Research Article: 2021 Vol: 25 Issue: 4S

Populism, Seigniorage and Inequality Dilemma in Perspective of Pakistan

Ahmed Raza ul MUSTAFA, Shaheed Benazir Bhutto University (SBBU)

Asif Ali ABRO, Newports Institute of Communications and Economics

Tariq HUSSAIN, The University of Lahore

Syed Rashid Ali, College of Accounting and Management Sciences (CAMS)

Citation Information: Mustafa, A.R., Abro, A.A., Hussain, T., & Ali, S.R. (2021). Populism, seigniorage and inequality dilemma in perspective of pakistan. Academy of Accounting and Financial Studies Journal, 25(S4), 1-14.

Abstract

Populism rises in the milieu of political catastrophes when the political structure's status quo looks unable to reply to the populations’ needs. This phenomenon leads to inequality. Inequality becomes a familiar, burning, and perplexing spectacle. In this study, inequality is accentuated in the perspective of populism and seigniorage. Populism emphasized growth and income redeployment to reduce disparities. However, after acquiring power, their policies further rose to inflation, minimized living standards, and led to inequality. Besides this, seigniorage induces inflation. Seigniorage is an easy source for developing economies to generate finance. It further leads to inequality of income due to inflation. The period of the study is 1973-2016. Auto Regressive Distributed Lags (ARDL) approach is applied to observe the relationship between populism, seigniorage, and inequality. Both populism and seigniorage have a significant role in accelerating income inequality.

Keywords

Populism, Seigniorage, Inequality, Inflation, Auto Regressive Distributed lags (ARDL) Model.

JEL Classification Codes

D72, E31, E51, E52, D63

Introduction

The concept of populism is distinctive, multidimensional, controversial, and slippery. It is now a catch-all word and not easy to define (Houwen, 2013). The term populism instigated from the last decades of the nineteenth century when a union of farmers, laborers, and miners in the United States assembled in contrast to the Gold Standard and the Northeastern banking management (Frieden, 1997; Rodrik, 2018). Generally, populism takes the forms of Right-Wing or Left-Wing, and it takes forms differently in developed and developing economies as deteriorated governance prevail and divided societies existed. Canitrot, (1975) was the first prominent economist to transcribe economic populism. Generally, there are two categories of economic populism: First, the populism of the Left, frequently categorized by the restructuring of wages or unjust redistribution of income. Second, the populism of the Right a phenomenon that is very adjacent to developmentalism.

It is a kind of fiscal sloppiness (Pereira, 1991). Populism is also a form of political behavior.

There are two words significant to capture populism: instability and discontent, as when there is political and economic instability, which generates the right energy for the populist plea. The political fundamentals of displeasure and instability are the significant issues that appear to be central to populism (de Castro & Ronci, 1991). Therefore, this becomes the critical reason for a power struggle, and authority tends to counterbalance the outlines of economic populism. Political instability engenders inflation (Albanesi, 2007; Dolmas et al., 2000). Elevating inflation can generate uncertainty, increase hopes regarding upcoming macroeconomic instability, upset financial marketplaces, and lead to distortionary economic strategies (Romer & Romer, 1998). Cukierman et al., (1989) elaborated empirically that the economies with a more unsteady, polarized, and divided political structure have more incompetent tax structures. Henceforth, these economies have to depend additionally on seigniorage.

Besides this, seigniorage works as a driver of inequality. As political instability elevates in a country, it heavily depends upon seigniorage. This study focuses on political instability, which directs toward inflation and seigniorage; therefore, inequality engenders in Pakistan. Pakistan, from the very beginning of her independence, remains under the shackles of political instability. Pakistan is a developing economy, and inequality is a common issue. Both the military and the democratic government played their part in inequality. The story of Pakistan is attractive; high income persisted side by side with high-income inequality with political instability. This study investigates the relationship between populism, seigniorage, and inequality from 1973 to 2016.

| Table 1 Inflation and Seigniorage (Average Values) |

||

| Years | Inflation (Percentage) |

Seigniorage (Rs Million) |

|---|---|---|

| 1973-78 (Democracy) | 17.59 | 1448.27 |

| 1978-88 (Military) | 7.2 | 4267.67 |

| 1989-98 (Democracy) | 10.09 | 8391.95 |

| 1999-08 (Military) | 7.02 | 14609.14 |

| 2009-16 (Democracy) | 8.79 | 25879.85 |

Source: Annual Financial Statements, SBP (1978-2019)

Inflation and seigniorage values are presented according to democratic and military rulers in Pakistan's history during 1973-2016. Here the democracy and military-ruled turn after turn, during democracy, political instability prevailed, and this causes inflation. High inflation is observed in democracy, while in military rule, it is low. Similarly, the dependency on seigniorage is higher in a democracy, especially during 2009-2016.

The remaining part of this study containing the different sections as the theoretical framework is given in section II. An exhaustive review of the literature is collected in section III. Section IV highlights the data sources and the econometric methodologies to test the hypothesis, as per this study's objective. The detailed elucidation of the research outcomes is given in section V. In section VI, the conclusion and the policy implications are enclosed.

Theoretical Framework

Regardless of the gigantic and opulent bibliography transcribed on populism, there is minute unanimity on its meaning and definition. Some scholars attempt to resolve the difficulties of the theoretical discrepancy by confining it to a constituency history segment (Schamis, 2006) or by theoretical methods that separate politics from social and economic procedures and development (Roberts, 1995; Weyland, 2001).

Populist approaches to gain popularity as the institutions become staunch. A populist ruling occurs when the people’s concern can no longer be captivated through the institutions' structure, resulting from calamities of representation (Laclau, 2005). Different outlooks are there, such as; Populism is the classic appearance of a fixed social class and portrays together with the movement and its ideology. Along with this, populism is believed to be a classic of a diverse social class. Second, the founding class implications of populism are challenging, and it clues to a second origin, which might be baptized a type of theoretical pessimism. In this way, populism is a type of concept barren of content. Third, this origin attempts to conquer the complications by confining the term ‘populism’ to describe an ideology, not a movement. The classic topographies of this philosophy are believed to be aggressive 1) to the status quo, 2) distrust of traditional representatives of politics, 3) plea to the people not to classes, and 4) anti-intellectualism. Fourth, the functionalist origin of populism: Populism stems from the procedures of change from an old-fashioned to the industrial culture (Laclau, 2012). Diverse approaches and types of populism are under discussion by researchers and scholars.

Cas Mudde, (2004) described that the populist parties are not only categorized by populist component but also by their host philosophy. Consequently, these can take the form of left-wing populist parties (March, 2012), or right-wing populist parties (C Mudde, 2007), or centrist populist parties (Havlík & Stanley, 2015). Besides this, classical populism becomes the root cause of political instability and the higher inflation rate in Latin American countries. The key features of these economies are following a ritual of extraordinary inflation as a consequence of populism. The implementation of the policies for populism generates budget deficits, political instability, and inequality (Cortés, 2010). Inequality and its types remain a crucial issue among researchers and scholars. Research on inequality can be distributed into three leading traditions in Sociology: quantitative, structural, and intermediate. However, the quantitative ritual bred out of economics. Adam Smith considered income inequality for granted. In his famous book Wealth of Nations, he presented the thought of a free open market for goods and labor, leading to an accumulative division of labor and thus to economic growth. The product is disseminated among the population so that everybody profits from this development. Though, the output is dispersed not equally but according to share, proportionately (Guidetti & Rehbein, 2014). Ricardo, (1817) focused on the distribution of output among three partners and the surplus-value concept. Kuznets, (1955) presented the inverted U shaped inequality curve. Dynan et al. (2004) favor inequality and consider it suitable for growth; however, Persson & Tabellini, (1994); Alesina & Rodrik, (1994) found a negative relationship between inequality and economic development.

Political instability enriches the dependence on seigniorage. Aisen &Veiga, (2008), Bohn, (2000), and Cukierman et al., (1989) elaborated that political instability accelerates the dependency on seigniorage, which leads to inequality. Seigniorage is an excellent source of income for governments and monarchs for a long (Bailey, 1956; Cagan, 1963; Friedman, 1971; Klein & Neumann, 1990; Phelps, 1973). There is a dearth of unanimity on the meaning and definition of seigniorage. Therefore, it indicates the lack of agreement over the classification and description of money itself (Baltensperger & Jordan, 1997; Bjerg, 2014). Seigniorage is too acknowledged as money printing and demarcated as the worth of existing resources attained by the government through its authority of dominance as the money printing monopoly (Begg et al., 1994). There have been diverse explanations and terms in the literature. Keynes uses the manifestation of legal-tender money (Keynes et al., 1971). Keynes undertakes an institutional structure, which is mentioned as fiat money. This type of money can be printed at the freewill and distributed through the government outlay. Therefore, such money is exogenously supplied to the economy. Treatments of Seigniorage is based upon the concerned monetary systems, can be originated in the number of articles as (Cagan, 1963; Calvo, 1978; Mankiw, 1987; Heijdra, 2017; Cecchetti et al., 2006).

Along with optimal seignorage theory, inflation and nominal interest rate are gritty due to a government requirement to finance its budget dearth and deficiency. The theory directs that inflation and nominal interest rate are random walks but propose that such indicators move collectively with the tax rate. Mankiw, (1987) confirmed this theory for the USA for 1952-1985 and provided selected backing for the view. The study elaborated on the relationship between populism, seigniorage, and inequality as populism enriches the dependence on political instability that escorts to high inflation and inequality. Also, the political instability leads towards seigniorage, and it moves toward inequality.

Literature Review

Sachs (1989), Dornbusch & Edwards (2007), and Veiga (2000) elaborated that political instability leads towards higher dependency on a higher level of inflation. Bang and Marsh (2018) elaborated and examined the term populism. Populism is a contested term that provides the surge in favor of populist movements throughout the globe. The principal aim of the study is to find critical issues in the present era debates of populism. What is populism? There are a few characteristics regarding populism that are commonly agreed upon it. A conflict between the elite and the ordinary people, populism is a plea to the people contrary to the established erection of power, philosophies, and ethics. Generally, populists’ support powerful leaders rather than democratic institutions. There are three variants of populism, populist group versus politicians, positive versus negative populism and left or right populism. Populism is a serious problem and can be solved by economic growth and democratic reforms. Populism rises due to uncoupling between the government and citizens hence inequality increased. This issue can be solved by equity offers in a different segment of society.

O'Connor, (2017) elaborated how inequality gives rise to populism. There are three ways in which inequality performs, and populism acquires approbation. Generally, Economic inequality is connected with cyclical economic catastrophes. Major catastrophes liberate political loyalties and offer an inaugural for populists to flourish electorally. Thrilling economic inequality rings with the populist doctrine that the people are uneven against a self-serving if the elite is not corrupt. Populist economists’ depict thrilling inequality as an indication that political formation has misplaced democratic legality. Significant deviations from western economies have lowered people’s net economic benefit. Populist pomposity frequently states that the complete decline of opulence and part of the cumulative vote portion for populist is from economically disregarded communities. Non-economic features elucidate many aspects of populism. Then economic inequality supports to explain mounting populism and should not be unnoticed in any inclusive analysis.

Bittencourt, (2012) elaborated on the populists’ opinion regarding inflation in South African Countries. The newly democratic states put their economies into a high inflation phenomenon after the political dictatorship. Therefore, recently voted governments coming into power afterward, the epoch of political totalitarianism, and forced to face redeployment requests. It appeals to populist distributive policies and inclines to lead to extraordinary inflation and general meagre macroeconomic presentation. The period of the study was 1970-2007, where the panel data approach was applied. African countries that re-democratize and still have neither proper political mellowness nor formal economic institutions like an independent central bank, directing comprehensive monetary strategy and a trustworthy fiscal consultant in place that turned out to be more detrimental than good macroeconomic performance.

Haider et al., (2011) analyzed the outcomes and impacts of political volatility, corruption, and poor governance on inflation and economic growth in Pakistan's perspective, where a theoretical model and two Markov-Regime switching models regarding inflation are used. It was found that a high level of corruption besides poor governance outcomes the high inflation and low level of economic growth. Due to prevailing poor governance, corruption, and political instability during the democratic eras, dependence on seigniorage increased, ultimately increases inflation. Good governance and control of corruption are essential for improved economic growth.

Aisen & Veiga, (2008) tried to dig the relation between political instability and seigniorage. The higher the level of political instability leads to higher dependence on seigniorage, which is a common phenomenon, especially in developing economies, where the inflation rate is also higher. The data set captured 100 countries for the period 1960-1999 and was used the panel data techniques. It is found that political instability causes a higher dependency on seigniorage. A sound and robust political structure are needed to have less reliance on seigniorage. Cukierman et al., (1989) examined the correlation between political instability and seigniorage. Pooled regression was applied in this study for 79 developed and developing economies of the world. It was found that countries are politically unstable and have to rely on seigniorage heavily.

By reviewing the literature, it is found that political stability and populism have a close relationship and sufficient to reduce seigniorage. Moreover, populism and seigniorage are useful to increase the inequalities in the concerned economies.

Data and Research Methodology

A time-series data set for the period 1973-2016 is gathered from World Development Indicators (World Bank, 2018) and Handbook of Statistics, annually published by the State Bank of Pakistan (SBP). The data generated on POY (Polity) through Principal Component Analysis (PCA), with the help of three variables DEMO (Democracy), CONE (Constraints on the executive), and PCOM (Political Competition). The data on political instability (PINS) is generated with the help of competitiveness of participation (PAR) and political competition concept (PLC). The information on Polity IV is taken from the Center for Systemic Peace (Polity, 2018).

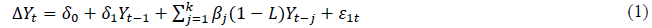

In time series exploration, the stationarity of data is a necessary condition. The Augmented Dickey-Fuller (ADF) test (Dickey & Fuller, 1979) is applied that evaluate the unit root of different time series variables. The ADF assumes the subsequent equation to check the unit root test as:

Where L is the lag operator and ΔYt = Yt - Yt-1, k defines the number of lags, and ε1t is the stochastic error term. The supposition of hypothesis for ADF is as follows: H0: 1 =0; ( t is Non-Stationary) H1: 1 <0; ( t is Stationary).

In empirical analyses for the long-run relationship, four models are used. The Auto Regressive Distributed Lags (ARDL) model is used to evaluate the long-run relationship among the variables where the significance of this method is that it applies regardless of whether the regressors are I(1) or I(0) (Pesaran & Pesaran, 1997). This model also takes adequate lags length of the variables to seizure the data engendering procedure in general to specific modeling structure (Laurenceson & Chai, 2003). Besides this, an error correction model (ECM) can result from ARDL via a meek linear transformation (Banerjee et al., 1993). The error correction model puts together the short-run dynamics and the long-run equilibrium without losing long-run information. The models are given below to observe the relationship between Populism, Seigniorage, and Inequality Dilemma.

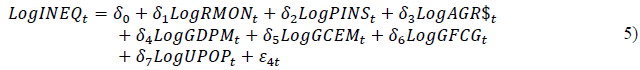

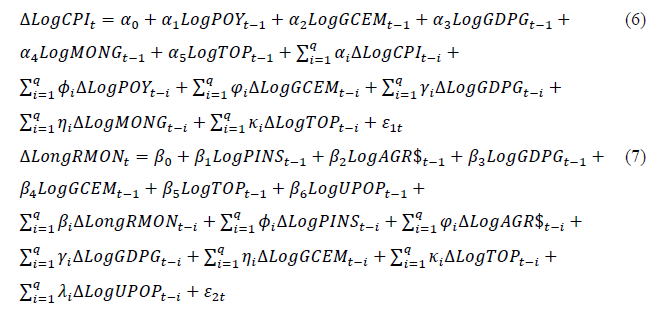

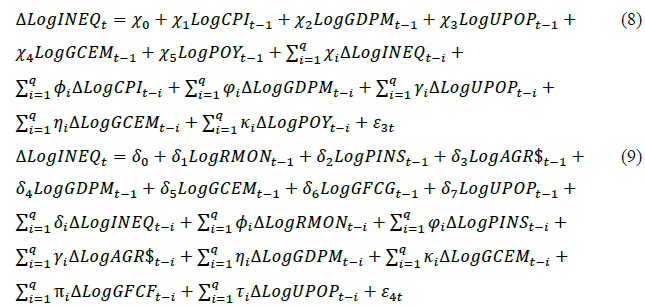

Model 1

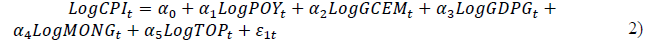

Model 2

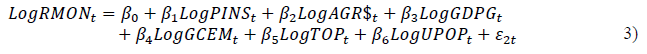

Model 3

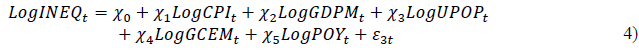

Model 4

Where α0, β0, χ0 and δ0 are intercepts; and α, β, χ, and δ are the coefficients of the variables. Also, the Inflation (CPI), Polity (POY), Government Consumption Expenditures (GCEM), Gross Domestic Product Growth (GDPG), Money Growth (MONG), Trade Openness (TOP), Reserve Money (RMON)1, Political Instability (PINS), Agriculture Output (AGR$) in Dollars, Urban Population (UPOP), Gross Fixed Capital Formation (GFCF) and Gross Domestic Product (GDPM) are the variable incorporated in the models. Log describes the logarithmic formation of such variables in the existing models.

The ARDL descriptions of the equations mentioned above are given below to gain pragmatic proof of long-run equilibrium.

Where α, β, χ, and δ are the coefficients, confirm the long-run effects and ?, φ, γ, η, κ, π, and τ are coefficients, highlights the short-run effects. In the first phase, the ARDL method is used by evaluating the equations mentioned above. In the second phase, practice is made to trace cointegration by confining all coefficients being assessed, including the lagged variables equal to zero. Such a hypothesis will test cointegration in each equation using F-statistic with an asymptotic non-standard distribution.

H0: δ10 =δ11 = δ12 = δ13 = 0 implies that there is No Cointegration

H0: δ10 =δ11 = δ12 = δ13 = 0 implies that there is No Cointegration

Two asymptotic critical value bounds give a test for cointegration when the assume that all the regressors are I(1) I(0), respectively. The calculated F-statistics greater than the upper bound is the sign of rejection for the null hypothesis, indicating a cointegration. Conversely, the lesser value of the calculated F-statistics than the lower band is the sign of acceptance for the null hypothesis means no cointegration. The conclusion would be inconclusive as the F-statistics fall within critical bounds.

Empirical Research

Pragmatic results are presented in this part of the study. Regarding populists' views, an Analysis to check the relationship between (1) Political Instability and Populism; (2) Political Instability and Seigniorage; (3) Populism, Inequality, Seigniorage, and Inequality is made.

Time series data covering the period of 1973-2016 is used to appraise the variables' relationship and effects. The stationarity of data is a common issue. In this regard, the Augmented Dickey Fuller (ADF) test is applied, where all variables are enunciated in logarithmic form. All the core variables and control variables are tested for a unit root. The results are highlighted in Table 2.

| Table 2 Unit Root Test |

||||

| I(0) | I(1) | |||

|---|---|---|---|---|

| Variables | Intercept | Trend and Intercept | Intercept | Trend and Intercept |

| LogCPI | 0.955 | 0.017* | 0.002* | 0.013* |

| LogPOY | 0.308 | 0.427 | 0.000* | 0.000* |

| LogGCEM | 0.951 | 0.545 | 0.000* | 0.000* |

| LogGDPG | 0.002* | 0.003* | 0.000* | 0.000* |

| LogMONG | 0.001* | 0.002* | 0.000* | 0.000* |

| LogTOP | 0.251 | 0.472 | 0.000* | 0.000* |

| LogRMON | 0.241 | 0.000* | 0.000* | 0.000* |

| LogPINS | 0.341 | 0.362 | 0.000* | 0.000* |

| LogAGR$ | 0.524 | 0.311 | 0.000* | 0.000* |

| LogINEQ | 0.098 | 0.237 | 0.000* | 0.000* |

| LogGDPM | 0.266 | 0.773 | 0.002* | 0.003* |

| LogUPOP | 0.777 | 0.015* | 0.456 | 0.717 |

Note: * represents 5% level of significance (Reject H0: Data series is non-stationary and Accept H1: Data series is stationary)

It is found that the majority of the variables (LogCPI, LogGDPG, LogMONG, LogRMON, LogUPOP, and LogINEQ) is non-stationary at I(0), but all of them become stationary at I(1) . It recommends that the ARDL method be applied as it settles the compound nature of vibrant belongings of variables, with a combination of I(0) and I(1) series, which are appropriate for applying the ARDL technique.

Political Instability and Populism

Populism and political instability are interconnected, where political instability enhances the rate of populism. The results are presented in Table 3. The ARDL method instigates with conducting the bound test. The calculated F-statistics (3.837) is larger than the critical value calculated, rejecting the null hypothesis at 5 percent level of significance. Consequently, it establishes that there is a long run connotation among the explained and explanatory variables. After forming the long-run association, coefficients of Model 1 being appraised. The findings are given in Table 3.

| Table 3 Short-Run/Long-Run Findings (Dependent Variable Logcpi) |

|||

| Short-Run Model | Long-Run Model | ||

|---|---|---|---|

| Variables | Coefficient (t-Statistic) |

Coefficient (t-Statistic) |

|

| LogPOY | -0.006 (-0.653) |

-0.414 (-2.917)* |

|

| LogGCEM | -0.227 (-3.209)* |

2.115 (7.758)* |

|

| LogGDPG | -0.007 (-0.839) |

0.204 (0.659) |

|

| LogMONG | -0.028 (-2.873)* |

0.665 (2.018)* |

|

| LogTOP | 0.063 (0.739) |

-1.415 (-0.801) |

|

| CointEq(-1) | -0.092 (-2.292)* |

||

| C | -11.273 (-1.516)** |

||

| R-Squared | 0.999 | 0.744 | |

| Adjusted R-Squared | 0.991 | 0.615 | |

| S.E. REG | 0.014 | 0.022 | |

| Observations | 42 | 42 | |

| Diagnostic Tests | |||

| Autocorrelation | Heteroskadacity | Ramsey tests | |

| Prob. | 0.839 | 0.896 | 0.453 |

Note: * and ** represent 5% and 10% level of significance respectively

The LogPOY, LogGCEM, and logMONG are significant; however, LogPOY has a negative coefficient sign that elaborates that inflation will reduce with the increase in political stability. The other coefficients have positive signs, illustrating that an increase in explanatory variables' values contributes to inflation. However, the trade openness coefficient explains that with the increase in trade, inflation reduces. The error correction sign assimilates the short-run investigation with the long-run analysis. The coefficients of different variables in the short-run error correction model indicate the short-run replies of inflation.

The ECT coefficient is statistically significant at 5 percent level of significance with a negative sign, confirmation about the cointegration from short-run to long-run. Also, the speed of adjustment to the long-run equilibrium after a short-run shock is about 9.2 percent. Moreover, the insignificant P values of the diagnostic tests focus on accepting the null hypothesis. It discloses that there is no autocorrelation, homoscedasticity, and the model is linear in parameters.

Political Instability and Seigniorage

Political instability causes to increase reliability on seigniorage. The results are presented in Table 4. The calculated F-statistics (20.687) is greater than the critical values at a 5 percent level of significance in the cointegration test. It foresees that there is a long run connotation between political instability and seigniorage. After forming the long-run association, coefficients of Model 2 are appraised. The results are given in Table 4.

| Table 4 Short-Run/Long-Run Findings (Dependent Variable Logrmon) |

|||

| Short-Run Model | Long-Run Model | ||

| Variables | Coefficient (t-Statistic) |

Coefficient (t-Statistic) |

|

| LogPINS | -2.088 (-8.682)* |

-0.633 (-11.686)* |

|

| LogAGR$ | 8.089 (5.221)* |

0.111 (3.263)* |

|

| LogGDPG | 48.254 (4.852)* |

2.864 (4.201)* |

|

| LogGCEM | 9.0264 (7.532)* |

2.734 (14.081)* |

|

| LogTOP | -40.964 (-6.504)* |

-2.634 (-7.455)* |

|

| LogUPOP | -3.725 (-4.456)* |

-2.066 (-5.602)* |

|

| CointEq(-1) | -0.807 (-7.624)* |

||

| R-Squared | 0.999 | 0.999 | |

| Adjusted R-Squared | 0.993 | 0.974 | |

| S.E. REG | 0.120 | 0.121 | |

| Observations | 42 | 42 | |

| Diagnostic Tests | |||

| Autocorrelation | Heteroskadacity | Ramsey tests | |

| Prob. | 0.853 | 0.927 | 0.295 |

Note: * and **, represent 5% and 10% level of significance respectively

The variables are significant in this model; however, the LogPINS logTOP and LogUPOP have a negative sign, which elaborates that the dependency on seigniorage will reduce with the increase in political stability. Political stability leads to less reliance on seigniorage (Aisen & Veiga, 2008). The coefficients of the remaining variables have positive signs, affirmative for the seigniorage. The ECT coefficient is statistically significant and has a negative sign that confirms the short-run to long-run cointegration. The error correction term's value displays that the speed of adjustment to the long-run equilibrium after a short run shock is about 80.7 percent. The diagnostic tests' insignificant probability values confirm the homoscedasticity, no autocorrelation, and linearity of the model.

Populism and Inequality

Inequality is accelerated in the presence of populists approaches. An increase in the rate of inflation ultimately increased the inequality ratio. The results are presented in Table 5. The ARDL method instigates with conducting the bound test. Therefore, the null hypothesis proposes no cointegration. At 5 percent level of significance, the calculated F-statistics (4.4071) greater than critical values confirm a long-run association between inequality and populism. Furthermore, the coefficients of Model 3 are appraised in Table 5.

| Table 5 Short-Run/Long-Run Findings (Dependent Variable Logineq) |

|||

| Short-Run Model | Long-Run Model | ||

|---|---|---|---|

| Variables | Coefficient (t-Statistic) |

Coefficient (t-Statistic) |

|

| LogCPI | 0.349 (2.215)* |

0.107 (2.612)* |

|

| LogGDPM | -1.335 (-2.688)* |

-1.086 (-11.989)* |

|

| LogUPOP | 8.277 (1.176) |

0.764 (3.975)* |

|

| LogGCEM | 0.382 (3.902)* |

0.315 (8.302)* |

|

| LogPOY | 0.034 (1.587)** |

0.011 (1.707)** |

|

| CointEq(-1) | -0.253 (-5.718)* |

||

| C | 0.059 (0.028) |

||

| R-Squared | 0.859 | 0.711 | |

| Adjusted R-Squared | 0.711 | 0.407 | |

| S.E. REG | 0.034 | 0.038 | |

| Observations | 42 | 42 | |

| Diagnostic Tests | |||

| Autocorrelation | Heteroskadacity | Ramsey tests | |

| Prob. | 0.776 | 0.691 | 0.309 |

Note: * and ** represent 5% and 10% level of significance respectively

In the results mentioned above, the majority of the variables are significant. With the increase in LogCPI, inequality will also increase. LogUPOP and LogGCEM are positive and insignificantly contributing to inequality. However, an increase in gross domestic product supports to reduce inequality. The ECT coefficient is statistically significant with a negative sign. It confirms the short run to long run cointegration, ensuring that the speed of adjustment to the long-run equilibrium is 25.3 percent. In the diagnostic tests, insignificant probability values guaranteed no autocorrelation, homoscedasticity, and the model's linearity because of rejecting the null hypothesis.

Seigniorage and Inequality

Inequality is enhanced in the presence of seigniorage. As the dependency on seigniorage increased, inequality further accelerates. The ARDL method instigates with conducting the bound test. The null hypothesis proposes (no cointegration) is rejected because of the greater calculated F-statistics (8.091) than the critical values at 5 percent level of significance. It institutes that there is a long run connotation among the inequality and explanatory variables, including seigniorage. After forming the long run association, the variables' coefficients are appraised, shown in Table 6.

| Table 6 Short-Run/Long-Run Findings (Dependent Variable Logineq) |

|||||

| Short-Run Model | Long-Run Model | ||||

| Variables | Coefficient (t-Statistic) |

Coefficient (t-Statistic) |

|||

| LogRMON | 0.136 (2.901)* |

0.085 (4.824)* |

|||

| LogPINS | 0.028 (0.889) |

0.015 (0.730) |

|||

| LogAGR$ | -0.105 (-3.034)* |

-0.014 (-1.529)** |

|||

| LogGDPM | -1.551 (-2.784)* |

-0.184 (-2.281)* |

|||

| LogGCEM | 0.358 (2.945)* |

0.182 (2.648)* |

|||

| LogGFCF | -0.959 (-4.246)* |

-0.359 (-9.935)* |

|||

| LogUPOP | 6.011 (2.397)* |

0.687 (6.239)* |

|||

| CointEq(-1) | -0.832 (-3.694)* |

||||

| R-Squared | 0.969 | 0.957 | |||

| Adjusted R-Squared | 0.841 | 0.777 | |||

| S.E. REG | 0.024 | 0.024 | |||

| Observations | 42 | 42 | |||

| Diagnostic Tests | |||||

| Autocorrelation | Heteroskadacity | Ramsey tests | |||

| Prob. | 0.130 | 0.717 | 0.231 | ||

Note: * and ** represent 5% and 10% level of significance respectively

In this model, all the variables are significant except LogPINS. The Log RMON has a significant and positive coefficient sign that shows that inequality increases because of seigniorage. The LogGDPM and LogGFCF have a significant and negative coefficient sign, indicating that the gross domestic product and gross fix capital formation effectively reduce inequality. The error correction sign and its significance put together the short-run analysis with the long-run analysis. Findings are presented in Table 6.

The ECT is significant with a negative coefficient sign. It is a sign of cointegration and convergence to the long run equilibrium where the speed of adjustment is 83.2 percent. In diagnostic tests, the insignificant probability values reject the null hypothesis and guaranteed the homoscedasticity, no autocorrelation, and linearity of the model.

Granger Causality

To check the causality between the seigniorage and inequality, the Granger Causality test is applied, where the findings are shown in Table 7. The results highlight that inequality is significantly causing seigniorage. Conversely, the seigniorage does not have a significant cause for inequality. Conclusively, there is unidirectional causality from inequality to the seigniorage.

| Table 7 Granger Causality Test |

|||

| Null Hypothesis: | N | F-Statistic | Prob. |

|---|---|---|---|

| LogINEQ does not Granger Cause LogRMON | 39 | 4.00421 | 0.0274 |

| LogRMON does not Granger Cause LogINEQ | 39 | 1.18861 | 0.317 |

Conclusion and Policy Implications

This study inspected the relationship between populism, seigniorage, and income inequalities dilemma. There is political instability from the beginning after independence in Pakistan, where the military took control numerous times. During democracy, political instability remains there. Classical populism is adjacent to a higher degree of political instability and inflation. In this study, four models are used. The first two models elaborate on the relationship between political instability, populism, and seigniorage. The results indicate that as political stability increases the dependency on populism, then seigniorage will reduce. The last two models show the relationship between inequality, populism, and seigniorage. As populism and seigniorage increase, inequality also accelerated. The government of Pakistan needs to focus on and keep political stability in the country. Inflation must be controlled, and the use of seigniorage needs to be calculated.

References

- Aisen, A., & Veiga, F.J. (2008). The political economy of seigniorage. Journal of Development Economics, 87(1), 29-50.

- Albanesi, S. (2007). Inflation and inequality. Journal of Monetary Economics, 54(4), 1088-1114.

- Alesina, A., & Rodrik, D. (1994). Distributive politics and economic growth. The Quarterly Journal of Economics, 109(2), 465-490.

- Bailey, M.J. (1956). The welfare cost of inflationary finance. Journal of Political Economy, 64(2), 93-110.

- Baltensperger, E., & Jordan, T.J. (1997). Principles of seigniorage. REVUE SUISSE D ECONOMIE POLITIQUE ET DE STATISTIQUE, 133, 133-152.

- Banerjee, A., Dolado, J.J., Galbraith, J.W., & Hendry, D. (1993). Co-integration, error correction, and the econometric analysis of non-stationary data. OUP Catalogue.

- Bang, H., & Marsh, D. (2018). Populism versus neo-liberalism: is there a way forward? Policy Studies, 39(3), 251-259.

- Begg, D., Fischer, S., & Dornbusch, R. (1994). Economics. England: McGraw-Hill Publishing.

- Bittencourt, M. (2012). Democracy, populism and hyperinflation: Some evidence from Latin America. Economics of Governance, 13(4), 311-332.

- Bjerg, O. (2014). Making money: The philosophy of crisis capitalism: Verso Trade.

- Bohn, F. (2000). The Rationale for Seigniorage in Russia—A Model-Theoretic Approach Restructuring, Stabilizing and Modernizing the New Russia (pp. 243-266): Springer.

- Cagan, P. (1963). The first fifty years of the national banking system. Banking and Monetary Studies, edited by Deane Carson, 15, 42.

- Calvo, G.A. (1978). Optimal seigniorage from money creation: An analysis in terms of the optimum balance of payments deficit problem. Journal of Monetary Economics, 4(3), 503-517.

- Canitrot, A. (1975). La experiencia populista de redistribución de ingresos. Desarrollo económico, 331-351.

- Cecchetti, S.G., Schoenholtz, K.L., & Fackler, J. (2006). Money, banking, and financial markets. 4: McGraw-Hill/Irwin.

- Cortés, R.O. (2010). The danger of populism. macroeconomic populism in latin america, is colombia the exception? Prolegómenos. Derechos y Valores, 13(26), 99-122.

- Cukierman, A., Edwards, S., & Tabellini, G. (1989). Seigniorage and political instability: National Bureau of Economic Research.

- de Castro, P.R., & Ronci, M. (1991). Sixty years of populism in Brazil The macroeconomics of populism in Latin America (pp. 151-173): University of Chicago Press.

- Dickey, D.A., & Fuller, W.A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427-431.

- Dolmas, J., Huffman, G.W., & Wynne, M.A. (2000). Inequality, inflation, and central bank independence. Canadian Journal of Economics/Revue canadienne d'économique, 33(1), 271-287.

- Dornbusch, R., & Edwards, S. (2007). The macroeconomics of populism in Latin America: University of Chicago Press.

- Dynan, K.E., Skinner, J., & Zeldes, S.P. (2004). Do the rich save more? Journal of Political Economy, 112(2), 397-444.

- Frieden, J.A. (1997). Monetary populism in nineteenth-century America: An open economy interpretation. Journal of Economic History, 367-395.

- Friedman, M. (1971). Government revenue from inflation. Journal of Political Economy, 79(4), 846-856.

- Guidetti, G., & Rehbein, B. (2014). Theoretical approaches to inequality in economics and sociology. A preliminary assessment. Transcience (2014), 5.

- Haider, A., ud Din, M., & Ghani, E. (2011). Consequences of political instability, governance and bureaucratic corruption on inflation and growth: The case of Pakistan. The Pakistan Development Review, 773-807.

- Havlík, V., & Stanley, B. (2015). New populist parties in Central and Eastern Europe: Non-ideological or centrist?

- Heijdra, B.J. (2017). Foundations of modern macroeconomics: Oxford university press.

- Houwen, T. (2013). Reclaiming power for the people. Populism in democracy: [Sl: sn].

- Keynes, J.M., Moggridge, D.E., & Johnson, E.S. (1971). The Collected Writings of John Maynard Keynes (Vol. 1): Macmillan London.

- Klein, M., & Neumann, M. J. (1990). Seigniorage: what is it and who gets it? Weltwirtschaftliches Archiv, 126(2), 205-221.

- Kuznets, S. (1955). Economic growth and income inequality. The American economic review, 45(1), 1-28.

- Laclau, E. (2005). On populist reason: Verso.

- Laclau, E. (2012). Politics and ideology in Marxist theory: Capitalism, fascism, populism: Verso Trade.

- Laurenceson, J., & Chai, J. (2003). Financial reform and economic development in China. Edward Elgar Publishing.

- Mankiw, N.G. (1987). The optimal collection of seigniorage: Theory and evidence. Journal of Monetary Economics, 20(2), 327-341.

- March, L. (2012). Towards an understanding of contemporary left-wing populism. Paper presented at the Political Studies Association (PSA) Annual International Conference, Belfast.

- Mudde, C. (2004). The populist zeitgeist. Government and Opposition, 39(4), 541-563.

- Mudde, C. (2007). Populist Radical Right Parties in Europe (Cambridge). New York: Cambridge University Press.

- O'Connor, N. (2017). Three connections between rising economic inequality and the rise of populism. Irish Studies in International Affairs, 28, 29-43.

- Pereira, L.C.B. (1991). Populism and economic policy in Brazil. Journal of Inter-American Studies and World Affairs, 1-21.

- Persson, T., & Tabellini, G. (1994). RIs inequality harmful for growth. American Economic Review, 84(3), 600-621.

- Pesaran, M.H., & Pesaran, B. (1997). Microfit 4.0: Interactive econometric analysis: Oxford University Press.

- Pesaran, M.H., Shin, Y., & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326.

- Phelps, E. S. (1973). Inflation in the theory of public finance. The Swedish Journal of Economics, 67-82.

- Polity, I. (2018). Polity IV Annual Time Series, 1800-2018. Polity IV, Center for Systemic Peace, Vienna, VA. https://www. systemicpeace. org/inscrdata. html.

- Ricardo, D. (1817). On Principles of Political Economy and Taxation (reprinted 2001): Batoche Books: Kitchener, Ontario.

- Roberts, K.M. (1995). Neoliberalism and the transformation of populism in Latin America: the Peruvian case. World politics, 82-116.

- Rodrik, D. (2018). Populism and the economics of globalization: Journal of International Business Policy. Internetquelle: https://drodrik. scholar. harvard. edu/files/dani-rodrik/files/pop ulism_and_the_economics_of_globalization. pdf (Abruf: 12.10. 2019).

- Romer, C.D., & Romer, D.H. (1998). Monetary policy and the well-being of the poor: National bureau of economic research.

- Sachs, J.D. (1989). Social conflict and populist policies in Latin America: National Bureau of Economic Research.

- Schamis, H.E. (2006). A" Left Turn" in Latin America? Populism, socialism, and democratic institutions. Journal of democracy, 17(4), 20-34.

- Veiga, F.J. (2000). Delays of inflation stabilizations. Economics & Politics, 12(3), 275-295.

- Weyland, K. (2001). Clarifying a contested concept: Populism in the study of Latin American politics. Comparative politics, 1-22.

- World Bank. (2018). World Development Indicators database, 2018. Washington, DC: The World Bank.