Research Article: 2025 Vol: 29 Issue: 2

Mergers and Acquisitions in the Banking Sector: A Bibliometric Analysis (1991 To 2023)

Santosh Kumar, Sage University

Bipin Chauhan, Galgotias University

Raghvendra, Mahatma Jyotiba Phule Rohilkhand University

Rashi Saxena, Department of Management Studies, HBTU, Kanpur

Smita Dron, Department of Management Studies, HBTU, Kanpur

Sanny Kumar, Mahatma Gandhi Central University

Citation Information: Kumar, S., Chauhan, B., Raghvendra, Saxena, R., Dron, S., & Kumar, S. (2025). Mergers and Acquisitions in the Banking Sector: A Bibliometric Analysis (1991 To 2023). Academy of Marketing Studies Journal, 29(2), 1-21.

Abstract

Mergers and acquisitions (M&A) continue to be a widely used strategy for organisational growth in order to secure future competitiveness. Mergers and acquisitions (M&As) are significant methods that corporations use to implement their domestic and worldwide plans. M&A research has gathered a considerable amount of knowledge as a significant area of study. Nevertheless, despite the substantial amount of study conducted in recent years, there are noticeable disparities between the comprehension of the M&A phenomena in academic literature and the practical significance of M&A activities. The presence of diverse viewpoints from many schools of thought, conflicting study outcomes, and ongoing debates, together with the dynamic nature of economic conditions, contribute to the intricate nature of M&A research. This underscores the importance of adopting comprehensive and all-encompassing techniques. This study performs a comprehensive bibliometric analysis utilising published data from the Elsevier Scopus database to examine the development and pattern of mergers and acquisitions in the banking sector. The search query "TITLE-ABS-KEY"(Merger*, OR Acquisition*, AND Bank*) was employed to find pertinent papers on merger and acquisition in the banking industry. We conducted a comprehensive analysis of selected 276 articles based on a minimum citation threshold of 10 and published during a span of 23 years, from 1991 to 2023. The purpose of the study was to examine publishing patterns and determine key contributors, prolific authors, influential institutions, leading countries, the temporal evolution of publications, citation trends, and the dissemination of research across different sources. The analysis offers a comprehensive view of the discipline, highlighting the works that have had the most significant influence, the intellectual linkages between authors and works, the primary research traditions, and the issues explored in M&A-related study. Through structural and longitudinal investigations, the alterations in the conceptual framework of the field are unveiled as time progresses. It can be concluded that strategic choices like M&As always prioritise the imperative of achieving sustainable expansion in order to secure future competitiveness in the contemporary era. The continuous and proactive extension of a firm's own development limitations through mergers and acquisitions is a crucial strategy for effectively and efficiently meeting the consequent obligations. The appeal of M&A in this setting lies in its capacity to effectively address the strategic issues of a rapidly changing environment. Given the growing level of economic and financial integration, mergers and acquisitions in the banking sector has been evolved at a broader scale.

Keywords

Mergers, Acquisitions, Bank, Citation, Network Map, Bibliometric Study, Review, Banking, Merger & Acquisition, Banking Sector, M&As, Analysis Etc.

Introduction

The financial services sector has witnessed a substantial reduction in global barriers to competition as a result of worldwide deregulation, progress in information processing, telecommunications, and financial technology. This has facilitated the amalgamation of geographically remote financial enterprises and heightened the need for institutions that can offer financial services across international borders. Nevertheless, the banking industry still lacks complete global integration, as cross-border mergers and acquisitions (M&As) are unusual. The increase in mergers and acquisitions is fundamentally reshaping the business landscape in many nations, encompassing both traditional and innovative businesses. The influence of mergers and acquisitions (M&As) on pricing strategy is not only dependent on market power and effectiveness, but also impacts the merging companies' capacity and incentive to tackle informational concerns.

The recent upswing in economic integration among nations has resulted in a swift rise in the need for global financial services, prompting the implementation of deregulatory laws to improve the effectiveness of domestic financial institutions and facilitate foreign banks' entry into domestic markets. Three prominent trends have been observed in the global banking industry: the privatisation of publicly-owned banks, mergers and acquisitions within and across borders, and the international expansion of financial services providers.

Mergers and acquisitions (M&A) are significant activities that have a profound impact on the market. Since the mid-1960s, when the concentration process reached a new peak and the trading of enterprises became active, numerous research have been conducted on mergers and acquisitions (M&As). Economists, social scientists, managers, and business consultants have shown interest in the topic of shifting firm ownership. In recent years, research has moved its focus from forecasting the performance of mergers and acquisitions before they happen to studying the phenomena that occur after the mergers and acquisitions take place. Organisations prioritise mergers and acquisitions as a strategic approach to get a competitive edge over their rivals.

In the current cutthroat and volatile business environment, companies strive to optimise profits and augment the value of their shareholder’s investments. Organisations have various choices at their disposal to achieve this goal, such as introducing new products and services, expanding their operations, and prioritising cost reduction.

Internal growth can be attained through the introduction of novel products, whereas external expansion can be obtained by engaging in mergers and acquisitions. Mergers and acquisitions have emerged as a crucial means to expand and acquire resources that would empower the organisation to compete on a global level. Nevertheless, there have been cases where mergers and acquisitions (M&As) have been undertaken for motives that do not maximise value, as evidenced by studies conducted.

Highlights that several theories of merger motives emphasise the predominant involvement of large corporations in this domain. “Historically, the majority of scholars have focused on assessing mergers by analysing share prices. Multiple ideas on the consequences of mergers can be identified, including efficiency theory, monopoly theory, raider theory, empire-building theory, and valuation theory. All of these theories centred around the concept of shareholder value and the redistribution of wealth”.

The factors influencing mergers are subject to fluctuations in the legal, political, economic, and social conditions. The available literature has identified two prevalent factors, namely efficiency gain and strategic rationale. “The theories that support mergers are those based on synergy and efficiency, while the theories that oppose mergers are those based on agency cost, free cash flow conflict, and managerial motivation”. Argued that mergers and acquisitions (M&As) are intended to achieve cost efficiency by taking use of economies of scale.

“Bank mergers and acquisitions might be motivated by cost savings, revenue enhancement, risk diversification, market power, and inadequate corporate control. The impact of a merger on the acquirer’s profitability is assessed by comparing the book value measures of profitability before and after the merger”. Meeks shown that these measurements can exhibit bias. “However, the expenses associated with it can influence these advantages. The challenges associated with overseeing a larger organisation, integrating information technology, and managing cultural disputes can lead to diseconomies of mergers, resulting in a reduction of potential merger advantages”.

“Mergers and acquisitions (M&As) serve as a means of buying or selling collections of resources in resource markets that are characterised by significant imperfections, either in terms of control or knowledge”. This perspective is supported by the works. “Acquisitions improve performance by providing businesses with exclusive access to resources that are not available for purchase in a competitive market”. Consequently, mergers have the potential to generate value and increase revenues.

“Mergers and acquisitions (M&As) are critical components of the business, product, and geographic strategies of organisations”. “M&As have emerged as critical strategic instruments for multinational corporations' expansion, have a substantial influence on the performance of firms, and have long-term repercussions for the organisation”. The field of M&A research has flourished due to its relevance. As the disciplines of study evolve and mature, it is beneficial to review the accumulated knowledge, its past directions, and future challenges.

This study performs a comprehensive bibliometric analysis utilising published data from the Elsevier Scopus database to examine the development and pattern of mergers and acquisitions in the banking sector. The search query "TITLE-ABS-KEY"(Merger*, OR Acquisition*, AND Bank*) was employed to find pertinent papers on merger and acquisition in the banking industry. We conducted a comprehensive analysis of selected 276 articles based on a minimum citation threshold of 10 and published during a span of 23 years, from 1991 to 2023. The purpose of the study was to examine publishing patterns and determine key contributors, prolific authors, influential institutions, leading countries, the temporal evolution of publications, citation trends, and the dissemination of research across different sources.

Literature Review

“Bibliometric studies utilise already published research to analyse and investigate the patterns and trends of publications, hence facilitating the exploration, organisation, and comprehension of work conducted within a specific discipline or subject of study” (Ferreira, 2014). “Alternative traditional methods for conducting a literature review may not provide an accurate understanding of the current state of knowledge on the subject, even though they may involve a more thorough analysis of the substance of each published work.”

“Bibliometric studies utilise a quantitative analysis of written source documentation, such as academic articles, books, reports, theses, dissertations, and news media, as an objective method to examine a specific area or the entirety of a scholarly discipline. This approach is supported by various researchers” (Shafique, 2013).

“Bibliometric methods can be enhanced by incorporating expert’s evaluations and perceptions or meta-analyses”. “However, their primary advantage lies in their ability to eliminate subjectivity and provide quantitative and observable data. This data may or may not confirm scholars' intuitive beliefs.”

“Bibliometric research can gain insights into the organisation of scientific knowledge or a community of scholars in particular subjects or disciplines by utilising objective measurement” (Shafique, 2013).

Some of the prominent literature review related to mergers and acquisitions in banking sector are as follows:

Amel Dean et al., (2003): critically examined literature that explores the primary sectors of the financial industry (including commercial and investment banks, insurance companies, and asset management firms) in major industrialised countries over the past two decades. Their objective is to identify common trends that go beyond national and sector-specific characteristics. Our research indicates that consolidation in the banking sector is advantageous up to a certain extent, but there is less evidence to support the idea that mergers result in cost savings or improved managerial effectiveness.

Rezvanian et al., (2008): Investigated the influence of ownership on the efficiency, efficiency change, technical progress, and productivity growth of the Indian banking industry between 1998 and 2003. Evidence indicates that foreign banks exhibit superior levels of efficiency compared to privately-owned and publicly-owned banks. The report proposes that Indian officials should advocate for private ownership, ease the admission of international banks, and promote mergers and acquisitions to improve efficiency and competitiveness in the global market.

Kalra et al., (2013): Examined the post-merger performance of Indian banks, specifically analysing factors such as profitability, liquidity, shareholders' wealth, and share price volatility. By employing a paired sample t-test and event study methodology, it is found that there is no statistically significant effect on financial performance. Nevertheless, mergers result in significant improvements in earnings per share and the market value to book value ratio of equity. According to the study, the Indian stock market demonstrates efficiency over long periods of time, even though it may exhibit short-term reactivity to merger announcements.

Ferreira et al., (2014): Applied bibliometric analysis to examine the current body of literature on mergers and acquisitions (M&As) in the disciplines of international business and strategy. We conducted a methodical analysis of a sample of 334 papers that were published in sixteen prominent management/business journals over a 31-year period, from 1980 to 2010. The results provide a comprehensive perspective on the discipline, emphasising the works that have had the most significant impact, the intellectual connections between authors and works, the primary research traditions, and the themes that are investigated in M&A research. The cognitive structure of the discipline is analysed using structural and longitudinal analysis to identify changes over time.

Huang et al., (2014): Analysed the impact of directors with investment banking expertise on the acquisition strategies of corporations. Our analysis reveals that companies with investment bankers serving on their board of directors have a greater likelihood of engaging in acquisition activities. In addition, companies that have investment banker directors experience higher returns when they announce acquisitions, pay lower prices for the companies they acquire, and spend less in fees for advisory services. These companies also perform better in the long term. In summary, our findings indicate that directors with investment banking expertise contribute to improved acquisition outcomes for organisations. They are effective in selecting appropriate targets and minimising the expenses associated with the agreements.

Reddy (2015): Analysed current state of the case study research in the literature on mergers and acquisitions (M&A). Among the 93 papers that were reviewed, 66 specifically addressed either established or emergent markets. 27 studies focused on developed markets, 39 studies focused on emerging markets, and 44 studies utilised a single case study methodology. 46 research included several case studies, whereas three studies utilised survey and interview approaches. The study was conducted from 1991 to 2015. Only a limited number of research have effectively examined established hypotheses and formulated novel ones. The paper examines the methodological concepts necessary for establishing a strong research environment in qualitative case study methodologies.

Gulamhussen et al., (2016): Employed a gravity model to examine the determinants of mergers and acquisitions between commercial banks in 89 acquiring nations and 118 target countries during a span of 30 years (1981-2010). The findings indicate a direct relationship between the size of the acquiring nation and the value of cross-border mergers and acquisitions (M&As). Additionally, the level of financial market advancement and the existence of clients in the target country have a beneficial impact on M&As.

Bindal (2018): Proposed that banks alter their merger and acquisition activities when they reach regulatory size thresholds, which in turn affects lending to small businesses. A newly developed research methodology quantifies indirect effects on banks just below specific thresholds. The results demonstrate the impact of indirect treatment on merger behaviour and lending practices towards small enterprises, emphasising the significance of indirect treatment effects in difference-in-differences investigations.

Eulerich et al., (2022): Made a comprehensive analysis of M&A research by examining the connections between important documents, authors, institutions, and countries. It also tracks the development of M&A research over time and proposes areas for future research to enhance the scope of M&A scholarship. To achieve this, a sample of 580 articles from 9 prominent management science journals was analysed using bibliometric methods. The analysis included 42,630 citations and 18,734 unique references spanning the years 1963–2019.

Cumming et al., (2023): “provides an examination of the publication patterns and primary themes in research pertaining to mergers and acquisitions in the fields of finance and accounting. Major research themes in the finance area include takeovers as governance mechanisms, drivers of mergers, bank mergers, cross-border mergers, shareholder wealth effects of mergers, and the role of financial experts and ownership structure. In the accounting area, major research themes include corporate governance and accounting outcomes, predicting takeovers and their outcomes, valuation, financial reporting and takeover decisions, and financial reporting and performance”.

Due to the rapid rate of academic publication, it is becoming more and more difficult to stay updated on all the published works. Bibliometry is a valuable tool for analysing a large amount of information, identifying trends over time, researching themes, detecting changes in disciplinary boundaries, identifying the most productive scholars and institutions, and providing an overview of existing research. This is particularly important in the face of the overwhelming volume of new information, conceptual developments, and data. These investigations have the potential to reveal what would otherwise be hidden groups of scholars, often known as "invisible colleges". “In addition, conducting a longitudinal bibliometric analysis over an extended period of time allows for a more comprehensive understanding of the most impactful books, ideas, academics, schools of thought, and issues”.

“Also, Scholars have utilised bibliometry to investigate emerging subjects, recent advancements in a particular discipline (Shafique, 2013), prominent writers, and the influence of a researcher (Ferreira et al., 2014). The significance of various journals has been analysed in bibliometric studies, such as the research conducted. Other studies, on the other hand, have chosen to concentrate on the author’s affiliations, as demonstrated. Alternatively, some studies have focused on the intellectual framework of a particular field, as exemplified.”

Methodology

This study performs a comprehensive bibliometric analysis utilising published data from the Elsevier Scopus database to examine the development and pattern of mergers and acquisitions in the banking sector. The Elsevier Scopus database is selected for its extensive coverage of top-tier scholarly literature across multiple fields. The search query "TITLE-ABS-KEY" was employed to find pertinent papers on merger and acquisition in the banking industry. The search terms used were Merger*, OR Acquisition*, AND Bank*. The search focused on items that contained these key terms in their title, abstract, or keywords.

The analysis covers the time frame from January 1, 1991 to December 31, 2023, providing a minimum duration of 23 years for a thorough longitudinal investigation. The original Scopus search produced a wide variety of materials, including articles, conference papers, reviews, and book chapters, published in many languages. Given the extensive amount of published data available, this analysis focusses exclusively on a subset of 650 published publications.

This study specifically focusses on topic areas that fall under the subject area of "Economics," "Business, management, and accounting," and "social sciences". The analysis is limited to only 6 keywords that includes, “Mergers and Acquisitions”, “Merger”, “Mergers”, “Acquisitions”, “Bank Mergers”, and “Corporate Governance”. The study encompasses mainly the articles published in the journal that have been written in the English language.

The search results also included details about the titles of the sources, types of documents, keywords, affiliations, and funding organisations. The gathered data was analysed to examine publishing patterns and determine key contributors, prolific authors, influential institutions, leading countries, the temporal evolution of publications, citation trends, and the dissemination of research across different sources.

The VOS-Viewer software has been employed for bibliometric mapping and visualisation. It enabled the examination of co-authorship to reveal collaboration networks between researchers and institutions. In addition, it facilitated the study of term co-occurrence to discover primary research themes and new subjects. Out of the total 650 papers, only 276 articles have been included in this study. These included articles were selected based on a minimum citation threshold of 10.

This analytical approach provided a comprehensive examination of the research environment, emphasising key participants, prominent publications, notable research subjects, and emerging patterns. Consequently, it yielded useful insights into the progression and present condition of research in the domains of mergers and acquisitions in the banking sector. The bibliometric indicators utilised in this study are as follows:

• Analysis of Year-wise Published Documents

• Analysis of Top 12 Journal wise published documents

• Analysis of Top 12 Source documents through Network Map

• Analysis of Top 12 Journals Having Maximum Citation

• Analysis of Network Map of Top 12 Cited Journals

• Analysis of Top 12 authors having maximum citations

• Analysis of Network Visualization of Co-authorship among top 12 authors

• Analysis of Country-wise Publication

• Analysis of top 50 cited articles

• Analysis of Network Map of Country-wise publications

• Major findings revealed from literature

Findings and Analysis

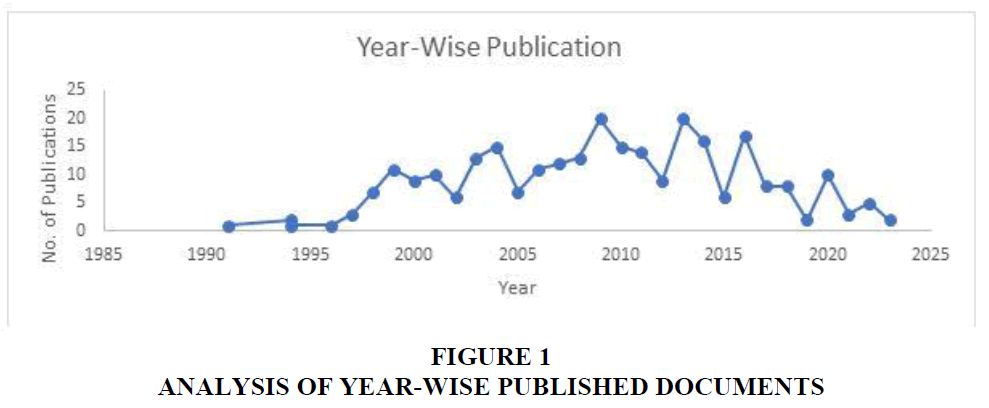

Analysis of Year-Wise Published Documents

This image displays a line graph titled "Year-Wise Publication," which illustrates the number of publications from approximately 1990 to 2025. The y-axis represents the number of publications, which ranges from 0 to 25, while the x-axis represents the years, which range from approximately 1985 to 2025 Figure 1.

Between 1990 and 2005, the number of publications first began at a low level in the early 1990s and steadily rose, seeing a significant surge from the mid-1990s to the early 2000s. From 2005 to 2010, the number of publications reached its highest point, peaking at approximately 22 publications in a single year. Following 2010, the quantity of publications exhibited notable oscillations, characterised by sharp drops in certain years and temporary revivals in others. However, the overarching pattern indicated a decline in the overall number of publications.

Between 2020 and 2025, there was a persistent low level of publications, marked by occasional small uptick but an overall decline. The graph indicates a notable increase in academic or scientific interest in the subject topic between the 1990s and 2000s, reaching its highest point around 2010. Subsequently, following the culmination of this surge, there was a conspicuous decrease and variability in the quantity of publications, with more recent years exhibiting diminished levels of activity.

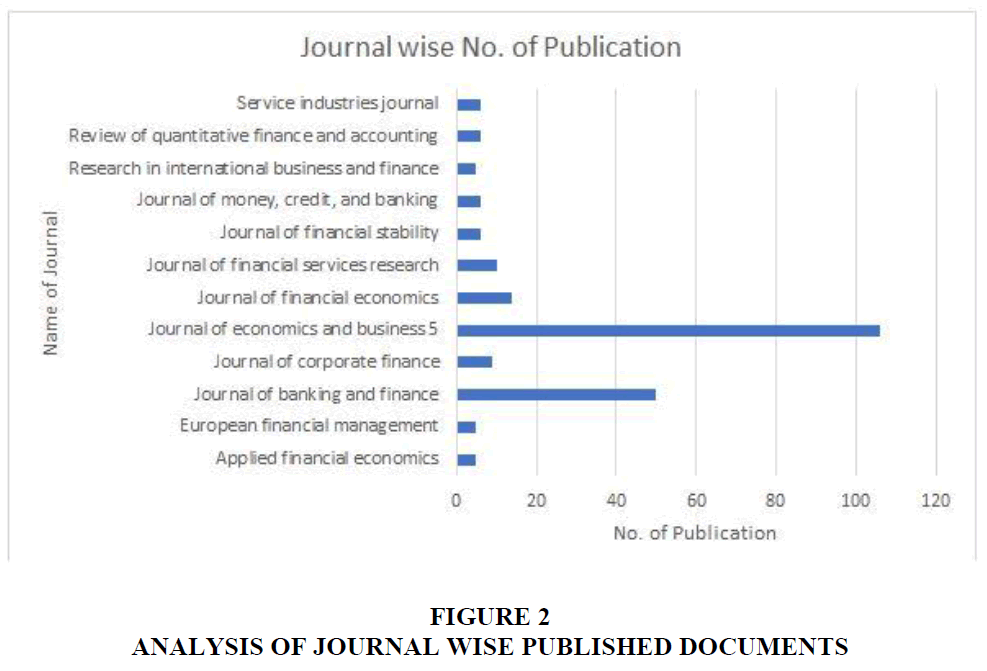

Analysis of Journal Wise Published Documents

This graph depicts a horizontal bar graph labelled "No. of Publication," illustrating the comparison of publication numbers among several academic journals. The y-axis represents the number of publications, which ranges from 0 to 120, while the x-axis represents the Name of Journal related to finance, economics, and management Figure 2.

The "Journal of Economics and Business" has the biggest number of publications, over 120, while the "Journal of Banking and Finance" has just over 60 publications. Several reputable academic journals, such as the "Journal of Corporate Finance," "Journal of Financial Economics," "Journal of Financial Services Research," and "Journal of Financial Stability," have a modest yet significant number of publications, typically ranging from around 10 to 25. The aforementioned journals, namely "Service Industries Journal," "Review of Quantitative Finance and Accounting," "Research in International Business and Finance," "Journal of Money, Credit, and Banking," "European Financial Management," and "Applied Financial Economics," have a limited number of publications, typically fewer than 10.

The data suggests that the "Journal of Economics and Business" and "Journal of Banking and Finance" are the most commonly published journals among those mentioned, with the former holding a substantial advantage. Other journals exhibit a lower number of publications in comparison, with certain journals including only a limited no. of entries. This indicates a focalisation of research efforts and publications within these two journals in the specified topic.

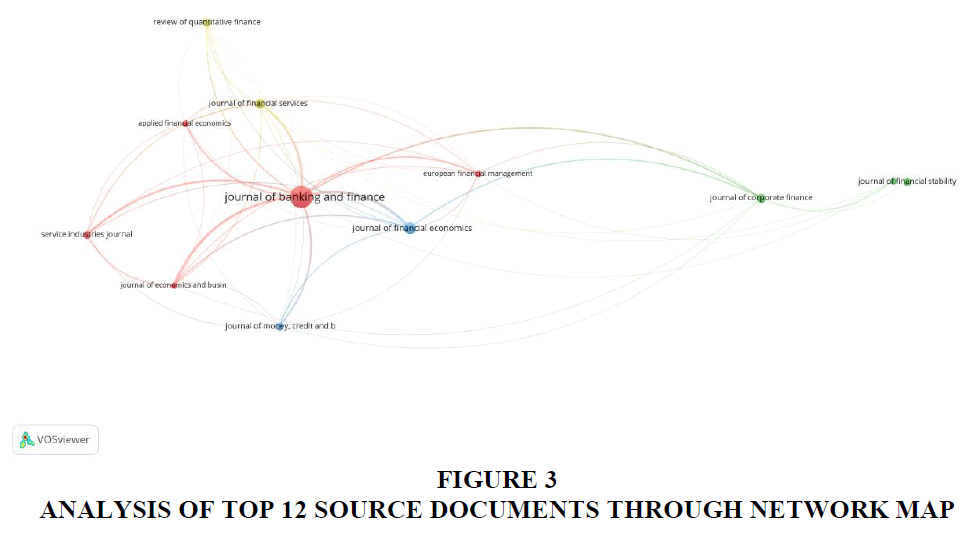

Analysis of Top 12 Source Documents through Network Map

This image is a network visualisation graph that was generated using VOS viewer. It illustrates the relationships or co-citations between various academic journals related to mergers and acquisitions in the field of finance, business management and economics Figure 3.

Network Map of Top 12 Source Documents

The "Journal of Banking and Finance" holds a central and prominent position in the network, signifying robust linkages with numerous other journals and implying that it receives high citations or co-citations. The "Journal of Financial Economics," "Journal of Economics and Business," "Journal of Corporate Finance," and "Journal of Financial Stability" are also important nodes, but they are not as central. These journals have several links, indicating that they are often cited together with other significant publications.

The graph displays distinct clusters or groupings of journals, presumably organised according to thematic or topical similarities. An example of this is the "Journal of Banking and Finance," which has connections to other journals, suggesting a wide scope of influence and study areas that overlap with other publications. Journals such as the "Service Industries Journal," "Applied Financial Economics," and "Review of Quantitative Finance" are considered peripheral, suggesting fewer associations and possibly more specialised or focused research areas.

To summarise, the network visualisation highlights the interconnections between different journals in the fields of finance and economics. The "Journal of Banking and Finance" is a prominent and influential publication in the subject, serving as a major hub. Additionally, the "Journal of Financial Economics" and "Journal of Economics and Business" also play crucial roles in integrating different research topics. The presence of distinct clusters in the journals suggests that there are thematic connections among them. On the other hand, the peripheral journals are indicative of articles that are either more specialised or less frequently cited.

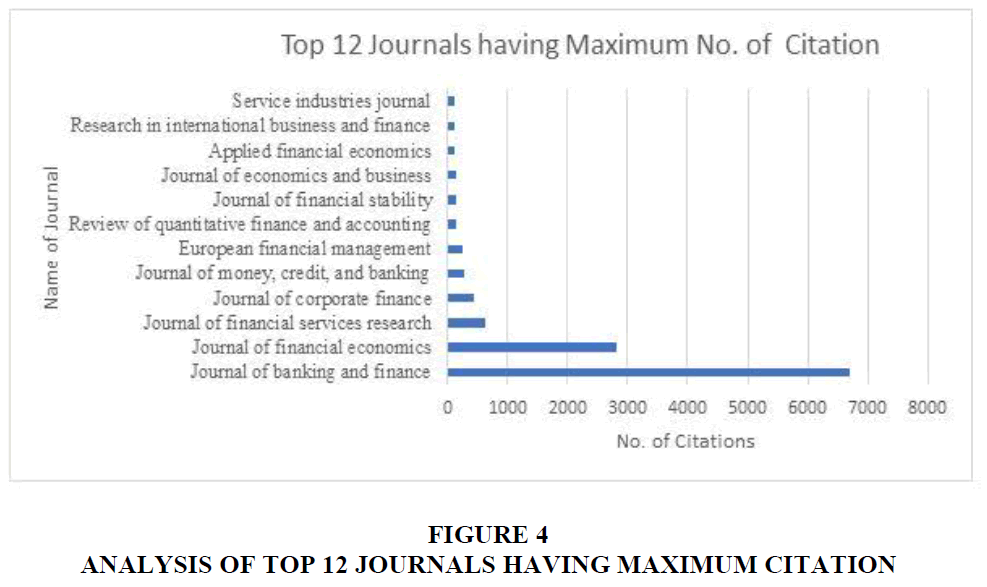

Analysis of Top 12 Journals Having Maximum Citation

The bar chart termed "Journals with the Highest Number of Citations" presents the citation counts for different publications. The y-axis represents the name of journal, while the x-axis represents the Number of citations related to journal publishing research paper on merger and acquisitions in the banking sector in the fields of finance, economics, and management Figure 4.

The "Journal of Banking and Finance" is the most prominent journal on this list, as witnessed by its 6701 citations, which demonstrate its significant influence and extensive reputation in the field of finance. The "Journal of Financial Economics" holds significant influence, as seen by its 2826 citations, ranking it as the second most referenced journal. The "Journal of Financial Services Research" has garnered 632 citations, while the "Journal of Corporate Finance" has received 442 citations, indicating a modest level of influence for both publications. The "Journal of Money, Credit, and Banking" has 267 citations, while "European Financial Management" has 254 citations. Despite having fewer citations, both journals continue to be influential in academic study. The journals mentioned, such as "Review of Quantitative Finance and Accounting," "Journal of Financial Stability," "Journal of Economics and Business," "Applied Financial Economics," "Research in International Business and Finance," and "Service Industries Journal," have fewer than 150 citations each.

This suggests that they have lower levels of influence or a more specialised focus within the academic community. On the whole, this data emphasises the differing degrees of influence and acknowledgement among various finance-related journals, with the "Journal of Banking and Finance" and the "Journal of Financial Economics" being particularly notable for their high citation rates and influence.

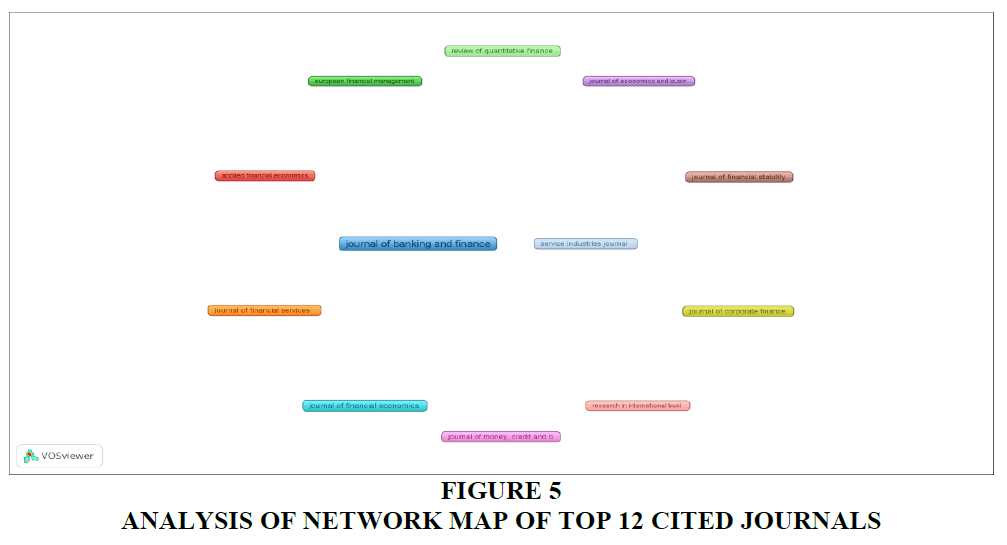

Analysis of Network Map of Top 12 Cited Journals

Based on citation data, the figure seems to be a visualisation produced with VOS viewer displaying the network and links across several finance-related publications Figure 5.

The Journal of Banking and Finance, located at a central position within the network, demonstrates its pivotal function and extensive connections with other journals. The Journal of Financial Economics is strongly associated with the Journal of Banking and Finance, as evidenced by its enormous influence and strong citation relationships. The Journal of Corporate Finance is in close proximity to the centre node, indicating a significant citation link. In close proximity is the Journal of Financial Services Research, demonstrating a moderate level of influence and citation linkage. This is followed by the Journal of Money, Credit, and Banking, which has a slightly connected relationship, highlighting its relevance in terms of citations.

European Financial Management and the Review of Quantitative Finance and Accounting are located at a greater distance, suggesting a lower number of citation connections. The Journal of Financial Stability and the Journal of Economics and Business are moderately close to each other, suggesting a certain level of relevance in terms of citations. Applied Financial Economics and Research in International Business and Finance have less citation connections and are positioned relatively distant from the centre. The Service Industries Journal, on the other hand, is positioned at a greater distance and has the fewest citation connections.

The network visualisation identifies the Journal of Banking and Finance as the most central and influential journal, displaying strong citation connections to many other publications. The Journal of Financial Economics and the Journal of Corporate Finance have substantial impact as well. Some journals, such as the Service Industries Journal and Applied Financial Economics, have less citation relationships inside this network compared to others. This visualisation provides a clear and accurate representation of the citation landscape and the connections between finance-related publications. It highlights the importance of specific significant journals in the academic area.

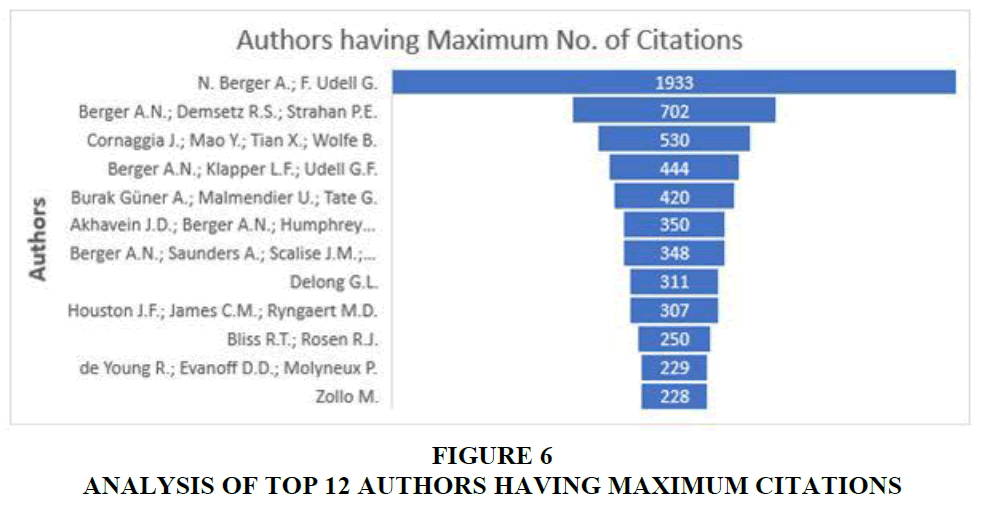

Analysis of Top 12 Authors Having Maximum Citations

This graph is a bar chart that displays the number of citations obtained by authors, with the chart being titled "Authors having maximum number of citations". The authors are ranked based on the quantity of citations their work has garnered. The names of the authors are presented on the left side, while the bars extending horizontally to the right indicate the number of citations associated with each author Figure 6.

The author (Berger et al., 2007) have the greatest citation count, with a total of 1933 citations. The paper by (Berger et al., 1997) has the second-highest citation count of 702. The number of citations exhibits a downward trend as one progresses along the list, reaching its lowest point at 228 citations for (Zollo, 2009) The lengths of the bars represent the number of citations, allowing for a straightforward comparison of the effect of these authors' works based on citation count. The chart illustrates a substantial advantage held by the top authors in comparison to others.

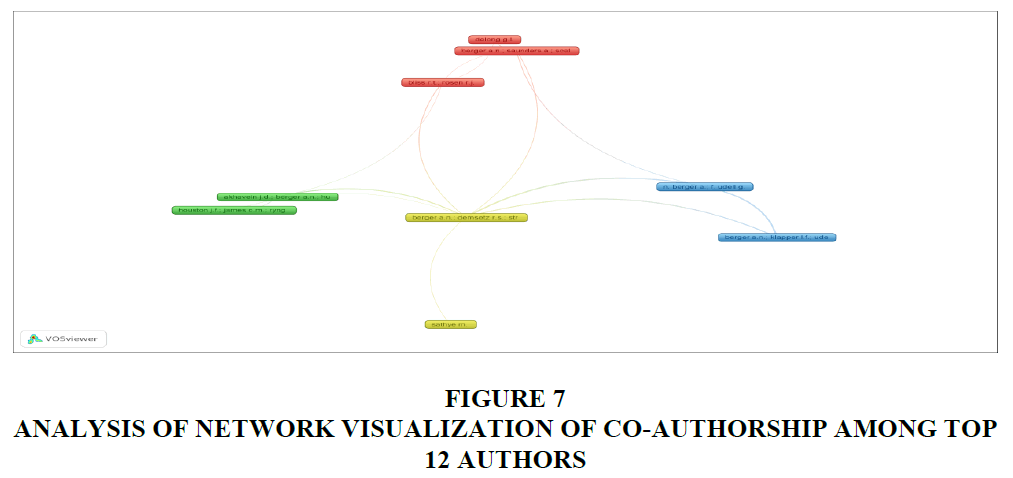

Analysis of Network Visualization of Co-Authorship among Top 12 Authors

This image depicts a network visualisation of academic citations or co-authorships, most likely created by VOS viewer. The visualisation depicts links between distinct writers or author clusters, as depicted by coloured nodes and connecting lines Figure 7.

The network visualisation illustrates the connections between different writers or research groups based on co-authorships and citations. An author or a group of authors who have collaborated or cited each other's work is represented by a node, which might be a circle or box. Distinct colours correspond to distinct groups or clusters associated with different research fields or partnerships. Thick lines indicate stronger or more frequent connections. The lines, or edges, linking these nodes show relationships like co-authorships or citations.

The image shows multiple distinct clusters: the Red Cluster consists of (Delong et al., 2001) this indicates that these authors collaborate or cite each other frequently; the Green Cluster consists of (Akhavein et al., 1997) this cluster also shows strong internal connections; the Yellow Cluster consists of (Berger et al., 1999) the Blue Cluster consists of (Berger, 2001) indicating a focus on distinct research or collaboration areas.

Furthermore, cross-cluster relationships show citations or interdisciplinary cooperation across numerous academic domains. Some clusters' pivotal presence draws attention to how important a role they play in bridging various research areas.

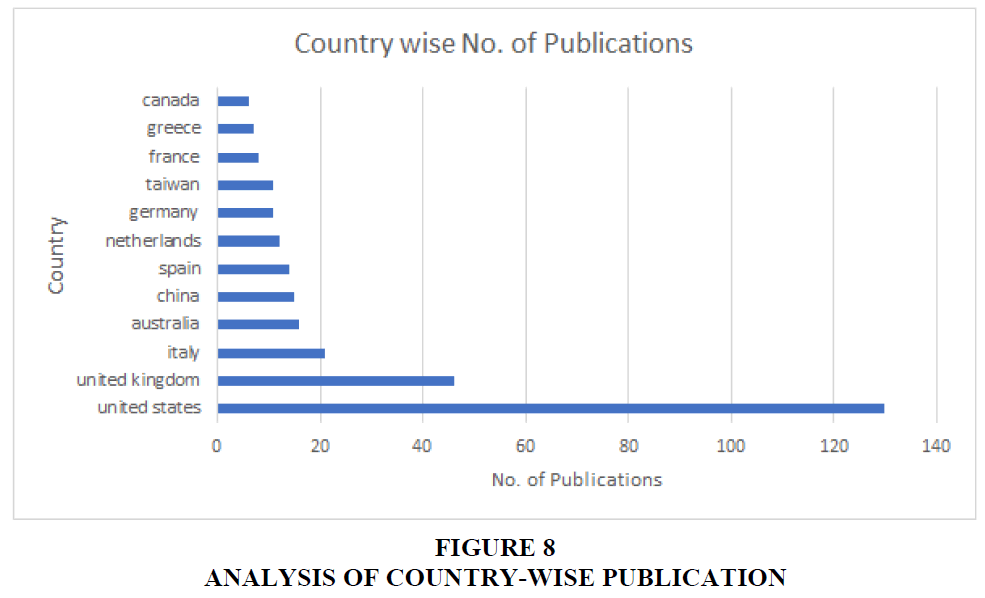

Analysis of Country-Wise Publication

This chart displays the number of publications derived from different countries. The y-axis displays the countries, while the x-axis represents the number of publications Figure 8.

The data illustrates that the United States has the highest number of publications, nearing 140, while the United Kingdom has just over 60 publications. Italy is ranked third, with approximately 20 publications. Australia, China, Spain, Netherlands, Germany, Taiwan, France, Greece, and Canada all have less than 20 publications each. The caption "No. of Publications" indicates that the chart is a comparison of research output or scholarly papers among different countries.

Analysis of top 50 cited articles

The table of analysis of top 50 cited articles is a comprehensive compilation of significant scholarly publications in the banking sector. It provides detailed information about the authors, titles, publication years, citation counts, and document kinds (all of which are articles). This table has been enclosed as Annexure No.1 after reference section of this paper.

This set of citations highlights prominent scholarly works in the field of finance that specifically examine the impacts of mergers, acquisitions, and market structures on banking and small business finance. The work most frequently referenced is the study conducted by (Berger et al., 1998). This study examines the impact of private equity and debt markets on the growth of small businesses. In (Berger et al., 2001) conducted a significant study that investigates the reasons and consequences of consolidation in the financial industry.

The study conducted by (Cornaggia et al., 2015) on the relationship between banking competition and innovation has received 530 citations, highlighting its importance in comprehending the impact of competition on technological progress. In their study, (Berger et al., 2007) examine the lending practices of banks towards small enterprises that have poor financial transparency.

The study conducted by (Burak et al., 2008) examines the influence of financial expertise among directors on the success of firms. In (Akhavein et al., 1997) assess the effectiveness and impact on prices of major bank mergers.

In (Berger et al., 1998) evaluate the impact of bank mergers on the provision of loans to small businesses. In (Delong, 2001) examines the differences in shareholder benefits between bank mergers that focus on specific areas and those that diversify their operations. (Houston et al., 2001) examine the origins of benefits in bank mergers from both internal and external viewpoints.

In (Bliss & Rosen, 2001) analyse the correlation between CEO remuneration and bank consolidations. (De Young et al., 2009) provide a comprehensive analysis of the literature published after 2000 that focusses on mergers involving financial institutions. (Zollo, 2009) examines the process of acquiring knowledge from infrequent strategic judgements made in corporate acquisitions.

In (Rogers & Veraart, 2013) examine the occurrence of failure and the act of rescuing in interbank networks, whereas (Houston & Ryngaert, 1994) evaluate the total benefits derived from mergers involving large banks. In (Rhoades, 1998) presents a summary of the efficiency impacts of nine bank mergers. In (Kim & Finkelstein, 2009) analyse the strategic and market complementarity in the performance of acquisitions. In (Piekkari et al., 2005) investigate the human resources implications of a shared corporate language decision in cross-border mergers.

In (Hayn & Hughes, 2006) highlight key factors that can predict goodwill impairment, whereas (Hagendorff & Vallascas, 2011) examine the relationship between CEO pay incentives and the level of risk-taking in bank acquisitions. Examine the globalisation of the banking industry in 20 European countries, whereas (Halkos & Tzeremes, 2013) calculate the efficiency improvements that could result from future bank mergers using a DEA bootstrapped technique.

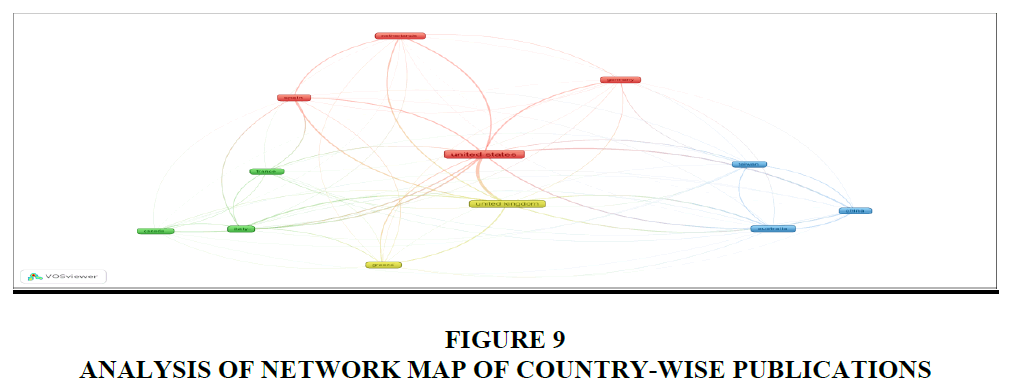

Analysis of Network Map of Country-Wise Publications

The picture displayed here is a network visualisation that was made with VOS viewer. It most likely illustrates the ties and connections that exist between a number of different countries that have published maximum number of articles which is associated with mergers, & acquisitions Figure 9.

The visualisation depicts worldwide research collaboration patterns by displaying each country as a circle, where the size of the circle corresponds to the number of publications or overall level of activity originating from that country. Greater circles represent more substantial contributions. The lines, or edges, that connect the circles depict collaborations or interactions between countries. Thicker lines represent greater or more regular collaborations, while colours indicate various clusters or communities of closely collaborating countries.

For Example, the red cluster comprises the United States, Germany, Spain, and the Netherlands, signifying robust collaborative connections among these countries. The green cluster consists of Canada, France, Italy, and Greece, whereas the blue cluster consists of China, Taiwan, and Australia. The yellow cluster represents the United Kingdom.

The Notable observations indicate that the United States is strategically located, emphasising its pivotal role in global partnerships. European countries have a highly interconnected network of collaborations, particularly within the red and green clusters. China and Taiwan have stronger connections with each other and other countries in the blue cluster. The United Kingdom functions as an intermediary, linking several clusters and facilitating connections between numerous groupings. The visualisation highlights the global patterns of research collaboration, displaying specific countries as major hubs in international research endeavours.

Major Findings Revealed from Literature Related to Merger and Acquisitions in Banking Sector have been Summarized as Follows

An extensive body of research has been conducted on mergers and acquisitions from both domestic and international perspectives, with a significant portion of this scholarship falling within the realm of strategic management. The issue of performance has surfaced as a significant focus within numerous studies related to mergers and acquisitions, with a considerable number of investigations concentrating on the performance metrics before and after acquisitions, yet a definitive consensus remains elusive. Identified a favourable impact on the liquidity, leverage, and profitability of the acquiring entity. Mergers and acquisitions enhance the efficiency and effectiveness of entire industries, influencing the competitive capabilities of individual companies, and positively affecting firms' performance.

Additional researchers have determined that mergers and acquisitions may either exert no influence or negatively impact the performance of firms following the acquisition. Mergers and acquisitions may adversely affect the performance of firms following the acquisition. The performance issues stem from suboptimal target selection, insufficient synergies, inadequate integration of the acquired entities, cultural, and the burden of excessive debt arising from the acquisition endeavours. In conclusion, the influence of mergers and acquisitions on the performance of firms remains ambiguous. Current scholarly discourse on post-acquisition integration has underscored the complexities associated with cultural discrepancies when merging diverse national and organisational cultures. Additionally, it has examined the implications of resource relatedness, the potential devaluation following acquisitions, and the criteria for target selection.

A body of research has employed transaction cost theory (TCT) to elucidate mergers and acquisitions (M&As). This viewpoint has facilitated the elucidation of the decision-making process regarding various foreign entry modes. According to, greenfield ventures incur lower transaction costs compared to mergers and acquisitions, as greenfield operations circumvent the expenses associated with workforce retraining and the integration challenges that arise from merging distinct organisational cultures. Mergers and acquisitions offer enhanced prospects for improved organisational efficiencies compared to other modes of foreign entry. Despite these significant contributions, our data indicates a notable decline in the application of TCT in M&A research.

A growing segment of contemporary research is grounded in the resource-, capabilities-, or knowledge-based perspectives of the firm. Mergers and acquisitions serve as instruments for acquirers to enhance and expand their repository of knowledge, resources, and capabilities (Ferreira, 2014), particularly for the procurement of resources and insights that are not accessible in the factor market (Ferreira, 2014). Consequently, this body of research concerning mergers and acquisitions as avenues for firms to reorganise their operations and modify their array of resources and capabilities (Ferreira, 2014) has made considerable progress in elucidating the potential advantages arising from M&As that extend beyond mere financial or economic outcomes. Existing studies have delineated a range of motivations that propel firms towards acquisition. Posited that a significant impetus for mergers and acquisitions lies in the ability to leverage synergies within the value chains of the firms, which would remain unexploited in the absence of such consolidation. The potential synergies may aim to enhance operational efficiency and augment market power, mitigate competition, lessen reliance on a specific consumer base, facilitate price increases for consumers, capitalise on cost reductions and economies of scale, or achieve effective resource coordination.

Observed that mergers and acquisitions serve as a means to address the deficiencies present in financial markets. Proposed that mergers and acquisitions serve as a means of restructuring companies that are poorly managed, while argued that these transactions are methods for accessing or controlling valuable resources that are not easily imitable and are essential for attaining a competitive advantage Appendix Table 1.

Conclusions and Recommendation

In the contemporary era, strategic choices always prioritise the imperative of achieving sustainable expansion in order to secure future competitiveness. The continuous and proactive extension of a firm's own development limitations through mergers and acquisitions is a crucial strategy for effectively and efficiently meeting the consequent obligations. The appeal of M&A in this setting lies in its capacity to effectively address the strategic issues of a rapidly changing environment.

The literature on mergers and acquisitions has experienced significant growth, particularly since the early 1990s. Through the utilisation of co-citation and network analysis techniques, we offer a comprehensive and expansive examination of the characteristics and extent of M&A research. Researchers with an interest in M&A can get advantages from the broader scope of M&A research in at least two ways. Initially, we have emphasised the progression of research endeavours over a period of time and delineated the most impactful papers in the field of M&A research. This serves as a convenient reference for academics, enabling them to comprehend and consider the fundamental literature in M&A research. Furthermore, we have outlined the development of authors, institutions, and attributes within the M&A research community. This analysis offers a valuable viewpoint on author-specific publication activities, funding and awards, and the identification of prominent M&A collaborators or universities for rankings.

This study utilises the bibliometric review method to provide a comprehensive analysis of the research on mergers and acquisitions (M&As) published in the subject area of "Economics," "Business, management, and accounting," and "social sciences" from 1991 to 2023. The research on mergers and acquisitions (M&As) has experienced a significant increase during the 2000, with frequent surges in research activity coinciding with rises in merger activity. The primary contributions to the research have unsurprisingly originated from the United States and the United Kingdom, which are two of the largest takeover markets worldwide. Our studies reveal both the origins of highly productive and influential research, as well as the authors who have made significant contributions to the field. We also examine the effect of their research, the specific study topics they have examined, and their connections with other researchers. An in-depth analysis of research on mergers and acquisitions (M&As) shows that the primary topics in the field of finance include takeovers as a means of governance, factors that drive mergers, the processes involved in mergers, bank mergers, mergers that occur across national borders, the impact of mergers and related events on shareholder wealth, and the influence of financial experts and ownership structure. Regarding the accounting field, significant topics encompass corporate governance and accounting results, forecasting takeovers and their consequences, valuation, financial reporting and takeover choices, and financial reporting and performance. It is evident that a significant amount of study on mergers and acquisitions (M&As) has been influenced by the viewpoint of corporate governance. In recent times, there has been a shift in study towards examining corporate culture, information flows, the legal and economic environment, information asymmetry, expertise, and the value implications of specific types of transactions.

Similar to other review papers, this study also has specific shortcomings. The focus of our study is limited to M&A-related publications published in specific subject areas. In addition, our search of previous literature relies on a predefined set of precise keywords through the Scopus database. Consequently, there is a possibility that we may have overlooked papers that do not meet our search parameters. In addition, we assess the influence of each article by examining the number of times it has been cited in the Scopus database. Due to the limited scope of this database, it only includes citations from sources that are mentioned inside it. As a result, the true influence of an item is likely to be underestimated in our studies. It is important to consider these limitations when interpreting our findings.

Considering the extensive body of research on mergers and acquisitions (M&As) from several fields, they have emerged as a distinct area of study. Researchers have attempted to elucidate the various facets of these extensive and intricate transactions that include multiple stakeholders, both within and external to the organisation. Despite the extensive body of literature on the topic, there are still some questions that remain either unresolved or without a clear answer. In addition, the evolving external environment, which encompasses legislative changes, macroeconomic shocks, and alterations in accounting rules, is expected to generate new enquiries for the research community to address. Considering the information provided, it is anticipated that the topic will continue to be important and deserving of additional investigation. The bibliometric technique is limited by the references cited in the articles, which can be influenced by editorial policies, inclusion of well-known publications that the authors may not have really read, various versions of books or articles, and self-citations. Nevertheless, this occurrence should be uniformly spread throughout the authors, and we have thoroughly and scrupulously examined the references included in it. Given that we examined a time span over 23 years, it is possible that the findings may be influenced by the delay in the publication and establishment of citation records for articles. This delay could result in a lack of representation for contemporary yet prominent authors and documents.

Appendix

| Appendix 1 Details of Top 50 Cited Articles | |||||

| S.N. | Authors | Title | Year | Cited by | Document type |

| 1 | N. Berger A.; F. Udell G. | The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle | 1998 | 1933 | Articles |

| 2 | Berger A.N.; Demsetz R.S.; Strahan P.E. | The consolidation of the financial services industry: Causes, consequences, and implications for the future | 1999 | 702 | Articles |

| 3 | Cornaggia J.; Mao Y.; Tian X.; Wolfe B. | Does banking competition affect innovation? | 2015 | 530 | Articles |

| 4 | Berger A.N.; Klapper L.F.; Udell G.F. | The ability of banks to lend to informationally opaque small businesses | 2001 | 444 | Articles |

| 5 | Burak Güner A.; Malmendier U.; Tate G | Financial expertise of directors | 2008 | 420 | Articles |

| 6 | Akhavein J.D.; Berger A.N.; Humphrey D.B. | The Effects of Megamergers on Efficiency and Prices: Evidence from a Bank Profit Function | 1997 | 350 | Articles |

| 7 | Berger A.N.; Saunders A.; Scalise J.M.; Udell G.F. | The effects of bank mergers and acquisitions on small business lending | 1998 | 348 | Articles |

| 8 | Delong G.L. | Stockholder gains from focusing versus diversifying bank mergers | 2001 | 311 | Articles |

| 9 | Houston J.F.; James C.M.; Ryngaert M.D. | Where do merger gains come from? Bank mergers from the perspective of insiders and outsiders* | 2001 | 307 | Articles |

| 10 | Bliss R.T.; Rosen R.J. | CEO compensation and bank mergers | 2001 | 250 | Articles |

| 11 | de Young R.; Evanoff D.D.; Molyneux P. | Mergers and acquisitions of financial institutions: A review of the post-2000 literature | 2009 | 229 | Articles |

| 12 | Zollo M. | Superstitious learning with rare strategic decisions: Theory and evidence from corporate acquisitions | 2009 | 228 | Articles |

| 13 | Sathye M. | X-efficiency in Australian banking: An empirical investigation | 2001 | 225 | Articles |

| 14 | Amel D.; Barnes C.; Panetta F.; Salleo C. | Consolidation and efficiency in the financial sector: A review of the international evidence | 2004 | 219 | Articles |

| 15 | Berger A.N.; Leusner J.H.; Mingo J.J. | The efficiency of bank branches | 1997 | 212 | Articles |

| 16 | Rogers L.C.G.; Veraart L.A.M. | Failure and rescue in an interbank network | 2013 | 211 | Articles |

| 17 | Houston J.F.; Ryngaert M.D. | The overall gains from large bank mergers | 1994 | 209 | Articles |

| 18 | Cybo-Ottone A.; Murgia M. | Mergers and shareholder wealth in European banking | 2000 | 201 | Articles |

| 19 | Berger A.N.; DeYoung R. | The Effects of Geographic Expansion on Bank Efficiency | 2001 | 197 | Articles |

| 20 | Avkiran N.K. | The evidence on efficiency gains: The role of mergers and the benefits to the public | 1999 | 193 | Articles |

| 21 | Strahan P.E.; Weston J.P. | Small business lending and the changing structure of the banking industry | 1998 | 193 | Articles |

| 22 | Rhoades S.A. | The efficiency effects of bank mergers: An overview of case studies of nine mergers | 1998 | 189 | Articles |

| 23 | Kim J.-Y.; Finkelstein S. | The effects of strategic and market complementarity on acquisition performance: Evidence from the U.S. commercial banking industry, 1989-2001 | 2009 | 183 | Articles |

| 24 | Piekkari R.; Vaara E.; Tienari J.; Säntti R. | Integration or disintegration? Human resource implications of a common corporate language decision in a cross-border merger | 2005 | 159 | Articles |

| 25 | Raghavendra Rau P. | Investment bank market share, contingent fee payments, and the performance of acquiring firms | 2000 | 158 | Articles |

| 26 | Peek J.; Rosengren E.S. | Bank consolidation and small business lending: It's not just bank size that matters | 1998 | 142 | Articles |

| 27 | Ragozzino R.; Reuer J.J. | Geographic distance and corporate acquisitions: Signals from IPO firms | 2011 | 141 | Articles |

| 28 | Hayn C.; Hughes P.J. | Leading indicators of goodwill impairment | 2006 | 140 | Articles |

| 29 | Hughes J.P.; Lang W.W.; Mester L.J.; Moon C.-G. | The dollars and sense of bank consolidation | 1999 | 140 | Articles |

| 30 | Hagendorff J.; Vallascas F. | CEO pay incentives and risk-taking: Evidence from bank acquisitions | 2011 | 138 | Articles |

| 31 | Buch C.M.; DeLong G. | Cross-border bank mergers: What lures the rare animal? | 2004 | 134 | Articles |

| 32 | Gu F.; Lev B. | Overpriced shares, Ill-advised acquisitions, and goodwill impairment | 2011 | 130 | Articles |

| 33 | Amihud Y.; DeLong G.L.; Saunders A. | The effects of cross-border bank mergers on bank risk and value | 2002 | 128 | Articles |

| 34 | Huang Q.; Jiang F.; Lie E.; Yang K. | The role of investment banker directors in M&A | 2014 | 124 | Articles |

| 35 | Campa J.M.; Hernando I. | M&As performance in the European financial industry | 2006 | 123 | Articles |

| 36 | Berger A.N.; Rosen R.J.; Udell G.F. | Does market size structure affect competition? The case of small business lending | 2007 | 122 | Articles |

| 37 | Berger A.N.; Dai Q.; Ongena S.; Smith D.C. | To what extent will the banking industry be globalized? A study of bank nationality and reach in 20 European nations | 2003 | 116 | Articles |

| 38 | Penas M.F.; Unal H. | Gains in bank mergers: Evidence from the bond markets | 2004 | 116 | Articles |

| 39 | Beitel P.; Schiereck D.; Wahrenburg M. | Explaining M&A success in european banks | 2004 | 108 | Articles |

| 40 | Boone A.L.; Harold Mulherin J. | Do auctions induce a winner's curse? New evidence from the corporate takeover market | 2008 | 96 | Articles |

| 41 | Cornett M.M.; McNutt J.J.; Tehranian H. | Performance changes around bank mergers: Revenue enhancements versus cost reductions | 2006 | 96 | Articles |

| 42 | Halkos G.E.; Tzeremes N.G. | Estimating the degree of operating efficiency gains from a potential bank merger and acquisition: A DEA bootstrapped approach | 2013 | 95 | Articles |

| 43 | Hadlock C.; Houston J.; Ryngaert M. | The role of managerial incentives in bank acquisitions | 1999 | 92 | Articles |

| 44 | Crespí R.; García-Cestona M.A.; Salas V. | Governance mechanisms in Spanish banks. Does ownership matter? | 2004 | 90 | Articles |

| 45 | Elston J.A.; Goldberg L.G. | Executive compensation and agency costs in Germany | 2003 | 89 | Articles |

| 46 | Becher D.A. | The valuation effects of bank mergers | 2000 | 89 | Articles |

| 47 | Bharadwaj A.; Shivdasani A. | Valuation effects of bank financing in acquisitions | 2003 | 79 | Articles |

| 48 | Bonaccorsi Di Patti E.; Gobbi G. | The changing structure of local credit markets: Are small businesses special? | 2001 | 76 | Articles |

| 49 | Jayaratne J.; Wolken J. | How important are small banks to small business lending? New evidence from a survey of small firms | 1999 | 75 | Articles |

| 50 | Johnston K.D.; Yetton P.W. | Integrating information technology divisions in a bank merger: Fit, compatibility and models of change | 1996 | 74 | Articles |

References

Akhavein, J. D., Berger, A. N., & Humphrey, D. B. (1997). The effects of megamergers on efficiency and prices: Evidence from a bank profit function. Review of industrial Organization, 12, 95-139.

Amel, D., Barnes, C., Panetta, F., & Salleo, C. (2004). Consolidation and efficiency in the financial sector: A review of the international evidence. Journal of Banking & Finance, 28(10), 2493–2519.

Indexed at, Google Scholar, Cross Ref

Amihud, Y., Delong, G. L., & Saunders, A. (2002). The effects of cross-border bank mergers on bank risk and value. Journal of International Money and Finance (Vol. 21).

Berger A’, A. N., Leusner, J. H., & Mingo, J. J. (1997). Monetary economics, The efficiency of bank branches. Journal of Monetary Economics (Vol. 40).

Berger, A. N., & DeYoung, R. (2001). The effects of geographic expansion on bank efficiency. Journal of financial services research, 19, 163-184.

Berger, A. N., Demsetz, R. S., & Strahan, P. E. (1999). The consolidation of the financial services industry: Causes, consequences, and implications for the future. Journal of banking & finance, 23(2-4), 135-194.

Berger, A. N., Klapper, L. F., & Udell, G. F. (2001). The ability of banks to lend to informationally opaque small businesses. Journal of Banking & Finance (Vol. 25).

Berger, A. N., Rosen, R. J., & Udell, G. F. (2007). Does market size structure affect competition? The case of small business lending. Journal of Banking & Finance, 31(1), 11-33.

Berger, A. N., Saunders, A., Scalise, J. M., Udell, G. F., Burke, J., Ettin, E., Kolari, J., Kwast, M., Pilloff, S., Rhoades, S., & Strahan, P. (1998). The effects of bank mergers and acquisitions on small business lending. In Journal of Financial Economics (Vol. 50).

Bindal, S., Bouwman, C. H., & Johnson, S. A. (2020). Bank regulatory size thresholds, merger and acquisition behavior, and small business lending. Journal of Corporate Finance, 62, 101519.

Bliss, R. T., & Rosen, R. J. (2001). CEO compensation and bank mergers. Journal of Financial Economics, 61(1), 107-138.

Burak Güner, A., Malmendier, U., & Tate, G. (2008). Financial expertise of directors. Journal of Financial Economics, 88(2), 323–354.

Cornaggia, J., Mao, Y., Tian, X., & Wolfe, B. (2015). Does banking competition affect innovation? Journal of Financial Economics, 115(1), 189–209.

Cumming, D., Jindal, V., Kumar, S., & Pandey, N. (2023). Mergers and acquisitions research in finance and accounting: Past, present, and future. European Financial Management, 29(5), 1464-1504.

De Young, R., Evanoff, D. D., & Molyneux, P. (2009). Mergers and acquisitions of financial institutions: A review of the post-2000 literature. Journal of Financial services research, 36, 87-110.

Indexed at, Google Scholar, Cross Ref

Delong, G. L. (2001). Stockholder gains from focusing versus diversifying bank mergers.

Ferreira, M. P., Santos, J. C., de Almeida, M. I. R., & Reis, N. R. (2014). Mergers & acquisitions research: A bibliometric study of top strategy and international business journals, 1980–2010. Journal of Business Research, 67(12), 2550-2558.

Gulamhussen, M. A., Hennart, J. F., & Pinheiro, C. M. (2016). What drives cross-border M&As in commercial banking?. Journal of Banking & Finance, 72, S6-S18.

Indexed at, Google Scholar, Cross Ref

Hagendorff, J., & Vallascas, F. (2011). CEO pay incentives and risk-taking: Evidence from bank acquisitions. Journal of Corporate Finance, 17(4), 1078–1095.

Halkos, G. E., & Tzeremes, N. G. (2013). Estimating the degree of operating efficiency gains from a potential bank merger and acquisition: A DEA bootstrapped approach. Journal of Banking and Finance, 37(5), 1658–1668.

Hayn, C., & Hughes, P. J. (2006). Leading indicators of goodwill impairment. Journal of Accounting, Auditing and Finance, 21(3), 223–265.

Houston, J. F., & Ryngaert, M. D. (1994). The overall gains from large bank mergers. Journal of Banking & Finance, 18(6), 1155-1176.

Houston, J. F., James, C. M., & Ryngaert, M. D. (2001). Where do merger gains come from? Bank mergers from the perspective of insiders and outsiders. Journal of financial economics, 60(2-3), 285-331.

Indexed at, Google Scholar, Cross Ref

Huang, Q., Jiang, F., Lie, E., & Yang, K. (2014). The role of investment banker directors in M&A. Journal of Financial Economics, 112(2), 269–286.

Kalra, N., Gupta, S., & Bagga, R. (2013). A wave of mergers and acquisitions: are Indian banks going up a blind alley?. Global Business Review, 14(2), 263-282.

Indexed at, Google Scholar, Cross Ref

Kim, J. Y., & Finkelstein, S. (2009). The effects of strategic and market complementarity on acquisition performance: Evidence from the U.S. commercial banking industry, 1989-2001. Strategic Management Journal, 30(6), 617–646.

Indexed at, Google Scholar, Cross Ref

Piekkari, R., Vaara, E., Tienari, J., & Säntti, R. (2005). Integration or disintegration? Human resource implications of a common corporate language decision in a cross-border merger. International Journal of Human Resource Management, 16(3), 330–344.

Indexed at, Google Scholar, Cross Ref

Reddy, K. S. (2015). The state of case study approach in mergers and acquisitions literature: A bibliometric analysis. Future Business Journal, 1(1–2), 13–34.

Indexed at, Google Scholar, Cross Ref

Rezvanian, R., Rao, N., & Mehdian, S. M. (2008). Efficiency change, technological progress and productivity growth of private, public and foreign banks in India: evidence from the post-liberalization era. Applied Financial Economics, 18(9), 701–713.

Indexed at, Google Scholar, Cross Ref

Rhoades, S. A. (1998). The efficiency effects of bank mergers: An overview of case studies of nine mergers. Journal of Banking & Finance (Vol. 22).

Rogers, L. C. G., & Veraart, L. A. M. (2013). Failure and rescue in an interbank network. Management Science, 59(4), 882–898.

Sathye, M. (2001). X-efficiency in Australian banking: An empirical investigation. Journal of Banking & Finance, 25(3), 613-630.

Shafique, M. (2013). Thinking inside the box? Intellectual structure of the knowledge base of innovation research (1988–2008). Strategic Management Journal, 34(1), 62–93.

Zollo, M. (2009). Superstitious learning with rare strategic decisions: Theory and evidence from corporate acquisitions. Organization Science, 20(5), 894–908.

Indexed at, Google Scholar, Cross Ref

Received: 25-Sep-2024, Manuscript No. AMSJ-24-15298; Editor assigned: 26-Sep-2024, PreQC No. AMSJ-24-15298(PQ); Reviewed: 26-Nov-2024, QC No. AMSJ-24-15298; Revised: 06-Dec-2024, Manuscript No. AMSJ-24-15298(R); Published: 10-Jan-2025