Research Article: 2019 Vol: 20 Issue: 4

Revisiting Competitiveness of Special Economic Zones Comparison between Thailand and Vietnam

Sari Wahyuni, University of Indonesia

Noverio Cesar, University of Indonesia

Abstract

Globalization has brought the idea of special instrument which will enable a country to be competitive in attracting investments. One of the most viable instruments is Special Economic Zones (SEZ). The success of SEZs development in China has inspired many countries to develop the same concept, including Southeast Asian countries. This paper aims to know how Thailand and Vietnam, as members of Southeast Asian countries, developing success special economic zones in their countries. Thailand has successfully brought the local economies to the global value chain through SEZ. While Vietnam has recorded remarkable economic growth through the development of SEZs. Using in-depth interview and thorough literature review as the main methodology, this paper will discover some aspects in comparing the development of SEZs in both countries. Several key success factors of Thailand founded in this research are: 1) clear incentive schemes; 2) strong government participation in promoting local economies; 3) good investment services. While in Vietnam, the success factors are: 1) strong government direction; 2) high-tax incentives.

Keywords

Special Economic Zone, High-technology, Political Economy, Industrial Policy, Investment Service, Global Value Chain

Introduction

The globalization of economy encourages the formation of special instruments which were designated to come up with an organized environment that could be illustrated as business friendly, offering more advantageous conditions for business. This is countries’ strategy to attract foreign direct investments and to reform its institutions to be more market reasonable and up-to-date that should satisfy the needs of current economy. In this case, Special Economic Zones (SEZs) are the most visible example of policy concept and tool which were tested over long periods of time with different level of modifications in a large number of different parts of the world (Liptak et al., 2015).

The formation of well-designed SEZs is claimed to bring many benefits for the host countries, such as increasing employment, boosting foreign direct investment inflow and foreign exchange earnings, promoting economic growth, increasing global exposure, helping the transfer of new technologies and skills (Sarbajit & Shimegi, 2010). The success of SEZs in China has motivated other developing countries to take SEZs as the part of economic growth plans, including Southeast Asia countries. With population of more than 600 million and a nominal GDP of $2.31 trillion, ASEAN is becoming a major economic force in Asia and a driver of global growth. As China and India decelerate, and U.S. shifts its focus to the East, this region is increasingly becoming a destination for investment (Morgan, 2014).

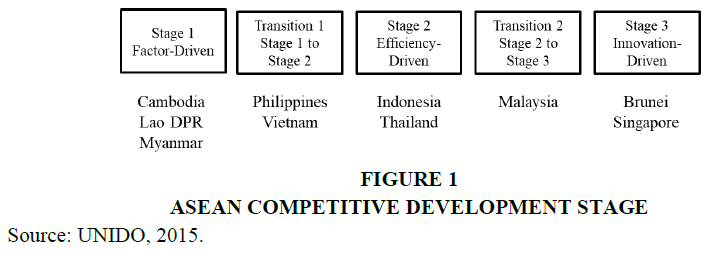

However, the economic condition of ASEAN members is different. It leads to a wide disparity in the members’ competitive development. Based on UNIDO (2015), the stage of development of ASEAN countries in Figure 1.

This paper will only focus to know the difference of SEZs development of countries which are now in Stage 2 and Transition 1 Stage. There are four countries in these categories, which are Indonesia, Thailand, Philippines, and Vietnam. This paper excludes Philippines as the comparison in SEZs development because the development of SEZs in Philippines in moving toward services industries, especially to accommodate IT-Business Process Outsourcing (IT-BPO) industry. The SEZs in Philippines are dominated by service-related companies with share of 76%, much more than manufacturing companies with share of 24%. This situation is reversed in Indonesia, Vietnam, and Thailand (UNCTAD, 2017). Then, out of three countries, Thailand and Vietnam will be the only countries to be included in this study as they are two countries with highest Ease of Doing Business Ranking in 2017 - Thailand 26; Vietnam 68; Indonesia 72 (World Bank, 2018).

The rationality to study Special Economic Zones (SEZ) in Thailand is the success of this country in developing its SEZs as the main economic growth engine. Through the development of SEZs, Thailand has successfully developed its automotive industry as “The Detroit of Asia”. Thailand was the largest car producer in Southeast Asia and ranked 12th globally in 2016 (Bangkok Post, 2018). Many international automotive companies (from Japan, U.S., Germany, India, China, Italy, U.K., Sweden) have chosen Thailand as their production base (Thailand Automotive Institute, 2017). SEZs in Thailand provide 2.69% of total employment in Thailand, compared to only 1.36% in Indonesia.

It is also important to learn Vietnam’s Special Economic Zone (SEZ) because of its rapid development. Through the development of SEZs, Vietnam had recorded the highest percentage of FDI to GDP among those countries in 1997-2016. Vietnam has a remarkable achievement in attracting foreign direct investment. Based on Le and Tran-Nam (2018), Vietnam has recorded the highest annual growth rate of net inflows of FDI, as a percentage to GDP in East Asia over the period of 1980-2013. Thus, Vietnam was one of the largest recipients of FDI in Asia (Nguyen et al., 2017). Moreover, Vietnam is now the main smartphone production base of Samsung. This company has invested $17.3 billion and established eight factories and one research and development centre in Vietnam. As the biggest foreign investor in Vietnam, Samsung’s exports account for about 25% of country’s total exports (Reuters, 2018). SEZs in Vietnam provide 2.19% of total employment in Vietnam, compared to only 1.36% in Indonesia.

Research Model

SEZs are specific defined duty-free area and considered as foreign region for the trade, duties, and tariffs purposes (Chaudhuri & Yabuuchi, 2010). Moreover, SEZs are employed to promote the trade and financial liberalization, improve resource utilization, and drive economic growth and structural changes (Ge, 1999). SEZ is the general definition that includes recent iterations of traditional commercial zones (Sosnovskikh, 2017). There are several specific characteristics of SEZs (Akinci & Crittle, 2008).

1. It has defined geographic territory

2. It has single administration

3. It has tax benefits offered for the business in the zone

4. It offers an autonomous customs zone with simpler procedures and duty-free benefits

5. It provides more liberal economic and juridical regulations than the rest of the economy

The formation of well-designed SEZs is claimed to bring many benefits for the host countries, such as increasing employment, boosting foreign direct investment inflow and foreign exchange earnings, promoting economic growth, increasing global exposure, helping the transfer of new technologies and skills (Sarbajit & Shimegi, 2010).

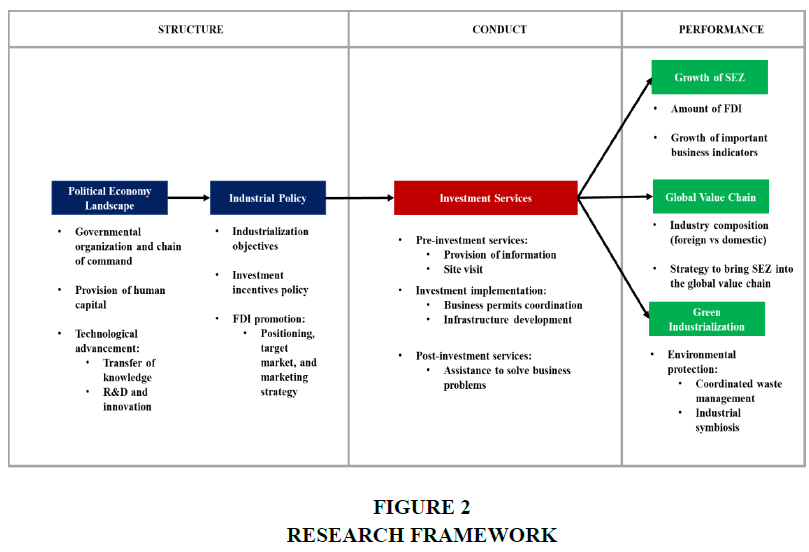

This study uses the Structure-Conduct-Performance framework. “Structure” explains the characteristics and composition of markets and industries in an economy. It also relates to the environment in which firms in a particular market operate (Ferguson, 1988). In this research, the political economy landscape and industrial policies in each country are considered as the structure which drive the market or industry. On the other hand, the special economic zones being studied are considered as the “firms” in the market.

In the opinion of Bain (1968), market conduct is referred to the behavioral pattern followed by firms in adopting or adjusting to the markets in which they exist. The behavior of the firms is determined by the structural characteristics of the industries (Mohamed, 2013). Conduct is also related to the firms’ product strategies, innovation, and advertising (Scherer & Ross, 1990). Therefore, in this research, the investment service is considered as the market conduct. It contains the strategies of the “firms” to attract and give services to investors.

Based on Bain (1968), the market performance represents the economic results of the structure and conduct. In this research, the market performance is measured in three variables; those are growth of special economic zones, the efforts to join global value chain, and the implementation of green industrialization. However, the key success factors of special economic zones being explored are laid in all three parts of the frameworks in Figure 2.

Research Methodology

Qualitative research methodology is going to be utilized for this study because of the research questions imply. This study explores the “why” and “how” of decision making which are more explanatory, as opposed to “what”, “where”, and “when” of quantitative research (Yin, 2003). It does not use statistics or numbers to arrive at conclusions, unlike quantitative research (Wahyuni, 2012). Qualitative research is descriptive in which the data collected are in the form of pictures or words rather than numbers. The written result of the research also comprises quotations from the data to illustrate and verify the fact that have been captured in this study (Wahyuni, 2012). Qualitative approach offers its main strength which is ability to explore the underlying values, beliefs, and assumptions. This type of underlying reason typically is not provided by quantitative approach (Yauch & Steudel, 2003).

This research uses in-depth interview as the main tool of data collection, with the support of intensive literature studies on Special Economic Zones. Researchers employs semi-structured interview in gaining insights from key participants using open-ended questions. Semi-structured interview provides flexibility in which new questions can be raised during the interview process as a follow-up procedure of interviewees’ answer Chirban (1996); Wahyuni (2003). By using this type of interview, researchers can gain not only answers, but also the reasons behind the answers. However, the interviewers have prepared a framework of themes to be explored during the interview (Wahyuni, 2014).

This research collects primary data through interviews with Thailand Board of Investment and Bang Poo Industrial Estate, as well as and field visit to Yen Phong Industrial Park and Vietnam Ministry of Planning and Investment. This study utilizes purposive sampling method with chosen respondents are considered as experts with complete understanding about industrial parks in Vietnam and Thailand. Detail of respondents is explained in Table 1.

| Table 1 List of Respondents | |

| Location | Institution |

| Vietnam | Ministry of Planning and Investment |

| Viglacera Corporation | |

| Thailand | Thailand Board of Investment |

| Bang Poo Industrial Estate | |

Results and Discussion

Political Economy Landscape

Vietnam and Thailand have a sharp difference in the political economy landscape. Vietnam adopts single-party socialist republic framework as its political system led by the Communist Party of Vietnam. While Thailand embraces constitutional monarchy system with a parliamentary democracy. However, Thailand has been struggling to provide political stability since military coup in 2006. This impacted Thailand’s business competitiveness in which government instability was ranked 1st as the most problematic factor for doing business in Thailand (World Economic Forum, 2017). This is much different for Vietnam with its socialist republic framework. Vietnam has high level of political stability index in 2010-2014 with score of 0.15, higher than Thailand (-1.2), India (-1.19), Indonesia (-0.61), China (-0.57), and Malaysia (0.12). The government’s commitment to retain the socio-political stability is one of the country’s attractiveness for multinational companies to make foreign direct investment (World Economic Forum, 2014).

Organizational Structure and Chain of Command

In the context of investment coordination, both Vietnam and Thailand are very centralized. The role of coordinating investment in Vietnam is handled by Ministry of Planning and Investment of Vietnam (MPI). Specifically, this ministry has function of provisioning the general advices on strategies, master plans, plans for national socio-economic development, and public investment; on domestic investment; foreign investment into Vietnam and Vietnam’s investment abroad; on official development assistance (ODA); economic zones; preferential loans and foreign non-governmental aids; on development of enterprises (Ministry of Planning and Investment, 2018). This ministry is directly under the Prime Minister of Vietnam. However, the management of special economic zones in this country is handled by private sectors (for example: Yen Phong Industrial Park is developed and managed by Viglacera Corporation, a state ow enterprise).

Thailand has The Office of the Board of Investment of Thailand (BOI) as the anchor of promoting direct investment, both inward and outward investment in Thailand. “The head Office of Board of Investment is the General Secretary. Our role and responsibilities are to promote direct investment to come to Thailand and Thailand overseas investment by providing tax and non-tax incentives,” (Thailand Board of Investment Interview). In contrast with Vietnam, the management of economic zones in Thailand is controlled by Thailand Ministry of Industry which has special body (Industrial Estate Authority of Thailand–IEAT) to handle that function.

Provision of Human Capital and Talents

Private sector has a big role to provide and develop the human resources in Vietnam. “Investors need to survey the availability of human resources in that area by themselves. It is because each place has its own condition and specification, while each company has its own requirements. If the area you are interested in does not have the resources needed, we can introduce the investors with other area.” (Vietnam Ministry of Planning and Investment Interview).

Therefore, Viglacera Corporation has established strategy in developing human capital in their zone. For example, in Yen Phong Industrial Park, Viglacera has Viglacera Vocational College to provide investors inside the industrial park with qualified human resources. Nevertheless, there is no specific strategy nor incentive has been for companies who train or give transfer of knowledge to their employees. This is different with Malaysia who have clear strategy and tax incentives for companies who give transfer of knowledge (Wahyuni, 2014).

Understanding the important value of professional human capital, Thai government has established some human resources development programs which are intended to provide investors with high-skilled labors. This initiative is one of Thailand strategy to attract investors to come and build their business in this country. Some of them are in Table 2.

| Table 2 List of Human Resource Development Program to Support EEC | |

| Human Resource Development Program | |

| Talent Mobility Program (TM) | Collaborative research-matching services between the public and private sector |

| Work Integrated Learning (WiL) | Collaborative educational services between educational institutes and the private sector in the form of Public Private Partnerships (PPP) |

| Dual Vocational Training (DVT) | Vocational education institutes establish agreements with private enterprises to create effective curriculums, training, testing, and evaluation for students to gain practical working experiences |

| Cooperative Education (for graduate study, university, and college) | Combining the classroom-based education with practical work experience |

Technological Advancement Efforts

To promote transfer of technology and R&D capabilities, Vietnam has established three hi-tech parks: Hoa Lac Hi-Tech Park, Saigon Hi-Tech Park, and Danang Hi-Tech Park. These high-tech parks are designed to attract high-tech companies and be the center of technological innovation and intellectual capital development (Saigon Hi-Tech Park, 2017).

Thailand relies on tax and non-tax incentive to push the transfer of technology from foreign companies to local talents. One of the scheme is to establish university-industry linkage. There are some examples of university-industry linkage in Thailand to support the transfer of knowledge and technology to local people. Seagate, the producer of hard disk drive has cooperation with Khon Kaen University, and Suranaree University of Technology to open research and development center. Seagate Technology also provides assistance with curriculum development and selected trainers, while universities provide the facilities and most of teaching resources (Brimble & Doner, 2006).

Industrial Policy

Industrialization Objectives: Vietnam has been experiencing some transformation in its industrialization objectives since 1965. The most remarkable transformation was started in 1986 when the country launched Doi Moi reform to switch its economy orientation form planning economy to open and market-oriented economy. This process also shifted import substitution strategy to export orientation (Anh etal., 2016).

Vietnam government has encouraged the development of particular sectors, those are: education, health care, sport or culture, high technology, environmental protection, scientific research and technology, infrastructure, processing of agricultural and aquatic products, software production and renewable energy. New investment projects on these sectors are granted tax incentives by the government (PwC, 2018). Since the development of special economic zones is done by private sector, zones developers should also consider the overall government’s plan.

“Yen Phong Industrial Park is only for high-tech, electronics, food, and beverage industries. Phong Dien Industrial Park is for garment and textile industries, while Phu Ha Industrial Park is for garment and electronic industries. However, if there are investors that want to invest in our industrial parks, but the industry is different from government’s plan, they will be guided to choose other areas” (Viglacera Interview).

Thailand government transforms its economic model into “Thailand 4.0”. Thailand is focusing to become a value-based and innovation-driven economy by moving from producing commodities to innovative products; emphasizing on promoting technology, creativity, and innovation in targeted industries; moving from production-based to a serviced-based economy (Thailand Board of Investment, 2017).

The investment incentives policies for zones in Vietnam are arranged based on the type of the zones. In Vietnam, there are three kinds of developed area which act as the center of economic activities, those are industrial zone (specializes in producing industrial products); export processing zone (focus on producing export-oriented products); and economic zone (separate economic space with a favorable investment and business environment).

In general, Vietnam government relies heavily in tax incentives to attract investment. Government can provide corporate income tax discount for a long period of time. For example, to promote the investment on R&D and high-technology application in industrial parks and economic zone, Vietnam can give CIT of 10% for 30 years.

“I can tell you that we compare the policy, subsidy, and exemptions with other South East Asian countries and China. We must give at least the same of higher incentives than our neighbor countries because we want to compete with them,” (Vietnam Ministry of Planning and Investment Interview).

However, Vietnam government also realizes that incentive is not the only thing to be considered. We are trying to balance the incentives and the quality of infrastructures, and human resources. We know that incentive is not the most important thing to attract foreign direct investment to our country.” (Vietnam Ministry of Planning and Investment Interview).

Thailand has a very clear incentive structure for investment. Basically, Thailand Board of Investment has two investment incentives schemes; those are tax incentives, and non-tax incentives (Wahyuni & Wahyuningsih, 2018). However, there are several criteria to be met by investors to get the tax incentives. These criteria are based on some components, such as type of activities, type of innovations, and area development. Here is the list of investment incentives offered for investors in Thailand in Table 3.

| Table 3 List of Types of Incentive | |

| Tax Incentives | Non-Tax Incentives |

| Exemption or reduction of import duties on machinery | Permit to own land |

| Import duties reduction for raw or essential materials | Permit to take out or remit money abroad in foreign currency |

| Import duties exemption on imported materials for R&D purposes | Permit to bring skilled workers and experts into Thailand to work in investment promoted activities |

| Corporate income tax exemption on the net profit and dividend derived from the promoted activities | Permit to bring foreign people into Thailand for the purpose of studying investment opportunities |

| Corporate income tax exemption on net profit and dividends derived from the promoted high technology and innovation activities |

|

| 50% reduction of corporate income tax | |

| Double deduction from the costs of transportation, electricity, and water supply | |

| Additional 25% deduction of the installation costs or construction costs | |

| Import duties exemption on imported raw or essential materials for exported goods production |

|

Investment Promotion

The responsibility to do investment promotion in Vietnam is handled by Foreign Investment Agency under Ministry of Planning and Investment. However, based on our interview, it is clear that Vietnamese government, specifically Ministry of Planning and Investment has not established any positioning strategy for its industrial areas. This country also does not have any specific target market as potential investors and invite any kind of firms to the country. This had been highlighted by Freeman (2002); Kokko et al., (2003) which argued that FDI in Vietnam was largely unfocused. Anwar & Nguyen (2010) argued that Vietnam government should set a policy which directs FDI to industries where Vietnam has cost advantage over competing locations.

On the other hand, Viglacera actively promotes their industrial parks by participating exhibitions in many Asian countries. “We go to the exhibitions in other Asian countries, such as Korea, Japan, Hongkong, Taiwan. However, our investors come from many channels. We only advertise the industrial parks and the investors will come to us. Therefore, we need to have a close relationship with the governments.” It shows that Vietnam government has a central role in helping the management of industrial parks to get the investors.

Thailand has a very clear positioning and targeting strategy. Thai industrial objectives are to become the innovation hub at the heart of Southeast Asia. It also targets investment from high-tech companies by providing many incentives packages for research and development, innovation, and training activities done by those companies. To do the promotion, Thailand Board of Investment is actively involved in international seminars, conferences, and business submits to give presentation about Thailand as an investment destination (Thailand Board of Investment, 2018).

Investment Services

To give information about investments in Vietnam, each Investment Promotion Center of Ministry of Planning and Investment has a website which provides some information about their industrial zone and potential investment in each area. For the investment implementation services, management boards of industrial parks and economic zones in Vietnam have responsibility to provide one stop service administration service for the investors.

“So, when enterprises come to our industrial parks, they have to get investment certificate from the province. We will serve them with free charge service to do the paperwork and get the license.” (Vietnam Ministry of Planning and Investment Interview).

Thailand has some platforms and policies to help the investors in realizing their investments. Those services are aimed to make the business process and procedures easier so that many investors will come to Thailand. Thailand’s investment promotion regime has been claimed as one of the most successful in Asia, due to government policies’ consistency in supporting the private sector (Thailand Board of Investment, 2018).

As a part of their commitment to investors, Thai government also helps investors in solving their problems. Any kind of problems faced by investors in Thailand will be solved by Ministry of Interior. “Basically, Board of Investment itself cannot solve all problems. Ministry of Interior take care most of the problems. However, sometimes we set up Urgent Commission to solve some specific problem. We coordinate some representative from many related ministries and discuss together what will be the solution for the problem,” (Thailand Board of Investment Interview).

Global Value Chain

Industry Composition: Although the local investors account 30% of total investors in Yen Phong Industrial Park, Vietnam local companies are not highly attached with foreign companies as their input source. Data from International Monetary Fund (2017) shows that the percentage share of local inputs in Vietnam is still limited (Table 4).

| Table 4 Percentage of Share of Local Inputs in Vietnam | |

| All Sectors | 18% |

| Food and beverages | 25% |

| Textiles and wearing apparel | 18% |

| Wood and paper | 24% |

| Petroleum and chemicals | 19% |

| Metal products | 13% |

| Electrical and machinery | 11% |

| Transport equipment | 17% |

| Other manufacturing | 22% |

Bangpoo Industrial Estate is dominated by domestic firms, with 39% contribution of total firms. For the foreign companies, Japanese firms dominate this industrial estate with share of 24%, followed by Taiwanese with 20%. In addition, Japanese firms have been always the main investors for Thailand, at least in the last three years (Board of Investment, 2018).

Strategy to Bring SEZ into the Global Value Chain

Results of our interview indicated that there is not yet clear strategy established by Vietnam government to bring up its local companies into the global value chain. This insight from our interview is supported by World Bank report (2017) which states that Vietnam has not successfully promoted its domestic firms into international market. Vietnam has been successfully attracting foreign direct investment (FDI) but less successful in entering global value chains (GVCs). The majority of local firms are small and only serving domestic markets. However, the foreign direct investment has not been contributing significantly to the linkage development with domestic economy.

On the other hand, Thailand has successfully brought its local industries into the global value chain. The success story of Thai companies in moving up to the global value chain cannot be separated from the government’s initiatives. The Board of Investment of Thailand established BOI Unit Industrial Linkage Development (BUILD) in 30th of June 1992. Its roles are to support industrial linkage and usage of industrial parts manufactured in Thailand. It connects Thai small and medium suppliers to large foreign manufacturers. This function does not only help the procurement process but also production cost saving by promoting the purchase of domestically produced products and decrease import costs.

Green Industrialization

Environmental Protection: Vietnam’s success story of reducing poverty through industrialization also has environmental issue. Air pollution levels rose in Hanoi and Ho Chi Minh City, rivers became polluted, greenhouse emissions almost tripled between 2000 and 2010. Therefore, in 2012 the government of Vietnam promoted the concept of green growth in which developing sustainable base for growth and further reducing poverty was the main focus as it wanted to tackle the severity of many environmental issues (World Bank, 2016). Vietnam’s effort to move toward this green industrialization is implemented by transforming existing Industrial Zones to Eco Industrial Parks in Table 5.

| Table 5 Vietnam’s Pilot ECO-Industrial Parks | ||

| Industrial Park | Province | Registered Enterprises |

| Khanh Phu | Ninh Binh | 38 |

| Hoa Khanh | Da Nang | 205 |

| Tra Noc 1 | Can Tho | 101 |

| Tra Noc 1 | Can Tho | 46 |

There are three pilot eco-industrial parks:

Thailand government has also developed its plan to strengthen its green industrialization. In 2010, the Thailand Ministry of Industry launched Eco Industrial Town development program. This program was started in five regions, and then expanded to six other provinces in 2013. This program consists of three levels of green industrial transformation: (1) Green Industry at a factory level; (2) Eco-Industrial Estate at an industrial estate level; and (3) Eco Industrial Town at a community level (Global Green Growth Institute, 2017). Thailand government also offers some benefit (tax and duty benefit) as incentives for companies’ participation (Thailand Ministry of Industry, 2018).

Integrated Waste Management and Industrial Symbiosis

Based on UNIDO (2016), from 295 industrial zones across Vietnam in 2014, 40% of its effluent waste is untreated. Moreover, 20% of industrial waste is hazardous. The concept of transforming industrial parks into eco-industrial zones also contains integrated and industrial symbiosis apparently not yet been strictly implemented in Vietnam.

On the other hand, Thailand has implemented the concept of integrated waste management and industrial symbiosis. IEAT, as the developer and manager of Bangpoo Industrial Estate has established integrated waste water treatment system and incinerator system in this zone.

“In here we have three waste water treatment systems. Two are in general industrial zone with capacity of 3,600 m3/day and 45,000 m3/day. In the IEAT free zone we have rotating biological contactor with capacity of 2,300 m3/day. Every factory will treat its own waste and then transferred to our system” (Bangpoo Industrial Estate 2017).

Growth of Special Economic Zones

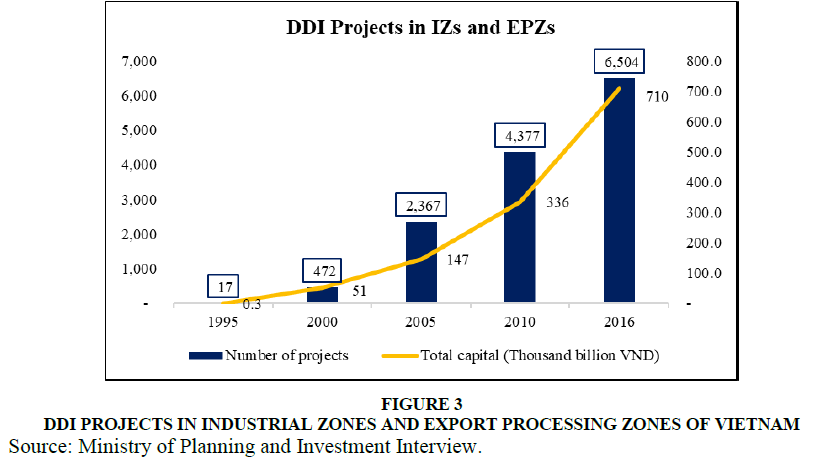

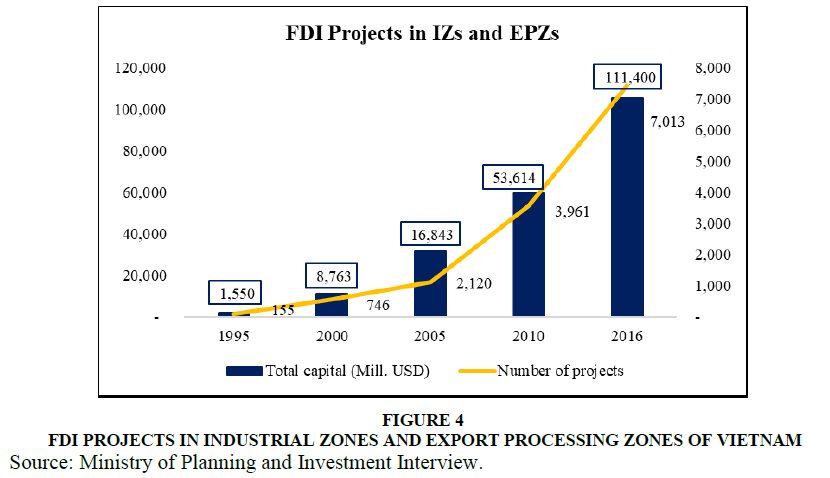

Vietnam’s industrial zones and export processing zones has been growing at a very significant rate in the last 20 years as shown by Figures 3 & 4.

Figure 3 DDI Projects in Industrial Zones and Export Processing Zones of Vietnam

Source: Ministry of Planning and Investment Interview.

Figure 4 FDI Projects in Industrial Zones and Export Processing Zones of Vietnam

Source: Ministry of Planning and Investment Interview.

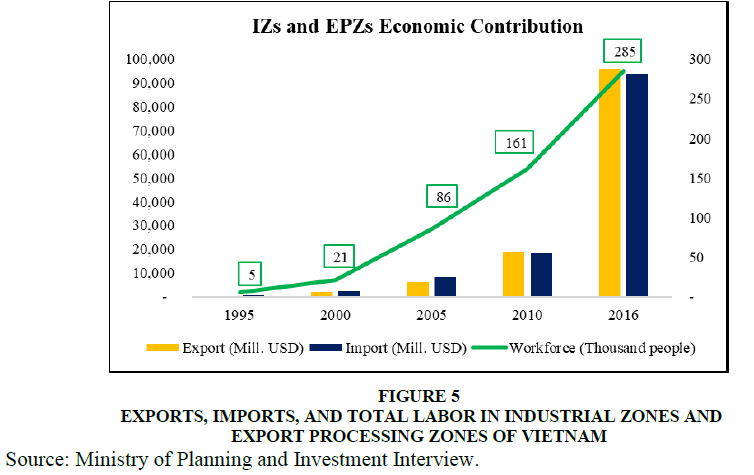

The industrial zones and export processing zones of Vietnam has been successfully attracting investments in this country. The amount of capital investment and the number of projects by foreign firms in Vietnam doubled from 2010 to 2016. It shows that Vietnam is getting more attention from multinational companies as investment destination in Figure 5.

Figure 5 Exports, Imports, and total Labor in Industrial Zones and Export Processing Zones of Vietnam

Source: Ministry of Planning and Investment Interview.

Different from Vietnam, the performance of IEAT’s industrial estates in 2014-2016 periods was fluctuative. The total area sold, land users, investments, and number of workers in its industrial zones were declining. It is confirmed by Krungsri Research (2018) which states that between 2013-2015, the industrial estate sector was not in a good condition due to some factors, such as: (1) Thailand’s declining exports which hurt the overall economic performance, (2) investment decline due to disturbance in Thailand politics between 2010 and 2014, (3) higher requirements related to environmental and health impact assessment, following a bad air pollution at Map Ta Phut industrial estate in 2007.

Conclusions

The above analysis clearly shows that development of SEZs has important role for both countries as the center of economic growth. Thailand SEZ stage and strategy apparently are more advance compare to Vietnam who is still in the infant stage in developing special economic zone. As a new comer, Vietnam is still unclear in developing and executing their strategy. Their main objective is to draw inflow of investment and they have been quite successful in this respect by attracting Samsung (and other companies) to heavily invest in Vietnam. The interesting point of Vietnam special economic are: 1). Its political system has successfully created stability for business environment which is fairly attractive for investors; 2). All aspects of SEZs development are handled by private sectors which eventually create competitive environment for SEZs developers due to the rising of competition in providing the best services for investors. 3). There is lack of government’s initiative in promoting local business to be involved in the global value chain.

On the other side, Thailand has: 1). Very clear and organized industrial objectives, completed with vivid strategies in providing high-skilled human resources, and stimulating technology transfer 2). Well-pronounced incentives schemes for investors, both tax and non-tax incentives; 3) Strong investment services, including the existence of high-quality local suppliers as a result of their fine strategies in bringing local companies in the global value chain.

In general, the development of SEZs in Vietnam and Thailand provide a clear signal for other South Asian countries that competition in attracting investors is now becoming tighter. To have a world-class reputable SEZ, government should develop a clear strategy and decisions about tradeoffs should be made throughout the process. Since SEZ likely cannot contribute to meeting all national economic development objectives, a government should take a disciplined approach to deploying zones for narrow and clearly defined purposes. This is easier to accomplish if clearly defined targets and metrics exist-such as specific job creation targets, industry target or levels of contribution to GDP the SEZ should make within a particular timeframe. A clear goal, milestones of strategy development and consistent implementation could hopefully lay down a strong foundation for a high competitive special economic zone.

However, this research has some limitations, such as limited time to further explore the respondents, and bounded expertise of the respondents. This research result is also a generalization of special economic zones development in Thailand and Vietnam in which the policy might be vary between special economic zones within both countries.

References

- Akinci, G., & Crittle, J. (2008). Special Economic Zones: Performance, Lessons Learned, and Implications for Zone Development. Washington: World Bank Group.

- Anh, N.T., Duc, L.M., & Chieu, T.D. (2016). The Evolution of Vietnamese Industry. In C. Newman, J. Page, J.

- Anwar, S., & Nguyen, L.P. (2010). Foreign direct investment and economic growth in Vietnam. Asia Pacific Business Review, 183-202.

- Bain, J. (1968). Industrial Organization 2nd Edition. New York: John Wiley and Sons Inc.

- Bangkok Post. (2018, January 25). Auto production set to skyrocket in 2018. Retrieved from Bangkok Post Website: https://www.bangkokpost.com/auto/news/1401562/auto-production-set-to-skyrocket-in-2018

- Bangpoo Industrial Estate. (2017). Bangpoo Industrial Estate Presentation for Batam FTZ.

- Brimble, P., & Doner, R.F. (2007). University–Industry Linkages and Economic Development: The Case of Thailand. World Development 35: 1021-2036.

- Chaudhuri, S., & Yabuuchi, S. (2010). Formation of special economic zone, liberalized FDI policy and agricultural productivity. International Review of Economics and Finance, 779-788.

- Chirban, J. (1996). Interviewing In-depth: The Interactive Relational Approach. Thousand Oaks: Sage Publications.

- Ferguson, P.R. (1988). The Structure-Conduct-Performance Paradigm. Industrial Economics: Issues and Perspective, 7-22.

- Freeman, N. (2002). Foreign direct investment in Vietnam: an overview. Workshop on Globalisation and Poverty in Vietnam.

- Morgan, J.P. (2014). ASEAN'S BRIGHT FUTURE: GROWTH OPPORTUNITIES FOR CORPORATES IN THE ASEAN REGION. Retrieved from JP Morgan Website: https://www.jpmorgan.com/country/US/EN/cib/investment-banking/trade-asean-future

- Kokko, A., Kotoglou, K., & Krohwinker-Karlsson, A. (2003). Characteristics of Failed FDI Projects in Vietnam. Transnational Corporations 12(3), 41-77.

- Krungsi Research. (2018). Thailand Industry Outlook 2018-2020: Industrial Estate. Krungsi Research.

- Liptak, F., Klasova, S., & Kovac, V. (2015). Special Economic Zone Constitution According to Cluster Analysis. Procedia Economics and Finance, 186-193.

- Ministry of Planning and Investment. (2018). Ministerial Functions and Responsibilities. Retrieved from Vietnam Ministry of Planning and Investment: http://www.mpi.gov.vn/en/Pages/cnnv.aspx

- Mohamed, Z. (2013). Measuring competition along the supply chain of the Malaysian poultry industry. International Conference on Social Science Research. Penang.

- Nguyen, D.T., Sun, S., & Anwar, S. (2017). A long-run and short-run analysis of the macroeconomic interrelationships in Vietnam. Journal of Economic Analysis and Policy, 15-25.

- PwC. (2018). Vietnam Pocket Tax Book 2018. Hanoi: PwC.

- Reuters. (2018, April 20). Samsung Electronics to expand production in Vietnam. Retrieved from Reuters: https://www.reuters.com/article/us-samsung-elec-vietnam/samsung-electronics-to-expand-production-in-vietnam-idUSKBN1HR1SD

- Saigon Hi-Tech Park. (2017). Saigon Hi-Tech Park-Overview. Retrieved from Saigon Hi-Tech Park: http://www.eng.shtp.hochiminhcity.gov.vn/about/Pages/shtp-overview.aspx

- Sarbajit, C., & Shimegi, Y. (2010). Formation of special economic zone, liberalized FDI policy. International Review of Economics and Finance, 779-788.

- Scherer, F., & Ross, D. (1990). Industrial Market Structure and Economic Performance. Scherer, F.M. and Ross,

- Sosnovskikh, S. (2017). Industrial clusters in Russia: The development of special economic zones and industrial parks. Russian Journal of Economics (3), 174-199.

- Thailand Automotive Institute. (2017). Thailand Automotive Industry Situation and Master Plan. Bangkok: Thailand Automotive Institute.

- Thailand Board of Investment. (2017). A Guide to the Board of Investment 2017. Bangkok: Thailand Board of Investment.

- Thailand Board of Investment. (2017). Investment Opportunities in Thailand. Bangkok: Thailand Board of Investment.

- Thailand Board of Investment. (2017). Strategic Talent Center. Bangkok: Thailand Board of Investment.

- Thailand Board of Investment. (2018). BOI Policies and Plans for Attracting Investment in 2018. Bangkok: Thailand Board of Investment.

- Thailand Board of Investment. (2018). BOI Unit for Industrial Linkage Development. Thailand Board of Investment.

- Thailand Board of Investment. (2018). Investment Promotion Measures Supporting Economic Transformation. Bangkok: Thailand Board of Investment.

- UNCTAD. (2017). ASEAN Investment Report 2017: Foreign Direct Investment and Economic Zones in ASEAN. Jakarta: ASEAN.

- United Nations Industrial Development Organization. (2015). Economic Zones in the ASEAN: Industrial Parks, Special Economic Zones, Eco Industrial Parks, and Innovation Districts as Strategies for Industrial Competitiveness. United Nations Industrial Development Organization.

- United Nations Industrial Development Organization. (2016). Eco-Industrial Park in Vietnam. United Nations Industrial Development Organization.

- Wahyuni, S. (2003). Managing International Strategic Alliance: A Study on Conflict, Control, and Partner Contribution. Ph.D. Dissertation, SOM Research School, Netherland.

- Wahyuni, S. (2012). Qualitative Research Method: Theory and Practice. Jakarta: Salemba Empat.

- Wahyuni, S. (2014). Competitiveness of Special Economic Zone: Comparison between Indonesia, Malaysia, Thailand, and China. Jakarta: Salemba Empat.

- Wahyuni, S. & Wahyuningsih (2018). Strategi Pengembangan Kawasan Ekonomi Khusus, Jakarta: Salemba Empat.

- World Bank. (2013). Joining, Upgrading, and Being Competitive in Global Value Chains. World Bank.

- World Bank. (2016). A Commitment to Grow Green and Address Climate Change in Vietnam. Retrieved from World Bank: http://www.worldbank.org/en/news/feature/2016/11/09/a-commitment-to-grow-green-and-address-climate-change-in-vietnam

- World Bank. (2018). Doing Business: Measuring Business Regulations. Retrieved from The World Bank: http://www.doingbusiness.org/rankings

- World Economic Forum. (2014). Why foreign investment in Vietnam is booming. Retrieved from World Economic Forum: https://www.weforum.org/agenda/2014/05/foreign-investment-booming-vietnam/

- World Economic Forum. (2017) Tthe Global Competitiveness Report 2017-2018. Geneva: World Economic Forum.

- Yauch, C.A., & Stuedel, H.J. (2003). Complementary Use of Qualitative and Quantitave Cultural Assessment Methods. Organizational Research Method, 465-481.

- Yin, R. (2003). Case Study Research: Design and Methods, 3rd Edition. Thousand Oaks, CA: Sage Publications.