Research Article: 2020 Vol: 19 Issue: 5

Quality of Strategic Business Management in the Aspect of Growing the Role of Intellectual Capital

Yevheniia Khaustova, Kyiv National University of Technologies and Design

Akmal Durmanov, Tashkent Institute of Irrigation and Agricultural Mechanization Engineers

Maryna Dubinina, Mykolayiv National Agrarian University

Oksana Yurchenko, Central Ukrainian National Technical University

Elvira Cherkesova, Don State Technical University

Abstract

The article is devoted to the formation of guidelines for the new role of intellectual capital in strategic business management. It is determined that at the micro level the development of the business model of the firm is formed on the basis of strategic changes and transformations of its own position in the market, at the expense of material and financial resources. The article reveals the essence of intellectual capital and its role in the evolution of economic systems, also, during the study of the intellectual capital, its definition as an objective economic category was formulated and substantiated, which allowed to show the general and personal aspects of intellectual capital in business. It was proved that the efficiency assessment regarding the formation of entrepreneurial intellectual capital is the basis for making appropriate commercial decisions and ensuring the process of self-regulation of entrepreneurship organizational and economic mechanism, it allows to influence the current state and tendencies of the intellectual capital development, to determine directions and scales of entrepreneurial initiatives.

Keywords

Strategic Management, Model of Strategic Management, Business Model of the Firm, Intellectual Capital, Intellectual Resources, Performance Evaluation, Organizational and Economic Mechanism.

JEL Classifications

L26, M11, M54

Introduction

In today's world, important economic changes are taking place, related to the intensification of the accumulation and usage of intellectual capital.

In macroeconomic terms, intellectual capital has become a major factor determining the country's place in the new economy in the process of economic globalization. The rapid intensification of the intellectual capital impact on economic development led to the emergence of “intellectual economy” and “knowledge society” concepts. Intellectual capital mostly determines the possibilities and directions of the financial and material capital usage. It can be confidently asserted that intellectual capital is the primary and driving force of the new economy. Self-growth of intellectual capital plays the same role as the self-growth of material and capital in industrial sphere, during the formation of a new economy. Thus, the growth of intellectual capital and the efficiency of its usage determine the possibilities of country`s further economic development.

The Analysis of Recent Research and Publications

The issue of intellectual capital functioning and development in the field of business has developed and complicated over the past years and has become one of the key notions in the theory of firm and entrepreneurship. Among well-known researchers of intellectual capital issues it is advisable to mention the following works (Andriessen, 2007; Burr & Girardi, 2002; Mitchelmore & Rowley 2010; Singh & Kansal, 2011), which substantiated the economic technological change impact, developed a model of endogenous scientific and technological development, formulated theories of unique competitive advantages and management of intellectual assets, highlighted the life cycle of intellectual assets, etc. The following scientists conduct research in the field of intellectual capital (Baumol, 2002; Drobyazko et al., 2019a; Joia, 2007), which supplemented the modern theories of innovative development, theoretical and methodological aspects regarding internal-firm management of intellectual assets, methodology of entrepreneurial intellectual capital formation, methods for intellectual resources assessment.

Methodology

In the methodological content, this scientific article will be constructed in a dialectical manner based on the following theoretical approaches: 1) structural approach, within which intellectual capital is the aggregate knowledge of the entrepreneurial structure represented by the business owner and his staff, as well as methodologies, patents, architectures and relationships. In this definition, intellectual capital has already taken the form of methodological category (“aggregate knowledge”); 2) the definition of “capital” is based on a functional approach (cost that brings new value). Therefore, the definition of intellectual capital must undoubtedly be based on the same principle and approach, as on the basis of the basic concept; 3) terminological approach indicates that intellectual capital - is capital created by human and/or machine intelligence and represented by intellectual resources, but only by those, which are capable of creating new value. It is important to have a clear understanding of the dichotomy between intellectual capital and all intellectual resources of an entrepreneur. Intellectual capital is a means of creating new value. The entrepreneur's intellectual resources include both intellectual capital and intellectual labor, products, which in turn can also be used as means of manufacturing.

Results and Discussions

The choice of priorities for scientific, technological and innovation policy should be based on the analysis of global directions of technical and economic dynamics, as well as the prerequisites for the formation of competitive advantages in entrepreneurial activity. Nowadays, as the formation of a new economy type in a number of countries takes on a new character, the main feature of the global economic is the change in the dominant type of capital and the nature of labor, they mostly from the types of intellectual capital of business structures (Acs et al. 2016).

The following types of intellectual capital can be distinguished by functional content: personalized, technical and technological, infrastructural, client capital, branded. Each type contains the corresponding types of intellectual capital.

1. Personalized - job-related knowledge, skills, creativity, education, professional qualifications, loyalty, staff values, psychometric characteristics.

2. Technical and technological - inventions, useful models, industrial samples, patents, trade secrets (know-how), design rights.

3. Infrastructural - information technologies, databases, organizational structure, management philosophy, corporate culture, business cooperation.

4. Client capital - customer relationships, contracts, order portfolio, franchises, license agreements.

5. Branded capital - trademarks, trademarks, corporate brand (name), service brands. The image of the entrepreneur or his business reputation can be classified in this category (Watson & Stanworth, 2006).

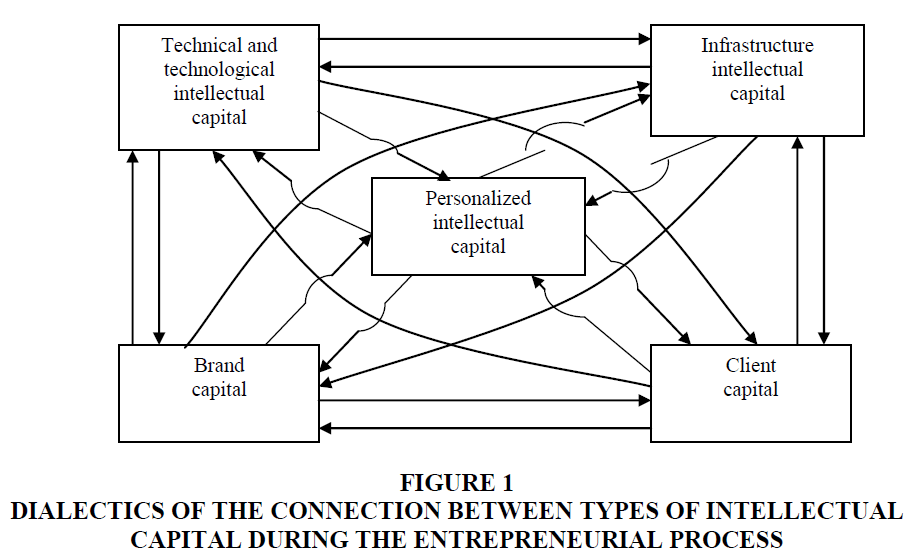

All types of intellectual capital are closely interconnected (Figure 1), but the personalized intellectual capital is major.

Figure 1 Dialectics of the Connection Between Types of Intellectual Capital During the Entrepreneurial Process

Availability and efficiency of intellectual resource usage determines the formation and possibilities of using other types of intellectual capital, because the capability of creation new technologies, inventions, and new brand projects is primarily depends on human intelligence. The proposed classification of intellectual capital according to the relevant features reveals its essence in various aspects and creates a scientific basis for the development of methodological provisions on such urgent problems as the creation of a system for the formation of entrepreneurial intellectual capital, its reproduction and evaluation (Green, 2013).

Organizational and economic mechanism of intellectual capital management should rationally combine appropriate management methods, which in their turn should ensure the effective implementation of intellectual capital functions and achievement of the set goals.

Considering the fact that the process of managing intellectual capital is carried out with the help of intellectual labor, the motivational mechanism is another first-rate element of the organizational and economic mechanism of the intellectual capital formation of the entrepreneur (Sarasvathy, 2001; Tkacheko et al., 2019). The motivational mechanism of intellectual work is a set of regular relationships that determine the realization of actualized individuals needs (interests) with the help of labor intellectual activity, through labor behavior. The motivational mechanism consists of the main components of involvement or non-involvement into entrepreneurial activity. It helps to realize the aspects that were formed in the process of individual socialization. Involvement into intellectual work determines the structure of labor values, their relative significance (Lim et al., 2010; Drobyazko et al., 2019b).

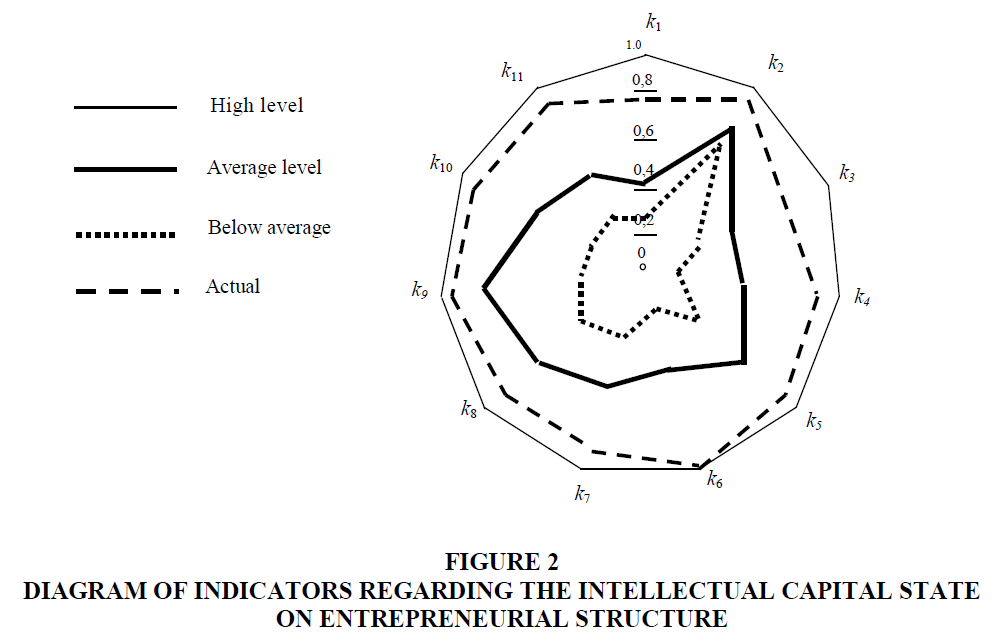

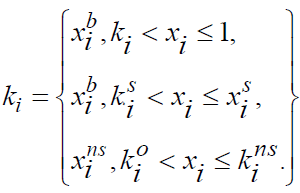

We propose to consider the following methodological approach to assessing the effectiveness of intellectual capital formation in business sphere. In order to evaluate comprehensively the effectiveness of the formation process of this resource, we have introduced three levels of entrepreneurial intellectual capital: high, average and below average. Let`s suppose Ki (i=1 ..., m) – a system of indicators that characterize the entrepreneur intellectual capital; Ki – the barrier normalized value of the indicator corresponding to the average level of intelligence of the entrepreneur. Change of values xi of the intelligence indicator Ki is carried out in the range o ≤ xi ≤ 1 and these values are determined by the following ratios:

(1)

(1)

Here the level of the entrepreneur's intelligence on each component of his intellectual capital (human, structural and consumer) is indicated as follows: b – high level, s – average, ns – below average, ? – absent. If we use the graphical approach which is represented in Figure 2, then the condition of growth of entrepreneur's intellectual capital will be the following: Sb≥ Ss≥ Sns, where Sb— the area of the polygon at high level of entrepreneur's intellectual capital; Ss– the area of the polygon at the average level of entrepreneur's intelligence; Sns– polygon area at low level of entrepreneur's intellectual capital.

Figure 2 Diagram of Indicators Regarding the Intellectual Capital State on Entrepreneurial Structure

Graphical interpretation of the indicative analysis results regarding economic concepts, estimates, and calculations in practice contributes to a better perception and acceleration of obtaining both quantitative and qualitative values of indicators, which, in turn, plays an important role in the visual, operational, complex comprehensive assessment of the coherence of various factors that determine the status and prospects of the entrepreneur development.

The graph contains a lot of information, but its main advantage is that it gives a complete picture of the situation at the enterprise. The graph describes not only the current state of the entrepreneur, but also indicates the orientation of its development strategy. By having similar data on competing or related companies, you are able to compare yourself with others and evaluate your strengths and weaknesses, compare and match your capabilities with the capabilities of other companies. Also, by creating dynamics over the years, you can compare the status of the entrepreneur, as well as analyze the progressing or degrading entrepreneur is, identify and parry dangerous deviations from the normal condition.

As an example of assessing the intellectual level, we propose to consider a certain business entity, whose activity is characterized by a certain system of indicators (Table 1).

| Table 1 System of Indicators for Assessing the Intellectual Capital of the Entrepreneur (Example on the basis of Expert Evaluations) | ||||||

| Indicators | Indication of the indicator | The value of the indicator at a high level of intellectual capital, % | The level of intellectual capital indicator | |||

| High | Average | Below average | Actual | |||

| The ratio between the market value and the balance value of the entrepreneur | k1 | 1000 | 1 | 0.39 | 0.23 | 0.82 |

| Stability of intellectual labor | k2 | 94 | 1 | 0.83 | 0.71 | 0.92 |

| Share of new products in amount of total sales | k3 | 90 | 1 | 0.49 | 0.31 | 0.8 |

| R&D share in the amount of work | k4 | 20 | 1 | 0.51 | 0.22 | 0.91 |

| The employees` attitude to the entrepreneur | k5 | 90 | 1 | 0.69 | 0.44 | 0.94 |

| Estimated cost of database change | k6 | 100 | 1 | 0.49 | 0.25 | 1 |

| Working capital turnover | k7 | 600 | 1 | 0.58 | 0.41 | 0.91 |

| The ratio of sales to non-production costs | k8 | 90 | 1 | 0.74 | 0.42 | 0.91 |

| Level of customer satisfaction | k9 | 90 | 1 | 0.81 | 0.3 | 0.95 |

| Trademark loyalty | k10 | 80 | 1 | 0.62 | 0.33 | 0.91 |

| Customer stability | k11 | 80 | 1 | 0.52 | 0.32 | 0.91 |

Indicators k1,k2,k3,k4,k5 are the measures of human capital; k6,k7,k8 – structural capital; k9,k10,k11 – measures of consumer capital (Tabachnick et al., 2007).

For integral assessment of intellectual capital the values of indicators are standardized: the indicators values corresponding to a high level of intelligence, taken as a unit, however, the mean values of the intelligence indicators and the values of the actual status are calculated in fractions for that unit. This is a principled authorial position.

Then, for instance, the standard of stability of the intellectual cadre of a highly efficient entrepreneur (taking into account natural migration, decline, personal circumstances, etc.) is equal to, for example, 94%, which corresponds to the higher estimation of the entrepreneur's intelligence, “1” on a scale from 0 to 1. The average level of intellectual capital corresponds to the value of personnel stability on this scale with the value of 0.85 (the stability of the entrepreneur's personnel is 93% ? 0.87 = 80.1%), below the average - 0.71 (66.1%), and the actual stability corresponds to the value 0.94 (90.2%) on the scale.

Each company must independently define its system of indicators for calculating intellectual potential and defining the strategy of development, due to the specifics of its activity and the individuality of the personnel organization. For the purpose of sustainable development, in the self-interest of the entrepreneur and sometimes for the sake of survival, it is necessary to be able to give self-esteem to the own potential and, first of all, to the intellectual potential, what is more, to compare its possibilities with the needs of the market (Ramezan, 2011; Tatiana et al., 2018).

While noting the uniqueness of this approach, we should highlight its positive aspects, such as complexity and clarity. At the same time, it is necessary to point out the following significant disadvantages. First, the use of expert polling method to assess intellectual capital is quite subjective, secondly, the indicators used for the assessment (Table 1) are of different nature and their significance in the complex assessment varies, moreover, the list of indicators does not reflect the objective picture of the intellectual capital usage on the enterprise Third, the adoption of a complex indicator of the polygon area (Figure 2) cannot reflect the adequate state of intellectual capital and the efficiency of its usage, since the indicators and, respectively, the sides of the polygon are not comparable.

An important methodological issue regarding the creation of a system for assessing the efficiency of the entrepreneur's intellectual capital formation is to change approaches in the perception of R&D costs from spending to investment. Comparison of data is extremely important for evaluating the efficiency of the intellectual capital formation obtained in the entrepreneurial environment (as a result of the mentioned indicators calculation) not only during the previous period, but also with similar indicators in the external environment.

Comparison of the results obtained by a certain entrepreneurial unit with similar indicators of competitors allows evaluating the efficiency level of the intellectual capital formation from the point of view of its socially necessary level.

Recommendations

The organizational and economic mechanism of intellectual capital formation in the entrepreneurial activity allows overcoming the destructive influence of private property, which due to the classical provisions of economic theory, causes the contradiction between the producer and the owner on the means of production. We consider this possible because personalized intellectual capital, as a means of production, is linked to its carrier and moves from the category of private property to the category of personal property of the entrepreneur. These provisions may receive further research and guidance on understanding the role of intellectual capital in entrepreneurship. Thus, the most important feature of the organizational and economic mechanism of the entrepreneur's intellectual capital formation, in the subsystem of management of personalized intellectual resources, is the elimination of the traditional political and economic contradiction between the producer, the owner of the means of production and the results of labor.

Conclusions

It was proved that the effectiveness assessment regarding the formation of intellectual capital is basic for making appropriate commercial decisions and ensuring the process of self-regulation of the organizational and economic mechanism, also, it allows to influence effectively the current state and tendencies of the intellectual capital development, what is more, to set directions and scope of entrepreneurial actions and initiatives. Assessing the formation effectiveness of the personalized intellectual capital is a fundamental element of the overall evaluation system. In this aspect, we propose a system a system of performance indicators for the formation of personalized intellectual capital, which involves directing the entrepreneur to an intensive way of development and achieving a high level of efficiency in dynamics. It was determined that client capital is manifested through a steady positive attitude of clients to the entrepreneur and (or) its products, which is a means of generating additional income, also, it gives additional advantages in the market, on the basis of which a system of efficiency estimation of client capital formation is developed, which allows to carry out complex assessment regarding the current state of client capital.

References

- Acs, Z., Åstebro, T., Audretsch, D., & Robinson, D.T. (2016). Public policy to promote entrepreneurship: a call to arms. Small Business Economics, 47(1), 35-51.

- Andriessen, D. (2007). Designing and testing an OD intervention: reporting intellectual capital to develop organizations. The Journal of Applied Behavioral Science, 43(1), 89-107.

- Baumol, W.J. (2002). Entrepreneurship, innovation and growth: The David-Goliath symbiosis. Journal of Entrepreneurial Finance, 7(2), 1-10.

- Burr, R., & Girardi, A. (2002). Intellectual capital: More than the interaction of competence x commitment. Australian Journal of Management, 27(1_suppl), 77-87.

- Drobyazko, S., Blahuta, R., Gurkovskyi, V., Marchenko, V., & Shevchenko, L. (2019a). Peculiarities of the legal control of cryptocurrency circulation in Ukraine. Journal of Legal, Ethical and Regulatory Issues, 22(6), 1-6.

- Drobyazko, S., Makedon, V., Zhuravlov, D., Buglak, Y., & Stetsenko, V. (2019b). Ethical, technological and patent aspects of technology blockchain distribution. Journal of Legal, Ethical and Regulatory Issues, 22, 1-6.

- Green, F. (2013). Skills and skilled work: An economic and social analysis. Oxford University Press.

- Joia, L.A. (2007). Strategies for Information Technology and Intellectual Capital: Challenges and Opportunities. Information Science Reference.

- Lim, L.L., Chan, C.C., & Dallimore, P. (2010). Perceptions of human capital measures: from corporate executives and investors. Journal of Business and Psychology, 25(4), 673-688.

- Mitchelmore, S., & Rowley, J. (2010). Entrepreneurial competencies: a literature review and development agenda. International journal of entrepreneurial Behavior & Research, 16, 92-111.

- Ramezan, M. (2011). Intellectual capital and organizational organic structure in knowledge society: How are these concepts related?. International Journal of Information Management, 31(1), 88-95.

- Sarasvathy, S.D. (2001). What makes entrepreneurs entrepreneurial?. Harvard Business Review, 21, 1-9.

- Singh, S., & Kansal, M. (2011). Voluntary disclosures of intellectual capital. Journal of Intellectual Capital, 12(2), 301-318.

- Tabachnick, B.G., Fidell, L.S., & Ullman, J.B. (2007). Using multivariate statistics. Boston, MA: Pearson.

- Tatiana, U., Ludmyla, G., Iryna, T., Olga, D., & Ludmila, S. (2018). Economical Self-Sufficiency of a Territorial Community as a System Characteristic of Its Self-Development. Academy of Strategic Management Journal, 17(5), 1-8.

- Tkacheko, S., Shatskaya, Z., Dashchenko, N., Mu, J., & Malakhovsky, Y. (2019). Organizational maintenance of internal control of electronic money at the enterprise. Academy of Accounting and Financial Studies Journal.

- Watson, A., & Stanworth, J. (2006). Franchising and intellectual capital: A franchisee’s perspective. The International Entrepreneurship and Management Journal, 2(3), 337-349.