Review Article: 2022 Vol: 26 Issue: 4

Non-Performing Assets: A Comparative Study with Reference To Selected Public and Private Banks

Prasad Kandi, V.S., Koneru Lakshmaiah Education Foundation

Jetti Amrutha, Koneru Lakshmaiah Education Foundation

Muppidi Sheba Susanna, Koneru Lakshmaiah Education Foundation

Citation Information: Prasad Kandi., Amrutha, J. & Susanna, M.S. (2022). Non-Performing Assets: A comparative study with reference to selected public and private banks. Academy of Marketing Studies Journal, 26(4), 1-8.

Abstract

A thriving economy necessitates a strong monetary region. The monetary zone's blunder could have serious consequences for another region. Non-performing assets (NPA) are one of the most pressing concerns for Indian banks. NPAs reflect a bank's performance. Given the presence of NPASA, the banks' potential and benefits are greatly impacted. A high level of nonperforming assets (NPAs) indicates that many credit defaults negatively influence a bank's advantage and net worth. Considering everything, the public region banks have outperformed the private region banks. This report attempted to assess how well the selected and private region banks managed their nonperforming assets (NPAs).

Keywords

Non-performing assets, Public Sector Banks, Private Sector Banks, Gross NPAs, Net NPAs.

Introduction

The massive accumulation of non-performing assets in banks has been recognized as being of enormous significance. The importance of the issue of terrible obligations was first recognized plainly in the 1990s, with NPAs in banks and money-related foundations totaling over Rs.1,50,000 crores. Net NPA displays the certified burden of banks, whereas gross NPA reflects the idea of the advances provided by banks. The critical defaulters are currently dynamically clear to be the large debtors from the non-need zone. The banks and money-related associations need to take care of business and diminish NPAs in a period-bound key strategy. Public region banks figure obviously in the conversation since they rule the monetary endeavors, yet they have significantly greater NPAs appeared differently from the private region banks. This raises a concern in the business and the academic local area since it is all around felt that NPAS reduces the efficiency of money-related prosperity and dissolvability. For the recuperation of NPAs, an expansive structure has developed for the administration of NPAS under which a few choices are accommodated obligation recuperation and rebuilding. Banks and Fl’s have the opportunity to plan and carry out their strategies for recuperation and discount consolidating split the difference and arranged settlements.

Non-performing Assets (NPA)

Activity for authorization of safety interest can be started provided that the got resource is named Nonperforming resource. Non-performing resource implies a resource or record of the borrower which has been characterized by the bank or monetary establishment as unacceptable, dice, or misfortune resource, as per the bearing or rules connecting with resources order given by RBI. Amounts payable in an unapproved office are treated as "delinquent" if they are not paid 30 days after the due date. We have decided to abolish "delinquency charges" due to improvements in installment payments and billing limits, a clawback environment, and some innovations in the financial.

Literature Review

Hafsal, et al. (2020) Non-performing resources (NPAs) in the Indian money-related district, with insights on 46 banks for the money year 2016. The assessment was done utilizing an intermediation technique to get a handle on the divisional and framework proficiency of the banks, first with Kao and Hwang's standard two-stage network DEA model, and afterward with Kao's overall two-stage network DEA model, with NPAs as an unwanted exogenous result to comprehend the suitability opening because of NPAs. NPAs represent 16.2 percent of the ampleness challenge in the Indian money-related locale, as indicated by ability appraisals of these two models Ankit (2016).

Prasanth & Mary Jones (2020) ordinarily, the productivity of the financial area relies upon the recuperation of credits on time which is dispensed to the various areas. The presentation of the banking area relies upon how successfully you deal with nonperforming resources. Here, the banks like the Central Bank of India, Dhanalakshmi, Bank, and so forth are encountering serious misfortunes that result in the organization's negative active development pace. But SBI and Punjab National Bank every risk dealing with issues with deference to NPAs. It doesn't show that the more NPAs the more benefits for SBI however the biggest bank in India can get more benefits simply because of its wide assortment of monetary administrations and compelling administration of NPAs. Be that as mayday if NPAs go on similarly then at that point, even enormous banks will likewise stagger like Lehman Brothers in the US which came about in Global financial emergency the apparatuses which are utilized are relationship a regression on Richa & Deepak (2018).

Agarwala & Agarwala (2019) As given by the RBI feature declining ease in the NPA advancement rate, which is an improvement. However, there is still an extraordinary arrangement to be done. Simply time will say how powerful has the RBI been in controlling the NPA advancement nearby. It is essential to pull the trigger hard as these lamentable credits are genuinely influencing the liquidity position of banks and, shockingly, the banks have been drawn nearer to going deferred concerning advancing, which is, finally, influencing the monetary turn of events, which has been postponed during the past scarcely any quarter.

Fred (2018) The purpose of the audit was to find out if bad assets were a desperate factor affecting the quality of Kenyan commercial banks' assets. The unit has been found to manage assets that influence the wealth ideas of Kenyan commercial banks. The findings show that the estimated resource quality of bad resources, concerning the ratio of full credit to the ratio of adversity arrangements to wages, affected the financial execution of Kenyan commercial banks. The latest combination results of the least-squares model showed a huge positive coefficient of asset quality in the model. It proposes the fundamental effect of asset quality on the execution of commercial banks. This result is a generous sign that improving the quality of wealth is a stressful financial reality, curbing the development of bad debts, further lowering monetary damage limits, and improving commercial banks' monetary enforcement. Is shown. Kenya.

Ujjwal (2017) The bank appears to have a rising pattern of NPA in the most recent four years. The bank needs to be proactive in the determination of clients and clients while endorsing advances. The activity of the bank is wide to the point of taking care of the requirements of an expansive range of the society and economy of India at large. Bank of Maharashtra ought to rigorously follow every one of the stand RBI's standards and subordinates given by RBI. Bank needs an acknowledged examination framework to keep NPAs from happening. Be that as it may, when NPAs do come into existence, the issue can be settled if there is empowering lawful design since recuperation of NPAs frequently requires prosecution and court requests to recuperate stock advances. With verbose suit in India, obligation recuperation consumes a large chunk of the day. Regardless of whether the bank is going to important lengths for recuperating the advances, it needs the help of the framework. In any case, it takes somewhere around one to two years to get consent from the court for actual ownership of any property, which postpones the further technique.

Siva (2016) Distressed assets have created significant timing issues for Indian banks. It’s a problem not only for banks but also for the economy. Money entering the NPA directly affects the efficiency of banks, as Indian banks rely specifically on payments from credited savings income. This study shows that open region banks have almost exceptionally high NPA levels. Public authorities have made various progress to reduce NPA, but how should an agreement be reached to resolve this issue? The NPA level of our bank is still high compared to unknown banks. It isn't in any way shape or forms conceivable to have zero NPAs. The bank and the board ought to accelerate the recuperation cycle. The issue of recuperation isn't with little borrowers yet with enormous borrowers and a severe approach ought to be followed for tackling this issue. The public authority ought to likewise make more arrangements for quicker settlement of forthcoming carcasses more thou, get to decrease the obligatory loaning to need area as this is the serious issue making region. So, the issue of NPA needs NPA needs genuine endeavors any other way NPAs will continue to kill the benefit of banks which isn’t great for the developing Indian economy by any means Krishna (2014).

Methodology Research

Community of the Study

Research strategy is an approach to efficiently take care of the exploration issue system establishes examination techniques, determining the standard of exploration strategies and setting of examination study, and clarification of utilizing of a specific technique or method so that exploration results are equipped for being assessed either by analyst himself or by others

Optional data for the years 2013-2021 is used in this current review. The data was acquired from several examination papers, websites, and other sources. The nonperforming resources of Indian banks have been accepted with the use of this information. The banks picked for the research are well-known banks in their respective areas.

Public Sector: State bank of India (SBI) and CANARA Bank.

Private Sector: HDFC Bank and ICICI Bank.

In the current review, Mean, Standard Deviation, and coefficient of difference has been utilized to examine and decipher the information.

Sample of the Study

1. In the public sector out of 12 banks I selected two banks with a high amount of NPAs.

2. In the private sector out of 21 banks I selected two banks with a high amount of NPAs.

Research Gap

Although various parts of the distressed asset test have been edited and used for this test over the years, there is a significant delay in inspecting the high-quality parts of the non-performing asset. Non-performing, with huge loans and upfronts to different business houses and industries with different types of progress, two banks which are from public and private sector banks, in our report.

Statement of Problem

Foundation was also established for the organization of ongoing events to enable lending and prepayment to people in need. However, a recent concern is that individuals are unable to meet their commitments, affecting their public image and degrading the performance of resources within their organization.

Objectives

The current review depends on examining the Non-Performing Assets of public area banks and private area banks explicitly the goals of the review are:

1. To compare its exhibition in the selected Public and private sector banks.

2. To assess the Gross NPAs and Net NPAs of select Public and Private Sector Banks.

Research Design

The audit focused on the NPA's connection between selected public and private banks. The ongoing investigation was primarily based on discretionary data compiled from each bank's annual report. This model includes two public sector banks, SBI and CANARA, and two private sector banks, ICICI Bank and HDFC Bank. The check will consider the data for the 7 years from 2013 to 2021

Data Collection

1. The present study relies on secondary information. We gathered secondary data on non-performing assets from 2013 to 2021.

2. The data is collected from the official websites of banks.

Study period

7 years

The Validity and Reliability of the Study Tool

A fraction of the measurable equipment, including such, has been used in this investigation.

Mean

The mean is the average of a significant number's "central" value that is not fixed. This was calculated by multiplying the potential benefits of all distinctions by the number of insights available.

Where Σ=sum of factors and N/Number of perceptions.

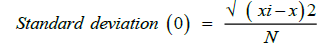

Standard deviation

Standard deviation is the most generally utilized proportion of scattering of a series and is normally signified by the image. Standard deviation is characterized as the square foundation of the normal of squares of deviations, hence such deviations for the upsides of individual things in a series are acquired from number-crunching normal.

Co-efficient of Variation

Co-efficient of standard deviation is a general measure and is frequently utilized for the contrasting and comparable proportions of other series. Series, for which the co-effective of variety is more noteworthy, is supposed to be more factor or less steady. In the investigation of monetary information, this proportion is taken to control the board more readily.

Co-efficient of fluctuation = standard deviation/mean *100

Data Analysis

The method involved assessing information utilizing insightful and intelligent thinking to analyze every part of the information given. This type of examination is only one of the many advances that should be finished when an exploration analysis. Information from different sources is accumulated, seen, and afterward dissected to frame finding or end.

Table 1 shows it tends to be seen that toward the finish of 2013-14, gross NPAs of SBI bank was 5.61% while toward the finish of 2020-21, it was 5.68%, with the most noteworthy being 5.68% toward the finish of the year 2020-21. Toward the finish of 2013-14, gross NPAs of CANARA bank was 2.59% while toward the finish of 2020-2021, it was 8.37%, and it is the most noteworthy. Toward the finish of 2013-14, the gross NPAs of HDFC were 0.97% while toward the finish of 2020-21, it was 1.33%, with the most elevated being 1.33% toward the finish of the year 2020-21. Toward the finish of 2013-14, gross NPAs of ICICI bank was 3.63% while toward the finish of 2020-21, it was 4.86%, with the most noteworthy being 4.86% toward the finish of the year 2020-21.

| Table 1 Gross Npas Of Public Area And Private Area Banks |

||||

|---|---|---|---|---|

| YEARS | SBI | CANARA | HDFC | ICICI |

| 2013-2014 | 5.61 | 2.59 | 0.97 | 3.63 |

| 2014-2015 | 4.91 | 4.00 | 0.92 | 4.40 |

| 2015-2016 | 7.27 | 9.36 | 0.96 | 5.59 |

| 2016-2017 | 7.87 | 9.70 | 1.06 | 7.18 |

| 2017-2018 | 12.38 | 11.97 | 1.30 | 7.28 |

| 2018-2019 | 8.58 | 8.63 | 1.39 | 5.89 |

| 2019-2020 | 7.14 | 7.56 | 1.27 | 5.16 |

| 2020-2021 | 5.68 | 8.37 | 1.33 | 4.86 |

| Sum | 59.44 | 62.18 | 9.2 | 43.99 |

| Mean | 7.43 | 7.7725 | 1.15 | 5.49875 |

| S.D | 2.355953 | 3.072504 | 0.191386 | 1.275208 |

| Variance | 4.8567 | 8.260244 | 0.03205 | 1.422886 |

Source: Author computation.

Investigation of public and private area banks.

1. Mean amount of the relative multitude of things/number of years

2. Standard Deviation= (amount of the squares of deviation from mean/number years as)1/2

3. Coefficient of variation= (standard deviation/mean) × 100

In the wake of investigating the pattern of gross NPAs of the relative multitude of four banks, one might say that out of the multitude of four banks, SBI has performed similarly well as in the year 2018-2020 and has attempted to lessen its gross NPA proportion over years while the relating proportions of different banks have expanded portraying that SBI has controlled how much gross NPAs nearly well in contrast with other noticeable banks.

Regular private banks (ICICI average 5.49475 and HDFC average 1.15), along with regional banks (SBI average 7.43 and CANARA average 7.7725) and banks (regular SBI and CANARA), function abnormally well in the management of NPA. CANARA Bank used other blueprint checks to check total NPA levels. Similarly, of the identifiable private banks. The usual HDFCs, ICICI, and HDFC use various strategic checks to control the total NPA level, which ICICI Bank controls. By focusing the NPA of these banks on yet another cut-off, the collection factor, the adoption of HDFC is even more reliable because its impact factor is explicitly shown. After that, SBI Bank's total NPA grade is more consistent. From ICICI Bank of Public Regional Banks (SBI and CANARA) and Private Regional Banks (ICICI and HDFC) and NET NAP (%) of CANARA Bank as of March 31 Valliammal & Manivanam (2018).

Table 2 reveals that it tends to be seen that toward the finish of 2013-14, NET NPAs proportion of SBI bank was 2.97% while toward the finish of 2020-21, it was 3.23% with the most noteworthy being 3.23% toward the finish of the year 2020-21. Toward the finish of 2013-14 Net NPAs proportion of CANARA bank was 2.06% while toward the finish of 2020-21, it was 3.71%, and it being the most elevated. Toward the finish of 2013-14, NET NPAs proportion of HDFC bank was 0.28% while toward the finish of 2020-21, it was 0.41%, with the most elevated being 0.41% toward the finish of the year 2020-21. Toward the finish of 2013-14, NET NPAs proportion of ICICI bank was 1.08% while toward the finish of 2020-2021, it was 1.15%, with the most noteworthy being 1.15% toward the finish of the year 2020-21.

| Table 2 Net Npas Of Public Sector And Private Sector Banks |

||||

|---|---|---|---|---|

| YEARS | SBI | CANARA | HDFC | ICICI |

| 2013-2014 | 2.97 | 2.06 | 0.28 | 1.08 |

| 2014-2015 | 5.07 | 2.71 | 0.25 | 1.84 |

| 2015-2016 | 4.26 | 6.22 | 0.30 | 2.66 |

| 2016-2017 | 4.23 | 6.25 | 0.34 | 0.34 |

| 2017-2018 | 6.56 | 7.36 | 0.41 | 3.48 |

| 2018-2019 | 3.45 | 5.04 | 0.40 | 1.96 |

| 2019-2020 | 2.61 | 3.50 | 0.36 | 1.31 |

| 2020-2021 | 3.23 | 3.71 | 0.41 | 1.15 |

| Sum | 32.38 | 36.85 | 2.75 | 13.82 |

| Mean | 4.60625 | 4.60625 | 0.34375 | 1.7275 |

| S. D | 1.896749 | 1.896749 | 0.062092 | 0.989931 |

| Variance | 1.461169 | 3.147948 | 0.003373 | 0.857469 |

Source: Author computation.

Analysis of public area and private area banks.

1. Implies amount of the relative multitude of things/number of years

2. Standard Deviation (amount of the squares of deviation from mean/number of years)1/2

3. Coefficient of variety (standard deviation/mean) x 100

After investigating the pattern of net NPA’s proportion of the relative multitude of four banks, one might say that out of the relative multitude of four banks, SBI has performed similarly well as in the year2017-2018,2019-2020 has attempted to diminish, and ICICI has performed nearly well as in the year 2016-2017has attempted to lessen its NET NPAS proportion over years while the comparing proportions of different banks have expanded portraying that SBI&ICICI has controlled how much gross NPAs relatively well in contrast with other noticeable banks.

Private banks (ICICI average = 1.7275 and HDFC average 0.34375) have worked well in managing banks other than NPA, and public regional banks (SBI average 4.0475 and CANARA average 4.60625) and featured local public banks. SBI and CANARA checked the NET NPA level in a typical SBI using a different method check on the CANARA bench. Also, a famous private regional bank. Typical HDFCs, ICICI, and HDFC used non-ICICI Bank method checks to check NET-NPA levels. Therefore, it can be said that it is more stable. Survey of ICICI Bank and CANARA Bank.

Findings and Suggestions

Findings

1. I found NPAs of SBI, CANARA, HDFC, and ICICI year by year.

a. Gross NPA ratio of SBI at the end of the year 2019it was decreasing, CANARA increasing every year, HDFC increasing year by year, ICICI also increasing year by year.

b. Net NPA ratio of SBI at the end of the year 2018 was decreasing, CANARA also decreasing from 2017from-2019, HDFC increasing every year, ICICI increasing 2017.

c. I found the mean standard deviation, the variance of four banks of public sector banks and private sector banks

d. Gross NPA of SBI mean is 7.43, SD is2.355953, variance is 4.8567

e. Gross NPA of CANARA mean is 7.7725, S.D is3.0772504, variance is 8.260244

f. Gross NPA of HDFC mean is 1.15, S.D is 0.191386, and variance is 0.03205

g. Gross NPA of ICICI mean is 5.49875, S.D is 1.275208, and variance is 1.422886

h. Net NPA of SBI mean is 4.0475, S.D is 1.292249, and variance is 1.461169

i. Net NPA of CANARA mean is 4.60625, S.D is 1.896749, and variance is 3.147948

j. Net NPA of HDFC mean is 0.34375, SD is 0.062092 and variance is 0.003373

k. Net NPA of ICICI mean is 1.7275, S.D 0.989931, variance is 0.857469

Suggestions

In the wake of doing the entire review, a few ideas have been prescribed to stay away from future NPAs and oversee existing NPAS:

1. Build a good recreation cell at the headquarters/zone office / local office level by distinguishing the basic recreational branches.

2. Examination and credit review.

3. Credit examination and checking.

4. Select appropriate methods for tackling the issue of every NPA.

5. Lowering the level of NPA requires a great deal of administrative effort in favor of banks.

6. Financier can continually screen the borrower to guarantee that the sum endorsed is used appropriately for the reason to which it has been authorized.

Conclusion

Expecting the NPA to be killed in the financial industry is ridiculous, but it needs to be contained. It is generally beneficial to follow appropriate strategy reviews, controls, and progress tracking to stay away from the NPA. Banks need to not only make efforts to reduce the current NPA, but also take basic security measures to avoid future NPA. Studies have generally found that studies have increased NPA. In any case, the downsizing of NPA shows an improvement in the concept of wealth for public regional banks in India and private banks in the region. The assessment points out that the organization of distressed assets of public regional banks in India has improved significantly.

References

Ankit, G. (2016) " A Study on management of non performing assets in context of Indian banking system" International Journal of Engineering, Technologies and Management Research, 3(11), 15-25.

Fred, S. (2018) SportsDistressing Effect of Non-Performing Assets to Asset Quality for Commercial Banks in Kenya”, 3(6) 71-83.

Hafsal, K., Suvari, A., Durai, S. (2020) “Efficiency ofIndian banks withnon-performing assets: evidence fromtwo-stage network DEA” Future Business Journal, 6(1): 1-9.

Indexed at, Google Scholar, Cross Ref

Krishna, M. (2014) " Comparative Evaluation of Non performing assets of indian Banks: A study of public and private sector banks" Asian journal of research in banking and finance Volume 4, Issue 5, pp. 232-247, May 2014.

Prasanth, K.K., & Mary, J.T. " (2016) _Effect of non-performing Assets on the profitability of banks- A selective study “_International Journal of Business and General Management, 5, (2), 53-60.

Richa, B. & Deepak, V. (2018) “ Non-performing Assets: A comparative study of the Indian commerical Banks ”International journal of social Relevance &concern, 6(2), 5-21.

Indexed at, Google Scholar, Cross Ref

Siva, S. (2016), ‘‘Non-Performing Assets of Commercial Banks in India - A Study”, 3(6) 168-173.

Ujjwal M. Mishra, Jayant R Pawaskar, “ A Study of Nonperforming assets and its impact on Banking sector ”, Journal for research, 3(1), 01-05.

V. Agarwala, N. Agarwala,“ A critical review of nonperforming assets in the Indian banking industry”, Rajagiri Management Journal, 13(2), 12-23.

Valliammal, M., & Manivanam, S.K. (2018)" a Study of non performing assets and it's impact on public sector banks in India " International Journal of Scientific Research in Science and Technology, 4(8), 43-45.

Received: 05-May-2022, Manuscript No. AMSJ-22-11975; Editor assigned: 07-May-2022, PreQC No. AMSJ-22-11975(PQ); Reviewed: 21-Mar-2022, QC No. AMSJ-22-11975; Revised: 23-May-2022, Manuscript No. AMSJ-22-11975(R); Published: 30-May-2022