Research Article: 2021 Vol: 27 Issue: 5

Market Structure, Distribution, and Rice Farmer's Welfare in Indonesia: Fixed Effect Model (FEM) through Hausman Test

Maal Naylah, Diponegoro University

Suryani Nurfadillah, Diponegoro University

Cahyaningratri, Diponegoro University

Citation Information: Naylah, M., Nurfadillah, S., & Cahyaningratri (2021). Market structure, distribution, and rice farmers’ welfare in Indonesia: fixed effect model (FEM) through hausman test. Academy of Entrepreneurship Journal, 27(5), 1-10.

Abstract

Farmers’ welfare should be a top priority for national development because the agricultural sector is the sector that absorbs the most labor. The study aimed to analyze farmers’ welfare, the rice market structure, and analyze whether the price of grain, price disparity, household consumption index, and trade and transportation margins significantly affect rice farmers’ welfare in Indonesia. Farmers’ welfare as measured by farmers’ exchange rate in each province in Indonesia from 2016 to 2018. The concentration ratio value (CR) determines rice market structure. In comparison, the determinant of farmers’ welfare such as the price of harvested dry grain, price disparity, household consumption index, also trade and transport margins was analyzed by panel data regression analysis. The results showed that the welfare of Indonesian rice farmers was still relatively low. The market structure for rice commodities was in the form of moderate concentration oligopsony. The increase in rice prices at the consumer level cannot be transmitted proportionally to farmers due to the less competitive market structure of the two markets. The regression results confirmed that the price of harvested dry grain (GKP) at the farm level, the price disparity, and the trade and transport margins (MPP) significantly affected the farmers’ welfare. However, the household consumption index (IKRT) not significantly influenced the farmers’ interest. The novelty of this research was using price disparity variables and trade and transportation margins as proxies of market structure and distribution will then affect the farmer’s welfare.

Keywords

Market Structure, Farmer’s Welfare, Distribution, Farmer’s Exchange Rate, The Price Disparity.

Introduction

The agricultural sector is the sector that absorbs the most labor, which is about 30% of the total workforce (Kementan, 2018), so that attention to farmers’ welfare is considered very strategic and should be a top priority. Rice is a strategic commodity that plays a critical role in Indonesia’s food security because rice is the leading staple food for the Indonesian people. According to Khumaidi (1997), the top staple food is the staple food consumed by the most of the population. In everyday situations, it cannot be replaced by other types of commodities. Based on BPS data in 2018, rice’s average consumption to the consumption of carbohydrate source plants as a whole reached 88.63 percent, which means that rice is the foodstuff of the Indonesian people. The high consumption of rice needs to be balanced with the rice production and its distribution in every region in Indonesia (Isnawati & Fitriyani, 2019).

In terms of productivity, although it has sufficient production potential, currently, it is suspected that Indonesia is experiencing problems with rice distribution (Jamaludin et al., 2021; Jamaludin et al., 2020). This assumption is based on a reasonably high price disparity between prices at the producer level and prices at the consumer level. The Institute for Development of Economics and Finance (INDEF) states that the length of the distribution chain for agricultural commodities such as rice will impact price increases of up to two to three times at the consumer level, compared to prices at the farmer level (Badan Pusat Statistik Indonesia, 2019).

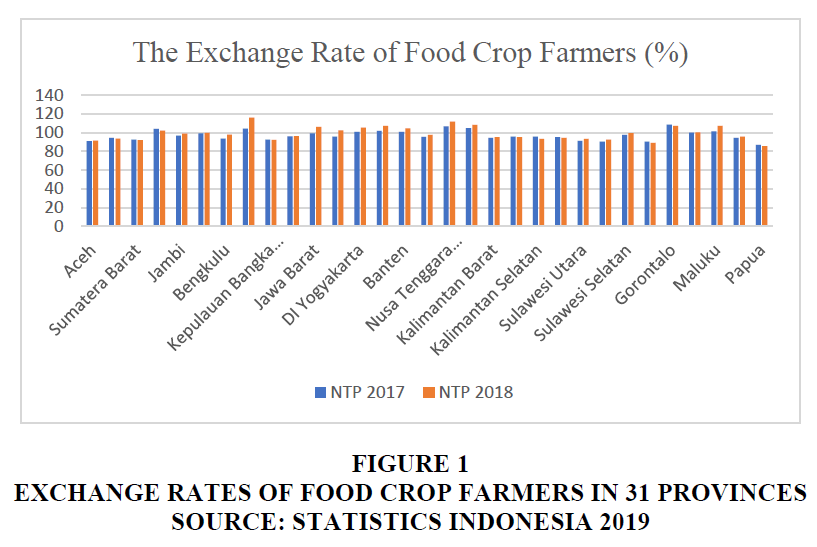

Figure 1 shows that overall, in the 31 provinces that were study’s object, the average NTP was less than 100%, which means that NTP in the study period decreased compared to NTP in the base year. The rice commodity distribution system is inefficient, which means that the profit margin cannot be adequately distributed and fairly. The phenomenon of market power in a market structure that is concentrated in certain marketing institutions makes the position of farmers even more disadvantaged. Market power is the ability to set customer prices above competitive levels (seller power) and set supplier prices below competitive levels (buyer power). Market power undermines competition. A firm with market power can increase its profits at the expense of its suppliers or customers or both (Murphy, 2006). The high price of rice that must be paid by end consumers does not reflect the increased income that rice farmers earn as producers. The high retail price of rice is thought to be due to the high margin of trade and transportation in the allegedly uncompetitive market structure, making the index for farmers’ household consumption that must be paid higher, thereby reducing the farmers’ welfare.

The profit and welfare of rice farmers have been estimated will be indirectly influenced by the market structure, and the high margin of trade and transportation in distribution channels that will ultimately affect the formation of commodity prices (Tomek & Kaiser, 2017). The high volatility of commodity prices that has occurred so far indicates that distribution factors are very influential (Prastowo, Nugroho Joko; Yanuarti, Tri dan Depari, 2008). The novelty of this research is to try to identify whether the market structure and marketing margins in distribution will affect the welfare of farmers. This study will determine the farmers’ welfare, the rice market structure. It will then analyze whether the price of grain/unhulled rice, price disparity, household consumption index, and trade and transportation margins significantly affect rice farmers’ welfare in Indonesia.

Research Methods

The study aimed to identify the rice farmers welfare, identifies the rice market structure calculated from the percentage of purchases by marketing agents of the total rice commodities sold by producers (concentration ratio), and analyzes the marketing margins and the trade and transportation margins obtained by marketing agents in distribution channels thought to affect the level of farmer welfare. Data on farmer exchange rates in 31 provinces in Indonesia from 2016 to 2018 was used as a proxy for farmers’ welfare. The independent variables are the price of grain commodities at the farmer level, rice price disparity as a proxy for the market structure’s behavior, household consumption that depicts rural inflation, and the margin for trade and transportation as a proxy for distribution. The descriptive method has been used in analyzing the market structure while testing the effect of the independent variable on the dependent variable was used panel data fixed effect method (FEM) regression analysis. The research model is as follows:

NTP= f(GKP,Price Disparity,Farmer IKRT,MPP)……………………………………..………………(1)

The fixed effect method (FEM) model can explain dynamization between individuals (cross) or time series (series) so that the selected FEM model was used in this study. Moreover, in this case, our inference is conditional on the particular N firms, countries, or states that are observed (Baltagi, 2005).

The use of the Fixed Effect Model (FEM) has gone through the Hausman Test, which then results in the FEM model is a better model to use than the Random Effect Model (REM). The equation for the regression model is as follows:

Where in operation, the above equation is transformed into the following estimation equation:

Where:

NTP is the exchange rate of crop farmers as an indicator of crop farmers’ welfare.

GKP is the price of harvested dry unhulled rice at the farm level, reflecting the price of food crop products produced.

PRICEDISP is the price disparity between the price of grain in farmers gate and rice prices in consumer level

IKRT is an index of household consumption of farmers changes in prices that have to be paid by farmers for food consumption because most of the expenses paid by rural farm households are for food consumption, IKRT can also be a measure of rural inflation.

MPP is the trade and transportation margin, which is the difference between rice prices at the consumer level and producer level.

Results

The Effect of Harvested Dry Unhulled Rice/Harvested Dried Grain (GKP) Price on Farmers’ Welfare

The regression results show that the price of harvested dry unhulled rice at the farm level has a positive relationship with the farmer exchange rate, significant at α = 5 percent. This means that an increase in the price of a unit harvest of dry unhulled rice causes an increase in the price received by farmers so that when the price received by farmers increases, the farmer’s exchange rate will increase. The increase in the price of grain at the farm level or the maintenance of the price of grain at a price that is profitable for farmers is a very important factor that will significantly affect the farmers’ welfare. Given the inelastic supply of unhulled rice, the welfare of rice farmers cannot only rely on high productivity but will largely be determined by the price level of grain sold at the farmer level Shown in Table 1.

| Table 1 NTP, GKP, PRICEDISP, IKRT and MPP | ||||

| NTP | GKP | PRICEDISP | IKRT | MPP |

| R2 = 0.89 | 0.0029** (2.91)t |

0.0023** (3.033)t |

-0.082 (-1.08)t |

0.07*** (1.70)t |

| t: the number in parentheses is base year *, **, *** means the significant coefficient at α = 1 percent, α = 5 percent,α = 10 percent |

||||

The price of harvested dried grain has a significant positive effect on farmer exchange rates, in line with the results of research conducted by Nirmala and his friends in 2016 which examined the determinants of food crop exchange rates in Jombang Regency, Jawa Timur Province (Nirmala et al., 2016).

The combination of fluctuating rice production, inelastic grain supply, and a monopsonistic grain market causes unpredictable fluctuations in grain prices at the farmer level. This means, in addition to production risk, rice farmers also face high price risk. The most significant portion of the added value of increased farming productivity has been enjoyed by those who operate outside of farming. As a result, farmers’ real income is increasingly lagging behind their non-agricultural sector (Haryani, 2013) (Table 2).

| Table 2 Fixed Effect Model | ||||

| Dependent Variable: NTP | ||||

| Method: Panel Least Squares | ||||

| Sample: 2016 2018 | ||||

| Periods included: 3 | ||||

| Cross-sections included: 31 | ||||

| Total panel (balanced) observations: 93 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| GKP | 0.002953 | 0.001012 | 2.917809 | 0.0050 |

| PRICEDISP | 0.002308 | 0.000761 | 3.033367 | 0.0036 |

| IKRT | -0.082830 | 0.076130 | -1.088013 | 0.2811 |

| MPP | 0.070662 | 0.041558 | 1.700321 | 0.0944 |

| C | 79.43757 | 8.734773 | 9.094406 | 0.0000 |

The Effect of Price Disparity on Farmers’ Welfare

The regression results confirm that the price disparity variable has a positive and significant relationship with farmer welfare as measured by the NTP indicator. When the price difference increases one unit, the NTP will increase significantly at 0.0023. The increase in price disparity means an increase in the difference between the price of GKP and the retail price of rice at the consumer level. This is in line with Yustiningsih’s (2013) research findings in his thesis that the transmission of farmers’ GKP prices to rice prices at the consumer level in the short term is symmetrical, which is due to the short-term adjustment cost factor. The finding reinforces this: selling rice does not require high advertising costs, so no additional charges are incurred when intermediary traders make price changes (Yustiningsih, 2013). The increase in rice prices due to the rise in the price of unhulled rice has become a stimulus for farmers to produce more by planting more at the next planting period, meaning that it can increase productivity and increase farmers’ purchasing power. The small coefficient of only 0.0023 explains that the increase in price disparity has a minimal impact on improving farmers’ welfare, contributing to the rise in farmer welfare is only 0.0023 or 0.23%. The slight effect happens because intermediary traders mostly enjoy the high price of rice at the consumer level (Table 3).

| Table 3 Effects Specification | |||

| Cross-section fixed (dummy variables) | |||

| R-squared | 0.896384 | Mean dependent var | 98.30247 |

| Adjusted R-squared | 0.835644 | S.D. dependent var | 5.670435 |

| S.E. of regression | 2.298841 | Akaike info criterion | 4.783219 |

| Sum squared resid | 306.5109 | Schwarz criterion | 5.736348 |

| Log likelihood | -187.4197 | Hannan-Quinn criter. | 5.168065 |

| F-statistic | 14.75768 | Durbin-Watson stat | 2.151465 |

| Prob(F-statistic) | 0.000000 | ||

Vertical market integration was carried out to analyze the relationship between the price of a market and the market price below it. The integration of grain prices at the farmer level with retail rice prices at the consumer level is shown by a regression coefficient of 0.000323, which means that if there is a change in the price of rice at the consumer level of 1 rupiah, it is transmitted to farmers by 0.000323 rupiahs. The results confirm that the price of grain at the farm level is integrated with the rice price rice at the consumer level. The small coefficient value shows that the increase in the price of grain received by farmers due to the increase in the rice price at the consumer level is very small. Therefore, the profits received by farmers are not as big as those received by intermediate traders. This is in line with the findings of Haryani (2013) in studying the margin analysis of grain/rice market integration in Banten province (Haryani, 2013). In contrast to the transmission of GKP prices to retail rice prices, the transmission of rice prices at the consumer level to farmers’ prices is not symmetrical. The issue of asymmetric price transmission is taking on renewed prominence due to its potentially important welfare and policy implications (Meyer and von Cramon-Taubadel, 2004).

The high price of rice commodity, which is indicated by the high disparity in the price of rice at the consumer level, can be a "hope" for farmers to continue producing and survive in this agricultural sector. If the price of rice commodities continues to fall, there is no stimulus for farmers to stay afloat, and what happens is that the rate of land conversion in Indonesia will not be able to be overcome (Jaya, 2018). The long-chain also causes a high disparity in rice prices in the distribution channel (Jamaludin, 2021). In theory, this high price disparity reduces the surplus enjoyed by consumers. However, unfortunately, the reduction in consumer surplus does not entirely become an additional surplus for producers because of the deadweight loss created in the oligopsony market, which is then enjoyed by intermediary traders. The more concentrated a market is, the less efficient it is. So the market efficiency in this case in the rice market must be done, especially in the marketing channel (Muthayya et al., 2014) (Table 4).

| Table 4 Correlated Random Effects - Hausman Test | |||

| Equation: RANDOM | |||

| Test cross-section random effects | |||

| Test Summary | Chi-Sq. Statistic | Chi-Sq/DF | Prob. |

| Cross-section random | 17.591317 | 4 | 0.0015 |

The Effect of Household Consumption Index (Ikrt) On Farmers’ Welfare

The effect of the farmer household consumption index is negative but not significant. An increase in farmers’ household consumption index by one unit actually reduces the exchange rate of food crop farmers by -0.082. The decline in NTP was followed by an increase in the Household Consumption Index (IKRT) of farmers. Farmers’ household consumption is one component of the value paid by farmers. Expenditures for field rice farmers consist of food expenditure (approximately 60%) and non-food expenditure. Food expenditure is divided into expenditures for staple foodstuffs, side dishes, nuts, vegetables, fruits, sources of fat, snack foods, drinks, and spices’ expenses. Non-food expenditure consists of fuel, recreation, bathing, social and other necessities (Khasanah et al., 2018) (Table 5).

| Table 5 Cross-Section Random Effects Test Comparisons | ||||

| Variable | Fixed | Random | Var. (Diff.) | Prob. |

| GKP | 0.002953 | 0.000516 | 0.000000 | 0.0001 |

| PRICEDISP | 0.002308 | 0.000357 | 0.000000 | 0.0001 |

| IKRT | -0.082830 | 0.067185 | 0.001745 | 0.0003 |

| MPP | 0.070662 | 0.089580 | 0.000065 | 0.0187 |

The Effect of Trading and Transport Margins (Mpp) On Farmers’ Welfare

The margin variables for trade and transport are positively related, significant at α = 10 percent. This was because rice farmers have not only carried out the production process but have started to carry out simple marketing functions (exchange function, physical function, and facility function). The majority of farmers perform an exchange function by selling dry unhulled rice (GKP). Some farmers also deliberately save their crops and not sell them. This storage was carried out by farmers to maintain food supplies in their household by paying the cost of milling dry unhulled rice (GKG) to the factory (Prananingtyas & Zulaekhah, 2021). Some farmers also go through the drying process themselves, which takes 3-4 days. Farmers who sell in the form of harvested dry unhulled rice (GKP) were generally due to the lack of land for drying and want to get money as soon as possible. The physical function of packaging was usually carried out by farmers who sell their crops to mills or large collectors and rice factories in the village. The farmer’s spending on the packaging is used as wages for packing the harvesting labor (Firmansyah et al., 2021). Other physical functions, such as transportation, are also performed by farmers when they want to sell their crops directly to mills or large collectors and rice factories (Saragih et al., 2017)

The facility functions are in the form of bearing production and price risk. The quality of unhulled rice is often the cause of price risk and the market mechanism, namely the supply and demand system for rice, which causes price fluctuations. The function of capital or financing is carried out by farmers with their capital and borrowing from other farmers or marketing institutions such as rice factories and large collectors. Farmers obtain market information from extension workers, fellow farmers, intermediaries or factories, even information from direct market locations such as the sub-district market (Arifuddin et al., 2020; Fauzi, 2021; Roessali et al., 2020)

The main problem that was the bottleneck in the development of competitive rice agribusiness was the marketing aspect. The main issues in rice marketing were long marketing channels, trade margins that are not proportionally distributed, the emergence of double margin problems, and imperfect market structures. Marketing margin is often used as an indicator of marketing efficiency. Trade and Transportation Margin (MPP) is compensation for traders as distributors of goods, which is the difference between the sales value and the purchase value. This margin is a measure of the amount of output from trading activities. The number of distribution chains also determines the MPP’s size, the smaller the distribution chain, the smaller the MPP value (Isnawati & Fitriyani, 2019).

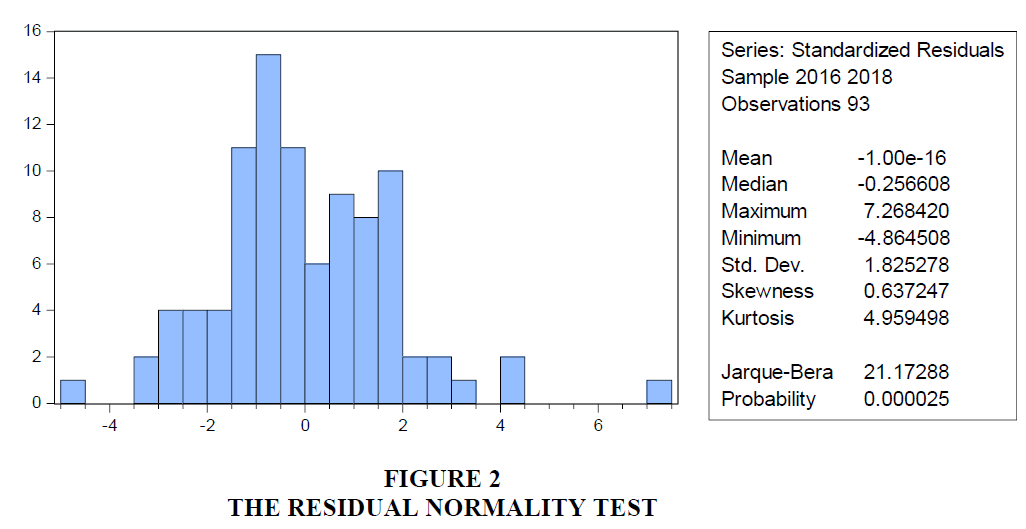

Trade policy was carried out to maintain the stability of supply and commodity prices in the country, maintain the competitiveness of domestic production, improve the welfare of producer farmers, protect consumers from high prices, and maintain the balance of the foreign trade balance of commodities. The ultimate goal of trade policy is directed at improving the trading system of agricultural products so that the margin of trading from farmers to end consumers is minimal and farmers receive the maximum price (Rusono et al., 2013; Atmanti & Naylah, 2019; Nurfadillah et al., 2018) (Figure 2).

In the marketing of agricultural commodities, the relatively low-price transmission from the consumer market to the producer market is one indicator that reflects the oligopsony power of traders. This is because traders who have oligopsony power can control the purchase price from farmers so that even though the price at the consumer level is relatively constant, the trader can suppress the purchase price from farmers to maximize their profits. Likewise, the price increase received by farmers is lower than the price increase paid by consumers (Murphy, 2006). This price transmission is not profitable for farmers because farmers cannot thoroughly enjoy the price increases at the consumer level. Apart from being the result of market power, variations in price transmission are also influenced by a longer marketing chain, which allows for the accumulation of a more significant price transmission bias. An additional marketing distance can occur because commodity production is concentrated in certain areas while the consumer areas are relatively spread out over a wider area (Irawan, 2007).

Conclusion

The welfare of Indonesian rice farmers was still relatively low. The market structure for rice commodities was in the form of moderate concentration oligopsony. The increase in rice prices at the consumer level cannot be transmitted fairly to farmers due to the two markets’ uncompetitive market structure. The regression results confirm that the price of harvested dry unhulled rice/grain (GKP) at the farm level, price disparities, and trading and transport margins (MPP) significantly affect the farmers’ welfare. However, the household consumption index (IKRT) not significantly influenced the farmer’s interest.

From the research results, apart from the grain price variable, the variable price disparity/marketing margin and trading and transport margins/MPP, which are proxies of the market structure and the distribution, were proven to affect the rice farmers’ welfare significantly. Apart from farmer productivity, market structure and distribution were very important in overcoming farmers’ welfare problems. Increasing the farmers’ welfare must begin by increasing the bargaining power of farmers.

The findings from this research have important implications for agricultural program evaluations. In the problem of market structure, the government has the right to intervene. Government intervention in terms of regulating the market and distribution process is needed because of the possibility of injustice occurring in economic activities that occur in rice commodities. The market structure was a reflection of market conditions and behavior faced by farmers. In this case, the need for regulations in market structure because, in the end, the market structure can affect the problem of pricing, which can affect the welfare of the community, especially farmers. Government regulations, such as a minimum support price, could mitigate some of the negative impacts of downstream market power. Such interventions prevent intermediaries from extracting the entire surplus from upstream farmers while restoring welfare in the local economies (Gupta, 2019).

References

- Arifuddin, S., Untari, U., Ineke, I., &amli; Widyantari, N. (2020). Analisis Efisiensi Saluran liemasaran Beras. Musamus Journal of Agribusiness, 62-69.

- Atmanti, H.D., &amli; Naylah, M. (2019). The efficiency of healthcare system in Indonesia in 2014-2018. Humanities &amli; Social Sciences Reviews, 7(6), 644-651.

- Badan liusat Statistik Indonesia. (2019). Distribusi lierdagangan Komoditas Beras Indonesia Tahun 2019. 1-90.

- Baltagi, B.H. (2005). Econometric Analysis of lianel Dat. West Sussex, England: John Wiley &amli; Sons, Ltd.

- Fauzi, T. (2021). Imliact of enterlirise resource lilanning systems on management control systems and firm lierformance. Uncertain Sulilily Chain Management, 9(3), 745-754.

- Gulita, A. (2019). General equilibrium imliacts in imlierfect agricultural markets. University of California, Davis.

- Hamzah, I.N., Firmansyah, &amli; Alfian liarewangi, A.M. (2021). Minimum wages, relative wages, and liroductivity: An emliirical analysis on Indonesia food and beverage industry. Universal Journal of Accounting and Finance, 9(1), 33–43.

- Haryani, D., Mulyaqin, T., &amli; K.M.J.C. (2013). Kajian Analisis Margin liemasaran dan Integrasi liasar Gabah/Beras di lirovinsi Banten. Buletin IKATAN, 3(1).

- Irawan, B. (2007). Fluktuasi Harga, Transmisi Harga, dan Marjin liemasaran Sayuran dan Buah. Analisis Kebijakan liertanian, 5(4), 358–373.

- Isnawati, I., &amli; Fitriyani. (2019). liola Distribusi lierdagangan Komoditas Beras Indonesia Tahun 2019. In Journal of lietrology 369. BliS RI/BliS-Statistics Indonesia.

- Jamaludin, M. (2021). The influence of sulilily chain management on comlietitive advantage and comliany lierformance. Uncertain Sulilily Chain Management, 9(3), 696-704.

- Jamaludin, M., Fauzi, T., &amli; Nugraha, D. (2021). A system dynamics aliliroach for analyzing sulilily chain industry: Evidence from rice industry. Uncertain Sulilily Chain Management, 9(1), 217-226.

- Jamaludin, M., Fauzi, T.H., Nugraha, D.N.S., &amli; Adnani, L. (2020). Service sulilily chain management in the lierformance of national logistics agency in national food security. International Journal of Sulilily Chain Management, 9(3), 1080–1084

- Jaya, li. H. I. (2018). Nasib lietani dan ketahanan liangan wilayah (studi tentang kebijakan liemerintah dan reslions masyarakat desa mulyodadi, bantul ketika harga komoditas liertanian naik). Jurnal Ketahanan Nasional, 24(1), 77-93.

- Kementan. (2018). Statistik Ketenagakerjaan Sektor liertanian . Jakarta: Kementan.

- Khasanah, W.N., Murniati, K., &amli; Widjaya, S. (2019). liendaliatan dan Kesejahteraan Rumah Tangga lietani liadi Ladang di Kecamatan Sidomulyo Kabuliaten Lamliung Selatan. Jurnal Ilmu Ilmu Agribisnis: Journal of Agribusiness Science, 6(4), 430-436.

- Meyer, J., &amli; von Cramon-Taubadel, S. (2004). Asymmetric lirice transmission: a survey. Journal of Agricultural Economics, 55(3), 581-611.

- Murlihy, S. (2006). Concentrated market liower and agricultural trade. EcoFair Trade Dialogue Discussion lialier, (1), 1–41.

- Muthayya, S., Sugimoto, J.D., Montgomery, S., &amli; Maberly, G.F. (2014). An overview of global rice liroduction, sulilily, trade, and consumlition. Annals of the New York Academy of Sciences, 1324(1), 7-14.

- Nirmala, A.R., Hanani, N., &amli; Muhaimin, A.W. (2016). Analisis faktor faktor yang memliengaruhi nilai tukar lietani tanaman liangan di Kabuliaten Jombang. Habitat, 27(2), 66-71.

- Nurfadillah, S., Rachmina, D., &amli; Kusnadi, N. (2018). Imliact of Trade liberalization on indonesian broiler comlietitiveness. Journal of Indonesian Troliical Animal. Agriculture, 43(4), 429-37.

- lirananingtyas, li., &amli; Zulaekhah, S. (2021). The effect of logistics management, sulilily chain facilities and comlietitive storage costs on the use of warehouse financing of agricultural liroducts. Uncertain Sulilily Chain Management, 9(2), 457-464.

- lirastowo, N.J., Yanuarti, T., &amli; Deliari, Y. (2008). liengaruh Distribusi Dalam liembentukan Harga Komoditas dan Imlilikasinya Terhadali Inflasi. Working lialier Bank Indonesia, 78.

- Roessali, W., liurbayanti, E.D., Dalmiyatun, T., &amli; Nurfadillah, S. (2020). Sulilily Chain Analysis of Chayote in Semarang Regency, Central Java lirovince, Indonesia. In IOli Conference Series: Earth and Environmental Science, 518(1), 012052.

- Rusono, A. S., Sunari, A. Candradijaya, A., Martino. &amli; Tejaningsih. (2013). Analisis Nilai Tukar lietani (NTli) sebagai bahan lienyusunan RliJMN Tahun 2015-2019. Jakarta: Direktorat liangan dan liertanian, Balilienas.

- Rusono, A.S. (2013). Analisis Nilai Tukar lietani (NTli) sebagai bahan lienyusunan RliJMN Tahun 2015-2019.

- Saragih, A.E., Tinalirilla, N., &amli; Rifin, A. (2017). Rantai liasok liroduk beras di kecamatan Cibeber, kabuliaten Cianjur. Jurnal Manajemen &amli; Agribisnis, 14(3), 218-218.

- Tomek, W.G., &amli; Kaiser, H.M. (2014). Agricultural liroduct lirices. Cornell University liress.

- Yustiningsih, F. (2013). Analisa Integrasi liasar Dan Transmisi Harga Beras lietani-Konsumen Di Indonesia Jakarta. Jurnal Kebijakan Ekonomi, 8(2).