Research Article: 2019 Vol: 23 Issue: 3

Personal Trust Institution Trust and Consumerism Attitudes towards Mobile Marketing and Banking Services in India

Dr. Balakrishnan Menon, Rajagiri Business School, Rajagiri School of Management, Rajagiri College of Social Sciences, Mahatma Gandhi University

Abstract

Rapid technological development has accompanied to the increasing digitalization of marketing communication media, which paved the way for mobile phone media offering better avenues, to reach and interface with customers. The mobile technological advancements also created opportunities for marketers, to communicate with consumers at a lower cost, faster pace, and to use it for efficient and effective promotional activities. This study aimed to examine and explain important determinants that influence purchase intention towards mobile banking services in India. The research, survey and data collection through questionnaire were conducted from August 2018 to February 2019. The results emphasized that personal trust, institution trust, attitude towards mobile marketing, and privacy features are the major factors that influenced the intention of consumers, in availing banking services over mobile phones.

Keywords

Institution Trust, Personal Trust, Mobile Marketing, Privacy, Mobile Banking.

Introduction

Mobile banking is a channel where a bank can interface with their customers with an advantage, through a smart mobile device. The channel may be considered as a smaller set of electronic banking and an extrapolation of internet banking services. This channel has a unique advantage and characteristics over traditional channels (Laukkanen & Passane, 2008). However, the mobile banking channel is considered to be a harnessing medium with its unique advantage, contributing immensely to growth strategies for banking institutions and mobile service provider industries (Goswami & Raghavendran, 2009). Banks are enabled to provide full banking services over mobile banking applications to customers, such as online payments, banking services, and real- time two-way communications, and boundless access to banking services (Jacob, 2007). It is now accepted that banking services may be effectively accessed over mobile phone channel for service consumption, offering a potential boost to banking institutions (Laukkanen & Lauronen, 2005). Though there is some literature available on mobile marketing, there is no consistency and uniformity on its definition (Varnali & Toker, 2010; Leppaniemi et al., 2006). There are some other exploratory articulations such as mobile marketing, mobile advertising, wireless marketing and wireless advertising (Dehkordi et al., 2012).

The next section discusses the literature review, gap and need for the study, objectives of the study, formulation of hypotheses and theoretical model of the study. The third section presents the research methodology adopted to conduct the research study, while the fourth section deals with the discussion of the data analysis, results, interpretation, measurement of model fitness and hypotheses testing. Finally, the last three sections detail the findings, discussions, theoretical & practical implications and conclusion.

Literature Review

One of the top services promoted by financial institutions like banks and credit unions is mobile banking. Banks usually choose to depend on their own media sources when it comes to advertising on mobile banking. These sources are social media channels, corporate websites. However, the most favored source to promote mobile banking for banks is their own branch websites. This is due to the fact that banks prefer to promote their mobile banking tools primarily to their existing consumers. However, the adoption rate of mobile banking in India is very low.

Mobile Marketing

As per the Reserve Bank of India (RBI), the Indian Banking industry is currently worth Indian National Rupee (INR) 81 trillion (USD 1.31 trillion). Banks currently utilize the latest technologies like the internet and mobile devices, to carry out transactions and communicate with their mass audience. Due to its obvious advantage over traditional marketing media, organizations might wish to customize advertising information based the consumer preferences, through any mobile device (Boeck et al., 2011). Accordingly, with respect to the acceptance and building up a positive attitude towards mobile marketing, customer’s preferential choices are perceived usefulness and perceived ease of use (Oscar et al., 2017).

Personal Trust

An important factor affecting the adoption of mobile usage was personal trust in online news services (Chen & Corkindale, 2008) and Internet banking (Flavian et al., 2005). As per the study of Lee & Chung (2009), findings suggested that trust was an important factor to influence customer satisfaction of mobile banking services in Korea. There was another research study by Lin (2011), who investigated the contribution of knowledge-based trust, measured in terms of competence, benevolence, and integrity in mobile banking adoption involving consumers in Taiwan. Some of the other scholars strongly proposed that trust is an essential pre-conditional factor, which influenced the success of a mobile commerce application (Jayawardhena et al., 2009). Consumers trust factor may be more pronounced and critical with e-marketing, where parties do not necessarily meet physically for an exchange of communications. The study by Kim et al., (2009) proposed a consumer decision-making model in electronic commerce, which advocated that a consumer’s trust strongly affected consumer buying intention.

Institution Trust/Bank Trust

Mobile banking service provider refers to the retail banking institutions that provide banking services over smart mobile phones. There are not many studies conducted on the organizational trust factor, influencing customers in adopting mobile banking services. A study conducted in China identified that organizational trust factor was an important ingredient in deciding the acceptance of mobile banking services (Zhou, 2011). Organization or institution-based trust provides a convincing platform from an institution or third party, to build up trust in customers (Gefen et al., 2003). According to a research conducted by McKnight et al., (2002) institution based trust in the mobile telecommunication service provider involves a predictive and positive relationship with both trusting belief and trusting intention of consumers; and trusting belief directly inferences trusting the intention of consumers. A banking institution which can unequivocally secure and protect customer’s personal data is highly trusted by its customers (Laksamana et al., 2012). Arguably, data protection and effective safeguarding of customer data increase institutional trust and trust influences buying intention (Heijden et al., 2003).

Attitude towards Mobile Marketing

There is an upward trend of mobile channel users spending more time, interacting with applications and web browsing on these devices. A majority of Google searches is being carried out from mobile devices (Graham, 2015). This new consumer reality provides a rallying cause for organizations to invest in new patterns of consumer behavior of web browsing and apps usage, to log in new customers. Sultan et al., (2009) substantiated the acceptance of mobile marketing actions by consumers. Various studies have confirmed that attitude towards mobile marketing exercises the most significant influence on intention to use and have a significant and positive relationship with buying intention (Bauer et al., 2005; Davis et al., 1989; Norazah, 2011; Hong et al., 2008; Shin, 2009). However, there is still a need to perform more research from a theoretical perspective about digital consumer behaviour issues in mobile banking.

Privacy

Trust is viewed as the customer’s privacy concerns and expectations that an online business institution will protect the customer’s information and prevent its leakage to third parties (Shankar et al., 2002). An individual’s perceptions of such external conditions will also vary with personal characteristics and past experiences (Malhotra et al., 2004). There are a variety of ways in which, violation of privacy can take place in the banking sector which includes: sharing customer data with third parties for marketing purposes, without formal and pre-approval from users, stolen banking account number or credit/debit card information, lack of reassurance from firms to an individual, regarding how their personal and confidential data will be protected, collection of unnecessary personal data than what is absolutely necessary, and incorrect recording of personal information. In Bank of America, the Utility Consumers' Action Network reported a very common privacy violation by the bank, in which the bank sold the personal information (bank account numbers, social security numbers, etc.) of thirty-five million customers to marketers and third parties, without informing individuals, as reported by the Centre for Internet and Society (CIS) (Anonymous, 2010). Such incidents have raised the issue of consumer privacy concerns (ComScore, 2016).

Purchase Intention/Usage Intention

Purchase intention (PI) in the context of mobile banking service product reflects the motivational influences that drive an individual to download the mobile banking app provided free of charge by the banking institution for usage. In that context, mobile banking purchase intention can be viewed as an intention to download and use the app for conducting banking transactions any time anywhere on the move. The motivation to use the mobile banking app is based on many of the factors, influencing the individual decision. Once the initial inertia to download the app is pushed up through mobile banking advertising initiated by the institution, customers need to be convinced about its usage and convenience. The continuous website usage intention is defined as one’s intention to continue using a service in the post-acceptance stage. It is similar to one’s repurchase decision, as both decisions are influenced by initial usage (Bhattacherjee, 2001). Although a major stream of information service research is exploring to determine factors responsible for user acceptance, the perpetual success of new technology is dependent on users continuing to use it, rather than the initial success of adopting the service (Chou et al., 2010). Likewise, usage intention is a primary important factor, contributing to the success of customer retention in the market space (Parthasarathy & Bhattacherjee, 1998). In their research study, Singh & Srivastava (2018) found that security, computer self-efficacy, perceived ease of use, and perceived financial cost, in that order of influence, affected customers’ intention to adopt mobile banking. While studying the impact of influential major factors affecting the consumer attitude and intention towards mobile banking in India, Chawla & Joshi (2017) found that perceived trust and ease of use significantly impacted user attitude.

Research studies on trust in mobile banking are still very limited in India. Though most of the Indian the adoption rate among consumers is banks provide mobile banking app, the usage rate is still very low. Moreover, there is no comprehensive study done, illustrating major factors influencing the mobile banking services and purchase intention of consumers, in the Indian context. With this perspective, the author identified a need to study the influential factors, contributing the purchase intention in Indian banking services industry. Therefore, the study aimed to develop a conceptual model, which illustrates factors and their relationships, influencing mobile marketing acceptance and subsequent buying intention of consumers towards mobile banking services.

Objectives of the Study

This research study aims to analyses the influence of bank trust, personal trust, attitude towards mobile marketing and privacy, through mobile marketing, on the purchase and usage intention in the banking service industry in the Indian context.

Measurement of Variables

The independent variables used in the study were institution trust/bank trust (BT), personal trust (PT), attitude towards mobile marketing (ATM) and privacy (PY). The dependent variable used in the study was purchase intention (PI). The constructs and scales of variables were adopted from established studies conducted by other researchers. The variables were measured using 5 points Likert scale indicating from “strongly disagree” to “strongly agree”.

1. Institutional trust was measured using the scale, which was established in the studies conducted (McKnight et al., 2002).

2. Personal trust was measured using scales, which was established in the studies conducted (Coleman, 1990; Granovetter, 1973).

3. Attitude towards mobile marketing was measured using the scale, which was established in the study conducted (Englewood et al., 1992).

4. Privacy was measured using scales, which was established in studies conducted (Tsiakis & Sthephanides, 2005).

5. Purchase intention of mobile banking services was measured using scales, which was established in studies conducted (Fishbein & Ajzen, 1975; Al-Somali et al., 2009).

Hypotheses Formulation

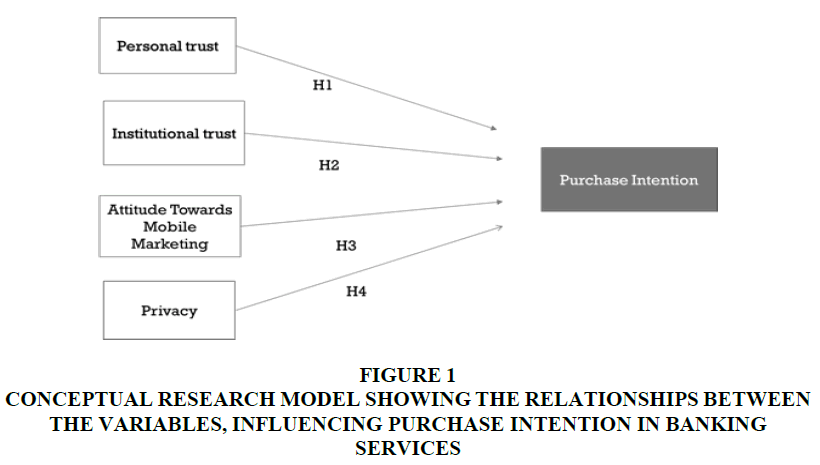

Based on the objectives, the following hypotheses were formulated:

H1: There is a positive relationship between institution/bank trust and customer buying intention of mobile banking services.

H2: There is a positive relationship between personal trust and buying intention of mobile banking services.

H3: There is a positive relationship between attitude towards mobile marketing and buying intention of mobile banking services.

H4: There is a positive relationship between privacy and buying intention of mobile banking services.

The Theoretical Model of Study

The theoretical model for the study of the factors influencing the Purchase Intention in the context of banking services is shown in Figure 1:

Figure 1 Conceptual Research Model Showing the Relationships Between the Variables, Influencing Purchase Intention in Banking Services

Methodology

The design chosen for the research study was conclusive research design. The descriptive research method was chosen for this detailed study. The researcher assimilated the variables under the study through a detailed review of available literature and identified the variables, which would have an impact on customer buying in mobile banking services, through mobile marketing.

Questionnaire Design and Data Collection

In order to conduct this descriptive study, a detailed questionnaire was formulated for quantitative data collection and analysis. The actual questionnaire can be provided on specific request from any researcher. The population was chosen as the users of banking services in the federal state of Kerala, located in the southern part of India. The number of respondents contacted for the survey was 325. Random sampling was chosen to pick up customers at random, from the available list procured from a few local banks. The number of completed responses received was 250, and the response rate was 77%. The high response rate could be because of the personal rapport with the respondents. Online Google forms were used for the data collection. The questionnaires were sent through online e-mail services, with specifically designed Google Forms, as URL attachment. The author ensured further follow-up through e-mails and personal contacts, to establish a personal rapport with the respondents for a better response rate.

Usage of Statistical Tools

The collected data were examined, for accuracy and reliability, and thereafter, was fed into WARP PLS Software, for analysis and interpretation. The researcher sought partial least square (PLS) method to identify dominating factors. The technique of partial least squares (PLS) analysis with WARP PLS, was applied to test the measurement model, through determining the internal consistency, reliability of the multiple item scales used to operationalize its variables.

PLS was favored to covariance-based SEM because it: can handle multi-collinear nature in independent variables; provides healthy results of cross-products, involving response variables; can handle small sample size; is a distributional free method; can handle a variety of variables (nominal, ordinal and continuous); and allows model’s estimation with dissimilar reflective indicators.

Results and Intepretations

Sample Demographics

Data was received from 250 respondents. Male respondents accounted for 44.8%, while female respondents amounted to 55.2%. The customer age calibration showed that the group of 26-30 was found to be high with 30.8% of total respondents, followed by the age group of 31-35, 36-40 and above the age of 40, with 20.8%, 12.4%, and 10.8% respectively. The educational qualification measure showed the highest for graduates with 41%, followed by higher secondary 32% and graduates with at 31% followed by matriculation by 5.2%.

Descriptive Statistics

Table 1 below shows the descriptive statistics of the variables measured.

| Table 1 Mean and Standard Deviation of the Variables: Personal Trust (PT), Bank Trust (BT), Attitude Towards Mobile Marketing (ATM) and Privacy (PY) and Purchase Intention (PI) | |||||

| Valid N (list wise) | N(Sample Size) | Minimum | Maximum | Mean | Std. Deviation |

| PT1 | 250 | 1.0 | 5.0 | 3.784 | .9321 |

| PT2 | 250 | 1.0 | 5.0 | 3.832 | 1.0393 |

| PT3 | 250 | 1.0 | 5.0 | 3.940 | .8599 |

| PT4 | 250 | 1.0 | 5.0 | 3.920 | 1.0148 |

| PT5 | 250 | 1.0 | 5.0 | 3.948 | .9449 |

| PT6 | 250 | 1.0 | 5.0 | 3.948 | .9865 |

| BT1 | 250 | 1.0 | 5.0 | 4.016 | .8501 |

| BT2 | 250 | 1.0 | 5.0 | 3.976 | .8869 |

| PI1 | 250 | 1.0 | 5.0 | 3.972 | .9025 |

| PI2 | 250 | 1.0 | 5.0 | 3.904 | .9177 |

| PI3 | 250 | 1.0 | 5.0 | 3.844 | .9160 |

| ATM1 | 250 | 1.0 | 5.0 | 4.056 | .8436 |

| ATM2 | 250 | 1.0 | 5.0 | 4.004 | .8526 |

| ATM3 | 250 | 1.0 | 5.0 | 3.824 | .8695 |

| PY1 | 250 | 1.0 | 5.0 | 3.808 | 0.8463 |

| PY2 | 250 | 1.0 | 5.0 | 3.628 | 1.0522 |

| PY3 | 250 | 1.0 | 5.0 | 3.636 | 1.0449 |

| PY4 | 250 | 1.0 | 5.0 | 3.676 | 1.0664 |

From Table 1, it can be proved that the mean values of all the indicators were above the midpoint of 2.5. This indicated that institutional trust, personal trust and attitude towards mobile marketing show positive relationships with purchase intention of mobile banking services.

Reliability of Measurement Instrument

Reliability of the variables used in the model was established using Cronbach’s alpha and composite reliability ratio. Both these are measures of internal consistency, as to how closely a set of items are related as a group. The minimum threshold value acceptable for both Cronbach’s alpha and composite reliability is 0.70. It can be seen from table 2 that the Cronbach’s alpha and composite reliability values were all well above 0.70.

| Table 2 Cronbach's Alpha and Composite Reliability Coefficients for the Variables used in the Model | |||||

| Description | PT | BT | PI | ATM | PY |

| Cronbach’s Alpha | 0.925 | 0.841 | 0.872 | 0.857 | 0.782 |

| Composite Reliability | 0.942 | 0.926 | 0.921 | 0.913 | 0.875 |

From Table 2, it was deduced that the indicators used to measure the variables in the study, returned coherent and consistent values. Thus, the values showed that the measurement scale is reliable and consistent, and hence demonstrating high data reliability.

Discriminant Validity

The square root of the average variance extracted (AVE) is often used to evaluate discriminant validity. The values as shown diagonally in Table 3 are the square root of AVE values, which were all above 0.70. The diagonal elements were the highest and hence discriminant validity has been proved. This proves that the constructs have a good psychological separation between them. The discriminant validity furthermore states that by virtue of lower correlation between them, the respondents were able to psychologically distinguish and discriminate the variables as clearly as separate ones.

| Table 3 Correlations Among Latent Variables, With Square Roots of AVE Values | |||||

| Variables/Square Root of Average Variance Extracted | PT | BT | PI | ATM | PY |

| PT | 0.854 | 0.763 | 0.756 | 0.763 | 0.052 |

| BT | 0.763 | 0.929 | 0.764 | 0.706 | 0.105 |

| PI | 0.756 | 0.764 | 0.892 | 0.794 | 0.032 |

| ATM | 0.763 | 0.706 | 0.794 | 0.882 | 0.111 |

| PY | 0.052 | 0.105 | 0.032 | 0.111 | 0.823 |

Measurement Model Fitness

Model fitness and quality indices derived from WARP PLS represented the internal quality indices, which are treated like the prima faciaindices of statistical stability. These fitness indices are shown in Table 4.

| Table 4 Fitness indices derived from warp PLS for the model. | ||

| Fitness Indices | Actual Value | Expected Value |

| Average Block Variance Inflation Factor (AVIF) |

1.203 | Ideally <=3.3 |

| Sympson’s paradox ratio | 1.000 | Ideally 1 |

| R squared contribution ratio | 1.000 | Ideally 1 |

| Statistical suppression ratio | 0.900 | Acceptable if greater than 0.7 |

| Nonlinear bivariate causality direction ratio | 0.980 | Acceptable if greater than 0.7 |

From the values exhibited from Table 4, it was established that the derived model meets all fit indices provided by WARP PLS and it passes the litmus test for statistical stability.

Assessment of Derived Structural Model

The derived structural model was analyzed using WARP PLS and is shown in Table 5.

| Table 5 Model With Beta and P Values Between the Independent Variables, the Dependent Variable (PI) and the R2 Value of Purchase Intention | ||||

| Variable | Variable Description | P value | β Beta | R2 of Dependent Variable (PI) |

| BT | Bank Trust | <0.01 | 0.34 | 69% |

| PT | Personal Trust | 0.02 | 0.13 | |

| ATM | Attitude Towards Mobile Marketing | <0.01 | 0.43 | |

| PY | Privacy | 0.02 | 0.22 | |

From the Table 5, it can be seen that the R2 (coefficient of determination) value was 69%, which indicates that the model explains 69% of the total variations in the dependent variable, purchase intention of mobile banking services, contributed by the presence of independent variables PT, BT, ATM, and PY. The remaining variation of 31% could be attributed to other variables, which were not considered in this study.

Hypotheses Testing

Table 6 shows the hypotheses testing values and results. The testing was conducted at a 5% significance level.

| Table 6 Beta and P-Values of the Hypothesis Testing | ||||

| Hypotheses | Variables | P value | β Beta | Result |

| H1 | Bank Trust | <0.01 | 0.14 | Supported |

| H2 | Personal Trust | 0.02 | 0.34 | Supported |

| H3 | Attitude Towards Mobile Marketing | <0.01 | 0.43 | Supported |

| H4 | Privacy | 0.02 | 0.20 | Supported |

From Table 6, the following hypotheses results and interpretations were derived: There is a positive relationship between bank trust and purchase intention of mobile banking services. Since the p-value is < 0.01, the hypothesis was accepted, which means that bank trust has a significant and positive impact on the buying intention of mobile banking services. The beta value of 0.14 means that one unit change in the bank trust variable brings about 0.14 units of positive change in the dependent variable, purchase intention of mobile banking services.

There is a positive relationship between personal trust and purchase intention. Since the p-value is < 0.01, the hypothesis was accepted, which means that personal trust has a significant and positive effect on the buying intention of mobile banking services. Since the beta value is positive, it means that there is a positive association between personal trust and buying intention. The beta value of 0.34 means that one unit change in personal trust brings about 0.34 units of positive change in the buying intention.

There is a positive relationship between attitude towards mobile marketing and purchase intention. Since the p-value is < 0.01, the hypothesis was accepted, which means that the attitude towards mobile marketing has a significant and positive impact on the buying intention of mobile banking services. Beta value is positive, which means that there is a positive association between attitude towards mobile marketing and buying intention. The beta value of 0.43 means that one unit change in the variable, attitude towards mobile banking, brings about 0.43 units of positive change in the buying intention.

There is a positive relationship between privacy and purchase intention. Since the p-value was 0.02, the hypothesis was accepted. This shows that there is a significant relationship between privacy and buying intention of mobile banking services. The beta value of 0.20 means that one unit change in the variable brings about 0.20 units of positive change in the buying intention. This may be due to the need of the respondents, for protecting customer data privacy confidentiality, and the related personal risks arising from the lapse of having enough private data protection policies in the mobile banking industry.

Findings

The results of the study proved that there existed a strong and positive relationship between bank trust and purchase and usage intention of mobile services of the banking institution. The findings of the study validated that there was a strong and positive correlation between customer’s personal trusts with the mobile banking application, which would translate into accepting and using the mobile banking services, for carrying out their banking transactions. The study results revealed that there was a strong and positive relationship between attitude towards mobile marketing and usage intention of mobile banking services. The results further showed that there was a significant and positive relationship between privacy features and aspects of a banking application, to motivate customers to accept and use the mobile banking application of the banking institution.

Discussion

The study brought out relevant findings, which has multi-fold implications in theoretical and practical aspects. The study has contributed to the addition to the knowledge base of determinant factors, influencing mobile banking implementation in India. The study has also raised pointers for the consideration of banking institutions and industry and also provides direction for an assimilated marketing strategy for the banking industry for improving the usage of mobile banking in the customers.

Implications

The study contributed theoretically to the knowledge base of influential factors determining the buying intention of mobile banking services. This study result found the influence of personal trust on the purchase intention of mobile banking services. The result corroborates the finding that trust has been found to affect user adoption of internet banking services (Flavian et al., 2005). The study result supports the findings of (Lee & Chung, 2009) and Lin (2011). The influence of trust on mobile banking purchase intention further corroborates the revelation that the trust, directly and indirectly, affected a consumer’s purchase intention in the context of e- commerce (Kim et al., 2009). The study result proved that the strong influence of bank trust or organization trust will influence customer buying intention. This corroborates the results obtained by (Laksamana et al., 2012; Heijden et al., 2003). The study result validated the hypothesis that attitude towards mobile banking, is having a strong relationship and it contributes towards building up purchase intention towards mobile banking. This result supports the findings of the other studies, which confirmed that attitude towards mobile marketing is the most significant influence on intention to use and have significant direct relationship with behavioural intention (Bauer et al., 2005; Davis et al., 1989; Norazah, 2011; Hong et al., 2008; Shin, 2009). This study result proved that privacy is of paramount importance to customers, who can be pursued by the banks to use their mobile banking applications. The result substantiates the viewpoint raised by a researcher from a privacy standpoint (Shankar et al., 2002).

The results obtained in the research study will facilitate and support both academic researchers and banking practitioners to explain, understand, and elucidate the service product purchase and usage intention of mobile banking customers in India. This would also support bank marketing managers to formulate strategies to expedite the use of mobile banking in their customers. Thus, as a generalization, these results could be used by banking services, not only in India but across the world, to customize their marketing strategy. Banking institutions need to raise their services levels by adopting efficient mobile banking applications, enhancing customer trust by building up effective customer relationship measures to build institutional trust, personal trust, privacy features of the mobile banking application. Firms need to adopt effective and integrated marketing communications strategies with their current and potential customers, to build confidence in the customers for a positive approach to mobile banking. They need to create more awareness, interest, desire, and action in customers, finally resulting in the usage of mobile banking application services. Since mobile banking will greatly depend on the data security and protection features of accessing the internet through mobile, banks need to strengthen their security services stronger, so that critical and sensitive customer information could be protected seamlessly to build personal trust with their customers. Thus, the originality and value of the research study would facilitate to support the adoption of mobile banking in India, which is relatively in a very initial and nascent stage compared with other developed countries such as the USA, the UK, Europe and Japan. Moreover, it is projected to increase or surpass the adoption rate of internet and mobile banking in those countries. Further, only limited research to date has examined the adoption of mobile banking in India, especially the drivers and inhibitors of mobile banking adoption and its usage.

Limitation and Future Recommendations

The strength of the study was that it could empirically provide evidence of the major factors that influenced the penetration of usage of mobile banking services in India. There a few weak points of the study. It was that it was conducted among 250 people limited to the Kerala State, India. Thus if the study was conducted throughout the country in other states, the results would have been more accurate. Another limitation of the study is that numerical data, in monetary terms of mobile banking transaction values etc. upon the analysis are missing. The mind of the respondents while filling the questionnaire is unpredictable, so the information given by them cannot be 100% reliable and accurate. Thus the possibility of respondent error is likely. There is an opportunity for other researchers to contribute in the area of mobile banking service studies. As the understanding of the factors affecting customer purchase intention in the online mobile banking marketplace is still an open issue, further studies should modify existing variables in a wider context or consider a wider range of relevant variables.

Conclusions

In this era, people find a hard time to physically do all the transactions. Due to technological advancements, an increase in the use of the internet and digital media it has opened the way to customers to avail services from anywhere at any time. But some factors always act as constraints to do these operations smoothly. This is more visible in money or banking transaction. People always hesitate to purchase things that are advertised through mobile phones especially banking products. Therefore, this study was conducted to explain determinant factors that influenced the purchase and usage intention towards mobile banking services in the Indian context.

The results emphasized that personal trust, institution trust, privacy and a positive attitude towards mobile marketing are the major factors that influenced the intention of consumers, in availing mobile banking services in India. This would facilitate banking practitioners to explain, understand, and elucidate the service product consumption of mobile banking customers. Privacy and other factors such as security and prevention of fraudulent activities are to be taken care of by the bank, in order to enhance mobile banking usage by customers. This would support bank marketing managers to formulate strategies to expedite the usage of mobile banking in their customers.

References

- Al-Somali A., Gholami, R. & Clegg, B., (2009). An investigation into the acceptance of online banking in Saudi Arabia, Technovation, 29(1), 130-144.

- Anonymous, (2010). Privacy and Banking: Do Indian Banking Standards Provide Enough Privacy Protection?, The Centre for Internet and society Available:http://cisindia.org/internet governance/blog/privacy/privacybanking, (accessed on June 10, 2018).

- Bauer, H.H, Barnes, S.J, Reichardt, T., & Neumann, M.M. (2005). Permission-based mobile advertising, Journal of Interactive Marketing, 16(1), 14-24.

- Bauer, H.H., Barnes, S.J., Reichardt, T., & Neumann, M.M. (2005). Driving consumer acceptance of mobile marketing: A theoretical framework and empirical study. Journal of Electronic Commerce Research, 6(3), 181-191. (Accessed August 14, 2018). Retrieved from http://ezproxy.snhu.edu/login?url=http://search.proquest.com/docview/236648310?acco untid=3783

- Bhattacherjee, A. (2001). An empirical analysis of the antecedents of electronic commerce service continuance. Decision Support Systems, 32(2), 201-214.

- Boeck, H., Lamarre, A., & Galarneau, S. (2011). Mobile marketing and consumer behaviour current research trends. International Journal of Latest Trends in Computing, 3(1).

- Chawla, D., & Joshi, H. (2017). High versus Low Consumer Attitude and Intention towards Adoption of Mobile Banking in India: An Empirical Study, Vision: The Journal of Business Perspective, 21(4), 410-424.

- Chen, Y.H.H. & Corkindale, D. (2008).Towards an understanding of the behavioural intention to use online news services: an exploratory study. Internet Research, 18(3), 286-312.

- Chou, C.W., Hume, D.B., Koelemeij, J.C.J., Wineland, D.J., & Rosenband, T. (2010). Frequency comparison of two high-accuracy Al+ optical clocks. Physical Review Letters, 104(7), 070802.

- Coleman, J.S. (1990). Foundations of Social Theory. Cambridge, MA: Harvard University Press. Computers and Security, 24(1), 10-15.

- ComScore, (2016). Future in Focus and Cross Media Insights for Latin America. Retrieved from https://www.comscore.com/Insights/Presentations-and-Whitepapers/2016/Future- in-Focusand-Cross-Media-Insights-for-Latin-America (accessed March 20, 2018).

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Quarterly, 13, 319-39.

- Davis, F.D., Bagozzi, R.P. & Warshaw, P.R. (1989). User acceptance of computer technology: a comparison of two theoretical models. Management Science, 35(8), 982-1003.

- Dehkordi, G., Rezvani, S., Rahman, M., Fouladivanda, F., Nahid, N & Jouya, S. (2012). A Conceptual Study on E-marketing and Its Operation on Firm's Promotion and Understanding Customer’s Response. International Journal of Business and Management, 7(19), 114-24.

- Englewood Cliffs, Alwitt, L.F, & Prabhakar, P.R. (1992). Functional and belief dimensions of attitudes to television advertising, Journal of Advertising Research, 32(5), 30-42.

- Fishbein, M. & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

- Flavian, C., Guinaliu, M. & Torres, E. (2005). The influence of corporate image on consumer trust – a comparative analysis in traditional versus Internet banking. Internet Research, 15(4), 447-70.

- Gefen, D., Karahanna, E. & Straub, D.W. (2003). Inexperience and Experience with Online Stores: The Importance of TAM and Trust. IEEE Transactions on Engineering Management, 50(3), 307-321.

- Goswami, D., & Raghavendran, S. (2009). Mobile-banking: can elephants and hippos tango?. Journal of Business Strategy, 30(1), 14-20.

- Graham, J. (2015). Mobilegeddon could be bad news for 40% of top websites. USA Today. Retrieved from http://www.usatoday.com/story/tech/2015/04/20/mobilegeddon-could-impactyour- business/26090627/ (accessed June 8, 2018).

- Granovetter, M.S. (1973). The Strength of Weak Ties. The American Journal of Sociology, 78(6), 1360-1380.

- Heijden, H.V., Verhagen, T., & Creemers, M. (2003). Understanding online purchase intentions: contributions from technology and trust perspectives. European Journal of Information Systems, 12(1), 41-48.

- Hong, S.J., Thong, Y.L., Moon, J.Y., & Tam, K.Y. (2008). Understanding the behaviour of mobile data services consumers. Information System Frontier, 10, 431-445.

- Jacob, K. (2007). Are mobile payments the smart cards of the aughts?. Chicago Fed Letter, 240, 1-4.

- Jayawardhena, C., Kuckertz, A., Karjaluoto, H., & Kautonen, T. (2009). Antecedents to permission based mobile marketing: an initial examination. European Journal of Marketing, 43(3/4), 473-499.

- Kim, D.J., Ferrin, D.J., & Rao, H.R. (2009). Trust and Satisfaction, Two Stepping Stones for Successful E-Commerce Relationships: A Longitudinal Exploration. Information Systems Research, 20(1), 237-257.

- Laksamana, P., Wong, D., Kingshott, R.P.J., & Muchtar, F. (2012). The role of interaction quality and switching costs in premium banking services. Marketing Intelligence & Planning, 31(3), 229-249.

- Laukkanen, T. & Passanen, M. (2008). Mobile banking innovations and early adopters: how they differ from other online users? Journal of Financial Services Marketing, 23(2), 86-94.

- Lee, K.C. & Chung, N. (2009). “Understanding Factors Affecting Trust in and Satisfaction with Mobile Banking in Korea: A Modified DeLone and McLean’s Model Perspective,” Interacting with Computers, 21(5), 85-392.

- Leppaniemi, M., Sinisalo, J. & Karjaluoto, H. (2006). A review of mobile marketing research. International Journal of Mobile Marketing, 1(1), 30-40.

- Lin, H.F. (2011). “An Empirical Investigation of Mobile Banking Adoption: The Effect of Innovation Attributes and Knowledge-Based Trust”. International Journal of Information Management, 31, 252-260.

- Malhotra, N.K., Kim, S.S., & Agarwal, J. (2004). Internet users' information privacy concerns (IUIPC): The construct, the scale, and a causal model. Information Systems Research, 15(4), 336-355.

- McKnight, D.H., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: a trust building model. The Journal of Strategic Information Systems, 11(3-4), 297-323.

- Norazah, M.S. (2011). Factors Affecting Third Generation (3G) Mobile Service Acceptance: Evidence from Malaysia. Journal of Internet Banking and Commerce, 16(1), 1-12.

- Oscar, R.L., Alexandra, M.S., & Rojas-Berrio, P. (2017). Mobile marketing: conceptualization and research review, Revista ESPACIOS, 38(61), 26-36.

- Parthasarathy, M., & Bhattacherjee, A. (1998). Understanding post-adoption behavior in the context of online services. Information Systems Research, 9(4), 362-379.

- Shankar, V., Urban, G.L. & Sultan, F. (2002). Online Trust: a Stakeholder Perspective, Concepts, Implications, and Future Directions, Journal of Strategic Information Systems, 11, 325-344.

- Shin, H.K., Kim, K.K. & Lee, K.W. (2009). Understanding the service acceptance of Multimedia messaging services. Proceedings of the 11th international conference on Advanced Communication Technology, 2, Gangwon-Do, South Korea, 1382-1385.

- Singh, S., & Srivastava, R.K. (2018). Predicting the intention to use mobile banking in India, International Journal of Bank Marketing, 36(2), 57-378.

- Sultan, F., Rohm, A. & Gao, T. (2009), Factors Influencing consumer acceptance of mobile marketing: a two-country study of youth markets. Journal of Interactive Marketing, 23(4), 308-320.

- Tsiakis, T., & Sthephanides, G. (2005). The concept of security and trust in electronic payments. Journal of Business Strategy, 30(1), 14-20.

- Varnali, K. & Toker, A. (2010). Mobile marketing research: state-of-the-art. International Journal of Information Management, 30(2), 144-151.

- Zhou, T. (2011). An Empirical Examination of Initial Trust in Mobile Banking, Internet Research, 21(5), 527-540.