Research Article: 2019 Vol: 23 Issue: 6

Organizational Performance in Iraqi SMEs: Validity and Reliability Questionnaire

Haitham Mohsin Kareem, Southern Technical University, University Kebangsaan Malaysia

Khairul Azman Aziz, University Kebangsaan Malaysia

Ruhanita Maelah, University Kebangsaan Malaysia

Yusasniza Mohd Yunus, University Kebangsaan Malaysia

Mohammed Dauwed, Al-Rafidain University College

Abstract

Small and medium enterprises (SMEs) in Iraq encounter substantially greater problems and challenges that increase their risk of low performance and failure. The low level of use of accounting information systems (AIS), knowledge management capabilities (KMC), and innovation that are being used in these SMEs indicates one possible cause of their poor performance. Due to a lack of studies that looked into the inter-relationships of all three factors concerning SMEs’ organizational performance. Therefore, the aim of the study is to determine the validity and reliability of the questionnaire concerning the use of AIS, KMC, and innovation in Iraqi SMEs. A pilot study was conducted with 32 participants from Iraqi SMEs to prove that the instrument was reliable and free of errors. Two steps were performed, first, the validation phase with experts in relevant fields to verify the questionnaire. All their recommendations were taken into consideration and followed before the second step, which was conducting a pilot study to test the reliability of the instrument. The data collected were analysed using exploratory factor analysis (EFA) and Cronbach’s alpha coefficient. The results of the study indicated that the instrument was reliable and valid as the Cronbach’s alpha value was above 0.7, and the exploratory factor analysis was above 0.7 for the Kaiser–Meyer– Olkin (KMO) and significant constructs.

Keywords

Accounting Information Systems, Knowledge Management Capability, Innovation, SMEs, Organizational Performance.

Introduction

Accounting information systems (AIS) are one of the modern information systems with great potential in terms of their influence on organizational performance. Organizational performance concerns the effectiveness and efficiency in the evaluation of the probable actions that can be taken to improve organizational productivity. In the context of business management, organizational performance is highly recommended to enhance the process of achieving business goals as well as to evaluate the effectiveness and efficiency of individual business actions (Ismail, 2009). The subject of organizational performance has generated much coverage over the years in many disciplines within the private and public sectors to increase job quality through the use of a new trend of technology (Dauwed & Meri, 2019; Soudani, 2012). However, involving advanced AIS can enhance and improve organizational performance and lead to success for small and medium-sized enterprises (SMEs) in terms of the competitiveness of their business. Many types of research have discussed the effect of knowledge management capabilities (KMC), Furthermore, the literature shows that there is a need to pursue managing the capabilities of knowledge management in terms of good judgment and investigation concerning the impact of the decision-making pattern on the processes and support to improve organizational performance (Abubakar et al., 2017; Adams & Graham, 2017; Brix, 2017; Vila et al., 2015). The issue that encourages the implementation of an important role in the advancement of new knowledge is through the adoption of innovation (Cooper, 1998). SMEs need to innovation besides IT, which can be done through internal or external elements to survive in a competitive market and achieve competitive advantage (Cofriyanti & Hidayanto, 2013; Lyu et al. 2009). One important way to do this is to utilize information by means of IT, which should be ready to contribute positively to organizational performance, thereby, realizing its advantages through business opportunities and creating innovation to obtain a competitive advantage (Yunis et al. 2018).

Soudani (2012) asserted that AIS now play an important role in the global competitive environment by enhancing organizational effectiveness and performance. Therefore, AIS are necessary for better resource management, productivity, marketing, and services. As such, AIS offer several advantages, such as system effectiveness, flexibility, improving job quality, reducing cost, and providing timely information. The level of use of information technology in SMEs is very low due to the lack of use of advanced AIS and limited features to improve competitiveness. Ghobakhloo et al. (2011) stated that SMEs have a weakness at the managerial, organizational, individual, technological, and environmental levels. Furthermore, SMEs are facing problems and great challenges, such as failure to continue in their business successfully (Kareem et al., 2019).

Most SMEs do not fully utilize the AIS due to lack of new technological resources (Harash, 2017). Small enterprises still face many problems in their growth performance, such as cash flow, raw materials management, satisfying client bases, and lack of finance (Manurung & Manurung, 2019). In particular, obtaining loans from banks due to the insufficient guarantees and financial data. In developing countries, SMEs that use AIS are still lagging behind the developed countries (Ismail, 2009). Therefore, there is a necessity to process the transactions correctly and efficiently based on the performance data by the implementation and coherent use of AIS (Kim et al., 2017). In the context of Iraq, the previous studies reported there is a weakness in these factors and could influence performance. Therefore, it is necessary to enhance performance of SMEs through use of AIS, KMC, and innovation (Al-Hakim & Hassan, 2013; Alawi et al., 2018; Harash, 2017; Kareem et al., 2019; White, 2012). This study believes that through innovation, and the effective use of AIS, as well as managing their knowledge capabilities in a proper way, SMEs will have better performance. Therefore, the importance of study is due to the lack of studies considering the relationship of all three factors in the context of developing and developed countries. This study aims to bridge this gap by looking at the relationship of using AIS, KMC, and innovation concerning SMEs’ organizational performance by determining the validity and reliability questionnaire for related factors.

Background

The low level of use of AIS has resulted in poor data quality and affects the decision-makers when handling difficult situations. Therefore, the use of AIS is essential for SMEs if they are looking to improve their financial performance (Daoud & Triki, 2013). AIS can improve the quality of services and cover a wide range of information recording. Moreover, several barriers, such as financial problems, organizational structure, organizational culture, human resources, middle managers, and environmental factors could influence the implementation of AIS, and, if these problems continue, SMEs will not enjoy the advantages from the use of AIS (Salehi & Abdipour, 2011).

Hadrawi (2018) asserted that firms face a lack of competitiveness and low productivity when in an unstable environment. Therefore, to enhance the profitability, firms need to increase their capability in terms of knowledge management and the use of modern information technology. The identified factors include accounting information system, knowledge management capabilities, and innovation is found as important factors that could affect the organizational performance in the Iraqi SMEs. These variables have been identified from many resources as shown in Table 1. As evidence, the current weakness in SMEs concerning how to use the knowledge management capabilities and technology innovation, which is still modest, has led to some passive thinking in the development of SMEs in terms of technological and managerial issues, as the majority of SMEs still need to invest in technology to enhance their performance. These challenges are a major problem for users, especially in Iraq (Alawi et al., 2018).

| Table 1 Variables Definitions | ||

| Variables | Definition | Source |

| Accounting Information System |

As systems that use for data collection, processing, classifying, and reporting financial events and provides useful information to take decision-making by the organization or external interested parties. | (Harash, 2017; Soudani, 2012) |

| Knowledge Management Capabilities |

The process of creating, sharing, and using knowledge | (Shujahat et al., 2019) |

| Innovations | As an idea to develop a process or new product in the organisation. | (Cofriyanti & Hidayanto, 2013) |

| Organizational Performance | The ability of the organization to achieve its set objectives by using its resources efficiently and effectively | (Kareem et al., 2019) |

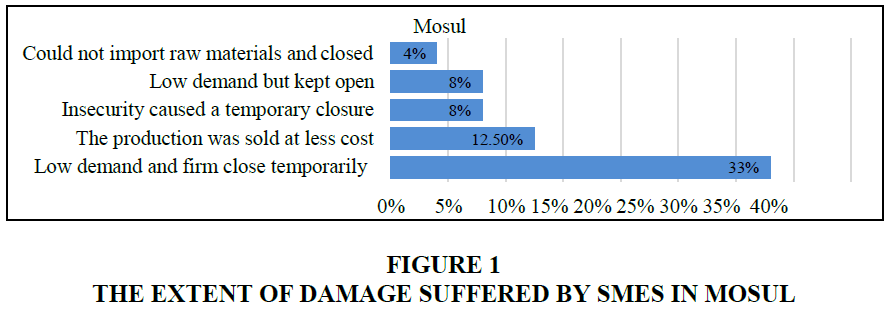

The lack of security seriously affects SMEs, for example, from 2014-2017 three years of governance by the Islamic State of Iraq and the Levant (ISIL), increased the challenges, especially in Mosul, Kirkuk and Anbar. As a result, small and medium enterprises now face a dual challenge represented by the returns of their enterprise due to the effect of ISIL, and the new players at competitive prices in the marketplace. In addition, the complete or partial closure of some small industries due to the imposition of taxes by ISIL on certain industries and transportation difficulties. Based on the international organization migration (IOM) data collected from 24 founders’ employees and focus groups from five participants in Mosul. The firms showed that 4% unable to import raw materials and then closed them, while 8% of firms are still kept open although low demand in the markets. The firms that close temporary 8% due to the low security, and other 33% of firms where they closed temporarily due to a market recession that was reflected in lower demand, at this time about 12.5% of the products sold at the lowest cost (see Figure 1) (IOM, 2018a).

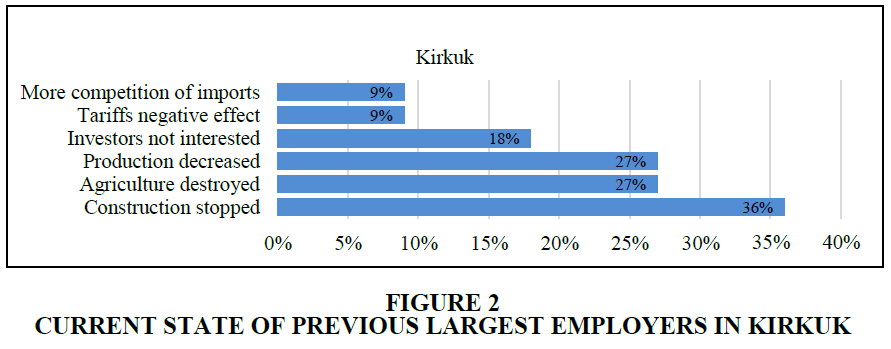

In Kirkuk the IOM reported based on interview with 11 key informants, 97 employers, 6 participants for discussions within the three focus groups. Despite the high prices of services and the lack of market demand, as well as tariff charged that were excessive on business. Accordingly, about 9% of firms have suffered from the competition of imported products, and 9% from tariffs charged. Consequently, 18% of new projects were also suspended due to investor concerns. In addition, production decreased by 27% and also destroyed agriculture.

While construction has stopped around 36% (see Figure 2) (IOM, 2018b).

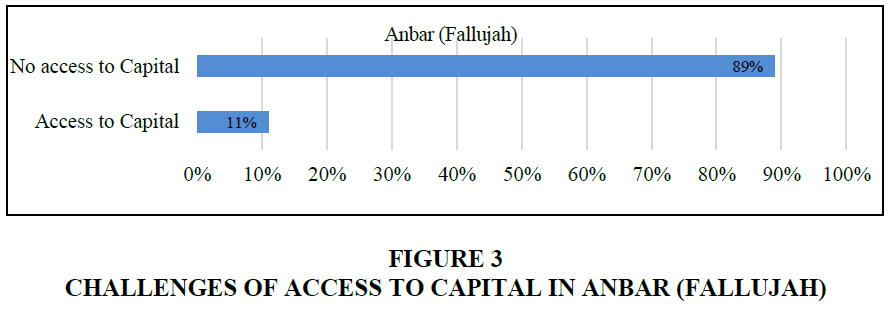

Also, in Fallujah, IOM interview with 87 employers, 6 key informants and 6 participants within the focus group in order to assess the extent of damage suffered by SMEs. IOM has endeavored to provide adequate support to SMEs, in order to assist and motivate SMEs to create job opportunities and other economic and social returns. The report showed the most important operational challenges faced by these firms, as represented 89% cannot access capital, and only 11% can access capital (see Figure 3) (IOM, 2018c). Therefore, entire firms were affected by these circumstances, and government support has decreased. Moreover, SMEs have suffered from these obstacles in obtaining financial support to be able to meet these challenges and to improve their business performance. For this possible reason, one impact on these firms is that their system cannot be upgraded, as well as obtaining potential opportunities to invest in technological innovations and directing capabilities for knowledge management to improve their business performance.

Literature Review

Many frameworks and models were proposed in prior studies to enhance the organizational performance of firms. For example, Yin (2015) found that executive information systems (IT) are positively related to organizational performance. Ismail & King (2005) reported that AIS were significant in Malaysian SMEs, which were achieving better organizational performance with high AIS alignment. Also, Soudani (2012) used a quantitative study of 74 firms, and showed that AIS were very useful and affect the organizational performance of listed companies in the Dubai financial market.

Awasthi & Varman (2003) investigated the influence of information technology on decision-making, and found that information technology can improve the rationality, speed of decision-making, and positive participation. In addition, it had increased influence on management, and the type of decisions affected by IT. Using 399 questionnaires, Zakaria et al. (2011) reported that the adoption of E-Accounting can improve reporting, controlling, and budgeting. Nicolaou (2000) found that the fit and effectiveness of AIS are important factors in terms of decision- makers, satisfaction and control of the effectiveness of output. Systems that can help management control have been confirmed since 1980 as important factors for designing management control systems, particularly in the context of technology, the environment, structure, size, and strategy (King et al., 2010).

McDermott and Stock (1999) contended that firms can obtain operational efficiency in terms of improvement flexibility and productivity based on advanced technology. Lausa (2016) found a significant relationship between the operational efficiency of IT and organizational performance. Therefore, the higher the capacity of small and larger firms to put information technology investment towards operational efficiency to convert critical success factors into profitability. Mirchandani & Lederer (2014) considered the planning process to be important to achieve the objectives of the organization, especially when using information systems in such a way that can enhance firm performance. In addition, Mcilquham-schmidt (2010) pointed out that there is a positive relationship between strategic planning and firm performance.

McChlery et al. (2005) investigated the effects of financial accounting systems in terms of financial reporting, for which the results showed a highly positive reaction to financial reporting with a score of 79.1% for overall satisfaction, and 86.1% for the organizations using computerized accounting systems. Thus, the use of AIS can help to create financial reporting reliability. Other study found significant correlations between the extent and frequency of financial reports and measures of growth and performance of SMEs (McMahon, 2001).

Cheng et al. (2016) proved that the effectiveness of open innovation activities depends on having capabilities for both knowledge acquisition and knowledge sharing. Therefore, knowledge management represents the process of using accurate steps to acquire and share knowledge by organizations to achieve greater performance. Meanwhile, the best practices for SMEs that are interested in knowledge management could improve both technological innovation and competitive advantage. Silva & Rossi (2018) asserted that knowledge acquisition is necessary in order to open innovation activities that are primarily linked to acquiring outer knowledge to accelerate innovation in lead firms to maintain their existing technologies organizationally.

Shujahat et al. (2019) also found that knowledge utilization has a positive effect on innovation. Moreover, the knowledge utilized activities have more profit and enhance organizational performance. Consequently, Chen and Fong (2012) argued that KMC affects organizational performance. Therefore, one can be certain that KMC positively affects product innovation performance. Yunis et al. (2018) found that the use of information and communications technology (ICT) is positively related to organizational performance and innovation, and that innovation mediates the relationship between ICT use and organizational performance. Therefore, knowledge management capability showed a large and significant effect on innovation speed and financial performance.

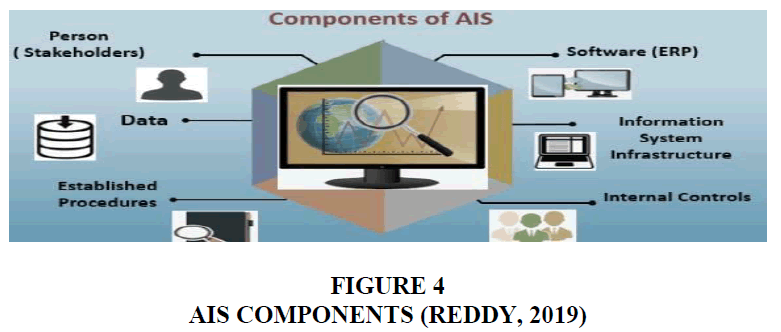

Overall, based on the above literature, we can conclude that most studies on enhancing organizational performance focused on the KMC context and various factors concerning the use of information systems. In addition, these studies focused on specific areas to achieve specific needs for firms. Very few researchers focused on identifying the factors that can be implemented to achieve goals. Thus, this study has determined the important factors for the variables that influence organizational performance through the use of AIS and KMC, and the mediation of innovation. Accounting information systems make life easier for firm owners. Figure 4 shows the six components of AIS. People perform various functions, such as feeding the system with information, e.g. collection, analysis, and reporting. Data refer to the raw facts or figures concerning the organization’s transactions. The procedure refers to the collecting, saving, returning, and processing of the data. Software refers to every application utilized to run the organization’s processes. Information technology infrastructure covers all the techniques and devices that serve AIS, while the internal control refers to the protection of sensitive data and ensures the qualitative output of using AIS (Ganyam & Ivungu, 2019; Reddy, 2019).

Based on these components of AIS, although there are several advantages to using this system there are also disadvantages in relying on the computer for all accounts (Ghasemi et al., 2011; Leonard, 2019). These can be summarized as follows: The advantages of using AIS can be categorized under six points.

1. Reliability: Provide accounts that are accurate and reliable and the system can ensure that all the accounts and financial transactions of the firm are properly balanced before preparing the financial statements.

2. Cost-Effectiveness: No need to outsource the work as an accountant or accounting company can be costly. The company only needs to buy and set up software, as most of them work on operating systems for years, which sometimes require an inexpensive upgrade.

3. Ability to Collaborate: The users can access data based on the permission of business owners or managers. The company can synchronize information with bank and credit accounts, as well as import the data.

4. Increased Functionality: Improve the efficiency of the accounting departments of the firm by increasing the timeliness of the accounting information. The firm can analyse the business transactions and prepare reports for management with an accurate picture of current transactions. Improve the number of financial reports. The firm can access the cash flow statements, departmental profits, and losses.

5. Faster Processing: Help firm to process large amounts of financial information quickly. The firm can accurately determine the balance of available funds at any time. Helps the firm to reduce the amount of time required to close each accounting period, for example, end of month or year. Shortening the time period helps a firm in controlling costs, which increases the efficiency of the company in general.

6. Better External Reporting: Can improve the financial reports used by outside investors and stakeholders. Provides improved reporting that allows suitable decision-making in terms of investment.

7. The disadvantages of using AIS can be categorized under three points.

8. Potential Fraud: Hackers can obtain and use the company's financial data because most of the software data are in the cloud. The risk of accessing someone within the firm for financial information who can possibly steal money from the daily deposits and change the original data in the program.

9. Technical Issues: The computers may acquire a virus and may damage all the files. The users can incorrectly perform program tasks, or the users are not familiar with the program.

10. Incorrect Information: Financial reports may not be accurate, because the users may not take adequate time for account categories to enter data correctly.

Theoretical Model

The present study investigates the theories that are used to monitor using AIS and KMC among the mediated innovation and organizational performance in SMEs. The research model attempts to determine the most significant factors that may enhance organizational performance. The resource-based view (RBV) and dynamic capability (DC) theories have been adopted to support the study framework. The resource-based view explains the relationship between the information system and organizational performance. Based on the RBV, the firm may obtain an improvement in its resource-based competitive edge performance when its resources are valuable, rare, imperfectly imitable, and non-substitutable (VRIN) (Barney, 1991). Information technology resources are considered to be a driver of the competitive characteristics and sustainability of organizational performance. As such, accounting information systems are one such resource, and, at the same time, are valuable when used effectively for data processing. Therefore, can assist a firm in decision-making and business planning to reach the objectives of the firm by providing advantageous information. The RBV of firms could clarify the internal resources and abilities including AIS competency, which can influence performance (Tontiset, 2018).

Based on the resource-based theory, Ravichandran et al. (2005) stated that information systems functional capabilities and intangible information system resources are important to the determinants of IT that are used in the organizations, and, in turn, may affect the firm's performance. The contribution of the dynamic abilities of IT to firm value begins with the fact that information technologies and information systems can support organizations working under dynamic and speedily changing markets and situations. Teece et al. (1997) defined dynamic capabilities as “the firm’s ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments.” Therefore, it reflects an organization’s capability to achieve new innovative patterns adoption for competitive advantage. Information systems are considered to be a resource due to several features that are related to the dynamic capability. Therefore, IT assists in the development, integration, generation, decision support, and improvement of important resources over time, which proves the features of dynamic capabilities (Yunis et al., 2018). This is consistent with the theory of innovation, which holds that the firm can obtain economic benefits as well as gain a competitive advantage by means of introducing successful innovations and managing resources in an innovative way. This study applies the RBV and DC to support the proposed model to enhance organizational performance among Iraqi SMEs.

Research Method

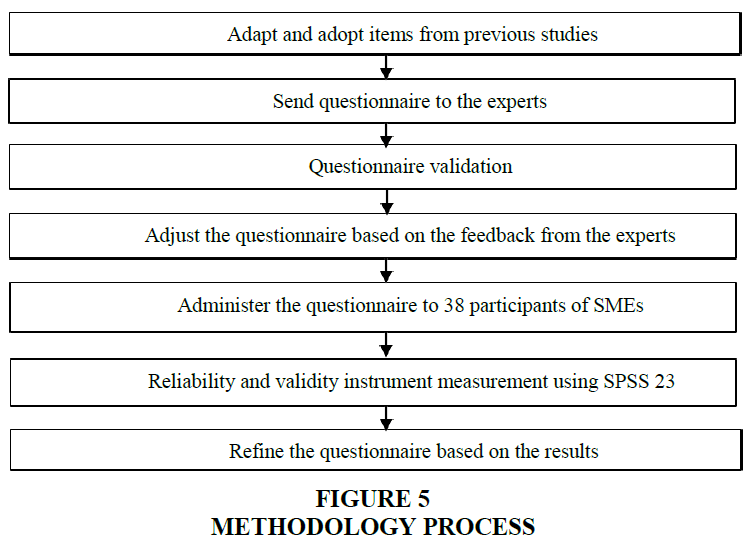

The reliability and validity of the questionnaire were measured in this study to investigate the influence of use of AIS, KMC, and innovation on organizational performance in Iraqi SMEs. The justification for selecting a questionnaire design is because it can reduce respondent bias and measurement errors, as well as facilitate data collection when the sample size is large or covers a large geographical region. In addition, a questionnaire enables easier and accurate analysis of the data and a full description of various types of answer sets (Omar et al., 2018). The methodology used in this study is described in the next section. Figure 5 shows the steps of the methodology used in this study.

Questionnaire Design

The questionnaire was designed using closed-ended questions that made the respondents reply to each question simply and accurately. The items for the questionnaires were adapted and adopted from prior studies. The questionnaire was first written in English and then translated into Arabic, which is the native Iraqi language. The questionnaire was translated by the Office of Legal Translation and approved and certified the versions after final validation. The questionnaire had five sections; the first section covered questions related to the demographic information for the respondents, the second section was related to the use of AIS. The third section was related to KMC, the fourth section was related to innovation, and the fifth section was related to organizational performance. The items for the questionnaires and the references are shown in Appendix A.

| Appendix A Measurement Items | ||

| Sub-construct | Measurement Items | References |

| Decision-Making | 1. Rational decision-making. 2.Speed of decision-making. 3. Formalization in decision-making. 4. Participation in decision-making. 5. Influence in decision-making. 6. Type of decision-making. |

(Awasthi & Varman, 2003) |

| Controlling Process | 1. Provide control reports frequently on a systematic, regular basis, e.g., daily, weekly reports. 2. Provide information useful for ongoing monitoring decisions and actions. 3. Use indicators from competitive ability of early warning system to assess success or failure. 4. Provide information about the business’ reaction strategy. 5. Check the validity of the business strategy. 6. Provide feedback to enable adjustments to be made. 7. Provide feedback about the strategy performances in the market. |

(Nicolaou, 2000; Yin, 2015) |

| Operational Efficiency | 1. Improve workflow. 2. Increase output. 3. Increase efficiency. 4. Increase reliability. 5. Increase repeatability. 6. Increase quality. 7. Increase flexibility. |

(McDermott & Stock, 1999) |

| Planning Process | 1. Align information technology with business needs 2. Gain a competitive advantage from information technology 3. Identify new and higher payback applications 4. Identify strategic applications 5. Increase top management commitment to information technology 6. Improve communication about information technology with users 7. Forecast information technology resource requirements 8. Allocate information technology resources 9. Develop an information architecture 10. Increase visibility of information technology in the organization |

(Mirchandani & Lederer, 2014) |

| Financial Reporting | 1. Provide bank balance at any point in time 2. Provide information about debtors at any time 3. Provide information about creditors at any point in time 4. Provide good level of periodic reporting. 5. Provide good level of annual budgeting. 6. Provide good level of performance reporting. 7. Provide good level of overall accounting system. |

(McChlery et al. 2005) |

| Knowledge Acquisition | 1. Acquire information from customers. 2. Acquire information from external partners. 3. Use feedback from customers and external partners to improve subsequent services 4. Acquire new basic knowledge 5. Acquire the technology the company needs 6. Acquire intellectual property |

(Cheng et al. 2016; De Silva & Rossi, 2018) |

| Knowledge Sharing | 1. Exchange information with its customers. 2. Exchange information with its external partners. 3. Share information effectively throughout the organization. 4. Share information between all parties involved in new service development. |

(Cheng et al., 2016) |

| Knowledge Utilizing | 1. Uses accumulated knowledge to solve new problems 2. Applies knowledge to changing competitive conditions 3. Uses shared knowledge to improve efficiency 4. Applies knowledge learned from mistakes |

(Chen & Fong, 2012) |

| Sub-construct for innovation Innovation atmosphere |

1. Pursuit of novel knowledge 2. Search for latest technology 3. Investigation in various directions 4. Exploration of new areas 5. Discovery 6.Breakthrough improvements |

(Yunis et al., 2018) |

| Innovation opportunities | 1. Opportunities for product innovation are abundant in our industry 2. Opportunities for technology innovation are abundant in our industry 3. High research and development spending in industry 4. High research and development spending in company 5. Our products/services require the adoption of new and different methods and procedures |

(Yunis et al., 2018) |

| Organizational Performance |

1. Is more competitive 2. Has more customers 3. Is growing faster 4. Is more profitable 5. Is more innovative 6. Has more employees |

(King et al., 2010) |

Questionnaire Validation

This research used two steps to validate the questionnaire before it was distributed to the SMEs to make sure that all the items were easy to understand and free from errors. The first step included experts who worked in universities in related fields. Five of the seven experts work in Malaysian universities, and two work in universities in Iraq. In the second step, one manager from a Malaysian SME, two managers from Iraqi SMEs, and one owner were selected to validate the questionnaire.

The language of the questionnaires should be evaluated to determine the level of understanding of the participants. It is vital to word the questions in a way that can easily be understood by the participants, and to check for any inconsistencies or duplications. However, the questions were formulated correctly and implemented the recommendations and feedback from the experts before the questionnaire was distributed. These two steps were performed to test the content validity and face validity, where the validity is defined as an evaluation of the adequacy and appropriateness of the uses of the assessment results. The accuracy and reliability of the instrument can be confirmed by the experts in the field to allow for the results to be generalized (Bolarinwa, 2015). Content analysis can be determined by the judgment of experts in the area through relying heavily on face or content analysis. Content analysis gives a mechanism to provide interesting and theoretically important generalizations with limited loss of information from the original data (Downe-Wamboldt, 1992), while face validity refers to the correspondence between the investigator's definition of the concepts and analytical structures that are supposed to be measured (Wolf, 2008).

Pilot Study

The purpose of the pilot study is to identify potential problems that may affect the quality and validity, by exploring, investigating, refining, and testing the measurement tools and procedures of the results. Many researchers recommend testing and improving the questionnaires by employing a pilot study before carrying out a formal study (Johanson & Brooks, 2010; Omar et al., 2018). The pilot study aimed to make sure that the design selected for this study was acceptable before progressing to the final study. The reliability of a measuring instrument is its ability for consistency. Therefore, self-administered printed questionnaires to collect the data from managers/owners in Iraqi SMEs. Questionnaires were sent to thirty-eight participants. The number of respondents in this study was considered suitable for a pilot study, albeit only 32 questionnaires were collected from SMEs.

Demographic Information

Based on the demographic information, as shown in Appendix B, we found that the majority of the respondents were within the age group of over 40 years of age with more than 4 years’ experience in the current position as manager, owner, or IT. The educational background indicates that the majority have a Bachelor Degree (59.4%), followed by a Master’s Degree (15.6%), degree Diploma (21.9%) and 3.1% with a PhD. This result means that the SMEs are able to implement AIS at a good level by providing training courses from the IT vendors. Most SMEs were operated by individuals (43.8%) followed by partnership (37.5%), and family business (18.8%), with the years of firm establishment (43.8%) being more than 10 years, and were divided into small (53.1%) and medium- sized (46.9%) enterprises. Based on the definition of SMEs in Iraq by White (2012) from 4 to 10 employees is considered to be a small firm and from 11 to 50 is considered to be medium.

| Appendix B Demographic Information | |||

| Measure | Categories | Frequency | Percent |

| 25 – 30 | 9 | 28.1 | |

| 31 – 35 | 3 | 9.4 | |

| Age (Years) | 36 – 40 | 9 | 28.1 |

| above 40 | 11 | 34.4 | |

| Bachelor | 19 | 59.4 | |

| Diploma | 7 | 21.9 | |

| Education Level | Master | 5 | 15.6 |

| PhD | 1 | 3.1 | |

| Manager | 12 | 37.5 | |

| Owner | 10 | 31.3 | |

| Position | Other | 10 | 31.3 |

| Less than 1 year | 6 | 18.8 | |

| 1 - 2 years | 4 | 12.5 | |

| Experience | 3 - 4 years | 6 | 18.8 |

| above 4 years | 16 | 50 | |

| Agriculture | 3 | 9.4 | |

| Manufacturing | 3 | 9.4 | |

| Construction | 8 | 25 | |

| Industry | Trade and Retail | 7 | 21.9 |

| Services | 6 | 18.8 | |

| Others | 5 | 15.6 | |

| 4 – 10 | 17 | 53.1 | |

| Number of full-time employees | 11 – 50 | 15 | 46.9 |

| Very important | 19 | 59.4 | |

| Important | 9 | 28.1 | |

| Importance of AIS to your firm | Medium Priority | 2 | 6.3 |

| Low Priority | 2 | 6.3 | |

| Not a Priority | - | - | |

| Years of firm establishment | Less than 2 years | 3 | 9.4 |

| 2–10 years | 15 | 46.9 | |

| More than 10 years | 14 | 43.8 | |

| Individual | 14 | 43.8 | |

| Firm Structure | Partnership | 12 | 37.5 |

| Family Business | 6 | 18.8 | |

| Others | |||

Results

The researcher gave attention to the type of reliability test. The overall method used to measure the reliability of the pilot study questionnaire was Cronbach’s alpha and exploratory factor analysis (EFA) including the Kaiser-Meyer-Olkin test (KMO) and Bartlett's test of sphericity. Acceptable alpha values have been reported with a maximum alpha value of 0.90 (Tavakol & Dennick, 2011). Therefore, Churchill, (1979) has recommended that the measure the internal consistency of Coefficient alpha should be the first in order to obtain the quality of the instrument, by means of a large alpha indicates the true score of the items. Gliem & Gliem (2003) provided the following rules of thumb: > 0.9= Excellent, > 0.8= Good, > 0.7= Acceptable, > 0.6= Questionable, > 0.5= Poor, and < 0.5= Unacceptable. For the KMO values, between 0.5 and 0.7 are medium, 0.7 and 0.8 are good, 0.8 and 0.9 are great, and Bartlett’s test of sphericity will be significant at the level p<0.05 to be acceptable for factor analysis (Hadi et al., 2016). Therefore, EFA analysis is used to assess the level of significance for each factor. The EFA is exploratory in nature and allows the key dimensions to be explored to create a model or theory from a comparatively large set of latent constructs, which are represented by a set of items. The data collected from the pilot study were analyzed using SPSS version 23 to determine the values of all the factors in respect of the Cronbach’s alpha and EFA. The results of the analysis revealed that no changes are required for any of the items in the pilot study. Table 2 shows the Cronbach’s alpha and EFA for each of the factor items. The variables in the pilot analysis were all above 0.70. Consequently, all the factors were acceptable.

| Table 2 Cronbach’s Alpha and Exploratory Factor Analysis | ||||

| Factor | Cronbach’s Alpha coefficient |

EFA | No of items |

|

| KMO | Sig. | |||

| Decision-Making | 0.892 | 0.776 | 0.00 | 6 |

| Controlling Process | 0.883 | 0.799 | 0.00 | 7 |

| Operational Efficiency | 0.889 | 0.824 | 0.00 | 7 |

| Planning Process | 0.861 | 0.803 | 0.00 | 10 |

| Financial Reporting | 0.882 | 0.843 | 0.00 | 7 |

| Knowledge Acquisition | 0.907 | 0.825 | 0.00 | 6 |

| Knowledge Sharing | 0.880 | 0.799 | 0.00 | 4 |

| Knowledge Utilization | 0.876 | 0.804 | 0.00 | 4 |

| Innovation Atmosphere | 0.903 | 0.772 | 0.00 | 6 |

| Innovation Opportunities | 0.898 | 0.849 | 0.00 | 5 |

| Organizational Performance | 0.944 | 0.866 | 0.00 | 6 |

Discussion

The purpose of this study is to determine the reliability and validity questionnaire to the related factors of improve SMEs performance. The study was motivated by the real reason for the low performance of SMEs. Therefore, there is a necessity to examine the influence of use of AIS, KMC, and innovation on organizational performance, as well as the low level of the use of AIS among the SMEs, as found in past studies, thereby indicating one possible cause of their poor performance (Bachmid, 2016; Daoud & Triki, 2013; Harash, 2017). The knowledge management is still minimal, which has a negative effect on the development of SMEs in terms of technical and managerial issues (Alawi et al., 2018). Despite SMEs having knowledge of their business processes, studies have found that their low capability to share and utilize such knowledge adversely affects their performance (Kareem et al., 2019).

The success of the SME model can lead to significant economic growth and national development. Furthermore, it can increase prosperity and employment creation in terms of good strategy. A questionnaire was designed according to prior studies that investigated the same factors based on a survey. This study implemented validity and reliability for all the factors to ensure that the participants' responses were consistent. The findings of this study revealed instrument reliability and that this measure is convenient to the factors concerning use of AIS, KMC, and Innovation factors on the organizational performance of SMEs in Iraq.

This type of tool has rarely been studied in the literature, and there is a particular lack of studies measuring these factors in the Middle East. Therefore, this study shows that this questionnaire is valid and reliable to assess the use of AIS (decision-making, controlling process, operational efficiency, planning process, and financial reporting), KMC (knowledge acquisition, knowledge sharing, and knowledge utilization), and innovation (innovation atmosphere and innovation opportunities) to enhance the performance of SMEs.

Conclusion

The proposed study offers reliable instrument that could facilitate the collecting data for the related factors to help the decision makers to assess and enhance the organizational performance in the Iraqi SMEs. The results proved that this questionnaire is reliable and error-free based on the Cronbach’s alpha test. The pilot study showed that the factors had values greater than 0.7. In addition, the EFA, including KMO and Bartlett's test of sphericity, also showed that they did not exceed the threshold, and were significant for all factors.

The results of the validity and reliability tests indicated that this questionnaire can lead to final model validation. Therefore, this questionnaire was designed to measure the suggested research framework related to organizational performance and the relationship between these factors. In addition, these variables will be examined to detect their influence on organizational performance. The next step is to test a larger population of Iraqi SMEs, and then test the hypotheses of the proposed research framework. The outcomes of this study can be expected to provide a better understanding of the performance of SMEs in their activities. For future work, researchers are recommended to cover the scope of use of AIS, including cloud accounting and mobile accounting due to the rapid changes in the technology as well as the adaptation to the technological developments.

References

- Abubakar, A.M., Elrehail, H., Alatailatc, M.A., & Elc, A. (2019). Knowledge management, decision-making style and organizational performance. Journal of Innovation & Knowledge, 4(2), 104-114.

- Adams, F.G., & Graham, K.W. (2017). Industrial marketing management integration, knowledge creation and B2B governance: The role of resource hierarchies in financial performance. Industrial Marketing Management, 63, 179-191.

- Al-Hakim, L.A.Y., & Hassan, S. (2013). Knowledge management strategies, innovation, and organizational performance: An empirical study of the Iraqi MTS. Journal of Advances in Management Research, 10(1), 58-71.

- Alawi, M., Rashid, N., Al-Shami, S.A., & Al-Lamy, H. (2018). The determinants of E-commerce quality on small business performance in Iraq case study from ceramic industry. Journal of Advanced Research in Dynamical and Control Systems, 10(2), 1348-1360.

- Awasthi, A., & Varman, R. (2003). Investigating the influence of information technology on decision making. Journal of Advances in Management Research, 1(1), 74-87.

- Bachmid, F.S. (2016). The effect of accounting information system quality on accounting information quality. Research Journal of Finance and Accounting, 7(20), 26-31.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Bolarinwa, O.A. (2015). Principles and methods of validity and reliability testing of questionnaires used in social and health science researches. Nigerian Postgraduate Medical Journal, 22(4), 195-201.

- Brix, J. (2017). Exploring knowledge creation processes as a source of organizational learning?: A longitudinal case study of a public innovation project. Scandinavian Journal of Management, 33(2), 113-127.

- Chen, L., & Fong, P.S.W. (2012). Revealing performance heterogeneity through knowledge management maturity evaluation: A capability-based approach. Expert Systems with Applications, 39(18), 13523-13539.

- Cheng, C.C.J., Yang, C., & Sheu, C. (2016). Effects of open innovation and knowledge-based dynamic capabilities on radical innovation: An empirical study. Journal of Engineering and Technology Management, 41, 79-91.

- Churchill, G.A. (1979). A paradigm for developing better measures of marketing constructs. Journal of Marketing Research, 16(1), 64-73.

- Cofriyanti, E., & Hidayanto, A.N. (2013). The relationship among organisations’ factors, information technology, innovation and performance: An Indonesian SMEs study. International Journal of Innovation and Learning, 14(3-4), 422-443.

- Cooper, J.R. (1998). A multidimensional approach to the adoption of innovation. Management Decision, 36(8), 493- 502.

- Daoud, H., & Triki, M. (2013). Accounting information systems in an ERP Environment and Tunisian Firm Performance. The International Journal of Digital Accounting Research, 13, 1-35.

- Dauwed, M., & Meri, A. (2019). IOT Service Utilisation in Healthcare. Retrieved from https://www.intechopen. com/books/internet-of-things-iot-for-automated-and-smart-applications/iot-service-utilisation-in-healthcare

- De Silva, M., & Rossi, F. (2018). The effect of firms’ relational capabilities on knowledge acquisition and co- creation with universities. Technological Forecasting and Social Change, 133, 72-84.

- Downe-Wamboldt, B. (1992). Content analysis: Method, applications, and issues. Health Care for Women International, 13(3), 313-321.

- Ganyam, A.I., & Ivungu, J.A. (2019). Effect of accounting information system on financial performance of firms: A review of literature. Journal of Business and Management, 21(5), 39-49.

- Ghasemi, M., Shafeiepour, V., Aslani, M., & Barvayeh, E. (2011). The impact of information technology (IT) on modern accounting systems. Procedia - Social and Behavioral Sciences, 28, 112-116.

- Ghobakhloo, M., Arias-Aranda, D., & Benitez-Amado, J. (2011). Adoption of e-commerce applications in SMEs. Industrial Management & Data Systems, 111(8), 1238-1269.

- Gliem, J.A., & Gliem, R.R. (2003). Calculating, interpreting, and reporting Cronbach’s alpha reliability coefficient for likert-type scales. Midwest Research-to-Practice Conference in Adult, Continuing, and Community Education.

- Hadi, N.U., Abdullah, N., & Sentosa, I. (2016). An easy approach to exploratory factor analysis: Marketing perspective. Journal of Educational and Social Research, 6(1), 215-223.

- Hadrawi, H.K. (2018). Network analysis of the effect of strategic leadership on organizational success: Evidence from Iraqi Heavy Industry. Academy of Strategic Management Journal, 17(4), 1-12.

- Harash, E. (2017). Accounting performance of SMEs and effect of accounting information system. A Conceptual Model. Global Journal of Management and Business Research, 17(3), 21-26.

- IOM. (2018a). Enterprise Development Opportunities and Challenges in Mosul. Retrieved from http://www.uniraq.org/index.php?option=com_k2&view=item&task=download&id=3016_16058aa49a65e1b2531cfdf4f9ba8ccb&Itemid=626&lang=en

- IOM. (2018b). Enterprise Development Opportunities and Challenges in Kirkuk. Retrieved from https://iraq.iom.int/files/Kirkuk.%20%20Market%20Assessment.pdf

- IOM. (2018c). Enterprise Development Opportunities and Challenges in Fallujah. Retrieved from https://iraq.iom.int/files/Falluja.%20Market%20Assessment.pdf

- Ismail, N.A. (2009). Factors influencing AIS effectiveness among manufacturing SMEs: Evidence from Malaysia. The Electronic Journal of Information Systems in Developing Countries, 38(10), 1-19.

- Ismail, N.A., & King, M. (2005). Firm performance and AIS alignment in Malaysian SMEs. International Journal of Accounting Information Systems, 6(4), 241-259.

- Johanson, G.A., & Brooks, G.P. (2010). Initial scale development: Sample size for pilot studies. Educational and Psychological Measurement, 70(3), 394-400.

- Kareem, H.M., Aziz, K.A., Maelah, R., Yunus, Y.M., & Dauwed, M.A. (2019). Review article enterprises performance based accounting information system: Success Factors. Asian Journal of Scientific Research, 12(1), 29-40.

- Kim, R., Gangolly, J., & Elsas, P. (2017). A framework for analytics and simulation of accounting information systems: A Petri net modeling primer. International Journal of Accounting Information Systems, 27, 30-54.

- King, R., Clarkson, P.M., & Wallace, S. (2010). Budgeting practices and performance in small healthcare businesses. Management Accounting Research, 21(1), 40-55.

- Lausa, S.M. (2016). Operational efficiency of information technology and organizational performance of state universities and colleges in in region VI, Philippines. Asia Pacific Journal of Multidisciplinary Research, 4(4), 34-43.

- Leonard, K. (2019). Advantages and disadvantages of computerized accounting. Retrieved from https://smallbusiness.chron.com/advantages-disadvantages-computerized-accounting-4911.html

- Lyu, J.J., Yan, Y.W., & Li, S.C. (2009). The relationship among information technology, innovation and firm performance: An empirical study of business services in SMEs. IEEM 2009-IEEE International Conference on Industrial Engineering and Engineering Management, 1258-1262.

- Manurung, E.T., & Manurung, E.M. (2019). A new approach of bank credit assessment for SMEs. Academy of Accounting and Financial Studies Journal, 23(3), 1-13.

- McChlery, S., Godfrey, A.D., & Meechan, L. (2005). Barriers and catalysts to sound financial management systems in small sized enterprises. The Journal of Applied Accounting Research, 7(3), 1-26.

- McDermott, C.M., & Stock, G.N. (1999). Organizational culture and advanced manufacturing technology implementation. Journal of Operations Management, 17(5), 521-533.

- Mcilquham-schmidt, A. (2010). Strategic planning and corporate performance. What is the relationship? Retrieved from https://pdfs.semanticscholar.org/c355/695fbd24071a3ef35d104b265c853aea8087.pdf

- McMahon, R.G.P. (2001). Business growth and performance and the financial reporitng practices of Australian manufacturing SMEs. Journal of Small Business Management, 39(2), 152-164.

- Mirchandani, D.A., & Lederer, A.L. (2014). The impact of core and infrastructure business activities on information systems planning and effectiveness. International Journal of Information Management, 34(5), 622-633.

- Nicolaou, A.I. (2000). A contingency model of perceived effectiveness in accounting information systems: Organizational coordination and control effects. International Journal of Accounting Information Systems, 1(2), 91-105.

- Omar, A.S., Razak, M.R.A., Yasin, M.H.M., & Dauwed, M. (2018). Validity and reliability questionnaire for social, environment and self-efficacy related of deaf adolescents physical activity. Journal of Theoretical and Applied Information Technology, 96(21), 7041-7054.

- Ravichandran, T., Lertwongsatien, C., & Lertwongsatien, C. (2005). Effect of information systems resources and capabilities on firm performance: A resource-based perspective. Journal of Management Information Systems, 21(4), 237-276.

- Reddy, S. (2019). Accounting information system (AIS). Retrieved from https://www.wallstreetmojo.com/ accounting-information-system/

- Salehi, M., & Abdipour, A. (2011). A study of the barriers of implementation of accounting information system: Case of listed companies in Tehran Stock Exchange. Journal of Economics and Behavioral Studies, 2(2), 76-85.

- Shujahat, M., Sousa, M.J., Hussain, S., Nawaz, F., Wang, M., & Umer, M. (2019). Translating the impact of knowledge management processes into knowledge-based innovation: The neglected and mediating role of knowledge-worker productivity. Journal of Business Research, 94, 442-450.

- Soudani, S.N. (2012). The usefulness of an accounting information system for effective organizational performance. International Journal of Economics and Finance, 4(5), 136-145.

- Tavakol, M., & Dennick, R. (2011). Making sense of Cronbach’s alpha. International Journal of Medical Education, 2, 53-55.

- Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilites and strategic management. Strategic Management Journal, 18(7), 509-533.

- Tontiset, N. (2018). Analysis of the factors affecting successful accounting information of listed companies in the stock exchange of Thailand. Journal of Modern Accounting and Auditing, 14(3), 103-112.

- Vila, L.E., Cabrer, B., & Pavía, J.M. (2015). On the relationship between knowledge creation and economic performance. Technological and Economic Development of Economy, 21(4), 539-556.

- White, S. (2012). Micro, Small and Medium-sized Enterprises in Iraq; A Survey Analysis. Retrieved from http://www.psdc-iraq.org/sites/default/files/ILO%20Iraq%20MSME%20Analysis%20Final.pdf

- Wolf, J. (2008). The nature of supply chain management research: insights from a content analysis of international supply chain management literature from 1990 to 2006. Springer Science & Business Media.

- Yin, C.Y. (2015). Measuring organizational impacts by integrating competitive intelligence into executive information system. Journal of Intelligent Manufacturing, 29(3), 1-15.

- Yunis, M., Tarhini, A., & Kassar, A. (2018). The role of ICT and innovation in enhancing organizational performance: The catalysing effect of corporate entrepreneurship. Journal of Business Research, 88, 344-356.

- Zakaria, W.Z.W., Rahman, S.F., & Elsayed, M. (2011). An analysis of task performance outcomes through e- accounting in Malaysia. Journal of Public Administration and Governance, 1(2), 124-139.