Research Article: 2018 Vol: 22 Issue: 1

Patronage Factors of Islamic Banking System in Pakistan

Muhammad Farhan Basheer, School of Economics, Banking and Finance University of Utara Malaysia

Aref Abdullah Ahmad KhorramI, Management and Science University Malaysia

Saira Ghulam Hassan, School of Economics, Banking and Finance University of Utara Malaysia

Keywords

Islamic Banking, Patronage factors, Pakistan.

Introduction

Islamic banking system is considered to be a developed segment of the global financial market; with a huge prospective it is growing very rapidly in all parts of the globe (Nizar, 2015). Islamic Banks established themselves in the comparatively short period by capturing a good market share from its competitors. The existence of Islamic Banks in some Muslim states is 5%, 12% and 30% in Malaysia, Kingdom of Saudi Arabia and Kuwait respectively. It is expected that in the coming 8 to 10 years Islamic Banking Institutes will become a part of at least 40-50% of the total savings of worlds Muslims .Islamic banks are showing emphasis on the domestic markets whereas Western conventional institutions like Merrill Lynch International a high net value (Marimuthu, Jing, Gie, Mun & Ping, 2010).

A country like Pakistan is considered as the pioneers of full Islamization. Pakistan’s model of Islamic banking was initiated in the earlier 1950s. At that time economists were thinking about the philosophy of implementing Islamic system in the state. Pakistan becomes a leader by enacting a full Islamic financial system in the country. Twenty years later, it was understood by the governing bodies that they still inherit the British system in the state and it could not be transformed so quickly. The existing system was making difficult to establish a full Islamic financial system as they were trying to make a change in a very short time.

In 1992 the Federal Shariat Court (FSC) affirmed that banking running on interest principle is non-Islamic and hence it must prohibit. Finally, in the year 1998, the decision was made to abolish usury “riba” from the country’s banking system.

Quran and Disqualification of Interest

Allah Kareem prohibited charging financial cost and He has directed each Muslim to make sure that his dealing in life is free from the evil of interest whether he is doing any trade or attached to any profession. Some of the Verses from the Holy Quran are quoted below:

“Allah destroys interest and gives increase for Charity. And Allah does not like every sinning disbeliever”. (Al-Quran: 2:276)

The above-mentioned verse 2:276 of the Quran illustrates the Allah act of demolishing of interest and asked to practice the donations.

“O, believers, fear Allah and give up what is still due to you from the interest (usury) if you are true believers.” (Al-Quran: 2:278)

In Surat Al-Baqarah, Allah says;

“If you do not do so, then take notice of war from Allah and His Messenger. But, if you repent, you can have your principal. Neither should you commit injustice nor should you be subjected to it.” (Al-Quran:2:279)

It is clear from the verse that Allah has clearly mentioned a war against those who practice interest and Allah has warned for committing any injustice.

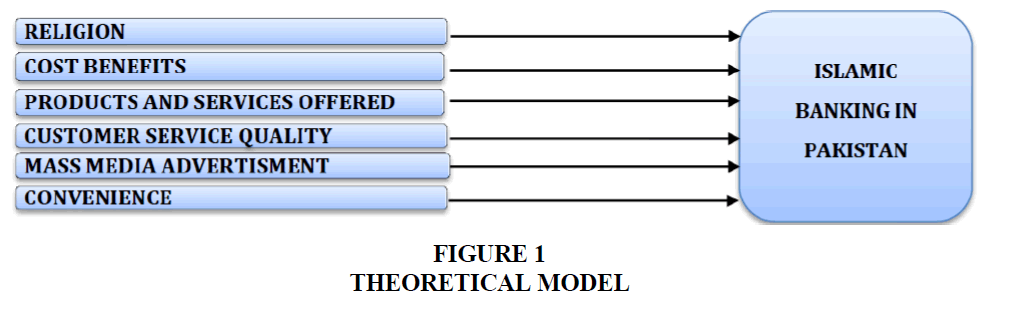

The primary objective of this paper is to exploit Pakistani customers consider important while selecting Islamic banking for this we are taking Islamic banking as dependent and Religion, customer choice behaviour, product and service customer service quality, role of mass media and customer convenience as independent variables.

Literature Review

In this section, the literature review of factors which are affecting Islamic banking across the world and their nature of influence are discussed in detail.

Religion

The researchers (El Nagar & El Biely, 2011) stated that religious faith and social obligation were the two most imperative features that decide bank selection criteria. They examined the highest elements that encourage people to deal with Islamic banking system. They determined that the Islamic banking selection criteria seem to largely depend on the mutual presence of Islamic and financial prominence and service quality of services offered by the bank. In Pakistan, (Manzoor, Aqeel & Sattar, 2010) did their research on Islamic banking growth factors. Their findings contributed that religion was the main reason for growth which dominated over other patronizing factors. According to the (Hin, Wei, Bohari & Zainol, 2011; Nizar, 2015) study, the client consideration towards the presence of Shariah was the strong reason for selecting the Islamic banks. However, during their findings, they measured goodwill of the bank as the prime factor that influences the choice of customers while selecting a bank. They placed religion influence as a second important factor affecting the customer’s decisions towards Islamic Banking. (Ahmad, Rahman, Ali & Seman, 2008) concluded religion as primary and financial knowledge as secondary determine of interest-free banking selection.

Cost Benefits (Return on Deposits, Investments, etc.)

(Marimuthu, Jing, Gie, Mun & Ping, 2010) Research for selection of a bank was followed with the choosing criteria of cost and benefits. They included the interest rates and returns as top five elements of selecting criteria while choosing a bank. The researchers also found out that profit or return on the products offered by Islamic Banking Institutes served as the main reason for loyalty between the customers and Islamic Banks. Haron & Ahmad (2000) stated that interest rate is permanently been distinguished as the main attention in the explanation of individual saving behaviour. Islamic banks operate as agents while accepting deposits and as a principal while lending on the basis of sharing profits and losses. Hin, Wei, Bohari & Zainol (2011) from their study on bank selection criteria stated that profit incentive on the deposits overtakes the religious factor while choosing banks. The study by Khattak & Rehman (2010) and Rustam et al. (2011) found that the clients who have a long-term relationship with their bank were more valuable than those who have a short-term relationship.

Products and Services Offered

Athanassopoulos (2000) stated that managing customer’s orientation and the quality of service is normally recognized as one of an efficient cause of constructing a good position in the service activities, as well as in improving the performance of the organization. Ahmad & Haron (2002) found that customer’s preferred large and banks with good repute and they willingly shift to the bank sift the new bank will provide them a superior quality in its products and services. A study by Khattak & Rehman (2010) suggested that customers of Islamic banking lack knowledge about the products that are being offered by the Islamic Banking Institutes such as Ijara, Murabaha financing and Musharakah. This means that the Islamic Banking Institutes should consider providing education to their clients about the product offerings. Akram, Rafique & Alam (2011) discussed some of the products that are being offered by fully fledge Customer Service Quality (Fast and Efficient Services) is termed as the consumer perception about the inferiority or superiority of any organization and its given services (El Nagar & El Biely, 2011). Ahmad & Haron, (2002) studies the research that was conducted on the large and giant corporation companies of South Africa. The purpose of the research was to discover the factors that were measured essential for corporate clients while selecting any banking institutions. They found out that service quality was the essential factor in founding a relationship between corporate customers and their bank. Dusuki & Abdullah (2007) in their study highlighted the quality of services as the main determinant of Islamic Bank selection. Service qualities consist of treating customers with good manners. Marimuthu, Jing, Gie, Mun & Ping (2010) reported that it is very important to identify the importance of service values that are being offered by any bank to its customers that could appreciably influence customer satisfaction towards their banks. Siddiqi, (2011) carried out a study in retail banking sector of Bangladesh. Mass Media Advertisement Communication is the capability of providing reliable information in a timely manner (Ndubisi, 2007). The task of communication is to form awareness, convince interested customers and encourage enough for making a purchasing decision. Communications also deliver that what the organization is doing to rectify the reasons for being dissatisfied. An effective communication of the organization with its clients will lead to better relations and customers will be more loyal.

In their study, Haque, Ahmed & Jahan (2010) mentioned that religious terminology can be used in ads to attract and encourage consumers towards Islamic products and services. Customers towards the products and services and the promotion of products they are providing. Marimuthu, Jing, Gie, Mun & Ping (2010) explained the effect of mass media advertisement on the banking selection criteria and placed mass media advertisement as the fourth criteria on their list. They found that there was a negative but insignificant connection between profitability and advertisement. They evident the advantages of mass media advertisement in banking sector whether it was Islamic Banking or Conventional Banking.

Convenience (Location, Interior Comfort, etc.)

Findings of Dusuki & Abdullah (2007) showed that in Malaysia, factor like convenient to approach the Islamic Banking Institutes was the second important factor. The researcher merged the product price with the convenience factor and proposed a factor called “convenience and product price” and mentioned it second essential element following the “reputation and service delivery” factor. Marimuthu, Jing, Gie, Mun & Ping (2010) mentioned convenience as the first criteria for selecting a bank. Siddiqi (2011) also concluded that convenience and effectiveness of the banks are the two significant features for the satisfaction of the customers.

Hypothesis

Hypothesis 1

H1: There is a relation between Religion and Islamic Banking in Pakistan.

H0: There is no relation between Religion and Islamic Banking system in Pakistan.

Hypothesis 2

H1: There is a relation between Cost Benefits and Islamic Banking system in Pakistan.

H0: There is no relation between Cost Benefits and Islamic Banking system in Pakistan.

Hypothesis 3

H1: There is a relation between Product and Services offered and Islamic Banking system in Pakistan.

H0: There is no relation between Product and Services Offered and Islamic Banking system in Pakistan.

Hypothesis 4

H1: There is a relation between Customer Service Quality and Islamic Banking system in Pakistan.

H0: There is no relation between Customer Service Quality and Islamic Banking system in Pakistan.

Hypothesis 5

H1: There is a relation between Mass Media Advertisement and Islamic Banking system in Pakistan.

H0: There is no relation between Mass Media Advertisement and Islamic Banking system in Pakistan.

Hypothesis 6

H1: There is a relation between Convenience and Islamic Banking system in Pakistan.

H0: There is no relation between Convenience and Islamic Banking system in Pakistan.

Results And Methodology

To find the patronage factors of Islamic banking in Pakistan we have used ordinary least square and Pearson Correlation test.

Instrument Reliability

For data collection we have used two-page survey which consists of two main sections, the first section is about demographics and in second section measure the factors which affect Islamic banking in Pakistan. Using five-point Likert scale respondents were asked to answer 32 questions.

The initial sample includes all Islamic banking customers present in Lahore. However, because the study was resource and time constrained so a final sample of 500 customers was selected out of which 368 detected as true respondents. The reliability of the variables can be figured out by using the value of Cronbach's alpha. The following tables show Cronbach's alpha value for each of the variables that are being tested in this research. In our study, Cronbach's alpha is greater than 0.700 for all the variables, which shows a high level of internal consistency for the scale with the selected sample.

Descriptive

Summary statistics of respondents’ gender. The main respondents were Male with a 75% while female participation was of 25%. The right side of the page indicates the bar chart of gender (Figure 1). Almost 62 percent of respondents fall in the range of 22-30 years of age. However, the lowest percentage respondent falls within the range of above 41years which constitute about 2%. The remaining respondents fall within the range of 31-40 years of age that constitute about 25% of the samples. As for marital status, 42% of the respondents are married while 58% are single. The percentage of the unmarried respondent is greater than the married respondents.

Results the occupation of respondents that what profession sector they are belonged to. 41% of the respondents are in public sector. Student respondents were 38% of the total sample. 14% people were from the private sector while the remaining 7% are self-employed. The majority of the respondents were educated as the stats show 56% of the respondents is graduated. 37% were at the level of a master or above that again shows a high trend of professional education in the respondents. Results in relation with bank shows the respondents attachment with their respective Islamic bank.40% of the respondents were dealing with their bank from 1-3 years, it shows that Islamic banking is still a new system for the people of Pakistan although in the country Islamic banking was started in 2004, but people are now started dealing in Islamic Banking Institutes. 27% were using Islamic banking with a less than a 1-year period. It is a positive sign for Islamic Banking Institutes as people are now showing interest in the Islamic way of banking. 27% of the people are those respondents who are using Islamic Banks with a period of 3-8 years, which means they attached themselves with Islamic Banks when it was new in the country.

Inferential

For each variable, there are 368 responses with no missing value. The values of the mean for the variables are IB (3.0617), RF (3.3180), CB (3.5060), PSO (3.3600), CSQ (3.8940) MMA (3.4600) and CF (3.7040). This shows that the response rate is falling in the range of 3 and 4.The lowest scale value which most of the respondent selected for IB, RF and MMA is 1 while CB, PSO, CF and CSQ are 2. The maximum value which most respondents marked is 4 for IB, RF, CB, PSO and MMA while CSQ maximum value marked was 5.

Correlation

It is used to verify the association between variables. To examine the relationship, we will make assumptions (hypothesis): Null (H0) and alternative (H1). Pearson Correlation is used to examine the relationship between the variables. In correlation Table 1, religion factor has no correlation with cost benefits as p-value=0.051 which is greater than 0.05. The Pearson Correlation is 0.196 which is indicating a positive direction among the variables, but the strength of relation is weak. The p-value of religion factor and product services offered is 0.003 which is less than 0.05, so there exist relations among these variables. The Pearson Correlation is 0.291 which shows a positive but weak correlation. Religion factor has no correlation with customer services quality as p-value=0.152 which is greater than 0.05. The Pearson Correlation value is 0.144 which displays a positive direction among the variables, but the strength of relation is weak.

| Table 1: Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | 0.517a | 0.474 | 0.120 | 0.64300 |

| a. Predictors: (Constant), CCF, RFF, CBF, CSQF, PSOF, MMAF | ||||

Regression

In coefficient the significant value all the variables are less than 0.05 so there is association among the variables. For testing the goodness of the model, we consider the significant value in which is 0.006 which is less than 0.05 so the relation is also good. The F value in Table 2 is 3.259, so the model is a good fit with a value 3.259. The adjusted R square value in the Model Summary that in what percentage the independent variable contributes to the dependent variable. Here the adjusted R² value is=0.474 that is 47% dependency coefficient. The results all the variables according to their mode and mean values with a scale 1=strongly disagree to 5=strongly agree. The highest factor that the respondents have selected is customer service quality (mean=3.8940). It indicates that people want good customer service quality as it attracts them for choosing a specific Islamic bank meanwhile regression results also indicates that customer service quality has positive but significant effect on Islamic banking consumers and results are consistent with Rustam, Bibi, Zaman, Rustam & Haq (2011); (Siddiqi, (2011).

| Table 2: Anovab | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 8.085 | 6 | 1.348 | 3.259 | 0.006a |

| Residual | 38.451 | 93 | 0.413 | |||

| Total | 46.536 | 99 | ||||

| b. Dependent Variable: IBF | ||||||

The research followed with a religious factor on a second most demanded factor by the respondents with mean 3.704. This and regression results together confirm that t religion has significant impact on consumer choice for Islamic vs. conventional banks and results are consistent with prior studies of Marimuthu, Jing, Gie, Mun & Ping (2010); Dusuki & Abdullah (2007); El Nagar & El Biely (2011); and Manzoor, Aqeel & Sattar (2010). The people ranked cost benefits on the third number (mean=3.506) so cost benefits attract customers for choosing a bank. Further regression shows appositive significant results which prove over hypothesis that there is some relation between Cost Benefits and Islamic Banking system in Pakistan and results are consistent with studies of Marimuthu, Jing, Gie, Mun & Ping (2010); Haron & Ahmad (2000); Kaleem & Isa (2009); and Hin, Wei, Bohari & Zainol (2011).

Product services being offered and convenience factor has same mean values and both are significantly and positively related to Islamic banking and results are consistent with the prior findings of Rashid, Hassan & Ahmad (2008); Ahmad & Haroon (2002); Okumus (2005); Akram, Rafique & Alam (2011).

Marimuthu, Jing, Gie, Mun & Ping (2010), Hin, Wei, Bohari & Zainol (2011), Gait & Worthington (2008) and Ahmad, Rehman, Saif & Safwan (2010). The overall Multimedia advertisement (MMA) is the least priority for the consumer of Islamic banking (mean=3.0617) as shown in Table 3,but if we look at regression results it shows a positive and significant relation between MMA and Islamic banking and results are consisting with the findings of Ndubisi (2007); Haque, Ahmed & Jahan (2010); and Rustam, Bibi, Zaman, Rustam & Haq (2011).These results indicate that Pakistani consumer behaviour about Islamic banking is more inclined toward quality of services religious views and cost benefits of products and services and less inclined towards convenience and advertisement. At last, the research indicates that people have little knowledge about the Islamic banking system in Pakistan. The mean 3.0617 indicates that people have impartial thought regarding this system. They know that Islamic banking system exists in the county but are not aware of the functioning of it (Aaker et al., 2001).

| Table 3: Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 0.892 | 0.690 | 1.293 | 0.199 | |

| RFF | 0.298 | 0.113 | 0.287 | 2.630 | 0.010 | |

| CBF | 0.127 | 0.123 | 0.104 | 1.034 | 0.004 | |

| PSOF | 0.097 | 0.133 | 0.076 | 0.731 | 0.006 | |

| CSQF | 0.099 | 0.105 | 0.099 | 0.949 | 0.045 | |

| MMAF | 0.183 | 0.186 | 0.117 | 0.983 | 0.128 | |

| CF | 0.044 | 0.143 | 0.033 | 0.307 | 0.260 | |

| a. Dependent Variable: IBF | ||||||

Conclusion

Islamic banking system can no longer rely on a marketing strategy to attract only customers that follow a religion, who may only consider Islam for using financial institutions. Important concepts that have been recognized in Table 3 of the several banks choosing criteria suggests the need for the Islamic Bank to strengthen the quality of its services which is now measured as a main element that marks a difference in the competitiveness of the institutions.

Results of this study also indicate that the products and services of Islamic banking have a decent scope in the banking sector of Pakistan. The profit-sharing principle is the only principle that can replace the element of interest in the Islamic banking system. In addition to this, there is another big issue which needs consideration and that is the need to increase education and public awareness for spreading the unique characteristics that an Islamic banking system holds and how these distinctive features beneficially fit according to the needs of customers in the financial dealings.

Following are some of the recommendations according to the findings of the study:

1. One of the exceptional features of IB system is the presence of ethical and moral values with its operations of banking. Specifying these values to the public can gain the intention of them towards Islamic banking system.

2. Islamic banks have also a deficiency of qualified Islamic scholars. To improve financial system, they should hire more scholars.

3. For penetrating into the conventional market Islamic banks should collaborate with different Islamic organizations and take the confidence of several religious icons for spreading the use of riba free system.

References

- Aaker, D.A., Kumar, V. & Day, G.S. (2001). Marketing research (Seventh Edition). New York, USA: John Wiley & Sons.

- Ahmad, A., Rehman, K.U., Saif, I. & Safwan, N. (2010). An empirical investigation of Islamic banking in Pakistan based on perception of service quality. African Journal of Business Management, 4(6), 1185-1193.

- Ahmad, N. & Haron, S. (2002). Perceptions of Malaysian corporate customers towards Islamic banking products & services. International Journal of Islamic Financial Services, 3(4), 13-29.

- Ahmad, W.W., Rahman, A.A., Ali, N.A. & Seman, A.C. (2008). Religiosity and banking selection criteria among Malays in lembah klang. Shariah Journal, 16(2), 279-304.

- Akram, M., Rafique, M. & Alam, H.M. (2011). Prospects of Islamic banking: Reflections from Pakistan. Australian Journal of Business and Management Research, 1(2), 125.

- Athanassopoulos, A.D. (2000). Customer satisfaction cues to support market segmentation and explain switching behaviour. Journal of Business Research, 47, 191-207.

- Dusuki, A.W. & Abdullah, N.I. (2007). Why do Malaysian customers patronize Islamic bank? International Journal of Bank Marketing, 25(3), 142-160.

- El Nagar, H.M. & El Biely, M.M. (2011). A comparison of banking behaviour of Islamic bank customer some evidence from Egypt and the Kingdom of Saudi Arabia. International Journal of Economics & Financial Studies, 1(1), 1-14.

- Gait, A.H. & Worthington, A.C. (2008). An empirical survey of individual consumer, business firm and financial institution attitudes towards Islamic methods of finance. International Journal of Social Economics, 35(11), 783-808.

- Haque, A., Ahmed, K. & Jahan, S.I. (2010). Shariah observation: Advertising practices of Bank Muamalat in Malaysia. Journal of Islamic Marketing, 1(1), 70-77.

- Haron, S. & Ahmad, N. (2000). The effects of conventional interest rates and rate of profit on funds deposited with Islamic banking system in Malaysia. International Journal of Islamic Financial Services, 1(4), 1-7.

- Hin, C.W., Wei, C.C., Bohari, A.M. & Zainol, D.M. (2011). Bank selection criteria and service quality of Islamic banking: A comparison between Muslim and non-Muslim students and its effect on student’s satisfaction. Jurnal Ekonom, 14(3), 104-114.

- Islamic Banking Bulletin. (2011). Retrieved April 28, 2012, from State Bank of Pakistan: http://www.sbp.org.pk/ibd/bulletin/2011/IBB-Dec-2011.pdf

- Islamic Banking Bulletin. (2012). Retrieved April 28, 2012, from State Bank of Pakistan: http://www.sbp.org.pk/ibd/bulletin/2012/IBB-March-2012.pdf

- Kaleem, A. & Isa, M.M. (2009). Causal relationship between Islamic and conventional banking instruments in Malaysia. International Journal of Islamic Financial Services, 4(4), 1-8.

- Kasri, R.A. & Kassim, S.H. (2009). Empirical determinants of saving in the Islamic banks: Evidence from Indonesia. JKAU: Islamic Econ, 22(2), 181-201.

- Khattak, N.A. & Rehman, K.U. (2010). Customer satisfaction and awareness of Islamic banking system in Pakistan. African Journal of Business Management, 4(5), 662-671.

- Manzoor, M.M., Aqeel, M. & Sattar, A. (2010). Factors paving the way towards Islamic banking in Pakistan. International Journal of Economics and Management Engineering, 4(6).

- Marimuthu, M., Jing, C.W., Gie, L.P., Mun, L.P. & Ping, T.Y. (2010). Islamic banking: Selection criteria and implications. Global Journal of Human Social Science, 52(10), 52-62.

- Ndubisi, N.O. (2007). Relationship marketing and customer loyalty. Marketing Intelligence & Planning, 25(1), 98-106.

- Nizar, S.M.R. (2015). Consumer attitudes and purchase intentions toward Islamic banks: The influence of religiosity. International Journal of Bank Marketing, 33(2).

- Okumus, H.S. (2005). Interest-Free banking in Turkey: A study of customer satisfaction and bank selection criteria. Journal of Economic Cooperation, 26(4), 51-86.

- Rashid, M., Hassan, M.K. & Ahmad, A.U. (2008). Quality perception of the customers towards domestic Islamic banks in Bangladesh. Journal of Islamic Economics, Banking and Finance, 5(1), 109-131.

- Rustam, S., Bibi, S., Zaman, K., Rustam, A. & Haq, Z.U. (2011). Perceptions of corporate customers towards Islamic banking products and services in Pakistan. The Romanian Economic Journal, 41, 107-123.

- Siddiqi, K.O. (2011). Interrelations between service quality attributes, customer satisfaction and customer loyalty in the retail banking sector in Bangladesh. International Journal of Business and Management, 6(3), 12-36.

- Smith, M.E., Biddle, K.G. & Locke, K. (2008). Working with pluralism: Determining quality in qualitative research. Organizational Research Methods, 11(3), 419-429.

- Zikmund, W.G. (2000). Business Research Methods (Sixth Edition). USA: Dryden.