Research Article: 2021 Vol: 24 Issue: 1S

Money Laundering from Maqasid Al-Shariah Perspective with a Particular Reference to Preservation of Wealth (Hifz Al-Mal)

Muhammad Nazmul Hoque, Universiti Teknologi MARA

Jamaliah Said, Universiti Teknologi MARA

Md Faruk Abdullah, Universiti Sultan Zainal Abidin

Abu Umar Faruq Ahmad, Islamic Economics Institute, King Abdulaziz University

Keywords:

Maqa?id al-Shar??ah, Money Laundering, Hifz al-M?l, Shar??ah Restrictions

Abstract

This research aims to evaluate the concept of money laundering in reference to the objective of the protection of wealth (Hifz al-M─ül). It also examines the process of money laundering on whether they are halal in the SharÃ┬?«Ã┬?¿ah. This study adopts a qualitative approach. It reviews and analyses authentic data in relevant literature and documents on the principles of maqaß╣Żid al-Shar─½╩┐ah, especially on those mentioned in the Qur’an and Sunnah. The significance of this study is that a new contribution through exploring the viewpoints of maqaß╣Żid al-Shar─½╩┐ah on the sources which are involved in the money laundering process and the wealth achieved through this process. From the teaching of the Quran and Sunnah, it can be concluded that the Shar─½╩┐ah restrictions on the process of money laundering are far more stringent than any other ordinary laws since the Shar─½╩┐ah emphasises more on the protection of wealth for the welfare of human beings.

Introduction

The Shar??ah is all about justice, mercy, wisdom, and well-being. The overall objectives of Shar??ah are to protect the community’s social order and ensure its advance progress by developing the well-being and human rights. Human well-being is achieved through the preservation of faith, life, intellect, progeny, and wealth (al-Ghazali 1937, 139). These essentials are the guarantors of preserving the universal values: freedom, justice, equality, security, etc. (al-Suyuti, 2016).

The universal ingredients of maq??id al-Shar??ah provide comprehensive guideline and holistic worldview of Islam which has a strategic connection with all areas of human life. Therefore, maq??id al-Shar??ah, always encourages to protect human wealth and preserve it in a lawful way that is approved by Islamic law. Money laundering is considered a crime according to Islamic law, and many provisions involving the concept of money laundering in the Qur’an and Sunnah have been discussed here.

There is an argument on the concept of money laundering. One of the interpretations is that paying Zakah on the wealth achieved through money laundering could purify it. Therefore, Islamic law only approves the process when the money is clean. On the other hand, the process of money laundering is unlawful if black money is involved in the process (Agha 2006, 406-411).

For a Muslim, one of the ways to purify the laundered money is to return the unlawfully achieved wealth to its legal owner, if he knows him. But if the owner is unknown, he has to return the money to the authority of the respective country. Shar??ah demands such process of purification from a Muslim, which ensures the purity of wealth and thus preserves it for the sake of humanity which is the objective of maq??id. Hence, this study will focus on the formation theory of money laundering in maq??id al-Shar??ah. The first part of this study includes the Shar??ah and its common characteristics as well as the lawful and unlawful provisions based on ’Qur’an and Sunnah. This study will also examine the application of the principles of maq??id al- Shar??ah on the money laundering process, factors that lead to money laundering and possible Shar??ah remedies that could be applied to prevent this financial crime. Finally, significant policy recommendations will be provided in this paper.

Shar??ah and its Common Characteristics

The Shar??ah which is the ultimate guidance that came from Allah is one and the same. The difference appears only in the application, methodology, practical execution and so on.

Ibn Qayyum (691-751 H.) says:

Though all Shar??ah appears to be different from each other, from the perspective of foundational basis and principles, they are the same and considered to be acceptable and better to the mind. If that was not the case, this Shar??ah would be cast outside the boundary of wisdom, human welfare and rahmah (Ibnul Qayyim P. 2)

Islamic Shar??ah has certain general and universal characteristics, which have distinguished features and made this Shar??ah an exceptional way of life. This Shar??ah is the last and the best, and it will sustain as long as the human race survives on this planet (Al Amin & Bashir, 1995, 11). Some of those characteristics are discussed here:

Universality and Extensiveness

Islamic Shar??ah is universal and extensive. It is not limited to any person, nation or community. Rather, it is for all creation of the entire ages and places.

Allah SWT says:

“And we have not sent you except comprehensively 1 to mankind as a bringer of good tidings and a warner. But most of the people do not know” (Al Qur’an, 34: 28).

Blend of Unchangeable and Changeable Principles

Islamic Shar??ah combines two types of principles. The first kind is specific and unchangeable. It does not change with the change of place, time, person, or culture. This set includes the fundamental and universal principles, basic rules, and general regulations of Islam, which serve as the foundation to offer solution to new problems. There are other principles, which subject to change according to person, place and time. The rules are made according to the practice, culture and necessity-not conflicting with Islamic principles to ensure human wellbeing. In a different setting, if the practice, culture and necessities as to the rules are also allowed to be modified to ease the practice of Shar??ah. This balanced combination of permanent and non-permanent principles makes the Islamic Shar??ah dynamic. The laws formulated based on these principles provide a solution to the emerging problems of the time, and it will continue to do so until the end of time (Habib, 2018, 28).

Islamic Shar??ah and Public Wellbeing

The primary objective of Islamic Shar??ah is to ensure human wellbeing be it worldly or other-worldly, private or social. Islam teaches its followers to reconcile between this world and hereafter, and keep balancing between not completely depriving themselves of the blessings and favors of Allah that have been bestowed upon them on this earth while keeping their focus and efforts on life after death. If different forms of wellbeing contradict each-other, Islam suggests a comparative approach and directs to ensure those of higher priority first. The principles followed in such cases are: Taking a balanced position, taking the middle course, establishing justice and ‘adl, removing oppression and torture, eliminating pains and suffering, etc. (Habib 2018, 29).

Keeping the Conscience of Hereafter Alive all the Time

One of Islam's central characteristics is to attach daily human chores, customs and behaviour, transactions etc., to the faith in Allah and accountability in the hereafter. Every step has to be carried out within the limit set by Allah. A person needs to remember Allah's presence and the post-death accountability in every step and only that could ensure the wellbeing of all the creation. (Habib, 2018).

Fundamental sources need to be Preserved from Change or Extension

Another characteristic of Islamic law is that it has been ensured that the prime source, the al-Quran, will remain protected from all kinds of changes and extensions.

Allah SWT says:

“Indeed, it is we who sent down the message [i.e., the Qur’?n], and indeed, we will be its guardian” (Al-Qur’an, 15: 9). The following section will focus on money laundering and the formation theory of money laundering in maq??id al-Shar??ah.

Money Laundering

There are various definitions of money laundering. According to INTERPOL (n.d.), it refers to “any act or attempted act to conceal or disguise the identity of illegally obtained proceeds so that they appear to have originated from a legitimate source”. The main aim of this process is to gain money in an unlawful way. The criminals manipulate this process to gain money without disclosing their sources.

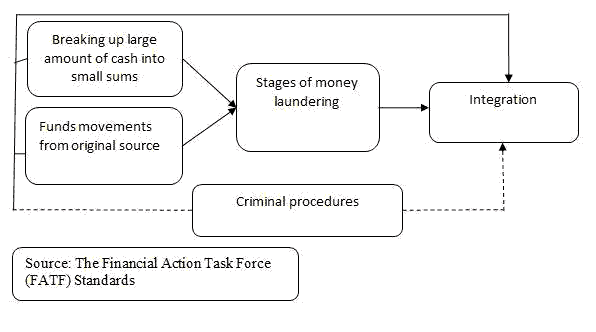

This criminal process takes place in various stages. The stages are outlined in the following diagram.

The above diagram indicates the stages of the money laundering process which the criminals go through. The launder deposits his unlawfully gained profits to financial banks, and then, simultaneously, it is drawn from the bank in smaller amounts by varieties of checks, money orders, etc. So, the banks do not get the chance to sutilise the money.

In the second stage, the launderer undertakes a sequence of transfers or moves of funds in order to detach them from their source. The money can be channelled by purchasing and selling of investment securities or the launderer may simply pass the funds to different banks worldwide through multiple accounts.

In the final stage, after successfully processing the illegal income through the first two stages, the launderer then brings it to a third level-integration/incorporation-where funds are reintegrated into the legal economy. The launderer may choose to use the funds for investment in real estate, or enterprises, etc.

The above stages of money laundering involve an illegal process which has got prominence in recent time. Islamic law always discourages this kind of activities and it is against the principles of maq??id al- Shar??ah. In the following sections, the role of maq??id in preventing money laundering has been highlighted.

Formation Theory of Money Laundering in Maq??id Al-Shar??ah

There are few status and scope of protection against money laundering in maq??id al- Shar??ah. Therefore, Islamic law has given the following two statuses:

1. If the money is intentionally generated by illegal activities and real owner is known, then the seized money needs to be brought back to the original owner to remove this dirty” ’money’s illegal status.

2. On the other hand, if the money is generated by unlawful activities and the real owner is unknown, then the seized money should be invested for public needs like establishing hospitals or using for any other charitable purposes. (Samah al-Agha, 2007, 406-411).

Meanwhile, the owner of the dirty money should not think that he is contributing to the public good and he will be rewarded for these kind acts. This donation does not count as sadaqah or Zakat, because the money is illegally generated, and he is just paying compensation for the crime he has committed (Saleh & Saleh, 2006). The evidence expressed in authentic hadith that Prophet Muhammad (pbuh) said: “Sadaqah comes from theft are not acceptable” (Sahih Muslim, 1/204). The objective of Shar??ah is to preserve and safeguard other people’s wealth, and so this kind of illicit practices are always discouraged in maq??id al-Shar??ah.

There are Quranic verses where criminal activities and getting wealth in illegal ways have been declared unlawful. For instance, Allah says:

“O you who have believed, do not consume one” ’another’s wealth unjustly but only [in lawful] business by mutual consent. And do not kill yourselves [or one another]. Indeed, Allah is to you ever Merciful”. Surah An-Nisa 30

In the following verse, Allah has mentioned the punishment for those who are involved in unlawful activities. Allah says:

“And whoever does that in aggression and injustice - then we will drive him into a Fire. And that, for Allah, is [always] easy”.

Ibn Katheer, in his commentary of the Quran, explained these two verses and said that “Allah, the Exalted and Most Honored, prohibits His believing servants from illegally acquiring each’ ‘’other’s property using various dishonest methods such as riba, gambling and other wicked methods that appear to be legal, but Allah knows that, in reality, those involved seeking to deal in interest” (Ibn Katheer, 1999).

Therefore, Allah only allows people to invest in a proper way which should be free from any riba (interest). Otherwise, it will be unlawful and will be resulted in a painful punishment in the Hereafter. This is also an objective of Islamic commercial law is to confirm and enhance one or several maq??id. Islamic law declared and promoted as they preserve, strengthen and assist the assets (hifz al-Mal). In the following section, various provisions of the objective of Shariah pertaining to money laundering will be highlighted and some elements of maq??id al-Shar??ah applicable on hifz al-mal will be discussed.

The Mediums ()????? in Pertaining to Money laundering

| Table 1 Mediums Pertaining to Money Laundering |

|

|---|---|

| The mediums of money laundering |

Evidence pertaining to crime |

| Al- Harabah ??????? | According to Imam Malik harabah is raping or laundering money in a scaring way either money can be achieved or not. (Ad-Dusuqi, 539/4). Shari?ah always forbid the harabah . Allah says “Indeed, the penalty for those who wage war against Allah and His Messenger and strive upon earth [to cause] corruption is none but that they be killed or crucified or that their hands and feet be cut off from opposite sides or that they be exiled from the land. That is for them a disgrace in this world; and for them in the Hereafter is a great punishment”. |

| As- Sariqah ?????? |

Sariqah or theft in Islam is strictly forbidden and Islamic law declared painful punishment. As Allah says in surah Ma’idah “[As for] the thief, the male and the female, amputate their hands in recompense for what they committed as a deterrent [punishment] from Allah, And Allah is Exalted in Might and Wise”. (Qur’an, 5:38) |

| Al-Gulul ?????? |

Gulul is taking money or any kind of wealth from public treasury that is not permitted to use it (Sharhu Hudud ibn Arafa, 310/1). Islam always discourages this kind of activity and given penalty as well as asking to return money to its original sources. Qur’an says in surah al-Imran verse 161“It is not [attributable] to any prophet that he would act unfaithfully [in regard to war booty]. And whoever betrays, [taking unlawfully], will come with what he took on the Day of Resurrection. Then will every soul be [fully] compensated for what it earned, and they will not be wronged”. Imam Qurtubi defined that the meaning of unfaithful activity is like “to betray his companions in what God has paid them off from the money of his enemies”. |

| Al-Ihtikar ???????? |

According to Hanafi School, Ihtikar is saving goods until sold out the same commodity from the market and reselling it in later time with higher price. The position of Islamic Shari?ah about ihtikar or monopoly is totally prohibited. Prophet Muhammad warned the people who sell the commodity in the way of monopoly. He said: “monopolist is damned” (Saleh & Saleh, 2006). |

| ????? Ar-Riba | Usury or interest is forbidden by Islamic law as narrated in many Quranic verses and hadeeth from prophet Muhammad (pbuh). Allah Says: “Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, ““““Trade is [just] like interest”””.” But Allah has permitted trade and has forbidden interest. So, whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein.” Surah Baqarah, 275). In a hadeeth, it was saying that: “prophet Mohamed damned the bene?cial of Riba, the giver of Riba, the writer of the contract of Riba, and the witnesses of the contract of Riba” (Pickthall, 2005). The reason behind it forbidden in Islam is that riba always encourages to make an unjustified financial transaction. (Abu Sulayman, 1998) |

| ?????? Ar-Rashwah |

Rashwah or bribery is payment of money by one person to another in order to achieve vanity or nullify a human right. Thus, bribery is a form of financial corruption and corruption suffered by different |

| societies. There is no doubt that bribery under the definition stated above mentioned which is forbidden in the Islamic Shari?ah. There are many pieces of evidence for the prohibition of bribery in the ’Qur’an and the Sunnah. In a Qur’anic verse, Allah says: “And do not consume one ” ’another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you [to] consume a portion of the wealth of the people in sin, while you know [it is unlawful]”. (Al- Qur’an, 2:188). In a prophetic saying. Prophet Muhammad pbuh said “Allah damned briber and bribe” |

|

Islamic law focuses not only on restricting crimes that include money-laundering activities, but also gives some remedies in order to find a way out from these illegal practices of financial activities. In the following section, few methods will be discussed that could preserve wealth from getting into illegal financial activities.

Methods (??????) Pertaining to the Preservation of the Wealth (Hifz al-Mal)

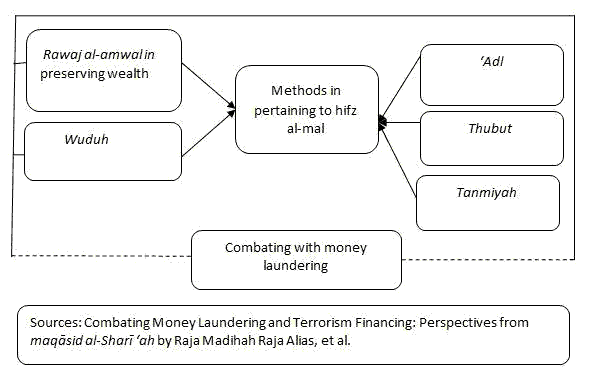

Islamic law always looks at preserving wealth by finding various mediums that are growing and developing other resources and different aspects as well as social activities. In this regard, there are some methods namely rawaj (circulation of wealth), ‘adl (justice), wuduh (clarity), thubut (proof) and tanmiyah (growth) under maq??id al-Shar??ah, in pertaining to money laundering. Mentioning the above method, Ibn ‘ashur stated that these methods are for the great legitimate purpose, which was indicated by the desirability of treating money, legitimacy to document the transfer of funds from one hand to another. The methods and provisions mentioned by Ibn ‘Ashour are expressed in the following diagram:

In the diagram above, it is shown that the first method to combat money laundering is rawaj or circulation of wealth. It is one of the objectives to preserve wealth. According to ibn ‘Ashur, debt is one of the greatest reasons for circulating money. Money could be reduced from the real owner because of given loan to the borrower, but the borrower could use this money for trading in the company and commercial industry. Because the affluent may run out of money from his hands if he does not protect his money system (El- Mesawi 2016, 1-22).

Wuduh or Clarity

Wuduh or clarity defines in the sense that transactions between people must be exact, specificand precise, as well as to be far away from any harm and exposure to rivalries and disputes (Ibn Ashur, 1991). The concept of wuduh provides a strong basis to combat money laundering. It provides the foundation of transparency in financial transactions as it requires that all kinds of financial transactions must be transparent. A person should be transparent by declaring his source of income. Secondly, he should clarify his real purpose for executing the transaction. Therefore, the concept of wuduh is a powerful tool to combat money laundering.

‘Adl or Justice

‘Adl or justice is correlated with the desire to have the same social system and to deal with justice in financial transactions. In the Qur’an, this method is defined by the concepts of rightness, justice, equality, peace, balance and modesty. Thus, the ultimate purpose of this method is to focus on the constructive and legislative principles of the Shar??ah, community development and personal performance (Akram & Furqani, 2010, 61-84). An unlawful income is achieved usually by doing injustice to the counterparty. Furthermore, it is an injustice to society as the perpetrator consumes society’s money illegally and hinders the economic development of the community.

Thub?t or Proof

Another method is thub?t or proof. Thub?t ensures the ownership of the funds that is decided by its owners to transfer to others without risky and undisputed way. According to Ibn ‘Ashur, thub?t is essential to apply in a financial transaction to show that the property belongs to the owner and to prevent future conflicts (El- Mesawi 2016, 1-22).

Tanmiyah or Growth

Tanmiyah or growth and development of wealth is one of the most significant objectives of Shar??ah. Imam Ghazali and Shatibi both ranked hifz al-mal in the last objective of Shar??ah. Because without save or developing wealth, the other four purposes of Shar??ah is not stable to gain the strength that must be available to ensure general prosperity (Ar-Razi, 1997). It is undeniable to say that money laundering is a barrier to the economic development of a country. As discussed earlier, people intent to legalese their illegal income through the money laundering process. The money earned illegally is a loss to the country’s economy. In many occasions, the money earned through unlawful means might have hindered real economic activity. Furthermore, it leads to the loss of the government’s revenue. In these ways, it hinders the development of a country either directly or indirectly. Therefore, the concept of tanmiyah advocates that money laundering is against the very purpose of the Shar??ah.

It is very clear from the above discussion that hifz al-mal in Maq??id al-Shar??ah is an excellent area for further study. Islamic scholars, including Ibn Ashur and Al-Ghaz?li, claimed that the preservation of wealth is a duty not only for an individual but also for the state. It can be noted that the idea of maq??id al-Shar??ah in combating money laundering has significant effort for society to avoid illegal activities.

Tawhidic Method for Unlawful Fund and its Implication in the Society.

Tawhidic method always encourage on lawful earning. Only the method Allah has mentioned in the Qur’an by advising messengers, in the same manner, Allah has advised believes for the same issue in the Qur’an. Allah has described in surah Mu’minun and surah Baqarah.

“O messengers, eat from the good foods and work righteousness. Indeed, I, of what you do, am knowing” (Al-Quran, 23:51).

“O you who have believed, eat from the good things which we have provided for you and be grateful to Allah if it is [indeed] Him that you worship”. (Al-Qur’an, 2:172) for explanation of this above verse, Imam Nawawi said, Allah advised the believers to show their gratitude with eating and earning in permissible way and then the believer must adhere to the good, which is the permissible replacement (Al- Nawawi, n.d).

Based on tawhidic law on earning by unlawful activities or any illegal properties will be rendered unveiled. Tawhidic law has clearly expressed between legal and illegal earnings in the Qur’an. Allah has forbidden unlawful earnings by any means of activities. (Ibn Taymiya. Al-hisba fi Islam, p. 44.) Allah (s.w.t.) said: Say “Not equal are things that are bad (Kabith) and things are good, even though abundance of the bad, May dazzle thee; So fear God, O ye that understand; that (so) ye may proper” (Al-Qur’an, 5:103).

The Muslim jurists scholars agreed and opined that authority/ruler must spend the unlawful earning for the maslahah of the society. In this case, any properties achieved by illegal means must either be spent instantly on charitable activities or must be sent to bayt al mal. On the other hand, this money could be used for the welfare-based institutions of Muslim society for the sake of public betterment (Maslahah).

According to Islamic law, any earnings resulting from illegal activities or even usury related transactions as available under the conventional banking systems is considered unlawful property (mal kabith) and every transaction including such earnings will be rendered invalid. Also, whoever sells an illegal object in exchange for cash (‘“‘ayn), whatever he obtains from that transaction is unlawful, and the item will still be considered to be unlawful if the recipient knows about how it was initially obtained. Shar??ah has drawn a clear distinction between lawful earnings and unlawful earnings. (Ibn Taymiya, Fatawa al-Kubra 321-25) The’ messenger of Allah has explicitly forbidden earnings property by unlawful means.

It was narrated that Abu Hurairah said: "The Messenger of Allah said: 'O people, Allah is Tayyib (good) and does not accept anything but that which is good. Allah has enjoined upon the believers that which He has enjoined upon the Messengers. He says: O (you) Messengers! Eat of the Tayyibat (the lawful) and do righteous deeds. Verily, I am Well-Acquainted with what you do" and He says: O you who believe! Eat of the lawful things that we have provided you with ..., and then he mentioned a man who has undertaken a lengthy journey and is disheveled and dusty, raising his hands towards heaven and saying: 'O Lord, O Lord!' But his food is unlawful, his drink is unlawful, his clothing is unlawful, and he is nourished with what is unlawful, so how can he receive a response?" (Sahih Muslim, 2007; hadith, 2346)

There is Muslim jurists have no disagreement among the Muslim jurists that any unlawful earnings should be confiscated by the ruling power. The ruler must act in the public interest to protect the five basic aspects of human life – religion, life, lineage, mind and property. Any transgression against one or more of them is unlawful and, if necessary, punishable. Moreover, the ’”rulers’ power to determine offences and their punishment is based not only on juristic reasoning (ijtihad), but also on the general commands which prohibit transgressions and corruption.

Moreover, in order to keep justice among the people’s transactions, the tawhidic paradigm recommends founding the hisbah institution. It is an institution which primary task is supervising and monitoring the transactions in the market. It should inspect whether there is cheating, injustice, fraud in the trades. The prophet Muhammad (SAWS) has laid the foundation of this institution. Afterwards, all Islamic rulers kept this tradition of inspecting the marketplace (Ibrahim, 2019, 1-5). The concept of hisbah was much emphasised in the commandments of Allah SWT in the following verse:

“Let there arise from you a group calling to all that is good, enjoining what is right and forbidding what is wrong. It is these who are successful” (Al-Qur’an, 3: 104).

Conclusion

It can be summarised from the above discussion that the Shar’iah is able to provide rules and principles that serve as a means to establish and maintain well-being in the society. While Islam recognises freedom, this freedom is however, not absolute. There is no freedom to destroy or weaken” ’society’s valuable framework or even to harm others. The Islamic concept of hifzul mal (protection of wealth), justice in the circulation of wealth, socio?economic justice, communal prosperity through the transactions of wealth and other related principles which have been earlier discussed in this paper should be treated seriously when dealing with any illegal activities such as money laundering. Rrespectively, the muamalat profession of hisbah (social conduct of business) can be identified at any temporary evolutionary station of knowledge. Both the supervisory and control functions of the state are viewed as permanent features of the socio?economic system, the state has an important role of legislating fresh legislation and guide the socio?economic system in affairs left unregulated by the ’’’Shar’iah, to guarantee the fulfilment of the economic objective, maintaining the social order and eradication of all kinds of Zulm or injustice which Islam frowns upon and condemns.

References

- Al-B???, M.S.R. (1973). ?aw?bi?ul Ma?la?ati f?sh Shar??atil Isl?miyyah. Beir?t, Mu´assasatur Ris?lah.

- Al-F?s?, ?A. (1993). Maq??idush Shar??atil Isl?miyyati wa Mak?rimuh?. Beir?t, D?rul Gharbil Isl?m?.

- Al-Fayr?z-?b?b?, M.Y. (1952). Al-Q?m?sul Mu???, Al-Q?hirah, Ma?ba?at al-B?b? al-?alab?.

- Ab? ??mid al-Ghaz?l? (1937). al-Musta?f? min ?ilm al-u??l. Cairo, al-Maktabah al-Tij?riyyah,, 1:139–40;

- Al-Jurj?n?, A.S. (1983). Al-Ta?r?f?t, Beir?t, D?rul Kutubil ?Ilmiyyah

- Al-Juwayn?, I.Y. (1418H). Al-Burh?nu F? U??lil Fiqh, al-Man??rah, D?rul Waf?´.

- Al-Kh?dim?, N.I.M. (2001). ?Ilmul Maq??idish Shar?iyyah, al-Riy??, Maktabat al-?Ubayk?n.

- Al-Khal?f?, R.M. (2004). “Al-Maq??idush Shar?iyyatu wa Atharuh? f? Fiqhil Mu??mal?til M?liyyah. Journal of King Abdulaziz University: Islamic Economics, 17, 3-49.

- Al-Sh??ib?, A.G. (1997). Al-Muw?faq?tu f? U??lish Shar??ah. Cairo, D?ru Ibnu ?Aff?n.

- Al-Suy???, J. (1959). Al-Ashb?hu wan Na??´iru fil Qaw??idi wa Fur??i Fiqhish Sh?fi?iyyah. Cairo.

- Mu??af? al-B?b? al-?alab?. Al-Qaw??idu wa? ?aw?bi?ul Fiqhiyyatu ?inda Shaykhil Isl?mi Ibni Taymiyyata f? Kit?bay? ?ah?rati wa? ?al?h. PhD, J?mi?atu Ummil Qur?.

- Al-Qara??w?, Y. (2008). Maq??idush Shar??atil Muta?alliqati bil M?l. 18th Session of The European Council for Fatwa and Research Dublin, Ireland.

- Al-Qara??w?, Y. (2008). Maq??idush Shar??atil Muta?alliqatu bil M?l. 18th Session of The European Council for Fatwa and Research Dublin, Ireland.

- Al-R?zi, F. (1997). “Al-Mah??l f? ?ilmi us?l al- Fiqh. Beir?t, Mu´assasatur Ris?lah.

- El-Mesawi, M.T. (2006). Maqasid al-Shari’ah as an usuli doctrine or independent discipline: a study of Ibn ‘Ashur’s project. Proceeding of the International Conference on Islamic Jurisprudence and the Challenges of the 21st Century: Maqasid al-Shari’ah and Its Realisation in Contemporary Societies, 3, 51-66.

- El-Mesawi, M.E.-T. (2006). Ibn Ashur Treatise on Maq??id al-Shar??ah. London, The International Institute of Islamic Thought (IIIT).

- Rahman, M.H. (2018). Maq??id as-Shar??ah (The Objectives of Islamic Law). Dhaka, Islamic Law Research and Legal Aid Centre.

- Ibn Taymiya. (N.D). Al-hisba fi Islam. Bairut, Dar al Kutub al-Ilmiyyah. 44.

- Ibrahim, A. (2019). The fundamentals of hisbah strategic in developing of human civilization. Academy of Entrepreneurship Journal, 25(1), 1-5.

- Katheer, I., & Ámr, I. I. (1999). Tafseer al-Quran al-Azeem. Riyadh, Dar Taibah.

- Laldin, M.A. (2008). Fundamentals and Practices in Islamic Finance. ISRA, Kuala Lumpur, IMEFM 6(4).

- Laldin, M.A. 2010. Understanding the concept of maslahah and its parameters when used in financial transactions. ISRA International Journal of Islamic Finance, 2(1), 61-84.

- Mohamed Sanusi, M. (2008). Money laundering with particular reference to the banking deposit transactions: An Islamic perspective. Journal of Money Laundering Control, 11(3), 251-260.

- Pickthall, M. (2005). The Meaning of the Glorious Qura’an, Al-Aar’ff Surah. Islamic Dawah Centre International (IDCI), London, Trans.

- Saleh, A. & Saleh, M.B.A. (2006). Money laundering in positive laws. Islamic Version.

- Agha, A.S. (2007). “Money laundering from Islamic perspective. Journal of Money Laundering Control, 10(4), 406-411.

- United Nations Security Council. (2001). Resolution 1373 (2001), Adopted by the SecurityCouncil at its 4385th meeting on 28 September 2001.