Research Article: 2018 Vol: 17 Issue: 2

Nexus between Informal Networks and Risk-Taking: Implications for Improving the Performance of Small and Medium Enterprises (SMEs) In Nigeria

Fatai Alani Lawal, Covenant University

Omotayo A Adegbuyi, Covenant University

Oluwole O Iyiola, Covenant University

Omisade Ezekiel Ayoade, Covenant University

Akeem A Taiwo, Covenant University

Keywords

Risk-Taking, Informal Networks, Entrepreneurial Orientation, Informal Institutions.

Introduction

SMEs perform crucial role and are adjudged to be one of the major driving forces in the socio-economic development of both developed and developing modern economies (Turyakira & Mbidde, 2015). It has being a long-standing believe in entrepreneurial, managerial and economics literature that membership of a network is beneficial to entrepreneurial firms (including SMEs), assisting small firms in the acquisition of information and advice (Birley, 1985). Today’s market conditions are also compelling businesses to adapt to changes in order to survive, grow and be competitive. Such changes include interpersonal and inter-business cooperation and networks, which provide room for innovation and competition in a dynamic environment.

In the pursuit of innovation, venturing efforts and strategic renewal as component of SMEs growth strategies, SME managers may trail the risk-taking path by forming decisions and taking actions in the circumstance of uncertainty as well as effecting substantial resource commitments without being privy to the consequences of their decisions/behaviors (Schott & Jesen, 2016). In developed and transition economies, Wang & Poutziouris (2010) noted that risk taking, as a firm-level strategic orientation, constitutes a potential source of competitive advantage with positive and long-term effect on growth and financial performance of SMEs. According to Lin & Lin (2016) networking can sustain performance of SMEs through a number of avenues including the reduction in the cost of transactions, supplying resources in a more flexible manner and at reduced cost, facilitating the flow of knowledge and technological improvements (Vanhaverbeke et al., 2009).

A number of research approaches have provided insight into networks and networking dimensions of entrepreneurs and the small firm as well as entrepreneurial orientations. The diversity of research approaches include risk taking and performance of firms on Nigeria Stock Exchange (Olaniyan et al., 2016), risk taking in agro-processing SMEs (Wambugu et al., 2015), entrepreneurial orientation and network ties (Gunawan, Jacob & Duysters, 2013) and entrepreneurial orientation and performance with social networking moderating (Kiprotick et al., 2015). These studies examined the influence of risk taking propensity on performance on one hand and informal networks on the other hand in isolated contextual situation without considering the institutional framework that take cognizance of the informal structures and risk-taking propensity. Our paper contributes to the literature on SMEs and entrepreneurial orientation by integrating studies that stress the significance of entrepreneurs’ networks (particularly informal networks) and those that emphasize the importance of risk-taking dimension of entrepreneurial orientation, under the theoretical canopy of the resource based view. To the best of our knowledge, this is the first work that examines the role of risk-taking and informal networks in relation to the performance of SMEs in developing settings like Nigeria. Thus, objectives of the study are as follows: (1) To examine the effects of risk-taking on SMEs performance; (2) to investigate the influence of informal networks on SMEs performance.

Literature Review

Theoretical Literature

Jack (2010) considers network research in entrepreneurship from the standpoint of Resource-Based Theory. This examines how a number of tangible and intangible resources (derivable from business and social relations of entrepreneurs) foster new venture formation and growth. Within this perspective, successive growth and survival of new business is achieved through utilizing both internal resources as well building external contacts (Lechner & Dowling, 2003). The large bundle of resources that networks produce can increase the ability of the firm to generate new blends of knowledge, thereby boosting its competitive advantage (Wernerfelt, 1984).

Networks afford SMEs access to external resources and enable the creation and exploitation of social capital which in itself is considered as a source of competitive advantage (Barney, 1991). Intangible capabilities and resources connected with social capital, business model design and innovation are valuable to SME performance (Peteraf & Barney, 2003). Thus they attributed performance differences between competing firms to differences in their resources endowment. The intangible resources and the business processes that exploit them are less imitable and provide the basis for more competitive advantage (Ray et al., 2004).

Conceptualizing Risk Taking Propensity

Risk taking propensity refers to the predisposition of an individual to exhibit risk avoidance or risk acceptance when confronted with risky situations. Historically, entrepreneurship is linked with risk taking and entrepreneurs are portrayed as having a high penchant to take risk than others (Littunen, 2000). The concept of risk-taking has been long associated with entrepreneurship as evidenced in the definition of entrepreneurship which focuses on the willingness by entrepreneurs to be involved in calculated business risks (Leko-Simic & Horvat, 2006). These authors argue further that risk taking propensity, though a reasonably stable characteristic can be altered through experience.

Kiprotich et al. (2015) conceptualize risk taking propensity as an individual characteristic with a predisposition to take or avoid risks. Panzano & Billings (2005) asserted that the existence of positive relationship between risk propensity and risky decision-making by individuals is anticipated to translate to organizations through top management teams. Risk propensity (or affinity for risk taking) incorporates an inclination to allocate considerable resources to opportunities with a moderate chance of costly failure and an eagerness to dissociate from pessimistic disposition (Wiklund & Shepherd, 2005). Risk-taking propensity could in essence be effectively conceptualized as an individuals’ orientation toward taking chances in any decision-making circumstance.

According to Dess & Lumpkin (2005), the aspect of risk taking in entrepreneurial orientation involves calculated and manageable risks so as to actualize benefits, rather than taking hazardous risks which have adverse effect on firm performance. Risk taking is reliant upon risk perception and risk propensity. Risk perception is considered to be the perceived degree of risk inherent in a certain situation. The higher the risk propensity, the lower the concern over risk or risk taking (Olaniran, Namusonge & Muturi, 2016). The individual risk aversion tendency is decisive in determining entrepreneurial success. Tolerance for a fair degree of risk is more internal than external and the willingness to assume some element of risk is an important variable that determines success of small business owners.

In seizing advantage of opportunities in the marketplace, risk-taking involves firms’ inclination to assume courageous acts such assigning a tangible amount of resources to ventures with doubtful outcomes, venturing into unfamiliar markets, as well as the proclivity to borrow heavily with the anticipation of reaping high returns (Dess, Lumpkin & Eisner, 2007; Entebang, Harrison & Ernest, 2010). Consequently, managers and organizations are confronted with three types of risk, vis-a-vis: (i) Business risk-taking involving venturing into the unknown without being sure about the probability of success; (ii) financial risk-taking, a situation when a company needs to borrow heavily or commit a large portion of its resources in order to grow; and (iii) personal risk-taking, encompassing the risks that an executive assumes in taking a stand in favour of a strategic course of action. Wendestam (2008) viewed the total risk management in business from three perspectives: (1) The strategic perspective that lay emphasis on risks from the strategic goals of the business which includes risks associated with new innovations and launching a new product in a new market; (2) the tactical risk management that focuses on the tactical decisions of the venture and takes ownership for handling risks connected with the yearly planning; and (3) the operational risk management which concerns the day-in-day-out operations of the business.

From market perspective, Olaniran et al. (2016) identified three types of risks, namely:

1. Market or social risk: The risk which matures when a market decline thereby squashing the performance of investments even when the quality of the investments remain the same.

2. Monetary risk-associated with the resultant effect of inflation. In this scenario, inflation reduces the purchasing power of money, thus causing firms to consume more money in the production and distribution of products and services and consequently affecting the profit level negatively.

3. Psychological risk, a risk connected with debtors’ inability to fulfil their repayment obligations, thereby impairing the liquidity situation of the firm and its performance.

Entrepreneurial Networks and Informal Networks

Aldrich & Zimmer (1986) defined networks as personal relationships between an entrepreneur and his external actors (outsiders) who can be an organizations or individuals. Though these external actors are not directly being employed by the entrepreneur, but such network relationship (contacts) are built up by entrepreneurs so as to obtain required resources and to carry out certain activities (Birley, 1985). From this perceptive, Aldrich & Zimmer view entrepreneurial networks as consisting of four major components identified as actors, activities, resources and linkages. Being part of a network can represent a vital source of competitive advantage, may permit one to have access to resources and knowledge at considerable lower costs (Zaheer & Bell, 2005) and to benefit from economy of scale exclusive of the shortcomings of the big dimension (Watson, 2007).

Networking in SMEs refers to the network process embarked upon by SME owner managers in managing business pursuits (Hakimpoor et al., 2011). De Jong & Hulsink (2012) argue that the benefits accruing from networking involvement enable trusting relationships among businesses. Schallenkamp & Smith (2015) argue that networks bestow entrepreneurs with information regarding their environment in addition to helping them to develop reputation and credibility both for themselves (as individuals) as well as the firm they are operating or contemplating to establish. According to Ogunnaike & Kehinde (2013), entrepreneurs embark on networking with others because they mostly rely on information, raw materials, knowledge and technology in order to constantly develop their enterprises and be pleasing to societies. Networking activities such as membership of business associations is of benefit to a firm as it enhances the flow of information and SMEs’ access to training, technical assistance and other activities packaged by the association (Brown, Earle & Lup, 2005). The researchers further emphasized that informal network assure MSMEs access to dependable marketing information, friendly contacts, referrals and other forms of support that assists in ameliorating information asymmetry often encountered.

In entrepreneurship research, social network and informal networks are frequently used interchangeably. Surin & Wahab (2013) defined social network as the inter-relationship between the entrepreneurs (ego) and their contacts for business purposes. Entrepreneurs need capital, information, skills and labour to commence business activities. While some of these resources are within the reach of the entrepreneurs themselves, they often complement their resources by leaning on their contacts which are often informal and non-work connections. According to Greve (2003) the contacts result in successful outcomes, contributes to entrepreneurial goals, constitute entrepreneur’s social capital and are vital components of entrepreneurial networks.

A good social network is perceived as constituting an essential tool for business improvement with network structures and connections enabling the flow of information and creating cooperation and reciprocal trust (Lechner & Dowling, 2003). According to Anwar & Tabassum (2011), positive relation always subsists among ownership concentration and performance of firms because they both ensure the success of the business. The performance of the promoter of the firm is influenced by his talent, good luck and circumstances, as well as his financial, social and human capital (Zafar, Yasin & Ijaz, 2012).

Link between Informal Networks (Social Networks) and SMEs Performance

The support that entrepreneurs receive from both informal network (friends, business contacts, family, etc.) and formal networks (accountants, bankers and lawyers) affect the form and performance of their ventures (Birley, 1985). According to Birley, while different networks provide diverse resources, however, the informal networks constitute the major sources of support in gathering resources in form raw materials, equipment, employees and supplies and the informal contacts of friends and families.

Studies on impact of social networks on venture performance have taken diverse positions. Some researchers posited the positive effect of informal networks on SMEs performance (Machirori, 2012; Surin & Wahab, 2013; Machirori & Fatoki, 2013; Tendai, 2013), while others believe that extensive social networking of SMEs owner-managers do result into decline in firm’s performance (Watson, 2007; Yu & Chiu, 2010). Weerawardena & Mort (2006) focused on the positive effects of networking on performance. According to Surin & Wahab (2013) network centrality has positive and significant effect on business performance. However, family members networking and network density have positive but not significant effect on business performance. Research conducted by Watson (2007) reveals that beyond certain levels, networking start having a negative impact on firm performance. Similarly, Yu & Chiu (2010) established that extensive social network of a firm’s owner or manager often culminate in decrease in firm performance.

Relationship between Risk Taking Propensity and SMEs Performance

Risk-taking is an important feature of entrepreneurship. According to Wambugu et al. (2015) as the risk-taking orientations of entrepreneur increase, the higher the profitability of entrepreneurial ventures. The effect of risk taking on venture performance is viewed from different perspectives in the literature. Kiprotich et al. (2015) posited that risk-taking, innovativeness and pro-activeness significantly affect performance of SMEs with social networking having a positive moderating relationship between the variables. Otieno, Bwisa & Kihoro (2012) noticed the existence of significant positive relationship between risk-taking and performance more importantly considering sales, profitability and employees growth. On the other hand, Olaniran et al. (2013) observed that negative relationship exist between risk-taking and firm performance when return on equity and return on assets are considered respectively Assets and return on equity respectively.

According to Kiprotich et al. (2015) the environment in which a firm operates its business activities may have an effect on whether a firm takes a risk or not. The resultant effect is the existence of an entrenched relationship between entrepreneurial risk-taking and performance of firm in dynamic environments. In the bid to improve performance, Small and Medium Enterprises are confronted with decisions involving risk-taking. In the opinion of Otieno et al. (2012) firms that implement a moderate or reasonable level of risk taking are high performers when compared to those firms that take on very high or very low levels of risk taking. They stressed that managers need to take daring and risky strategic decisions in an attempt to cope with dynamic environments characterized by constant state of change. This argument presupposes that organizational risk-taking will be more positively associated with firm performance in dynamic environments than in stable environments. Also Ahimbisibwe & Abaho (2013) observed that risk taking firms are able to ensure long term profitability and superior growth compare to risk avoiders.

Nexus between Risk-Taking, Informal Networks and SMEs Performance

Pro-activeness and risk-taking are the two traits of entrepreneurial orientation well distinguished in literature (Stam & Efring, 2008; Wiklund & Shepherd, 2005). Kreiser (2011) opined that risk-taking orientation indicates the degree of firm’s tolerance of uncertainty, thus capturing the firms’ preparedness to partake and create risky investments. While Naldi, Nordqvist, Sjoberg & Wiklund (2007) observed that a too low risk-tolerance prevents a firm from progressing, the work of Ward (1997) revealed that in the absence of risk taking, prospects for the growth of a business diminishes. SMEs with high risk-taking orientation may be remarkably skilful at building new network ties because such a firm strives for resources that would add value to the firm both in the present and near future (Gunawan et al., 2013).

For a business venture to succeed, it must own certain ability to consistently build and nurture its networks and to process and implement newly mustered information and knowledge. This ability is encapsulated in the entrepreneurial orientation capabilities, define as the extent to which SME managers are inclined to taking business-related risks and seek opportunity in predicting future demand (Perez-Luno, Wiklund & Cabrera, 2011). While entrepreneurial network is critical for the performance of SMEs, we argue that a wider perspective and understanding of the link between risk-taking and informal networks influence the performance of SMEs.

In view of the foregoing synthesis that takes a cursory look at the link between risk-taking and informal networking relationship as a key component of the informal institutional environment and within the purview of the resource-based theory, we hypothesize the following:

H1: There is significant impact of risk-taking propensity on SMEs performance.

H2: Informal Networks have positive significant impact on SMEs performance.

Methodology

Research Design and Data Collection

The study adopted descriptive design to combine relevance of the research purpose with robust procedure that provides a broad overview of the study objectives (Kothari, 2004). In utilizing descriptive design, survey was conducted by administering questionnaire on 381 SMEs owner managers (out of the study population of 2590) that registered their businesses with selected professional associations (National Association of Small and Medium Enterprises, Association of Small Business Owners in Nigeria and National Association of Small Scale Industrialists) in south west, south-south and north-central geo-political zones. These zones were selected because of their political and economic significance to Nigeria. Purposive and stratified sampling technique respectively was used in the selection of respondents and distribution of questionnaire based on each association membership register.

Measurement Model and Validation

This study (being quantitative in nature) embraces the numerical manipulation and representation of observations with the purpose of describing and explaining the phenomena which the observations manifest. Thus, respondents’ responses were evaluated on a 5 point Likert scale (ranging from 1: Strongly disagree, 2: Disagree, 3: Neutral/undecided, 4: Agree and 5: Strongly agree). We followed the approach of Wabungu et al. (2015) to measure risk-taking. Items on the scale of Premaratne (2002) were adapted (within the context of the study) to measure informal networks, while items measuring SMEs performance were adopted from the works of Khan & Muhammad (2012). We developed multi-item variables using Confirmatory Factor Analysis (CFA), testing for the reliability of measurement items and validity (both convergent and divergent). The reliability of these indicators were confirmed by computing the Cronbach’s-alpha coefficient which was respectively 0.79 for risk-taking, 0.91 for informal networks and 0.86 for performance; well above the benchmark value of 0.70 (Hair et al., 1998).

Convergent validity of the constructs was established using item loadings and their significance. As shown in Table 1, the factor loadings of items on their respective constructs, ranges from 0.6631 to 0.9416 and are all in excess of the suggested minimum value of 0.5 (Bagozzi & Yi, 1988) implying that the constructs have convergent validity. Also construct Composite Reliability (CR) and Average Variance Extracted Estimate (AVE) indicated the satisfaction of conditions for convergent validity in line with the recommendation by Fornell & Larcker (1981). This imply that most of the measurement items and scale are significant and exceeded the minimum value criterion of CFA loading>0.5, error variance<0.5, composite reliability>0.8 suggesting that the constructs are reliable and AVE>0.5 providing further evidence of convergent validity and that the variables could therefore be included in the model testing.

| Table 1 Results of Measurement Model |

||

| Constructs and items | Factor Loading | |

| Risk Taking (Risk_Tak) (α=0.789; CR=0.945; AVE=0.661) | ||

| 1 | My firm often demonstrate the tendency to commit a large portion of its resources in order to grow (Res_Comt) | 0.7526 |

| 2 | My firm often exhibit the inclination to invest in high risk projects which promises high returns (Inv_HPP) | 0.7714 |

| 3 | My firm shows predisposition to finance its major projects through heavy borrowing (Pre_Brw) | 0.6631 |

| 4 | My firm does display affinity to continuously seek opportunities related to its present line of business. | 0.8164 |

| Informal Networks (Inf_Nwk) (α=0.906; CR=0.944; AVE=0.684) | ||

| My access to informal network involving family, friends and professional contacts, provide benefits in form of: | ||

| 1 | Access to information about developments in my business. | 0.9017 |

| 2 | Access to new contacts and suppliers. | 0.9416 |

| 3 | Access to new markets for my business. | 0.8881 |

| 4 | Provision of financial support for my business. | 0.6549 |

| Performance (α=0.861; CR=0.945; AVE=0.589) | ||

| 1 | I am satisfied with my firms’ performance for the past three years in comparison to her competitors | 0.7298 |

| 2 | I reached the expected profitability target | 0.7915 |

| 3 | I reached higher profitability than others in my business sector in the last three years | 0.7615 |

| 4 | Profitability has increased in the last three years | 0.7236 |

| 5 | Total sales volume has increased in the last three years | 0.6690 |

| 6 | Employees number has increased in the last three years | 0.7624 |

| 7 | Our market share has increased in the last 3 years | 0.8007 |

| 8 | Our customers base has grown significantly in the last 3 years | 0.8085 |

| 9 | In dealing with our competitors, we typically initiate actions, which competitors then responded to. | 0.8755 |

| 10 | In dealing with our competitors, we are very often the first to introduce new products/services | 0.7839 |

| 11 | The company knows the main competitors and is aware of its own competitive position in the market. | 0.6964 |

| 12 | The company gathers competitors information continuously | 0.7877 |

Note: α=Cronbach’s Alpha; AVE=Average Variance Extracted; CR=Composite Reliability

To satisfy the requirement of discriminant validity of the measurement model, the criterion suggested by Fornel & Larcker (1981) was followed. The discriminant validity established as the square root of a construct’s average AVE was greater than the correlation between the construct and other constructs in the model.

The above Table 2 explains correlation analysis depicts that there are substantial and significant level of correlation among variables of the same construct. For instance, a medium-high level of correlation from 0.29 to 0.76 was found among the measures of risk taking, while 0.55 to 0.87 was found between informal networks measures. For variables measuring different constructs, the correlations are low. This trend can be implied as evidence of construct validity (convergent validity phase for items within a variable and divergent validity for items that are outside a variable). The test of Multicollinearity was carried out using Tolerance and Variance Inflation Factor (VIF). As shown in Table 3, both tolerance and VIF was 1.00<3 respectively depicting that there was no risk of multicollinearity associated the variables (Belsley et al., 1980).

| Table 2 Means, Standard Deviations and Correlations |

|||||||||||

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| Sup_Acc | 3.97 | 0.907 | 1 | ||||||||

| Mkt_Acc | 3.86 | 0.924 | 0.604** | 1 | |||||||

| Info_Acc | 3.94 | 0.882 | 0.616** | 0.549** | 1 | ||||||

| Inv_HPP | 3.49 | 1.15 | 0.016 | 0.033 | -0.023 | 1 | |||||

| Pre_Brw | 3.27 | 1.26 | -0.091 | -0.073 | 0.021 | 0.350** | 1 | ||||

| Res_Comt | 4.17 | 0.880 | 0.162** | 0.021 | 0.097 | 0.322** | 0.291** | 1 | |||

| Inf_Nwk | 3.92 | 0.771 | 0.868** | 0.846** | 0.842** | 0.011 | -0.057 | 0.109* | 1 | ||

| Risk_Tak | 3.64 | 0.816 | 0.019 | -0.014 | 0.035 | 0.765** | 0.784** | 0.660** | 0.015 | 1 | |

| Performance | 3.21 | 0.724 | 0.234** | 0.214** | 0.254** | 0.068 | 0.111* | 0.172** | 0.274** | 0.151** | 1 |

| N | 381 | 381 | 381 | 381 | 381 | 381 | 381 | 381 | 381 | ||

** Correlation is significant at the 0.01 level (2-tailed) * Correlation is significant at the 0.05 level (2-tailed)

| Table 3 Regression Coefficients Risk-Taking and Informal Networks on Smes Performance |

||||||||||

| Unstd Coeff. | Std. Coeff. | F Change | t | Sig. | Collinearity Statistics | |||||

| R2 | β | Std Err | β | Tolerance | VIF | |||||

| Regression Summary | M1 | 0.097 | 0.690 | 0.000 | ||||||

| Anovaa | Reg.Resid | 20.27 | 0.000b | |||||||

| Coefficients | Constant | 1.73 | 0.241 | 7.198 | 0.000 | |||||

| Risk_Tak | 0.131 | 0.043 | 0.147 | 3.012 | 0.003 | 1.00 | 1.00 | |||

| Inf_Nwk | 0.256 | 0.046 | 0.272 | 5.565 | 0.000 | 1.00 | 1.00 | |||

| a. Dependent Variable: SME Perf | ||||||||||

| b. Predictors: (Constant), Inf_Nwk, Risk_Tak | ||||||||||

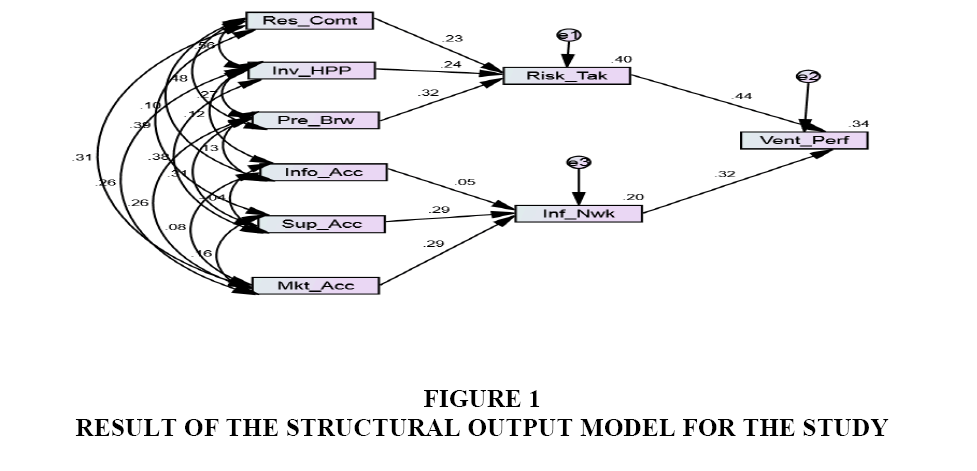

In structural equation modelling, several fitness indexes in use reflect the extent to which the model fits the data at hand. In the absence of agreement among researchers on the fitness indices to use, Hair et al. (1998); Holmes-Smith (2006) recommended the adoption of at least one fitness index from each model fit category (absolute, incremental and parsimonious). The acceptable cut-off threshold reported thus varies according to the supporting literature. Evidently, the results of the various indicators of goodness-of-fit adopted for this study are above the benchmark recommended as follows: Absolute fit-Bentler (1990) (Goodness of Fit Index GFI=0.904>0.9; Root Mean Squared Error of Approximation RMSEA=0.069<0.08), Incremental fit-Bentler & Bonett (1980) Comparative Fit Index CFI=0.908>0.90; and parsimonious fit-chisq/df=4.036<5 (Bentler & Hu, 2002).

Hypotheses Testing and Structural Model

The multiple regression procedure of SPSS statistics (V.22) and structural equation modelling analysis of moment structure (SPSS-Amos V.22) were used to test the hypotheses. The multiple regression coefficient (R2) indicates a measure of how much variance in the outcome (SME Performance) is accounted for by the predictors (risk-taking and informal networks) as shown in Table 3. In the first model (M1) regression summary, the R2 value of 0.097 implies that both risk-taking and informal networks variables accounts for 9.7% variation in venture performance and this is significant at p<0.001. The analysis of variance tests (ANOVA) demonstrate that the model is significantly better at predicting the outcome with the F-ratio representing the ratio of improvement in the prediction that results from fitting the model (regression) relative to the inaccuracy that exists in the model (residual) in the table. The F-Change of 20.27 with the significant p-values<0.001 depicts that the independent constructs predicted the scores on the dependent variable (SME performance) to a statistically significant level.

In testing the hypotheses, T-test statistics and standardized betas were used to test the significance of the relationship between risk-taking and informal networks respectively and SME performance where critical values of t-statistics should be higher than 1.96 at 0.05 significant level. Hypothesis 1 (H1) predicted that risk-taking is positively related to SME performance. As shown in Table 3, the results support H1 (β=0.147; t=3.012>1.96; @ p<0.001); implying the acceptance of the hypothesis stating that risk-taking has a significant and positive impact on SME performance. Results of hypothesis (H2) are also supported showing that (β=0.272; t=5.565>1.96; @ p<0.05), indicating that informal networks positively and significantly impact SME performance. Thus, hypothesis (H2) stating that informal networks have significant impact on SME performance was also accepted. Resultant T-tests statistics showed that the model was significant at 95% level for a two-tailed test.

The inner or structural model specification was achieved by exploring the path coefficients between the constructs representing each hypothesis. The path coefficients are represented by the standardized regression estimate in Table 4 and Figure 1 respectively. The level of relationship between risk-taking, informal networks and SME performance are positive and estimated to be r=0.436 (p<0.05) and r=0.325 (p<0.05) respectively. These path regression estimates imply that for every 1 unit increase in risk taking, SME performance was increased by 0.436 units and for every 1 unit in informal networks, SME performance was increased by 0.325 respectively, thus reflecting significant and positive predictive influence. The contributions of the measures of risk taking (resource commitment, predisposition to heavy borrowing and investment in high risk projects) and those of informal networks (access to business development information, market access and access to new suppliers and contacts) are significant as shown by their regression weights.

| Table 4 Model Results & Estimates of Regression Weights for Predicting SME Performance |

|||||||

| Estimate | S.E. | C.R. | P | Label | |||

| Risk_Tak | <--- | Res_Comt | 0.235 | 0.108 | 2.793 | 0.005 | par_1 |

| Risk_Tak | <--- | Pre_Brw | 0.324 | 0.072 | 4.479 | *** | par_2 |

| Risk_Tak | <--- | Inv_HPP | 0.244 | 0.075 | 3.172 | 0.002 | par_3 |

| Inf_Nwk | <--- | Info_Acc | 0.047 | 0.090 | 0.637 | 0.524 | par_4 |

| Inf_Nwk | <--- | Mkt_Acc | 0.294 | 0.066 | 3.957 | *** | par_5 |

| Inf_Nwk | <--- | Sup_Acc | 0.291 | 0.062 | 3.921 | *** | par_6 |

| Perf | <--- | Risk_Tak | 0.436 | 0.078 | 5.591 | *** | par_7 |

| Perf | <--- | Inf_Nwk | 0.325 | 0.085 | 4.166 | *** | par_8 |

Discussion of Findings and Conclusion

The present study investigated the impact of risk-taking and informal networks and the implications the relationship have on SME performance. The results revealed that risk-taking has a significant positive influence on the performance of SMEs in terms of growth, profitability and competitiveness. The result is consistent with findings of other studies which establish that risk taking impacts the performance of entrepreneurial firms (Awang et al., 2010; Rao, 2012; Wambugu et al., 2015). However, the findings is at variance with the work of Olaniran et al. (2013) that posited the existence of negative relationship between risk-taking and firm performance in terms of return on assets and return on equity respectively. The findings of this study demonstrate that the tendency of SMEs to stay competitive is directly related to the extent of risk taking. SMEs with reasonable levels of risk-taking are more likely to perform better than those that undertake high or extremely low levels of risk-taking. Risk taking by demonstrating the tendency to commit significant proportion of resources, investment in high risk projects that promises considerable returns as well as pre-disposition to heavy borrowing in the face of uncertainty makes it possible for entrepreneurial firms to improve on performance level. The findings give credence to the resource based theory by demonstrating the important role of risk taking as a strategy that leads to competitive advantage and performance of SMEs.

In the same vein, the results also confirmed that informal networks have positive and significant effect on SME performance. This implies that an increase in informal networks has the likelihood of enhancing the performance of SMEs. These findings align with the works of Machirori (2012); Surin & Wahab (2013); Machirori & Fatoki (2013); Tendai (2013) to the extent that in developing settings like Nigeria, informal networks impact positively on SME performance. This finding is contrary to studies conducted by Watson (2007); Yu & Chu (2010) who have shown that extensive social networking of SMEs owner-managers often lead to decrease in firm’s performance.

There is need for entrepreneurs and SMEs owner-managers to leverage on assistance provided through informal networking relationship with business contacts, family and friends amongst others so as to optimally benefit from opportunities associated with access to business development information, new markets, suppliers and financial support for improved SME performance. Considering the fact that risk-taking and informal networks are integral components of the informal institutional environment, the ability of SME managers to accept and manage risks in addition to seizing opportunities arising from informal networks could guarantee successful performance in the face of uncertainties.

Limitations and Future Research

This study is not without limitations, but also delivers opportunities for future research. In the study, we used SMEs owner managers that registered with SME professional associations in Nigeria without paying attention to the sector they operate. This may limit the generalizability of the results across different SMEs sector grouping. Nonetheless, lessons drawn from this study may be relevant for SME segregations based on sector or industry type. Secondly, this study used subjective performance parameters obtained from primary data. Future research may consider complimenting primary data with secondary data source using financial performance indices derived from audited accounts of SMEs.

References

- Ahimbisibwe, G.M. & Abaho, E. (2013). Export entrepreneurial orientation and export performance of SMEs in Uganda. Global Advanced Research Journal of Management and Business Studies, 2(1), 56-62.

- Aldrich, H. & Zimmer, C. (1986). Entrepreneurship through social networks’. In D.L. Sexton & R. Smilor (Eds.), The Art and Science of Entrepreneurship (pp. 3-23). Cambridge.

- Awang, A., Ahmad, Z.A., Asghar, A.R., Subari, K.A. & Kassim, S.A. (2011). Firm entrepreneurial orientation and knowledge/networking of agro based enterprises in Malaysia: The role of technology and strategy. African Journal of Business Management, 5(22), 9685-9706.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Bentler, P.M. & Bonnet, D.C. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychological Bulletin, 88(3), 588-606.

- Bentler, P.M. (1990). Comparative fit indexes in structural models. Psychological Bulletin, 107(2), 238.

- Belsley, D.A., Kuh, E. & Welsch, R.B. (1980). Regression diagnostics: Identifying influential data and sources of collinearity. Wiley series in probability and statistics: Wiley, New York.

- Birley, S. (1985). The role of networks in the entrepreneurial process. Journal of Business Venturing, 1(1), 107-117.

- Brown, D., Earle, S. & Lup, D. (2005). What makes small firms grow? Finance, human capital, technical assistance and the business environment in Romania. Economic Development and Cultural Change, 54(1), 33-70.

- De Jong, J.P.J. & Hulsink, W. (2012). Patters of innovating networking in small firms. European Journal of Innovation Management, 15(3), 280-297.

- Dess, G.G., Lumpkin, G.T. & Eisner, A.B. (2007). Strategic management: Text and cases. McGraw-Hill Irwin: New York, NY.

- Greve, A. (2003). Social networks and entrepreneurship. Entrepreneurship Theory and Practice, 28(1), 1-22.

- Gunawan, T., Jacob, J. & Duysters. (2013). Entrepreneurial orientation and network ties: Innovative performance of SMEs in an emerging-economy manufacturing cluster. Maastricht School of Management Working Paper No. 2013/28.

- Hair, J.F., Anderson, R.E., Tatham, R.L. & Black, W.C. (1998). Multivariate analysis (Fifth Edition). Englewood Cliffs, NJ: Prentice-Hall.

- Hakimpoor, H., Tat, H.H., Khani, N. & Samani, M.B. (2011). Marketing networking dimensions and SMEs performance: A new conceptual Mosel. Australian Journal of Basic Applied Sciences, 5(10), 1528-1533.

- Holmes-Smith, P. (2006). School socio-economic density and its effect on school performance.

- Hu, L. & Bentler, P.M. (1999). Cut-off criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modelling: A Multidisciplinary Journal, 6(1), 1-55.

- Jack, S. (2010). Approaches to studying networks: Implications and outcomes. Journal of Business Venturing, 25(1), 120-137.

- Kiprotich, S., Kimosop, J., Kemboi, A. & Chepkwony, P.K. (2015). Moderating effect of social networking on the relationship between entrepreneurial orientation and performance of small and medium enterprises in Nakuru County, Kenya. European Journal of Small Business and Entrepreneurship Research, 3(2), 38-52.

- Kothari, C.R. (2004). Research methodology-methods and techniques. New Age International (P) Limited, New Delhi, India.

- Kreiser, P.M. (2011). Entrepreneurial orientation and organizational learning: The impact of network range and network closure. Entrepreneurship Theory and Practice, 35, 1025-1050.

- Lechner, C. & Dowling, M. (2003). Firm networks: External relations as a source for the growth and competitiveness of entrepreneurial firms. Entrepreneurship and Regional Development, 5(1), 1-26.

- Leko-Simic, M. & Horvat, J. (2006). Risk taking propensity and export performance of Croatian exporters. Managing Global Transitions: International Research Journal, 4(4), 313-326.

- Lin, F. & Lin, Y. (2016). The effect of network relationship on the performance of SMEs. Journal of Business Research, 69, 1780-1784.

- Littunen, H. (2000). Entrepreneurship and the characteristics of the entrepreneurial personality. International Journal of Entrepreneurial Behavior & Research, 6(6), 295-309.

- Machirori, T.L. (2012). The impact of networking on access to finance and performance of SMEs in the Buffalo City Municipality, Eastern Cape, South Africa. Doctoral dissertation.

- Machirori, T. & Fatoki, O. (2013).The impact of networking on access to debt finance and performance of small and medium enterprises in South Africa. Journal of Economics, 4(2), 97-104.

- Naldi, L., Nordqvist, M., Sjoberg, K. & Wiklund, J. (2007). Entrepreneurial orientation, risk taking and performance in family firms. Family Business Review, 20(1), 33-47.

- Ogunnaike, O. & Kehinde, O.J. (2013). Social networking and business performance: The case of selected entrepreneurs in Ota, Nigeria. Journal of Business Administration and Management Sciences Research, 2(5), 116-122.

- Olaniran, O., Namusonge, G.S. & Muturi, W. (2016). The role of risk-taking on performance of firms on Nigerian stock exchange. International Journal of Research in Business Studies and Management, 3(3), 36-44.

- Otieno, S., Bwisa, H.M. & Kihoro, J.M. (2012). Influence of entrepreneurial orientation on Kenya’s manufacturing firms operating under East African regional integration. International Journal of Learning & Development, 2(1), 299-320.

- Panzano, P.C. & Billings, R.S. (2005). An organizational level test of a partially mediated model of risky decision-making behaviour.

- Perez-Luno, A., Wiklund, J. & Cabrera, R.V. (2011). The dual nature of innovative activity: How entrepreneurial orientation influences innovation generation and adoption. Journal of Business Venturing, 26(5), 555-571.

- Peteraf, M.A. & Barney, J.B. (2003). Unravelling the resource-based tangle. Managerial and Decision Economics, 24, 309-323.

- Rao, S. (2013). The impact of entrepreneurial orientation and leadership styles on business performance: A study on micro, small and medium enterprises. Journal of Entrepreneurship & Business Environment Perspective, 2(1), 111-118.

- Ray, G., Barney, J.B. & Muhanna, W.A. (2004). Capabilities, business processes and competitive advantage: Choosing the dependent variable in empirical tests of the resource-based view. Strategic Management Journal, 25, 23-37.

- Schallenkamp, K. & Smith, W.L. (2015). Networking and entrepreneurial ventures.

- Schott, T. & Jensen, K. (2016). Firms’ innovation benefiting from networking and institutional support: A global analysis of national and firm effects. Research Policy, 45, 1233-1246.

- Surin, E.F. & Wahab, I. (2013). The effect of social network on business performance in established manufacturing SMEs in Malaysia.

- Stam, W. & Elfring, T. (2008). Entrepreneurial orientation and the performance of high-technology ventures: The moderating role of intra-and extra-industry social capital. Academy of Management Journal, 51(1), 97-111.

- Surin, E.F. & Wahab, I. (2013). The effect of social network on business performance in established manufacturing SMEs in Malaysia.

- Tendai, C. (2013). Networks and performance of Small and Medium Enterprises (SMEs) in different stages of the life cycle: A case study of a small business in the Netherlands. Journal of Communication, 4(2), 89-94.

- Turyakira, P. & Mbidde, C.I. (2015). Networking for SMEs in Uganda: A conceptual paper. African Journal of Business Management, 9(2), 43-49.

- Vanhaverbeke, W., Gilsing, V., Beerkens, B. & Duysters, G. (2009). The role of alliance network redundancy in the creation of core and non-core technologies: A local action approach. Journal of Management Studies, 46, 215-244.

- Ward, J.L. (1997). Growing the family business: Special challenges and best practices. Family Business Review, 10(4), 323-337.

- Wambugu, A.K., Gichira, R., Wanjau, K.N. & Mungatu, J. (2015). The relationship between risk-taking and small and medium agro processing enterprises in Kenya. International Journal of Economics, Commerce and Management, 111(12), 441-455.

- Wang, Y. & Poutziouris, P. (2010). Entrepreneurial risk taking: Empirical evidence from UK family firms. Entrepreneurial Behaviour & Research, 16(5), 370-388.

- Watson, J. (2007). Modelling the relationship between networking and firm performance. Journal of Business Venturing, 22, 852-874.

- Weerawardena, J. & Sullivan-Mort, G. (2006). Networking capability and international entrepreneurship: How networks function in Australian born global firm. International Marketing Review, 23(5), 549-572.

- Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171-180.

- Wiklund, J. & Shepherd, D. (2005). Entrepreneurial orientation and small firm performance: A configurational approach. Journal of Business Venturing, 20, 71-91.

- Witt, P. (2004). Entrepreneur’s networks and the success of start-ups. Entrepreneurship and Regional Development, 16(5), 391-412.

- Yu, S. & Chiu, W. (2010). Social capital and firm performance: The impact of technical uncertainty.

- Zafar, M.J., Yasin, G. & Ijaz, M. (2012). Social networking a source for developing entrepreneurial intentions among entrepreneurs: A case of Multan. Asian Economic and Financial Review, 2(8), 1072-1084.

- Zaheer, A. & Bell, G. (2005). Benefiting from network position: Firm capabilities, structural holes and performance. Strategic Management Journal, 26(9), 809-825.