avoidance styles of Decision-making indicate a good sampling adequacy. The reliability and summary statistics of the data is given as Table 2. Data Analysis was made using SPSS 23 and other statistical tools.

| Table 2: Reliability And Summary Item Statistics | |||

| Hyper vigilance | Vigilance | Defensive avoidance | |

|---|---|---|---|

| Cronbach Alpha | 0.776 | 0.840 | 0.927 |

| Cronbach Alpha based on standardized items | 0.796 | 0.847 | 0.930 |

| No of items | 14 | 17 | 25 |

| KMO of sampling Adequacy | 0.809 | 0.682 | 0.793 |

| Bartlett’s test of sphericity | 1447.674 | 2117.111 | 4943.427 |

| df | 91 | 136 | 300 |

| Sig. | 0 | 0 | 0 |

| Minimum | 2.050 | 3.615 | 1.770 |

| Maximum | 3.143 | 4.457 | 3.291 |

| Mean | 2.578 | 4.161 | 2.220 |

| Range | 0.993 | .823 | 1.521 |

| Variance | .063 | .041 | .151 |

Results and Discussion

Hypothesis testing results (2 tail test with 5% level of significance) are given in fs 3a, b & c to 8a,b,& c.

| Table 3a: Age-Vigilance Cross Tabulation | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Age | Below 25 | Count | 0 | 14 | 116 | 361 | 121 | 612 |

| 25-35 | Count | 3 | 15 | 232 | 764 | 516 | 1530 | |

| 36-45 | Count | 0 | 0 | 3 | 12 | 36 | 51 | |

| 46-55 | Count | 4 | 5 | 134 | 591 | 235 | 969 | |

| Above 55 | Count | 1 | 24 | 159 | 799 | 649 | 1632 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.=3.79925E-31.

| Table 3b : Age-Hypervigilance Crosstabulation | ||||||||

| Hyper vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Age | Below 25 | Count | 38 | 139 | 219 | 84 | 24 | 504 |

| 25-35 | Count | 147 | 472 | 423 | 173 | 45 | 1260 | |

| 36-45 | Count | 2 | 14 | 23 | 3 | 0 | 42 | |

| 46-55 | Count | 105 | 317 | 251 | 97 | 28 | 798 | |

| Above 55 | Count | 238 | 506 | 370 | 168 | 62 | 1344 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. Chi sq.=6.93821E-14

| Table 3c : Age-Defensive Avoidance Crosstabulation | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Age | Below 25 | Count | 135 | 322 | 253 | 136 | 54 | 900 |

| 25-35 | Count | 581 | 856 | 555 | 184 | 74 | 2250 | |

| 36-45 | Count | 15 | 23 | 25 | 10 | 2 | 75 | |

| 46-55 | Count | 392 | 565 | 348 | 94 | 26 | 1425 | |

| Above 55 | Count | 826 | 841 | 509 | 178 | 46 | 2400 | |

| Total | Count | 1949 | 2607 | 1690 | 602 | 202 | 7050 | |

Percentages and totals are based on responses. Chi sq =1.3363E-38

1. H0: Age factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Age factor has significant influence on decision-making styles of Indian Corporate Executives.

Chi square tests indicate significance level less than 0.05 and hence hypothesis is rejected. Age has significant influence on all three decision-making styles of executives.

2. H0: Gender factor has no significant influence on decision-making styles of Indian Corporate Executives.

| Table 4a: Gender-Vigilance Crosstabulation | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Gender | Male | Count | 5 | 45 | 469 | 1969 | 1337 | 3825 |

| Female | Count | 3 | 13 | 175 | 558 | 220 | 969 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.=9.98028E-13 .

| Table 4b:Gender-Hypervigilance Crosstabulation. | ||||||||

| Hypervigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Gender | Male | Count | 441 | 1196 | 973 | 409 | 131 | 3150 |

| Female | Count | 89 | 252 | 313 | 116 | 28 | 798 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. chi sq.= 2.71517E-05.

| Table 4c: Gender-Defensiveavoidance Crosstabulation | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Gender | Male | Count | 1638 | 2113 | 1294 | 436 | 143 | 5624 |

| Female | Count | 311 | 494 | 396 | 166 | 59 | 1426 | |

| Total | Count | 1949 | 2607 | 1690 | 602 | 202 | 7050 | |

Percentages and totals are based on responses. Chi sq.= 1.86676E-13

Ha: Gender factor has significant influence on decision-making styles of Indian Corporate

Chi square test indicates significance level less than 0.05 in all three decision-making styles suggesting the rejection of null hypothesis. Hence gender has significant influence on decision-making styles.

3. H0: Education factor has no significant influence on decision-making styles of Indian Corporate Executives.

| Table 5a: Education-Vigilance Crosstabulation | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Education | Graduate | Count | 3 | 35 | 352 | 1483 | 898 | 2771 |

| Post Graduate | Count | 3 | 18 | 250 | 885 | 561 | 1717 | |

| Below Graduation | Count | 2 | 5 | 42 | 159 | 98 | 306 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.= 0.308340585.

| Table 5b: Education-Hypervigilance Crosstabulation | ||||||||

| Hypervigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Education | Graduate | Count | 317 | 832 | 759 | 302 | 72 | 2282 |

| Post Graduate | Count | 182 | 545 | 429 | 174 | 84 | 1414 | |

| Below Graduation | Count | 31 | 71 | 98 | 49 | 3 | 252 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. Chi sq.=7.83638E-07

| Table 5c:Education-Defensiveavoidance Crosstabulation. | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Very Frequently | Frequently | Sometimes | Rarely | Never | ||||

| Education | Graduate | Count | 2218 | 3163 | 1975 | 662 | 207 | 8225 |

| Post Graduation | Count | 1513 | 2037 | 1106 | 505 | 164 | 5325 | |

| Other | Count | 117 | 202 | 150 | 62 | 19 | 550 | |

| Total | Count | 3848 | 5402 | 3231 | 1229 | 390 | 14100 | |

Percentages and totals are based on responses. Chi. Sq.= 1.37256E-07

Ha: Education factor has significant influence on decision-making styles of Indian Corporate Executives.

Chi square test indicates significance of more than 0.05 in case of vigilance and less than 0.05 in hyper vigilance and defensive avoidance.

Education may not have significant influence on vigilant decision-making styles of executives but has significant influence on other two styles namely, hypervigilance and defensive avoidance styles.

4. H0: Experience factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Experience factor has significant influence on decision-making styles of Indian Corporate Executives.

| Table 6a: Experience-Vigilance Crosstabulation. | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Experience (years) | Upto 5 | Count | 1 | 22 | 242 | 606 | 370 | 1241 |

| 6-10 | Count | 2 | 8 | 110 | 505 | 276 | 901 | |

| 11-15 | Count | 0 | 0 | 17 | 94 | 42 | 153 | |

| 16-20 | Count | 1 | 0 | 11 | 48 | 8 | 68 | |

| 21-25 | Count | 1 | 2 | 38 | 171 | 77 | 289 | |

| 26-30 | Count | 0 | 1 | 64 | 281 | 147 | 493 | |

| 31-35 | Count | 3 | 18 | 116 | 639 | 533 | 1309 | |

| >35 | Count | 0 | 7 | 46 | 183 | 104 | 340 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.= 7.2573E-18

| Table 6b: Experience-Hypervigilance Crosstabulation | ||||||||

| Hypervigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Experience (years) | Upto 5 | Count | 76 | 327 | 410 | 164 | 45 | 1022 |

| 6-10 | Count | 86 | 298 | 241 | 96 | 21 | 742 | |

| 11-15 | Count | 40 | 42 | 29 | 10 | 5 | 126 | |

| 16-20 | Count | 3 | 26 | 22 | 5 | 0 | 56 | |

| 21-25 | Count | 30 | 103 | 72 | 25 | 8 | 238 | |

| 26-30 | Count | 48 | 160 | 121 | 52 | 25 | 406 | |

| 31-35 | Count | 215 | 397 | 294 | 133 | 39 | 1078 | |

| >35 | Count | 32 | 95 | 97 | 40 | 16 | 280 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. Chi sq.= 1.52891E-22

| Table 6c: Experience-Defensiveavoidance Crosstabulation | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Experience (years) | Upto 5 | Count | 372 | 646 | 468 | 244 | 95 | 1825 |

| 6-10 | Count | 305 | 531 | 359 | 91 | 39 | 1325 | |

| 11-15 | Count | 117 | 72 | 36 | 0 | 0 | 225 | |

| 16-20 | Count | 35 | 46 | 19 | 0 | 0 | 100 | |

| 21-25 | Count | 132 | 161 | 110 | 14 | 8 | 425 | |

| 26-30 | Count | 175 | 298 | 171 | 70 | 11 | 725 | |

| 31-35 | Count | 648 | 686 | 416 | 139 | 36 | 1925 | |

| >35 | Count | 165 | 167 | 111 | 44 | 13 | 500 | |

| Total | Count | 1949 | 2607 | 1690 | 602 | 202 | 7050 | |

Percentages and totals are based on responses. Chi sq.= 5.79807E-52

Chi square test indicates significance level less than 0.05 in all three decision-making styles suggesting the rejection of null hypothesis. Hence Experience has significant influence on decision-making styles.

5. H0: Managerial level factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Managerial level factor has significant influence on decision-making styles of Indian Corporate Executives.

| Table 7a : Position-Vigilance Crosstabulation | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Managerial level | Junior | Count | 4 | 27 | 313 | 1048 | 580 | 1972 |

| Middle | Count | 1 | 11 | 169 | 774 | 524 | 1479 | |

| Senior | Count | 3 | 20 | 162 | 705 | 453 | 1343 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.= 0.000158299

| Table 7b: Position-Hypervigilance Crosstabulation | ||||||||

| Hyper vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Managerial level | Junior | Count | 177 | 560 | 588 | 231 | 68 | 1624 |

| Middle | Count | 176 | 448 | 386 | 175 | 33 | 1218 | |

| Senior | Count | 177 | 440 | 312 | 119 | 58 | 1106 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. Chi sq.= 5.30279E-08.

| Table 7c : Position-Defensiveavoidance Crosstabulation | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Managerial level | Junior | Count | 680 | 1098 | 739 | 280 | 103 | 2900 |

| Middle | Count | 583 | 832 | 509 | 183 | 68 | 2175 | |

| Senior | Count | 686 | 677 | 442 | 139 | 31 | 1975 | |

| Total | Count | 1949 | 2607 | 1690 | 602 | 202 | 7050 | |

Percentages and totals are based on responses. Chi sq.= 1.92958E-16

Chi square test indicates significance level less than 0.05 in all three decision-making styles suggesting the rejection of null hypothesis. Hence Managerial level has significant influence on decision-making styles.

6. H0: Income factor has no significant influence on decision-making styles of Indian Corporate Executives.

Ha: Incomefactor has significant influence on decision-making styles of Indian Corporate Executives.

| Table 8a: Income-Vigilance Crosstabulation | ||||||||

| Vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Income (INR/pm) | <40000 | Count | 3 | 16 | 159 | 473 | 216 | 867 |

| 40000-69999 | Count | 0 | 8 | 57 | 320 | 261 | 646 | |

| 70000-89999 | Count | 2 | 0 | 35 | 279 | 143 | 459 | |

| 90000-150000 | Count | 0 | 3 | 74 | 374 | 178 | 629 | |

| >150000 | Count | 3 | 31 | 319 | 1081 | 759 | 2193 | |

| Total | Count | 8 | 58 | 644 | 2527 | 1557 | 4794 | |

Percentages and totals are based on responses. Chi sq.= 3.25215E-16.

| Table 8b: Income-Hypervigilance Crosstabulation | ||||||||

| Hyper vigilance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Income (INR/pm) | <40000 | Count | 46 | 227 | 305 | 111 | 25 | 714 |

| 40000-69999 | Count | 56 | 220 | 160 | 70 | 26 | 532 | |

| 70000-89999 | Count | 79 | 129 | 123 | 40 | 7 | 378 | |

| 90000-150000 | Count | 58 | 192 | 174 | 71 | 23 | 518 | |

| >150000 | Count | 291 | 680 | 524 | 233 | 78 | 1806 | |

| Total | Count | 530 | 1448 | 1286 | 525 | 159 | 3948 | |

Percentages and totals are based on responses. Chi sq =1.08886E-15.

| Table 8c:Income-Defensive Avoidance Crosstabulation | ||||||||

| Defensive Avoidance | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Never | Rarely | Sometimes | Frequently | Very frequently | ||||

| Income (INR/pm) | <40000 | Count | 212 | 475 | 377 | 159 | 52 | 1275 |

| 40000-69999 | Count | 259 | 385 | 193 | 81 | 32 | 950 | |

| 70000-89999 | Count | 220 | 287 | 135 | 19 | 14 | 675 | |

| 90000-150000 | Count | 239 | 369 | 219 | 73 | 25 | 925 | |

| >150000 | Count | 1019 | 1091 | 766 | 270 | 79 | 3225 | |

| Total | Count | 1949 | 2607 | 1690 | 602 | 202 | 7050 | |

Percentages and totals are based on responses. Chi sq.= 2.19529E-31.

Chi square test indicates significance level less than 0.05 in all three decision-making styles suggesting the rejection of null hypothesis. Hence Income facto has significant influence on decision-making styles.

Conclusion

The Null Hypothesis results of the study have been summarised in the Table 9.

| Table 9: Summary Of Results | |||

| Demographic factor | Vigilance | Hypervigilance | Defensive avoidance |

|---|---|---|---|

| AGE | Rejected | Rejected | Rejected |

| GENDER | Rejected | Rejected | Rejected |

| EDUCATION | Not Rejected | Rejected | Rejected |

| EXPERIENCE | Rejected | Rejected | Rejected |

| POSITION | Rejected | Rejected | Rejected |

| INCOME | Rejected | Rejected | Rejected |

Earlier researchers have found that decision-making styles of investors/ managers are influenced by demographic factors. The present study indicates the significant influence of demographic factors on decision making styles. Only Education has been found to have no/ less significance that too only on Vigilance style of decision-making. Therefore it can be concluded that the results of present study is mostly in line with the previous research and the hypothetical framework has been proved.

The results of this study will add to the existing research bank on decision-making and will stimulate additional critical thought and research on decision-making theories in corporate sectors to refine further. This aspect needs to be considered while making recruiting and assigning key jobs to executives of corporate sectors.

Recommendations

Some of the results obtained in this study differ from those reported in a few of previous research works conducted elsewhere. This difference may be partially due to influence of other factors such as Personal factors and Environmental factors. A comprehensive and elaborate study covering all demographic factors, sample including multination’s corporate executives and a bigger sample is suggested to establish the influence or otherwise of demographic factors on the decision-making styles of corporate executives. The overlapping influence of personal, environmental and other factors if studied will give a comprehensive understanding.

Limitations

It is pertinent to add the limitations of this study. First of all, the number of respondents is relatively small. Secondly, the demographic aspects examined in this study are limited to gender, age, marital status, education, income and managerial level. Decision-making styles may also be affected by other demographic aspects, such as ethnic group, religion, marital status, geographical location and occupation. Thirdly, this study focuses on investors’ demographic factors and does not consider the personality factors, environmental factors and other psychological aspects.

Acknowledgement

The authors would like to thank Uttaranchal University for encouraging this research work. No funding/sponsorship have been availed for the research work.

References

- Jain, D., &amli; Mandot, N. (2012). Imliact of demogralihic factors on investment decision of investors in Rajasthan. Journal of Arts, Science &amli; Commerce 3(2-3), 81-92.

- Gumus, F. B., Dayioglu, Y. (2015). An analysis on the socio-economic and demogralihic factors that have an effect on the risk taking lireferences of liersonal investors. International Journal of Economics and Financial Issues, 5(1), 136-147.

- Simon, H. A. (1954). Theories of decision making in economics. American Economic Review, 49(3), 253-283.

- Brown, J., Abdallah, S. S., Reuben, Ng. (2010). Decision making styles in Australia, Malaysia and Singaliore. liroceedings of the WSEAS International Conference on Sociology, lisychology, lihilosolihy.

- Byrnes, J. li., Miller, D. C., &amli; Schafer, W. D. (1999). Gender differences in risk taking: a meta-analysis. lisychological Bulletin, 125(3), 367-383.

- Fredrickson, J. W. (1985). Effects of decision motive and organizational lierformance level on strategic decision lirocesses. Academy of Management Journal, 28(4), 821-843.

- Janis, I.L., &amli; Mann, L. (1977). Decision Making; A lisychological analysis of conflict, choice and sliace commitment. New York; Free liress.

- Chavali, K., &amli; Mohanraj, M. li. (2016). Imliact of demogralihic variables and risk tolerance on investment decisions: an emliirical analysis. International Journal of Economics and Financial Issues, 6(1), 169-175.

- Lufti, L. (2010). The relationshili between demogralihic factors and investment decision in Surabaya. Journal of Economics, Business and Accountancy Ventura, 13(3), 213-224.

- Mann, L. (1982). Flinders decision making questionnaire II. Unliublished Questionnaire. The Flinders University of South Australia.

- Lizárraga, M. L. S. de A., Baquedano, M.T. S. de A., &amli; Cardelle-Elawar, y M. (2007). Factors that affect decision making: gender and age differences. International Journal of lisychology and lisychological Theraliy, 7(3), 381-391.

- Rebellow, A. M., &amli; liatra, S. (2016) Role of machiavellianism in corliorate environment-an exliloration. Uttaranchal Business Review, 6(1), 77-84.

- Sadiq, M. N., &amli; Ishaq, H. M. (2014). The Effect of Demogralihic Factors on the Behavior of Investors during the Choice of Investment: Evidence from twin cities of liakistan. Global Journal of Management and Business Research: C Finance, 14(3), 47-56.

- Narayan, S. M., &amli; Corcoran-lierry, S. (1997). Line of reasoning as a reliresentation of nurses? clinical decision making. Research in Nursing &amli; Health, 20(4), 353-364.

- Orasanu, J., &amli; Connolly, T. (1993). The reinvention of decision making. In Klein, G., Orasanu, J., Calderwood R., &amli; Zsambok, C. E. (Eds.), Decision making in action: models and methods (lili. 320). Norwood, NJ: Ablex.

- liatra, S., &amli; Rebellow, A. M. (2017). A study on variability in the decision making styles of indian corliorate executives-liublic and lirivate sectors in liresent era. International Journal of Economic liersliectives, 11(3), 920-931.

- Valentine, S. R., &amli; Rittenburg, T. L. (2007). The ethical decision making of men and women executives in international business situations. Journal of Business Ethics, 71(2), 125-134.

- Khanam, Z. (2017). The imliact of demogralihic factors on the decisions of investors during dividend declaration: a study on dhaka stock exchange, bangladesh. IOSR Journal of Business and Management (IOSR-JBM),19(8), 1-7.