Research Article: 2022 Vol: 26 Issue: 3S

Organization of Construction Accounting in the Process of Development

Shulenbayeva Gaisha, Narxoz University

Jondelbayeva Aigul, Narxoz University

Nurgaliyeva Aliya, Narxoz University

Zhanseitov Azamat, Narxoz University

Citation Information: Gaisha, S., Aigul, J., Aliya, N., & Azamat, Z. (2022). Organization of construction accounting in the process of development. Academy of Accounting and Financial Studies Journal, 26(S3), 1-21.

Abstract

The aim of this study was to examine the perceptions of different professionals who are working in the construction industry about construction accounting, within the context of construction project management and development. A primarily quantitative research approach was used in this study. The researcher developed a bespoke survey questionnaire as the research instrument. This research instrument was then used in the collection of the data from the respondents. Considering that this study was implemented at the height of the Covid-19 pandemic, the data gathering procedures had to be conducted virtually. The sample population used in the present study was composed of 100 individuals (N = 100). These 100 individuals have already been working as accountants in a company that is operating in the construction industry for at least 1 year at the time of the study’s implementation. The participants’ responses to the survey questionnaire were collected and then sorted using Microsoft Excel. The corresponding scores were then analyzed using descriptive statistical analysis. This was done by determining the frequency (percentage) of the participants who chose a specific answer to every question in the survey. In conclusion, if quality, efficiency, and profitability are a construction firm’s main focus, then there is a good chance that the use of construction accounting or its integration in the construction project management and development process would be of great help. However, if the goal is to shorten the project delivery timeframe, or to improve the project completion rates (i.e., productivity), then chances are the construction firms should stay away from construction accounting, at least at the moment.

Keywords

Accounting, Construction Accounting, Development, Development Process, Project Management.

Introduction

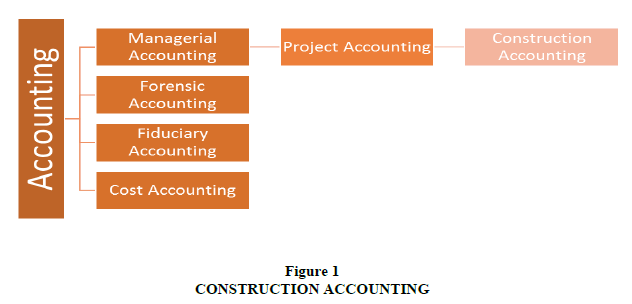

Accounting is such a diverse discipline. Accounting can be divided into numerous specialties. Some of the more commonly-cited ones in previously published studies include financial accounting, managerial accounting, tax accounting, forensic accounting, fiduciary accounting, auditing, and cost accounting. In this paper, the researcher focused solely on construction accounting. Construction Accounting (hereinafter referred to simply as CA, for brevity) is an accounting specialization that falls under managerial accounting. It is worth noting that this hierarchical classification (for Construction Accounting) may differ, depending on the specific accounting literature that one is looking at. In Peterson’s, (2013) textbook about construction accounting and financial management, for example, it was implied that construction accounting falls well within the boundaries of managerial accounting. According to Tuovila, “managerial accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization’s goals; it differs from financial accounting because the intended purpose of managerial accounting is to assist users internal to the company in making well-informed business decisions”. Additionally, managerial accounting decisions may be made in relation to an organization or any of the projects that are being undertaken by said organization. The performance of the accounting duties for an engineering firm’s construction projects, for example, can still fall within the scope of managerial accounting; although in this particular situation, the correct term to use would be construction accounting, which is essentially a specialization that falls under managerial accounting.

Figure 1 shows where exactly Construction Accounting lies, at least within the context of this study, vis a vis the much broader field of project accounting, and on top of that which is managerial accounting, and further on top of that, which is just accounting. For context, Schwarz, (2019) defined project accounting as an accounting specialty that “focuses on the financial transactions related to managing a project, including costs, billing, and revenues”. Professionals in the field of project management use project accountants as consultants or an actual part of the project management team to ensure that all of the essential financial tasks are executed on a project-by-project and phase-by-phase basis, so that they can accurately document and monitor their (i.e., the project’s) costs. These documentations are then compiled in a single report; depending on the scale and scope of the project, the filing and submission of the construction accounting reports may have to be done on a regular basis. The preparation and submission of such reports are important, because it is what eventually gets presented to the construction firm, and are then used to evaluate the construction project’s overall progress, and to determine if its execution is still in line with their success indicators and criteria.

Aims and Objectives

The aim of this study was to examine the perceptions of different professionals who are working in the construction industry about construction accounting, within the context of construction project management and development. In order to fulfill this aim, the researcher has developed a set of specific objectives, which are listed below.

Research Objective 1: To examine the perceptions of different construction industry professionals about construction accounting’s impact on project efficiency

Research Objective 2: To examine the perceptions of different construction industry professionals about construction accounting’s impact on project quality

Research Objective 3: To examine the perceptions of different construction industry professionals about construction accounting’s impact on project timeliness / delivery

Research Objective 4: To examine the perceptions of different construction industry professionals about construction accounting’s impact on productivity

Research Objective 5: To examine the perceptions of different construction industry professionals about construction accounting’s impact on profitability

Each of the five research objectives that have been declared herein represents at least one aspect of construction project management and development that the author examined, in relation to construction accounting’s impacts. This aims to, once and for all, answer any lingering questions about construction accounting, and whether its use can really help improve the outcomes of construction projects, or otherwise.

Scopes, Limitations, and Delimitation

The present study’s focus was narrowed down to just a specific niche or specialization within the relatively broad accounting discipline. This has been shown in Figure 1. Under accounting lies several branches of specialization. Among those specializations is managerial accounting. Under managerial accounting lies project accounting; and finally, under project accounting lies construction accounting. It is important to note that this hierarchical arrangement is not exactly universal, and therefore only applies within the context, and intents and purposes of the present study.

The present study’s scope was intentionally delimited to focus only on the construction industry. This was done in order to give the researcher sufficient time and opportunities to explore the impacts of the organization of construction accounting on the different outcomes of construction project management and development.

Significance of the Study

In order to highlight the significance of the present study, the researcher conducted a brief but comprehensive stakeholder analysis. Emphasis was put on how each of the stakeholder groups in the construction industry and accounting discipline would be able to make use of the results and findings of this study.

Professionals in the accounting discipline can use the results and findings of the present study as a guide in deciding whether it is a good idea to invest their time in developing their construction accounting skills. This would definitely be an attractive path to traverse should the present study find that construction accounting indeed has a positive impact on construction projects’ quality, efficiency, productivity, and timeliness, among other outcomes.

Those who are working in the construction industry meanwhile, would also have a lot of potential uses for the results and findings of this study. They can, for example, use it as the basis of deciding whether they should include a construction accountant who would handle all of the construction accounting-related matters in the project or not.

Statement of the Problem

The problem that the present study aims to solve is the apparent lack (or at least a low level) of awareness about the importance and impacts of construction accounting, among the professionals in the accounting and construction industries. The author of this paper sees this as a problem in the sense that the lack of awareness about the potential advantages of construction accounting on construction project management and development, as well as its pitfalls, unknowingly exposes the different stakeholder groups who have a stake in both the construction and the accounting industries to threats such as opportunity losses, efficiency losses, and even actual financial losses.

Conceptual Framework

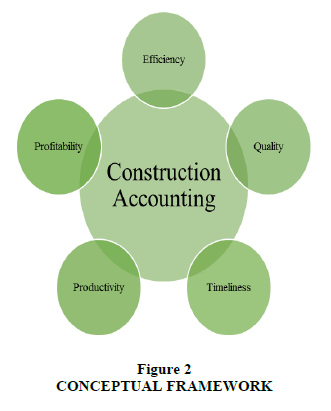

The conceptual framework that was used in the implementation of this study is shown in the figure below.

Figure 2 shows that the overall impact and perceptions about construction accounting would most likely be based upon the combined impacts of CA on the efficiency, quality, timeliness, productivity, and profitability outcomes of a construction project.

Literature Review

Construction accounting is not exactly a new practice or discipline. For many years, construction firms have been practicing construction accounting, one way or another. The problem is that most of them do not recognize construction accounting as a field or a discipline in and of itself (Peterson, 2013; Salling & Leleur, 2015). The relative newness of construction accounting is definitely one of the reasons behind the seemingly low level of awareness about its impacts (whether they are positive or negative) on the overall outcomes of a construction project.

Construction accounting is essentially a form of project accounting where the costs are assigned to a specific contract, and eventually to specific parts within a certain contract (Clough et al., 2000; Onaolapo & Odetayo, 2012; Halpin & Senior, 2009). This is done in order for the project manager and the accountants to have a complete awareness of what goes where, from an accounting standpoint (Holm, 2018; Tang, et al., 2015).

In a typical construction accounting system, for example, a separate job is often set up for every accounting system, and this is also done for every construction project (Keisala, 2010; Ying, 2016). This way, the project manager, and virtually every member of the construction team, can have access to information that tells them which projects get what type and level of funding; and which parts of a specific project have gotten which type and level of funding.

Considering that this method of accounting is designed to be used in the construction industry, most of the costs and expenses that can be tracked using construction accounting include, but may not be limited to, the cost of materials, labor, and additional charges, such as those that are allocated for architectural and consultation fees (e.g., structural engineers, mechanical engineers, electrical engineers, among others) (Lankauskiene, 2016; Chandler et al., 2019; Celik, 2016). Construction accounting can also be used to effectively keep track of a certain number of indirect costs that are charged during the actual construction phase. These indirect costs include, but may not be limited to, administrative costs, cost of supervision, rental fees (for tools and equipment) support costs, legal fees, communication fees, and insurance (Jang et al., 2020; Davila et al., 2015; Hussain et al., 2020; Hong, 2008).

Revenue recognition is one of the biggest tasks that can be effectively undertaken with the help of a construction accountant (Coetsee & Wyk, 2020; Wustemann & Kierzek, 2005). When a construction firm uses a different revenue recognition method or system for each of their projects, for example, the process of booking revenues and assigning them to every project can easily get complicated. One project, for example, can be charged using the completed contract method; while another project may be charged using a different revenue recognition method. This often leads to a situation where the project managers would not be able to accurately determine the completion rate of a project. This can be easily resolved with the help of construction accounting. A seasoned construction accountant, for example, may insist on the use of a single revenue recognition method (e.g., completed contract method, or percentage of completion method.

Another commonly-occurring problem in construction projects that can be resolved through the use of construction accounting would be the tendency for liabilities to be overbilled (Haider, 2009; Foster, 2020). This problem happens when the amount that was billed for a construction project (or a part of a construction project) ends up being greater than the actual value of the costs incurred. In most cases, the difference is considered as part of the contractor’s liability, until such time that the cost incurred catches up with the actual billing.

Research Methodology

Research Approach

A primarily quantitative research approach was used in this study. The researcher developed a bespoke survey questionnaire as the research instrument. This research instrument was the one that was used in the collection of the data from the respondents. Considering that this study was implemented at the height of the Covid-19 pandemic, the data gathering procedures had to be conducted virtually. For this, the researcher used online surveying platforms such as Google Forms and Survey Monkey. The custom survey questionnaire was distributed online.

Research Design

The research design choices for a study are usually contingent upon the type of research approach that was chosen in its implementation. Since the present study features a quantitative research approach, that means that the research design choices that can be picked have to be those that fall under the quantitative research approach’s umbrella. For quantitative studies, there are usually four main research design choices, namely: 1) Descriptive research design, 2) Correlative research design, 3) Experimental research design, and 4) Quasi-experimental research design. Among these four possible research designs, the author chose a combination of descriptive and correlative research design for the present study.

Sample Population

The sample population used in the present study was composed of 100 individuals (N = 100). These 100 individuals have already been working as accountants in a company that is operating in the construction industry for at least 1 year at the time of the study’s implementation.

Sampling Techniques and Procedures

The researcher used a convenience sampling technique to recruit the 100 research participants. This is a nonprobability sampling technique that bases the eligibility of a participant on his or her willingness to be a part of the study. Both the sampling and the data gathering procedures were executed online.

Research Instrument

Table 1 shows a blank copy of the survey questionnaire that was used to collect the data from the participants.

| Table 1 Research Instrument (Survey Questionnaire) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gender | Female | Male | |||||||||||||

| Age Group | 18 to 25 Years Old | 26 to 35 Years Old | 36 to 50 Years Old | 51 to 60 Years Old | Older than 60 | ||||||||||

| Educational Attainment | Secondary School | Bachelor's Degree | Master's Degree | Doctor's Degree | |||||||||||

| Employment Status | Unemployed | Employed, Part-Time | Employed, Full-Time | ||||||||||||

| Employment Level | Entry-Level, Associate | Junior Management, Supervisory | Middle Management | Senior Management | Executive | ||||||||||

| Annual Income Per Year | < $25,000 | $25,001 to $50,000 | $50,001 to $75,000 | $75,001 to $100,000 | > $100,000 | ||||||||||

| Efficiency | Please choose the best answer | ||||||||||||||

| Construction accounting has led to an increase in the speed of construction project planning | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the speed of construction project implementation | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the speed of materials and equipment procurement | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the rate of work completion | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the total number of construction projects completed per year | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Quality | Please choose the best answer | ||||||||||||||

| Construction accounting has led to an increase in the quality of construction projects | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the quality of materials procured for a project | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the quality of equipment procured for a project | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the quality of manpower recruited to work on a project | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to an increase in the quality of construction project clients that the firm has attracted | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Timeliness | Please choose the best answer | ||||||||||||||

| Construction accounting has led to the faster planning of construction projects | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to the faster implementation of construction projects | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to the faster delivery of materials and equipment in construction projects | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to the faster implementation of the post-construction review process | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to the faster turn-around times for clients | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Productivity | Please choose the best answer | ||||||||||||||

| Construction accounting has led to a higher number of project completion rate | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has enabled the team to handle multiple construction projects simultaneously | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to higher construction equipment utilization rates | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to higher construction labor productivity rates | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to lower capital input to construction output ratios | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Profitability | Please choose the best answer | ||||||||||||||

| Construction accounting has led to the minimization of the occurrence of bad overhead estimates | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has decreased the occurrence of cost-accrual problems | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has decreased the occurrence of scope creep | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has improved the accuracy of cost estimates | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

| Construction accounting has led to significant improvements in net profitability per project | Strongly Disagree | Disagree | Somewhat Disagree | Neither agree nor disagree | Somewhat Agree | Agree | Strongly Agree | ||||||||

Analysis and Statistical Treatment of Data

The participants’ responses to the survey questionnaire were collected and then sorted using Microsoft Excel. The corresponding scores were then analyzed using descriptive statistical analysis. This was done by determining the frequency (percentage) of the participants who chose a specific answer to every question in the survey. The participants’ answers were then statistically analyzed based on a 7-Point Likert scale (with 1 being the lowest possible score, and 7 being the highest possible score, indicating the positivity or negativity of the participants’ perceptions about construction accounting, and how it can affect construction project management and development outcomes).

Results, Findings and Discussions

Descriptive Findings

Table 2 shows the results of the descriptive analysis, with emphasis on the demographic factor-related questions in the survey. So far, it was found that majority of the participants were male (56%), aged 26 to 35 years old (26%), with at least a Bachelor’s Degree (29%). In terms of employment status, all of them were working full-time, at an entry-level or associate position in their respective construction firms (75%).

| Table 2 Demographics |

||||

|---|---|---|---|---|

| Gender | ||||

| Gender | Frequency | Percent | Valid Percent | Cumulative Percent |

| Female | 44 | 44 | 44 | 44 |

| Male | 56 | 56 | 56 | 100 |

| Total | 100 | 100 | 100 | |

| Age Group | ||||

| Age Group | Frequency | Percent | Valid Percent | Cumulative Percent |

| 18 to 25 Years Old | 22 | 22 | 22 | 22 |

| 26 to 35 Years Old | 26 | 26 | 26 | 48 |

| 36 to 50 Years Old | 18 | 18 | 18 | 66 |

| 51 to 60 Years Old | 20 | 20 | 20 | 86 |

| Older than 60 | 14 | 14 | 14 | 100 |

| Total | 100 | 100 | 100 | |

| Educational Attainment | ||||

| Educational Attainment | Frequency | Percent | Valid Percent | Cumulative Percent |

| Secondary School | 21 | 21 | 21 | 21 |

| Bachelor's Degree | 29 | 29 | 29 | 50 |

| Master's Degree | 23 | 23 | 23 | 73 |

| Doctor's Degree | 27 | 27 | 27 | 100 |

| Total | 100 | 100 | 100 | |

| Employment Status | ||||

| Employment Status | Frequency | Percent | Valid Percent | Cumulative Percent |

| Employed, Full-Time | 100 | 100 | 100 | 100 |

| Employment Level | ||||

| Employment Level | Frequency | Percent | Valid Percent | Cumulative Percent |

| Entry-Level, Associate | 75 | 75 | 75 | 75 |

| Junior Management, Supervisory | 5 | 5 | 5 | 80 |

| Middle Management | 9 | 9 | 9 | 89 |

| Senior Management | 6 | 6 | 6 | 95 |

| Executive | 5 | 5 | 5 | 100 |

| Total | 100 | 100 | 100 | |

| Annual Income Per Year | ||||

| Annual Income Per Year | Frequency | Percent | Valid Percent | Cumulative Percent |

| < $25,000 | 86 | 86 | 86 | 86 |

| $25,001 to $50,000 | 2 | 2 | 2 | 88 |

| $50,001 to $75,000 | 6 | 6 | 6 | 94 |

| $75,001 to $100,000 | 3 | 3 | 3 | 97 |

| > $100,000 | 3 | 3 | 3 | 100 |

| Total | 100 | 100 | 100 | |

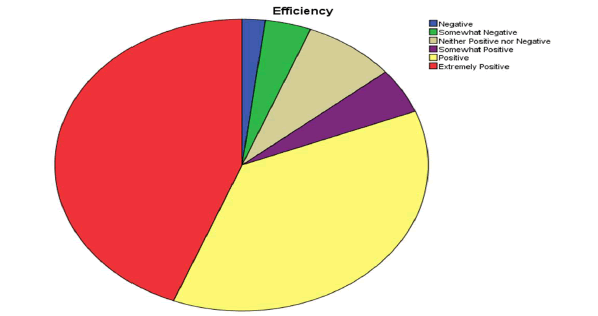

Table 3 shows the results of the survey based on the participants’ perception about construction accounting’s impact on the efficiency of construction project management and development outcomes. So far, majority of them have a positive opinion of construction accounting’s impact in this regard.

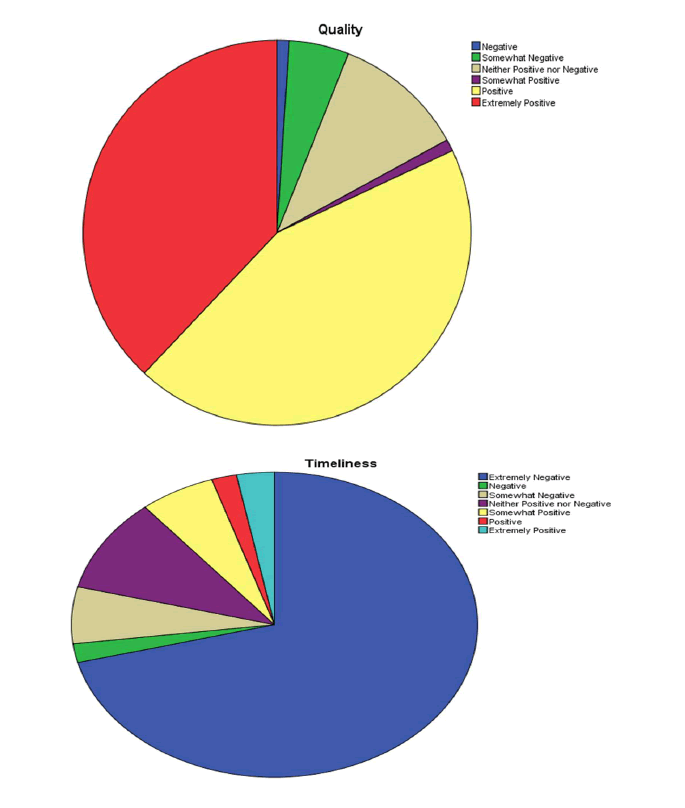

The same observation was made when it comes to the participants’ opinion of the potential impact of construction accounting on the quality of construction projects. Most of them agree that construction accounting will have a positive influence on the quality of the projects that they are developing and undertaking Table 4.

| Table 3 Efficiency |

||||

|---|---|---|---|---|

| Construction accounting has led to an increase in the speed of construction project planning | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 6 | 6 | 6 | 6 |

| Disagree | 6 | 6 | 6 | 12 |

| Somewhat Disagree | 3 | 3 | 3 | 15 |

| Neither agree nor disagree | 1 | 1 | 1 | 16 |

| Agree | 45 | 45 | 45 | 61 |

| Strongly Agree | 39 | 39 | 39 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the speed of construction project implementation | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 2 | 2 | 2 | 2 |

| Disagree | 3 | 3 | 3 | 5 |

| Somewhat Disagree | 2 | 2 | 2 | 7 |

| Neither agree nor disagree | 5 | 5 | 5 | 12 |

| Somewhat Agree | 3 | 3 | 3 | 15 |

| Agree | 40 | 40 | 40 | 55 |

| Strongly Agree | 45 | 45 | 45 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the speed of materials and equipment procurement | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 5 | 5 | 5 | 5 |

| Disagree | 2 | 2 | 2 | 7 |

| Somewhat Disagree | 2 | 2 | 2 | 9 |

| Neither agree nor disagree | 4 | 4 | 4 | 13 |

| Somewhat Agree | 3 | 3 | 3 | 16 |

| Agree | 34 | 34 | 34 | 50 |

| Strongly Agree | 50 | 50 | 50 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the rate of work completion | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 1 | 1 | 1 | 1 |

| Disagree | 2 | 2 | 2 | 3 |

| Somewhat Disagree | 4 | 4 | 4 | 7 |

| Somewhat Agree | 3 | 3 | 3 | 10 |

| Agree | 52 | 52 | 52 | 62 |

| Strongly Agree | 38 | 38 | 38 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the total number of construction projects completed per year | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Disagree | 4 | 4 | 4 | 4 |

| Somewhat Disagree | 4 | 4 | 4 | 8 |

| Neither agree nor disagree | 5 | 5 | 5 | 13 |

| Somewhat Agree | 3 | 3 | 3 | 16 |

| Agree | 43 | 43 | 43 | 59 |

| Strongly Agree | 41 | 41 | 41 | 100 |

| Total | 100 | 100 | 100 | |

The participants, or at least majority of them, did not agree that the construction project’s timeliness would be positively affected by the integration of construction accounting principle sin the construction project management and development process Table 5. This can be evidenced by the frequency of participants (north of 75%) who said so.

| Table 4 Quality |

||||

|---|---|---|---|---|

| Construction accounting has led to an increase in the speed of construction project planning | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 6 | 6 | 6 | 6 |

| Disagree | 6 | 6 | 6 | 12 |

| Somewhat Disagree | 3 | 3 | 3 | 15 |

| Neither agree nor disagree | 1 | 1 | 1 | 16 |

| Agree | 45 | 45 | 45 | 61 |

| Strongly Agree | 39 | 39 | 39 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the speed of construction project implementation | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 2 | 2 | 2 | 2 |

| Disagree | 3 | 3 | 3 | 5 |

| Somewhat Disagree | 2 | 2 | 2 | 7 |

| Neither agree nor disagree | 5 | 5 | 5 | 12 |

| Somewhat Agree | 3 | 3 | 3 | 15 |

| Agree | 40 | 40 | 40 | 55 |

| Strongly Agree | 45 | 45 | 45 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the speed of materials and equipment procurement | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 5 | 5 | 5 | 5 |

| Disagree | 2 | 2 | 2 | 7 |

| Somewhat Disagree | 2 | 2 | 2 | 9 |

| Neither agree nor disagree | 4 | 4 | 4 | 13 |

| Somewhat Agree | 3 | 3 | 3 | 16 |

| Agree | 34 | 34 | 34 | 50 |

| Strongly Agree | 50 | 50 | 50 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the rate of work completion | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 1 | 1 | 1 | 1 |

| Disagree | 2 | 2 | 2 | 3 |

| Somewhat Disagree | 4 | 4 | 4 | 7 |

| Somewhat Agree | 3 | 3 | 3 | 10 |

| Agree | 52 | 52 | 52 | 62 |

| Strongly Agree | 38 | 38 | 38 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to an increase in the total number of construction projects completed per year | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Disagree | 4 | 4 | 4 | 4 |

| Somewhat Disagree | 4 | 4 | 4 | 8 |

| Neither agree nor disagree | 5 | 5 | 5 | 13 |

| Somewhat Agree | 3 | 3 | 3 | 16 |

| Agree | 43 | 43 | 43 | 59 |

| Strongly Agree | 41 | 41 | 41 | 100 |

| Total | 100 | 100 | 100 | |

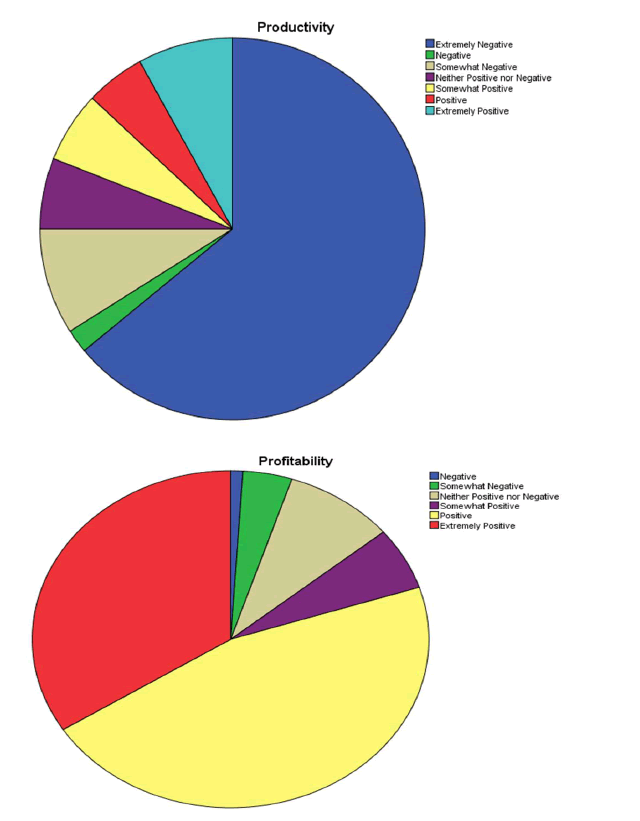

Most of the participants believe that construction accounting is going to lead to a hit in the construction firm’s productivity levels Table 6. This may be due to the fact that more stringent accounting methods would eventually lead to a significant increase in the amount of time to finish certain parts of a project, which would, in turn, lead to a drop in productivity levels.

| Table 5 Timeliness |

||||

|---|---|---|---|---|

| Construction accounting has led to the faster planning of construction projects | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 77 | 77 | 77 | 77 |

| Disagree | 3 | 3 | 3 | 80 |

| Somewhat Disagree | 6 | 6 | 6 | 86 |

| Neither agree nor disagree | 2 | 2 | 2 | 88 |

| Somewhat Agree | 1 | 1 | 1 | 89 |

| Agree | 3 | 3 | 3 | 92 |

| Strongly Agree | 8 | 8 | 8 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to the faster implementation of construction projects | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 74 | 74 | 74 | 74 |

| Disagree | 3 | 3 | 3 | 77 |

| Somewhat Disagree | 1 | 1 | 1 | 78 |

| Neither agree nor disagree | 4 | 4 | 4 | 82 |

| Somewhat Agree | 3 | 3 | 3 | 85 |

| Agree | 6 | 6 | 6 | 91 |

| Strongly Agree | 9 | 9 | 9 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to the faster delivery of materials and equipment in construction projects | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 73 | 73 | 73 | 73 |

| Disagree | 4 | 4 | 4 | 77 |

| Somewhat Disagree | 5 | 5 | 5 | 82 |

| Neither agree nor disagree | 4 | 4 | 4 | 86 |

| Somewhat Agree | 1 | 1 | 1 | 87 |

| Agree | 9 | 9 | 9 | 96 |

| Strongly Agree | 4 | 4 | 4 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to the faster implementation of the post-construction review process | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 78 | 78 | 78 | 78 |

| Disagree | 3 | 3 | 3 | 81 |

| Somewhat Disagree | 2 | 2 | 2 | 83 |

| Neither agree nor disagree | 2 | 2 | 2 | 85 |

| Somewhat Agree | 1 | 1 | 1 | 86 |

| Agree | 4 | 4 | 4 | 90 |

| Strongly Agree | 10 | 10 | 10 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to the faster turn-around times for clients | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 76 | 76 | 76 | 76 |

| Disagree | 3 | 3 | 3 | 79 |

| Somewhat Disagree | 5 | 5 | 5 | 84 |

| Neither agree nor disagree | 1 | 1 | 1 | 85 |

| Somewhat Agree | 1 | 1 | 1 | 86 |

| Agree | 8 | 8 | 8 | 94 |

| Strongly Agree | 6 | 6 | 6 | 100 |

| Total | 100 | 100 | 100 | |

Profitability is definitely an important aspect to evaluate in regard to the potential impacts of construction accounting on construction development Table 7. This is largely due to the fact that most, if not all, construction firms are for-profit entities. So far, majority of the participants whom the researcher surveyed said that they believe that the integration of construction accounting is a good way to boost the profitability of projects.

| Table 6 Productivity |

||||

|---|---|---|---|---|

| Construction accounting has led to a higher number of project completion rate | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 71 | 71 | 71 | 71 |

| Disagree | 5 | 5 | 5 | 76 |

| Somewhat Disagree | 3 | 3 | 3 | 79 |

| Neither agree nor disagree | 2 | 2 | 2 | 81 |

| Somewhat Agree | 1 | 1 | 1 | 82 |

| Agree | 11 | 11 | 11 | 93 |

| Strongly Agree | 7 | 7 | 7 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has enabled the team to handle multiple construction projects simultaneously | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 67 | 67 | 67 | 67 |

| Disagree | 4 | 4 | 4 | 71 |

| Somewhat Disagree | 5 | 5 | 5 | 76 |

| Neither agree nor disagree | 2 | 2 | 2 | 78 |

| Somewhat Agree | 2 | 2 | 2 | 80 |

| Agree | 15 | 15 | 15 | 95 |

| Strongly Agree | 5 | 5 | 5 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to higher construction equipment utilization rates | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 71 | 71 | 71 | 71 |

| Disagree | 3 | 3 | 3 | 74 |

| Somewhat Disagree | 3 | 3 | 3 | 77 |

| Neither agree nor disagree | 1 | 1 | 1 | 78 |

| Agree | 9 | 9 | 9 | 87 |

| Strongly Agree | 13 | 13 | 13 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to higher construction labor productivity rates | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 70 | 70 | 70 | 70 |

| Disagree | 2 | 2 | 2 | 72 |

| Somewhat Disagree | 3 | 3 | 3 | 75 |

| Neither agree nor disagree | 1 | 1 | 1 | 76 |

| Somewhat Agree | 2 | 2 | 2 | 78 |

| Agree | 8 | 8 | 8 | 86 |

| Strongly Agree | 14 | 14 | 14 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to lower capital input to construction output ratios | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 66 | 66 | 66 | 66 |

| Disagree | 5 | 5 | 5 | 71 |

| Somewhat Disagree | 2 | 2 | 2 | 73 |

| Neither agree nor disagree | 2 | 2 | 2 | 75 |

| Somewhat Agree | 4 | 4 | 4 | 79 |

| Agree | 15 | 15 | 15 | 94 |

| Strongly Agree | 6 | 6 | 6 | 100 |

| Total | 100 | 100 | 100 | |

After analyzing the participants’ responses to each of the survey questions, the researcher collated all of the answers and summarized them per cluster. The per-cluster results were then further analyzed to obtain the overall perceptions of the participants about the organization of construction accounting and its impacts on construction project management and development outcomes Table 8.

| Table 7 Profitability |

||||

|---|---|---|---|---|

| Construction accounting has led to the minimization of the occurrence of bad overhead estimates | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 6 | 6 | 6 | 6 |

| Disagree | 3 | 3 | 3 | 9 |

| Somewhat Disagree | 2 | 2 | 2 | 11 |

| Neither agree nor disagree | 3 | 3 | 3 | 14 |

| Somewhat Agree | 1 | 1 | 1 | 15 |

| Agree | 37 | 37 | 37 | 52 |

| Strongly Agree | 48 | 48 | 48 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has decreased the occurrence of cost-accrual problems | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 2 | 2 | 2 | 2 |

| Disagree | 4 | 4 | 4 | 6 |

| Somewhat Disagree | 5 | 5 | 5 | 11 |

| Neither agree nor disagree | 2 | 2 | 2 | 13 |

| Somewhat Agree | 2 | 2 | 2 | 15 |

| Agree | 47 | 47 | 47 | 62 |

| Strongly Agree | 38 | 38 | 38 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has decreased the occurrence of scope creep | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 3 | 3 | 3 | 3 |

| Somewhat Disagree | 3 | 3 | 3 | 6 |

| Neither agree nor disagree | 6 | 6 | 6 | 12 |

| Somewhat Agree | 3 | 3 | 3 | 15 |

| Agree | 47 | 47 | 47 | 62 |

| Strongly Agree | 38 | 38 | 38 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has improved the accuracy of cost estimates | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 2 | 2 | 2 | 2 |

| Disagree | 1 | 1 | 1 | 3 |

| Somewhat Disagree | 1 | 1 | 1 | 4 |

| Neither agree nor disagree | 6 | 6 | 6 | 10 |

| Somewhat Agree | 4 | 4 | 4 | 14 |

| Agree | 41 | 41 | 41 | 55 |

| Strongly Agree | 45 | 45 | 45 | 100 |

| Total | 100 | 100 | 100 | |

| Construction accounting has led to significant improvements in net profitability per project | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Strongly Disagree | 5 | 5 | 5 | 5 |

| Disagree | 3 | 3 | 3 | 8 |

| Somewhat Disagree | 2 | 2 | 2 | 10 |

| Neither agree nor disagree | 3 | 3 | 3 | 13 |

| Agree | 51 | 51 | 51 | 64 |

| Strongly Agree | 36 | 36 | 36 | 100 |

| Total | 100 | 100 | 100 | |

Table 8 overall (across the five independent variables), the participants’ opinion of construction accounting is still mixed, i.e., neither positive nor negative, as evidenced by the 80% of the participants who said so Table 9.

| Table 8 Per-Cluster Findings |

||||

|---|---|---|---|---|

| Efficiency | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Negative | 2 | 2 | 2 | 2 |

| Somewhat Negative | 4 | 4 | 4 | 6 |

| Neither Positive nor Negative | 8 | 8 | 8 | 14 |

| Somewhat Positive | 5 | 5 | 5 | 19 |

| Positive | 37 | 37 | 37 | 56 |

| Extremely Positive | 44 | 44 | 44 | 100 |

| Total | 100 | 100 | 100 | |

| Quality | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Negative | 1 | 1 | 1 | 1 |

| Somewhat Negative | 5 | 5 | 5 | 6 |

| Neither Positive nor Negative | 11 | 11 | 11 | 17 |

| Somewhat Positive | 1 | 1 | 1 | 18 |

| Positive | 44 | 44 | 44 | 62 |

| Extremely Positive | 38 | 38 | 38 | 100 |

| Total | 100 | 100 | 100 | |

| Timeliness | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Extremely Negative | 71 | 71 | 71 | 71 |

| Negative | 2 | 2 | 2 | 73 |

| Somewhat Negative | 6 | 6 | 6 | 79 |

| Neither Positive nor Negative | 10 | 10 | 10 | 89 |

| Somewhat Positive | 6 | 6 | 6 | 95 |

| Positive | 2 | 2 | 2 | 97 |

| Extremely Positive | 3 | 3 | 3 | 100 |

| Total | 100 | 100 | 100 | |

| Productivity | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Extremely Negative | 64 | 64 | 64 | 64 |

| Negative | 2 | 2 | 2 | 66 |

| Somewhat Negative | 9 | 9 | 9 | 75 |

| Neither Positive nor Negative | 6 | 6 | 6 | 81 |

| Somewhat Positive | 6 | 6 | 6 | 87 |

| Positive | 5 | 5 | 5 | 92 |

| Extremely Positive | 8 | 8 | 8 | 100 |

| Total | 100 | 100 | 100 | |

| Profitability | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Negative | 1 | 1 | 1 | 1 |

| Somewhat Negative | 4 | 4 | 4 | 5 |

| Neither Positive nor Negative | 9 | 9 | 9 | 14 |

| Somewhat Positive | 6 | 6 | 6 | 20 |

| Positive | 46 | 46 | 46 | 66 |

| Extremely Positive | 34 | 34 | 34 | 100 |

| Total | 100 | 100 | 100 | |

| Overall | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| Somewhat Negative | 2 | 2 | 2 | 2 |

| Neither Positive nor Negative | 80 | 80 | 80 | 82 |

| Somewhat Positive | 11 | 11 | 11 | 93 |

| Positive | 4 | 4 | 4 | 97 |

| Extremely Positive | 3 | 3 | 3 | 100 |

| Total | 100 | 100 | 100 | |

| Table 9 Mean Comparison |

|||||

|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Efficiency | 100 | 2 | 7 | 6.03 | 1.226 |

| Quality | 100 | 2 | 7 | 5.96 | 1.205 |

| Timeliness | 100 | 1 | 7 | 1.96 | 1.675 |

| Productivity | 100 | 1 | 7 | 2.35 | 2.057 |

| Profitability | 100 | 2 | 7 | 5.94 | 1.135 |

| Overall | 100 | 3 | 7 | 4.26 | 0.705 |

| Valid N (listwise) | 100 | ||||

To further verify this finding, the researcher conducted a mean comparison analysis of the five variables that were examined-in relation to construction accounting’s influence or impact on them. The researcher also conducted an overall mean assessment (combining the findings across all of the five variables). So far, the results were still the same. It would be safe to suggest that timeliness and productivity are construction accounting’s weak points, based on the low mean scores that the participants gave in those areas. The strong points of construction accounting meanwhile would be efficiency, quality, and profitability. Overall, that would equate to a mean score of 4.26, which, based on a seven-point scale, is in the midline.

Conclusion and Recommendations

In conclusion, if quality, efficiency, and profitability are a construction firm’s main focus, then there is a good chance that the use of construction accounting or its integration in the construction project management and development process would be of great help. However, if the goal is to shorten the project delivery timeframe, or to improve the project completion rates (i.e., productivity), then chances are the construction firms should stay away from construction accounting, at least at the moment.

Further studies are definitely needed in order to accurately assess the different impacts and use cases of construction accounting. As a recommendation for future researchers, they should try to use a larger sample population size, of at least one thousand. This will lead to an increase in the external validity of the study’s results and findings.

References

Çelik, ?.E. (2016). Mathematics and excel based statistical lean accounting implementation on a construction industry firm. Beykent Üniversitesi Sosyal Bilimler Dergisi, 9(1).

Indexed at, Google Scholar, Cross Ref

Chandler, D., Hardie, M., Perera, S., & Langston, C. (2019). A proposed framework for measuring future construction industry performance. Routledge, 215-234.

Indexed at, Google Scholar, Cross Ref

Clough, R., Sears, G., & Sears, K. (2000). Construction project management. John Wiley & Sons.

Coetsee, D., & Wyk, M. (2020). The adequacy of IFRS 15 for revenue recognition in the construction industry. Journal of Economic and Financial Sciences, 1-13.

Indexed at, Google Scholar, Cross Ref

Davila, M., Alonso, M., & Gamez, C. (2015). Managerial accounting for safety management. The case of a Spanish construction company. Safety Science, 116-125.

Indexed at, Google Scholar, Cross Ref

Foster, S. (2020). Management Strategies for Improving Construction Industry Ethics. Dissertation, Walden University.

Haider, T. (2009). Financial management of construction contracts, constructability and its relation with TQM, cost shifting risk and cost/benefit. International Research Journal of Finance and Economics, 42-51.

Halpin, D., & Senior, B. (2009). Financial management and accounting fundamentals for construction. John Wiley & Sons.

Indexed at, Google Scholar, Cross Ref

Holm, L. (2018). Cost accounting and financial management for construction project managers. Routledge.

Indexed at, Google Scholar, Cross Ref

Hong, W., 2008. On Application of Task-driven Technique in the Teaching of Engineering Cost Accounting. Journal of Kumming Metallurgy College.

Hussain, S., Liu, L., & Miller, A. (2020). Accounting as a dichotomised discipline: An analysis of the source materials used in the construction of accounting articles. Critical Perspectives on Accounting.

Indexed at, Google Scholar, Cross Ref

Jang, Y., Jeong, I., & Cho, Y. (2020). Business failure prediction of construction contractors using a LSTM RNN with accounting, construction market, and macroeconomic variables. Journal of Management Engineering.

Indexed at, Google Scholar, Cross Ref

Keisala, J. (2010). Cost accounting methods for construction projects in North-West Russia.

Lankauskiene, T. (2016). Application of the growth accounting method for the construction industry. Journal of Business Economics and Management, 430-443.

Indexed at, Google Scholar, Cross Ref

Onaolapo, A., & Odetayo, A. (2012). Effect of accounting information system on organisational effectiveness: a case study of selected construction companies in Ibadan, Nigeria. American Journal of Business and Management, 183-189.

Indexed at, Google Scholar, Cross Ref

Peterson, S. (2013). Construction accounting and financial management. Pearson.

Salling, K.M., & Leleur, S. (2015). Accounting for the inaccuracies in demand forecasts and construction cost estimations in transport project evaluation. Transport Policy, 8-18.

Indexed at, Google Scholar, Cross Ref

Schwarz, L. (2019). Project Accounting Concepts and Business Calculations.

Tang, J., Zhang, M., Tang, H., & Chen, Y. (2015). Research on cost management of construction project based on activity-based costing. International Conference on Civil, Materials and Environmental Sciences.

Indexed at, Google Scholar, Cross Ref

Wustemann, J., & Kierzek, S. (2005). Revenue recognition under IFRS revisited: conceptual models, current proposals and practical consequences. Accounting in Europe, 69-106.

Indexed at, Google Scholar, Cross Ref

Ying, H. (2016). The highway construction cost control model based on the improved earned value method theory. IEEE.

Indexed at, Google Scholar, Cross Ref

Appendices

Received: 31-Dec-2021, Manuscript No. AAFSJ-22-10709; Editor assigned: 03-Jan-2022, PreQC No. AAFSJ-22-10709(PQ); Reviewed: 17-Jan-2022, QC No. AAFSJ-22-10709; Revised: 21-Jan-2022, Manuscript No. AAFSJ-22-10709(R); Published: 28-Jan-22