Research Article: 2019 Vol: 20 Issue: 1

Necessity of Effective Economic Valuation of Environmental Resources

Ahmad Fatahi, Ardakan University

Foad Eshghi, Sari University of Agricultural Science and Natural Resources

Roya Amirhajilo, Ardakan University

Abstract

Valuation is one of the most important approaches in order to reducing destruction of natural resources and the environment. However the economic approaches canâÂÂt determine overall functional value of the environment, but also they denote the importance of more valuation in order to determine the priority of resource utilization. As well as the average prices increase, yearly valuation in most developing countries doesnâÂÂt work anymore, because it has high inflation rate and decreases each year. Purpose of this study was to use dollar and gold rates as two essential agents for estimate the value of natural resource. EVIEWS and Shazam software were used for the parameter estimation of the model. The results showed that valuation of gold and dollar are equal over time, so increase the prices, increase natural resources value and decrease the overuse of them. To this end, we can use a universal unit, for checking the value of natural resources and environmental products, which firstly approved in other countries and secondly; its value doesnâÂÂt decreases over time. This is especially effective in comparing valuation of different places in various times. This studyâÂÂs results suggest that in past six years, discounted moneyâÂÂs value of country was 96.2 and this value for gold and dollar was 3.36 and 3.23, respectively. From the little difference between the value of money and the dollar and gold, we can conclude that dollar and goldâÂÂs rate can be more effective than monetary value. So that, this method, we can compare different resources values in different countries and at different years easily.

Keywords

Valuation, Environment, Monetary, Valuation Techniques, Gold Rate, Yazd Plain-Ardakan.

Introduction

Environmental issues are of increasing concern to the community and are often presented to Commonwealth, state and local governments for attention and action. This increased awareness acknowledges the importance of environmental benefits and costs, the need to value them (Binning & Canberra Resource Assessment Commission, 1995). The term value in economics has a precise definition, it is the price individuals are willing topay in order to obtain a good or service. Thus, the functionality of economic value is between one entity and a set of human preferences (Lipton et al., 1995). Different empirical models can be formulated to estimate the expected WTP of a sample of respondents and then, through aggregation, the social valuation of the good is inferred. (Bengochea-Morancho et al., 2005) one of the strengths of the technique is that it measures both use and non-use values of an environmental resource (Robinson, 2001). Dollar-based ecosystem valuations are in part a communications strategy. Dollar valuations translate nature’s complicated role in our well-being into a simple bottom-line message that speaks to people in understandable monetary terms. It is clear that monetary estimates of the value of ecosystem services could immediately be applied within decision frameworks that already measure outcomes in economic terms (Boyd, 2011). Valuation and determination of the prices of natural resources products is very difficult because of product’s nature and diversity. But because the assets of natural resources are very essential and human life depends on it, economics, considering its complexity and developed some methods for evaluating and determining their prices regarding units which are comparable to other products in another sectors (Bateman & Kenneth, 2003; Fattahi, 2009).

In the past, human population was low, so that using technologies to exploit the Earth's resources were limited, therefore human impact on the environment was limited to a place and nature could rebuild itself again.

Moreover, the effect of long-term use of natural resources wasn’t so significant. The basic problem becomes crucial since the human population was increasing significantly and power of technologies become more and more, so that human’s effect on the natural resources wasn’t locally anymore and become extensive.

On the other hand, human technological progress in the last two decades has increased the power of being effective in the environment exclamatory and it make environmental problems caused by human activity spread gradually from the local level to the regional level and eventually, global level (Bengouchea-Morancho et al., 2005; Fattahi, 2009)

Economists calculate how much people would like to pay for protecting or improving servicesand then evaluate the value of ecosystem services regard to people’s opinion and this process called “economic approach of evolution”.

According to this definition, natural resources produce some goods and give people services so that they can have more welfare life. Therefore, from people standpoint, economic valuation predicate as quantifying the value at common monetary units.

In recent decades many researcher have addressed to the issue of natural resources valuation. A study in china have analyzed Guangzhou residents’ motivations and Willingness-To-Pay (WTP) for an urban biodiversity conservation program in the National Baiyun Mountain Scenic Area and the annually median WTP to support the urban conservation project have been estimated in this study (Chen & Jim, 2010). Chen et al. (2009) have evaluated the total value of all the water resources in Chinese rivers and contributions of them to the real wealth of the Chinese economy (Chen et al., 2014). Researcher in Belgium has explored the impacts of residents’ perceived importance of various ecosystem services and has stated financial constraints on their willingness-to-pay for the proposed restoration project. About values of hunting in Sweden, Boman et al. (2011) conducted a research based on two national contingent valuation studies dealing with the extent and economic values of moose hunting. Moose hunting value and its determinants were compared now and two decades ago and result showed that significant changes have taken place. Remoundou et al. (2014) examined whether the value of environmental goods is sensitive to the source of public financing in Turkey and Ukraine. They conducted choice experiments on the valuation of a marine restoration program in the Black Sea. The results reveal that the marginal value of public money depends on the funding source and attribute values are sensitive to the trade-off implied by the funding scheme. In tow scholarly work, hoteling’s valuation principle has been tested by using cross-sectional data on gold mines and for nonrenewable resources. Matched pairs tests indicated that prediction accuracy is roughly comparable across all of the equations examined (Eisenhauer, 2005).

Valuation on the environment shows that these resources are important and rare, although there is no special market for that. To this end, we can determine the scale of being rare with valuation the environment.

In every country, natural resources are critical infrastructures for economic development. This is especially true about developing countries. Products which are produced by natural resources has a large rang of variety and are specialized for human’s uses, so that part of their value belongs to use values (Fattahi, 2009).

“Pricing” explains scarcity of resources, but actually calculated monetary values are no longer valuable because of decreasing money’s value, as well as it can’t determine actual value of resource by the time.

“Devaluation” is a modern monetary policy, consist the devaluation of the currency in a country, with respect to gold or other foreign currencies. This event increases balance of export and decreases import, because other countries find this product inexpensive. This phenomenon, has negative effect on trade, industry and valuable papers market and decreases purchasing power, as well as it decrease the value of raw sources in countries with high rate inflation and makes the exporting country trades natural resources extremely. So selecting one of money’s value decreasing methods can solve decrease in value by the time problem.

Calculated valuations should demonstrate scarcity of resources well and methods which determine resources value less than actual bring pernicious consequences, for example extreme using of resources and destruction, because money can’t reflect actual value of resources.

The inflation rate is the agent which can shows actual value of money. In this study, we tried to calculate the value of environmental products regarding to dollar price and gold rate, according to the author, “Fattahi” and his colleagues studies in field of valuation ground waters in Yazd-Ardakan plains.

Literature Review

World Gold Valuation

Many agents has effect on gold valuating but in summary, world gold value actually determine by the market supply and demand and the global economy, usually dollar is a global currency and is a rival for gold, whenever dollar value decreases, gold price increase inversely.

In London, Sydney and the United States market, the situation is a little different and transactions are like to pay in US dollars for per ounce. Oz is a unit which is used for weighing things “oz” is the acronym of ounce. One ounce equals 35.28 gms and one sixteenth pound. “Oz” unit has been used in various devices, such as English units, Imperial units and common units of United States. Oz is a unit which is used for weighing materials as well as precious metals such as gold, silver, platinum, etc. we use once troy unit equals to 31.1034768.

Oil and gold have some effective agents in common which cause their prices grow together most of the times, because there is a relation between these two indicators with dollar. As an example, increasing dollar price cause decrease in oil price and consequently gold price, but there is no direct relation between oil price and gold.

Oil is an effective indicator, because decreasing in oil price cause decreasing in prices and eventually, global inflation. In such situation, investors tend to invest their saving mode to their current state.

In this current situation, according to global economics, gold is a strategic reserve for preserving the value of assets that can be sold and so that provide requiring capital for economic circulation. Hence, this work increase gold offering, on the contrary, increase or decrease the price of gold will have no effect on oil prices. Changing in gold price also has effect on global financial markets, especially dollar market.

Gold sometimes play a prior role or latter role, in global currency market. But what is clear is dollar price characterizing the role of gold, because dollar valuated in global market.

Increasing in dollar price will increase gold price for purchasers who wants to buy things in the other currencies, so that gold demanding and its price decrease. Oppositely, decreasing in dollar price cause decrease in gold price, so demanding increases and gold prices increase, finally.

Generally gold price has an inverse relationship with dollar, but in some special cases, this relationship is incoherent for some reasons.

Dollar Price

The definition of dollar is a rial value which is equal to 1 American dollar. The dollar value depends on many agents, including economic, social, political, central banks and government priorities and the most important one, is the supply and demand of market. If each of these agents changes, dollar rate can change, too. After 1st World War, for some reasons, including the issue of trade balance or fluctuations in the price of gold, etc. Some countries began to publish fiat money and offend of maintenance the bankroll.

In 1994, according to the efforts of America, in the “Bretton-Woods conference”, it was decided that only America can hold gold as a financial support equal to the released amount and other country only can hold dollar as their financial support and whenever it was necessary, America is responsible for giving them gold, instead of dollar (Isaac, 2018).

This system lasted until the 70’s when the costs of the Vietnam War and domestic inflation in America and America’s debt to other countries, especially European countries increased and the dollar has become the hot money and European countries have started to exchange the dollar into gold.

Finally, in early 1971, President Nixon exclaim that America wont exercise the commitment in the Berton-woods conference anymore, after that speech, the dollar was published without bankroll and became as valuable and since then, America sometimes reduce the value of the dollar by their economic interests and thus the value of the dollar reduces its foreign debts this occurrence make the opec secretariat began some studies in the field of determining the value of oil in the other units except dollar, because they deduced that if they determine the value of oil in the other units, the dollar value decreases and cause a decreasing in the power of purchasing of opec’s members or the other oil producers and it bring the recessions and transmit the America’s inflation to the other countries.

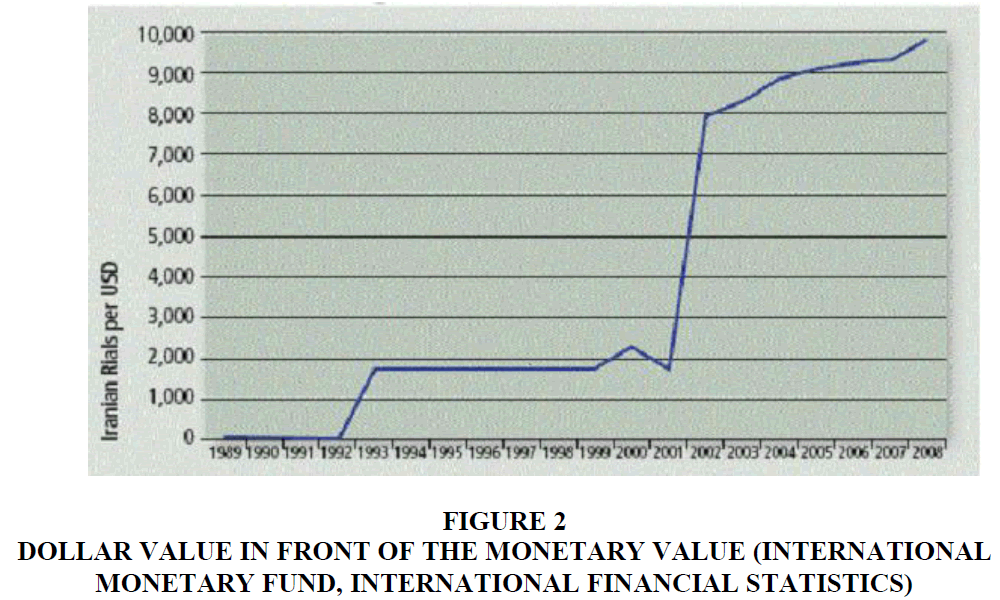

In the diagram below, we can see the procedure of increasing dollar in comparison to rial, by the authority of the global money case.

By studying this Figure 1 we can deduce that the dollar value in front of the monetary value has increased by time and cause some problems including deduction in the interior monetary value, or increasing the exporting because of the cheap price of interior goods, by time.

Hence, generally we can calculate our resources but using gold and dollar rates and compare the resources by the global indicator, otherwise we face with the exporting of raw resources to the other countries and cause depleting natural resources & overthrow the infrequent animals by passing the time.

Methodology

In this study, the MS Excel (14.0.4756.1000, 2010), EVIEWS (7, 2010) and Shazam (10.2, 2011) software were used for the statistical analysis of variables, mathematical calculation and parameter estimation of the model (Figure 1).

The relation between profit rate and utilization of natural resources is straight which increases as utilization rate increase, so that it has some consequences including destruction of the environment. As an example, there is a relation for Trees output:

For maximizing Trees output we should let the tree grow until its income becomes equal to its assets income in the other works. On the other hand, utilization rate and revenue rate become equal.

Where, “r” indicates utilization rate and is revenue rate of tree’s’ growth (Soori & Ebrahimi, 2011).

Actually, as utilization rate increases, balance of utilization of natural sources decrease and using natural resources become more and more every day.

To this end, because of decreasing in natural resources value by increasing utilization rate, using resources increase and the resources can’t achieve their maximum growth, resulting in early harvest of natural resources before maximum efficiency time.

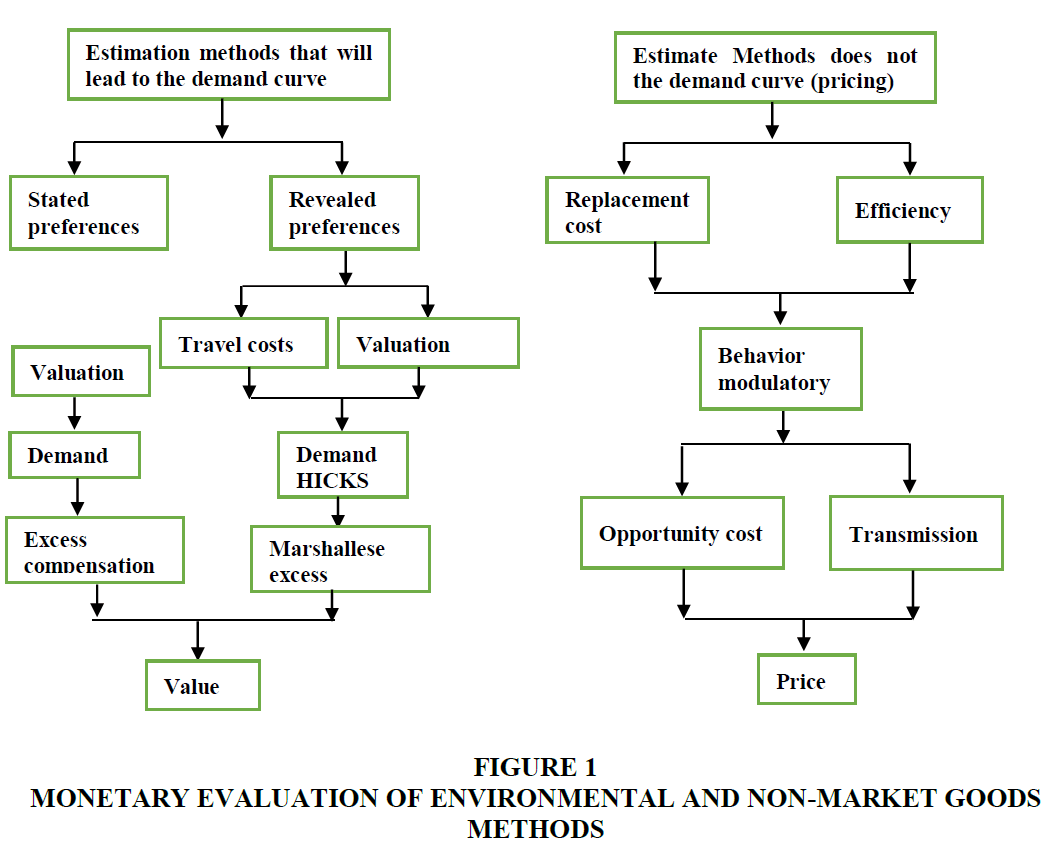

Generally, valuation means to find a numerical value for what its value is relative. Nowadays, one of the main functions of environmental economics, is to obtain a value for the non- use of the environment and depletion of natural resources, depicted in Figure 2 (Bateman & Jones, 2003).

Figure 2: Dollar Value In Front Of The Monetary Value (International Monetary Fund, International Financial Statistics)

There are several methods for valuation by various ways for utilization of natural resources.as an example; there are some methods for monetary valuation for valuation or pricing of natural resources that eventually calculate the real price or value of study area. To this end, we can utilize dollar and gold as two essential agents for decreasing monetary value to studding pricing processes (Bateman & Jones, 2003).

The Future Monetary Value

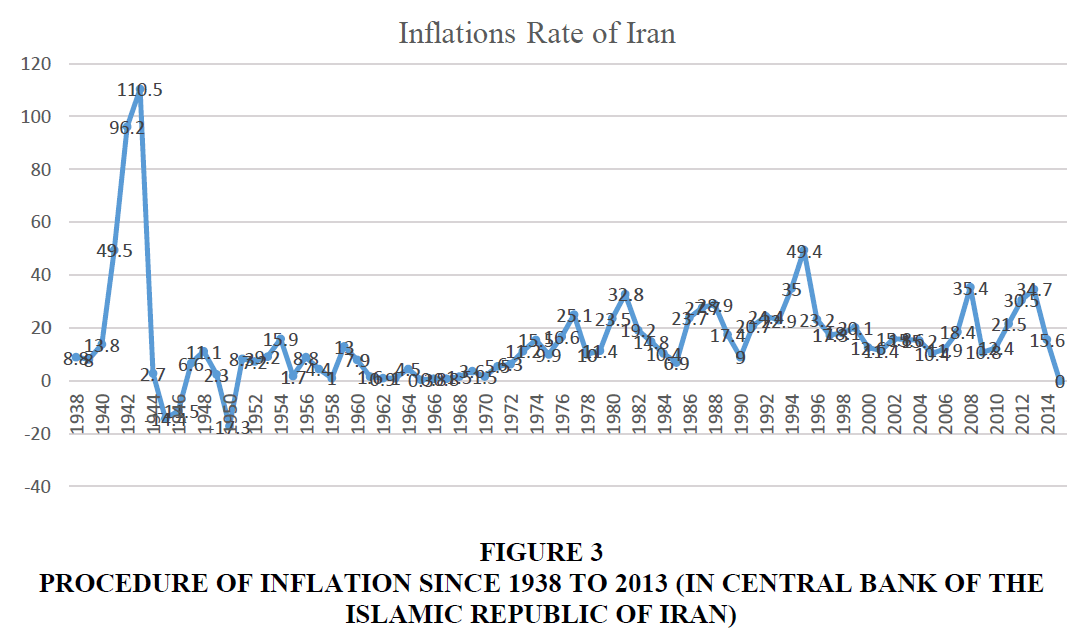

The increasing of inflation rate and devaluation of monetary value decreases the resources value and follows overuse of the resources. Figure 3 demonstrates the procedure of inflation since 1316 to 1391 in the country, as you can see in the Figure 3, the inflation rate was always positive & the ascendant procedure of this rate, demonstrates the monetary value’s decreasing.

Figure 3: Procedure Of Inflation Since 1938 To 2013 (In Central Bank Of The Islamic Republic Of Iran)

The future monetary value is one of the most important concepts in financial works, which is explanatory of the monetary value in time. On the other hand, at this time, we can say the money that we have, has more value than the money which we can have in future. We can obtain the monetary value in past by this relation:

Here, FV means the future value, PV means the monetary value for now of the inflation rate and n demonstrates “year”.

By using this relation we can calculate the decreased monetary value in different years, unit age inflation rate.

Results And Discussion

We utilize the study of Fattahi (2009) about the ground waters in Yazd-Ardakan plains for demonstrating the procedure of decreasing the valuations. In this study, they determined the recreational value of the ground waters and measures how much people would like to visit these places in 2010.

The results showed that the total recreational value is 1.38 billion rials as well as by considering the scale average of inclination to pay entrance price for using the landscapes; they calculated this price about 4700 rial.

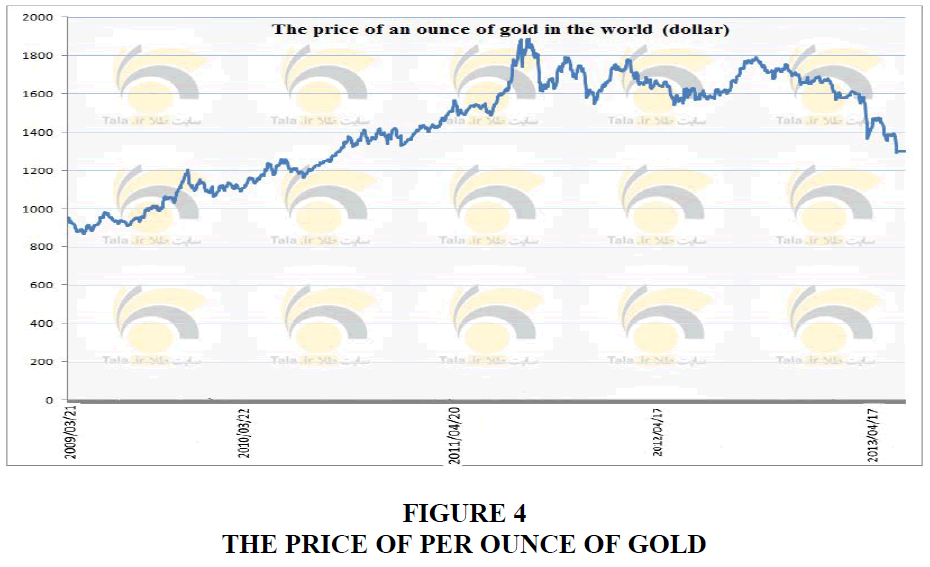

The price of these ground waters was about 1.38 billion in 2010 at the time that per ounce was equal to 1150 dollar, so that the price of per ounce was equal to 11477000 rials, therefore we can utilize the gold as an agent for valuing the ground waters in gold value equivalent 120.240 ounce.

In 2016, per ounce‘s value was equal to 38592000 rials, do its actual value is about 4.46 billion now. Table 1 demonstrates the creational value of the four areas of Yazd-Ardakan plain in 2010.

| Table 1 Calculating The Recreational Value Of The Four Areas Of Yazd-Ardakan Plain In 2010 |

|||

| Recreational value (Rial) | Number of Visitors | Recreational expected value (Rial) | Area |

| 628787500 | 137500 | 4573 | Daregahan falls |

| 571750000 | 125000 | 4576 | Tamehr fountain |

| 1164750000 | 250000 | 4659 | Gharbalbyz fountain |

| 1760500000 | 350000 | 5030 | Chak chak fountain |

Note: According to Fattahi (2009) and his colleagues.

We can calculate the recreational value of studied plains in Table 1, by using gold price in 2010. In Figure 4, the price of per ounce of gold in different years has been inserted and we can use this information as the value of mentioned plains.

Table 2 demonstrates the recreational value of Yazd-Ardakan plain by using per ounce of gold as an index of measuring the values.

| Table 2 Calculating Valuation By Using Each Ounce Of Gold Price In 2010 |

||||||

| Percentage changes in the per ounce Rial | The value of the ounce at the time of valuation | Recreational value(ounce) | Recreational value (rial) | Number of Visitors | Recreational expected value (rial) | Area |

| 3.362 | 2114328326.4 | 54.7867 | 628787500 | 137500 | 4573 | Daregahan falls |

| 3.362 | 1922537664 | 49.8170 | 571750000 | 125000 | 4576 | Tamehr fountain |

| 3.362 | 3916354752 | 10.1481 | 1164750000 | 250000 | 4659 | Gharbalbyz fountain |

| 3.362 | 5919742656 | 153.393 | 1760500000 | 350000 | 5030 | Chak chak fountain |

According to the data in Table 2, we can see that if the studied plains were evaluated by gold, now their value was 36.2 times more.

Valuation by using Dollar Rate

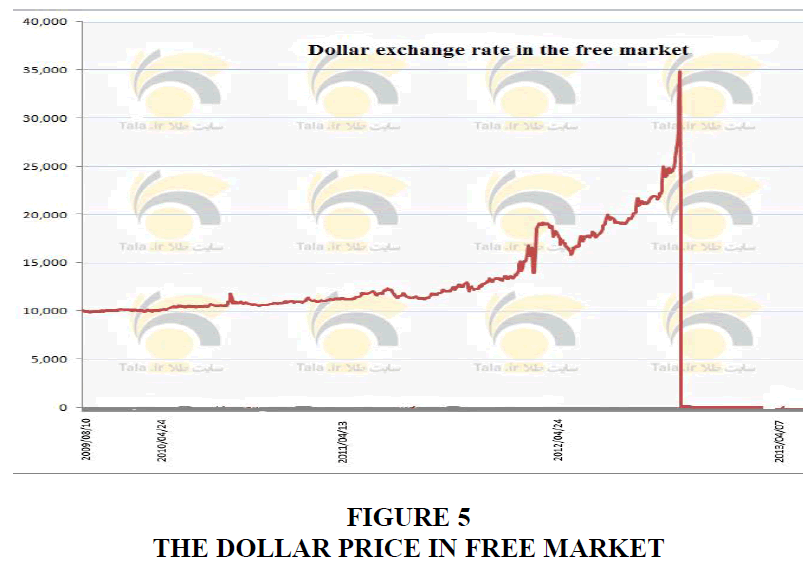

We can also calculate the value of Yazd-Ardakan plains by using dollar price in 2010, as demonstrated in Table 1. In Figure 5, we can see the procedure of dollar price in free market, from this information we can calculate the dollar price of mentioned areas (www.tala.ir). Table 3 shows the creational value of Yazd-Ardakan plain, by using dollar as an index for value.

| Table 3 Calculating The Valuation By Using The Dollar Price In 2010 |

||||||

| Percentage change against the dollar Rial | The value of the dollar at the time of valuation | Recreational value(dollar) | Recreational value (rial) | Number of Visitors | Recreational expected value (rial) | Area |

| 3.23 | 2032547026.96 | 63011.0732 | 628787500 | 137500 | 4573 | Daregahan falls |

| 3.23 | 1848175137.24 | 57295.320 | 571750000 | 125000 | 4576 | Tamehr fountain |

| 3.23 | 3765040660.36 | 116720.112 | 1164750000 | 250000 | 4659 | Gharbalbyz fountain |

| 3.23 | 569079542.336 | 176420.483 | 1760500000 | 350000 | 5030 | Chak chak fountain |

According to Table 3, we can understand that if the studied plains were evaluated by dollar, now their value was 23.3 times more nowadays.

Next step is to calculate decreased value of money in the country from 2010 to 2016, according to annual inflation rate, approximately.

According to Table 4, the recreational value of Ardakan-Yazd plains decreases 99.2 times because of decreasing in money value, since the valuation time until now. We can also use these calculated valuations for changing to dollar or once, in comparison to the other valuations. Table 5 demonstrates the valuation changing to dollar and gold rate, in various places in 2010, 2012 and 2014.

| Table 4 Calculating The Valuation By Using Inflation Rate Since 2010 To 2016 |

|||||

| Percent revaluation | The area valuation with numeration inflation rate (rial) | Recreational value (rial) | Number of Visitors | Recreational expected value (rial) | Area |

| 2.924 | 1838654946.92 | 628787500 | 137500 | 4573 | Daregahan falls |

| 2.924 | 1671870013.17 | 571750000 | 125000 | 4576 | Tamehr fountain |

| 2.924 | 3405877739.99 | 1164750000 | 250000 | 4659 | Gharbalbyz fountain |

| 2.924 | 5147926818.01 | 1760500000 | 350000 | 5030 | Chak chak fountain |

Note: Extracted from Fattahi (2009) & Abbaspour (2013).

| Table 5 Valuation Changing To Dollar And Gold Rate |

||||

| Recreational value(ounce) | Recreational value(dollar) | Value (milliard rial) | Year valuation | Area |

| 1549.486 | 2324230.098 | 28 | 2012 | Gamishan pond |

| 30.182 | 46782.728 | 1.22 | 2013 | Yazd Gharbalbyz fountain |

| 2334139.78 | 2450846778.23 | 24457 | 2010 | Arzhan lake |

Note: Extracted from Fattahi (2009) & Abbaspour (2013).

Therefore, we can change these calculated valuations in “Rial”, to dollar &gold rate by using the relation below:

Here, wtpD , shows calculated value in dollar, wtp is calculated area’s value in rial, pD is the price of per dollar to rial in the time of valuation, as well as we can calculate the value with per ounce of gold, then the valuation is calculating like that:

Here, wtpoz demonstrates calculated value in dollar, wtp means calculated area’s value in rial and poz is the price of per ounce in the time of valuation.

Discussion

Research on the monetary valuation of environmental resources dates back to the early 1960’s but received wide attention with the publication of Costanza et al. (1997) and since then there has been a steady growth in the number of articles and reports on the monetary valuation of natural resources, ecosystem services and biodiversity. Many studies have been conducted on the economic valuation of environmental resources (Crossman & Bryan, 2009; Crossman et al., 2011; Payne & Sand, 2011; Farley, 2008; Farley & Costanza, 2010; Leimona, 2011; TEEB Foundations, 2010; TEEB in Business, 2011; TEEB in Local Policy, 2011).

In this paper, we present the results of an analysis of the monetary values of environmental resources provided by 96.2 biases and this value for gold and dollar was 3.36 and 3.23, respectively. Although valuation of environmental resources in monetary units still has many caveats, the outputs of environmental assessments are increasingly important in the policy debate regarding exploitation versus sustainable use. It is therefore important to provide the best available information and engage in an open dialog on the advantages, disadvantages and limitations of monetary valuation of ecosystem services, and to pursue strategies to improve the various valuation approaches. Values in monetary units will never in themselves provide easy answers to difficult decisions, and should always be seen as additional information, complementing quantitative and qualitative assessments, to help decision makers by giving approximations of the value of environmental resources involved in the trade-off analysis (Groot et al., 2012)

Better knowledge about the monetary value of environmental resources communicates important information to complement quantitative and qualitative insights and can help to make the positive and negative externalities of changes in ecosystems visible and eventually internalize at least part of their true economic and social importance in decision making, economic accounting and policy response (Groot et al., 2012).

Conclusion

The results of this study indicate that the value of the studying resources has decreased by decreasing in the money value in the country over time and according to the results of Table 4, this value was about 2.96 times. However, in order to estimate the value of this resource, the estimating price is about the same at $1.38 billion, while the value is not correct and shows the resource value less than the actual value. As well as with the calculated values from 3 inflation procedures, we can see that the devaluation rate of currency (the inflation rate), since 1388 until now is approximately about the value of dollar and gold at the time of calculating the area’s value.

The dollar and gold rate with a little variation, differ from the time of valuation and now, as well as the difference of these rate with the devaluation value of money is about 0.3, so that we can say valuation with gold, dollar & the devaluation money value are equal over time, so we suggest to use dollar and gold rates as a tool for valuation, because increasing the prices, increase natural resources value and decrease the overuse of them.

Hence, we can compare the calculated valuated at different years or different places to each other by using this method. Actually, we select a unit that not only its value doesn’t reduce over time, but also along inflation and an increase in average prices, the calculated valuations become greater and prevent the indiscriminate use of resources because of decreasing their value.

Increasing dollar rate is one of the most important effective agents on inflation, because it is one of the determinant agents of raw materials, intermediate goods, capital equipment and final goods and according to the production & consumption dependence on importing, it is effective on the formation of inflationary pressures. according to this, increasing in dollar rate increase the price of importing goods which are the consumption goods that increasing in their prices cause increasing in inflation, directly, or Intermediate goods that increase in their price has effect on the inflation by increasing the production prices. This has a direct effect on the price of importing goods which are using as the production inputs, so that this means the entire price of importing goods increases, including raw materials, capital equipment and intermediate goods and eventually the price of production increases and makes the good prices higher than before.

The calculated pricing also increases by the procedure of increasing prices.

It is notable that devaluation of national currency and rising inflation in the country, certainly decrease the power of purchasing, so as a result we can say that valuation of resources in dollar increases the price of raw materials in the country along with the dollar price and decrease the consumption and exporting raw materials because of the inflation& downfall of dollar for rial.

By comparing Table 2 to Table 5, we can see Yazd Gharbalbyz fountain and Tamehr fountain, At first glance, this fountain with 1.22 billion rial has more worth than Tamehr fountain, but with a closer look and calculating the value by using ounce, we can see that Tamehr fountain not only has more worth than Gharbalbyz, but also it is 1.65 times more than that fountain. as well as for exchanging between countries, we can utilize the calculated valuations in different countries &years for comparing and eventually the valuation of natural resources in dollar & gold rate restrain the downfall of these area’s value because of decreasing the currency value.

The value of resources decreases by passing the time and this leads to wastage & overuse of the resources, because people consider their own benefit for utilizing these resources and so that the utilization of these resources increases by time.

Increasing in dollar rate, increases exporting & put the country at risk of overuse exporting of raw materials and natural resources, because the country’s goods prices is cheaper than the foreign goods and by passing the time these goods prices become cheaper by calculating lower rate of inflation. The valuation of natural resources only prevented overuse of resources at first years because they did valuation correctly at those years and these resources value become low and lower and the process of overusing them become greater by time.

Recommendation

Although this analysis supports the ensuring sustainability of environmental resources in Iran, multi-agency management systems have caused some issues in economic valuation based on natural resources in Iran. Therefore, economic valuation projects, integrated with environmental considerations will be a good chance to provide the sustainability of environmental resources especially in developing countries.

References

- Abbaspour, M. (2013). Economic valuing marketing functions of the environment resources of Parishan Arjan lake with emphasis on aquatic species. Environment Science and Technology, 15(1).

- Bateman, I.J., & Jones, A.P. (2003). Contrasting conventional with multi-level modeling approaches to meta-analysis: Expectation consistency in UK woodland recreation values. Land Economics, 79(2), 235-258.

- Bateman, I.J., & Willis, K.G. (2003). Valuing environmental preferences: Theory and practice of the contingent valuation method in the US, EU and developing Countries. Oxford University press, New York.

- Bengochea-Morancho, A., Fuertes-Eugenio, A.M., & Del Saz-Salazar, S. (2005). A comparison of empirical models used to infer the willingness to pay in contingent valuation. Empirical Economics, 30(1), 235-244.

- Binning, C., & Canberra Resource Assessment Commission. (1995). Techniques to value environmental resources: an introductory handbook. Australian Government Pub., Service.

- Boman, M., Mattsson, L., Ericsson, G., & Kriström, B. (2011). Moose hunting values in Sweden now and two decades ago: the Swedish hunters revisited. Environmental and Resource Economics, 50(4), 515-530.

- Boyd, J. (2011). Economic valuation. Ecosystem Services, and Conservation Strategy, 177-189.

- Chen, D., Chen, J., Luo, Z., & Lv, Z. (2009). Emergy evaluation of the natural value of water resources in Chinese rivers. Environmental Management, 44(2), 288-297.

- Chen, W.Y., & Jim, C.Y. (2010). Resident motivations and willingness-to-pay for urban biodiversity conservation in Guangzhou (China). Environmental Management, 45(5), 1052-1064.

- Chen, W.Y., Aertsens, J., Liekens, I., Broekx, S., & De Nocker, L. (2014). Impact of perceived importance of ecosystem services and stated financial constraints on willingness to pay for riparian meadow restoration in Flanders (Belgium). Environmental Management, 54(2), 346-359.

- Costanza, R., d'Arge, R., De Groot, R., Farber, S., Grasso, M., Hannon, B., Limburg, K., Naeem, S., O’Neil, R.V., Paruelo, J., Raskin, R.G., Sutton, P., &van den Belt, M. (1997). The value of the world’s ecosystem services and natural capital. Nature, 387(6630), 253-260.

- Crossman, N.D., & Bryan, B.A. (2009). Identifying cost-effective hotspots for restoring natural capital and enhancing landscape multifunctionality. Ecological Economics, 68(3), 654-668.

- Crossman, N.D., Bryan, B.A., & Summers, D.M. (2011). Carbon payments and low?cost conservation. Conservation Biology, 25(4), 835-845.

- de Groot, R., Brander, L., Ploeg, S., Costanza, R., Bernard, F., Braat, L., Christie, M., Crossman, N., Ghermandi, A., Hein, L., Hussain, S., Kumar, P., McVittie, A., Portela, R., Rodrigues, L.C., ten Brink, P., & van Beukering, P.J.H. (2012). Global estimates of the value of ecosystems and their services in monetary units. Ecosystem Services, 1(1), 50-61.

- Eisenhauer, J.G. (2005). A test of Hotelling’s Valuation Principle for nonrenewable resources. Empirical Economics, 30(2), 465-471.

- Farley, J. (2008). The role of prices in conserving critical natural capital. Conservation Biology, 22(6), 1399-1408.

- Farley, J., & Costanza, R. (2010). Payments for ecosystem services: from local to global. Ecological Economics, 69(11), 2060-2068.

- Fattahi, A. (2009), Economic valuing of ground waters in Yazd Plain-Ardakan. Unpublished Doctoral Dissertation, Tehran University, Iran.

- Isaac, O.C.I (2018). History of the international economy: The Bretton wood system and its impact on the economic development of developing countries. Athens Journal of Law, 4(2), 105-126.

- Leimona, B. (2011). Fairly efficient and efficiently fair: Success factors and constraints in payment and reward for environmental schemes in Asia. Wageningen University, Wageningen (NL).

- Lipton, D.W., Wellman, K.F., Sheifer, I.C., & Weiher, R.F. (1995). Economic valuation of natural resources: A handbook for coastal resource policymakers.

- Payne, C., & Sand, P. (2011). Gulf war reparations and the UN compensation commission: Environmental liability. Oxford University Press.

- Remoundou, K., Adaman, F., Koundouri, P., & Nunes, P.A. (2014). Is the value of environmental goods sensitive to the public funding scheme? Evidence from a marine restoration program in the Black Sea. Empirical Economics, 47(4), 1173-1192.

- Robinson, J. (2001). A review of techniques to value environmental resources in coastal zones.

- Soori, A., & Ebrahimi, M. (2011). Natural resource economic and the environment. Noor Elem publication: Tehran.

- TEEB Foundations (2010). In Kumar, P. (ed.), The Economics of Ecosystems and Biodiversity: Ecological and Economic Foundations. Earthscan, London, Washington.

- TEEB in Business (2011). In Bishop, J. (Ed.), The Economics of Ecosystems and Biodiversity in Business and Enterprise. Earthscan, London, Washington.

- TEEB in Local Policy (2011). In Wittmer, H., Gundimeda, H. (Eds.), The Economics of Ecosystems and Biodiversity in Local and Regional Policy and Management. Earthscan, London, Washington.