Research Article: 2019 Vol: 23 Issue: 3

Prospecting for Structure Capital: Proactive Strategic Innovation and the Performance of Manufacturing SMEs in Yemen

Zakaria Bin Abas, University Utara Malaysia

Sany Sanuri Mohd Mokhtar, University Utara Malaysia

Abstract

The implications of strategic innovation for the performance of SMEs have attracted major interest among practitioners and academics. However, empirical studies on the relationship between strategic innovation and performance mediating structure capital have not yet been examined, and it is this significant theoretical gap which this paper will fill. The study also contributes by proposing and developing a framework underpinned by Contingency Theory. Our PLS analysis reveals that strategic innovation is significantly associated with SME performance, and that the relationship between strategic innovation and SME performance is significantly mediated by structure capital. In this dynamic business world, SME managers should invest in and fully utilize strategic innovation and structure capital to achieve a high level of performance and competitive advantage.

Keywords

Strategic Innovation (SI), Structure Capital (SC), Yemeni SMEs, Performance.

Introduction

The business environment in the 21st century is characterized by enterprise prosperity and growth that largely depend on the structure of the company and its relationship with customers and their overall level of satisfaction. This premise is supported by several studies, including those by Kumar et al. (2017); Laszlo & Cescau (2017); Kymabalesa (2017), Schutz (2016); Skene & Murray (2017).

Coupled with this are the dynamic changes occurring in the global business environment, that urge organizations to adopt innovative strategies to obtain and maintain their competitiveness (Omari, 2017; Avila et al., 2016; Yang, 2015; Apak & Atay, 2014; Morabito, 2015). It has long been accepted that strategic innovation (SI) has an expansive coverage that encapsulates the development and inclusion of new technologies into services/products and beyond (Afuah, 2009). In relation to this, the implementation of innovative business models, both evidence- and result-oriented, can bring about the changes in the dynamic business environment efficiently.

There is also a demand for increasing strategic innovation to address the rapid changes in the global market (Sriboonlue et al., 2015; Derrick & Soren, 2007). In fact, strategic innovation enables the effective achievement of the needs of customers and keeping abreast of rivals, capitalizing on strategic market opportunities and consistently matching the strengths of the organization with the opportunities found in the market (Chen & Shanxing, 2017). Consequently, a majority of authors have proposed the role of strategic innovation in the determination of organizational success (Yang, 2014; Akinwale et al., 2017; Soto-Acosta et al., 2016).

Hence, strategic innovation is deemed to be one of the major competitive advantages to be achieved by 21st century organizations for successful ventures (Apanasovich et al., 2016). Specifically, SMEs are searching for methods to improve their capability in effectively developing innovations (Isaga et al., 2015) because this is viewed as a success factor among small market players in a dynamic and competitive global environment. Following this line of argument, innovative and competitive SMEs have been evidenced to be related to the economic growth of developing nations.

Generally speaking, SMEs have a key role in driving current economies, with the consensus on the need to examine their functioning. In the context of developing nations like Yemen, there is cognizance in both sectors (private and public) of the significance of SMEs in the growth of the economy, facilitating employment, social cohesion and the development of local communities. In fact, Yemen has a very large number of SMEs operating in the manufacturing sector, with over 485,000 employees, and a contribution of over 7.2% to GDP (Yemeni Ministry of Industry & Trade, 2017; Al-Swidi & Mahmood, 2011; Ministry of Planning International Cooperation, MOPIC, 2004).

Added to the above, according to the Yemeni Ministry of Technical Education and Vocational Training (2016), with reference to the national development of manufacturing SMEs, intellectual capital poses the topmost challenge to performance enhancement, taking the form of lack of equality structure capital, and lack of knowledge about the structure of organizations, markets and customers.

This view is similar to that presented by the World Bank (2015) and Sky News (2012) that the most common reasons behind failed businesses in Yemeni manufacturing industry are the lack of competitive ability, poor management competency and lack of a skilled and experienced workforce. The World Bank (2015) also commented that the lagging performance of private manufacturing industries is the core of the country’s weak and slow growth. This holds true for many countries in the Middle East, including Jordan, Kuwait, Sudan, Iraq and Egypt, as evidenced in several studies: Dzenopoljac et al. (2017); Marwa (2014); Al Domoor (2013); Ebtisam (2013); Naseba (2012); Bontis (2004); Seleim et al. (2004); Lin & Edvinsson (2010); Sharabati et al. (2010).

This article is an exploratory case study of the performance of Yemeni manufacturing SMEs in light of the adoption of strategic innovation. Many studies have been carried out on innovation in Asian and European countries, but despite the area’s distinctive culture and economic conditions, research focused on Middle Eastern countries, particularly Yemen, is still lacking. Therefore, the present study attempts to bridge this gap in the literature. It is pertinent for Yemen to transform its economic structure from solely agricultural one to one exporting commodities.

In this regard, the World Bank (2015) revealed that Yemen has lagged behind in its uptake of an entrepreneurial approach to business and industry, as a result of which the country is facing intense international competition in terms of the price and quality of its products. Yemeni SMEs are therefore forced to bring about changes that can influence different operational aspects, processing efficiency, reorganization of management, new products/services development and new market ventures in order to meet customer needs and wants. Such activities are all related to innovation (Yemeni Ministry of Industry & Trade, 2017; OECD, 2017).

According to the Global Innovation Index (2015), Yemen took 137th position in the global ranking of innovation capability, improving in 2016 to 128th and in 2017 to 127th (Global Innovation Index Rankings, 2015, 2016, 2017). The entire Yemeni businesses play a core role in the economic growth of the country and have considerably reduced the rate of unemployment and helped in the rebuilding of the economy. The government of Yemen has been cognizant of the importance of SMEs and, as such, it has provided consistent assistance; however, regardless of this assistance, their rate of adoption of strategic innovation is still lagging (Yemeni Ministry of Industry & Trade, 2017).

This can be attributed to the ad hoc government assistance that has been based on plans and activities that have not been well researched when it comes to the adoption of innovation specifically for Yemeni SMEs. Therefore, this paper aims to assist policy makers and managers in Yemeni SMEs to obtain a better insight into the innovation processes in business, to boost their adoption of innovation.

It is evident that the main gaps in the literature stem from the limited number of studies that have examined the relationship between strategic innovation and the performance of SMEs (Oh et al., 2015; Muhammad, 2014) or that have provided information on individual intellectual capital components (structural capital) and their influence on the performance of Yemeni SMEs. This may be because past studies have failed to examine structural capital’s mediating role in the relationship between strategic innovation and SMEs’ performance, particularly in Yemeni manufacturing industry. Therefore, the present study is an attempt to close this gap.

Literature Review

Strategic Innovation and Structure Capital

Innovation is a word that originated from the Latin word “innovare”, meaning to make something new or to bring about changes to the current product or service (Gandotra, 2010). The premise behind the innovation concept concentrates on the creation of new results to assist business to become competitive and enhance their performance (Chahal & Bakshi, 2015). Moreover, the objective behind strategic innovation goes beyond product/technology innovation encapsulating values by adopting a strategy that involves the whole set of organizational activities and systems (Chen & Shanxing, 2017).

According to Drucker (2014), discovering new market avenues does not always involve fresh product/technology invention, but creating a new business model that has a strategic relationship with the value offerings to meet market demand. With the operations of organizations based on a business model, the value offered to customers is defined (Drucker, 2014).

In this regard, Charitou & Markides (2002) defined strategic innovation as an innovation adopted in a business model that can result in novel ways of playing the game in the market. In other words, strategic innovation can take place in the product/process or the organization. As for the structural capital-innovation relationship, firms possessing a robust structural capital will have a higher tendency to create positive conditions within which human capital is effectively used to its full potential, in order to ultimately enhance the innovation capital of the firm.

Firms with higher SC levels are also more inclined to promote higher innovation levels (Wu et al., 2008). This shows that SC is able of improving the level of a firm’s innovation. Along similar lines, Dost et al. (2016) showed that SC has a positive influence over the adoption of innovation and its creation structural capital interaction thus contributes to the influence of SC on its adoption. However, human capital was found not to have any significant influence over the generation of innovation.

In a similar recent study, Allameh (2018) revealed that the outcomes of PLS-SEM analysis showed that knowledge sharing positively influences SC which, in turn, eventually promotes innovation. Dumay et al. (2013) reported that innovation success arises when riskaverse decision-making behaviors are present, requiring various management practices according to the type of innovation (radical, evolutionary or incremental). The authors also reported 12 factors that drive innovation processes and have the potential to contribute to innovation success. Other authors have examined the relationship between innovation and intellectual capital; for instance, Subrahmaniam & Youndt (2005) contended that from the three components of capital, structural capital has a key role in innovation capabilities and superior business performance. Innovation is the driver behind the development of new technologies and structures, which are brought about by enhanced SC; as a result, this assists in the creation of value and in maintaining an optimum market niche and position.

With the advent of globalization, competitiveness among firms has increased with the accelerating pace of technological developments. Meanwhile, SC, being the core of corporate responsibility, assists cooperative arrangements in the form of equity-based joint initiatives and joint marketing. Innovation assists firms to improve their R&D, the introduction of new products to the global market, and mitigating costs. Specifically, the innovation idea is a crucial driver for dynamic capabilities that lead practitioners and authors to focus on the competitive advantage of firms.

Furthermore, according Donaldson, (2001) Contingency Theory argues that innovation depends on the level of contingencies available. Against this background, incremental innovation may have a simpler nature, but technology existing in the organization may be unable to tackle new tasks. This necessitates the development of new strategies to deal with the constantly changing contingencies. Normally, this would result in the assumption that incremental innovation would be viewed as an internal issue, while radical innovation would be viewed as both internal and external when it comes to contingencies. This testing of organizations could result in various structures and practices, ultimately instigating and incorporating different strategic structures to match the overall fit of the environmental contingencies. Under the same concept, organizations would select supply chain partners based on the new strategic orientation; for the leveraging of contingencies (internal or external), organizations may utilize suppliers as contingency solutions.

Against the above background, firms that are able to determine their environment/market direction through interaction with customers and suppliers can configure their resources and needs to meet new market demands and obtain competitive advantage. Along with a firm’s physical, human and organizational resources that enable it to access and manage inimitable and rare resources, competitive advantage may also be obtained in the ever- changing global environment. It is therefore proposed that:

H1: Higher levels of SI can lead to higher levels of SC in the performance of SMEs.

Strategic Innovation and SME Performance

Strategic innovation is an important way to achieve higher performance (Talke et al., 2011). It is a situation whereby companies succeed in attacking a big market leader, which ultimately leads to an increase in profits (Yang et al., 2012). Afuah (2009) believes that the game of competition is driven by companies following well-defined traditional approaches to the market.

According to Sniukas et al. (2016), strategic innovation leads to improved performance through new business models that offer greater value to customers. Previous studies have investigated the relationship between innovation and performance. For example, Kalay & Lynn (2015) investigated the relationship between strategic innovation and innovation performance among manufacturing firms in Turkey and found a significant association. In addition, Lilly & Juma (2014) investigated the relationship among commercial banks in Kenya and found a significant relationship in the study population. Karabulut, (2015) investigated this relationship in manufacturing firms in Turkey and found a significant positive association. Kumar et al., (2012) investigated the impact of innovation on performance among SMEs and large companies in Italy; they also found a significant association between strategic innovation and performance.

However, according to Rosenbusch et al. (2011), several studies have reported that innovation does not affect performance (Birley & Westhead, 1990), while others have identified negative performance implications in innovation (McGee et al., 1995). Many other researchers believe that enterprises can only survive and develop through continuous innovation (Wu et al., 2016, Hill & Rothaermel, 2003; Soderquist et al., 1997).

In the Yemeni context, the performance of manufacturing firms is very low (World Bank, 2015; Abdulmalek & Mohd, 2016), partly as a result of very low innovation in the country. According to the Global Innovation Index (2014, 2015, 2016, 2017), Yemen was ranked 141, 137, 128 and 127 globally in successive years, indicating very little innovation activity. Based on previous studies that found significant relationship between strategic innovation and performance (Kalay & Lynn 2015; Lilly & Juma, 2014) and in line with the Global Innovation Index and the fact that previous studies in Yemen have not investigated the influence of strategic innovation on performance, this study hypothesizes as follows:

H2: Higher levels of SI lead to a higher extent of SME performance in the organization.

Structure Capital and SME Performance

Structure capital is a concept that is linked to the structure and systems of the organization, elements that support the productivity of employees but remain with the company even after an employee leaves (Wang et al., 2014; Edvinson & Malone, 1997). Structural capital is frequently described as the culture of the organization that furnishes an aligned perception of things, decision-making processes and value systems (Itami, 1987). It represents the gathered intellectual resources of the firm (Secundo et al., 2016), including knowledge, products, internal procedures, routines, capabilities and components of technology and also intellectual characteristics as explained by Bueno et al. (2014); Leitner (2004); Sanchez (2008).

Performance is thus considered as the most important dependent variable in management (Naala, 2016), with the majority of financial and non-financial factors utilized for its measurement (profit, profitability, return on sale (ROS), return on asset (ROA), return on equity (ROE), return on investment (ROI) and growth of revenue). Other authors also utilized market share and growth of sales, including Mokhtar et al., (2014), Parnell & Wright (1993), Thomas & Ramaswamy (1996); Snow & Hrebiniak (1980). The Balanced Scorecard Model was introduced by Kaplan & Norton (1992) to guarantee a rational interpretation of performance measurement that provides a description of the influence of learning, growth, activities of businesses and clients.

The performance of 34 life insurance firms in China, in the period spanning 2006 to 2010, was investigated by Lu et al. (2014). The results of their regression analysis indicated that structural capital has a significant positive relationship with the operating efficiency of firms. These findings support the results reported by prior studies, that SC can be profitable source in the dynamic market place. The authors recommended management of life insurance firms to leverage and use SC in order to obtain and maintain competitive advantage. Similarly, Liu (2017) looked into the influence of SC attributed to the overall performance relationships among cultural and creative organizations (CCOs) in Taiwan and the findings showed significant relationships.

A significant direct relationship between SC and performance was also evidenced by Sharabati et al. (2010), while Zerenler et al. (2008) examined the SC-innovation performance relationship and revealed that the former contributes to enhancing the services/products features. Other authors reported that innovation encapsulates the entire functional and operational activities that help in mitigating production costs, improving quality and methods of delivery, obtaining shares in the market, and achieving optimum performance (Gunday et al., 2011; O’Sullivan & Dooley, 2008).

Jardon & Martos (2009) attempted to test different models in the hopes of validating relationships between SC and performance in wood manufacturing SMEs in Obera, Argentina, their findings indicating a significant relationship. The same result was found for Thai manufacturing firms by Phusavat et al. (2011). They focused on the intangible assets among large manufacturing firms upon examining the SC effects on firms’ performance and operations. They found a positive and significant influence of SC on performance, impacting four performance indicators (ROE, ROA and revenue growth and employee productivity). This study was supported by Vishnu and Gupta’s (2014) study in the Indian context, which showed a positive SC-performance relationship among Indian firms.

In the context of social cooperative enterprises (SCEs) working in non-profit sectors, Bontis et al. (2018) hypothesized a positive relationship between SC and the economic and mission-based performance, and their findings supported a positive and significant one. They also found no significant influence of structural capital on social cooperatives’ performance. Inkinen (2015) tested whether SC affected firm performance and found that it does influence it via interactions, combinations and mediations. From the above, there is ample evidence pointing to a significant relationship between SC and innovation performance.

Furthermore, structural capital has been reported to make strategic contributions in the form of non-human assets of information systems, routines, procedures and databases, forming the core of the organization in its furnishing of tools and architecture needed to retain, package, and relay knowledge throughout the value chain (Cabrita & Bontis, 2008). Over recent decades, structural capital has been recognized as a core part of the growth and competitive strategies of the majority of organizations, assisting in strengthening firms’ competitiveness and increasing efficiencies in accessing required resources/capabilities (Rothaermel & Boeker, 2008), as well as bringing about entry to new markets (Wang et al., 2016).

In fact, the majority of studies have evidenced the relationship between innovation and structural capital, among them Uziene (2015); Marques et al. (2006); Agostini et al. (2017); Jordao et al. (2017). Specifically, structural capital comprises culture, infrastructure, information systems and procedures, that is the internal processes driving human capital and enabling productivity (Khalique et al., 2015; Salmador & Longo-Somoza, 2014; Uziene, 2015). In other words, the SC dimension of IC forms the backbone of any organization in its quest towards enhancing its performance (Ikinen, 2015; Diaz-Fernandez et al., 2015).

According to Bontis (1998), SC has become a key to the competitive success of both major companies and start-ups in a dynamic global market; so much so that SC learning has become significant as a component of long-term competitiveness (Kamukama et al., 2010). SC also furnishes a platform upon which the innovation capability concept can be based. It has two major elements, namely SC experience and organizational processes that enable firms’ profitability (Joshi et al., 2010). It is thus proposed that:

H3: Higher levels of SC lead to a higher extent of SME performance in the organization.

The Mediation Role of Structural Capital

Prior studies have described structural capital as processes, systems, procedures and practices that employee’s use (Wang et al., 2014; Ordonez de Pablos, 2004). The concept of SC is sometimes used synonymously with organizational capital, despite the fact that the former consists of institutionalized knowledge and codified experience stored in databases, routines, patents, manuals, structures and other storage systems (Cricelli et al., 2018; Bueno et al., 2014; Nazari & Herremans, 2007). Successful organizations have the right institutional culture and in this regard, researchers have extensively examined the relationship between institutional culture and optimum performance.

The direct relationship between SC and radical innovation performance was evidenced by Agostini & Nosella (2017). They also validated the mediating role of SC on the relationship between HC and radical innovation performance (RIP), and between RC and RIP. Also, innovation was found to fully mediate the relationship between SC and competitive advantage in Chahal & Bakshi’s (2015) study. Mediating and moderating evidence was reported by Sivalogathasan & Wu (2015); they found an influence on SC and innovation capability from motivation and organizational characteristics in the context of Sri Lanka’s textile and apparel industry. SC was found to have a significant positive association with innovation capability, with related mediating effects. Tseng et al., (2013) also examined the mediating role of business strategy between SC and financial performance; while SC significantly impacted business strategy and financial performance, business strategy partially mediated the relationship between SC and financial performance.

More importantly, structural capital is deemed to be a strategic asset that consists of nonhuman assets (information systems, procedures, routines and databases) and it is the core and glue that holds the tools and architecture of the organization together for retaining, packaging and relaying knowledge across the value chain (Cabrita & Bontis, 2008). Bontis (1998) referred to structural capital as the element that makes it possible to measure IC at the organizational level.

In the present study, the definition provided by Wang et al., (2016); Kamukama et al., (2010) is adopted: it refers to the concept as competitive intelligence, patents, policies, formulations, information systems and organizational culture that stem from a firm’s products/systems developed over time.

Bontis (1998) referred to IC as entailing the development of novel operational capabilities, as a result of which, it is deemed to be a crucial source of sustainable competitive advantage. In other words, business firms can make use of their dynamic capabilities to create structural capital and use it with innovation to promote high levels of performance and competitiveness (Coff, 1999). On the basis of the above discussion, it can be stated that structural capital with innovation is significant for corporate responsibility, mediating the SI- high performance relationship. As such, this study proposes the following hypothesis for testing:

H4: The relationship between SI and SME performance in the organization is mediated by SC.

Research Methodology

Survey Administration

This study adopted a cross-sectional and quantitative research design to examine the proposed hypotheses, and a sampling method to acquire data from which inferences can be made about the target population. The study sample consists of Yemeni manufacturing SMEs, obtained from the Directory of Small and Medium Manufacturing Companies (Yemeni Ministry of Trade & Industry, 2017), which lists 494 manufacturing firms of two regions in Yemen. The study gathered primary data by distributing questionnaire surveys to the general managers of these SMEs.

More specifically, the author chose the study population from two regions of Yemen, the total number calculated based on the formula established by Krejcie & Morgan (1970). With the population increase, the size of the sample also increases at a diminishing rate, after which it remains constant at 214 when the population lies between 480 and 500. The study made use of simple random sampling, by picking the firms’ names without replacement from the box until they reached 214. In other words, the unit of analysis in this study is the SME, with senior management being the unit of inquiry. Of 214 questionnaires distributed, 126 were retrieved, indicating a response rate of 58%.

From the many methods of data collection available, this study gathered primary data using questionnaires distributed to Yemeni manufacturing SMEs to be completed by their general managers. The questionnaire administration, according to Dillman (1991) should be effective as it will influence the response rate. This study thus utilized the self-administration of questionnaires. In this regard, quantitative research is invaluable in translating data from the survey into outcomes that are important for the development of research (Cooper et al., 2006). Therefore, the researcher distributed the questionnaire copies to the study sample by hand and retrieved them personally.

Moreover, the study adopted proportionate stratified sampling for the selection of the firms from the list of SMEs, as this type of sampling furnishes more information for a specific sample size (Sekaran & Bougie, 2016). Simple random sampling is widely used as each population member has an equal chance of being chosen (Norman & Fraenkel, 2000). This study thus used a proportionate stratified sampling for the selection of firms from each SME category, after which a random sampling technique was adopted to choose the final sample based on the size of the firms.

Variable Measurement

The items in the structured questionnaire were adapted from previous studies. The author tested for non-response bias by conducting a comparison between early and late responses, as suggested by De Winter et al., (2005). In addition to these tests, the univariate test of significance (t-tests) was also carried out, and no significant difference was found between the two respondent groups along the main constructs.

The construct of SME performance was explained through several subjective measures using nine items obtained from the literature: Gupta & Govindarajan (1984); Mokhtar et al., (2014); Kaplan & Norton, (1992). The respondents evaluated the performance of their firms over the past three years using ROI, sales volume, market share, sales growth, profitability growth, cash flow, new product development, research and development activates, and cost reduction programmers. The items were gauged on a 5-point Liker scale ranging from 1 (much lower) to 5 (much higher).

With regards to structure capital, this study adapted the view taken by Sharabati et al., (2010), in that the construct was measured by items that include: organization supports employees constantly, upgrading skills whenever necessary, employee influence decisions made by organizations, reward systems are developed related to performance, systems and procedures of organizations support innovation, work processes are developed, appropriate and sufficient budgets for R&D are developed. Meanwhile, the strategic innovation construct was measured by items adapted from Yang (2014) that covered product innovation, communication innovation, corporate financial innovation, material innovation, channel innovation, marketing innovation, inbound logistics innovation, outbound logistics innovation, operations innovation and technology innovation.

Data Analysis

The Measurement Model

Following the data collection process, the data was analyzed with the help of the Statistical Package for Social Sciences software (IBM SPSS v. 22) (Field, 2013), and partial least squares (PLS) with Smart PLS 3.0. PLS was chosen for its better convergence behavior representation even with small-sized samples, compared to covariance-based structural equation modeling (SEM), and that is, PLS converges and generates admissible solutions, unlike covariance-based SEM (Sarstedt et al., 2011). Also, PLS method is widely used and popular in global studies. Despite the simultaneous estimation of measurement and structural parameters, a PLS path modeling approach is analyzed and interpreted in two phases: why first, assessing the reliability and validity of the measurement model; and second, assessing the structural model (Hair et al., 2012).

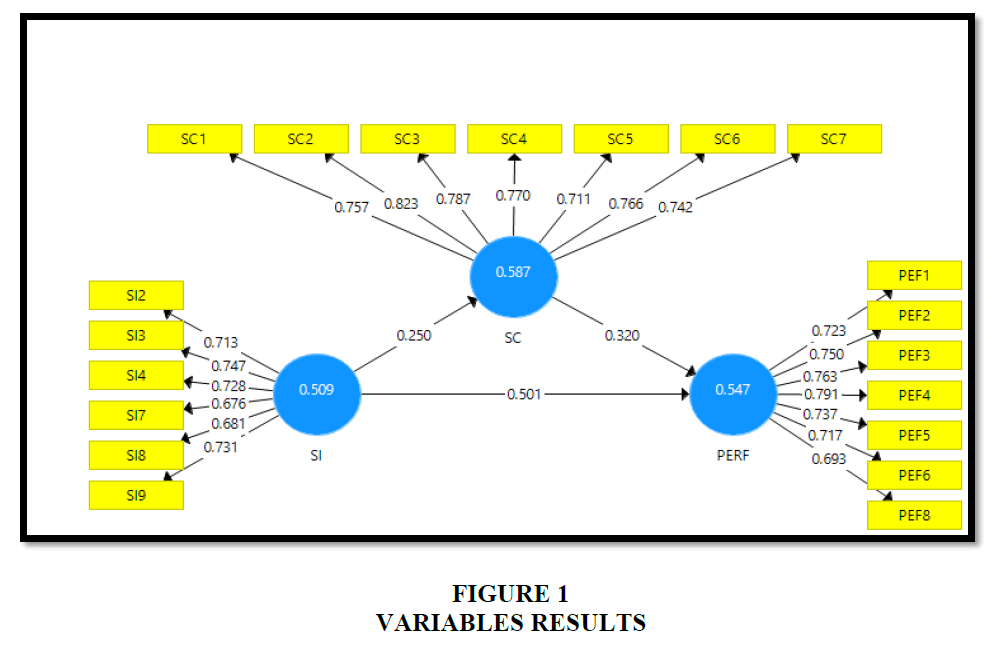

In the initial step of confirming the measurement scales’ reliability and validity, the composite reliability (CR) was obtained (Table 1); they indicate a very good level of internal consistency by the majority of the constructs (Hair et al., 2016). Both convergent and discriminant validity were assessed. The former refers to the representation of a set of items of one and the same underlying construct. In this regard, the average variance extracted (AVE) by Hair et al., (2006) was used as a criterion for convergent validity. AVE values should exceed 0.50, for different reflective items to explain at least 50% of the variance (Table 1). In addition, assessment of the individual item reliability examines the outer loadings of each construct measure (Hair et al., 2017). Hair et al. (2014) established the rule of thumb for retention of items as between 0.40 and 0.70. The results of the measurement model showed that 5 of 25 items were deleted because of out-of-range loadings; items were retained as their loadings ranged between 0.676 and 0.823 (Table 2).

| Table 1: Model Constructs | |||||

| Construct Reliability and Validity | |||||

|---|---|---|---|---|---|

| Composite Reliability | Average Variance Extracted (AVE) | 1 | 2 | 3 | |

| PERF | 0.894 | 0.547 | 0.740 | ||

| SC | 0.908 | 0.587 | 0.445 | 0.766 | |

| SI | 0.861 | 0.509 | 0.581 | 0.250 | 0.713 |

| Table 2: Measurement Results | |||

| Cross Loadings | |||

|---|---|---|---|

| PERF | SC | SI | |

| PEF1 | 0.723 | 0.269 | 0.442 |

| PEF2 | 0.750 | 0.432 | 0.468 |

| PEF3 | 0.763 | 0.414 | 0.444 |

| PEF4 | 0.791 | 0.368 | 0.481 |

| PEF5 | 0.737 | 0.221 | 0.402 |

| PEF6 | 0.717 | 0.267 | 0.364 |

| PEF8 | 0.693 | 0.276 | 0.387 |

| SC1 | 0.328 | 0.757 | 0.185 |

| SC2 | 0.401 | 0.823 | 0.207 |

| SC3 | 0.373 | 0.787 | 0.163 |

| SC4 | 0.374 | 0.770 | 0.273 |

| SC5 | 0.275 | 0.711 | 0.166 |

| SC6 | 0.307 | 0.766 | 0.181 |

| SC7 | 0.301 | 0.742 | 0.144 |

| SI2 | 0.395 | 0.289 | 0.713 |

| SI3 | 0.446 | 0.194 | 0.747 |

| SI4 | 0.533 | 0.168 | 0.728 |

| SI7 | 0.263 | 0.123 | 0.676 |

| SI8 | 0.312 | 0.089 | 0.681 |

| SI9 | 0.442 | 0.165 | 0.731 |

For discriminant validity, AVE can be obtained in such a way that the square root of AVE (diagonal) is tested if it is higher than the correlation between latent constructs in the model (off-diagonal), as demonstrated by Sarstedt et al. (2011). This criterion was met by all model constructs (Table 1). The study also mitigated common method bias through the following ways: protecting respondent anonymity, and taking care that the items measuring the dependent variable were not closely associated with the independent variable, as suggested by Podsakoff et al., (2003); Conway & Lance, (2010).

The study also ran Harman’s single-factor test on the basis of principal component analysis (PCA) (Meade et al., 2007; Podsakoff et al., 2003). The top component constituted 0.31.26 % of the variance, indicating the absence of common method bias. Also, consistent with Podsakoff et al. (2003) study, a partial correlation method was calculated, wherein the first PCA factor was entered into the PLS model as a control variable for performance (dependent variable). This control factor covers the top approximation of common method variance, being a general factor loaded on by the rest of the variables. The results however did not reflect changes in the explained level of variance (Figure 1).

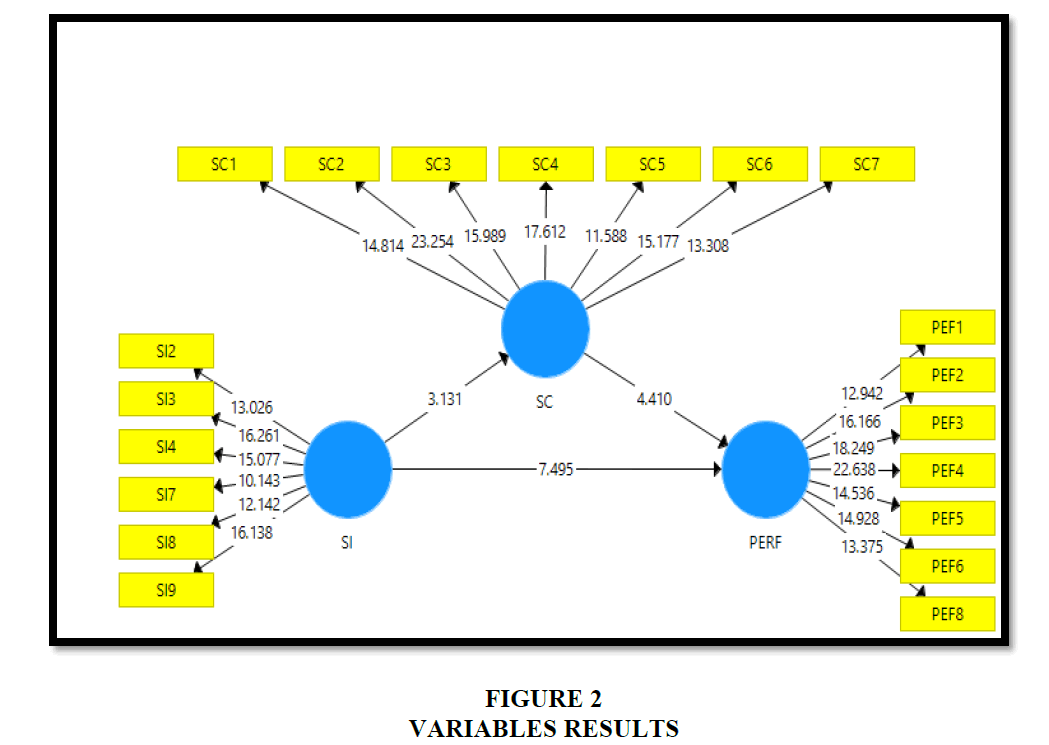

The Structural Model

In order to examine and test the proposed study hypotheses, the structural model was designed. First, the significance of the weighting was done through the bootstrapping method, which consists of producing a significant number of sub-samples from the initial sample, by the systematic deletion of observations. The assumed mediating influence illustrated by Baron & Kenny (1986); non-parametric bootstrapping by Simar & Wilson, (2000) was used. In Figure 2, (a) is the total effect of social capital on performance; (c) is significant, without any mediating effects (Baron & Kenny, 1986). For testing the mediating hypothesis, the Sobel test (Sobel, 1982; Sobel, 1986), also referred to as the product-of-coefficients approach, can be used (MacKinnon et al., 2002).

Therefore, in this study, as suggested by Simar & Wilson, (2000); Hayes et al. (2011), the non-parametric bootstrapping method was utilized for the evaluation of the mediating effects. The weights means are compared with those of the initial weights and the path coefficients and its product were multiplied for 500 samples, with a 97.5% confidence interval. Table 3 tabulates the results of the direct and indirect effects.

| Table 3: Results Of The Direct And Indirect Effects | ||||||

| Relationships | Confidence intervals | |||||

|---|---|---|---|---|---|---|

| Std Beta | Std. Error | t-values | p-values | LL | UL | |

| SC-PER | 0.320 | 0.073 | 4.410*** | 0.000 | 0.165 | 0.469 |

| SI-PER | 0.501 | 0.067 | 7.495*** | 0.000 | 0.372 | 0.623 |

| SI-SC | 0.250 | 0.080 | 3.131*** | 0.002 | 0.060 | 0.387 |

| SI -> SC -> PERF | 0.080 | 0.035 | 2.286** | 0.023 | 0.026 | 0.163 |

| *p <0.05; **p <0.01; ***p <0.001 | ||||||

Based on the results obtained, four hypotheses indicated showed no significant changes in the confidence interval which, according to Hayes et al., (2011), indicates that five hypotheses went beyond the minimum level as reflected by the t-distribution with a one-tailed test (n-1, where n=the number of resamples), the degrees of freedom (Table 3).

From the results, it is evident that the predictor variable has a significant impact on performance, without the mediating effect (Table 3). However, after entering the mediator into the model, the path coefficient c’ reduce from 0.581 to 0.501 indicating that there is a partial mediation effect. For assessment of the model quality, this study conducted several tests, the first of which is Chin’s (1998) goodness of fit in PLS estimation. This is illustrated by the significant factor loadings or correlations, and significant path coefficients (greater than 0.2) and high values of R2. In fact, the main criterion of inner model assessment is R2 (coefficient of determination) as it represents the level of variance explained of each endogenous latent variable (Hair et al., 2017). In the present study, the total variance explained by each endogenous construct is 42% (performance). Such values meet the least R2 value (10%) of the endogenous variables established by Hair et al., (2016). Using the blindfolding and jack knife re-sampling techniques, the model’s predictive power was tested through Stone-Geisser’s Q2, cross-validated index as recommended by Chin (1988). There are two types of index, namely, the cross-validated redundancy index and cross-validated communality. The Q2 values of the entire latent constructs exceeded zero, which confirms the model’s predictive relevance.

Discussion

Previous work long concluded that there is a positive relationship between SI and performance, but the question of what contributes to the accomplishment of SI in the era of the dynamic environment remains to be answered. The current paper therefore explores the SI and performance relationship and incorporates the significance of SC in the Yemeni context. It developed a framework that allows for a mediating impact. The results show that SI positively affects SME performance, and that SC acts as a mediator.

The current research also contributes to three areas of the literature. First, it explained how the impact of SI is perceived. Despite rich research on SI and its impact, scholars seldom explored how it is realized and rarely identified SC from among firm’s capabilities. In a dynamic environment, it is difficult to demonstrate from the SI perspective why some firms can efficiently respond to rapid changes in the environment, while others go bankrupt. This study confirms the previous static research into the disorderly environment and explores how and when SI is related to SME performance from a SC capability perspective. The empirical findings showed that SI is positively related to SME performance, and that SC mediates the relationship; this explains the mechanism of the influence of SI on SME performance.

Second, the current study clarifies the role that SC plays in the relationship between SI and SME performance. While previous studies were inconclusive on whether SC is a mediator, the findings of the current study support a mediating role, indicating that SC transforms the usefulness of SI on SME performance. Third, the results increase our understanding of the impact and mechanism of SI in a unique context, Yemen. Most of literature considers companies in developed economies, which may not be fully applicable to emerging economies (Abubakar et al., 2018; Story et al., 2015). The results of the current paper therefore have useful implications for organizations aiming to achieve a high level of performance and compete with other countries’ products, especially to meet local customers’ requirements.

Additionally, strategic innovation and firm performance reflects an overview of the entire organization. Based on Contingency Theory, decisions made by the organization influence its structures, following the input-transformation-output cycle according to what the organization is based on. That is, the core competencies resulting from the decisions of the organization become its structures and practice (Lawrence & Lorsch, 1967; Drazin & Van de Ven, 1985; Fisher, 1998).

Contributions, Limitations And Future Research

The current research relies on contingency theory and examines the synergistic impact of several constructs on SME performance. Specifically, it hypothesizes that SI and the resources embedded in it are very important and affect the strength of the relationship with SC; this, in turn, affects SME performance. The findings are relevant to marketing perspective and practice. From a theoretical perspective, the contribution of this paper lies in the affirmation of the synergistic influence of SI, SC and SME performance. Thus, the study concludes that the SI and SME performance relationship is better understood with the mediation of SC. Second, the current study confirms that SI and SC have an important effect on SME performance. This is a significant finding in the sense that SI and SC orientation by SME managers may improve the productivity of their firms, particularly in developing countries such as Yemen and the Middle East.

Limitations of the study are that varied findings arise from the research methodology used to measure SI, SC and SME performance. Although the constructs have been defined as precisely as possible from the instruments used in previous studies, this work takes into consideration questions that are closely linked to firms which appropriately represent every variable.

The current study examined manufacturing SMEs. Future research could involve large firms and a larger sample size with multiple respondents, and the service sector. The study employed quantitative approach, but future research could focus on a qualitative research design. While this study focuses on SC as the mediator between strategic innovation and SME performance, future research could address other dimensions of intellectual capital, e.g. innovation capital.

Future studies might examine the multi-dimensional nature of the performance of SMEs and the association with both SI and SC, specifically through testing the proposed hypotheses using sequential methods to meet distinct objectives. Lastly, after the recent tendency in research circles to examine the complex SI-SC relationship, it would be valuable to shed light on the new contingency relationships, considering the classic variables (environment, strategy, structure) and those that are relationship-specific between SI and development activities.

Conclusions and Recommendations

It is possible for organizations to consider strategic innovation as a managerial technique to achieve better performance over a period of time. Also, innovation should be viewed as complementary to the cumulative innovation paths through which human resource management practices can be based. Hence, strategic innovation can be merely seen as a trend of technology as it is capable of providing a common resource upon which a robust competitive advantage can be developed by the organization. Added to this, it is pertinent for managers to establish strategic innovation and structure capital practices for the promotion of innovation capabilities and enhancement of performance. Managers should be cognizant of the logical sequence between structural aims and innovation aims, to be able to shift from innovation approaches to continuous learning approaches.

This study addresses the debate concerning the relationship between SI and firm performance practices. Theoretically, arguments in favor of the relationship have been presented, although specifically based on theoretical evidence; achieving performance in innovation requires the firm’s SC, which in turn limits its scope to the achievement of customer satisfaction, and the outcome could influence business operations and institutional performance. Moreover, based on current trends, the continuous high-performance concept is synonymous with the strategic innovation principle of continuous improvement. Accordingly, it can be assumed that management models that are centered on strategic innovation boosts firm performance in structural capital, the combination of which relates to the principles of continuous improvement and customer-centered practices.

On the basis of empirical evidence, the relationship between SI and SME performance has produced significant results and thus, through this article, this relationship is explained in a different light. The study showed identical effects of SI on firm performance and the proactive contribution of the relationship between strategic innovation-based structure capital practices in the development of firm capital. In this regard, the institutional view provides the basis for the performance of the firm, in that a mechanism has to be adopted to transform SI to firm performance. This concept of a mechanism has its basis in the contingent/strategic fit technique. Despite its appearance in limited theoretical works on the relationship between SI and performance, the relationship between innovation and performance, with structural capital as a mediating variable, has not been tested in prior studies.

References

- Acs, Z.J., Laszlo, S., & Ainsley, L. (2008). The global entrepreneurship index. Washington, D.C., USA.

- Al-Abd, Y., & Mezher, T. (2014). Toward building a national innovation system in UAE. Masdar Institute of Science and Technology, Abu Dhabi, 2014.

- Hawila, D., Kennedy, S., Mondal, A., & Mezher, T. (2014). Renewable Energy Readiness Assessment for North

- African Countries. Renewable and Sustainable Energy Reviews, 33, 128-140,

- Isenberg, D.(2011). The entrepreneurship ecosystem strategy as a new paradigm for economis policy: Principles for cultivating entrepreneurship. Babson Global.

- Kenton, W. (2018). Startup Investopedia, March 2018. Available: https://www.investopedia.com/terms/s/startup.asp.

- Mason, C., & Brown, R. (2013). Entrepreneurial ecosystems and growth oriented entrepreneurship. OECD, Netherlands.

- Mezher, T., El-Saouda, R., Nasrallah, W., & Al-Ajam, M. (2008). Entrepreneurship in lebanon: A model for

- successes. International Journal of Arab Culture, Management and Sustainable Development, 1(1), 34-52.

- Mohammed Bin Rashid, (2017). He Launches Five-Decade Government Plan 'UAE Centennial 2071'," The United Arab Emirates Cabinet.

- Mondal A., Kennedy, S., Hawila, D., & Mezher, T. (2016). The GCC countries re-readiness: strengths and gaps

- for development of renewable energy technologies. Renewable and Sustainable Energy Reviews, 54, 114-128.

- National Innovation Strategy, (2013). The government of the united arab emirates. Available: https://government.ae/en/about-the-uae/strategies-initiatives-and- awards/federal-governments-strategies-and-plans/national-innovation-strategy.

- Rangaa, M., & Etzkowitz, H. (2013). Triple helix systems: An analytical framework for innovation policy and practice in the knowledge society. Human Sciences and Technology Advanced Research Institute, Stanford CA.

- Ranga, M., & Etzkowitz, H. (2013). Triple helix systems: An analytical framework forinnovation policy andpractice in the Knowledge Society. Industry and Higher Education, 27(3), 237-262.

- Saif, O, Mezher, T., Arafat, H. (2014). Water security in the GCC countries: Challenges and Opportunities. Journal of Environmental Studies and Sciences,4, 329-346.

- Spigel, B. (2015).The Relational Organization of Entrepreneurial Ecosystems. Entrepreneurship Theory and Practice, 41(1), 1-24.

- Stam, E., & Spigel, B. (2016). Entrepreneurial ecosystems in discussion per series 16-13.