Research Article: 2023 Vol: 29 Issue: 6S

Role of Crypto Currency and Financial Institutions in the Entrepreneurship Development in India

M Anthony, Thiruvalluvar University

S Sasikumar, Thiruvalluvar University

Citation Information: Anthony. M., Sasikumar. S. (2023). The influence of perceived organizational support, knowledge sharing, and employee engagement on performance: the mediating effect of organizational commitment. Academy of Entrepreneurship Journal, 29(S6), 1-08.

Abstract

The world of money and finance is transforming before our eyes (Bryan Zhang Cofounder and Executive Director). The advent of Crypto currency is a phenomenon which influences and attracts the businessmen. Crypto currencies are based on block chain technology. It is a decentralized and transparent ledger. This digital currency reality creates history amidst fast growing usage of internet and various applications with advanced features. The active users of crypto currency are estimated between 2.9 million and 5.8 million. However it poses big threats, challenges, and uncertainties to all the investors and the entrepreneurs. Crypto currency which is a decentralized system and peer to peer technology and so it can lead to dismantling the system of financial institutions in India. Financial institutions will lead to economic development, entrepreneurial growth and the prosperity in India. But the system of crypto currency is doubtful in entrepreneurial growth in India at present. Moreover there are major banks, central banks and regulatory agencies reacted to Crypto currency positively and negatively. In this article the challenges and the opportunities of crypto currency and the functions and financial assistance of SIDBI (Small scale industries and development Bank of India), IFCI (Industrial Finance Corporation of India), IDBI (The Industrial Development Bank of India), NABARD (The National Bank for Agriculture and Rural Development) are analyzed and discussed based on the literature review articles from Google Scholar.

Keywords

Crypto Currency, Opportunities, Challenges, Financial Institutions, Entrepreneurs, Industrial Development.

Introduction

A crypto currency is a digital currency under cryptography. Each currency owns its own block chain and all the transactions are cross checked. It enables secure online payments ignoring the third person. “Crypto” on encryption involves algorithms and techniques of cryptographic that protect the entries. It is a technology based on the block chain which is secure and it is similar to balance sheet or ledger and functions through the network of computers. The involvement, interference or manipulation by the government is neglected regarding the issue of Crypto currencies. The popular crypto currencies are Bitcoin, Ethereum, Bitcoin cash and Litecoin, Tezos, EOS and Zcash, etc, The top five Crypto currencies are Hanging Trails, Ypredict.ai (YPRED), XPR (Ripple), Tether (USDT) and USD Coin (USDC) (Outlook for Brands, 2023). Without the presence of bank or payment processor it can transfer value online globally. It offers service 24/7 for low fees. Anyone can participate and no country, no third party is in control of this crypto currency. Crypto currency has many advantages like transferability, privacy, security, portability, transparency, irreversibility, safety etc. On the other hand it has disadvantages such as internet fraud, hackers stealing money in spite of proper security system. Therefore the investors and the entrepreneurs always look for the reliable source which can give assurance that their capital is safe and it takes the responsibility for any malpractices , fraud, illegal transaction or hacking. In Indian context it is always the financial institutions which assist the entrepreneurs in their entrepreneurial ventures.

Objective

The objective is to analyze the role of crypto currency and financial institutions and opportunities and the challenges of crypto currency for the entrepreneurs.

Methodology

The reviewed articles on crypto currency are collected from Google Scholar for analyzing the opportunities and the challenges of crypto currency. This article is divided into four sections. The first section deals with the role of entrepreneurs in India and the second section deals with the opportunities and challenges of crypto currency and the third section deals with the functions and financial assistance of financial institutions and its relevance for the entrepreneurs. And the article ends with fourth section discussion and conclusion.

Role of Entrepreneurs in India

Entrepreneurs play a crucial role in economic development in India. They are the significant contributors to job creation in India. Sixth economic census and Ministry of MSMEs driven by entrepreneurs employed over 111 million people in 2013-14. They are the major source of employment in sectors such as Manufacturing, Services and Technology. They are into innovation and technological advancement particularly in sectors such as information technology, software development, biotechnology, renewable energy, and e-commerce. Entrepreneurs contribute to India’s economic growth and GDP (Gross Domestic Product). Startups and potential business have a potential role to play. According to NASSCOM the startups ecosystem contributed 1.8% to country’s GDP in 2020. Successful entrepreneurs have attracted substantial Foreign Direct Investment (FDI). Entrepreneurs in India focus in social impact and inclusive growth and they address the social and environmental issues through their businesses. They strive for inclusive growth by creating solutions that benefit marginalized communities, promote sustainable practices, improve access to education and healthcare, and empower women and underprivileged groups. Entrepreneurs actively engage in policy advocacy and ecosystem development. They collaborate with government agencies, industry associations, and educational institutions to shape policies that foster entrepreneurship, promote ease of doing business, and provide support to startups. Entrepreneurial networks, incubators, accelerators, and co-working spaces have emerged to provide resources, mentorship, and networking opportunities for aspiring entrepreneurs. Successful entrepreneurs in India serve as role models and sources of inspiration for aspiring entrepreneurs. Their stories of perseverance, innovation, and success motivate others to pursue their entrepreneurial dreams. Through entrepreneurship, they showcase the potential to overcome challenges, create impact, and achieve personal and professional fulfillment.

Findings (Crypto Currency: Opportunities and Challenges for the entrepreneurs) Opportunities

Martino et al., (2020) reveal as opportunities that these new technology and innovation offer entrepreneurs and investor’s theory based opportunities, including wider access to credit, availability of up-to-date information, reduced costs and information on strategies, regulatory and law enforcement challenges. And it allows anyone to invest any amount in any company and therefore reducing entry barriers and allows the participation of non - professional investors. It provides greater liquidity and reduces the monitoring costs of investors. Investors may benefit from additional revenue derived from subsequent appreciation in value of their shares, namely crypto currencies. Ismael (2021) identified the opportunities that crypto currency has the comparative advantage of extraction. It reduces the distance between capitalists and the ventures. It revolutionizes the world in reducing the transaction cost. And it reveals that entrepreneurs can raise millions of dollars in equity within days. Larios-Hernández (2017) recognizes the opportunity for those who are unbanked. They can have the easy access to money by way of considering advantages of mobile. Transparency, security and accountability and trust are the benefits. The countries which have poor banking infrastructure and dependent upon cash could utilize this technology which assures safe network to transfer money.

Challenges

Martino et al., (2020) point out that there is no clear understanding of potential of this new innovation and the literature is still in infancy. The European Securities and Market Authority (ESMA) pose five potential risks from deriving from ICOs (Initial Coin Offering). They are 1.Unregulated which leads to fraud, illicit activities and misuse of technology, 2. Highly risky in safeguarding capital, 3. Exit options are limited and high price fluctuation, 4. Lack of adequate information, 5. ICO lost its 10% funds due to technology which has flaws and leads to hacker attacks. Ismael (2021) brings out the challenges that are price fluctuation and instability, the lack of clear rules and regulations, the economy threat, lack of clear identity of sender and receiver, weakening the central bank and intermediary entities, the possibility of tax evasion, money laundering, and development informal economic part, the occurrence of security problems, the inheritance problem, jurisprudential challenges, uncertainty in crypto currency, failure to maintain the value and the high energy consumption. Kartarzyna (2019) identified the challenges such as scams and market abuse practices 2017. It was identified that 78% of projects worth USD 1, 34 billion ended up in scams. According to FBI (Federal Bureau of Investigation) statistics in 2017 USD 58, 3 million was stolen due to hacker attacks. Exchange platforms’ thefts , money laundering , financing of illegal activities, terrorist financing, evading tax and challenges in accounting, lacking taxonomies, standard procedures and regulations are the threats and challenges of crypto currency. The following table 1 also gives the opportunities and the challenges of crypto currency.

| Table 1 Opportunities and Challenges of Crypto Currency | |

| Opportunities | Challenges |

|

|

Financial Institutions

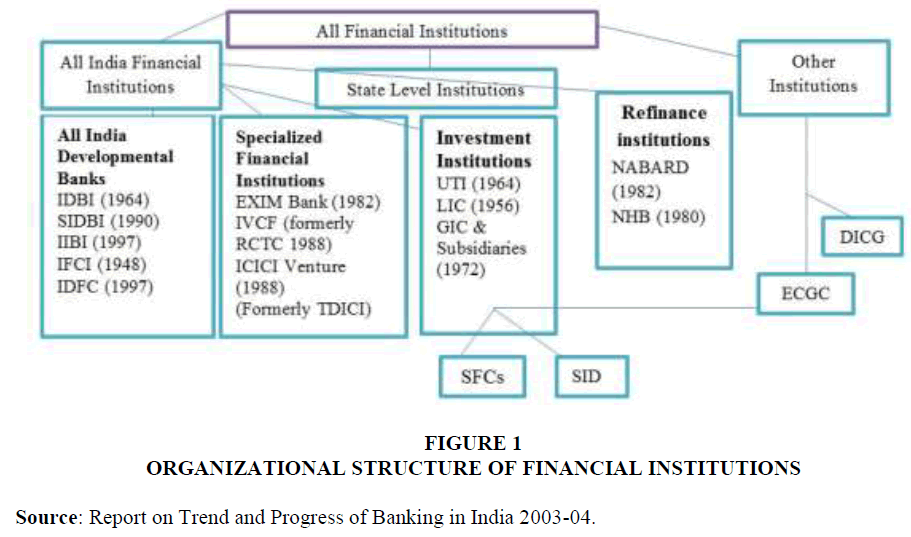

Financial institutions are significant in the life of the entrepreneurs to start new ventures. Development banks and financial institutions render financial assistance to entrepreneurs and their ventures.

The following figure 1 gives the organizational structure of financial institutions.

Figure 1 Organizational Structure of Financial Institutions

Source: Report on Trend and Progress of Banking in India 2003-04.

Industrial Finance Corporation of India (IFCI)

The Industrial Finance Corporation of India (IFCI) provides medium and long-term credit to industries in India. It is established in 1948 with an act of Parliament. It was transformed into a corporation from 21st May, 1993. The objective is to provide flexibility to the needs of changing financial system. It provides advances, medium and long-term loans to industrial and manufacturing units, studies the performance of the industry, the overall cost of the project, the product quality and functions of management and provides guarantees to the loans taken by such industrial companies. IFCI provides assistance to pollution control, to energy conservation, to import and export industry, to agricultural based industries like paper, sugar, rubber and to basic industries like steel, cement, chemicals etc, to service industries like restaurants, hospitals, hotels etc, and to capital and goods industries like electronics, fibers, telecom services, etc.

The Industrial Development Bank of India (IDBI)

The Industrial Development bank of India (IDBI) was established on 1st July, 1964. It is subsidiary of the reserve bank of India. The IDBI ownership had been transferred to the central government 1976 (Public financial institutions laws Amendment Act, 1975). The main function of IDBI was to co-coordinate the activities of the institutions dealing finance, and to promote or develop the industries. Industrial enterprises are provided financial assistance. Institutions involved in industrial development are promoted and technical assistance provided for the expansion. It undertakes the survey in industry development, market and investment research. Without restriction it grants advances and loans to industrial units. IDBI refinances term loans within 3 to 25 years provided by the IFCI, the State Financial Corporation, SIDCs (State Industrial Development Corporations), Commercial banks and Cooperative banks which extend term loans for 10 years. Also it subscribes to the shares and bonds of the financial institutions and provides supplementary resources.

The National Bank for Agriculture and Rural Development (NABARD)

NABARD (The National Bank for Agriculture and Rural Development) was established in 1982, (B. Sivaramman Committee recommendations by the Act 61, 1981). It was initiated with a paid up capital of Rs.100 cr. by 50:50 contribution by government of India and Reserve Bank of India (Hemant, 1982). It promotes agriculture, village industries, cottage and small scale industries, and handicrafts providing credit to them and refinancing rural sector. It has been the force behind in social innovations, social enterprises and rural activities. It operates at 32 Regional offices as of May 2020. NABARD focuses on institution building for improving credit delivery system, formulation of rehabilitation initiatives, monitoring, credit institutions restructuring and training of personnel. It undertakes the work of coordinating the rural financing activities by all institutions, monitoring and evaluating of the projects and regulating, supervising the cooperative banks and the institutions providing financial help and providing training facilities for rural development.

The Small Industries Development Bank of India (SIDBI)

The SIDBI (Small Industries Development Bank of India) was established in 1990 (Parliament act 1988). It is a subsidiary of IDBI (Industrial Development Bank of India). It promotes cleaner production and energy efficiency and develops and finances MSME (Micro, Small and Medium Enterprise) sector. It fulfills the needs of individual’s requirement of various businesses providing several schemes and offering financial services. SIDBI refinances loans to the small scale industrial units and offers assistance to them.

SIDBI provides the following assistance 1. Financial Support, 2. Risk mitigation, 3. Entrepreneurial Development Programs, 4. Mentorship and Networking, 5. Access to Market and Export Assistance, 6. Technology upgradation and innovation (Jitendra, 2023).

SIDBI concentrates on semi urban areas and employment oriented industries for employment opportunities. Initiates modernization and technological up-gradation and enables flow of credit for working capital, term loans to Small Scale Industries. Assistance provided are loans according to the business requirements, dedicated size according to the business size. Offers attractive interest rate, concessional interest rate, the required advice and the right decision making, Offers security free giving Rs.100lakhs without providing security and giving adequate capital for Growth. SIDBI offers subsidies and various schemes with concessional interest rates and comfortable terms (Table 2). And it insists on transparency and there are no hidden charges.

| Table 2 Difference between Financial Institutions and Crypto Currency | |

| Financial Institutions | Crypto Currency |

| Access to Capital: Traditional sources of Capital for the entrepreneurs Regulation: Highly regulated and abide by rules and regulations of Government Innovation: Innovative but slower to adopt the new technology Technology: Use technology and not adopt the emerging technology like crypto currencies Market Acceptance: Long established acceptance by consumers and businesses |

Access to Capital: Not yet widely accepted and not a source for entrepreneurs Regulation: Not yet fully regulated and so involves high risk Innovation: New innovative Technology can offer new opportunities for entrepreneurs Technology: Rely on block chain technology and offer security, transparency and efficiency Market Acceptance: In early stages of adoption and not yet widely accepted |

Discussion and Conclusion

Crypto currency gains its advantage as there are 300 academic articles have been published on various aspects of Bitcoin and other crypto currencies over the past several years. The combined market value of crypto currencies is $27 million which represents value creation (Hileman & Rauchs, 2017). There is increased growth for crypto currency and the education on crypto currency goes along with increased demand. According to the Times of India there are over 10crore Indians who own crypto currency and it is estimated that there is 18 million Bitcoin in circulation (Stan, 2021). However, it faces the challenge of clarifying how the market will be regulated in the future and until it becomes a part of the regulated economy, it will be associated with a notion of criminality (Sheelah, 2021). The European Securities and Market Authority (ESMA) predict major threats of crypto currency. They are vulnerable to internet fraud, illicit activities, and high risk losing the invested capital, no exit options, price volatility, inadequate information, and poor technology and hacker attacks. There is a problem of money laundering, financing of illicit purposes, terrorist financing, tax evasion and accounting challenges, lacking standard procedures, rules and regulations and proper definitions are the dark side of crypto currency. Therefore, banks are cautious of Crypto currencies. Study made by Association of Certified Anti-money Laundering Specialists (ACAMS) and the UK’s Royal United Service Institute, 63% of respondents working in the banking industry understand crypto currency inviting risk than opportunities. The reasons behind are 1) decentralized nature 2) absence of intermediary 3) absence of centralized government, bank or agency. It is because of the trust on the block chain code and distributed nature of block chain. It undermines the authority of central banks (Marissa & Scicchitano, 2020). And so, the challenges are to be considered and addressed by startups (Bennet et al., 2022). However, Regulatory agencies work to change the perception of digital currencies by the banks. It believes that crypto currency positively influence financial institutions to a new world of innovation and efficiency. It foresees how traditional financial institutions can have transactions adopting digital currencies. Regulatory Agencies help banks feel comfortable with digital assets and they have allowed the National banks and Federal savings associations to use public block chains (Marissa & Scicchitano, 2020). Realizing the fast growth of crypto currency undermining or neglecting the long established financial institutions may cause damage to the entrepreneurial growth and economic development. The role of entrepreneurs in India is very significant as it contributes to GDP, in Job creation, in Innovation and Technology, Foreign and Direct Investment (FDI), Social impact and inclusive growth, policy advocacy and ecosystem development, networking opportunities, role models and source of inspiration.

The above mentioned financial institutions SIDBI, IFCI, IDBI, NABARD which are well established in India provide the entrepreneurs with enormous opportunities in terms of loans, advances, schemes, financial assistance to small and medium enterprises and job opportunities, providing technical assistance through entrepreneurship institutes and to establish one’s own enterprises. These financial institutions have been accepted by all the businessmen and the entrepreneurs in India. Women entrepreneurs are encouraged and supported by financial institutions providing them innovative and imaginative scheme of activities. They help them in developing income and employment generation ventures and their skills required for the development in different sectors (Pandey & Ansari, 2016). The above comparison between financial institutions and crypto currency such as access to capital, regulation, innovation, and technology and market acceptance except technology reveal financial institutions are the safest platform for investing and establishing as entrepreneurs. This article is with the limitation not analyzing the rest of the financial institutions as in the organizational structure of financial institutions.

In this context, the role and functions of financial institutions of central government of India are significant in the development. entrepreneurship There is no role and functions such as financial institutions in the system of crypto currency. The financial institutions are committed towards the industrial development and the entrepreneurship development. Therefore it will be prudent and wise for the entrepreneurs in choosing financial institutions for the industrial and entrepreneurship development rather than adopting crypto currency throughout the country.

References

Bennet. S., Vincent. G., & Lisa. K. (2022). Blockchain economy : The challenges and opportunities of initial coin offerings. Handbook of Digital Entrepreneurship, 256-270.

Hemant, S. (1982). NABARD: Functions, roles & achievements.

Hileman, G. & Rauchs, M. (2017). Global cryptocurrency benchmarking study. 112.

Indexed at, Google Scholar, Cross Ref

Ismael, R. (2021). Challenges and opportunities cryptocurrency in Iran economy & E-businesses. Bulletin of the Peoples' Friendship University of Russia. Series: Economics, 29(4): 689-698.

Jitendra, K. (2023). SIDBI: The unsung hero of Indian economy.

Kartarzyna, C. (2019). Cryptocurrencies: Opportunities, risks and challenges for anti-corruption compliance systems. OECD Conference on Global Anti-corruption and Integrity Forum. Paris.

Larios-Hernandez, G.J. (2017). Block chain entrepreneurship opportunity in the practices of the unbanked. Business Horizons, 60(6): 865-874.

Indexed at, Google Scholar, Cross Ref

Marissa A., & Scicchitano, CPA. (2020). How crypto currencies may impact the banking industry. Wolf & Co.

Martino. P., Cristiano. B., & Carlos. M.D. (2020). Cryptocurrencies and entrepreneurial finance. The economics of cryptocurrencies, 51-56.

Indexed at, Google Scholar, Cross Ref

Outlook for Brands, (2023). 5 Top Cryptocurrency: Exploring the world of cryptocurrency.

Pandey, N., & Ansari, M.A. (2016). Role of financial institutions in the development of women entrepreneurship. Indian Research Journal of Extension Education, 12(2), 279-282.

Sheelah, K. (2021). The challenges of regulating crypto currency.

Stan, K. (2021). Cryptofication of financial institutions in 2022 and beyond.

Received: 15-July -2023, Manuscript No. AEJ-23-13980; Editor assigned: 19-July-2023, PreQC No. AEJ-23- 13980(PQ); Reviewed: 31-July-2023, QC No. AEJ-23-13980; Revised: 06-Aug-2023, Manuscript No. AEJ-23- 13980(R); Published: 15-August-2023