Research Article: 2020 Vol: 21 Issue: 3

Re-Appraisal of the Validity of Long-Run Money Neutrality: Evidence From Nigeria

Amassoma Ditimi, Federal University Oye-Ekiti, Ekiti State, Nigeria

Badmus Ademola, Federal University Oye-Ekiti, Ekiti State, Nigeria

Ogbuagu, M.I. Federal University Oye-Ekiti, Ekiti State, Nigeria

Abstract

The study re-appraised the validity of long-run money neutrality in Nigeria. The reason for this owes from the dilemma faced by monetary authorities via their inabilities to utilize an effective monetary policy that can drive and actualize her key macroeconomic objectives in a sustainable manner. The study employed Johannsen co-integration test and Vector error correction mechanism approach to re-validate the tenacity of money neutrality in Nigeria, both in the long and short-run using annual time series data from 1981 to 2018. The results from the Phillips curve model refute the validity of long-run money neutrality while that of Fishers effect relation exerted partial long-run money neutrality in Nigeria. Hence, revealing that Fishers effect is more effective in validating money neutrality in Nigeria comparatively. Similarly, the Normalized co-integration test and the VECM estimate supported that of the above. Also, the error correction model (ECM) suggests that, for money to be wholly neutral in the long-run, it will take one year and nine months. Consequently, the study concludes that the old debate of money neutrality is not entirely practicable in Nigeria due to the existence of nominal rigidity and partial violation of the classical and monetarist dichotomies of monetary aggregates. Based on the above conclusion, the study recommends that the government should adopt sound policy coordination to achieve an overall macroeconomic objective in the long-run. Furthermore, the CBN should put all measures in place to suppress the uncomplimentary time lag between the time they spot the need for changes in monetary policy and the time to take action, to enhance a successful result of fine-tuning monetary policy instruments

Keywords

Money Neutrality; Money supply; Johannsen Co-integration; Fishers effect; Nigeria

JEL Codes

B22, C22, E58

Introduction

Rendering to David Laidler (1992) proposition of "neutrality of money" which is attributable to an Austrian economist called Friedrich - Hayek in 1931. As a matter of fact, Hayek defined money neutrality as the market rate of interest that mal-investments (poorly allocated business cycle theory) did not occur; neither did it exhibit any business fluctuation Syndrome. This in turn led to the scenario when the neoclassical and neo-Keynesian economists adopted and applied it to their general equilibrium framework; given its current meaning, which depicts how changes in the money supply affects nominal variable and not real variable in the long-run; knowing quite well, that this assumption underlies almost all macroeconomic theory. It is in this regard that, Chen (2007) defined money neutrality has "a permanent unite or a stochastic shock to the money supply, has a unit or a proportional effect on prices, but a zero effect on real output in the long-run and not in the short-run".

Consequently, it can be deduced that money neutrality match with the policy ineffectiveness proposition while non-neutrality of money is for policy interventionism. In particular, the reinstatement of the natural rate of unemployment and potential output to the expected optimum position in the long-run despite the consistent change in the policy instrument. Which is an indication that the utilized policy instrument is an ineffective tool for influencing output level in the long-run; hence, this justifies money neutrality and vice-versa for policy interventionism for non-neutrality of money in the long run.

Little wonder why William-McChesney in 1951 describes the primary profession of all central banks as "taking the punch bowl away at the party." To him, the punch bowl at the party is money; such that, if the monetary authorities set out the punch bowl of money, which could temporarily give the economy a brief high. Nevertheless, if the central banks are worried about inflation in the long-run, it must take the punch bowl away and everyone must sober-up. Meaning that, If the central bank does not take the punch bowl away, the result will be the ongoing increases in prices. It is in this wise that money neutrality is termed a core phenomenon to all monetary authority while deciding to achieve diverse macroeconomics objective ranging from nominal to real variable control tools either in the short or long-term in any economy.

Over time, the assertion of money neutrality has often been with mixed feelings, since monetary policy is not responsive to the real output in the long-run. Therefore a rise in the monetary growth rate will result in an explosive inflation level, which in turn can lead to a fall in real returns on money via investment. The above was supported by Galbacs-Peter (2015), who pointed out that people will be discouraged from their asset holding via money to real assets such as goods inventories or even productive assets. Consequently, the shift in money demand will directly affect the supply of loanable funds, and the mutual changes in the nominal interest rate and the inflation rates will drive the real interest rate away from its former state. If so, real expenditure on physical capital and durable consumer goods can be pretentious, hence making the money neutrality hypothesis illusionary.

Despite the above criticisms, this idea has been a very weighty target for the classical macroeconomic model and policy endorsement, and its genuineness or in-genuineness which has a long-reaching consequence for smooth implementation of macroeconomic policy within countries. Those above are the reason why several researchers have investigated and are still investigating the dichotomy of money neutrality. By possibly measuring the extent to which changes in some macro-economic variables can be measured in currency units, while the one that cannot are constant when money supply changes in the economy. Hence, the reason why this current study intends to re-investigate the validity of long-run money neutrality in Nigeria in orders to validate or refute the work-ability of core theoretical propositions, among others.

Generally, this study would be sub-divided into five sections. Section A, is the first aspect which unfolds the problem statement, pivotal question(s), objective(s) and focus of the study. Section B addresses the literature review and theoretical foundation of the study. While section C showcases the research methods, model specification and the technique of analysis. After which, Section D, analyses and discusses the results and finally, Section E, concludes and proffer policy implication.

Literature and Empirical Review

In the analysis of the adaptive expectation hypothesis by Friedman in 1968, represented by the vertical slope of the Long-run Phillip Curves is an indication of money neutrality in the long-run. The reason for this is not far-fetched from the changes in a nominal variable such as inflation (price level), due to the introduction of policy instrument by the government which in turn will not affect real variable such as the real output or the real employment level thereby making this theory to be a core phenomenon in money neutrality hypothesis.

Consequent upon the above line of argument, it can be deduced that both inflation and unemployment (short of output) are undesirable in an economy. Thereby, leaving the government with the choice of either adopting a contractionary or expansionary policy instrument to regulate aggregate demand to control either of the two core macro-fundamental variables depending on the policy target or goal of the government. Although, there is a trade-off between them as buttressed by the Phillips Curve theory, which means that any policy instrument employed to curb either of the variables will escalate the other and vice-versa.

Moreover, the response of this variable to government policy is often conflictual in the labour market concerning actual inflation and expected inflation rate its generates. Which in turn, makes the forces that regulate the actual and expected inflation level via policy instrument introduced by the government to serve as a dominant invisible hand which, indirectly restores the economy to the full employment level or natural rate of unemployment (NRU). While the price level either increases or decreases, depending on whether the policy instrument by the government is contractionary or expansionary—in essence, depicting evidence of money neutrality in the long run. Which disappointingly, cannot reinstate the economy to its state of full employment, especially in a developing country in order to guarantee the credibility of the long-run Phillip curve concerning money neutrality? Thereby, portraits the fact that the government does not have adequate knowledge to successfully fine-tune policy instrument that will match the exact economy need.

The second theory in this line of research is the Fisher effect theory that was postulated by Irving Fisher. Here, the relationship between inflation and interest rates was employed to explain the intricacies of money supply in an economy to illustrate the evidence of money neutrality in the long-run among others. More particularly, Fisher Effect buttresses that, the real interest rate should be equals to the nominal interest rate minus the expected inflation rate according to (Adam 2019). The implication is that the real interest rate is supposed to reduce as inflation increases apparently because of the change in time value of money. However, this will be tenable when the nominal interest rates and inflation rate increases proportionately. Hence, resulting in a situation where the real interest rate remains constant, thereby showcasing the presence of money neutrality. Also, the Fisher effect depicts how money supply serves as a great deal in explaining the significance of money neutrality. Because it describes how money supply affects the nominal interest rate and inflation rate simultaneously.

For instance, if a change in the CBN monetary policy pushes the country’s inflation rate to rise by 35% points, then it is expected that the nominal interest in the Nigeria economy should increases by 35% as well. In this regard, it may pinpoint that a change in money supply due to the policy instrument imposed by the government will affect the real interest rate. On the other hand, if the percentage changes, in inflation, is not equal to the percentage changes in the nominal interest rate, then, we can conclude that money is not neutral in this context. Above all, if changes in money supply bring about proportionate percentage changes in price level and nominal interest rate (that is, like a bicycle that moves the two variable at a constant velocity) while the real interest rate remains unchanged in the long-run, then we can say that money is neutral. It is in this wise that, this study refers these theories (Phillips Curve Theory and Fishers Effect Theory) to the long-run twin theory of money neutrality due to the innate dynamic interplay it showcases in buttressing money neutrality across the globe.

Empirical Review

Despite different studies on the validity of long-run money neutrality in emerging and developed economies, only a few are in developing countries which Nigeria is inclusive. At the same time, most of the investigations are in the developed economies. This study seeks to reappraise and re-investigate the validity of long-run neutrality of money; in order to contribute to the body of literature in Nigeria. Notably, the first study in this regard is the one carried out by Chuku (2011) who explored the long-run money neutrality propositions in Nigeria by using the Eclectic methodology. His study pinpointed the existence of long-run money neutrality in Nigeria. Though, his research was carried out under contemporaneous money exogeniety and contemporaneous money neutrality. He also establishes that the long-run Fisher relation was refuted in Nigeria due to the appearance of a co-integrating relationship between inflation and real interest rate.

Contrary to those mentioned above, the study of Nkem Nwanna (2017) revealed that the US money supply is not neutral due to its impact on the real and nominal variables of the Nigerian economy which is another violation of the classical dichotomy of the effect of money. Hence, the implication is that monetary policy in Nigeria considers the spillover effects of US monetary policy. It is thereby showcasing that the US money supply has heavily influenced the domestic interest rate of Nigeria. Consequently, depicting that the US money supply will sway the ease and constraints on liquidity in the Nigerian economy. Hence, buttressing the absence of the coordination between US-Nigerian monetary policy, thereby making the CBN's policy to become pro-cyclical and therefore exacerbated instability in the Nigerian financial system.

Furthermore, Osuji and Chigbu investigated the existence of money neutrality in Sub-Sahara Africa with emphasis on Nigeria. Their results buttressed the fact that there is a counter relationship between some exogenous variables (money supply and price) and output. Though, their findings align with the work of Nkem Nwanna (2017). Direct affiliation is recognized between Total Government Expenditure and output. It is established that the measures of money neutrality were co-integrated with the output at I(1). Hence, there is a long-run rapport between money neutrality argument and economic growth in the developing countries. Therefore, they suggested that the government should actively endeavour to sustain a policy that will contribute positively to sound macroeconomic environment that will promote foreign direct investment which in turn will create employment for the teeming youth in Nigeria.

In a similar but different study, Jean-Jacques (2003) examined the long-run money neutrality on actual output in the case of Cameroon, Central African Republic, Chad, Congo and Gabon. The upshot indicates a co-integrating relationship between money and real output only for Cameroon, the Central African Republic, Chad and Congo, On the other hand, the empirical evidence shows that the assumption of long-run money neutrality is rejected for the above countries. To him, the above results imply that in the context of low economic growth that characterizes the following economies, their Central Bank's monetary stability strategy could be non-credible. In this repute, he believes that the Central Bank should pursue an objective of stabilization of the product along with the aim of monetary stability to achieve an optimum punch bowl economy.

In a different line of study, Asongu & Simplice (2013) addressed two substantial issues which are the neglect of developing countries in the literature and the use of new financial dynamic fundamentals that broadly reflect monetary policy. In the same vein, his analysis was based on annual time series data from 34 African countries for the period 1980 to 2010 by employing batteries of tests for integration and long-run equilibrium properties. Surprisingly, their results were consistent with the traditional economic theory of long-run neutrality of money; hence, refuting the study of Jean-Jacques (2003).

Surprisingly, a more recent study by Tawodros in 2007 tested the proposition of long-run money neutrality in Egypt, Morocco, and Jordan using a seasonal co-integration test with the use of data on money, price and real income. The empirical outcomes revealed that money is co-integrated with prices, but not with output level at a zero frequency for Egypt, Morocco, and Jordan. Consequently, suggesting proposes that money supply influences nominal variables such as price level, employment but not real variables such as output in the long run, implying that money is neutral in these three Middle Eastern economies. His inference for policy analysis suggested that the anti-inflation policy prescription adopted by the monetarist school should be utilized in these three Middle Eastern countries, in order to curb inflation.

In the same vein, various studies have been carried out in most Asia emerging economies. For instance, the study, on the long-run monetary neutrality as evidence from SEACEN Countries, revealed that the classical theoretic propositions of long-run neutrality and long-run super-neutrality of money had been confirmed by them using the dynamic simultaneous equation model developed by Fishers and Seaters. They apply the Fishers and Seaters model to 10 SEACEN member countries. They also gave distinct attention to the non-stationarity and co-integration properties of the data, since meaningful Fishers and Seaters tests critically depend on such properties. They detected that most of the money series are I(1), except for Singapore and Sri Lanka, where they had two unit-roots. However, Sri Lanka has been excluded in the test of long-run super-neutrality of money because its money series exhibited a common trend between real output.

Besides, the empirical results showed that long-run deviations from long-run neutrality and long-run super-neutrality exist in their data. While money does not matter for the economies of Malaysia, Myanmar, Nepal, the Philippines, and South Korea, due to its long-run non-neutrality as regards to real output in, Taiwan, and long-run Thailand, and Indonesia. Meanwhile, they discovered evidence that refuted super-neutrality of money in Singapore. Subsequently, depicting that the perpetual shock to the rate of monetary growth does have a relevant effect on real economic performance.

The above was further refuted by the study of Chen (2007), where he examined the long-run and short-run neutrality of money for South Korea and Taiwan. He tested the long-run as well as the short-run real output response to a permanent monetary shock using eclectic approach. The empirical evidence showed that the long-run neutrality of money was fully supported in the case of South Korea which contravened the assertion of, while that of Taiwan is in line with his assertion of non-neutrality of money in the long-run. Furthermore, evidence from the Impulse Response Function indicated that the hypothesis of the short-run neutrality of money must be rejected for South Korea and Taiwan.

In the same vein, Seher Nur Sulku (2011), in Turkey, investigated the long-run money neutrality hypothesis by applying the Fisher and Seater ARIMA framework. Interestingly, his study finds strong evidence in favour of long-run money neutrality under M1, M2 and M3. Furthermore, he then tested the result of long-run money neutrality; therefore M2 case is restored by adding dummy variables for the major banking and currency crises and the introduction of the new Turkish currency. As a consequence, the long-run money neutrality hypothesis holds in Turkey under all alternative monetary aggregates during the period 1987 to 2006.

In contrast to the above, in Asia, Singh and team investigated the relationship between money supply, output and prices for both short and long-run in India. The period under this research was from 1991 -2016 using the Johansen techniques for co-integration and Granger causality test for causality. To comprehend the relationship between money, prices, and output, his empirical confirmation exposed that variable choice was pertinent in such cases. He, establish that there was no long-run nor the short-run relationship between money supply and output, indicating that there is no long-run nor short-run neutrality of money in the Indian economy.

Surprisingly, Puah et al. (2008) came out with a similar result with that of Singh and team in 2015, after he verified the long-run monetary neutrality on real output in Malaysia for the period of 1981 to 2004. He used the Fisher and Seater non-structural reduced form bivariate ARIMA model. He established that in Malaysia, evidence contradicted the long-run money neutrality proposition of which indicated a permanent shock to the level of Divisia money had a significant effect on real economic performance.

From the developed economies, a series of studies have been carried out concerning the validity of long-run money neutrality. For instance, Antonio N (2004) carried his study in America and Europe. Surprisingly, his study showed evidence of monetary neutrality using low-frequency data. Though, he gave close attention to properly determining the order of integration of money and output, since it is hard in testing neutrality propositions. Interestingly, it was found that long-run neutrality holds for Brazil, Canada, Mexico's M2 and Sweden. However, for Argentina, Australia, Denmark, Italy, Mexico, and the U.K., long-run neutrality of money does not hold, suggesting that monetary policy in these countries has not been fully effective in segregating real production from permanent shocks to the level of money. Finally, for Denmark and the U.S., the stationarity of money and output under the unit-root testing strategy indicated that long-run neutrality of money is not addressable.

In a similar vein, Evans (2010) examined the long-run neutrality of money in 27 countries. These countries include Costa Rica, Australia, Denmark, El Salvador, Finland, France, Germany, Ghana, Greece, Guatemala, Honduras, India, Ireland, Japan, Italy, Korea, Mauritius, Mexico, Netherlands, Norway, Pakistan, Philippines, Sweden, Spain United Kingdom, Venezuela and United States. The period under investigation was from 1960-1992. By using the simple stochastic growth models and ordinary least squares, he found that in an extensive class of models, money was not neutral in the long-run.

Besides, Giordani (2001) remarked on Bernanke and Mihov's research concerning long-run money neutrality in the U.S. He used the quarterly time series sample period that capture 1966-1998 and used the data of real GDP, CPI and M2 of the U.S. for that sample period. The author claimed that the lapse of a measure of output gap from the VAR estimated by Bernanke and Mihov VAR reclined exclusively on the extreme persistence of the output response to MP shocks. From his empirical finding, it showed that the attachment of proxy for the output gap in the VAR was revealed to tremendously increase the evidence for long-run neutrality of money on US data.

In contrast to the above, Hamid (2002), provided evidence in support of super neutrality of money in Iran. However, his empirical result was extracted from the test of seasonal co-integration between money supply on the one hand and output and price on the other hand. The co-integration test result shows that (growth of) money supply and output at zero frequency (which represent the long run) are not co-integrated at all frequencies, including zero. The results also showed that (growth of ) money supply in the long run influences nominal and not real variable; hence, supporting the proposition of long-run super-neutrality of money.

Evidence, from the above-reviewed literature, unconcealed that, of the various studies carried out on the validity of money neutrality in both developing and developed economies. Most of the researches have validated money neutrality via the use of Phillip curve theory, Eclectic methodology, among others. However, this current study intends to extend the window by verifying money neutrality via the use of Fishers effects and Phillips curve theory and also to establish the theory that is most effective in validating the neutrality of money in Nigeria. More importantly, because it has distorted the achievement of vital macroeconomic objectives such as curbing inflation into a manageable rate, controlling target-able nominal and real variable in either the short or long term among others.

Material and Methods

The models in this study will be on the twin- theories of money neutrality. That is the long-run Phillip curve and the fisher’s effect, theories. To check if the outcome of the result after estimation will match a-priori ground or will violate it, which in turn would serve as a yardstick of refuting or validating the existence of long-run money neutrality in Nigeria? Here, two models would be specified and estimated based on the theories mentioned earlier. The first model is the one specified on the premises of the Fishers Effect hypothesis that, when expected inflation rises, then the nominal interest rates will also rise on a one-to-one basis. Hence, the Fishers Effect hypothesis is as follow:

Given the above, we assume the below:

Though, it is completely imperative to take cognizance of the fact that there are other factors other than inflation that exert influence on the nominal interest rate. Thus, in order for the Fishers Effect model not to be under specified in this study. Hence, the researchers decided to control for the above model by incorporating money supply in order to ascertain its effect on real variable and nominal effect. Hence, equation 3 specified as follows.

Where:

NINTR = nominal interest rate

CPI = consumers price index

Ms = money supply

α0 = intercept or the constant term

α 1= coefficients of the exogenous variable, which is the parameter to be estimated

μ = stochastic error term

In contrast, the Phillips curve believes that money supply should not impact the real output in the long-run but should affect the price level when money supply changes. In justifying this assumption the real GDP is written as a function of money supply as seen below.

Expressing the above equation in an econometric form we have:

Where:

RGDP = real gross domestic product

Ms = money supply

β0= intercept or the constant term

β1 = coefficients of the exogenous variable, which is the parameter to be estimated

Ҽ= stochastic error term.

Given the above, equations (4) and (6) would estimate to ascertain accordingly.

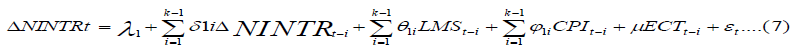

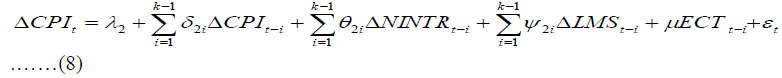

The data were collected gathered from the recent Central Bank of Nigeria (CBN) and the Bureau of Statistical Bulletin, respectively. The data utilized are on an annual basis from 1981-2019. As a pre-requisite for time series analysis, the study tested for stationary by both Augmented Dickey-Fuller (ADF) and Phillip-Perron (PP) unit root method. After the unit root test, as mentioned above, if the variables under consideration are not zero, integrated, that is they are all I(1), then there is evidence of co-integration. Consequently, making the co-integration test useful and prominent in the analysis. This test is carried out via the Johannsen co-integration approach, as suggested by Johannsen and Juselius. For instance, if co-integration does not exist between the series under consideration, there is a need for an additional error correction term that is, the error correction model (ECM). The Johannsen co-integration procedure in a Vector Autoregressive (VAR) environment is employed, that is, the unrestricted VAR. Here, the null hypothesis, i.e. H0: is that there is a different number of co-integration relationships as against the H1, that all series in the VAR is stationary. More particularly, if the above scenario were real, then a VECM model of the below form would be specified.

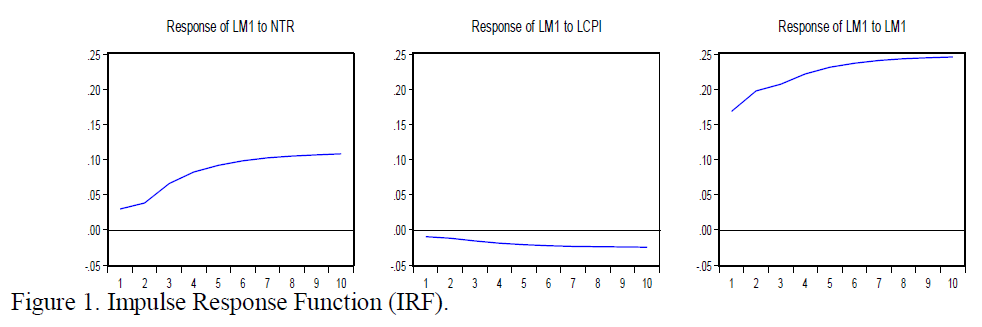

It is worthy of note that equation (7), (8) and (9) above, showcases the ECTt-1 term which describes the long run causality. In the same vein, the joint f-test of the considered coefficients of the first differenced explanatory variables signifies the short run causality. To ascertain causality, the Wald joint significant test would be used. In order to ascertain further the interrelationship among the variables of interest, variance decomposition (VDF) and impulse response function (IRF) are utilized.

Results and Discussion

In this section, the empirical analyses were done and presented accordingly. The descriptive statistics, as illustrated in Table 1, depicts that the average of gross domestic product (GDP) is 10.269 with S.D of 0.561; the mean of MS is 6.027 with S.D of 2.459. Furthermore, the average value of consumer price index (CPI) and nominal interest rate are 2.795 and 11.933 with their respective S.D as 1.9889 and 4.8059. Surprisingly, NINTR and GDP are the most and least volatile among the variables under consideration. Beyond those above, the skewness statistics showed that money supply (MS), and the consumer's price index (CPI) showed a were negatively skewness; while, the remaining variables are positively skewed. The Jarque-Bera statistic accepted the null hypothesis of a normal distribution for all the variables at a 5% level of significance.

| Table1 Result of Descriptive Statistics | ||||

| Variable | RGDP | MS | CPI | NINTR |

| Mean | 10.26894 | 6.026951 | 2.794502 | 11.93263 |

| Median | 10.04588 | 6.215964 | 3.363278 | 10.86500 |

| Std. Dev | 0.561194 | 2.459223 | 1.988876 | 4.805880 |

| Skewness | 0.344411 | -0.172905 | -0.498818 | 0.749252 |

| Kurtosis | 1.630051 | 1.604644 | 1.791904 | 3.292949 |

| Jarque-Bera | 3.722790 | 3.272124 | 3.886727 | 3.691279 |

| Probability | 0.155456 | 0.194745 | 0.143221 | 0.157924 |

| Observation | 38 | 38 | 38 | 38 |

As a follow up of the outcome of the descriptive statistics of the variables, the researcher considered it necessary to check for the time-series properties of the variables used. The Augmented Dickey-Fuller (ADF) test was employed to check the time-series properties the results presented in Table 2 below. The results of the unit root test revealed that all variables were not stationary at a level in both models but later became stationary after first differencing. The implications of this are that; all the variables are differenced stationary at a 5% level of significance. Moreover, this means that we can proceed to the co-integration test.

| Table 2 Result of Unit Root Test | ||||||

| Augmented Dickey Full Test | ||||||

| Variable | AT LEVEL | AT DIFFERENCE | ||||

| t-statistics | Prob.Value | Status | t-statistics | Prob.Value | Status | |

| MS | -0.861358 | 0.7892 | I(0) | -4.652392* | 0.0006 | I(1) |

| RGDP | -0.027819 | 0.9497 | I(0) | -3.395053** | 0.0177 | I(1) |

| RINTR | -2.808300 | 0.0668 | I(0) | -5.990208* | 0.0000 | I(1) |

| CPI | -1394477 | 0.5745 | I(0) | -2.969319** | 0.0475 | I(1) |

(Note: * and ** denote 1% and 5% critical values respectively)

Before conducting the co-integration test, it is pertinent for us to first an initial VAR model in order to determine the lag order/length of the co-integration test. The reason for this is not far-fetched from the fact that it is pre-requisite to conducting the co-integration test. As a guide, the current study chose the AIC as our decision criteria. Surprisingly, the outcome of the estimation of the lag structure of a system of VAR in levels indicates that the optimal lag length based on the AIC is 2 as shown in Table 3.

| Table 3 Lag Order Selection | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | -318.475 | NA | 1182.881 | 18.42715 | 18.60491 | 18.48851 |

| 1 | -160.5592 | 270.7131 | 0.358450 | 10.31767 | 11.20644* | 10.62447 |

| 2 | -138.1724 | 33.26051* | 0.258833* | 9.952706* | 11.55249 | 10.50495* |

| 3 | -123.1351 | 18.90399 | 0.302830 | 10.00772 | 12.31852 | 10.80541 |

Consequent upon the above, we defined the lag order as the 2nd order using AIC. The above VAR specification has some inherent merit(s). Fundamental of all is that it allows for the computation of impulse Response function (IRF), that is, functions of the dependent variables to one standard deviation shock in any other endogenous variable in the system as emphasized by Rad (2014). Based on the preceding, the researchers proceed to the analysis of the co-integration test, whose result is as shown in table 4. Table 4 has two panels; that is, A and B. Expectedly, Panel A, reflect the outcome from the Fishers Effect model specification. While Panel B entails the result from the Phillips curve theory specification accordingly.

| Table 4 Co-Integration Test | |||||||

| Trace Value (PANEL A) Phillips Curve | Maximum Eigen Value (PANEL A)Phillips Curve | ||||||

| Null | Alternative | Statistics | 95% CV | Null | Alternative | Statistics | 95% CV |

| r=0 | r≥1 | 6.048001 | 15.49471 | r=0 | r=1 | 3.488432 | 14.26460 |

| r≤1 | r≥2 | 2.563675 | 3.841466 | r≤1 | r=2 | 2.563615 | 3.841466 |

| PANEL B (Fishers Effect Model) | PANEL B (Fishers Effect Model) | ||||||

| Trace Value | Maximum Eigen Value | ||||||

| r=0 | r≥1 | 27.37635 | 29.79702 | r=0 | r=1 | 14.54361 | 21.13162 |

| r≤1 | r≥2 | 12.83271 | 15.49471 | r≤1 | r=2 | 6.962037 | 14.26460 |

| r≤2 | r≥3 | 5.870671 | 3.841466 | r≤2 | r=3 | 5.870671 | 3.841466 |

So, we begin with Panel A. From table 4. Here, we observe that the null hypothesis of no co integration was accepted as seen from the results of both the Trace and Max Eigen test, which revealed the presence of no co integrating equation. Thus, suggesting that the linear combination of the variables in equation (4) were not stationary and therefore pinpointing the non existence of a long run linear relationship among the variables of interest. Probing further into the co integration test results, the researchers took a cursory evaluation of the estimate from the Normalized regressio n outcome as presented in the appendix.

In the normalization process, the signs of the coefficients changed to ensure proper interpretation. The results revealed that money supply had a positive and significant impact on GDP in the long run; such that a 1 per cent increase in the money supply (MS) triggers 0.18% increase in the real output (RGDP). This outcome is against the a priori ground of almost all the classical and Cambridge schools dichotomies of the long run money neutrality, which pinpointed that money should not affect real variables in the long run. Hence, buttressing that money is not neutral in Nigeria in this context. Besides, the results strictly violate the proof that money is neutral. Given the assumption of contemporaneous money exogeniety and contemporaneous money neutrality, according to the research work of Chuku (2011). Hence, pinpointing that the monetarist anti inflationary prescriptions are bound to be ineffective for the management of the Nigerian economy because, as real output increases due to increase in money supply, the price will also increase and vice versa.

Contrary to the above, Panel B revealed the evidence of one co integrating equation as seen from both the Trace and Max Eigen test. Thereby suggesting that the linear combination of the variables in equation (4) were stationary, therefore pinpointing that there is a long run linear relationship among the variables under consideration in the Fishers effect relation/model. More hypothetically, the researchers evaluated the normalized version of the co integration test. The estimate revealed that CPI has a positive and insignificant impact on the nominal interest rate. On the other hand, Money supply exhibited a negative and significant impact on the nominal interest rate. Thereby partially contravening the theoretical foundation which expects that real interest rate is supposed to reduce as inflation increases due to change in the time value of money. Based on the above proportionality premises is supposed to exist between the nominal interest rate and inflation, consequently making real interest rate to be constant, hence inferring with the full neutrality of money in the long run.

The VECM results further supported the above claim. This estimation technique is unique as a result of its ability to estimate both the long run and short run at a time. However, the long run estimate revealed that CPI exhibited a negative and insignificant relationship on the NINTR, such that a 1% increase in CPI will lead to 2.53% decrease in NINTR in the long run. Disappointingly, this result refutes the Fishers’ dichotomy, which expects, a 1% increase in CPI to lead to a corresponding 1% increase in NINTR if the RINTR is to be constant. Based on this ground, money is not wholly neutral in the long run.

Interestingly, the outcome of our research corroborates the findings from the study of Uduakobong. His result revealed a partial Fisher effect in Nigeria due to the positive and insignificant relationship between the nominal interest rate and consumer price index in the long run. The reason for the above, may not be far fetched from the fact that; in the long run, there is little or no focus on the use of inflation targeting strategies to stabilize price in Nigeria given its significant relationship to the interest rate as buttressed by Uduakobong. However, this little impact of money supply on the nominal interest rate corroborates the fact that NINTR does not co move at the desired pace if money supply changes thereby signifying the stickiness of nominal interest rate. Hence, we conclude that monetary policy instruments are a poor measure for controlling the real economic variable in the long run Table 5.

| Table 5 Long-Run Regression Estimate: (Standard Error in Parentheses) [T-Statistics Bracket] | |

| Phillips Curve | |

| LRGDP | LMS |

| 1.000000 | -0.184478 (0.04022) |

| [-4.58672] | |

| Log Likelihood = 88.78967 | |

From the short-run estimations in Table 6, the error correction term ectt-1 which is negative and statistically significant at 5% significance level. The significance of the coefficient of the error term supports our earlier affirmation that the variables under study are really co-integrated in the long-run. The absolute value of the coefficient of the error term indicates that the disequilibrium in the long run trend of the dependent variable (nominal interest rate) takes exactly 1/0.52 years (1.9 years) to be corrected back to the equilibrium level. This coefficient signifies the speed of adjustment which goes side by side with the hypothesis of convergence to the long-run equilibrium once the inflation (CPI) equation fluctuates from its equilibrium in the short-run.

| Table 6 Vector Error Correction Model (VECM)-Fishers Effect | |||||

| PANEL A -Long Run Estimate | |||||

| Dependent variable | Regressors | Estimated Co-efficient | Standard Error | t-Statistics | |

| ΔNINTR | ΔLCPI | -2.531142 | 1.93148 | -1.31047 | |

| ΔLMS | 2.531801 | 1.57299 | 1.60954 | ||

| C | -20.30396 | ||||

| Short Run Regression Estimate (PANEL B) | |||||

| D(NINTR) | ECM(-1) | -0.523405 | 0.18180 | -2.87904 | |

| DΔ(NINTR) | -0.101548 | 0.16645 | -0.61009 | ||

| DΔ(LCPI) | -0.214076 | 4.57518 | -0.04679 | ||

| DΔ(LMS) | 8.058480 | 3.81831 | 2.11049 | ||

| C | -1.445916 | 1.14434 | -1.2653 | ||

| R2=0.337124 AIC = 5.451025 | F-statistic = 3.941475 | ||||

Surprisingly, the past lagged value of NINTR has a negative and insignificant impact on the NINTR, such that a 1% increase in the lag of NINTR will have 0.1% decrease in the NINTR. This indicates that NINTR does not chiefly respond to it lag in the short-run, consequently connoting that NINTR does not predicts its previous value. In the same vein, the present value of CPI also displayed a negative and insignificant impact on NINTR, such that a 1% increase in CPI will lead to 0.21% decrease in NINTR in the short-run, which is also against the a-priori expectation. In other words, pinpointing that the relationship between them is one-to-one, on this ground the allusion of super-neutrality of money is void, due to the fact that CPI does fully respond to the NINTR even in the short-run.

In contrast, the short-run regression estimates showed that MS has positive and significant impact on NINTR, such that, a 1% increase in Ms will lead to 8.1% increase in NINTR in the short-run. Consequently, this confirms that increase in money supply possesses the capability of making money to be neutral in the short-run, because a positive response of Ms on NINTR will make the real interest rate (RINTR) to be constant. In addition, the result of the R2 equally showcase that 33.7% of the changes in the nominal interest rate are explained by money supply and CPI; hence indicating that money neutrality is partial in Nigeria.

In order to give further consideration to the short-run and the long-run dynamic properties of the nominal interest rate with respect to the variables in the system, we make use of the Variance Decomposition Function (VDF) as seen in Table 7 below. Consequently, VDF indicates the amount of information each variable contributes to the other variables in the Fisher effect model. Findings from the VDF result exhibited in Table 7 showed that the dynamic response of the nominal interest rate report 100% variation of the fluctuation in the first year when innovation by a standard deviation (SD) of 3.46 is the variable itself. In the short-run, that is period 3, shock to nominal interest rate account for 91.96% variation of the fluctuation in its own shock, whereas an impulse to the consumers price index and money supply cause 0.41% and 8.48% fluctuation in the nominal interest rate respectively. However, in the long-run that is period 10, the nominal interest rate contributes 85.99% to its own shock, however; shock to the consumer price index and money supply can cause 5.1% and 8.91% to the variance of the nominal interest rate, respectively. From the investigation, we find that in the short run, the consumer price index contributed more to own shock, but in the long run such impact declined significantly. But in the case of the consumer price index the analysis is contrary, because in the short-run it contributes less but as it moves to the long-run the contribution increased. However, the dynamic response of money supply to the variation of the nominal interest rate is erratic in both the short-run and the long-run.

| Table7 Variance of Decomposition of NTR | ||||

| Period | S.Error | NINTR | LCPI | LMS |

| 1 | 3.464093 | 100.0000 | 0.000000 | 0.000000 |

| 2 | 3.961941 | 91.74797 | 0.058190 | 8.193836 |

| 3 | 4.119600 | 91.11434 | 0.408690 | 8.476966 |

| 4 | 4.216554 | 90.96181 | 0.918443 | 8.119742 |

| 5 | 4.282234 | 90.57579 | 1.528853 | 7.895361 |

| 6 | 4.335260 | 89.93466 | 2.209518 | 7.855825 |

| 7 | 4.383759 | 89.09261 | 2.926556 | 7.980837 |

| 8 | 4.430399 | 88.12002 | 3.656426 | 8.223547 |

| 9 | 4.476222 | 87.07223 | 4.384152 | 8.543619 |

| 10 | 4.521599 | 85.98927 | 5.100370 | 8.910359 |

Noticeably, from the result it can be seen that the contribution of the consumer price index is getting more consequential to the variation in the nominal interest rate; this is an indication that the CBN might have been taking some measure to make the interest rate constant so that money can be neutral overtime. However, the erratic behavior of money supply to the shock on the nominal interest rate suggests that monetary policy instrument will be poor tools for achieving money neutrality in both the short-run and the long-run.

Here, IRF depicts the shock affiliated to the VAR system. Impulse response typically ascertains the sensitivity of the endogenous variable to one positive shock in the exogenous variable in the VAR when the shock is ascribed to the error term. Chiefly, in this study, the IRF is utilized to establish the effect of a one standard deviation generalized innovation in the consumer price index and money supply on the nominal interest rate in Nigeria. The result of the impulse response is, as shown in Figure 1. Here, we started with the response of the nominal interest rate to its innovation. That is, to ascertain how one positive standard deviation (SD) shock of nominal interest rate reacts to its shock. In the graph, we discover that the NINTR indicate a positive shock from year 1 to 10, but increasingly encroaches stable condition in the long-run but never touches it. One positive SD shock of CPI generates an increasingly positive reaction on NINTR between periods 1 to 10 in the future. In the same vein, this reaction applies to the response of CPI to NINTR, the response of NINTR to CPI, the response of CPI to its own innovation, and the response of MS to its own innovation both in the short-run and the long-run. However, one positive SD shock of CPI as a response to MS generated the stable condition in the year 1, become negative in year 2, return to the stable condition in year 3, and increasingly become favourable for the remaining year in the long-run. Consequently, one positive SD shock of NINTR as a response to MS increasingly become positive in year 1, reaches its peak in year 2, touch the stable condition in year 4 and increasingly become negative for the remaining years.

Finally, one positive SD shock of MS as a response to CPI increasingly become in both the short-run and the long-run.

Conclusion and Recommendation

As against the general traditional belief of economic theory which pinpoints that monetary policy has the potential to trigger the business cycle of an economy via the growth of its monetary aggregates and its inherent effect on real variables (Money neutrality); which evidence, from both theoretical and empirical studies, have proven contrary in the developing and developed economies. Little wonder, why policymakers, macro-economists, investors and monetarists are interested in knowing the reason for the inconsistencies which has, in turn, violated the proposition of money super/neutrality. It is based on the aforementioned that this study re-investigated the validity of money neutrality in Nigeria.

The results revealed that all variables employed were stationary after first differencing, both in the Phillips curve and Fisher's effect model which is one of the essential requirement that must be satisfied before the co-integration as buttressed by Essays, UK (November 2018). interestingly, the Fishers effect model revealed evidence of long-run linear relationship among the variables under consideration. While, in contrast, the Phillips curve model showed no evidence of co-integration. Also, the results from the Phillips curve as seen in Panel A of Table 4, revealed that output growth increased as money supply increases, thereby refuting the validity of the classical and Cambridge dichotomies of money neutrality. The implication is that attempts by the government to increase her monetary aggregates resulted in a rise in the output growth which is contrary to the traditional belief of economic theory concerning money neutrality in the long run. Besides, the results from the Phillips curve model in the current study, violated the outcome of the research conducted by Chuku (2011); Westerlund & Costantini (2009) which asserted that money is neutral under the assumption of contemporaneous money exogeniety and contemporaneous money neutrality thereby, buttressing that, his study is not a full proof of the validity of money neutrality in Nigeria.

On the contrary, the evidence from the Fishers effect relation model showcased that, there is a long run linear relationship among the variables in the model owing from the results of the Johannsen Co-integration test. However, on the other hand, evidence from the normalized co-integration test revealed that CPI exerted a positive but insignificant impact on nominal interest rate in Nigeria. While money supply exerted an inverse and significant impact on the nominal interest rate. Hence, partially contravening the theoretical underpinning which expects the real interest rate to reduce as inflation proxied with CPI increases due to changes in the time value of money. Subsequently, the aforementioned outcome was also supported by the VECM estimate. In the same vein, the VDF results pinpointed that, the contribution of inflation is more consequential to the variation in the nominal interest rate thereby revealing the measures the CBN have put in place to contain and make interest rate to be constant so that that money can be neutral in the long run.

Consequently, the study concludes that there is partial neutrality of money both in the short and long run due to partial satisfaction of the requirement for money to be neutral. More importantly, the findings of this study were corroborated by the study of Uduakobong, whose study revealed that there is a partial Fisher effect in Nigeria. Also, the study has been able to comparatively pinpoint that the Fishers effect relation is more effective in validating the neutrality of money in Nigeria than the Phillips curve theory.

Above all, findings from this research has pose some salient policy directions. First is that the monetarist anti-inflationary medicament is bound to be ineffective for the management of the Nigerian economy as a result of the direct relationship between money supply and real output in the long run. Secondly, the study revealed the existence of sizeable nominal rigidity in Nigeria, which accounted for the inverse relationship between inflation and the nominal interest rate. It is in line with the above observations that the study recommends that, for the government to achieve its vital macroeconomic objectives such as full employment, price stability, real output among others, in the long run, there is need to systematically use a fine-tuned policy coordination in order to achieve the required optimum level. Furthermore, the CBN should put all measures in place to suppress the uncomplimentary time lag between the time they spot the need for changes in monetary policy and the time to take action, to enhance a successful result of fine-tuning monetary policy instruments. Despite the fantastic results gotten from this study, we have data limitations as at the time the study was carried out, which made it impossible to ascertain the time-variant and volatility of the monetary aggregates. Consequently, we suggest that the study of such should be conducted using daily frequency data to be able to estimate the time-variant and volatility of money supply for a more robust outcome.

References

- Adam H (2019). Monetary Interest Rates Fisher Effect Definition.

- Antonio E. & Noriega (2004), long-run monetary neutrality, and the unit-hypothesis: further international evidence, Department of Econometrics, School of Economics, University of Guanajuato 15(2004), 179-197.

- Asongu, & Simplice A. (2013), a note on the long-run neutrality of monetary policy: new empirics, Africa Governance and Development Institute, AGDI working paper. No.WP/13/032.

- Chuku, A. C. (2011). Testing long-run neutrality propositions in a developing economy: the case of Nigeria. Journal of Economic Research, 16, 291-308.

- David Laidler (1992). Hayek on neutral money and the cycle. Department of economics working papers 9206. The new palgrave: A Dictionary of Economics London: Macmillan Press Ltd, 19987, pp 609-614.

- Evans, P. (2010). Growth and the neutrality of money. Empirical Economics, 21, 187-202.

- Friedman & Milton (1968) “The Role of Monetary Policy”, American Economic Review.

- Jean-Jacques Emokie, (2013). A Multivariate Long-run Money Neutrality Investigation: Empirical Evidence for CAMEU. Department of Economics, Omar Bongo University, Libreville, Gabon. 4, 384-390. Dio.10.436/me.

- Galbacs & Peter (2015). The Theory Of New Classical Macroeconomics. A Positive Critiques, Contribution To Economics. Heidelberg/ New York/ Dordrecht/London: Springer Doi: 10.1007/978-3-319-17578-2.

- Giordani, P. (2001). Stronger evidence of long-run neutrality: a comment on Bernanke and Mihov. Working paper series in Economic and Finance, No. 441.

- Hamid A., (2002). Testing the Long-run Neutrality of Money Based on the Seasonal Co-integration Theory, the Case of Iran. Iranian Economic Review, VOL 6, NO. 6

- Nkem Nwanna (2017), An examination of the neutrality of US money in Nigeria economy, University of Lagos, Akoka, MPRA paper No, 8227.a

- Puah, C.H., Habibullah, M.S., & Shazali, A.M. (2008). Some empirical evidence on the quantity theoretic proposition of money in ASEAN-5. Pakistan Journal of Applied Economics, 18, 31-47.

- Seher Nur Sulku,(2011), testing the long-run neutrality of money in developing county, evidence from turkey, Faculty of Economics, Gazi University, Turkey, JAEBR, 1(2): 65-74 (2011).

- Westerlund, J. & Costantini, M. (2009). Panel co-integration and the neutrality of money. Empirical Economics,36, 1-26.