Research Article: 2020 Vol: 24 Issue: 4

Mobile Banking in An Emerging Economy: Facilitating Factors and Challenges

Akwesi Assensoh-Kodua, Durban University of Technology

Steven Kayambazinthu Msosa, Mangosuthu University of Technology

Abstract

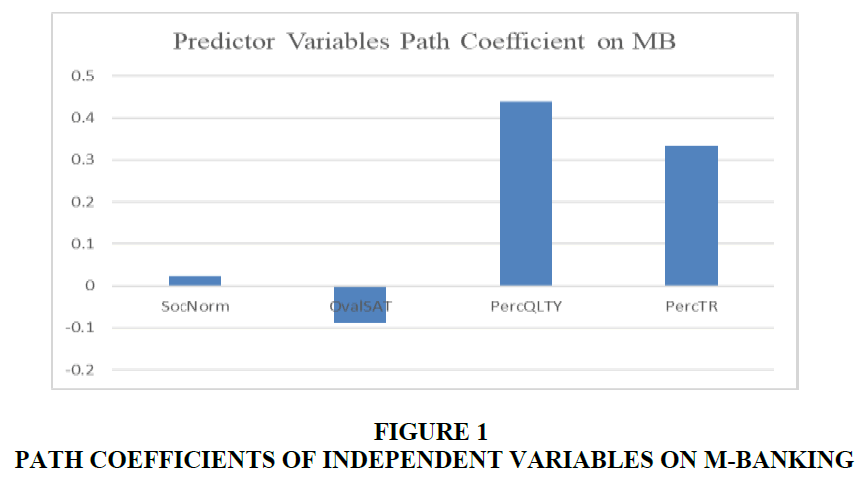

In recent times, there has been a global surge in mobile-banking (m-banking). Surprisingly, emerging economies have taken a competitive and leading role in this new wave of banking. The continent of Africa, especially sub-Saharan Africa is a leading region when it comes to this phenomenon, given the number of mobile device holders that accept to perform m-banking relative to other parts of the world. However, there is a gap between the numbers that initially accept m-banking and those who really use the concept. This paper highlights the factors that are encouraging this practice, and challenges confronting m-banking in an emerging economy (Durban Metro -South Africa), where the study was carried out. A cross-sectional, descriptive, and quantitative approach was adopted to collect data from 150 online m-banking respondents in Durban through the help of an online data agent. WarpPLS 5.0 structural equation modelling software for regression analysis was used to analyse data. The findings of this study showed that perceived quality of m-banking service delivery (β=0.439), followed by perceived trust (β=0.334) and then, social norm (β=0.038) have a positive and significant influence on m-banking generally. Recommendations towards addressing m-banking challenges and ways of improving m-banking applications are provided for practitioners. These could also be adopted in other emerging economies as these countries have common socioeconomic issues. This study was motivated by the number of mobile users who accept to use their devices for m-banking vis-à-vis those who are really using it. Thus, it addresses the questions of (1) What motivate initial m-banking adoption, and (2) what factors contribute towards its continuance usage and discontinuation? Hopefully, this will help banking practitioners to be aware of the facilitating factors and challenges of m-banking.

Keywords

Continuance Intention, M-Banking, Mobile Device.

JEL Classifications

M150, G21, G28, G41, M31

Introduction

There are a number of factors that lead to the m-banking adoption as one of the banking services (Zhou, 2011). Initial acceptance of technology does play a major role, but what is more important is to identify factors that contribute towards its repeated and continuation as well as those that cause discontinuance use (Lin & Shih, 2008). For banks to survive this phenomenon, it is important to have adoption and continued usage strategies (Lin & Shih, 2008). In emerging countries such as South Africa (SA), initiatives such as WIZZIT are reported to be yielding good results among low-income earners using m-banking (Duncombe and Boateng, 2009). WIZZIT is the business buzz, used to describe a banking services provider for the people that are unbanked and/or underbanked citizens in South Africa. A study online (Pretorius, 2013) showed that SA m-banking records have witnessed increases in the number of people using their mobile devices to do banking since 2011. This is good news for SA because over the years, the implementation of m-banking is being viewed as a powerful concept due to the high coverage of the rural population in areas with limited access to banks (Zhou, 2011). This revelation notwithstanding, there has never been a comprehensive study, according to the literature review of this study, that integrates perceived trust (PT), social norms (SN), user satisfaction (SAT) and service quality (SEQUAL) to measure m-banking continuance intention in SA. Though the methodology followed in this study is closely related to that of Brown et al. (2003), these authors only demonstrated acceptance of m-banking by cell phone users in SA, and not the facilitating factors or the challenges. This certainly creates a research gap. The "Klynveld Peat Marwick Goerdeler” (KPMG) m-banking report of 2015 positioned SA as the number two after China, in terms of global adoption of m-banking. As of January 2016, 49% of SA`s total population of 54.73m were active internet users according to this report. This augurs well for these phenomena. Nevertheless, only 26% were keen on m-banking.

The aim of this paper was to highlight the facilitating factors underpinning m-banking in an emerging economy of South Africa together with challenges for its continuance usage. This was motivated by the fact that m-banking acceptance is not the same as m-banking continuance usage (Lin & Shih, 2008), thus creating a gap between acceptance factors and that of discontinuation. When this is done successfully, the study will address (1) What motivate initial m-banking adoption, and (2) what factors contribute towards its continued usage and discontinuation? This will help banking practitioners to be aware of the facilitating factors and challenges of m-banking for the appropriate actions.

Literature Review

Facilitating Factors

Social Norm

M-banking has become a social phenomenon since it is conducted through a mobile gadget that has assumed a social dimension than technological advantage. It has become so much intrinsic of our daily activities that; one feels alienated from the social settings when not in possession of one. A mobile phone is used more than anything else these days as a medium of communication and thus compels every class of the society to stay connected through this gadget. It is no wonder therefore that, concepts like social norm are deployed to investigate issues of mobile studies. Social Norms (SN) (or the importance of others in one`s decision making), is the act of an individual belief that persons important to him or her expect them to perform certain behaviours, and vice versa. In this regard, the social norm is affirmed by the total set of available normative beliefs of important friends. Hence the individual in question is bound to respond to social normative influences to establish a favourable image among reference groups in the social settings, and these have been widely validated in a group-oriented studies, such as mobile banking adoption (Riquelme & Rios, 2010; Schepers & Wetzels, 2007; Puschel et al, 2010). Previous studies have shown that social influence is an important “early-stage concept” as opposed to “future time approval,” but decreases when continued (Fishbein & Ajzen, 1975). Therefore, it is not unusual to find studies that show that social norms have an insignificant effect on m-banking (Cheah et al., 2011). Nevertheless, on m-banking adoption, the concept had proven to be a force to reckon with. Many studies that have used social norms to foster understanding of this concept have seen a significant relationship between the social norm and m-banking (Schepers & Wetzels, 2007; Puschel et al., 2010; Riquelme & Rios, 2010; Chitungo & Munongo, 2013). Thus, this study believes that, social norm is a facilitating factor to m-banking adoption, and that the deployment of this variable in investigating m-banking in emerging economies can shed important light on m-banking adoption behaviour. The variable has been validated in studies such as wireless finance adoption (Riquelme & Rios, 2010; Helkkula et al., 2012), and internet banking (Riquelme & Rios, 2010) due to its effects on satisfaction and perceived quality on users.

Satisfaction and Perceived Quality

Investigations in SA about SAT and SEQUAL (Oliver, 1993) by Petzer & De Meyer (2011) show that SAT and SEQUAL of suppliers are insignificant to the younger age group when compared to the older cohorts, though they agreed between SEQUAL of experience, SAT and behavioural intentions. This will surely affect the former`s behavioural intentions. Again, Bankole & Cloete (2011) adopted the Unified Theory of Acceptance and Use of Technology (UTAUT) to compare m-banking between SA and Nigeria, and found that, short message services (SMSs) to alert customers about financial services was the most m-banking activities undertaken in the two countries, whiles lack of awareness and knowledge, and convenience of this practice, proved to impact the approval of m-banking in all two places. Talking about SEQUAL, it could be seen as customers’ verdicts, after evaluating the quality of received services against that of anticipated levels. M-banking is enabled through electronic (e) mobile device (MD), thus, SEQUAL could be affected by technical issues such as networks and not vendor’s competency. Thus, SEQUAL has generated a lot of discussions. Therefore, this study settles that SEQUAL should be measured relative to the happiness of the service receiver. The confusion surrounding SEQUAL notwithstanding, it is a key to competitive advantage and customer retention in today`s business.

Satisfaction, on the other hand, is the immediate motivator that determines a person’s intention to continue using information systems such as m-banking (Venkatesh et al., 2012; Brown et al. 2012). These authors believe that a consumer creates anticipation for a service or product and evaluates this anticipation after use. When the consumer`s experience surpasses what was expected, s/he forms a positive decision based on the degree of satisfaction, otherwise a decision to discontinue use is taken. Lack of technological standard for safe payment, gainful business models, consumer assurance over personal data, trust in online businesses among others, are constraining the persistent practice of online services (Zott et al., 2011) such as mbanking. SAs, being part of the community of social beings, are not exempted from such worries.

Theory of Trust

According to Castelfranchi & Falcone (2010), socio-cognitive trust (TST) is an idea by agents in terms of cognitive ingredients that treat rational trust as a construct between a trust giver and a trust receiver in a given context. To this end, businesses or individuals choose who they want to trust to suggest that, they are determined that, somebody, group or organisation is or are trustworthy.

The extant research by (Maduku & Mpinganjira, 2012) on patrons’ attitude to cell phone banking in S.A exposed trust as the most influential factor of cell phone banking. The total of 328 valid replies used a self-filling structured questionnaire. In support of this, a related study in this same country showed that, peoples’ trust in IT-facilitated monetary services are the third most vital construct (Wentzel et al., 2013).

Challenges

Banking institutions across Africa are confronted with several challenges which include high-cost models and fees. As a result, the m-banking platforms are very costly for low-income segments. This makes users to have a high preference for cash transactions over technologydriven platforms. As such, Africa’s retail-banking penetration is operating below the global average for emerging economies which stands at 38% of the gross domestic product (Dahir, 2018). In addition, crime and fraud with respect to payments is very prevalent in South Africa. This has been re-echoed by other studies and writers in the country. For instance, in a 2014 survey by global firm Price Water Coopers (PwC), 69% of South African respondents said that they had been victims of some form of financial crime in the two years preceding the study, compared to 37% of global respondents (Staff Writer, 2015). Security gaps impact negatively on trust towards this innovative and low-cost channel, and in turn slow down acceptance of this concept. The republic of SA Online Fraud Resource Centre, has also assessed that phishing spasm occurs every minute, and one out of every four directed at mobile networks. It, therefore, stands to reason that, hacking is now a business for these computer attackers, who move from one region to another till they are noticed, and in some instances, creates service arrangements with their counterparts. Malware is created and sold on the “dark web”. This escalation of payment crime and fraud has put fear into many would-be m-banking users (McKane, 2019; Nolte, 2016). Nevertheless, this has also made it possible for escrow services to start mushrooming in South Africa recently. An escrow service is a neutral third party that securely holds money for payment of purchases in a trust until the transaction is completed. This service (escrow), is a payment arrangement that is meant to protect against payment fraud, non-payment and the problem of chasing payments after a business or financial transaction. It is meant to add an extra level of security and convenience to both buyer and seller (Hogg, 2015).

Methodology

A questionnaire using a Five-Point Likert scale from 1 (strongly disagree) to 5 (strongly agree) was developed and operationalized to investigate the facilitating and challenging factors of m-banking in South Africa, since the researcher is based in Durban, South Africa. The questionnaire was conveniently forwarded to a list of 173 m-banking users online in Durban. This was collected from an online data agent in the country and yielded 150 usable responses. The five-factor scale was measured by various items, from pre-validated studies, and adjusted to fit this m-banking study. For instance, social norm (Taylor & Todd, 1995), perceived trust (Hassanein & Head, 2007), overall satisfaction (Oliver, 1981) and perceived service quality (Oliver, 1993). In order to ensure the applicability of these modified items, this performed a pilot-test at the Durban University of Technology in South Africa, and the experimentation of the collected data followed steps outlined by Kock (2010).

The data were edited and coded before capturing with excel into the WarpPLS 5.0 structural equation modelling software for regression analysis. The PLS regression analysis is an advanced multivariate statistical analysis method that is capable of dealing with criterion variables even if they are not normally distributed (Chin & Todd, 1995). Simple frequencies were used to capture the number of responses for each set of blocks of constructs. The information gathered from the frequencies, hence, allows for a comparison between the demographic variables and the compelling factors.

Results

Validity and Reliability

The questionnaire was assessed through pilot study before rolling it out to the public. No major changes were made for the actual collection. Composite reliability and Cronbach’s alpha were used to assess the discriminant and convergent validity of the research variables, (Kock, 2010). A confirmatory factor analysis (CFA) was also performed, to validate reliability and validity. (Aibinu & Al-Lawati, 2010) through internal consistency (Cronbach, 1951) and composite reliability. The Cronbach alpha reliability coefficients for Social norm (0.928), overall satisfaction (0.866), perceived quality (0.934), perceived trust (0.922), and m-banking (0.843) were adequate as shown in Table 1. The validity test was meant to test if the questionnaire captured what it was meant to capture. A model`s validity tells whether a measuring instrument measures what it was supposed to measure. According to Fornell & Larcker (1981), these values should be above 0.5 as shown in Table 1.

| Table 1 Latent Variable Coefficient | |||||

| SocNorm | OvalSAT | PercQLTY | PercTR | M-banking | |

| R-square | 0.586 | 0.618 | 0.676 | 0.494 | |

| Adjusted R-squared | 0.582 | 0.617 | 0.675 | 0.488 | |

| Composite reliability | 0.941 | 0.909 | 0.943 | 0.935 | 0.906 |

| Cronbach`s alpha | 0.928 | 0.866 | 0.934 | 0.922 | 0.843 |

| Ave. var. extra. (AVE) | 0.668 | 0.715 | 0.582 | 0.589 | 0.765 |

| Full collinearity (VIF) | 3.246 | 2.393 | 3.251 | 3.475 | 1.923 |

| Q-squared | 0.585 | 0.616 | 0.673 | 0.493 | |

| Minimum | -3.790 | -3.898 | -4.189 | -4.298 | -3.830 |

| Maximum | 1.407 | 1.382 | 1.444 | 1.435 | 1.267 |

| Median | 0.133 | 0.062 | 0.257 | 0.272 | -0.007 |

| Mode | 0.108 | 0.062 | 1.444 | 0.135 | -0.007 |

| Skewness | -1.400 | -1.249 | -1.728 | -2.050 | -1.292 |

| Excess Kurtosis | 2.661 | 2.637 | 4.155 | 5.726 | 2.559 |

Discriminant validity is about the degree to which measures of different constructs vary from one another. Constructs have discriminant validity when the variance shared between a construct and any other construct in a model is less than the variation that constructs shares with its indicators. Table 1 values prove that the questionnaire has good reliability (Fornell and Larcker 1981; Henseler et al., 2009; Bagozzi & Yi, 2012) since the values were above 0.7. The predictor variables (Table 2) were also good as there were no issues of multicollinearity (Kock, 2010).

| Table 2 Beta Coefficient and P-Values for Each Latent Variable | ||

| Variables | β (Path Coefficient) | P-Value |

| Social Norm | 0.038 | 0.244 |

| Overall Satisfaction | -0.089 | 0.051 |

| Perceived Quality | 0.439 | <0.001 |

| Perceived Trust | 0.334 | <0.001 |

Outcomes for Investigating Facilitating Factors

The predictor variables, namely; Social norm (SocNorm), perceived quality (PercQLTY) and perceived trust (PercTR) have positive effects on the m-banking usage in Durban, South Africa as shown in Table 2. Overall satisfaction which is negative (β= -0.089), however, did not affect a positive effect on users. This calls for further research to deal with users of m-banking concerns regarding this factor if this practice of banking through MD is to be sustained. Perceived quality of m-banking service delivery seems to have met users’ expectations (β=0.439), followed by perceived trust (β=0.334) and then, social norm (β=0.038).

The support for each variable, having an effect on m-banking continuance intention in this study is assessed by noting the positive or negative sign, and statistical impact of the P-value of its corresponding path. WarpPLS 5.0 uses a bootstrapping procedure to perform this testing and to explain the importance of each variable on the users` decision making of m-banking. Figure 1 shows the result of the variables (factors) influencing effects, whereby satisfaction is not a compelling factor for users to adopt m-banking in Durban. This means that what is making the few that have adopted the practice and continues its use is about the quality of service (β=0.439, p<0.001) that they receive from their various m-banking service providers. The measure of this quality of service includes interaction quality, systems quality, and information quality. It is, therefore, important to note that, during m-banking service delivery, the way service providers interact with clients, the type of information they give them, and the quality of systems is highly regarded by their clients in their decision to accept and continue m-banking.

The second most influencing factor, according to this study is perceived trust (β=0.334, p=<0.001). This underpins the importance of this factor in moving people to accept m-banking. Again, it should be pointed out here that, since m-banking is done on a device without the physical presence of banking agents, clients rely on the reputations of the bank in question to accept this practice. It is, therefore, important that banks cultivate this trust habit into their client in order to win them for continued practice.

The value of SN and m-banking is remarkably worth noting (β=0.038), at a significance level of p=0.244. Though this seems to be less influential in impacting on the users` decision to accept m-banking, statistically, it is good enough to support a hypothesis. Meaning that there is a contribution that social norm plays in compelling users to accept m-banking in South Africa. The factor (Social norm) touched on both internal and external influences. Practitioners and stakeholders will do well to investigate this factor further to uncover which of these two social norms need to be given the most attention. As the bulk of the respondents of this study are young people, between the ages of 18 and 35, this social norm factor, could be a great source of influence when properly studied and utilized. This is because young people are known, to consult their social networks for advice (Wang & Xiao, 2009) before making any decision to use an electronic device for business.

Regarding the proportion of the population who have not bought into the idea of mbanking in South Africa, or have simply discontinued with the phenomenon, this paper has proven with the section of the survey on third-party warranty that, with little effort to make these third-party organisations known to the public, their fear of crime and fraud about m-banking will be overcome. Practitioners need to collaborate with third-party warranty organisations to take advantage of the positive outlook projected by this research paper.

Outcomes for Investigating the Challenges

Below is the outcome of the three constructs in the survey instrument that attempted to capture the perceptions of the m-banking users in Durban regarding the escrow services (that is, trust in the third party).

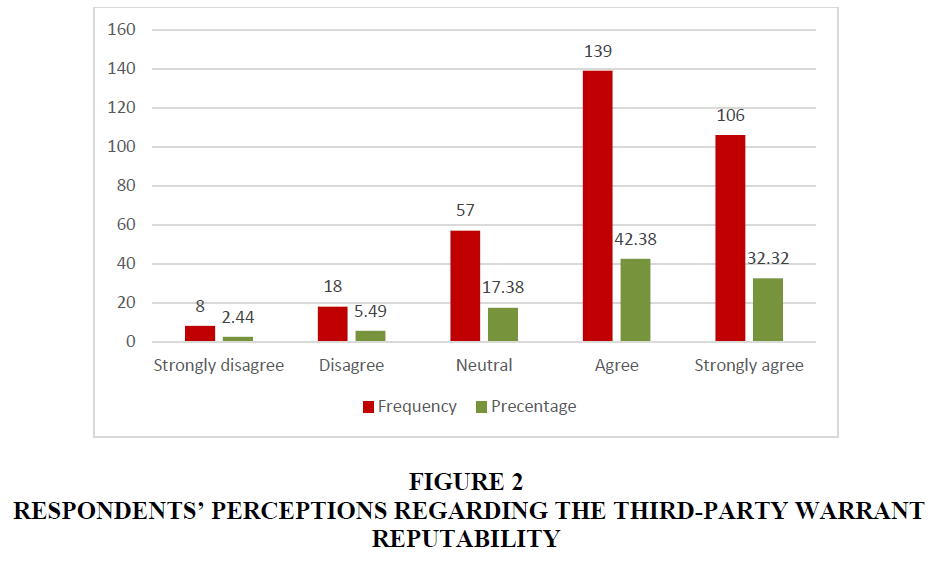

Q. There are many reputable third-party certification bodies for assuring the trustworthiness of Internet bankers?

From Figure 2, it is evident that, the percentage of respondents who know about a thirdparty warranty or escrow services as reputable organisations are very high (Agree=42.38%) and (Strongly agree=32.32%) as compared to those who disagree (Disagree=5.49%), (Strongly disagree=2.44%). This means that, if efforts are stepped up to bring these organisations into mainstream m-banking operations in South Africa to win over that proportion of the population who are neutral about third-party warranties, m-banking will go a long way to curtail the fears surrounding the practice. This can also increase the number of users who will accept m-banking and will eventually be expected to continue with the behaviour.

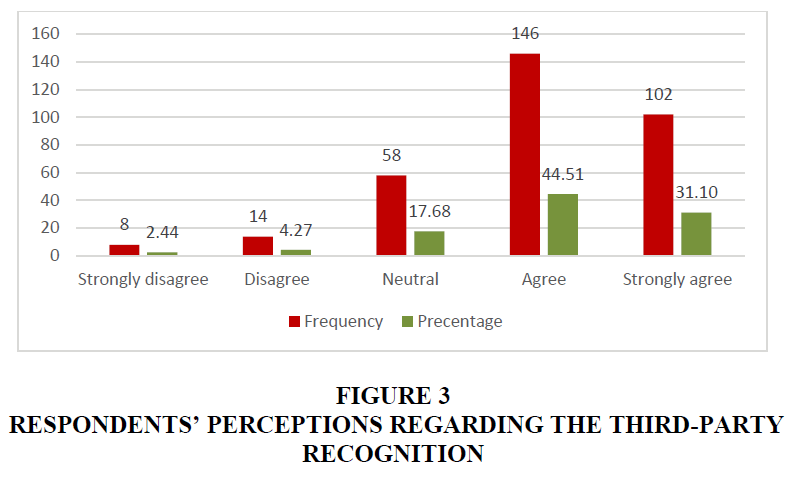

Q. I think third-party recognition bodies are doing a good job?

The scenario from Figure 2, is not much different from that being seen under Figure 3 when it comes to third-party recognition. (Agree=44.51%) as against (Disagree=4.27%), and (Strongly agree=31.10%) as compared to those who strongly disagree (Strongly disagree=2.44%). If the proportion of the population who do not know about escrow services can be made to be aware of them, m-banking in South Africa will be a force to reckon with.

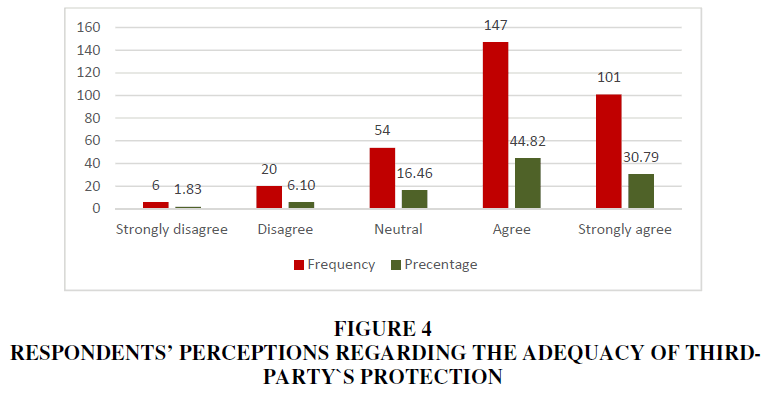

Q. Existing third-party recognition bodies are adequate for the protection of m-banking users` interest.

Regarding the protection that these third-party bodies are able to accord the m-banking users, again, the outcome shows a positive outlook (Figure 4). A good proportion of respondents said they agree (44.82%) as against those who disagree (6.10%), and strongly agree (30.79%) as against those who strongly disagree (1.83%). This result proves that there is hope for the future of m-banking in Durban South Africa.

Discussion

Perceived quality, according to the results of this study is the most influencing factor among customers that causes continuance intention. This is dependent upon so many factors with different assessment levels, such as information quality, interaction quality and systems quality. It therefore, makes sense to call on practitioners, to give serious attention to these three factors that were used to measure this variable. Management could also make them one of their core business principles. Though what is quality for “A” might not be the same for “B”, it is hoped however that, when this is done, in general, organisations will have a better rating and increase the level of satisfaction among their clientele base. This can lead to continued usage of mbanking. When banks train their m-banking service consultants who handle calls from users and answer their numerous queries and problems promptly as possible, service quality could be achieved. Such call centers should have toll free numbers which do not charge customers anything for calling.

When customers are happy because of this, they will certainly tell other people, and given that they wield the power of influence over such people, they can serve as agents of change for the banks. In this manner, the influence of social norm is already taking effect. Related to the above, it is important that the banks train their representative to provide quality information to clients. They should avoid unnecessary communications during such interactions. Information given to clients should be what they need, accurate, up-to-date and above all comprehensive in order not to waste their data bundles.

The next important factor for customers is trust. Although m-banking for the unbanked is being deployed in some 44 countries, including South Africa, there is currently the challenge of security and alleviation of fears among the users. Fears can be dealt with, through the use of third parties. Trust is very important, especially in business settings, such as m-banking. The issue of trust plays a significant role in the success of this phenomenon. The third-party recognition, as exposed in the current study is the solution to this problem. Banks are encouraged to enter into a partnership with such third-party bodies to provide the needed assurance and security to customers to alleviate their fears. Trust, according to the outcome of this study, which is the second most important factor influencing m-banking practice, will increase the acceptance of mbanking in SA. This emerging trust problem, with consequences that are significant for our discussion on the use and adoption of m-banking, is a complicated concept, as individuals, can trust (or distrust) various interrelated parts of the m-banking system; including themselves to do business with the device correctly. The trust constructs in this study captured issues of trust in technology, trust in e-vendor, and trust in third-party. Trust in technology, could be addressed by practitioners when they embark on massive advertisement to promote m-banking and let the public know the various practices in place to overcome this. For instance, in the Standard Bank of South Africa, if a client performs a foreign transaction that involves the transfer of money from their accounts, immediately, a consultant contacts such client to verify whether he /she is the actual person who made the transaction. If not, they follow up to retrieve the money back into the client`s accounts. This good practice needs to be made public to increase customers’ confidence. An internal advertisement in the banking halls to those who prefer to visit the banks should intensify such advertisements to build their confidence in m-banking. Other legal and technological practices such as encryptions put in place to safeguard transactions on MDs should also be advertised massively for the public to know. Such advertisement shown to the customers, inside the banks, while they wait in queues to be served could go a long way to consolidate their trust in m-banking.

Conclusion

Perceived quality of m-banking service delivery, (β=0.439), followed by perceived trust (β=0.334) and then, social norm (β=0.038) are the three most influential factors of m-banking in Durban. For these reasons, it is recommended that banks have a page on social media and join potential customers’ social networks. They should interact with participants to get the actual reasons why they do not want to accept or continue with m-banking and provide individuals with the steps in place to make their m-banking practice problem-free. Bank representatives, promising such individuals and assuring them to mitigate any misfortunes that occur to them can go a long way to whip up the confidence among potential clients. It might take a while before the message gets down with them, but continuous interaction and promotion of m-banking to such individuals on social networks certainly pays off (Kirakosyan & Danaiata, 2014) in the long run. The Denizbank recent announcement of their intention to have a branch via Facebook for customers to transfer money and manage their daily agenda and also have the opportunity to continuously communicate with the bank by means of the “Customers First” application, available on the website (Çelik, 2008) should be emulated by SA banks.

Again, time spent on social media should be used to investigate the background of network members. While those who have ever used online services to conduct any business will be easy targets for m-banking, such investigation will also reveal the main causes for nonacceptance among those who do not want, and the appropriate measures are taken to address their concerns. In addition to the above recommendations, it is prudent for practitioners to consider the following for their practical implications as well as their encouragement:

Fries (2016) suggestion that financial institutions can protect their m-banking customers from cyber-attacks by adding another layer of security before customers log into their accounts from a mobile device is wealthy of investigation and implementation. Fries assert that device analytics work behind the scenes to assess devices for risk before customers’ access their mbanking application, protecting the financial institution and the customer from cyber criminals. Although the technology seems complex, the process is simple for customers: When they launch their m-banking application on their device, it is immediately checked against eight factors to determine whether the device is at high risk of hacking or not. If the device is secure, customers are allowed to log in and continue banking. If their device is viewed as risky, they will need to provide additional confirmation or be denied access to the mobile application of their banks.

This study has some limitations that constrain the application of its findings. The study gave summarised reports of the variables that impact on m-banking continuance intention in Durban, South Africa such that the findings cannot be generalised beyond the current scope. Future research should investigate additional factors that affect m-banking across other districts or regions.

References

- Aibinu, A.A., & Al-Lawati, A.M. (2010). Using PLS-SEM technique to model construction organizations willingness to participate in e-bidding. Automation in Construction, 19(6), 714-724.

- Bagozzi, R.P., & Yi, Y. (2012). Specification, evaluation and interpretation of structural equation model. Journal of the Academy of Marketing Science, 40(1), 8-34.

- Bankole, O., & Cloete, E. (2011). M-banking: A comparative study of South Africa and Nigeria. IEEE. Available at: https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=6072178.

- Baron, R., & Kenny, D. (1986). The moderator-mediator variable distinction in social psychologicalresearch: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 5(16), 1173–1182.

- Brown, A., Charlwood, A., & Spencer, D.A. (2012). Not all that it might seem: why job satisfaction is worth studying despite it being a poor summary measure of job quality. Work, employment and society, 26(6), 1007-1018.

- Brown, I., Zaheeda, C., Douglas, D., & Stroebel, S. (2003). Cell phone banking: predictors of adoption in South Africa: An exploratory study. International Journal of Information Management, 23, 381-394.

- Castelfranchi, C., & Falcone, R. (2010). Trust theory: A socio-cognitive and computational model, 18th ed. John Wiley and Sons: West Sussex.

- Çelik, H. (2008). What determines Turkish customers' acceptance of internet banking? International Journal of Bank Marketin, 26, 353-370.

- Cheah, C.M., Teo, A.C., Sim, J.J., Oon, K.H., & Tan, B.I. (2011). Factors affecting Malaysian mobile banking adoption: An empirical analysis. International Journal of Network and Mobile Technologies, 2(3), 149-160.

- Chin, W.W., & Todd, P.A. (1995). On the use, usefulness, and ease of use of structural equation modeling in MIS research: A note of caution. MIS Quarterly, 19(2), 237-247.

- Dahir, A.L. (2018). Mobile money is the key to growing Africa’s banking sector. Available at: https://qz.com/africa/1243637/mobile-money-is-key-to-growing-banks-in-africa/.

- Duncombe, R., & Boateng, R. (2009). Mobile Phones and Financial Services in Developing Countries: A review of concepts, methods, issues, evidence and future research directions. Third World Quarterly, 30, 1237-1258.

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Available at: https://philarchive.org/archive/FISBAI .

- Fornell, C., & Larcker, D.F., (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Fries, G. (2016). Learn to Reduce Online and M-banking Threats. Available at: https://securityintelligence.com

- Hassanein, K., & Head, M., (2007). Manipulating perceived social presence through the web interface and its impact on attitude towards online shopping. International Journal of Human Computer Studies, 65(8), 689-708.

- Henseler, J., Ringle, C., Sinkovics, R. (2009). The use of partial least squares path modelling in international marketing. Advances in International Marketing, 8(20), 277-319.

- Helkkula, A., Kelleher, C., & Pihlström, M. (2012). Characterizing value as an experience: implications for service researchers and managers. Journal of Service Research, 15(1), 59-75.

- Hogg, A. (2015). Securing payments from Africa and abroad: E-escrow moves north. Available at: https://www.biznews.com/sponsored/2015/08/14/securing-payments-from-africa-and-abroad-e-escrow-moves-north.

- Kirakosyan, K., & Danaita, D. (2014). Communication management in electronic banking. Better communication for better relationship. Procedia-Social and Behavioral Sciences, 124, 361-370.

- Kock, N. (2010). Using WarpPLS in e-collaboration studies: An overview of five main analysis steps. International Journal of e-Collaboration, 6(4), 1-11.

- Lin, Y.M., & Shih, D.H. (2008). Deconstructing mobile commerce service with continuance intention. International Journal of Mobile Communications, 6, 67-87.

- Maduku, D.K., & Mpinganjira, M. (2012). An empirical investigation into customers’ attitude towards usage of cell phone banking in Gauteng, south Africa. Journal of Contemporary Management, 9(1), 172-189.

- McKane, J. (2019). Massive rise in mobile banking fraud in South Africa. Available at: https://mybroadband.co.za/news/banking/311457-massive-rise-in-mobile-banking-fraud-in-south-africa.html

- Nolte, S. (2016). African banks lead world in mobile security. Available at: https://techcentral.co.za/african-banks-lead-world-in-mobile-security/65907/

- Oliver, R.L. (1993). A cognitive model of the antecedents and consequences of satisfaction decisions. Journal of Marketing Research, 17, 460-469.

- Oliver, R.L. (1981). Measurement and evaluation of satisfaction process in retail settings. Journal of Retailing, 57(3), 25-48.

- Petzer, D.J., & De Meyer, C.F. (2011). The perceived service quality, satisfaction and behavioural intent towards cellphone network service providers: A generational perspective. African Journal of Business Management, 5(17), 7461-7473,

- Pretorius, H. (2013). Internet banking SITEisfactio in South Africa. Columinate. Available at: http://www.bizcommunity.com/PressOffice/PressRelease.aspx

- Puschel, J., Mazzon, J.A., & Hernandez, J.M.C. (2010). M-banking: Proposition of an integrated adoption intention framework. International Journal of Bank Marketing, 28(5), 389-409.

- Riquelme, H.E., & Rios, R.E. (2010). The moderating effect of gender in the adoption of mobile banking. International Journal of Bank Marketing, 28(5), 328?41.

- Schepers, J., & Wetzels, M. (2007). Ameta-analysis of the technology acceptance model: Investigating subjective norm and moderation effects’’, Information and Management, 44(1), 90-103.

- Staff Writer (2015). Why third-party payment trusts are the best way to protect against payment fraud and crime. Available at: http://paymentsafrika.com/payment-news/general/articles

- Taylor, S., & Todd, P.A. (1995). Understanding information technology usage: A test of competing models. Information systems research, 6(2), 144-176.

- Venkatesh, V., Thong, J.Y., & Xu, X. (2012). Consumer acceptance and use of information technology extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

- Wang, J., & Xiao, J.J. (2009). Buying behavior, social support and credit card indebtedness of collegestudents. International Journal of Consumer Studies, 33(1), 2-10.

- Wentzel, J.P., Diatha, K.S., & Yadavalli, V.S.S. (2013). An application of the extended TechnologyAcceptance Model in understanding technology-enabled financial service adoption in South Africa. Development Southern Africa, 30(5), 659-673.

- Zhou, T. (2011). An empirical examination of users' post-adoption behaviour of mobil services. Behaviour and Information Technology, 30(2), 241-250.

- Zott, C., Amit, R., & Massa, L. (2011). The business model: Recent developments and future research. Journal of Management, 37(4), 1019-1042.