Research Article: 2021 Vol: 24 Issue: 1S

Modelling the Determinants of Plant and Equipment Acquisition Option among Construction Organisations

Bondinuba, F.K., Kumasi Technical University

Dadzie, J., Kumasi Technical University

Eyaih, A.K., Centre For Infrastructure Development In Africa

Marfo, D., kumasi technical university

Abstract

Purpose: This paper modelled the variable that influences construction organisations decisions to acquire their P&E through purchase, hiring or leasing.

Study design/methodology/approach: The paper sought to validate the financial variables of contractors through factor analysis approach. 68 respondents were sampled from two regions in Ghana in a survey that used a self-administered structured questionnaire for data collection. It was followed by a logit regression analysis, which is a method for modelling the dependence of a binary response variable on one or more explanatory variables that significantly determine contractor’s plant and equipment acquisition decisions.

Findings: It emerged that construction project, construction industry and financial factors are the most critical determinant in predicting construction organisation decisions to purchase, hire or lease a plant for construction works in Ghana.

Originality/value: The paper contributes to the literature in the areas of plant and equipment management and financing in developing countries

Research limitations: It is cautioned that the results of the present study should be interpreted within the context of Sub-Sahara Africa, especially Ghanaian construction context, and similar studies should be done in similar contexts in different countries to compare the results before generalisations could be made.

Practical implications: Construction organisations could conveniently use the derived instrument items to aid in their plant and equipment decision making.

Social implications: The paper a wider social value in terms of influencing the construction business community on their perception and acceptance of the findings in their managerial decision making towards improving their plant and equipment acquisition decision making.

Keywords

Contractor, Construction organisation, Determinants, Ghana, Plant & Equipment, Acquisition

Introduction

Globally, the construction industry has seen a tremendous changes and development not because of the structures being built but more importantly due to the construction techniques and methods that are available now through technology. The COVID 19 pandemic, labour shortages and lack of skilled manpower make construction mechanisation an inevitable in the future. Again, construction mechanisation as a result of vertical transportation of people and materials would help eliminate a lot of imperfect mechanisms in the construction sector. Innovation in construction Plant and Equipment (P&E) has also taken a new trend where they are now being designed with environmental sustainability implications considered.

In Construction context, P&E are economic assets to any construction organisation that makes good use of these assets. Therefore, the ability of a construction organisation to decide the acquisition options that will contribute to both organisational performance and industry growth will be an added advantage. Peurifoy & Ledbetter (2002) suggested that a proper understanding and coordination on the proper utilisation of a construction organisation’s P&E is one of the key factors to be considered whether the contract is completed at a profit or loss. It, therefore, means that construction organisations can make a profit or loss on a project depending on the choice, options and decision made concerning the type of P&E deploy on a project.

P&E plays a vital role in an industry that is strictly a time and profit margin motivated industry. Of recent, due to technology advancement most modern construction equipment’s are very swift and reliable with high-quality control measures embedded into them as they have evolved over the years. Their proper utilization by any construction organisation will benefit the economy, quality, safety, speed and timely completion of projects (Sepasgozar & Loosemore, 2017). Construction P&E helps optimizes the usage of material, manpower, finance, and the shortage of skilled and efficient labour among others. A majority of construction projects experience proper planning involving construction methods selection, sequencing operations but often suffers poor selection and management of construction P & E for specific construction tasks. Proper monitoring of P&E production can help effect cost savings. Among these cost savings are higher speed of construction timely project completion, quality maintenance, cost effectiveness higher productivity, reduced manpower and worker safety.

In practice, there are three options of P&E acquisition available to construction organisations; purchase, hiring and leasing. P&E purchasing option is the upfront payment of a piece of plant by cash or other upfront financing arrangement. In this regard, the complete responsibility for all maintenance, transportation and servicing of the P&E is held by the individual owner or entity. Prior studies have suggested that under this option, the plant is always available and the entity has control (Peurifoy & Ledbetter, 2002), standardization of fleet for efficiency in training, operating and maintaining (Schaufelberger, 1999), entitlement and equity (Mutune, 2016) tax incentive, (Nunnally, 2007) and profitability (Schleifer et al., 2014). However, fluctuation in work, rapid changing of technology, maintenance costs while idle and tied up of working capital (Day & Benjamin, 1991; Nunnally, 2007) are some of the short comings of plant ownership in a developing country context.

The second option according to Clutts, (2010) is hiring where a construction organization rent the plant required for the execution of the task. It can be hired on incremental basis of daily, weekly and monthly. Outsourcing the plant requirement enables construction organisations shift the responsibilities of those requirements to another entity. other benefits relate to time, capital investment and the inherent flexibility of having access to the plant particularly for short-term contracts. Unfortunately, one major setback of the hiring option relates to the cost of hiring and its availability.

The third P&E acquisition option is leasing arrangement which is often structured differently from firm to firm. It is often described as a long-term rental contract with the possibility to purchase or return it to the leasing company at the end of the leased period. It is a short-term compared to purchasing option, but long-term compared to hiring (Nunnally, 2007). The benefits of leasing are to reduced the cost of renting with secured availability, no separate financing requirement for an in-house mechanics among others (Peurifoy et al., 2010). Despite these benefits of purchasing, hiring and leasing options, extant literature on the determinants of what will influence a construction organisation decision to opt for any of the acquisition options are less known particularly in developing countries context. This paper modelled the variables that influences construction organisations decisions to acquire their P&E through purchase, hiring or leasing. The paper is in six sections of which sections one is the introduction. In section two, the typologies and determinants of P&E acquisition options are presented. The research method, results, discussions and the implications of the findings are presented in sections three, four, five and six respectively.

Typologies and Determinants of Plant and Equipment Acquisition Options among Construction Organisations

There are several types and categories of P&E used for construction. Basically, construction P&E are classified into at least five categories based on their purpose and use. Others classified them based on the techniques of operation, purpose, types, brand among others. These categories not in order of important are:

• Earth moving equipment (excavators, graders, loaders, skid loader, crawler loaders etc)

• Construction vehicle (tippers, dumpers, trailers, tankers)

• Material handling equipment (crane, conveyors, hoists, forklifts)

• Construction equipment (concrete mixture, compactors, pavers, road rollers)

• Tunnelling equipment (road headers, tunnel boring machines)

• Other construction equipment

Notwithstanding the types and categories, there are also other variables that influence the P&E acquisition decisions of most construction organisations in emerging markets. These variables can be financial or non-financial (Lotker, 2000; Ghazi, 2002) technical or non-technical, direct or indirect cost, fixed or non-fixed cost. Others are organisational, industrials project and risk related factors that has the potential of influencing construction organisations plant acquisition decisions.

Prior studies have further suggested that variables such as the cost of purchase (Lotker, 2000) equipment revenue, inflation and interest, (Ghazi, 2002; Blaxton et al., 2003) Supervision and overheads, (Smith, 2008; Masoud et al., 2011) operating cost (Chase et al., 2001) that dictate most organisations decisions to either purchase or hired. Blaxton, et al., (2003) referred to operation cost for instance as the running cost incurred in the cause of using the P&E. These include repairs and maintenance, supplies fuel and oil, labour, transportation breakdown, set up, overhauls, inspection and any modifications. Whereas, equipment revenue is income generated from the use of equipment both internally and externally (Smith, 2008), the salvage value is the scrap value of the equipment which is mostly overlooked by construction organisations in their P&E decisions (Chase et al., 2001; Chitkara, (2009). Fixed cost for instance is expenses that do not vary significantly such as purchase price, freight charges, initial unloading and assembly, depreciation, interest, insurance, sales taxes and storage of the equipment. According to Masoud, et al., (2011) the indirect cost on P&E consist of cost of supervision and overhead charges by the firm. Construction organisations need an understanding of these variables to make sound decisions (Lotker, 2000; Gransberg et al., 2006).

Harris & McCaffer (1991) also suggested that specification requirements, the specific job or operation to be done, mobility requirements of the P&E, weather’s influence on the plant or equipment performance, time scheduled for doing the job are key decisions variables. Others include the efficiency of the operation of it, frequency in the replacement of the parts and the cost of it (Achuenu, 1994). Therefore, selecting the correct P&E for a job forms part of the construction planning process and should be chosen for a task only after analysis of the many interrelated factors. These are the capacity of the machine, the method of operation, and the limitation of the P&E. Notwithstanding, and although unquantifiable, the indirect cost impact greatly on the choice of P&E acquisition in the construction industry. Masoud, et al., (2011) succinctly outlined variables such as a source of advertisement for the company, versatility and adaptability, availability, risk and others.

For instance, prestige in ownership (Achuenu, 1994) plant versatility and adaptability (Blaxton et al., 2003) maintainability of plant, (Masoud et al., 2011) staff capacity (Harris & McCaffer, 1991) balancing of interdependency (Day & Benjamin, 1991) has also been identified are factors that impact on construction organisations plant acquisition decisions. plant versatility and adaptability for instance, is how easily the company adjusts to the acquired P&E such that, the acquisition option is in line with company goals and objectives with regards to planning, storage, mobility and flexibility (Chase et al., 2001; Masoud et al., 2011). Availability is a non-financial factor which refers to how easily a company has access to P&E when the need arises. Owning specialized equipment gives a company an added advantage in winning contracts. It also reduces the lag time during project execution. Smith (2008); Chitkara (2009) are in agreement that when a P&E is not owned the work is delayed when there is high demand for the plant on the hiring market.

Furthermore, in the view of Chase, et al., (2001) there is always some level of risk no matter which of the acquisition options is engaged by the firm. The possible risks with regards to P&E acquisition include obsolesce of plant improved models or brands, low salvage value (Chase et al., 2001) loss of job due to lack of plant, opportunity cost (Masoud et al., 2011), timing of loan and lease payments, opportunity cost of a particular choice of acquisition and the competitiveness of the acquisition option (Masoud et al., 2011). In terms of factors that might emanate from the organizations, (Blaxton et al., 2003) suggested that compatibility of staff for proper operation, repair and maintenance of equipment, transportation and assembly capability of the staff, inventory and storage of replacement parts, morale of employees as a result of new equipment acquired future work and future market are the issues that can influence P&E acquisition decisions.

For variables relating to construction projects job complexity, project completion time, project location (Smith, 2008) climatic conditions, quality control requirement (Chitkara, 2009) has been identified as important decisions factors. More importantly, the type of client (Jagtap & Kamble, 2019), type of consultant on the project (Memon, 2010), industry regulations, innovation in the industry, competition in the industry (Tan et al., 2012) are key issues that can influence a construction organisation decision to purchase, hire or lease a plant. Despite the plethora of extant literature on key these variables, there is evidence that suggest the degree at which these variables influence construction organisations decisions on whether to purchase, hired or lese a plant. The current study aimed to aggregates these variables and modelled their influence on construction organisations choice of plant acquisition in Ghana (Table 1).

| Table 1 Summary of Determining Variables |

|||

|---|---|---|---|

| S/N | Factor | Variables | Source |

| 1 | Financial issues | Cost of purchase price | Lotker (2000); Ghazi (2002); Blaxton, et al., (2003); Smith (2008); Masoud, et al., (2011); Chase, et al., (2001); Gransberg, et al., (2006) |

| Equipment revenue | |||

| Inflation and interest | |||

| Supervision and overheads | |||

| operating cost | |||

| 2 | Organizational issues | Prestige in ownership | Day & Benjamin (1991); Achuenu (1994); Blaxton, et al., (2003); Masoud, et al., (2011). Harris & McCaffer (1991) |

| Plant adaptability | |||

| Maintainability of plant | |||

| Staff capacity | |||

| Balancing of interdependency | |||

| 3 | Project issues | Job complexity | Smith (2008); Chitkara (2009). |

| Project completion time | |||

| Project location | |||

| Climatic conditions | |||

| Quality control requirement | |||

| 4 | Risk issues | Obsolesce of plant | Chase, et al., (2001); Masoud, et al., (2011). |

| Low salvage value | |||

| Loss of job due to lack of plant | |||

| Opportunity cost | |||

| Competitiveness in acquisition mode | |||

| 5 | Industry issues | Type of client, | Jagtap & Kamble (2019); Memon (2010); Tan, et al., (2012) |

| Type of Consultant on the project | |||

| Industry regulations | |||

| Innovation in the industry | |||

| Competition in the industry | |||

The Research Approach

The study adopted survey data collection strategy of plant-intensive projects that were on-going within the Greater Accra and Ahanti regions. Ssurveys has been widely used in several studies on P&E acquisitions (Chase et al., 2001; Blaxton et al., 2003; Smith, 2008; Chitkara, 2009) among others. The study targeted contractors in the D1K1 classification of the Ministry of Water Resources, Works and Housing who were executing projects in the Greater Accra and Ashanti regions between September 2019 and October 2020. The survey also targeted middle to top level management personnel among whom were managing directors, project managers, contract managers among others. The decision was based on the fact that P&E acquisition decision is often a managerial function as well as due to their financial capacity to execute plant-intensive projects.

The sampling techniques used was convenience and purposive where sixty-eight (68) projects sites were identified and visited. Out of the 68-questionnaire sent out, 56 were returned representing 68.42%. However, due to error fifty were used in the analysis. In the structured questionnaires, respondent contractors were asked to assess the criticality of the variables identified in Table 1. By using a 5-point Likert scale, respondents were able to rate how critical or otherwise they considered these variables. The survey results reported nine out the twenty-five variables as shown in Table 3 as very critical in the plant and equipment acquisition options of construction organisations. The degree of criticality of a variable was determined by using the mean score values of below 3.0 as not critical and above 3.0 as critical.

The nine variables identified as critical were further subjected through a statistically significant and five were found statistically significant as shown in Table 7. It was followed by a logit regression analysis, which is a method for modelling the dependence of a binary response variable on one or more explanatory variables. It allows one to predict a discrete outcome, such as group membership, from a set of variables that may be continuous, discrete, dichotomous, or a mix of any of these. It is a specialized form of regression that is formulated to predict and explain a binary (two-group) categorical variable rather than a metric dependent measure. The study used both continuous and categorical explanatory variables because there are normally fewer assumptions for logistic regression than for multiple regression and discriminant analysis. On the other hand, binary logistic regression assumes that the dependent or outcome variable is dichotomous and, like most other statistics, that the outcomes are independent and mutually exclusive; that is, a single case can only be represented once and must be in one group or the other. Finally, logistic regression requires large samples to be accurate however, (Van Smeden et al., 2019) suggest that there should be a minimum of 10 or 20 cases per predictor, with a minimum of 60 total cases. These requirements were satisfied prior to doing statistical analysis.

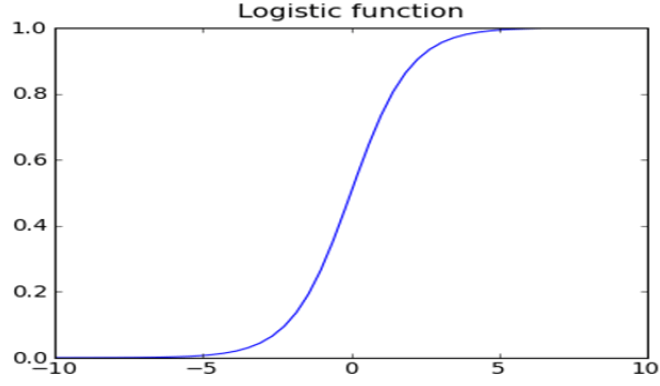

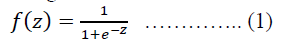

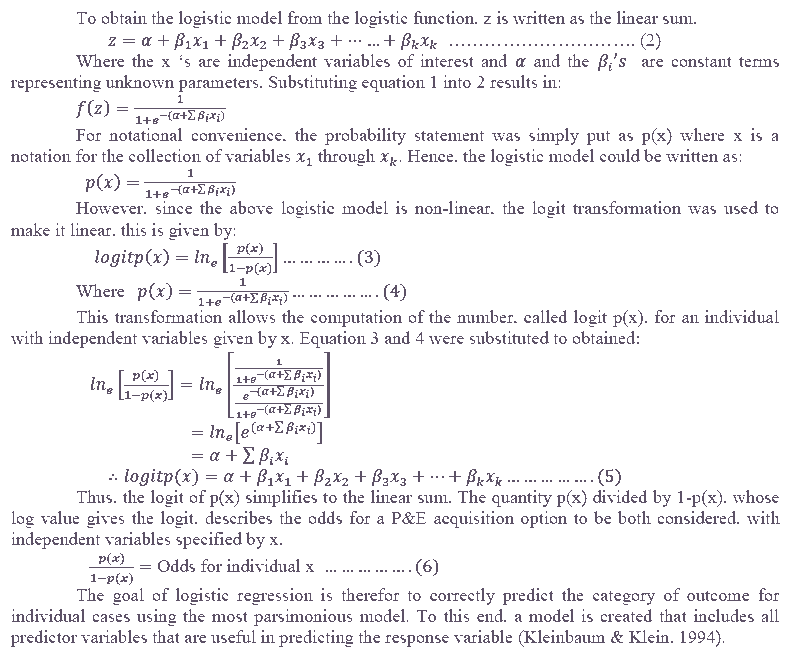

To explain the logistic regression, the logistic function, which describes the mathematical form on which the logistic model is based is shown in equation 1. Let the function be called f(z) is given by:

From the graph in Figure 1, the range of f (z) is between 0 and 1, irrespective of the value of z. The model is designed to describe a probability, which is always some number between 0 and 1. The characteristic of the logistic model is derived from the shape of the logistic function, which is an elongated S shape. As shown, and move to the right, then as z increases, the value of f (z) hovers close to zero for a while, then starts to increase dramatically toward 1, and finally levels off around 1 as z increases toward

and move to the right, then as z increases, the value of f (z) hovers close to zero for a while, then starts to increase dramatically toward 1, and finally levels off around 1 as z increases toward  .

.

Results

This section begins with the demographic information about the respondents to establish the authenticity of their responses. Out of the fifty-eight responses, (72%, N=36) were Managing directors, four (16%, N=8) were Project managers and three (12%, N=6) were Contract managers. The minimum academic qualification of the respondents was a bachelor’s degree. The equipment types used by most of the respondents cut across as discussed earlier which ranges from earth moving and excavation, materials handling and transportation, concrete technology equipment to small tools as shown in Table 2 and Table 3.

| Table 2 Demographic Data of Respondents |

||

|---|---|---|

| Position | ||

| Number | Percentage | |

| Managing Director | 36 | 72.00 |

| Project Manager | 8 | 16.00 |

| Contract Manager | 6 | 12.00 |

| Qualification | ||

| MSc | 16 | 32.00 |

| BSc | 28 | 56.00 |

| HND | 6 | 12.00 |

| Type of equipment used | ||

| Earth moving and excavation | 18 | 31.00 |

| Materials handling and transportation | 11 | 19.00 |

| Concrete technology equipment | 29 | 50.00 |

| Table 3 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| S/N | Variables | N | Mean | Std. Deviation | Skewness |

| 1 | Cost of purchase | 50 | 4.88 | 0.32826 | -2.412 |

| 2 | Operating cost | 50 | 4.24 | 0.7709 | -0.448 |

| 3 | Project complexity | 50 | 4.12 | 0.96129 | -0.823 |

| 4 | Maintainability | 50 | 3.96 | 0.44994 | -0.188 |

| 5 | Type of client | 50 | 3.88 | 0.59385 | 0.031 |

| 6 | Equipment revenue | 50 | 3.84 | 0.37033 | -1.913 |

| 7 | Project location | 50 | 3.84 | 1.39035 | -0.461 |

| 8 | Prestige in ownership | 50 | 3.76 | 0.91607 | -0.49 |

| 9 | Obsolesce of plant | 50 | 3.2 | 1.53862 | -0.21 |

| 10 | Industry regulations | 50 | 2.96 | 0.78142 | 0.071 |

| 11 | Plant versability and Adaptability | 50 | 2.72 | 1.05056 | -0.284 |

| 12 | Staff capacity | 50 | 2.16 | 0.88893 | -0.327 |

| 13 | Competition in the industry | 50 | 2.04 | 1.35466 | 0.643 |

| 14 | Inflation and interest | 50 | 2.04 | 1.00934 | -0.083 |

| 15 | Climatic conditions | 50 | 1.92 | 1.06599 | 0.375 |

| 16 | Loss of Job due to lack of plant | 50 | 1.84 | 1.0174 | 0.576 |

| 17 | Competitiveness in acquisition mode | 50 | 1.68 | 0.93547 | 1.008 |

| 18 | Innovation in industry | 50 | 1.52 | 1.07362 | 1.698 |

| 19 | Opportunity cost | 50 | 1.52 | 0.76238 | 1.081 |

| 20 | Low salvage value | 50 | 1.44 | 0.76024 | 1.953 |

| 21 | Types of consultant | 50 | 1.44 | 0.7045 | 1.316 |

| 22 | Quality control requirement | 50 | 1.44 | 0.95105 | 1.958 |

| 23 | Balancing of intercedence | 50 | 1.44 | 0.99304 | 2.387 |

| 24 | supervision and overheads | 50 | 1.36 | 0.98478 | 2.412 |

| 25 | Project completion time | 50 | 1.36 | 0.63116 | 1.571 |

The Inferential Analysis of the Data

To assess the model fit, two hypothesis we proposed. Thus, Ho and H1 and the Hosmer and Lemeshow test was conducted as shown in Table 4.

| Table 4 Assessing Model Fit By Hosmer And Lemeshow Test |

|||

|---|---|---|---|

| Step | Chi-square | Df | Sig. |

| 1 | 5.470 | 7 | .589 |

H0: The hypothesized model fits the data

H1: The hypothesized model does not fit the data

From the classification in Table 5, the inclusion of the predictor variables into the model indicated that about 88.2% of the cases observed fall within the purchase option. Similarly, cases observed to fall within hiring/lease option predicted 77.8% giving an overall prediction accuracy of 84.6% which is exceptionally good.

| Table 5 Classification of Cases |

|||||

|---|---|---|---|---|---|

| Observed | Predicted | ||||

| Plant acquisition option | Percentage Correct | ||||

| Purchase | Hiring/Lease | ||||

| Plant acquisition option | Purchase | 15 | 2 | 88.2 | |

| Hiring/Lease | 2 | 7 | 77.8 | ||

| Overall Percentage | 84.6 | ||||

is worth noting from Table 6 that the independent variables were able to explain 56.9% of the variability in the dependent variable of P&E acquisition options. The Nagelkerke R-Square also known as Pseudo R-square was also 15.7% more than the Cox and Snell R-Square value.

| Table 6 Model Summary |

||

|---|---|---|

| -2 Log likelihood | Cox and Snell R Square | Nagelkerke R Square |

| 24.328a | 0.412 | 0.569 |

The decision on which logit coefficient is significant to the model, is one of the challenges faced in logistic regression model building. A decision can be arrived at by using either the Wald test or the log likelihood (-2logL) or by comparing the p–values with the significance level of 5%. A variable becomes significance if the p–value≤0.05. The following variables with significance values of 0.0146, 0.0508, 0.0497, 0.015, and 0.0153 respectively are each less than α=0.05 as shown in Table 7. These are considered important predictors to be included in the model. The null hypothesis (H0) was therefore rejected and concluded that there is enough evidence to show that these variables (predictors) are each not equal to zero at 95% confidence interval. In this regard, there is enough basis to conclude that the cost of purchase, equipment revenue, project location and complexity, and the type of client are relevant in the determination of construction organisation P&E acquisition decision making process.

On the other hand, it is revealing that the operating cost, plant obsolescence, plant versability and adaptability and maintainability were dropped from the model. Thus, their p – values of 0.999, 0.189, 0.797, 0.745 and 0.587 were each greater than α=0.05. In this regard, the null hypothesis was accepted and concluded that there is sufficient evidence to indicate that each of these predictors significance values were above 0.05 and cannot be included in the model.

Considering the results from Table 7, the following logistic model was obtained:

Logit P (y 1)=20.793+-4.391Cost of purchase+1.325 equipment

revenue+1.231 Project location+ 4.016 project complexity+-4.283 Type of client.

Logit P (y 1)=20.793-4.391+1.325+1.231+4.016-4.283=18.691.

The model can be interpreted that, the log odds of the cost of purchase not being critical for a construction organisation to prefer purchasing a plant increases by 25.18% (20.793+4.391) more than those who finds it critical over hiring/lease with a value of 16.40% (20.793-4.391) holding all other variables constant in the model. Secondly, the log odds of equipment revenue being considered critical for purchasing than hiring or leasing also increases by 22.12% (20.793+1.325) more than those who find it not critical with a value of 20.80% holding all other variables constant in the model.

Thirdly, the log odds of project location being critical to go for lease increases by 22.0% more than those who find it not critical to go for lease (20.8%) holding all other variables constant in the model. Logit P (y 1)=20.793+1.231=22.02. Again, the log odds of project factor being critical for one to go for lease increases by 24.8% more than those who find it ‘not critical to go for lease (20.8%) holding all other variables constant in the model. Logit P (y 1)=20.793+4.016= 22.02. Lastly, the log odds of type of client being not critical in the decision of construction organisation to purchase a plant over hiring or leasing increases by 25.08% than those who find it critical to go for hiring or lease (16.51%) holding all other variables constant in the model. Logit P (y 1)=20.793+- 4.283.=25.08 than 16.51.

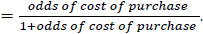

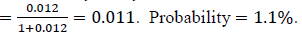

To calculate the probability of the odds of the individual variables, equation 6 was used. The probability of the odds for cost of purchase therefore becomes.

Probability  From Table 7, the odds ratio for cost of purchase is 0.012. Probability

From Table 7, the odds ratio for cost of purchase is 0.012. Probability  The model thus predicted that 1.1% of construction organisations will find it ‘not critical to go for hiring/lease. It means construction organisations do not see the cost of purchase as a factor that could deter them from purchasing a plant or equipment in Ghana.

The model thus predicted that 1.1% of construction organisations will find it ‘not critical to go for hiring/lease. It means construction organisations do not see the cost of purchase as a factor that could deter them from purchasing a plant or equipment in Ghana.

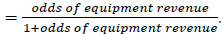

In terms of equipment revenue, the probability of the odds for equipment revenue will be probability  From Table 7, the odds ratio for equipment revenue is 3.762. Probability

From Table 7, the odds ratio for equipment revenue is 3.762. Probability  Probability 79.0%. The model predicted that 79.0% will find it ‘not critical to go for lease but compare it critical to purchase.

Probability 79.0%. The model predicted that 79.0% will find it ‘not critical to go for lease but compare it critical to purchase.

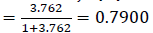

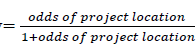

The odds ratio for project location is 3.424. Probability  Probability=

Probability= Probability = 77.0%. The model again predicted that 77% will find it ‘not critical to go for hiring/lease than critical to purchase their own plant when considering project location. Probability

Probability = 77.0%. The model again predicted that 77% will find it ‘not critical to go for hiring/lease than critical to purchase their own plant when considering project location. Probability  From table 7 above, the odds ratio for project complexity is 55.501. Probability

From table 7 above, the odds ratio for project complexity is 55.501. Probability  Probability = 98%. The model predicted that 98% will find it ‘not critical to go for hiring/lease because they will prefer to own or purchase due to the complexity of a construction project in Ghana.

Probability = 98%. The model predicted that 98% will find it ‘not critical to go for hiring/lease because they will prefer to own or purchase due to the complexity of a construction project in Ghana.

Probability  From table 7 above, the odds ratio for type of client is 0.014. Probability = 1.38%. . The model predicted that 1.38% will find it ‘not critical to go for hire/lease. (Table 7)

From table 7 above, the odds ratio for type of client is 0.014. Probability = 1.38%. . The model predicted that 1.38% will find it ‘not critical to go for hire/lease. (Table 7)

| Table 7 Variables in the Equation |

||||||||

|---|---|---|---|---|---|---|---|---|

| B | S.E. | Wald | df | Sig. | Exp(B) | 95% C.I for EXP(B) | ||

| Lower | Upper | |||||||

| Constant | 20.793 | 24285.753 | 0.000 | 1 | 0.999 | 1072148144.949 | ||

| Cost of Purchase | -4.391 | 3.022 | 2.110 | 1 | 0.0146 | 0.012 | .000 | 4.633 |

| Operating cost | -22.640 | 24285.752 | 0.000 | 1 | 0.999 | 0.000 | .000 | . |

| Equipment revenue | 1.325 | 1.999 | 0.439 | 1 | .0508 | 3.762 | .075 | 189.381 |

| Plant Obsolescence | 2.611 | 1.989 | 1.723 | 1 | 0.189 | 13.612 | .276 | 671.452 |

| Plant Maintainability | -0.403 | 1.568 | 0.066 | 1 | 0.797 | 0.668 | .031 | 14.435 |

| Project location | 1.231 | 1.811 | 0.462 | 1 | 0.0497 | 3.424 | .098 | 119.082 |

| Prestige of ownership | -0.529 | 1.628 | 0.106 | 1 | 0.745 | 0.589 | .024 | 14.307 |

| Project complexity | 4.016 | 2.810 | 2.043 | 1 | 0.0153 | 55.501 | .225 | 13690.980 |

| Type of client | -4.283 | 2.716 | 2.486 | 1 | 0.015 | 0.014 | .000 | 2.831 |

Source: Field data, 2020.

Discussion of Findings

The variables within the model can be classified into three groups or determinants. project, financial and industry determinants. These variables are found within the determinants because of their interrelationship and attributes that contributes to the overall criticality and relative importance of the determinant. The determinants are further discussed below.

Construction Project Determinant: This factor is defined by project complexity and location variables. The above implies that construction project features or attributes needs to be considered generally in P&E acquisition decision before any of the other determinants and their attributes. Construction project complexity are in three forms. Thus, structural Williams (1999), technical (Dao, 2016), directional (Hass, 2008) and temporary (Lee & Xia, 2002). However, the above findings fall with the technical and directional complexity consideration of construction project where construction project complexity such as facility operational and functional requirements, project characteristics, and the level of knowledge required for the project would influence contractor decision to purchase a plant or hire. Other attributes such as the sophistication of control system, number of operators; location of project, type of work force skills needed, and right type of technical expertise will also influence contractor decision to buy or hire a plant. Of recent executing construction projects in the built environment with constant changing technology has the potential of increasing project complexity that will warrant a plant to constantly remain on site until the project is completed. It will be beneficial therefore for a contract to purchase than to hire or lease a plat for such a project.

Project location is of utmost importance as projects environment such as the physical, social, legal and economic variables has influence on the plant and equipment decision making process of contractors. Projects in a restricted, public environment, an ancient and exposed environment, contaminated land, brownfield sites will dictate the plant acquisition option. Again, an understanding of the market conditions and the legal environment in terms of international projects will determine whether to deploy own plant or to hiring or lease. Project location also has the potential of increasing project risk and uncertainty. Uncertainty such as lack of uniformity due to mechanical or other resource breakdown and the effect of weather or climatic condition, unpredictable sub surface, poor buildability assessment and more importantly lack of experienced local workforce can influence a contractor decision to purchase or to hire or lease.

Construction Industry Determinant: this category has the second greatest influence in P&E acquisition. none of the organisational factors emerged as an important consideration. However, surprisingly the type of client at hand at a particularly time can influence contractor’s decision to opt for purchase than hiring and leasing. Poor relationships between the project parties such as the client can affect a contractor cash flow in term of plant utilisation on a project. Therefore, dealing with known client may results in a contractor going for hiring so that if there is any conflict the plant can be return to avoid further cost. A problematic client with a poorly defined project roles and poor communication with affect contractor plant and equipment decision making

Financial Determinant: It comprises the financial variables of cost of purchase and expected revenue expected from purchasing the plant. In terms of selection whether for purchasing, hiring or leasing the use of equipment available with the organization and the suitability for job condition with special reference to climatic and operating conditions are factors prior studies as alluded to as affecting plant selection and utilisation. The two variables constitute the financial factors that can influence the economic life of the plant. Thus, the age in years and replacement that will maximize the expected revenue and profit return from the plant. Construction organisations would there consider the cost of the equipment and the maximum returns. Again, the unit cost of production and availability of spare parts and selection of manufacturers has all been advocated as factors affecting plant selection however the outright purchase and future expected revenue as emerged from this study adds a new perspective to the subject. The cost efficiency, holding on to value when well-maintained and strong resale value are influence construction organisations decision to opt for purchasing than hiring or leasing.

The Implication for Policy And Practice

In policy terms procurement policies and laws must consider the plant equipment acquisition option in setting tender data requirements for construction projects in Ghana. In the solicitation of bids for construction works the project complexity and location must be paramount in setting the plant requirement for contractors. The plant acquisition option proposed by contractors in their bids must be carefully evaluated and given higher weighting than the current over reliance on lowest evaluated bids which often centre on price as the priority.

Tertiary institutions of higher learning curriculum within the built environment need to emphasis on the plant acquisition, investment and management in the built environment. Project cost management programmes and course on estimating has to incorporate plant Acquisition and management as developing life cycle cost models of plant and equipment in the Ghanaian context. Th estimating departments of construction organisations has to consider project complexity, location the investment cost and revenue in the estimation of construction project cost in order to remain competitive in the industry.

Conclusion

It can be concluded that construction organisations attached importance to the type and nature a construction project in determining the P&E option than other determinants such as construction industry and construction organizational determinants. Some of the findings in this study contradicts findings in other jurisdictions that placed financial factors as the most important factors considered by construction organisation in their P & E acquisition decision.

It implies that the construction project features and attributes could have greater influence on the P&E acquisition decision of construction organisations. It is so due to the importance of project attributes such as completion time, complexity of a project, site and climatic conditions, client and consultant preference for a type of P&E among others.

Construction organisations can rely on the findings of this study and identify the most critical determinants influencing their P&E acquisition and thus develop mitigation measures. This is to say that managerial decisions whether or not to acquire a P&E at any point in time can be effectively taken by identifying whether or not the circumstances prevailing are critical or not. Although limited to Ghana, stakeholders in the construction industry particularly consultants and constructors will benefit from the findings concerning their P&E holding options as a critical organisation resource in the evaluation and bidding decisions. It is however cautioned that the results of the should be interpreted within the context of Sub-Sahara Africa, especially Ghanaian construction context, and similar studies should be done in similar contexts in different countries to compare the results before generalisations could be made. Finally, the expansion of items could be grouped under each dimension as well as the inclusion of additional dimensions as knowledge keeps evolving and existing policies and practices keep changing. Therefore, future research should explore other critical factors in plant and equipment submarket context in different developed and emerging countries for a better understanding of contractor’s plant and equipment acquisitions options.

References

- Blaxton, A.C., Fay M.J., & Hansen C.M. (2003). “An analysis of USMC Heavy Construction Equipment (HCE) requirements” (Master of Business Administration Dissertation Monterey, CA).

- Bludon, G.H. (1980). “Comparison of methods of evaluating construction equipment acquisition”. (Degree of Master of Engineering Dissertation, Concordia University)

- Bondinuba, F.K. (2012). Exploring the challenges and barriers in accessing financial facilities by small and medium construction firms in Ghana. Civil and Environmental Research, 2(6), 25-35.

- Chase, B.R., Jacobs, F.R., Aquilano, J.N., & Agarwal, K.N. (2001). Operations management for competitive advantage. (Eleventh edition). New Delhi, McGraw-Hill publications

- Chitkara, K.K. (2009). Construction project management, planning, scheduling.

- Clappa, D., Shulera, S., Nobea, M.D., DeMirandaa, M., & Nobea, M.E. (2007). “Capital equipment acquisition in heavy construction”. International Journal of Construction Education and Research.

- Clutts. A.C. (2010). “Profitability versus construction equipment maintenance”. (Degree of Masters of Science Engineering Dissertation Purdue University).

- Dao, B.P. (2016). Exploring and measuring project complexity (Doctoral Dissertation Texas A&M University).

- Day, D.A., & Benjamin, N.B.H. (1991). Construction equipment guide, (2nd edition). Wiley, New York, NY.

- Fuerst, M.J., Jacobs, B., & Hicks, D.K. (1992). “Specifications for Integrating Expert Systems.

- Ghazi, A.A. (2002). Construction equipment management practices of major contractors in Saudi Arabia. King Fahd University of Petroleum & Minerals, Box # 1637, Dhahran

- Gransberg, D.D., Popescu, C.M., & Ryan, R.C. (2006). Construction equipment management for engineers, estimators and owners. CRC Press is an imprint of Taylor and Francis Group.

- Harris, F., & McCaffer, R. (2001). Modern Construction Management. Blackwell Science Ltd, Oxford.

- Jagtap, M., & Kamble, S. (2019). The effect of the client–contractor relationship on project performance. International Journal of Productivity and Performance Management.

- Lotker, Z.B.P.-S. (2000). Rent, lease or buy. Symposium on Theoretical Aspects of Computer Science.

- Masoud, N.S., Mohammadali K.S., Arham A., Mohammadreza K., & Hoda R. (2011). Evaluation of factors affecting on construction equipment acquisition methods in Malaysia. International Conference on Information and Finance IPEDR, 21, IACSIT Press, Singapore. Methods. (Eighth edition). McGraw-Hill Limited, Kogakusha

- Memon, A.H., Rahman, I.A., Abdullah, M.R., & Azis, A.A.A., (2010). Factors affecting construction cost in mara large construction project: Perspective of project management consultant. International Journal of Sustainable Construction Engineering and Technology, 1(2), 41-54.

- Mutune, M.M. (2016). Investigation of leasing in asset financing: A case study of investment companies listed at nairobi securities exchange (Doctoral dissertation, United States International University-Africa).

- Nunnally, S.W. (2007). Constructions methods and management, (2nd edition). Prentice Hall, Englewood Cliffs, NJ.

- Olaleye, M.O. (2016). Effect of tax incentives on foreign direct investment in listed nigerian manufacturing companies(Doctoral Dissertation, Coherd, JKUAT).

- Palinkas, L.A., Horwitz, S.M., Green, C.A., Wisdom, J.P., Duan, N., & Hoagwood, K. (2015). Purposeful sampling for qualitative data collection and analysis in mixed method implementation research. Administration and Policy in Mental Health and Mental Health Services Research, 42(5), 533-544.

- Peurifoy & Ledbetter (2002). Construction planning, equipment and methods, (Sixth edition). McGra.w-Hill Limited, New York.

- Peurifoy R.L., Shexayder C.J., & Shapira A. (2010). Construction planning, equipment and production costs and maximizing profitability”. Journal of Plastic Film and Sheeting, 24, 21.

- Prasertrungruang, T., & Hadikusumo, B.H.W. (2007). Heavy equipment management practices and problems in thai highway contractors. Engineering, Construction and Architectural Management, 14(3), 228-241.

- Schaufelberger, J.E. (1999). Construction equipment management, prentice-hall, Upper

- Schleifer, T.C., Sullivan, K.T., & Murdough, J.M. (2014). Managing the profitable construction business: The contractor's guide to success and survival strategies. John Wiley and Sons.

- Sepasgozar, S.M., & Loosemore, M., (2017). The role of customers and vendors in modern construction equipment technology diffusion. Engineering, Construction and Architectural Management.

- Smith, D., Mark, A.S., & Gould, R.J. (2008). “Selecting equipment to minimize with equipment management systems to optimize equipment investment decisions”. Technical Report FF-9201, U.S. Army corps of Engineering Research (USACERL), IL.

- Tan, Y., Shen, L., & Langston, C. (2012). Competition environment, strategy, and performance in the Hong Kong construction industry. Journal of Construction Engineering and Management, 138(3), 352-360.

- Van Smeden, M., Moons, K.G., de Groot, J.A., Collins, G.S., Altman, D.G., Eijkemans, M.J., & Reitsma, J.B. (2019). Sample size for binary logistic prediction models: Beyond events per variable criteria. Statistical Methods in Medical Research, 28(8), 2455-2474.