Research Article: 2019 Vol: 23 Issue: 4

R&D Investment, the Signaling Effect of Stock Dividends, and the Corporate Value of R&D Intensive Firms and Biotech Firms

Namryoung Lee, Korea Aerospace University

Abstract

This study examines how the market evaluates increases in the R&D spending of R&D intensive firms, particularly biotech firms. In addition, the signaling effects of stock dividend distributions are analyzed to investigate whether a firm’s dividend policy mitigates agency conflicts and delivers future sustainable prospects for the firm to the market. The results suggest that the market positively evaluates increases in the R&D expenditures of R&D intensive firms. The findings also confirm the signaling effects of stock dividend distributions. Among R&D intensive firms, these tendencies are stronger for biotech firms. Moreover, the analysis finds that an increase in sales further strengthens the positive association between R&D investment increases and corporate value.

Keywords

R&D Investment Increase, Stock Dividends, Signaling Hypothesis, Sales Increase, Corporate Value.

Introduction

R&D intensive firms spend huge amounts of money on their R&D projects, but it takes a significant amount of time for these projects to generate sales. In Korea, for particular niche areas such as biotechnology where investing in R&D is vital for a firm’s sustainable development, history has shown that firms might generate only 1 billion Korean won (approximately 850,000 US dollars) of sales after 20 years of operation. Such results do not stem from a lack of management acumen to achieve firm performance, but simply reflect industry characteristics. There are many Korean biotech firms that have not been very successful in business for more than 10 years since their inception. According to a 2018 survey by the Korea Biotechnology Industry Organization, 46.3 percent of the companies surveyed took more than 10 years to produce results. Among existing biotech companies, 27.6% were still "before sales" and 38.7% had generated sales but below the break-even point. This has also been the case in Europe. European biotech firms often have little or no sales and, furthermore, their enormous R&D investments result in short-term losses. As an example, Intercell, the fourth-largest EU biotech company, invested more than twice its net sales in R&D in 2010 (Chojnacki & Kijek, 2014).

According to the pecking order theory (Myers and Majluf, 1984), a hierarchy exists in firm financing. Firms initially go for internal funding, and then seek external financing only if internal financing is difficult. External financing is available in two types: debt and equity. Among the two methods, companies prefer debt to equity. R&D spending is an inseparable part of the biotech industry, but the amount of cash invested on R&D is gigantic. On average, it takes 800 million dollars to develop a single product (Kaitin, 2003). Consequently, R&D intensive firms like biotech firms have an inclination to retain cash in the firm to secure funds for R&D investment rather than pursue a shareholder friendly policy that returns profits to shareholders.

A typical method to distribute a company ’s profits to investor s is the payment of dividends. Firms set their dividend policies using various determinants such as firm size, profitability, and ev e n taxes (Denis & Osobov, 2008; Gill et al., 2010). The most common types of dividends are cash and stocks. While Korean listed firms have typically increased their cash dividends by returning profits to shareholders, biotech firms have decreased their cash dividends . It seems obvious that Korean biotech firms listed on both the KOSPI ( Korea Composite St ock Price Index : a benchmark stock market in Korea) and KOSDAQ market ( Korea Securities Dealers Automated Quotation: for the purpose of providing funds for startup companies) place greater focus on securing R&D funds for future growth than on dividends distribution. For example, Korea’s leading biotech company, which made the largest R&D investment among all pharmaceuticals and biotech companies, invested 264 billion Korean won (39% of sales) in R&D in 2016. Most biotech firms have been found to reduce or not to pay cash dividends at all.

Some companies do pay dividends in stocks, although the distribution of stock dividends requires the use of retained earnings as a source. It is acknowledged that firms that implement a bonus issue and a stock dividend have relatively superior corporate characteristics. In other words, the implementation of a bonus issue and a stock dividend is taken as a sign that the company is in good condition. A stock dividend is beneficial for both the company and the shareholder. The shareholder obtains more stocks for free and may expect a better rate of return in the future by allowing the company to reinvest in R&D with the cash reserved.

Investing in R&D h as generally been discovered to have a positive inf luence on enhancing a firm’s performance or value Reynard, 1979; Chan et al., 1990; Lev and Sougiannis, 1996; Chan et al., 2001; Chung et al., 2003; Hall and Orani, 2003; Eberhart et al., 2004). Recent research papers have also confirmed this positive impact (Xu and Sim, 2018; Jin et al., 2018; Lee, 2019). However, R&D itself is considered as a proxy for asymmetric information Dittmar et al., In that regard, a firm’s stock dividend distribution can play a role in reducing information a symmetry regarding R&D progress . Even though Miller & Modigliani (1961) suggested the dividend irrelevance theory under perfect capital markets, in reality, a dividend policy can be used to c ommunicat e with investors and can therefore mitigate the agency p roblem (Lease et al., 2000).

Biotech companies are booming, and there ha s accordingly been quite a lot of research on the biotech industry . it is still a valuable and interesting area of research because of the unique nature of the industry. Therefore t his research analyzes the impacts on corporate value of increased R&D and also examines whether a stock dividend distribution enhance s corporate value by sending a signal that the company is doing well and that current R&D investment is probabl e to result in sustainable future growth.

The remainder of the paper is organized according to the following: Chapter 2 pr esents a review of literature and hypotheses. Chapter 3 provides samples and method ologies . Chapter 4 suggests statistics description, correlations, and analysis results. Chapter 5 provides the results and offers discussion. Chapter 6 is the conclusion.

Literature Review and Hypotheses

R&D Investment and Corporate Value

The correlation between R&D investment and corporate value is no longer a new research topic. F rom the 1970s to the present , m any prior studies have consistently shown that invest ing in R&D has a positive effect on improving a company's performance or value even though R&D investment causes cash outflows Reynard, 1979; Chan et al., 1990; Lev and Sougiannis, 1996; Chan et al., 2001; Chung et al., 2003; Hall and Orani, 2003; Eberhart et al., 2004; Xu and Sim, 2018; Jin et al., 2018; Lee, 2019). In a way, it's a cliché, but it's still an important issue.

Therefore, researchers observe the issue from a slightly different perspective or in conjunction with other issues. Chan et al. (2001) examined the association between R&D intensity and stock returns based on the asset-pricing theory. Other studies, such as Penman and Zhang (2002) and Eberhart et al. (2004) analyzed relations between current R&D growth and future stock returns. It has also been shown that the relationship between R&D activity and corporate value may depend on ownership concentration or corporate governance ( Chung et al., 2003; Lee and O’Neill, 2003).

As mentioned in the introduction, R&D intensive firms, especially for biotech firms, take a considerable amount of time to generate sales. However, for biotech firms, considering their unique characteristics, their sustainable futu re value through R&D achievement is highly appreciated in the market independently from visible results such as sales (Chan et al., 1990; Chan et al., 2001; Chung et al., 2003; Hall and Orani, 2003; Eberhart et al., 2004). Chan et al. (1990) found that the R&D investments in high-tech industries had a positive market value, but those in non-high-tech industries had an adverse effect on stock prices. Because of the biotech industry's distinctive nature nature, the market may assign value differently depending on R&D progress. Most of the papers on biotech value relevance have commonly found that R& D outlays are highly evaluated in the market in their development or maturity stage. Ely et al., 2003; Hand, 2005; Guo et al., 2005; Xu et al., 2007).

On the other hand, due to the high risk and unpredictability of R&D procedures in biotechnology, financial performance may vary depending on the state of investment across firms (Pisano, 2006). Therefore, research concerning the connection between R&D activity and the value of bio companies is still controversial, against the consistent view that the R&D activity of other industries adds corporate value Xu et al. 2007). Likewise, diversified research on investment in pharmaceutical R&D is still needed (Nivoix & Nguyen, 2018).

Agency Theory and Signaling Hypothesis of Stock Dividends

A firm’s dividend policy is driven by various factors. Denis and Osobov (2008) and Gill et al. (2010) identified a number of different determinants such as firm size, growth opportunities, profitability, profit margin, growth in sales, ratio of debt-to equity, and taxes. Desmiza et al. (2019) show the effect of institutional ownership and board of independence on dividend policy. They find that institutional ownership and board of independence are significantly positively associated with dividend payout ratio.

Firms generally distribute dividends in cash or stocks The most frequent type of dividend distribution is cash dividends and can be paid regularly or irregularly. Unlike cash dividends, stock dividends adopt retained earnings as a re source and are distributed in the form of stocks . Stock dividend distribution could be better for both the company and its shareholders. In particular, stock distributions may give various signa ls T he dividend relevance theory, developed by Lintner (1962) and Gordon (1963) suggest s that a company’s dividend policy may directly affect the market value of a company , contrary to the dividend irrelevance theory under perfect capital markets suggested by Miller and Modigliani (1961).

According to Filson et al. (2015), investment in R&D in the biotech sector is particularly criticalcritical. However, information asymmetry follows R&D investme nt for two reasons. First, the R&D project’s future success cannot be guaranteed , and the greater the R& D investment , the greater the uncertainty (Cho and Lee, 2013). Holmstrom (1989) also referred to the high risk due to the probability of failure that is unpredictable in the outcome of the R&D. The second reason is that information on R&D activities is not well disclosed and projects proceed secretly because of concerns that the ideas could be stolen. According to Deng, et al., 1999, shareholders are not able to know exactly which products are under development, nor do they know the value of the products even though they can figure out how much a firm spends on R&D. Therefore, R&D itself can be a measure of asymmetric information (Dittmar et al., 2003), or it may increase asymmetric information (Aboody and Lev, 2000).

Based on such asymmetric information, the agency theory, pecking order hypothesis, and signaling hypothesis have been developed. The agency theory (Jensen and Meckling, 1976; Jensen, 1986; Hart and Moore, 1994) implies that managers pursue their private benefits instead of aiming at maximizing the value of the company and its shareholders. Under the pecking order hypothesis (Myers & Majluf, 1984), companies prefer raising resources in the following order: internal resources, debt issues, and equity issues.

According to the signaling hypothesis (Spence, 1973; Bhattacharya, 1979), a decision to pay dividends can be used as a signal from a business under the asymmetry of information. Companies can declare stock dividends and send a positive signal regarding their prospects and future profitability improvement . This would be perceived positively by a market. Managers have more information than shareholders about the company's investments , and therefore, they will probably pay dividends as a means of sharing this information with outsiders Bhattacharya, 1979; John & Williams, 1985; Miller & Rock 1985) According to Bhattacharya (1979), dividends indicate how long a company has the ability to pay interest and dividends.

There are some research on the R& D intensive firms' dividend policy. According to Lease et al. (2000), a policy on dividends is used as a communication tool to deliver information about the company to the market. The association between R&D expenses and dividend payouts is usually negativ e as R&D intensive firms with high growth opportunities are prone to pay fewer dividends (La Porta et al., 2000; Fama and French, 2001; Li and Zhao, 2008; Lahiri & Chakraborty, 2014). Meanwhile, a dividend policy can reduce the agency cost (Easterbrook, 1984). Dividend distribution may mitigate the agency problem (Rozeff, 1982; La Porta et al., 2000; Lozano et al., 2005). Lin et al. (2017) found that companies with more asymmetric information tended not to pay dividends. Li and Zhao (2008) also concluded that firms having higher agency problems tended to pay smaller dividends than firms with lower agency problems. Institutional ownership may affect the use of dividend policy by a company to mitigate the agency conflicts depending on the firms’ performance (Chang et al., 2016). Ultimately, dividend policy decisions are one of the most significant financial decision that can determine a firm’s value (Baker & Powell, 1999; Sáez & Gutiérrez, 2015).

Therefore, based on the a bove men tioned theories , this study establishes the following hypotheses.

H1: R&D investment increases in R&D intensive firms will be value relevant , and this tendency will be stronger for biotech firms.

H2: R&D investment increases in R&D intensive firms that distributed stock dividends in the previous year w ill be more value relevant than those of the firms that did not distribute stock dividends and this tendency will be stronger for biotech firms

The market knows that significant time is required to generate sales particularly for biotech firms, and an increase in sales will further increase corporate value . Therefore, Hypothesis 2.1 has also been extended in view of the fact that an increase in the R&D of biotech firms directly results in growth in sales.

H2.1: An increase in sales will further increase the value of R&D investment increases of biotech firms. This tendency will be stronger for firms that distributed stock dividends in the previous year

Research Design

Selection of Sample

The research uses a sample constructed from the Korea Investors Service database for the period of 2000 t hrough 201 7 . The sample includes publicly listed Korean companies that have annual accounting periods that end on December 31 . For consistency in comparison , f inancial companies are excluded. Top and bottom 1 percent of the variables are winsorized . The final sample includes 21,673 firm year observations. TThe scope of the biotechnology field used in this study includes both biopharma firms and biotechnology firms. B iopharma or biotech firms account for 5.64 % of the sample firms . The sample distribution is shown in Table 1

| Table 1 Industry Sample Distribution | ||

| Industry | Number of Firm-Year Observations | % |

| Agriculture / Forestry / Mining / Fishing | 111 | 0.51 |

| Manufacturing | 12,455 | 59.52 |

| Electricity / Water supply / Environment | 213 | 0.98 |

| Construction | 843 | 3.89 |

| Wholesale / Retail | 1,661 | 7.66 |

| Transportation / Warehousing | 389 | 1.79 |

| Lodging / Restaurants | 10 | 0.05 |

| Publication / Broadcasting / Communication | 1,523 | 7.03 |

| Medical / Computer / Information | 614 | 2.83 |

| Real Estate / Renting / Leasing | 57 | 0.26 |

| Biopharma / Biotech | 1,667 | 5.64 |

| Others | 2,130 | 9.83 |

| Total | 21,673 | 100 |

Research Model and Variables Measurement

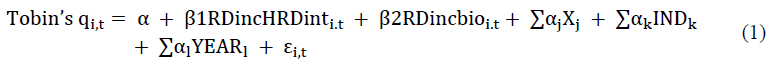

The ordinary least squares regression (OLS) model for testing Hypothesis 1 is the following.

The dependent variable is Tobin's q, which is used to appraise the value of a firm. Tobin's q was first launched by Griliches (1981) and it is t the most commonly used metric of market value (McConnell and Servaes, 1990 ; Simon and Sullivan, 1993; Rao & Ruekert , 1994; Dahya et al., 2007). Tobin's q is the equity plus l iabilities market value , divided by total assets . RDincHR D inti,t is the interaction between RDinci,t and HRinti,t. RDinci,t equals 1 if the firm increases its R&D spending in year t and HRDinti,t is coded 1 where R&D intensity is above the median, and 0 otherwise. RD inc bioi,t represents the interaction between RDinci,t and bio , the biotechnology dummy variable. Xi,t represents the control variables that may have an effect on corporate value . As control variables, size, growth in sales, leverage (Jensen, 1986), investment, and market to book value are included IND and YEAR are dummy variable for the industry and dummy variable for the year , respectively.

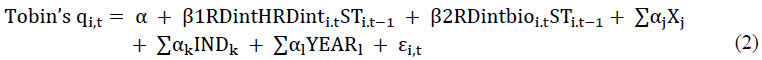

The model of OLS regression used to examine Hypothesis 2 is the following.

Explanatory variables RDincHRDinti,tSTi,t-1 and RDincbioi,tSTi,t-1 are included to analyze Hypothesis 2. RDincHRDinti,tSTi,t-1 is the interaction between RDincHRDinti,tSTi,t-1 and STi,t-1. STi,t-1 equals 1 if a firm distributed a stock dividend in year t-1, and 0 otherwise. RDincbioSTi,t-1 is the interaction term between RDincbio and STi,t-1. The model also includes control variables that can affect corporate value, including size, sales growth, STD, investment, and market-to-book value. Again, IND is dummy variable for the industry and YEAR is dummy variable for the year.

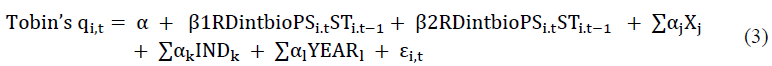

To investigate Hypothesis 2-1, the model below was used.

Explanatory variables RDincbioPSi,t and RDincbioPSi,tSTi,t-1 are used to analyze Hypothesis 2.1. RDincbioPSi,t is the term of interaction between RDincbioi,t and PSi,t. PSi,t equals 1 if a firm’s sales increase, and 0 otherwise. RDincbioPSi,t STi,t-1 is the interaction between RDincbioPSi,t and STi,t-1. The model also includes control variables which may influence corporate value, including size, growth in sales, STD, investment, and market-to-book value. Again, IND is dummy variable for the industry and YEAR is dummy variable for the year.

Results of Empirical Analysis

Statistics Description

Table 2 demonstrates the variables descriptive statistics . The mean (median) value for TQ is 1.3813 (0.5816). 50% of R&D intensive firms (6% of biotech firms) showed R&D investment increases. In addition, 6% of R&D intensive firms (1% of biotech firms) that distributed stock dividends during the previous year showed R&D investment increases during the following year. The mean (median) control variables SIZE, LEV, GROW, MTB, and INV values are 18.5675 18.3605), 0.1025 0), 0.3835 ((-0.0205), 1.3705 (1.0196), and 0.2506 0.1323), respectively.

| Table 2 Statistics Description of Variables | |||||

| Variables | Mean | StdDev | Median | Q1 | Q3 |

| TQ | 1.3813 | 2.9469 | 0.5816 | 0.3109 | 1.1562 |

| RDincHRDint | 0.5053 | 0.5000 | 1 | 0 | 1 |

| RDincbio | 0.0622 | 0.2415 | 0 | 0 | 0 |

| RDincHrdintST | 0.0557 | 0.2294 | 0 | 0 | 0 |

| RDincbioST | 0.0081 | 0.0894 | 0 | 0 | 0 |

| RDincbioPS | 0.0214 | 0.1447 | 0 | 0 | 0 |

| RDincbioPSST | 0.0044 | 0.0665 | 0 | 0 | 0 |

| SIZE | 18.5675 | 1.4969 | 18.3605 | 17.5686 | 19.3327 |

| LEV | 0.1025 | 0.1161 | 0 | 0.0632 | 0.1672 |

| GROW | 0.3835 | 2.2159 | -0.0205 | -0.1767 | 0.0747 |

| MTB | 1.3705 | 1.0436 | 1.0196 | 0.6183 | 1.7639 |

| INV | 0.2506 | 0.4946 | 0.1323 | 0.0547 | 0.2533 |

TQ Tobin’s Q, the market value of equity plus liabilities, all divided by total assets.

RDincHRDint : interaction term between RDinc and HRDint. RDinc is coded as 1 if the firm’s R&D

investment increases, 0 otherwise. HRDint is coded 1 where R&D intensity is above the median, 0 otherwise.

RDincBio : interaction term between RDinc and biotech firm dummy.

RDincHRDintST : interaction term between RDincHRDint and ST. ST is coded 1 if the firm distributes stock dividends in year t-1

RDincbioST : interaction term between RDincbio and ST.

RDincbioPS : interaction term between RDincbio and PS. PS is coded 1 if the firm’s sales increase, 0 otherwise.

RDincbioPSST : interaction term between RDincbioPS and ST

SIZE : natural log of total assets.

LEV : short term liabilities divided by total assets

GROW : growth in sales, the sales changes = (sales t sales t 1 )/sales t 11.

MTB market to book ratio, market value of equity divided by book value of equity.

INV fixed assets (except land and construction in progress) divided by total assets assets.

The results of the Pearson correlation are shown in Table 3. There are significant favorable correlations between TQ (market value and all explanatory variables (RDincHRDint, RDincbio, RDincHRDintST, RDincbioST, RDincbioPS, RDincbioPSST) (p < 0.01). There are also significant positive correlations between TQ and the control variables other than LEV (p < 0.01). The variance inflation factors (VIFs) are calculated for testing multi collinearitycollinearity. VIFs for all variables less than 10, mean VIF 1.47. No multi-collinearity problems are evident.

| Table 3 Correlations | ||||||||||||

| Variables | TQ | RDinc HRDint | RDincbio | RDincHRDintST | RDincbio ST | RDincbio PS | RDincbio PSST | SIZE | LEV | GROW | MTB | INV |

| TQ | 1 | ? | ? | ? | ? | ? | ? | ? | ? | ? | ? | ? |

| RDincHrdint | 0.1066* | 1 | ? | ? | ? | ? | ? | ? | ? | ? | ? | ? |

| RDincbio | 0.1148* | 0.1000* | 1 | ? | ? | ? | ? | ? | ? | ? | ? | ? |

| RDincHRDintST | 0.2752* | 0.2404* | 0.0493* | 1 | ? | ? | ? | ? | ? | ? | ? | ? |

| RDincbioST | 0.1722* | 0.0475* | 0.3501* | 0.2800* | 1 | ? | ? | ? | ? | ? | ? | ? |

| RDincbioPS | 0.1515* | 0.0603* | 0.5744* | 0.0687* | 0.3300* | 1 | ? | ? | ? | ? | ? | ? |

| RDincbioPSST | 0.1824* | 0.0369* | 0.2594* | 0.2113* | 0.7409* | 0.4518* | 1 | ? | ? | ? | ? | ? |

| SIZE | 0.1030* | -0.1157* | -0.1104* | 0.0323* | 0.003 | -0.0536* | 0.0081 | 1 | ? | ? | ? | ? |

| LEV | -0.1325* | -0.0645* | -0.0282* | -0.0469* | -0.0197* | -0.0155* | -0.0061 | -0.0632* | 1 | ? | ? | ? |

| GROW | 0.6701* | 0.0134* | -0.0126* | 0.1590* | 0.0407* | 0.0507* | 0.0725* | 0.2086* | -0.0074 | 1 | ? | ? |

| MTB | 0.3776* | 0.1823* | 0.1639* | 0.1221* | 0.1083* | 0.1113* | 0.0819* | -0.1272* | -0.0891* | 0.0234* | 1 | ? |

| INV | 0.5812* | 0.0096 | 0.0057 | 0.1414* | 0.0636* | 0.0626* | 0.0997* | 0.2381* | 0.0294* | 0.7540* | -0.0141* | 1 |

Results and Discussion of OLS and the Robust Regression

Table 4 shows both the OLS and the robust regression results for the association between the market value and the R&D spending increase s of R&D intensive firms and biotech firms . Previous research has asserted that R&D investment had a positive impact on corporate value . Similar to the existing evidence, t he results for the OLS regression show that the increase in R&D investment is significant ly positive ly associat ed with the market value of R&D intensive firms (p<0.01), and this tendency is stronger for biotech firms . T he results thus provide support for H 1. They i ndicate that R&D investment increase s for R&D intensive firms ( biotech firms are suggestive of value relevance as long as the market recognizes the particular importance and necessity of invest ing in R&D for future sustainable growth of companies . Of course, it cannot be ruled out that t hese results may imply that information about the R&D processes of R&D intensive firms (biotech firms) is not accurately delivered to the market and is being overvalued .

| Table 4 Regression Results | |||

| Variables | Expected Sign | Dependent Variable: TQ | |

| OLS Regression | Robust Regression | ||

| Constant | ? | -0.1208 (-0.47) | -0.1207 (-0.52) |

| RDincHRDinc | + | 0.0780*** (3.07) | 0.0780*** (3.06) |

| RDinbio | + | 0.6112*** (10.75) | 0.6112*** (7.70) |

| SIZE | ?/? | -0.0166* (-1.75) | -0.0166* (-1.76) |

| LEV | ? | -2.4429*** (–21.88) | -2.4429*** (-25.53) |

| GROW | + | 0.6269*** (73.18) | 0.6269*** (22.38) |

| MTB | + | 0.8938*** (69.01) | 0.8938*** (44.01) |

| INV | + | 1.1337*** (29.25) | 1.1337*** (9.32) |

| Industry dummy variables | Included | Included | |

| Year dummy variables | Included | Included | |

| F value | 1056.82*** | 170.49*** | |

| Adjusted R2 | 0.6322 | 0.6328 | |

| N | 21,673 | 21,673 | |

Among the control variables, three variables GROW, MTB, and INV are positively associated with market value, whereas SIZE and LEV have negative associations with market value. A robust regression analysis is additionally conducted, and the findings are in line with the OLS results.

Table 5 shows the analysis results for Hypothesis 2. These are for companies that made stock dividends in year t-1. Table 4 exhibits the results for companies that did not pay stock dividends in year t-1. Comparing the two results, it is confirmed that companies that made stock dividends in year t-1 had a more significant positive association with market value in year t (p < 0.01) than companies that did not. To test whether the parameters that are generated from two different regressions are equal to each other, the test of equality of coefficients is performed. The equality hypothesis is rejected at the 1% level (degrees of freedom: 83.60). A stock dividends distribution may elicit a significant enhancement to corporate value in the following year. Thus these results support Hypothesis 2. Stock dividends are generally perceived as a policy issued by a company in good condition or a company with the potential for future growth. In particular, for companies that need to withhold internal resources for their R&D investment, stock dividend payouts are a good way to save cash and signal the market to future R&D success. The results seem to support the signaling hypothesis. A declaration of stock dividends conveys information about the company and sends a positive signal concerning the company's future growth potential. Therefore, it mitigates agency conflicts, and the market accepts this positively and looks forward to future R&D success. The results also seem to indicate the validity of the attention hypothesis (Grinblatt et al., 1984; Arbel and Swanson, 1993) in which the firm obtains another opportunity to secure market attention. This can be seen in the results, in which the tendency is stronger for biotech companies.

| Table 5 Regression Results | |||

| Variables | Expected Sign | Dependent Variable: TQ | |

| OLS Regression | Robust Regression | ||

| Constant | ? | 0.0269 (0.11) | 0.0269 (0.12) |

| RDincHRDincST | + | 0.6022*** (9.36) | 0.6022*** (5.03) |

| RDinbioST | + | 2.0862*** (15.14) | 2.0863*** (5.77) |

| SIZE | ?/? | -0.0230** (-2.45) | -0.0231*** (-2.48) |

| LEV | ? | -2.4952*** (–22.58) | -2.4952*** (-26.02) |

| GROW | + | 0.6303*** (73.95) | 0.6303*** (22.68) |

| MTB | + | 0.8959*** (70.70) | 0.8959*** (44.36) |

| INV | + | 1.1140*** (28.88) | 1.1140*** (9.27) |

| Industry dummy variables | Included | Included | |

| Year dummy variables | Included | Included | |

| F value | 1085.26*** | 168.56*** | |

| Adjusted R2 | 0.6365 | 0.6371 | |

| N | 21,673 | 21,673 | |

Among the control variables, GROW, MTB, and INV are positively associated with market value, while SIZE and LEV are negatively connected with market value. Additionally, a robust regression analysis is conducted, and the results correspond to OLS results.

Table 6 indicates the ways in which sales increases have an effect on the value relevance of biotech firms when they increase their R&D investment This takes into consideration the assertion that increases in R&D directly results in sales growth . As can be seen in the results, sales increases strengthen a positive relationship between R&D investment increases and the value of R&D b iotech firms . The results indicate that sales growth is acting as a catalyst in the positive association between the R&D investment increase and the corporate value of biotech companies , as the market has been looking forward to the generation of sales for these biotech companies. An increase in sales may also be a p roduct of proving that R&D investment has not been spent in vain. It could mean that a firm’s R&D has been succe ssful and the firm has entered a stage of future sustainable growth. Table 6 also shows the results of a nalysis on market value w hen there are increase s in the R&D expenditure s and the growth in sales of the biotech firms that made stock dividends in the previous year. S ales growth seems to further boost the positive association between increased R&D spending and corporate value when a firm made stock dividends in the previous year.

| Table 6 Regression Results | |||

| Variables | Expected Sign | Dependent Variable: TQ | |

| OLS Regression | Robust Regression | ||

| Constant | ? | -0.0151 (-0.06) | -0.0151 (-0.06) |

| RDincbioPS | + | 0.7847*** (7.67) | 0.7847*** (4.08) |

| RDincbioPSST | + | 2.4359*** (11.79) | 2.4359*** (4.38) |

| SIZE | +/- | -0.0210** (–2.23) | -0.0210** (–2.25) |

| LEV | - | -2.5176*** (–22.76) | -2.5176*** (-26.25) |

| GROW | + | 0.6284*** (73.70) | 0.6284*** (22.61) |

| MTB | + | 0.9018*** (71.18) | 0.9018*** (44.80) |

| INV | + | 1.1022*** (28.53) | 1.1022*** (9.21) |

| Industry dummy variables | Included | Included | |

| Year dummy variables | Included | Included | |

| F value | 1082.72*** | 169.35*** | |

| Adjusted R2 | 0.6360 | 0.6366 | |

| N | 21,672 | 21,672 | |

There are again significant correlations between the market value of a firm and the control variables. MTB, GROW, and INV have positive correlations to market value, while SIZE and LEV are negatively correlated. The results of the robust regression analysis are compatible with the results of OLS.

Results of Fixed Effect Regression

Panel data analysis offers a more precise inference of model parameters and pools information to produce more precise predictions of individual outcomes and confident outcomes (Jianu and Jianu, 2018). However, panel data heterogeneity may lead to misspecification problems and inconsistency. Therefore, for verifying the main hypotheses of the study, the fixed effect regres sions are conducted to reexamine the signaling effects of stock dividend distributions (Panel A) and the effect of sales growth on the association between R&D investment increases and corporate value (Panel B). As shown in Table 7 Panel A&B, t hese findings are compatible with OLS results.

| Table 7 Fixed Effect Regression Results | ||

| Panel A. | ||

| Variables | Expected Sign | Dependent Variable: TQ |

| Fixed Effect Regression | ||

| Constant | ? | -4.6421*** (-7.88) |

| RDincHRDincST | + | 0.5353*** (8.04) |

| RDinbioST | + | 1.4091*** (9.38) |

| SIZE | ?/? | 0.2099*** (6.58) |

| LEV | ? | -1.9237*** (–12.48) |

| GROW | + | 0.5832*** (65.54) |

| MTB | + | 0.7956*** (42.29) |

| INV | + | 1.4145*** (33.61) |

| Industry dummy variables | Included | |

| Year dummy variables | Included | |

| F value | 1383.91*** | |

| Adjusted R2 | 0.6095 | |

| N | 21,672 | |

| Panel B. | ||

| Variables | Expected Sign | Dependent Variable: TQ |

| Fixed Effect Regression | ||

| Constant | ? | -4.8354*** (-8.23) |

| RDincbioPS | + | 0.5863*** (5.24) |

| RDincbioPSST | + | 2.3654*** (11.52) |

| SIZE | ?/? | 0.2212*** (6.95) |

| LEV | ? | -1.9347*** (-12.57) |

| GROW | + | 0.5816*** (65.46) |

| MTB | + | 0.7982*** (49.54) |

| INV | + | 1.4060*** (33.44) |

| Industry dummy variables | Included | |

| Year dummy variables | Included | |

| F value | 1389.84*** | |

| Adjusted R2 | 0.6087 | |

| N | 21,672 | |

Additional Analysis

An additional analysis is performed to reexamine how firm performance improvement impacts the value relevance of investment increases in R&D of biotech firms. For the additional analysis, two different measures earnings before interest and taxes (EBIT) and net income (NI) are used as proxies for firm performance. Table 8 shows the additional analysis results. As shown in Table 8, firm performance improvement and stock dividend payouts in the previous year have significant positive effects on corporate value (p < 0.01).

| Table 8 Additional Analysis Results | |||

| Variables | Expected Sign | Dependent Variable: TQ | |

| Model 1. | Model 2. | ||

| Constant | ? | -0.0071 (-0.03) | 0.0162 (0.06) |

| RDincbioEBIT | + | 0.3127*** (3.72) | - |

| RDincbioEBITST | + | 1.8671*** (8.90) | - |

| RDincbioNI | + | - | 0.1991** (2.37) |

| RDincbioNIST | + | - | 1.5958*** (7.45) |

| SIZE | ?/? | -0.0229** (–2.42) | -0.0233** (-2.46) |

| LEV | ? | -2.5181*** (–22.63) | -2.5244*** (-22.67) |

| GROW | + | 0.6276*** (73.25) | 0.6268*** (73.38) |

| MTB | + | 0.9082*** (71.24) | 0.9121*** (71.52) |

| INV | + | 1.1360*** (29.30) | 1.1291*** (29.07) |

| Industry dummy variables | Included | Included | |

| Year dummy variables | Included | Included | |

| F value | 1065.69*** | 1061.86*** | |

| Adjusted R2 | 0.6323 | 0.6315 | |

| N | 21,672 | 21,672 | |

RDincbioEBIT : RDincbio interaction term with EBIT. EBIT is coded as 1 if the firm’s EBIT increases increases, 0 otherwise.

RDincbioEBITST : RDincbioEBIT interaction term with ST.

RDincbioNI : RDincbio interaction term with NI. NI is coded as 1 if the firm’s NI increases increases, 0 otherwise.

RDincbioNIST : RDincbioNI interaction term with ST.

Note: See the variable definitions in Table 2 . The parentheses show z values . * p < 0.10, ** p < 0.05, *** p <0.01.

The dividend policy of a firm is driven by various circumstances in which the firm is in. Cash dividend s can be distributed if the company pulls in large profits and generates sufficient cash. However, for R& D intensive firms, which require huge amounts of R&D investment, cash will probably to be a ssigned to the company to se cure R& D investment funds rather than put toward a shareholder friendly policy This is because , based on the pecking order hypothesis, c ompanies prefer internal resources first when funds are needed (Myers and Majluf, 1984; Ross, 1977). Meanwhile, the signaling hypothesis allows firms to deliver messages about prospects that can mitigate the agency problem through dividend distribution. Firms send a signal through stock dividend distribut ion instead of paying cash dividends. This tendency is likely to appe a r in R&D intensive firms.

The study initially looked at how R&D investment increases of R&D intensive firms and/or biotech firms were being evaluated in the market and second, how the signaling effects of stock dividend payouts were examined. This study also looked at whether an increase in sales could further enhance the value of the firms with R&D investment increases.

According to the analysis results, the R&D investment increases of R&D intensive firms positively affected corporate value, and this tendency was stronger for biotech firms. Second, when stock dividends were distributed in the previous year, R&D investment increases in the following year were more positively related with corporate value. Therefore, this result seems to confirm the signaling effect of stock dividend distributions. Additionally, the market seemed to assess firms with R&D investment increases more positively if their sales increased. This may indicate that the market judged that R&D investment increases directly led to sales growth. In conclusion, the analysis found that corporate value was even further enhanced if the following three conditions were satisfied: stock dividends payment in year t-1, R&D investment increases in year t, and sales growth in year t.

The findings may have important consequences in that a dividend policy can serve as a win-win strategy for R&D intensive (biotech) firms and their shareholders. By adopting a stock dividends payment policy, R&D intensive (biotech) firms do not have to leave a shareholder friendly policy and may have opportunities to invest in R&D, hoping for future sustainable growth, with cash reserved by not giving cash dividends. On the shareholder side, they get more stocks and may look forward to benefiting from stock value rises through firms’ future sustainable growth by accepting signals from firms. Furthermore, as shown in this research, if there is evidence that an increase in the R&D of biotech firms has been successful, such as an increase in sales, the faith in the future sustainability of the company appears to be further strengthened. Policymakers also need to consider R&D intensive (biotech) companies’ features and develop measures to support their sustainable growth.

Because the number of biotech samples is relatively small, this paper could not conduct analysis focused only on biotech companies. Nevertheless, this study offers some contributions to the current related literature by looking at how the market values the R&D investment increases of R&D intensive firms, particularly biotech firms, in connection with the signaling hypothesis. Although research on biotechnology has been ongoing, it is still considered an interesting topic due to the specificity of the industry. It is the author's hope that by extending the work done in this paper, a more elaborate analysis can be carried out. In the future, it would be interesting if various types of dividends could be more elaborately linked with capital structure. Another interesting area for further studies would be a comparative study between countries, with the expectation that the results will be different.

References

- Aboody, D., & Lev, B. (2000). Information asymmetry, R&D, and insider gains. The Journal of Finance, 55(6) 2747-2766.

- Arbel, A., & Swanson, G. (1993). The role of information in stock split announcement effects. Quarterly Journal of Business & Economics , 32, 14-25.

- Baker, H.K., & Powell, G.E. (1999). How corporate managers view dividend policy. Quarterly Journal of Business and Economics, 38(2), 17-35.

- Bhattacharya, S. (1979). Imperfect Information, Dividend Policy, and “the Bird in the Hand” Fallacy. The Bell Journal of Economics, 10, 259-270.

- Chan, L., Lakonishok, J., & Sougiannis, T. (2001). The stock market valuation of research and development expenditure. The Journal of Finance, 56, 2431-2456.

- Chan, S., Martin, J., & Kensinger, J. (1990). Corporate research and development expenditures and share value. Journal of Financial Economics, 26, 255-276.

- Chang, K., Kang, E., & Li, Y. (2016). Effect of institutional ownership on dividends: An agency-theory-based analysis. Journal of Business Research, 69(7), 2551-2559.

- Cho, J., & Lee, J. (2013). The venture capital certification role in R&D: Evidence from IPO underpricing in Korea. Pacific-Basin Finance Journal, 23(1), 83-108.

- Chojnacki, P., & Kijek, T. (2014). R&D expenditures and market value of biotechnology firms, Roczniki (Annals), Polish Association of Agricultural Economists and Agribusiness - Stowarzyszenie Ekonomistow Rolnictwa e Agrobiznesu (SERiA), 6.

- Chung, K., Wright, P., & Kedia, B. (2003). Corporate governance and market valuation of capital and R&D investments. Review of Financial Economics, 12, 161-172.

- Dahya. J., & McConnell, J. (2007). Board composition, corporate performance and the Cadbury Committee Recommendation. Journal of Financial and Quantitative Analysis, 42, 535-564.

- Deng, Z., Lev, B., & Narin, F. (1999). Science and technology as predictors of stock performance. Financial Analysts Journal, 55, 20-32.

- Denis, D.J., & Osobov, I. (2008). Why do firms pay dividends? International evidence on the determinants of dividend policy. Journal of Financial Economics, 89, 62-82.

- Desmiza, Nidar, S.R., Masyita, D., & Anwar, M. (2019). Analysis of Determinant Factors towards Dividend at Manufacturing Companies Listed in Indonesia Stock Exchange, Academy of Accounting and Financial Studies Journal, 23(2), 1-10.

- Dittmar, A., Mahrt-Smith, J., & Serveas, H. (2003). International corporate governance and corporate cash holdings. Journal of Financial and Quantitative Analysis, 38, 111–133.

- Easterbrook, F.H. (1984). Two agency-cost explanations of dividends. The American Economic Review, 74(4), 650-659.

- Eberhart, A., Maxwell, W., & Siddique, A. (2004). An examination of long term abnormal stock returns and operating performance following R&D increases. Journal of Finance, 59(2), 623-650.

- Ely, K., Simko, P.J., & Thomas, L.G. (2003). The usefulness of biotechnology firms’ drug development status in the development of research and development costs. Journal of Accounting, Auditing and Finance, 18(1), 163-196.

- Fama, E.F., & French, K.R. (2001). Disappearing dividends: Changing firm characteristics or lower propensity to pay? Journal of Financial economics, 60(1), 3-43.

- Filson, D., Olfati, S., & Radoniqi, F. (2015). Evaluating mergers in the presence of dynamic competition using impacts on rivals. The Journal of Law and Economics, 58(4), 915-934.

- Gill, A., Biger, N., & Tibrewala, R. (2010). Determinants of dividend payout ratios: Evidence from United States. The Open Business Journal, 3(1), 8-14.

- Gordon, M.J. (1963). Optimal Investment and Financing Policy. Journal of Finance, 18(2), 264-272.

- Griliches, Z. (1981). Market Value, R&D, and Patents. Economics Letters, 7(2), 183-187.

- Grinblatt, M.S., Masulis, R.W., & Titman, S. (1984). The valuation effects of stock splits and stock dividends, Journal of Financial Economics, 13(4), 461-490.

- Guo, R., Lev, B., & Zhou, N. (2005). The valuation of biotech IPOs. Journal of Accounting, Auditing & Finance 20(4), 423-459.

- Hall, B.H. & Oriani, R. (2006). Does the market value R&D investment by European firms? Evidence from a panel of manufacturing firms in France, Germany, and Italy. International Journal of Industrial Organization, 24(5), 971-993.

- Hand, J.R.M. (2005). The value relevance of financial statements in the venture capital market. The Accounting Review, 80(2), 613-48.

- Hart, O., & Moore, J. (1994). A theory of debt based on the inalienability of human capital. The Quarterly Journal of Economics, 109(4), 841-879.

- Holmstrom, B. (1989). Agency costs and innovation. Journal of Economic Behavior and Organization, 12, 305– 327.

- Jensen, M. (1986). Agency cost of free cash flow, corporate finance and takeovers. American Economic Review, 76, 323-329.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jianu, I., & Jianu, I. (2018). The share price and investment: Current footprints for future oil and gas industry performance. Energies, 11(2), 1-15.

- Jin, Z., Shang, Y., & Xu, J. (2018). The impact of government subsidies on private R&D and firm performance: Does ownership matter in China’s manufacturing industry? Sustainability, 10, 2205.

- John, K., & Williams, J. (1985). Dividends, dilution, and taxes: A signaling equilibrium. The Journal of Finance, 40, 1053–1070.

- Kaitin, K.I. (2003). Post-approval R&D raises total drug development costs to $897 million, Tufts Center for the Study of Drug Development Impact Report, 5(3).

- Lahiri, P., & Chakraborty, I. (2014). Explaining dividend gap between R&D and non-R&D Indian companies in the post-reform period. Research in International Business and Finance, 30, 268-283.

- La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R.W. (2000). Agency problems and dividend policies around the world. The Journal of Finance, 55(1), 1-33.

- Lease, R.C., Kose, J., Avner, K., Uri, L., & Oded, H.S. (2000). Dividend policy: Its impact on corporate value. Harvard Business School Press, Boston, Massachusetts.

- Lee, N. (2019). R&D accounting treatment, firm performance, and market value: Biotech firms case study. Journal of International Studies, 12(2), 66-81.

- Lee, P., & O’Neill, H. (2003). Ownership structures and R&D investments of U.S. and Japanese firms: Agency and stewardship perspectives. Academy of Management Journal, 46(2), 212–225.

- Lev, B., & Sougiannis, T. (1996). The capitalization, amortization, and value-relevance of R&D. Journal of Accounting and Economics, 21, 107-138.

- Li, K., & Zhao, X. (2008). Asymmetric information and dividend policy’. Financial Management, 37(4), 673-694.

- Lin, T.J., Chen, Y.P., & Tsai, H.F. (2017). The relationship among information asymmetry, dividend policy and ownership structure. Finance Research Letters, 20, 1-12.

- Lintner, J. (1956). Distribution of incomes of corporations among dividends retained earnings and taxes. The American Economic Review, 46(2), 97-113.

- Lozano, M.B., Miguel, A.de., & Pindado, J. (2005). Dividend policy in regulated firms: An analysis from two agency problems. Eurasian Review of Economics and Finance, 1(1), 9–22.

- McConnell, J.J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27, 595-612.

- Miller, M., & Modigliani, F. (1961). Dividends and taxes: Empirical evidence. Journal of Political Economy, 90, 1118-1141.

- Miller, M.H., & Rock, K. (1985). Dividend policy under asymmetric information. The Journal of Finance, 40, 1031-1051.

- Myers, S.C. & Nicholas, S.M. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13, 187-221.

- Nivoix, S., & Nguyen, P. (2012). Characteristics of R&D Expenditures in Japan’s Pharmaceutical Industry. Asia Pacific Business Review, 18, 225–240.

- Penman, S.H., & Zhang, X.J. (2002). Accounting conservatism, the quality of earnings and stock returns. The Accounting Review, 77, 237–264.

- Pisano, G. (2006). Profiting from innovation and the intellectual property revolution. Research Policy, 35(8), 1122-1130.

- Rao, A.R., & Ruekert, R.W. (1994). Brand alliances as signals of product quality. Sloan Management Review, 36(1), 87-97.

- Reynard, E. (1979). A method for relating research spending to net profits. Research Management, 22, 12–14.

- Rozeff, M.S. (1982). Growth, beta and agency costs as determinants of dividend payout ratios. Journal of Financial Research, 5(3), 249-259.

- Sáez, M., & Gutiérrez, M. (2015). Dividend policy with controlling shareholders. Theoretical Inquiries in Law, 16(1), 107-130.

- Simon, C.J., & Sullivan, M.W. (1993). The measurement and determinants of brand equity: A financial approach. Marketing Science, 12(1), 28-52.

- Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87(3), 355-374.

- Stephen Ross, S. (1977). The determination of financial structure: The incentive-signaling approach. Bell Journal of Economics, 8(1), 23-40.

- Xu, B., Magnan, M.L., & André, P.E. (2007). The stock market valuation of R&D information in biotech firms. Contemporary Accounting Research, 24(4), 1291–318.

- Xu, J., & Sim, J. (2018). Characteristics of Corporate R&D Investment in Emerging Markets: Evidence from Manufacturing Industry in China and South Korea, Sustainability , 10 (9), 3002.