Research Article: 2025 Vol: 29 Issue: 2S

Modeling the Dynamic Decision of a Contractual Adoption of a Continuous Innovation in B2B Markets

Yingge Qu, University of North Alabama, Florence

Kumar V, St. John's University

Yi Zhao, Georgia State University, Atlanta

Citation Information: Qu, Y., Kumar, V., & Zhao, Y. (2025). Modeling the dynamic decision of a contractual adoption of a continuous innovation in b2b markets. Academy of Marketing Studies Journal, 29(S2), 1-29.

Keywords

Continuous Innovation, B2B Hi-Tech Service Markets, Dynamic Programming, Bellman Equation, Learning Process, Structural Model.

Summary Statement of Contribution

This study develops a dynamic structural model that jointly examines customers' adoption and contract length decisions in high-tech markets. By integrating a customer’s forward-looking behavior and the effects of technology evolution, we provide insights into how firms can tailor their innovation strategies. Our findings suggest that continuous updates drive market penetration, while substantial updates enhance profitability, contributing to both marketing theory and practice in B2B contexts.

Introduction

We are currently in an era of rapid innovation which significantly affecting daily life and the global business landscape. In this competitive environment, organizations find it increasingly difficult to thrive or survive without integrating the latest technologies into their operations. This relentless pace of innovation places a growing burden on IT departments, forcing companies to allocate more resources to maintain and advance their technological capabilities.

In response to these challenges, leading firms have begun offering high-tech services like cloud computing to their B2B clients, allowing businesses to redirect resources traditionally spent on internal IT departments to cloud providers that offer specialized expertise, flexible services, and enable cost savings. Today, 94% of all worldwide companies have embraced theses services across various sectors with the global market projected to reach $1 trillion by 2027 (Precedence Research, 2024). As demand for high-tech cloud services grows, many organizations remain concerned about security, privacy, and data integrity (Abadi, 2009; Sadavarte et al., 2020). Addressing these requires ongoing technological innovation to enhance processing speed, data storage, and security measures, such as more secure data centers and improved encryption protocols. We define this iterative improvement as "continuous innovation" or "sustaining technology improvement."

The success of continuous innovation services hinges on customer adoption decisions. From a customer perspective, decision-making involves not only the choice to adopt but also determining the contract length, which requires balancing the desire for the latest technology with concerns about potential obsolescence. Customers must consider both immediate benefits and long-term implications, leading to a forward-looking approach to decision-making. Conversely, service providers aim to understand how technological advancements influence these decisions and how strategic planning can best support different business objectives. Given the unique and novel phenomena in the continuous innovation high-tech B2B service market, we highlight our research questions as below:

1. Modeling the customer’s dynamic decision process: How do customers make simultaneous decisions on adoption and contract length in a continuously innovating market? how to design a holistic model to consider multiple aspects in a customer’s decision process, such as a customer’s forward-looking behavior, influences of technology evolution and the balance between benefit and cost in a customer’s decisions?

2. Evaluating the impact of technology evolution: How does technological progress, including the rate and quality of advancements, affect customer decisions?

3. Strategic communication of technological improvements: how should a firm strategically communicate their technology innovation to its customers? Should firms release updates incrementally or in larger batches to maximize customer engagement and value perception?

4. Appraising customer decision-making effort: In the B2B market, decision-making often requires substantial effort. How can firms optimize these efforts to enhance customer decisions?

In order to answer these questions, we propose a dynamic structural model that jointly models a customer’s dual decision: the discrete choice of whether to buy and the continuous decision of for how long to buy, e.g., the contract length. Our research builds upon our previous work (Qu et al., 2023) by structuring the model of customer contractual decisions with forward-looking behavior in marketing. Notably, we enhance this framework by incorporating outside resources to capture technology innovation and integrating consumer learning, addressing critical aspects previously overlooked. We highlight our methodological contributions as follows: we model a customer’s contract length decision by integrating it into the dynamic programming process through a structural modeling approach. Specifically, the contract length involves the determination of the customer’s transition states in the value function in the dynamic programming approach. Moreover, our modeling approach can automatically capture the contract lock-in effect, e.g., once the customer signs the contract, they are bonded with the technology level at the decision occasion; therefore, the customers cannot capitalize on the technology update within the contract duration. Our model leverages three years of service contract data from a global high-tech company providing continuous innovation services, yielding actionable insights for decision-makers.

Our empirical findings reveal substantive implications to aid managerial decision making. Our findings show that while an increase in the overall technology level encourages adoption, higher speeds of technological improvement lead customers to prefer shorter contract durations. Policy simulations further suggest that providers should tailor their innovation strategies based on their business goals. For market penetration, continuous updates are recommended, whereas for profitability, fewer but more substantial updates may be more effective. While our research focuses on B2B high-tech markets, the framework can be extended to other sectors where contractual decisions involve forward-looking considerations, including warranty services, post-purchase support, and telecommunications.

The remainder of this article is structured as follows: we first review relevant literature on structural modeling of forward-looking customer decisions and technology evolution. We then describe the data and institutional context that inform our model setup, followed by detailed methodology and results. Finally, we conclude with contributions and directions for future research.

Literature Review

Our study focus is modeling a customer’s contractual decision in a continuous innovation high-tech B2B service market, and our modeling approach fundamentally inherits from the research stream of modeling the customer’s dynamic decision process with a forward-looking behavior. Therefore, we will review the literature in the areas of both forward-looking structural model and technology innovation. Specifically, we will address three aspects when reviewing forward-looking structural models: 1) Types of decisions; 2) triggers of forward-looking behavior, and 3) model application contexts.

Types of Decisions

A large number of forward-looking studies focus on modeling the discrete choices, e.g., whether the customer will buy or not buy a product (Sriram et al., 2010). Recently, researchers introduce a customer’s continuous decision into the forward-looking structural model, such as a subscription plan for grocery store (Goettler et al., 2011), mobile phone usage (Yao et al., 2012) and bank account consumption. In the existing literature, the continuous decision is usually considered as a covariate or control variable in the utility function. An effective method to structurally model the continuous decision by integrating it into the dynamic programming approach is still lacking.

Triggers of Forward-Looking Behavior

Monetary factors, such as price (Song et al., 2003) and promotion (Gönül et al., 1996), are frequently considered as the trigger of a customer’s forward-looking behavior. However, more recent studies show that a customer’s forward-looking behavior is not necessarily the “patent” of price or cost of the product. For example, (Ryan et al., 2012) brings in the idea that the network evolution can play an important role in determining the customer’s dynamic decision process. Gordon addressed that, in product replacement (e.g., PC processor) purchases, a customer’s dynamic decision process can be triggered by the obsolescence status of the product due to both the quality elevation and price reduction. Lewis claimed that the loyalty program can also incite a customer’s forward-looking behavior. Yang and Ching identify the impact of a customer’s age on their forward-looking zones. There is no doubt that the technology improvement should also be considered as a trigger of a customer’s forward-looking behavior. However, few studies focus on investigating how the technology improvement will influence a customer’s dynamic decision through a structural modeling approach.

Model Application Contexts

Forward-looking structural models have been applied in a variety of marketing contexts, including Consumer Packaged Goods (Erdem et al., 1996), durable goods, PC processor industry (Gordon, 2009), online grocery and drug items (Lewis, 2004), ATM card (Yang & Cheng, 2014), sales-force compensation plan (Chung et al., 2014), content contribution on social media (Tang et al., 2012), bank account (Liu et al., 2014) and mobile phone usage (Xu et al., 2015) etc. However, few studies pay attention to the B2B high-tech service market. The possible reasons could be both the complexity of a customer’s decision process and the difficulty of obtaining quality data in the B2B context.

It is worth mentioning that, in the domain of a forward-looking structural model, Erdem and Keane’s study has the most similar modeling structure to ours. Both models consider forward-looking and a customer’s learning in order to structurally model a customer’s dynamic decision process. However, because of the unique features in our B2B context, our study is different from Erdem and Keane’s study. First, in our context, customers need to simultaneously decide on whether to buy and for how long to buy. Therefore, the decision variables in the dynamic process include both discrete choice and continuous decision (e.g., contract length). Second, because of the technology improvement, customers make decisions in a turbulent market and will form beliefs on the speed of the technology improvement according to the technology improvement related official news released by the service provider. Specifically, we will investigate the multi-dimensional effects of technology improvement on a customer’s dynamic decisions.

Technology Innovation

Since a focus of this research is to identify the influence of technology improvement on a customer’s decision process, our study also reviews the research stream of “technology innovation”. In the marketing literature, a large body of the “technology innovation” studies focus on improving the theories in technology innovation. For example, (Ettlie & Rubenstein, 1987) pointed out the necessity of differentiation between radical and incremental technology when investigating the relationship between firm size and successfulness of innovation. (Chandy et al., 1998) found that, given the possibility of cannibalization, today’s high-tech firms, especially large firms, are still willing to invest on radical innovation. Although technological innovation brings remarkable growth to the firms (Sood et al., 2005), the actual performance of an innovation is tied to many factors, such as the firm’s strategic orientation resource base creative idea in the innovation (Im and Workman, 2004), etc. Another group of studies aim at discovering the pattern of technology improvement. Exponential shape (Moore, 2003; Walter, 2005), S-curve (Foster, 1986), Bass diffusion model (Bass, 1969; Young, 1993), SAW shape (Sood et al., 2012) and step function etc. have been proposed in the existing literature to simulate the technology improvement. Although some researchers evaluate the influences of innovation from a firm’s perspective, such as the relationship between innovation and the firm’s financial reward (Sorescu et al., 2003) or performance (Zhou et.al, 2005), etc., few studies consider the effects of technology innovation, especially the continuous innovation, from a customer’s perspective, e.g., how the continuous technology innovation plays a role in a customer’s decision process.

In sum, there is no study aiming at utilizing a structural modeling approach to evaluate the impact of technology improvement on a customer’s contract decision in the B2B high-tech service market. Our proposed study fills the following research gaps: 1) we provide a structural way to model a customer’s continuous decision by integrating the contract length decision into the dynamic programming approach; 2) we identify the multi-dimensional effects of continuous innovation (technology level and technology speed of updates) on a customer’s dynamic decision process; and 3) we extend the forward-looking structural model into the B2B high-tech service market.

Empirical Context

Our data comes from a leading global high-tech company (service provider). Its products include almost all kinds of high-tech products and infrastructures, such as hardware, software, and personal computers, and covers both B2B and B2C settings. Around the second half of the previous decade, they began to offer a cloud service for their B2B customers. Managers are interested in understanding how their business customers decide on adopting the cloud service and what would be a good strategy to manage the technology improvement. There are distinct characteristics in our study context which make our research unique and guide our modeling approach.

1. The price of the service has no demonstrable variation in the long-term, but firms can offer random promotion, such as occasional price discount or additional services to the customers: Due to confidentiality, we are not revealing the price of the service in our data. But from observations of the data and discussions with the managers in this firm, e.g., the unit price of the service is almost constant but the technology keeps on updating. Therefore, in our study context, technology improvement, instead of monetary factors (such as price, cost, fees etc.) is the primary trigger of a customer’s forward-looking behavior. To effectively evaluate how the technology improvement will influence a customer’s decision process, we integrate both the technology improvement and the contract length decision into the dynamic programming

2. For each step of technology update, the firm releases relevant news to announce the update to the customers: This suggests that, in our context, the quantity of the officially released news is related to the degree of technology improvement. Thus, we can observe the current technology update by collecting and reviewing the official news. We obtain how many news are released, but we have no information to quantify the relative importance of the technology update captured by the individual news. As per the industry norms, on average, the more news released, the faster the technology improvement is.

3. The business customer’s purchasing decision is not an easy process but associated with a remarkable one-time effort: The one-time effort can include learning the technology, training employees, cooperation with multiple internal departments, negotiating with service providers and sending a budget application to the top manager for approval, etc. This one-time effort is associated with each contract. Each time the business customers decide to sign the contract, they will have to put forth such effort. However, once the decision is made and the contract is signed, within the contract length, there is no additional effort required. This effort, from a modeling perspective, will influence a customer’s decision but is latent to the researchers. Obviously, if the customers have already spent greater energy and resources to finalize a contract, they will intend to sign a relatively longer contract to avoid another input. Therefore, an effective modeling approach should also consider the latent one-time effort.

4. Once the customers sign a contract, they are bonded with the on-site technology level at the decision occasion – we define it as a “lock-in” effect in our context: In principle, the customers can’t break the contract. In B2B contexts, it is rare that the customers would break a contract as signing a contract is associated with remarkable effort from both the firm and customer sides. In our data, we do not observe any customers breaking their contract. Once the customers sign the contract, within the contract duration, service is provided based on the technology level at the decision occasion. Consequently, customers are not able to enjoy the technology update within the duration of the contract. Our model automatically considers the lock-in effect in our dynamic programming approach.

5. The cloud service is a “brand-new” offer in the industry: The high-tech firm is one of the pioneers of the cloud service in the industry. During our data collection period, both the firm and the business customers have little experience with making strategic decisions. From a customer’s perspective, his/her knowledge about the cloud service is obviously unclear. When the service was just publicized, customers possessed little knowledge about it; as time elapses and more information is released, customers accumulate knowledge about the service through the process of learning. From the firm’s perspective, it provides the service and hence does not have a strategic way to announce the technology-related news to the customers. Therefore, in our study context, we do not encounter endogeneity issues.

Data Description

Our data includes 218 business customers. All of them have had at least one historical purchase with the service provider before purchasing the new service. This characteristic suggests that the 218 buyers should consider the service provider in our study as the first choice over other competitors when adopting the high-tech service, not only because the service provider holds the superior power in the market, but also because the buyers are existing business customers who retain better knowledge about the service provider, and a relationship with the service provider.

Our data includes both the service transaction and the technology-related news. As we stated previously, the service provider releases news corresponding to each step of the technology update. We researched all of the news (more than 500) on service provider’s official website. Each step of service-related technology update is reflected on the news platform although not all of the news we researched are related. If the news is related to the technology update, there always are clear statements in the news content, such as building new data center, new cloud-based software, technology breakthroughs, adding new computing capabilities etc. Therefore, the process of identifying the technology-related news is manageable. Finally, with the help from the professionals in the firm, we collected 154 relevant news. The time frame of technology-related news ranges from October 2008 to December 2011 and the data were recorded as the number of technology-related news per month. And the time frame of service transaction data ranges from January 2009 to September 2011 and the data includes both the customer purchase decision time (year & month) and the decision of the contract length (in unit of months). Both transaction and news data were available at the monthly level.

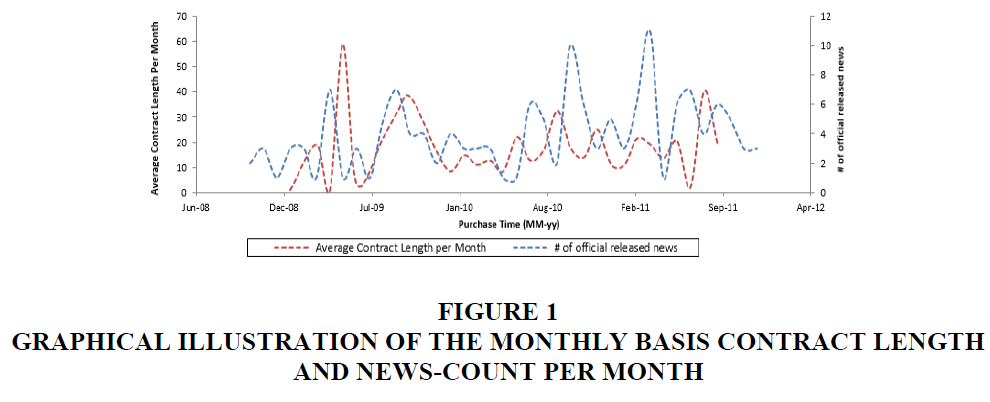

We present both a graphical illustration (Figure 1) and summary statistics of a customer’s contract length decision and officially released news-counts (Table 1). On average, customers purchase the service for 18 months, which is about one and a half years, but the range can be from 1 month to 60 months, e.g., 5 years (Table 1). Additionally, the average number of official news-counts that the service provider released every month is 3.95, with the minimum of 1 and maximum of 11 (Table 1). Moreover, the patterns of the contract length and the news-counts (Figure 1) suggest that, in general when the news-count is high, the contract length tends to be low. Recall that news-count is used to capture the improvement of technology. We previously mentioned that when customers consider the tech improvement to be fast, they may either postpone their adoption decision or sign a shorter contract; our data pattern shows this concept to be empirically true.

| Table 1 Distribution of News-Count and the Customers’ Contract Length Decisions | |||||

| mean | std | median | min | max | |

| News_count | 3.95 | 2.42 | 3 | 1 | 11 |

| Contract Length | 18.05 | 19.42 | 12 | 1 | 60 |

Modeling Framework

Given the empirical setting and the research objectives in our study, we aim at building a holistic structural model to account for the following aspects in a consumer’s decision process. First, customers have to decide whether to adopt and for how long to adopt (contract length) at each decision occasion t. Therefore, we will simultaneously model both decisions of the customer. Second, because of the technology improvement, customers exhibit both forward-looking and learning behaviors in their decision processes. Customers will have to consider both current utility and discounted future utility to make an optimal current purchase decision. We will employ a dynamic programming approach to account for customers’ forward looking behavior. Being in a turbulent environment, customers will have to continuously learn from the existing information related to the technology improvement in order to update their beliefs about the technology level. We will integrate this learning behavior in our model as well. Last, to better evaluate how the technology improvement influences a customer’s decision process, we define two states related to technology improvement: overall technology level and technology improvement pace. We assume that: the overall technology capability level will encourage buyers to purchase. Only if the technology level meets or exceeds a customer’s needs, the adoption decision will be invoked. The technology improvement pace will produce two effects: one is postponing customers’ adoption decision; the other is to encourage a short term contract. The intuition is that, if the customers consider the technology improvement to be very fast and expect a more advanced technology to appear in the near future, then, the customers may either hold their current adoption decision to wait for the future better offer, or at most try a service with a shorter contract. To test our modeling assumptions, we will separately quantify the effects of both technology improvement states on a customer’s decisions in our model.

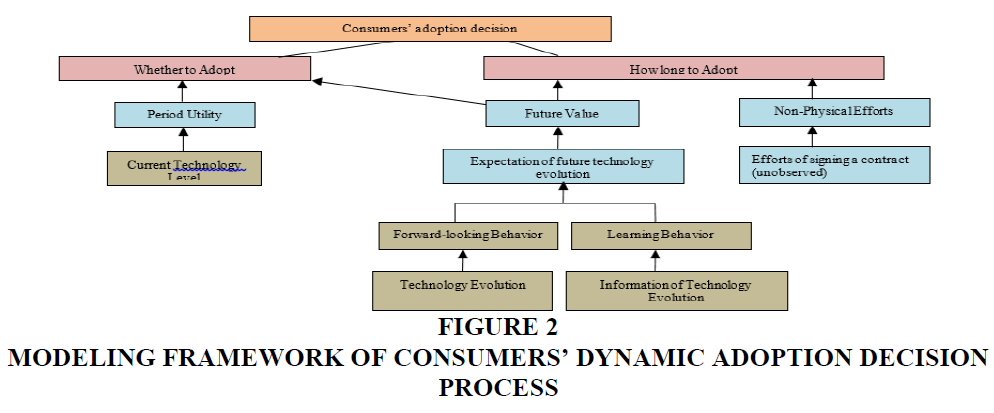

In the conceptual framework (Figure 2), we first start with modeling a customer’s period utility. We build the customer’s period utility as a function of the overall technology level. Next, we show how we account for a customer’s forward-looking behavior and learning behavior in our model. Finally, we explain the process of integrating both a customer’s contract length decision and the two states of technology improvement into the dynamic programming approach. This process is the essence of our model setup that allows us to separately quantify the impacts of the two technology improvement states on a customer’s decision process.

Timing

There are fundamentally two steps in customer’s decision process. First, they will need to learn about the technology improvement. Then, customers will make decisions on whether to buy and how long to buy. We illustrate the timing of our model follows: on each decision occasion (t)

1. Customers observe the official news released by the service provider

2. Customer update their belief about the technology improvement

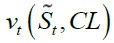

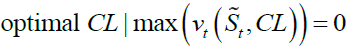

3. Optimal contract length decision (CL): Customers make the contract length decision by maximizing the total discounted utility V: optimal CL = CL/max(V)

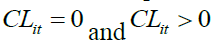

4. If the customer’s decision is “no purchase”, e.g., CL = 0, then we move to the next decision occasion (t+1) and the customer can make another decision.

5. If the customer’s decision is to “purchase a contract”, e.g., CL > 0, then within the contract duration, e.g. from to t + CL-1, customer is locked with the purchased contract and is temporarily not available for making decision. Starting from occasion t+CL, customers can make decision again.

Empirical Evidence from a Simple Reduced Form Model

In this section, we use Regression and Logit models to show the empirical evidence of the impact of technology improvement on a customer’s decision. Although both models are basic model approaches, it is widely acknowledged that they provide solid proof of the relationship between focal variables.

Based on the technology-related news, we are able to derive the overall technology level and the technology improvement pace at each decision occasion (t): we use the cumulative number of news to represent overall technology level and the number of news at prior occasion (t-1) to represent the technology improvement pace. Since we have both “whether to buy” and “for how long to buy” decisions, we have both the discrete choices for Logit model and the continuous decision for Regression model. The parameter estimates (Table 2) indicate that the overall technology level has a positive impact on both P (buy)t and CL(buy)t, while technology improvement pace has a negative impact on both P (buy)t and CL(buy)t. Except for the coefficient of technology improvement pace for P (buy)t, all the other coefficients are significant at 0.1 significance level. The results match with our prior expectation that, 1) the overall technology level determines the customer’s decision of whether to buy and therefore it should positively impact the customer’s purchase probability; 2) both overall technology level and the technology improvement pace influences the customer’s decision of how long to buy. If the technology improvement is fast, customers are more likely to sign a shorter contract. Therefore, the technology improvement speed negatively influences the contract length decision. In summary, the data pattern is consistent with our intuition and modeling assumption, and the empirical evidence from the simple model can help us recover our parameters.

| Table 2 OLS Parameter Estimation for Impacts of Technology Evolution on Customer’s Decision | ||||

| A: Purchase Probability P(buy) | ||||

| Coefficients | Standard Error | t Stat | P-value | |

| Intercept | -0.0039 | 0.1321 | -0.0293 | 0.9768 |

| overall tech level | 0.0025 | 0.0013 | 1.9908 | 0.0557 |

| tech update pace | -0.0133 | 0.0515 | -0.259 | 0.7974 |

| B: Contract Length CL(buy) | ||||

| Coefficients | Standard Error | t Stat | P-value | |

| Intercept | 2.68 | 1.009 | 2.657 | 0.013 |

| overall tech level | 0.024 | 0.01 | 2.467 | 0.02 |

| tech update pace | -0.669 | 0.393 | -1.701 | 0.099 |

Model Setup

Period Utility Function (ui)

We define the customer’s period utility as follows:

Where  represents the customer i-specific expected net-utility when the actual overall technology level equals zero. As we described earlier, the price of the service has no demonstrable variation in the long-term. In our model setup, we are not able to separately identify the effect of price and the customer’s intrinsic preference toward the technology. Therefore

represents the customer i-specific expected net-utility when the actual overall technology level equals zero. As we described earlier, the price of the service has no demonstrable variation in the long-term. In our model setup, we are not able to separately identify the effect of price and the customer’s intrinsic preference toward the technology. Therefore  , indicates the difference between the baseline benefit from the cloud computing service and the period cost, e.g., price of the service.

, indicates the difference between the baseline benefit from the cloud computing service and the period cost, e.g., price of the service.  is the customer i-specific coefficient of the actual overall technology level. It captures the customer’s utility sensitivity of the overall technology level, e.g., the extent to which the change of overall technology level will impact customers’ period utility. Techt indicates the actual overall technology level at purchase occasion t.

is the customer i-specific coefficient of the actual overall technology level. It captures the customer’s utility sensitivity of the overall technology level, e.g., the extent to which the change of overall technology level will impact customers’ period utility. Techt indicates the actual overall technology level at purchase occasion t.  is the net-utility error for customer i at purchase time t. It captures all unobserved factors that influence the utility, such as the random promotion offered by the firm and the demand shock by the customers. We assume a normal distribution for the random component

is the net-utility error for customer i at purchase time t. It captures all unobserved factors that influence the utility, such as the random promotion offered by the firm and the demand shock by the customers. We assume a normal distribution for the random component  . And we fix the variance term at 1, e.g.

. And we fix the variance term at 1, e.g.  for identification purpose. We represent the customer utility for the outside (or no adoption/purchase) option as

for identification purpose. We represent the customer utility for the outside (or no adoption/purchase) option as  e.g. set the corresponding period utility level to zero. Finally, to account for the customer heterogeneity, we assume that the

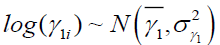

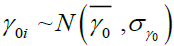

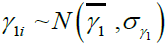

e.g. set the corresponding period utility level to zero. Finally, to account for the customer heterogeneity, we assume that the  will follow a normal distribution, e.g.

will follow a normal distribution, e.g.  , and the

, and the  will follow a log-normal distribution, e.g.

will follow a log-normal distribution, e.g.  . Intuitively, customers should gain benefit from the technology improvement so that a positive number of

. Intuitively, customers should gain benefit from the technology improvement so that a positive number of  makes more sense to describe the relationship between customers’ net utility and overall technology level. Therefore, we choose a log-normal distribution for

makes more sense to describe the relationship between customers’ net utility and overall technology level. Therefore, we choose a log-normal distribution for  .

.

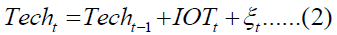

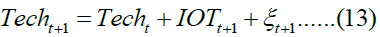

Customer Learning about Technology Level (Techt)

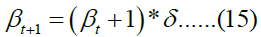

Considering that the current technology is updated based on the previous level, we assume the pattern of technology update as follow:

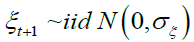

Where Techt is the actual overall technology level at current purchase occasion t; this is the same as the Techt in the period utility function in Equation 1. Techt-1 is the actual overall technology level at previous purchase occasion t-1. IOTt is defined as the “improvement of technology” at current purchase occasion t. In our context, once there is a service-related technology update, the service provider releases relevant news to announce the innovation to the customers. The number of news releases is correlated to the degree of innovation. Therefore, we use IOTt, which is the number of technology related official news released by the high-tech service provider at current purchase occasion t, to capture the improvement of technology. Considering that the number of news is still a general indicator of the technology improvement and we do not have a measurement to quantify the relative importance of each individual news, we introduce an error term “  ”, which follows a normal distribution of

”, which follows a normal distribution of  , to capture the unobserved technology improvement.

, to capture the unobserved technology improvement.

The estimation of  can inform us about the capability of officially released news on capturing the improvement of technology.

can inform us about the capability of officially released news on capturing the improvement of technology.

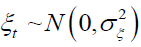

Customer Learning on News Releasing Frequency (IOTt)

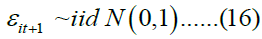

In our learning model, customers believe “news” produced at time (t) following a Poisson distribution with parameter of λ. The reasons of choosing Poisson distribution are described as follows: First, customers learn on the future technology-related news which is a count-data. Therefore, we cannot utilize the normal distribution as the common learning model does. Poisson distribution has been widely accepted for modeling count data (Allenby et al., 1999; Gupta, 1991). Second, Poisson distribution is flexible and possesses analytical advantages. It belongs to the exponential family hence we could reach close form solution in Bayesian update.

Where λ represents the true mean level of the IOTt, which is unknown to the customers. This equation suggests that the news release frequency provides imperfect information about the true mean level of the IOTt.

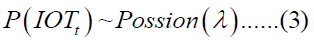

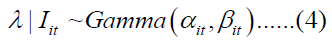

Next we define that, customers will learn this λ from the previous information set Iit. Given the existing information set Iit, a customer has formed a prior opinion about the true mean level of IOTt, e.g. λ, which follows a gamma distribution:

In Equation 4, Iit is defined as customer i’s existing information set at time t. Several sources can contribute to the customer information set Iit -- 1) customers’ prior knowledge about the high-tech  , e.g., the prior knowledge level before observing any technology improvement. 2) the officially released online news IOTt, which is considered as the representative of the improvement of technology. 3) customers’ intrinsic information process, which demonstrates how customers continuously evaluate the periodically released news. Each source will contribute to updating the customer beliefs about the technology improvement described in the following equations.

, e.g., the prior knowledge level before observing any technology improvement. 2) the officially released online news IOTt, which is considered as the representative of the improvement of technology. 3) customers’ intrinsic information process, which demonstrates how customers continuously evaluate the periodically released news. Each source will contribute to updating the customer beliefs about the technology improvement described in the following equations.

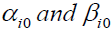

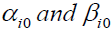

Note that in the later estimation approach, we fix the both the initial parameter of belief updating, e.g.  at zero for two reasons. First, the cloud service is a novel technology in the market thus it is reasonable to assume that customers do not possess knowledge about the specification of the technology at the beginning time. Second, from our empirical findings, the absolute values of these two initial parameters do not contribute significantly to the parameter estimation but add a computation burden. Therefore, we fix

at zero for two reasons. First, the cloud service is a novel technology in the market thus it is reasonable to assume that customers do not possess knowledge about the specification of the technology at the beginning time. Second, from our empirical findings, the absolute values of these two initial parameters do not contribute significantly to the parameter estimation but add a computation burden. Therefore, we fix  at zero for all customers. Consequently, the parameters of

at zero for all customers. Consequently, the parameters of  dimension reduces from both i- and t-specific to only t-specific

dimension reduces from both i- and t-specific to only t-specific

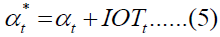

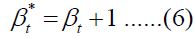

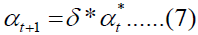

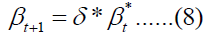

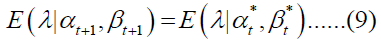

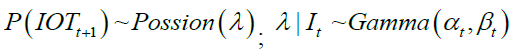

After observing the actual technology related news at time (t), customers begin to update their beliefs on the true mean level of news, e.g. λ through updating the two parameters of gamma distribution  .

.

Where  are the parameters of the prior distribution before observing the historical technology related news before time t and

are the parameters of the prior distribution before observing the historical technology related news before time t and  are the parameters of posterior distribution of λt after the customers are exposed to the technology related news at time t.

are the parameters of posterior distribution of λt after the customers are exposed to the technology related news at time t.

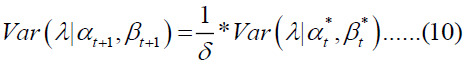

Although customers can learn about the current technology level based on all the historical news, information far from the decision occasion may not be easily remembered or accessible to the customers. On the other hand, customers intuitively may consider the more recent information as more relevant because of both the easier accessibility and fresher memory. Moreover, according to the information process theory, it is highly possible that the customers will place more weight on the more recent information. Therefore, to account for such possibility in our model, we posit that customers recall their prior evaluation on the technology related news with noise. We capture such noise in the information updating model by keeping the mean level of the news perception constant and allow the variances to increase over time (Zhao, et al. 2011) δ. is the parameter that accounts for the information discount process and takes the value between 0 and 1. δ = 1 means there is no information discount.

This setting ensures that the information discount process only impacts the variance of news perception while keeping the mean level constant, e.g.

Our model is very flexible because the discount factor can vary between 0 and 1. Our estimation will tell us whether the discount equals 1 or not. If it equals 1, this means there is no discount, meaning that customers treat all historical information equally. The smaller the discount factor is, the heavier the historical information will be discounted.

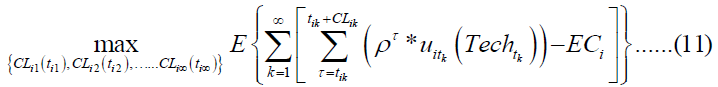

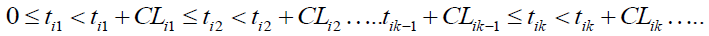

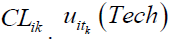

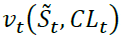

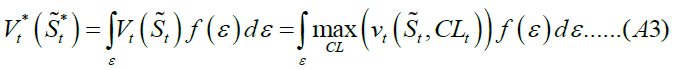

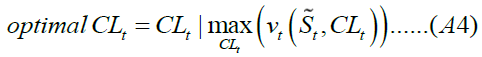

Customer Dynamic Optimization on the Contract Length (CL)

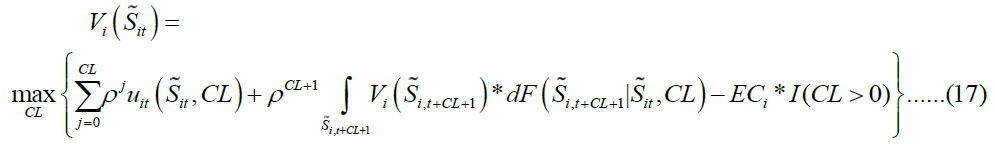

We model the customers’ decisions of whether to adopt the high-tech service and how long to sign a specific length of contract CL as a dynamic programming process. Specifically, as we illustrated previously, in order to quantify the impacts of technology improvement on customer’ decision process, we integrate both customer’s contract length decision and the two states of technology improvement into the dynamic programing approach. The customers’ objective is to make an infinite sequential decision. This corresponds to the method of using infinite-horizon dynamic programming to solve a customer’s Markov decision process (Rust, 1994). Basically, the optimal decisions of whether to buy and how long to buy for each customer i at any purchase occasion t is the solution to the following problem:

With the constraint of

Where  indicates that customer i make the kth adoption decision at time kik with a contract length of

indicates that customer i make the kth adoption decision at time kik with a contract length of  is the “current net-utility” that customer i possessed from making the kth adoption decision at purchase occasion tik . For customer i, as shown in Equation 1,

is the “current net-utility” that customer i possessed from making the kth adoption decision at purchase occasion tik . For customer i, as shown in Equation 1,  is defined as follows:

is defined as follows:

Both Equation 1 and Equation 12 define the customer’s period utility associated with the current decision. The only difference is that: Equation 1 in general defines the net-utility at any given purchase occasion t; while Equation 12 specifically indicates the net-utility at any kth adoption decision occasion tk. Therefore, we use tk in Equation 12 instead of . Recalled that there is a “lock-in” effect in our empirical context, e.g., customers are bonded with the on-site technology level once they sign a contract. Reflected in our model, once customers sign a contract, the period-utility that customers can receive within the contract duration will be the same as the utility at the decision occasion.  is the utility discount factor, which is used to discount all the future utilities to the current purchase occasion.

is the utility discount factor, which is used to discount all the future utilities to the current purchase occasion.  is the customer i-specific unobserved one-time effort associated with signing a contract. EC is associated with each individual contract. Considering that customer’s efforts on signing a new contract can be diversified because the customer’s needs are unique, we assume that the unobserved effort

is the customer i-specific unobserved one-time effort associated with signing a contract. EC is associated with each individual contract. Considering that customer’s efforts on signing a new contract can be diversified because the customer’s needs are unique, we assume that the unobserved effort  will follow a log-normal distribution, e.g.,

will follow a log-normal distribution, e.g.,  . The reason of choosing a log-normal distribution for

. The reason of choosing a log-normal distribution for  is that customers’ effort is equivalent to a cost measure, which should be non-negative.

is that customers’ effort is equivalent to a cost measure, which should be non-negative.

Derive Bellman Equation

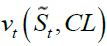

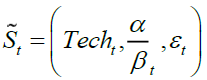

To solve the optimal decision shown in Equation 11, we derive the bellman optimality equation. We define the major components in the Markov decision process in our study as follows:

1. Decision variable(s)  : the decision variables indicate customers’ decisions at each decision occasion. In our study, the decision variable is customer’s “contract length” decision e.g.

: the decision variables indicate customers’ decisions at each decision occasion. In our study, the decision variable is customer’s “contract length” decision e.g.  , which is a continuous variable. When contract length equals zero, it represents customer’s no-purchase decision.

, which is a continuous variable. When contract length equals zero, it represents customer’s no-purchase decision.

2. State variables  :

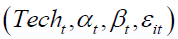

:  represents the current state variables that customer face at the current decision occasion . The state variables determine the value that the customer can obtain from the contract length decision. In our study, we have four state variables, e.g.,

represents the current state variables that customer face at the current decision occasion . The state variables determine the value that the customer can obtain from the contract length decision. In our study, we have four state variables, e.g.,  .

.

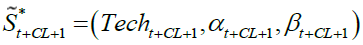

3. The transition probabilities for all state variables  : Given a contract length decision CL, the

: Given a contract length decision CL, the  . Note that the structure of transition probability is novel in our study. In existing studies, the state variables usually transit to the next period, e.g.

. Note that the structure of transition probability is novel in our study. In existing studies, the state variables usually transit to the next period, e.g.  . However, in our study, the new states are determined by the contract length decision. In order to optimize a current purchase decision, customers need to combine both the utility at the decision occasion and all future discounted utilities. When customers evaluate the all future utilities, they do not know the corresponding level of the state variables. Therefore, we will have to take the expectation, which requires the transition probability. We compute the expectation through simulation and we define that the state variables update in the following manner:

. However, in our study, the new states are determined by the contract length decision. In order to optimize a current purchase decision, customers need to combine both the utility at the decision occasion and all future discounted utilities. When customers evaluate the all future utilities, they do not know the corresponding level of the state variables. Therefore, we will have to take the expectation, which requires the transition probability. We compute the expectation through simulation and we define that the state variables update in the following manner:

Where  ; and

; and

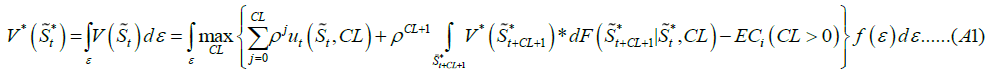

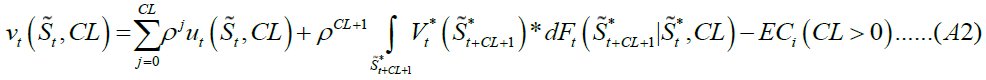

Following the theory defined in dynamic programming, we derive the Bellman Equation, e.g., the value function specifically for our study as follows:

Where  is the maximum value customer i can obtain at a decision occasion t conditional on a set of states

is the maximum value customer i can obtain at a decision occasion t conditional on a set of states  . At the decision occasion t, customers are available for making any contract length decision. Only at the optimal contract length decision, customers can receive this maximum value

. At the decision occasion t, customers are available for making any contract length decision. Only at the optimal contract length decision, customers can receive this maximum value  , which is larger than the values that the customers can obtain from any other contract length decisions.

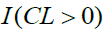

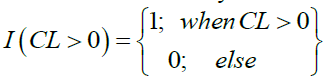

, which is larger than the values that the customers can obtain from any other contract length decisions.  is an indicator function.

is an indicator function.  . The derivation and simulation of value function are in detail described in Appendix A.

. The derivation and simulation of value function are in detail described in Appendix A.

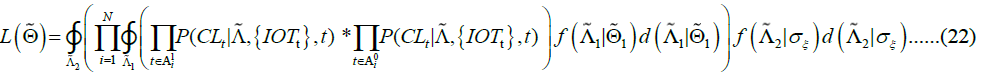

Likelihood Function

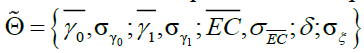

In our model setup, we can categorize the parameters into four groups: 1) the parameters in the period utility function:  ; 2) the parameters in the technology improvement function:

; 2) the parameters in the technology improvement function:  ; 3) the parameters in the customer learning model: δ; and 4) efforts of signing the contract:

; 3) the parameters in the customer learning model: δ; and 4) efforts of signing the contract:  .

.

To derive the likelihood function, we need the expression of the stochastic term as a function of the decision variable  . However, it is difficult to extrapolate the likelihood function with all the parameters involved in the relationship between

. However, it is difficult to extrapolate the likelihood function with all the parameters involved in the relationship between  and

and  . Therefore, we employ the following logic to find the likelihood function. First, we derive the relationship between

. Therefore, we employ the following logic to find the likelihood function. First, we derive the relationship between  and

and  conditional on all the parameters; second, we show how we deal with customers’ two decisions, e.g. and

conditional on all the parameters; second, we show how we deal with customers’ two decisions, e.g. and  ; last, we integrate out all the parameters to obtain the likelihood function.

; last, we integrate out all the parameters to obtain the likelihood function.

Combining the value function (Equation 17), technology improvement function (Equation 2) and customer learning function (Equation 5 to Equation 8), we can obtain the relationship between  and

and  given all the parameters as follows:

given all the parameters as follows:

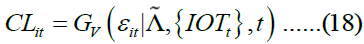

Where “GV” is the solution of  as a function of εit given all the parameters

as a function of εit given all the parameters  and data of

and data of  . Obviously,

. Obviously,  is the inverse function of GV and gives the solution of

is the inverse function of GV and gives the solution of  as a function of

as a function of  .

.  is the parameter space and

is the parameter space and  . Since we do not have the close-form solution for

. Since we do not have the close-form solution for  , we will numerically find ε at a given "CL".

, we will numerically find ε at a given "CL".

Recall that, in our context, there is a lock-in effect when customers sign a contract. Within the contract duration, customers are temporarily unavailable for decision making. To illustrate the likelihood function more straightforwardly, we define that  is the set of all decision occasions t for customers i. For all the decision occasion t within the

is the set of all decision occasions t for customers i. For all the decision occasion t within the  , customers i is available for making decision, e.g. they are not locked with a contract. Within the decision occasion space of , the customer’s decisions has two circumstances. One is the “no-purchase decision” meaning that the customer i do not purchase the service. We define

, customers i is available for making decision, e.g. they are not locked with a contract. Within the decision occasion space of , the customer’s decisions has two circumstances. One is the “no-purchase decision” meaning that the customer i do not purchase the service. We define  as the set of “no-purchase occasions”. The other is the “purchase decision” meaning that the customer i purchases the service and signs a contract. We define

as the set of “no-purchase occasions”. The other is the “purchase decision” meaning that the customer i purchases the service and signs a contract. We define  as the set of “purchase occasions”.

as the set of “purchase occasions”.

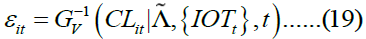

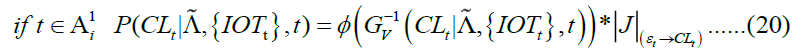

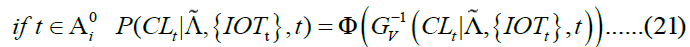

Next we can define the two parts of the Likelihood function corresponding to the two types of decision:

Where  is the pdf of normal distribution and

is the pdf of normal distribution and  is the cdf of normal distribution.

is the cdf of normal distribution.  is the Jacobian of the transformation from the random utility error to the likelihood of observed data

is the Jacobian of the transformation from the random utility error to the likelihood of observed data  .

.

Finally, we are able to derive the Likelihood function:

Where  is the i-specific parameter space and

is the i-specific parameter space and  whose location parameters space is

whose location parameters space is  ; is the t-specific parameter space and .

; is the t-specific parameter space and .

Model Estimation

We estimate the model parameters using a “Simulated Maximum Likelihood Estimation” approach. And we use the “Simplex Method” to identify the optimal parameter estimation result (Nelder et al., 1965). Although Simplex is not as efficient as Newton-Raphson method, it is more stable and robust because it does not need the numerical solutions of Hessian Matrix and Gradients in the process of maximization  .

.

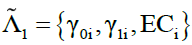

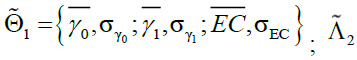

Empirical Identification

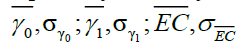

As shown in the Equation 22, the parameters in our forward-looking structural model include:  . Major concern may exist on whether we can separately identify the parameters taking into account the customer heterogeneity, e.g.,

. Major concern may exist on whether we can separately identify the parameters taking into account the customer heterogeneity, e.g.,  . We address that, given the information in our data, we can successfully identify them.

. We address that, given the information in our data, we can successfully identify them.

First of all, both γ0 and γ1 exist in the period net-utility function (Equation 1) and the period net-utility is a major component in the value function (Equation 8) that determines both “whether to buy” and “how long to buy” decisions. Therefore, both decisions involve in the identification of γ0 and γ1. Further, in the period net-utility function (Equation 1) γ0, represents the customer’s mean-level net-utility toward the technology and γ1 captures customer’s utility sensitivity of the overall technology level. It is obvious that they can be separately identified because we can observe the current technology level through identifying the number of news.

Second, the identification of EC, e.g., efforts of signing a contract, depends on both the “whether to buy” and “for how long to buy” decisions. In our setting, EC does not exist in the period net-utility function. Thus, it has no effect on the period utility. However, it affects the customer’s contract length decision through influencing customer’s overall value. Specifically, a higher EC means that the customers will have to input heavier one-time effort, such as learning the technique, training employees and negotiating with the firm, etc. in order to finalize the contract. Consequently, the customers tend to sign a longer contract to avoid another input. When EC are too high, customers can delay the purchase decision. Therefore, EC can also influence the “whether to buy” decision.

Further, we conducted a simulation study to empirically demonstrate that both our estimation algorithm is valid and all our parameters are identifiable. We generated customers’ contractual decision data based on the value function we derived in Equation 17. Our simulated data contains 100 customers each making purchase decisions in a 36 time periods window. According to our simulation result, we are able to recover all the true parameters within 95% confidence interval, which justify the validity of our model estimation on real data. For details on the simulation process.

RESULTS

In this section, we first discuss the estimation results of the proposed model. Based on the parameter estimation results, we will show how customer’s value is shaped, e.g., the value function structure.

Parameter Estimation

The parameter estimation appears in Table 3. We take into account the customer heterogeneity for three parameters in the model, e.g., γ0, which is the mean-level net-utility; γ1, which is the coefficient of technology in the utility function (Equation 1), and EC, which is the parameter to capture the effort of signing a contract. Therefore, their parameter estimations include both the mean-level and the standard deviation.

| Table 3 Dynamic Structural Model Parameter Estimations | |||||

| γ0 | γ1 | EC | δ | σξ | |

| mean | -1.741 | -5.747 | -0.0734 | 0.821 | 0.988 |

| -0.096 | -0.337 | -0.506 | -0.072 | -0.814 | |

| Standard deviation | 2.041 | 0.542 | 4.086 | ||

| -0.291 | -0.278 | -0.799 | |||

Standard error (Table 3) of the estimation suggests that all estimated parameters (except for  ,

,  and

and  ) are significant at the 95% significance level. It is worth mentioning that parameters γ1 and EC are estimated as log-normal distribution. The significance of the estimation results for

) are significant at the 95% significance level. It is worth mentioning that parameters γ1 and EC are estimated as log-normal distribution. The significance of the estimation results for  ,

,  does not have a physical meaning.

does not have a physical meaning.

From Table 3, we can see that, all three variance-term, e.g.,  are statistically significant. This confirms the existence of customer heterogeneity in their decision process.

are statistically significant. This confirms the existence of customer heterogeneity in their decision process.

Next, we observe that the estimated absolute value of  appears to be small (

appears to be small (  = -5.747 implies that mean-level of γ1 is approximately 0.0032). γ1 captures the extent to which the change of overall technology level (e.g. Techt) will impact customers’ period utility (Equation 1). Shown in Equation 2, the overall technology level has two major components: the cumulative technology-related news (e.g. Newst) and unobserved technology improvement (e.g.

= -5.747 implies that mean-level of γ1 is approximately 0.0032). γ1 captures the extent to which the change of overall technology level (e.g. Techt) will impact customers’ period utility (Equation 1). Shown in Equation 2, the overall technology level has two major components: the cumulative technology-related news (e.g. Newst) and unobserved technology improvement (e.g.  ). From our data, we observe that the cumulative news can range from 3 to 137 within our transaction data time frame (e.g., from Jan. 2009 to Sep. 2011). Adding in the

). From our data, we observe that the cumulative news can range from 3 to 137 within our transaction data time frame (e.g., from Jan. 2009 to Sep. 2011). Adding in the  term will make the overall variation even larger. Therefore, given the fix variance of the net-utility error

term will make the overall variation even larger. Therefore, given the fix variance of the net-utility error  , the term of

, the term of  still plays an important role in determining the customer’s period utility due to the large variation of the Techt. Our policy simulation also show that the overall technology level significantly impact the customer’s net-utility.

still plays an important role in determining the customer’s period utility due to the large variation of the Techt. Our policy simulation also show that the overall technology level significantly impact the customer’s net-utility.

The estimated information discount δ is 0.821 suggesting a relatively heavy information discount. With a discount factor of 0.821 at the monthly level, information that is more than two years old is no longer considered in a customer’s evaluation of future technology level. These results suggest that in the fast developing high-tech B2B market, customers’ beliefs about the technology improvement significantly discounted over time.

Table 3 indicates that the estimation result of  is not significant at 95% level. This result implies that the news-count provides a reasonable estimation of the technology improvement.

is not significant at 95% level. This result implies that the news-count provides a reasonable estimation of the technology improvement.

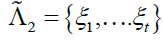

Value Function under Parameter Estimation Results

Based on the estimated parameters, it will be interesting to know how a cloud adopter’s value is shaped in our study. Recall that in our model, we have four state variables, e.g.,  and the decision variable is the contract length CLit. We will show the structure of value function through different angles.

and the decision variable is the contract length CLit. We will show the structure of value function through different angles.

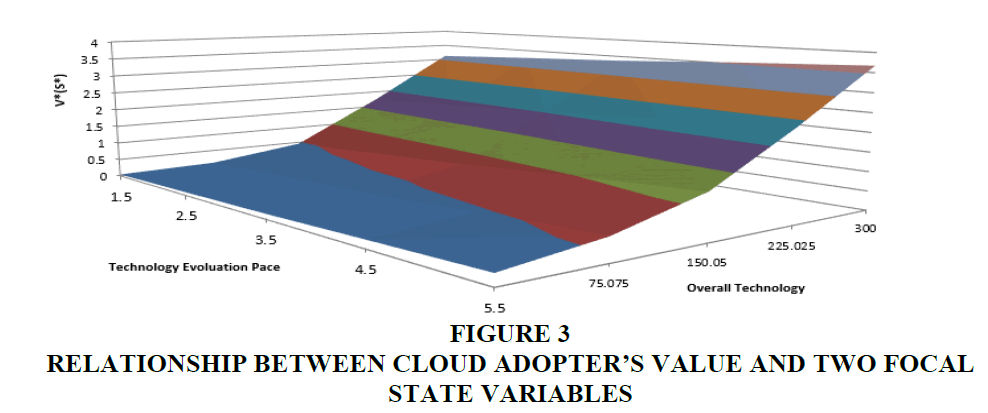

Firstly, we show how customers’ value  will change with the two technology improvement states, e.g. Tech and

will change with the two technology improvement states, e.g. Tech and  (Figure 3). By optimizing the contract length decision CL and integrating out the (Equation A1), we are able to derive the customers’ value only as a function of the two focal state variables of technology improvement, e.g. the technology improvement pace

(Figure 3). By optimizing the contract length decision CL and integrating out the (Equation A1), we are able to derive the customers’ value only as a function of the two focal state variables of technology improvement, e.g. the technology improvement pace  and the overall technology level Tech. Figure 3 shows that, the customer’s value is positively related to both overall technology "Tech" and technology improvement pace

and the overall technology level Tech. Figure 3 shows that, the customer’s value is positively related to both overall technology "Tech" and technology improvement pace  . This result confirms that customers should be beneficial from both the elevation of overall technology level and the increase of technology improvement pace.

. This result confirms that customers should be beneficial from both the elevation of overall technology level and the increase of technology improvement pace.

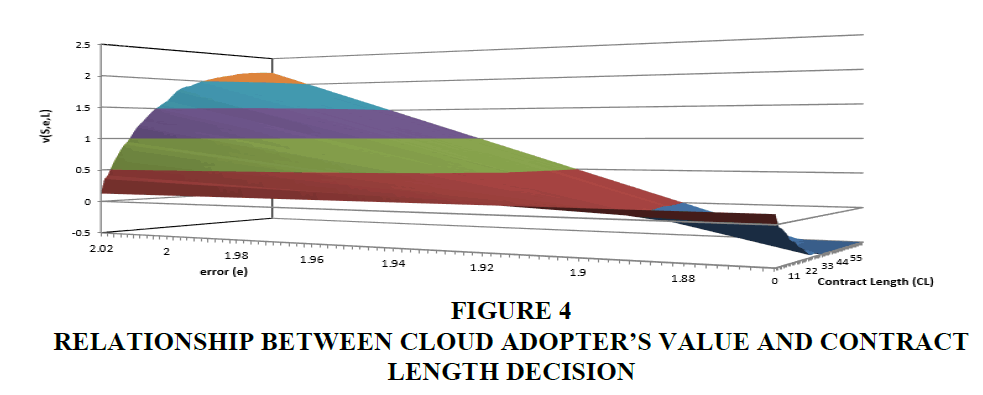

Next, we present the customers’ value as a function of the other two focal states: contract length decision CL and error term ε (Figure 4). Since there is no way to derive a marginal function, the relationship between  (Equation A2), CL and ε shown in Figure 4 is given conditional on a combination of Tech and

(Equation A2), CL and ε shown in Figure 4 is given conditional on a combination of Tech and  states. We have several observations from Figure 4. First, a customer’s value has a clear positive relationship with the error term ε. Recall that ε captured the unobserved factors impacting customer’s net-utility. It is obvious that the customers should receive more value if there is a larger positive impact in the business environment. For example, the service provider gives a temporary price discount or offers some additional services. Next, we observe that, there is a monotonic relationship between ε and optimal contract length decision CL ,e.g. ε increase, the

states. We have several observations from Figure 4. First, a customer’s value has a clear positive relationship with the error term ε. Recall that ε captured the unobserved factors impacting customer’s net-utility. It is obvious that the customers should receive more value if there is a larger positive impact in the business environment. For example, the service provider gives a temporary price discount or offers some additional services. Next, we observe that, there is a monotonic relationship between ε and optimal contract length decision CL ,e.g. ε increase, the  also increase and vice versa. This monotonic relationship ensure the one-to-one mapping between ε and CL optimal thus the feasibility of maximum likelihood estimation.

also increase and vice versa. This monotonic relationship ensure the one-to-one mapping between ε and CL optimal thus the feasibility of maximum likelihood estimation.

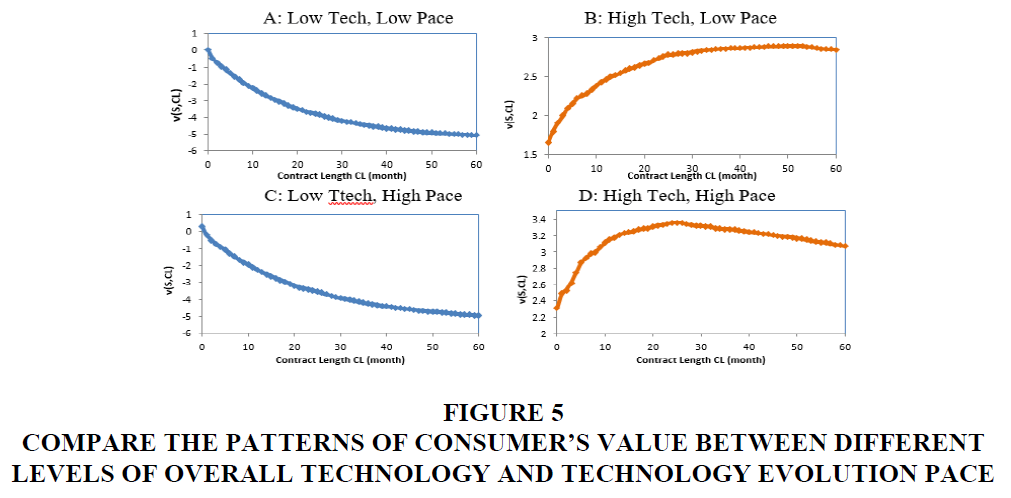

Finally, we compare the patterns of customers’ value  (Equation A2) between different levels of Tech and

(Equation A2) between different levels of Tech and  (Figure 5). We extract the relationship between

(Figure 5). We extract the relationship between  and CL given all state variables in order to demonstrate how the technology improvement will influence the optimal contract length decisions. From Figure 5, we firstly observe that, when the overall technology level is low, no matter whether the technology improvement pace is low (Figure 5A) or high (Figure 5C), the shape of a customer’s value indicates that the

and CL given all state variables in order to demonstrate how the technology improvement will influence the optimal contract length decisions. From Figure 5, we firstly observe that, when the overall technology level is low, no matter whether the technology improvement pace is low (Figure 5A) or high (Figure 5C), the shape of a customer’s value indicates that the  . This result suggests that, when the technology level is low, customers do not purchase the service. When the overall technology level is high enough (Figures 5B and 5D), the optimal CL is greater than zero, meaning customers purchase the service. Next, by comparing Figures 5B and 5D, we find that given the same technology level, a lower improvement speed is associated with a longer optimal CL. This result indicates that, when the technology improvement pace is low, if the customer decides to buy, he/she is more likely to buy with a longer contract. In contrast, customers are more likely to buy a shorter service contract when expecting a fast technology innovation pace.

. This result suggests that, when the technology level is low, customers do not purchase the service. When the overall technology level is high enough (Figures 5B and 5D), the optimal CL is greater than zero, meaning customers purchase the service. Next, by comparing Figures 5B and 5D, we find that given the same technology level, a lower improvement speed is associated with a longer optimal CL. This result indicates that, when the technology improvement pace is low, if the customer decides to buy, he/she is more likely to buy with a longer contract. In contrast, customers are more likely to buy a shorter service contract when expecting a fast technology innovation pace.

Figure 5 Compare the Patterns of Consumer’s value between Different Levels of Overall Technology and Technology Evolution Pace

Policy Simulation

Given the parameter estimation results, we conduct two policy simulations to answer our research questions. First, we examine the effect of changing technology improvement structure on a customer’s decisions. This experiment demonstrates how the technology improvement influence a customer’s decision processes and how managers could strategically manage the technology improvement. Second, we investigate how the effort of signing a contract impacts a customer’s decision. This analysis provides insights on how managers can influence a customer’s decision through adjusting a B2B customer’s efforts of signing a contract.

Technology Improvement Structure

As we all know that in a hi-tech market, both releasing new technology and updating existing technology are very strategic. It is a very common phenomenon in a hi-tech market that firms may research and develop a new tech this year, but release it 5 years later. For example, Apple releasing a new version of Iphone every year is a strategic way to announce technology improvement to its B2C customers. Our policy simulation of how customers respond to different structures of technology improvement sheds light on how the firm could strategically adjust the technology improvement in a B2B service market.

We define two schemes of technology improvement: “jogging pace” and “leaping pace” in our policy simulation. In the “jogging pace” improvement, the technology update happens more frequently but the degree of each update is smaller. The “jogging pace” improvement is represented by an evenly distributed technology update every month. In the “leaping pace” improvement, the technology update happens less frequently but the degree of each update is larger. The “leaping” pace is represented by a remarkable technology update in one month after no update for several months.

There are two types of the “leaping pace” improvement: 6 month leaping pace and 12 month leaping pace. In the first one, the technology update happens only in months 6, 12, 18, 24, 30 and 36; and in the latter, the technology update happens only in months 12, 24, 36. To make the two paces of improvement comparable, we will keep the cumulative updates consistent between the “jogging” and “leaping” paces. For example, if cumulative updates is 12 in month 6 (evenly distribute 2 updates per month) under “jogging pace”; then in month 6, 12 updates are simultaneously released (no updates from month 1 to 5) under “leaping pace”.

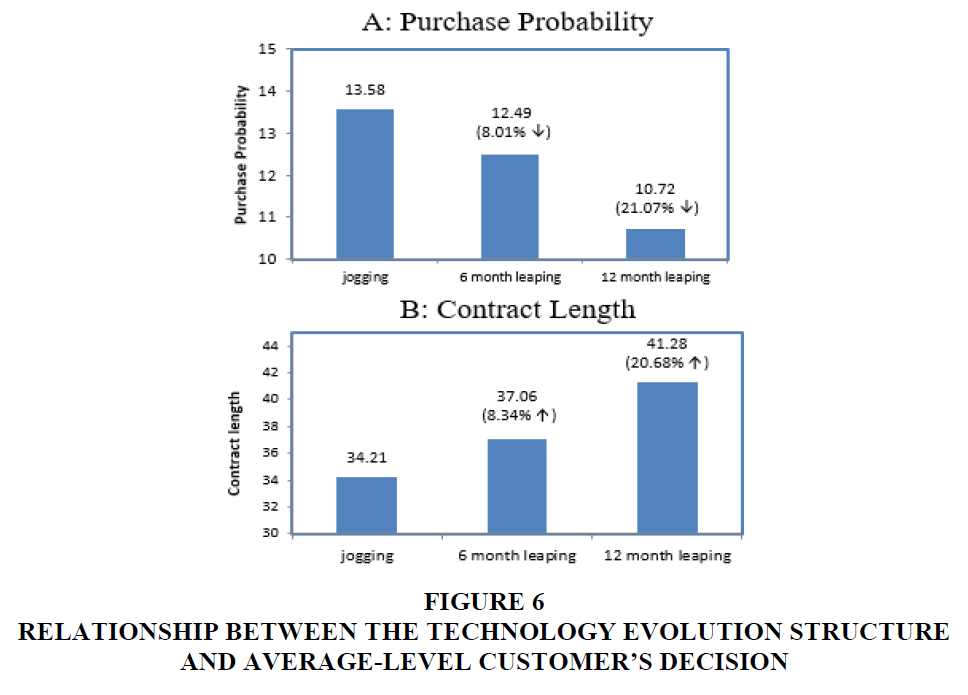

In our results, we firstly compare, on average, the customer’s purchase probability and contract length decision between jogging pace and leaping pace (Figure 6). We can see that, over a 36 months window, on average, changing from jogging pace to leaping pace results in a systematic decrease in purchase probability (Figure 6A) and an increase in contract length decision (Figure 6B). Specifically, from jogging pace to 6 months leaping pace, the purchase probability reduce 8.01% and contract length increase 8.34% (Figure 6A); from jogging pace to 12 months leaping pace, the purchase probability reduce 21.07% and contract length increase 20.68% (Figure 6B). This suggests that, when facing leaping pace technology improvement, customers are less interested in adopting the service; but if they decide to purchase, they tend to sign a longer contract.

Figure 6 Relationship between the Technology Evolution Structure and Average-Level Customer’s Decision

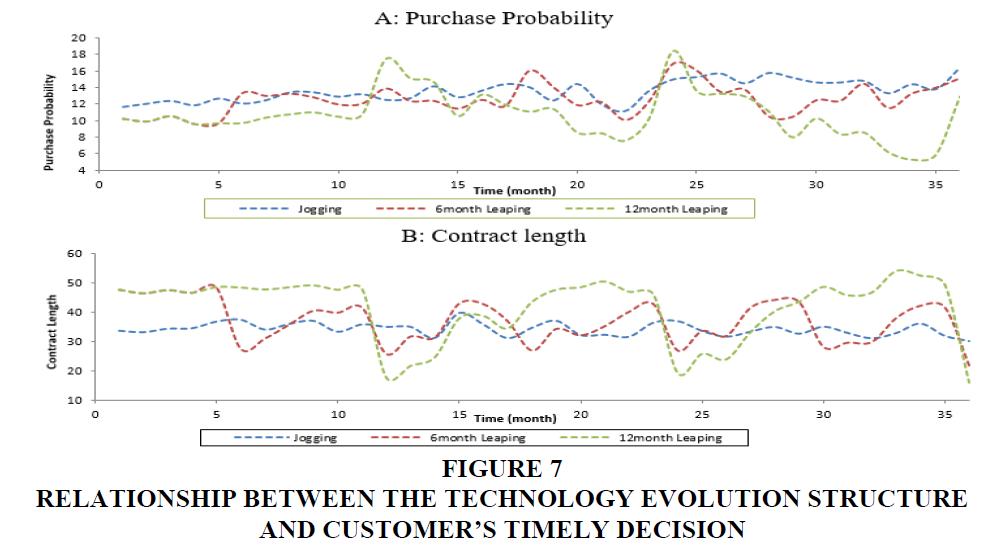

Second, we illustrate how a customer’s purchase decision will change over time (Figures 7A and 7B). We are interested to know how the technology improvement influences the customer’s timely decision. We find that, under jogging pace, a customer’s purchase probability shows a slightly upward trend over time (Figure 7A, Blue line), while his/her contract length decision shows no systematic trend (Figure 7B, Blue line). When the technology update is evenly distributed every month, the overall technology level will gradually increase over time, but the speed of technology improvement is relatively stable. Reflected in customers’ decisions, over time, customers will become more willing to buy, but their decisions on the contract length do not have a systematical change. Next, under leaping pace, both customers’ purchase probability and contract length decision clearly respond to the technology update occasion. For example, a customer’s purchase probability remarkably peaks at the technology update months (Figure 7A); while the customer’s contract length significantly drops at the technology update months (Figure 7B) for both leaping paces. This result indicates that, a remarkable technology update can also create an instant effect on customers’ purchase decisions. Specifically, a customer’s willingness to buy significantly increases due to the abrupt elevation of overall technology level. The high speed of technology improvement incites customers to form higher expectation on the future technology update. Consequently, customers tend to sign a much shorter contract to capture future benefits.

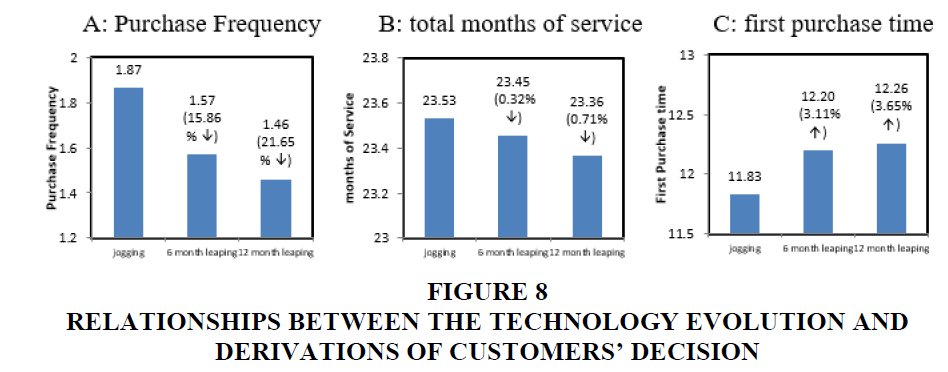

Last, we show the policy simulation results of three derivations of customers’ decisions: the purchase frequency, the total months of service used by the customer and the customer’s first purchase time (Figure 8). All three items are calculated within a 36-month decision time window. The reasons of selecting these three items are as follows: First, in our data, we do not observe the customers’ cost and value to the firm. But, we could use customers’ decisions to infer their potential cost and value and show the possible changes with the technology improvement structure, which can be especially interesting to the firm. It is widely acknowledged that the business buying process is a complicated one and each contract is associated with remarkable cost (Marketing Charts staff, 2014). From the firm’s perspective, it can save more cost if the customers sign the contract less frequently. Therefore, we use the purchase frequency to infer the firm’s cost on the customers. Next, it is obvious that the more months the customers use the service, the more revenue the firm can earn from the customers. And the earlier the customers begin to make the purchase, the quicker the service provider can start to reap profits from the customers. Therefore, we use the total months of service and the customer’s first purchase time to infer the potential value of the customers to the firm.

From the policy simulation, we find that changing from jogging to leaping pace technology improvement systematically reduces the customer’s purchase frequency (Figure 8A). Specifically, from jogging pace to 6-month and 12 month leaping paces, customers’ purchase frequency, on average, reduce 15.86% and 21.65%, respectively. Next, we observe that the total months of service slightly decreases from jogging to leaping pace (<1%) (Figure 8B). Recall that we use purchase frequency and total months of service to infer the customer’s potential cost and revenue to the firm respectively. These results imply that, comparing with jogging pace, customers contribute similar level of revenue (<1% decrease) but save more than 15% cost to the firm in leaping pace. Consequently, firms could seize more profit from the customers by utilizing leaping pace strategy to announce technology evolution. Further, the first purchase time increase about 3% when changing from jogging pace to leaping pace (Figure 8C). This implies that, the firm waits longer in leaping pace for a customer to adopt the service.

Efforts of Signing a Contract

In this section, we will show how a customer’s decision is changed with the “efforts of signing a contract.” Again, the “efforts of signing a contract” is a customer’s one-time effort associated with each contract, such as training employees and negotiating with the firm etc. Although this one-time effort is primarily under the control of the business customer, firms can still implement some plans to partially alter it. For example, to reduce this effort, the firm could proactively offer some help to the customers, such as collaborating with the customers to train their internal IT employees or providing some extra support to help customers learn the service technique, etc. On the contrary, the firm can also increase the customer’s effort of signing a contract by acting less friendly toward the customers. Therefore, the policy simulation on efforts of signing a contract can also provide valuable strategic implications.

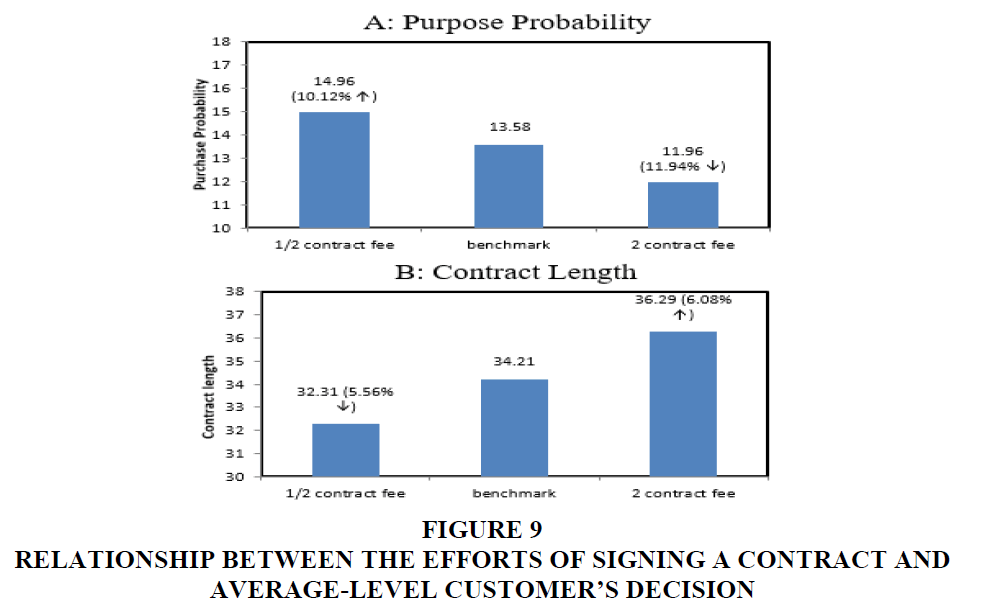

We compare the customers’ decisions at three levels of the “effort of signing a contract”: benchmark effort; half of the benchmark effort and twice of the benchmark effort. Similar as the policy simulation for technology improvement structure, we will show results in the following two fields: 1) on average the customers’ purchase probability and contract length; and 2) the three derivations of customers’ decisions inferring the cost and value of the customers to the firm. Changing the efforts does not alter the pattern of a customer’s decision over time. Thus, we omit the results of it here.

First, on average, a customer’s purchase probability shows a negative relationship with the effort (Figure 9A); and a customer’s contract length has a positive relationship with the effort (Figure 9B). Specifically, reducing 50% of the effort can increase 10.12% of customers’ purchase probability, while doubling the efforts can reduce about 11.94% of the purchase probability. On the contrary, reducing 50% of the efforts deducts the contract length by 5.56%, while doubling the efforts can boost it up by 6.08%. The results indicate that, reducing customers’ efforts does incite customers to buy the service; however, when signing a contract becomes easier (less effort), customers tend to sign shorter contract to better capture future benefit from the technology improvement. On the other hand, when the efforts of signing a contract are increased, customers are less likely to buy; but if they decide to buy, they tend to buy with a longer contract to avoid another bulky input.

Figure 9 Relationship between the Efforts of Signing a Contract and Average-Level Customer’s Decision

Next, Figure 10 illustrates the relationship between the effort and the three derivations of customers’ decisions: purchase frequency, total months of service, and the first purchase time. From Figure 10, we observe that, when we reduce 50% of the efforts, customers sign the contract more frequently (7.40% increase), use slightly more months of service (0.14% increase), and adopt the service earlier (3.09% decrease in first purchase time). The findings suggest that reducing the efforts can incite customers to buy earlier and earn slightly higher revenue. However, customers tend to sign contracts more frequently thus consuming more cost from the firm. In comparison, doubling the efforts reduces both customers’ purchase frequency (6.46% decrease) and total months of service (0.52% decrease), and elevates the customers’ adoption time (1.73% increase). The results suggest that increasing the efforts can help the firm save cost on the customers, but both the revenue slightly decreases and customers tend to adopt later.

Figure 10 Relationship between the Efforts of Signing a Contract and Derivations of Customers’ Decision

Managerial Implication