Research Article: 2022 Vol: 26 Issue: 1S

Mint Next Emerging Market

Ratna Vadra, Institute of Management technology Ghaziabad India

Citation Information: Vadra, R. (2022). Mint next emerging market. Academy of Marketing Studies Journal, 26(S1), 1-13.

Abstract

Forget the BRICS and the CIVETS; Mexico, Indonesia, Nigeria, and Turkey are the newest members of the club, and MINT stands for "identifying new developing countries with the best growth potential for the future of the world economy." Those countries include Mexico, Indonesia, Nigeria, and Turkey. The availability of raw materials, such as petroleum, natural gas, and metals, as well as the ability to attract foreign investment, know-how, and jobs, are all variables that contribute to STEM countries' success and development. Furthermore, Mexico, Indonesia, Nigeria, and Turkey have huge populations, ensuring a sufficient workforce at affordable prices until 2050, as well as a strategic geographic location.The paper's main goal is to look at a few macroeconomic indices for Mexico, Indonesia, Nigeria, and Turkey, particularly in connection to the BRICS countries (Brazil, Russia, India, China and South Africa).

Keywords

BRICS, MINT, Emerging markets, Fast growing economies, Trade, Investment.

Originality

This research adds to the body of knowledge in the field of international economics, specifically the bilateral trade interactions between India and MINT.

Introduction

Since the early 2000s, when the acronym "BRICs" became popular to describe the large fast-growing economies of Brazil, Russia, India, and China, economists and investment managers have been trying to come up with a new set of large emerging economies with brightprospects that can be combined to form a catchy acronym or word. The CIVETs (Colombia, Indonesia, Vietnam, Egypt, and Turkey), MINT (Mexico, Indonesia, Nigeria, and Turkey), and Tiger cubs have all been part of this over the years (Indonesia, the Philippines, Malaysia and Thailand). The economies of Mexico, Indonesia, Nigeria, and Turkey are likely to be the next priority in terms of foreign commerce and trade. Over the last year, the shift in focus from the BRIC countries to the MINT countries - Brazil, Russia, India, and China – has piqued interest. Jim O'Neill, a Goldman Sachs economist, was the first to coin the term "MINT." Mexico, Nigeria, Indonesia, and Turkey are known as MINT. These four countries were recognised under this designation, as were the BRICS countries, primarily because their economies were predicted to take a huge leap in the long run. The MINT is expected to increase at a positive rate till 2020, according to Goldman Sachs: The United States. Investment bank expects an annual growth higher than 5% per year in the four countries.

The MINT has a lot in common with the MINT. They all have large and expanding populations due to vast supplies of youthful labour. This could help them expand quickly, while many developing countries (including China) are expected to see reduced growth rates in the future decades due to population ageing and decline. With Indonesia next to China, Turkey on the outskirts of the European Union, and Mexico on the doorstep of America, they are well positioned geographically to take advantage of enormous markets nearby.

Objective of the Study and Methodology

The objective is to study the growing importance of MINT economies and compare MINT with BRICS. The trade of India with the MINT economies is also analyzed.

Literature Review

There are few academic research dedicated particularly to MINT countries (and their economy), especially when compared to the quantity of studies dedicated to the BRICS. To achieve this goal, this research will depend on current literature, newspaper articles, and World Bank data.

Despite the stagnation of the major Western economies over the last decade, emerging economies, particularly the BRICS countries, have experienced significant GDP growth, allowing entrepreneurs, particularly those who first believed in these countries' economic development, to gain significant competitive advantages (Porter, 1993). However, the above economies' slowing in recent years, combined with a large number of international competitors who have somewhat oversupplied these markets with products, has shifted operators' attention to new emerging economies, namely the MINT countries (Mexico, Indonesia, Nigeria, and Turkey) (Demez & Ustao).

Akpan, et al. (2014) compare the BRICS and MINTs to study the determinants of FDI in Fast-Growing Economies. We might also mention Durotoye's (2014a, b) two short, mostly descriptive studies on the MINTs' possibilities and challenges as a "growing economic power bloc" and the MINT countries' young unemployment crisis.

Oztürk and Yildirim (2015) investigated the environmental Kuznets curve in the MINT countries, using evidence from a long-run panel causality test, and came up with equivocal conclusions. “According to (Jim) O'Neill, MINT countries have significant advantages that might potentially catapult them to the top 10 greatest economies in the world in three decades,” they added.

Simplice (2015) conducted research on the factors of growth in fast-growing emerging economies, allowing us to compare the BRICS and MINT countries. Simplice employs a dynamic instrumental quantile approach, which combines a two-stage least-squares and IV least absolute deviations technique with an instrumental variable (IV) quantile regression approach. In their article, Akinola Ezekiel Morakinyo and Mabutho Sibanda (2016) look at the major causes of non-performing loans in the MINT (Mexico, Indonesia, Nigeria, and Turkey) economies. Identifying main causes of non-performing loans, which have recently been observed to be on the rise in these countries.

In their study, Ansgar H Belke, Paul de Grauwe, and Sushanta Kumar Mallick(2017) look at how currency rate volatility affects foreign trade activity in Mexico, Indonesia, Nigeria, and Turkey. For both nominal and real effective exchange rate data, we employ volatility predicted by GARCH models.

Marcin & Gryczka. (2018) undertook statistical data and report-based study and found no persuasive evidence of such a process, especially in light of current economic and political challenges in Mexico and Turkey.

Tansu (2014) ” By 2050, Mexico, Indonesia, Nigeria, and Turkey (MINTs) will be members of the G7. We use chosen Global Innovation Index (GII) factors to analyse the current status and growth potential of MINTs because innovation is closely connected with competitiveness and high rates of economic growth. R&D appears to be the most major barrier for MINTs, and it alone can explain the GII for MINTs at Rsq =0.96. MINTs are not encouraged by political stability or the rule of law. University/R&D Collaboration, Local Collaboration Intensity, and Infrastructure, on the other hand, give MINTs a chance to catch up with the G7. The study by Filip Okotovi and Petar Kurecic (2016) examines the fundamental economic patterns in MINT countries by examining the linear relationship between GDP as the dependent variable and household consumption, foreign direct investment, and government consumption as independent variables.

In their 2018 study, Simplice Asongu, Uduak S. Akpan, and Salisu R. Isihak (2018) used panel analysis to look at the determinants that influence FDI flows to the fast-growing BRICS (Brazil, Russia, India, China, and South Africa) and MINT (Mexico, Indonesia, Nigeria, and Turkey) countries. This research is notable because it adds to the literature on FDI determinants by broadening the scope of earlier studies that were often limited to the BRICS.

Why Mint Economies

The countries were grouped for a variety of reasons, but the following are the most important ones:

Growing GDP

With a nominal GDP of US$ 928.274 billion in 2012, Indonesia is the largest economy in Southeast Asia. The nominal per capita GDP was $3,797, while the PPP per capita GDP was $4,943. (international dollars). According to Citigroup, between 2010 and 2050, Nigeria would have the highest average GDP growth in the world. Turkey had the eighth-largest nominal GDP and the fifteenth-largest GDP-PPP in the world. This nominal GDP is anticipated to reach $4.45 trillion by 2050, making it the fourteenth-largest in the world.

Large Population

The demographic factor is the MINTs' second distinguishing feature. MINT countries all have large, young populations, which is unavoidable. All four countries have large, young, and growing populations. With a population of almost 113 million people, Mexico is the world's most populous Spanish-speaking country. Indonesia is the world's fourth most populous country, behind China, India, and the United States. Jakarta, Indonesia's capital and largest city, has a population of 28 million people, making it the world's third most populous city. With its vast population, Indonesia is predicted to rank seventh in terms of gross domestic product (GDP) by 2050. Nigeria will be one of the world's twenty largest economies by 2020. Nigeria's capital city is Abuja, but Lagos, with a population of 15 million people, is the country's largest city. Because of the MINT populations' youth, all four nations could see a rapid increase in domestic consumption in the next years.

Favorable Positioning

For starters, a strategic positioning for the MINTs would be advantageous. Furthermore, the MINT countries' locations are favourable for international trade, and each government has prioritised economic growth. The geographical position of the MINT countries also provides an advantage in terms of future economic development. Mexico, Indonesia, and Turkey all have favourable market positioning due to their proximity to large markets. Indonesia is in the heart of emerging Asia, being situated near BRIC giant China and resource-rich Australia. On the outskirts of the EU, Turkey is the gatekeeper to Asia and Africa. With a GDP of $1.2 trillion, Mexico is the largest economy among the MINT nations, well positioned on both the US and Latin American doorsteps. Nigeria has the smallest geographical advantage among the MINT nations, owing to the continent's relative lack of growth during the last 20 years. Nigeria, on the other hand, has the potential to become Africa's economic hub, and it may have already eclipsed South Africa as the continent's most resource-rich country. Mexico is strategically located between North and Central America, and many enterprises choose to enter the North American market through Mexico. Mexico, which borders the United States and Latin America, Turkey, which straddles Europe and Asia, and Indonesia are all in Southeast Asia and not far from China. It might also be claimed that Nigeria is ready to take advantage of the continent's potential for strong growth.

Investment Destination

Indonesia is already performing well and attracting investors; according to the country's investment board, foreign direct investment in Indonesia hit $28.5 billion in 2013, up 22.4 percent from the previous year. Over the last five years, Mexico's exports to the United States have expanded dramatically, currently accounting for 75% of the country's total exports. As a result, growth has accelerated to a rate of a percentage point every year. Furthermore, Mexico's upcoming comprehensive economic reform programme will aid in making the country more appealing to potential investors. Reforming and liberalising the Mexican energy market, in particular, is expected to attract considerable amounts of international investments in the future.

Natural Resources

Nigeria ranks 11th in the world in terms of raw material supply, including crude oil, natural gas, and metals. Indonesia (minerals, coal, oil, and gas), Mexico, and Nigeria are three of the MINTs that are important commodity producers (both mainly in oil).

Member of Organizations

Mexico is a member of the G20, the OECD, and over 40 free trade agreements, including the North American Free Trade Agreement (NAFTA) and the European Union (EU) (EU-Mexico TLC). Indonesia is the largest country in Southeast Asia. It is tightly linked to the ASEAN (Association of Southeast Asian Nations) countries. Economic growth, when combined with the country's political stability, has served to boost foreign markets' confidence in the medium- and long-term viability of the country's development. In terms of trade agreements, it's worth noting the presence of a 'Customs Union' between Turkey and the European Union, which has been in effect since 1996 and has substantially aided the EU's position as a major trading partner. Furthermore, according to research conducted by the Italian Ministry of Foreign Affairs, the Turkish economic system's exceptional performance over the last decade may be linked to structural reforms done as part of the EU accession process. Nigeria is the only MINT economy not to be a G20 member. Some analysts, however, believe that Nigeria's government would now move toward membership. These ‘MINT' countries are predicted to take the lead from the BRICs and become the most prominent group of rising countries.

Mint and Brics Compared

There are considerable similarities between MINT and the BRICS countries, particularly in terms of geography and demographics (Bootle 2014, Matsangou 2015) First and foremost, BRICS and MINT countries are spread across four continents, with some of them also being members of economic unions and trade blocs such as NAFTA (Mexico), MERCOSUR (Brazil), ECOWAS (Nigeria), ASEAN (Indonesia), SAARC (India), and APTA (Australia) (China and India). Furthermore, three of the BRICS countries (Brazil, Russia, and South Africa) are net natural resource exporters, whereas the other two are net big natural resource importers (India and China). At the same time, India, particularly China, is one of the world's major exporters of industrial goods. Three MINT countries, on the other hand, are net natural resource exporters (Indonesia, Mexico, and especially Nigeria). Turkey is a net importer of natural resources while also being a significant and booming exporter of industrial goods (Elliott 2014) Table 1.

| Table 1 Macro Economic Variables: Mint Economies and Brics Economies | ||||||||

| Country | Population Million (2019) |

GDP (per capita) 2016 | Exports (billions dollars)2017 | Percentage share in world Exports , 2017 | Imports (billion,dollars,2017) | Percentage share in world Imports, 2017 | HDI (2019) | |

| 1 | Mexico | 125.929 | 9 872 | 409 | 2.9 | 432 | 3.0 | 76 |

| 2 | Indonesia | 266.998 | 3974 | 169 | 1.2 | 167 | 1.1 | 111 |

| 3 | Nigeria | 199.206 | 2456 | 47 | 0.3 | 45 | 0.2 | 158 |

| 4 | Turkey | 83.023 | 14117 | 151 | 1.1 | 234 | 1.6 | 59 |

| 5 | Brazil | 209.791 | 10826 | 218 | 1.6 | 157 | 1.1 | 79 |

| 6 | Russia | 143.896 | 11309 | 353 | 2.5 | 238 | 1.9 | 49 |

| 7 | India | 1,351.774 | 1 855 | 298 | 2.1 | 447 | 1.8 | 129 |

| 8 | China | 1,400.174 | 6 773 | 2263 | 16.2 | 1842 | 12.9 | 85 |

| 9 | South Africa | 58.643 | 7490 | 89 | 0.6 | 101 | 0.7 | 113 |

http://hdr.undp.org/en/content/2019-human-development-index-ranking

Table 1 shows some of the noteworthy differences between those groups.

MINT is an abbreviation for Mexico, Indonesia, Nigeria, and Turkey, which stands for Mexico, Indonesia, Nigeria, and Turkey. In comparison to the countries that make up the BRIC moniker, MINTs have significantly smaller economies (Brazil Russia India and China). The BRIC is a group of emerging-market economies that have seen rapid growth over several years.

India, out of all the BRICS and MINT countries, stands head and shoulders above the rest. India is the group leader in percent GDP yearly growth, trailing only China in population size and having a population larger than the next seven countries combined. In 2019, India's overall population is 1,351.774 million people. The GDP per capita is $1 855 USD. India accounts for 2.1 percent of global exports and 1.8 percent of global imports. India has almost the strongest rule of law and some of the lowest levels of corruption in terms of political and legal risk. Although China, South Africa, Mexico, and Indonesia are less enticing than India, all four markets have appealing traits. In terms of the political and legal environment, all four score rather well. China is enticing since it has the world's largest population (1,400.174 million in 2019). China accounts for 16.2% of global exports and 12.9 percent of global imports.

On the other hand, South Africa is at the other end of the range. Although it has the smallest population (58.643 million in 2019), it has the second greatest population growth rate among the nine countries. Mexico is currently in a very vulnerable position. In terms of population, it is a small country (125.929 million in 2019)

When compared to other emerging markets, Indonesia is another country that is now in the middle of the pack. On the plus side, it boasts the third largest population of these countries and a strong GDP yearly growth %. (in 2019: 266,998 million)

The four countries in this category, Brazil, Russia, Nigeria, and Turkey, are the least favourable of the nine. Russia has the slowest population growth and does poorly in all four aspects of the political and legal framework among the BRICS. Furthermore, its economy is strongly reliant on oil, a commodity whose future is highly volatile and unclear.

Brazil, Russia, Nigeria, and Turkey, the four countries in this category, are the least favourable of the nine. Among the BRICS countries, Russia has the slowest population growth and performs poorly in all four components of the political and legal system. Furthermore, its economy is heavily reliant on oil, a commodity with a highly volatile and uncertain future.

India Trade with Mint Economies

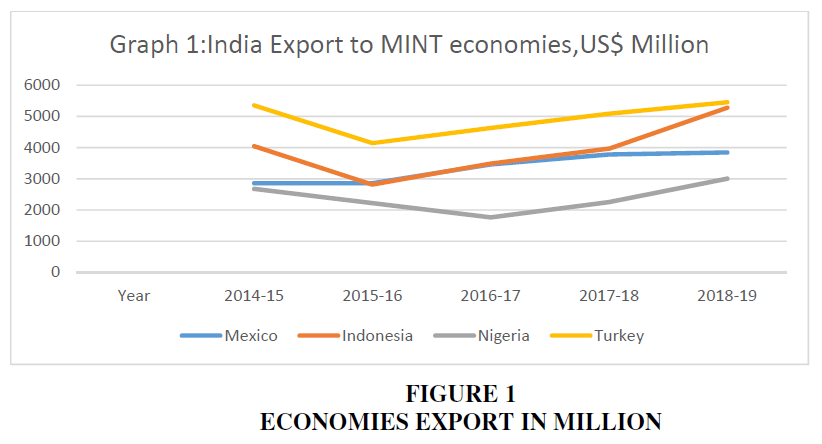

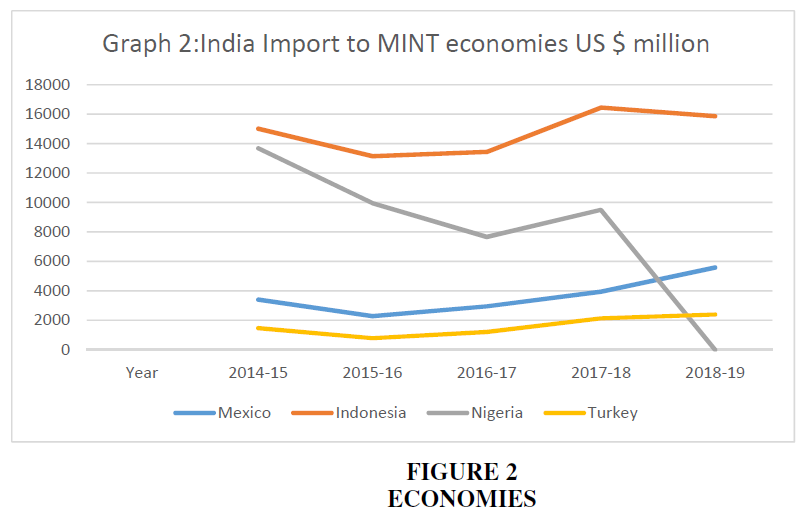

Tables 2 and 3 shows India’s export and import with MINT economies. Indonesia is the largest trading partner of India in the ASEAN.Bilateral trade increased from US $ 4043 million in 2004-5 to US $ 5275 million in 2018-19. The percentage share in India’s total trade increased from 1.30 percent in 2014-15 to 1.60 percent in 2018-19. India is the second largest buyer of coal and crude palm oil from Indonesia. India imports minerals, rubber, pulp and paper and hydrocarbons from Indonesia. India exports refined petroleum products, maize, commercial vehicles, telecommunication equipment, oil seeds, animal feed, cotton, steel products and plastics to Indonesia. India’s export is highest with turkey followed by Indonesia during the study period Figures 1 and 2.

| Table 2 India Export to Mint Economies (US$ Million) | ||||||||

| Mexico | Indonesia | Nigeria | Turkey | |||||

| Year | Percentage share in India’s total trade | Percentage share in India’s total trade | Percentage share in India’s total trade | Percentage share in India’s total trade | ||||

| 2014-15 | 2865.13 | 0.92 | 4043.32 | 1.30 | 2681.37 | 0.86 | 5358.90 | 1.73 |

| 2015-16 | 2861.55 | 1.09 | 2819.49 | 1.07 | 2221.90 | 0.85 | 4140.00 | 1.58 |

| 2016-17 | 3460.98 | 1.25 | 3488.12 | 1.26 | 1764.11 | 0.64 | 4626.59 | 1.68 |

| 2017-18 | 3782.79 | 1.25 | 3963.77 | 1.31 | 2254.92 | 0.74 | 5090.70 | 1.68 |

| 2018-19 | 3841.51 | 1.16 | 5275.60 | 1.60 | 3005.21 | 0.91 | 5452.45 | 1.65 |

| Table 3 India Import from Mint Economies (US$ Million) | ||||||||

| Mexico | Indonesia | Nigeria | Turkey | |||||

| Year | Percentage share in India’s total import | Percentage share in India’s total import | Percentage share in India’s total import | Percentage share in India’s total import | ||||

| 2014-15 | 3393.15 | 0.76 | 15004.64 | 3.35 | 13682.97 | 3.05 | 1463.87 | 0.33 |

| 2015-16 | 2283.19 | 0.60 | 13131.93 | 3.45 | 9949.17 | 2.61 | 776.94 | 0.20 |

| 2016-17 | 2944.52 | 0.77 | 13427.99 | 3.49 | 7659.48 | 1.99 | 1207.31 | 0.31 |

| 2017-18 | 3930.26 | 0.84 | 16438.80 | 3.53 | 9501.33 | 2.04 | 2132.20 | 0.46 |

| 2018-19 | 5577.03 | 1.08 | 15849.67 | 3.08 | 10, 884.71 | 2.11 | 2388.26 | 0.46 |

Table 4 shows India’s export with Mexico of top five commodities. In the year 2018-19 vehicles other than railway or tramway rolling stock, and parts and accessories thereof where the highest commodity which were being export to Mexico with US$ 1617.8 million. At the fifth rank was iron and steel were being exported by India to Mexico. Table 5 Shows India import from Mexico of top five commodities. First rank was taken by Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes followed by electrical machinery and equipment and parts in year 2018-19. Fifth rank was of organic chemicals.

| Table 4 Top 5 Commodities of India Export with Mexico: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 87 | VEHICLES OTHER THAN RAILWAY OR TRAMWAY ROLLING STOCK, AND PARTS AND ACCESSORIES THEREOF. | 1,027.08 | 1,350.57 | 1,872.68 | 2027.07 | 1617.8 |

| 2 | 29 | ORGANIC CHEMICALS | 243.90 | 262.17 | 253.86 | 279.6 | 352.85 |

| 3 | 76 | ALUMINIUM AND ARTICLES THEREOF | 399.94 | 203.70 | 164.32 | 159.24 | 308.05 |

| 4 | 84 | NUCLEAR REACTORS, BOILERS, MACHINERY AND MECHANICAL APPLIANCES; PARTS THEREOF | 113.25 | 118.73 | 141.35 | 161.35 | 210.75 |

| 5 | 72 | IRON AND STEEL | 91.97 | 65.99 | 147.24 | 137.84 | 105.53 |

| Table 5 Top 5 Commodities of India Import with Mexico: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 2,684.32 | 1378.92 | 1842.40 | 2766.02 | 4,269.55 |

| 2 | 85 | ELECTRICAL MACHINERY AND EQUIPMENT AND PARTS THEREOF; SOUND RECORDERS AND REPRODUCERS, TELEVISION IMAGE AND SOUND RECORDERS AND REPRODUCERS, AND PARTS. |

284.67 | 351.31 | 448.89 | 554.46 | 652.45 |

| 3 | 87 | VEHICLES OTHER THAN RAILWAY OR TRAMWAY ROLLING STOCK, AND PARTS AND ACCESSORIES THEREOF. | 39.89 | 67.65 | 52.59 | 82.71 | 118.11 |

| 4 | 32 | TANNING OR DYEING EXTRACTS; TANNINS AND THEIR DERI. DYES, PIGMENTS AND OTHER COLOURING MATTER; PAINTS AND VER; PUTTY AND OTHER MASTICS; INKS. | 4.77 | 12.52 | 38.20 | 70.80 | 73.84 |

| 5 | 29 | ORGANIC CHEMICALS |

36.17 | 35.36 | 49.63 | 49.32 | 44.9 |

Source: Ministry of Commerce (INDIA).

Tables 6 and 7 shows top 5 commodities of India’s export and import with Indonesia. In 2018-19 India exported ships, boats and floating structures to Indonesia followed by organic chemicals. fifth rank is taken by iron and steel.

| Table 6 Top 5 Commodities of India Export with Indonesia: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 89 | SHIPS, BOATS AND FLOATING STRUCTURES. | 53.40 | 84.15 | 304.50 | 36.07 | 734.61 |

| 2 | 29 | ORGANIC CHEMICALS | 536.58 | 406.65 | 374.67 | 425.40 | 629.71 |

| 3 | 87 | VEHICLES OTHER THAN RAILWAY OR TRAMWAY ROLLING STOCK, AND PARTS AND ACCESSORIES THEREOF | 239.65 | 185.50 | 277.97 | 565.44 | 558.76 |

| 4 | 84 | NUCLEAR REACTORS, BOILERS, MACHINERY AND MECHANICAL APPLIANCES; PARTS THEREOF. | 322.26 | 269.70 | 271.83 | 373.12 | 512.93 |

| 5 | 72 | IRON AND STEEL | 224.93 | 135.68 | 300.73 | 540.82 | 276.76 |

*Rank is assigned as per commodities’ top share in 2018-19.

| Table 7 Top 5 Commodities of India Import with Indonesia: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 7,497.34 | 5,089.67 | 5,036.24 | 6,322.78 | 7,283.42 |

| 2 | 15 | ANIMAL OR VEGETABLE FATS AND OILS AND THEIR CLEAVAGE PRODUCTS; PRE. EDIBLE FATS; ANIMAL OR VEGETABLE WAXEX. | 3,893.77 | 3,642.56 | 4,244.97 | 5,024.80 | 3,440.97 |

| 3 | 38 | MISCELLANEOUS CHEMICAL PRODUCTS. |

223.60 | 218.62 | 342.24 | 452.99 | 476.68 |

| 4 | 40 | RUBBER AND ARTICLES THEREOF. | 392.94 | 343.51 | 364.70 | 502.06 | 402.45 |

| 5 | 28 | INORGANIC CHEMICALS; ORGANIC OR INORGANIC COMPOUNDS OF PRECIOUS METALS, OF RARE-EARTH METALS, OR RADI. ELEM. OR OF ISOTOPES. | 22.52 | 58.78 | 42.98 | 67.17 | 360.31 |

When we see top 5 commodities India import from Indonesia, first rank is taken by mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes followed by animal or vegetable fats and oils and their cleavage products; pre. edible fats; animal or vegetable waxex. Fifth rank is taken by inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, or radielem. or of isotopes.

Table 8 and 9 shows top 5 commodities of India’s export and import with Nigeria. In 2018 19 top item of India export to Nigeria was pharmaceutical products and top item of import is Mineral Fuels, Mineral Oils and Products of Their Distillation; Bituminous Substances; Mineral Waxes.

| Table 8 Top 5 Commodities of India Export with Nigeria: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 30 | PHARMACEUTICAL PRODUCTS | 381.70 | 392.89 | 345.28 | 413.90 | 391.51 |

| 2 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 28.60 | 27.02 | 24.43 | 31.36 | 179.45 |

| 3 | 39 | PLASTIC AND ARTICLES THEREOF | 148.44 | 111.12 | 111.50 | 107.88 | 137.12 |

| 4 | 29 | ORGANIC CHEMICALS | 59.19 | 51.56 | 66.50 | 83.43 | 96.27 |

| 5 | 48 | PAPER AND PAPERBOARD; ARTICLES OF PAPER PULP, OF PAPER OR OF PAPERBOARD. | 38.50 | 38.16 | 41.60 | 62.57 | 58.46 |

| Table 9 Top 5 Commodities of India Import with Nigeria: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 13,532.36 | 9,769.56 | 7,461.06 | 9,293.95 | 10,619.60 |

| 2 | 08 | EDIBLE FRUIT AND NUTS; PEEL OR CITRUS FRUIT OR MELONS. | 25.16 | 54.68 | 52.35 | 64.79 | 121.45 |

| 3 | 76 | ALUMINIUM AND ARTICLES THEREOF. | 40.88 | 45.80 | 39.24 | 40.96 | 24.11 |

| 4 | 12 | OIL SEEDS AND OLEA. FRUITS; MISC. GRAINS, SEEDS AND FRUIT; INDUSTRIAL OR MEDICINAL PLANTS; STRAW AND FODDER. | 4.51 | 5.36 | 9.68 | 5.14 | 21.88 |

| 5 | 78 | LEAD AND ARTICLES THEREOF | 9.66 | 7.57 | 8.72 | 9.37 | 15.34 |

Commodity trade has taken over Nigeria-India commerce in recent years. To India, Nigeria exports mineral fuels, cotton, edible fruit, ore slag and ash, aluminium, iron and steel, coffee, tea, and spices, lac gum resins and other vegetable wood and articles of wood, raw hides and skins, and other items. Pharmaceuticals, nuclear reactors, boilers and machinery, articles of iron or steel, vehicles, iron and steel, rubber and articles thereof, electrical machinery and equipment, iron and steel, and other items make up India's exports to Nigeria, which account for 67.28 percent of the total India's export to Nigeria over the last decade. Table 9,10 & 11 shows top 5 commodities of India export and import with Turkey. Top item India exported and imported to turkey is mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.

| Table 10 Top 5 Commodities of India Export with Turkey: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 1,363.12 | 858.10 | 1,225.81 | 933.52 | 1,209.58 |

| 2 | 84 | NUCLEAR REACTORS, BOILERS, MACHINERY AND MECHANICAL APPLIANCES; PARTS THEREOF | 401.86 | 397.04 | 515.23 | 510.22 | 407.51 |

| 3 | 87 | VEHICLES OTHER THAN RAILWAY OR TRAMWAY ROLLING STOCK, AND PARTS AND ACCESSORIES THEREOF | 603.18 | 581.10 | 555.58 | 521.71 | 377.30 |

| 4 | 71 | NATURAL OR CULTURED PEARLS,PRECIOUS OR SEMIPRECIOUS STONES,PRE.METALS,CLAD WITH PRE.METAL AND ARTCLS THEREOF;IMIT.JEWLRY;COIN. | 31.52 | 23.26 | 31.66 | 93.88 | 445.59 |

| 5 | 54 | MAN MADE FILAMENTS | 305.01 | 247.44 | 254.92 | 321.07 | 296.26 |

| Table 11 Top 5 Commodities of India Import with Turkey: 2014-19, Us$ Million | |||||||

| Rank* | HSCODE | Commmodity | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1 | 27 | MINERAL FUELS, MINERAL OILS AND PRODUCTS OF THEIR DISTILLATION; BITUMINOUS SUBSTANCES; MINERAL WAXES. | 633.87 | 151.31 | 391.03 | 289.18 | 1,138.19 |

| 2 | 84 | NUCLEAR REACTORS, BOILERS, MACHINERY AND MECHANICAL APPLIANCES; PARTS THEREOF. | 113.04 | 90.44 | 106.31 | 160.89 | 306.21 |

| 3 | 25 | SALT; SULPHUR; EARTHS AND STONE; PLASTERING MATERIALS, LIME AND CEMENT. | 101.07 | 109.95 | 103.51 | 146.84 | 149.66 |

| 4 | 28 | INORGANIC CHEMICALS; ORGANIC OR INORGANIC COMPOUNDS OF PRECIOUS METALS, OF RARE-EARTH METALS, OR RADI. ELEM. OR OF ISOTOPES. | 57.90 | 38.57 | 47.04 | 57.73 | 121.01 |

| 5 | 72 | IRON AND STEEL | 45.90 | 26.31 | 59.87 | 70.5 | 78.04 |

Conclusion

MINT economies mirror emerging and rapidly rising economies, albeit with major variances. These nations will become increasingly significant in the global economy. All four countries have large populations that are both youthful and growing. Because of the MINT populations' young, all four nations should see a rapid increase in domestic consumption in the next years. The geographical position of the MINT countries is also advantageous in terms of future economic growth. Mexico, Indonesia, and Turkey all have significant markets nearby, giving them an advantage. Indonesia is located in the heart of rising Asia, close to BRIC giant China and resource-rich Australia. Indonesia is already performing well and attracting a lot of attention from investors.

Among the MINT economies, India had the most trade with Turkey during the study period, followed by Indonesia. Mineral fuels are India's main import from Indonesia. Turkey's geostrategic prominence will continue to grow. Nigerian oil would continue to be important as long as there is oil in the country. The MINT countries' young population, which is regarded an advantage now and in the future, is one of the primary drivers of designating them as potential economic power blocs.

These 'MINT' countries are expected to seize the lead from the BRICs and emerge as the most powerful emerging market. Bribery and corruption, high levels of debt, governance challenges, slow infrastructure growth, and poor education systems plague MINT countries, as they do many other emerging markets. Mexico, Indonesia, Nigeria, and Turkey, according to economists, are the world's future economic powerhouses, with wealth and population expected to grow significantly. The MINT countries' young population, which is seen as an asset both now and in the future, is one of the key factors of their classification as potential economic power blocs.

References

Durotoye, A. (2014) The MINT Countries as Emerging Economic Power Bloc: Prospects and Challenges. Developing Country Studies, 4(15): 99-106.

Durotoye, The Crisis of Youth Unemployment in the MINT Countries: Causes, Consequences, and Corrections. European Journal of Business and Management, 6(24): A. (2014b) 123-135.

Instrumental Quantile Approach. African Governance and Development Institute Working Paper, 15/009.

Marcin, Gryczka. Mint Countries As Possible Rising Stars In The Global Economy Benchmarking With Brics Countries. 17. 23-31. 10.22630/Aspe.2018.17.3.34.(2018)

Simplice Asongu, Uduak S. Akpan & Salisu R. Isihak (2018) Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries, Financial Innovation 4, Article number: 26.

Simplice, A.A. Drivers of Growth in Fast Emerging Economies: A Dynamic

Tansu, (2014) Mint Countries: How “Sweet” Is Their Future? California Business Review 2(3), 39-46.