Research Article: 2022 Vol: 26 Issue: 6

Minimizing Dissonance through Optimum Time-Lapse In Online Impulse Buying

Jyoti Tandon, Delhi Technological University

Rajan Yadav, Delhi Technological University

Saurabh Agrawal, Delhi Technological University

Citation Information: Tandon, J., Yadav, R., & Agrawal, S. (2022). Minimizing dissonance through optimum time-lapse in online impulse buying. Academy of Marketing Studies Journal, 26(6), 1-17.

Abstract

Purpose- The present study examined the effect of the time gap between the costs incurred and benefits received on post-purchase dissonance when customers have impulsively bought online. The purpose of the study is to reduce post-purchase dissonance and product returns in online impulse buying. Design/methodology/approach- A structured questionnaire was used to collect the data. Structural Equation Modeling and Paired T-tests were used to analyze the data. The approach to theory testing involves a longitudinal design, and it aims to scrutinize the effect of time on online impulse buying. Findings- The results indicate that in online impulse buying, when costs precede benefits (study 1) the felt dissonance decreases with time. Conversely, when benefits precede costs (study 2) the felt dissonance increases with time. The manager should aim at minimizing the dissonance associated with the product since there is an inverse relationship between dissonance associated with the product and the consumer's willingness to repurchase the product. Research implications/Limitations–The manager in study 1-should aim at increasing the time between the costs incurred and benefits derived because, over time, the dissonance, kept on decreasing. The manager in study 2, should aim at reducing the time lapse between consumption and payment. The scope of this study remains limited to the Indian student population with a sample size of 100 individuals in study one and 99 participants in study two. Originality/value - This research is the first to focus on minimizing post-purchase dissonance in online impulse buying through managing delivery time.

Keywords

Sunk Cost; Sunk Benefit; Payment Depreciation; Mental Accounting; Benefit Depreciation; Dissonance; Online Impulse Buying.

Introduction

It is well established that researchers have studied impulse buying for many years (Amos, Holmes, Kenson 2014), (Xiao and Nicholson, 2013). Turkyilmaz et al. (2015) pointed out that only a few studies have examined this phenomenon in an online context.

With the advent of e-commerce, approximately 8.8 percent of total shopping is happening online globally. According to Statista (2019) sales in e-commerce is growing at an extraordinary rate of over 300 percent starting from 2014 with 1336 billion US Dollars to 4878 billion US Dollars in 2021. The online context is different compared to the offline one because buying and consumption are often temporally separated. In an offline context, we visit the store, pay for the product and get the product back home. The product can be bought and consumed at the same time while this is not the case in online purchases.

Whereas in the online context, payment is made today, the product might reach us in 2 days, 5 days, 10 days, or even a month. Thus a difference in buying and consuming the product.

Liu et al. (2013) highlighted that as much as 40% of all online consumers' expenditures consist of online impulse buying. It is also established that online shopping intensifies more impulse-buying behavior as compared to the offline setting. (Eroglu et al., 2001)

Extant research informs that customers feel guilt and remorse (Rook, 1987) or excitement and pleasure (Ferrell and Beatty 1998; Rook and Gardner 1993) after buying impulsively in both online as well as offline scenarios. Greenfield (1999) highlighted the online scenario wherein users return the products because they buy the merchandise online thus resulting in consumer’s remorse and guilt which develops consumer binge/remorse/purge cycle known as ‘consumer bulimia’.

The present study is critical because the feelings of dissonance due to impulse buying may lead the customer to rectify his decision by returning the product. It is because the consumers get swayed by guilt and regretful emotions after an impulse purchase for spending the money unnecessarily (Dittmar and Drury, 2000).

Cognitive dissonance is one of the reasons associated with the return of retail products. There are three components of cognitive dissonance as highlighted by Sweeney et al. (2000). Emotional, Concerns over the deal, and Wisdom of Purchase. Emotional is "Psychological discomfort associated with the product", Concerns over the deal is "acknowledging and believing that they were influenced while buying" and Wisdom of Purchase is "realizing that they made a wrong choice and or didn't need the product at all". Customers experiencing cognitive dissonance may look out to undo its impacts by returning the product Powers & Jack (2013), and maybe because of this Product return is one of the significant issues facing online shopping

Dennis (2017) states that the product return rate is much higher in online purchases as compared to their offline counterparts. Online shopping has higher chances of product returns. The major cause of returns is impulse purchase (Nancy L. Cassill, 1998). Out of every three products purchased by online retailers, one is returned (Banjo, 2013). As per (Credit Action, 2008), as many as 9/10 of the consumers are indulged in making impulse purchases, and out of that, 40 % describe themselves as impulse buyers. The percentage of return is highest in items like shoes and fashion goods, where over 50% of the online purchases are typically returned (Ofek et al. 2011; Flood 2013). The high rate of impulse buying tendency is reasonable from the viewpoint of retailers but brings undesirable consequences for consumers because of increased debts. (Credit Action, 2008). A fact is that online retailers have to experience product returns as high as around 30%, thus bearing high reverse logistics costs from $6 to $18 per product (Minnema et al., 2016).

It is established as per the basic price reference that free returns have a direct relationship with higher sales as well as increased returns. Lenient return policies surge the probability of a customer making impulse purchases because, in lenient/free returns, customers do not face any immediate risk. It is well established in the literature that free returns and free delivery trigger impulse buying (Lantz and Hjort, 2013).

The present study bridges this gap in the online impulsive buying literature by examining the changes in the feelings of dissonance during the period when payment, delivery, and, consumption (there can be a time lag between delivery and consumption) are temporally separated. The study examines changes in dissonance in two conditions 1) when costs precede benefits temporally and 2) when benefits precede costs temporally.

In scenario one, when costs precede benefits, the payment is made in advance, and the product gets delivered later. The use of online modes of payment has a favorable impact on impulse buying as compared to offline payment methods. In scenario two, benefits precede cost. A credit card, being a mode of payment in which the consumer has to pay to the card issuer after a specified period, is a manifestation of the difference in actual consumption and payment. This payment method is widely used in online purchases. As advocated by Dittmar and Drury (2000) and Tuttle (2014), in the case of online payment methods, the money seems less real, and consumers do not get the actual feeling of spending the money. That is how this economic outcome of impulse buying is not recognized instantly (LaRose, 2001).

Researchers have primarily ignored the examination of post-purchase behavior in online impulse purchases (Chang and Tseng, 2014). It is well established in the literature that post-purchase dissonance exists more in an online scenario as compared to an offline one (Pirog & Roberts, 2007). Extant research in the offline context informs that customers feel guilt and remorse (Rook, 1987) after impulse purchases. However, post-purchase behavior in online impulse buying may be different from offline context. It is because; there is often a time lag between the online impulse buy and the delivery of the merchandise, whereas offline both are concurrent. The current study bridges this gap in the literature by examining post-purchase dissonance after online impulse purchases with respect to time. Further, customers are prepaying and paying post-delivery while buying online. The method of payment may moderate the post-purchase dissonance of the customer in an online impulse purchase.

Sweeney et al. (2000) stated that people have different levels of dissonance, and it is not essential that all purchases would lead to dissonance. Impulse buying is associated with higher dissonance than planned purchases (Zaichkowsky, 1985), and higher planned shopping lowers the levels of impulse buying Bellini et al. (2017). The apparent reason for higher dissonance is less involvement of impulse buyers in the purchase decision, which in turn acts as a hindrance in the rational choice model. This leads an impulse purchase to be a less informed purchase, and thus, there are high chances of impulse purchases going wrong. (Rook and Fisher, 1995). Zhao et al. (2019) studied the relation between product type and online impulse buying and found that low-involvement feeling products excite the tendencies of online impulse buying.

The present study intends to examine the existence of dissonance in four time periods (zero-days, three days, seven days, and fourteen days) in two studies using an already established scale by Sweeney et al. (2000). We have taken small time periods because the study is conducted over a long time period from 3 weeks to many years. The study measures the impact of e-impulse buying in increasing/decreasing the dissonance with time.

The sequence followed in the rest of the paper is as follows. In the first level, the relevant literature on online impulse buying, time as a sunk cost, payment depreciation, and benefit depreciation will be presented. Next, we will postulate the hypotheses for the study and discuss the methodology in detail. Later we discuss the results followed by discussion. Finally, we conclude by sharing the managerial implications, limitations, and directions for future research.

Literature Review

Online Impulse Buying

Impulse buying is concerned with a situation when a consumer undergoes an unexpected, often influential, and relentless longing to buy something instantaneously (Liu et al., 2013). DeSarbo and Edwards (1996) analyzed that impulse buying arises because of external triggers.

As described by Aruna & Santhi (2015), impulse purchase behavior is a novelty or escape purchase that disrupts the consistent buying arrangement. The growth in e-impulse buying can be attributed to growth in the e-commerce sector as well as betterment in Information Technology. (Eroglu et al., 2001) The online atmosphere for shopping is more favorable for impulse buying compared to the offline model. The online shopping environment gives many advantages over offline counterparts like convenient locations of the store, operating 24*7, and no pressure from staff to buy the goods. The obstacles and constraints faced in offline setup are eradicated in online buying, thus augmenting the chances of impulse buying.

The prevailing literature on impulse buying is mainly in the offline context where purchase and consumption are synonymous (Rook and Fisher, 1995; Bayley and Nancarrow, 1998; Dholakia, 2000).

Piron (2001) stated that “online impulse buying is sudden and immediate online purchase with no pre-shopping intentions.”

Numerous studies have emphasized the impact of impulsiveness in online buying (Liu et al., 2013; Floh and Madlberger, 2013). Sultan (2002) scrutinized online impulsive purchasing behavior. Luo (2005), in his study, examined the impact of the presence of peers and family members on the desire to purchase online and found that the presence of peers has a positive effect on the call to buy online while the presence of family members harms the same. Zhang et al. (2019) examined the effects of self-control and social interactions on consumers’ impulse buying using stimulus-organism-response-framework and dual systems theory. There are four distinct types of impulse buying – Pure impulse buying, planned impulse buying, suggestive impulse buying, and reminder impulse buying as explained in Table 1. (Madhavaram and Laverie, 2004) Xiang et al. (2016) Table 1.

| Table 1 Types of Impulse Buying with Examples | ||

| Type of Impulse Buying | Definition | Example |

| Pure Impulse Buying | Pure impulse buying is an exclusive buying behaviour that halts a predictable purchase pattern. | An example of pure impulse buying is: When one is browsing pictures of apparel/clothes on a social commerce platform aimlessly and suddenly decides to buy an outfit. |

| Planned Impulse Buying | The second type of impulse buying is planned impulse buying, which takes place when the judgment to buy a product or service is driven by a discount in price. | An example of planned impulse buying is: When one is browsing pictures of clothes/apparel on online platforms with a shopping list but they ultimately purchase the outfit basis coupons or sales promotion offers. |

| Suggestive Impulse Buying | Suggestive impulse buying is the one that occurs when after seeing the product for the first time, the customer develops a need to buy it. | An example of suggestive impulse buying is: When a person buys a new type of outfit on the basis of recommendations from social commerce platforms. |

| Reminder Impulse Buying | Reminder impulse buying is when a consumer gets introduced to the enriched info about the product, remembers an advertisement related to the product, or when after seeing the product the consumer realizes the shortage of it at home. | An example of reminder impulse buying is: When a person is browsing outfits/apparel on social commerce websites and while browsing realizes that he or she is short of it and buys it. |

Unplanned buying behavior occurs in a situation wherein the number of articles put in the shopping basket is compared to the actual shopping list (Bell; Corsten and Knox 2011; Hui et al., 2013). The difference between the two is the result of unplanned buying behavior. In the context of impulse buying, Generation Y is taken to be an attractive target group by the organizations from the point of view of possible customers because of their hedonism and extravagance Lissitsa & Kol (2016). According to Aruna & Santhi (2015), there is a significant impact of the age factor on impulse buying; this is true in the case of Generation Y, which is more inclined to "impulse buying" as compared to others. Impulse buying is also said to be influenced by arousal and pleasure. Lamis et al. (2022).

There has been a substantial upsurge in the total of online stores visited by consumers and time spent in such online stores because of the persistent growth of e-commerce and immense internet penetration in society due to smartphones Melis et al. (2015). It shows that the use of technology impacts this behavior invalid source specified. Impulse buying can enhance retail sales and profits majorly for high-margin products. In the context of external factors, price, and communication factors encourage impulse buying behavior. Iyer et al. (2020).

Time as a Sunk Cost

Impulse buying means buying the product instantly and not spending time selecting it. In the words of Rook (1986), it is a spontaneous behavior that is "Bad". While making an impulse purchase short amount of time is spent between watching and purchasing the product. There are two schools of thought on impulse buying and its association with time. The first one claims that the availability of time directly impacts the chances to purchase impulsively. The consumer having more time will tend to browse for longer and thus the chances of it being an impulse purchase are higher. (Beatty and Smith, 1987). Similarly, paucity of time will lead to fewer chances of making an impulse purchase. The second highlights that impulse purchase takes place within 5 minutes of shopping, if it is taking longer it is less likely to be an impulse buy. (Graa et al., 2012).

The concept of mental accounting took its roots in the contribution of Thaler (1985). Thaler (1980, 1985) explains how a consumer opens a mental account as soon as he makes the payment and closes it after the consumption is done. Various disciplines like psychology (Arkes and Blumer, 1985; DeVoe and House, 2012; Garland, 1990), marketing (Soster et al., 2010; Soman ( 2001), and behavioral economics (Thaler, 1999; Navarro and Fantino, 2009) have studied sunk cost fallacy. Arkes and Blumer (1985) describe the sunk cost as the "higher propensity to endure an endeavor when investment in effort, money, or time has been made." In the terminology of organizational behavior, this is known as the escalation of commitment. Now, after making the payment in an online setup, the consumer gradually gets adapted to the payment made, thus leading to a reduction in the effect of sunk cost with time.

Talking about an online scenario, there will always be a “time lag between purchase and actual consumption” because the product gets delivered later. Thus sunk time spent on post-purchase scenarios should be studied for understanding sunk cost fallacy in online impulse buying.

As per recent research, individuals are more likely to stick and spend time in a relationship wherein substantial time has been devoted. (Rego et al., 2018, Sharma et al., 2006).

There are various aspects which are found about the allocation of time, as abridged in Robinson (1977), several environmental elements (weather, day of week, and emergencies), individual factors (age, sex, and education), role factors (employment, parenthood, and marriage) and resource associated factors (appliances and income) affect the way time is spent in online impulse buying.

Soman (2001) stated that there is a difference in the treatment of sunk money and sunk time, which happens because people are incompetent to deal with time as they do for money. Thaler (1999) propounded that all dollars are not the same, and money earned in a lottery is highly likely to be spent differently as compared to the regular income of the individuals. The marginal propensity to consume would vary in both cases because the consumer would be less extravagant in his approach to spending money if there is an increase in his monthly salary as compared to a windfall gain.

Heath (1995) postulates that individuals establish mental budgets to keep a check against an over-escalating obligation to any action. A budget can be predefined for the time as well as money, or most of us, as we frequently say, time is money; we spend much money on finding out ways to use time optimally. Jacoby, Szybillo, & Berning (1976) compared mental accounting of money and time and pointed out the significant difference that, unlike money, time is scarce, i.e., 24 hours for everyone, and the time cannot be stored. Also, the process of paying in advance and consuming later increases the obligation to consume the associated benefit (Arkes & Blumer, 1985; Gourville & Soman 1998).

Payment Depreciation Theory

There are two ways by which the separation of costs and benefits can take place with regard to time. According to scenario one, the individual pay for the product before, and consume it later. In the words of Gourville and Soman (1998), individuals pay more consideration to sunk costs in case one. However, as per payment depreciation, with time, the sunk cost effect keeps on reducing.

Thaler (1980, 1985) proposes that people open a mental account on entering a transaction and as and when the payment is made, and they close that account when they consume the product, thus generating a mental link to regulate the costs and benefits of that product. After making the payment, with time, he adapts to the situation of having made the payment, this concept is known as payment depreciation which includes “gradual discounting of an upstream transaction payment over time.”

The prevailing literature on payment depreciation has studied this phenomenon when payment made is preceded by benefits derived over a long time period from 3 weeks to many years. (Arkes and Blumer, 1985; J. T. Gourville and Soman, 1998)

In the present study, we are trying to see the impact of the short time period between the payment made and the benefits derived in the case of online impulse buying. We are considering a shorter time period of 0 days (buying and consumption occur together)*, 3 days (the difference between buying and consumption is 3 days; buying is preceded by the consumption)*, 7 days (the difference between buying and consumption is 7 days; buying is preceded by the consumption)*, and 14 days (the difference between buying and consumption is 14 days; buying is preceded by the consumption)*.

As the number of days between the payment made and actual derivation of benefits increases from zero, three, seven to fourteen days, the dissonance associated with online impulse buying keeps on decreasing.

H1: As the number of days between the payment made and benefits derived in online impulse buying

increases, dissonance associated with the product decreases.

Benefit Depreciation

As per the second scenario, transaction benefits are succeeded by transaction costs. Individuals, in this case, use the product first and then pay for it later. Due to an increased usage of deferred payments and credit cards, it has become a conventional practice for individuals to consume the product first and pay later. This process, which is the inverse of payment depreciation (Gourville and Soman, 1998), is known as benefit depreciation.

Till now, we have seen a process of payment depreciation in which cost precedes benefits. However, there exists an inverse process in which benefit precedes costs. Gourville and Soman (1998) defined it as "benefit depreciation." As per benefit depreciation, the buyer uses the product before making the payment. According to Benefit Depreciation hedonic impact of the benefit diminishes over time, and making payments in the future feels like a burden and thus a loss. Credit cards act as a medium by which benefits derived can be segregated with payment incurred. It promotes the "buy now and pay later" approach. It is established that credit card users make more impulsive purchases than cash or debit card users Wanninayake & Chovancová (2012). This is the reason why credit card users will have more dissonance as compared to other modes of payment.

In the present study, we are trying to see the impact of the short time period between benefits derived and payments made in the case of online impulse buying. We are considering a shorter time period of 0 days (consumption and buying occur together)*, 3 days (the difference between consumption and buying is 3 days; consumption is preceded by buying)*, 7 days (the difference between consumption and buying is 7 days; consumption is preceded by buying)* and 14 days (the difference between consumption and buying is 14 days; consumption is preceded by buying)*.

As the number of days between benefits derived (product delivery/consumption) and making payment (buying) increases from zero, three, seven to fourteen days, the dissonance associated with online impulse buying keeps on increasing.

H2: As the number of days between benefit derived and payment made in online impulse buying increases, dissonance associated with the product also increases.

Methodology

The hypotheses of both studies one and two were tested using a popular multivariate analysis method known as Structural Equation Modelling using AMOS. The method was selected because it can study simultaneous variables containing many items.

Study One

The motive of this research was to prove that as the time-lapse between buying (payment made) and consumption (delivery of benefits) of a product bought impulsively in an online setup increases, dissonance associated with the product decreases. In this case, costs preceded benefits.

Sample

The initial sample in the study had 100 students registered in different courses (UG/PG/Ph.D.) in different universities in India. A varied mix of the population of students from different cities was selected to fetch a cross-sectional pool of students. Nonprobability sampling technique, convenience sampling was used, and respondents were required to fill online surveys at time T0 (immediately after the purchase), T1 (after three days), T2 (after seven days), and T3 (after fourteen days). However, usable questionnaires kept on decreasing after every stage. After each time interval, some of the respondents dropped. Starting with 100 participants in T0, the number of participants was reduced to 68 in time T1, 54 in time T2, and 48 in time T3. However, the same set of people took part in an experiment at all four stages. For filling the questionnaires, the students were given a hypothetical situation "Today, while scrolling down Tyntra's website you happen to see one outfit, worth INR 2500, and you impulsively purchased it. You are done with the payment, and now you realize that you do not need the product, and you should not have bought it. You received the product immediately after the purchase." The survey aimed at capturing their feelings and level of dissonance when immediately after the impulse purchase, they received the product and paid for the product in advance. The receipt of the outfit and payment of the transaction is both fictive. Post this, individuals who received the product immediately, i.e., the no-delay condition, were given the online survey link through e-mail to register the dissonance incurred when the phenomenon of the cost incurred and benefit derived went hand in hand. Individuals who did not receive the product instantly and were referred to as individuals in delay conditions accomplished the same tasks as those in the no-delay state, but in delay conditions, costs were incurred earlier, and benefits are to be derived later within a time delay of three-days, seven days, and fourteen days respectively.

Procedure

The sample in consideration is mainly young males/females. The same has been taken because online shoppers across the globe have standard features like being young (Strough et al., 2008) and having high impulsiveness.

Among the subjects, 72 (82%) were female, and 28 (28%) were male. All of them either completed their post-graduation or were pursuing post-graduation. They were all at least graduate students. The average age of the subjects was 25.1.

The other reason to take the student sample is that the younger generation's shopping behavior is considered to be the reference model for shopping behavior in the future society. The procedure followed is illustrated as:

In the first stage, the samples were recruited through e-mail, WhatsApp messages in college groups, and Facebook pages. The e-mails sent to the students had a link to the online survey on google forms. Reminder e-mails were sent regularly to boost participation. A PayTM reward of INR 200 to those who completed the survey in all four time zones was used to encourage participation. In the first survey, only the respondents were asked about their willingness to continue since it will have three more questionnaires following up.

In the second stage, only questionnaires were completed by students at all four-time intervals with valid e-mail addresses and were included. Third, the first questionnaire submitted by the respondent was included in case of multiple submissions from the same respondent. An E-mail address was used as the basis to identify the replication. Fourth, to control the respondents who would have filled the same answer choice for all the question items of the survey, the answers to each question item were checked. No such case was found and thus, no response was deleted on this ground.

The design was chosen for three main reasons. First, by having participants engage in four experiments within one month, the data was adequately ascertained regarding time. Secondly, it ensured more validity and reliability because it is an experimental study, and thirdly it had greater flexibility and involvement.

Instrument Development

The survey instrument contained measures for impulsivity and measures for dissonance using multi-dimensions, including emotions, the wisdom of purchase, and concern over the deal. The questionnaire comprised 32 items that included eight items on impulsivity in an online setup adapted from Rook and Fisher (1995); twenty-two items on cognitive dissonance were taken from Sweeney et al. (2000). The items were rated with a five-point Likert-type scale with anchor points: 1 (strongly disagree) and 5 (strongly agree). All scales used in this study were employed multiples items earlier. The scales were developed and validated in previous research.

Results

The impulsiveness scale having eight items and a dissonance scale having 22 items were used. There are three dimensions of cognitive dissonance, emotional (psychological distress due to purchase decision), Wisdom of Purchase (if the product was needed or not and if the person has bought the appropriate one or not), Concerns over deals (if they have been influenced intrinsically or extrinsically).

Preliminary Analyses

We eliminated items not loading at least 0.50 on their construct (Cheon and Stylianou, 2001). So, we were left with four variables from the emotional aspect, three variables from each wisdom of purchase, concerns over the deal, and impulsiveness, respectively. The fit is evaluated using the RMSEA, CFI, and Bollen IFI fit statistics (Bender, 1990). Bollen IFI fit indices, and CFI reports the relative fit of the model as opposed to the null model. IFI and CFI fit indices are chosen over absolute fit indices (Bollen, 1989a). Bollen IFI value was registered at 0.993. RMSEA (Root Mean Square Error of Approximation) deals with a lack of model parsimony, thus making it a vigorous index. Model CFI and IFI should exceed 0.90, and the value of RMSEA should lie between 0.05 and 0.08 to demonstrate a good fit (Bentler, 1990). The results of our measurement model suggest that the proposed factor structure has a good fit. However, the RMSEA was recorded at 0.030.

The survey instrument includes four constructs; the first construct was emotional; the second was the wisdom of purchase and the third was concerns over the deal, the scale developed by Sweeney et al. (2000) was used to measure dissonance. The fourth construct was Impulsiveness, developed by Rook and Fisher (1995). The χ 2 was 63.87, and for the default model, the discrepancy divided by degrees of freedom is 63.879 / 59 = 1.083. Comparative fit index (CFI) and goodness of fit index (GFI), 0.90 or above suggest robust uni-dimensionality Bentler (1990), Kline (2015). The GFI and CFI value was 0.913 and 0.992, respectively.

Results

The dissonance in online impulse buying for "delay" (3 days, seven days, and 14 days) and "no delay" (0 days) conditions were tested at a 95 percent significance level using a paired t-test, and the results are mentioned in Table 2. Hypotheses were tested using paired sample t-test. Paired T-tests were performed for all three dimensions, taking two time zones at a time, the resultant mean values were:

| Table 2 Supported/Not Supported Paired T-Test (Based on Significance Value) | ||||||

| Variable/Time | T0T1 | T1T2 | T1T3 | T0T2 | T0T3 | T2T3 |

| Emotional | 0.007 Yes |

0.980 No |

0.552 No |

0.016 Yes |

0.006 Yes |

0.511 No |

| Wisdom of Purchase | 0.069 No |

0.114 No |

0.044 Yes |

0.002 Yes |

0.000 Yes |

0.357 No |

| Concern over Deal | 0.006 Yes |

0.641 No |

0.049 Yes |

0.007 Yes |

0.000 Yes |

0.065 No |

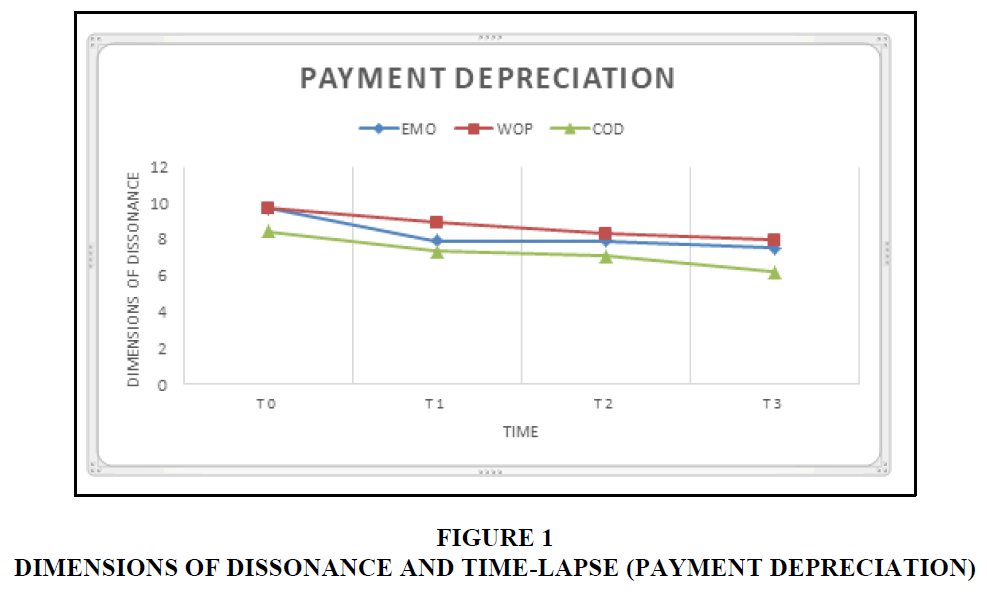

EMOT0 (9.69) > EMOT1 (7.91) < EMOT2 (7.92) >EMOT3 (7.53)

WOPT0 (9.69)> WOPT1 (8.93) >WOPT2> (8.29)> WOPT3 (7.96)

CODT0 (8.45)>CODT1 (7.33)>CODT2 (7.08)>CODT3 (6.18).

The resultant mean values are mentioned in Figure 1.

The results were significant for many but not significant for all three dimensions at T1T2 and T2T3.

As per the findings, the below table 2 explains, paired t-test between T0T1, T0T2, T0T3, T1T2, T2T3, and T3T1 of three dimensions of dissonance; emotional, the wisdom of purchase, and concern over the deal.

So, does dissonance and its dimensions support differences in time-lapse in payment depreciation study? Table 2.

EMO=Emotional

WOP=Wisdom of Purchase

COD=Concern over deal

T0= immediately after; 0 days

T1=3 Days

T2= 7 Days

T3=14 Days.

After the experiment, which included consumers filling up a questionnaire at times T0, T1, T2, and T3, it was discovered that individuals were least satisfied and had a maximum level of dissonance when payments and benefits co-occurred at time T0. In the later stages, when time delay came into the picture, respondents preferred a long delay at time T2 to a long delay at time T1 and thus preferred T3 over T2.

Study Two

The motive of this research was to prove that as the time-lapse between purchase action and consumption of a product bought impulsively in an online setup increases, associated dissonance increases. This was a case of "Buy now, pay later." These benefits preceded costs.

Sample

The initial sample in the study comprised 99 students registered in different courses in different universities in India. The respondents were required to fill out questionnaires at time T0 (immediately after the purchase), T1 (after three days), T2 (after seven days), and T3 (after fourteen days). However, usable questionnaires kept on decreasing after every stage. The same set of individuals took part in all four stages. Starting with 99 individuals at T0, it dropped to 81 in T1, 52 in T2, and 44 in T3.

The purpose of this study was to prove that due to the Buy now and Pay Later' options, there exists a time delay between benefits derived from the transaction and costs incurred on it. As per this phenomenon, benefits are followed by costs. It aims at establishing that individuals tend to be more gratified at time interval T0.

As time-lapse between the benefit received and the cost incurred in a transaction made for a product bought impulsively in an online setup increases, dissonance associated with the product increases.

Procedure

Among the subjects, 75 (76%) were female, and 25 (24%) were male. All of them either completed their post-graduation or were pursuing post-graduation. They were all at least graduate students. The average age of the subjects was 24.7.

Individuals have approached the basis of convenience sampling and were given a vignette to be adhered to in the time delay and no-delay conditions. The subjects experienced a time delay (0 days, three days, seven days, or fourteen days) between receiving the benefit (outfit) and paying for the cost (INR 2500).

Using four time periods (0 days, three days, seven days, and 14 days) enabled examination across several data points, thus allowing for the detection of a continuous trend.

As per the given scenario, while scrolling down Tyntra's website, the individuals happen to see one outfit, worth INR 2500, and they impulsively purchased it. The payment and receipt of the product were made immediately and simultaneously. After which they realize that the product was not needed and the purchase could have been avoided. Post this, individuals in the no-delay condition were given the online survey to register the dissonance incurred when the phenomenon of benefit derived and the cost incurred went hand in hand.

Individuals in the delay conditions (3 days, seven days, and 14 days) accomplished the same tasks as those in the no-delay state (product received immediately), but in delay conditions, benefits were derived earlier, and costs were to be incurred later within a time-delay of three-days, seven days, and fourteen days respectively Fenton‐O'Creevy et al. (2018).

Preliminary Analyses

We eliminated items that failed to load at least 0.50 on their construct. So, we were left with eight variables from the emotional aspect, four variables from the wisdom of purchase, two variables for concerns over the deal, and 4 for impulsiveness. Bollen IFI value was registered at 0.972.

The χ 2 was 149.86, and for the default model, the discrepancy divided by degrees of freedom is 149.86/ 125 =1.19. Comparative fit index (CFI) and goodness of fit index (GFI), 0.90 or above suggest robust uni-dimensionality. The CFI and GFI value was recorded at 0.98 and 0.87, respectively.

Results

The dissonance in online impulse buying for the "delay" and "no delay" conditions was tested at a 95 percent significance level using paired t-test, and the result is mentioned in Table 3. Hypotheses were tested using paired sample t-test. Paired T-tests were performed for all three dimensions, taking two time zones at a time, the resultant mean values were:

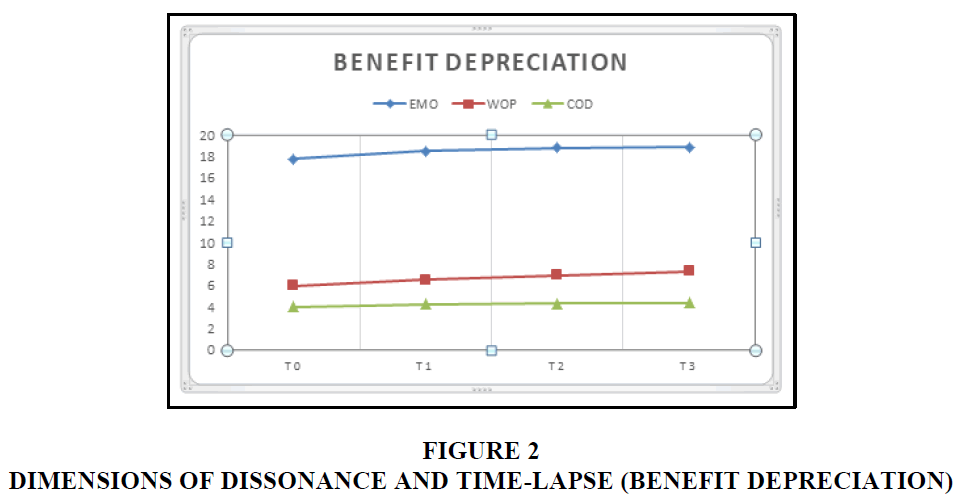

EMOT0 (17.8) < EMOT1 (18.54) < EMOT2 (18.83) < EMOT3 (18.91)

WOPT0 (5.95) < WOPT1 (6.56) < WOPT2< (6.93) < WOPT3 (7.35)

CODT0 (4.02) < CODT1 (4.24) < CODT2 (4.34) <CODT3 (4.40).

The resultant mean values are mentioned in Figure 2.

The results were significant for many but not significant for all three dimensions at T1T2.

As per the findings, the below table 3 explains, paired t-test between T0T1, T0T2, T0T3, T1T2, T2T3, and T3T1 of three dimensions of dissonance; emotional, the wisdom of purchase, and concern over the deal.

| Table 3 Supported/Not Supported Paired T-Test (Based on Significance Value) | ||||||

| Variable/Time | T0T1 | T1T2 | T1T3 | T0T2 | T0T3 | T2T3 |

| Emotional | 0.047 Yes |

0.763 No |

0.038 Yes |

0.045 Yes |

0.025 Yes |

0.024 Yes |

| Wisdom of Purchase | 0.049 Yes |

0.163 No |

0.009 Yes |

0.045 Yes |

0.007 Yes |

0.032 Yes |

| Concern over Deal | 0.036 Yes |

0.446 No |

0.007 Yes |

0.049 Yes |

0.043 Yes |

0.006 Yes |

So, does dissonance and its dimensions support differences in time-lapse in benefit depreciation study? Figure 2.

EMO=Emotional

WOP=Wisdom of Purchase

COD=Concern over deal

T0= immediately after; 0 days

T1=3 Days

T2= 7 Days

T3=14 Days.

After the experiment, which included consumers filling up a questionnaire at times T0, T1, T2, and T3, it was discovered that individuals were more satisfied and had a minimum level of dissonance when transaction benefits and costs coincided at time T0. In the later stages, when time delay came into the picture, respondents favored a small delay at time T1 compared to a long delay at time T2 and thus preferred T2 over T3. Because of dissonance affecting transaction satisfaction, it is highly likely that the perceived fairness of the transaction would be less, thus resulting in reduced chances of completing the transaction again shortly. With the introduction of deferred payments, the use of credit cards has augmented multifold. The users get an opportunity to delay the payment for a good.

Discussion

Results of study one signify that with time the dissonance keeps on decreasing in online impulse buying. While the outcomes of study two indicate that in the case of "buy now, pay later," the dissonance increases with time in online impulse buying.

A year ago, from now, Mr. X paid $60 for one football match that would be played later this week, Yesterday, Mr. Y paid $60 for the same football game, and on the day of the game, both of them gets a high viral fever, now, who is more likely to brave the temperature and still go on the match? Now, from an economic perspective, they both have spent $60, which is a “sunk cost” now, and their choice to go or not to go should be dependent on the marginal cost and marginal benefits of going. The mental accounting system, in many cases, tends to violate economic concepts, and that is why Mr. X and Mr. Y will behave differently. In the end, both X and Y want to close their mental accounts.

Mr. X will gradually adapt to the cost of a ticket with the time (1 year, in this case), thereby fading the sunk-cost impact on his choice to attend the game. This adaptation is known as payment depreciation. Mr. Y has little time to adapt to the cost of the ticket before the game so, he will take effect of the full sunk cost of his $60 payment when concluding whether to attend or not. Thus we will predict Mr. Y will have a higher sunk cost than Mr. X, and therefore, the probability of him attending the game is more. In the words of Gourville and Soman (1998), a scenario to explain payment depreciation can be illustrated by this: An individual has paid gym fees for one year in advance, and the other pays monthly fees. With time, the one paying gym membership fees for one year in advance is less likely to go to the gym as compared to the one paying the fee every month.

Gourville and Soman (1998) and Prelec and Loewenstein (1998) studied the occurrence of “buy now, pay later” transactions while considering actual money scenarios affecting sensitivities of sunk costs. They elaborated that sunk costs would be perceived differently when the payment for a good is made with cash as against credit cards. It is likely to have less sunk cost when the mode of payment is credit cards. Benefit depreciation states, that as the time lapse between transaction cost incurred and benefits derived from it, increases, the perceived benefit derived from the transaction decreases. In an impulse buying, if an individual receives the product/benefit and pays for the product after three days, seven days, or fourteen days, then the enjoyment derived from the benefit would be reduced at the time of payment, thus resulting in less satisfaction with the payment. The reason for less satisfaction with the transaction would be the disassociation of the cost incurred with the benefits received. Study two demonstrates that with time, there is a decline in the benefits prominence, causing lower transaction satisfaction at the payment time. This is in line with the previous studies, which have depicted that instead of disseminating the positive and negative events over time, the individuals prefer to combine them on the same day (Linville and Fischer, 1991). As per the results, the difference was significant between T0 and T1, T2 and T3, T3, and T1, T0 and T3, T0 and T2. The results were not significant for the difference between T1 and T2 Strack & Deutsch (2006).

Also, the present study adds to the findings by indicating that in the case of the requirement of sequential delay between consumption and payment, individuals experience more transaction contentment at the payment time after a shorter delay in comparison to the longer one. Some remarkable findings appear after the careful examination of differences in three delay conditions (three-day, one-week, and two-weeks). When transaction satisfaction is considered as an outcome, it is found that a longer gap in the transaction benefit and cost results in less satisfaction. The temporal delay experience might be changed by making use of other payment mechanisms like debit cards, where the payment is considered instantaneously getting out of one's account. Soman (2001a) found that the evaluation of payment is affected by whether there is immediate wealth depletion or a deferred reduction (as in the case of credit cards). The payment mode also affects one’s tendency to buy an additional discretionary item in the future Díaz et al. (2017).

Spiteri Cornish (2020) found that future impulse buying is reinforced or curtailed by post-purchase experience rather than by purchase experience. Where a product/service is established to have less use or fails to provide expected benefits, it results in a negative post-purchase experience and leads to curtailment of future impulse buying and vice-versa Xu et al. (2020).

The outcomes of the study can be generalized as the characteristics depicted by the sample resemble the profiles of online shoppers. (Sethi and Sethi, 2017).

The results of the study can be made applicable for developing a model of prediction of customer behavior. If the consumer has purchased something impulsively online and has paid in advance while the product is reaching him/her immediately, after three days, after seven days, and after fourteen days, when he faces dissonance, the dissonance will decrease over time. (Payment depreciation).

If the consumer has purchased something impulsively online and has not paid for it, and is following the principle of buy now and pay later, and the product is reaching him/her immediately, after three days, after seven days, and after fourteen days, when he faces dissonance, the dissonance will increase over time. As the customer comes near to the day of payment, the dissonance keeps on rising.

Implications

Retailers, if given a chance, would love to forecast or impact the felt dissonance in online impulse buying. Higher levels of impulsive buying are related to progressively unfavorable financial results for consumers (Mark Fenton-O'Creevy, 2018). However, a loss for one is a gain for another. This study has many practical implications. The moderating role of time-lapse between the cost incurred and benefits received in online impulse buying influencing dissonance has been recognized in this research. The two hypotheses H1 and H2 revealed that when cost precedes benefits, in an online impulse buying scenario, with time, the dissonance keeps on decreasing. Whereas "buy now, pay later" established the increase in dissonance with time in the same situation.

The present study intended to comprehend the dissonance associated with online impulse buying.

The findings of study one suggested that with time, the dissonance associated with the emotional aspect, the wisdom of purchase, and concern over deals declines steadily, whereas study two established an increase in dissonance with time. Impulse buying has a considerable share of the total volume of goods sold every year. Further, Eder (2002) and Iyer et al. (2020) examined the impact of sales of impulse items on planned purchases and found that the rise in sales of impulse items does not affect planned purchases.

The dynamic nature of consumer behavior makes it a tedious task for managers to predict it accurately. The manager should aim at reducing the dissonance felt by consumers. Managers should be quick to identify the consumer identity to ensure whether he/she is a Squanderer who indulges in impulse buying and, after that, does not utilize the more significant part of what has been purchased. It is theirs, persistent, passionate buying, quick dissonance of things purchased, and careless disposal, which make the difference. Kartik et al. (2016)

There are two principles associated with the dissonance theory. First, the dissonance is uncomfortable, and thus a consumer tries to reduce it. Second, consumers experiencing dissonance would avoid situations that can create more dissonance. . Ultimately in both the scenarios that we have established in study one and study two, the manager aims at reducing the dissonance. The results from study one and study two depict the satisfaction level of customers in events of payment at a different period. A longer delay between the transaction costs and benefits leads to more satisfaction in study one. A longer delay between the transaction benefit and downstream transaction cost leads to less satisfaction in study two.

The findings of the paper have necessary implications for not only the managers but also for customers and service providers. With the outbreak of information technology, there is an exponential hike in online sales and the number of customers accepting the online shopping mode. In the case of online selling, sales from impulse buying have become one of the essential tools for managers to surge total sales using various promotional activities. To augment the online sales marketers use various promotional stimuli like cashback, buy one get one, free shipping, same-day delivery, free containers, extra coupons, etc. However, the managers should also consider the dissonance associated with such purchases and aim to reduce it to the minimum level. To reduce the dissonance, the factors responsible for it, like the timing of payment and mode of payment, should be strategically designed and implemented. To favorably influence impulse buying, advertising, distribution, and promotion should be tactfully used. Sales promotional strategies like instant rewards have noteworthy effects on reminder impulse buying (Shu-Ling Liao, 2009). It has been established earlier that if any service provider is compensated in advance for a task to be performed later, the service provider may be less satisfied at the time of completion of service because of the psychological benefit depreciation over time. This may have implications regarding the quality of service being performed Huang & Kuo (2012).

Future Research and Limitations

Although the conclusions of this research are informative and exciting, several limitations persist. The findings of this study were restricted to questionnaire surveys only, experiments conducted in the laboratory may be invited to generalize these conclusions. The scales in consideration were not developed, keeping Indian students in mind, as the items were amended and included from previous literature. There might be differences in actual outcomes if the scale was established specifically for Indian students as there is a stark difference between Asian and Western cultures. The second limitation is that it was a scenario-based study where they were recording their dissonance at different time intervals; there may be differences in results if they were paying for the product and receiving the product. The present study aimed at analyzing scenarios for recording the intentions of the respondents, but intentions may or may not predict their actual purchase behaviors (Hassan et al., 2016). The payments made were fictive and so was the delivery of products. The actual dissonance may not work similarly and be impacted if one pays for the products from his/her pocket.

Conclusion

Research can be directed to identify customers with high impulsivity and low impulsivity. It can be directed at segregating the products or services in which the sunk cost effect depreciates faster from the ones in which it depreciates at a slower pace. This segregation can help in proper targeting and offering the right kinds of promotions to provoke them to stimulate online sales.

A significant limitation of this research is its sample size. Massive efforts were made to contact as well as retain a large number of samples; a large number of respondents dropped out in the following stages. A larger sample size in stages may convey a changed interaction of factors and affect the outcomes.

Acknowledgement

Disclosure Statement: No potential conflict of interest.

References

Aruna, S., & Santhi, P. (2015). Impulse purchase behavior among generation-Y. The IUP Journal of Marketing Management, 14(1).

Bellini, S., Cardinali, M.G., & Grandi, B. (2017). A structural equation model of impulse buying behaviour in grocery retailing. Journal of Retailing and Consumer Services, 36, 164-171.

Indexed at, Google Scholar, Cross Ref

Díaz, A., Gómez, M., & Molina, A. (2017). A comparison of online and offline consumer behaviour: An empirical study on a cinema shopping context. Journal of Retailing and Consumer services, 38, 44-50.

Indexed at, Google Scholar, Cross Ref

Fenton‐O'Creevy, M., Dibb, S., & Furnham, A. (2018). Antecedents and consequences of chronic impulsive buying: Can impulsive buying be understood as dysfunctional self‐regulation?. Psychology & Marketing, 35(3), 175-188.

Indexed at, Google Scholar, Cross Ref

Huang, Y.F., & Kuo, F.Y. (2012). How impulsivity affects consumer decision-making in e-commerce. Electronic Commerce Research and Applications, 11(6), 582-590.

Indexed at, Google Scholar, Cross Ref

Iyer, G.R., Blut, M., Xiao, S.H., & Grewal, D. (2020). Impulse buying: a meta-analytic review. Journal of the academy of marketing science, 48(3), 384-404.

Kartik, D., Willis, R., & Jones, C. (2016). Consumer identity and marketing implications: I ndian urban youth. International Journal of Consumer Studies, 40(4), 435-443.

Kline, R.B. (2015). Principles and practice of structural equation modeling. Guilford publications.

Lamis, S.F., Handayani, P.W., & Fitriani, W.R. (2022). Impulse buying during flash sales in the online marketplace. Cogent Business & Management, 9(1), 2068402.

Lissitsa, S., & Kol, O. (2016). Generation X vs. Generation Y–A decade of online shopping. Journal of retailing and consumer services, 31, 304-312.

Indexed at, Google Scholar, Cross Ref

Melis, K., Campo, K., Breugelmans, E., & Lamey, L. (2015). The impact of the multi-channel retail mix on online store choice: does online experience matter?. Journal of Retailing, 91(2), 272-288.

Indexed at, Google Scholar, Cross Ref

Powers, T.L., & Jack, E.P. (2013). The influence of cognitive dissonance on retail product returns. Psychology & marketing, 30(8), 724-735.

Indexed at, Google Scholar, Cross Ref

Soman, D. (2001). Effects of payment mechanism on spending behavior: The role of rehearsal and immediacy of payments. Journal of Consumer Research, 27(4), 460-474.

Indexed at, Google Scholar, Cross Ref

Spiteri Cornish, L. (2020). Why did I buy this? Consumers' post‐impulse‐consumption experience and its impact on the propensity for future impulse buying behaviour. Journal of Consumer Behaviour, 19(1), 36-46.

Indexed at, Google Scholar, Cross Ref

Statista. (2019). Retail e-commerce sales worldwide from 2014 to 2021 (in billion US dollars).

Strack, F., & Deutsch, R. (2006). Reflective and impulsive determinants of consumer behavior. Journal of Consumer Psychology, 16(3), 205-216.

Indexed at, Google Scholar, Cross Ref

Sweeney, J.C., Hausknecht, D., & Soutar, G.N. (2000). Cognitive dissonance after purchase: A multidimensional scale. Psychology & Marketing, 17(5), 369-385.

Indexed at, Google Scholar, Cross Ref

Turkyilmaz, C.A., Erdem, S., & Uslu, A. (2015). The effects of personality traits and website quality on online impulse buying. Procedia-Social and Behavioral Sciences, 175, 98-105.

Indexed at, Google Scholar, Cross Ref

Tuttle, B. (2014). The big reason to beware Twitter and Facebook’s ‘buy’buttons. Time Newsletters.

Wanninayake, W.B., & Chovancová, M. (2012). Exploring the Impact of Consumer Impulsiveness on Cognitive Dissonance: An Empirical Study. of the University of Pardubice Faculty of Economics and Administration, 160.

Xiang, L., Zheng, X., Lee, M.K., & Zhao, D. (2016). Exploring consumers’ impulse buying behavior on social commerce platform: The role of parasocial interaction. International journal of information management, 36(3), 333-347.

Indexed at, Google Scholar, Cross Ref

Xu, H., Zhang, K.Z., & Zhao, S.J. (2020). A dual systems model of online impulse buying. Industrial Management & Data Systems, 120(5), 845-861.

Indexed at, Google Scholar, Cross Ref

Zhao, Z., Du, X., Liang, F., & Zhu, X. (2019). Effect of product type and time pressure on consumers’ online impulse buying intention. Journal of Contemporary Marketing Science.

Indexed at, Google Scholar, Cross Ref

Received: 26-Jun-2022, Manuscript No. AMSJ-22-12257; Editor assigned: 28-Jun-2022, PreQC No. AMSJ-22-122578(PQ); Reviewed: 19-Jul-2022, QC No. AMSJ-22-12257; Revised: 25-Aug-2022, Manuscript No. AMSJ-22-12257(R); Published: 02-Sep-2022