Research Article: 2019 Vol: 23 Issue: 3

Owners Perspective of Factors Associated with Performance of Small, Medium and Micro Enterprises

E.M Rankhumise, Tshwane University of Technology

M.E Letsoalo, University of Limpopo

Abstract

This cross-sectional qualitative study was aimed at exploring the factors that are associated with the performance of small, medium and micro enterprises in South Africa and China. Purposive sampling was used to select 10 business owners to take part in the study. Data collected was analysed using Tesch’s data reduction technique of open coding. The study revealed that training in financial management, managerial skills, government support and access to market, use of technology and start-up capital, all of which are important for the viability and success of businesses, are important for the performance of the business. The results of the study indicate that access to finance by small, medium and micro enterprises remains an important challenge. It is recommended that policy-makers and government support agencies refine their support intervention strategies and policies for small businesses to thrive.

Keywords

Capabilities, Business Performance, Small Business, Venture, Owner’s Insight.

Introduction

There is growing recognition of the important role small and medium enterprises (SMEs) play in economic development. They are often described as efficient and prolific job creators, the seeds of big businesses and the fuel of national economic engines (Abor & Quartey, 2010). Business performance refers to the business’s success in the market, which may have different outcomes. Business performance is a focal phenomenon in business studies. However, it is also a complex and multidimensional phenomenon. Performance can be characterised as the business’s ability to create acceptable outcomes and actions (Chittithaworn et al., 2011). Small, medium and micro enterprises (SMMEs) are important for the economy of every country, more so in developing economies. Muriithi (2017) posits that SMMEs serve as a powerful engine that drives world economies and as a stepping stone to industrialisation. Over the years, attention has been given to the role played by SMMEs worldwide (Abdullahi & Sulaiman, 2015). Scholars in the area of entrepreneurship indicate that many SMMEs are established out of economic necessity because the owners were perhaps out of work or even needed to supplement their income (Baporikar et al., 2016). SMMEs are known globally for their contribution towards economic growth, job creation and social progression of society. Successful SMMEs result in the growth of the economy, which in turn contributes to the employment of the members of society. For SMME owners to succeed in their business endeavours, it is imperative for them to have the necessary capabilities that would enable them to think out of the box. It becomes critical for them to have enabling capabilities such as managerial skills, experience in the business sector in which the business is operating and financial skills.

Taking into account the importance of the role played by SMMEs globally, they usually face a number of problems. These problems are characterised by cumbersome legal and regulatory constraints, lack of access to external financing, low human resources capabilities, lack of managerial skills and training and low technological capabilities (Bouazza et al., 2015). It is, however, important that these factors be properly managed if SMMEs are to succeed in their business activities. The findings of Bouazza et al. (2015) are in line with those of Mnisi & Rankhumise (2015), namely that some of the factors that can cause frustration for SMMEs are (i) not being able to access start-up capital, (ii) facing high costs of borrowing finance, (iii) fear of failure and (iv) lack of appropriate training and business education.

Studies have used various approaches to identify factors that influence the performance of SMEs. Those factors may be categorised in two groups, namely internal and external factors. Internal factors encompass the sum of all factors which occur within the business which are influenced, either directly or indirectly, by management decisions (Strydom & Nieuwenhuizen, 2007). In this regard, the entrepreneurs have full control over these factors. The business owner has no control over external factors, as they occur outside the business. Those factors can influence the business either positively or negatively.

The category of internal factors includes managerial capabilities of the business owner. Managerial capabilities refer to the set of knowledge, skills and competencies that can influence the effectiveness and efficiency of small businesses (Fatoki & Garwe, 2010). SME owners who possess these skills are likely to implement relevant economic principles in their business. It is crucial for business owners to possess good managerial insight and skills. These may potentially allow the business to flourish. Basic management knowledge is needed in the initial stages of running an enterprise and also later during the development stage. Papulová & Mokroš (2007) highlight that in the beginning; the management of the enterprise is carried out mostly by the sole founder/owner, who must perform all the actions needed in running the business. Therefore, if the person runs the business on their own, then they have to cover all areastechnical/ professional, managerial and entrepreneurial. However, they devote too much of their own energy to the enterprise and later simply “run out of breath”. Crises occur when the enterprise expands successfully and the entrepreneur (usually still the founder and owner) is not capable of running it due to lack of needed knowledge and managerial skills.

Scholars, such as Papulová & Mokroš (2007); Fatoki & Garwe (2010) and Van Scheers (2011), have studied entrepreneur characteristics in the area of small business and entrepreneurship. Passion, self-confidence and willingness to take risks and to learn are some of these characteristics. It must be noted that the success or failure of a business is associated with many factors. Some characteristics may have a positive effect on the business and others may have a negative effect.

Scholars argue that entrepreneurs should be committed to what they are doing and care about it. Once they have a passion for what they do, they stand a good chance of succeeding in their business. Business operations are characterised by turbulence and as such, entrepreneurs should have self-confidence that they will succeed, irrespective of the challenges that they may face. It is of great importance for SME owners to have self-efficacy in the running of their businesses. They need to be conversant with risks that are associated with their businesses. For them to understand these risks, they may need to conduct some preliminary investigation to understand the environment under which the business is to perform. This investigation may form part of a feasibility study (Wang et al., 2003), which is an analysis and evaluation of a proposed project to determine if it is technically feasible, feasible within the estimated cost and will be profitable. It is through this approach that the risk is understood and the business owner may be in a position to mitigate its effect on the business. Therefore, the characteristic that business owners must be willing to take a risk means that they have to be responsible in that they have to consider calculated moves.

Business owners always try to remain competitive. They accomplish this by engaging in some continuous learning process, as they learn from others. Arguably, those who are not open to learning are more likely to compromise business success. There are numerous benefits for those owners that are willing to learn. They will understand the risks that are associated with the business. Another set of skills important for the survival of a business are marketing skills (Van Scheers, 2011). As highlighted by Bouazza et al. (2015), marketing skills have been recognised as contributing to the survival and performance of a business. A business’s success or failure depends on its ability to reach its potential clients and results in those in the buyers’ market making decisions to buy its products or services. A lack of marketing skills could have a negative impact on the success of the business as posited by Van Scheers (2011). Arguably, business owners should ensure that they acquire marketing skills as they could contribute to a higher turnover.

A legal and regulatory framework, access to finance, human resources capabilities and government support constitute external factors that have an effect on the success of a business. In the business fraternity, the environment plays a crucial role. For instance, if the environment is not conducive to running a business, the greater possibility is that investors or entrepreneurs will not pursue their business endeavours in that environment. Tax laws also play a role in the performance of SMEs. For this sector to flourish, it is important for the government to provide tax incentives to lessen the burden of tax on them.

The ability of SMEs to grow depends largely on their potential to invest in restructuring, innovation and qualification of business owners and managers. All of these investments need capital and therefore access to finance. Simply, access to capital is crucial to the development of small businesses. In other words, lack of access to finance hinders the prospects of the businesses to expand operations. Studies have reported that access to external finance is a major problem in SME success (Abor & Biekpe, 2006; Bouazza et al., 2015; Yang, 2015). Banks and other financial intermediaries have always viewed lending to small business as a very time-consuming and costly proposition. Generally, small firms lack proper accounting procedures and owners frequently mix their business and personal finances, so financial statements are unreliable.

Among other factors, the gender of the business owner is sometimes problematic, as it relates to the perception of financial institutions or sources of funding (such as banks) regarding the performance of the business. A significant amount of research has explored whether males and females differ in terms of their access to start-up capital. Van Hulten (2012) states that studies from the USA, the UK and the Netherlands demonstrate that women tend to start their firms with less external capital and that gender also affects the sector-of-entry and subsequent firm performance.

Human capabilities in the business play an important role in the performance of the business and form one of the fundamental factors in the development of the firm (Bouazza et al., 2015). A common phenomenon in the business fraternity is that businesses with a more skilled and educated workforce is more likely to be efficient and successful. Notably, a well-educated and skilled workforce essentially possesses more learning and innovative abilities to contribute positively to the business. For example, proper accounting procedures that may be implemented by skilful and professional employees in a business ensure that the business stands a better chance of attracting funding from external sources.

The importance of SMMEs in many economies has prompted many governments worldwide to prioritise the development and support of this sector (Gengatharen & Standing, 2005). This is done with an understanding that economic growth is driven and dominated by the activities of SMMEs (Mahendra, 2015). In the South African context, the support is provided by government agencies such as the Small Enterprise Development Agency (SEDA), which provides non-financial support, and the Small Enterprise Finance Agency (SEFA), which provides financial support to small businesses.

Literature Review

The Importance of Small Businesses

Entrepreneurship is one of the significant factors contributing to economic growth through job creation, innovation and productivity growth. On the same vein, Raza et al. (2018) attest that the importance of SMMEs cannot be undervalued due the contribution that they make in addressing poverty eradication, social upliftment, job creation and economic growth. Business development, especially in the area of SMMEs, is regarded as a strategy that can be used to generate employment and income in developing countries such as South Africa. As underscored by Hyder & Lussier (2016), the trend globally is that SMMEs form the largest employer in either developed or developing economies. Consequently, poverty could be alleviated through the promotion of SMMEs. SMMEs are labour-intensive by their nature. They have the ability to create new employment opportunities or they have considerable potential for increased employment creation (Dockel, 2002), but it would appear that there is high turnover in this sector. In particular, small businesses in South Africa show signs of stagnation in both turnover and employment in a country with a 26.5% unemployment rate (Statistics South Africa, 2010).

In report (Chandra et al., 2001) citing international evidence, SMME turnover is said to be about 50% for the first three years. As highlighted by Ensari & Karabay (2014), SMMEs are a primary component of economic liberalisation and social stability. They contribute towards economic growth (Kambwale et al., 2015). Not only do they contribute to outputs, but they also fulfil social objectives, such as job creation, which subsequently helps poverty-stricken communities. They also contribute to the gross domestic product (GDP) of the country. For example, in South Africa, SMEs contribute 52-57% to the GDP and 60% to employment (SEDA, 2018). Yang (2015) reports that the output value of SMMEs in China is 55.6% of the GDP, generating more than 75% of employment opportunities. The Chinese SMMEs have shown an increase in growth and become an important driver for promoting the development of the economy. Worldwide, SMEs account for roughly 99% of all firms (OECD, 2017). These businesses are making strides in addressing the social instabilities in communities (Kambwale et al., 2015). Because of the economic contribution made by SMMEs, strategies to catalyse growth and address unemployment have become a priority for every government. The reason for greater emphasis on SMMEs is the benefits made by the sector. For example, SMMEs employ more people and there is a need to encourage the unemployed to start new businesses (Molefe et al., 2018).

Turnover and employment are important factors since the former has a strong bearing on the wealth being created in the economy and the latter is of great importance for the community’s social stability. The role of governments in stimulating SMME development is a global imperative. Pansiri & Yalala (2017) explain that governments have attempted various approaches to develop these enterprises such as low-interest loans, education programmes and business incubators and also by simplifying government regulations. From a global perspective, it is recognised that SMMEs play an important role in economic development because they serve as a primary source of employment creation and contribute towards economic growth. Obviously, there is significant interaction between SMMEs and government. SMMEs’ success becomes a monumental task when there is arguably very little to no real economic growth overall in the incubation and host country.

Factors Contributing to the Performance of SMMEs

Numerous factors are associated with the performance of SMMEs. The list of factors discussed in this study is not exhaustive. However, as highlighted by Agbim (2013), entrepreneurial success depends on factors that include entrepreneurial capability. This relates to the ability to use resources adequately in performing tasks in the enterprise. It is therefore important to acquire the capabilities that will enhance the success of the venture in the context of the environment in which the business is operating. In particular, most businesses actually start as small enterprises and often from a modest home-base, so the decision to grow and potentially move from a home-base has personal implications for the owner-operator in relation to aspects such as additional risk, both of a financial and emotional nature (Walker & Brown, 2004). Therefore, infrastructure is highly associated with business performance. Kinyua (2014) is of the view that a lack of proper infrastructure could inhibit SMMEs from performing beyond expectation. In this regard, a spatial planning approach ensures that there is efficient use of land by balancing competing demands within the context of sustainable development, which will ensure continued operation of the business. In other words, where people choose to operate their businesses may well be an important factor in business owners’ measures of success, as there are different financial pressures attached to whether the business has to pay rental and travelling expenses. Another important factor that could lead to the success of a business is access to finance and this could contribute to the expansion of the business and ensure sustainability.

Information and communication technology (ICT) facilitates the delivery of many new products and services (Brynjolfsson et al., 2003). Most sectors of the economy have adopted ICT to enhance productivity, enlarge market reach and reduce operational costs (Brynjolfsson & Kahin, 2002). This adoption of ICT is illustrated by the spread of broadband connectivity in businesses, which in almost all countries that are part of the Organisation for Economic Cooperation and Development (OECD) is universal for large enterprises and reaches 90% or more even in smaller businesses. The digital economy has given rise to a number of new business models. Although many of these models have parallels in traditional business, modern advances in ICT have made it possible to conduct many types of business on a substantially greater scale and over longer distances than was previously possible (Brynjolfsson & Kahin, 2002).

The network approach to entrepreneurship (NAE) is a prominent theoretical perspective within the literature on entrepreneurship and has become one of the most popular perspectives in the debate about self-employment, entrepreneurship and small business formation (Aldrich & Zimmer, 1986). Similarly, Zarefard & Cho (2018) explain that technology competencies are important for business founders to survive in a competitive environment and knowledge-based economy. It is therefore critical for the SMME owners to have technology competencies and adopt advance technology within their businesses. This literature assumes that entrepreneurs try to mobilise, and actually benefit from, social network resources in the start-up period of their businesses (Brüderl & Preisendörfer, 1998). Businesses that perform well are most likely (properly) marketed. Arguably, business performance is highly correlated to business marketing. SMME marketing difficulties are due to a lack of suitable marketing frameworks and severe constraints or limitations on SMME marketing resources (Carson, 1990; Gilmore et al., 2001). As emphasised by Gilmore et al. (2006), the characteristics of marketing in SMMEs are determined by key constraints such as limited resources, lack of time and lack of good market information or information sources. SMMEs also suffer from a lack of marketing expertise that may be due to the owner/manager’s limited skills in marketing or the absence of a marketing specialist. SMMEs have a limited impact on the marketplace because of these characteristics.

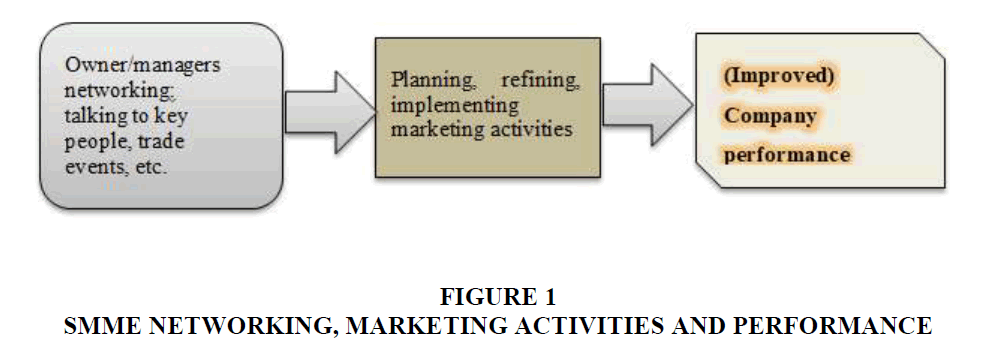

Networking is used by managers to make sense of what happens in complicated markets and provides understanding of inter-organisational relationships in business-to-business markets. Similarly, Lin & Lin (2016), among others, attest that network relationships can improve SMEs’ performance and this is built on the principles of sharing knowledge, accelerating innovation, reducing transaction costs and gaining a better reputation for the enterprise. Therefore, it can be an important business dimension given the resource constraints and limitations of SMMEs (Gilmore et al., 2006). Figure 1 (Gilmore et al., 2006) presents the hypothetical relationships between networking and related activities for (improved) business performance.

In the context of China, the success of SMMEs is attributed mostly to top management’s ability to develop effective strategies that would assist the business in achieving its objectives (Yang, 2015). It is notable that the other crucial factors for the success of SMMEs are entrepreneurial resources and supporting resources. According to Premaratine (2001) as cited by Yang (2015), entrepreneurial resources entail assets that are mobilised by the entrepreneurs during the establishment stage of the business. These resources include financing such as credit and investment capital and could further include abstract resources such as knowledge of a particular field, technology or even network that could provide support of some kind to the business. Sidik (2012) further indicates that market orientation plays a pivotal role in the success of SMMEs and this is regarded as part of organisational culture, which is critical to a firm’s success by emphasising and focusing more on competitor orientation, customer orientation and inter-functional coordination. Scholars worldwide are of the view that marketing orientation plays a strong role in SMMEs’ performance and in this context, small businesses may demonstrate patterns that are different from those of large firms (Sidik, 2012). Lo et al. (2016) share the same sentiments that customer focus is important as it is regarded as a key contributor to the profitability of the firm. These authors explain that customer focus is similar to market orientation as it focuses on innovative solutions that will likely build superior customer or market value.

Studies have reported that entrepreneurial orientation (EO), which refers to tendencies, processes and behaviours that lead to new markets (Lo et al., 2016), is significantly associated with business performance. In particular, EO enhances the success of small businesses. Therefore, it exploits new innovations and processes with the primary objective of making new market entries. Ordinarily, this is characterised by riskiness, competitive aggressiveness, innovativeness, proactiveness and autonomy.

The effects of inherent attributes of business owners on business performance have been studied. Industry Canada (2015) reports that majority female-owned enterprises lag behind majority male-owned enterprises in terms of sales, profits, employment, innovation, loan approvals, exports, sales growth and employment growth. This lower performance is attributed to the industrial sectors within which female entrepreneurs operate (e.g., they are more likely to operate in retail and service industries) (Coleman, 2002), their personal characteristics and preferences, their management strategies and institutional constraints. In their study which investigated whether majority female-owned businesses were affected by discrimination in terms of their access to bank loans compared to majority male-owned businesses, Muravyev et al. (2009) report that majority female-owned businesses were less likely to have their bank loans approved than majority male-owned businesses. While some studies agree that the gender of the business owner is associated with business performance, others report that there is not sufficient evidence to suggest that male-owned businesses perform better than female-owned business, and vice versa (Robb & Wolken, 2002; Orser et al., 2006).

Government support programmes are associated with SMMEs’ performance. Abdullahi & Sulaiman (2015) indicate that one of the critical success factors is government support programmes. In this regard, support may be financial and non-financial. The Chinese and South African governments have prioritised SMMEs by creating government support agencies that ensure the prosperity of their respective SMMEs. Furthermore, external factors such as social networks and legality are the primary strategic dimensions that are positively associated with the success of small businesses.

Theoretical Framework

Entrepreneurship theories and research remain imperative to the development of the entrepreneurship discipline (Simpeh, 2011). In order to ensure effective development for entrepreneurship, a path way for effective business development, it is important to focus on the methodology of enhancing the running of the business. The study on which this article is based on two entrepreneurship theories, (i) psychological entrepreneurship theories – these theories focus on personal characteristics associated to entrepreneurship. Accordingly, personal traits and locus are reviewed (Simpeh, 2011). Personality traits are referred to as stable qualities that people display in most situations. This definition attests that a person possesses inborn qualities or potentials if the individual that naturally make him an entrepreneur. Some of these traits or characteristics associated with entrepreneurs tend to be more opportunity driven to ensure that the entrepreneurs display high level of for instance management skills which are critical for the running of the business; creativity and innovation; business know-how; hard work; perseverance. According to these theories, the success of entrepreneurs emerge from his or her own abilities and support from the external environment and (ii) research-based entrepreneurship theories – scholars such as Alvarez & Busenitz (2001) argue that access to resources by founders is important predictor of opportunity based entrepreneurship and new venture growth. In other words, the entrepreneurs should have access to resources in order to prosper in their business endeavours. In this regard, access to resources such as capital and human resources enhance the individual’s ability to detect and take action on discovered opportunities. These two elements are critical, for instance, education and experience play an important attributes in the exploitation of the business opportunities. Various studies for instance, Davidson & Honing (2001) in their study found that human capital factors are positively related to becoming nascent entrepreneur, increase opportunity recognition and even success.

Purpose Of The Study

Various studies have contributed to the existing body of knowledge developing various models, such as linear regression models, logistic regression models and ANOVA, and frameworks to assess the performance of businesses. This cross-sectional study reported on here followed a qualitative study design. Qualitative research is an interpretive research approach that relies on multiple types of subjective data and investigates people in particular situations in their natural environment (Denzin & Lincoln, 1994). A cross-sectional study design has the advantage of measuring current perceptions, attitudes or practices of individuals within a short period of time (Letsoalo, 2017). The objective of this study was to explore the perceptions of SMME owners in China and South Africa on factors that influence the performance of their businesses. Therefore, the purpose of this study was to explore the factors associated with the performance of SMMEs from the owners’ perspective. To achieve this objective, the researchers attempted to answer the following research question:

What insights are revealed through the use of an exploratory qualitative study in the analysis of the South African and Chinese SMME owners’ perceptions about factors that are associated with SMMEs’ performance?

Significance Of The Study

The research is useful to business administrators and planners, researchers, scholars, government departments and non-governmental organisations that work on factors associated with the performance of SMMEs, especially in South Africa and China. Also, this study provides valuable information on how small business owners share their experiences in running their business and on the factors hampering the success of their business activities. The results further provide critical information to assist policy-makers and government support agencies in refining their support interventions. All these stakeholders will appreciate the perceptions of business owners with regard to the effects of factors that are associated with SMMEs’ performance. As such, proper consideration and adjustments for covariates may be properly effected when devising intervention strategies that are aimed either at improving SMMEs’ performance or at assisting owners with the management of affective factors of business performance. This is the first study conducted in Mpumalanga, South Africa and Chuzhou, China.

Materials and Methods

A research design is a specific plan or guide for studying a research problem (Joyner et al., 2018). Similarly, as explained by Richey & Klein (2007), it is a blueprint geared to guide the researcher to successful completion of the research. Creswell & Creswell (2017) concurs that it is a plan or procedure for research that spans the broad spectrum of data collection and analysis. Arguably, a research design is a tool that is employed to engineer the successful progression and completion of research.

This qualitative cross-sectional exploratory study used the non-probability sampling technique (Cochran, 1977; Scheaffer et al., 2006), i.e., sampling without using random selection methods (Cooper et al., 2006), to select the study participants. In particular, researchers used their own judgement to select what seemed like an appropriate sample (Stenhouse, 1980; De Vos et al., 2011; Creswell, 2012). Therefore, the selection of participants for this study was based on the researchers’ judgement that the participants had experience in running their businesses. The study population consisted of SMME owners who were selected from the Mpumalanga and Chuzhou provinces of South Africa and China, respectively. A total of 10 (5 in Mpumalanga & 5 in Chuzhou) business owners constituted the study population. In order to ensure that anonymity was maintained, no personal identifiers were used for the participants.

Unstructured in-depth interviews were used for data collection. This method gives interviewees the opportunity to be open about their experiences and opinions in relation to factors that influence the performance of their businesses. It also enables researcher to capture the participants’ perspectives and meanings (Kvale, 2007). In addition to the interview, the researchers used audiotaping and took field notes during the interviews to ensure that accurate data was collected. In this regard, permission was requested by way of informed consent from the respective interviewees to ensure that their privacy was not violated. Data collection was not reliant on saturation but rather a build-up on a quantitative approach since this study is more of baseline.

Prior to data analysis, the researchers transcribed responses from the unstructured indepth interviews. Tesch’s data reduction of open coding was used for data analysis (Creswell, 2009). To ensure consistency and trustworthiness of the developed theses, double data encoding was performed by two independent encoders. The co-coder and the researchers analysed the data independently to ensure the credibility of results. The following procedure was adopted in the analysis of the data: (i) the researcher read the field notes to understand the data properly and to get a sense of the whole. (ii) Topics were abbreviated as codes and these were written next to the appropriate clusters of the text. (iii) To attain commonality, the related topics were grouped to reduce sub-themes. A final decision regarding the wording for topics was made to turn these into categories (Creswell, 2009).

Findings and Discussion

The results and the discussion of the study are organised into the main themes that emerged during the analysis, namely access to finance, lack of financial management training, managerial skills, and access to the market, access to technology, hard work, start-up capital, government support and planning.

Access to Finance

The study revealed that access to finance was seen as critical for the business to succeed in various business transactions. It emerged that SMME owners face challenges where banks require collateral for loans. Banks are more risk averse towards SMMEs because of the latter’s lack of collateral security. This is what some of the participants had to say:

“Banks always require high collateral which I do not have and without security, no capital will be given. According to me the governments should help us, for instance you will have a start-up capital, but one will not be able to get money for operating expenses…” [Mpumalanga, South Africa]

“…When I started my business, I used my own money. The money was not enough and I had to apply for bridging funds from the bank…” [Chuzhou, China]

“…The business is self-funded and additional funding of RMB 5 000 000 was received from the bank as loan…” [Chuzhou, China]

A number of indicators are used by banks when assessing SMME owners for funding and this range from educational literacy on financial matters to financial history. Based on these indicators, banks are able to determine whether applicants have the capacity to manage their financial affairs. The findings are in line with Rankhumise & Rugimbana (2010); Mahadea & Pillay (2008); Rogerson (2006), who found in their respective studies that financial institutions are not willing to fund small businesses due to their inability to manage their finances. Baporikar et al. (2016) concur with these authors that banks do not want to give funds to SMMEs as most of them do not have collateral. Large established businesses have collateral and are known for their sound financial standing, and therefore it is easier for them to get bank loans. This is common in both South Africa and China. Pletnev & Barkhatov(2016) also agree that access to finance plays an important part in the success of the business. Similarly, Sham & Pang (2014) found in their study that Chinese SMMEs experience the same challenges because the banks are not willing to fund them due to lack of qualified collateral and the lack of a credit repayment track record. Muriithi (2017) also concurs with other scholars that the inability to access finances remains a major impediment to SMMEs’ survival and growth.

Lack of Financial Management Training

Lack of financial management training emerged as one of the factors that inhibit SMMEs from carrying out business activities optimally. The participants from South Africa felt that they required financial management training and this could assist them in managing the financials of the business correctly. This is different from the Chinese SMME owners, who indicated that they had received training in financial management. The most common statements were as follows:

“You know financial management is important to me, say the bank give you funding, though I have a bit of knowledge on how to use the money, but it will be helpful if some training is provided so that the money is not directed to other purposes that are not meant for the business…” [Mpumalanga, South Africa]

“…I received financial and enterprise management training from Chuzhou Economic and Technological development. That helped me to be able to management my finances properly and effectively…” [Chuzhou, China]

In the South African context, the lack of training gives banks the impression that these businesses are unable to manage their resources and therefore they are not always willing to grant loans to them. The reality is that if funding is misappropriated, it will result in the business yielding less income and probably not being able to meet its obligations as they become due. It can be deduced that lack of financial management can cause problems such as cash flow difficulties. Eniola & Entebang (2017) agree that financial knowledge has a direct effect on a firm’s performance and this could be either positive or negative.

Managerial Skills

The participants indicated that for them to succeed in their business activities, it would be imperative for them to have managerial skills. This sentiment is in line with what Dzansi et al. (2015) found, that ineffective management capacities, more especially during start-up, can lead to a low creation rate. Efficient management with capacities such as knowledge, skills and competencies could make small businesses more efficient. Having sound managerial skills would lead to successful business operations and will likely motivate employees to work towards the achievement of the set goals. It is notable that if SMME owners possess good managerial skills such as planning, interpersonal skills, communication skills and computer skills, they can ensure that the right decisions are made in managing the overall performance of the business. These findings are in line with those of Bouazza et al. (2015) that lack of management skills is regarded as one factor that could impede the success of the business. The following is what the participants had to say:

“…We need to have some skills for instance planning, technical skills, communication skills. Without these, the business might not succeed in the operations of the business. You know you need to speak from time to time your employees or even suppliers …” [Mpumalanga, South Africa].

“…Some of the larger companies absorb the clients because of their reputation. Clients sometimes do not prefer working with small businesses fearing the quality of our products...” [Chuzhou, China]

If SMME owners had management skills, this would help them in running the business and in planning and organising resources for the business.

Access to Market

The participants from both countries regarded lack of access to market as one of the factors that leads to the failure of SMMEs. They indicated that accessing markets was a challenge for them in the pursuit of their business activities. This was more so in China, due to the high level of competition. This notion suggests that SMMEs need to be more innovative in order to stay competitive in the market environment. These findings confirm what Fernandez et al. (2016) found in their survey that firms consider the competition in China to be very intense. Based on what the participants indicated, two reasons that could be attributed to lack of access to market are lack of market research prior to the start-up of the business and lack of marketing skills. Rahman et al. (2016) also found that marketing issues of SMMEs are among the reasons for their failure. Further to this, Mnisi & Rankhumise (2015) in their study also found that access to market creates challenges because if there is no possible market to serve, the business is unlikely to succeed. This is what some of the participants had to say:

“…As business we are faced with vicious competition and this is as a result of many SMMEs in our city. At times it is not simple to run a business successfully and one should always think of better way to run the business. There is vicious competition and you need to compete in this hostile market environment …” [Chuzhou, China].

“…Competition is a serious factor that can harm the business. There are many businesses selling the same products and one needs to vigilant in combating competition in the market. Innovation is the way one should think of…” [Mpumalanga, South Africa]

It is evident from the analysis that SMMEs are still unable to access markets and this essentially calls for aggressive marketing of their products and the businesses.

Access to Technology

It emerged that technology has a pivotal role to play in the performance of businesses. Access to and use of technology is important because technology brings about opportunities for the business and enhances the business network. A business that has access to technology may retain its competiveness in the market. Mahendra (2015) shares the same view that a business that has access to technology has a greater chance of improving its performance and overall competitiveness, for instance the use of e-marketing and other business processes. This is what the participants said:

“…The use of technology is important for me to do some transactions, for instance, one can do payments for stock online and can also do marketing using technology through my phone. Lack of access can hinder the business operations…” [Mpumalanga, South Africa]

“…As a business you need to focus on business solutions, for instance make use of electronic business platform, mobile internet. What I can say is that we need to use technology to assist us in running the business. We can always use financial software to assist in our financial system…” [Chuzhou, China]

The use and adoption of technology is likely to enable the business to be more innovative and to form good relationships with distant suppliers. This ensures the expansion and growth of the business. Of great importance is that the participants from both countries utilised technology for their business transactions and other platforms pertaining to their businesses.

Hard Work

Important revelations emerged in this theme, with Chinese business owners indicating that hard work is an important factor that contributes to the success of the business. They strongly indicated that getting involved in and putting effort into the business would assist in the identification of pitfalls in the business operations. This is what they had to say:

“…I believe that hard work is important for the success of the business. What I can say is that without committing time and efforts, the business will not survive, therefore one has to work hard to achieve the objectives of the business…” [Chuzhou, China]

“…Without hard work, my business will not make a profit. I am working hard with my people and I am a manager and a worker as well…” [Chuzhou, China]

It can be deduced that working hard can influence the success of a business. Business owners need to be an example to their staff in working towards a common goal.

The Need for Start-Up Capital

Lack of start-up capital was seen as a factor that leads to business failure. Ordinarily, at the inception of the business, start-up capital is important to cover the day-to-day running of the business. If bridging funds are not available to meet the needs of the business, the business is likely to struggle in pursuing the business activities.

“…When starting the business, I had money from my personal savings which was enough to get the set-up of the business. I did not have enough money to pay other obligations and I was forced to work on the small scale…” [Mpumalanga, South Africa]

“My family helped me with some funds when starting off with my business…” [Mpumalanga, South Africa]

“…We funded the business from our own money and some of the money was from the banks which help us to finance our debt…” [Chuzhou, China]

It emerged that small business owners used their personal savings and no other capital was received when they started their businesses. Most of the small businesses could not access financing because of a lack of collateral and/or guarantees. These findings confirm those of Hyder & Lussier (2016), who report that most businesses fail due to lack of capital. Wonglimpiyarat (2015) agrees that financing is a constraint for SMMEs. The Chinese government has attempted to improve SMMEs’ access to finance by introducing interventions such as the 12th Five Year National Economic and Social Development Plan.

Government Support

The study revealed that government support is critical for the success of a small business. Both non-financial support and financial support play a pivotal role to ensure success in business activities. Participants strongly believed that business skills training and financial training interventions could assist the SMMEs in fully understanding the essence of running and managing the business properly. Notably, the Chinese participants indicated that they were provided with training as part of support from the government. However, South African participants were not offered the same opportunity as their counterparts in China.

“…It was not easy to start a business on my own without any support from the government or even the bank. I used my own personal savings to start the business, with no training on how to run the business. I relied more on the business books to understand the running and management of the business venture…” [Mpumalanga, South Africa]

“…Our government is very helpful when you start enterprise. As a business owner, I received lot of training to help me run the business better. I attended a course on business skills and financial management…”[ Chuzhou, China]

It is evident that there is still a lack of government support according to the South African business owners interviewed, whereas the Chinese business owners indicated that they received training during the start-up of the businesses. The findings are consistent with those of Irjayanti & Azis (2012), namely that government should maintain the SMMEs’ continuity by creating more programmes to assist the sector. They suggest that government agencies should go to the SMMEs and see the conditions in which they operate so that effective support and development programmes can be developed to overcome the problems experienced.

Planning

It emerged that planning plays an important role in the success of a business. This means being able to communicate and deliver results by providing employees with a strong business plan to achieve the goals set for the business. Managerial skills are required to manage the business properly and these include overseeing workplace issues, employees, teamwork, team development and communication.

“…Planning is important for me as a business man. What it means is that planning assist one to know what to do and by when? It serves as a road map towards working towards your goals in the business and this assist a lot in managing the business successfully…” [Chuzhou, China]

Without planning, owners will not know what to do next. Planning in this regard serves as a road map for the activities of the business. Arguably, planning is essential for managing the business.

Limitations

As qualitative research is mostly open-ended, the participants had more control over the content of the data collected. The researchers had no way of verifying the results objectively against the scenarios stated by the respondents. The analysis of the collected data was labourintensive due to its design (Elo & Kyngäs, 2008). The use of double data encoding was intended at minimising the possibility of arriving at different conclusions based on the same information (Maxwell, 2005).

Conclusions And Recommendations

In view of the findings of this study, based on the literature review and the empirical investigation, the following conclusion can be made:

Understanding the factors contributing to the success of small businesses is important for both SMME owners and policy-makers. This research identified factors that are perceived to be key contributors to the success of small businesses. These factors are access to capital, managerial skills, government support, planning, access to market and financial training interventions. The findings are important because they could help prospective and current entrepreneurs to understand what needs to be done to be successful in the business endeavour. They could therefore learn from the pitfalls identified in the study, for instance the challenge of collateral required by the banks.

Based on the conclusions, a few suggestions can be made. It is suggested that the government play a role in assisting SMMEs with financial assistance through its agencies. Some training interventions, such as financial skills, management skills and marketing skills, should be provided to SMMEs. This will help the owners acquire the necessary knowledge and insight that would assist their performance.

Networking is a useful way for SMME owners/managers to expand their marketing expertise and knowledge. Therefore, the need to develop marketing frameworks suitable for smaller business is acknowledged. Moreover, many studies about entrepreneurship and (social) networks mainly follow a qualitative approach, they are based on small samples and they ignore important variables that should be controlled for by appropriate statistical procedures. The researchers recommend that a large-scale study that follows a mixed methods approach be commissioned to account for the almost total variation in the performance of SMMEs.

Conflict Of Interest

The authors declare that they have no financial or personal relationship(s) that could have influenced them inappropriately in writing this article.

Acknowledgements

The researchers duly acknowledge support from the National Research Foundation, South Africa, for providing funding to conduct the research in South Africa and China. Special appreciation goes to Eunice Mtshali and Given Luvhimbi (Information Librarians: Tshwane University of Technology) and Alice Machele (Client Manager Services: Tshwane University of Technology) for technical assistance.

References

- Abdullahi, I. I., & Sulaiman, C. (2015). The determinants of small and medium-sized enterprises performance in Nigeria. Advances in Economics and Business, 3(5), 184-189.

- Abor, J., & Biekpe, N. (2006). SMEs' access to debt finance: A comparison of male-owned and female-owned businesses in Ghana. The International Journal of Entrepreneurship and Innovation, 7(2), 105-112.

- Abor, J., & Quartey, P. (2010). Issues in SME development in Ghana and South Africa. International Research Journal of Finance and Economics, 39, 218-228.

- Agbim, K. C. (2013). The relative contribution of management skills to entrepreneurial success: A survey of small and medium enterprises (SMEs) in the trade sector. IOSR Journal of Business and Management, 7(1), 8-16.

- Aldrich, H. E., & Zimmer, C. (1986). Entrepreneurship through social networks. The Art and Science of Entrepreneurship, 3- 23. Retrieved April 21, 2018, from http://works.bepress.com/howard_aldrich/71/

- Alvarez, S., & Busenitz, L. (2001). The entrepreneurship of resource based theory. Journal of Management, 755-775.

- Baporikar, N., Nambira, G., & Gomxos, G. (2016). Exploring factors hindering SMEs’ growth: evidence from Namibia. Journal of Science and Technology Policy Management, 7(2), 190-211.

- Bouazza, A., Ardjouman, D., & Abada, O. (2015). Bouazza, A.M., Ardjouman, D. & Abada, O. 2015. Establishing the Factors Affecting the Growth of Small and Medium-sized Enterprises in Algeria. American International Journal of Social Science, 101-121.

- Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded business. Small Business Economics, 10(3), 213-225.

- Brynjolfsson, E., & Kahin, B. (2002). Understanding the digital economy: Data, tools, and research. MIT Press.

- Brynjolfsson, E., Hu, Y., & Smith, M. D. (2003). Consumer surplus in the digital economy: Estimating the value of increased product variety at online booksellers. Management Science, 49(11), 1580-1596.

- Carson, D. (1990). Some exploratory models for assessing small firms’ performance. European Journal of Marketing, 24(11), 1-40.

- Chandra, V., Moorty, L., Nganou, J. P., Rajaratnam, B., & Schaefer, K. (2001). Constraints to growth and employment in South Africa. Report No 2, World Bank.

- Chittithaworn, C., Islam, M. A., Keawchana, T., & Yusuf, D. H. (2011). Factors affecting business success of small & medium enterprises (SMEs) in Thailand. Asian Social Science, 7(5), 180-190.

- Cochran, W. (1977). Sampling techniques. Harvard University: John Wiley & Sons.

- Coleman, S. (2002). Characteristics and borrowing behavior of small, women-owned enterprises: Evidence from the 1998 survey of Small business finances. Journal of Business and Entrepreneurship, 14(2), 151-166.

- Cooper, D. R., Schindler, P. S., & Sun, J. (2006). Business research methods (Vol. 9). New York: McGraw-Hill Irwin.

- Creswell, J. W. (2009). Research design: qualitative, quantitative, and mixed methods approaches. London: Sage.

- Creswell, J. W. (2012). Educational research: Planning, conducting and evaluating quantitative and qualitative research. New Jersey: Pearson Education, Inc.

- Creswell, J. W., & Creswell, J. D. (2017). Research design: Qualitative, quantitative, and mixed methods approaches. Sage publications.

- Davidson, P., & Honing, B. (2001). The role of social and human capital among naascent entrepreneurs. Journal of Business Venturing, 121.

- De Vos, A. S., Strydom, H., Fouché, C. B., & Delport, C. S. (2011). Research at grass roots for the social sciences and human service professions. Pretoria: Van Schaik.

- Denzin, N. K., & Lincoln, Y. S. (1994). Handbook of qualitative research. Thousand Oaks, CA: SAGE.

- Dockel, A. A. (2002). Factors that contribute to small business survival. Southern African Business Review, 6(2), 1-7.

- Dzansi, Y. D., Rambe, P., & Coleman, W. J. (2015). Enhancing new creation success in South Africa: a project management perspective. Problems and Perspective in Management, 417- 425.

- Elo, S., & Kyngäs, H. (2008). The qualitative content analysis process. Journal of Advanced Nursing, 62(1), 107-115.

- Eniola, A., & Entebang, H. (2017). SME managers and financial literacy. Global Business Review, 1-18.

- Ensari, M. S., & Karabay, M. E. (2014). What helps to make SMEs successful in global markets. Procedia Social and Behavioural Sciences, 150, 192-201.

- Fatoki, O., & Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A principle component analysis approach. African Journal of Business Management, 729-738.

- Fernandez, J., Xu, B., Xu, Z. D., Puyuelo, & MJ. (2016). China Business Survey Report. China.

- Gengatharen, D., & Standing, C. (2005). A framework to assess the factors affecting success or failure of the implemetation of government-supported regional e-marketplaces for SMEs. European Journal of Information Systems, 412-433.

- Gilmore, A., Carson, D., & Grant, K. (2001). SME marketing in practice. Marketing Intelligence and Planning, 19(1), 6-11.

- Gilmore, A., Carson, D., & Rocks, S. (2006). Networking in SMEs: Evaluating its contribution to marketing activity. International Business Review, 15(3), 278-293.

- Hyder, S., & Lussier, R. N. (2016). Why businesses succeed or fail: a study on small businesses in Pakistan. Journal of Entrepreneurship in Emerging Economies, 8(1), 82-100.

- Industry Canada. (2015). Majority Female-Owned Small and Medium-Sized Enterprises.

- Irjayanti, M., & Azis, A. (2012). Barrier factors and potential solutions for Indonesian SMEs. Procedia: Economics, 3-19.

- Joyner, R. L., Rouse, W. A., & Glatthorn, A. A. (2018). Writing the winning thesis or dissertation: A step-by-step guide. Thousand Oaks, CA: Corwin Press.

- Kambwale, J. N., Chisoro, C., & Karodia, A. M. (2015). Investigation into the causes of small and medium enterprise failures in Windhoek, Namibia. Oman Chapter of Arabian Journal of Business and Management Review, 34(2603), 1-30.

- Kinyua, A. N. (2014). Factors affecting the performance of small and medium enterprises in the Jua Kali sector in Nakuru town, Kenya. IOSR Journal of Business and Management, 16(1), 80-93.

- Kvale, S. (2007). Doing interviews. London: Sage.

- Letsoalo, M. E. (2017). Learners' perceptions on factors that affect their overall performances in mathematics. Gender and Behaviour, 15(3), 9502-9523.

- Lin, F. J., & Lin, Y. H. (2016). The effect of network relationship on the performance of SMEs. Journal of Business Research, 1780-1784.

- Lo, M. C., Wang, Y. C., Wah, C. T., & Ramayah, T. (2016). The critical success factors for organizational performance of SMEs in Malaysia: a partial least squares approach. Review of Business Management, 18(61), 370-391.

- Mahadea, D., & Pillay, M. (2008). Environmental conditions for SMME development in a South African province. South African Journal of Entrepreneurship and Small Business, 433-436.

- Mahendra, A. (2015). Impact of government support and competitor pressure on the readiness of SMEs in Indonesia in adopting the information technology. Procedian Computer Science, 102-111.

- Maxwell, J. A. (2005). Qualitative research design: An interactive approach, SAGE Publications.

- Mnisi, K. L., & Rankhumise, E. M. (2015). Factors affecting the running of small and medium enterprises in greater Giyani Municipality. Commonwealth Youth and Development, 13(2), 72-85.

- Mnisi, K., & Rankhumise, E. (2015). Factors affecting the running of small and medium enterprises in greater Giyani municipality. Commonwealth Youth and Development, 72-85.

- Molefe, K., Meyer, N., & de Jongh, J. (2018). A comparative analysis of the socio-economic challenges faced by SMMEs: The case of the Emfuleni and Midvaal local municipality areas. Journal of Economics and Behavioural Studies, 7-21.

- Muravyev, A., Talavera, O., & Schäfer, D. (2009). Entrepreneurs’ gender and financial constraints: Evidence from international data. Journal of Comparative Economics, 37(2), 270-286.

- Muriithi, S. M. (2017). African small and medium enterprises (SMEs) contributions, challenges and solutions. European Journal of Research and Reflection in Management Sciences, 5(1), 36-48.

- OECD. (2017). Enhancing the contributions of SMEs in a Global and Digitalised Economy. Paris: OECD.

- Orser, B., Riding, A., & Manley, K. (2006). Women Entrepreneurs and Financial Capital. Entrepreneurship Theory and Practice, 30(5), 643-665.

- Pansiri, J., & Yalala, A. T. (2017). The evolution of entrepreneurship and small-to-medium business development in Botswana. Botswana Journal of Business, 10(1), 53-79.

- Papulová, Z., & Mokroš, M. (2007). Importance of managerial skills and knowledge in management for small entrepreneurs. E-leader, Prague, 1-8.

- Pletnev, D., & Barkhatov, V. (2016). Business success of small and medium sized enterprises in Russia and social responsibility of managers. Procedia-Social and Behavioural Sciences, 185-193.

- Rahman, N., A.Z. Yaacob, A., & Radzi, R. (2016). The challenges among Malaysian SME: a theoretical perspective. World Journal of Social Sciences, 124-132.

- Rankhumise, E. M., & Rugimbana, R. O. (2010). Micro enterprise owner perspectives on performance: Insights from selected municipalities in Mpumalanga Province, South Africa. African Journal of Business Management, 4(16), 3500-3507.

- Raza, S., Minai, M., Zain, A. Y., & Tariq, T. (2018). Dissection of small businesses in Parkistan: issues and directions. International Journal of Entrepreneurship, 1-13.

- Richey, R. C., & Klein, J. D. (2007). Design and development research. Mahwah, NJ: Lawrence Erlbaum Associates.

- Robb, A., & Wolken, J. D. (2002). Firm, owner, and financing characteristics: Differences between female-and male-owned small businesses.

- Rogerson, C. M. (2006). “Developing SMMEs in peripheral spaces: the experience of Free State province, South Africa. South African Geographical Journal, 66-78.

- Scheaffer, R. L., Mendenhall III, W., & Lyman Ott, R. (2006). Elementary survey sampling. Toronto, Canada: Thomson Books/Cole.

- SEDA. (2018). SMME Quarterly Update 3rd Quarter 2017. Pretoria : SEDA.

- Sham, T., & Pang, I. (n.d.). China’s SMEs development. Retrieved September, 2014 from http://www. ocbcwhhk. com/webpages_cms/files/Investment% 20Newsletter/English/Investment% 20Newsletter_Sep_e (1). pdf.

- Sidik, I. G. (2012). Conceptual framework of factors affecting SME development: Mediating factors on the relationship of entrepreneur traits and SME performance. Procedia-Economic and Finance, 4, 373-383.

- Simpeh, K. (2011). Entrepreneurship theories and empirical research: A summary review of the literature. European Journal of Business and Management, 1-8.

- Statistics South Africa. (2010). Quarterly labour force survey. Statistics South Africa.

- Stenhouse, L. (1980). The study of samples and the study of cases. British Educational Research Journal, 6(1), 1-6.

- Strydom, J., & Nieuwenhuizen, C. (2007). Entrepreneurship and how to establish your own business. Cape Town: Juta.

- Van Hulten, A. (2012). Women's access to SME finance in Australia. International Journal of Gender and Entrepreneurship, 4(3), 266 - 288.

- Van Scheers, L. (2011). SMEs' marketing skills challenges in South Africa. Journal of Business Management, 5048- 5056.

- Walker, E., & Brown, A. (2004). What success factors are important to small business owners? International Small Business Journal, 22(6), 577-594.

- Wang, Z., Zhang, G., & Qiu, M. (2003). The feasibility study on the combined equipment between micro-SMES and inductive/electronic type fault current limiter. IEEE Transactions on Applied Superconductivity, 13(2), 2116-2119.

- Wonglimpiyarat, J. (2015). Challenges of SMEs innovation and entrepreneurial financing. World Journal of Entrepreneurship, Management and Sustainable Development, 295-311.

- Yang, S. (2015). A theoretical framework of competitive advantage for SMEs in China under new normal economy. European Scientific Journal, 11(34), 1-12.

- Zarefard, M., & Cho, S. (2018). Entrepreneurs' managerial competencies and innovative start-up intentions in university students: focus on mediating factors. International Journal of Entrepreneurship, 1-22.