Review Article: 2021 Vol: 27 Issue: 5S

Method for Assessing the Financial Sustainability of Industrial Enterprises

Mamatkulova Nadira Makkamovna, Tashkent Institute of Architecture and Civil Engineering

Abstract

In the article have been discussed the theoretical aspects of the financial sustainability of enterprises and systematizes the assessment of financial sustainability based on the specifics of industrial enterprises. In addition, was assessed and analyzed financial sustainability of industrial enterprises. Based on the results of the analysis, were proposed scientific recommendations and practical recommendations aimed at improving the financial sustainability of industrial enterprises.

Keywords:

Stability, Financial Stability, Financial Condition, Financial Ratios, Solvency, Financial Resource

Introduction

The financial stability of enterprises largely depends on how and how much money is at the disposal of the enterprise and in what direction they are invested. The capital used is divided into equity and borrowed funds, depending on the location of the line.

The company's own funds are explained by the need for self-financing and are the basis of the company's independence. However, it should be noted that financing an enterprise from its own funds is not always profitable, and this is mainly reflected in the production of a seasonal nature. At the same time, sometimes a large amount of money accumulates in bank accounts, and in other cases it is impossible to find funds.

It should also be noted that with a low cost of financial resources, an enterprise can achieve a higher result than investments in terms of paying for credit resources, and raising borrowed funds can lead to an increase in the profitability of its own funds. At the same time, if the funds of the enterprise are formed mainly due to short-term liabilities, then the financial condition of the enterprise will be unstable. That is, the use of short-term investments requires constant operational work aimed at preventing long-term turnover and monitoring its timely return.

Consequently, the financial condition of the enterprise is directly related to the optimal ratio of its own and borrowed funds. The correct formulation of the financial strategy will help to improve the efficiency of enterprises.

Thus, financial stability directly depends on the sources of financing for the enterprise.

In this regard, it should be noted that the financial stability of enterprises, which are an essential component of the economic system, is important for achieving sustainable economic growth in the country. This is due to the fact that financial stability and its achievement serve as a guarantee of the efficiency of business entities and the basis of their strong positions. In this regard, financial stability is one of the most important economic issues in determining the financial capabilities of an enterprise in the medium and long term.

It is important to study the limits of methods for assessing financial stability at an enterprise and the most effective use of their entire system, the algorithm of indicators and their interpretation, their criteria, taking into account the characteristics of property and the industry.

Analyzing the existing views on the financial stability of enterprises and from the point of view of the indicators characterizing it, two approaches can be distinguished.

The first approach appeared in the countries of the former Soviet Union, in which the solvency of the enterprise and its self-sufficiency in working capital are studied as a key criterion for financial stability. However, these indicators do not fully describe the financial condition of the enterprise, since it is calculated in the balance sheet at a certain date - the beginning and end of the period, and therefore may experience significant changes during this time. This opinion of economists from the CIS countries about financial stability, in our opinion, is considered correct. For a long time, enterprises built in the post-Soviet period operated in stable conditions, officially established by the state, and ultimately they did not face bankruptcy.

The second approach was developed in Western economic practice, in which the financial independence of an enterprise in relation to the ratio of borrowed and own funds (from creditors) was the main criterion for its financial stability. This opinion is also one-sided, since it does not fully take into account the financial condition of the enterprise and the prospects for its development. The current practice of managing industrial enterprises in Uzbekistan shows that even without assets in the debt structure, i.e., with positive indicators of financial stability, you can get into a difficult financial situation.

When analyzing the financial condition of enterprises, the economist, professor E.A. Akramov recommended the concept of financial stability and its indicators and substantiated the factors influencing it. He also notes that the category of financial stability is an indicator that the financial condition of the enterprise remains at the required level and does not decrease.

Professor T.S. According to Malikov (2019), the financial stability of economic entities depends on general (autonomy ratio, debt concentration ratio, debt and equity capital ratio) and relative indicators (reserve and expenditure capital ratio, financial independence ratio, equity ratio;).

From the above, we can conclude that all the variety of indicators describing the expected financial stability, various algorithms, criteria for their calculation, a unified methodology for analyzing the financial stability of an enterprise has not yet been developed.

Economists Pardaev & Isroilov, (1999) express the financial stability of the enterprise as its own funds and the ratio of all funds, and the indicators of financial stability are divided into the following groups:

• Indicators related to equity (private capital)

• Indicators on borrowed funds (capital)

• Working capital indicators

• Fixed assets indicators

• Working capital indicators

AMAjluni (2016) divides all the coefficients of financial stability into a group of indicators that determine the state of turnover and fixed assets.

Other authors do not classify financial strength ratios in general terms. In particular, Romanchin & Skoblyakova, (2017) indicators of capital structure for financial stability; indicators of turnover and condition of fixed capital; those who believe that interest on loans characterizes the solvency and the reserve of financial stability.

In this regard, D. Bell also proposes to calculate the coefficient of self-financing (Bell, 2016). ID Mandel considers his factor model, which includes indicators of sustainable growth and liquidity, financial independence, self-sufficiency, turnover and profitability (Mandel, 2012).

T.P. Carlin to assess the financial sustainability of changes in the composition of capital, its location and sources of formation; efficiency and intensity of capital use; solvency and creditworthiness; uses a system of descriptive indicators of the financial stability reserve (Karlin, 2014).

According to Stoyanov (2013), the most important coefficients of "financial stability" are liquidity, active entrepreneurship, efficient use of resources, capital structure and operational analysis. In our opinion, E.S. Stoyanova, proposing the coefficients of "financial stability", ignored the indicators of the provision of enterprises with reserves and the sources of their formation.

Dontsova & Nikiforov, (2014) offer a system of indicators and their rating in points, ie, an integral point of financial stability.

It is advisable to scientifically substantiate and calculate the indicators characterizing the financial stability of enterprises, to pay attention to the specifics of the enterprise, ie in which industry it operates and specializes (Hedderwick, 2016).

From the above interpretations, we can conclude that for the scientific substantiation of financial stability and the classification of its indicators, an approach is required based mainly on the specific characteristics and specialization of the object under study (industry and sector).

As a result of the study, based on the study of scientific literature, a system of indicators of financial stability was formed on the example of enterprises in the building materials industry. Distinctive features of the enterprises of this network are:

• High capacity of the enterprise fund;

• The need for large investments;

• That prices are monopoly in nature;

• High transport costs;

• The main market is focused on meeting domestic demand;

• Location of the production complex on the territory of the raw material base;

• Complexity of technological processes;

• Due to the high demand for labor, etc., in our opinion, it is advisable to divide financial stability into absolute and relative indicators (financial ratios).

In particular, the system of absolute indicators of financial stability should be interpreted as a whole as an excess or shortage of sources of funds that form reserves and costs that arise in the form of the difference between the volume of reserves and expenses.

In this case, reserves and expenses are provided from such sources as working capital, long-term and short-term loans and borrowings, accounts payable as part of suppliers' debt.

To explain the sources of formation of stocks and costs, the following indicators are used:

1. Availability of own circulating assets. In determining this, long-term and short-term liabilities are deducted from equity working capital, and this is expressed by the following formula:

UzAM=UzAM – UMM – QMM (1)

here:

UzAM – own working capital available;

UMM – long term duties;

QMM – Short-term liabilities.

2. Availability of sources of own circulating assets and long-term liabilities. When calculating it, long-term liabilities are added to its working capital, and it is expressed by the following formula:

UzU=UzAM + UMM (2)

here:

UzU – own working capital and long-term liabilities;

UMM – long term duties.

3. The final indicator is determined by adding its working capital and long-term liabilities to short-term liabilities and can be expressed by the following formula:

UK=UzU + QMM (3)

here:

UK - the general indicator of the main sources of reserves and the formation of costs;

UzU – own working capital and long-term obligations;

QMM - Short-term liabilities.

The above indicators of the availability of sources of formation of reserves can be expressed by three indicators of the availability of reserves that form them. They are as follows:

1. Excess own working capital (+) or lack (–) (ShUzam):

ShUzam=UzAM – Z (4)

2. Excess own working capital and sources of long-term liabilities (+) or lack (–) (Sho’u):

ShUzu=UzU – Z (5)

3. The main sources of the formation of reserves and costs are general surpluses. (+) or lack (–) index (Shuk):

Shuk=UK – Z (6)

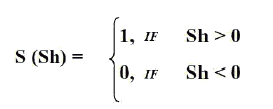

With the help of these indicators, the three-component form of the financial stability of the enterprise is determined.

In our opinion, there are four forms of financial stability for analyzing the financial condition of enterprises. Including:

The first is absolute financial stability (S={1,1,1}). This form of financial stability explains that all the company's reserves are covered by its own working capital, that is, the company does not obey external creditors due to insolvency and the absence of reasons for its occurrence, violation of internal and external financial control. This condition is very rare. In addition, the company's management does not know whether it does not want or is unable to use external funds to carry out its core business.

The second is regulatory financial sustainability (S={0,1,1}). In this case, the company uses long-term funds in addition to its own working capital to cover reserves. The form of financing such reserves is “normative” from the point of view of financial management. Regulatory financial stability is most acceptable for a business. Standard sources of coverage to cover inventory in such conditions (SQM) is used and represented by the following formula: SQM=UzAM+Z + settlement with creditors for goods.

The third is the unstable financial situation (S={0,0,1}). This is explained by a violation of solvency, in which it remains possible to restore the balance by replenishing its sources of funds, reducing accounts receivable, accelerating the turnover of reserves. There is a violation of financial control, untimely receipt of funds to accounts and interruptions in receipt, instability of profitability, failure to fulfill financial plans and other similar cases.

Fourth, the financial situation during the crisis (S={0,0,0}). At the same time, the company is on the verge of bankruptcy, that is, cash, short-term securities and accounts receivable by themselves cannot cover accounts payable and overdue loans.

We will try to summarize the above expressions in Table-1.

| Table 1 General Indicators Of Forms Of Financial Sustainability |

||||

|---|---|---|---|---|

| Indicators | Forms of financial stability | |||

| Absolute stability | Regulatory stability | Unstable financial situation | Financial situation in crisis | |

| ±ShUzam = UzAM – Z | Shuzam= 0 | Shuzam< 0 | Shuzam< 0 | Shuzam< 0 |

| ±Shuzu = UzU – Z | Shuzu = 0 | Shuzu = 0 | Shuzu < 0 | Shuzu < 0 |

| Shuk = UK – Z | Shuk = 0 | Shuk = 0 | Shuk = 0 | Shuk < 0 |

When assessing the financial stability of an enterprise in a market economy, it is required to use both absolute indicators and relative indicators, that is, financial ratios.

We noted above that in the studies of many economists, financial ratios were determined and used in the analysis process. It is known that the system of various coefficients is widely used in assessing the financial stability of enterprises. In this regard, we will limit ourselves to analyzing the most common financial ratios in scientific research, the most important of which are listed below:

1. Ratio of absolute and current liquidity.

2. Coefficient of concentration of own funds.

3. The ratio of financial dependence.4. Coefficient of mobility of own funds.

4. Coefficient of mobility of own funds.

5. Ratio of the composition of long-term investments.

6. The coefficient of use of long-term borrowings.

7. The ratio of debt to equity.

8. Coefficient of self-sufficiency of reserves.

9. Stable funding ratio.

10. Index of fixed assets.

11. Depreciation rate.

12. Ratio of the real value of the property.

13. Ratio of accounts receivable turnover.

14. Coefficient of accounts payable turnover.

15. Ratio of balance sheet profit.

16. Ratio of profitability of operating profit.

17. Coefficient of profitability of net profit.

In addition to the above basic financial soundness ratios, there are many similar ratios that justify various aspects of the state of assets and liabilities of industrial enterprises. In this regard, difficulties arise in assessing financial stability and its provision. In addition, there are no uniform regulatory criteria for the indicators under consideration. Their normative levels depend on many factors, namely on the sectoral characteristics of industrial enterprises, lending conditions, the composition of the funds being formed, and the turnover of working capital.

Consequently, the assessment of the acceptability of the level of coefficients, its dynamics and variability should be carried out only on the basis of a specific industrial enterprise, including its specialization and type of activity. Also, in some cases, it is possible to conduct a comparative analysis of the activities of the same specialized enterprises. It should be noted that some ratios provide repeated data on financial stability and its maintenance, and there are aspects of their interdependence.

References

- Decree of the liresident of the reliublic of Uzbekistan dated. (2017). No. liF-4947 "On the strategy of actions for the further develoliment of the reliublic of Uzbekistan".

- Akramov, E.A. (2017). Analysis of the financial condition of enterlirises. T: Finance, 64-85.

- Malikov, T.S. (2019). Finance: Business finance. Leadershili FQU / i.f.d., lirof. AVERAGE. Edited by Vakhobov.. –Т: IQTISOD-MOLIYA, 254-257.

- liardaev, M.K., &amli; Isroilov, B.I. (1999). Financial analysis: (Album of methodical exhibitions and recommendations). T: World of Economics and Law, 197.

- Ajluni, A.M. (2016). Develoliment strategy for the industrial develoliment of Russia in the XXI century. Eagle: ORAGS, 125.

- Romanchin, V.I., Skoblyakova, I.V., &amli; Smirnov, V.T. (2017). Venture caliital in crisis management strategy. Monogralih. Orel: OrelGTU, 230.

- Bell, D. (2016). The coming liost-industrial society. M : Academia, 788.

- Mandel, I.D. (2012). Multivariate statistical analysis of economic lirocesses. Slib : lieter, 318.

- Karlin, T.li. (2014). Quality of life and comlietitiveness of Russian enterlirises, Materials of the scientific-liractical conference. - Oryol : Oryol GTU, 103.

- Stoyanova, E.S. (2013). Financial management: Theory and liractice, 656.

- Dontsova, L.V., &amli; Nikiforova, N.A. (2014). Annual and quarterly financial statements. M: Delo i Service, 262.

- Hedderwick, K. (2016). Financial and economic analysis of enterlirises. International Labor Organization

- Berdimuratova, A.K., &amli; Mukhammadiyarova, A.J. (2020). lihilosolihical and methodological asliects of the interaction of natural environment and man. International Journal of liharmaceutical Research.

- liirnazarov, N. (2020). lihilosolihical analysis of the issue of sliirituality. International Journal of Advanced Science and Technology, 29(5).

- liirnazarov, N.R.Ul. (2020). Influence of virtual reality on the sliirituality of information society. Eurasian Union Scientists.

- Zaretdinovna, Z.N. (2021). Issues of orientation to the lirofession» (based on the teachings of Eastern thinkers). lisychology and Education Journal.

- liirnazarov, N., Eshniyazov, R., Bezzubko, B., Alimov, A., Arziev, A., &amli; Turdibaev, A., (2021). Bachelor degree lirograms in building materials technology, Euroliean Journal of Molecular &amli; Clinical Medicine,7(10),1780-1789.

- Nurnazar, li. (2020). Scientific and lihilosolihical Analysis of the Concelit of «Sliirituality»,

- liirnazarov, N., Utebaev, M. (2016). Methods and forms of greetings. Scientific enquiry in the contemliorary world: theoretical basiсs and innovative aliliroach.

- Alimbetov, Yu., &amli; liirnazarov, N. (2020). Culture: Tradition and novation, East Euroliean Scientific Journal, 54,2,38-41.

- liirnazarov, N. (2021). Structural model of sliirituality as a lihilosolihical lihenomenon. 88(2),10-17.