Research Article: 2018 Vol: 22 Issue: 3

Raw-materials Potential of Corporate Enterprises: Topical Issues of Accounting, Analytical Procurement and Financial Backing

L Ya Shevchenko, Donetsk National University of Economics and Trade, Named After Mykhailo Tugan-Baranovsky

?? Shendrygorenko, Donetsk National University of Economics and Trade, Named After Mykhailo Tugan-Baranovsky

Abstract

The article and the structure of the resource potential, the transformation of the yogo warehouses, yak ob'ektiv in the accounting region, allows you to formulate a comprehensive methodology for the accounting system of resource potential in the integrated computer system of corporate systems on the basis of the resource base in the modules.

Keywords

Resources, Potential, Corporate Accounting, the Resource Potential of the Corporation.

Introduction

New political and economic fundamentals require changes in managerial approaches as well as finding such forms that would meet current economic conditions of economic management. It becomes much more difficult to manage a corporate enterprise effectively; it requires searching innovative managerial techniques on the basis of available resources.

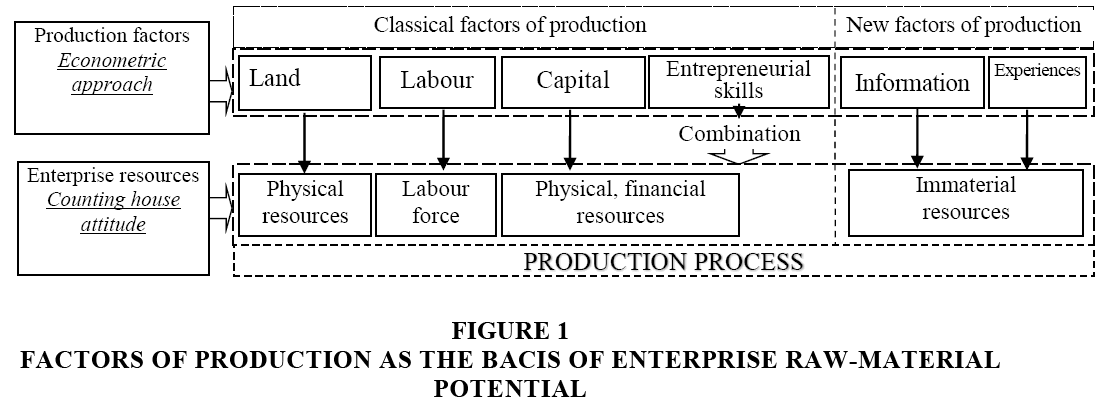

Independent components of corporate resource potential include means, materials and supplies. Combination of these components provides continuity of economic activity. It should be taken into account that the subject of economic activity is output of products (services, works), while the study of the resource potential components has been taken by us as the BACIS four factors of production (land, labor, capital, entrepreneurial ability).

However, with the development of economic knowledge and economic relations, this theory is complemented with new factors of production information, experience and etc.

Review Of Previous Studies

Shyhun (2011) note that "the theory of production factors is formed under G Hegel’s laws of development - expanding with each idea and moving to a higher level. At the first phases of researches factors, affecting the production were presented only by obvious things, such as labor, land and capital and in course of time even less obvious things were distinguished as playing a significant role. In particular, out of a group of scientists, some defined national characteristics of countries, some described organizational skills; organizational skills and experience were described by others. Some became the author of innovation, while others represented social institutions and technology. All these facts give evidence that the process of studying economic processes exceeded the scope of economy.

Presentation Of Basic Material Of The Research

Approach to determining resource potential structure of a corporate enterprise through classical and new factors of production (land, labor, capital, entrepreneurial abilities, information and knowledge) is based on the fact that each component of the resource potential is an element of the corresponding factor of production (Figure 1).

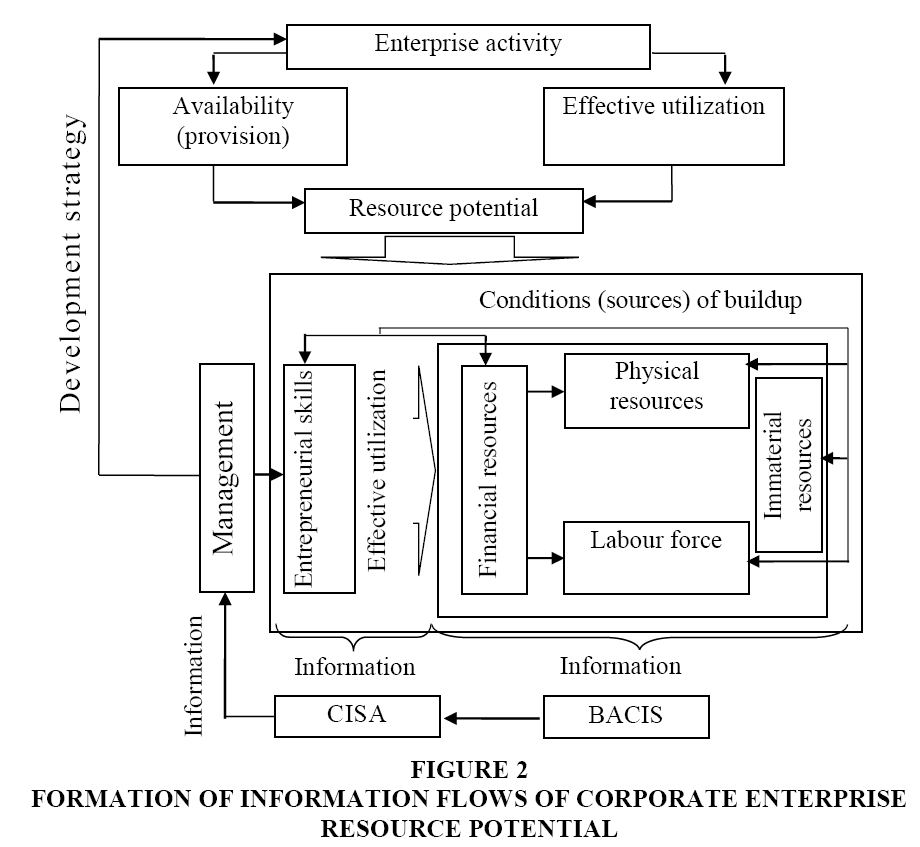

The combination and efficient use of resource potential components is implemented through corporate enterprise data intelligence through the use of business accounting computer information systems (BACIS) and computer information systems of analysis (CISA) (Figure 2).

In order to form information on the resource potential components in bookkeeping accounts it is necessary to determine their content, which will show their structure through the accounting system facilities and promote establishment of BACIS subsystem modules as a part of an integrated computer information system of the corporation.

Material resources occupy the largest share in the enterprise expenditure pattern, as they are the main component in formation of finished products primecost. Need for some material resources as the main component of production capacity is among the reasons why business entities are combined and corporations are created. This updates the necessity of material management and the formation of a separate subsystem in a corporate enterprise integrated computer system, which will meet informational needs of internal and external users for making informed managerial decisions (Pozhars'ka, 2012).

As the result of limitation of resources which may be needed for various needs it is certain that there will be competition as for their use. Here the matter is not about competition between manufacturers for selling markets, but about competition between alternative goals of resource application. The fact that almost every separate kind of resources can be used for various needs and get multivalued application. In this connection there is competition between the goals of limited resources and conditions of their extraction. At the same time there is a possibility of alternative solutions. Thus every decision can have positive and negative consequences. Therefore, specialists in economics should reasonably make decisions in terms of minimization of material costs in the process of production, through deep analysis and calculations, considering all pro and contra concerning immediate and long-term results in order to achieve the greatest benefit for the enterprise.

Let's emphasize results of the study of the logistics and reengineering approach to management of enterprise material resources. Thus, Lola (2009) came to the following conclusion: scientific literature summarization suggests that while defining the category of "material resources" there are different approaches reflecting the diversity of their properties. While supervizing the subject of research, we justified and proposed the following definition of material resources: these are objects of labor being parts of manufactured products and creating their substance or promoting the process of production. In the natural form “enterprise material resources” are raw materials, bacisic and auxiliary materials, component parts, fuel, work in progress and production waste.

As for determining the structure of material resources Stelmaschuk (2007) includes the following definition to the notion of material resources: fixed assets, low value items, raw materials and supplies, fuel, semi-finished products, components, spare parts for repairing, material costs of completed production and finished goods.

Material resources are resources in natural and material form used in the course of enterprise production (economic). They include assets and shares of current assets. Fixed assets are enterprise material and real property used as materials and supplies. Part of current assets is a part of material resources, low value items, packaging materials, fuel, electricity, etc. (Mitsenko, 2010).

From the standpoint of economic theory and in the context of the need to ensure production process and the economic activities material resources include the following accounting items: fixed assets and other non-current assets, capital investments, long-term biological assets, inventories, current biological assets, low value items, work in progress, lack of production, semi-finished products, agricultural products, goods (Bihdan, 2003).

Intangible resources are another component of the resource potential and according to the economic theory, a relatively new factor of production, which taking on its significance in conditions of information-oriented society development.

Mitsenko (2010) point out that investigating resource potential of enterprises, under intangible resources we should understand the industrial and intellectual property, which will benefit for a long time, goodwill, know-how, knowledge bacise, databacises, patents, inventions and more. “Intangible resources are a part of enterprise potential able to provide economic benefits for a relatively long period. The distinctive features of these resources are insufficient material bacisis of income and uncertainty of the volume of future profits from their use".

The illustrated approaches to understanding the essence of intangible resources and availability of a large number of criteria for recognition of their components as objects of accounting, lack of clear economic classification and unambiguous interpretation of regulations prevent to form a unified approach to managing intangible resources as part of enterprise resource potential.

The whole organization and its separate parts in particular in enterprise integrated corporate computer informational systems offer their attributes for forming unified information about the intangible resources availability and movement: software CISA, acquired database, other intangible assets and accumulation of costs for human capital formation that will be displayed on the off-balance sheet.

Human capital assets are formed or developed as a result of investments and backlog of human health, knowledge, skills, abilities, motivations and that gives them an opportunity to carry out their professional activities successfully. These activities should be used for obtaining useful results, promoting productivity and efficiency and thus affecting growth of revenue obtained by its owner, as well as growth of company profits and national income. Education, professional qualifications, knowledge and experience of employees affect the amount of human capital (Mnykh, 2008).

For ensuring proper functioning economic development of an enterprise financial resources are needed. Their peculiar feature is that they can be converted into any other type of resources.The following under financial resources: own, loaned and borrowed capital used by an enterprise for creating its own assets and for its industrial and financial activity implementation. As a result of generalization and systematization of researchers’ approaches to financial resources economic substance, Prokopchuk (2010) defined them as a combination of cash accumulated in fund and non-fund form that is used to create assets for business purposes.

Understanding economic substance of financial resources is important for determining directions of their development and use. Three groups of funds according to their areas of distribution: replenishing the compensation fund covering expenses; forming a consumption fund developing logistics of enterprises; forming an accumulation fund gains in equity.

When determining the approach to the corporate enterprise financial management, it is necessary to consider properties of these enterprises as economic categories and needs of their economic activity according to criteria of classification, reflecting specific features of their formation and use.

Composition of financial resources in accordance with the objects of accounting includes: long-term financial investments, long-term receivables, cash, bank accounts, other funds, short-term notes and current financial investments, settlements with buyers and customers, settlements with various debtors, expenses of future periods.

Formation and application of labor resources contribute to the efficient economic process organization. Labour force is an important component of the resource potential because its availability and efficient use can improve competitive ability of corporation and, in case of continuous training such vailability and efficient use can form new competitive advantages of a business entity.

While investigating human resources Baulina (2008) argues that enterprise labor (labor or human resources) is an aggregate of employees at the enterprise as for the main and auxiliary activities. Just the employment potential triggers all the other components of the enterprise resource potential (Zamora, 2006). It can be described from different positions depending on quantitative and qualitative characteristics. This allows us to assess staff potential in cost categories which is particularly relevant for business owners. This assessment helps to get a real idea of how abilities of workers exceed the cost of their involvement, training and development.

Economic scientific literature considers human resources as a set of quality characteristics (education, experience, occupation, availability of academic degrees, diplomas, awards, certificates of training), which require formation of a unified approach to their management and grant management personnel based on information on their quantitative and qualitative component in some form.

According to production factors human resources combine all other components of the resource potential in order to organize the production process which is a part of entrepreneurial skills.

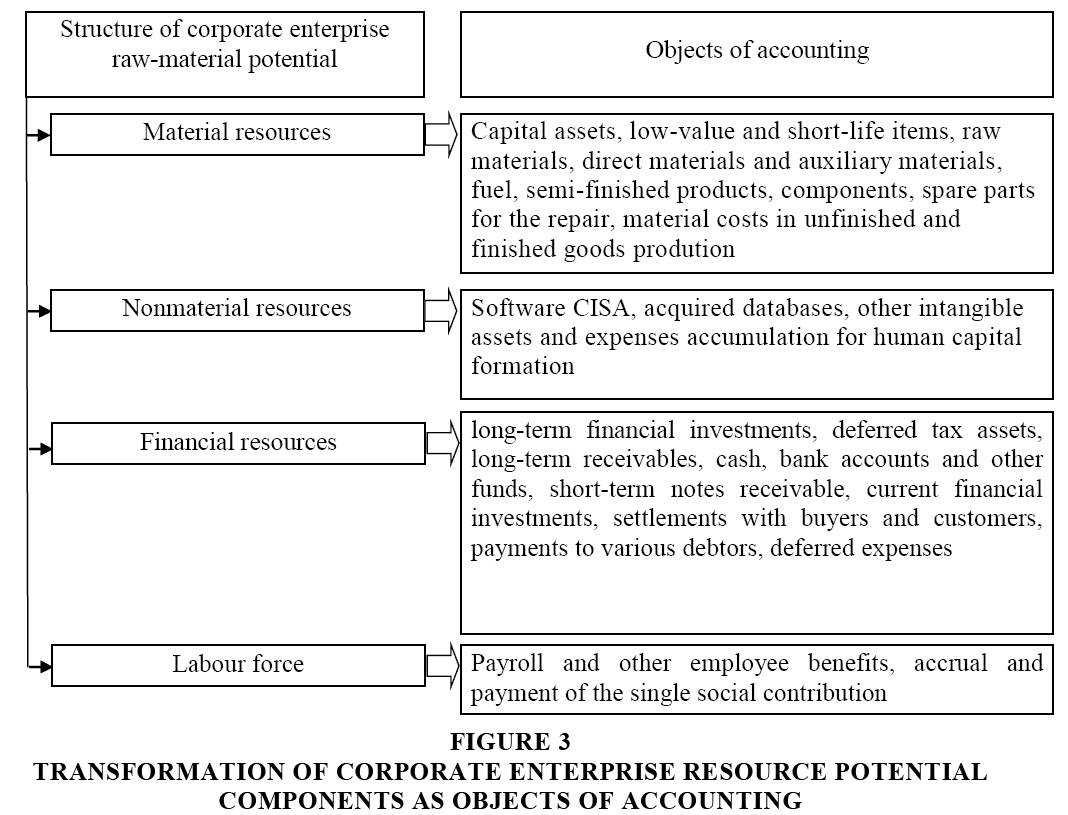

According to the conducted study we can distinguish the following structure of the resource potential which is intended for improving the system of accounting and analytical support of corporate enterprise management through the development of integrated information computer system (Figure 3).

Figure 3: Transformation Of Corporate Enterprise Resource Potential Components As Objects Of Accounting

The structure and resource potential concerning transformation of its components as objects of accounting will form a complex methodology of resource potential accounting in the integrated computer information system on the basis of accounting resource potential of subsystems of the corresponding modules.

Conclusion

Thus, as a result of researching economic substance of such concepts as: "resources", "potential", "resource potential" and considering defined features of corporate enterpriseas as a form of enterprises association, interpretation of the term "corporation resource potential" have been improved from two perspectives. In the context of overall economic and theoretical understanding of corporate enterprises resource potential is defined as ability of corporations to achieve maximum economic and social effects on the basis of association member’s resources transformation and generation. For the purposes of accounting corporate enterprise resource potential is a collection of available material and non-material, financial resources, labor union members that characterize the possibility of corporations to receive future economic benefits from their use.

Formation of accounting and analytical provision of corporate enterprises resource potential is needed for developing an integrated computer information system which takes into account activities of the corporate enterprise and its constituent resource potential. This requires a conceptual approach to organization and implementation of accounting and analytical maintenance of resource potential through the development of integrated CISA.

References

- Baulina, T.V. (2008). Human resources as the main factor of change management at enterprises. Economics and Management, 1, 67-71.

- Bihdan, I.A. (2003). Accounting and auditing on non-material assets: Abstract of a thesis for scientific degree of a candidate of economic sciences: specialty. Accounting Analysis and Auditing, Kharkiv, 19.

- Lola, Y.Y. (2009). Management of material resources at enterprises (logistic and reingineering approach): Abstract of a thesis for scientific degree of a candidate of economic sciences: Speciality. Economics and Management of Enterprises (According to Kinds of Economic Activity), 2.

- Mitsenko, N.H. (2010). Enterprise resource potential, essence, structure, strategy of use. Access mode: http://nltu.edu.ua/nv/Archive/2010/20_9/193_Micenko_NV_20_9.pdf

- Mnykh, Y.V. (2008). Economic analysis of enterprise activities. National University of Trade, 514.

- Pozhars'ka, L. (2012). Economic essence and classification of non-material assets of TV enterprises. Access mode: http://www.nbuv.gov.ua/portal/soc_gum/vknteu/2012_1/4.pdf

- Prokopchuk, D.V. (2010). Problems of financial resources classification of economic entities. Access mode: http://nltu.edu.ua/nv/Archive/2010/20_2/231_Prokopczuk_20_2.pdf

- Shyhun, M.M. (2011). Factors of production and methods of production: Economic nature and interrelation of categories. Bulletin of Zhytomyr State Technological/Economic sciences. Zhytomyr: ZSTU, 2(56).172-178.

- Stelmaschuk, A.M. (2007). Accounting: Study guide. Center of Study Literature, 528.

- Zamora, O.I. (2006). Using labor forces at agricultural enterprises abstract of a thesis for scientific degree of a candidate of economic sciences: Speciality. Economy of Agriculture and the Agro-industrial Complex, 22.