Research Article: 2019 Vol: 23 Issue: 2

Organization of Bank Accounting In the Conditions of the Financial Crisis

Marek Garbowski, University of Warmia and Mazury in Olsztyn

Natalia Kozitska, National University of Shipbuilding

Yevheniia Poliakova, International Technological University

Nataliia Kornilova, Cherkassy State Technological University

Lidiya Synytsia, InterRegional Academy of Personnel Management

Abstract

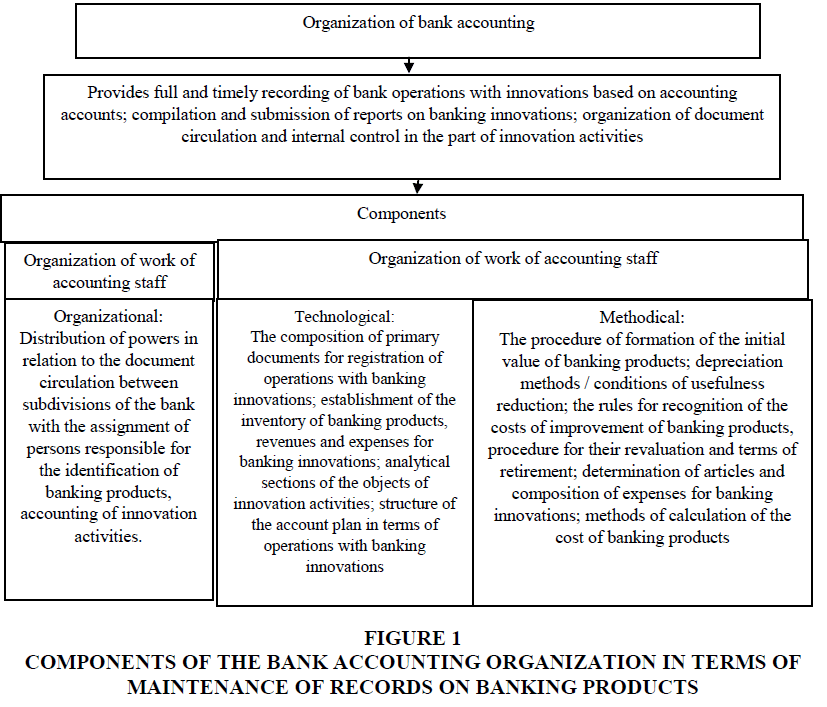

The organization of accounting in banks is influenced by a significant number of factors, the main of which are: features of normative regulation of bank activities, specifics of bank activities, special public role of the banking sector, and rapid development of bank activities. It was proved that the bank accounting policy is disclosed through the methodological and technological component of the organization of accounting, as well as its components were characterized: organizational (distribution of duties on accounting records of creation and introduction of banking products), methodical (development and introduction of methods of accounting records of banking products at all stages of their life cycle) and technological (ensuring the effective use of selected methods of data processing, and forms of management reporting). The consideration of certain elements of the accounting organization will allow to raise the informativity and to accelerate the provision of responses to inquiries of interested persons, carried out during the management of the innovative activity of the bank, by optimizing this process and identifying assets and expenses for banking innovations.

Keywords

Accounting Organization, Banking Operations, Management Reporting, Accounting Policy, Information Base.

JEL Classifications

M21, O16

Introduction

In the face of the consequences of the political and financial crises, the problem of increased reliability is of interest to every commercial bank. Some of them were almost on the verge of bankruptcy; others only have to face potential complications. The introduction of innovative banking products and, at the same time, cost savings of the bank and creation of a complex of qualitative internal banking documentation is only a brief list of tasks for solution of which the management of commercial banks requires operational detailed information. This makes it necessary to pay particular attention to the information base of the management of the innovative development of a commercial bank. The timely provision of the Bank's management with the necessary and reliable information on innovation activities is possible only if the organization of accounting is efficient.

The organization of accounting in banks can be presented as a certain system of conditions and elements of building of the accounting process in order to obtain accurate and timely information about the activities of the bank. The proper organization of accounting in

banking institutions ensures control over the saving money, state of settlement and credit operations, and also directly affects the state of accounting of enterprises.

Literature Review

The process of organization of the accounting of innovative banking products involves identification and establishment of interrelationships between certain stages (Marton & Runesson, 2017). In terms of quantity and characterization of certain stages, we agree with the opinion of a large number of scientists (Hilorme et al., 2019) and consider it necessary to distinguish between the methodological (choice of methods and methods of accounting records), technological (choice of the method of processing of accounting data, development of the composition and forms of accounting registers, documents, forms of reporting, etc.) and organizational (organization of work of accounting personnel) stages (Drobyazko, 2018; Garbowski et al., 2019). The first two are directly related to the organization of the maintenance of accounting records and are determined, first of all, when forming the accounting policy of the bank (Li, 2017). The organizational phase may also be partly described in the Provision on accounting policy, but it is regulated by a much wider list of documents (Crawford et al., 2017).

It should be emphasized that we have indicated the technological stage, not the technical one. After all, accounting technology is a collection of tools, skills and methods of the accounting process (Hope et al., 2017). The technology of the accounting process includes a set of methods for registration and conversion of accounting information, algorithms for solving individual accounting problems (Carneiro et al., 2017).

Methodology

The application of methods of induction and deduction, theoretical generalization allowed us to determine the essence and place of banking innovations in the composition of innovations, and substantiate the characteristic features of innovative banking product. An assessment of the current state of the organization, methodological support of accounting and analysis of operations with innovative products was carried out using the methods of questioning, analysis and synthesis.

Results and Discussion

One of the important tasks, which in today's conditions are solved by each bank, is the improvement of its organizational structure. In the conditions of innovation activities carried out by banks, special attention should be paid to the further development and optimization of the organizational structure of the accounting service.

The choice of the bank in favour of an active strategy of innovation development determines the features of the organization both as a structure and the work of the accounting service. Among them we can identify a complex system of relationships of subdivisions, a multi-level system of document circulation, diverse managerial reporting on projects related to development of new banking products.

That is why we think it is expedient to carry out the modernization of the accounting service in a qualitatively new and open structure integrated with other units that ensure the continuity of the bank's innovative processes.

The creation of the Department of Finance and Accounting as a result of the reorganization of the existing accounting department by joining a number of subdivisions to it units will, in our opinion, speed up the receipt and ensure a higher level of reliability of the accounting information on the bank's innovative activities. The Department of Finance and Accounting can combine both accounting and non-accounting structural units. However, they all have to fulfill the same tasks within the framework of regulations.

When developing the proper organizational support for the accounting of innovative banking products, it is also necessary to form of the Provision on the Department of Finance and Accounting, Provision on the departments that are part of the structure of the Department of Finance and Accounting, job descriptions of departmental staff, which determine the list of tasks and responsibilities of each accountant. In addition, the Provision on the Department of Finance and Accounting should describe the scheme of interaction with the bank's subdivisions, which will ensure the effectiveness of innovation activities as a system of interconnected elements.

When developing accounting policies and basing it on the formation of an information base, it should be taken into account that timely and properly provided information is the key to making sound managerial decisions by the management of the bank for its effective operation. Of course, the choice of a particular element of accounting policy has its impact on the bank's activity, which confirms the fact of individuality of all recommendations for specific institutions. However, there are a number of requirements that need to be fulfilled in the development of accounting policies, in particular in terms of innovation: the accounting policies should not duplicate the provisions of the regulatory documents; the element of accounting policy should be disclosed only if there is uncertainty about it or alternativeness of the choice of the option; certain provisions must not contradict each other (in particular, with respect to the opening of analytical accounts).

The next stage of our study is the disclosure of the features of the formation of accounting policies in terms of operations with innovative banking products. In general, if the bank is just created, then the questions on the object of research shall be indicated at the very beginning. The overall sequence of accounting policy formation for operations with innovative banking products will be as follows: analysis of the bank's innovation activities and the determination of the influence of external factors (taking into account changes in the current legislation); development and approval of methods, methods of accounting for operations with innovative banking products; development and decision making on the need for changes in accounting policy (an assessment of the appropriateness of making changes should be performed).

Taking into account the above position regarding the relation between the concepts of "accounting organization" and "accounting policy", we describe the organizational, methodological and technological components of the accounting organization, each of which is disclosed through a plurality of elements, and determine the composition of the issues of the accounting policy of the bank in terms of innovative banking products (Figure 1).

Figure 1 Components of the Bank Accounting Organization in Terms of Maintenance of Records on Banking Products

The results of our study are confirmed by the following studies accounting policy. So, Tetyana et al., 2018) being disclosing the structure of the Provision on the accounting policies of the institution of the bank, differentiated general provisions (principles of accounting, recognition of certain items of the balance, their assessment), organizational, methodological and technical aspects of accounting policies.

To eliminate the disadvantages and improve the quality of accounting processes (especially in relation to operations with innovative banking products), it is proposed to use techniques, components, and tools for reengineering of business processes.

The basis of reengineering is the transition from functional specialization to a process approach. At the input of the accounting process, there are primary documents that reflect the intermediate and final products of the business process. At the exit reporting prepared in accordance with the requirements of the current legislation on innovation activities and information about the cost of innovative banking products.

In addition, we propose to optimize the organizational structure of the system of innovation activity in the bank. The building of an effective organizational structure of the innovation activity system in a commercial bank is based on the development of process and engineering approaches to management. We propose two major organizational structure improvements: formation and consolidation of the criteria of necessity and procedures of nomination of specialists responsible for registration of primary documents in the corresponding business subdivisions in the internal documents of the bank; active use of project organizational structures for solving problems of innovation activities.

The above elements characterize the features of the organization of the work of accounting staff. As regards accounting policy, its content should be represented as a technological and methodological component of the accounting organization.

The technological component of accounting policy is largely determined by the form of accounting and the specific software product used for these purposes. As for operations with innovation bank products, the elements of the technological component of the bank's accounting policy should be the following: developed forms of primary documents for registration of operations with banking innovations; proposed forms of internal reporting on operations with innovative banking products; a certain order of inventory of banking products, incomes and expenses incurred during their creation and implementation; analytical sections of the objects of innovation activities.

The methodical component of the bank accounting policy for operations with innovative banking products is presented in a much wider list due to the lack of regulatory documents (instructions, regulations, explanations) from the accounting records of the object of our study. That is why we consider it expedient to disclose such elements of the methodical component as: the procedure for formation of the initial cost of innovative banking products; methods of depreciation of an innovative banking product (provided that it is recognized as an intangible asset or main asset); rules for recognition of costs for improvement of innovation bank products; definition of articles and composition of expenses for bank innovations; methods of calculation of the cost of innovation bank products.

Recommendations

The following is recommended to be approved as part of the accounting policy of banks: a work plan of the bank accounts, which is a list of personal accounts opened by the bank from the moment of its creation to liquidation or reorganization; forms of primary accounting documents used in the accounting commercial bank are subject to approval in the album of forms, which is created in the bank for the convenience of accounting for individual banking operations; the procedure for bank settlements with its branches and other structural subdivisions; rules for accounting of individual banking and business operations. This component is a list of accounting postings in all areas of bank and non-bank operations, disclosure of the procedure for accounting of all operations for each group of operations, etc.

Based on this, we believe that the accounting policy of the bank is disclosed through the methodological and technological component of the accounting organization.

Conclusion

The proper organization of the accounting of innovation bank products requires the coordination of the solution of major issues of the nature such as: organizational (distribution of duties on accounting records of creation and introduction of banking products), methodical (development and introduction of methods of accounting records of banking products at all stages of their life cycle) and technological (ensuring the effective use of selected methods of data processing, and forms of accounting registers).

One of the important issues of accounting organization in a bank is the formation of its accounting policy, because the Provision (order) on accounting policy reflects the principles of an evaluation and methods of accounting for individual articles of reporting. The paper identifies the elements of the organization of accounting and accounting policy of the bank in terms of operations with innovation bank products. Taking into account the suggestions for improvement of the organization of accounting will accelerate the process of processing and obtaining information.

References

- Carneiro, J., Rodrigues, L.L., & Craig, R. (2017). Assessing international accounting harmonization in Latin America. Accounting Forum, 41(3), 172-184.

- Crawford, J., Kashyap, S., Nilsson, F., Stockenstrand, A. K., & Tirmén, M. (2017). Accounting and control in banks: A literature review. In Bank Regulation, Routledge.

- Garbowski M., Drobyazko S., Matveeva V., Kyiashko O., & Dmytrovska V. (2019). Financial accounting of E-business enterprises. Academy of Accounting and Financial Studies Journal, 23(2).

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance, 10, 4-11.

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(S1).

- Hope, O.K., Thomas, W.B., & Vyas, D. (2017). Stakeholder demand for accounting quality and economic usefulness of accounting in US private firms. Journal of Accounting and Public Policy, 36(1), 1-13.

- Li, J. (2017). Accounting for banks, capital regulation and risk-taking. Journal of Banking & Finance, 74, 102-121.

- Marton, J., & Runesson, E. (2017). The predictive ability of loan loss provisions in banks effects of accounting standards, enforcement and incentives. The British Accounting Review, 49(2), 162-180.

- Tetiana, H., Karpenko, L., Fedoruk, O., Shevchenko, I., & Drobyazko, S. (2018). Innovative methods of performance evaluation of energy efficiency project. Academy of Strategic Management Journal, 17(2), 112-110.