Research Article: 2022 Vol: 26 Issue: 3S

Risk Disclosure Compliance with IFRS 7 and IAS 39: Evidence from the Uk

Najeb Masoud, Aldar University College

Citation Information: Masoud, N. (2022). Risk disclosure compliance with ifrs 7 and ias 39: evidence from the UK. Academy of Accounting and Financial Studies Journal, 26(S3), 1-21.

Abstract

The primary purpose of this study is to investigate the issue of compliance with the risk disclosure requirements indicated in the IFRS 7 and ISA 39. The investigation is undertaken with non-financial firms in the UK, listed in the FTSE-350 index and covers a six-year period (2007-2014). A quantitative approach involving panel data regression analysis is adopted to determine the impact of firm variables on the extent of risk disclosure compliance in annual reports. A sample of 175 non-financial UK listed firms is used. The results of the study indicate that over the six-year period, the extent of risk disclosure compliance with IFRS 7 and IAS 39 is, on average, 42.93% which is considered very low. The regression results suggest that the variables of governance, leverage, and firm size are positively and significantly associated, while profitability is negatively and insignificantly associated with the extent of risk disclosure compliance under IFRS 7 and IAS 39. Several important empirical findings emerge, which provide much of insight regarding the relevance of these standards to countries outside the western context. Future researchers might concentrate more on other requirements, such as measurement and presentation, on including financial sectors, and on giving attention to the other scoring methods mentioned in the study.

Keywords

Risk Disclosure, Compliance, IFRS 7, IAS 39, Quantitative Approach, UK.

Introduction

Risk is a complex concept to define precisely and has a multi-faceted character. Despite the width of the definition of the concept of risk disclosure, firms are mandated to disclose (or voluntary disclose) risk-related information focused mainly on financial risks (Elshandidy et al., 2018; Dobler et al., 2014). The risk disclosure literature discusses three research areas, these being: the determinants of risk disclosures (incentives); the extent (financial versus non-financial Risk) of risk disclosure; and the informativeness of risk disclosures (Elshandidy et al., 2018). Among these three research areas, risk disclosure is crucial since empirical evidence on the effects of risk disclosure compliance remains inadequate, and the potential benefit of the disclosure of information on risks has yet to be fully explored. In particular, the emergence of the International Financial Reporting Standards (IFRS) and their adoption by several countries obligates firms to report in accordance with these standards. Dumay (2018) argues that disclosure is distinctive from reporting, even if the terms are mostly used synonymously. More clearly, disclosure is “the revelation of information that was previously secret or unknown”, whereas reporting is a “detailed periodic account of a company’s activities, financial condition, and prospects that is made available to shareholders and investors” (Dumay, 2018). Disclosures are thus more functional than reports because investors are always looking for well- timed and hence, valuable information, especially if it is secret or unknown. In this connection, stakeholders such as investors, regulators, and financial analysts consider risk disclosure pertinent to manage uncertainties (Epstein & Buhovac, 2006). Furthermore, the American Institute of Certified Public Accountants (AICPA) reported that shareholders were increasingly demanding that financial statements include more information about risk and uncertainty. And, to reduce risk and uncertainty, firms are under pressure to disclose more information to the market (Courtis, 2000). It would, therefore, seem pertinent to consider how to improve the disclosure of information related to risk and the activities implemented to manage it.

As McGee (2006) pointed out “adopting IFRSs is one thing. Implementing them is something else”. This paper studies the concept of risk disclosure compliance with the standards adopted to augment accounting harmonization, as well as to help achieve the desired objectives, such as understanding the standards, the strength of enforcement of accounting regulations, and the need for information by firms’ stakeholders, it is important to explore the challenges of the IFRS in respect of their requirements pertaining to disclosures, and all the risks arising from the implementation of financial instruments Deloitte. Furthermore, IFRS 7, in combination with IAS 39 are considered to be among the most difficult aspects of the financial reporting standards in terms of their interpretation and consistent application in the UK where there is considerable discretion in the standards’ implementation process concerning whether to make a disclosure. Accordingly, disclosure has been classified as Mandatory or Voluntary. Voluntary disclosure, which constitutes the focus of this study, refers to all the information that an entity wishes to disclose, for instance, the transparency and strength of its position within a progressively competitive environment. Hence, voluntary disclosure, in the context of globalisation of the world’s financial markets, has received considerable attention in the accounting literature in recent years (Einhorn, 2007; Healy & Palepu, 2001). Thus, a firm’s decision to make more voluntary disclosure might be a response to innovation, globalisation, or the changes in business and capital market environments (Healy & Palepu, 2001).

In the UK setting, risk reporting is voluntary, and listed companies are encouraged to disclose business risk information in the Operating and Financial Review (OFR). In fact, since the year 1997, the Institute of Chartered Accountants in England and Wales (ICAEW) has endeavoured to guide and motivate UK firms to voluntarily furnish information about risk in their annual reports. The Institute has published several discussion papers on risk reporting covering prospects and problems of risk reporting together with guidance on how firms can report risk information in their annual report narratives (ICAEW, 1997, 1999, 2002, 2011).

In this paper, the researcher develops a framework for the identification and measurement of risk disclosure in firms’ compliance annual reports by considering the accounting standards, rules, and guidelines issued by the national regulatory bodies and the reporting requirements established at the supranational level by the IASB (IFRS 7 and ISA 39). This approach allows the researcher to investigate risk disclosure compliance under IFRS 7 and IAS 39 by non- financial UK firms listed in the FTSE-350 index. Specifically, the paper examines the extent and determinants of risk disclosure compliance with the requirements of IFRS 7 and IAS 39 over a six-year period (2007-2014) using a quantitative approach that employs panel data regression analysis. The paper addresses the following two research questions: to what extent do firms comply with harmonised accounting standards, to ensure their risk reporting is contained within the organisation’s performance indicators? And if firms do comply, what are the steps (guidelines) suggested when considering the influence of the four firm variables of governance, leverage, size, and profitability on the level of risk disclosure compliance with IFRS 7 and IAS 39 requirements?

To address these research questions, the study focuses on firms’ risk disclosure based on Cooke’s disclosure analysis. Regression analysis is used to establish whether the four variables mentioned influence the extent of risk disclosure compliance, and the scoring formula employed for measuring the index score. The quantitative results indicate that compliance with the requirements of IFRS 7 and IAS 39 is very low, and this finding is consistent with the findings of (Adam-Müller & Erkens, 2020; Tauringana & Chithambo, 2016). The panel data regression results indicate that the extent of risk disclosure compliance is significantly associated with the governance, leverage, and firm size, but not with profitability.

The paper contributes to the literature in two ways. Firstly, to the best of the author’s knowledge, this study is a pioneer in investigating risk disclosure compliance of non-financial UK firms listed in the FTSE-350 index using a quantitative approach (panel data regression) with annual reports. Secondly, the paper contributes to the development of a risk disclosure framework based on IFRS and IAS thereby supporting previous efforts in the area of improving disclosure in response to reporting standards, responding to professional requirements, assisting policy-makers and, government institutions, and supporting the regulatory framework in the western context. This level of risk disclosure practices in important developed country non-financial listed firms is measured using a comprehensive 73-item risk disclosure instrument based on an extensive list of business, operating, strategy, market, and credit voluntary risk disclosure items featured in previous studies.

The rest of the paper is organised as follows. The next section reviews the literature related to compliance levels and develops the hypotheses. Section three then highlights the research design, and Section four presents the significant empirical results of the study. Section five concludes with a summary of the key outcomes of the study.

Risk Disclosure and Hypotheses Development

The risk disclosure literature includes several empirical studies that provide evidence of the usefulness of a firm’s risk-related information for shareholders. The attribute of disclosure is to provide an information system for optimal economic decisions that will contribute to social sustainability (Einhorn, 2005). In addition, disclosure, including risk disclosure, might trigger various types of direct or indirect costs, such as the costs of revealing proprietary information to competitors. De Luca & Phat (2019) inferred that firms provide risk-related information at different levels of specificity based on whether the information is risk description or risk management, whether the firms are operating in manufacturing or non-manufacturing and the type of risk that the firms disclosed in their reports. On the same lines, Li et al. (2019) investigated the effect of risk disclosure on firm investment efficiency, providing evidence of a positive and significant association between risk disclosure and a firm’s investment efficiency.

This study, on the other hand, focuses on disclosure and to the best of the researcher’s knowledge, constitutes the first exploration of risk disclosure compliance of non-financial UK listed firms in the developed countries. In this domain, the studies of Leopizzi et al. (2020), De Luca & Phat (2019); Manes Rossi et al. (2017) all concentrate on non-financial risk disclosure in the Italian context and conduct a manual content analysis. Manes Rossi et al. (2017) investigated the non-financial risk disclosure in corporate firms, reporting that in the year 2015 the majority of firms disclosed non-monetary risk information, backward-looking information on risk, and neutral news on risks.

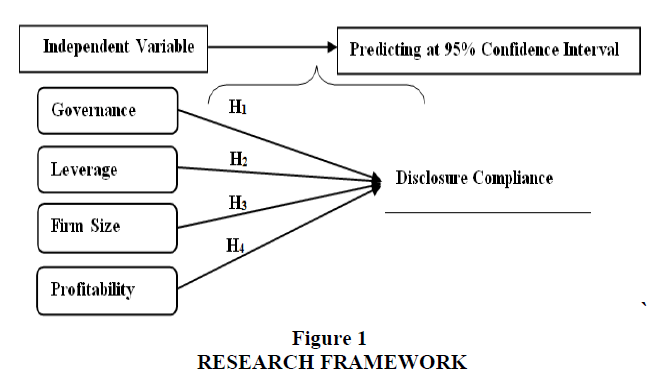

Previous studies regarding IFRS compliance have shown mixed results (for instance, Agyei- Mensah, 2019; Ballas et al., 2018; Tauringana & Chithambo, 2016), which led several researchers to investigate these contradictory findings by conducting more studies in the area. Thus, after the adoption of IFRS, increased interest has been shown in the measurement of disclosure levels by focusing on the issue of compliance, and critically evaluating the outcomes (Elshandidy et al., 2018; Mazumder & Hossain, 2018; Abdul Rahman & Hamdan, 2017; Alfraih & Almutawa, 2017; Juhmani, 2017; Ebrahim & Abdel Fattah, 2015; Elshandidy et al., 2013, 2015). The efforts in this field have also attempted to ascertain the impact of compliance with IFRS mandatory or voluntary disclosure on diverse issues including economic and social factors and the performance of capital markets. The overviews of the literature provided by Elshandidy et al. (2018); Mazumder & Hossain (2018) are analysed in this study as a means of retrieving and examinig the most influential research works on the determinants of mandatory and voluntary financial risk disclosure. Recently, Elshandidy et al. (2018) presented an excellent overview of the empirical literature on firms’ risk disclosure, demonstrating significant divergence in relation to mandatory versus voluntary disclosure, manual versus automated content analysis, within-country versus cross-country analysis, and risk disclosure of financial versus non-financial firms. These scholars identified only one other paper that, similar to this paper, analyses voluntary risk disclosure of non-financial firms in a cross-country setting. However, that paper, by Elshandidy et al. (2015), used automated textual analysis, that was applied to data from three countries with dissimilar accounting standards. The study inferred that country characteristic(s), such as the legal system and cultural values have a higher explanatory value in terms of the observed variations in mandatory risk reporting compared to voluntary risk reporting. In this paper, however, the authors manually collected data from annual reports from a single country with identical standards. As such, the paper explains the variation in risk disclosure compliance between firms across that country in order to address the empirical question of whether voluntary risk disclosure compliance is meaningful. Accordingly, the present study examines the four independent predictor variables of governance, leverage, firm size, and profitability.

Governance

Several studies have confirmed that governance attributes can mitigate risk exposure by enhancing transparency and disclosure quality, protecting shareholders’ interest, and monitoring management (Allini et al., 2016; Al-Maghzom et al., 2016; Elshandidy & Neri, 2015; Taylor et al., 2010). However, some empirical research provides mixed evidence regarding the impact of governance on risk disclosure. Adam-Müller and Erkens (2020) for example, reported a positive relationship between governance and risk disclosure; and on the same lines, Ball (2006) inferred that governance strength is positively related to the precise application and implementation of reporting standards, and therefore, a more pronounced role for governance will ensure more efficient use of firms to apply the same reporting standards (Leuz, 2010). However, previously Armstrong et al. (2010) found a negative market reaction to the adoption of the IFRS in countries with weak governance devices. Consequently, Li (2010) shows that IFRS adoption shrinks financing costs only in countries with strong governance. On the basis of this empirical evidence, the first hypothesis is:

H1: There is a positive and stronger relationship between governance and risk disclosure compliance.

Leverage

Leverage as the second predictor variable explored in this study is one of the most widely used measures, is expressed as the total debt to total equity ratio (Gupta, 2018). Linsley & Shrives (2006) argue that firms with higher levels of risk disclosure provide greater amounts of risk- related information as their managers are prepared to elucidate the causes of high risk. From an agency theory perspective, creditors of highly leveraged firms (i.e., more debt in the capital structures) demonstrate strong incentives to encourage management to disclose more information (Hussainey & Elzahar, 2012). Some of the risk disclosure literature asserts that firms characterised by high leverage ratio tend to be riskier and more speculative (e.g., Khlif & Hussainey, 2016; Elshandidy et al., 2013; Amran et al., 2009), but empirical analyses of an association between leverage ratio and risk disclosure provides mixed evidence. For instance, several studies (Gonidakis et al., 2020; Ntim et al., 2013; Probohudono et al., 2013; Miihkinen, 2012; Oliveira et al., 2011; Linsley & Shrives, 2006; Malone et al., 1993) do not infer a significant association between leverage and risk disclosures, whilst others (Adam-Müller & Erkens, 2020; Tauringana & Chithambo, 2016; Elshandidy et al., 2013; Hassan, 2009; Vandemaele, 2009; Deumes & Knechel, 2008; Iatridis, 2008) find a positive association between the two variables. Based on this inconclusive empirical evidence, the following hypothesis is formulated:

H2: There is a positive and stronger relationship between leveraged firms and risk disclosure compliance.

Firm Size

Firm size is the third predictor variable explored in this study. Prior research (Das et al., 2015; Vandemaele, 2009; Hasan et al., 2009; Linsley & Shrives, 2006; Beretta & Bozzolan, 2004) asserts that firm size is an important determinant of the level of risk disclosure, showing this to potentially influence more/less disclosure. According to the agency theory, larger firms tend to incur lower disclosure costs compared to smaller firms, as larger firms need to disclose more information to different users leading to a reduction in agency costs and information asymmetry between managers and shareholders (Watts & Zimmerman, 1986). Elzahar & Hussainey (2012) furthermore concluded that large firms were likely to disclose more risk information. However, empirical evidence on the effect of firm size on risk disclosure is mixed. While some findings denote a significant positive association between firm size and risk disclosure (Adam-Müller & Erkens, 2020; Tauringana & Chithambo, 2016; Barakat & Hussainey, 2013; Elshandidy et al., 2013, 2015; Ntim et al., 2013; Deumes & Knechel, 2008; Linsley & Shrives, 2006; Beattie et al., 2004) other studies conclude an insignificant association between these two variables (Campbell et al., 2014; Hill & Short, 2009; Kou & Hussain, 2007; Lajili & Zegal, 2005). Moreover, some other studies find no association between firm size and risk disclosure (Ashbaugh-Skaife et al., 2007; Doyle et al., 2007). This study suggests that larger firms provide higher financial risk disclosure and thus, presents the following hypothesis:

H3: There is a positive and stronger relationship between firm size and risk disclosure compliance.

Profitability

Regarding profitability, the fourth predictor variable in this study, the literature contends that managers of profitable firms tend to release more information to express their ability to maximise shareholder value. High-profitability firms, therefore, execute relatively greater disclosure not only to reassure investors (Camfferman & Cooke, 2002) but also to increase managerial compensation (Wallace & Naser, 1995). Managers of unprofitable firms are less likely to release additional information to conceal their bad performance and safeguard corporate shares from being undervalued, as evidenced in several studies (Aljifri et al., 2014; O’Sullivan et al., 2008; Alsaeed, 2006). The empirical results on the relationship between profitability and risk disclosure are also inconclusive as a positive relationship is supported by several empirical studies (e.g., Nandi & Ghosh, 2013; Miihkinen, 2012; Chavent et al., 2006; Mohobbot, 2005; Giner, 1997; Wallace & Naser, 1995), while an insignificant relationship between the said variables is reported in others (Gonidakis et al., 2020; Adam-Müller & Erkens., 2020; Al?Maghzom, 2016; Tauringana & Chithambo, 2016; Oliveira et al., 2011; Linsley et al., 2006; Lajili & Zegal, 2005). Based on this inconclusive empirical evidence, the following hypothesis is offered:

H4: There is a positive and stronger relationship between profitability and risk disclosure compliance.

The Research Designs

This section outlines the required process for constructing mandatory disclosure requirements as outlined in IFRS 7 and IAS 39. It indicates the methods employed in this study, illustrating the steps in constructing an index. It is divided into two sections, the first describing the sample selection and data collection, and the second discussing the guidelines being utilised in building the research conceptual framework.

Sample and Data Collection

The sample was taken from the UK companies listed under the IFRS 7, IAS 39 and covers six time periods (2007-2014). As IFRS 7 was implemented on 1 January 2007, the analyses are based on data from the first fiscal year starting after that date. A six-year interval was chosen to ensure greater time coverage for the analyses, hence allowing a better in-depth analysis of the trends. The firms are representative of a wide range of businesses. Based on the selection criteria, a sample comprising the annual reports of 175 non-financial companies listed in the FTSE-350 index was sought, collected, and analysed. IFRS 7 and IAS 39 were selected to highlight the significance of financial instruments and their impact on financial information quality in general. Secondary sources were used to collect risk data from reports, namely annual reports (whether from the stock markets’ websites or the official websites of the firms), information from the official IFRS website, and from sources like DataStream, auditing firm websites, and prior literature (Ding et al., 2005; Kaufmann et al., 2009). The disclosure compliance score is based on mandatory disclosure requirements as outlined in IFRS 7 and IAS 39.

The next important step was to take into consideration the materiality of the items, and to specifically assess whether the average disclosure of items reached the value of 73 (see Appendix 1). Then the most appropriate approach for scoring the items on the checklist was determined, and here the work of Tsalavoutas et al. (2018) was germane since it highlights the six most-commonly used methods by researchers as: Cooke’s method, Cooke’s adjusted, partial compliance PC method, item by item, Saidin index, and counting items. In their work, Tsalavoutas et al. (2018) provided a rich review of 81 studies related to compliance with IFRS mandatory disclosure requirements. observing that around 44% of the sample adopted Cooke’s method for scoring the index. Consequently, this study also used Cooke’s method, which computes compliance as the ratio of the total number of items disclosed to the maximum possible number of disclosure items. Items considered as non-applicable to a particular firm have been excluded from the computation. More specifically, this method has been used in 46 studies (e.g., Agyei-Mensah, 2019; Dawd & Charfeddine, 2019; Ajili & Bouri, 2018; Dawd, 2018; Agyei-Mensah, 2017; Sellami & Tahari, 2017; Devalle et al., 2016; Cascino & Gassen, 2015; Tsalavoutas & Dionysiou, 2014; Tsalavoutas, 2011). Despite the importance of this step, several researchers may not be aware of the significant discussion and clarification needed during this step as a part of the process for formulating the risk disclosure. Notably, as a starting point, if an item is disclosed, the indicator variable takes a value of 1, or 0 otherwise. Thereafter, the items are indicated and divided taking into account the actual disclosure level, for instance, where no exposure to commodity risks was present, the items related to commodity risks were omitted.

Research Conceptual Frameworks

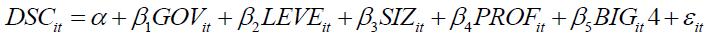

In order to perform the value relevance analysis, the current study adopted the quantitative approach that uses panel data regression analysis to verify whether firm variables determine the extent of risk disclosure compliance (Figure 1). Specifically, researchers must sometimes decide whether to use either a fixed or a random effects approach in an analysis similar to that undertaken in this study. In econometrics, the random effects models (REM) are used in panel analysis of hierarchical or panel data when one assumes no fixed effects as a single common intercept term. In addition to the REM, it is assumed that there is one common intercept term and that the intercepts for individual companies vary from this common intercept in a very random manner for which the fixed effects model assumes different intercepts for individual companies (Ibrahim et al., 2011). Correspondingly, to choose the appropriate model, both the random- and fixed-effects estimators (RE and FE, respectively) are two competing methods that are used to estimate the coefficient in the model. The next step is the Hausman test, which rejected the null hypothesis that the unobserved heterogeneity is uncorrelated with the regressors. The distribution demonstrates a useful simplification when one of the compared estimators is efficient under the null, as originally proposed by Hausman (1978). This is a significant finding, according to which, although the random and the fixed effects regression model were significantly different, the fixed effects’ estimator was observed to be more consistent and efficient. As such, to test the research hypothesis on the association between risk disclosure compliance, and independent variables (Table 1), the model used for the quantitative approach (panel data regression) of the annual reports is expressed as the following equation:

| Table 1 Summary of Variable Measurement | ||||

| Acronyms | Type of Variables/ Proxies |

Measurement | Predicted Sign | Data source |

| Dependent variables | ||||

| DSC | Disclosure Compliance | Risk disclosure compliance score measured by the number of IFRS 7 and IAS 39 disclosure items included in the index that are disclosed in the annual report of an individual firm divided by the maximum total number of risk disclosure items applicable to a particular firm. | (+) | Annual report |

| Independent variables | ||||

| GOV | Governance Enforcement | Governance measured by the five dimensions of governance corresponding from a factor analysis of country-level voice and accountability; government effectiveness; regulatory quality; rule of law; control of corruption (Kaufmann et al., 2009) |

(+) | Annual report DataStream |

| LEVE | Leverage (Gearing) | Leverage ratio is measured as total debt at the end of the financial year divided by total equity plus total debt as at the financial year-ends of each of the six years. |

(+/-) | Annual report DataStream |

| SIZE | Firm Size | Firm size measured by the natural logarithm of total assets as at the financial year-ends of each of the six years. |

(+/-) | Annual report DataStream |

| PROF | Profitability | Profitability is measured by net income to net sales ratio as at the financial year-ends of each of the six years. |

(+/-) | Annual report DataStream |

| BIG4 | BIG4 auditor | indicates whether a firm is audited by a BIG4 firm | (?) | Annual report |

In which the DSCit is the disclosure compliance at year end t for firm i. The subscript i denotes observations at the firm level and the subscript t denotes years starting from one to six. α is a constant whereas β1 … β5 is regression coefficients. GOVit is governance that emerges from a factor analysis using five components: Analysis of country-level voice and accountability, government effectiveness, regulatory quality, rule of law, and control of corruption at year end t for firm i. LEVEit is leveraged firm at year end t for firm i, SIZit is firm size at year end t for firm i, PROFit is Profitability at year end t for firm i. BIGit 4 is a dummy variable that measures the audited firms’ going concern risk (it takes the value of 1 when there is going concern risk in the audit report and 0 otherwise), and εit is a random error term.

The dependent variable in this model is the extracted risk disclosure score. Several studies (Leopizzi et al., 2020; De Luca & Phat, 2019; Manes Rossi et al., 2017; Abdullah et al., 2015; Ntim et al., 2013; Elzahar & Hussainey, 2012; Linsley & Shrives, 2006) have employed content analysis to measure the level of risk disclosure in annual reports. The main independent variable - the determinants of risk disclosure governance – is assessed via a factor analysis using five components: country-level voice and accountability, government effectiveness, regulatory quality, rule of law, and control of corruption, all taken from Kaufmann et al. (2009). Other variables that have been observed and compiled from other sources include leverage, firm size, and profitability. Firms with a high level of risk sustain high monitoring costs, which can be reduced by greater levels of disclosure, either mandatory or voluntary (Abraham & Cox, 2007; Lajili & Zéghal, 2005; Camfferman & Cooke, 2002). Moreover, high-risk firms need to satisfy the demands for information from their long-term creditors. These lines of argument suggest a positive relationship between the intersecting variables. However, firms with higher levels of risk may not draw attention to their ‘riskiness’, and therefore, they may be reluctant to voluntarily disclose significant amounts of risk information. The larger the firm, the more likely it is to have sophisticated information systems capable of producing data for internal and external reporting, thereby making it less expensive for larger firms to provide risk disclosures than it is for smaller firms. Beretta & Bozzolan (2004) did not find a positive significant association between size and risk disclosure, and Elshandidy et al. (2013, 2015); Dobler et al. (2011), Abraham & Cox (2007); Linsley & Shrives (2006) did obtain a positive relationship between the two variables. With respect to profitability, higher profitability has been found to induce firms to provide greater disclosure not only to reassure investors (Camfferman & Cooke, 2002) but also to augment managerial compensation (Wallace & Naser, 1995). In this matter, some scholars have found an expected positive association between the two variables (Elzahar & Hussainey, 2012; Taylor et al., 2010; Deumes & Knechel, 2008; Marshall & Weetman, 2007), while Elshandidy et al. (2015) demonstrated an insignificant negative impact of higher profitability on risk disclosure.

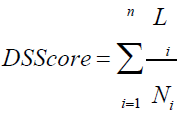

In order to create an index score that can measure the degree of risk disclosure compliance, the researcher suggests several steps that researchers in this area should follow. These steps have been developed from the main sources, that is, the guidelines provided by the two standards IFRS 7, and IAS 39 (see Appendix 1). Here, the purpose was to ensure that the score encompassed all of the requirements of these pronouncements, and the accounting literature (Abdallah et al., 2015; Barakat & Hussainey, 2013; Kaufmann et al., 2009). To assess the level of risk disclosure in the present study, the researcher used content analysis, which is a traditional approach in disclosure studies (see for example, Krippendorff, 2008; Mangena & Tauringana, 2007; Hossan et al., 1994) since it guarantees repeatability and valid inferences can be made from the data according to their contexts. Other methods of measuring disclosure such as the classification approach to disclosure indexes (weighted and unweighted) have also been suggested in the literature. Cooke (1989, 1992) argued that attaching weights to items of information is irrelevant because those enterprises that are better at disclosing ‘important items’ are also better at disclosing ‘less important items’, that is to say that firms are coherent with their disclosure policies. He used that argument because his research was not focused on one group of users but rather took into account all user groups. Although the weighted index has often been used in accounting research, it does have some drawbacks. For instance, as noted by Marston and Shrives (1991), there is an uncertain theoretical justification for the weighting, and weighting a particular item does not represent the exact importance of the item, but rather just the perceptionof one particular user or class of users. Given this circumstance, the unweighted index is more popular amongst others. Without doubt, both techniques have positive and negative points, and it is the researcher’s decision which is the most suitable approach for a study based on the different situations. In the current study, Cooke’s method, also referred to as the ‘unweighted dichotomous approach’ is chosen as the most appropriate since no importance is given to any specific user groups (Hossain et al., 1994; Cooke, 1989).

A two-step process was adopted, involving an initial extensive review of prior studies and the subsequent identification of the common items used in risk disclosure; and a subsequent segregation of items in in accordance with regulatory requirements (IFRS 7 and IAS 39 standards). This step, correspondingly, raised an important question: What kind of item is being looked for? If the purpose of the index score is measuring disclosure, it is necessary to focus only on all the disclosure requirements and ignore those related to presentation items or measurement methods used in financial operations.

In total, the proposed risk disclosure index includes 73 items spread across ten categories of information (Table 1). Furthermore, using Cooke’s unweighted approach, the index is considered appropriate to measure the compliance level for more than one standard, since the calculation for this approach requires the total items for each standard (Tsalavoutas et al., 2012). However, the firm is not penalised if an item does not apply.

Furthermore, in order to make a judgment regarding the applicability of an item in the risk disclosure, when allocating the compliance index score to the firm, the author took into account the firm’s complete annual report (e.g., Wallace & Naser, 1995; Cooke, 1989). To compute the level of risk disclosure by companies, the researcher assigned to each of these risk items the number of sentences disclosed in companies’ annual reports. After constructing the risk disclosure, the next key step included following code risk disclosures by any sentence that informs the reader about “any opportunity or prospect, or of any hazard, danger, harm, threat or exposure, that has already impacted or may impact upon the firm, as well as the management of any such opportunity, prospect, hazard, harm, threat, or exposure” (Linsley & Shrives, 2006).

The magnitude of the compliance issue highlights the need to focus on the instrument used to measure the compliance index score to achieve the desired results and, in turn, to reduce the differences in the application of standards across the country. Hence, to ascertain the index score, the author considered alignment of the process with the necessary requirement for improved disclosure as suggested by earlier researchers (e.g., Adam-Müller & Erkens, 2020; Yamani & Hussainey, 2020; Elshandidy et al., 2018; Oliveira et al., 2011; Nazli & Ghazali, 2007; Barako et al., 2006; Owusu-Ansah, 1998). Moreover, in line with prior literature, and for the purposes of the current study, Cooke’s method has been applied to score the disclosure of IFRS 7 and IAS 39 requirements: 1 for disclosed items, 0 for non-disclosed items, excluding non-applicable items. As such, the total risk disclosure compliance score per firm was measured as follows:

Where the DSScore is the aggregate risk disclosure compliance per observation. where Li is 1 if the item i is disclosed and 0 otherwise, Ni is the number of items which has an upper limit for each firm and n is the total number of disclosure items applicable to each firm. Firms were not penalised because the inapplicable items were unpublished since the disclosure index score dominator was adjusted to include only the number of relevant items that a firm might have been expected to publish. Furthermore, to ensure robustness, the counting items method was applied as additional analysis for scoring disclosure by applying Cooke’s methods on 175 non-financial firms listed in the FTSE-350 index over a six-year period (2007-2014) in the UK.

After concluding the disclosure index score related to IFRS 7 and IAS 39 in its final version of items, its reliability was verified as a part of the study analysis, and accordingly, several relevant tests were conducted to secure that objective. Specifically, the researcher performed an inter?rater reliability test to check for consistency in coding, and for accuracy of risk disclosure scores. It has been observed that in respect of accuracy, a Cronbach’s alpha test which helps to measure the internal consistency between the items in the index score is typically used (Krippendorff, 2013; Hayes & Krippendorff, 2007). On the same lines, here, alpha is equal to 80%, which is considered a good score, and this, in turn, increases the level of reliability of the index score employed for this study, with a minimum of 0.67 (Rouf & Akhtaruddin 2018; Krippendorff, 2008).

Empirical Results and Discussion

Descriptive Analysis

The descriptive statistics relating to the risk disclosure compliance score and all other variables are presented in Table 2. A visual inspection of the table illustrates that the average disclosure compliance by the sampled firms over the whole six-year period is inferred at 42.93%, with a large variation in risk reporting between the sampled firms, with a minimum of 10.02% and a maximum of 60.81%. This finding is consistent with the prior studies conducted by Adam-Müller and Erkens (2020); Tauringana and Chithambo (2016) which revealed the average risk disclosure compliance to be only 62% and 40% perceptively. However, in contrast, these findings are inconsistent with the study conducted by Taplin et al. (2002) who found a higher level of compliance with disclosure issues, that being 95.5%. This disparity may be due to the following reasons. Firstly, in Europe (excepting the UK), corporate risk disclosure is mandatory (Veltri et al., 2020), and this study’s use of voluntary disclosure may partially account for the dichotomy in findings as provided by the ICAEW regulation and policy. Nevertheless, in concurrence with Elshandidy et al. (2018), the author believes that mandating disclosure incentivises, as it encourages higher levels of conformance to regulations when there is no other incentive to disclose and therefore helps reduce information asymmetry (Dobler, 2008). Moreover, the incentives to voluntarily disclose information appear to be relatively low precisely when they might be most desirable, for instance, when financial risks are high (Marshall & Weetman, 2007). On the contrary, theories of voluntary disclosure struggle to explain why firms are incentivised to reveal risk information (Abraham & Shrives, 2014). Secondly, in terms of reporting, firms are required to provide analogous information about disclosing information that carries different levels of risk. Hence, as regards risk reporting, Dobler et al. (2011) revealed that observed variations in the quantity of risk disclosure are partially associated with domestic regulation, which plays an important role in firm incentives. Malafronte et al. (2016) also inferred that the amount of risk information provided in an annual report is associated with size, technical provision, and country-level characteristics. In particular, because complex elements like risk disclosure can be included in a statement in the annual reports and accounts, executives might withhold information that is not easily verifiable or accurate.

| Table 2 Descriptive Statistics (N=175) | ||||||

| Variables | Mean | Median | SD | Min | Max | VIF |

| DSC | 0.4293 | 0.3910 | 0.1407 | 0.1002 | 0.6081 | - |

| GOV | 0.1362 | 0.1011 | 0.4637 | -1.4307 | 1.1363 | 1.079 |

| LEVE | 0.2830 | 0.2598 | 0.1731 | 0.0002 | 0.8079 | 1.234 |

| SIZE | 7.7370 | 7.5206 | 1.5677 | 4.2125 | 11.3620 | 1.002 |

| PROF | 0.0720 | 0.0405 | 0.0809 | -0.2101 | 0.3265 | 1.298 |

| BIG4 | 0.8240 | 0.2410 | 0.2910 | 0.0000 | 1.0000 | 1.272 |

The descriptive statistics of the main independent variable governance show a 13.62% mean which emerges from a factor analysis using five components: country-level voice and accountability, government effectiveness, regulatory quality, rule of law, and control of corruption, all taken from Kaufmann et al. (2009). A more detailed investigation of Table 2 reveals that the mean of leveraged firms is 28.30, while the profitability ranges from minus 21.01% to 32.65%. Thus, before conducting the regression analysis, multicollinearity was tested by employing the Variance Inflation Factors (VIFs) to detect any noises in the model. According to Field, low values of VIFs are expected when there is a need to control the multi- collinearity problem. In this study, the mean VIFs range from 1.002 to 1.298, as illustrated in Table 2, that is, all the values are below 3.3, implying that multicollinearity does not appear to be a real problem in our model.

Univariate Analysis

Table 3 presents the correlation matrix showing the relationship between each of the independent variables and the dependent variables. As seen in the results, positive as well as negative relationships were observed. Table 3 also shows that the dependent variable disclosure compliance is strongly related to governance, and leveraged firms are at 0.73, and 0.68 values respectively, with less than 1% p-values. The highest correlation among independent variables between leveraged firms and profitability is -0.42. Correspondingly Field suggested that a simple correlation between independent variables should not be considered harmful in regression estimates unless the values exceed 0.8 or 0.9. This suggests that multicollinearity problems among the dependent variables are unlikely to arise in the proposed model. The correlation coefficients between the disclosure compliance and leverage, firm size, and profitability are 0.39, and -0.32, respectively, and have p-values of less than 1% (Table 3).

| Table 3 Correlation Matrix | |||||

| Variables | DSC | GOV | LEVE | SIZE | PROF |

| DSC | 1 | ||||

| GOV | 0.728** | 1 | |||

| LEVE | 0.682** | -0.018 | 1 | ||

| SIZE | 0.386** | -0.013 | -0.019 | 1 | |

| PROF | -0.320* | 0.263 | - 0.421* | -0.027 | 1 |

| BIG4 | 0.041 | 0.239 | -0.071 | 0.392 | 0.460* |

Multivariate Analysis

Table 4 presents the results of the regression estimates regarding the relationship between disclosure compliance and firm characteristics. These estimates provide evidence that the coefficients of governance, leverage, and firm size are statistically positive and significant. Furthermore, the computed values of the profitability variable are statistically insignificant, and the efficiency coefficient values are negative. In contrast, firms with low efficiency were reluctant to disclose risk, creating significant problems. Based on this classification, the adjusted R2 measuring the strength of the relationship between the set of independent variables and the dependent variable is 82.79%, which indicates that independent variables are relevant in predicting DSC. The Wald chi2 statistic is 342.2, indicating that the errors in regression are independent. The computed Prob > F is 0.0012 and hence, supports the study hypotheses.

| Table 4 The Results of Regression Model for Determinants of DSC | |||||||

| Variables | ES | Unstandardized coefficients | t-statistic | Sig. | 95% Confidence Interval for B |

||

| B | Std. Error | Lower Bound | Upper Bound | ||||

| Intercept | (?) | -0.4182 | 0.3105 | -1.08 | 0.180 | -0.8982 | 0.1890 |

| GOV | (+) | 0.3490*** | 0.2504 | 2.91 | 0.000 | 0.8417 | 0.1643 |

| LEVE | (+/-) | 0.1252** | 0.1015 | 2.17 | 0.005 | 0.1090 | 0.5301 |

| SIZE | (+/-) | 0.1645** | 0.1231 | 2.14 | 0.001 | 0.7652 | 0.0982 |

| PROF | (+/-) | -0.0522 | 0.1412 | -0.04 | 0.620 | -0.4162 | 0.2849 |

| BIG4 | (?) | 0.2750 | 0.2359 | 1.06 | 0.143 | 0.5244 | 0.1236 |

| R-squared | 82.79% | Adj. R-squared | 71.68% | ||||

| Wald chi2 | 342.2 | Prob > F | 0.0012 | ||||

| sigma_u | 1.207 | sigma_e | 1.231 | ||||

| # of observation | 175 | Root MSE | 0.0931 | ||||

Considering the results in Table 4, it is seen that the coefficient on governance is 0.3490 and is positively significant at the 1% level, suggesting the governance variable is positively and significantly associated with disclosure compliance as estimated (H1). Accordingly, this process is similar to the revision of relevant items, wherein, the five governance indicators are, as expected, positively related to disclosure compliance. For instance, an increase of one standard deviation in governance strength correlates to a 0.46-standard-deviation increase in disclosure compliance. The study findings are consistent with those obtained by Adam-Müller and Erkens (2020); Kaufmann et al. (2009) and reflect the inherently conservative nature of the principles that guide the views of a diverse range of informed stakeholders (Tsalavoutas et al., 2018).

The analysis presented in Table 4 also suggests that firm risk (leverage ratio) is significantly associated with disclosure compliance under IFRS 7 and IAS 39, leading to acceptance of H2 (consistent with agency theory tenets). This result is concurrent with previous empirical evidence (e.g., Adam-Müller & Erkens., 2020; Tauringana & Chithambo 2016; Elshandidy et al., 2013; Abraham et al., 2012; Vandemaele, 2009; Malone et al., 1993) of a positive correlation. However, several other studies (Gonidakis et al., 2020; Probohudono et al., 2013; Miihkinen, 2012; Ahmed & Courtis, 1999; Hossain et al., 1995) did not infer any relationship between risk disclosure and leverage ratio. Specifically, firms with high levels of risk should disclose as much information as possible to their shareholders and pay special attention to sharing complete, adequate, correct, and accurate information so that investors have all the intelligence they need about the causes of risks, as well as the steps being taken to mitigate the associated negative impacts. Hence, there should be a positive relationship between disclosure and the level of risk. Disclosure compliance refers to tools that enable the reduction of information asymmetries between shareholders and debt holders through managing social and political pressures and improving investors’ confidence. This association is also consistent with both agency theory and enhanced legitimacy, which advocate that stakeholders’ monitoring and pressure indeed improve market discipline (Frolov, 2007; Fernández?Alles & Valle?Cabrera, 2006). The results of the regression test show that the main effect of leverage remains positive and significant (Tsalavoutas et al., 2028).

Table 4 also presents the estimated relationship between firm size and disclosure compliance as seen in the annual reports. The firm size seemed to have a very important influence (H3), which garners sufficient support from a multi-theoretical perspective from agency and stakeholders’ theories. Large firms that depend on shareholders are motivated to provide additional financial information. On the same lines, Deumes & Knechels (2008) used a sample of Dutch publicly- traded firms revealing that the managers of large firms disclosed more risk information. This study finding is consistent with previous studies (Adam-Müller & Erkens., 2020; Tauringana & Chithambo, 2016; Barakat & Hussainey, 2013; Elshandidy et al, 2013, 2015; Probohudono et al., 2013; Beattie et al., 2004; Firth, 1984). Correspondingly, other scholars, like, Elzahar & Hussainey (2012); Linsley & Shrives (2006), and Abraham & Cox (2007) found that UK firms disclosed more risk information. Furthermore, Konishi & Ali (2007) inferred that firm size is positively related to risk disclosure. However, they did not find any relationship between risk disclosure and other firm characteristics. Beretta & Bozzolan (2004) concluded the existence of a significant relationship between risk and firm size in Italy. A similar relationship was revealed by Elshandidy et al. (2013); Hossain et al. (1995). Consequently, firm size (with a positive coefficient) variables are statistically significant factors in helping to explain the level of disclosure compliance.

Furthermore, the coefficient on profitability is negative (-0.0522) and thus not a significant predictor of the extent of disclosure compliance, as presented in Table 4. This inference is contrary to the study hypothesis of a positive association. Thus, there is no evidence to accept the hypothesis (H4) that profitability is related to disclosure compliance. Higher profitability induces firms to provide greater disclosure not only to reassure investors (Camfferman & Cooke, 2002) but also to increase managerial compensation (Wallace & Naser, 1995). Indeed, it may be argued that less profitable entities might decide to disclose more information in order to lower the cost of capital. As such, these study findings are consistent with previous studies that inferred a negative impact on risk disclosure (Gonidakis et al., 2020; Adam-Müller & Erkens., 2020; Juhmani, 2017; Al?Maghzom, 2016; Tauringana & Chithambo, 2016; Oliveira et al., 2011; Taylor et al., 2010; Reverte, 2009; Linsley et al., 2006; Lajili & Zegal, 2005). However, in contrast, other studies (Nandi & Ghosh, 2013; Miihkinen, 2012; Chavent et al., 2006; Mohobbot, 2005; Giner, 1997; Wallace & Naser, 1995) found a positive relationship between the variables of profitability and risk disclosure. From the analysis of the study as reported in Table 4, it emerges that the coefficient of Big4 audit firms is positive but statistically insignificant. This finding is consistent with the research conducted by Ferreira & Morais (2020). In addition, Deumes & Knechel (2008) obtained a negative association between auditor type and the extent of disclosure. On the other hand, Das et al. (2015) reported that financial statements of firms that are audited by the Big4 audit firms are perceived to be more credible than those audited by non-Big4 firms. And Taplin et al. (2014) inferred that firms audited by Chinese domestic auditors have significantly lower compliance than firms audited by Big4 auditors for disclosure. In fact, under the Chinese accounting standards, compliance remains low even after firms receive unqualified reports from these international auditors. These results suggest that larger firms, high-profitability firms, and firms audited by Big4 firms provide more risk disclosure. One possible explanation is that the bigger the firm, and the higher the profitability, the higher is the level of resources available, and thus the higher is the level of disclosure produced. As such, it may be argued that the presence of a Big4 firm is not fundamental to stimulating the disclosure of risk information independently of the risk regulation system in the country studied in this paper.

Conclusion

This study, as previously mentioned, addresses the following questions: To what extent do firms conform with harmonised accounting standards, such that their risk reporting lies within the organisation’s performance indicators? And in the situation where firms do comply, what are the steps (guidelines) suggested to influence the level of risk disclosure compliance with IFRS 7 and IAS 39 requirements in respect of the firm variables? To address these research questions, the study has focused on firms’ risk disclosure based on Cooke’s disclosure analysis, and has used regression analysis to verify whether the four variables of governance, leverage, firm size, and profitability were influential upon the extent of risk disclosure compliance in the UK during the period 2007-2014.

In order to provide empirical evidence of compliance, the disclosure requirements of IFRS 7 and IAS 39 were used as the basis for constructing an index score. The next important step was to study the materiality of the items, specifically the average disclosure of items, and this was seen to reach 73 at the final stage. The results suggest that the extent of risk disclosure compliance over the six-year period is, on average, 42.93% which is very low, and consequently, the study raises the need for more principles of disclosure to be introduced together with clarification of the role of the specific disclosure requirements in IFRS and IAS standards, and for firms to do more to enforce compliance. According to the empirical findings, three variables governance, leverage, and firm size were found to be significantly related to the extent of risk disclosure compliance. Profitability was not found to be a significant influence. Firms with less profitable entities might decide to disclose more information in order to lower the capital cost.

The results of the current study present important implications for theory and practice. Firstly, to the best of the author’s knowledge, this is the first study that explores the Disclosure Compliance of non?financial firms within a developed country. This focus is significant in that it measures the risk?disclosing practices of firms in response to the requirements of IFRS 7 and IAS 39 in their annual reports. Simultaneously, the paper provides a great deal of insight into the revision or addition of mandated rules regarding the relevance of certain accounting standards to countries outside the Western context. In addition, the findings provide valuable insights for policy-makers in the UK who are concerned about the implications of disclosure compliance. The study findings emphasise the role of enforcement in disclosure compliance and suggest that a country should require mandatory or aggregated (voluntary plus mandatory) risk disclosure in annual report narratives since the adoption of the IFRS has become mandatory in most countries around the world.

As with all research, this study has its shortcomings, one being that it focuses only on the disclosure requirements, and therefore, it would benefit to expand the focus to other types of requirements, for instance, performance measurement, and presentation requirements. Since the current study addresses only IFRS 7 and IAS 39 standards, the application of some methods of scoring, such as Cooke’s method, which requires more than one standard with different categories, can be limiting. Further, from the literature, and particularly from the studies conducted by Tsalavoutas, it is apparent that Cooke’s method is the most widely applied methodology in related studies and research. This suggests that more attention might be given to the other methods as offered by Tsalavoutas for future researchers, providing they can be demonstrated as being sufficiently robust to enhance the validity of the compliance scores and are able to explicate on or interpret a set of phenomena. Lastly, this study did not consider firms in the financial sector, and future investigations may consider including these to attract more attention to the measurement of compliance in this sector.

Declaration of Competing Interest

As the author, I declare that I have no known competing financial interests or personal relationships that may have been influential in the work reported in this paper.

References

Abdul Rahman, A., & Hamdan, M.D. (2017). The extent of compliance with FRS 101 standard: Malaysian evidence. Journal of Applied Accounting Research, 18(1), 87-115.

Indexed at, Google Scholar, Cross Ref

Abdullah, M., Evans, L., Fraser, I., & Tsalavoutas, I. (2015). IFRS mandatory disclosures in Malaysia: The influence of family control and the value (ir)relevance of compliance levels. Accounting Forum, 39(4), 328-348.

Indexed at, Google Scholar, Cross Ref

Abraham, S., & Cox, P. (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review, 39(3), 227-248.

Indexed at, Google Scholar, Cross Ref

Abraham, S., & Shrives, P.J. (2014). Improving the relevance of risk factor disclosure in corporate annual reports.

Indexed at, Google Scholar, Cross Ref

Abraham, S., Marston, C., & Darby, P. (2012). Risk Reporting: Clarity, Relevance and Location. ICAEW. Accounting and Business Research, 40(3), 229-256.

Adam-Müller, A.F., & Erkens, M.H. (2020). Risk disclosure noncompliance. Journal of Accounting and Public Policy, 39(3), 106-739.

Indexed at, Google Scholar, Cross Ref

Agyei-Mensah, B.K. (2017). The relationship between corporate governance mechanisms and IFRS 7 compliance: Evidence from an emerging market. Corporate Governance (Bingley), 17(3), 446-465.

Indexed at, Google Scholar, Cross Ref

Agyei-Mensah, B.K. (2019). The effect of audit committee attributes on compliance with IAS 24-related party disclosure: An empirical study. Managerial Law, 61(1), 266-285.

Indexed at, Google Scholar, Cross Ref

Ahmed, K., & Courtis, J.K. (1999). Associations between corporate characteristics and disclosure levels in annual reports. The British Accounting Review, 31(1), 35-61.

Indexed at, Google Scholar, Cross Ref

Ajili, H., & Bouri, A. (2018). Corporate governance quality of Islamic banks: measurement and effect on financial performance. International Journal of Islamic and Middle Eastern Finance and Management, 11(3), 470- 487.

Indexed at, Google Scholar, Cross Ref

Alfraih, M.M., & Almutawa, A.M. (2017). Voluntary disclosure and corporate governance: Empirical evidence from Kuwait. International Journal of Law and Management, 59(2), 217-236.

Indexed at, Google Scholar, Cross Ref

Aljifri, K., Alzarouni, A., Ng, C., & Tahir, M.I. (2014). The association between firm characteristics and corporate financial disclosures: Evidence from UAE companies. International Journal of Business & Finance Research, 8, 101-123.

Allini, A., Rossi, F.M., & Hussainey, K. (2016). The board’s role in risk disclosure: An exploratory study of Italian listed state-owned enterprises. Public Money & Management, 36(2), 113-120.

Indexed at, Google Scholar, Cross Ref

Al-Maghzom, A., Hussainey, K., & Aly, D. (2016). The level of risk disclosure in listed banks: evidence from Saudi Arabia. Corporate Ownership and Control, 14(1), 175-194.

Indexed at, Google Scholar, Cross Ref

Alsaeed, K. (2006). The association between firm-specific characteristics and disclosure. Managerial Auditing Journal, 21(5), 476-496.

Indexed at, Google Scholar, Cross Ref

Amran, A., Bin, A.M.R., & Hassan, B.C.H.M. (2009). Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal, 24(1), 39-57.

Indexed at, Google Scholar, Cross Ref

Armstrong, C.S., Barth, M.E., Jagolinzer, A.D., & Riedl, E.J. (2010). Market reaction to the adoption of IFRS in Europe. Accounting Review, 85(1), 31-61.

Indexed at, Google Scholar, Cross Ref

Ashbaugh-Skaife, H., Collins., D., & Kinney, W. (2007). The discovery and reporting of internal control deficiencies prior to SOX-mandated audits. Journal of Accounting and Economics, 44(1-2), 166-192.

Indexed at, Google Scholar, Cross Ref

Ball, R. (2006). International Financial Reporting Standards (IFRS): pros and cons. Accounting and Business Research, International Accounting Policy Forum, 5-27.

Indexed at, Google Scholar, Cross Ref

Ballas, A., Sykianakis, N., Tzovas, C., & Vassilakopoulos, C. (2018). Measuring compliance with IFRS mandatory disclosure requirements: Some evidence from Greece. In Perspectives, Trends, and Applications in Corporate Finance and Accounting, 273-300.

Indexed at, Google Scholar, Cross Ref

Barakat, A., & Hussainey, K. (2013). Bank governance, regulation, supervision, and risk reporting: Evidence from operational risk disclosures in European banks. International Review of Financial Analysis, 30, 254-273.

Indexed at, Google Scholar, Cross Ref

Barako, D., Hancock, P., & Izan, H. (2006). Factors influencing voluntary corporate disclosure by Kenyan companies. Corporate Governance: An International Review, 14(2), 107-125.

Indexed at, Google Scholar, Cross Ref

Beattie, V., McInnes, B., & Fearnley, S. (2004). A methodology for analysing and evaluating narratives in annual reports: A comprehensive descriptive profile and metrics for disclosure quality attributes. Accounting Forum, 28(3), 205-236.

Indexed at, Google Scholar, Cross Ref

Beretta, S., & Bozzolan, S. (2004). A framework for the analysis of firm risk communication. The International Journal of Accounting, 39(3), 265-288.

Indexed at, Google Scholar, Cross Ref

Camfferman, K., & Cooke, T.E. (2002). An analysis of disclosure in the annual reports of UK and Dutch companies. Journal of International Accounting Research, 1(1), 3-30.

Indexed at, Google Scholar, Cross Ref

Campbell, J.L., Chen, H., Dhaliwal, D.S., Lu, H., & Steele, L.B. (2014). The information content of mandatory risk factor disclosure in corporate filings. Review of Accounting Studies, 19(1), 396-455.

Indexed at, Google Scholar, Cross Ref

Cascino, S., Gassen, J. (2015). What drives the comparability effect of mandatory IFRS adoption? Review of Accounting Studies, 20, 242-282.

Indexed at, Google Scholar, Cross Ref

Chavent, M., Ding, Y., Stolowy, H., & Wang, H. (2006). Disclosure and determinants studies: an extension using divisive clustering method (DIV). European Accounting Review, 15(2), 181-218.

Indexed at, Google Scholar, Cross Ref

Cooke, T.E. (1989). Disclosure in the corporate annual report of Swedish companies. Accounting and Business Research, 19(74), 113-124.

Indexed at, Google Scholar, Cross Ref

Cooke, T.E. (1992). The impact of size, stock market, listing and industry type on disclosure in the annual reports of Japanese listed companies. Accounting and Business Research, 22(87), 229-237.

Das, S., Rob, D., & Amir, M. (2015). Corporate mandatory reporting: A longitudinal investigation of listed companies in Bangladesh. Global Review of Accounting and Finance, 6, 64-85.

Dawd, I. (2018). Aggregate financial disclosure practice: Evidence from the emerging capital market of Kuwait. Journal of Applied Accounting Research.

Indexed at, Google Scholar, Cross Ref

Dawd, I., & Charfeddine, L. (2019). Effect of aggregate, mandatory and voluntary disclosure on firm performance in a developing market: The case of Kuwait. International Journal of Accounting Auditing and Performance Evaluation, 15(1), 31-56.

De Luca, F., & Phan, H. (2019). Informativeness assessment of risk and risk-management disclosure in corporate reporting: An empirical analysis of Italian large listed firms. Financial Reporting, 2, 9-41.

Deumes, R., & Knechel, W.R. (2008). Economic incentives for voluntary reporting on internal risk management and control systems. Auditing: A Journal of Practice & Theory, 27(1), 35-66.

Indexed at, Google Scholar, Cross Ref

Devalle, A., Rizzato, F., & Busso, D. (2016). Disclosure indexes and compliance with mandatory disclosure – the case of intangible assets in the Italian market. Advances in Accounting, incorporating Advances in International Accounting, 35, 8-25.

Indexed at, Google Scholar, Cross Ref

Ding, Y., Jeanjean, T., & Stolowy, H. (2005). Why do national GAAP differ from IAS? The role of culture. The International Journal of Accounting, 40(4), 325-350.

Indexed at, Google Scholar, Cross Ref

Dobler, M. (2008). Incentives for risk reporting a discretionary disclosure and cheap talk approach. The International Journal of Accounting, 43, 184-206.

Indexed at, Google Scholar, Cross Ref

Dobler, M., Lajili, K., & Zéghal, D. (2011). Attributes of corporate risk disclosure: An international investigation in the manufacturing sector. Journal of International Accounting Research, 10(2), 1-22.

Indexed at, Google Scholar, Cross Ref

Dobler, M., Lajili, K., & Zéghal, D. (2014). Environmental performance, environmental risk and risk management. Business Strategy and the Environment, 23(1), 1-17.

Doyle, J., Ge, W., & McVay, S. (2007). Accruals quality and internal control over financial reporting. The Accounting Review, 82(5), 1141-1170.

Indexed at, Google Scholar, Cross Ref

Dumay, J., & Hossain, M.D.A. (2018). Sustainability risk disclosure practices of listed companies in Australia. Australian Accounting Review, 29(2), 343-359.

Indexed at, Google Scholar, Cross Ref

Ebrahim, A. (2014). IFRS compliance and audit quality in developing countries: The case of income tax accounting in Egypt. Journal of International Business Research, 13(2), 19-37.

Einhorn, E. (2005). The nature of the interaction between mandatory and voluntary disclosures. Journal of Accounting Research, 43(4), 593-621.

Indexed at, Google Scholar, Cross Ref

Einhorn, E. (2007). Voluntary disclosure under uncertainty about the reporting objective. Journal of Accounting and Economics, 43(2-3), 245-74.

Indexed at, Google Scholar, Cross Ref

Elshandidy, T., & Neri, L. (2015). Corporate governance, risk reporting practices, and market liquidity: Comparative evidence from the UK and Italy. Corporate Governance: An International Review, 23(4), 331-356.

Indexed at, Google Scholar, Cross Ref

Elshandidy, T., Fraser, I., & Hussainey, K. (2013). Aggregated, voluntary, and mandatory risk reporting incentives: Evidence from FTSE all-share. International Review of Financial Analysis, 30, 320-333.

Indexed at, Google Scholar, Cross Ref

Elshandidy, T., Fraser, I., & Hussainey, K. (2015). What drives mandatory and voluntary risk reporting variations across Germany, UK, and US? The British Accounting Review, 47(4), 376-394.

Indexed at, Google Scholar, Cross Ref

Elshandidy, T., Shrives, P.J., Bamber, M., & Abraham, S. (2018). Risk reporting: A review of the literature and implications for future research. Journal of Accounting Literature, 40, 54-82.

Indexed at, Google Scholar, Cross Ref

Elzahar, H., & Hussainey, K. (2012). Determinants of narrative risk disclosures in UK interim reports. Journal of Risk Finance, 13(2), 133-147.

Indexed at, Google Scholar, Cross Ref

Epstein, M.J., & Buhovac, A.R. (2006). The reporting of organizational risks for internal and external decision making. Canada: CMA Canada, AICPA and CIMA.

Fernández-Alles, M.L., & Valle-Cabrera, R. (2006). Reconciling institutional theory with organizational theories. How neoinstitutionalism resolves five paradoxes. Journal of Organizational Change Management, 19(4), 503-517.

Indexed at, Google Scholar, Cross Ref

Ferreira, C., & Morais, A.I. (2020). Analysis of the relationship between company characteristics and key audit matters disclosed. Revista Contabilidade & Finanças, 31(83), 262-274.

Indexed at, Google Scholar, Cross Ref

Firth, M. (1984). The extent of voluntary disclosure in corporate annual reports and its association with security risk measures. Applied Economics, 16(2), 269-277.

Indexed at, Google Scholar, Cross Ref

Frolov, M. (2007). Why do we need mandated rules of public disclosure for banks? Journal of Banking Regulation, 8(2), 177-191.

Indexed at, Google Scholar, Cross Ref

Giner, B. (1997). The influence of company characteristics and accounting regulation on information disclosed by Spanish firms. European Accounting Review, 6(1), 45-68.

Indexed at, Google Scholar, Cross Ref

Gonidakis, F.K., Koutoupis, A.G., Tsamis, A.D., & Agoraki, M.E.K. (2020). Risk disclosure in listed Greek companies: the effects of the financial crisis. Accounting Research Journal, 33(4/5), 615-633.

Indexed at, Google Scholar, Cross Ref

Gupta K. (2018). Environmental sustainability and implied cost of equity: International evidence. Journal of Business Ethics, 147(2), 343-365.

Indexed at, Google Scholar, Cross Ref

Hassan, K.M. (2009). UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal, 24(7), 668-687.

Indexed at, Google Scholar, Cross Ref

Hassan, O.A., Romilly, P., Giorgioni, G., & Power, D. (2009). The value relevance of disclosure: Evidence from the emerging capital market of Egypt. The International Journal of Accounting, 44(1), 79-102.

Indexed at, Google Scholar, Cross Ref

Hausman, J.A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251-1271.

Indexed at, Google Scholar, Cross Ref

Hayes, A.F., & Krippendorff, K. (2007). Answering the call for a standard reliability measure for coding data. Communication Methods and Measures, 1(1), 77-89.

Indexed at, Google Scholar, Cross Ref

Healy, P., & Palepu, K. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 405-440.

Indexed at, Google Scholar, Cross Ref

Hill, P., & Short, H. (2009). Risk disclosures on the second-tier markets of the London Stock Exchange. Accounting and Finance, 49(4), 753-780.

Indexed at, Google Scholar, Cross Ref

Hossain M, Tan, L.M., & Adams M. (1994). Voluntary disclosure in an emerging capital market: Some empirical evidence from companies listed on Kuala Lumpur Stock Exchange. International Journal of Accounting, 29(4), 334-351.

Hossain, M., Perera, M.H.B., & Rahman, A.R. (1995). Voluntary disclosure in the annual reports of New Zealand companies. Journal of International Financial Management and Accounting, 6(1), 69-85.

Indexed at, Google Scholar, Cross Ref

Hussainey, K., & Elzahar, H. (2012). Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance, 13(2), 133-147.

Indexed at, Google Scholar, Cross Ref

Iatridis, G. (2008). Accounting disclosure and firms' financial attributes: Evidence from the UK stock market. International Review of Financial Analysis, 17(2), 219-241.

Indexed at, Google Scholar, Cross Ref

Ibrahim, W.H.W., Ismail, A.G., & Zabaria, W.N.W.M. (2011). Disclosure, risk and performance in Islamic banking: A panel data analysis. International Research Journal of Finance and Economics, 72, 100-114.

ICAEW. (1997). Financial reporting of risk: Proposals for a statement of business risk. London: Institute of Chartered Accountants of England and Wales.

ICAEW. (1999). No surprises: The case for better risk reporting. London: Institute of Chartered Accountants of England and Wales.

ICAEW. (2002). No surprises: Working for better risk reporting. London: The Institute of Chartered Accountants in England and Wales.

ICAEW. (2011). Reporting business risks: Meeting expectations. London: Institute of Chartered Accountants of England and Wales.

Juhmani, O. (2017). Corporate governance and the level of Bahraini corporate compliance with IFRS disclosure. Journal of Applied Accounting Research, 18(1), 22-41.

Indexed at, Google Scholar, Cross Ref

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2009). Governance matters VIII: aggregate and individual governance indicators, 1996-2008. World bank policy research working paper, (4978).

Indexed at, Google Scholar, Cross Ref

Khlif, H., & Hussainey, K. (2016). The association between risk disclosure and firm characteristics: A meta?analysis. Journal of Risk Research, 19(2), 181-211.

Indexed at, Google Scholar, Cross Ref

Konishi, N., & Ali, M.M. (2007). Risk reporting of Japanese companies and its association with corporate characteristics. International Journal of Accounting, Auditing and Performance Evaluation, 4(3), 263-285.

Indexed at, Google Scholar, Cross Ref

Kou, W., & Hussain, S. (2007). Predictive gains to segmental disclosure matrices, geographic information and industry sector comparability. The British Accounting Review, 39(3), 183-195.

Indexed at, Google Scholar, Cross Ref

Krippendorff, K. (2008). Testing the reliability of content analysis data. In K. Krippendorff & M. A. Bock (Eds.), The content analysis reader (pp. 350-357). Los Angeles, CA: Sage. Krippendorff, K. (2013). Content analysis: An introduction to its methodology. Los Angeles, CA: Sage.

Lajili, K., & Zéghal, D. (2005). A content analysis of risk management disclosures in Canadian annual reports. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration, 22(2), 125-142.

Indexed at, Google Scholar, Cross Ref

Leopizzi, R., Iazzi, A., Venturelli, A., & Principale, S. (2020). Nonfinancial risk disclosure: The ‘state of the art’ of Italian companies. Corporate Social Responsibility and Environmental Management, 27(1), 358-368.

Indexed at, Google Scholar, Cross Ref

Leuz, C. (2010). Different approaches to corporate reporting regulation: How jurisdictions differ and why. Accounting and business research, 40(3), 229-256.

Li, F. (2010). The information content of forward-looking statements in corporate filings-A Naïve Bayesian machine learning approach. Journal of Accounting Research, 48(5), 1049-1102.

Indexed at, Google Scholar, Cross Ref

Li, L., Liu, Q., Wang, J., & Hong, X. (2019). Carbon Information Disclosure, Marketization, and Cost of Equity Financing. International Journal of Environmental Research and Public Health, 16, 150.

Indexed at, Google Scholar, Cross Ref

Linsley, P.M., Shrives, P.J., & Crumpton, M. (2006). Risk disclosure: An exploratory study of UK and Canadian banks. Journal of Banking Regulation, 7(3-4), 268-282.

Indexed at, Google Scholar, Cross Ref

Linsley, P., & Shrives, P. (2006). Risk reporting: A study of risk disclosure in the annual reports of UK companies.

Indexed at, Google Scholar, Cross Ref

Malafronte, I., Porzio, C., & Starita, M.G. (2016). The nature and determinants of disclosure practices in the insurance industry: Evidence from European insurers. International Review of Financial Analysis, 45, 367- 382.

Indexed at, Google Scholar, Cross Ref

Malone, D., Fries, C., & Jones, T. (1993). An empirical investigation of the extent of corporate financial disclosure in the oil and gas industry. Journal of Accounting, Auditing and Finance, 8(3), 249-273.

Indexed at, Google Scholar, Cross Ref

Manes Rossi, F., Nicolò, G., & Levy Orelli, R. (2017). Reshaping risk disclosure through integrated reporting: Evidence from Italian early adopters. International Journal of Business and Management, 12(10), 11-23.

Indexed at, Google Scholar, Cross Ref

Mangena, M., & Tauringana, V. (2007). Corporate compliance with non-mandatory statements of best practice: the case of the ASB statement on interim reports. European Accounting Review, 16(2), 399-427.

Indexed at, Google Scholar, Cross Ref

Marshall, A., & Weetman, P. (2007). Modelling transparency in disclosure: The case of foreign exchange risk management. Journal of Business Finance & Accounting, 34(5-6), 705-738.

Indexed at, Google Scholar, Cross Ref

Marston, C.L., & Shrives, P.J. (1991). The use of disclosure indices in accounting research: a review article. British Accounting Review, 23(3), 195-210.

Indexed at, Google Scholar, Cross Ref

Mazumder, M.M.M., & Hossain, D.M. (2018). Research on corporate risk reporting: Current trends and future avenues. Journal of Asian Finance, Economics and Business, 5(1), 29-41.

Indexed at, Google Scholar, Cross Ref

McGee, R.W. (2006). Adopting and implementing internarional financial reporting standards in transition economies. In G.N. Gregoriou, M. Gaber (Eds.), International accounting: Standards, regulation and financial reporting, Elsevier, Burlington, 199-224.

Miihkinen, A. (2012). What drives the quality of firm risk disclosure? The International Journal of Accounting, 47(4), 437-468.

Indexed at, Google Scholar, Cross Ref

Mohobbot, A.M. (2005). Corporate risk reporting practices in annual reports of Japanese companies. Japanese Journal of Accounting, 113-133.

Nandi, S., & Santanu, K.G. (2013). Corporate governance attributes, firm characteristics and the level of corporate disclosure: Evidence from the Indian listed firms. Decision Science Letters, 2, 45-58.

Indexed at, Google Scholar, Cross Ref

Ghazali, N.A.M. (2007). Ownership structure and corporate social responsibility disclosure: Some Malaysian evidence. Corporate Governance: The international journal of business in society, 7(3), 251-266.

Indexed at, Google Scholar, Crossref

Ntim, C.G., Lindop, S., & Thomas, D.A. (2013). Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post-2007/2008 global financial crisis period. International Review of Financial Analysis, 30, 363-383.

Indexed at, Google Scholar, Cross Ref

O’Sullivan, M., Percy, M., & Stewart, J. (2008). Australian evidence on corporate governance attributes and their association with forward-looking information in the annual report. Journal of Management and Governance, 12(1), 5-35.

Indexed at, Google Scholar, Cross Ref

Oliveira, J., Lima Rodrigues, L., & Craig, R. (2011). Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics. Managerial Auditing Journal, 26(9), 817-839.

Indexed at, Google Scholar, Cross Ref

Owusu-Ansah, S. (1998). The impact of corporate attributes on the extent of mandatory disclosure and reporting by listed companies in Zimbabwe. The International Journal of Accounting, 33(5), 605-631.

Indexed at, Google Scholar, Cross Ref

Probohudono, A. N., Tower, G., & Rusmin, R. (2013). Risk disclosure during global financial crisis. Social Responsibility Journal, 9(1), 124-137.

Indexed at, Google Scholar, Cross Ref

Rouf, M.A., & Akhtaruddin, M. (2018). Factors affecting the voluntary disclosure: A study by using smart PLS- SEM approach. International Journal of Law and Management, 60(6), 1498-1508.

Indexed at, Google Scholar, Cross Ref

Sellami, Y.M., & Tahari, M. (2017). Factors influencing compliance level with AAOIFI financial accounting standards by Islamic banks. Journal of Applied Accounting Research, 18(1), 137-159.

Indexed at, Google Scholar, Cross Ref

Taplin, R., Tower, G., & Hancock, P. (2002). Disclosure (discernibility) and compliance of accounting policies: Asia–Pacific evidence. Accounting Forum, 26(2), 172-190.

Indexed at, Google Scholar, Cross Ref

Taplin, R., Zhao, Y., & Brown, A. (2014). Failure of auditors: the lack of compliance for business combinations in China. Regulation & Governance, 8(3), 310-331.

Indexed at, Google Scholar, Cross Ref

Tauringana, V., & Chithambo, L. (2016). Determinants of risk disclosure compliance in Malawi: a mixed-method approach. Journal of Accounting in Emerging Economies, 6(2), 111-137.

Indexed at, Google Scholar, Cross Ref

Taylor, G., Tower, G., & Neilson, J. (2010). Corporate communication of financial risk. Accounting and Finance, 50(2), 417-446.

Indexed at, Google Scholar, Cross Ref