Research Article: 2019 Vol: 23 Issue: 3

Marketing innovation in service SMEs A study in the Egyptian food and beverage Industry

Marwa Elgebali, Newgiza University

Abstract

Purpose: In this work it is intended to analyse how the discipline of innovative marketing plays a role in small-to medium-sized enterprises. Design/methodology/approach: Data from a survey conducted with restaurants and cafes as well as customers of these establishments. Data was analysed through the statistical methods of Principal Component Analysis (PCA), and using the Varimax rotation method. Findings: The results of this work suggest that a key concept regarding innovation at the organizational level is newness. This concept, which is related to the radicalness degree, provides to innovation with a valid requirement to sustenance an undimensional construct. Originality/value: This paper focuses on a review of the literature regarding relevant topics to marketing innovation and testing them in the restaurants and cafes market in Egypt. A comparative view between customers and organizations is presented.

Keywords

Small to Medium-Sized Enterprises, Marketing Innovation, Food and Beverage Services.

Introduction

In spite of the decreases in tourism, the Egyptian foodservice sector has been growing over the past five years (GAIN, 2017). The growth is driven by social and technological shifts, as well as changes in consumer behaviour. Egyptians are spending more time outside of the home and a larger percentage of women are joining the workforce. The main viable advantage of popular foodservice companies is the cost and prices reduction, which is aimed to hold down the customers’ expectations.

Other authors had previously noted the overwhelm empathy that some companies shown for technological advance, leading to a lack of competitive advantages in the field of marketing innovation (Ren et al., 2010). These authors consider marketing innovation as a proper method to acquire sustainable and competitive advantage.

Other authors state that small and medium sized companies can stand out from the big ones applying the concepts of marketing innovation, which consists on continuous and complementary modifications to their current activities and practices (O’Dwyer et al., 2009). One successful example of this line of thinking is the one of Epetimehin (2011), who shown that the innovation in the offered services, prices, promotion and distribution in the insurance sector impacts in a positive attraction of clients, leading to a competitive advantage.

In analysing Nespresso’s competitive advantage through innovation Brem et al., (2016) summarized their innovative branding strategy in three important factors positioning, distribution channels (suppliers and selling outlets) and unique customer approach. Some researchers found the innovation capability as a crucial competitive factor for organizations related with tourism (Brooker et al., 2012, Martínez-Ros & Orfila-Sintes, 2012; Rodgers, 2008).

The present study is mainly related with the aim to define properly the concept of marketing innovation and with trying to find the best way to operationalize it in small and medium food service enterprises.

Literature Review

Innovation

Despite the huge increase in literature in the field of innovation -due to the continuously growing importance that has gained in entrepreneurship (Drazin & Schoonhoven, 1996; Drucker, 1985) - there is still no consensus on the definition of innovation (Jon-Arild & Lumpkin, 2001). One of the reasons, some authors says, is the absence of a significant measure, which hinders the development of theories and the subsequent suggestion of actions for companies which wants to apply this concept (Kotabe & Swan 1995).

The concept of newness has been associated with many of the definitions of innovation. Newness is a key factor to distinguish innovation from change and has been proposed as an important factor linking innovation and entrepreneurship in previous works related to the creation and management of new business (Gartner, 1988; Stevenson & Jarillo, 1990; Utkun & Atilgan, 2010).

Marketing Innovation

One of the definitions of marketing innovation states that is the implementation of a new marketing method involving significant changes in product design or packaging, product placement, product promotion or pricing (OECD/Eurostat, 2005). The usage of a new way for selling products or services that includes important changes in the product design, the packaging, the placement of the product or the pricing and promotion can be certainly defined as a marketing innovation.

Another definition, given by Utkun & Atilgan (2010), relates innovation in marketing with the employment of a new marketing method that introduces considerable changes in the pricing, in the promotion or in the packaging of a product.

Nowadays, the determination of customers’ needs is not so easy due to the constant and fast changing markets, technology and collective behaviour. These facts make necessary the application of innovative marketing activities in order to expand the satisfaction degree and retention of clients (Noori & Salimi, 2005). One of the limitations is that doesn’t exist enough evidence regarding the application of innovation in marketing (Bhaskaran, 2006; Geldes & Felzensztein, 2013; Medrano-Sáez & Olarte-Pascual, 2016; Rammer et al., 2009; Schubert, 2010).

While in reality innovation is the driving force in SME, the direction that research followed in the field of marketing innovation has been marked by some innovation characteristics specifics of certain firms and by the environment effect (O'Dwyer, 2009).

Medrano & Olarte-Pascual (2016) postulates that it is not necessary to include novel marketing practices. They say that the inclusion of adapted old concepts and adapted old practices previously developed is enough. Another possibility is the inclusion of marketing practices integrated by other companies.

In the current study, the composition of innovation variables regarded with newness had been taken from the previous work of Johannessen & Lumpkin (2001). The variables for marketing innovation had been proved in the work of Medrano & Olarte-Pascual (2016). An interesting conclusion of this last mentioned work is that service companies must hold innovative strategies (placement, promotion or pricing) due to its close contact with the end consumers.

There are three questions related with the concept of newness that can be really helpful to analyse it: what means that something is new? How new need to be something? And to whom something is new? These questions have been addressed in the work of Johannessen & Lumpkin, (2001). For the answering of the first question, six variables have been taken into account in the mentioned work: (1) new products; (2) new services; (3) new methods of production; (4) opening new markets; (5) new sources of supply; and (6) new ways of organizing, in addition to marketing innovation variables that were added by the OECD/Eurostat, (2005), namely (7) New ways of promotion and (8) New pricing.

RQ 1 Are food service providers considered innovative?

How new need to be something? A distinction between a radical and an incremental innovation needs to be made. A radical innovative process would be something ground breaking, whereas an incremental innovation is normally set within a paradigm (Dosi, 1982; Dewar & Dutton, 1986). In his work, Hage (1980) stated that the innovation processes moves in a continuum way, going from incremental towards radical. However, other works illustrated the fact that both terms can be used inside a paradigm context. One example is the one of Damanpour (1996), who refers to radical innovations to the things producing large deviations from the current practices, whereas an incremental innovation will produce smaller deviations. In both cases, radical and incremental apply to within-organization innovations.

Oke (2007) found that the innovation processes in service organizations are more related with the incremental type of innovation of products and services. Moreover, several authors think that the marketing innovation is just a type of incremental innovation (Naidoo, 2010). An example of this is given in the work of Bhaskaran (2006), who after performing an analysis of the shellfish market found that the focusing of small and medium sized companies in the incremental innovation (like marketing innovation) provided a substantial competitive advantage, allowing the competition with big companies. In the same way, has been shown by Rammer et al. (2009) that those small and medium sized companies that are not investing on research and development still can achieve very good results using incremental innovation.

Another example is, showing the effective performance of the airport industry after the application of marketing innovation.

The mentioned cases are all evidence of the importance that the innovation have in the performance of a company (Hull & Rothenberg, 2008; Hult et al., 2004; Qian & Li, 2003; Rhee et al., 2010). However, research is still necessary to know more about the factor influencing marketing innovation (Nieves & Diaz-Meneses 2016).

RQ2 what is the degree of marketing innovativeness in the food service market?

RQ3 is innovativeness related to company’s performance?

RQ4 is innovativeness related to company’s size?

To whom something is new? This question has been previously addressed, and some research suggested that the degree of newness of an innovation depends on the filed the innovation is being applied. In this way, Cooper (1993); Kotabe & Swan (1995) suggested to investigate innovation as a function of the newness degree to the company and as a function of the newness degree to the market. Kotabe & Swan says that the newness relative to the company won’t say too much about the impact that a product could have in the consumers or in the competition, however will be useful for analyse the ability of a firm to update its innovative solutions, which is a key consumer concern. In this research the customers will be the relevant unit of adoption.

RQ5 Do customers in the food service market viewed companies the market to be innovative?

The food service sector in Egypt

The restaurants and cafes market has been on the rise over the past few years. Egyptians are spending more time outside of the home and a larger percentage of women are joining the workforce. These two factors encourage Egyptian consumers to rely more heavily on ready-toeat meals or online ordering. Additionally, internet penetration in Egypt has now reached almost 33 percent of the population and online foodservice is growing quickly. Otlob.com, an online ordering and delivery platform for restaurants, is growing in popularity and other online retailers, such as Souq.com and Jumia.com, now sell groceries and food products. The foodservice sector’s sales in 2016 reached $3.8 Billion with a five-year CAGR of 9.5 percent.

Independent restaurants still account for the lion’s share of food service establishments and sales in 2016 represented 85 percent of total consumer foodservice sales. Though independently owned restaurants dominate the sector, chain restaurants are growing at a notably higher rate. Chain restaurants grew their sales 29 percent from 2011 to 2015, while independent restaurant sales increased only 17 percent. Both sectors saw a precipitous drop in sales in 2016 following the economic reforms and currency devaluation. The total value of the Egyptian consumer foodservice sector sales is estimated at $3.8 billion. Cafes make up the majority of sales at $1.34 billion, or 37 percent of the total. This is likely due to cultural preferences for cafes and lower capital requirements to open these establishments. Café sales are followed by fast food, full-service restaurants, and home delivery at $1.10 billion, $823 million, and $314 million respectively. Self-service cafeterias and street vendors comprise an additional $261 million in sales (GAIN, 2017).

Methodology

Marketing Innovation is assessed in small and medium firms within the Egyptian food and beverage service market and from the perspective of consumers of these services.

The present analysis is focused primarily on SME’s that are relatively new and small (less than ten years old and less than 100 employees). In order to attempt to answer the research question, a field survey was designed collecting data in subcategories within the industry.

In total 103 SMEs & 310 consumers were interviewed with a primary, quantitative, using structured online application questionnaire in Cairo. Interviews were conducted face-to-face and the Sample was split over the eight following different markets:

1. Fast food restaurant

2. Traditional cafes

3. Non-traditional cafes

4. Dessert shops

5. Juice shops

6. Bakeries

7. Dairy products shops

8. Restaurants

Hence, for both studies, eight variables were studied with the aim to assess the marketing innovativeness of the SME’s. These variables include:

1. New products (NEWPROD)

2. New services (NEWSERVI)

3. New methods of production (NEWMETO)

4. Opening new markets (NEWMARK)

5. New sources of supply (NEWMATER)

6. New ways of organizing (NEWORG)

7. New ways of promoting (NEWPROM)

8. New ways of pricing (NEWPRICE).

To measure the question regarding with the what?

For each one of the eight variables mentioned, a five-point scale was used for the respondents to indicate the degree of the changes made by their companies during the last three years. The scale ranges from 1, meaning to no extent, to 5, meaning to a very great extent.

To measure the question regarding with the how new?

Was measured through the extent of innovation in each of the six dimensions.

To measure the question regarding with the to whom?

Respondents from customers of each business where asked to how they rated this business on the same 8 innovation variables.

Results and Analysis

RQ1 Are Food Service Providers Considered Innovative?

The above construct (Marketing Innovation) was measured through different questions. An internal consistency/reliability between the questions/dimensions measuring the construct was assessed through Cronbach’s alpha and indicated a high consistency and agreement for the two studies with alpha given for data gathered from business and consumer studies equal to 0.92 and 0.947, respectively (Table 1).

| Table 1 Varimax-Rotated Component Loadings of the Six Constructs (Sample Size=103) for Business Data | |||||

| Marketing innovation (MKTINV) | |||||

| Variable | Mean | SD | Components | Factor loadings | Corrected item total correlation |

| New products (NEWPROD) | 3.204 | 1.353 | 0.676 | 0.457 | 0.603 |

| New services (NEWSERVI) | 2.874 | 1.242 | 0.872 | 0.761 | 0.821 |

| New methods of production (NEWMETO) | 2.942 | 1.274 | 0.859 | 0.738 | 0.800 |

| Opening new markets (NEWMARK) | 3.544 | 1.467 | 0.606 | 0.368 | 0.529 |

| New sources of supply (NEWMATER) | 3.029 | 1.302 | 0.811 | 0.657 | 0.743 |

| New ways of organizing (NEWORG) | 2.835 | 1.261 | 0.915 | 0.837 | 0.870 |

| New ways of promoting (NEWPROM) | 2.505 | 1.448 | 0.876 | 0.767 | 0.807 |

| New price (NEWPRICE) | 2.903 | 1.325 | 0.872 | 0.760 | 0.814 |

| Eigen Value | 5.344 | ||||

A method to determine the sampling adequacy (Kaiser-Meyer-Olkin-KMO) was used, revealing that Innovativeness Construct has an adequate distribution of values for the performing of a factor analysis. The Bartlett’s sphericity test was also conducted for it and was statistically significant. According to all the extracted measures, it is assured now that the questions assigned to measure a construct can be reduced to one variable (Table 2 for business). The methodology used is principal component analysis. The method of varimax rotation was chosen due to its simplicity.

| Table 2 Sample Adequacy and Reliability Measurements for Business Data | ||

| Measure | MKTINV | |

| KMO | 0.88 | |

| Approx. Chi-Square | 638.5 | |

| Bartlett's Test of Sphericity | df | 28 |

| P-value | 0 | |

| Cronbach's Alpha | 0.92 | |

An Eigen value greater than one was chosen to determine the quantity of components/constructs needed, and all revealed that only one construct can be formulated from the assigned questions. From Table 1 and Table 3, it can be seen that factor loadings values ranged between 0.368 to 0.837 for both studies. Additionally, corrected item total correlation has values above 0.4. Accordingly, construct validity exists among all questions (Table 4 for consumer data).

| Table 3 Varimax-Rotated Component Loadings of the Six Constructs (Sample Size=310) for Consumer Data | |||||

| Marketing innovation (MKTINV) | |||||

| Variable | Mean | SD | Components | Factor loadings | Corrected item total correlation |

| New products (NEWPROD) | 3.081 | 1.186 | 0.867 | 0.752 | 0.82 |

| New services (NEWSERVI) | 2.894 | 1.214 | 0.908 | 0.824 | 0.874 |

| New methods of production (NEWMETO) | 3.084 | 1.193 | 0.876 | 0.767 | 0.832 |

| Opening new markets (NEWMARK) | 3.481 | 1.306 | 0.733 | 0.537 | 0.662 |

| New sources of supply (NEWMATER) | 3.165 | 1.164 | 0.868 | 0.754 | 0.825 |

| New ways of organizing (NEWORG) | 2.832 | 1.208 | 0.901 | 0.811 | 0.865 |

| New ways of promoting (NEWPROM) | 2.568 | 1.394 | 0.841 | 0.708 | 0.784 |

| New price (NEWPRICE) | 2.935 | 1.265 | 0.856 | 0.733 | 0.81 |

| Eigen Value | 5.887 | ||||

| Table 4 Sample Adequacy and Reliability Measurements for Consumer Data | ||

| Measure | MKTINV | |

| KMO | 0.904 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 2376.491 |

| df | 28 | |

| P-value | 0 | |

| Cronbach's Alpha | 0.947 | |

RQ2 What Is the Degree of Marketing Innovativeness in the Food Service Market?

Table 5 shows some descriptive measures about innovativeness measured dimensions, presenting mean and standard deviation of each, these descriptive measures show the degree of marketing innovativeness in the food service from Business and consumer point of view. Dimensions with higher mean values indicate higher degree of marketing innovativeness in the food service market. Both Business and Consumers showed similar point of views.

| Table 5 Average Score of Innovation Dimensions for Business and Consumer Data | ||

| Questions | Mean | Mean |

| New products (NEWPROD) | 3.204 | 3.081 |

| New services (NEWSERVI) | 2.874 | 2.894 |

| New methods of production (NEWMETO) | 2.942 | 3.084 |

| Opening new markets (NEWMARK) | 3.544 | 3.481 |

| New sources of supply (NEWMATER) | 3.029 | 3.165 |

| New ways of organizing (NEWORG) | 2.835 | 2.832 |

| New ways of promoting (NEWPROM?) | 2.505 | 2.568 |

| New price (NEWPRICE) | 2.903 | 2.935 |

RQ3 Is Innovativeness Related to Company’s Performance?

According to Pearson correlation there exist a significant positive moderate relationship between Performance and innovation with 99% confidence level, from both studies (Table 6 appendices).

| Table 6 Pearson Correlation Between Innovativeness and Company’s Performance | ||

| Performance measure over the past three years | Marketing innovation | |

| Data gathered from | Pearson Correlation Value | |

| Business | 0.404** | |

| Consumers | 0.377** | |

| **. Correlation is significant at the 0.01 level (2-tailed). | ||

RQ4 Is Innovativeness Related to Company’s Size?

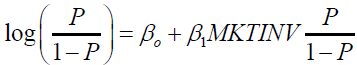

A Binary logistic model is conducted to assess the relationship between innovativeness and company’s size. Company’s size is a binary variable measured through two categories (small with code 0 and medium with code 1). This model is constructed from Business data. The model is given as:

is the odds ratio (OR)

is the odds ratio (OR)

The probability that an outcome occurs for a given exposure, compared with the probability of the outcome occurring without that exposure is represented by the OR. In the present case, the OR represents the probability that a company size will be 13 medium when innovativeness exists, in comparison with the probabilities if the outcome given for the case of absence of innovativeness. P is the probability of the event to occur (the company size become medium). According to Omnibus test of model coefficients Table 7, we can conclude that model is significant having p-value <0.05 (Table 7).

| Table 7 Omnibus Tests of Model Coefficients | ||||

| Step 1 | Chi.square | df | Sis. | |

| Step | 6.003 | 1 | 0.014 | |

| Block | 6.003 | 1 | 0.014 | |

| Model | 6.003 | 1 | 0.014 | |

Nagelkerke’s R2 is 5.7% which indicates that the model is poor. Cox & Snell R Square: we can conclude that 10.7% probability of the event of having the company’s size to be medium is explained by the logistic model. We can conclude that between 5.7% and 10.7% of the variation in the dependent variable can be explained by the model in block 1(Table 8). 87.4% of the model is correctly classified. The overall percentage row tells us that this approach to prediction is correct 87.4% of the time (Table 9).

| Table 8 Model Summary. A. Estimation Terminated at Iteration Number 6 Because Parameter Estimates changed by less than 0.001. | |||

| Model Summary | |||

| Step | -2 Log likelihood | Cox & Snell R Square | Nagelkerke R Square |

| 1 | 72.097a | 0.057 | 0.107 |

| aEstimation terminated at iteration number 6 because parameter estimates changed by less than .001. | |||

| Table 9 Classification Tablea | |||||

| Observed | Predicted | ||||

| Size | Percentage Correct | ||||

| Small | Medium | ||||

| Step 1 | Size | Small | 90 | 0 | 100 |

| Medium | 13 | 0 | 0 | ||

| Overall Percentage | 87.4 | ||||

| a The cut value is 0.500 | |||||

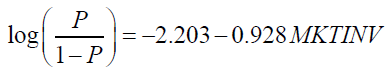

There exists a significant negative impact between from marketing innovation on Business Size. When marketing innovation increase log of odds ratio will decrease by 0.928.

Interpreting odds ratio → odd ratio of Marketing innovation is equal to e-0.928 =0.395, meaning that when Marketing innovation increases odds of Business size to be medium is less likely to occur than odds of having small business size with (1-0.396)*100=60.5% chance (Table 10). Finally, this concludes that there exists a negative relationship between Innovation and Company sizes. Which means that the bigger the organization in size the less innovative it becomes?

RQ5: Do Customers in the Food Service Market View Companies in the Market to be Innovative?

This research question is already answered through the above 4 questions where a comparison between Data gathered from Business side and data gathered from Consumers side is viewed. The undimensionality of the scale was confirmed by the principal component factor analysis of the innovation variables. All the variables loaded strongly on the same factor for both Business and customer’s responses.

Furthermore, the reliability analysis confirmed the six variables contribution as indicators of an overall construct of innovation. Besides that, the innovation construct also met the requirement of convergent validity. This is due since all the corrected items total correlation was all above 0.4.

Discussion

So far, has been discussed how innovation is of critical importance, providing a way to generate and sustain a competitive advantage. Innovation has been described as the specific instrument of entrepreneurship (Drucker, 1985), in fact, for entrepreneurial firms, it may be the most critical success factor. Given the important role of innovation to have entrepreneurship and business success in increasingly knowledge-based and hyper-competitive environments, the need to understand innovation has become vital.

The overall goal of this work was the searching of significant measurements of innovation, based on the concept of newness. The obtained results indicates that at organization level, innovation can be defined and measured as a single construct, described solely by the degree of radicalness, i.e., placing newness as a central role of innovation. As Campbell & Fiske (1959), here was also shown that innovation met the condition of convergent and discriminant validity to support an undimensional construct.

Conclusion

Despite the conclusion regarding an undimensional innovation construct, the methods used here provide a way to take into consideration a range of innovative activities, i.e. different types of newness, which are characterized by the six areas analysed in this study, where innovation can occur. The success of an innovation is determined by the extent of its adoption and not rely strongly on who originates it or how technologically advanced it is. Newness is what makes innovation.

With regards to companies size it was found that there exists a negative relationship between Innovation and Company sizes. Which means that the bigger the organization in size the less innovative it becomes? The most important variables that contributed to the innovativeness of the food and beverage companies are offering new products, new markets, and new suppliers, which makes these variables the most important to focus on for any company that wants to open and stay in this market.

References

- Brem, A., Maier, M., & Wimschneider C. (2016). Competitive advantage through innovation: The case of Nespresso. European Journal of Innovation Management, 19(1), 133-148.

- Brooker, E., Joope, M., Davidson, M.C.G., & Marles, K. (2012). Innovation within the Australian outdoor hospitality parks industry. International Journal of Contemporary Hospitality Management, 24(5), 682-700.

- Bhaskaran, S. (2006). Incremental innovation and business performance: Small and medium-size food enterprises in a concentrated industry environment. Journal of Small Business Management, 44(1), 64-80.

- Campbell, D.T., & Fiske, D.W. (1959). Convergent and discriminant validation by the multitrait-multimethod matrix. Psychological Bulletin, 56(2), 81-105.

- Cooper, R.G. (1993). Wining at new products: Accelerating the process from idea to launch. Reading, MA: Addison-Wesley.

- Damanpour, F. (1996). Organizational complexity and innovation: Developing and testing multiple contingency models. Management Science, 42(5), 693-716.

- Dewar, R., & Dutton, J. (1986). The Adoption of Radical and Incremental Innovations: An Empirical Analysis. Management Science, 32, 1422-1433.

- Dosi, G. (1982). Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Research Policy, 11(3), 147-162.

- Drazin R., & Schoonhoven C.B. (1996). Community, population and organization effects on innovation: A multilevel perspective. The Academy of Management Journal, 39(5), 1065-1083.

- Drucker, P.F. (1985). Innovation and entrepreneurship, practice and principles. New York: Harper & Row.

- Epetimehin, F.M. (2011). Achieving competitive advantage in insurance industry: The impact of marketing innovation and creativity. European Journal of Social Sciences, 19(1), 123-127.

- GAIN. (2017). USDA. FOREIgn agricultural service, global agricultural information network report (GAIN) 2017.

- Gartner, W.B. (1988). Who is an entrepreneur? Is the wrong question. American Journal of Small Business, 12(4), 11-32.

- Geldes, C., & Felzensztein, C. (2013). Marketing innovations in the agribusiness sector. Academia Latino americana de Administración Academy, 26(1), 108-138.

- Hage J. (1965). Theories of organizations: Form, process, and transformation. New York: Wiley

- Hage J. (1980). Theories of organizations: Form, process and transformation. NewYork: Wiley Form, Process and Transformation. NewYork: Wiley

- Hage, J.T. (1999). Organizational innovation and organizational change. Annual Review of Sociology, 25, 597-622.

- Hult, G.T.M., Hurley, R.F., & Knight, G.A. (2004). Innovativeness: Its antecedents and impact on business performance. Industrial Marketing Management, 33(5), 429-438.

- Hull, C.E., & Rothenberg, S. (2008). Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strategic Management Journal, 29(7), 781-789.

- Hungenberg, H. (2012). Strategic management in companies. Gabler Verlag, Wiesbaden.

- Jon‐Arild, J., Bjørn, O., & Lumpkin, G.T. (2001). Innovation as newness: What is new, how new and new to whom? European Journal of Innovation Management, 4(1), 20-31.

- Nieves, J., & Diaz-Meneses, G., (2016). Antecedents and outcomes of marketing innovation: An empirical analysis in the hotel industry. International Journal of Contemporary Hospitality Management, 28(8), 1554-1576.

- Kotabe, M., & Swan, K.S. (1995). The role of strategic alliances in high-technology new product development. Strategic Management Journal, 16, 621-636.

- Naidoo, V. (2010). Firm survival through a crisis: The influence of market orientation, marketing innovation and business strategy. Industrial Marketing Management, 39(8), 1311-1320.

- Noori, B., & Salimi, M. (2005). A decision‐support system for business‐to‐business marketing. Journal of Business & Industrial Marketing, 20(5), 226-236.

- Martínez-Ros, E., & Orfila-Sintes, F. (2012). Training plans, manager’s characteristics and innovation in the accommodation industry. International Journal of Hospitality Management, 31(3), 686-694.

- Medrano N., & Olarte-Pascual C., (2016). The effects of the crisis on marketing innovation: an application for Spain. Journal of Business & Industrial Marketing, 31(3), 404-417.

- O'Dwyer, M., Gilmore A., & Carson, D. (2009). Innovative marketing in SMEs: A theoretical framework. European Business Review, 21(6), 504-515.

- OECD/Eurostat. (2005). Guidelines for collecting and interpreting innovation data.

- Oke, A. (2007). Innovation types and innovation management practices in service companies. International Journal of Operations & Production Management, 27(6), 564-587.

- Qian, J., & Li, L. (2003). Profitability of small-and medium-sized enterprises in high-tech industries: The case of the biotechnology industry. Strategic Management Journal, 24(9), 881-887.

- Rammer, C., Czarnitzki, D., & Spielkamp, A. (2009). Innovation success of non-R&D-performers: Substituting technology by management in SMEs. Small Business Economics, 33(1), 35-58.

- Ren, L., Xie, G., & Krabbendam, K. (2010). Sustainable competitive advantage and marketing innovation within firms: A pragmatic approach for Chinese firms. Management Research Review, 33(1), 79-89.

- Reuters. (2012). Kaffeekapseln lassen Nestle-Umsatz steigen. Handelsblatt.

- Rhee, J., Park, T., & Lee, D.H. (2010). Drivers of innovativeness and performance for innovative SMEs in South Korea: Mediation of learning orientation. Technovation, 30(1), 65-75.

- Rodgers, S. (2008). Technological innovation supporting different food production philosophies in the food service sectors. International Journal of Contemporary Hospitality Management, 20(1), 19-34.

- Schubert, T. (2010). Marketing and organisational innovations in entrepreneurial innovation processes and their relation to market structure and firm characteristics. Review of Industrial Organization, 36(2), 189-212.

- Stevenson, H., & Jarillo, J. (1990). A paradigm of entrepreneurship: Entrepreneurial management. Strategic Management Journal,11, 17-27.

- Utkun, E. & Atilgan, T. (2010). Marketing innovation in the apparel industry: Turkey. Fibres & Textiles in Eastern Europe, 18(6), 26-31.