Research Article: 2021 Vol: 20 Issue: 4S

Reflection of Bubbles Assets During the Global Financial Crisis Facing Covid-19 in Indonesia

Moh. Adenan, University of Jember

Keywords:

Asset Bubble, Central Bank, Macroeconomic Fundamentals, and Vector Error Correction Model (VECM)

JEL Classification:

B22, E44, E58, F43

Abstract

The movement of macroeconomic fundamentals prior to the global financial crisis is a phenomenon that arises as a result of the impact of a country's policies or economic turmoil. Investors will respond to this phenomenon by issuing capital (capital outflow) and investing (capital inflow), which causes the presumption of inflating the price of the asset value of the shares (asset bubbles). This study aims to detect the presence of an asset bubble and to determine the effect of macroeconomic fundamentals on the asset bubble during the global financial crisis in Indonesia. To detect an asset bubble, it can be done by comparing the Composite Stock Price Index (IHSG) with the Consumer Price Index (CPI). The fundamental influence of macroeconomics on asset bubbles is studied using the Vector Error Correction Model (VECM). The results of this study found that in Indonesia there was a small asset bubble from September to December 2010. In the short term, interest rates have a significant positive effect on the asset bubble, while in the long run all fundamental variables of exchange rates and interest rates have a positive effect, while inflation has a significant negative effect. Efforts to overcome this phenomenon can be controlled by reducing interest rates in the short term, while in the long run, increasing inflation and exchange rate depreciation can be controlled by decreasing the exchange rate.

Introduction

The interaction of asset price bubbles with the banking system and the real economy is important for understanding the boom-bust cycle. The global financial crisis is an immediate impetus for studying interactions. The losses from subprime mortgage defaults led to a severe credit crisis and deepest recession since the 1930s. This episode is not strange in history. In Japan, during the 1980s, real estate prices grew rapidly, allowing property developers to borrow from banks using real estate as collateral. When property prices collapsed in the 1990s, Japan experienced a protracted banking crisis and 'lost decades of low economic growth. In all of these historical episodes, the banking system is hit by a housing bubble bursting through incidents that are higher than household standards. According to Reinhart & Rogoff (2014) showing, using rich time-series and cross-country data sets, the resulting losses from the financial system lead to a decrease in activity (Aoki & Nikolov, 2015).

Meanwhile, the global crisis has raised concerns regarding several policies that are suitable for achieving optimal macroeconomic evolution (Ihnatov & Capraru, 2014). The 1997 - 1998 East Asian crisis, the 2008 global financial crisis and the uero zone crisis have provided a paradigm in determining monetary policy (Aizenman, 2017). The 1997-1998 monetary crisis caused a drastic decline in the domestic currency so that the exchange rate depreciated very sharply in various countries (Lai, 2000; Caprio, 2013). The crisis eventually expanded into a monetary crisis and reached its peak in 1998 (Caprio, 2013; Endika, 2018). The development of the rupiah exchange rate against the dollar in 2008 came under pressure again. The exchange rate against the dollar peaked at Rp 11,866 per US dollar in February 2009. This was due to the impact of the global financial crisis that occurred during that period. Meanwhile, inflation also gave the same response. In September inflation had peaked at 12.14%. So that in October the rate was raised by 9.5% to keep inflation back to normal. The real interest rate was one of the variables affected by the 2008 global crisis. From these conditions, it is possible that Indonesia's economic fundamentals could cause a bubble phenomenon. According to Yuhasnara 2017, in his research, Yui 2009 identified an asymmetrical negative effect of real interest rates on housing prices which explains that price bubbles are influenced by real interest rates.

Economic development of a country accelerates and enhances the quality of life of the inhabitants by increasing productive capacity and expanding its core infrastructure base. Enormous efforts have been put forth by various studies and policymakers to scrutinize different alternatives which are instruments in the enhancement of economic growth. Of the possible factors contributing towards economic growth, the role of financial sector has begun to receive more attention during the recent past. Earlier, the writings of McKinnon (2010) and Shaw (1973) initiated the discussion by presenting the hypothesis of a strong relationship between financial development and economic growth (Shravani & Sharma 2020). Financial development includes an improvement in the financial transactions with simultaneous increase in the volume of financial services of banks and other financial intermediaries (Hussain & Chakraborty, 2012). To appreciate and analyze the contribution of financial sector towards the economic growth of an economy, it is essential to understand the critical functions of this sector towards the upliftment of the economy. One of the most prominent functions of the financial sector includes providing credit facility to the entrepreneurs and farmers as they hardly have enough of their own capital to carry out investments themselves.

The 2008 global financial crisis, which was preceded by problems in the financial sector in the United States, was preceded by the phenomenon of rising property prices. The ease of obtaining a loan can facilitate speculation on property assets that are financed through credit. This condition encourages an increase in property prices. For banks themselves, lending to the property sector, which is experiencing a trend of increasing prices, is considered quite profitable, so that credit expansion in the property sector occurs. The conditions above can cause unreasonable property prices which are called bubbles (price inflation) (Wartowardojo, 2016).

Subprime mortgage is a credit instrument for the property sector. The biggest mistake was in giving more subprime mortgages to residents who actually did not deserve housing loan assistance. It is said to be inadequate because these residents do not have the economic capacity to settle the credit coverage they borrow. This triggered bad credit in the property sector. Then bad credit in this sector led to the collapse of major US finance companies. The collapse of this finance company also affected financial institutions in the US. This is because finance companies generally borrow short-term funds from other parties, including financial institutions. In addition, the impact of the collapse of financial institutions in the US has also affected investment institutions and investors around the world (Kuncoro, 2009).

The exchange rate of a country is closely related to the country's macroeconomic fundamentals, such as interest rates and inflation (Bacchetta, 2009). When there is a decrease in interest rates, it will cause capital outflows so that the supply of domestic US dollar reserves decreases which results in the domestic currency depreciating against the US dollar (Kutty, 2010). The exchange rate has an important role in maintaining the stability of a country's economy. Exchange rate stability is supported by the applied exchange rate policy. This policy aims to maintain the domestic exchange rate so that it does not depreciate against the dollar (Novianti 2017).

Based on Table 1, it is known that Indonesia is implementing the Inflation Targeting Framework (ITF). The ITF policy is inflation targeting through interest rate and price stability policies as well as low inflation carried out by a country's central bank (Inoue, 2012). In Indonesia, Bank Indonesia explicitly announces to the public the inflation target and monetary policy aimed at achieving the targeted inflation target (Bank Indonesia, 2005; Novianti, 2017). However, the table shows that Bank Indonesia has set a fairly wide inflation target. This demonstrates flexibility and is an early hallmark of implementing the ITF. Meanwhile, from the comparison with the inflation data that occurs each year, since the full implementation of the ITF in mid-2006, the inflation target can be achieved in 2007 and 2009 (Setiawan, 2012). However, in 2008 when the crisis occurred, the inflation target was far from reaching the 11.06% range. This phenomenon proves that Indonesia has received the impact of the financial crisis that has occurred.

| Table 1 Comparison of Target and Actual Inflation |

||

|---|---|---|

| Year | Inflation Target | Actual Inflation |

| 2006 | 8±1% | 6,60 |

| 2007 | 6±1% | 6,59 |

| 2008 | 5±1% | 11,06 |

| 2009 | 4,5±1% | 2,78 |

| 2010 | 5±1% | 6,96 |

On the other hand, for investors this phenomenon will be used to analyze fundamentals in a profitable position (Saragih & Sirait, 2015). In fact, this economic bubble condition often occurs in the world of capital markets. The act of speculation is one of the activities that is often carried out in the capital market and can cause economic bubbles. The act of speculation referred to in this case is when an investor takes an action by considering a reasonable possibility and goes well, so that profits can be obtained without any problems in the future. If the action is not what was expected, then the loss can cause a significant problem in the future. So the act of speculation is vulnerable to future problems that may arise (Galbraith, 2009).

Speculative action is carried out by buying an asset today and is expected to increase the next day. The increase and prospects for these assets can attract new investors in. As many investors are interested in buying, prices will continue to increase so that momentum for speculation will be created (Galbraith, 2009). On the other hand, the tendency of investors to influence the market stems from more dominant asset ownership that can control market conditions into an unreasonable trend such as conditions from economic bubbles (Yuhasnara, 2017). Meanwhile, on the stock market, continued pressure on global financial markets had an impact on the downturn in the Composite Stock Price Index (IHSG) during August 2008. The decline in JCI performance was mainly due to external turmoil stemming from major problems on global exchanges (Bank Indonesia, 2008).

There are at least two outcomes from the asset bubble. First, the asset bubble will push out the real economy after it explodes. Second, the asset bubble is an important source of financial risk. Aoki and Nikolov, 2015 show that the risk effect of asset bubbles should be considered more than the extrusion effect. Asset bubbles can be strengthened by means of transmission in the financial system and exert a deep impact on the real economy. Historical evidence has found a significant explanation of asset bubbles in determining financial stability. However, studies, eg Claessensm et al., (2001); Vives (2002); Gertler & Kivotaki (2005); Collard, et al., (2017), ignore the impact of asset bubbles on financial stability (Wang et al., 2018).

On the other hand, when a pandemic occurs, the volatility of macroeconomic fundamentals tends to fluctuate. This was caused by weakening economic growth due to the pandemic. The movement of asset bubbles, exchange rates, inflation and interest rates has the effect of uncertainty. This causes the economic turmoil to experience a boom-bust cycle. Naoui (2011) conducted research on intrinsic bubble on the American Stock Exchange using the S&P 500 Index. This study uses data from 1871 to 2009 where the data used are real prices and dividends from the S&P 500 Index. In this test, two methods are used, namely stationary and cointegration and directly estimating the intrinsic bubble coefficient. The conclusion of this study states that there is a bubble that is consistent with the intrinsic bubble theory.

Literature Review

The Concept of Spillover and Contagion International

Basically, there is no standard definition that describes spillover and contagion. The International Monetary Fund (2011) defines spillover as the impact of policies implemented by a country that can affect other countries both through trade and financial channels. Contagion can be defined as an externality of the financial crisis phenomenon that occurred in a country. The externalities in question can be in the form of economic shocks in other countries (Trihadmini, 2011). Dornbusch, et al., (2000) define contagion as a condition of increasing significant relationship between several financial markets after a shock occurred in several countries. Rigobon (1999) defines contagion through three classifications, namely contagion can be interpreted as the occurrence of a crisis in a country and then the crisis causes speculative attacks on other countries. A country experiencing a crisis will experience an increase in return volatility, so that contagion can be characterized as the transmission of volatility from one country to another, and contagion can be defined as a chain change that is spread or transmitted among various countries.

Masson (1998); Pritsker (1999) explain contagion into two categories, namely: 1) spillover is described as a category arising from shocks that spread to other countries through real links and financial links; and 2) financial crisis involving the financial condition of a country. The financial crisis that threatens the economy of a country can cause investors to attract investments in that country. This category is often caused by irrational investor phenomena and leads to financial panic, herding behavior, loss of confidence and an increase in risk aversion.

Spillover Effect Transmission

The Spillover Effect can be transformed to another country through several channels. The Spillover Effect transformation process begins with the process of spreading shock to macro variables in a country. Research conducted by Forbes & Rigobon (2001) states that there are two theories that underlie the widespread process of shock, namely the crisis contingent theory and the non-crisis contingent theory.

Contingent Crisis Theory

Crisis Contingent theory explains the change in the transmission mechanism when a crisis occurs and the increased correlation between markets after a shock. Crisis Contingent theory can be divided into three mechanisms, namely: multiple equilibria, endogenous liquidity, and political economy. The first mechanism, multiple equilibria, explains that a crisis that occurs in a country causes the country to become a sunspot for other countries. Based on research conducted by Masson (1998), it shows that the factors that influence the formation of investor expectations and encourage investors to move from a good equilibrium to a bad equilibrium cause a crisis in the economy in the second country. Another opinion states that investors imperfectly make withdrawals of investment in the previous period (Mullainathan, 1998). A crisis in a country can be triggered by a previous crisis. These conditions can be caused by recalculating previous investment failures and giving a sign of a bad country. This theory not only explains the series of crises, but also explains speculative attacks on economic fundamentals.

The second mechanism is endogenous liquidity. Endogenous liquidity theory is built from a model in which a crisis in a country can be reduced by market participation (Valdes, 1996). This condition can be used to strengthen investors to change their portfolios and sell assets to other countries and continue market operations to meet profits. The same way happens if the liquidity shock is large enough, then a crisis in a country can increase the amount of credit available and the power of investors to sell their shares of assets in a country that was not affected by the previous crisis. Calvo (1999) developed a different model of endogenous liquidity, which provides different information among investors. Investors get information about the fundamentals of the country and about liquidity shocks.

The last transmission mechanism is political contagion. Research conducted by Drazen (1998) examines the devaluation of Europe from 1992 to 1993 and builds a model assuming that the central central bank is under political pressure to maintain the country's exchange rate. The transmission in the crisis contingent theory is a different transmission path through international transmission shocks including, multiple equilibria based on investor psychology, endogenous liquidity shocks caused by portfolio composition, and political economy is influenced by the exchange rate regime.

Non-Crisis Contingent Theory

The non-crisis contingent theory explains that there is a similarity in the transmission mechanism when there is a shock or in a stable condition. This theory assumes that the transmission mechanism after a shock is not significantly different from that before the crisis. The high correlation between markets after the shock is a continuation of the linkages that existed before the crisis. Forbes & Rigobon (2001) divide the transmission mechanism of the non-crisis contingent theory into several channels including: trade channels, policy coordination, country evaluation, and random aggregate shocks. These paths are often called real linkages.

The first transmission mechanism of the non-crisis contingent theory is through the trade route. Trade routes have direct and indirect impacts on trade conditions between countries. An example of a direct impact from the trade route is a devaluation carried out by a country which will have an impact on increasing product competitiveness and have the potential to increase exports to trading partner countries but can reduce domestic sales in that trading partner country. Meanwhile, the indirect impact is the losses incurred by trading partner countries, which can lead to devaluation of the exchange rate in other countries.

The second transmission is policy coordination. Policy coordination can be interpreted as the response of a country in facing the global economic crisis so that it tends to follow the policies of other countries that are also affected by the crisis, thus issuing similar policies between the two countries. The policy equation used between these countries proves the close economic relationship between countries. The third mechanism is country reevaluation. This mechanism is intended as a condition in which investors already have the perception that the similarity of macroeconomic structures and economic policies in several countries means that these countries will also be affected by the same economic shocks. The last mechanism is random shock. This mechanism states that the economic fundamentals of several countries can be caused by global shocks simultaneously.

Financial Kontagion

Based on Claessens & Forbes (2001) in their book "International Financial Contagion" states that there is a theory of the spread in a financial crisis that spreads either directly or indirectly called financial contagion. Financial Contagion as a significant increase in the correlation of financial prices, such as exchange rates, interest rates, and stock prices. An increase was observed in a group of countries, after controlling for macroeconomic fundamentals and general shocks, after crises elsewhere. Financial contexts, in large part, depend on past economic policy choices. This means that victims of transmission are rarely completely powerless to prevent infection. However, once in a crisis zone, the outcome of domestic policy actions is uncertain.

In a broad sense, contagion refers to a situation where there is financial panic and vulnerability between markets. Another view of contagion is often concerned with how to detect transmission in financial markets. For example, financial contagion arises when the spread of a crisis shock from one market to another cannot be explained by fundamental changes. Transmission occurs when the probability of a crisis in a particular country increases in light of a crisis event in another. One of the contagion factors apart from the strength of economic and financial relations that exist throughout the market is the contingency effect associated with the outbreak of a crisis on market players. This means that the panic decision of investors in a crisis country to withdraw capital can provoke panic in other markets. Finally, geographic proximity contributes significantly to amplifying the speed and seriousness of the effects of transmission (Arouri et al., 2009).

Arouri, et al., 2009 research discusses the channels through which recurring financial crises affect the financial systems of developing countries, the extent to which emerging markets are affected by the current global financial crisis originating in the US which has been traced. In practice, various econometric techniques are used to explore the short- and long-term relationships between the new stock market and the US, as well as the potential for financial contagion around the current crisis.

Asset Bubbles

An asset bubble effect includes both a growth effect and a well-being effect. Samuelson (1958) argues that bubbles resolve markets in an overlapping generation model, and thus increase welfare. Tirole (1985) shows that bubbles push outward on investment and increase welfare in a dynamic economy inefficient. In contrast, Grossman & Yanagawa (1993), Raja and Ferguson (1993); Saint-Paul (1992) suggest that insufficient and bubble accumulation of capital can exacerbate economic growth and welfare by crowding out investment in an economy with externalities. Azariadis & Reichlin (1996) find that bubbles increase welfare in an economy with marginal production variants of capital and weak externalities.

Since 2008 when the financial crisis occurred, the literature has incorporated financial friction into bubble theories. Caballero & Krishnamurthy (2006); Farhi & Tirole (2012) found that bubbles provide firms with financial friction liquidity in an economy, thereby stimulating investment and economic growth. Kocherlakota (2009); Miao & Wang (2011) show that bubbles expand the collateral value of firms, which in turn facilitates loan accessibility and economic growth. Ventura (2012) reveals that the financial friction barrier to capital flows between countries and capital will decrease when a bubble exists. Miao & Wang (2014) combine the bubble into a two-sector economic model with credit friction and find that the bubble produces both a credit easing effect and a capital reallocation effect. The rest will increase efficiency while the second may be less precise use of capital depending on the interaction between sectors. Therefore, the effect of bubble growth depends on the direction and extent of both effects.

The existing literature on determining banking stability has various views. Claessens et al., (2001) found that an influx of foreign banks will stabilize the banking sector of the host country. Gale & Vives (2002) show that dollarization can improve banking stability with ex-ante controls on moral hazard. Following this paper, deposit insurance and limited liability companies have been discussed in many determinants of banking stability. Kim & Santomero (1988) reveal that banks tend to hold risky portfolios due to inefficient deposit insurance while the need for capital reduces bank risk taking. Gertler & Kiyotaki (2015) found that deposit insurance mitigates the procyclical effects caused by bankruptcy. Meanwhile, moral hazard will increase the possibility of bankruptcy.

However, the existing literature pays little attention to the stability effects of the banking asset bubble. The aim is to examine the impact of asset bubbles on banking stability and the impact of banking stability on economic growth from both theoretical and empirical perspectives (Wang et al., 2018). Based on Suryati & Affandi's (2018) research to see the accuracy of the research results, the researchers also compared the IHSG and the IHK to detect asset bubbles.

Methodology

This study uses two methods, namely the descriptive method by comparing the IHSG with the IHK and the Vector Error Correction Model (VECM) method. The descriptive method used to determine the asset bubbles that have occurred during the global financial crisis in Indonesia uses a quantitative descriptive by comparing the IHSG with the CPI. Furthermore, to determine the effect of macroeconomic fundamentals on asset bubbles in Indonesia using the Vector Error Correction Model (VECM) method. The third research method is the Vector Error Correction Model (VECM). The VECM method is used to answer the third problem formulation, namely seeing the effect of macroeconomic fundamentals on asset bubbles. The condition of the occurrence of asset bubbles is by comparing the composite stock price index with the consumer price index, while the movement of macroeconomic fundamental variables during the global financial crisis in Indonesia is proxied by using the Exchange Rate (ER), Interest Rate (IR) and Inflation (IF) data. This reflects the impact during the global financial crisis in Indonesia. This study uses secondary data from 2006, the 1st month to the 12th month 2010, taken from international financial statistics and Bank Indonesia.

The use of the Vector Error Correction Model (VECM) method through macroeconomic indicators that are related to domestic economic conditions, namely the exchange rate, inflation and interest rates which affect asset bubbles by correlating economic conditions. The VECM model is an restricted form of VAR (Enders, 2017). This additional restriction must be given because of the existence of data forms that are not stationary in the form of levels but are co-integrated. VECM then utilizes the cointegration restriction information into its specifications. Therefore, VECM is called the VAR design for non-stationary series which has a cointegration relationship (Firdaus, 2020). Johansen test has investigated the existence of co-integration by determining how many co-integrating vectors are present. It estimates all the different relationships. Through the Johansen test, the long-run equilibrium relationship has been examined. After that, the integrating relationship between the two factors has been verified. Vector Error Correction Model (VECM) has also been used to estimate both shortrun and long-run impact of each variable's time series on the other, and to define the direction of the relationship and to determine whether it is a unidirectional relationship or a bidirectional relationship. Impulse response analysis is used in to explain this relationship (Bokhari 2020).

Results and Discussion

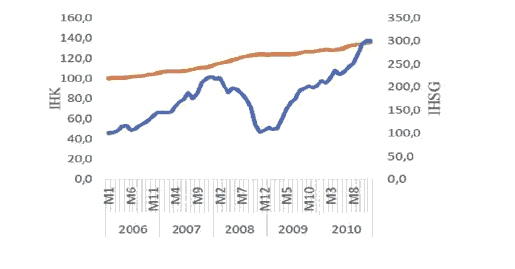

Figure 1 depicts the movement of the IHSG and IHK in Indonesia in the period 2006 January to December 2010 with the 2006 January 2006 baseline figure of 100. The results of the IHSG study provide a more surprising fact by having a high volatility of fluctuations compared to the IHK. From January 2006 to July 2007 the JCI trend tended to increase, followed by the IHK.

Comparison of the Composite Stock Price Index and the IHK

Figure 1: Movement of IHSG and IHK in Indonesia, January 2006 - December 2010 (International Financial Statistic)

However, in 2007 August to 2009 March the JCI trend experienced a drastic decline compared to the IHK which tended to be stable. This is because the financial crisis made investors withdraw their funds on a large scale. Furthermore, when macroeconomic fundamentals began to improve followed by an upward trend in the JCI in 2009 April to December 2010, investors returned to investing massively with the expectation that they would receive the greatest possible profit in the future.

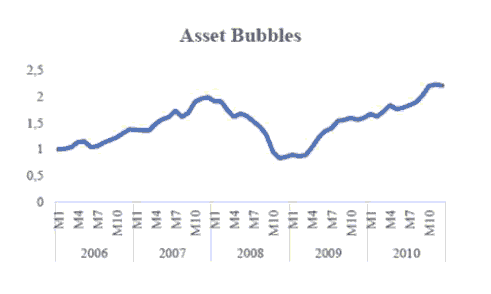

Bubbles Asset Classification Ratio

According to Steve Keen (2013) asset bubbles can be identified by comparing the JCI to the CPI. figure 4.6 shows the movement of the asset bubble ratio during the global financial crisis in the period 2006 January to December 2010 using the 2006 January base year.

The stock market represented by the composite stock price index has a surprising JCI to CPI ratio. The potential for an asset bubble can only be seen after the global financial crisis in September-December 2010 with a ratio of 2.02: 1, 2.2: 1, 2.23: 1 and 2.21: 1. Post the global financial crisis that occurred in the world has had a bad impact on Indonesian market conditions so that the ratio of IHSG to CPI reaches 2.21: 1 and continues to increase over time (Figure 2).

Based on Steve Keen's criteria for asset bubbles, the event is classified as a small bubble. In the same year, an asset bubble on the stock market also occurred in the United States with a ratio of 10.5: 1. The Indonesian stock market experienced a spillover due to the peak stock market bubble in the United States. The Indonesian stock market continues to provide surprising facts with the ratio increasing after April 2009. If this condition continues without being followed by the accuracy of a policy, it does not rule out the possibility of an asset bubble explosion in the Indonesian stock market.

The Result of Fundamental Macroeconomic Estimation on Asset Bubble in the VECM Model

a) The estimation results of the Vector Error Correction Model

The estimation results from Table 2 for the long-term VECM model above can be interpreted in the form of the following equation:

AB=0.027111+0.000167 NTt-1+0.02928 IFt-1+0.135437 SBt-1+e

| Table 2 Long-Run VECM Model |

||

|---|---|---|

| Variable | Coefficient | t-statistic |

| D(AB(-1)) | 1.000000 | 1.000000 |

| D(NT(-1)) | 0,000167 | [8.94237] |

| D(IF(-1)) | 0,029284 | [1.65621] |

| D(SB(-1)) | 0,135437 | [2.75423] |

| C | 0.027111 | - |

The equation model is said to be significant when the t-statistic value is greater than the t-table, which is (1.67). Long-term estimation with research range 2006M1 - 2010M12 on the Exchange Rate variable (NT) has a t-statistics of 3.61990 which is greater than the t-table (1.67). This means that the exchange rate has a significant positive effect on the Asset Bubble (AB). The coefficient value of NT is 0.000554, meaning that one percent depreciation of the exchange rate will increase the asset bubble by 0.000554 percent. The Inflation Variable (IF) has a significant negative effect on (AB) in the long run, where the t-statistics value of IF is -5.80790 above 1.67. When the IF is increased by one percent, it will reduce the asset bubble by 0.28985. The interest rate variable (SB) has a t-statistics value of [5.30809] above the t-table 1.67. This means that the SB variable has a significant effect on the asset bubble in the long run. B. Short Run Vector Error Correction Model (VECM) Estimation Results.

Based on the VECM estimation results in Table 3, as a whole, it can be seen that the variables built in the model are statistically significant to the other variables. This is determined by looking at the t-statistic which is greater than the t-table 1%, 5% and 10% which respectively have t-tables 2, 394, 1.672 and 1.296. This determination is because in this study using an error rate of 1%, 5% and 10%. Table 2 is a summary of all variables that have levels of 1%, 5% and 10% in influencing other variables.

| Table 3 VECM Estimation Results |

||||

|---|---|---|---|---|

| Error Correction | D(AB) | D(NT) | D(IF) | D(SB) |

| D(AB(-1)) | -0.360538 | -9.561.727 | -4.189.420 | 0.401811 |

| (0.15568) | -617.983 | -193.994 | (0.26348) | |

| [-2.31584] | [-1.54725] | [-2.15957] | [1.52501] | |

| 1.38E-05 | -0.508134 | -0.001804 | 0.000306 | |

| D(NT(-1)) | (4.6E-05) | (0.18287) | (0.00057) | (7.8E-05) |

| [0.29959] | [-2.77865] | [-3.14216 | [3.92378] | |

| -0.036566 | -3.958.199 | 0.749123 | -0.048721 | |

| D(IF(-1)) | (0.02307) | -915.576 | (0.28741) | (0.03904) |

| [-1.58531] | [-.43232] | [2.60644] | [1.24809] | |

It can be seen that in the short-term estimation results the value of t-statistics between the asset bubble variable D (AB (-1)) t-statistics is [1.52501] which is greater than t-table α=10%, which is 1.296, so there is a short-term relationship. Where the variable D (AB (-1)) in the short term affects the interest rate variable D (SB). In the exchange rate variable D (NT (-1)) has a t-statistics of [3,92378] which is greater than the t-table value α=1% of 2.394, so it can be estimated that it has a short-term relationship. Where the variable D (NT (-1)) in the short term affects the interest rate variable D (SB). Meanwhile, the exchange rate variable D (NT (-2)) has a t-statistics of [2.22860] which is greater than the t-table value α=5% of 1.672 so that it can be said to have a short-term relationship to variable D (SB). Furthermore, the inflation variable D (IF (-1)) has ¬t-statistcs of [2.60644] which is greater than the t-table value α=1% of 2.394, so it can be said to have a short-term relationship to variable D (IF).

Discussion

Macroeconomic Policies during the Global Financial Crisis in Indonesia

During the global financial crisis, slowing economic growth in Indonesia was often mitigated by monetary policy. The interest rate is considered as one of the appropriate instruments because the United States, through the Fed, has raised its benchmark interest rate in order to normalize its monetary policy. The monetary policy adopted by the central bank in this study is to use the main instruments of interest rates and exchange rates, while inflation is a result of global phenomena.

Bank Indonesia policy is aimed at stabilizing the inflation rate through the interest rate channel. The Inflation Targeting Framework (ITF) is a medium-term inflation targeting policy and the central bank's commitment to achieving price stability as a long-term goal (Kadir et al., 2008). In Indonesia, Bank Indonesia explicitly announced to the public the inflation target and monetary policy aimed at achieving the targeted inflation target (Bank Indonesia, 2005).

Based on Table 4, in 2008 the inflation target used by Bank Indonesia was far from the target. This is because the global crisis shows that macroeconomic instability can also come from the financial sector (Utari et al., 2015). Meanwhile, the exchange rate regime implemented by Indonesia is a free-floating exchange rate. Table 5 describes the policies of Bank Indonesia in the effort to stabilize the Indonesian economy.

| Table 4 Inflation Target Achievement |

|||

|---|---|---|---|

| Year | Inflation Target | Actual Inflation | Description |

| 2006 | 8±1% | 6,60 | Approaching Target |

| 2007 | 6±1% | 6,59 | On Target |

| 2008 | 5±1% | 11,06 | Far from Target |

| 2009 | 4,5±1% | 2,78 | Approaching Target |

| 2010 | 5±1% | 6,96 | Approaching |

| Table 5 Implications of Monetary Policy in Stabilizing Inflation, Interest Rates and Exchange Rates |

||

|---|---|---|

| No | Policy | Description |

| 1 | Inflation Targeting Framework (ITF) | Inflation targeting through interest rate and price stability policies as well as low inflation carried out by a country's central bank. |

| 2 | BI 7-day Repo Rate (BI 7-day RR Rate) | Maintain macroeconomic stability and financial system stability |

| 3 | Free floating | Free floating exchange rate regime |

Meanwhile, the results of this study support the research of Froot & Obstfeld (1991) which states that there are intrinsic bubbles where these bubbles are caused by variations in macroeconomic fundamentals. This bubble occurs due to overreaction on changes in fundamentals. This research is in line with Anggito Abimanyu (2011) who stated that in the short term the asset bubble has a positive effect on interest rates. Because when interest rates rise, investors will invest their capital with the expectation of making a profit. Meanwhile, in the long term, rising inflation, exchange rate fluctuation, interest rate hikes and world oil increases, if an asset bubble is not anticipated, because there is a risk of return.

On the other hand, it is different from the findings made by Nicholas Sargen (2016) which states that credit growth, high property value and weak economic growth can cause an asset bubble. Another contradictory research is from Shu Ping Shi 2010 which states that in the Markov-switching Augmented Dickey-Fuller (MSADF) model the volatility of base money, exchange rates and consumer indexes can cause an error in asset bubble analysis.

Policy Steps Taken During the Global Financial Crisis as an instrument for early monitoring and early warning, the BKF dashboard is quite adequate, especially if the features and applications are continuously improved and developed as needed. The accuracy and speed of information continues to be improved with simple and anticipatory analysis. Furthermore, the instrument must be able to anticipate and prevent worsening conditions.

The steps that must be taken are first, following Sri Mulyani's policies and commitments, all units must consolidate data continuously and consistently with improved quality and routinely and automatically distributed to the warehouse database at BKF, secondly, early monitoring exposure must be followed and discussed. Intensively among leaders in the Ministry of Finance to find out the symptoms, phenomena and trends that occur, thirdly to monitor whether the trend is within the safe, unsafe and dangerous threshold limits, fourth, the exposure to the early warning system must be observed, discussed openly but confidentially. The focus is on policies to prevent and anticipate worsening (Abimanyu, 2011).

In addition, the application of the Bank Indonesia policy mix played an important role in strengthening the resilience of the Indonesian economy in the face of global economic and financial turmoil and uncertainty since the 2008/2009 global financial crisis. The central bank policy mix is basically an optimal integration between monetary policy, macroprudential policy and foreign capital flow management implemented by the central bank to achieve price stability and support the maintenance of SSK.

This term has a broader scope than the Flexible Inflation Targeting Framework (FIT) suggested in a number of studies (Agenor & da Silva, 2013; Svensson, 2009; Ito, 2010; Warjiyo, 2013; Juhro, 2015) among others:

The Final Target to be Achieved is not Only Price Stability but also to Support the Maintenance of SSK.

The central bank's mandate in supporting financial system security is mainly carried out through macroprudential policies, namely regulating and supervising financial institutions from a macro-financial perspective and focusing on systemic risk. Macroprudential policy is primarily directed at two main targets to support the maintenance of SSK. The first objective is to prevent the accumulation of risk from the boom-bust of the financial cycle, especially the credit boom and the hausing bubble, both due to factors in the financial system itself and its interactions with the domestic and international economy. Meanwhile, the second objective of macroprudential policies is to strengthen resilience and mitigate contagion risks from the interconnection and network of the financial system.

The Instruments Used are Monetary Policy, Capital Flow Management, and Macroprudential Policy in an Optimal Mix.

There are three basic frameworks for formulating policies that underlie the main building blocks of the central bank's policy mix. First, monetary policy is still directed towards achieving price stability, by giving more consideration to asset prices (financial and property) to support the maintenance of SSK. Second, macroprudential policy covers the regulation and supervision of financial services institutions from a macro-financial perspective and focuses on systemic risk in order to promote financial system stability. Macroprudential policy to control financial procyclicality, in particular the credit boom and the housing bubble. Third, management of foreign capital flows can strengthen the effectiveness of monetary policy to achieve price stability as well as the effectiveness of macroprudential policies in supporting the safeguarding of SSK from the effects of the global economy.

The Formulation of the Policy Mix Requires a Macroeconomic Analysis and Forecast Framework that Includes Macro-Financial Linkages.

The formulation of policies to control the cyclical risk of SSK is carried out in several stages. The first stage determines whether the risk of CNS is excessive. A number of financial variables can be indicative of this, such as a high increase in asset prices during an economic boom. The high increase in asset prices generally encourages high credit expansion, leading to correction of asset prices and credit crunch. The second stage is to determine what policy responses are appropriate to address the risk of excessive SSKs. Tightening monetary policy to achieve price stability can also help maintain SSK (Warjiyo & Juhro, 2016). Vigilance and appropriate response is needed both in terms of monetary policy, macroprudential and foreign capital flow management to be able to pre-emptively analyze, predict and control risks both in the domestic and external economy and in the financial system to achieve price stability and supports the maintenance of SSK.

Conclusion

The ratio of the occurrence of asset bubbles in Indonesia during the research period from 2006 January to 2010 December shows that in 2006 January to 2010 August the bubble ratio figure was below 2: 1. This figure means that the presumption is that there are asset bubbles in Indonesia which is not empirically proven. Meanwhile, after the global crisis occurred in 2010 September to December 2010 in Indonesia, the bubble ratio was classified as small according to the bubble criteria popularized by Keens (2013). The results of data testing show that the highest share bubble ratio reaches 2.23: 1. This figure is included in the small bubble criteria.

The movement of macroeconomic fundamentals towards the asset bubble during the 2008 global financial crisis in Indonesia, it was found that in the short term only interest rates had a significant positive effect. This reflects that interest rate movements have a direct effect on the asset bubble. Meanwhile, in the long term the movement of macroeconomic fundamentals has a significant positive and negative effect on asset bubbles. This can be concluded if the movement of macroeconomic fundamentals is proven to affect the asset bubble. The fluctuation of macroeconomic fundamentals in empirical observations will affect the asset bubble because if inflation decreases, investors will withdraw their funds massively and when interest rates and exchange rates start to move up, investors quickly respond to this phenomenon with the expectation of obtaining the maximum profit.

In the short term, the only macroeconomic fundamental variable is the interest rate which has a significant direct effect on the asset bubble. This reflects that the decline in interest rates causes a decrease in the asset bubble. The implication of the right policy in the short term when an asset bubble occurs, the central bank must lower interest rates to control the flow of investor capital so as to minimize and even anticipate an asset bubble.

In the long run, the macroeconomic fundamental variables consisting of exchange rates and interest rates have a significant unidirectional effect on the asset bubble, while inflation has the opposite effect. This reflects that an increase in inflation will cause an increase in asset bubbles and a decrease in interest rates and exchange rates will cause a decrease in asset bubbles. The implications of the right policy in the long run when an asset bubble occurs, which is marked by a high increase in inflation and depreciation of the exchange rate, will make investors withdraw their capital flows to invest in other countries, so that they can maintain what they were originally in, the central bank must raise interest rates. Thus, it can control the flow of investor capital so as to minimize and even anticipate the occurrence of an asset bubble.

References

- Abimanyu, A. (2011). Refleksi dan gagasan kebijakan fiskal. Jakarta : PT Gramedia Pustaka Utama.

- Arouri, M. E. H., Jawadi, F., & Nguyen, D.K. (2009). “International financial crisis and contagion”. Contributions to management science, 185–202.

- Aoki, K.D.N.K. (2015). “Bubbles, banks and financial stability”. Tokyo: Faculty of economic University of Tokyo.

- Bank Indonesia. (2008). “Tinjauan kebijakan moneter september 2008”. September. Jakarta : Bank Indonesia

- Bank Indonesia. (2011). Bank Indonesia Policy Direction in 2011 (Annual Banking Meeting, 21 January 2011). January. Jakarta : Bank Indonesia

- Bokhari, A.A.H. (2020). “The twinning of inflation and unemploymenphenomena in saudi arabia: Phillips curve perspective.” Contemporary Economics, 14(2), 254–71.

- Claessens, S., & Forbes, K.J. (2001). “International financial contagion”. New York, Kluwer Academic Publishers.

- Claessens, S., & Forbes, K. (2001). International financial contagion: An overview of the Issues and the book. New York, Kluwer Academic Publishers

- Eichengreen, B., Hale, G., & Mody, A. (2001). Flight to quality: Investor risk tolerance and the spread of emerging market crises. New York : Kluwer Academic Publishers

- Endika, S. (2018). “Empirical study of policy trilemmas and macroeconomic variables in Indonesia: Dynamic ordinary least squares approach”. Jember: thesis on development economics, University of Jember

- Firdaus, M. (2020). Econometrics application with E-Views, stata, and R, (First Edition). Bogor, Bogor Agricultural University (IPB).

- Fito, R.R.J. (2015). The influence of macroeconomic fundamental factors on the composite stock price index (IHSG) (Period 2008 – 2014)”. Bandung, Thesis of Widyatama University.

- Froot, K.A., & Maurice, M. (2014). Intrincic bubbles: The case of stock prices. American Economic Association. 81(5), 1189-1214.

- Kadir, A.M., Widodo, P.R., & Suryani, G.M. (2008). Implementation of Monetary Policy in the Framework of Inflation Targeting in Indonesia. Jakarta, Center for Central Banking Education and Studies (PPSK) Bank Indonesia.

- Kuncoro, M. (2009). “The urgency of policy stimulants amid global crisis”. Surakarta : Muhammadiyah University of Surakarta.

- Ludin, S.M., & dan T.A.F. (2013). Overheating pressure analysis: An evaluation of indonesia compared to emerging market economies. Journal Deparetment of Economics, Faculty of Economics University of Indonesia.

- Marsili, M.D.R. (2006). “Risk bubbles and market instability”. Roma, University Roma “La Sapienza”

- McKinnon, R.I. (2010). Money and capital in economic development. Brookings Institution Press.

- Miao, J.D.W.P. (2015). “Banking bubbles and financial crises”. Boston, Department of Economics, Boston University

- Misgiyanti, D.I.Z. (2008). The influence of federal reserve (The Fed) foreign interest rates, rupiah/US$ exchange rates and inflation on the composite stock price index in the indonesia stock exchange period 2006-2008. Journal of Development Economics, 7(1): 19-32

- Naoui, K. (2011). “Intrinsic bubbles in the american stock exchange: The Case of teh S&P 500 Index. International Journal of Economics and Finance, 3(1), 124–132.

- Novianti, F. (2017). “International spillover effect on macroeconomic variables in asean 5: Global var approach”. Jember, thesis on economic development, University of Jember.

- Octaviantri, R. (2015). Early warning financial system in maintaining macroeconomic stability. Thesis of the department of development economics, University of Jember.

- Haslinda., D.M.J. (2016). The effect of budget planning and budget evaluation on organizational performance with standard costs as a moderating variable in the local government of Wajo Regency. Total Scientific Accounting Civilization, 2(1), 1-21.

- Rahmadani, E. (2018). “The influence of consumer price index, inflation, and investment on gross domestic product in indonesia”. Telungagung, Tulungagung State Islamic Institute.

- Raz, F.A., Indra, P.K.T., Artikasih, K.D., Citra, S. (2012). “The global financial crisis and economic growth: An analysis of the east asian economies”. Department of economic research and monetary policy: Bank indonesia. Bulletin of monetary economics and banking,15(2).

- Reindartis, V. (2015). Analysis of the effect of macroeconomic variables on banking credit in indonesia in 2000Q1-2013Q4. thesis. Undergraduate program faculty of economics and business, University of Jember.

- Sargen, N.P. (2016). Global shock an investment guide for turbulent markets. Washington, Springer Nature

- Sari, P.K., & Fakhruddin. (2016). “Identification of the causes of the monetary crisis and central bank policy in indonesia: Cases of crisis in the years (1997-1998 and 2008)”. Banda Aceh, Faculty of Economics and Business, Syiah Kuala University. Student Scientific Journal, 1(2).

- Sihono, T. (2008). “United states financial crisis and indonesian economy”. Yogyakarta: Yogyakarta State University. Journal of Economics & Education, 5(2).

- Seragih, A.N., & Sirait, K.H. (2015). “The effect of macroeconomics on the stock price index of four countries in southeast asia for the 2003-2013 period”. West Jakarta, Trisakti University Journal.Z

- Setiawan, A. (2012). Inflation targeting framework and changes in monetary policy response. Journal of Financial Education and Training Agency Badan, 5, 65-76.

- Shravani, & Supran, K.S. (2020). “Financial development and economic growth in selected asian economies: A Dynamic Panel ARDL Test.” Contemporary Economics, 14(2), 201–18.

- Shi, S.P. (2010). Buble or volatility: A markov-switching unit root test with regime-varying error variance. Research School of Economics. Juni 2010. Working Paper, Australian Natinal University, 524.

- Suryai, (2018). “Detection of bubble economy and analysis of factors affecting residential properties in indonesia”. Yogyakarta, Thesis on financial economics, islamic university of indonesia.

- Tabak, B.M., Fazio, D.M., Paiva, K.C.O., & Cajueiro, D.O. (2016). “Financial stability and bank supervision”. Brazilia : Department of economics and law and economics, Universidade catolica de brazilia.

- Umami, F.D. (2016). “The effect of net exports, FDI and Exchange rates on economic growth in indonesia for the period 2005.I-2014iv”. Jember, Thesis on development economics, university of jember

- Utari, G.A.D., Cristina, S.R., & Pambudi, S. (2016). Inflation in Indonesia: Characteristics and Control. Jakarta, Bank Indonesia Institute.

- Warjiyo, P.D.S.M. (2016). Central bank policy theory and practice, (First Edition). Jakarta: pt raja grafindo persada.

- Wartowardojo, A.D.W. (2016). “Peeling Macroprudential Policy”. Jakarta : Bank Indonesia

- Wang, S., Chen, L., & Xiongxiong. (2018). “Asset bubbles, banking stability and economic growth”. Guangzhou, Lingnan (Universitas) College

- Wang, S., & Dan, C.L. (2019). “Driving factors of equity bubbles”. Zhuhai : International school of business & finance, sun yat-sen university. Journal of Financial Economics Studies.

- Ventura, J. (2012). “Bubbles and capital flows”. Barcelona, University Pompeu Fabra.

- Violita, E. (2018). “Retesting and synthesizing the twin deficits hypothesis and the feldstein horioka puzzle in indonesia and thailand”. Jember, thesis on development economics, university of jember.

- Yuhasnara, O.M. (2017). “Empirical analysis: economic fundamentals & housing price bubbles in indonesia for the period 2002-2016”. Semarang, Diponegoro University.