Case Reports: 2024 Vol: 30 Issue: 2S

Negotiations for International Joint Ventures: Packages and Mitsubishi.

Muhammad Bilal Anwar, Superior University

Muhammad Rafiq, Superior University, Lahore

Citation Information: Anwar, M.B. & Rafiq. M (2024). Negotiations for international joint ventures: Packages and mitsubishi. Journal of the International Academy for Case Studies, 30(S2), 1-11.

Abstract

A crucial negotiation between two corporate behemoths was about to take place in the sprawling metropolis of Tokyo, amidst the tall skyscrapers and busy streets: Packages, a prominent American conglomerate recognized for its cutting-edge technology, and Mitsubishi, he well-known Japanese powerhouse with a history steeped in precision engineering. Executives from both sides assembled in the slick boardroom, their expressions a careful fusion of resolve and strategic calculation, and the air crackled with anticipation. The goal was to create a global joint venture that promised success for both parties as well as the blending of cultures and specialties in an innovative technological project. With a negotiation that could completely change the nature of international cooperation, the stakes were high and the expectations were even higher. Early in May 1993, Mr. Javed Aslam, the Deputy General Manager of Packages Limited, Pakistan (Packages), was thinking back to the joint venture talks his company had been in with Mitsubishi Corporation (Mitsubishi) and Mitsubishi Heavy Industries (MHI) in Japan. The talks were about establishing a plant in Hattar, Pakistan, to produce Biaxially Oriented Polypropylene (BOPP) film. The Packages team has not had an easy time negotiating with the Japanese squad over the past year. The parties had given up on reaching a mutually agreeable resolution because talks had repeatedly broken down. As said by Mr. Javed Aslam: “Prior to commencing negotiations with Mitsubishi, we assumed that both parties would be seeking a win-win agreement. I anticipated that some cultural differences, particularly those involving language, would make things challenging, but I never imagined that the entire process would end up being this laborious and lengthy, requiring countless hours to resolve seemingly straightforward problems’’.

History of Packages Limited

Packages was established in 1957 in Lahore, Pakistan as a joint venture between the Wazir Ali Group, a leading group of family businesses in Pakistan, and AB Akerlund and Rausing of Sweden to convert paper and board into packaging products. Later the company expanded its operations to include manufacture of paper and board. The company grew rapidly and became a dominant force in the paper and packaging industry in Pakistan. By 1992, sales reached Rs 1,737.83 million (approximately US $67.36 million) with net income of Rs 175.95 million (approximately US$6.82 million). Packages' sales grew at an average rate of 19% annually over the period 1988 to 1992. The return on equity over the same five-year period was an average of 21.17% annually. The idea of setting up a packaging company to serve the need for quality packaging in Pakistan's industrial sector was conceived by Syed Babar Ali, a member of the Wazir Ali family. As the first Managing Director of Packages, he formulated corporate guidelines with the objective to make Packages into a significant entity in the Pakistani packaging industry. At the time of Syed Babar Ali's retirement from the position of Managing Director, Packages had achieved a dominant market share in the packaging industry in Pakistan. In his current position as Advisor to Packages, he continues to identify business opportunities and determine the longterm strategic positioning of the company. He has remained the guiding force in establishing joint ventures between Packages and several foreign companies (Table 1).

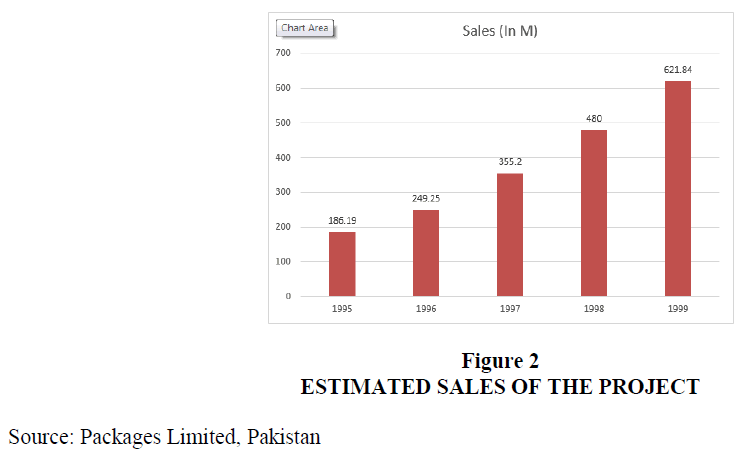

| Table 1 Estimated Sales of the Project | |||||

| Year | 1995 | 1996 | 1997 | 1998 | 1999 |

| Sales (Rs Millions) |

186.19 | 249.25 | 355.20 | 480.00 | 621.84 |

The management at Packages focused on building the company to maintain its competitive edge in the market. Emphasis was placed on upgrading existing operations to provide better quality products to customers and to add new product lines to widen its customer base. Over the years, Packages had grown into other packaging related businesses and diversified intonon-related businesses as well. The senior executives of Packages headed each of these various projects (Figure 1).

In 1981, Packages diversified into manufacture and marketing of consumer products. Initially it introduced a line of paper products for personal use and later included products for the home market as well. The line of products included facial tissues, kitchen and toilet rolls, and paper cups and plates. In 1992, RicePak Private Limited was incorporated as a wholly owned subsidiary of Packages. In 1993, Packages began manufacturing and marketing the Scott brand of tissues in Pakistan under license from Scott Worldwide Incorporated. At the end of 1993 another joint venture was formed between Packages and Coates Lorilleux of France to produce printing ink. The industrial users imported most of the printing ink used in Pakistan as concentrate. As a result of the collaboration with Coates Lorilleux, Packages developed the capability to fully cater to its own ink requirements as well as sell to others (Figure 2).

Mitsubishi Corporation

The three major economic organizations in Japan prior to World War II were Mitsubishi, Mitsui, and Sumitomo. Mitsubishi and other major Japanese enterprises were divided into smaller, independent businesses following the war in order to prevent the consolidation of undue economic power. Most of these businesses, including Mitsubishi Heavy Industries (MI-11) and Mitsubishi Corporation (Mitsubishi), grew over time to become major global players. With over 700 distinct items produced, including steel structures, air conditioning, pollution control systems, industrial power plants, and high-speed transportation systems, MHI rose to prominence as the industry leader in heavy machinery manufacturing.

In Japan, corporations formed business partnerships by appropriately introducing themselves to one another through a third party known as a Shokaisha, who was generally aware of the two individuals. The Shokaisha attended several talks and set up the first contacts between the two parties. In addition to being particularly significant in Japanese commercial dealings, Shokaishas were also significant for Japanese corporations operating abroad. Mitsubishi served as a principal or an agent in trade transactions between two parties, offering Shokaisha services to businesses all over the world.

Mitsubishi Corporation maintained liaison offices in Pakistan, namely in Karachi, Lahore, and Islamabad. Mitsubishi has formed a joint venture with Dewan Suleiman, a local partner, for a $100 million project to create polyester yarn for textiles. Mitsubishi partnered with a Korean company to contribute 25% of its profits to the equity fund. The endeavor had yielded great success. There were also several additional initiatives being worked on in association with Pakistani businesses (Figure 3).

The Product and Its Market

The use of polypropylene film in food and other consumable packaging has become increasingly common. It served as the outer layer of the packaging or as wrapping that came into direct touch with the product. Items with polypropylene film wrapping had a 3000% longer shelf life than those covered in polythene. High-quality polypropylene film has features like consistent film thickness, little static production, and non-stickiness on the wrapping machine (Figure 4). The wrapping didn't shrink or distort on the package because of its uniform thickness. The Bubble process and the Tenter process were the two methods used to manufacture the polypropylene produced using the Biaxially Oriented Technology. In 1992, average market price of imported BOPP in Pakistan (Table 2).

| Table 2 1992 Average Market Price of Imported Bopp in Pakistan | ||

| Exchange Rate @ Rs 30.00=US $1.00 (US $ per Kg) | Europe | Far East |

| Cost & Freight Price of BOPP (C&F) |

US $1.31 | US $1.23 |

| International Trade Price (ITP) (Rs per Kg) | US $1.65 | US $1.50 |

| C&F Price | Rs 39.30 | Rs 36.90 |

| ITP | Rs 49.50 | Rs 45.00 |

| Import Duty 80% on ITP | Rs 39.60 | Rs 36.00 |

| Duty Paid Value (C&F and Duty) |

Rs 78.90 | Rs 72.90 |

| Sales Tax 15% on Duty Paid Value |

Sales Tax 15% on Duty Paid Value |

Rs 10.93 |

| Iqra Surcharge 5% on C&F Price |

Rs 1.96 | Rs 1.84 |

| Import License Fee 6% on C&F Price |

Rs 2.35 | Rs 2.21 |

| Miscellaneous Expenses 7% on C&F Price | Rs 2.73 | Rs 2.58 |

| Flood Relief 2% on C&F Price |

Rs 0.78 | Rs 0.73 |

| Market Price of BOPP In Pakistan | Rs 98.54 | Rs 91.19 |

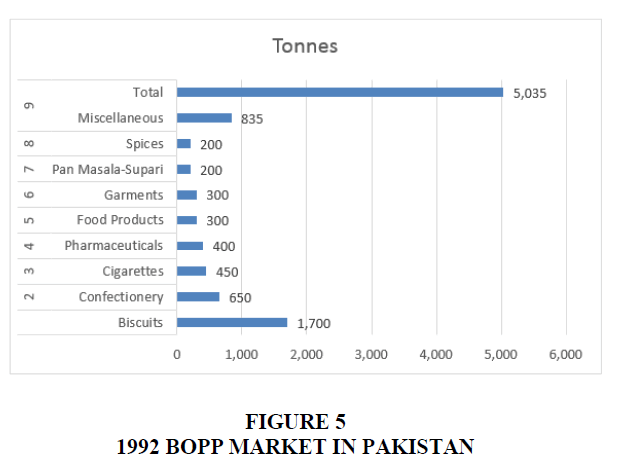

While the Tenter technique yielded film of comparatively higher quality, the previous method did not guarantee a uniform thickness in the film (Table 3, Figure 5).

| Table 3 1992 Bopp Market in Pakistan | ||

| Sr. No. | Industry | Tonnes |

| 1 | Biscuits | 1,700 |

| 2 | Confectionery | 650 |

| 3 | Cigarettes | 450 |

| 4 | Pharmaceuticals | 400 |

| 5 | Food Products | 300 |

| 6 | Garments | 300 |

| 7 | Pan Masala-Supari | 200 |

| 8 | Spices | 200 |

| 9 | Miscellaneous | 835 |

| Total | 5,035 | |

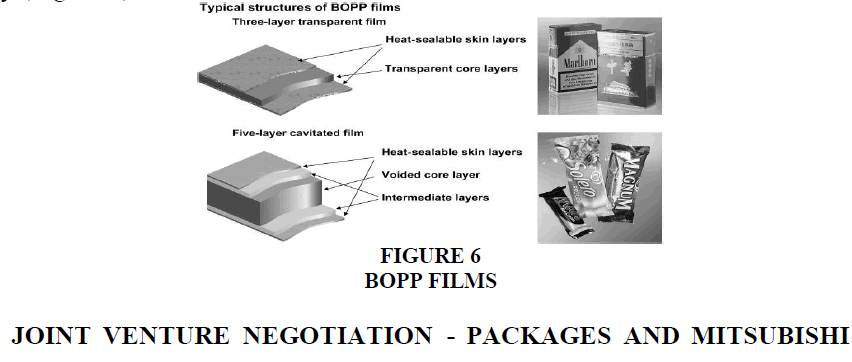

The variety of films made with Biaxially Oriented Polypropylene (BOPP) comprised films that were chemically coated, co-extruded, and mono-extruded. These goods' applications varied according to their composition. In contrast to the co-extruded film, which had many layers of polypropylene, the mono-extruded film only had one layer. The product benefited from an extra scent and an oxygen barrier from the chemically coated variety (Figure 6).

Joint Venture Negotiation - Packages and Mitsubishi

In the process of establishing a joint venture between Mitsubishi and Packages in Pakistan, Mr. Yamamura, the head of Mitsubishi's operations in Pakistan, took the initiative by approaching Syed Babar Ali in early 1992. Recognizing the potential for collaboration, Mr. Yamamura facilitated a meeting between senior executives of Mitsubishi and Syed Babar Ali in China, laying the foundation for further discussions.

Syed Babar Ali, impressed by Mr. Yamamura's proactive approach, expressed his surprise at the level of initiative displayed. Mr. Yamamura's favorable opinion of Packages and Pakistan played a crucial role in advancing the negotiation process. In April 1992, Syed Babar Ali visited Mitsubishi Corporation senior executives in Japan, proposing a business partnership between the two organizations. Syed Babar Ali, having already established joint ventures with European firms, saw this as an opportunity to expand collaboration with a Japanese company, driven by his admiration for Japanese business style and ethics.

Highlighting Mitsubishi's impeccable reputation in Pakistani business circles and citing a successful recent joint venture with a business in Pakistan, Syed Babar Ali underscored the promising prospects of partnering with Mitsubishi. The negotiation teams from both companies were poised to discuss the nature of the joint venture, and the significance of this business relationship was emphasized by a remarkable gesture from the Mitsubishi senior executive. Personally informing fellow senior executives and relevant managers, he conveyed the importance of this collaboration, setting the stage for strategic discussions between Mitsubishi and Packages (Figure 7).

Initial Phase

Early in May 1992, Mitsubishi and Packages started having preliminary discussions. After a few casual conversations, the Mitsubishi office in Lahore was able to persuade Syed Babar Ali to support the establishment of a BOPP film plant. For the first time, Mitsubishi chose a joint venture partner before choosing the product, according to the manager of the company's Lahore office.

“Packages perfectly matched our requirements for a joint venture partner.”

During a brainstorming session on product diversification in 1987, Packages' initial idea to include Polypropylene film in its product line was proposed. Through a collaboration with a nearby business, Mitsubishi attempted to sell Packages MHI's cutting-edge BOPP film manufacturing technology two years later. At the time, Pakistan had an 1,800–2,000 tonne annual demand for BOPP film. Packages' management decided not to move forward with the proposal after determining that there was insufficient market demand for the project. In this regard, a senior Mitsubishi executive from Lahore visited Packages, but he was unable to persuade Packages to accept the project. But now, Packages' top executives were eager to collaborate with Mitsubishi Corporation on a joint venture. The negotiation team was led by Deputy General Manager Javed Aslam on behalf of Packages, with assistance from General Manager Tariq Hamid, Finance Manager Khalid Yaqub, and Sales Manager Saulat Saeed. While Mr. Aslam and Mr. Saeed attended every meeting, Mr. Hamid and Mr. Yaqub only attended a few of the negotiation sessions.

By mid-June 1992, Packages hired Management International (Private) Limited, a reputable local market research company, to conduct a market study. As per the study's findings, two Karachi-based companies, Polycraft Ltd and Metaplast Ltd, produce the majority of the BOPP film used in Pakistan, with the remaining 50% being imported. Due to its poor quality, the locally produced film could not meet requirements for high quality. With a 1,800-ton production capacity, Polycraft produced 1,200 tons annually, while Metaplast had a 3,000-ton production capacity and produced 1,200 tons annually as well.

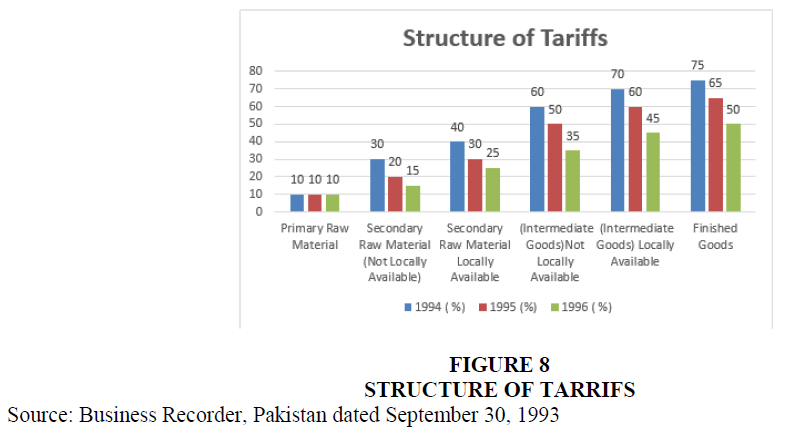

According to the market survey, Pakistan's demand for BOPP film in 1992 was projected to be 5,035 tonnes. Packages asked Mitsubishi Corporation to submit a price bid for a plant with an annual production capacity of 4,000 tonnes based on these figures. Packages also looked into the potential for obtaining technology from Hoechst, a German company that produces and distributes medications and insecticides in Pakistan. In Germany, among other things, they produced polypropylene pellets, which were then utilized in the casting process to create polypropylene film. Packages management, however, believed that this film's qualities did not meet the demands of the premium BOPP film market and determined that a product made with Mitsubishi technology would be more appropriate. The Pakistani government formally declared in September 1992 that import taxes on raw materials, intermediate goods, and finished goods would be gradually reduced from 1993 to 1997.

Polypropylene granules were categorized as secondary raw materials, and BOPP film was classified as an intermediate good. Duty on imported BOPP film was to be lowered from 80% to 45%, and duty on BOPP granules was to be lowered from 50% to 15% (Table 4, Figure 8).

| Table 4 Structure of Tariffs | |||

| Category | 1994 ( %) | 1995 (%) | 1996 (%) |

| Primary Raw Material | 10 | 10 | 10 |

| Secondary Raw Material | |||

| Not Locally Available | 30 | 20 | 15 |

| Locally Available | 40 | 30 | 25 |

| Intermediate Goods | |||

| Not Locally Available | 60 | 50 | 35 |

| Locally Available | 70 | 60 | 45 |

| Finished Goods | 75 | 65 | 50 |

Second Phase

The Mitsubishi team arrived to begin formal talks between the two parties in the first week of September 1992. The visiting team also included a representative from MHI and another from Mitsubishi, Lahore, in addition to representatives from Mitsubishi, Japan. The MHI representative gave details on the different types of BOPP film that are available and gave Packages information on the specific BOPP film manufacturing technology during the first few meetings. The parties had a thorough discussion about the degree of technology and expertise MHI was ready to transfer to Packages. MHI was happy to teach plant operators in order to share their expertise. Mitsubishi Corporation wanted to include a provision in the joint venture agreement that would require Packages to repay Mitsubishi's investment in the event that the business experienced continuous operational losses. Mr. Javed Aslam, who was already offended by the exorbitant price that Mitsubishi Corporation had quoted, said of this proposal, "It seemed like something was off from the beginning. This condition, in our opinion, is completely unfair and benefits the other party. We got the impression that they weren't trying to build a lasting bond with us."

The two sides' disagreements persisted on the crucial topic of equipment price. At this point, the Packages team expressed their concerns to Mitsubishi since they were starting to doubt the technology that the company was offering. Following a series of meetings, the two parties decided that Packages would look into other sources for equipment suppliers and that they would pick up again with their talks.

Syed Babar Ali traveled to Europe in October 1992 to inquire about additional suppliers. Manufacturer of industrial equipment in Germany, Bruckner, provided Mitsubishi-like technology- based equipment at a reduction of 20%. The Bruckner plant's cost of production for BOPP film was comparable to Mitsubishi's cost per unit. Bruckner did, however, decline to offer any operational or technical support beyond the services of a retired engineer to assist with machinery setup. Furthermore, there was no chance of a joint venture between the two businesses. When Mitsubishi was informed of the Bruckner price quotation, they declined to match it, stating that their product was better and that there was no way to compare the two prices.

The Packages Board of Directors gave its approval to the partnership with Mitsubishi in December 1992. Packages and Mitsubishi convened in mid-December to deliberate on the preliminary version of the joint venture agreement. They discussed a variety of topics, such as project financing, management, and any ramifications for the law. The project would be established as a public limited company with 40% equity and 60% debt, as agreed upon by both parties. Investment firms, as well as regional and international banks, were to fund the debt. Packages held a 40% financial stake in the equity fund, with Mitsubishi having committed to contribute 30% of it. A public offering was to be used to finance the final 30% of the equity.

Last Phase

The negotiations recommenced in April 1993. In relation to the liability of business losses, Mitsubishi Corporation stipulated that Packages would only be required to purchase Mitsubishi shares at book value if TriPak's cumulative losses exceeded its paid-up capital. "We agreed to this proposal since under this eventuality Packages would not be required to pay any cash to Mitsubishi because the book value of the shares would be zero," Mr. Javed Aslam said in response to this offer. We refused to give them even a single additional rupee." The agreement also included a new clause requiring the opening of a letter of credit within six months of the contract's signature. On 13 April 1993, the "memorandum of understanding" was signed. The question of the equipment's cost was still open at this point. Given that the difference between the two prices was roughly Rs 50 million (US $1.8 million), Bruckner's price offer was obviously more acceptable than MI-H's. Mitsubishi's 51 million rupees (US $1.9 million) equity investment was nearly equal to the savings from choosing the Brockner equipment. The management of Packages now turned to Syed Babar Ali to make a final determination on this issue. He suggested that they go with MHI equipment, but he also asked them to negotiate for the lowest cost. Although the managers were unhappy that MI-II cost more than Bruckner's quote, they acknowledged that selecting MHI was "now an entrepreneurial decision and not a managerial one." Packages and MHI recommenced their negotiations. Despite having good English communication skills, there were times when the parties found it difficult to comprehend one another's viewpoints. The Japanese were very thorough in their work, and their conversations frequently repeated themselves. Every now and then, Lahore-based Mitsubishi representatives had to step in to advance the conversation.

During the course of the negotiations, the rupee's value increased relative to the dollar and the yen (Table 5 & Table 6). Packages received a sales proposal from a British company that provided Bruckner with some of the BOPP equipment at the same time. MHI was paying far more for comparable equipment that it purchased from a Japanese business. The Packages team asked MM to lower their price after suggesting that they replace some of their equipment with British-made items. There would be an extra savings of Rs 30 million (US $1.1 million) if they consented to purchase the machinery from the British company. Regardless of the source, MHI declined to reduce their price. The Packages team believed at this point that the Japanese were not attempting to reach a mutually beneficial agreement. Mr. Aslam expressed his displeasure with the negotiation process in a letter to the relevant senior executive at MHI.MHI representatives gave Packages an option to buy a 6,000 tons capacity plant for Y720 million (US $6.4 million) when it looked like they were at a standstill. The cost of BOPP film from the 6,000 tons plant was the same as the cost per unit from Bruckner's plant due to the greater economies of scale (Table 7 & Table 8) Packages made the decision to carry out a second market study at the end of April 1993 in order to ascertain the rate of increase in Pakistan's demand for BOPP films. According to the survey, Pakistan's demand for BOPP film would rise by 12% to 15% annually.

| Table 5 Foreign Exchange Rates Value of Rupee to Yen (Close of Week Rates) | ||||

| 1992 | 1st Week | 2nd Week | 3rd Week | 4th Week |

| January | 0.200 | 0.193 | 0.201 | 0.197 |

| February | 0.198 | 0.195 | 0.193 | 0.192 |

| March | 0.189 | 0.187 | 0.188 | 0.187 |

| April | 0.189 | 0.189 | 0.188 | 0.189 |

| May | 0.191 | 0.195 | 0.195 | 0.194 |

| June | 0.198 | 0.199 | 0.200 | 0.202 |

| July | 0.203 | 0.202 | 0.200 | 0.198 |

| August | 0.199 | 0.200 | 0.202 | 0.205 |

| September | 0.205 | 0.202 | 0.210 | 0.210 |

| October | 0.210 | 0.209 | 0.206 | 0.206 |

| November | 0.207 | 0.207 | 0.208 | 0.207 |

| December | 0.208 | 0.210 | 0.206 | 0.207 |

| 1993 | ||||

| January | 0.208 | 0.207 | 0.209 | 0.210 |

| February | 0.211 | 0.218 | 0.222 | 0.227 |

| March | 0.226 | 0.228 | 0.230 | 0.234 |

| April | 0.236 | 0.243 | 0.240 | 0.244 |

| Table 6 Foreign Exchange Rates Value of Rupee to US Dollar | ||||

| 1992 | 1st Week | 2nd Week | 3rd Week | 4th Week |

| January | 24.868 | 24.868 | 24.828 | 24.790 |

| February | 24.798 | 24.798 | 24.798 | 24.828 |

| March | 24.878 | 24.948 | 25.049 | 25.129 |

| April | 25.129 | 25.200 | 25.200 | 25.200 |

| May | 25.250 | 25.250 | 25.250 | 25.250 |

| June | 25.280 | 25.280 | 25.280 | 25.280 |

| July | 25.280 | 25.280 | 25.280 | 25.280 |

| August | 25.280 | 25.280 | 25.280 | 25.230 |

| September | 25.230 | 25.230 | 25.230 | 25.230 |

| October | 25.250 | 25.301 | 25.301 | 25.351 |

| November | 25.471 | 25.653 | 25.653 | 25.723 |

| December | 25.773 | 25.773 | 25.804 | 25.854 |

| 1993 | ||||

| January | 26.005 | 26.055 | 26.105 | 26.105 |

| February | 26.307 | 26.407 | 26.407 | 26.407 |

| March | 26.323 | 26.659 | 26.809 | 26.623 |

| April | 26.809 | 26.809 | 26.860 | 26.860 |

| Table 7 Costs of Production Bruckner 4000 Tonne Capacity Plant | |||

| COGS | Selling & Admin | Other Charges | |

| 1000-2000 | 65 | 5 | 0.04 |

| 2000-3000 | 61 | 5 | 1.07 |

| 3000-4000 | 58 | 5 | 1.74 |

| 4000-5000 | 58 | 5 | 1.83 |

| 5000-6000 | 55 | 5 | 1.46 |

| Table 8 Mitsubishi 6000 Tonne Capacity Plant | |||

| COGs | Selling & Admin | Other Charges | |

| 1000-2000 | 66 | 5 | - |

| 2000-3000 | 62 | 5 | 0.07 |

| 3000-4000 | 59 | 5 | 1.10 |

| 4000-5000 | 58 | 5 | 1.64 |

| 5000-6000 | 57 | 5 | 1.95 |

Depreciation Straight line over a five-year Period

Commercial interest rate 20%

Corporate tax rate 50%

Source: Packages Limited, Pakistan

By now, Packages and Mitsubishi were exerting pressure on Mr. Javed Aslam to decide whether to move forward with the project and, if so, under what terms. Along with choosing between the 4,000 and 6,000 tons capacity plants, he also had to determine what counter offer Packages should make to MHI. "The senior management at Packages had decided early on in the negotiation process to form a joint venture with Mitsubishi,” but the ultimate decision of whether to proceed with the project was left to Mr. Javed Aslam.

Conclusion

Upon reflection, the talks between Packages and Mitsubishi represent a critical turning point in their endeavor to form a joint venture. The accomplishments include the bringing of visions into harmony, the laying of the groundwork for agreements, and the development of mutual respect and understanding. Going forward, the concerned parties might think about taking a few crucial actions:

a) How could they strengthen their lines of communication to guarantee continued openness and confidence?

b) What tactics could they use to deal with any operational complexities and possible cultural differences?

c) Furthermore, how are they going to adjust to the changing dynamics of the market and technological advancements?

The organization and its managers should give careful thought to these issues and make strategic decisions based on their findings. A joint venture's success requires more than just signing agreements.