Research Article: 2022 Vol: 25 Issue: 4S

Model for assessment of the level of foreign economic security of regions based on determination of risk zones

Dmitry Grigorievich Rodionov, Peter the Great St. Petersburg Polytechnic University

N.A. Kulagina, Bryansk State Engineering and Technological University

O.V. Mikheenko, Bryansk State Engineering and Technological University

E.A. Bessonova, Bryansk State Engineering and Technological University

Citation Information: : Rodionov, D.G., Kulagina, N.A., Mikheenko, O.V., & Bessonova, E.A. (2022). Model for assessment of the level of Foreign economic security of regions based on determination of risk zones. Journal of Management Information and Decision Sciences, 25(S4), 1-12.

Keywords

Model, Foreign Economic Security, Security Levels, Region, Risk Zones, Foreign Trade Activity Indicators

Abstract

This article proposes a model for assessing foreign economic security based on ranking of regions according to remoteness of risk zones from the threshold values. The author’s approach assumes a comprehensive assessment, including a system of indicators generalized in various areas of foreign economic security: a group of industrial, investment, foreign trade indicators and a block of general macroeconomic criteria. Approbation of the proposed methodological approach is carried out on the example of constituent entities of the Central Federal District. Based on the assessment results, a map of foreign economic security of constituent entities of the Central Federal District is compiled and radar diagrams are provided reflecting the risk level of each group of indicators in the context of the regions studied. The practical significance of the research results is determined by the possibility of their use by public authorities as a methodological basis for determining the set of threats and substantiating their management decisions to build a mechanism to counter the identified threats to foreign economic security of regions.

Introduction

In modern conditions characterized by a high degree of globalization of the economy, foreign economic relations acquire special significance for the stable socio-economic development of not only the state as a whole, but also its individual constituent entities. At the same time, the issues of ensuring economic security remain topical, and the conventional understanding of the economic security is the ability of a system to independently ensure a stable position of the economy and development of the territory under the influence of negative factors, to mitigate and neutralize their effect.

The involvement of the constituent entities of the Russian Federation in the system of international foreign economic cooperation necessitates the allocation in the structure of economic security of such an important component as the foreign economic security, which is usually understood as a set of measures, both at the macro and micro levels, aimed at ensuring the stability of the economy, its development and protection of foreign economic interests from the impact of negative factors and their consequences, which also ensure the integration of a region into the world economy on the basis of the international division of labor.

Assessment of the level of foreign economic security of regions allows us to determine the stability of their economic systems to the influence of destabilizing factors (threats), as well as the degree of independence of economic sectors from imports based on the calculation of various kinds of indicators.

Theoretical and methodological aspects of assessing the level of foreign economic security and its individual components are examined in the works of Russian and foreign scientists. However, in our opinion, relevant methodological provisions for assessing the level of foreign economic security in relation to regional economic systems in the context of the impact of modern threats on their strategic development need to be developed.

The purpose of this study is to develop a model for assessing the level of foreign economic security of a territory, taking into account the multicollinearity between the indicators used, based on determination of the risk zones of the region.

The goal set above have led to the need to solve the following complex of interrelated tasks:

- • To consider the approaches of domestic and foreign researchers to solving the problem of assessing foreign economic security of territories and its impact on the level of economic security of the country;

- • To propose a system of criteria and indicators that take into account various areas of ensuring an acceptable level of foreign economic security;

- • To propose a model for assessing foreign economic security based on determination of risk zones of a region, since it is the ability of the economic system to withstand a set of threats that is its key characteristic and affects the entire complex of reproduction processes;

- • To test the developed methodological approach and provide a description of the research results obtained.

The “Theory” section examines the approaches to the term “foreign economic security” reflected in domestic and foreign literature.

In the “Data and Method” section, a methodological approach to assessing foreign economic security is proposed, based on classification of risk zones of regions.

In the “Results” section, the author’s approach is tested on the example of the regions of the Central Federal District of the Russian Federation. The obtained results of the empirical study made it possible to compile a map reflecting the classification of the Central Federal District regions according to the levels of foreign economic security.

In the “Discussion” section, a detailed analysis of particular indicators of each region is carried out in the context of the foreign economic security groups identified by the author. Diagrams are provided reflecting the state of each group of indicators in the context of the studied regions of the Central Federal District.

In conclusion, the main study findings of the work are presented.

Theory

Foreign economic security, as a property of any environment, is extremely complex, and in modern science there are many approaches to its definition, structural analysis and assessment. The primary decomposition of this concept allows to define “security” as the central category under study. Essentially, the security of a system of any kind can be understood as the ability to maintain the sustainability or stability of a given system in countering the development of crisis phenomena, which in turn determines the need to take measures to manage risks and threats, which are the results of risk realization (Strelcová et al., 2014). Extrapolation of the described essence of the “security” category to the foreign economic activity of the state is possible only in the context of current political, economic and social specifics. As a fundamental example, the differentiation of the democratization process in the context of the foreign economic specifics of different countries can be cited. At the moment, even despite the large-scale political transformations in the Middle East, which are a relatively open and indicative case suitable for systemic research, the scientific community does not have any unambiguous perception of the relationship between the foreign economic specifics of different countries and the process of their democratization. Some researchers focus on the “modernization” hypothesis, according to which a high level of democratization is a consequence of urbanization and an increase in the well-being of the population (Robert J. Barro, 1999). This hypothesis is also supported by many empirical studies that also investigate the relationship between democratization and the economic well-being (Bernhard et al., 2001). However, at the same time, an alternative hypothesis is dispelled, according to which the process of democratization is only indirectly related to foreign economic specifics and manifests itself exclusively in an increase in predictability of returns on external investment (Persson et al., 2009). Thus, even at the level of interpretation of the relationship between the main components of the definition of “foreign economic security”, there are conceptual differences observed. One of the most universal approaches defines the essence of the state security in the context of international interaction in ensuring sustainable and conditionally independent (primarily, from other countries) economic development, which is based on the principles of effective formation and preservation of international economic relations (Senchagov V.K. et al., 2011). At the same time, the state security as an integrated object can be multiply differentiated. As a rule, political, military, economic, social and environmental specifics are distinguished in horizontal section, and individual, public and international security are distinguished in vertical section (Buzan B. et al., 2005).

In accordance with the above theses regarding the essence of the concept of state security in the context of international interaction, it can be concluded that actually foreign economic security is a complex socio-economic category that continuously responds to both external and internal threats. At the same time, foreign economic security in the context of the globalization process is the basis of national security, and in fact reflects both the momentary and the predictive ability of political, economic and legal institutions established in the state to respond to threats and thereby ensure the interests of the main constituent entities (Grigoreva E., Garifova L., 2015). In the context of management, foreign economic security is usually viewed as an object of state regulation. However, the importance of public contribution to the formation of a sustainable level of foreign economic security should also not be underestimated, in particular in the context of democratization (Kremer-Matyškevic I., Cernius G., 2019). At the same time, the leveling of interests of foreign economic security on the part of the state can potentially lead to both a protracted economic crisis and a possible military crisis (Jankovska L. et al., 2018). Thus, despite the high public contribution to the formation of the country’s foreign economic security, it is the state that determines it in the first place. As a set of basic tasks of foreign economic security management, scientists emphasize the increase in competitive advantages of national production complexes, ensuring trade advantages in international markets, as well as protecting the country’s interests in the field of innovations, and many other advantages (Dzhafarova M.V. et al., 2019).

Multiple differentiation of potential tasks of ensuring the state foreign economic security also determined the variability of research in this area. A significant number of studies are devoted to the impact of the state of the country’s defense complex on the foreign economic security level (McGuire M.C., 1995). The hypothesis about the connection between the state of the country’s defense complex and the level of foreign economic security is mainly valid for the 20th century and the period of the Cold War, in times when, in modern conditions, the process of globalization has led to expansion of international trade, which in turn has led to an increase in importance of each participant market (i.e. state) within the framework of ensuring sustainability of the trade interaction process (Siew Mun Tang, 2015). Reflexion of this fact has led to a significant decrease in the likelihood of a recurrence of international military conflicts. The described specifics has led to an increase in intensity of research in the field of studying the impact of national welfare on foreign economic security (Long W.J., 1992). At the moment, the hypothesis about the primary impact of the state of the internal environment on the level of foreign economic security of the country is dominant in the world science. However, extrapolation of the consequences of local economic crises to all participants in the international economic interaction system indicates a more complex nature of managing the level of foreign economic security in an open economy (Walter A., 2015). Many scientists note the primacy of the energy factor in management of the country’s foreign economic security. Reducing dependence on imports of fuel resources and diversifying energy sources is one of the most significant areas for increasing foreign economic security (Turkenburg W.C. et al., 2012). Since outside the scope of energy consumption, the process of economic interaction is possible exclusively in the form of local natural exchange, the sustainability of electricity supply is one of the basic categories in the context of ensuring the country’s foreign economic security (Cherp A., Jewell J., 2011). However, it shall be noted that energy security largely determines the possibility of economic interaction, while upon reaching a certain level of this parameter, its share of influence on foreign economic security decreases. Thus, the thesis about the integrated nature and systemic complexity of managing the level of the country’s foreign economic security is conceptually substantiated. This statement determines the conduct of a variety of studies considering potential regressors of the parameter under consideration. Within the scope of research data, quantifiers of the political situation, the state of military conflicts, indicators of the country’s economic state and quantifiers of specifics of its interaction with other countries, the investment policy, parameters of international marketing, and much more are usually distinguished as indicators of the country’s foreign economic security (Klimuk V. et al., 2019). The multidimensionality of the described specifics confirms the lack of a common understanding of both the sources of formation and the indicators of effectiveness of managing the country’s foreign economic security level.

The described specifics is transforming both spatially and dynamically. As an example of significance of transformation of spatial factors in the context of managing the country’s foreign economic security, the current case of the Middle East (in particular, the Republic of Afghanistan) can be cited. The unique specifics of development of this state determined the inefficiency of the long-term and extremely capital-intensive transformation of society under the influence of a third-party state (Dobbins J. et al., 2013). The specifics of the global dynamics of development is no less significant in the framework of managing the level of the country’s economic security. Slowdown of economic growth, deterioration of macroeconomic indicators of the leading countries, as well as escalation of “trade wars” inevitably affect the level of foreign economic security of the participating countries (Dudin M.N. et al., 2018). This impact is also amplified by the process of globalization, which results in a decrease in the share of the impact of state institutions on the level of the country’s foreign economic security (Simanaviciene Z., Stankevicius A., 2015). In conclusion, it is necessary to separately note the impact of the COVID-19 pandemic on the management of the country’s foreign economic security. This influence is so fundamental that its manifestations can be established even in the change in the birth rate dynamics. The impact of the pandemic on the foreign economic security level has provoked many people to rethink their pregnancy prospects, which could potentially lead to an overall decrease in fertility (Greenwood J., 2005). Thus, it can be asserted that the specifics of ensuring foreign economic security is transformed both in space and in time.

Analysis of the literature allows to conclude that at present there is no unified approach to interpretation of the definition of “foreign economic security”. Nevertheless, most authors recognize that this economic category is the most important component of the national economic security. In this regard, the issues of constructing a model for assessing the level of economic security of a territory, taking into account the state of its foreign economic component, acquire particular relevance.

Data and Method

There are various approaches to assessing the region’s foreign economic activity and the structure of indicators. Nevertheless, most researchers note that the main components that make it possible to comprehensively assess the foreign economic security of a region are: macroeconomic, industrial, investment and foreign trade indicators.

- L. Vardomskiy, A. Maltsev, P. Mikhailovskiy, A. Tarasov and others were engaged in theoretical and practical study of the foreign economic activity of regions. A significant part of the works is devoted to the study of the export potential of a region or certain forms of foreign economic activity, as a rule, the foreign trade. The inclusion of indicators of criteria characterizing the investment attractiveness of a region, as well as the level of industrial development, in the system will make it possible to assess the foreign economic security of a region from the point of view of potential compliance with the strategic vectors of development.

In modern economic conditions, the economy of the constituent entities of the Russian Federation is largely diversified, each region has characteristic features associated with socio-cultural, natural-climatic and other factors. Thus, each group should be characterized by a sufficient number of indicators. Their number should not be too large (more than 25), but not less than 3 in each area. Since the dominant form of foreign economic activity for Russian regions is foreign trade, the study of this area should be given special attention.

The author’s system for assessing the region’s foreign economic security is based on the following system of criteria.

The list of primary indicators is considered in the context of 4 groups:

- • Macroeconomic indicators (Mi);

- • Industrial indicators (Pi);

- • Investment indicators (Ii);

- • Indicators of foreign trade activity (Vi).

A multidimensional model of the level of the region’s foreign economic security can be represented as:

?fts = f { Mi, Pi, Ii, Vi) }.

Each of the presented groups of indicators is characterized by a set of particular indicators that diversify the foreign economic security of the territory:

Mi = { ?1,?2,?3};

Pi, = { ?4,?5,?6, ?7,?8,?9, ?10 };

Ii, = { ?11,?16,?17, ?18 };

Vi = { ?19,?20,?21, ?22, ?23,?24,?25, ?26 ?27,?28}.

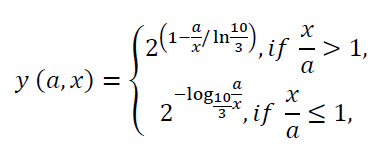

After calculating the actual data of FTS indicators, the indicators should be ranked according to the degree of remoteness from the threshold value. This is done in order not to lose the complexity of assessment after comparing the actual values of the indicators with the established threshold values. One of the options is the transformation function in order to position the indicator in the appropriate “risk zone”:

For “not less than” indicators, the following function is proposed:

where x is the initial value of the indicator;

a is its threshold value.

For “not more than” indicators, the following function is proposed:

At the next stage, ranking of territories is carried out on the basis of the obtained calculated value of Y, the risk zone and its qualitative characteristics are determined:

| Table 1 Classification of Risk Zones In Determining the Level of Foreign Economic Security of A Region* |

||

|---|---|---|

| Risk zone | Y indicator value | Risk zone description |

| Catastrophic risk | 0 – 0.25 | The actual indicator value is more than 10 times different from its threshold value |

| Critical risk | 0.26 – 0.5 | The actual indicator value is from 3 to 10 times different from its threshold value |

| Significant risk | 0.51 – 0.75 | The actual indicator value is from 1.6 to 3 times different from its threshold value |

| Moderate risk | 0.76 – 1.0 | The actual indicator value is not more than 1.6 times different from its threshold value |

| Stability zone | 1.01 – 1.75 | The actual indicator value is “safer” than its established threshold value |

* Compiled by the author.

The proposed methodological approach allows the most objective and mathematically sound assessment of the level of foreign economic security of a region, makes it possible to carry out interregional comparisons, identify threats that can lead to destabilization of the situation in the foreign economic sphere.

Results

In the course of the study, we calculated 26 analytical indicators using the example of the Bryansk region of the Russian Federation, for each of which threshold values are given (Table 2).

| Table 2 Assessment of Foreign Economic Security of The Bryansk Region for Years 2017-2018* |

|||||||

|---|---|---|---|---|---|---|---|

| Name | Threshold value | Bryansk region | Deviation | Y function value | Deviation | ||

| 2017 | 2018 | 2017 by 2018 | 2017 | 2018 | 2017 by 2018 | ||

| Macroeconomic indicators (Mi) | |||||||

| GRP in the average Russian GRP per capita, % (?1) | >100% | 60.32 | 56.82 | -3.5 | 0.75 | 0.72 | -0.03 |

| Average annual growth of GRP per year, % (?2) | >4-8-12% | 9.45 | 6.86 | -2.59 | 1.24 | 1.11 | -0.13 |

| Change in GRP indicator per 1% change in state GDP, % (?3) | >1% | 4.37 | 1.83 | -2.54 | 1.42 | 1.14 | -0.28 |

| Industrial indicators (Pi) | |||||||

| Industrial production index, % (?4) | >102-108% | 107.3 | 105.2 | -2.1 | 0.86 | 0.85 | -0.01 |

| Share of manufacturing industries in total industrial production, % (?4) | >50-70% | 88.97 | 89 | +0,03 | 1.13 | 1.66 | 0.53 |

| Depreciation of fixed assets, % (?5) | <35-37-40% | 47.6 | 48.8 | 1.2 | 0.65 | 0.63 | -0.02 |

| Share of fully depreciated fixed assets, % (?6) | <5% | 14.5 | 13.7 | -0.8 | 0.22 | 0.25 | 0.03 |

| Share of innovative products in industrial production, % (?7) | >10-15% | 5.68 | 2.54 | -3.14 | 0.72 | 0.45 | -0.27 |

| Ratio of expenditures on technological innovation to the total volume of industrial production, % (?8) | >2.50% | 0.57 | 0.88 | 0.31 | 0.43 | 0.55 | 0.12 |

| Innovative activity of organizations, % (?9) | Dynamics | -0.6 | -1.24 | -0.64 | 0 | 0 | 0 |

| Ratio of internal expenditures on research and development to GRP, % (?10) | >2% | 0.32 | 0.42 | 0.11 | 0.09 | 0.11 | 0.02 |

| Investment indicators (Ii) | |||||||

| Volume of investment in fixed assets (in % to GRP) (?11) | >15-25-40% | 17.91 | 18.16 | 0.25 | 0.93 | 0.94 | 0.01 |

| Share of investment in manufacturing industries in the total volume of investment in fixed assets, % (?12) | Dynamics | - | 10.55 | 10.55 | - | 1.01 | 1.01 |

| Share of foreign investment in the total volume of investment in fixed assets, % (?13) | <20% | 1.3 | 1.3 | 0 | 1.75 | 1.75 | 0 |

| Share of own investment, % (?14) | >28% | 47.9 | 48.5 | 0.6 | 1.11 | 1.11 | 0 |

| Indicators of foreign trade activity (Vi) | |||||||

| Annual growth rate of foreign trade turnover, % (?15) | >100% | 124.89 | 113.84 | -11.06 | 1.65 | 1.65 | 0 |

| Annual growth rate of export volumes, % (?16) | >10% | 27.1 | 19.6 | -7.5 | 1.62 | 1.6 | -0.02 |

| Share of exports in GRP (export quota), % (?17) | 40% | 5.67 | 6.34 | 0.68 | 0.32 | 0.35 | 0.03 |

| Share of fuel and energy complex exports in total exports, % (?18) | Dynamics | 8.62 | 1.53 | -7.09 | 1.01 | 1.01 | 0 |

| Share of mechanical engineering exports in total exports, % (?19) | >5% | 29.43 | 0.29 | -29.14 | 1.48 | 0.19 | -1.29 |

| Import-to-export coverage ratio (?20) | 2> y <5 | 0.38 | 0.4 | 0.03 | 0.38 | 0.4 | 0.02 |

| Foreign trade quota, (%) (Export + Import) / 2GRP (?21) | Dynamics | 1.43 | 0.51 | -0.92 | 1.01 | 1.01 | 0 |

| Trade balance deficit to GRP, % (?22) | <0% | -9.41 | -9.41 | 0 | 1.01 | 1.01 | 0 |

| International competitiveness ratio (Export-Import) / foreign trade turnover (?23) | Dynamics | 0.01 | 0.03 | 0.02 | 1.01 | 1.01 | 0 |

| Net export, in % to GRP (?24) | >2-3% | -9.41 | -9.41 | 0 | 0 | 0 | 0 |

| Share of imports in GRP, % (?25) | <30% | 15.08 | 15.76 | 0.68 | 1.49 | 1.45 | -0.04 |

| The volume of imported food products per capita, US dollars (?26) | <120 | 16.66 | 24.41 | 7.74 | 3.12 | 2.5 | -0.62 |

* Compiled by the author based on own calculations according to the data http://www.gks.ru.

As we see, the data presented in the table make it possible to conclude that special attention should be paid to industrial indicators and the factors influencing them, which implies the improvement of programs for the strategic development of the region.

Similar calculations were performed for other regions of the Central Federal District of the Russian Federation and the risk zones were identified.

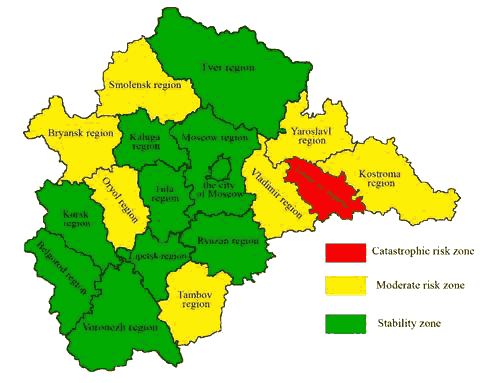

A comprehensive assessment of the above indicators allowed to determine the level of the general risk of the Central Federal District regions, which made it possible to compile a map of foreign economic security (Fig. 1).

Thus, the Ivanovo region has the lowest level of foreign economic security, since the calculated value of Y corresponds to the zone of catastrophic risk. Bryansk, Vladimir, Kostroma, Oryol, Smolensk, Tambov and Yaroslavl regions have a moderate risk of foreign economic security. The rest of the regions of the Central Federal District are in the stability zone.

Figure 1: Map of Foreign Economic Security of the Central Federal District Regions*

* Compiled by the author

Discussion

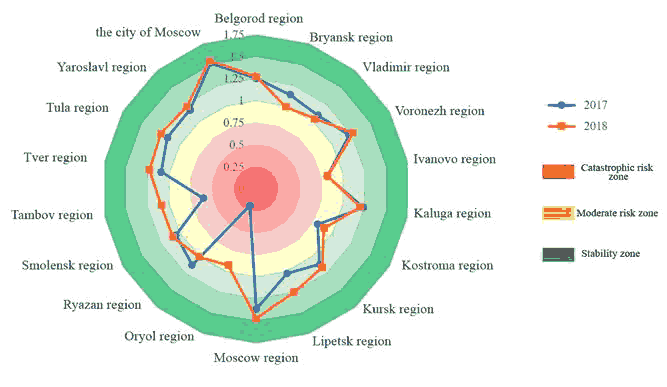

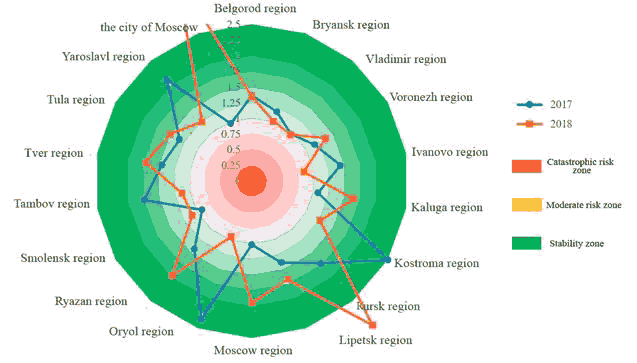

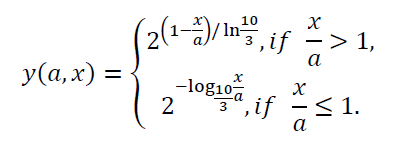

In order to conduct a more detailed analysis, particular indicators for each region were investigated in the context of the selected groups, and using the method of areal diagrams, the main results of the study are presented (Fig. 2-5).

Figure 2: Assessment of Risk Zones of Macroeconomic Indicators of Foreign Economic Security of The Central Federal District*

* Compiled by the author

Analyzing the diagram reflecting the assessment of risk zones of macroeconomic indicators of foreign economic security of the Central Federal District (Fig. 2), we see that most of the values are distributed in the moderate risk group or in the stability zone. Nevertheless, in 2017 there are regions with rather low indicators, which is due to the low annual growth of GRP. A significant deterioration in the situation in 2018 compared to 2017 is noted in the Bryansk and Ryazan regions. Other regions, on the contrary, were able to strengthen their positions compared to the previous year. The absolute leaders of this group are the city of Moscow and the Moscow region.

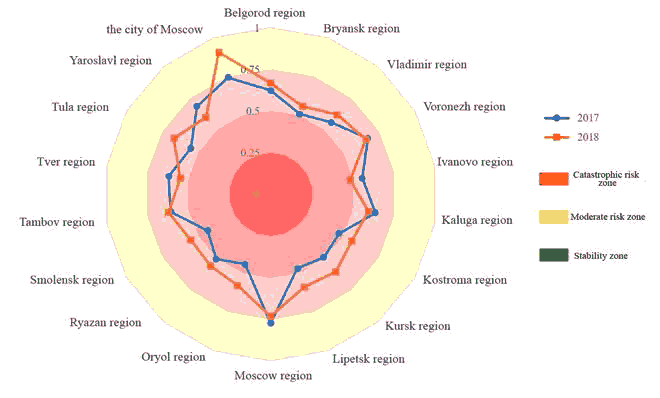

Figure 3: Assessment of Risk Zones of Industrial Indicators of Foreign Economic Security of The Central Federal District*

* Compiled by the author

An analysis of the industrial indicators shows a very bleak picture (Figure 3). Most of the Central Federal District regions in this area are in the zone of significant risk, with a particularly critical situation noted in the Bryansk, Ivanovo, Kostroma, Oryol and Smolensk regions. The most obvious reasons for such a situation are low values of innovative activity of organizations, a decrease in the share of innovative products in industrial production, and a decrease in internal expenditures on R&D relative to GRP. In a number of the Central Federal District regions, there is some improvement in the values of indicators of this group in 2018 compared to the values achieved in 2017, in particular, Moscow, Tula and Lipetsk regions show the greatest growth. The city of Moscow and the Moscow region are of the highest potential in this area.

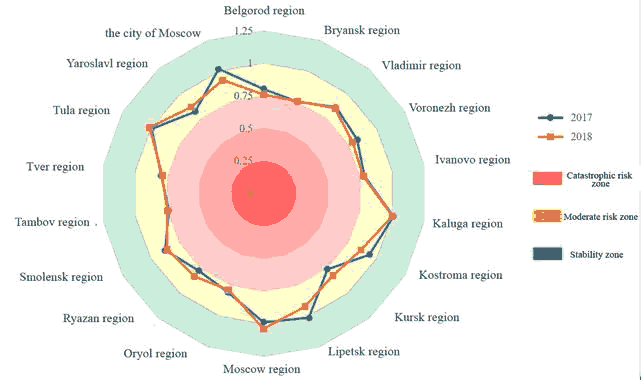

Figure 4: Assessment of Risk Zones of Investment Indicators of Foreign Economic Security of The Central Federal District*

* Compiled by the author

The most optimistic situation is observed in terms of the investment group indicators for the Central Federal District regions, which for the most part are in the zone of moderate risk or are generally characterized by stability (Fig. 4). The period under study did not reveal any significant changes in the situation in this area, however, there is a slight deterioration in the values of indicators in 2018, which, in our opinion, was provoked by a decrease in the volume of investments in fixed assets of the regions. Along with this, the share of foreign investments has decreased, which, on the one hand, makes the economy of the region more stable, but on the other hand, does not allow the entity to use its development potential to the full extent.

Figure 5 shows the last and most extensive group of foreign trade indicators, characterized by the most complex structure and dynamics of values.

Figure 5: Assessment of Risk Zones of Foreign Trade Indicators of Foreign Economic Security of The Central Federal District*

* Compiled by the author

In 2018, the foreign trade group indicators of the city of Moscow and the Moscow and Kursk regions show a significant leap towards growth and significantly strengthen the positions of the regions in this area. At the same time, a significant gap with the previous year’s values is noted in the Yaroslavl, Tambov, Oryol, Kostroma and Ivanovo regions. These fluctuations in the values of indicators are caused by changes in the volume of exports and imports of trade products. So, for example, a favorable factor that led to the positive dynamics of the indicators of this group is a decrease in the volume of imported food products, while a decrease in export volumes, in particular in mechanical engineering, and an increase in imports cause negative trends.

Conclusions

Summarizing the obtained study results above, it can be noted that ensuring the stability of the economy of the regions of the Russian Federation in the foreign economic sector can be achieved through an integrated approach based on a thorough analysis of the entire set of factors that determine the protection of the interests of the territory in this area. Here, the procedure of analyzing is greatly facilitated by systematizing factors into groups, among which the set of foreign trade indicators undoubtedly acts as the key one. At the same time, the assessment of the foreign economic security of the regions is complemented by the indicators of macroeconomic, industrial and investment groups. The formation of a strategy for ensuring the foreign economic security of the regions of Russia and the stability of development of their economies should be based on the results of analysis and should take into account the range of identified problems in order to reduce the impact of unfavorable factors.

Nevertheless, it should be noted that the approach proposed in this article to assessing the foreign economic security of Russian regions makes it possible to track generalized trends in the selected areas, and therefore, to describe individual territorial features, it should be supplemented with a detailed analysis of primary indicators. Besides, the equal identification of risk zones for different groups may be incorrect, which also requires further research in this direction.

The method proposed in the article can be used to organize effective monitoring of the level of threats to foreign economic security of the Russian regions.

References

Andruseac, G. (2015) Economic security - new approaches in the context of globalization. CES Working Papers, 7(2), 232-240.

Barro, R.J. (1999). “Determinants of democracy.”. Journal of Political Economy, 107(S6), S158–S183.

Bernhard, M., Timothy, N., & Christopher, R. (2001). “Economic performance, institutional intermed.,

Buzan, B., Waever, O., & De Wilde, J. (2005). Security: New Framework for Analysis (Bezpecnost: nový rámec pro analýzu), Centre for Strategic Studies, Brno. Crossref,

Cherp, A., & Jewell, J. (2011). The three perspectives on energy security: Intellectual history, disciplinary roots and the potential for integration, Curr. Opin. Environ. Sustain. 3, 202e212.

Dudin, M.N., Fedorova, I.J., Ploticina, L.A., Tokmurzin, T.M., Belyaeva, M.V., & Ilyin, A.B. (2018). International practices to improve economic security. European Research Studies Journal, 21(1), 459-467.

Dzhafarova, M.V., Shevchuk, T.A., Kalinovskaya, Ya.O., & Stashchak A.Yu. (2019). Economic security of Ukraine: Economic and legal aspect. Financial and credit activity: Problems of theory and practice, 3(30), 78-84.

Greenwood, J., Ananth, S., & Guillaume, V. (2005). "The baby boom and baby bust." American Economic Review, 95(1), 183-207.

Grigoreva, E., & Garifova, L. (2015). The economic security of the state: The institutional aspect. Procedia Economics and Finance, 24, 266-273.

James, D., Laurel, E.M., Stephanie, P., Christopher, S.C., Julie, E.T., Keith, C., Calin T.W., & Tewodaj, M. (2013). Overcoming obstacles to peace: local factors in nation-building, Santa Monica, Calif.: RAND Corporation, RR-167-CC.

Jankovska, L., Tylchyk, V., & Khomyshyn, I. (2018). National economic security: An economic and legal framework for ensuring in the conditions of the European integration. Baltic Journal of Economic Studies, 4(1), 350-357.

Klimuk, V., Piskunov, V., Pecherskaya, E., & Tarasova, T. (2019). Methodical approaches to assessing the economic security. The European Proceedings of Social & Behavioural Sciences, 3, 283-290.

Kremer, M.I., & Cernius, G. (2019). Country's economic security concept: Theoretical insights. Proceedings of Whither Our Economies - 2019: International Scientific Conference, 78-98.

Long, W.J. (1992). National security versus national welfare in american foreign economic policy. Journal of Policy History. 4(3), 272-306.

McGuire, M.C. (1995). Defense economics and international security. Handbook of Defense Economics. 1. Ames: North Holland. 606.

Official website of the Russian Federal State Statistics Service.

Persson, T., & Guido, T. (2009). “Democratic capital: the nexus of political and economic change. American Economic Journal: Macroeconomics, 1(2), 88–126.

Qizi, D.J.B. (2019). Influence of foreign trade relations on provision of azerbaijan’s economic security. European journal of economics and management sciences, (3).

Schilde, K. (2017). The political economy of European security. Cambridge University Press.

Schimmel, K., Liu, S., Nicholls, J., Nechval, N.A., & Forrest, J.Y.L. (2017). Economic security under disturbances of foreign capital. Advances in Systems Science and Applications, 17(2), 14-28.

Senchagov, V.K., Maximov, Y.M., Mityakov, S.N., & Mityakova, O.I. (2011). Innovative transformations as an imperative of economic safety of region: system of indicators. Innovation, 5(151), 56-61.

Siew, M.T. (2015). Rethinking economic security in a globalized world. Contemporary Politics. 21(1), 40-52.

Simanaviciene, Z., & Stankevicius, A. (2015). Economic security and national competitiveness. Public security and public order, 15, 126-143.

Strelcová, S., Simak, L., & Klucka, J. (2014). Modulation of limits in economic security of enterprises. Ekonomika polnohospodárstva. XIV(18).

Stukalo, N., Steblianko, I., Simakhova, A., & Doroshkevych, V. (2018). Trends in economic and social security at national and European level: Interrelationships, threats and opportunities. Journal of Security & Sustainability Issues, 8(2).

Turkenburg, W.C., Arent, D.J., Bertani, R., Faaij, A., Hand, M., Krewitt, W., …& Usher, E. (2012). Renewable energy, in: Global energy assessment - toward a sus- tainable future, 2012. Cambridge University Press, Cambridge, UK and New York, NY, USA and the International Institute for Applied Systems Analysis, Laxenburg, Austria. Chapter 11, 761e900.

Valeriu, I.F., & Diamescu, M.A. (2010). Some opinions on the relation between security economy and economic security. The National Institute for Economic Research, 129-159.

Walter, A. (2015). Open economy politics and international security dynamics: Explaining international cooperation in financial crises. European Journal of International Relations. 22,(2), 289-312.

Ya, B.B. (2016). Foreign trade factors as a hybrid threat to the economic security of Ukraine. Practical Science Edition" Independent Auditor", 2(16).

Received: 20-Dec-2021, Manuscript No. JMIDS-21-9151; Editor assigned: 23-Dec-2021; PreQC No. JMIDS-21-9151(PQ); Reviewed: 07-Jan-2022, QC No. JMIDS-21-9151; Revised: 14-Jan-2022, Manuscript No. JMIDS-21-9151(R); Published: 20-Jan-2022