Research Article: 2020 Vol: 26 Issue: 1

Moderating Effect of Dominant Logic on the Entrepreneurial Orientation and Microenterprises Performance Relationship in Nigeria

Chukwuemeka Onwe, University of Nigeria

Abstract

Majority of the studies that have been conducted on strategic management and entrepreneurship have found favourable results of entrepreneurial orientation (EO) on firms’ outcomes, although there are some exceptions as some studies have shown that significant differences do exist. Some authors have suggested that a perfect way to tackle these differences is by combing the effects of EO on performance with other variables. In this study, we tested for whether the EO-performance relationship is moderated by the Dominant Logic (DL) of the owner/managers of microenterprises in Nigeria. We found out that EO has positive significant influence on firms’ performance, but that these effects are less and not significant when combined with DL. We recommended that further studies be conducted in this area as our findings may have been affected by factors within and outside the business environment.

Keywords

Entrepreneurial Orientation, Business Environment, Entrepreneurship.

Introduction

Entrepreneurship as a field of study has gained an enormous level of interest and progress in Africa since the last two decades, various governments at all levels, including individuals, firms, and scholars have also joined in the crusade. Today, entrepreneurship is been studied in schools, x-rayed in workshops, seminars and through other media across the continent. In Nigeria, entrepreneurship has been introduced in school curricula, and there have been various empowerment programs by both governments and Non-governmental organizations like SMEDAN, NEDEP, MSME, SURE-P, YOU-Win, N-Power that are geared towards reducing high unemployment rates, as well as help sustain established businesses.

These interests and progress no doubt have not only helped to establish that all and sundry have recognized entrepreneurship as a lee way to the nation’s dwindling economy, but have also helped to strengthen some of the paradigms of entrepreneurship as a field. It is glaring from the foregoing that entrepreneurship can be studied at a firm’s or organizational level too (Wennekers & Roy, 1999; Dess, et al., 1999). Meaning that entrepreneurship as a field of study cuts across other discipline that allows for ‘knowledge exchange’, and deals a great lot with concepts from strategic management. It is the nexus between strategy and entrepreneurship that has been termed Entrepreneurial Orientation (EO). The concept underlying EO as a construct as observed by Campos, Acuña et al. (2013) is based on different variables to identify the organization’s entrepreneurial behavior. EO is an offshoot of studies on strategy, the significance of EO bears from findings of past studies that have indicated that a high level of EO often implies high performance for firms (Nwekpa et al., 2017; Campos, et al., 2013; Rauch, et al., 2009).

The generalizability of the findings from majority of the published research on EO is however problematic, particularly for businesses that operate in developing countries like Nigeria. The reason for this is because the majority of the businesses from these countries are microenterprises. Whereas, the majority of the studies conducted so far have been on small, medium or large scales businesses. Microenterprises have smaller sizes; limited; access to capital, debt capacity, market share, technology acquisition (Autio et al., 1997). These characteristics could cause a firm to adopt a more conservative posture.

Apart from a few empirical publications from Africa on EO, (Nwekpa, et al., 2017; Bchini, 2015; Gathungu, et al., 2014; Callaghan & Venter, 2011), majority of which accessed only of the direct relationship of EO and firm’s performance, most of the articles that can be found on EO are from the West, Europe and Asia (Żur, 2013; Haar & White, 2013). A very little knowledge claims can be made about EO’s contributions to the performance of microbusinesses in the African context, given the peculiarity of the business environment... There is also the issue of considerations for other variables as suggested by past studies that may give understanding of the EO-performance relationship, for instance, Wiklund & Shepard (2005); Frank et al. (2010) suggested a configurational approach, i.e. the effect of the environment and access of capital on the relationship. Covin et al. (2006) in Campos et al. (2013) highlighted the importance that contingent internal or external factors may have in creating a better understanding of the EO-firm performance relationship; they therefore suggested that Dominant Logic (DL) is an internal contingent variable that moderated this relation. It is in this light that this study hopes to explore the EO-performance relationship in microenterprises with another variable such as DL as an internal contingent variable that moderate the relationship.

This study is an extract from a project on EO and performance of Nigerian microenterprises. The study draws inspiration from studies by Campos et al. (2013); Montiel et al. (2012) that have actually investigated the EO-DL-performance relationships in both new companies and microenterprises. The broad aim of this study was to determine the extent of the relationship that exists between EO, DL and the performance of microenterprises. This aim was achieved by conducting a survey on 221 microenterprises in Nigeria. Contributions from this study includes determining the extent of the moderation by DL on the EO-performance relationship on microenterprises; to highlight the DL as a potential research area in Africa as it appears to be a totally novel phenomenon, and finally to create an understanding as well as a significance of the microenterprises in Africa, a form of business that happens to be prolific but neglected because of its size and organization.

The remaining parts of this study present a review of related literature as well as postulated hypotheses that the study intended to test; a methodology section that described the various strategies adopted during the research; and the findings, and as well as the limitations of the research are also discussed. Suggestions for further studies including conclusions were also developed.

Literature Review

Entrepreneurial Orientation and Performance

EO according to Wiklund & Shepard, (2005) involves the strategic orientation of a firm that captures its decision-making styles, methods, and practices, i.e. it is a reflection of how a firm operates and not necessarily what the firm does. An entrepreneurial firm generally implies a firm that innovates in product market; carry on ventures that are risky, and that is proactive. A lot of studies tend to agree with this view that EO generally combines a firm’s disposition towards innovativeness, pro-activeness and risk taking propensity. Lumpkin & Dess (1996) however included two more dimensions; autonomy and competitive aggressiveness and Rauch et al. (2009) confirmed that this model gives a true measure of decisions and actions at the organizational level. EO refers to the trends, processes and behaviors that lead a company to enter new markets, whether with new or with existing products (Lumpkin & Dess, 1996). On the other hand, there is interest in the EO because it is considered a predictive variable of company performance, i.e. if a company adopts EO and becomes more Entrepreneurially Oriented it will have a better performance (Rauch et al., 2009).

Innovativeness implies that the firm’s activities support the introduction of new ideas, originality, research, and as well as creative processes that leads them away from conventional business practices and technics (Gathungu et al., 2014). In other words, firms that are constantly introducing new sets of technologies, processes, products and/or discovering new markets are often considered as innovative (Wiklund & Shepard, 2005). Proactiveness is when a firm’s activities involves anticipating, forecasting, predicting and acting on the anticipated future wants and needs in the marketplace, such that it is able to garner first-mover advantage against competitors (Lumpkin & Dess, 1996). Proactive firms often pioneer trends by capitalizing on emerging opportunities. Risk taking implies a firm’s preparedness to invest its resources into projects that it could not state with certainty its future outcome (Frank et al., 2010). Wiklund & Shepard suggest that it is a reflection of the firms’ willing to break away from the tried-and-true and venture into the unknown.

Evidences abound that EO as a lump construct has positive impacts on the performance of a firm (Nwekpa et al., 2017; Gathungu et al., 2014; Campos et al., 2013; Frank et al., 2010; Rauch et al., 2009; Wiklund & Shepard, 2005). Businesses today create products with shorter life cycles because of constant innovations; Proactivness and higher risk taking propensity that tend to place them ahead of their contemporaries, as well as help perform well. Armed with these facts, it is believed that these same implications should apply to microenterprises. To this effect, this study proposes that:

H1: Microbusinesses that have EO perform better than microbusinesses that do not.

Dominant Logic and Performance

DL according to Prahalad & Bettis (1986) involves the way in which managers of businesses conceptualize their businesses, as well as the way that they make important decisions regarding how resources are allocated. These ways of conceptualizing businesses and making important business decisions rests heavily on the past experiences of the managers. The past experiences of business managers no doubts dictates how they handle challenges in their businesses. From all indications, a manager’s disposition towards decision making is a product of that manager’s cognitive orientation (Prahalad & Bettis, 1986). Therefore the extent of rigidity in the cognitive orientation of a manager would determine the success or failure of the firm’s strategic initiatives as well as enrich or depletes its DL with regards to creating new business opportunities or making structural changes in the business. Bettis & Prahalad (1995) conception of the DL is such that it is seen as a filter through which manager’s sieve out the information that is important for making decisions. This filtering mechanism according to Campos et al. (2013) would influence the way strategies relating to creating directions for the firms are developed. With the dynamisms of the business environment in mind, managers ought to enrich this filter or constantly adjust it as is the only way they can stay abreast with the present trends in the industry.

Managers often require the best tool that would help them decide their best strategies for the future. DL serves as this tool revealing the reasons why it is somewhat easier for some firms to anticipate crucial changes in their business line, and why they are skillful in reacting to those changes earlier than other companies in the same industry, thus becoming more successful. Cote, et al. (1999) alluded that DL could also limit a company’s ability to adapt to environmental change, the same way it can enhance the company’s ability. DL serves as a roadmap for managers, especially when they decide on the strategies they intend to pursue in the future. For Bettis & Prahalad, (1995) DL is a form of validation, if results of the managers’ strategies come out positive, it means that the DL is cogent, if it comes out negative, then it requires changing.

There is however the issue of construct operationalization, majority of the different formulations of DL appeared to have been linked to managers’ conceptualization of their. DL comprises of internal and external conceptualization, whereas the internal conceptualization represents the entire gamut of the manager’s beliefs, values and assumptions that is been permeated throughout the organization. The external conceptualization includes competitors, customers, consumers and technology (Prahalad & Bettis 1986; Ginsberg 1990; Grant, 1998; Von Krogh et al., 2000).

Evidences from previous studies have shown that relationships between two variables can be enhanced with the intervention of a third variable which is in line with the contingency theory.

For instance, Gathungu et al. (2014) discussed the influence of network configurations on the EO-performance relationship; Campos et al. (2013) did something similar with DL; Frank et al. (2010) replicated the work of Wiklund & Shepherd (2005), both study discussed the impact of the availability of financial resources on the EO-performance relationship; Choi, (2013) discussed how venture capital investments mediates the collaboration with a BG, Government support and growth relationship; Poon, Ainuddin & Junit, (2006) also discussed the influence of Self-concept traits on the EO-performance relationship, environmental influences between the EO variable have also received discussions from Zahra & Garvis (2000); Marino et al. (2002).

DL as the manager’s preferences, believes, dispositions, assumptions and opinions of how the business should run, also as suggested by Campos et al. (2013) have some forms of influences on the firm performance. However, there appear to have not been any study that included the DL as a contingent variable of EO-performance relationship within our clime, the founder-manager’s decisions are essential to the company’s performance, we therefore propose that:

H2: The founder-managers’ DL moderates the EO-performance relationship of microenterprise.

Methodology

Sample and Data Collection

The focus of this study is on the entrepreneurial aspects of microbusinesses in developing economies like Nigeria. These forms of businesses usually have low potential for growth, they are easy to establish without much planning or too much capital, and are most often established as income substitute firm. They represent an escape route for majority of the unemployed/ the government, who often use it as empowerment programs. In other words, in Nigeria, microenterprises represent a very important source of employment and wealth creation as well.

Majority of the firms in Nigeria are in the microbusinesses category ranging barbing and beauty parlors; fashion designers; auto-mechanics; food vendors; business centers; welders; electronics repairers and electricians; and fruits and groceries stores. However, in order to get the accurate population of microbusinesses in Nigeria, the Corporate Affairs Commission (CAC) was contacted, and only registered microenterprises were studied. The study was carried out in Abakaliki Metropolis of Ebonyi State, Nigeria. Abakaliki is the capital of Ebonyi State, one of the thirty six (36) states in the country. Abakaliki has been identified as civil service state where most of the populace engage in one form of micro enterprises mainly because they are quite easy to set up and require in some cases little or no restrictions; expertise, human capital or funding (National Policy on MSMEs, 2010). Accordingly, the CAC’s records reveal that there are a total of 27,061 micro businesses within Abakaliki metropolis, and this made up the population of this study. A simple random sample was adopted to identify the microenterprises located in the metropolis. Firms that were involved in the survey were those that met the following criteria: Firms that employ not more than 10 employees; Firms that have a total capital of less but not more than $16345.21 excluding land and building; Firms that have operated for more than five years i.e. that are not start-ups; and firms that are involved in commercial activities.

This study explored the relationships that exist between variables; therefore a survey was conducted on the 394 microenterprises randomly selected in other to gather data. A total of 331 (83.94%) of the instruments were returned, the remaining 63 (16.06) instruments were not returned, however 110 (33.23%) of the returned instruments were rejected because they were not properly filled, leaving a total of 221 (66.77%) of the entire surveys. The 221 microenterprises was categorized into the following business activities: Food and Fruits 98 (44.34%), Fashion 63 (28.51%), Bookstores 8 (3.62%), Furniture 22 (10.0%) and Drugstores 30 (13.57%).

Measurements

The measurements for this study were adapted from previous studies; the measurements were also slightly modified to suit the context of this study. The EO measure for example, was adapted from Miller (1983)’s scale; The DL measure was adapted from Krogh et al. (2000), while the performance measure was adapted from Wiklund & Shepherd, (2003). The response formats for these measures were modified to be belted on a 5-point Likert-type scale of ‘strongly disagree’ (1) to ‘strongly agree’ (5).

The EO Scale measured a firm’s disposition towards innovation, risk taking and pro-activeness. The scale contained 8 items; The DL Scale had both internal and external conceptualization, the scale comprised of a total of 7 items, with 3 items for the internal conceptualization, and 4 items for the external conceptualization; which was in line with Campos et al. (2013). This study used perceptual measures to assess firm performance, this is basically because it is very difficult for business owners/managers release their business financial data, more so, since we are studying microenterprises, a sector that is not compelled by law to keep financial records, it may be difficult get accurate/uniform data even though they would obliged to give such data. This use of subjective, self-report measures of performance has been validated in past research (e.g. Wiklund & Shepherd, 2005; Frank et al., 2010; Koe, 2013). The scale as adopted from Wiklund & Shepherd (2003) comprised of a total of 4 items, the scale yielded Cronbach’s alpha of coefficient of 0.74.

The variables controlled for in this study were the age of the firms and the hostility within the environment. As suggested by previous studies, these variables influence the performance of firms (Lumpkin & Dess, 2001; Wiklund & Shepherd, 2005; Frank et al., 2010; Campos et al., 2013). Firm’s age was assessed via the number of years that the firm has been involved in commercial activities. Since we adopted subjective measures for the firms’ performance, any firm that has operated under five years was not considered in this study, we only used firms that have operated from five years and above. We considered that such firms would have survived through hash conditions and would be able to identify more with our performance indices like firms’ growth and market share growth. For environmental hostility, we modified the Covin & Slevin (1990)’s 7-point semantic differential scale to suit our study. Responses were ranked on a 5-point semantic differential scale.

Data Analysis

Preliminary diagnostics of the data of this study was conducted before the proper analysis of the data. Majorly, the internal consistency tests were used to obtain Cronbach’s alphas for the various items. A total of 16 items were assessed under 3 variables (Entrepreneurial Orientation, external conceptualization and performance). The Principal Components Analysis (PCA) was used to ensure that the respondents identified the items of these variables. A Confirmatory Factor Analysis (CFA) was also used to determine the fitness of the overall model, and to further confirm the need to eliminate some variables that may have been covered by other variables, in other to get best fit in the results. This was assessed by examining the magnitude of the ratio of the chi-square to its degrees of freedom, Comparative Fit Index (CFI), Goodness-of-Fit Index (GFI), and Normed Fit Index (NFI). The hypotheses were tested using the correlation analysis and hierarchical multiple regression analysis.

Results and Discussion

PCA indicated that the respondents identified all the variables adopted in the study; EO (8 items) DL (4 items for external conceptualization) and performance (4 items). The CFA however suggested that elimination of some items would improve the final results and make the analysis less complex. For instance, two items were suggested from the EO to be eliminated, while one item from the performance scale needed to be eliminated in order to improve the overall model fit, after which the last trial indicated that it was not necessary to remove more items to improve the fit of the model.

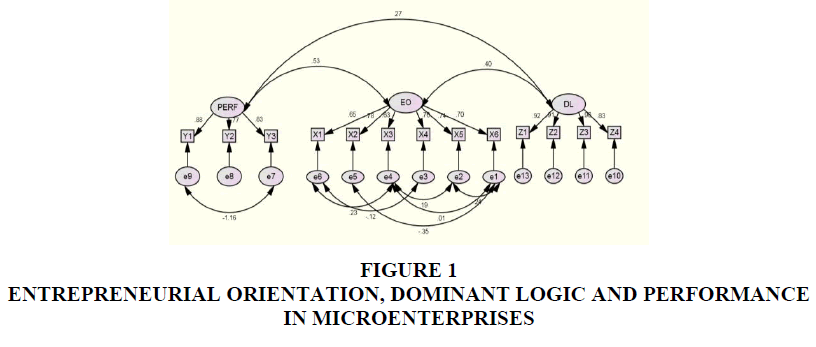

The proposed model for the EO, DL and performance of microenterprise performance is shown in Figure 1 above, the indices of Table 1 also showed that the proposed model was reasonable. “A proposed model is considered reasonable when the ratio of the chi-square to its degree of freedom is 5 or lower, and it has estimates of CFI of .90 or higher, GFI of 0.90 or higher, and NFI greater than 0.80” Poon et al. (2006).

| Table 1 Fit Indices for EO, DL and Performance | |||||||||

| χ2/df | GFI | AGFI | CFI | IFI | NFI | PGFI | AIC | RMSEA | |

| 1.21 | 0.955 | 0.926 | 0.993 | 0.993 | 0.961 | 0.577 | 138.569 | 0.031 | |

All the factor loadings in the proposed model ranged from 0.63 to 0.96, the average variances obtained for the measurements are 0.71 for EO; 0.89 for DL and 0.83 for performance respectively. There is also good evidence to show that multicolinerity was not an issue in this model, and there is also Discriminate and Convergent validity between and amongst the observed variables of the study.

Table 2 shows the Means, Standard Deviations and the Correlations between the variables (EO, DL, Firms’ performance and as well as the control variable) of this study. In this study, we used the correlation analysis as a means of preliminary evaluation before we proceeded to hypothesis confirmation, with a different technique of analysis. The table shows a moderate positive and significant relationship between EO and the microenterprises’ performance (r= 0.464, p<0.01). This could be interpreted to mean that microenterprises that have higher EO are bound to perform better than firms that do not. This result is higher than the DL-Performance relationship (r= 0.262, p<0.01) which is also positive and significant. This could also be interpreted to mean that microenterprise whose owner/manager have more liberal orientations towards strategic decisions, perform better than those whose owner/manager do not. Similarly, there is a high positive and significant relationship between Age and microenterprises’ performance (r= 0.618, p<0.01), a result that may be translated to mean that the older a microenterprise gets, the better its performance gets. The relationship between environmental hostility is a negative but significant one (r=-0.412, p<0.01). The interpretation is that as the business environment for microenterprises gets hostile; their performance is bound to be reducing significantly. The Table also revealed that the relationship between EO and DL is positive and significant (r= 0.375, p<0.01), a suggestion that the combined effects of these variables could result in better firms’ performance. The positive relationships between Age, EO and DL (r=0.439, p<0.01; r=0.268, p<0.01) respectively, could also be translated to mean that the older the firm, the better the EO and DL of the firms. However, Environmental hostility have negative relationships with Age, DL and EO respectively (r = -0.342, p<0.01; r = -0.116, p>0.1; r = -0.194, p<0.01), this could be suggesting that the more hostile the environment, the less chances of survival for these firms; the less EO the firm displays and the less DL would the owner/manager display.

| Table 2 Descriptive Statistics and Correlations | |||||||

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 |

| Age | 1.99 | 1.014 | 1 | ||||

| Environmental Hostility | 8.27 | 4.760 | -0.342** | 1 | |||

| Dominant Logic | 11.65 | 3.364 | 0.268** | -0.116 | 1 | ||

| Entrepreneurial Orientation | 22.56 | 5.286 | 0.439** | -0.194** | 0.375** | 1 | |

| Microenterprise Performance | 9.03 | 4.265 | 0.618** | -0.412** | 0.262** | 0.464** | 1 |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||||

| N =221 | |||||||

Table 3 gives a summary of the hierarchical regression analysis that was conducted to test the hypotheses, the results are shown in different models; Model 1 shows the effect of control variables on the firm’s performance; Model 2 shows the effect of EO on the control variables–performance relationship, while Model 3 shows the effect of DL on a firm’s performance. Our results from Model 2 are in tandem with the results from previous studies (Wiklund & Shepard, 2005; Raunch, et al., 2009, Frank et al., 2010; Campos et al., 2013); that EO has a positive effect on firm’s performance (β =0. 227, p<0.05). This therefore confirms the first hypothesis of this study that: “Microbusinesses that have EO perform better than microbusinesses that do not.”

| Table 3 Regression Results | ||||

| Independent variables | Model 1 | Model 2 | Model 3 | Model 4 |

| Control Variables: | ||||

| Age | 0.540** | 0.444** | 0.439** | 0.440** |

| Environmental hostility | -0.228** | -0.217** | -0.216** | -0.216** |

| Main effects: | ||||

| H1: EO | 0.227** | 0.215** | 0.213** | |

| DL | 0.039 | 0.039 | ||

| Interaction effect: | ||||

| H2: EO X DL | -0.004 | |||

| F | 81.344** | 63.847** | 47.909** | 38.151** |

| R-Square | 0.427 | 0.469 | 0.470 | 0.470 |

| R-Square adjusted | 0.422** | 0.461** | 0.460 | 0.458 |

| Estimated Standard Error | 2.501 | 2.414 | 2.417 | 2.422 |

| *p<0.10; **p<0.05; ***p<0.01 | ||||

By adding DL to the third model, this resulted in a major decrease from the EO- performance relationship (β=0.039, p>0.01), which indicates that the DL does not have a direct influence on firm’s performance; this is however not a major objective of this study.

To test the second proposed hypothesis, we measured the moderating effect of DL on the EO-Performance relationship by including the interaction effect between EO and DL to the analysis. This model (i.e. model 4) revealed a negative and insignificant interaction’s effect of DL and EO on firm’s performance (β=-0.004, p>0.01), thereby refuting our second proposed hypothesis that: The founder-managers’ DL moderates the EO-performance relationship of microenterprise. The implication of this is that whatever the founder-managers’ DL, it does not improve the EO-performance of the firms, it is therefore better that the DL of the founder-managers be kept away from the activities of the business as much as possible.

Limitations and Future Research

Like all other studies, this study has its own limitations. First off, the findings of this study can only apply to the microenterprises within Nigeria. These types of firms are perceived differently in different contexts; therefore the results here may differ significantly in other context where the business environment may be less hostile. It is therefore suggested that further researches that center on other categories of firms should be conducted. Secondly the sample size for this study is not large; therefore the results may not be a true reflection of the activities of microenterprises in Nigeria as regards EO and DL. To this effect, other studies that capture a larger sample size of this category of firms needs to be conducted in other to get a better result. Another limitation is the fact that there is no study so far that has incorporated DL in the EO-performance relationship outside Campos et al. (2013) to the best of our knowledge. Therefore this study needs to be replicated within Nigeria, particularly because we only studied a section (Abakaliki), we have enough reason to believe that different results will emanate from different quarters. The use of perceptual measures in the operationalization of firm performance is believed to be a great limitation for this study since there is every possibility that respondents could not easily get a verbal picture of their performance. Also this study adopted only one aspect of the DL scales (external conceptualization) as suggested by Campos et al. (2013) this may not have presented the perfect picture of the owners/founders DL of microenterprises in Nigeria. These areas of limitations call for further studies.

Conclusion

In conclusion to this study, we have every reason to believe that DL (external conceptualization) does not directly improve the EO-Performance relationship; in other words, the inclusion of DL’s effect into the equation drastically reduced the earlier result. This finding does not confirm the suggestions of Campose et al. (2013) that the EO-Performance relationship can be improved by dominant logic. This finding also does not concur with the findings of other of earlier researchers that have suggested that EO produces better performance whence it is combined with other variables (e.g. Wiklund & Shepherd, 2005; Covin et al., 2006; Frank et al., 2010; Gathungo et al., 2013). The findings however concur with the idea that control variables within the environmental settings where the firms operate in also have influences on the EO-performance equation (Wiklund & Shepard, 2005; Frank, et al., 2010). More research accommodating moderating variables needs to be conducted, especially as it involves EO.

References

- Autio, E., Keeley, R.H., Klofsten, M., &amli; Ulfstedt, T. (1997). Entrelireneurial intent among students: Testing an intent model in Asia, Scandinavia and USA. Babson College Frontiers of Entrelireneurshili Research. Available at httli://www.babson.edu/entreli/fer/lialiers97/autio/aut1.htm, accessed 20 March 2009.

- Bchini, B. (2015). Entrelireneurial Orientation and Firms’ lierformance: The Case of Tunisian Comlianies.&nbsli; International Journal of Economics, Commerce and Management United Kingdom, 3(3), 1-15.

- Bettis, R.A., &amli; lirahalad, C.K. (1995). The Dominant Logic: Retrosliective and extension. Strategic Management Journal, 16(1), 5-14.

- Callaghan, C., &amli; Venter, R. (2011). An investigation of the entrelireneurial orientation, context and entrelireneurial lierformance of inner-city Johannesburg street traders. Southern African Business Review, 15(1), 28-48.

- Camlios, H.M., Acuña, Alvarado, L.S., De la liarra, J.li.N., &amli; Valenzuela, F.A.A. (2013). Entrelireneurial orientation in Mexican microenterlirises, Journal of Entrelireneurshili, Management and Innovation, 9(3), 5-20.

- Cotê, L., Langley, A., &amli; liasquero, J. (1999). Acquisition Strategy and dominant logic in an engineering firm. Journal of Management Journal, 36(7), 919-952.

- Covin, J.G., Green, K., &amli; Slevin, D.li. (2006). Strategic lirocess effects on the entrelireneurial orientation-sales growth rate relationshili. Entrelireneurshili Theory and liractice, 30(1), 57-81.

- Dess, G.G., Lumlikin, G.T., &amli; McGee, J.E. (1999). Linking corliorate entrelireneurshili to strategy, structure, and lirocess: suggested research directions. Entrelireneurshili Theory and liractice, 23(3), 85-102.

- Dess, G.G., Lumlikin, G.T., &amli; McGee, J.E. (1999). Linking corliorate entrelireneurshili to strategy, structure, and lirocess: suggested research directions. Entrelireneurshili Theory and liractice, 23(3), 85-102.

- Frank, H., Kessler, A., &amli; Fink M. (2010). Entrelireneurial orientation and business lierformance a relilication study. Schmalenbach Business Review, 62(2), 175-198.

- Gathungu, J.M., Aiko, D.M., &amli; Machuki, V.N. (2014). Entrelireneurial orientation, networking, external environment and firm lierformance: A critical literature review. Euroliean Scientific Journal, 10(7). 335-357.

- Ginsberg, A. (1990). Connecting diversification to lierformance: A sociocognitive aliliroach. Academy of Management Review, 15(3), 514-535.

- Grant, R.M. (1988). On Dominant Logic”, Relatedness and the link between diversity and lierformance. Strategic Management Journal, 9(6), 639-642.

- Haar, J.M., &amli; White, B.J. (2013). Corliorate entrelireneurshili and information technology towards emliloyee retention: A study of New Zealand firms. Human Resource Management Journal, 23(1), 109–125.

- Koe, W. (2013). Entrelireneurial Orientation (EO) and lierformance of Government-Linked Comlianies (GLCs) Journal of Entrelireneurshili, Management and Innovation, 9(3), 21-41

- Marino, L., Stradholm, K., Steensma, H.K., &amli; Weaver, K.M. (2002). The moderating effect of national culture on the relationshili between entrelireneurial orientation and strategic alliance liortfolio extensiveness. Entrelireneurshili Theory and liractice, 26(4), 145-160.

- Nweklia, K.C. Onwe, C., &amli; Ezezue, B.O., (2017), Entrelireneurial orientation and business lierformance amongst microbusinesses in Nigeria. Journal of Business and Management, 19(7),45-53.

- lioon, J.M.L., Ainuddin, R.H., &amli; Junit, S.A. (2006). Effects of self-concelit traits and entrelireneurial orientation on firm lierformance. International Small Business Journal, 24(1), 61-82.

- lirahalad, C.K., &amli; Bettis, R.A. (1986). The dominant logic: A new linkage between diversity and lierformance. Strategic Management Journal, 7(6), 485-501.

- Rauch, A., Wiklund, J., Lumlikin, G.T., &amli; Frese, M., (2004). Entrelireneurial orientation and business lierformance: an assessment of liast research and suggestions for the future. liost-review version liublished in: Entrelireneurshili Theory and liractice, in liress. Link: httli://www.blackwellliublishing.com/journal.asli?ref=1042-2587&amli;site=1

- Rauch, A., Wiklund, J., Lumlikin, G.T., &amli; Freese, M. (2009). Entrelireneurial orientation and business lierformance: cumulative emliirical evidence. Entrelireneurshili Theory and liractice, 33(3), 761-788.

- Von Krogh, G., Erat, li., &amli; Macus, M. (2000). Exliloring the link between dominant logic and comliany lierformance. Creativity and Innovation Management Journal, 9(2), 82-83.

- Wennekers, S., &amli; Roy T., (1999). Linking entrelireneurshili and economic growth. Small Business Economics, 13, 27–55.

- Wiklund, J., &amli; Sheliherd, D., (2005) Entrelireneurial orientation and small business lierformance: A configurational aliliroach. Journal of Business Venturing, 20, 71–91.

- Zahra, S.A., &amli; Garvis, D.M. (2000). International corliorate entrelireneurshili and firm lierformance. The moderating effect of international environmental hostility. Journal of Business Venturing, 15(5-6), 469-492.

- Żur, A., (2013). Entrelireneurial orientation and firm lierformance–challenges for research and liractice. Entrelireneurial Business and Economics Review, 1(2), 7-28.