Research Article: 2022 Vol: 28 Issue: 2S

Policy Power Capabilities and Leading Indicators of Exchange Rate Stability in 7-Em Countries

Ade Novalina, Universitas Sumatera Utara, Indonesia

Ramli, Universitas Sumatera Utara

Murni Daulay, Universitas Sumatera Utara

Dede Ruslan, Universitas Negeri Medan

Citation Information: Novalina, A., Ramli., Daulay, M., & Ruslan, D. (2022). Policy power capabilities and leading indicators of exchange rate stability in 7-em countries. Academy of Entrepreneurship Journal, 28(S2), 1-13.

Keywords

Policy Power, 7-EMC, Exchange Rate Stability

Abstract

This research looks for leading indicators of exchange rate stability, namely economic growth inflation of seven emerging market countries (7-EMC), leading indicators determined by three policies, namely fiscal policy, monetary policy, and macro prudential policy (policy power). Analysis model using ARDL Panel. The study results proved that the leading indicator policy power to stability of exchange rate is a policy power through money supply that can control in China, India, and Brazil. Then macro prudential approach through NPL in Russia and Egypt. Leading indicators of countries that are most able to use policy power in strengthening exchange rate stability are Brazil, Turkey, and Egypt. Finally, policy recommendations in emerging market countries supporting exchange rate stability are China, India, and Brazil through monetary policy.

Introduction

All countries have the same long-term goal, namely the creation of strong economic fundamentals. Economic fundamentals are essential in maintaining sustainable financial stability (Warjiyo, 2019; Agung, 2018; Simorangkir, 2013; Wróbel et al., 2019; Nasir, 2019; Wimanda, 2014; Claessens et al., 2013). However, the results of all countries also vary due to the complexity of the problems of each country, especially emerging market countries. The strength of the fundamentals is strongly influenced by Policy Power. The combination of the three Policy Power policies can reduce systemic risk in the financial sector as an intermediary function before entering the real sector (Bianchi, 2019; Kuijs, 2012; Annafanada, 2015; Ade Novalina, 2017; Rakhmawati, 2017). Experience has shown that fiscal and monetary policies are less able to control the financial sector (Ansari, 2018). The addition of macro prudential policies is expected to stabilize the global financial crisis (Darmawan, 2017; Siklos, 2018). Wróbel (2013) concluded that the global financial crisis occurred when a stable economic situation caused the financial system to become more vulnerable due to excessive risk-taking by business market players (Alegria et al., 2017; Arijo Hadi, 2016; Saragih, 2015; Yakubu Musa, 2013). Most Emerging Market countries have their vulnerabilities because they still focus on the primary sector and not the secondary or tertiary industry (Novalina, 2018; BBVA Research, 2017). Indonesia is the country with the most potential for investors (Garcia-Herrero, 2017). Emerging market countries have a solid contribution to the global economy (Schwartz, 2017). For example, Indonesia, Brazil, Russia, India, China make total contributions to global economic progress (Pardede, 2016; World bank, 2015; Shetty, World bank, 2015).

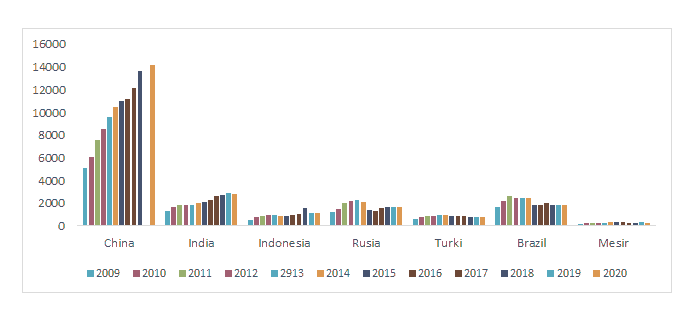

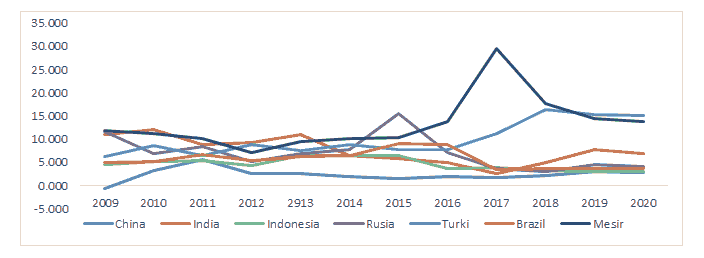

The graph that most experienced a slowdown in 2015, except for China and India, which were able to move up. The strength of China and India was due to stable domestic demand stemming from a large population. Turkey is the lowest.

China experienced the highest inflation increase in 2011, and there was another increase in China's inflation in 2018 and 2019. Turkey experienced a reasonably high inflation increase in 2018, which was around 4.93%. Inflation in India occurred in 2013, and there was a significant increase. Significantly in 2019. A substantial rise in inflation in Indonesia in 2013. For Russia and Brazil, the highest inflation occurred in 2015 due to the economic recession. And for the country of Egypt itself, there was a very high increase in inflation in 2017 caused by the increase in fuel and electricity prices. Hastiadi (2019). The problem of government policy is driving a crowding-out effect. The government is not appropriate to apply tax incentives. Fiscal easing is less effective in influencing consumption—ineffective policies on human and infrastructure investment. As a result, the country's economic performance experienced a slowdown (Bank Indonesia, 2019). Suhariyanto (2019) External factors affect the economic downturn, namely the US-China trade war and Indonesia's export destination countries such as China, Singapore, and South Korea. Developing countries (emerging markets) use macro prudential instruments more widely than developed countries (Antipa et al., 2011; Galati & Richchild, 2011; Tovar et al., 2012). Exchange rate regimes, and resilience to financial shocks (Unsal, 2011). Macros prudential mitigate systemic risk, credit growth that is too strong, liquidity risk, and risks due to capital outflows Kiley & SIM (2007, 2015); Aiyar, et al., (2012), Tovar, et al., (2012). Galati & Richhild (2011) used macro prudential to limit credit supply to the sector and credit pro cyclicality. Kiley & SIM (2015); Cronin & Mcquinn (2016) describe the risk and the problem of lending to value (NPL) used to identify credit health levels.

Almost all Emerging Market Economic Countries, prove a default risk on loans disbursed from banks. The phenomenon of the 2008/2009 crisis of macro prudential an essential role in reducing systemic risk (Baskaya et al., 2015; Claessens & Kose, 2013; Fendoglu, 2015) (Warjiyo & Juhro, 2016). Research conducted by Arnold, et al., (2012); Shi et-all (2014); Tomuleasa (2015); explained the importance of macro prudential policies in minimizing systemic risk in the financial system (Arnold et al., 2012; López et al., 2014; Bianchi et al., 2016; Tovar et al., 2012). Reduce systemic risk arising from credit growth from early warning systems López, et al., (2014); Bianchi, et al., (2016); Shim, et al., (2013); Zhang & Zoli (2014) describe macro prudential policies limiting credit supply from banks in Asia. That macro prudential policies reduce housing price inflation and credit growth effectively. Loan activities then lead to increased risk in the financial system (Chen et al., 2016; Akinci, 2015).

Literature Review

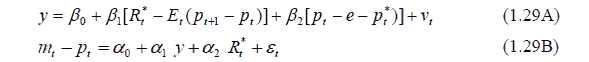

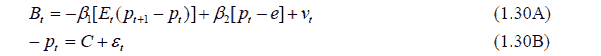

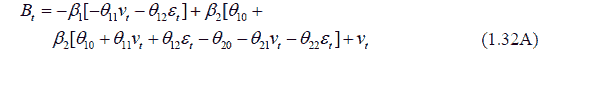

Exchange rate stability is based on the ability of fixed exchange rates in response to government policies. Stability of the exchange rate system as a condition under which monetary authorities determine fixed exchange rates permanently. Fixed exchange rate system means value et=e. Substitution of value et =e explains that in a fixed exchange rate and monetary policy to determine exogenously. Monetary policy is aimed at keeping the exchange rate at the par=e. This condition is called the description of the monetary policy of the fixed exchange rate regime. On a fixed exchange rate system, the IS model and LM model change to:

The effect of response  currency exchange rates and price levels are based on the assumption that pt*, Rt* and mt are constant in the long run so that:

currency exchange rates and price levels are based on the assumption that pt*, Rt* and mt are constant in the long run so that:

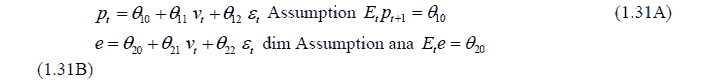

Assumption B and C are the constants of all variables and parameters contained in each variable. Domestic price levels are determined by surprise government consumption, foreign output and demand for money, namely:

Substitution to (1.30A) dan (1.30B) this will produce the following equations of surprises:

Assumption  Domestic price level response [pt] to surprise demand for money stock

Domestic price level response [pt] to surprise demand for money stock  is a negatip or domestic price level will fall if the surprise demand for positive money stock. Response of domestic par currency value [e] to surprise government consumption and foreign output [vt ] is the negatip and response to the shock of domestic money stocks

is a negatip or domestic price level will fall if the surprise demand for positive money stock. Response of domestic par currency value [e] to surprise government consumption and foreign output [vt ] is the negatip and response to the shock of domestic money stocks  It's positive.. The value of the domestic currency will appreciate if the surprise of government consumption and foreign output is positive, conversely the domestic currency exchange rate will depreciate if the surprise of demand for positive money.

It's positive.. The value of the domestic currency will appreciate if the surprise of government consumption and foreign output is positive, conversely the domestic currency exchange rate will depreciate if the surprise of demand for positive money.

Research Methodology

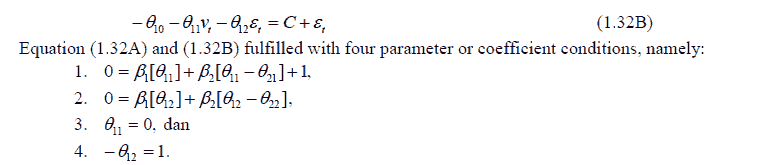

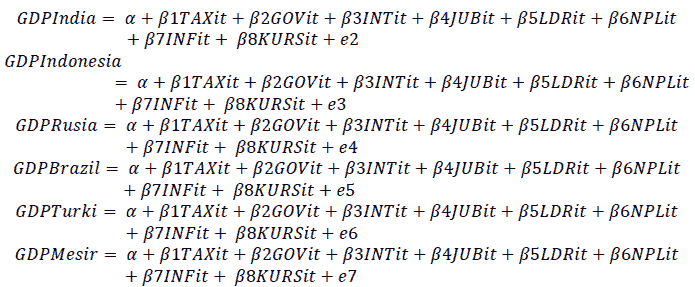

This research method uses the ARDL panel. The ARDL Panel equation for predicting Financial System Stability in this study is as follows:

Discussion

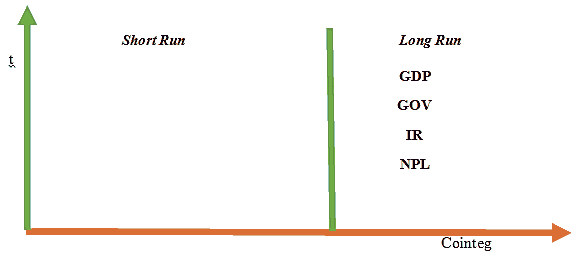

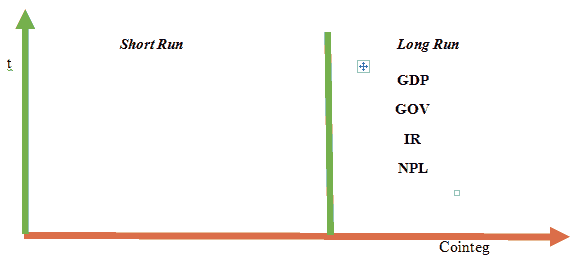

Panel analysis ARDL tests pooled data, which is a combination of cross-section data with time series.

| Table 1 Output Panel Ardl Y (Kurs)=Gdp, Gov, I.R. Dan Npl |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob.* |

| Long Run Equation | ||||

| GDP | 0.46254 | 0.03192 | 14.4919 | 0 |

| GOV | 0.06042 | 0.0108 | 5.59353 | 0 |

| IR | 0.08422 | 0.00868 | 9.70124 | 0 |

| NPL | -0.0362 | 0.01262 | -2.8695 | 0.0073 |

| Short Run Equation | ||||

| COINTEQ01 | -0.1503 | 0.05148 | -2.9188 | 0.0065 |

| D(GDP) | -0.4427 | 0.21924 | -2.0193 | 0.0522 |

| D(GOV) | -0.2468 | 0.15348 | -1.6082 | 0.1179 |

| D(IR) | -0.0363 | 0.04422 | -0.8199 | 0.4185 |

| D(NPL) | -0.0479 | 0.02276 | -2.1065 | 0.0433 |

| C | -0.2396 | 0.1136 | -2.109 | 0.0431 |

| Mean dependent var | 0.03114 | S.D. dependent var | 0.04775 | |

| S.E. of regression | 0.01622 | Akaike info criterion | -5.991 | |

| Sum squared resid | 0.00816 | Schwarz criterion | -4.5908 | |

| Log-likelihood | 276.654 | Hannan-Quinn criteria. | -5.4309 | |

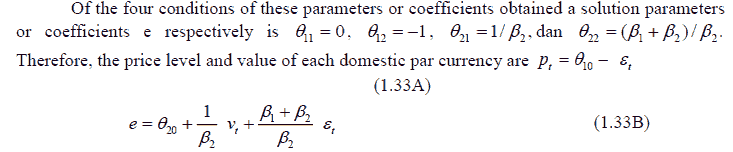

The accepted ARDL Panel Model is coefficient value has a negative slope with a level of 5%. ARDL Panel Model: (-0.15) and significant (0.0065<0.05) then accepted models. The ARDL panel results show that GDP, GOV, I.R., and NPL have a significant effect on the exchange rate in China. The ARDL panel results show that GDP, GOV, I.R., and NPL have a significant effect on the exchange rate in India. The ARDL panel results show that GDP, I.R. The ARDL panel results show that GDP, GOV, and I.R. significantly affect the exchange rate in Russia. ARDL panel results show GDP, GOV, I.R., and NPL significantly affect in Brazil. The ARDL panel results show that GDP, GOV, and NPL have a significant effect on the exchange rate in Turkey.

| Table 2 Output Panel Ardl Y (Gdp)=Npl, Jub, Tax Dan Ldr |

|||||

|---|---|---|---|---|---|

| Long Run Equation | |||||

| NPL | 0.494496 | 0.086320 | 5.728661 | 0.0000 | |

| JUB | 2.314342 | 0.228724 | 10.11847 | 0.0000 | |

| TAX | -2.636604 | 0.255574 | -10.31639 | 0.0000 | |

| LDR | 0.268976 | 0.105050 | 2.560456 | 0.0155 | |

| Short Run Equation | |||||

| COINTEQ01 | -0.287436 | 0.083399 | -3.446512 | 0.0017 | |

| D(NPL) | -1.783168 | 1.413757 | -1.261297 | 0.2166 | |

| D(JUB) | 0.619155 | 0.477601 | 1.296388 | 0.2044 | |

| D(TAX) | 1.520406 | 1.147690 | 1.324753 | 0.1949 | |

| D(LDR) | -0.271823 | 0.254608 | -1.067612 | 0.2939 | |

| C | 2.110331 | 0.674416 | 3.129121 | 0.0038 | |

| Mean dependent var | 0.022143 | S.D. dependent var | 0.179733 | ||

| S.E. of regression | 0.198098 | Akaike info criterion | -3.303235 | ||

| Sum squared resid | 1.216522 | Schwarz criterion | -1.903040 | ||

| Log-likelihood | 173.1746 | Hannan-Quinn criteria. | -2.743169 | ||

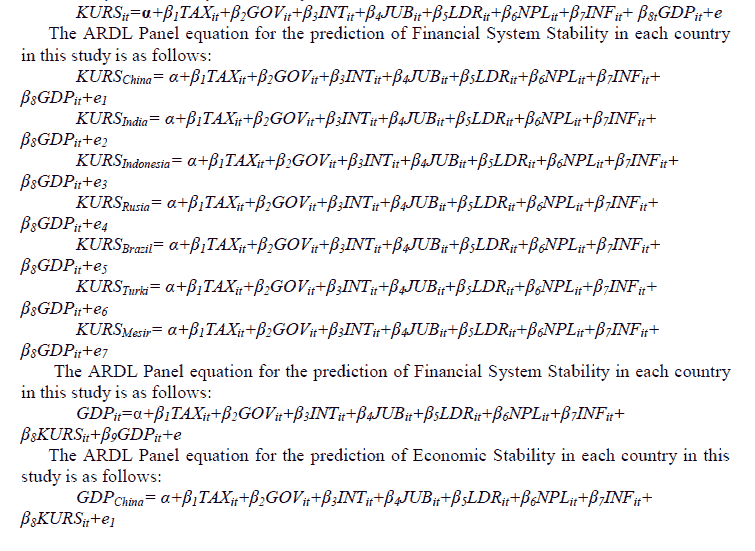

The coefficient value has a negative slope with a 5%. The ARDL panel results show that NPL, TAX, and LDR significantly affect GDP in China. Results show that NPL, TAX, and LDR have a considerable effect on GDP in India. Results show that NPL, JUB, TAX, and LDR significantly affect GDP in Indonesia. Results show that NPL, JUB, TAX, and LDR significantly affect GDP in Russia. Results show that NPL and LDR have a significant effect on GDP in Brazil. Results show that JUB and TAX have a substantial impact on GDP in Turkey. Finally, Results show that JUB and LDR have a significant effect on GDP in Egypt.

This analysis was conducted to find the Leading Indicators of Economic Stability (GDP) and Financial System Stability through Policy power. The results for exchane rate show the Leading Indicators of the Exchange Rates in each country. Based on the summary of the results of the ARDL Panel model for the Exchange Rate, it can be analyzed as follows:

| Table 3 Summary Of Ardl Panel Model Results For Exchange |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | China | India | Indonesia | Rusia | Brazil | Turki | Media | Short Run | Long Run |

| GDP | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 |

| GOV | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 1 |

| IR | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 1 |

| NPL | 1 | 1 | 1 | 0 | 1 | 1 | 0 | 0 | 1 |

The following is a summary of long-term stability in the Seven Emerging Market Economies Countries:

The Leading Indicators of Financial System Stability in 7 Emerging Markets shows that Financial System Stability in China are GDP, GOV, I.R., and NPL, this indicates that the effectiveness of policy power is indispensable in achieving financial system stability in China. The Leading Indicators of Financial System Stability in India are GDP, GOV, I.R., and NPL; this also shows that the effectiveness of policy power is very much needed in achieving financial system stability in India. The Leading Indicators Stability in Indonesia are GDP, I.R., and NPL; this also shows that power policy are very much needed to achieve financial system stability in Indonesia. The Leading Indicators Stability in Russia are GDP, GOV, and I.R.; this also shows that power policy effectiveness is indispensable in achieving financial system stability in Russia. Financial System Stability in Brazil are GDP, GOV, I.R., and NPL; this also shows that the effectiveness of policy power is very much needed in achieving financial system stability in Brazil. The Leading Indicators Stability in Turkey are GDP, GOV, and NPL; this shows that power policy are indispensable in achieving financial system stability in Turkey.

The research results above are in line with the studies that have been summarized, namely (Levi 2004). The factors that affect the rupiah exchange rate, inflation, and the BOP. The higher the income level, the greater the ability to carry out economic activities (imports) and will increase the demand for the dollar, causing the rupiah exchange rate to depreciate. Indonesia's economic growth is thought to be a factor affecting the rupiah exchange rate. Wanaset (2008) conducted in Thailand; in this study, the Thai Bath exchange rate movement by CPI, GDP, Money Supply, and oil prices. Research by Anca Elena Nucu (2011) shows that the direction of Ron Romania's exchange rate against the Euro is influenced by GDP, inflation rate, money supply, interest rate, and balance of payments. Yunika Murdayanti's research (2012).

The panel turns out that GDP, GOV, I.R., and NPL are the leading indicators of financial system stability (exchange rate) in China, India, Indonesia, Russia, Brazil, Turkey, and Egypt. Still, their positions are unstable. The beginning of the crisis in 2008 with conditions of low-interest rates increased risks lending activities which then led to increased risk in the financial system (Chen et al., 2016). The policy power formulated is the integration of monetary policy and macro prudential policy to maintain rupiah stability and financial system stability, implemented in 2010 (Warjiyo, 2010). In Brazil, monetary policy and macro prudential policy (capital and reserve requirements) worked together during the post-crisis period (2010-2011) to control risks from rapid credit growth. In Korea, fluctuations in housing prices have little correlation with inflation, and these fluctuations are controlled by Loan To Value and Debt to Income. At the same time, power policy is used to achieve output and price stability (IMF, 2013). Another country that has also adopted a policy mix is Turkey since 2010, which is designed to regulate short-term capital volatility (Uysal, 2016).

The determination of GDP, GOV, I.R., and NPL as leading indicators in the Seven Emerging Market Economies Countries is also supported by the opinion (Wimanda et al., 2014). The main policy instrument used by Bank Indonesia is the B.I. The rate policy rate is the interest rate reference as a policy transmission in achieving the final target of price stability. Therefore, implementation of the B.I., the rate policy instrument, is effective in maintaining price stability. Chadwik, M. G. (2018) shows that macro prudential policies effectively support credit growth and reduce financial system vulnerabilities. However, monetary and macro prudential policy power will be more potent in maintaining credit growth and financial system stability—the B.I. Rate and LDR reserve requirements are based on previous literature studies, which show that the two policy instruments are the most effective in influencing price stability. Analysis of the Effectiveness of Policy Power in Determining the Leading Indicators of Economic Stability in 7 Emerging Markets. ARDL Panel results for GDP show the Leading Indicators of GDP in each country. Based on the summary of the results of the ARDL Panel model for GDP, it can be analyzed as follows:

| Table 4 Ardl Panel Model Results Summary For Gdp |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | China | India | Indonesia | Rusia | Brazil | Turki | Media | Short Run | Long Run |

| NPL | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 1 |

| JUB | 0 | 0 | 1 | 1 | 0 | 1 | 1 | 0 | 1 |

| TAX | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 0 | 1 |

| LDR | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 0 | 1 |

The following is a summary of long-term stability in the Seven Emerging Market Economies Countries:

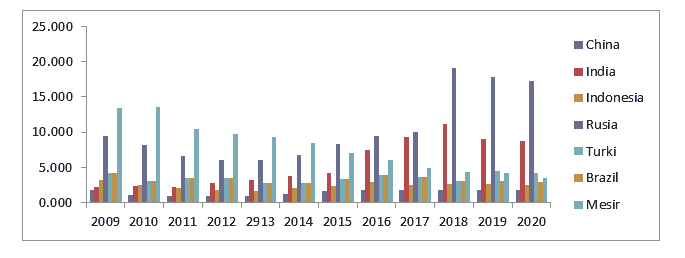

Figure 5: Effectiveness Of Policy Power In Determining The Leading Indicators Of Economic Stability In 7 Emerging Markets

The effectiveness of policy power in determining the Leading Indicators of Economic Stability in 7 Emerging Markets shows the Economic Stability in China are NPL, TAX, and LDR; this indicates that the effectiveness of power policy are indispensable in achieving economic stability in China. In India are NPL, TAX, and LDR; this also shows that the effectiveness of fiscal policy power and macro prudential policy achieving economic stability in India. Fiscal management, monetary policy, and macro prudential policy are indispensable in achieving financial stability in Indonesia. Economic stability in Russia are NPL, JUB, TAX, and LDR; this also shows that fiscal policy power, monetary policy, and macro prudence policy al are essential for achieving economic stability in Russia. The Leading Indicators of Economic Stability in Brazil are NPL and LDR; this also shows that the effectiveness of macro prudential policies is essential in achieving economic stability in Brazil. Finally, the Leading Indicators of Economic Stability in Turkey are JUB and TAX; this also shows that the effectiveness of power policy is very much needed to achieve economic stability in Turkey.

The research results have been summarized, namely (Abid, 2014) the GDP significant negative relationship to NPL. Furthermore, Abid (2014) explains that low GDP will negatively impact the NPL ratio, which shows a strong dependence on the ability of the debtor household sector to repay loans. Salas & Saurina (2002) show that there is a relationship between GDP and NPL. The results of this study are confirmed by Jimenez & Saurina (2005) that GDP influences NPL. In their research, Wu, et al., (2003) showed that GDP had a significant adverse effect on non-performing loans. While the study by Rahmawulan (2008); Ahmed (2006) showed the opposite, GDP had a significant positive impact on non-performing loans. In another research by Soebagia (2005); Nasution & Williasih (2007), it is known that GDP does not have a significant effect on non-performing loans.

Asnawi & Fitria (2018) concluded supply could increase economic growth; this is related because, with an increase in the money supply, people will get more goods, and then demand production factors increases. In Mashkoor, Yahya & Syed's (2010) research, taxes are crucial in development planning. Countries in global competition. Every government tries to get significant tax revenues to finance all state expenditures so that the government does not need to borrow funds from other parties. Other results in Anastassio & Dritsaki (2005). The analysis results show a positive relationship between NPL and bank size, LDR, CAR, and inflation but negatively associated with GDP. The finding of a negative relationship between NPL and GDP strengthens the study results by Irwan (2010). Setifandy (2014) states that the NPL decreases in the observation period and other variables remain for every increase in GDP.

The panel shows that NPL, JUB, TAX, and LDR are the leading indicators of economic system stability (GDP) in China, India, Indonesia, Russia, Brazil, Turkey, and Egypt. Still, their positions to long run. First, TAX and JUB can affect GDP. Government revenue derived from tax collections will increase with increasing tax rates. However, in the end, growing taxes reduce government revenues because taxes reduce the market size (Todaro, 2009; Mankiw, 2014; Asnawi & Fitria, 2018; Tiwa et al., 2016). Third, the effect of the LDR reserve requirement on the credit ratio per GDP states that if the LDR reserve requirement increases by 1%, the credit to GDP ratio will increase by 0.026% in the next three months. This shows that the LDR instrument is countercyclical; it can put a brake on the rate of economic growth that is too fast and accelerates low or even negative economic growth (Yoel, 2016).

The stability of the long run, NPL, JUB, TAX, and LDR in the long run significantly control Economic Stability. The determination of NPL, JUB, TAX, and LDR as leading indicators in the Seven Emerging Market Economies Countries is also supported (Bank Indonesia, 2016), where macroeconomic conditions resulting from the implementation of monetary policy will directly affect financial system stability. An economic slowdown or exchange rate volatility, for example, can directly impact the performance of banking credit distribution and quality—housing area. Purnawan & Nasir (2015); Wimanda et al., (2012) reveal that in the long term, the impact of macro prudential variables (GWM-LDR) is positively related to exchange rate volatility, which causes economic growth to increase due to exchange rate appreciation which causes a country's imports to grow.

Conclusion

The leading indicators of economic fundamentals in China are NPL, TAX, and LDR; in India are NPL, TAX, and LDR; in Indonesia are NPL, JUB, TAX, and LDR; in Russia are NPL, JUB, TAX, and LDR, in Brazil, are NPL and LDR in Turkey it is JUB and TAX, in Egypt, it is JUB and LDR, this also shows that the effectiveness of policy power, fiscal policy, monetary policy, macro prudential policy, is indispensable in achieving economic fundamentals in emerging market countries. The variable used as a leading indicator as policy power against solid economic fundamentals is the money supply that can control in China, India, Brazil, and then NPL in Russia and Egypt. On the other hand, Brazil, Turkey, and Egypt are the leading indicators of countries most able to use policy power in strengthening economic fundamentals. Therefore, policy recommendations in emerging market countries to support economic fundamentals are China, India, and Brazil through policies to control the money supply, Turkey with NPL and LDR or the financial sector, Egypt with NPLs and taxes, Brazil with money supply and taxes.

References

Agung, J. (2010). Integrating monetary and macroprudential policy: Towards a new paradigm of monetary policy in indonesia post-global crisis. Bank Indonesia Working Paper.

Ade Novalina, R.S. (2017). The effectiveness of monetary policy transmission mechanisms through interest rate channels on Indonesia's economic stability. Economic Studies and Public Policy, 1-12.

Ahmed, A. (2018). Economics of Nigeria and West Africa population growth: Panel ardl approach for West Africa. Asian Journal of Economic Modeling, 6(3), 327-355.

Alenso, A., & Rault, C. (2015). Monetary policy transmission: Old evidence and some new facts from Brazil. Discussion Papers.

Annafanada. (2015). Analysis of the effect of the money supply on inflation in Indonesia in 2004-. eprints.umm.ac.id,1-4.

Ansari, J. (2018). Macro prudential Policies in SEACEN Economies. The SEACEN Centre, 113.

Antipa, F., Xavier., Luc, L., & José-Luis, P. (2017). Forth coming, systemic risk, crises, and macro prudential regulation. MIT Press.

Ariefianto, M.D. (2012). Essential econometrics and applications using EViews. Jakarta: Erlangga.

Akinci, O., & Olmstead-Rumsey, J. (2015). How effective are macro prudential policies ? An empirical investigation board of governors of the Federal Reserve System, (1136).

Angelini, P., Stefano N., & Panetta, D.F. (2012). Monetary and macro prudential policies. Working Paper Series, No 1449, European Central Bank, Juli.

Arnold, B., Claudio, B., & Moshiran, L.E.D.F. (2012). Systemic risk, Mar prudential policy framework, Monitoring Financial System. And the evolution of capital adequacy. Journal of Banking and Finance, 36, 3125-3132.

Arijo H.A.D. (2016). The fiscal-monetary policy mix and its impact on the defense budget. Defense Journal, 145-170.

Arsana, I.G.P. (2005). Vector auto regressive. Laboratorium Komputasi Ilmu Ekonomi FEUI, Universitas Indonesia, Depok.

Aiyar, S., Charles, W., Calomiris & Tomasz, W. (2014). “Does macro-prudential regulation leak? Evidence from a UK. Policy experiment”. Journal of Money, Credit and Banking, 46(1), 181-214, 02.

Arellano, M., & Stephen, B. (2011). “Some tests of specification for panel data: Monte carlo evidence and an application to employment equations.” Review of Economic Studies, 58(2), 277-97.

Alegria, A., Alfaro, R., & Córdova, F. (2017). The impact of warnings published in a financial stability report on loan-to value ratios. BIS Working Paper No. 633.

Asghar. (2016). Institutional quality and economic growth: Panel ARDL analysis for selected developing economies of Asia. International Journal Economic, 34-45.

Alper, K., Binici, M., Demiralp, S., Kara, H., & Özlü, P. (2014). Reserve requirements, liquidity risk and credit growth. TCMB working paper 1416. Koc University TUSIAD Economic Research Forum.

Arnold, B., Borio, C., Ellis, L., & Moshirian, F. (2012). Systemic risk, macro prudential policy frameworks, monitoring financial systems and the evolution of capital adequacy. Journal of Banking and Finance. 36(12), 3125–3132.

Asgar, R., & Ongena, S. (2016). Institutional quality and economic growth: Panel ardl analysis for selected developing economies of Asia. 30(2), July – December 2015, 381-403.

Auer, R., & Ongena, S. (2016). The countercyclical capital buffer and the composition. BIS Working Paper No. 593.

Bank of England, (2011). “The role of macro prudential policy.” Discussion Paper, November.

Baasir, F. (2003). Development and crisis. Jakarta: Hope Library.

Bank Indonesia (2019). Financial stability study. Synergize to promote quality intermediation amid continuing uncertainty. Global No. 33, Sept 201 9.

Bappenas. (2008). Macroeconomic stability. 1-32.

Bappenas. (2014). Macroeconomic stability consolidation. Jakarta.

- (2019). Financial system stability. Jakarta.

Blog, M. (2010, June 23). Malqistitude's Blog.

BBVA Research (2017). Get to know BRICS and BRICS New Development Bank.

Bianchi, A.C., Thwaites, G., & Vicondoa, A. (2016). Monetary policy transmission in an open economy: New data and evidence from the United Kingdom. European University Institute & Bank of England and CfM.

Bahadir, B., & Gumus, I. (2016). Credit decomposition and business cycles in emerging market economies. Journal of International Economics. 103, 250-262.

Baskaya, Y.S., Giovanni, J., Kalemli-ozcan, S., Peydro, J., & Ulu, M.F. (2015). Capital flows, credit cycles and macro prudential. BIS Working Paper, 86: 63-68.

Basten, C., & Koch, C. (2015). Higher bank capital requirements and mortgage pricing: Evidence from the Counter-Cyclical Capital Buffer (CCB). BIS Working Paper No. 511.

Bauer, G.H. (2017). International house price cycles, monetary policy and credit. Journal of International Money and Finance. 74, 88–114.

Claessens, S., & Kose, M.A. (2013). Financial crises: Explanations, types and implications. IMF Working Paper No. 65.

Claessens, S., Swati, G., & Roxana, M., (2012). “Macro prudential policies to mitigate financial system vulnerabilities.” Journal of International Money and Finance, 39, 153–185.

Crowe., Dell, A., Christopher, W., Deniz, I., Giovanni., & Pau, R. (2011). “How to deal with real estate booms.” IMF Staff Discussion Note 11/02.

Dell, A., Cerutti, E., Jihad, D., & Giovanni. (2015), “Housing finance and real-estate booms: A cross-country perspective.” Forthcoming IMF Staff Discussion Note.

Darmawan, M.H. (2017). Monetary policy transmission capability in maintaining economic stability in 10 emerging market countries. 1-174.

DetikFinance. (2008). Masalah Likuiditas Bank Century Sudah Terjadi Sejak Lama.

Drehmann, M., & Tsatsaronis, K. (2014). The Credit-to-GDP gap and countercyclical capital buffers: Questions and answers. BIS Quarterly Review, March 2014.

De, N., Gianni., Giovanni, F., & Lev, R. (2012), “Externalities and macro prudential policy”. IMF staff discussion Notes, No.12/05.

Endri, A.I. (2009). Strengthening financial system stability through improving the intermediation function and efficiency of regional development banks (BPD). Journal of Finance and Banking, 120-134.

Enders, W. (1995). Applied econometric time series. New York, John Wiley Sons, Inc, Canada.

Fendoglu, S. (2015). Credit cycles and macro prudential policy framework in emerging countries. BIS working 86, 17–25.

Fleming, D., & Parker. (1962). Evidence on the determinant of tax payer compliance examination of effect with holding positions, Audit detection rates and penalty amount on tax compliance decisions. Thesis. Nova South Eastern University. USA.

Fendoglu, S. (2017). Credit cycles and capital flows: Effectiveness of the macro prudential policy framework in emerging market economies. Journal of Banking and Finance. 79, 110–128.

Galati, G., & Richhild, M. (2011). “Macro prudential policy - A literature review.” BIS Working Papers 337, Bank for International Settlements

Georgiadis, G. (2015). Determinants of global spillovers from us monetary policy. European central bank (ECB), Working Paper Series 1854 / September 2015.

Greene A. (2003).” Econometric Analysis, (Fifth Edition). New York University.

Gujarati, D. (2003). Basic Econometrics (Fourth Edition). McGraw Hill. Singapore.

Garcia-Herrero, A. (2017). Get to know BRICS and BRICS New Development Bank.

Hastiadi, F., & Faisal. (2019). Causes of the decline in Indonesia’s economic growth. LPFE University of Indonesia.

Herman, A., Igan, D., & Solé, J. (2017). The macroeconomic relevance of bank and nonbank credit: An exploration of U.S. Data. Journal of Financial Stability, 32, 124–141.

Hsing, Y. (2015). Monetary policy transmission and bank lending in china and policy implications. Journal of Chinese Economics, 2(1), 1-9.

Hahm, C., Tito., Pablo, F., Carlos, V., & Guillermo, V. (2014). “Reserve requirements in the brave new macro prudential world.” World Bank Policy Research Working Paper No. 6793.

Hanson, S., Anil, K., & Jeremy, S. (2011). “A macro prudential approach to financial regulation.” Journal of Economic Perspective, 25(1), 3–28.

Hwa, T.B. (2015). The transmission of financial stress and its interactions with monetary policy responses in the ASEAN-5 Economies. Bank Negara Malaysia. Working Papers WP6/2015.

Igan, D., & Pinheiro, M. (2011). Credit growth and bank soundness: Fast and furious? IMF working papers No. WP/11/278.

Igan, D., & Heedon, K. (2011). “Do loan-to-value and debt-to-income limits work? Evidence from Korea.” IMF Working paper 11/297.

Ikhsan, M., Dan, M.C., & Basri. (1991). " Private and government investment; substitution or complementary? The case of Indonesia". Economics and Finance Indonesia, 39(4), December, page, 359-391.

Jakarta, A.I. (2009). Strengthening financial system stability through improving the intermediation function and efficiency of regional development banks (BPD). Journal of Finance and Banking, 120-134.

Jimenez, G., Ongena S., & Dan Peydro, J.L. (2012). Hazardous times for monetary policy “ What do twenty three million bank loans say about the effects of monetary policy on credit risk taking, Side of Spain working Paper No. 0833.

Kompasiana. (2017). Fiscal policy and its effect on the national economy. Jakarta: kompasiana.com.

Kowalski, J.R., Mendoza-Blanco, X., Tu, M., & Dan-Gleser, L.J., (1999). On the difference in inference and prediction between the joint and independent t-error models for seemingly unrelated regressions. Communications in statistics. Part a theory and methods, 28, 2119-2140.

Kuijs, L. (2012). Monetary policy transmission mechanism and inflation in the Slovac republic. International Monetary Fund, Working Paper, WP02/80.

Kuncoro, S. (2014). Analysis of the effect of economic growth, unemployment and education levels on poverty levels in east java province 2009 - 2011. Scientific Journal. Fe Muhamadiyah Surakarta.

Karfakis, C. (2013). Credit and business cycles in Greece: Is there any relationship?Economic Modeling, 32, 23–29.

Kazanas, T., Philippopoulos, A., & Tzavalis, E. (2011). Monetary policy rules and business cycle conditions. The Manchester school, 79(2), 73–97.

Kiley, M.T., & Sim, J. (2015). Optimal monetary and macro prudential policies: Gains and pitfalls in a model of financial intermediation. Finance and economics discussion series 2015-78. Board of governors of the Federal Reserve systems.

Kilin, M., & Tun, C. (2014). Identification of monetary policy shocks in Turkey: A structural VAR approach. Working paper No. 14/23. Ankara: Central Bank of the republic of turkey.

Khalsum, U. (2000). Fiscal and monetary interaction analysis on indonesia's Gross Domestic Product.

Lim., Cheng, H., Francesco, C., Alejo, C., Piyabha, K., & Xiaoyong, W. (2011). “Macro prudential Policy: What instruments and how are they used? Lessons from Country Experiences”. IMF Working Paper 11/238.

Lim, C., Columba, F., Costa, A., Kongsamut, P., Otani, A., … & Wu, X. (2011). Macro prudential Policy: What instruments and how to use them? Lessons from country experiences. IMF Working Papers No. WP/11/85.

López, M., Tenjo, F., & Zárate, H. (2014). Credit cycles, credit risk and countercyclical loan provisions. Journal of Epidemiology and Public Health, 32(74), 9–17.

McCarthy, Y., & McQuinn, K. (2017). Credit conditions in a boom and bust property market: Insights for macro-prudential policy. Quarterly Review of Economics and Finance, 64, 171–182.

Mankiw, N.G. (2013). Macroeconomics (Eight Edition). New York: Worth Publishers.

Mag, A. (2015, March 19). Important things about financial stability.

Novalina, A. (2018). Economic stability prediction (Vol. 5). Medan: Japan.

Nugroho, A.C. (2019). 7 emerging markets countries to lead the world economy in 2030. Indonesia Ranks 4th The Rising Star in the World. Jakarta: Bisnis.com.

Mundell., & Robert, A. (1963). “The monetary dynamics of international adjustment under fixed and flexible exchange rates.” Quarterly Journal of Economics,74(May), 227–57.

Mahendra, I., Gede, Y., & Kesumajaya, I.W.W. (2015). Analysis of the effect of investment, inflation, United States dollar exchange, and credit interest rates on Indonesian exports in 1992-2012. E-Journal of Development Economics, Udayana University, 4(5), 525-545.

Moawad., & Ramadan, R. (2019). Financial development and economic growth: ARDL model, 4(7), July – 2019.

Manurung, J.J., Saragih, A.H., & Ferdinand, D. (2005). Gede yoga and I Wayan Wita Kesumajaya.

Mgadmi, N., & Chrigui, Z. (2015). Monetary policy’s transmission channels in Russia: SVAR Model Validation. Journal of Business and Management Research, 8(2015) 189-200.

Pardede, R. (2017). BBVA EAGLEs: Emerging market countries major destination for global investors.

OJK. (2017). Definition of financial system stability. Jakarta.

Rakhmawati, I. (2017). Resilience of the household sector in the context of maintaining financial system stability. Journal of Islamic Business and Management, 65-92.

Rahman, A. (2013). Analysis of the effectiveness of fiscal and monetary policy on Indonesia’s gross domestic product. Medan.

Rusiadi. (2018). Emerging market state monetary transmission, USU Medan's Dissertation.

Rosoiu. (2015). A emerging markets queries monetary policy and time varying parameter vector auto regression model. The Bucharest University of Economic Studies. Procedia Economics and Finance 32, 496 – 502.

Salikin, M.Y. (2016). The effect of monetary policy on inflation and Gross Domestic Product (GDP) in Indonesia. SKIRT, 1-7.

Setiawan,I. (2009). Analysis of the impact of monetary policy on the development of inflation and economic growth in Indonesia. Journal of Economics, Finance, Banking and Accounting, 1(1), 15 - 31. Bandung State Polytechnic

Sheefeni, J.P., & Kalikeka. M. (2013). Interest rate channel and monetary transmission in Zambia. Journal of Emerging Issues in Economics, Finance and Banking (Jeiefb) 2(6).

Saragih, J.P. (2015). Monetary-fiscal policy mix on achieving inflation and economic growth targets. Studies, 163-182.

Shenglin, N.Y.G., & Ben. (2016). Should practice simple central banking to help rmb internationalizatio. Journal of Chinese Economics,4(2), 35-46 (Online).

Cyclos, P. (2018). Monetary policy. Financial stability and the Macro prudential Illusion? CIGI Papers, 1-8.

Schwartz, S. (2017). “Who are the EAGLEs: Driving global growth for the next ten years.

Firm, Basuki, Umar, Maruto. (2009). “Impact of fiscal and monetary policy in the indonesian economy: Application of the mundell-fleming model”. Journal of Organization and Management,5(2), September 2009, 108-128.

Simorangkir, I. (2013). Coordination of monetary policy and fiscal policy in Indonesia: An approach to game theory. PPSK Bank Indonesia Working Paper.

Rydland, V., & Grøver, V. (2018). Argumentative peer discussions following individual reading increase comprehension. Language and Education.

Park, Y.C. (2011). The role of macro prudential policy for financial stability in east asia’s emerging economies. Asian Development Bank Institutuse Working Paper Series, (284).

Pesaran, M.H., Shin Y., & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326.

Pramono, B., Hafidz, J., Maulana, J.A., Muhajir, H., Alim, M.S., & Alim, S. (2015). The impact of the countercyclical capital buffer policy to credit growth in Indonesia. Working Paper No. WP/4/2015. Jakarta: Bank Indonesia.

Purnawan, M.E., & Nasir, M.A. (2015). The role of macro prudential policy to manage exchange rate volatility, excess banking liquidity and credit. Bulletin of Monetary Economics and Banking, 18(1), 21–44.

Rubio, M., & Carrasco-gallego, J.A. (2014). Macro prudential and Monetary Policies: Implications for financial stability and welfare. Journal Of Banking Finance, 49, 326-336.

Sáiz, M.C., Sanfilippo, A.S., Torre, O.B., & López, G.C. (2017). Trade credit, sovereign risk and monetary policy in Europe.International Review of Economics and Finance, 52, 39–54.

Shi, S., Jou, J., & Tripe, D. (2014). Can interest rates really control house prices? Effectiveness and implications for macro prudential policy.Journal Of Banking Finance, 47, 15–28.

Shijaku, G. (2017). Does concentration matter for bank stability? Evidence from the albanian banking sector. Journal of Central Banking Theory and Practice, 6(3), 67–94.

Shim, K., Kenneth, N., & Ilhyock. (2013). “Can non-interest rate policies stabilise housing markets? Evidence from a panel of 57 economies.” BIS Working Papers No 433.

Suh, H. (2014). Dichotomy between macro prudential policy and monetary policy on credit and inflation. Journal of Economics Letters.122(2): 144–149.

Thanassoulis, J. (2014). Bank pay caps, bank risk, and macro prudential regulation. Journal of Banking and Finance, 48, 139–151.

Tomuleasa, I. (2015). Macro prudential policy and systemic risk: An overview. Procedia Economics and Finance,20(15), 645–653.

Tovar, C.E., Garcia-Escribano, M., & Martin, M.V. (2012). Credit growth and the effectiveness of reserve requirements and other macro prudential instruments in Latin America. IMF Working Paper 12/142, 1–29.

Uysal, M., & European, C.B. (2016). Financial stability and macro prudential Policy, (9), 349–364

Wimanda, R.E., Maryaningsih, N., Nurliana, L., & Satyanugroho, R. (2014). Evaluation of the transmission of the bank Indonesia policy mix. Working Paper WP/ 03/ 2014, Bank Indonesia. ,

Warjiyo, P. (2016). Central bank policy mix: Main conceptions and experiences of bank Indonesia. Jakarta: BI Institute.

World Bank, L.B. (2018). Laporan Tahunan 2018. Indonesia: Bank Dunia.

Worldbank. (2019). September 3. World Bank Open Data. Retrieved from World Bank Group.

Wróbel, R. (2019). 13th International scientific conference on sustainable, Modern and safe transport (Transcom 2019), High Tatras, Novy Smokovec – Grand Hotel Bellevue, Slovak Republic, May 29-31, 2019 Dependencies of elements recognized as critical infrastructure of the state

Vasile, C., & Anca, E.N. (2014). Monetary policy and financial stability: Empirical evidence from Central and Eastern European countries. 75-98.

Yakubu Musa, B.K. (2013). Effect of monetary-fiscal policies interaction on price and output growth in Nigeria. CBN Journal of Applied Statistics, 55-74.

Yogi. (2013). Conceptual framework.Zhang, C.W. (2015). How might northern technology benefit but northern money hurt the south through trade. Department of economics, Monash university, Department of economics discussion Paper 47/15.

Received: 30-Nov-2021, Manuscript No. AEJ-21-9967; Editor assigned: 02- Dec -2021, PreQC No. AEJ-21-9967 (PQ); Reviewed: 13- Dec -2021, QC No. AEJ-21-9967; Revised: 20-Dec-2021, Manuscript No. AEJ-21-9967 (R); Published: 06-Jan-2022