Research Article: 2021 Vol: 24 Issue: 4S

Non-Monetary Economic Shift and Its Possible Application in Iraq

Sadiq To’mma Khalaf, Al-Mustansiriya University

Hendren Hassan Hussein, Al-Mustansiriya University

Bushra Ashour Hachim, Al-Mustansiriya University

Keywords

Non-Monetary Economic, Global Economic Changes, Iraq

Abstract

The shift to the non-monetary economy is not a personal desire of the researcher, but rather an imperative necessity that will be imposed by the economic reality and global economic changes, especially after the Covid-19 crisis that the world is exposed to. This imperative is not optional. Either it joins the development of the transition to the cash economy or it remains backward. For this reason, the Central Bank of Iraq takes measures in this regard to develop electronic payment methods and join the world of inevitable transformation.

Introduction

is no doubt that the Corona era and its aftermath necessitates the birth of a new world order, as the (Covid-19) pandemic revealed a lot of weakness in this global system. So, the discussion about the inevitability of change is certain, especially since the majority of specialists confirm that one of the causes of the spread of the Corona virus is the paper currency and its circulation in societies. This is the reason that the trend today is towards increasing confidence in the technology sector and confidence in technical performance and electronic payment with the imposition of change on consumer behavior and abandoning the old traditional habits.

The world is in a revolution on the verge of converting money into an endangered tool in some rich economies. Also, countries are working to cancel cash at varying speeds, but their direction towards transformation is very clear and, in some cases, it seems that this transformation is about to be completed, so what is the decimating role of backward economies? Are they trying Join the transformation or remain the same and this description is consistent with the Iraqi economy, as the Central Bank of Iraq is trying to catch up with the development in electronic payment methods. This will be discussed in order to prepare the appropriate ground for the transition to the cashless economy.

Problem of the Study

There is a big gap between the transition environment towards a cashless economy between the Iraqi environment and the rest of the developed and developing world and some Arab countries. Also, there are great challenges for preparing and catching up with the development of electronic payment methods.

Research Importance

The importance of research comes from the importance of the issue of the transition to the cashless economy, which is the hot spot of the developed and developing world, the inevitability of transformation is certain, and the Corona crisis will accelerate this transformation process.

Research Aims

1) Learn about the cashless economy.

2) Knowing the mechanisms of transformation and its inevitability.

3) Presenting the challenges of transformation in the world and where did this transformation reach in some Arab countries.

4) Knowing the local challenges in the mechanisms of the transition to the cashless economy.

5) Application possibilities of the cashless economy in Iraq.

Study Hypothesis

The Inevitability of Non-Monetary Economic Shift Post-Covid19

Study Outline

The research deals with the topic of transition to a non-monetary economy in two parts. The first is the theoretical framework of the monetary economy and the non-monetary economy and the negatives and positives of the transformation. The second topic deals with the process of transformation in global economies with a discussion of the process of transformation in Arab economies. It also discusses Iraq’s status in this transformation while addressing Challenges and applicability in Iraq.

The First Part

The Non-monetary Shift:A Cognitive and Theoretical Part

Throughout time, humans have used all the objects and resources to exchange valuable items "rare metals" and chains of shells and precious rocks. However, over time, these things have become ephemeral and temporary as paper money has replaced most of the coins and now increasingly occupies the digital image. Now, the question is whether the era of paper money could be completely over?

The First Branch

Monetary Branch

Money plays an important role in the economic life of the individual, as it does not need to be an economic person in order to feel the importance of money and that the standard of living. In this standard, what the people can achieve depends on the amount of money they get. Also, despite the historical multiplicity of forms and types of money, it is agreed upon that humans have known it for thousands of years, and money has gone through stages during which it has undergone a historical development according to the nature and conditions of economic and social life that dominated each stage of development. At the same time, money had an important role in directing and organizing economic and social life, whether that was at the individual’s level of running living requirements or at the level of society in general.

The monetary system includes all types of money in the state as well as the institutions that have the authority and responsibility to create and destroy money. Although there are laws, regulations, instructions and procedures governing the process of creating and destroying money, a question arises. The question is how much paper money is from the financial resources? The answer is not a large amount, at least. In terms of economic activity, according to the Bank for International Settlements based in Switzerland, there was a value of $ 4.54 trillion in liquidity in circulation in the eurozone countries and 17 major economies at the end of 2019. This represents only 8.9% of the total GDP. The United States has the biggest share of the banknotes in use, an estimated $ 1.42 trillion, but Japan had the highest percentage of banknotes issues compared to GDP at a rate of 4..1 % ( International settlement Banks, 2019).

There appears to be a real desire to get rid of the legacy of the monetary system in all its forms to turn to the monetary system. While the public and private institutions increasingly believe in the importance of the transition to a digital and cash economy, this matter will not happen overnight. Rather, it needs a long time, because there are many challenges related to digital technological tools, the societal environment, the work of institutions, and the extent of their ability to contribute to digital transformation.

The Second Branch

Non-Monetary from Illusion to Reality

The term cashless society refers to an economic situation in which data (usually electronic money) is transferred between any of the two parties in transactions instead of using money (in the form of paper money). This concept (the term) has been introduced on a large scale, especially as the world lives in a rapid and increasing use of digital methods in recording, managing and exchanging money in trade and investment and daily life. Also, some countries have set several limits for financial transactions and their values in which the cash payment system can be legally applied (Wahiba, 2016).

The trend towards the use of cashless transactions and settlements in daily life began since the 1990s when electronic banking transactions became widespread. Also, since 2010 to the present day, reliance on digital payment methods has expanded more in many countries, including intermediaries such as PayPal. The commercial and digital wallet systems operated by companies such as Apple, in addition to digital payments by electronic card or smart phone or electronic and bank bills. Furthermore, since 2016 the United Kingdom has recorded that one in seven people no longer uses and does not carry cash in their dealings. 75% prefer a credit card or loan card as a method of payment while only 11% prefer cash payments, and by 2019 digital payment methods have contributed to non-digital transactions by helping individuals pay directly to others without the need for cash Abdullah.

Some economists argue that there are significant gains in a cashless society (a society without monetary money), including lower transaction costs and new tools to manage economic growth and put an end to tax evasion and money laundering (The Federation of Egyptian Industries and the Federation of Egyptian Banks, 2017).

The Third Branch

Advantages and Disadvantages of Shifting to Non-Monetary Economy

There is no doubt that each system has its pros and cons. This is associated with the novelty of the experience and the tools it carries to protect this system and get rid of the risks that accompany the work of this system.

First: The Advantages (Wahiba, 2016)

1) Less crimes: It is easier to steal money when it is in cash, whether the amount is small or large. Also, illegal transactions such as drug trafficking are carried out using cash and thus there is no record of transactions.

2) The perpetrators of financial crimes need to hide the money, and it is more difficult to hide income or evade taxes when there is a record of all transactions and money sent.

3) The process of printing invoices and paper and metal money costs a lot of money and companies need to store money and provide more of it when it is about to run out or deposit huge sums in banks.

4) With regard to international payments, when visiting a foreign country, travelers need to buy the currency of that country, and thus payments will be easier if the countries deal in non-cash methods.

Second: Disadvantages (Things about FinTech – Arabic – Consumers international)

1) Privacy: Electronic payments reduce the opportunity for people to enjoy their privacy. The institutions that carry out the transfer process will control the personal data of customers without limits and may misuse it.

2) Piracy: Piracy may cause losses much greater than ordinary theft, as someone may seize huge sums from banks through piracy. This means that people can be deprived of groups and individuals of their cash.

3) Technical Problems: Some technical problems can disable customers to purchase the goods they need, and then sellers do not find alternative ways to accept payments from customers due to system failure. Also, this does not depend on the failure of large systems only, as even the phone battery runs out, disables people from making any payment, even a simple one.

4) Inequality: The opportunity for the rich may be better than the opportunity for the poor and those who are not registered in the banking system. Thus, the poor may suffer greater difficulties in a cashless society, as they do not have smart devices from the basis to enable them to pay online and there is still a long way to go before eliminating poverty in the world.

5) The electronic transfer of funds involves a lot of fees, which reduces the amount of savings compared to cash payments that do not require any fees. In rich countries, the cost of minting, sorting, storing and distributing money is estimated at about 0.05% of GDP.

6) Excessive Spending: When paying with cash, people feel the size of what has been spent, but this is not the case in electronic payment, as they may over-spend without noticing it. Therefore, people need to make a lot of efforts to monitor their expenditures according to this system.

7) Negative Interest Rates: When all money becomes electronic, governments have an opportunity to increase negative interest rates and when using this strategy to strengthen national economies, the sure result is a decrease in purchasing power.

From the foregoing, we notice that the size of the negatives outweighs the positives with regard to the transition to the non-monetary economy, but there is certainly an international interest for the large global economic powers to convert to the non-monetary economy. This is the control of capital movement and the domination of world economies. This contains many details, and the important thing is that are governments with weak economies able not to keep pace with the inevitability of this transformation. It is certain that they cannot and therefore must use in the development of its electronic technology in order to keep pace with this shift as the transformation towards a cashless economy is past and will not wait for someone who does not ride in it.

The Second Part

Challenges and possibilities of transformation of the cash economy in Iraq

There is no doubt that the process of transition to a non-monetary economy is not easy and needs an environment and an incubator for the transformation process that is looking for laws, a legislative environment, and technological tools. This is to keep pace with the era of inevitable transformation.

The First Branch

The Shift to the Non- Monetary Economy in the World

Although the idea of a non-monetary society is being circulated in different economies, this does not mean that the printing of paper currencies has ended. On the contrary, most countries still print their local currencies, but in different proportions, except for the Kingdom of Sweden, which began to reduce the sending paper currency since 2007. The number of cash transactions for individuals decreased by 80% for every citizen during the last ten years, and cash accounts compose for 6% of purchase transactions in Norway (in terms of value). In China, the digital payments increased from 4% during 2012 to 34% by 2019. Perhaps countries such as Britain are about six years behind the Nordic countries, while America has been delayed by about a decade, as cash is still prevalent, although there are attempts to shift to this economy. The Table 1 deals with the estimated share of payments in some countries.

| Table 1 The Estimated Proportion of Payments in Some Countries (Taken From the Reports of International Settlement in 2019) |

|||||||

|---|---|---|---|---|---|---|---|

| Country | Estimated Payed Proportions % | Country | Estimated payed proportions % | Country | Estimated payed proportions % | Country | Estimated payed proportions % |

| Singapore | 61 | Holland | 60 | France | 59 | Sweden | 59 |

| Canada | 57 | Belgium | 56 | UK | 52 | USA | 45 |

| Australia | 35 | Germany | 33 | South Korea | 29 | Spain | 16 |

| Brazil | 16 | Japan | 14 | China | 10 | UAE | 8 |

| Taiwan | 6 | Italy | 6 | South Africa | 6 | Pollan | 5 |

| Russia | 4 | Mexico | 4 | Greece | 2 | Colombia | 2 |

| India | 2 | Kenya | 2 | Malaysia | 2 | KSA | 1 |

| Pero | 1 | Egypt | 1 | Indonesia | 0 | Nigeria | 0 |

The general criterion for measuring the proximity of a country to becoming a cashless society is the number of non-cash payments in financial transactions between individuals in this country or transactions from one person to another that take place in that country.

Sweden is the most cashless society on earth, as banknotes and coins represent 1.7% of its gross domestic product.

The Second Branch

The Arab Shift towards a Cash Economy

The sales of electronic retail trade in 2019 reached about $ 2.842 trillion and are expected to increase to reach $ 8 trillion in 2025 considering an expected increase in the number of Internet shoppers in the world by 2 billion people. So, their percentage reaches 64.6% of internet users. These figures and statistics in the Arab world show that the percentage does not reach a quarter, and despite the lack of participation of the Arab world in the e-commerce market, some Arab countries have begun to take steps to increase participation, including Saudi Arabia, Qatar, the UAE, Kuwait and Egypt.

The countries of the Arab region can be classified according to the progress they have made towards the cashless economy into four basic groups, despite the economic and cultural diversity among the countries of this region. The countries of the Gulf Cooperation Council are in the first more developed group, which are the high-income countries in the Arab region with a high percentage. The second group includes Jordan and Lebanon, which have high rates of internet penetration because of the urban features of these two countries. The third group is North African countries with lower middle income (Algeria, Egypt, Morocco and Tunisia), while the fourth group includes Yemen, Iraq, Syria, Palestine, Sudan, Libya and the least developed countries. These countries are affected by conflicts and political, economic and security instability. The last group is the Comoros, Djibouti, Mauritania and Somalia with low incomes.

There is no doubt that there are great challenges facing the Arab region to convert to a cashless economy:

1) Strong internet infrastructure with fast service

2) Spreading the culture of electronic transactions, especially since many are afraid to risk their money in non-cash transactions.

3) The challenges of safe payment methods and the legislative and legal role.

4) Challenges of technological tools and electronic intelligence culture.

The Third Branch

The Cash Economy in Iraq, Challenges and Possibilities of Application

The transition to the cashless economy is not a personal desire of the researcher, but rather an imperative necessity imposed by reality. The historical imperative confirms the transformation to the cashless economy, and it is therefore necessary to keep pace with the development taking place in the world. It proposes an integrated national program to encourage the shift to the cashless economy, relying on three pillars, including facilitating procedures for opening bank accounts and reducing the costs associated with them. In addition, a set of broad legislative changes are carried out in the various laws regulating financial transactions in all their forms. This shift calls for the adoption of a government program to activate the work with electronic payment methods in line with the development taking place in the world according to the enactment of a new law that achieves the goal. The desired effect of this policy is to pay gradually but comprehensively to make a tangible effect in the non-monetary economic transformation.

First: Challenges Facing the Shift to Non-Iraq Monetary Economy

Challenges of the Legislative and Legal Role

The laws and the legislative structure are still old and do not comply with the laws and legislation of electronic banking, the law of fingerprint and electronic signature, and at the local level. The question is how much individuals can spend on smartphones and how widespread is the daily use of the internet and what the size of the market is and what is the number of individuals Adults who have a bank account.

At the local level, there are the challenges of spending on smartphones, the prevalence of daily use of the Internet, the challenges of the size of the electronic market and the size of adults who have a bank account. In particular, since 11% of adults have a bank account and 89% of adults do not have a bank account but deal in cash in the settlement of their commercial transactions and receivable accounts. Also, this increase in currency in circulation by 59.5% in 2019 is a clear indication of individuals' preference to settle their commercial transactions in cash and the spread of the phenomenon of hoarding. The ratio of 11% is very low if compared with the global average of 62% or compared with the rest of the Arab countries, for example, the United Arab Emirates and Bahrain recorded a very high percentage (83% and 82%), respectively.

1) The technology of switching to the international information network needs the speed required to complete banking and commercial transactions. A study that included eleven Arab countries showed changes in behavior in terms of dealing with the Internet because the numbers indicated that nearly 40 million Arabs use the Internet and that its use is highest in the Arab Gulf, where it occurred. Qatar is 100% and Iraq 35%.

2) Working with financial technology and the mechanisms of converting to electronic payment methods may lose privacy. This loss is because these services mostly depend on collecting in-depth information about consumers and their behaviors. Thus, they are not without risks and these risks are the risks of determining the legal status of the virtual currency or digital code and virtual currency conversions that have implications for total economy.

3) As the electronic banking services expanded and the development in their provision increased, the risks expanded, and the risks of using advanced programs, the Internet, settlement systems and electronic payment have recently emerged. The risks of cyber threats have risen and offset these threats the emergence of the term cyber security. Therefore, achieving “cyber security” has become the basis for the spread of electronic banking and its products. Modern.

4) Cyber-attacks pose a systemic risk, as the expansion of the connection through digital solutions increases the entry points for cyber pirates. These piracy increases the likelihood of the success of cyber attacks.

5) Through financial technology and the possibility of transforming into the cash economy, challenges arise. The policy-makers and regulators must adapt to the new changes while ensuring equal opportunities for all and protecting consumers as well as the risks of regulatory challenges. For example, crypto currencies such as Bitcoin can be used in conducting anonymous transfers across borders, which increases the risks of money laundering and terrorist financing.

6) The challenges of weak internet and fears that electronic payment systems will be subject to technical failures, power outages, electronic attacks and piracy.

7) In a cashless economy, the poor and the elderly may be neglected, and the government can sponsor the shopping habits of the people. The major players in the financial sector exploit the personal data of people in the absence of many of the joints of the law and its weakness in many aspects.

8) The challenge of the spread of electronic payment services and the shift in financial transactions from dealing in cash to the use of electronic payment devices and gradually getting rid of dealing with cash are considered. The same is true with the spread of payment services to the population of Iraq per 100,000 people, as this percentage is low. Despite its increase in 2018, the ratio of ATM to population reached (100,000) people (2.37), while POS reached (5.54), but this spread in payment services is still very simple.

9) From the above discussion, banking indicators are still below the level of ambition to enable financial technology and the transition to the cash economy to work better as Table (2), prepared by the researchers shows that.

| Table 2 Some Indicators in the Iraqi Banks |

|||||||

|---|---|---|---|---|---|---|---|

| Year | Bank Branches | Number of Adults (100 Person/15 Years) (1) | No ATM (2) | Key Car Stations (3) | (Ratio) (1/2) | No. of ATM in ever (1000) Km2 | No of Branches in every (1000) Km2 |

| 2010 | 912 | 19829 | 457 | ----- | ------ | 0 | 2.09 |

| 2011 | 929 | 19929 | 467 | 50000 | 2.3 | 1.07 | 2.14 |

| 2012 | 990 | 20569 | 467 | 50000 | 2.2 | 1.07 | 2.28 |

| 2013 | 1042 | 21227 | 467 | 30000 | 3.1 | 1.48 | 2.39 |

| 2014 | 1204 | 21926 | 337 | 30000 | 1.5 | 0.77 | 2.77 |

| 2015 | 854 | 22082 | 580 | 30000 | 2.6 | 1.33 | 2.79 |

| 2016 | 866 | 22654 | 660 | 30000 | 2.9 | 1.52 | 2.45 |

| 2017 | 843 | 22554 | 660 | 30000 | 2.8 | 1.51 | 2.45 |

| 2018 | 865 | 22556 | 660 | 30000 | 2.8 | 1.51 | 2.49 |

| 2019 | 867 | 22557 | 661 | 3000 | 2.8 | 1.51 | 2.50 |

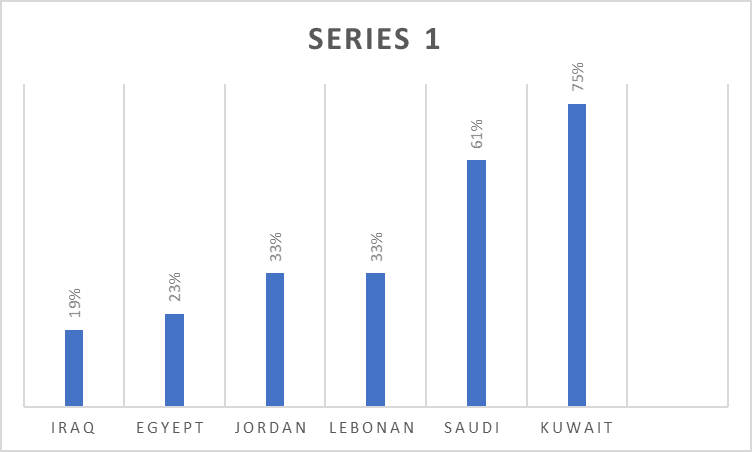

As for electronic payment services, the percentage of adults who use electronic payment tools in Iraq has reached (19%), which is a good percentage for the novelty of this activity. However, it still represents the lowest percentage when compared with some Arab countries. It requires financial institutions to raise these percentages and switch to using electronic payment services. (Figure 1)

Figure 1: The Percentage of Adults Who Use an Electronic Payment Method to Conduct Financial Transactions in Some Arab Countries.

Central Bank of Iraq, Financial Stability Report 2018, p.14.

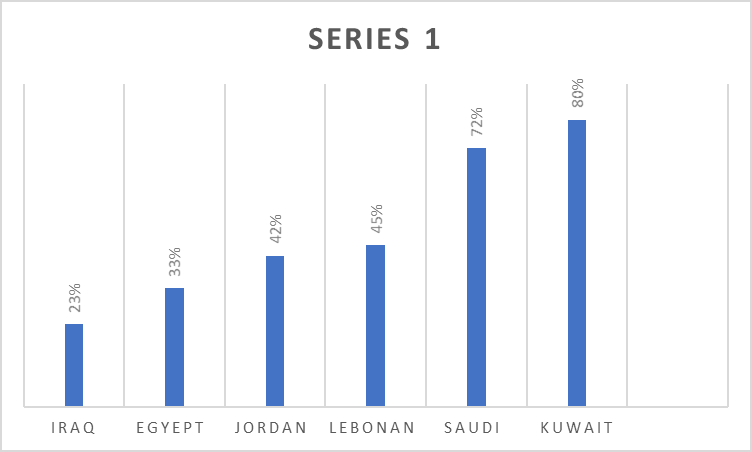

Figure (1) shows the percentage of adults who have bank accounts in some Arab countries. Comparing the inclusive financial indicators of some Arab countries, it was noticed that the percentage of adults who have bank accounts in Iraq reached (23%), which is the lowest percentage among the countries of the region, as shown in the Figure (2).

Figure 2: The Ratio of Adults With Bank Accounts in Some Arab Countries

This chart is taken from the Central Bank of Iraq, Financial Stability Report (2018, p. 111).

The Central Bank continues its policies towards achieving its strategic goals of increasing financial inclusion and adopting electronic tools in settling payments and exchanges instead of cash payments. This corresponds to global changes in a financial world without paper money and a lot of electronic cash trading in light of the "digital economy."

Second: The Possibility of Transformation and the Application of the Cash Economy in Iraq

1) There is a high cost to manage the infrastructure of the monetary economy in Iraq, such as ATMs, trucks that transport cash, and employees who check money, and now monetary institutions and financial companies are keen to abandon this system and switch to electronic payment methods.

2) The payments system is considered one of the basic foundations in the development of the banking sector. Therefore, the banks sought to develop payment development systems and settle electronic exchanges by developing mechanisms for electronically paying salaries to employees of state departments and retirees. In 2017, a consumer protection guide was issued which was circulated to Banks, money transfer companies and electronic payment companies, and providing the best banking services, especially in the field of electronic banking and settlement of payments. Several measures were taken in 2018 to adapt electronic payment systems, provide guarantees for transfers through the payments system, strengthen the role of supervision and control, and update the systems.

3) The role of the Central Bank in developing the electronic payments system, as developments in the latest economic report indicate participation in the regional payment system to settle Arab payments and automate all financial transfers between departments and institutions of the state and collect dues through the Iraqi payments system. Here, the electronic clearing system and complete linking operations are used with the national divider by banks after completing the administrative, technical and organizational procedures, the actual launch of the system, the formation of the Iraqi National Payments Board within the organizational structure of the Central Bank, the project of localizing the salaries of state employees, the Iraqi retail payment system IRPSI and linking comprehensive banking systems, without human intervention. This helps to avoid Errors and reduce risks in using electronic payment systems, providing guarantees for transfers through the payment system. This use also helps developing the CSD system, which is an electronic system that replaces securities and book entries, as it is allocated to each investor in which shares, bonds and certificates of deposit are recorded and traded in and ownership of this system which is transferred electronically.

4) Enhancing the role of supervision and control by the Central Bank by preparing a loyalty register system for banks and electronic payment service providers. This enhancement is in to meet the needs of supervision and control over card-issuing banks and electronic payment service providers through a database of agents and issuing licenses for some electronic payment companies for the purpose of subscribing to the retail payment system. This system works as a source and processor for prepaid cards and processing the settlements in coordination with the concerned departments.

5) Concentration in payment and settlement systems. The Central Bank of Iraq was obligated to deal in electronic instruments within the electronic clearing system and to quit dealing with the usual conventional instruments. This system has witnessed an increase in the volume of its transactions compared to other payment systems, as the volume of transactions in 2017 reached (23.5) trillion. Most of these operations are in three government banks, as they total (21.8) trillion dinars, amounting to (82%) of the total volume of transactions in electronic instruments.

6) The spread of mobile payment services and this comes in line with the upcoming shift in the global economy in relying on smartphones in shopping and commercial exchanges, as the use of electronic tools in settling payments enhances financial inclusion and the Central Bank of Iraq believes in the importance of the spread of electronic payment tools. Two companies were licensed to facilitate the electronic payment process via mobile, such as transferring money, paying bills, purchasing electronic cards, filling in prepaid lines, and the process of depositing and withdrawing cash to and from the wallet through the centers approved by the two companies (Asia Transaction and Zain).

7) The transition enables the Iraqi government to impose control and oversight over fraud, corruption and tax evasion.

8) It should be noted that financial technology provides an opportunity for the banking system in Iraq through the advanced electronic systems and programs it provides that help banks to develop their performance and increase their efficiency in services and transactions. Also, there is a fair percentage of owning a phone and everyone depends on it. It is expected that the number of those who own phones by 2020 will reach 5.4 billion people around the world and the Arab world is not tweeting out of the flock. The percentage of smartphone users in the Middle East region is 95% of the total population, 57% of these own smart phones and 36% of them own mobile phones In Iraq. The number of smart phone users is estimated to be more than 709,0007. While the number of mobile phone lines in Iraq amounted to 33.5 million lines, the number of Internet service lines for mobile phone companies operating in Iraq was 5.7 million lines.

Findings

1) The shift to the cash economy is not personal aim of the researcher, it is a public need required by the economic reality and the struggle of the great economic powers and the extent of their control over the world. Whoever controls the Internet will control the movement of money in the world.

2) The transition to a non-monetary economy is certain. Cash is dying due to two forces, one of which is the demand. Younger consumers who deal with smart communication devices want payment systems that are consistent with their ambition and interaction with the smart devices. These devices are frequently dealt with these days and which integrate easily with their digital lives. This will push the banks and technology companies in developed markets and telecom companies in emerging markets to develop quick and easy-to-use payment tools.

3) The transformation towards a cashless society is no longer an imaginary idea; the world is on its way towards that and there are many forces that are driving this transformation, including the developed countries, led by the United States of America.

4) The world is in the midst of a revolution on the verge of converting money into an endangered tool in some rich economies, and countries are working to cancel cash at varying speeds, but their direction towards the transformation is very clear, and in some cases this transformation appears to be nearing completion.

5) That there are significant gains in a cashless society (a society without monetary), including lower transaction costs and new tools to manage economic growth and put an end to tax evasion and money laundering.

6) The transition from a monetary economy to a cashless economy achieves many goals that serve the publics, businesses and governments alike and at the macroeconomic level. This transformation leads to enhancing financial inclusion by providing efficient, diverse, and cyber security and flexibility options for collection and payment and easy access to rural and remote areas that do not have banking branches.

Recommendations

1) The governments of the Arab region should move towards the automation of all government services and benefit from global experiences as well as the UAE's experience in developing electronic government and electronic payment methods and moving to a cash economy.

2) The government must maintain the commitment of banks to protect the privacy of customer information and the confidentiality of transactions. Also, the process of transition to a cashless economy requires a gradual form in exchange for banks being obligated to accept and distribute cash for a period of at least ten years, and the last period will give the government ample time to help the poor open Bank accounts, educating the elderly and promoting Internet access in rural areas.

3) Policy-makers and regulators must adapt to the new changes while ensuring equal opportunities for all and protecting consumers as well as the risks of regulatory challenges. For example, crypto currencies such as the digital currency (Bitcoin) can be used to conduct anonymous transfers across borders, which increases the risks. Money laundering and terrorist financing.

4) Development of the existing legislative system and initiatives support the transformation of the cashless economy by accelerating the legislation of the Electronic Signature Law and the Information Technology Industry Development Authority Law. In addition, the development of non-cash payments exchanges in Iraq, including the government electronic payment and collection project, the mobile phone payments initiative and the electronic payments service for the Iraqi government are also recommended.

5) There is still a need to do more steps towards providing an enabling environment for the application of financial technology in Iraq. Since the challenge of cyber-attacks pose a systemic threat, and preventing their occurrence should be at the top of the regulatory authorities' priorities, as the expansion of connectivity through digital solutions has increased the entry points for cyber hackers, which increases the likelihood of the success of cyber-attacks. Therefore, frameworks for information security to work comprehensively must be developed. To provide plans to prevent attacks, monitor them, share information about them, follow them up, and recover from their effects.

6) The information and communication technology infrastructure must be improved to enable business enterprises to rely on innovative financial technology applications, as there is a need to increase the penetration of the Internet and communication facilities via mobile phones, increase their speed, reduce their costs, and ensure the possibility of mutual communication between payment systems through mobile phones.

References

- Abdullah M., (n.d). Financial Technology and Community Development, Economic Money Center, www.maaI.com.

- Bank of International Settlements Report. (2019).

- Heba, W.A. (2016). Fintech companies in the Middle East and North Africa. Algeria: University Center.

- International Monetary Fund, International Electronic Trade Report. (2019).

- OECD (2019). Key issues for digital transformation in the G20

- Rahim, W.A. (2018). Middle East and North Africa financial technology companies. GIobaI Journal of Economics and Business, 1.

- The Federation of Egyptian Industries and the Federation of Egyptian Banks. (2017). The project to convert to a cashless economy. Cairo: The Federation of Egyptian Industries.

- The Central Bank of Iraq, The annual report on financial stability, the years 2010-2019.

- Things about FinTech – Arabic – Consumers international. www.consumersintenational.org accessed at October 2019.